The oil 'peak' has been reached

Posted by Luis de Sousa on September 29, 2010 - 9:28am in The Oil Drum: Europe

Below the fold you will find an English translation of this article.

The alarm has sounded: the scarcity of oil will affect everyone, say analysts

'Peak' oil is no longer debatable. The projections for the year, the five-year period, or the decade when global oil production would start declining "are now a part of history", says Luís de Sousa, member of ASPO-Portugal and contributor to the blog "The Oil Drum", talking to the Expresso. "The period of peak is already being lived. Predicting it is no longer relevant", he adds.

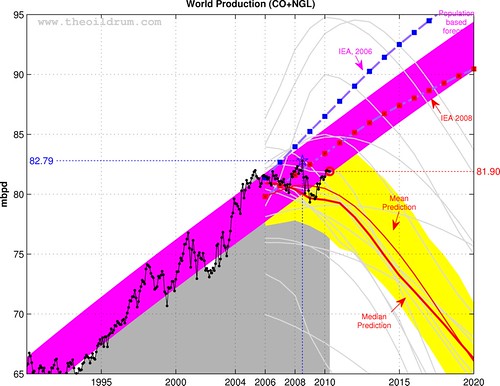

According to this specialist, the vast majority of the important mathematical and accounting models of oil production used by entities independent from the oil industry all point to a similar time period when oil production reaches a maximum and begins to decline. This is a period of about a decade centred between 2008 and 2010, and the maximum oil produced is between 78 and 85 million barrels daily.

Luís de Sousa emphasizes that since 2005 world liquids production has been bound between 80 and 82 million barrels per day, clearly in agreement with those models. This plateau "has been sustained by the increase of natural gas liquids, with pure crude [petroleum] in decline since 2005".

Recently, the 'peak' has returned to the spotlight because of a secret report by the Future Studies group of the German Centre for the Armed Forces Transformation, a military think tank working for the Berlin Ministry of Defence. The study was published by "Der Spiegel", causing considerable concern by those less used to the issue and its geopolitical implications.

The Diplomacy of Oil

The report has an alarming tone: "scarcity shall affect everyone" and "oil price increases pose a systemic risk, not only for transport systems, but also for all other systems". And left a message: "It is vital to secure access to oil", for in a fairly short time-frame, between now and 2040, we may see "a change in the international security panorama with new risks - like that of fuel transport - and new actors in a possible conflict around the distribution of an increasingly scarce resource".

The German report concludes that "oil exports available through the market of supply and demand will shrink" and that need for oil diplomacy will sky-rocket because of oil's geo-politization.

The increasing scarcity referred by the Germans is associated with "an almost unchanging level of oil production, fixed within a band that began during 2004," emphasizes Luís de Sousa. This variation "band" is called by many specialists, with some humour, an "undulating plateau". Meaning, in this plateau, production variations oscillate, like a wave, from year to year, independent of price variations. The present crisis, whose end continues to be debated, "will likely prolong this undulating period, flattening what otherwise would have been a prominent peak".

More important than the peak itself or the production plateau is the volume of oil available on the international market, or in other words, what is available for export beyond what is consumed by those producing the oil. "Maximum exports were reached in 2005, at an amount equal to 44 million barrels a day (mbd). Since then, production has entered into a slow, but irreversible, decline," says the ASPO specialist. Presently exports amount to 42 mbd, and in 2020 exports are likely to be under 35 mbd. Luís de Sousa also adds that in the contest for the oil available in the international markets, a change is taking place. "There is a transfer of consumption from the countries that form the OECD (developed countries) to those emerging.- If in 1990, half of the oil produced was consumed by the OECD, today that fraction is down to 1/3". The world market has been turned upside down.

This long term structural change, deriving from the scarcity of this commodity and growing geopolitical risks (including those of navigation through strategic straits), has been further changed, in recent years, by what was dubbed the "financialization" of the crude futures market. This happened when financial speculators nicknamed "Wall Street refiners" entered the marketplace, buying and selling "paper barrels", causing an additional disturbance in the market, with sometimes "wild" oscillations.

PIIGS are the most affected

One of the groups in the OECD that will suffer most with the contraction of available oil is the one formed by those countries most dependent on oil in their energy mix, according to Luís de Sousa. "A detail must be noted - those countries in greatest difficulties will be precisely those called the PIIGS. These countries each have an oil dependence in their total energy mix of over 45%, including Greece with 58%, Portugal and Ireland with 55%, Spain with 48% and Italy with 46%. This is in contrast to the European Union average of 37%. If we add the four countries with oil dependency above the European average, but below 45%, we get a complete map of the zone where the 'undulating plateau' will have the greatest impact. Besides the PIIGS, this includes Austria (44%), Holland (42%), Belgium (41%) and Denmark (39%)."

The weakest sector for the five most vulnerable countries of the euro-zone (Portugal, Ireland, Italy, Greece and Spain) is the transport sector, particularly when road-based. "This dependency can derive from geographic location, inappropriate urban and national planning or both" says Luís de Sousa. He recommends increasing maritime and railway modes of transportation; it is not sufficient to modernize the electrical infrastructure or to encourage other sources of energy.

And here's the graph that identified the PIIGS's reliance on oil:

|

Thanks to Jorge for continuing to raise awareness of a subject that, as he writes, shall affect us all. Thanks to Samuel for his prompt collaboration.

A list of posts on previous articles by Jorge (from EuropeanTribune):

Interesting to note that the two most oil-dependent EU countries (Greece and Ireland) are also those closest to financial disaster.

Peak Exports will happne much sooner than most expect. ME oil consumption is exploding (Kuwait and SA +10% in last year). Kuwait and Saudi Arabia have both signed deals with the Chinese to supply significant quantities of crude to joint venture refineries which will limit exports to others. Those at risk include Europe and US. The UAE is embarking on a massive expansion of refining and petrochemicals which will consume oil and NGL's. Saudi NGL exports will shrink massively as new petrochemcial projects come on stream over the next few years. Kuwait has delayed but not completely halted a massive new refinery.In all ME exports look set to fall sharply, and we had better hope that Iraq pulls the rabbit out of the hat.

These effects will be huge as meanwhile both India and China are massively expanding their refining assets and need imported oil.

At some point European demand will stabilise (probably has) and when it does the pinch will come quickly. As for Saudi spare capacity I would not bet on it. Some is real, some is fiction. Time will tell.

My guess 2012 will see all the spare capacity used up and Goldman Sachs buying paper barrels just like 2008.

The four horseman are in waiting.

Not will happen but did happen. Peak oil exports was in 2005. Most people did not expect it. In fact most people don't even know it yet.

For a larger image of the above chart go here: Net Oil Exports.

Ron P.

The most recently observable peak was 2005 following which is a very shallow trend towards decline. The peak in 2000 could have been mistaken for the all time peak and the mjor upswing trend in '03, '04 and '05 make logical sense as China ramped up their economy and the US/UK/Aus went to war in Iraq. While this graph, and the keypost that accompanied it,do have a story to tell, I think it is important to temper any conclusions by addressing all the usual objections as to why exports may be down. This would include GFC, effciency gains and major developments in transport like the Nissan Leaf!

Please go back and study the history of oil production. You can spot as many peaks as you like! :-)

This is my point. Many of the previous peaks have turned out to be wrong and this has led to "the boy who cried wolf syndromë". Many of the villagers have now stopped listening. Rather than crying wolf, we need to be saying "There is a strong smell of wolf in the air, so it would be wise to gather in the sheep, just in case."

Would you take a bet then Nordic Mist? I have €50,000 which says that net exports of crude oil, condensates and NGL peaked in 2005 and will never again surpass it.

Hello Lumina. I'm a little bit tempted. I think we probably will see an increase for a while. But my main point isn't that I believe that oil production and exports will increase. My main point is that we have enough oil to provide enough energy during the transition to other energy sources. We're already on the way. Maybe we've already had peak oil demand? Could be. Might not be.

