Oil Prices Below $40 per Barrel

Posted by Luis de Sousa on December 16, 2008 - 10:34am in The Oil Drum: Europe

This is a crosspost from the European Tribune.

Back in July, no one that I am aware of was forecasting a 100$ drop in oil prices during the following six months. Even Daniel Yergin, the Nemesis of modern day Peak Oil study, was at the time predicting higher prices. Back then a friend told me to go short on oil, because all price forecasts by CERA are wrong. If I were a trader, I would have probably followed that advice, but could never imagine what was to come.

One of my first dives into the Peak Oil world was with Kenneth Deffeyes' book Beyond Oil. In it, the Princeton Professor explains how resources' prices go through chaotic periods in face of scarce supply. Without knowing it, he derived an expression to explain movements like spot Natural Gas prices in the US after 2002, that was equivalent to Queueing Theory. This made immediate sense to me, after studying this theory in my formative years at the University.

Let me try to explain briefly what this theory is. Imagine a supermarket with a certain number of points-of-sale (POS), to which a certain number of costumers arrive per hour. Queueing Theory allows one to derive information like the average queue length at each POS and the average waiting time each costumer spends in the queue. This information is not only useful for supermarket managers but also in other fields like transport and tele-communications.

Queueing Theory shows also provides another important result: if the load on the system goes above a certain threshold, it becomes impossible to predict queue lengths or waiting times, and the system goes into chaos. Going back to the supermarket, imagine that for some reason the flow of costumers increases several-fold over its normal rhythm (e.g. Black Friday in the US). At first, lengthy queues form at each POS, waiting periods then go beyond costumers' patience, and they simply start quitting the queue and leaving the supermarket without shopping. The dissatisfaction is such that costumers quit entering the supermarket altogether and the manager is eventually forced to close down some POS. But this is Black Friday, the avalanche of costumers eventually returns and it starts all over again. During this chaotic period a random sample of queue length at any given POS can result in any possible number and becomes effectively impossible to predict.

Substituting costumers by oil importers, POS by oil exporters and queue length by oil prices we have the international oil market.

This chaotic outcome with respect to commodities prices in face of scarce supply was studied by Ugo Bardi, who found interesting examples of it in the past. I first got to know his work soon after I read Kenneth Deffeyes' book and was especially impressed with the pattern Ugo identified in whale oil prices after the peak in sperm whale catches in 1850. The Whaling Industry was possibly the largest of its time, on a global scale that in many ways can be compared with the modern day Oil Industry. To me a most fascinating aspect about Peak Whale Oil is that in the book Moby Dick, published right about that time, Herman Melville lays down quite clearly the reasons for a coming decline of the Industry: in his view Easy Sperm Whale was over.

With all this information I became convinced an increased volatility in oil prices would unfold, eventually leading to a series of "boom and bust" cycles, just like whale oil prices in the XIX century. Predictions of oil prices would become impossible, and I never attempted to forecast them.

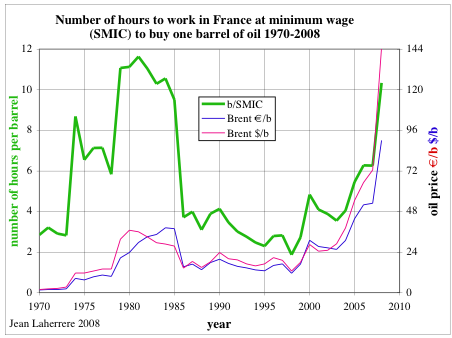

Another important aspect to my understanding of this issue was presented by Carlos Cramez and Jean Laherrère in 2006 at the seminar that kicked off ASPO-Portugal. They showed a chart with oil prices in terms of the number of working hours required to buy the oil in the US and France, and concluded that to return to 1980's levels, the last oil crisis, prices would have to reach something like 125$ per barrel (in 2006 dollars). This number stuck to my mind, and I assumed this would be about the level at which the "boom" would turn around into "bust".

|

| Oil prices as a function of working hours by the French minimum wage. For 2008 the oil price is taken as the July peak. |

Jean updated this graph recently and was kind enough to mail it to me, showing that by July, prices were very close to the level that had caused pain previously. When oil prices fell after that, they did so in dollar terms, but not so much against the euro, thus the 2008 barrel price in working hours will be below the 1979 - 1985 period but will likely surpass the 1974 - 1978 period.

|

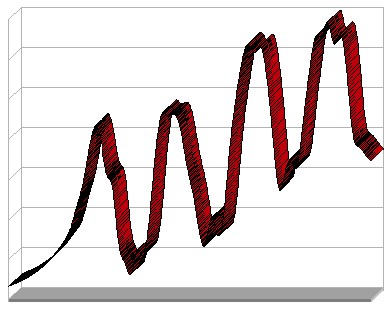

| My mental model of oil prices evolving with scarce supply and expanding monetary mass. |

Finally there was another piece to add to this puzzle: paper currency supply has been growing by two digit percentages every year. So these fluctuations would possibly occur within a band of ever higher numbers but without never surpassing the 1980s record oil price in terms of working hours. The following is a graphic rendition of this mental model for the long term evolution of oil prices.

Back in July with prices nighing on 150$, I was getting concerned that either my mental model was rubbish or that the fist turn was now overdue. I had the opportunity to write at that time that oil prices had become unbearable to many people in developed countries, protesters were dying in picket lines and less scrupulous people started stealing diesel from their neighbours. Something had to break and something broke.

But I would expect something more in the line with the price turn that took place in the second half of 2006 and could never imagine so much in such a short time: more than 100$ in six months.

As anyone knows, oil prices are in fact being pulled down by the Credit Freeze. It is perhaps worth to take a look back to the events that lead to to this point, and oil's important role in these events:

- 1999: Glass-Steagall Act is fully repealed;

- 2001: September the 11th, NATO goes to war;

- 2002: Interest rates are now at historic lows, monetary mass starts expanding fast to finance the war (eventually reaching as low as 1% in the US);

- 2003: Half of NATO invades Iraq;

- 2004: OPEC's spare capacity dries up;

- 2005: Oil prices go above 60$, interest rates are inverted towards ascent;

- 2006: US interest rates reach 5.25%; households are confronted with increasing daily prices and increasing mortgages simultaneously;

- 2007: The US housing market bubble pops;

- 2008: Bear Stearns and the Lehman Brothers collapse, panic leads to a halt of the fractional reserve system, Central Banks are effectively unable to put their monetary policy at work;

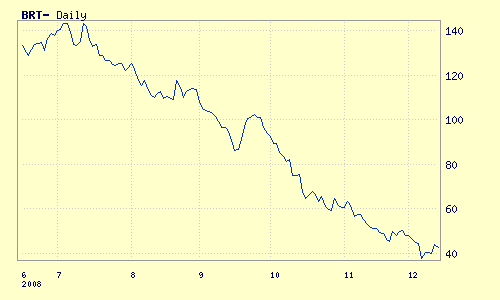

|

| Interest rates set by the European Central Bank, the US Federal Reserve and the Bank of England. |

The most important thing to take home here is that the Fed started the rate hike in 2004/2005 because it misunderstood the oil price rise as a consequence of its poor monetary policy. But instead crude oil production had reached a plateau that remained up to the second half of 2008. In fact, the underlying physical economy stopped growing soon after the invasion of Iraq.

With this interest rate hike, millions of American families slowly became unable to honour their debt compromises, squeezed between mortgages and consumer prices, both rising. This lead to a sharp decline in home prices (demand collapsed, supply sky-rocketed) that were the physical collateral for much of the paper currency created during the low interest rates years. Losing this collateral, banks had to devalue or even write off asset after asset on their balance sheets. These problems started to affect an increasing number of banks and financial institutions to the point of breaking trust among them. The rest is history.

|

|

In Europe, events unfolded in similar ways, although the interest rate swings were of smaller magnitude. Here the rate set by the ECB never dipped below 2% and never went above 4.25%. The problem was that many European banks had acquired financial instruments backed by assets in the US housing market; within days of the spectacular collapse of Lehman Brothers, several institutions here started showing serious difficulties. In spite of the reversal in monetary policy by the ECB, the inter-banking lending rate, Euribor, was perilously going up, menacing to squeeze households.

