Mind-sized Hubbert

Posted by Ugo Bardi on September 21, 2009 - 10:46am in The Oil Drum: Europe

The bell shaped Hubbert curve is commonly observed when a non renewable, or slowly renewable, resource is exploited in a free market. But what is the origin of the curve? Ugo Bardi and Alessandro Lavacchi have recently published a simple "mind sized" model of the Hubbert behavior in "Energies" . Fat cows and lean cows are not included in the equations of the model, but come as a logical consequence of it.

(Note: I made the figure above using two cow images that I had downloaded from the internet long ago. If someone owns these images, please alert me or the editors. We'll be happy to give due credit or to remove the images if so requested.)

Possibly, peak oil will always be beyond the intellectual capabilities of the average politician, but it is also true that there are plenty of intelligent people out there who are perfectly able to understand the concept. The problem is how do we explain it to them. And, if we have to explain it, we must understand it first. What is, exactly, that causes production peaks for oil and for other non renewable resources?

If you look at the common explanations for the Hubbert curve, you'll see that it is often said to be due to the sum of many extraction curves for individual wells. (see, e.g., Roger Bentley's paper, here ). There is something in this explanation: as you scratch the bottom of the wells, you produce less and less and that may generate some kind of curve that first goes up, then down (see this paper by Dudley Stark). But this interpretation requires a number of af hoc assumptions and I think it is not enough to explain how general these curves are. The bell shaped curve appears not just with crude oil, but with a number of resources which don't have the same behavior in terms of single production units. For instance, there are the cases of coal, whale oil, caviar, Carrara marble and many other cases of mineral resources . So, there must be some general explanation for why we have bell shaped curves so often and in so many different cases.

Hubbert himself never clearly explained what he thought was the origin of the bell shaped curve, but his model has been analyzed over the years using various versions of system dynamics and standard economics theory. There are many models which can explain bell shaped production cycles, including the well known "Limits to Growth" scenarios. The problem is that most of these models are not easy to understand for the non specialist. If you look at the scheme of the "world3" model used for "The Limits to Growth" scenarios, you'll see just a jumble of boxes and arrows. How does one make sense out of that? Yet, the bell shaped curve is not so complex, in itself. Can't there be a "mind sized" explanation for it?

"Mind sized" is a term invented by Seymour Papert, the creator of the "logo" programming language. He said that complex problems can always be broken into mind-sized blocks, and so can be grasped by the human mind. Indeed, most of us (including politicians) tend to take decisions based on the way we understand what's going on and our understanding can't be but mind sized. In addition, we tend to ignore what we don't understand. That may be one of the reasons why peak oil is so commonly ignored by politicians and decision makers.

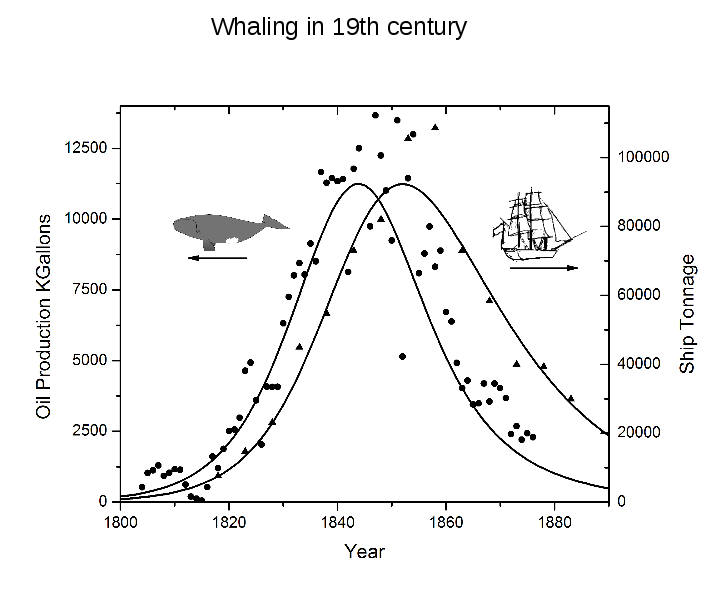

While trying to understand the Hubbert curve a few years ago, I started studying the history of whaling, which turned out to be a perfect example of a the Hubbert cycle. Even though whales are, theoretically, a renewable resource, they were exterminated so fast that they didn't have time to reproduce. So, I found very clear, bell shaped curves for the production of whale oil. It was while I was working on whales that there came to my mind the Lotka-Volterra model. After all, Volterra had developed his model studying Mediterranean fishing, so could the model be used to describe whaling?