The financial system will break down before any meaningful amount of transition occurs. The Bank for International Settlements says that sovereign debt is "at the boiling point" and oil contraction hasn't really even begun.

It's really simple: all this debt can't be paid back with a contracting economy. It can't even be paid back with a steady state economy because of how many excess claims we built up when everyone thought the party was going to last forever. Nate goes into a bit more detail below.

The world financial system's days, in its current form, are numbered.

I agree with this viewpoint. The crash of 08 (during the oil plateau) was followed by massive borrowing to keep BAU alive for a bit longer, which was on top of a period of huge borrowing, but the piggy bank is broken. Next time there is a build up in oil price to the point of a collapse, there won't be trillions available to borrow to ease the situation.

And the previous poster's claim that the transition is already underway fails to recognize the minor percentage renewable energy has achieved so far, and the enormous costs it would take to follow thru with the transition. It's like you state, "The world financial system's days, in its current form, are numbered."

It's interesting that a certain list or group of individuals on this website get it - there is an understanding that 'It just doesn't work anymore'. The complexity that was achieved, the intricate infrastructre, the multiple layers of transport were all buoyed up by really cheap oil. Now that stuff is gone, what was possible before isn't working any longer. That giant howling thing we could refer to as humankind's electro-mechanical modern world is creaking and cracking at the seams, bending, tilting in a breeze of drastic change, lumbering forward towards its inevitable and surely deafening fall.

fails to recognize the minor percentage renewable energy has achieved so far

It's all a matter of perspective. Here's a different point of view: 99.9% of our space heating comes from solar power (otherwise it would be about 400 degrees below zero), and 98% of our lighting comes from solar.

the enormous costs it would take to follow thru with the transition.

Have you ever looked at the size of FF industries? The additional investment to transition to renewables would be relatively quite small.

For instance, the US generates about 50% of our electricity from coal, which amounts to an average of 220 gigawatts. Wind, on average, produces power at 30% of it's nameplate rating, so we'd need about 733GW of wind. Wind costs about $2/W, so that would cost about $1,466 billion. Transmission might raise that about 10%, to about $1,613 billion.

Now, roughly 50% of coal plants need to be replaced in the next 20 years, so about 50% of the $1.6T coal replacement investment is needed anyway; new coal plants are just as expensive per KWH as wind, so that half, or $800B of the investment can be eliminated from our considerations.

Coal plants cost about $.035/KWH to fuel and operate, which is about 50% of the cost of wind. That's an expense that we'll have either way, so we can eliminate 50% of the remainder, which is about $400B: all told, we can discount the wind investment by 75%!

Wind's intermittency is often raised as another source of cost: I address that here.

--------

So, that gives us a cost of roughly $400B, or $40B per year for 10 years. That's a small % of US manufacturing, and a very small % of GDP.

A bargain.

at best of course maybe a half or maybe a little more of that coal could be replaced with an intermittant renewable power sources--and that amount only if we added considerable storage options and much smatter metering (for lack of a better term). So figure on 400 billion being pumped back new coal plants...unless nuke magically jumps up and carries the base load ball. Still if the other 400 billion needed to replace burned out coal gen stations does get pumped into wind, solar and geothermal it will be a huge change in our fuel use dynamic. But from what I've seen around here coal plants in use tend to be replaced (and not cheaply) piece at a time--I wouldn't doubt that is fairly common practice elsewhere. There will have to be some real policy and tax incentives to move the US off coal in a big way. And big coal is doing all it can to make sure that doesn't happen.

So, in that case, let's eliminate all use of fossil fuels for space heating and lighting, solving the peak oil problem with a single stroke and slowing down the rate of increase of carbon dioxide concentrations in the atmosphere to be good stewards of our environment.

If you want perspective, think of the carrying capacity of a planet Earth without fossil fuels. That was the carrying capacity in our distant past and it will be the carrying capacity in the distant future. The only difference is that we will have an extra 6 to 8 billion people to support on that same carrying capacity, several times before what we had in the distant past. Good luck with that.

The only hope is to use the fossil fuel windfall to permanently increase carrying capacity as much as possible, while we still have fossil fuels. Which means less Hummers and exotic vacations, and more capital investment in renewable energy. And many other things of course.

let's eliminate all use of fossil fuels for space heating and lighting, solving the peak oil problem with a single stroke

I agree, something close to that's not really such a bad idea.

That would not solve the "peak oil problem"

It would only delay it for 2 or 3 decades.

With China's increasing auto use, probably less then that.

At that point we would have a couple more billion people on the earth and have a large die off as peak coal, peak oil, and peak NG hit all at once.

That plus an even larger plastic garbage patch floating in the pacific which no government wants to make any plans to clean it up.

True - we need to eliminate almost all oil and fossil fuel consumption, and ASAP.

I agree with Ron that peak exports likely coincided closely with peak oil.

This is kind of a maximum likelihood or maximum entropy argument -- given no other knowledge than the mean yearly production, the most likely estimate for any "derivative" of production (in the sense of a related measure to production) will line up with that peak. In proportional terms, a higher peak with a roughly constant proportional export will also reach a peak at the same time.

Perhaps a call to action is timely....

Statement by Dr. James E. Hansen

Freedom Plaza:

Equal Protection of the Laws

We hold this truth to be self evident – all people are created equal. That truth is the basis for equal protection of the laws – a right guaranteed by our Constitution. "All people" includes young people, mountain people, poor people.

Our government was instituted to protect the rights of all people.

We are gathered here today to draw attention to the failure of our government to protect the rights of the people, and failure to provide equal protection of the laws. People have suffered a long train of abuses, invariably with the same objective – to enrich the few at the expense of the many.

First, the government is failing to protect the future of young people, knowingly allowing and even subsidizing actions that benefit the few at the expense of the public and at the expense of all life sharing this Earth.

Second, the legislative and executive branches of government knowingly propose actions that demonstrably and utterly fail to preserve our climate, and the environment for life.

Third, our government allows and contributes to a great hoax, perpetrated on the public by moneyed interests, aimed at confusing the public about the reality of climate change.

We are in danger of becoming the land for the rich and the home of the bribe.

More than 200 years after the founding of our nation, we face a great moral crisis. Human-made climate change pits the rich and powerful against the young and unborn, against the defenseless, and against nature. The moral issue is comparable to slavery and civil rights.

Solution for civil rights was provided by the combination of people in the streets and the courts, which provided equal protection of the laws and ordered desegregation.

Brave people have been standing up in West Virginia, in Kentucky, in Tennessee, in Utah, in Australia, in the United Kingdom, around the world.

But now is the time to go on the offensive. We should not be begging courts to forgive the brave people who protest. We must ask the courts to order the government to present plans to phase down fossil fuel emissions at a pace dictated by science, a pace stabilizing climate, preserving nature and a future for young people, providing young people equal protection of the laws.

We can bring that case. But we can win only if the public understands the situation, sees through the lies of the moneyed interests, sees what is needed to solve the problem.

As long as fossil fuels are the cheapest energy, we will not solve the addiction. There will be more mountaintop removal, longwall mining, tar sands, deep ocean drilling, shale gas, seeking the last drop in the most pristine places.

We must put a fee on carbon, collected from fossil fuel companies, with all proceeds distributed to the public. One hundred percent or fight! Most people will get more in the monthly green check than they pay in increased energy prices. Our economy and innovations will be stimulated. We will move to clean energies.

A coalition is building for a carbon fee with 100 percent distributed to the public in a monthly check. In October this coalition will launch a campaign, Million Letter March, gathering letters showing that the people insist on an honest equitable solution. Please join the March.

Let us resolve to have a rebirth – a rebirth of our nation, a rebirth of equality of opportunity, true equality -- with a government of the people, by the people and for the people – all of the people.