Governments are scrambling to invert the Credit Freeze and get their economies back on track. Luckily the ease seems to be coming first to Europe: the action by the ECB rapidly reducing interest rates and by state governments in providing credit and guarantees to ailing banks (or in some cases simply nationalizing them) has apparently restored confidence, as the collapsing Euribor rates show. Households in Europe are now facing declining consumer prices, with the fall in commodities' prices, and declining mortgages. This will bring some ease to European families and eventually pave the way for a turn around in Demand and avoid a serious expansion of unemployment. A major difficulty remaining is that an economic turn in Europe also depends on a turn in aggregate Demand of its main trading partners - especially the US.

In the US, things are not as simple. Not only were the interest rates swings much wider, but more importantly, the crisis is coinciding with the beginning of the transition between two governments (from two different parties). Interest rates have been brought down to the floor again and consumer prices are falling (also a consequence of a turn of the dollar exchange rates with other major paper currencies), but it came too late to avoid unemployment expanding. Restoring the confidence in the banking market seems a harder task, and similar to Europe, easing households from their obligations doesn't guarantee an immediate pick up in aggregate Demand.

All these actions by Governments and Central Banks, that translate into a rapid expansion of money supply, don't go without consequences. But that will be an issue for another time.

| __________________ |

The Credit Freeze impacted the oil market in two different ways:

a) It decreased Demand, by crippling industrial activity--this is especially the case in the US where unemployment is already reaching significant numbers; in Europe several states entered Recession in the third quarter. At this moment there isn't enough data yet to evaluate how much Demand contracted; only in following months, as institutions like the IEA or the EIA produce their regular reports, it will be known.

b) Companies hedging their business in the futures market were forced to liquidate their positions in order to meet near term obligations, leading to a collapse of the number of transactions in the market.

Now that oil Demand has retracted, bringing prices down with it, the opposite phenomenon occurs: Supply destruction. Current prices are too low for the development of many oil reserves, especially those on the fringe of technology. The perfect example is the sub-salt layer reservoirs identified in the Santos Basin off Brasil. A recent study by Deloitte pointed 90 $/barrel as the break even for production from these fields. An optimistic figure possibly, given that as indicated by Brazilian scientists last year, the technology for doing is so is yet to be developed.

With time, new projects needed to offset aging fields won't be there, either because of lack of exploratory activity or lack of financing. Even healthy fields can become unprofitable and be mothballed or abandoned. Supply will go down to the point it can't fulfill Demand any more at low prices, the cycle will be closed and a new "boom" phase will unfold.

It would be interesting to know when this new cycle will start. That's all but easy, made even more difficult by unpredictable monetary policy shifts. Looking at the present futures market, presenting a heavy contango pattern, it doesn't seem like an oil price rise is imminent. Likely, only when the futures market moves toward backwardation will the environment be propitious for a new price rally.

The impossibility of predicting long/mid term oil prices is a serious problem for governments and businesses planing ahead. But this is all part of the game: the destructive process of dependence on scarce resources. If a steady increase in prices was the outcome (as some believed), business would be able to plan ahead, for instance hedging on the futures market. Instead, these unpredictable price swings are very disruptive. Taking the example of an airline company, if it plans for a high oil price and prices go down, it will likely loose competitiveness. On the other hand, if it plans for a low price and it happens to go higher, the company will lose profits and eventually have financial difficulties. If Queueing Theory applies fully to the oil market, prices are effectively impossible to predict in the long term, guaranteeing losses to all airline companies.

Probably these "boom-and-bust" cycles will henceforth perpetuate until at least one of two things happens:

a) A "bust" phase permanently erases an important part of Demand;

b) A "boom" phase eventually takes place supported mainly by alternative energies;

I'm hoping for b).

It's really hard to see where oil will go from here. I have no idea how bad the economic situation is going to get. It could be a severe recession, a depression, or a return to the Dark Ages. Nobody really knows. The fractional reserve banking system is 500 years old and it's at risk. This is the engine of the Western/growth/industrial system. Without it, sure there are still advanced technologies and medicine, but it's hard to imagine us returning to anywhere near the same level of activity. If that's the case, it'll be many decades before we again reach the limits of the oil supply.

On the other hand, if the recession is just severe enough to dry up funding for new production, when the economy comes back, oil would be set for an even bigger run-up.

Who knows?

Yes, exactly, who knows? And this is pricisely the question, we don't have a clue. This unknowness is what's causing so much instability, the doubt, the fear, the horror, of where we might be heading, into a world we don't know, a world we don't understand or recognise.

I think, if we are ulucky, we could well see a slump on a scale that we haven't seen since the 1930's. In many ways it could be worse, as this is developing into a truly global crisis as the economies of the world are so interconected. What's happening? The world's economy is slowly grinding to a halt. Many sectors of the real economy are now, in reality, collapsing, on scale and at a speed not seen since the Great Depression.

How one get's the world's economy going again is a really hard question to answer. It may be a question with no real answer. I'm not sure Keynesian remedies will work this time. I'm not even sure they worked last time! If it was the second world war that really and finally ending the Great Depression, the creation of form of centrally controlled, state, command economy, preparing for war, then we have a lot of hard thinking to do.

I think "old-school" capitalism, the dogma of the "free market" is pretty much dead and buried. What we are seeing is the evolution, at speed, of new type of economy, a merging of state and market on an almost unprecedented scale. How this will influence the rest of society is too big a question to get into right now, though I do think it will have a profound affect.

I see this idea that WW2 ended the Great Depression repeated a lot. It depends on your definitions. If you look at unemployment and consumer spending, they still had not recovered in 1941. So in social terms, the Depression continued up until WW2 in the USA.

However, the stockmarket bottomed in 1932. GDP bottomed in 1933. It took a long time for the USA to climb out of that hole, but GDP grew in 1934,1935,1936 (recession in 1937),1938,1939 etc

Once FDR devalued the dollar against gold and started the big public spending programs, the economy moved to inflation and strong GDP growth (20-30% per anum) off a very low base.

I'm not saying this as a defence of Keynsianism. I'm just saying that in 1933 they conceived and executed a policy of engineering inflation, and they got inflation.

As for a "new type of economy, a merging of state and market" - it's all be done before, largely in the 30's. Public Works Administration, TVA,Civilian Conservation Corp, Resolution Trust Corporation after S&L. Recall the UK nationalisation of car makers, utility companies etc. There's nothing new under the sun.

Excellent post, Luis. The history of whale oil, indeed, has been a useful guide for me. On the basis of whale oil data, at the beginning of 2008, I predicted on my Italian blog that oil prices would stop their rising trend and collapse before the end of the year. It was a good prediction, especially considering that almost everyone was projecting oil at 200 $/barrel by the end of the year. I also made some calculations based on the whale oil price trends that told me that the "equilibrium" oil price should be now around 60-70 $/barrel. This value turns out to be similar to the cost of extraction of the "marginal barrel" as given by IEA. It seems that, indeed, we are going to fluctuate around that value.

The bottom line is that if one understands the mechanism of the market, it is possible to figure out where the market is going. Unfortunately, as you correctly point out, the vagaries of the market are chaotic and - as such - unpredictable. Too bad, but if it were possible to make correct quantitative predictions of oil prices we wouldn't be here chatting. Eh, well....

Pre-salt fields have been drilled in offshore Angola: Seeking Operatorship in Angola : Geoexpro

I had posted a comment on similar lines a couple of weeks back

http://www.theoildrum.com/node/4825#comment-439569

Nice to know that I was not totally off the mark with my line of thinking.

My own mental model matches yours - except that I see higher amplitudes as we go into the future and the boom and bust cycles happen more frequently taking into account declining net exports.

