An interview with Stoneleigh - the case for deflation

Posted by Euan Mearns on October 31, 2009 - 10:57am in The Oil Drum: Europe

At the ASPO conference in Denver, October 2009, I had the good fortune to meet Stoneleigh, former editor of The Oil Drum Canada, who left the The Oil Drum crew with colleague Ilargi to set up The Automatic Earth where they publish stories, news and analysis of the unfolding financial crisis. I spent a couple of days chatting with Stoneleigh where she recounted her rather gloomy prospects for the immediate future of the global economy. The following interview is a summary of her analysis of the unfolding situation. Note that in a departure from convention, my questions are set in "blockquotes" to distinguish these from Stoneleigh's responses.

Stoneleigh, the world economy seems to be suffering from two great structural woes at present, namely stubbornly high energy prices that are linked to demand that is persistently ahead of the supply curve, and a level of debt that has destabilized the global finance and banking systems. Can you explain for us the scale and structure of this debt and to what extent write-downs and quantitative easing (QE) have solved this problem?

Firstly, I would say that the energy prices that currently seem stubbornly high should fall substantially as the speculative premium evaporates and demand falls on a resumption of the credit crunch. The sucker rally that has spawned all the talk of green shoots is essentially over in my opinion. The result should be a reversal of a number of trends that depend on the ebb and flow of liquidity - we should see stock markets and commodity prices fall, a significant resurgence in the US dollar and a large contraction of credit. The scale of the reversal should be substantial, as should its effects on energy demand. Demand is not what one wants, but what one is ready, willing and able to pay for, and in a severe credit crunch the capacity to pay for supplies of most things will be severely reduced.

As demand falls, and with it prices, investment in the energy sector is likely to dry up. Many projects will be uneconomic at much lower prices, meaning that the projects which might have cushioned the downslope of Hubbert’s curve (and the much steeper net energy curve), are unlikely to be developed. In this way a demand collapse sets the stage for a supply collapse that could place a hard ceiling on any prospect of economic recovery. That is a recipe for extremely high energy prices in the future.

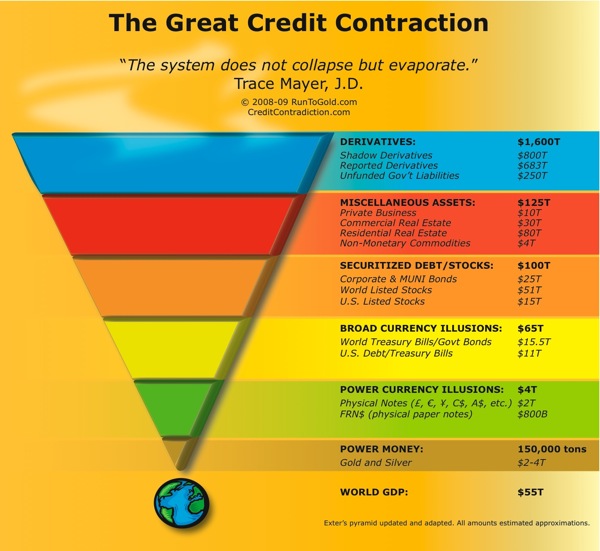

Secondly, our vulnerability to the consequences of debt is extremely high at the moment. The scale of that debt is staggeringly large. The global credit hyper-expansion has been decades in the making and is now significantly larger than notable events of the past such as the South Sea Bubble of the 1720s and the Tulip Bubble of the 1630s. It dwarfs the excesses that led to the Great Depression.

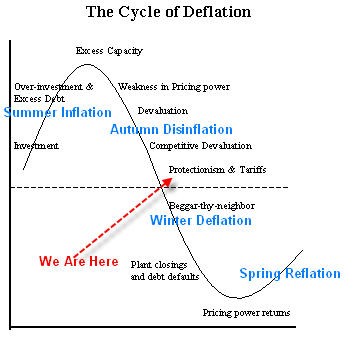

Credit bubbles are inherently self-limiting, proceeding until the debt they generate can no longer be supported. We have already passed that point, and we are now two years into a contraction phase that is about to accelerate. As the aftermath of a credit bubble is typically proportional to the scale of the excesses that preceded it, we should be in for the largest economic contraction in at least several hundred years, and it will be global.

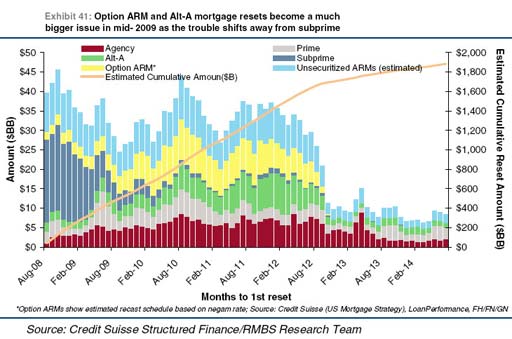

Real estate, which is a major focus of the mania, should do particularly badly in the coming years (in fact the coming decades or longer). There is still so much deleveraging ahead, and so many danger signals, such as the scale of the coming interest resets on US mortgages between now and 2012 (below). While the subprime resets are ending, Alt A and Option ARMs are just beginning.

There will be a very significant undershoot of historically average values, as there always is following a mania (much more than the Case-Shiller projection below suggests). In my opinion, housing prices are likely to fall at least 90% on average. For those who own property on margin, this will be a disaster.

For evidence that this crisis is indeed global, look, for instance, at European housing bubbles, which were worse than in the US.

Unlike inflation, which divides the underlying real wealth pie into smaller and smaller pieces, credit expansion creates multiple and mutually exclusive claims to the same pieces of pie. Once a credit expansion reaches its maximum extent, and contraction begins, these excess claims begin to be extinguished. Unfortunately, the leverage is such that there are probably over a hundred claims to each piece of pie. While contraction begins slowly, as is the nature of positive feedback loops, it picks up momentum until a cascade point is reached, whereupon one can expect the excess claims to be extinguished in a rapid and chaotic process. This amounts to a rapid collapse in the supply of money and credit relative to available goods and services, which is the definition of deflation.

The scale of the problem has been temporarily concealed by a market rally and the shovelling of tens of trillions of dollars of taxpayer’s money into a giant black hole of credit destruction. This has done nothing to reignite lending, but the temporary (and entirely irrational) resurgence of confidence has restored a measure of liquidity. As that confidence evaporates with the end of the rally, that liquidity will also disappear

Banks hold extremely large amounts of illiquid ‘assets’ which are currently marked-to-make-believe. So long as large-scale price discovery events can be avoided, this fiction can continue. Unfortunately, a large-scale loss of confidence is exactly the kind of circumstance that is likely to result in a fire-sale of distressed assets. The structure of the credit default swap component of the derivatives market makes this very much more likely.

The CDS market allowed large bets to be placed on certain prices falling, and by entities which did not have to own those assets. This creates a perverse incentive for some parties to cause others to fail for profit (akin to me being able to take out fire insurance on your house and thereby give me an incentive to burn it down). An added complication is the extreme degree of counterparty risk that resulted from a complete lack of capital adequacy regulation. Many parties with winning bets will not be able to collect, so they may cause financial mayhem for nothing. The CDS market is worth some $62 trillion, and a meltdown is very likely in my opinion.

A large-scale mark-to-market event of banks illiquid ‘assets’ would reprice entire asset classes across the board, probably at pennies on the dollar. This would amount to a very rapid destruction of staggering amounts of putative value. This is the essence of deflation.

I have for a long time argued and believed that there are so many interests vested in protecting our current system that national governments, the IMF and institutions working together would keep the market flooded with liquidity in order to ward off the threat of deflation. In fact, it seems that a prolonged period of inflation is the only way to diminish our debts. I sensed at ASPO International in Denver that this was the majority view. Do you agree that inflation is the most likely near term outcome of current monetary policy?

Absolutely not. I agree that this is the consensus opinion, but I see it as fundamentally mistaken. The debt monetization that is going on has done nothing to increase the supply of money and credit relative to available goods and services, which is the definition of inflation. Credit contraction dwarfs debt monetization, leaving us in a state of net contraction, even though we have just experienced a large rally lasting months, which should have been the most favourable condition for reigniting lending if such a thing were in fact possible. I would argue that it is simply not possible and that deflation is inevitable.