I have the utmost respect for Dr James Hansen. He is absolutely correct about the tax / green check on fossil fuels, and not just about the climate benefits. If we continue to use the fossil fuel energy surplus on hummers instead of wind turbines or solar panels until the day before the collapse, we are simply digging humanity's grave alongside the oil wells and coal mines. A stiff carbon tax is really all that is needed for private enterprise to provide the solutions which can make the hard landing more survivable.

Thank you Steve!

Yes a call to real action is timely indeed. Unfortunately what with the Glen Becks, Sarah Palins Rush Limbaughs Faux News and the ignorant but vocal Tea Partiers I think the small minority who actually understand the severity of the crisis and the forces that are coalesced against reality and sanity are in for a real struggle. I don't have a clue what the future holds for me personally but I'm ready for a monumental paradigm shift that is coming to a neighbor near everyone of us.

This is what we are up against: http://www.rollingstone.com/politics/news/17390/210904

Does anyone think these people even care about anthropogenic climate change, peak oil or can grasp

the consequences of continued population growth.

Our government was instituted to protect the rights of all people.

I don't know about that. Private property defined citizenship back in the day the constitution was written. Protection of property ownership is a huge part of the nuts and bolts of the constitution. The 'all people are created equal' in reality was only refering to male citizens (which all of the framers were) and in most of the framer's eyes that phrase just knocked down supposed 'divine right' monarchs and the like to same class of propertied male citizens to which the framer's themselves belonged.

Now citizenship is somewhat less narrowly defined these days, and property is defined far more broadly. You want to win in court.. showing damage to property is about as tried and true as it gets. It may seem banal to break down all those lofty ideals to property concepts but precious little useful work gets done around here unless property is involved.

Lets not be bashful,

This stupit country of ours(Ireland) went on a property buying spree with all of europe's money so when we default it will be like Iceland. It will be all the german pensions funds ect that will take the hit. When it finishes we will still have enough land to feed ourselves and 75% of Eu fishing waters. And the best wind resorce in europe. Also enough gas for power if we ever get it ashore from Corrib field.

it might be rough but we wont starve. The same cant be said for most of europe.

Hey!!!

I live in the U.S.........

Who can be more dumb than us?

We borrow and spend, live way beyond our means, and have a country that revolves entirely around cars.

We have no real mass transportation to speak of, and doubling or tripling the gas tax is not in the cards.

Some counter-arguments to think about:

- the agricultural sector is heavily dependent on inputs (one of the highest levels of application of nitrates in the EU)

- the ag sector is heavily tilted towards livestock etc, not easily or quickly turned to tillage

- eu subsidies (single payment etc) likely to dry up in the future

- climate change already causing reliability problems for traditional crops (flooded spud fields, washed-out grain)

- credit increasingly difficult for wind (energy price volatility)

- corrib gas will be sold "at market prices" (EUR or STG? or NOK?)

- visit killybegs and la coruna - compare the fleet sizes. big difference.

Teagasc supposedly have an emergency plan to convert all the urban green-spaces to allotments, but i'm not sure about stockpiles of spades, fertilizer and seeds ....

Hi Rib,

About 6 years ago, on a Western Ireland bicycle trip, I stopped in a pub in Leenane (Co. Galway) and talked for a bit with an elderly gentleman. He predicted the current situation in remarkable detail. I often wondered if it was just the Guinness or if he really was knowledgeable.

On future tours, I remember thinking that if I sold everything I owned in the States, I could buy a tiny lot and house in Ireland - not a good deal!

But, I still think that Western Ireland is one of the greatest places in the world (finances aside).

It might be interesting that Switzerland (not EU) is also in the 56% oil fraction category

but does for the moment relatively well. However, the question is for how long this ``island in the sun"

condition can continue.

Switzerland has a strong financial sector that will "extend and pretend" as long as they can and hide the truth for a bit longer until the house of cards collapses.

DD

A little googling tells me that Switzerland uses little coal, and a modest but growing amount of N gas. Elec generation seems to be mostly nuclear and hydro.

How is the oil use allocated between personal transportation, freight, home heating, etc?

hi,

the oil in Switzerland used to be divided roughly half in "heating" needs and

``transportation" needs. Now the heating needs (in actually i would say on average

excellently isolated housing) are substituted by gas 12%

thus the 2009 number says 21.7% for heating needs and 33.4% for transport needs.

(which together make the 55.1% oil use)

electric energy is 23.6% (40% nuclear and 55% hydropower (in fact if imported

nuclear pumped hydropower would be counted as nuclear it is more like 50% and 50% each)

Actually nicely presented every year here:

http://www.bfe.admin.ch/themen/00526/00541/00542/00631/index.html?lang=e...

Thanks. Unfortunately, few or none of the detailed reports are in english, but with online translation I'm making progress....

I'm interested to see that flat oil consumption hides another dynamic: transport is expanding reasonably quickly, while fuel oil (all for home heating?) is falling.

yes, i find that very interesting as well.

the transport use of oil has expanded enormously in Switzerland

(one can see it also on the streets.. bigger cars and many families have two cars now

like us one bigger family type one and one small etc the average km per liter has evolved a little down

but in reality the effect is kind of hidden by the "average" it seems.).

for the heating a big effort was done in Switzerland as far as I can see it..

michael

Note that Sam Foucher's mean and median predictions both seem to show production going down about now.

The actual numbers going up or down a bit as far as total production or imports are probably not even all that relevant in the very short term;any strong economic recovery will more than likely cause prices to spike sharply even if production and exports are still rising a little bit.

The really serious effects will only be felt some months or years down the road, as prices are bid up by buyers chasing falling supplies regardless of the state of the economy.

Demand destruction in my opinion simply cannot outrun declining production for very long.

But once the world does finally recognize the supply problem, it is going to knock economic confidence out for the count.Then we get the viscious circle of un welcome feedbacks for real.

The figures show only trends. The "crying wolf" comments above have some merit. It's logically possible we'll have a new peak. I don't think so personally, but I can't prove it in the same way I could predict the trajectory of something I threw into the air.

Some guy from Texas went into one on a thread on a Swiss Forum about how it couldn't be proved that there was going to be a Peak Oil anytime soon. It's difficult to argue him down as my point of view is the result of a few years reading posts on this site and media articles pointed at from Drumbeat. It's not like I can scribble down a theorem and add QED.

Even if peak exports have come and gone, and literal peak production is upon us, continuing to report on overall production and projections are still vitally important, as it provides a means to show "where we are and where we are going". Massive lifestyle changes (whether voluntary, imposed, and unavoidable) will affect demand, and communicating national/state/county/city/neighborhood/individual mitigations are as important as ever. Woulda/coulda/shoulda would not be constructive, of course

TOD's focus could continue to shift from "look at what's coming" to "now that it's happened, here's what you can do".

I have a problem with 'what you can do'. In my opinion, far too much of the 'what you can do' that I have seen is quite unrealistic, and would tarnish the credibility of TOD. That would weaken the 'now it's happening' message.

I don't have an alternative suggestion, just a whine about this one.

Specifically, which TOD articles are you referring to? Let's be clear that it's the articles I'm talking about, not 100% of the comments.

TOD has already started switching focus. That is why there is so much doom here compared to the past. Nate's recent campfire post was an indication of this, a reaction to the shift from the theories of a peak to the realities of the peak.

I do not want to be a doomer. I really, really don't. It is hard to make new friends. But with ~7,000,000 humans about to start coping with resource constraints it is very hard not to be a doomer. Every time you think you see a solution to any one of our problems the foundational problem of massive overshoot reminds you that solutions are just another form of denial.

DD

Not to nitpick but you are three zeros short. The figure should be 7,000,000,000. That's a lot of people. But you are right on target. People keep trying to figure a way to support seven billion people as fossil energy declines. There is simply no way.

The problem is overshoot. There is simply no cure for overshoot, not even more fossil energy. That would only add to the overshoot and make the misery much more intense when the collapse finally arrives.

Ron P.