Does this not have implications for the oil futures market itself?

Global supply chains will be hit very hard as well because sourcing plans, manufacturing were built on the assumption of cheap freight costs. I personally think that the future (after a rough transition) will be more local production and consumption of mostly necessities.

Srivathsa

Thank you for this posting that I enjoyed very much. I would like to add another factor that is increasing boom and bust cycles here. All new fields and alternative energy sources - even measures taken to increase energy efficiency need energy themselves. But not only is the EROI lower than for the easy oil, but in most cases the energy needs to be invested first while the resulting energy will be received later. Take a wind turbine for example. Lets assume the wind turbine has an EROI of 5 that is yielded within 20 years. But the invested energy is needed upfront for construction. So it will take 4 years until the initial enery invested is returned.

With rising oil prices governments and investors try to switch to alternative energy solutions. If this would be done within 4 years for 10% of the oil consumption this would mean an additional oil consumption of 10% during this time. Without spare capacity it is clear that this heavily expands the boom cycle. On the other hand with energy investments cancelled or delayed, it works the other way round as well.

regarding your comment about wind turbines: You are aware of the fact that oil is only a very minor part of the energy expenditure for constructing a windmill? Without knowing precise numbers, I would say the highest energy investment is in making the steel, which is done exclusively by burning coal. So installing infrastructure made of steel should lead to an increase in use of coal more than oil, which is indeed what has been happening in China on a tremendous scale.

We really have to let go of this simplistic view often prevalent here on the oil drum that oil equals all energy use. It really does not! Currently in Europe oil is only the basis for all road transportation fuel, but even freight and people can also be moved by electrified rail.

I agree with you that you are right at least in principle regarding the reinforcing of the boom and bust cycles, but this can and should (!) be smoothed out by state investment programs in renewable energy production and infrastructure that is long term and predictable. Indeed this can help too in smoothing out the economic boom bust cycles as well. If on the other hand we leave the private sector to its own devices here, it will indeed become ever more chaotic.

Thank you for clearifying that the real world is always more complex than simplistic examples.

Governments should spend money on energy efficiency and alternative energies. However the administrations are continuing the same unchanged politics. Building even more highways and subsidies for new cars are shortsighted programs that cost a lot of money. The population is more aware of the change needed and buys less cars. We should support that change and not try to reverse it.

The link below could be a useful real world comparison for wind turbine EROEI and lifecycle assessment.

http://www.isa.org.usyd.edu.au/education/documents/ISA_Wind_turbine_LCA_....

I would like someone to check my calculations but in the above example, in the best case scenario, this looks like about one year's output equivalent in embodied energy (>3,700,000kWh annual output for an embodied energy of 12,000GJ x 277.8). Worst case scenario could be 4 or 5 years worth of output?

PS I posted a bad link to this here before. Hope this one works OK.

The paper he links to compares different scenarios for building and placing wind turbines, looking at actual turbines built in Germany and Brazil. For example, building in the region the turbine's to be set up with recycled steel melted in a furnace powered by hydroelectricity is different to building with new steel in a furnace powered by coal and then shipping it across the world.

Thus old_europe's comment above,

is true, but not precisely true; steel is almost always made originally with coal, but you can use mostly recycled steel to make things, and for that you need great heat - which doesn't have to come from coal. (For interest, it seems that the rotors cost about as much energy to make as the tower, but the nacelle is most of all.)

And then where you place the thing makes a big difference, if one place gets twice the wind of another, it has half the energy payback period.

My check:-

Worst annual output = 881,972kWh = 3,175 GJ

Best annual output = 3,558,926kWh = 12,812 GJ

Highest embedded energy = 13,797 GJ

Lowest embedded energy = 6,289 GJ

Highest embedded energy / worst annual output = 13,797 / 3,175 = 4.35 years energy payback time

Lowest embedded energy / best annual output = 6,289 / 12,812 = 0.49 years energy payback time, or about 6 months.

The best payback time is for turbines constructed largely of recycled materials in Brazil and used there; the worst for those constructed of new materials in Germany and shipped to Brazil.

The German-Brazil report phil harris linked to complicates matters somewhat by not reporting turbine weight, and by discussing different models without specifying all the differences. We get heights of 45-65m, and foundation masses of 132.7-185.8t.

There was a Danish study of turbines constructed and used in Denmark, which gives figures of

- 3,169 GJ for construction and maintenance over 20 years

- 522 GJ for scrapping after 20 years

+ 733 GJ recovered from materials

or 2,958 GJ net.

Note that these figures are about half the German and Brazilian ones.

This all leads to an energy payback period of 3-4 months.

The Danish report notes,

So while phill harris' calculations were good, what must be borne in mind is that apparently the Germans, despite their reputation, are not terribly efficient - at least not with wind turbines :) Go with the Danes!

Lastly, given that a barrel of oil is about 6GJ, if we used nothing else to produce the energy required to make one of 500-600kW wind turbines above, that would be about 500bbl for the Danes, and 1,000-2,000 for the Germans. So we can say 1,000-4,000bbl oil per MW, if no other energy inputs were used. Or 3,000-12,000bbl/MW if we assume all the energy comes from burning oil in some furnace for electricity or just the heat (don't know why you'd do that when you can get electricity and heat from more efficient sources, but still).

But of course, at present oil is only required for the machinery to mine the ores, and that to transport, erect and maintain the turbines. So the actual oil use would be fairly trivial, I'd say.

Bear in mind that over the past quarter-century total electricity generation has risen IIRC some 3% annually. So already we're spending a lot of money, time and effort building new power plants.

I'm confused as to why building (say) a coal-fired plant, nobody worries about the costs or resources or energy required, but building (say) a wind turbine, suddenly doom is upon us, we'll all go broke, think of all the steel you need, etc. If we can build terawatts of coal or gas each year, I don't see why we can't build terawatts of wind or solar or whatever.

Thanks for an excellent post.

The Danish study is the best that I have seen for wind turbines because it includes the energy calculations for decomissioning and recovery of recycled materials.

IIRC, that would compare favorably to the most productive oil fields.

Well, I am bit uncomfortable with citing recycling as a gain in energy. This is a bit like the "emissions saved" nonsense that lets us pay for someone else to reduce emissions and claim it against our own.

Yes, energy or emissions were avoided, but others still happened. I think it's better not to talk of energy gain from recycling, but to think of it all as an ongoing process - the old turbines are scrapped and recycled into new turbines, so that over time the material required per kWh declines, and the EROEI improves.

Still, they give all their figures and you can make of them what you will. It seems that like anything else, different countries have very different efficiencies in things.

THE WAY IT REALLY HAPPENED

My history of posts on TOD US will demonstrate that I had repeatedly warned people against falling into the trap of believing that oil and other commodities were going nowhere but up in price. I say this not as a way of saying “I told you so” but as a way of reminding people to be very, VERY cautious about believing current projections.

The price of commodities shot up very quickly across the board, and then declined just as fast. Are we to believe that supply dropped that fast in EVERY AREA of commodities, and then recovered just as quickly? That does not seem likely. On the demand side, yes, demand has declined, but has it declined in EVERY AREA to the extent that price declines would indicate.

The fact that these price moves have been so fast, across the board and in both directions indicate that we are seeing a speculative bubble inflate and then pop, pure and simple, and price moves have little to do with supply and demand changes in the short term.

Logically we must ask, “What has caused such an acceleration in price changes over the last few years?” I think it is extremely informative that you mentioned first on your list of events “1999: Glass-Steagall Act is fully repealed”. Very perceptive observation to put this event right at the front of what would become the beginning of an accelerated increase in house prices, commodity prices and speculative investment. We must recall that another source of capital was the flood out of the already overextended tech sector.

With the repeal of Glass-Steagall and the flood of cash from the tech sector, we had a situation of huge amounts of money looking for a place to go. The banks could now jump in and play the speculative game just like the hedge funds and venture funds. Everybody, whether they knew it or not, was now playing in the casino and had money on the table, through hedge funds, banker’s investing in hedging, funds of funds, pensions, and homes, which would soon be subject to the same accelerated price swings that oil and other commodities were already subject to.