Credit bubbles always end this way, with the mass extinguishing of the excess claims debt represents. They are essentially Ponzi schemes, crucially dependent on the continued buy-in of new entrants. Globalized finance brought a flood of new entrants following the liberalization of the early 1980s, but there are now no more new sources of wealth to tap. Deregulation allowed the reckless to gamble away virtually everything, including bank deposits and pension funds. Globalized finance has created a giant Enron, which while appearing robust is actually almost completely hollowed out. Such structures implode, often without much notice.

In my opinion, deflationary deleveraging will continue until the (small amount of) remaining debt is acceptably collateralized to the (few) remaining creditors. Until that point, there can be no lasting return of the confidence required to rebuild shattered credit markets. Deflation is ultimately psychological. Without trust we will see hoarding of the cash which will be very scarce in the absence of the credit that currently comprises the vast majority of the effective money supply. The combination of scarce cash and a very low velocity of money will be toxic.

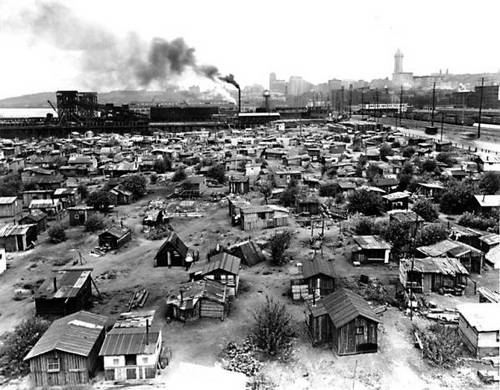

Money is the lubricant in the economic engine and without enough of it that engine will seize up as it did in the 1930s, when farmers dumped milk they couldn’t sell into ditches while others were starving for want of the money to buy food. There was plenty of everything except money, and without money, one cannot connect buyers and sellers. Potential buyers will have no purchasing power as they will have lost access to credit and their ability to earn an income will be hit by spiking unemployment. Those who still have jobs will find that they have no bargaining power and there is therefore no wage support. Sellers and producers will have no market and will themselves lose the means to purchase supplies or raw materials for the things they would like to produce. If conditions remain frozen for any length of time, they will go out of business. The deeper the collapse, the more protracted the trough and the more difficult the eventual recovery.

I would argue that we have no need to fear inflation until we have reached a trough - until the deleveraging impulse is spent. We can expect to spend a long time in the liquidity trap, where real interest rates will be much higher than nominal rates, leaving central bankers “pushing on a string”.

Some would argue that faced with the unimaginable specter of deflation that governments will seize control of interest rates from the bond market. Why do you think this may not happen?

The bond market is far more powerful than governments at this point. While the international debt financing model remains, the bond market will retain its power to prevent money printing. Even though governments are not succeeding in increasing the effective money supply for reasons already discussed, they are nevertheless increasing systemic risk with their activities. This is a recipe for very much higher interest rates as a risk premium. Governments do not set interest rates, they decide what rate to defend, but if that rate is substantially different from what the bond market requires, then defending it would be ruinous.

I think we are headed (not imminently but eventually) for a bond market dislocation, with nominal interest rates on government debt spiking into the double digits. This will amount to hitting the emergency stop button on the economy, especially since real interest rates will be substantially higher (the nominal rate minus negative inflation). I am in fact expecting interest rates on private debt to rise before we see problems in the market for government debt, as the latter should benefit substantially in the shorter term from a flight to safety. The risk premium on private debt is already rising, which is a serious danger signal for such thoroughly indebted societies as we see in the developed world.

But stock markets are booming again, several OECD economies are emerging from recession, unemployment has stabilized, there are green shoots everywhere. Surely the current QE strategy is working?

The green shoots are gangrenous. Some of the largest market rallies on record happened during the course of the Great Depression, as depressions are associated with very high volatility. Look for instance at the great sucker rally of 1930. There are always rallies of all different sizes in any bear market, just as there are pullbacks of all sizes in bull markets. No market ever moves in only one direction.

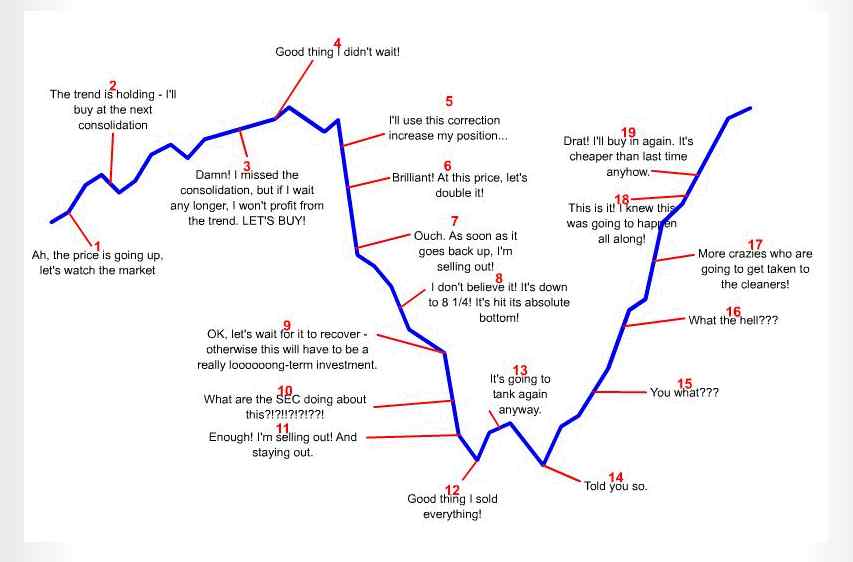

People tend to extrapolate recent trends forward, but this amounts to stepping on the gas while looking only in the rearview mirror. This is one reason why major trend changes are so rarely anticipated. Another is that the prevailing view of markets is fundamentally wrong. There is no perfect information, perfect competition, stabilizing negative feedback, rational utility maximization or efficient markets. Markets are irrational, driven by swings of optimism and pessimism, or greed and fear, in an endless tug of war, and largely in an information vacuum. Investors chase momentum by jumping on passing bandwagons, hence demand for financial assets increases when prices are rising and falls when prices are falling, in classic positive feedback loops.

We have just lived through a period of several months when greed and complacency were in the ascendancy, but that trend is about to reverse in my opinion. Looking at markets as constructs of human herding behaviour allows them to be probabilistically predictable, permitting the forecasting of trend changes. For anyone who is interested in pursuing this idea further, I suggest looking into Bob Prechter’s socionomics - a fascinating subject which delves into the many effects of changes in collective mood.

For instance, as pessimism deepens, driving economic contraction, one would expect to see many manifestations of collective anger and mistrust. As this progresses it is likely to lead to xenophobia and a blame-game, with skillful manipulators (such as the fascist BNP leader Nick Griffin in the UK) poised to direct the anger of the herd towards their own chosen targets. The potential for serious social fragmentation is very high when expectations have been dashed and there is not enough to go around. Having lived through a very long period of manic optimism and increasing inclusion, we in the developed world are not used to expressions of the dark side of human nature, except for entertainment purposes in popular television programmes. It will come as a considerable shock.

Would you care to give your opinion on where the Dow Jones Industrial Average is headed in the near (1 year) and medium terms (2 to 5 years)?

I think the market will fall hard (intervening short rallies notwithstanding) for perhaps 18 months. This was the length of the first leg down (October 2007-March 2009) and so represents a reasonable first guess at how long the next leg at the same degree of trend might last. I think we will see falls of thousands of points in a series of cascades. I don’t see the markets reaching a lasting bottom until probably the middle of the next decade, and even then I don’t expect it to be a final bottom. This has been the largest credit bubble in history, and the aftermath of a major bubble always undershoots where it began before any kind of recovery begins.

The aftermath of the last major mania - the South Sea Bubble in the 1720s - lasted decades and culminated in a series of revolutions.

We are still relatively near the beginning of our own crisis, but already it compares with the Great Depression.