Whoops! Thanks Ron! ;-)

DD

There are cures and then there are cures. Russia has found one way to reduce population which is rather self selecting. As oil induced affluence starts to recede around the world there will be far less intervention by do-gooders determined to save every poor starving wretch and natural causes will do what they have always done to populations in overshoot.

While I am totally against any form of "active" population reduction measures, I think we need to really consider the whole ethical and philosophical basis of medical intervention which could include the movement of food beyond its own region of production. Populations need to reach regional sustainability and actively manage the demographic dynamics that comes with a stable population.

Once the supply system breaks down I think population, at least in the first world countries will dive very fast. People simply do not know how to take care of themselves anymore without retail stores to supply their needs. I suspect that large cities will have people starve to death or kill each other off over spoils within a matter of a couple of months. People that have kept a connection to the land will be playing roulette avoiding roving bands looking for anything to devour. Growing a crop within the first year or so will be nearly impossible. Wild game is going to be hunted to near if not total extinction. Farm animals will disappear as quickly as humans. Do I get an A in Doomer 101?

I tend to agree. The most vulnerable to oil decline are actaully the developed countries but the effects will not be evenly distributed. Developing countries will also suffer but probably on a much longer horizon as the industrial services of the developed world are withdrawn. Poor people in developing countries are not as dependent on these services so their adjustments will be proportionally less and therfore far less socially disruptive. I'm not saying that there aren't massive problems in developing countries already, just that the change won't be as noticeable. The developed world however will find the adjustment much harder, even for those of us who have been aware of this problem and making individual preparations for some time.

@Termoil

I tend to agree But the developed world can afford the high prices for longer. There is also more slack in our systems and they are not efficient.

Perhaps the develpoed world only need hang on for longer than the developing countries.

Perhaps we could make our systems more efficient or even radically change our lifestyles by owning only the one car etc.

Perhaps the developing world could make themselves more efficient by having only the one meal per day.

I think governments in developed countries will organize massively to help----kind of like a bailout, but with food and medicine. Already the "free market" no longer really exists as of 2008, and what-----about 40 million Americans are on food stamps----so it is not such a stretch. I think this kind of basic assistance could go on for a long time (years) and it could be effective at keeping relatively young and healthy people alive while everyone reorganizes the world into a sun-based economy again. But sick people or older people might have more trouble staying alive for as long as before. Birthrates will be low, I think. People will be very serious about thinking long-term. Cities will get emptier. I think it doesn`t have to be such a cataclysm....in fact, I think some governments are working to try to make sure that it won`t be.

I personally believe mitigations exist on the small to medium scale (individual to town) that could make the transition less problematic. Will this work for 7 billion people? Highly doubtful.

Watch out there's a wolf at the door!

Luis, with OPEC spare capacity reported to be in the vicinity of 5 mmbpd (happy to adjust that down a bit to take into account heavy sour) how can we be at peak?

Fire away.

€

Chart lifted from Rembrandt's August oil watch monthly.

ME OPEC production is down and rig count is down, they just don't seem to be trying that hard, and why should they, more oil, lower price:

Source Baker Hughes

http://investor.shareholder.com/bhi/rig_counts/rc_index.cfm

The real problem for Europe is our very high dependence on imported oil - I got a shock when I plotted this:

Source BP 2010

Is there any more reason to believe Saudi Arabia's reported spare capacity than there is to believe Saudi Arabia's proven reserves?

We do not know. However, there are reports that floating storage has been largely drawn down, and there is no indication of increased output from OPEC in the last couple of months to balance the 0.5 mbpd implied shortfall of supply that would result. BRIC oil demand growth (particularly China) is showing no signs of slowing, so we may see a firm test of this spare capacity in the next few months.

Unless, of course, OECD economies re-enter recession.

I can't figure out which is worse: They have more oil, or they have less oil?

I have read here at TOD that KSA total capacity is now 12 million barrels per day and the above graph shows that its spare capacity is about 3.8 mbd. Since neither of these figures can be varified (KSA does not allow many details of their production to be made public, and will not allow any third party audits or reviews of these claims) these figures are suspect. Furthermore, because the increase in capacity of over 2 mbd has occured over the last two or three years, the time required to implement this spare capacity (more than just openning valves) may be many months or a few years. Also the question of reservior damage may be an issue with pumping some of these fields at maximum capacity with EOR techniques.

The only way to test KSA's ability to produce as promised is if prices spike to $100 or $120 per barrel and see if their production increases 2 or 3 mbd. If then they do not ramp up production to lower prices, their spare capacity claim is mostly bull sh*t.

Saudi net oil export numbers per day by year, versus average annual US spot crude oil prices (EIA):

2002: 7.1 mbpd & $26

2003: 8.3 mbpd & $31

2004: 8.6 mbpd & $42

2005: 9.1 mbpd & $57

2006: 8.4 mbpd & $66

2007: 8.0 mbpd & $72

2008: 8.4 mbpd & $100

What's interesting is that the Saudis increased their net oil exports from 7.1 mbpd in 2002 to 9.1 mbpd in 2005, in response to annual oil prices rising from $26 in 2002 to $57 in 2005, but then they "voluntarily" cut their net exports from 9.1 mbpd in 2005 to 8.4 mbpd in 2008, in response to annual oil prices rising from $57 in 2005 to $100 in 2008.

Some of us 'round these parts think that the Saudi's "voluntary" cuts after 2005 (especially 2005 to 2008) are analogous to the "voluntary" cuts in Texas oil production after 1972.

I can see the logic of that argument but I can also see an alternative viewpoint where the Saudis realised they could make as much or more money from pumping less oil. IIRC, the futures market in mid 2008 were pointing to much higher priced oil, meaning it was worth more in the ground than as production. Different story today and the Saudis may still be licking their wounds from investment losses of the GFC, which they realise was linked to $147/bbl. The reasonably stable price band this year may indicate the sweet spot that maximises revenue for oil producers, keeps OECD economies stable, (which protects Saudi Investments and demand) and still allows China to grow, which is important for geo-political stability.

I don't doubt that the Saudis are as shifty as rattlesnakes, but I don't believe they are fools either. I think they understand they are in the drivers seat, but that doesn't mean that they alone can choose the destination or drive in a manner dangerous to the the other passengers along for the ride.

I have always thought that way as well. Their output depends on their surplus revenue requirements more than anything else. I agree they will have thought through the price/production parabola and made a decision. However as their population, Royal and ordinary, rise rapidly; their choices diminish. When they need every penny of earnings, their production will be flat out.

But's let's look at Saudi exports tracked into IEA/OECD countries

Yes the sum of Saudi oil exports (IEA data) to places where the flow could be tracked reliably peaked in 2003 (Light peaked in 2002). But we are supposed to believe that Saudi Arabia actually increased production/exports through 2005 but sent all that increase and more only to countries where it could not be tracked by the IEA.

It is interesting to look at the area under these curves, by

seeing the daily, and annual, cash flows they represent

That is some serious wealth transfer going on here, and even as

exports fell 2005/6/7, the revenue still climbed.

It shows the Billions in motivation, to lower exposure to oil.

Euan, that EIA graph can't be trusted, because it says spare capacity never dropped below 1 million bpd even in summer 2008. Capacity being idled when the price was $147/barrel? I think not! So that suggests current spare capacity should be corrected to 4, not 5 million bpd.

The pie chart of European oil sources is interesting. I see you reference BP 2010 - presumably their Statistical Review of World Energy - so I assume that the definition of "Europe" is as per that source. I.e. not the EU: Baltic states are excluded, whilst Switzerland & Norway are included. I'm not sure whether Overseas Territories are included, though I don't suppose Martinique and the Falklands make much difference.

The average annual oil price to date for 2010 exceeds all prior annual oil prices, except for 2008, when we averaged $100. IMO, the small amount of excess capacity in the world consists largely of what Matt Simmons called "Oil stained brine."