You have probably heard of the Lotka-Volterra model that goes also under the name of "predator-prey" or "foxes and rabbits" model. You find it typically in biology textbooks, but it is not so often used in biology because it doesn't catch the complexity of a complete ecosystem. Nevertheless, the Lotka-Volterra model is a good "mind sized" model that tells you how populations grow and tend to overshoot their resource base. Think of an island inhabited by rabbits and foxes. Initially, foxes reproduce rapidly with plenty of rabbits: it is positive feedback. But, with many foxes around, the number of rabbits goes down and foxes starve and die, too. That's negative feedback. Then, without foxes, it is the surviving rabbits who have an easy life, they reproduce and grow. At this point, foxes start having plenty of food again, and the cycle restarts.

So, I spent a few Saturday afternoons developing a simple fitting program for the whaling data based on the Lotka-Volterra model and, bingo! It worked right away! The model could reproduce very well the production of whale oil (the prey) and the predator activity, taken as proportional to the tonnage of the fishing fleet. I could also simplify the model assuming that whales were just like crude oil: a non renewable resource. Here are the results in a graph that I made a few years ago (there is another, more refined version of this fitting in the paper in "Energies").

So, there is this very complex system with whales, whalers, whaling vessels, the whale oil market and all that, and the way it has evolved in time is - basically - mind sized. Whalers have been catching as many whales as they could, reinvesting their profit in more whaling vessels. It was positive feedback. But, with whale numbers dwindling, catching them became more difficult and expensive. Profits went down so that, after a while, whalers had to reduce their activity. It was negative feedback taking over. Eventually, they had to stop whaling altogether, at least for those species of whales hunted in 19th century. That was helped by the appearance of crude oil in the market but, surely, depletion was the main factor. It has been estimated that at the end of this whaling cycle there remained only fifty females of "right whale" (the main species hunted) alive in all the oceans.

Now, I think there are not many cases of a quantitative fitting of the Lotka Volterra model to a real life situation; so this is a very interesting result. And, when you discover something interesting, you feel excited and elated. But you have to see whether you have something that has general validity or if it is just a quirk of the particular system that you are studying. In my case, I needed to show that the model applies to other resources, including crude oil. That took quite a bit of head scratching.

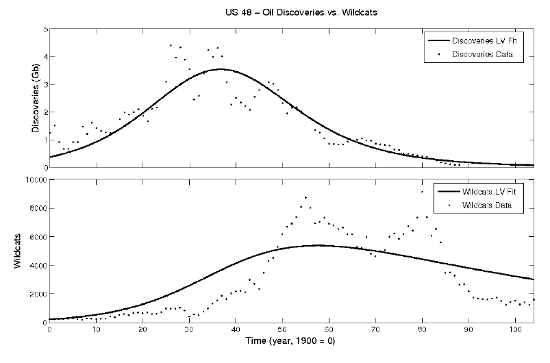

Think of crude oil, the "prey" is oil itself, but what is the "predator"? Evidently, it is all those things that are used to find and extract oil: people, machines, rigs, trucks, etc. All this can be described with a single term "capital", as it was done, for instance, when modeling similar situations in "The Limits to Growth". The problem is how to quantify capital.

There are plenty of historical data available in terms of the extraction of crude oil and of other mineral resources. But data on what I called "capital" are not easy to find. And, then, what should be used as capital for crude oil? The budget of the oil industry? The number of workers? The number of active rigs? When I could find data for these parameters, I tried to fit them to the model, but nothing worked. That was good, incidentally, because, at least, it told me that the model is not a "fit-all" model.

Since this work was done mainly overnight and with no financial support, it took me a lot of time, years, to reach a conclusion. (There is a general rule in scientific research that says, "No research that is relevant is ever financed".) Initially, I enlisted the help of Leigh Yaxley, petroleum engineer based in Jakarta, and we published a preliminary version of this study in the proceedings of ASPO-5 in 2006. Unfortunately, Leigh had to stop working on this subject because of other engagements. So, I asked Alessandro Lavacchi, a former PhD student of mine, to give me a hand. Both Leigh and Alessandro are much better than I am at data processing and curve fitting and, with their help, eventually, we found the key to the story.

Let's go back to whaling in 19th century; at that time the main problem related to killing whales was finding one. Once it was found, killing it and making whale oil out of it was a relatively quick process. In the case of crude oil, instead, the length of delay between discovering a field and getting oil out of it often amounts to several years. But, the main point is discovery: once a field is discovered, it will be put into production at some point--that's almost automatic. So, prospecting for oil is the main "predation" activity, and also the most expensive one. So, the production parameter in the model is the amount of oil found , not the produced oil. At that point, you can think that a measure of the effort (the capital) placed into prospection is the number of wildcats drilled. Once we found this idea, it was bingo again. The relationship of predator to prey was there, although it was not as good as for whaling. Here are the results for the US 48 lower states (the case studied by Hubbert).