How do you see the US$, gold and oil trading in the same time frame?

I think almost all assets will fall as price support is knocked out from underneath them, but the dollar should rise initially on a flight to safety. Scarce cash will be king for a long time, and the value of one’s currency relative to available goods and services domestically will matter much more for most people than its value relative to other currencies internationally.

In a deflationary scenario, prices fall, but purchasing power typically falls even faster, meaning that everything becomes less affordable despite the lower nominal prices. Prices in real terms, adjusted for changes in the supply of money and credit, are what matter. In a world where almost everything is becoming rapidly less affordable, the essentials will be the least affordable of all, as a much larger percentage of a much smaller money supply will be chasing them. This will confer relative price support.

Although we could initially see a large glut in energy supply as demand falls off a cliff, this is likely to lead to supply collapse as investment dries up, hence I expect energy prices to bottom early in this depression. Both financial and physical risks to energy exploration are likely to increase substantially in a destabilized and capital constrained world, and even maintaining existing assets could become very difficult. This is a recipe for much greater state involvement in ownership and exploitation of (probably deteriorating) energy assets, with increasing conflict over those assets as supply gets dramatically tighter with lack of investment.

As for gold, I expect it to fall initially as people sell not what they would like to, but what they can, in order to raise the cash they need for living expenses and debt servicing. Owning gold is likely to become illegal again (as it did in the Great Depression) in my opinion. This wouldn’t necessarily stop you owning it, but would stop you trading it (at least without taking major risks) for other things you might need. Owning gold now therefore only makes sense if one is confident of being able to sit on it for a very long time, as it will hold its value over the long term as it has for thousands of years.

What will be the consequences for unemployment levels and services provided by government?

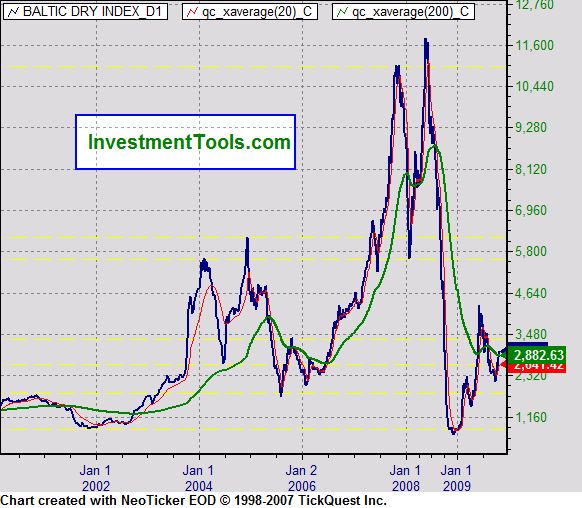

Unemployment will go through the roof as the prospects for selling most goods and services decline dramatically. In the developed world we are nations of middle men - generally service economies where we make a living figuratively taking in each other’s laundry. Most of us produce relatively little. Even those who do will find almost no market for their exports, and those who could find buyers may not be able to send shipments as credit contraction prevents shippers from getting the letters of credit they need to ship goods. A glance at what has happened to the Baltic Dry Index (below) indicates the difficulties already facing shipping companies.

Unfortunately middlemen are almost completely expendable, and the services of others are likely to become unaffordable for the majority very quickly. While there will be a huge surplus of labour, and the few who retain purchasing power will be able to hire anyone they want for very little, most people will have to do everything for themselves, as poor people have done throughout history and as most of the population of the world does now. Not only will we lose access to the paid labour of others, but we will lose our virtual energy slaves as well. This will represent an enormous fall in the standard of living for the vast majority.

Whereas inflation can conceal a fall in purchasing power, so that people may not even realize it is happening, deflation brutally exposes it. Wages would have to fall just to keep purchasing power the same, but keeping it the same will not be an option for cash-strapped employers. In addition, with a large surplus of labour, workers will have no bargaining power. This is a recipe for exploitation the likes of which we have not seen for a very long time, but in the intervening adjustment period it is likely to lead first to war in the labour markets.

I would expect general strikes and a breakdown in the reliability of centralized services such as healthcare, education, power systems, water treatment, garbage (and snow) removal etc. This will be exacerbated by plunging tax revenues for all levels of government, which governments will try to compensate for by raising taxes, on anyone still capable of paying, to punitive levels. We would thus expect rapidly deteriorating services at much higher cost.

Many people are at risk of being eventually priced out of the market for goods and services, and particularly the essential ones, entirely. In my opinion, we stand on the brink of truly tragic circumstances.

End note:

The day before the ASPO conference began in Denver, Stoneleigh, Rembrandt Koppelaar and myself took a drive into the Rocky Mountains National Park providing the opportunity to discuss and reflect upon the current global situation. As the week unfolded I realised that I was in denial about the gravity of the global financial situation. In what has become a situation of complexity that is beyond the ken of most folks, I find it simpler to break this down into smaller components that I can relate to.

In the UK, we have an escalating burden of government debt that we can unlikely ever repay. Unemployment is rising, tax receipts are plunging whilst expenditure on social security, health and the elderly go through the roof. We have been living way beyond our means, which with the peaking of UK oil and gas have suddenly become more meagre. We have an election in May 2010. The new government will want to raise taxes and cut public spending. The current reversal in global growth is sending energy prices higher. Higher unemployment, higher taxes, higher energy prices and reduced public services are a toxic mixture for an ailing economy. If the bond market decides to price in the risk premium for escalating debt it will be game over. The questions are if and when? Figure 13 is one of the more interesting for me.

That's me on the left and Rembrandt Koppelaar on the right, contemplating our future after a most enlightening, if not very cold day in the Rocky Mountains. Photographer - Stoneleigh.

Dumb question - what prevents governments from coercing banks from lending? Not that they should need coercion after a certain stage, after all, it isn't in their best interest to see things get to the stage where municipalities are unable to maintain basic services such as water distribution or sewage treatment. Such a situation unfolding in the developed world would be disastrous for their very existence; perhaps remedies to this situation are being hashed out behind the curtains, a rather Star Chamber or NWO scenario I admit.

Also, as a lame appeal to historicity, John Michael Greer wrote about how the alternative press was aflame with assurances that the world economy was on the verges of completely unraveling in the wake of the '87 stock market crash. This is a facet I always keep in mind reading analysis of energy/environmental/economic issues, and prognostications of dire collapse. I do recognize that the current recession is qualitatively worse than anything since the GD; is there no way out, however? People have shown to have an unquenchable thirst for mania, perhaps that can be met with some new hot market, Green tech, for instance. Or informal avenues of getting business done will take over where the FIRE sector has left people in the lurch.

I guess Stoneleigh's post above could be summarized as: Too much paper money everywhere! That has been a rallying cry since paper money first existed. However, I don't think it is the core problem. Free markets adjust to too much paper money with inflation and changes in exchange rates.

In terms of the immediate possibility of deflation and ensuing economic calamity: while in 2009 M2 money supply in the US is not growing and US private credit growth is declining, money supply and credit in the fastest growing part of the world is expanding. Look at Chinese M2 money supply growing and the massive Chinese credit expansion since the beginning of 2009.

In other words, are credit and money supply contracting globally? No. What is playing out a regional shift with the developed world deleveraging and the developing world leveraging. Global deflation is not likely in this scenario.

The lynchpin in all of this (if you believe that monetery policy has created the current situation) is that one of the largest economies in the world has been growing rapidly since the early 1990s in percentage terms and absolute terms while keeping their currency effectively pegged to a devaluing US dollar.

China's Yuan peg to the US dollar created the cheap credit flow in the developed world. It has hamstrung US monetary policy and free market adjustment. It allowed the Chinese to win jobs from every country in the world as the cost of production in China kept going down with the Yuan-dollar peg. Other developed word currencies (EUR, GBP, AUD etc.) all had to follow the descent in the USD (with the resultant cheap credit) in order to maintain relative competitiveness with the US. These developed currency devaluations were free-market driven but their core driver was also ultimately the Yuan-US Dollar fix.