Saudi Arabia has a few vast sour heavy crude oil fields - Safaniyah is the largest- that lie idle cos there's insufficient refining capacity for that class of crude. So they easliy had >1 mmbpd spare at peak price. If you look at the spare capacity chart it actually follows price developments quite well in recent years - pinches in spare capacity corresponding to high price.

My view is that if no-one can use it, then it isn't spare capacity. Say I drill 4 subsea wells and tie them back with a 10" pipeline designed for a maximum throughput of 60000bpd. If each well is capable of 20000bpd, does that mean my field has a production capacity of 80000bpd?? No, of course not.

OK, we could go through a debottlenecking exercise, and get the pipeline uprated to 80000bpd, but that takes time. Until then, the production capacity should correctly be stated as 60000bpd.

So you are agreeing with me?

Maybe. 4 million bpd spare capacity might be right, though I suspect it's still an overestimate.

More like 2 Million bpd. I wonder what will happen when Mexico goes away as an exporter.

How meaningful is it to talk about spare production capacity if there's no refining capacity to deal with it? Is this capacity truly likely to be put into production before such refineries are built? Are there any plans to build such refineries?

After all, what matters in the end is the rate at which oil products reach the market.

Europe = old west + old east excluding former yugoslavia and former soviet republics, and yes including Norway and Switzerland.

Euan!

You present Middle East rig count, but what about the Saudi-Arabian?

How to interpret this development? The number rises dramatically during the years 2005 and 2006 from between 10 and 20 in the preceeding period. Then have sort of a plateau at or above 50. Starts to drop below 50 in december 2008. And is now just about 30. (Source: Baker Hughes) The most obvious interpretation would be that they are very comfortable with their production capacity. Other interpretations?

/ Jan

P.S. And how do you include a figure in your comment.

D.S.

You need to upload the figure to a server somewhere (Flicker?) and then use HTML code in your comment to view it. I'm using a Mac and Safari that lets me view source code for web pages - can't paste it here cos its HTML and gets interpreted - maybe someone else can help?

Euan!

Are there (lots of) servers available that you may use for this purpose (free of charge)? Can you mention any?

If doing it this way is standard procedure (in HTML) I will try to find out how to do it!

I use a "Flickr" account for my pics, but I get that through my ISP (you might have to pay) - google to search for free services.

e.g.

To input that I used:

img src="http://farm5.static.flickr.com/4113/5003942982_3e9e5e73f4.jpg" width="166" height="73"

surrounded by < and > You can change the width/height settings as needed, or just don't include them to show graphs as big as they are (That graph is scaled down by 1/3 from original size). Always use preview when posting to make sure you've not fouled up.

Chris R!

Thanx, maybe I sort of (just about)understands this now!

/ Jan

There are always many alternative explanations when background facts are so sparse.

I am particularly skeptical of the inference that they are 'comfortable' with the current situation. Perhaps their planning experts believe that the cost of further drilling will never be recovered. World oil trade will collapse and they will have only their own local oil market to supply.

But they have also abandoned projects to make their country self-sufficient in food production, so it is really hard for me to see how they can be comfortable about their future.

Is there an Islamic analog to the Christian idea of final days and rapture? Maybe they are comfortable with that. If it exists.

Now I always mix up shia and sunni because their names are so similar. But anyhow, the version of islam present in Iran has such an idea. Historically, they had 11 great imams. Now there is a prophecy about the coming of the 12:th imam, and when he come, he will kick infidel asses all day long. Mahmoud Ahmadinejad is a firm believer that this 12:th imam will come early next week,or so. Surpriced he is building nukes to bomb Israel? After all, the 12:th imam will come any day now, so they will get away with nuking the jews away. Add door knocking, and remove nukes, and you get islams reply to Jehovas Witneses.

But I know of no such belief system in the Saudi version of islam, wich is of the other kind. Although islam as a whole has a prophecy of a big war at the end of days, present in all branches of islam.

Here's another one, http://www.energybulletin.net/node/38327 , where Henry Groppe argues that the IEA caused the large price swing of 08 since they were predicting far more added oil to the market from the OECD than occurred. And the Saudi's apparently believed them and did not scale up more oil for it.

Interesting to note in this article that Henry predicts an oil price of $65-$85 until mid decade and that Saudi Arabia can maintain an oil output of 8-9.5 mb/d for up to 20 years.

Well, here is the figure I referred to on Saudi-Arabian rig count.

As implied before, at least lately they seem to be in no hurry to increase production. But, maybe that is a misinterpretation!?

Elm, happy you got your htmling fixed - I agree this shows no crisis now in oil production, but there was one starting in 03/04 and it way / will return. Long time lags for price signal to work through system.

Long time lags for price signal to work through system.

But do the Saudi's do their planning based on price signals? They seem a little more foresighted than that.

Looking at rig count data, in 04 they were in panic mode, probably because of watering out in N and then S Aindar. But they will have learned lessons from that. Eventually geology will catch up with their foresight.

Hi there €uan, nice to have an objective question.

Saudi Arabia crude production is merely 1.5 Mb/d below what it was in the first half of 2008 when prices hit 147 $/barrel. There are good reasons to belive that real spare capacity is well below declared figures, as Rune recently pointed out.

Will we ever see a monthly petroleum production figure above the maximum moratorium of June 2008? Possibly. Will it make a difference? I doubt so, we should keep stranded inside the yellow band in Samuel's graph. The 2004-2008 price rampage, the so called Financial Crisis, are all but developing episodes of the peak, or more precisely the undulating plateau, when periods of supply destruction succeed periods of demand destruction.

Remembering the words of the late Ali Bakhtiari, the 2004-2008 period was the Transition 1 phase - a rather beneficial time when price rises had little impact on our lives. The Economic crisis we are now living is Transition 2 - when most of us reading these lines are feeling on our skins the effects of the end of cheap growth. Following comes Transition 3 - a time I envision to be prompted by new commodities' prices increases with still high unemployment figures and low (or negative) economic growth; some of the things we are used to may simply became inaccessible.

Transition 3 will in its turn provide the proper environment for Transition 4 - which I hope to be a time of serious commitment from our societies in the OECD to the effective replacement of fossil fuels, finally focusing on crucial sectors like Transport.

Hi £uis, this is the answer I expected , and don't entirely disagree. If the credit crunch continues and demand drops a little bit more and we see $40 (which was my "forecast" last Christmas) then the momentum from $147 will be lost and caution will abound. If QE manages to force economic activity higher near term then I see no problem with a new peak. I'm beginning to think we may hobble side ways for a long time.

I spent a lot of time looking at data this last couple of weeks and am convinced energy efficiency is the route to go (along with nuclear), aim for the OECD to halve per capita energy consumption by 2050. Efficiency actually enables higher prices that will allow more expensive resources to be exploited, hence efficiency is the friend of energy security but the enemy of the climate.

€

Hi €uan & £uis,

£O£! You could have combined the Euro with the Chinese Yuan to get €¥

Best,

ƒred

am convinced energy efficiency is the route to go

I agree that energy efficiency is extremely important. On the other hand, over the longer term (10-25 years) isn't replacement the way to go? That is, electric transportation & HVAC, powered by wind, nuclear and solar?

Quite. Efficiency only cuts fat from the system, it doesn't produce net energy. Eventually, we will have to get off FFs, and you can't be 200% efficient to do that. You have to transition. How and when we do that is anybody's guess. It looks like we're happy with token gestures and no real move from the addiction. This won't end well.

Token gestures or talk about breaking our addiction won't matter at all unless we seriously start dealing with the planet's population and this ridiculous notion that we must have economic growth at any cost, even if that cost means destroying our planet's life support systems. Are we all idiots or what? Don't answer that, it was purely a rhetorical question.

Re population I agree - but what to do? There are so many dilemmas and contradictions in human society.