Needless to say, the new flood of free flowing money brought out the “adventurer” in bankers (now freed up by the repeal of Glass Steagall), hedge fund managers, market advisors and gurus and even mutual fund and pension fund managers. The “Lords of the Universe” now had the chance to show what they could really do, and investment vehicles tied to underlying commodities, interest rates, and collateralized debt obligations could become ever more complex, multi layered and “hedged” six ways from hell.

The main point of all this is that price swings which would have in past years happened much more slowly now happen with whiplash inducing speed. The flood of money, the complexity, the speed of the internet has accelerated the “Queuing Theory” past a point that allows for comprehension by most humans. If you add in the pure irresponsibility and outright fraud of managers and financial firms who purposely complicate things for the purpose of obfuscation, you have a recipe for disaster.

Oil, like real estate and houses and other commodities are simply the vehicles to which the financial manipulators tied their wagons. The real value of the commodity simply does not matter to the speculators and financial managers at banks and hedge funds. What matters is that people can be convinced to pour money into the investment firms on the belief that the price will change, hopefully to the investors advantage.

When the economy is growing and things are going up, the tool used to recruit investors is greed, i.e., “look at the return you can get on this, you don’t want to be left out”, and when they are going down the tool used to recruit is fear, as in “we have a hedge against losses that can protect you”.

Finally, there were too many people playing the same game. Everyone wanted double digit returns, and everybody was pouring money in, and there was plenty of money to go around at first, with the money that had fled the tech boom available, the massive returns made by the banks on the prior rises in real estate available, and the depositors money now available if it were need since the repeal of Glass-Steagall, and a new fast moving almost completely unregulated group of funds, the Hedge Fund, and then the “fund of funds”, which could pretty much do anything they wished without oversight, but, and this turned out to be very important, without insurance or government protection.

So when the U.S. invaded Iraq in 2003 oil prices were already rising after the price decline caused by the 9-11 terror attack, and the war further accelerated the price gains. Production was starting to flatten because in the 1990’s investment had slowed to a crawl because oil had been so cheap as to be beyond belief (we’re talking about prices below $20.00 per barrel) and the OPEC nations and others had simply stalled on investment in E&P. The rumbles of “peak oil” were just beginning to get into the media. This was a DREAM RECIPE for those who wanted to suck investors into investing in oil, gas and commodities. As you say, “The Rest Is History”, as money flooded into the commodities markets. When the housing market started to show signs of weakness, investors began to get scared, and the ones that were able to bailed out, selling houses. More sold, the market was getting full of houses, but now there were fewer buyers. A few foreclosures became a few more as some of the “house flippers” could not unload at a profit. Again the rest is history, and the money from the real estate boom needed somewhere to go. Commodities, yes, said the investment gurus, commodities were safe!

Brokerage firms who know almost nothing about oil production, consumption and pricing began to talk about $200 per barrel oil (the disgrace that was Goldman Sachs), and retired geologists were on every channel telling the public that the end was near, we would be lucky to get through the next summer (whichever of the last three or four summers they were referring to) without a catastrophe. And the money just kept pouring in, and the commodities skyrocketed.

And then, like all bubbles, the bubble popped. The financial gurus were in trouble and they knew it because frankly they had not gotten it right for their investors for too long. From the collapse of the S&L’s they had herded the investor from one short lived bubble to another, from Asian bonds to the tech bubble, to the real estate bubble, to the Euro bubble, to the commodities bubble. But the acceleration of the cycle of promotion, inflation, extreme high prices and then bursting of these bubbles had become too fast. Even the banks and hedge funds could not stay up, and the investors themselves were either become scared or had been so cleaned out by the gurus they couldn’t keep adding money. Again, the rest is history…

A story of a friend of mine who is in the business, by which I mean the financial sector: She had her clients in the stock market, well diversified, funds, ETF’s, mutual funds, and Index funds. She saw the bad news getting worse, so she persuaded them to move to something “safer”, a mix of REIT’s and, yep, you guessed it, commodities funds. She had become persuaded that oil and gas were only going to get more and more expensive. Do I have to tell you the results of what happened? Her investors are now down by more than 55%. Some of them are getting rather close to planned retirement, and are horrified. Even if the market returns to 10% annual returns, it will take years for these aging boomers to regain what has been lost, post taxes and fees it may take even longer than they may live, and how likely do you think it is that the market will soon deliver double digit returns?

Many in the Peak Oil community have embarrassed themselves badly by making wild claims about short term prices. The same thing has happened in the climate change community, where people have made wild predictions about short term weather changes. The Oil Drum has been unfortunate, in that it is a very open forum, and has posts from both of these movements, peak oil and climate change. This means that people come to TOD and see streams of posts which are based on the two most unreliable and unpredictable patterns in the world, weather patterns and market patterns. This is not TOD’s fault, and long time visitors to the site know that these projections/predictions must be taken with a HUGE grain of salt, but newcomers to the site do not grant this license and the whole cause of peak oil and climate change thus lose credibility in the larger public because a few posters have essentially decided they are prophets.

As for the future, I agree with you Luis, I would not dare to predict future prices. I will say this however: I would be happy to live the rest of my natural life with oil and gasoline prices as much as twice what they currently are., inflation adjusted, meaning I will accept gasoline prices of $4.00 to $5.00 per gallon U.S. (I have survived worse than $4.00 and I was poorer then) So obviously I could hedge by buying oil and gasoline futures at ANY PRICE CURRENTLY AVAILABLE and still be happy! I am not seeking massive returns, just a stable price for my lifestyle. I would be amazed if the very wealthy are not hedging their oil price futures just this way, but I could be wrong.

On the other hand, I have been astounded by how many wealthy people and families have pissed away their money with this Ponzi hedge fund scheme run by Bernie Madoff, and wonder how many more of these type of funds are out there. With apologies to De Niro, “Ah markets, I love the smell of default in the morning!”

Roger Conner Jr.

Roger, I cannot tell you "how many more of these type of funds are out there" but know there will be many more. part of a bubble is the greed and lack of caution that is so beloved by scammers and con artists.

At the moment i am in Africa typing on a dusty Arabic keyboard with missing letters, i.e. remember which letter goes with which key:) i have spent a very entertaining 30 minutes being conned out of USD 20 and it was a delight to see how hard he worked and the tales he invented to obtain his money. i knew all along i was being conned but wanted to see how he would do it.

Roger,

Well said. Long winded, but well said.

So we can chatter the "price" of oil way up, way down and way up again; and it won't change the realities: Our populations keep growing, the environment keeps being depleted (non-renewably), and we keep chattering, making more babies, and making more "price" noises. What a joke! (On us.)

__________

p.s. I didn't know that in UK a "customer" (American spelling) is a costume-r. All dressed up and ready to spend, eh?

So, there was a speculative bubble on used cardboard?

Let's ask the question another way...Was there a shortage of used cardboard? If so was it caused by geological peaking? Or perhaps failure to invest in cardboard exploration and development? :-)

I have known financial people to speculate in products and commodities both new and used that I didn't even know a market could exist in. I also know personally a man who has spent his adult life making a living hauling and selling used cardboard to the recyclers.

RC

Thanks for the post. I would like to defend TOD, not because I have anything personally invested in it, but because it is, in fact, the most intelligent and open forum out there discussing "Peak Oil" and "Climate Change", their inter-relationships and their grounding in physical reality.

If "short term" or "new" readers come here for a quick fix, and if they are disappointed by the result, well so be it. TOD is a sort of blurry mirror of nature, and although we are all looking through that glass darkly, we all discern different things. For me, the beauty of this site its its essential honesty-- no idea or model has yet, and hopefully never will, reached the status of "orthodoxy." Even the founding principle "peak oil" has been subjected to intense scrutiny and redefinition and recalculation.