This beggar-thy-neighbor monetary policy (China taking growth from the rest of the world with an ever cheapening currency) can only last so long before it creates unsustainable distortions in credit markets and global employment/manufacturing. The credit crisis in 2008 was the first sign of a market convulsing under the Yuan-Dollar restraint.

If China decoupled (as they will have to do eventually), their currency would strengthen, global inflation would increase (as producing goods in China would become more expensive) and the monetary (a key part of which is credit) world could rebalance.

If China doesn't de-couple then the only solution is for all other countries to raise trade barriers to prevent the flow of capital to China.

The fixed Yuan is THE core of our current monetary problem.

Buster - not so by a long shot. It's not just credit - it's credit vs real resources per unit time.

The Chinese add even more credit based on air than OECD does. How much super high EROI energy is left to service the debts that China has entered into? And I don't think Stoneleighs point is that there was 'too much paper money everywhere' but that credit (now digital money) has too strong of a role in the foundations of our financial system. This situation has happened many times before - what most people see as inflation is the natural response to seeing lots more money/credit being thrown at the problem by governments - and if the world system stayed the same as it had the last 30 years then inflation would be the natural result - but credit/debt and interest are part and parcel of (the current) economic pyramid - we now have a debt imperative that in turn results in a growth imperative - this then creates a giant beggar-thy-neighbor tug of war where debtors vie with eachother in the market to capture enough of a finite supply of credit to repay their loans with interest. It is far far greater than a problem of US or China or various currencies - in the end it gets down to available energy gain per unit time relative to total debt (not paper money) supply. Virtual wealth far exceeds real productive capacity, and until this is recognized and equilibrated it will likely get worse (e.g. China and G20 nations throwing more debt at problem).

When looking at this situation from vantage point of whether oil or gold prices will go up or down as opposed to whether current distribution system can handle this extreme of systemic problem will lead one to different conclusions. I think these problems are solvable, but in likely only in unconventional ways -i.e. we have lots of natural resources remaining but not enough to service the ongoing claims structures-

How much debt is too much, though? I always imagine the prospective person wanting to start up a new business; give them just enough liquidity to get a start. Helicopter Ben seems OK with his money drops, is he insane? Indifferent? Deliberately engineering something sinister?

We seem to have concluded that energy can only consume so many percent of the economy before smoke begins to come out of the engine - ca. 6% - how monstrous a tab can we rack up on our children without the walls of the global Potemkin village keeling over? The global aspect of it all seems to be a strong qualification. Rather than an Argentina or Indonesia burning out in isolation, this all seems more like...what's the appropriate analogy, an episode of Gilligan's Island? The Stanford prison experiment? Collaboration between parties is essential, otherwise things will go sideways overnight, harming everyone involved. So this collapse will be catabolic and long duration. Or the patient will spend a long time in the hospital recovering.

On the subject of China, these are quite shocking images: Amazing Pictures, Pollution in China | ChinaHush

This is best explained by the Minsky moment that Herman Minsky came up with,

So basically when investors start having cash flow problems in keeping up with debt repayments and investors, people can't take on any more debt relative to income as their wages simply can't support the interest payments.

The last 30 years have seen real median wages in the US remain stagnant while debt has risen dramatically courtesy of Wars, excessive and often fraudulent lending and a collective mood of optimism. Now we see that people have overextended themselves and there simply isn't enough cash circulating in the economy to repay the debts.

My fundamental difference in view is that I think we have two challenges which happen to be coincidental: a monetary problem and an energy/resource predicament.

The monetary problem can be solved with time, patience, inflation and free exchange rates. These debts/currencies are tokens/markers with no intrinsic long term value. Their value is short-term and market restrictions, such as China's fixed exchange rate, can distort these short term values quite significantly.

The energy/resource predicament has no readily apparent solution. This predicament was not caused by the monetary system.

Reality check on income: In 2008 dollars (i.e. real inflation adjusted terms), the median household income in the US in 1980 was US$44,059. In 2008 it was US$50,303. (source: US Census Bureau)

I wouldn't disagee with you that absolute debt and debt/income may be higher now than 30 years ago. However, bear in mind that interest rates have been extremely low over the past ten years and so the burden of servicing that debt has been relatively less than 30 years ago.

What I am trying to convey is that this period of very low interest rates in the developed world has been caused by a distortion of the global monetary system resulting from China's fixed exchange rate policy. This monetary problem is solveable.

We've been in a 30 year treasury bull market, usually these are cyclical, each bear and bull market in treasuries lasts about 25-30 years. So we are now entering the final swan song of low treasury rates followed by rising rates.

Also as per Nate Hagens 147 page slide show here - http://www.theoildrum.com/node/5567

On page 109 and 110, real wages have been stagnant for 35 years after rising for 150.

The monetary problem is not solvable, the root of the problem is not China's fixed exchange rate, rather it has been the hyperexpansion of credit relative to the real, income producing assets in the economy. There was extreme malinvestment across all sectors of the global economy.

The correction is always equal and opposite to the deception that preceded it

The mathematics of debt vs income are irrefutable. This will end badly, all government intervention has served to do is to make the underlying crisis greater with it's asymmetric policies.

The problem is excessive debt and insolvency, countering this with more debt in the form of trillion dollar deficits and adding liquidity is foolhardy. The only way a credit induced depression can be solved is by making it worse as opposed to the garden variety inventory led recessions. As the bad debt must be cleared as it acts as a toxic sludge choking the whole system.

What about the almost 50% of the world economy (developing nations) that have extremely little debt compared to the developed world?

What about the vast majority of people in the developed world that are not defaulting on their debts?

What about the huge growth in real wages for those living in the developing world?

Yet.

When oil goes up again, the economy will contract further, putting the next tranche of debt-holders in trouble and so on.

There is a pattern here forming. We're just at the beginning of it and most people won't see it until it's too late.

The one thing governments can do that you or I can't is inflate away their debts - and ours along with them - through monetization.

No they can't. We are stuck in the liquidity trap, where the velocity of money is low (ie it is hoarded) and real interest rates will be punishingly high. Increasing the money supply, especially the supply in circulation, is not possible under those circumstances. The bond market will also keep a lid on such efforts while the international debt financing model still exists, which will be a while yet.

One begins to get the distinct impression that the massive potlatch of bailout money over the past year was not really about any sort of real assistance to the macro economy, but rather just a matter of simply throwing a life ring to the favored few with good political connections. The entire economy, and most of the people, may be going down, but they, at least, will be saved from the full consequences.

The best government that money can buy.

I agree. Bailouts are only ever for the well-connected few, although they are sold as being for the little guy. It's no surprise given the revolving door between Goldman Sachs and the treasury. Wall Street took over Washington a long time ago and is effectively using public money as its own private slush fund.

Oh where is Jeppin so s/he can show all of you up and explain how you are wrong about 'Wall Street took over Washington'.

Stoneleigh

'No they can't. We are stuck in the liquidity trap, where the velocity of money is low (ie it is hoarded) '

diagree. even michael panzer whose books u like says; they can put $/debit cards in our hands, & accounts electronically.

& i believe will do so when the chips are down for politicians, & they can no longer cater to the bankers. this is what is different than before.

blow the bond market/dollar, probably. maybe a war in the midst of such would provide some cover.

Why? What makes you think they give a damn that you have lost your home? Or about anything else? There is a reason some wealthy people are building lifeboats. And their lifeboats will be a hell of a lot seaworthy than most of ours.

This assumption that the wealthy and powerful are afraid of social chaos is silly to me. It seems fairly obvious to me they consider themselves above it all. After all, they just screwed the global pooch, sold us all their losses, bought up all the assets with any value with money we gave them, gave themselves huge bonuses with the same money, then started crowing about all the profits they were making because of all the money we gave them and debt we bought from them.

They will not be fighting any wars, either. Draft dodgers make the best war hawks, after all.

Where in all that do you see any concern for you and yours?

Cheers

ccpo

no assuming any concern, political reality i am talking about. probably endgame; only a matter of months at that point, but Nothin to do w/ concern for me or u or ours.

bankers & the wealthy will be against but til elections are voided fully then the politicians have to be at certain addresses some at times[read violence]; & they sometimes are not rich yet so party/politics is the main game for them.

thanks for the response.