Population is certainly our greatest challenge. But, birth rates are declining almost everywhere. Will they decline quickly enough? Remember the whole of South-East Asia with its enourmous population already has very low birth-rates as does Europe. Even the birth rates in India and Bangladesh are falling rapidly. The total fertility rate in India/Bangladesh is now 2.65 drastically down in just the last decade (CIA factbook). I used to be very, very pessimistic. Now I'm only a bit pessimistic. (With regard to population - With regard to everything else I'm an optimist!)

Luckily there are some pretty big "token" gestures out there. Such as Sweden being on the way to carbon free economy by 2020. Others will follow and it will probably end well.

Perhaps Sweden will reach a carbon free economy on its schedule. Perhaps. But, IMHO, they likely will have abandoned almost all of their charitable efforts throughout the rest of the World. Lives will be stunted by want and poverty, at least somewhere. In different local areas throughout the world events will happen unknown to people elsewhere in the world. After a while, those who suffer will die. But somewhere, and in many different places, there will be survivors, and children of survivors. The children will know nothing of the terrible times that happened elsewhere. There will be enough of these children of survivors to carry on at a level of civilization that will be much better than the condition of the homo primates of a few hundred thousand years ago. I suppose this can be called 'ending well'.

Man, you guys with your extremes.

I agree that some will do a great deal to prepare (or continue preparing), and they may see an easier time of it. Others might just find, like the Grasshopper vs the Ant, that they simply live in a part of the world that will support them pretty much as before..

and then there will be 'other' places which we can already see are so immensely overpacked with hungry mouths and too-few workable farms or fisheries.. and in many of these, will could easily see some very bad endings, as the luckier folks might have to start looking on in horror, without the spare resources to offer much by way of help.

Pakistan and New Orleans look like early shades of the horrible 'choices' by the rest of the world to restrain their generosity.. and it'll be hard to distinquish (after a while) when it was regionalism, racism, simple uncaringness.. or just the lack of enough surplus to do much about it.

Nordic_mist!

Your nick suggests your Nordic. Well I am a Swede. One tend to get a bit tired of all political goals that are proposed and discussed. And not always credible. I for one cannot remember them.

So I went to the governments web-site and checked. Maybe the targets are not quite as ambitious as you state.

http://www.sweden.gov.se/content/1/c6/12/00/88/d353dca5.pdf (page 2)

The Royal Academy of Sciences predicts that Sweden could be almost fossil-free in 40 years.

http://www.kva.se/en/pressroom/Press-releases-2010/Sverige-nastan-fossil...

(I did not find this release in English)

I live in Sweden and let me inform you that this is 100% words and 0% action. The only thing I've seen is a ramp up of wind farms. I live in a town who once got the award "the greenest city in Europe"and they still brag about it. You can see signs by the inroads to the town, "Wellcome to Växjö, the greenest city in Europe". So what do we got here? An extensive and quite efficient buss trafic system, and excellent bicycle roads going everywhere. And also, they want to brand themself as "the trade city", by building malls allover the place, with gigantic parking lots outside for all the cars. Excatly where is this sustainable? Green?

I would love it if it was just this town, but this is the case all over the country. Wind farms, some tax subsidies for "enviornmental cars", we have the largest relative fleet of ethanol blend combustion cars. But all this is just scraping on the surface. The politicians who said we should get off oil in 20 years or so simply don't understand the challenge.

OK Nick, anyone want to correct me if I'm wrong:

ERoEI = energy got / energy used

net energy gain = ERoEI -1

efficiency = net energy / ERoEI

Efficiency of wind (EroEi = 20) = 95%

Coal fired power has ERoEI = 0.36 (36% thermal efficiency) = -180% efficient.

So I conclude what you say is correct.

Happy to have a reasoned debate about this - I already stuck my neck on using this logic.

€

FWIW, wind has an E-ROI that is much higher than that. See Cutler Cleveland's summary of the literature at http://www.eoearth.org/article/Energy_return_on_investment_(EROI)_for_wind_energy which showed that wind's E-ROI was around 19. If you study his sources, you'll see that that most of the studies are quite old. If you look at the turbines used in those studies, you'll see that the turbines studied were much smaller than those in use today - look at Figure 2, and read the discussion. If you study that chart, you'll see a very clear correlation between turbine size and E-ROI. It's perfectly clear that Vesta's claim for a current E-ROI of around 50 is perfectly credible.

Now, I would really like to see coal get replaced ASAP, but I'm puzzled by your analysis of it's E-ROI: you're talking about a conversion to a higher quality form of energy, which is about 3x more useful. We can see just how much more useful electricity is from the fact that this conversion is reversible: we can take 1 btu of electricity and get 3 useful btu's of heat with a heat pump.

Of course, the external cost of coal make it much more expensive than wind power: pollution, CO2, occupational safety, slag heaps, radiation emissions, etc, etc.

I'm not sure where that leaves us, but I'm glad we agree.

ah - but that's the next stage of the calculation, of combining efficiencies. A heat pump run on wind will be enormously efficient, run on coal electric, still good but not so great as running on high ERoEI renewable.

€

hmmm. I'm not sure the efficiency argument is useful: wind power "wastes" about 2/3 of the wind that hits the turbine, and the upgrade of energy quality from coal heat to electricity makes the input and output not the same.

I think it's enough that wind is cheaper, clean, locally produced and renewable.

The true question is why do you need so much heat.

NAOM

speaking of heat pumps we are trying something new up here in the far north--recharging the ground with solar hot water in the summer. Its a brand new pilot project in these parts but I'm very interested in seeing how it pans out. If I recall Engineerpoet suggested some sort of ground recharging might make heat pumps feasible in the north a while back--he just didn't elaborate on the solar hot water aspect though it was probably intuitive to him.

you seem to be changing your concept of ERoEI in midstream here when you equate it with thermal efficiency. The actual ERoEI of coal fired power should essentially say how much coal was consumed to get the coal and build the machine that generated the electricity relative to the amount of coal that was actually producing useable end product energy (barrel of oil equivalents are of course acceptable). The thermal efficiency merely states how much of the potential energy available is lost which is a whole different can of worms. Of course a full analysis of ERoEI would seem to require a thorough accounting for all embedded energy and that is a mighty big can of worms in an of itself ?- )

Thanks for making this reply so I didn't have to.

Folks like Charlie Hall estimate the ERoEI of coal to be around 50.

Agree entirely. $40 certainly seems much more likely than $120. Hobbling sideways and perhaps upwards for a bit seems probably.

My forecast here on the Oil Drum from August 2008 when "everybody" else was screaming: "Oil prices will never fall below $100 etc" was that:

"Nordic_mist on August 12, 2008 - 5:20am Permalink | Subthread | Comments top Although I believe that the overall trend for Oil Prices will be up for the next couple of years at least, I also believe that the price spike up to 145 USD was in fact caused largely by the weakening dollar and a general rush into commodities. Remember, it is not long ago that the price of oil was at 55 USD/BBL. A steady upward trend would suggest a price of about 80-90 USD now. I therefore suspect that oil prices will fall back to about 80-90 USD/BBL and then continue to gradually trend upwards. Incidentally I believe the floor is at about this level due to increasing lift costs/bbl."

Ok. I didn't get it quite right. By the way on August 12th the oil price was about $115 and the following was the result of the Oil Drum poll:

http://www.theoildrum.com/node/4397

Do you remember your prediction at the time Euan? Just in case you have forgotten it was: "I voted 102-126 this time. Thinking we are close to bottom."

Well. Guess it depends on your definition of close! Won't hold that against you for a minute but it just shows how difficult it is to predict the future of oil prices. :-)

The question we have all tried to tease out here is when new finds and discoveries placed into production can no longer replace what is being used on a permanent basis. We know that time is near and may even be in the past for conventional oil(eg 2005/2008). 5 MB/day spare capacity plus some new production coming on line in a world of 5% overall declining fields leaves us with about 1.5 years. Maybe more. Hopefully not less.