Indeed, once you start thinking in these terms, you'll see that the "predator/prey" relationship is a very useful concept that can help you understand a lot of things. For instance, you may go back to the jumble of boxes and arrows that is the "world3" model, and now you'll see that you can cut it down to a number of "mind sized" subsystem that are often based on negative/positive feedbacks similar to those of the Lotka-Volterra model.

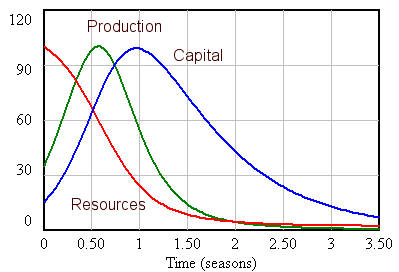

It may be difficult to find sufficient data for a quantitative fitting but, qualitatively, the Lotka-Volterra model can be applied to many cases. Here you can see it, without experimental points - mind sized.

Maybe I am seeing ghosts created by my own mind, but I tend to see many things that I have done in my life in these terms. I see it even with the research grants for my lab, at the university of Florence. Despite having stepped up our efforts, we are getting less and less money to run the lab. "Peak grants" has taken place a few years ago and my lab is being destroyed by the same mechanism that, long ago, brought down the Roman Empire.

But we had started with the idea of explaining the Hubbert curve to a politician; so, let me summarize the main assumptions of this "mind sized" model. It may still bee too much for a politician, but at least it gives you a fighting chance.

1. There exists a non renewable or slowly renewable resource which is limited in amount and "graded" in costs of extraction/production.

2. People will extract/produce first the low cost resource and will re-invest an approximately constant fraction of their profits in more facilities for extraction/production. This is the positive feedback that generates the rapid initial growth of the curve

3. As the resource is consumed, increasing costs of production reduce profits and - as a consequence - investments in extraction/production. This is the negative feedback that generates the decline.

When these three assumptions are described by two coupled equations, they generate a nearly symmetrical, bell shaped, curve. Political, technological and market factors may modify the behavior of the system. However, since the curve has been often observed in historical cases, we can conclude that these three assumptions are sufficient at least for accounting for the main tendency of this kind of system.

In the end, don't take the Lotka-Volterra model as the universal explanation of everything. But it is mind sized model that can help you describe what the peak is (including fat cows and lean cows) next time you discuss with a politician.

Acnowledgement

Besides my coauthor, Alessandro Lavacchi, I would like to thank the people who have helped me in various ways in this work: Leigh Yaxley, Colin Campbell, Jean Laherrere and Juergen Mueller. I would also like to thank the friendly and supportive staff of the "Energies" journal at MDPI References

The paper that we published in "Energies" in 2009. It is written in what (I believe) is a readable style, so that you can download the paper and understand it. Here is the full reference:

Ugo Bardi and Alessandro Lavacchi, "A Simple Interpretation of Hubbert’s Model of Resource Exploitation" Energies 2009, 2(3), 646-661; doi:10.3390/en20300646

The early paper on the LV model applied to the Hubbert cycle written with Leigh Yaxley is at http://www.aspoitalia.it/images/stories/aspo5presentations/Bardi-ASPO5.pdf

You can find one of my papers on whaling at http://www.energybulletin.net/node/3338

One thing that occurs to me as I read this post is that your model does not seem to say that world oil production will follow a Hubbert Curve on the way down. You have shown that it is really oil discoveries that follow a Hubbert Curve. It seems like world oil production may decline more rapidly after peak than a Hubbert Curve would suggest for several reasons:

1. The big old fields are depleting at the same time new smaller more recently discovered fields are depleting. The overall decline curve may be dominated by the drop-off in the big old fields.

2. Technology is such that production can be held up by horizontal drilling and injection of water or gasses before a steep terminal decline. This may tend to make the downslope of individual large fields steeper.

3. Demand has been held up by the world's large debt load. As major areas of the world are no longer able to maintain as high a debt load, their ability to buy the things that oil produces will drop off, so world oil demand will drop, reducing oil prices, and thus profitability of extraction.

4. The whole system is embedded in the world's financial system and the world's international trade system. If there are problems with these, they might tend to reduce world oil production.