I don't think the point of politics and a few people not being rich means much.

Cheers

i agree. the basic point to me stands; i. e. politicians are very short sighted & will ultimately take care of themselves doing anything that keeps them in office. bankers won't be in charge then; but endgame will be well underway.

And so long as an external force like FedGov needs tax payments via hard currency the well off will be able to exchange what they (Feel they) need from the non wealthy so that for the non wealthy have a shot at keeping FedGov at arms lenght.

Creg,

Governments are not going to put a significant amount of spending power into people's hands, except perhaps for food stamps as a means to prevent rioting. Bailouts are NEVER for the little guy. The bond market wields the power for the time being, although not in perpetuity. While it does there will be no inflation.

I agree that a war as cover is very likely.

They can't just print paper to pay off their debts? I wasn't talking about increasing the money supply through lending. I thought the threat of monetization was what earned Helicopter Ben his moniker...

Or is that what you meant by:

Here's where my understanding is lacking... wouldn't it be the foreign exchange markets that keep them in line by devaluing the currency? Although, if all the developed countries are doing the same then wouldn't we just see declines relative to developing countries' currencies and a shift in relative purchasing power between the two sets of currencies?

The Fed doesn't print paper, it midwifes credit expansion, but it can only do that if there are wiling borrowers and lenders. That will not be the case going forward. Helicopter Ben didn't drop free money, he dropped free debt (ie debt at negative real interest rates for several years), but that period is essentially over now.

After the initial flight to safety phase, with the US dollar as the primary beneficiary, I think we will see a chaotic currency regime with beggar-thy-neighbour competitive devaluations. I wrote about this in The Special Relativity of Currencies.

As some 80% of the derivatives market is based on currency and interest rate bets, both currencies and interest rates are likely to go haywire in the not too distant future, and counter-party risk in derivatives is huge, a metldown in the derivatives market is highly likely.

No, No, No!

If one starts with what might be considered 'original debt' or what I call to myself 'barn raising' then it is impossible to inflate away debt without an ill effect on the society.

By 'barn raising', I mean that this is where one farmer borrows from his neighbours their labour (energy) to raise his barn and later pays it back in similar manner. These debts are stored in the memory of a small community.

When the community becomes too large for that memory it moves to other increasingly complex means of debt memory as in our present world class community (ho ho). I suppose in the original barn raising situation the debt could be eliminated by the farmer dying or being caused to die (possibly due to a reluctance on his part to reciprocate), but that would be of great consequence to the debt holders of that community. In a similar neither would debt inflation be a solution that any sane government would enable.

Oops I think I've just destroyed my argument, what the hell does Summers and Geithner and pal Paulson care about all us riff raff, hoy polloi and assorted neer'- do- wells.! Stomp em, marginalize em, and tax their foul brood.

...but if the barn was owned by the whole community then there would be no debt, only a newly built communal barn. Oh! Darn! I just used a word suspiciously close to 'communist'. Better call Jo McCarthy, can't have subversives like me mouthing off...the rich deserve their 'own' barns...

;)

I don't recall saying anything about doing it without harm to society. I merely said they could do it.

That is because there are more wage earners per household than there used to be. Here is hourly wages, which had increased, adjusted for inflation since 1830 until peaking in 1974.

By the way I could argue the Chinese credit situation is WORSE than US. They grew private credit 17% in 2008 and are on pace for 35% in 2009 which would mean that private-non-financial credit is 150% of GDP for China (roughly 150% in US) so in a few years they are reaching same levels as we are - how will these huge amounts of assets, which tricked our global economic system into thinking things were affordable and thus pulled resources forward in time, be able to be serviced/paid back? I just don't see it.

And the monetary problem facing the world started long before China was on world scene. Based on your comments I detect that either we really disagree on the problem or more likely I am doing a bad job of explaining it. I'm trying to write a post that will make it clearer. One thing I agree is that the money situation can be fixed - but it will result in a great disappearance of what people thought they were entitled to and new rules (i.e. worldwide banking will not run on fractional reserves but gradually towards 100% reserve requirements)

Nate, you are right in that the number of income earners per households has increased so that while household income increased, income per worker declined. More money for each household but less for each worker. Just in case I miss timely responses on TOD, I will always tip my data hat to Nate Hagens (as a reliable data source).

On money/debt being an issue we need to be concered about: I just don't think monetary policy has ever been a long term problem except for those believing that money is a long term store of value or that debts defined in those monetary (rather than hard resource) terms are long term fixed obligations.

In other words, if the US owed China 20 million barrels per day of oil for 10 years then the US should be freaked out. But given that the US owes China a Trillion dollars, then that obligation is only worth the paper it is written on so long as the US economy remains strong. If the US is in real economic trouble then it could print a single Trillion dollar note, hand it to China and say thanks for your trust in the past.

Hey Buster don't come round my joint with your Trillion dollar note, I will cry havoc and set my dogs on you! Heh, love the smell of sundered flesh of a morning.

Here's my FRoEI chart which I'm pretty sure is related to your chart with some time lags and market distortions:

It comes down to the cost of energy slaves. If you have to pay more for the energy, then you have to pay the appliers of energy less.

http://www.theoildrum.com/node/5495

Funny thats exactly the "peak oil" time I came up with.

My opinion is that was the real peak in oil production just slightly masked by on going technical advances and some spare capacity. We sort of missed it.

Ahh posted in June I don't think I had really resolved this at that point.

What you need to do is show the expansion of debt on top of this curve.

Then "peak" is in my opinion obvious. There is a almost perfect divergence in the 1997-2000 time frame.

Figure 21: shows this.

IMHO that was peak oil.

Please provide a reference link to somewhere that you have stated a specific peak oil time. You are once again bluffing.

So you realize that someone will call you on it so you retract the statement.

Typical. These statements are essentially content-free.

Hmmm ...

Don't beat up Memmel, he's a good guy. Very smart. He gets it and there aren't alot out there that do.

Nevertheless, lookie here:

There are other peak oils, all in the past.

The modern world can do without the current interation of money or credit, it cannot run without cheap energy. Expensive energy is just as bad as no energy at all. Those who can afford expensive energy have little need for it, they can afford other slaves. To the rest, value added to labor must leave a residual. Otherwise, the 'invisible hand' flicks the offender into insolvency.

Aren't we ... having a lot of insolvencies??? Seems I've noticed this, myself. Hmmm ...

Stoneleigh is absolutely right about the unwinding of credit, described as eloquently and simply as can be done.

Credit is a problem, a 'laundry' is needed to turn it into real, cash money. Since laundries can only wash so- many shirts at any given time, it takes (a whole lot) longer to launder massive and gigantic dollops of credit into cash.

What am I talking about??? This is not a credit crisis, rather the long running 'Crisis Of Credit', the existential dilemma of what do do with credit after it's created.

If you buy a $1 million dollar house with a $950,000 mortgage, you are leveraged; that leverage is credit. If you sell the house for $1.4 million and pay off the mortgage you have laundered credit into cash; your $50,000 down payment has been turned into a $450,000 cash profit. Unfortunately, this cannot be done anymore; the $1 million house is only worth $600,000. The real estate market has turned against credit.

This is the 'market failure' the bobbleheads on CNBC talk about. Non- existant or malfunctioning markets (not going up) means no laundries for credit. Credit is thence marooned. The owner who spent a $1 million on his house might recoup in twenty years ... or never!

Laundering is buying on credit and selling for cash. The Fed is trying to create some liquid cash to facilitate the laundering process, this is the back- story of the stock market rising (and rising more because finance makes its own credit). Finance cannot create base money or cash; it can create unlimited credit, which is also a problem as it outruns any ability to launder it into cash in any combination of markets.

Unfortunately, the banking system is hoarding this new base money because the same Fed has ordered/wheedled them to do so; the banks are insolvent and need the cash reserves to keep the doors open. The liquidity trap exists not by what the Fed says, but by what the Fed does - by the Fed's actions.

Also, the banks' actions constrain markets and credit laundering; the banks don't lend anew. They are saddled with old loans turning bad by the day - an outcome of the market failures - and there are no new good loans to offset the bad.