Practically all other vaguely similar sites are organized around some favored notion, which is not permitted to be challenged, and so rapidly becomes irrelevant.

I

So I keep reading TOD. I read it like I read modern fiction -- I think we are looking at multiple parallel and intersecting stories-- each has a personality behind it, and a set of assumptions about how the world works. They can be read individually, but taken together, they form a complex and far more interesting tale.

Roger, yes the greatest of energy experts along with mere myself were taken in by this false call of the market. But the real one is surely not far behind. The demise of those auto makers and airlines doesn't come a day too soon.

Thanks Roger. Your post here feels very true to me. I am a lower-middle class single adult concerned about the future (for myself and for everyone). I don't pretend to understand the complexities of markets and financial trends, yet I try my best to use my reason to make the best decisions I can. Nonetheless a lot of what I have to go on is trust; trust in the opinions of other people, like yourself, who I find reasonable and more informed than myself. So I have a question for you...

I have recently moved more than half of my savings out of my credit union savings account and into gold (precisely, this would be seven Maple Leafs). What I want to know is if gold is also a bubble or if it reasonable to guess that gold will rise relative to the dollar over the next, say, 3-5 years. What are your thoughts on this?

Thank you,

Emanuel

I've also been buying maple leafs. I read somewhere that throughout history, an ounce of gold has always been able to buy about an acre of land. I can't answer your question, but a few weeks ago, I read that if the Chinese economy really starts to tank, they will start selling off all their gold reserves and so serve to greatly depress the price. However, I'll keep my maple leafs whatever happens.

What I heard is that an ounce of gold buys a fancy suit, and an ounce of silver buys a fancy meal. This is true for the years 1800, 1900, and 2000.

Since the Federal Reserve was established in 1913, the US dollar lost 96% of its value.

emanuel,

First, I have a bit of natural caution concerning precious metals due to my own history...In the 1970's I poured money into silver which at that time was going "nowhere but up", and quickly lost about two thirds of my investment :-(

Gold is a currency substitute (or it is really more correct to say that currency is a gold, silver, platinum, etc., substitute but that is a theoretical argument), so how you feel about hold depends on how you feel about the longer term stability of world currency. Someone down below in this string makes the humorous case that "while the oil consumers try to use gold to buy oil, the oil sheiks use oil to buy gold" :-)

The problem with gold is that you can't get paid while you wait. You have to sell it to collect your moeny. Did you feel your credit union accounts were in any danger? Did they have national government protection? Because to go to gold, you would have to believe that not only the credit union would collapse but that the protecting authority (usually the national government) would also collapse and fail to pay.

If that were to actually happen, then gold would not be a bad bet, you just have to figure the odds. By the time I am down to buying gold, I would feel even better about buying canned food, guns and ammo. Oh, and don't forget the all important can openers. :-)

Then when you sell the gold, it will be to buy back the dollar that you had lost faith in...as you ask "gold relative to dollar". It's a speculative route, and in a deflationary environment, which we now seem to be in, we will have to many goods chasing too few dollars...until the flood of paper from the worldwide bailouts hit the market place at least. It could be all over the place for quite awhile, meaning that you better not need the money soon.

So short term gain possible on the panic, long term, sell on gains and take the money UNLESS you are convinced of the collapse of worldwide currencies, something every national government will fight to the death. Gold is a bit against the world economy, so by nature it's a long shot.

That's my thinking as of now anyway, and you can't eat gold or burn it for heat, so you are still invested in an "exchange" market either way...but as a speculative investment, good for panic runups, yeah, I would take gold if anybody out there loses faith in it and wants to give some away...:-)

RC

Ron,

I liked your original posts and following comments but it was easy to predict years ago that we would be where we are today.

People need to read and understand their history. More people need to read about the Great Depression particularly with an eye to the events that led up to it rather than the misery after 1929. The similarities between 2008 and 1929 are great if you substitute oil for land and hedge funds for private bank stocks.

The pattern is the same and was fostered in both cases by a total belief in FREE MARKETS enabled in the U.S. by an Executive and Legislative government that had an active dislike of and worked to prevent OVERSIGHT of financial institutions. I stress financial institutions not business in general.

Those two things are all you need to repeat 1929 and 2008. The details will always be a bit different but the pattern and the outcome will be the same each time around. Engines without governors go to runaway mode and break. Now the TIMING of when things break, that's unpredictable.

With apologies to De Niro, “Ah markets, I love the smell of default in the morning!”

Great post, but that was Duvall:

"I love the smell of napalm in the morning. You know, one time we had a hill bombed, for 12 hours. When it was all over, I walked up. We didn't find one of 'em, not one stinkin' dink body. The smell, you know that gasoline smell, the whole hill. Smelled like... victory. Someday this war's gonna end..."

Seems a fitting quote for TOD...

your right, it was Duvall! I thought about double checking it, but I was overdue for some sleep and my old guy memory failed me...good catch jimbo...my error.

RC

' ... and “hedged” six ways from hell.'

Isn't it really ' ... and “hedged” six ways TO hell. '? ;-)

Hey, what is this, a literary magazine? :-) But your right, "six ways to hell" would be the more correct usage...as we say in the south, I got it "bass ackwards". :-)

RC

Very nice story.

And I even believe in most of it (no sarcasm intended).

However, the scientist within me wants to ask:

Where is the proof for all this?

To this this day no credible source that I have been able to find, has produced watertight evidence as to who, why, where and how manipulated oil prices or how speculation more than doubled the price of oil spot?

I can't say it didn't happen, but I don't yet see the proof anywhere. To me correlation just isn't sufficient.

Because, if we lack the proof we will NOT be able to stop it the next time around: the same people ('us' or 'them', doesn't matter), using same mechanisms will be able to do the same thing all over again.

That's why I'd really like to see some hard facts on the table.

As for the production and price linkage, I think you might be making a serious error of judgment.

Just as high price doesn't directly prove tight supply/demand situation or production problems, NEITHER does low price disprove any problems either.

One can't have it just one way, the correlation must work both ways.

To me the basic rule of thumb is still this:

High prices are a required, but not sufficient signal of tightness/problems in production (cf. demand). But, and this is a big but, this doesn't always pan out in the short term. Markets can stay irrational longer than one can stay solvent, Keynes used to say.

BTW, thanks for taking the time to write that lengthy post. I really appreciate it. It's much nicer to read long and well well thought out posts, which are not the norm here - or elsewhere for that matter.

Hi Luis

Thx for an interesting post. I've been thinking about this years volatility for some time and this thread seems a good one to post my tuppence-worth;

Is the main reason inelastic supply? On the upside we got to the position of almost zero spare capacity and we know creation of new supply takes time - far more time than the rate at which demand was growing. So once demand hit capacity the price shot up to the point at which demand was reduced. We get a brief glimpse of how much consumers are prepared to pay for oil, at least short-term.

The dramatic fall in price is just as easy to understand if you assume that supply holds up in the face of reduced demand. And I think it does unless OPEC manage to reduce it - history suggests they struggle thanks to the prisoners dilemma;

http://en.wikipedia.org/wiki/Prisoner's_dilemma

For oil producers it pays to keep pumping for all they are worth because, even at lower prices, they are better off covering part of their OPEX even if they can't cover all of it. The price point at which pumping is no longer cost effective is far lower than the point at which total costs are not covered (better to have some income to offset costs rather than none!).

Reduction in longer-term supply will happen as projects get delayed. But, as for the argument on the way up, this effect is on a different time-scale than the current rate of demand destruction. So a temporary gap opens up under the supply ceiling and prices head south rapidly.

So we have the possibility for fluctuations in demand that are not time-matched with fluctuations in supply. Maybe just a re-wording of others thoughts on here but sometimes it helps me to get my thoughts down even if just to clarify them for myself!

If this argument is correct then as soon as demand recovers to meet capacity, presumably with global recovery, then prices will once more shoot up. The only question (admittedly it's a big one) is when this recovery will happen.

TW

Reply to thewatcher,

"Is the main reason inelastic supply?"