I look at the price of gasoline and think of it as a gauge. If it goes too high, we have not produced enough **and** more importantly, we have not progressed far enough with implementing alternatives. If it goes lower, maybe we have more time to prepare. For me, that is getting my electric vehicle on the road, adding solar hot water to the house followed by additional solar and conservation based and food growing initiatives. I'm optimistic about EVs and solar power. I'm not too optimistic about being a farmer when most farmers my age are thinking of retiring. I know I can telecommute. There is fat in the system. There has to be a **concerted** effort to abandon non sustainable BAU for the next paradigm and I see that effort growing.

Let me see if I get this right;

In 2007 average (annual) oil price was $72/Bbl and world annual oil (all liquids) supply was 84,5 Mb/d.

OPEC supply in 2007 was 34,4 Mb/d (all liquids) and OPEC net exports of 28,5 Mb/d which was a decline of 1,3 Mb/d since 2005 when oil price (Brent) was $54/Bbl.

Was OPEC holding back marketable capacity these years to support a price growth or was OPEC running flat out?

Is there a relation between OPEC oil spare capacity and oil price?

First 6 months of 2010 world oil supply at 86,0 Mb/d, OPEC supply at 34,4 Mb/d (0,6 Mb/d is growth in OPEC lease condensates and NGLs) average oil price (first 6 months of 2010) $77/Bbl.

Non OPEC supply grew with 1,3 Mb/d from 2007 and as of the first 6 months of 2010.

Yes, it may be that OPEC has 5 Mb/d of spare marketable oil capacity; question is when was that developed? And what fields? To make the estimate complete we need to establish at what rate OPEC capacity is declining….after all we are now more than 2 years past July 2008.

Rooone, ME OPEC production does not decline in the same way that mortal fields decline. With supergiants you drive up the road and drill new wells to keep production going - that is until you run out of dry oil areas to drill. Hence link between rig count and production. Sure, in mortal areas like the north sea and Texas, once decline really takes hold, increasing rig count makes little difference. But KSA is not yet at that stage.

Relationship between OPEC spare capacity and price is clouded by discipline. When the spare capacity is low and price is high, discipline doesn't come into equation. When spare capacity is high then it dose. With increasing transfer of control to KSA (Kingdom Saudi Arabia) they have greater power to maintain discipline.

Non - OPEC supply growing, KSA is withholding more and more capacity. Actually doing us all a favor since dumping oil price will kill swathe of OECD new projects. System is finely balanced. KSA is very clever at keeping global oil industry alive.

Yoooooooooon,

So how do you explain that OPEC now has around 50 % (IIRC) compliance to present quotas?

Angola is way over its quota and some OPEC members have recently proposed to adjust quotas upwards.

How would you characterize present oil price of $80/Bbl, high or low?

According to the most recent data from EIA supply from KSA is growing, ref the chart above.

Supply from 9 other OPEC members running flat, and some countries are in decline.

More in my post Global Oil Supplies as Reported by EIA's International Petroleum Monthly for September 2010.

Euan - Not that I disagree with your general premise but my old Texas fields have benefited significantly over the last 40 years by increasing rig counts. It may be difficult to appreciate given the long time frame and relatively small (though not always) incremental gains. And at times it wasn't a drill rig increase but a workover rig increase that made the difference...another reason it's difficult to pick up such activities. A good example was in the early 70's when new recompletion techniques significantly increased production in 20+ year old fields. I saw old field rates increase from 200 bopd to 5,000 bopd over the course of a couple of years. A lot of enhanced recovery methods in west Texas required a lot of new holes drilled but this was done over decades so it doesn't tend to jump out at you.

But this history does point out a very different path we'll see on the downslide of ME (and most of the rest of the globe) production vs. the US IMHO. For the first 30 years of my career beating new production out of old fields has been my primary business. And it was done almost exclusively for small (and sometimes very small) independent companies. The majors did the same on their big heritage fields but cumulatively it's been the small companies making the gains. These efforts, though profitable, were labor intensive. This this is what we haven't seen in the rest of the world for the most part. The KSA can drill a new horizontal well and add 3,000 bopd. But a group of small US companies can do 1,000 work overs and add 10,000 bopd. But no one notices those efforts. The NOC's don't appear to have the ability/desire to work at this level. They may in time and provide a fatter tail than some project, but I think that potential gain is rather speculative. Thus I'm not sure if comparing US production history to future global declines is very instructive. The N Sea history may be more pertinent but the added complication there is the high operational costs of producing offshore vs. relatively cheap onshore ME ops.

I'm not sure how I would model the future global decline profile but my instincts tell me it will be very different from what we've seen in the US over the last 60 years.

Rockman: I agree with your general idea, but big companies, at least in US onshore fields, do the same thing. When I worked Prudhoe back in the late '80s everyone thought it would be done by now, but it is still making a lot of oil. I've been told that something like 40% of current Prudhoe production comes from wells that have either been drilled (short coil sidetracks mostly) or had a workover in the last 4 years. That trend has been happening for quite awhile. Prudhoe is in decline for sure, but this activity definately fattens the tail substantially. It is expensive and labor intensive.

I totally agree.

geo - Actually Prudhoe makes my point...I think. You probably have a better handle it it then me: when was the last time that you saw them bragging about bringing on a 20 bopd workover in Prudhoe? As you say about the costs of operating up there: when the big boys are finished getting the bulk out are we going to see a bunch of little companies doing 100's of 10 bopd recompletions/workovers? In that sense Prudhoe may serve as a better example of the future ME ops.

But that was my point: you and I can pull up tens of thousands of wells doing less than 10 bopd because the tiny operators make a decent living off of them. I just don't see the KSA spending a lot of time doing 5 bopd workovers anytime soon...if ever. That's all I was trying to get across...nothing earth shattering. I suspect a better model for future global declies would be to study some country with a well documented PO in which the NOC called the shots. Not all NOC's function exactly the same but I suspect none have ever behaved in a manner similar to small US independents.

Rock,

I thought I was agreeing with you, more or less? I was just pointing out that a similar thing is happening, at a slightly larger scale in legacy fields in North America. I'll have to ask around, but I think in Prudhoe they do workovers to gain as little as a couple of hundred bbls/day. Just your stripper well example but multiplied times 10 to account for higher costs due to the remote location. It would be interesting to hear what is happening in some of the old big California fields, such as Long Beach?

As far as I know, NOC's don't do that sort of thing, but then I'm pretty far out of the loop about them.

I did think you were but I like over selling sometimes. LOL. I haven't looked at the old legact fields in Texas for a while especially west texas but I think many of the majors have sold off their interests some time ago.

A couple of hundred bopd!!!! That's sounds like early retirement to me. LOL

Good question, but it underlines the folly of efforts to Peak Oil Spot.

As no one grossly overproduces oil, oil numbers are a measure of consumption (also at that price point), and recent numbers do show Consumption certainly HAS peaked.

Big deal.

It does not have to mean the sky is falling; It can mean that alternatives (which includes more prudent use) are ramping quickly enough, to start to impact total demand.

Which is a good sign, as it extends the tail, or half life, of Finite Affordable Fuel

jg - I'll jump in and offer a view that may be just my concept of PO: assume on 1 January 2011 the combined exporters have an excess capacity of 10 million bopd. Perhaps my definition of PO is different than most but that excess capacity has no implication as to whether we've hit PO or not. If on 1 January 2011 the combined rate of actual production + excess capacity is less than it has ever been and then never increases beyond that level then we've passed PO.

And given the uncertainty of the numbers today: if the real excess capacity + actual production today is less than it has ever been and doesn't increase beyond any previous historical rate then we've been at PO for a while. It wouldn't matter if there were 30 million bopd excess capacity today IMHO. OTOH if there were a huge jump in demand and every exporter was producing every bbl possible and there wasn't even 1 bopd extra out there, that wouldn't prove we were at PO either IMHO. Again, perhaps I'm in the minority but PO has nothing to do with consumption or excess capacity. It's simply the max rate oil could be produced on any given day and if that rate is less than it has been historically.