It would be better to kill off the banks and their bad loans with them and conjure some new banks with new capital.

What Stoneleigh doesn't mention is the level of corruption and criminality in the finance system. Read Stoneleigh to get the clarified deflation case and Denninger to get the idea of how corrupt the 'system' really is.

Extend and pretend is a way to institutionalize marooned credit. If there is no press to 'properly value' the various claims that credit represents, the claims can remain marooned for a long time. Chris Martinsen wrote an article about this not too long ago but I can't find it right this second.

Eventually, monetary expansion solves the problem represented by redundant claims.

Monetary and credit expansion is an artifact of modernity and trade. There have been deflationary spasms but inflation is the background noise of human 'progress'. Currencies always lose value, they have to. Only currencies that aren't in circulation hold their value. The remainder lose value because the act of circulation itself - velocity - devalues each unit of currency. The myth that some form of currency does not devalue is just that.

This is the gold 'phenomenon'; gold currency is held out of circulation - hoarded - requiring the addition of more gold into circulation by the authorities so as to have enough liquidity to conduct ordinary business. The addition is inflationary. Nevertheless, kings and bankers both learned long ago that the gains in trade outweighed the losses in 'monetary integrity'.

What matters as much as the amount of currency in circulation is what any particular currency can buy. The latter is generally more important than the former, this is my personal observation.

The desperation by central banks to expand monetary bases overnight suggests there are other issues behind the maturing of claims represented by credit. It is this press to 'instantly monetize' and the frenzied bubble- making in the US and China that suggests that there is more a resource issue and less a money/credit issue.

Time solves credit problems - debts cannot be collected from the dead - but resources are running out fast, particularly oil. Here, time is of the essense! When Mexico/Cantarell ceases exportable production in a year or two, there will be a collective heart attack in this country. A million- plus barrels per day - gone - is a lot of oil to simply disappear!

See Jeffrey Brown/westexas on this site and elsewhere ...

You can have all the money in the world, but if there is nothing to buy with it you may as well be penniless.

During the Depression, at issue was the change from agrarian America to urban/manufacturing ... that and the long- overdue abandonment of the gold standard. The crisis was more social and less economic. Manufacturing in the US wasn't comprehensive enough to employ the masses migrating from the countryside with few skills. Our current 'Niewe Depression' is the shift from shrinking energy productivity - lots of fuel guzzling machines earning little or nothing - toward shrinking labor productivity. Shrinking labor productivity means lots of hands working with simpler tools within less complex systems with less labor efficiency. As in the 1930's, the shift is as much social as economic, it is largely about how we fashion ourselves.

The Depression exposed a shortage of vocations at any wage; note all the artists and writers working for the Works Progress Administration. This country currently has an immense 'skill gap'. There lots of lawyers and administrators and folks sitting in offices sending emails to others sitting in indentical offices elsewhere - and lots of others who cannot imagine any other way of living. Those who do not work in this manner fantasize about doing so, not just in the US but around the world. This perception is enabled by cheap energy. Because the energy component is in the background, the participants believe the center orbits around the periphery; resumes or office locations or software or finance or legalisms or other outliers.

The crisis is really a process which is embedded within a social paradigm shift. Whether it is calamatous depends on how we define this shift and whether we have the courage to embrace it.

I remember this post.

The question is was oil production forced via economic means i.e the ever expanding fiat bubble.

If it was forced see my long post the forcing function was over about a 27 year period.

And if this resulted in over extraction of oil then we will see production basically collapse.

Nate has several posts on the economic side of the problem I don't think the economic situation is in

question. However the question is what was its effect on oil production ?

If the combination of a forced expansion of the economy and and effectively wartime advancement of technology was

able to extract oil at such a rate that we manage to maintain production rates at the expense of ever faster depletion then we should see production drop off rapidly once this forcing fails.

My opinion is there is nothing in any of the production data that indicates that we where not able to do just that.

In a private email I said if a system is set up to allow fraud to occur it will occur. By fraud in this statement I mean a complex system is capable of looking stable right to the point of collapse.

Thus using this concept if we are capable of over extraction then we did it.

Since I was unable to prove we did not and since we had a system that obviously would encourage it then we did.

Theoretically the probable should be to try and prove we didn't and about the only way to do that is to accept claimed reserve levels and also to accept that they a significant portion of the remaining reserves can be produced at rates close to our current production rates.

So by taking the approach of assuming guilt and proving innocence I was unable to really justify the reserve claims and much less convince myself of future production rates.

Any reasonable review of oil production suggest we have a lot of worn out old fields exploited to the max and any new finds are small or expensive to extract and are extracted rapidly once brought into production. No way could I even see us producing close to our current rate in say ten years.

Also of course the symmetric peak models that include the reserves with little adjustment suggest the same i.e production has peaked. So accepting the reserves still results in a peak.

So if the economic model suggests the system was forced. And the symmetric models suggest peak and we had the technology to distort the peak then its hard to dismiss asymmetric production.

And of course given my "rule of fraud" to disprove it I had to prove it could not happen unable to do that I had to accept it did.

Will I ever produce a post proving everyone else wrong I doubt it but I don't believe I have to thats simply the wrong question. Its up to others to prove that and asymmetric peak is impossible once enough data exists to make it probable.

And one more time it does not matter if we are asymmetric then we are past peak and production is in rapid decline and we will know the truth in months not years. Again most symmetric models and the asymmetric say peak oil is in the past its over the difference is the post peak decline rate.

What I don't understand is why people don't simply wait a bit see what happens over the next nine months and see if I'm right or wrong. If I'm right then things will get really crappy really fast if I'm wrong then we probably have at least 5-10 years to deal with slowly declining oil supplies.

Its a bit ridiculous given how long we have looked at peak oil to bash a model that either succeeds or fails in a matter of months.

I'll repeat my very short term prediction. If we are in a fast crash then as best I can tell global oil production is declining at the rate of 500kbd-1mbd per month. Since the "cliff" was actually curved we accelerated into this decline rate over the period from 2007-2008. I think we where in this zone if you will by the first part of 2009.

Getting this exact does not matter because if we are crashing then we are at the terminal decline rate right now.

Its high enough that it does not matter when we hit it exactly just that given the price movements if we are crashing then we are now in terminal decline. We can pick Oct 1 2009 as the date.

So taking the low estimate of 500kbd per month of declining production. Within three months of Oct 1 2009 then we would be down by 1.5 mbd globally so oil prices should be under serious strain by December and storage levels should be drawing down at a health clip. By March down another 1.5mbd so things should be getting really intresting and we should be entering a new price spike by that point perhaps even having past the old high.

By June 2010 and another 1.5mbd of declines we hit the point that outright shortages are becoming a serious issue god knows what the price will be.

Now of course these are just guesses and they can of course not be accurate but given that I believe that price has signaled a fundamental change if its fast decline then sometime in the next nine months at most we should be in a situation similar to what I outlined given the speed of decline and the expected high rate if your off wait a month :)

No matter what if collapse is correct and then any high decline rate pinned via the market price to now ensures very tight oil supplies within nine months. And I have not choice but to use market data or price to pin since now production figures are completely unreliable. Certainly there is wiggle room a brief unsustainable surge by KSA for example could temper prices for a few months perhaps a economic blowup could retard the system etc. However barring another rapid global collapse on the scale we had in 2008 then no other factor can retard the advance for more than a few months at most before its back into a tight supply situation.

Now I don't think that our economy can withstand another blow of the magnitude it took in 2008 its simply to weak.

So the only thing that prevents me from proving or disproving fast collapse of oil production then TSHTF is if TSHTF before we feel the full effects of collapsing oil production.

And again it does not matter I'm either completely wrong or right its pretty black and white and I think my predictions are near term enough and bold enough and I've stuck my neck far enough out on the chopping block that arguing my methodology can safely be reserved for nine months from now.

I see no real reason for people to blast me I'm in my opinion wide open. If I'm wrong then no real reason to look at what I've said its garbage.

If I'm right then it makes sense to really investigate the situation to see if better approaches are possible.