I think you are right that inelastic supply is a major factor. But there are many commodities that exist on the edge of demand matching supply at any given moment. This was the whole idea behind "Just In Time" inventory and planning.

This would seem to mean that any speculative activity could be greatly magnified in their impact on price, which is what seems to have happened. JIT inventory keeps the market jumpy, and the internet/hedge fund/short sale/long sale speed of the markets means that even short term jumpiness can be converted to big and fast price moves.

Energy markets are even more subject to nervousness due to the crucial role that energy plays in modern economies.

Years ago, I once heard an oil executive say in an interview, "with energy, the difference is at the margins, but the margins make all the difference." He went on to point out that if there was a 1% or 2% surplus in energy, no one noticed, but if there was a 1% or 2% shortage, it was a catastrophe that could derail the economy.

Energy, oil and gas in particular (although electric power is not immune as the Enron "emergency" power shortages showed us)are perfect for those who want to make money on hyper volatility and instability.

By the way, let's think of all those "investors" who bought oil at $70 to $80 per barrel and then innocently watched it go to $148 per barrel. They must have started selling up near the top or the price would not have dropped so far so fast...where did the profit from that doubling go? How many of them went one better and shorted on the downside, and made a second fortune on the way down..."anyone, anyone?"

I wonder how the market is holding up for "discreet" Chateaus in Switzerland, France or Malta or maybe luxury hunting lodges with private lakes in Canada are holding up these days? A fellow has to rest after all of that "hard work". :-)

RC

Great Post, Luis!

Your timeline is the best explanation of the relationship between monetary policy, war in Iraq, rising oil prices and the financial crisis today I have read so far.

Yergin was right, although his timing was off.:

So was Mike Lynch:

So was David O'Reilly:

Jerome "Countdown to $200 Oil" Paris was wrong.

Westexas (Jeffrey Brown) was mega-wrong:

Notice that the Cornucopian crowd continues to use price as a proxy for production?

http://www.energybulletin.net/node/38948

Published Jan 7 2008 by GraphOilogy / Energy Bulletin

Archived Jan 8 2008

A quantitative assessment of future net oil exports by the top five net oil exporters

by Jeffrey J. Brown and Samuel Foucher

In most of my presentations and comments, I also noted that the price of oil represents a horserace between declining demand and a long term decline in net oil exports.

Yergin’s point was that rising oil production would drive prices up. In reality, declining net exports, flat crude oil production and a slight rise in total liquids production—probably augmented by NGL’s from the dying gasps of large oil fields with gas caps, as they are blown down--caused prices to go up, through this summer. What is primarily driving prices down now is a decline in demand.

Here are the recent EIA numbers for annual net exports from the Top Five, along with annual US oil prices, including my estimate for 2008, through 9/08. While the top five are showing a year over year increase, primarily because of Saudi Arabia’s increase in production to a level below their 2005 annual rate, their 2008 rate, through 9/08, was substantially below their 2005 rate. And BTW, both the UK and Indonesia showed year over year net export increases, in their terminal decline phases. As you know, in the above paper we were building on work that I first did in January, 2006--warning of a near term decline in net oil exports by the top three net oil exporters.

EIA Top Five Net Exports & Annual Oil Prices:

2005: 23.9 mbpd & $57

2006: 23.2 & $66

2007: 22.0 & $72

2008: 22.5* & $100**

*Estimated net exports through 9/08

**Oil Prices through year end

I'm predicting right now, that if the avg price of oil in 2009 is below 100$ it will no longer be the avg annual price that really matters or people care about, but the "average decade price".

I think that we have a new syndrome. CPDBS--Cornucopian Production Decline Blindness Syndrome. If the top five had maintained their 2005 net export rate, their cumulative (post-2005) net exports through 2008 would have been on the order of 26.2 Gb. Through 2008, they probably will have (net) exported less than 24.7 Gb. This is the elephant in the room that the Cornucopian Crowd refuses to see.

In any case, I think that the real damage to the economy as we know it is still ahead of us. When demand recovers, I don't think that the net export capacity will be there to power the recovery.

I have often argued we have another syndrome, IGAS - Independent Geologist Assumption Syndrome. It assumes that if a model works for a couple of cherry picked countries it must work for all countries.

ELM has always and will always remain a worst case scenario that may or may not arise, depending on intranation demand. The case may be made that ELM likely will not arise due to other interdependencies on domestic and world economies for some nations (China can only ramp up domestic demand as long as US/world demand for goods maintains a certain level), however regardless of whether ELM proves to be a big decider (which depends on world economic growth), declining production is still the elephant standing in the room, waiting to crush any recovery effort. If geologists are correct about the basics of where oil and gas is to be found with good EROI, then we're in trouble. ELM just gives us a worst case timeline on how soon we'll feel the pinch.

It's always interesting when people accuse me of misusing the Export Land Model (ELM)--a term for a simple little mathematical model which I developed--citing the example of the UK, which had very little increase in consumption. The key point about the ELM is that production declines in exporting countries magnify the net export decline, and tend to result in accelerating net export decline rates. The rate of change in consumption usually just changes the slope of the net export decline.

In the top five paper (linked above), we noted that Export Land fell between the UK and Indonesia in terms of both production and consumption rates of change (Export Land had a faster rate of increase in consumption than the UK, less than Indonesia, while Export Land had a faster production decline rate than Indonesia, but less than the UK). The key similarity between the three was that all of them were consuming about half of production at their final peaks. See a similarity here in the year over year change in net exports for Export Land, the UK and Indonesia?

(Note that the graphs shows year over year changes, not exponential decline rates. The overall exponential net export decline rates are highlighted on the graph.)

BTW, anyone else find it bizarre that the Cornucopian Crowd is using the UK--a country that went from peak net exports to zero in seven years--in an attempt to rebut the Export Land Model? Especially when we cited the UK twice in our top five paper.

That graph is extremely misleading, and a form of statistical chicanery. The actual data for your ELM looks like this:

The column labeled "Decrement" shows the difference between the current and previous year's net exports. As you can see, the decline is sub-linear (i.e. the decrement decreases with each year), and there is no increase at all in the amount of exports lost each year.

Any ordinary linear decline can be painted as an "accelerating decline rate" using your gimmick. Suppose, for example, you have a gas tank filled with 10 gallons, and you use one gallon per hour. Then the hour-on-hour decline rates are: 1/10, 1/9, 1/8, 1/7, 1/6, 1/5, 1/4, 1/3, 1/2, 1 (= 10%, 11%, 13%,14%, 17%, 20%, 25%, 33%, 50%, 100%). Voila: an ordinary linear decline can now be misrepresented as "decline at an accelerating decline rate".

Here's the actual stats for the UK from the BP Stat. Rev. 2008:

As you can see from the Decrement column, the decline is basically linear. BTW, nobody knows where you got your data for Indonesia or the UK, because you didn't bother to cite it.

Westexas,

while your mathematics may be correct, your "export land model" only works for countries whose economy doesnt depends in a significant way on exporting oil. The export of the UK fell to zero very quick precisely because its economy doesnt depend on exporting oil in a major way. If Saudi Arabia would stop exporting oil, they'd probably implode, as almost all their income comes from exporting oil. If that income fell away, how would they buy the cars to burn the gas they dont export anymore?

So, I think it is fair to consider that oil exports slow down when oil becomes more expensive, but your simplistic export decline model will get significantly slowed by the fact that most major exporters (i.e. Arabia,Venezuela,Russia) cannot economically survive without exporting oil, so they will always want to export a significant amount, even if that would mean to slash internal gas subsidies. For instance Iran has done this last year and they also build nuclear power plants to conserve their oil exports.

Old Europe

I think the model does work for your so called 'oil export defendant countries' because it ignores assumptions such as this. Take Saudi for example, they are building a Large Chemical plant and an Aluminium Smelter, ie their consumption internally increases without effecting their export earnings in fact it can increase it. The scary thing with the Aluminium smelter is that KSA doesn't have a lot of gas (yet) and generates its electricity from oil, but it still makes sense for them to export electricity (which essentially what the smelting of Aluminium is) produced from oil.