My 2¢ worth. I 'm onboard with this view.

The practical issue of spare capacity guesstimates are not about the peak production value but rather the lifespan of the plateau. If there is a lot of spare capacity kicking about and the price is subject to bitfaltion™ the chances this spare capacity turns up on mass to boost production off the plateau into the stratosphere is unlikely. There is no motivation on the part of those that have it.

The amount of spare capacity is really a measure of how long the plateau of production can be held at the newly optimised post crash price.

The caveat is mega demand from BRIC could possibly boost production upwards if the oil is really is there.

to me the new prediction game is not the peak date but the rear side of the plateau date ..this will be dependent on how accurate these models of managed saudi production are.

Problem with that definition, is that it is totally virtual - the max rate oil could be produced on any given day is impossible to actually prove, plus will vary with time, and to me is less revealing than the area under the curve. - and especially the shape of the tail.

yeah it is. but its not virtual in the sense a omnipresent being with 100% knowledge would know. Or amortal being in the rear view mirror.. we peaked. what is the drop off date?

the shape of the tail is really dictated to a large degree by the amount of spare capacity.

if the peak figure is fire-walled as some think with a glass ceiling controlled in part by those with spare capacity then spare capacity is the metric we need to see the tail

How refreshing someone had the guts to say it that clearly and concisely.

Dear Euan,

Thank you for your sanity among so much total madness and blindness.

Before I am attacked let me mention the following: I have worked in the oil industry for the last 15 years in all areas from down-hole to production. I know the oil patch. I also have good friends in Saudi Arabia and other countries in the Middle East. I also know Brazil very well.

And before I am attacked with even more venom: I am fully aware that extracting oil is getting more expensive.

BUT: You have to be religous. A complete fanatic in fact to be able to extrapolate the World Production in the way that Luis does. Here we have a clearly rising trend of production with a few bumps during the financial crisis. To be able to produce the absolutely hilarious "mean" and "median" predictions from that trend is incredible. It is almost incredible as saying that a few years without a rise in production proves beyond all doubt that we are on an "undulating plateau" and oil production will fall from now on.

Let me be totally clear: There is LOADS of spare capacity out there.

Saudi Arabia: Huge areas have not even been prospected thoroughly. Several fields are ready to produce but have been left while Ghawar still produces. No hurry. No point in collapsing oil prices.

Brazil: Oil production will be rising for the forseable future. There are new finds being made on almost a monthly basis both by Petrobras and by OGX.

Iraq: Oil production will be rising for the forseable future. Hardly any drilling has taken place in the West of Iraq and it seems probable that there are vast reserves still to be found in that area.

Ghana: Just starting oil production and production will be rising for the forseable future.

Look. Stop the silliness. Let's focus on the important stuff: Reducing carbon emissions, reducing pollution both global and local. There are many very good reasons to replace oil (and gas) as soon as possible. In fact, we are doing so very rapidly already - so there may, just possibly, not be a huge increase in oil production going forward. But make no mistake about it. It will be due to DEMAND falling. Not due to there not being available supplies.

ps. I fully accept that at some point there will be peak oil and that there are limited supplies of hydrocarbons on the planet. But are we at the peak now? Hell no.

And don't forget the excess capacity in Texas and the North Sea. The following graph lines up the point in time when Texas producers started increasing their excess productive capacity (1972, Blue) with the point in time when North Sea producers elected to start increasing their excess productive capacity (1999, Black). Curiously, the initial voluntary cuts in production in both cases corresponded to sharply rising oil prices.

And we saw similar voluntary reductions in global crude oil production in the 2006 to 2008 time frame, in response to rising oil prices, with a cumulative shortfall in production, between what we would have produced at the 2005 rate and what was actually produced (EIA, C+C), also, curiously enough, in response to rising annual oil prices (from $57 in 2005 to $100 on 2008).

In any case, no worries, Party on!

What a perfect example of using "data that fits my thesis". Yes. Oil production fell in Texas and is currently falling in the North Sea. But of course you would also agree no doubt that US Oil Production is currently increasing and has been doing so since 2006 (Rembrandt Oilwatch Monthly). I'm not saying there will be a new peak. There probabaly won't. But there still very well might be!I also guess that you argued that Brazil was on an undulating plateau from 1985 to 1990 (It was as a matter of fact). But of course since then Brazilian oil production has trippled - and it now seems likely that it will tripple again. In short: Using the fact that oil production somewhere in the world has peaked - or stopped rising - as "proof" that the world has peaked is just silly.

Perhaps the fact that total global annual crude oil production has (so far at least) not exceeded the 2005 rate for four years and for 2010 to date might be meaningful--while it looks like four of the five years will show year over year increases in oil prices. Curiously, this is in marked contrast to the sharp increase in global crude oil production from 2002 to 2005, in response to rising oil prices.

Note that if we look at oil fields in the North Sea whose first full year of production was in 1999 or later, these "Post-Peak" oil fields had their own peak in 2005, at about one mbpd (versus a 1999 peak of about 6 mbpd). So the fact that new fields were coming on line, as the region peaked, didn't mean that the region had not peaked.

I'm not arguing that North Sea oil production is not falling. It most certainly is. Until an elephant or two is found it will keep declining. And that isn't very likely. However, Norway's oil production might possibly start rising again due to finds in other areas. (But obviously this won't affect production for at least 5-10 years).

You seem to be conflicted between "maybe global oil production will fall soon, maybe it won't".

What would you project the probability that peak oil (peak exports, actually) will occur in this decade? Over 50%? If so, why not pursue measures to mitigate the considerable risks?"

The answer should be obvious, except to those who wish to obfuscate.

I'm mostly sold on the Peak being around now, but am quite unsure as to what the near term (to 2020) will bring (continuation of post-'05 plateau or a drop). When I first learned about this subject I remember thinking 'we'll only be sure of Peak a decade at least after the fact'. I still think that.

However given the importance of oil, I'd say the implications of being at Peak now and facing a subsequent drop is so significant that even 10% risk is enough to justify acting immediately to reduce dependence on oil and enact whatever other attainable options we have (i.e. Damned if I know what to do).

Methinks Nordic_mist does not want to see the truth. I don't blame him/her.

DD

Dear Dan,

Instead of running around being miserable I'm working on a number of projects to reduce our dependence on oil including both renewables projects and energy savings. It will be interesting to see in 2015 who's truth is right. Anyway, predicting the future has always been completely impossible so we'll probably all be wrong when something totally unexpected happens!

On a positive note. If you look back at history you'll find that the new electricity generating capacity in Europe has almost always been totally different than the last. Things do change very quickly. eg. in the 2000's nearly all new generating capacity was from gas (70%) and renewables (30%). Now who would have predicted that in 1995? There'll be a bit of nuclear in the future as well. By the way - A number of European companies are now aiming to exceed their 20-20-20 goals and greatly increase the percentage of renewables in the mix. Add to that the possibility that electric cars (or serial hybrids) are a success and there might be masses of spare capacity of oil production available.

My key point is: Predicting the future is very, very, difficult. And the longer I've been studying energy the HARDER I find it to do. 3.5 years ago when I joined the oil drum I was totally convinced by the immediate peak-oil argument. Now I find it much harder to be. Luckily!

The other important issue is to start working on solutions to replace oil rather than complaining about how the world will go under in a couple of years.

I really hope that you and your comrades at arms can stop screaming wolf and shouting doom and do something to save the environment on the planet and help build a sustainable future.

Have to ask this of all newbies (or silent oldies) here: Where can you find a good first-principles model for global oil depletion, specifically constructed by people associated with the "oil patch"?

I will likely hear crickets.

They would ask the question as-- "When does the reserve replacement problem become the production flow problem?"

That is Reservegrowthrulz stock answer, which is really non-responsive.

The salient point is that this question is much easier to formulate an answer to than any general economics problem since oil is an inanimate object that can be counted.