They may well be but at its heart the difficulty is corrupted data and I don't see a easy way around that.

Not that its not possible just not trivial. The solution is effectively a lie detector.

Not impossible but also not obvious lies by their nature are generally hard to detect much less prove.

And also I've said this before but I'll repeat it I have three kids 2,5,7 I personally hope I'm wrong I'd much rather have my kids growing up in a world were oil production is slowly declining and alternatives have time to grow.

It may not be a easy world the financial issues are not going away but its going to far far better then what I'm afraid will happen if I'm right. I'm probably my own worst critic since I really really want to be wrong.

But the harder I tried to prove my self wrong the more it became evident I could be right.

So I'm in the same boat as everyone else waiting patiently to see if I'm right or wrong and hoping I just chased a red herring.

If I'm wrong then prices will rise until this trillion barrels of oil is profitable to produce by all measure todays prices are already high enough if they hold steady. OPEC really has 4 mbd of spare capacity and can manage price for a few years at least. By then new projects based on say a 60 floor price will be coming on stream project delayed by the crash will be up and probably accelerated and although oil production will be tight and prices high that are endurable.

If prices fall some all the better it means supply exceeds demand and OPEC will hold even more oil offline to bolster prices. The longer the better. If we even made it five years then my kids would be 7,10,12 and even then decline would probably be slow so perhaps they will enjoy a good bit of their childhood in a relatively comfortable middle class world. I hope so. As and adult I hate what we have done but I had a fun time as a kid and I hope my kids get a chance to enjoy their lives and I'm not running around desperately trying to feed them. So literally from the bottom of my heart I want to be wrong. My brain remains unconvinced.

Does anybody else see what kind of mumbo jumbo this is?

This is not logic from any planet that I came from. Anyway, since when have you tried to "prove" anything on this forum. Another in the unending stream from the Miss Ann Elk school of nonsense. "My theory #2, which is the second theory that I have."

Cripes, I just quoted in another comment that you are working the Chewbacca Defense as well. I wouldn't be able to make this up, as it is so bizarre. "If Chewbacca lives on Endor, you must acquit! The defense rests."

and then it starts to get even more convoluted:

Egad, no one talks in negative logic and expects to be understood!

The problem is Memmel, that you make absolutely no sense, and so whatever your deeper point is gets completely lost by everyone trying to read your words.

WHT - It seems clear that your admirably analytical mind is incapable of comprehending the subtleties of memmels thought process but that is no reason to keep attacking him.

He has consistently sussed out several valid elements of this unbelievably complex trifecta (quadfecta, quint...?).

Try and take it with a grain, or maybe 70 proof grain.

Cheers!

Jef

One issue is that these problems are not entirely complex. That people make them excessively complex, and further the complexity through convoluted language really drives me up the wall.

Plus you claim that I am not taking it with a grain of salt. The fact that I bring up South Park and Monty Python analogies describes the level I treat my exasperation. It's not like I am getting all Freudian about it. In other words, it drives me up the wall while being entertaining as hell.

I will have a contributed story to TOD coming up in the near future on complexity. I am somewhat prepping for it by monitoring all the spew I see being tossed around.

WHT,

It's quite clear to outside observers that you are on a crusade.

If you don't like what Mike is saying, just skip what he writes and move to the next comment. There is a really simple solution to this and you are making it more difficult that it needs to be. I and it seems several other people get value out of what Mike is saying even if you are not.

Please accept my and others' requests and stop your crusade.

Another common rhetorical argument is to claim that you speak for other people. On the list of fallacies, it is called "Appeal to Popularity"

http://www.nizkor.org/features/fallacies/

It would seem that a site like this would not be prone to such a belief.

I agree with aangel. Not a fallacy. Besides, at least one other person had already posted a concurring opinion.

Also, the part you quoted above calling negative logic, I think it was? It was completely clear. Evidence enough you're on a crusade. We've seen it before. Suggest you get over it.

As an example of aangel's advice, I don't read memmel's posts much simply because they are too long and his lack of grammatical structure and, more particularly, punctuation causes me to have to re-read. Given the already-voluminous length, I just don't read most of what he posts.

But that doesn't mean it's not good or not useful.

Chill.

Cheers

aangel speaks for me too.

I always look for Memmels post first. They're fragmented, tangential but are painting a picture of the whole. They touch upon the overwhelming corruption that can skew the best devised statistics. WHT may be a painter like Rembrandt but the world may be more like a Dali.

OK, I look forward to the day when Memmel comes up with something that knocks us for a loop.

WHT, I agree with you.

WHT,

I agree with you. I spend so little time on TOD that I don't want to read a bunch of Jabberwocky and Memmel is a master at it.

This sounds harsh but in corporate life I have seen many of his style. Far too many. Pretenders and wannabes. Folks who got there by pure bullshit. Ones who somehow seem to get into the ranks of management and cause great harm.

Airdale

I gave up reading Memmels posts after he claimed the falling oil price at the end of last year was manipulation in the markets in order to prepare for an attack on Iran. The attack never happened and it became obvious the fall in prices was due to falling demand.

It is a shame really because sometimes memmel comes up with some interesting ideas. Unfortunately you have to read an incredible amount of drivel to get the odd gem.

I can understand WHTs frustration, however, the answer is simple. Just don't read the posts.

LOL that one is not over.

http://www.nowpublic.com/world/u-s-bush-rejected-israeli-plea-attack-ira...

Probably the only smart move Bush made.

Will we probably when ? Dunno I'm sure it came very very close and who knows why we pulled back.

One time we won't. We where like a cat with a mouse playing with Iraq for years before the second invasion.

But war is a go/no go decision once your committed your committed for now its a no go.

But that can change in a hurry.

I too side with WHT. I remember what they told us about math in grade school:

Show your work.

If you present a result (in this case, Memmel's prediction) without showing your assumptions and sources, and the calculations you used to arrive at your conclusion, you're guessing.

It's fiction.

That said, note that even his supporters don't necessarily read his posts. Frequently, your rebuttals make him post again. Is this good for anybody? (I will admit that I usually only read the rebuttals after the initial post. Kinda like the Reader's Digest, only angrier.)

I'm with WHT.

Aangel,

Agreed,WHT needs to just ignore Memmel.There are a couple of regulars I ignore no matter what-its better for the site.

But Memmel-I must admit that WHT IS RIGHT IN ONE RESPECT-YOUR COMMENTS CAN BE VERY HARD TO FOLLOW-you could make your case much better by going over your comments and "tightening up"- your writing style is a sort of "stream on consciousness" and reminds me of Faulkner-one of our very best writers and yet one of the very hardest to read.

This works just fine in conversation but in a conversation you get continious feedback and minor little corrections and interjections continiously and that makes it possible to follow the speakers train of thought easily.

But please hang in there -there are a lot of gold nuggets in your comments.But a lot of dirt and gravel too.

I've offered to edit his posts, iirc. That aside, whether or not any of us agree with WHT or not is irrelevent. His attacks on memmel are personal and pointless.

And, again, not the first person he's done this with.

Seems to me the proper handling here is for WHT to use the inappropriate flag or for Leanan to force editing on memmel's part.

WHT's screeds are unpleasant and achieve nothing but to spill his bile over the site.

Cheers

Thank you for the honest appraisal. I didn't realize I come off that bad. My close associates say I can be "edgy". I guess that turns into bile when converted to the printed word.

Same here. My comments are observations.

Cheers

Thanks I wish I could use english I try to communicate as best I can. I used to not write at all since I was so ashamed of my inability to grasp language but at some point I just said to hell with it and write.

My experience has been when I try and clean things up I simply make them convoluted a different way.

And yes I'm to scared to do a key post. Posting in comments I feel comfortable but its like fear of heights when I have to write "officially" I freeze up big time. Stage fright maybe. Its something I've never been able to control so.

As far as proving my numbers well the real problem is once you do the corrects the result is awful. And it has nothing to do with current events but back in the 1980's. I have posted a bit on this but the picture in paints is extreme.

The US systematically gouged its own citizens and the corruption is huge.

I see no way to not come to this conclusion yet its impossible to "prove" so I don't see any solution.