Neven

KSA's oil is exportable worldwide; Iceland's hydropower is not. We can hope that Iceland will undercut KSA in the aluminum market (perhaps magnesium also?) and keep oil for transport fuel.

I thought that the UK and Indonesian examples were interesting. The UK has a high per capita income and energy consumption taxes--and had a low rate of increase in consumption. Indonesia has a low per capita income and energy subsidies--and had a fast rate of increase in consumption. Indonesia was also a founding member of OPEC. Indonesia went from final production peak to zero net oil exports in 8 years.

I guess the challenge would be to find a major net oil exporter that cut their consumption approximately in tandem with production, as their production declined, in order to maximize net exports. I really haven't seen any examples, but I suppose there may be some, although the EIA shows that Iran has been able to slow their rate of increase in consumption, through their rationing program. In any case, the primary problem, even with stable consumption, is that net exports declines tend to be magnified, because they "come off the top" after consumption is satisfied.

Also, assuming that a combination of voluntary + involuntary export restrictions drive oil prices back up, the cash flow from export sales will tend to increase, even as net export volumes decline, at least in what I call Phase One net export declines.

You and Pitt use the term sublinear to describe stuff. That is pretty odd, cuz I don't run across that term too often. You two might actually be the same guy, but Pitt seems much smarter. So you must have kiped it from him, as he associates with the academics.

Instead of sublinear, you should use the term decelerating or perhaps damping, which is a very real physical effect. As in a damped exponential, which you would see in a proportionality law. :)

I thought that the following comment was typical of JD's work, and as noted above, his allegation was completely false:

WT, yes, it is the typical hit-and-run work on JD's part.

This kind of stuff really annoys me, and perhaps my comeback had a condescending tone but I don't mind stooping to his level on occasion :)

Indeed,

In the past, the boom and bust cycles were caused by demand hitting the roof and then the roof getting higher. Now I think we're on the otherside and its the roof thats coming down and hitting demand.

Looks the same from a price side, but economically more disasterous.

Of all of the explanations for the bubble we just had, one that seems more convincing to me is that it was just human nature, feeding off the increase in prices.

There is an article in the December Atlantic magazine by Virginia Postrel, reporting on some research done on financial markets in a lab:

http://www.theatlantic.com/doc/print/200812/financial-bubbles

Short version: bubbles are part of human nature; when prices start to rise, humans get caught up in momentum trading, until there is no one left to push the bubble higher; then the crash. I think that what we had this past year was momentum trading, which crashed after the ability of the market participants to buy more paper barrels evaporated in the credit crisis.

But, longer term, no one should dispute this: we are constantly printing more dollars, while the amount of oil remaining in the world is declining (that’s what it means to be a fossil fuel). Even worse than that, the world is producing less oil every year. The second half of 2008 was the first time in many, many years when the amount of dollars in circulation decreased, even though the printing presses were running full tilt: the credit crunch was destroying money faster than the central banks of the world could produce it.

If we keep producing more and more dollars, and we keep producing fewer and fewer barrels, what else could result but a price increase? The only question is when the next rise in prices begins.

Short run, commodity markets may be voting booths; long term, they are weighing machines. Once this bubble passes, the next one, according to the research on human instinct, will be longer and bigger—driven at first by supply and demand, and then by greed. Natural oscillations, each ramping up higher.

I agree with GregTX. Reading Luis' post you might think this is all just business as usual, and there will be many more cycles of boom and bust as our grandchildren grow old. A friend of mine says "perception is reality". Do most people think that way? If you're conned into a belief, does that make it real. Is it all really just a confidence game? How long before confidence is restored and business as usual can proceed?

Should read: "Yergin’s point was that rising oil production would drive prices down."

Just to put that Mike Lynch quote into context, here's what precedes it in the linked article (emphasis added):

He was correct on the direction of the price movement but for the wrong reasons (or so it would seem, judging from the above quote). It may be too early to tell, but is non-OPEC production 'recovering' in the manner Lynch predicted? Thus far, judging by the current economic turmoil, it's 'demand side pressures' not increased production, which are helping to fuel the fall in oil prices.

I have no doubt many of the concepts raised above play a role in the psychology of oil pricing; however, I am left feeling a much simpler explanation is being given short shrift. Oil is prototypical product with an inelastic demand curve. When demand exceeds supply it takes a large increase to reduce that demand back to the level of supply. When demand falls below supply a market glut develops and the increasing stocks of oil drive price down. This behavior is based on very short term responses to the problem.

Luis de Sousa, very good points. JD....you also bring up some good points, but to say West Texas was MEGA WRONG, might be somewhat premature in your assessment. There is a GEOPOLITICAL FACTOR that many are not factoring in. Basically it is between the Great American Bull (along with England) and the Huge Russian Bear (including Iran and Venezeula). The Orchestrated Collapse of LTCM (Long Term Capital Management) back in 1998-99 helped collapse the price of oil which destroyed the Russian Economy. We have to remember, because of the collapse in the price of oil, Russia Devalued their currency overnight and Russian Citizens got wiped out overnight.

The Russian Govt would start to get in trouble at $80 a barrel oil. At $60, the Russian Ruble comes under severe pressure and the govt starts to prop up its currency. At $40...GAME OVER for Russia, as Russian Ruble is now in Danger.....Govt spends a great portion of its currency reserves to hold off a collapse of its currency. When Russia went into Georgia, it proved to the powerful entities that they did not learn their lesson from the 1998-1999 LTCM takedown. Thus, to keep the Russian Bear in check, the price of oil was taken down by the very institutions that held the opposite trades from their own customers. JP Morgan, Goldman Sachs to name the larger players, took down the very hedge funds they represented who were long commodities....while JP Morgan and Sachs were short.

People need to remember, the Russian Bear is not just fighting against the American Bull, but entities within it. JP Morgan, Goldman Sachs, the Fed, The Treasury are just as powerful in destroying a country as is its military. After the United States won the war in Iraq, JP Morgan was given the task of putting together the new National Bank of Irag in 2003. After the new National Bank was put in place, JP Morgan was able to start trading medium term Oil Contractsin Dec 2003 through the National Bank of Iraq along with the new control of 2 million barrels a day oil.

Many in this blog do not realize that JP Morgan is the FED. JP Morgan has the largest Derivatives exposure of any Bank in the United States. Furthermore, the way to control the price of oil, is to control the price of Gold. Ever since the United States withdrew its policy of backing the US Dollar with Gold, a new regime of World Fiat began. For the US Dollar to survive with out any backing, manipulation of commodities had to take place.

Lately, Antal Fekete, Professor Emeritus of Mathematics has been writing for years about how GOLD is MONEY. According to Fekete, Paper gold contracts started to trade in 1975 after Nixon unpegged the Dollar to gold in 1971. Ever since 1975, Gold has been trading in Contango. Contango means the futures price is higher than the present cash spot price. For the first time in history, Gold went into Backwardation on Dec 2, and continued to do so, and even got worse. Fekete has been writing about Gold going into Backwardation when the world starts to lose faith in FIAT PAPER MONEY. Instead of investors trading paper contracts, making risk free profits, they rather pay a premium for spot cash gold and take delivery. Fekete states that when gold goes into permanent backwardation, there will be no one willing to sell gold at any paper price. This means the end of Fiat Money....also the destruction of world trade.

There is a historic example of this. Back when the Roman Empire was starting to collapse, Gold went into hiding in Private hands. Basically Gold left the public arena and was bought up and taken into private hands. Thus after the Roman Empire Collapsed, the Dark Ages enused for over 1,000 years. On the other hand, the eastern Roman Empire, Constantinople allowed to keep their MINT open to gold and their Civilization remained vibrant for another 1,000 years.