Effectively its Enron on a global scale for oil with the US government deeply involved.

Basically what happened in the 1980's is the US claimed it was using a lot less oil and the Saudi's claimed they where not shipping it however if I'm right this never happened. Not that US consumption did not decline or flatten slightly but it was no where close to what was claimed.

This of course means the expectations of large demand drops as prices increase are false and oil demand becomes very inelastic past a small drop of optional usage. Same result I claim now. But if its true now then it was true in the 1980's so your left staring at a huge lie.

My views are extreme but this conclusion is beyond extreme however I see no way around it.

In any case either we have effectively been living a lie for most of my life or not.

Thats not a comfortable conclusion. And it probably does mean that our glass house will be shattered.

In any case I'm going to take a bit of a break and probably focus on the campfire side. I think I've said enough.

If things actually start devolving like I think they will then I'll post again if its relevant.

But I need to go to London tomorrow then I have several large software projects to release I have little more to say for a while and I'm really busy so its a good time to take a break from the oildrum.

I am all for memmel posting whatever he wants to say.

Granted sometimes I have trouble digesting everything, but then again, I have trouble digesting what a lot of excellent posters have to say - especially when they talk from the scientific point of view (coming myself from a Wall Street background).

I certainly hope memmel wil be around when oil goes through $100 - which may come quicker than many even here expect.

Thanks I'll leave one last post and I really have to go.

http://www.indexmundi.com/energy.aspx?product=oil&graph=production+consu...

Take a look at the chart. And think about it.

Edit:

And I found this so the charts on oil plus this article side by side help to give the big picture.

http://www.cfr.org/publication/7175/ussaudi_love_affair_predates_bush.html

The game of 20 questions, another common ploy I see to just make everyone confused. The chart shows that crude oil production is leveling off near 72,000/day but consumption (probably of all liquids) is going up to the high 80,000's/day. I think we kind of knew that this all/crude ratio was diverging.

I imagine this is part of your conspiracy that someone is hiding production numbers. I am sorry but you can't consume more than you make, so the production has to come from somewhere. If they are hiding crude production numbers, and the all liquids is fake data, that would mean that every oil-producing country in the world would have to be involved in the conspiracy. I don't buy it, but then again, why am I getting sucked into this discussion again? Oh yeah, I only want to make some sense out of the data I see.

I don't see this at all. Any conspiracy if you will it between the US and a few select producers to channel oil into the US and divert the funds to fight the Evil Empire. Given that the evil empire died before we started to see the divergence expand then I can't see how what effectively was a hidden tax to fund the cold war effects what your saying.

Now the divergence itself suggest for years at least since sometime in the 1980's NGL's where increasingly covering expanding demand because crude supply was not expanding fast enough. This could mean a lot of things but given that debt was expanding during this period it seems the demand was there and more crude would have resulted in more real growth and less inflation monetary inflation. But the key is this suggests we where able to grow NGL's but not crude production.

So there has been strain in expanding crude production for a long time.

If you further assume that real US consumption was higher back during the cold war evil empire days and it was met by off the record Saudi production and the cash diverted to fight the good fight against the Soviet union then the expanding debt bubble and stress on oil supplies is even.

Its hard to see how we could have had a sharp drop in US consumption and the world flooded with oil and the Saudi's cutting steeply to maintain prices then not long afterwards enter a period where NGL's where covering for slow growth of oil production. The entire time debt was being steadily increased.

That by no means says the Saudi's did not cut some production just that whatever their real production number where through the 1980's is not reflected in the official numbers.

Now assuming that the US did indeed institute a hidden tax on Americans via larger crude imports and whats effectively a profit sharing agreement with corrupt countries this mechanism is probably still around if not all that useful.

Also if you look outside of crude it explains our love affair with dictators around the world they allow the US to effectively cut a deal to sell our consumption with the US getting a cut of the money. Its a hidden tariff and of course inflation allowed us to pay it. Its a win win situation the dictator gets filthy rich and the US gets its money to fight unpopular wars and whatever other scheme we wanted and bypass congressional control.

Now this of course is your typical skimming operation so its on top of whatever is normal and can't be to large or its obvious so as far as oil itself goes all this does is add uncertainty into the numbers. With Saudi my best guess is say 1-2mbd or so of excess oil over what they reported as production.

Now of course just like in Texas these hot oil sales tend to depress the price of crude regardless of attempts to control crude production so there are of course limits. But the net result is a fairly good control of prices.

At least into the 1990's esp the late 1990's when we begin to see serious divergence and NGL growth diverge from crude.

Of course it seems that there was spare capacity in the system during almost the entire time but now its hard to know how often excess capacity was diverted to off balance sheet crude sales.

Of course its hard to say or guess the changes can't be that large but with us generally using 50-60mbd or so of crude

your talking about a variable that could be as large as 2-4mbd or 4-8% of the crude market. The steady monetary inflation makes it difficult to understand but price were in general fairly stable which means you had a nice set of feedback loops that for the most party kept the party going.

For oil the net result is the pressure on oil production was probably higher than we realize for quite a while.

The problem I have with the shark fin model is that it practically requires that a significant force is fairly constantly applied to oil production in other words the demand has to be relentless and as technical advances where made the oil was used. Assuming at the highest level the force was the expanding fiat currency debt is fine but it has to be connected to oil production basically from day one. I can't see how it makes sense that we where expanding our debt and oil was not effected then suddenly it was.

The divergence of course i.e ever more debt and slower and slower oil production starts in the late 1990's 1995->

However the system would have had to already been coupled before this I don't believe it just suddenly started coupling at that point that simply does not make sense. Petrodollar recycling was already in place back in the 1970's at least maybe even back into the 1960's. This stealth tax concept probably did not start with Regan either and it seems to be a game we play with many countries and a lot of different products not just oil. Which makes sense if this was/is something we do to fund our foreign operations outside of congressional control then its probably a generic game.

So looking at US imports.

This would have to be a smooth curve or a lot smoother than it looks starting as far back as the 1960's going forward.

I'm left with not choice but to invoke evil empire conspiracy theories and the war on communism as the underlying driver and source of the oil that would smooth the curve. So for several decades production was understated and then it moved to probably be overstated as the NGL divergence started occurred. Post 1998 for a while growing NGL production offset what ever was really happening with oil production. I've reached the point I'm willing to slap a +/-10mbd on the dang production number and forget about it. It is whatever it is and I'm not sure it really matters what the exact production was in any given year. What matters is that we have a greedy mechanism that can and will consume all oil production within reported production plus some large error term.

So the coupling between oil and US consumption esp once we went to fiat was alway present pressure on oil production was pretty constant and we produced basically at maximum minus whatever variation happened in unknown but uncomfortably large error term. Thats fine as year after year decade after decade the variations don't really matter as the pressure or demand side is constant. As long as the pressure existed if real production went a bit low one year it was probably higher the next.

In the late 1990's of course the pressure increased and oil production was unable to respond NGL's again are critical as they helped offset our inability to really increase oil production but the situation steadily worsened on the debt side.

Eventually oil prices themselves started increasing as far as I can tell closely linked to NGL production growth slowing or the widening gap with oil. Plenty of error in the numbers to speculate what may or may not have happened.

Now finally we can invoke the shark fin the system was stressed for a very long time technical advances allowed this stress to be offset by relatively high oil production and growing NGL production also help the supply side respond to the demand stress from constant fiat expansion. However this eventually comes at a price of course as if you do this to a system it can suffer catastrophic failure. The needed driver to create the stress seems to exist in my opinion over a long enough period to have distorted the system.

Now that by no means says that we will crash and I try to post repeatedly that I think that oil production is at a crossroads if we did what I think we did then we crash if not then we don't.

No I'm not going to repeat my post as to wha I think we are at a crossroads right now but heck 140 oil then already back to 75-80 suggest somethings going on we can leave it at that.

Now historically what I find really really interesting is this extension of the stress back through the 1980's it was done simply because I had absolutely no valid reason not to push the coupling all the way back in time with it strengthening rapidly after the onset of the fiat dollar.

But then I needed some sort of tin foil hat scheme or grand conspiracy to support higher unreported production.