The United States took Gold from its public back in 1933 by order of FDR...and only allowed trade through Foreign govts. US public citizens were not allowed to own gold until 1973. This was the beginning of the end of the US EMPIRE. Even though American citizens were allowed to own gold....this was the start of funneling gold from the public sector to private hands. Thus we had the beginning of the same situation that ended the Roman Empire. Today, with the Bailouts and the huge inflationary policies of the FED and US GOVT, gold is being taken off the shelves with alarming speed. Small denomination gold like small bars and coins are hard to find and if so may take months to receive. The only gold still easy to get are the 100 oz bars on the COMEX. And that is exactly what the smart investors and wise public are doing. They are buying contracts of Gold on the Comex and taking delivery. This is putting pressure on the shorts, thus backwardation is threatening the Gold Window. There is a great deal of talk about a Gold Default either in Dec or Feb 2009.

If the Gold window closes and defaults, this will end the Hedgemony of the US DOLLAR. Without the trust in the world Paper currency, world trade will plumment as foreigners will no longer take US PAPER MONEY for goods and oil. The United States has a Leech and Spend Economy...which can only survive on imports of oil. According to Antal Fekete, if Gold goes into Permanent Backwardation....there will be no trust in PAPER MONEY, even though there might be an attempt to reissue a new world currency or regional currencies. The only money that would put trust back in the market are gold and silver. If the world govt's backed their currencies with gold or at least a part of it, trust could have been put back in the markets, but when gold went into backwardation on Dec 2, all bets are off. It is too late for this to be an option. It is just a matter of time before Gold goes into permanent backwardation and the gold window closes. Thus the end of the Great United States Empire will take place.

When the US Dollar loses its place as the world currency.....imports will dry up into this country as the facade of paper money is destroyed. The lack of imports will put immediate shortages in this country. Their will be delfation of worthless assets such as real estate, most stocks, and paper assets as US Treasuries, Bonds and Retirement accounts...but inflation and hyperinflation of real goods that citizens will need to survive: Food, energy and clothing.

This is the end of the United States as we know it. Unfortunately....the public has no clue that the rug has been pulled out from underneath them. But...it time, they will

Very impressive summary of the current situation.

I love it - Hedgemony of the US dollar; should have gone for Hedgemoney. Well it used to be hedgemoney mostly due to being backed by guns and butter but the glory days of that seem behind us.

The fascination of so many armchair economic theorists with gold is amusing. The object of any currency is that it should be accepted in trade as having value in future trades. Who the hell wants gold? Why? That said, may I point out that the general price of oil since 1972 has been about ten barrels an ounce. Judging by the gold displays in Dubai, etc., the Gulf States seem to have far more fixation with gold acquisition than some poor sod in Minnesota whose concern is keeping his ass warm. When you have gold you trade for oil, when you have oil....

Gold made a big runup along with oil and the US debt/money creation inflation denial mess. My guess is that the relationship will continue, thus either the oil price will rise or gold will fall way down. Once you get the dollar out of the way the export price from the Gulf has been reasonably steady or self correcting.

SRSrocco, you write:

The 'backwardation' or 'bird in the hand' theory of Professor Feteke is as fascinating as it is controversial. So it's only fair to draw readers' attention to the other side of the debate. The articles can be consulted at

http://www.financialsense.com

Sample:

John Needham, writing on the backwardation controversy on 16 December:

Needham is clearly referring to Fekete, the chief of the permabull camp.

I'm not taking a stand on this myself, just like to point out that it's deep water for non-experts.

Carolus Obscurus,

You bring up a good point. Needham is not the only one offering opposing views. Mish Shedlock and Tom Szabo have offered different opinions. As for Fekete being a PERMA BULL, I might disagree. Fekete is not your typical GOLD BUG, who is full of $$$ in their eyes. Fekete could care less about the price of gold, but rather its use as money.

Fekete speaks about Gold in a classic sense and not in terms of Short term profits as many of the GOLD BULLS today. When Needham spoke about parting dollars for gold on March 17, stated that Gold Bugs keep getting it wrong, misses Fekete's point all together. Needham has no understanding of the Clandestine actions of both Goldman Sachs and JP Morgan in their smashing of the paper price of Gold.

As I stated in a Previous Post, the only way the US GOVT can control the price of Oil is to control the price of Gold. Gold Futures trading on the COMEX allows the REGIME of the FIAT DOLLAR to exist. When the Gold Window closes, so does the world of FIAT MONEY...and people rather own Real Money than Paper. This was true when the Soviet Union collapsed in 1989. Dimtry Orlov, commented that citizens in Russia rather have real goods, gold and silver than the Russian ruble to use for trade. When Orlov and some family members wanted to go into a distant town by way of car, to obtain gasoline they had to trade anything but Russian money.

People in this Blog are reacting to my post in a very shallow and ignorant way. That is to be expected. Most people have no clue that those little Federal Reserve Notes are not money but debts. If anyone held a NOTE on their House, it would be a Liablity, not an asset. A Federal Reserve note is a form of Debt that is backed by the US GOVT. With the bailouts and Quantitative Easing, the US DOLLAR is worth less than Toilet paper...as was witnessed today when the Dollar last 200 points.

Fekete's forcast for gold to go into Permanent Backwardation is not a HAPPY ONE. 2009 will be the DEATH BLOW to the US DOLLAR and the World Financial System. As the Roman Empire Fell when gold went into private hands...so will the United States.

SRSrocco,

Thanks for your highly informative reply, am currently digesting it.

All currencies are fiat, including gold. The benefit of gold, when it was chosen, is that it:

1. Doesn't corrode.

2. Is dense and therefore doesn't take up a lot of space.

3. Had no value.

Read #3 again. Gold was too soft to be useful for anything. Now we use it as a conductor, but for the most part it is still useless. That is why it makes a good medium of exchange. No one is going to melt it down to make a coffee pot out of it.

Another way of looking at this is to consider the copper penny. It isn't used any more because copper gained value beyond it's use as money. Once that happened it became worthless as money because people would rather melt it down and use for other things than keep it as money. If that doesn't occur with Gold it is because gold isn't valuable beyond its use as a fiat currency.

--

JimFive

deleted repeated comment

deleted repeated comment

Certainly, a few questionable assertions:

1) The United States took Gold from its public back in 1933 by order of FDR...and only allowed trade through Foreign govts. US public citizens were not allowed to own gold until 1973. This was the beginning of the end of the US EMPIRE.

1933 started END of empire? It didn't even START until mid-WWII, about 1944. Prior was British empire, but USA carefully stayed out of that one until British Empire was broken.

2) When the US Dollar loses its place as the world currency.....

It may happen, in fact I consider it likely, but will have NOTHING to do at all with gold. That's just a gold bug's wet dream.

Some interesting points, not sure whether this is the first time Gold has gone into Backwardation see

here.

These are interesting times :0

interesting analysis

but you have left out panic hoarding

i think in the next round the psychological & emotional factor will be different

that is, if export capacity declines rapidly, there is a shock to the system. people react irrationally (or more irrationally than usual)

i believe that a 5% decline rate on total 86 MBD, when applied to export capacity of 47 MBD, results in a 12 MBD loss of exports in 3 years, or 25%

the question is, when does this start. i think 2010 is the first year

the pessimistic view is 9% decline as mentioned by IEA, which results in 21 MBD over three years, or 45% of export capacity by 2012

then the system siezes up

It was and is a misreading of peak oil theory to conclude that prices only go up from here.

Instead, the plateauing of production (where we seem to be now) implies extreme price volatility.

Volatility means going up AND coming down.

My price prediction for oil?

Extreme price volatility.

Which is still a very good reason for reducing one's exposure to petroleum -- households, companies and countries.

on February 21, 2008 - 1:03 am I wrote one of my first comments ever on the Oil Drum. It addressed oil pricing, but wandered over into finance as a corollary issue that seems equally appropriate today. Here it is, with a few updated phrases marked in square brackets like these: [ ] .

Given the choice, would people rather start starving to death immediately, or quite a bit later?

That’s really what is at issue here, isn’t it?