5. What we see in a production curve is gross production. It is really net energy we care about, and it drops more rapidly.

One thing that could theoretically partially offset this steep decline is all of the very heavy oil from around the world. This was long ago discovered, but didn't seem to be worth producing. If it can be produced at a low enough cost (=high enough EROI) to be worthwhile, and the amount of capital and other inputs required is not too high (multiple big ifs), it could theoretically have its own flatter production curve.

Another possible source of long very slow recovery might be enhanced oil recovery techniques applied to fields that would other wise appear depleted. EOR issues would seem to be similar to those of very heavy oil (EROI, capital, other inputs).

All your points are correct, Gail. My model is a "zeroth order" model that explains the main forces at play. Then, there are other elements: first order, second order, etc, which have to do with technology, finance, etcetera. The point is, I think, that the fact that we see so often nearly symmetric curves means that there exists such a hierachy.

About the EROEI question, I suggest you to read the original paper; where we discuss the point in some depth.

Actually, in the real world we don't see your nice symmetrical Hubbert curves that you have drawn through the historical data - in reality all you can say is that that production of finite resources will peak then decline, but not in a predictable way (with serious economic consequences). If you don't believe me use Jonathan's Energy Export Databrowser

http://mazamascience.com/OilExport/

It is very rare to find a country with a symmetrical production curve - drawing a smooth single peak line through almost random data points (like your lower 48 plot for wildcats) when anybody can see two 'real world' peaks will convince few people - the single peak is clearly a lie so you will likely be ignored by most.

Because the timing of the world peak is not predictable, and your smooth curves through the data are not reality, IMO you will find it very difficult to convince anybody, especially politicians and oil company directors and indeed anybody whose livelyhood depends on the peak not being any time soon.

exroid -- taking upon myself to speak for all the thousands of us in the oil patch we all understand PO and agree it is upon us. But, yes, I don't know CEO of a public company or one board member who would say so publicly but who wouldn't agree privately. I personally don't get into the curve fitting and numeric models. Being a geologist I tend to keep my models simple...I'll leave that to the less math challenged. I don't try to estimate how much spay any one skunk might put out on any given day. But I know it stinks. And so, IMO, does the prospect for the world's ability to carry on FF BAU.

I would hazard a guess that secondary peaks -and perhaps even a longer 'bumpy plataue' are caused by real world 'harmonics' -i.e. the 2nd higher order impacts discussed above. This makes sense because the human 'energy system' can divert resources and borrow from the future to expand current production via debt.

-In the simple fox and rabit case the foxes cannot 'import' rabbits from outside the system at the first signs of 'rabbit scarcity' so it is a simple bell shape.

Nick.

Good image. If foxes could import rabbits from another island, they would keep growing for a while more, then their population would crash down even harder because also the other island would be eventually depleted of rabbits. Either there is an infinite number of islands, or - more likely - there is no escape from the limits of the system!

There actually is, in a practical sense, an infinite amount of *islands*. They are the stars with their planets, in the uncountable trillions. We're just, seemingly, trapped on this one, finite planet, and can barely even brush with our nascent hands, our own little moon.

Seemingly trapped? No, we are trapped. Please let us not go down that road again. Leave it to the science fiction fans and trekkers who are willing to believe anything is possible.

Ron P.

Leave it to the science fiction fans and trekkers who are willing to believe anything is possible.

No, anything is possible.

Just not probable.

Of course it is Eric, of course it is. All one must do to make the impossible possible is believe. Believe in free energy, perpetual motion, travel faster than light, believe all the impossible things that physics says are impossible. There are no laws of physics, just things that are not probable. Just believe!

Ron P.

So, ridicule is the mode of the doomers this week?

We need a better breed of religious fanatic, this is getting old.

So which impossible things do you believe in?

I believe that rational discussion can be had with anyone as long as guns aren't involved.

Ok, I'll agree to leave the guns outside. However as for the first part of your belief, let's just agree to disagree ;-) I start from the premise that rational discussion is at least a *TWO* way street. I also believe that ridiculing ridiculous ideas is fair game!

Sure, but ridiculing someone for saying that something that is clearly possible (i.e. can be done if sufficient priority and resources are assigned to it) is still likely to be impractical (enough resources are not likely to be available) just because it is an optimistic position is pure poo flinging.

It is clearly possible that we can establish a colony on the moon, maybe even on Mars.

Whether we can afford to do it, and whether we know enough to make a self-sustaining colony, I'd call "unlikely" at best right now.

The net result if we set out to do so right now would most likely be some new knowledge and an empty station on the moon.

The funny thing is, every response to that statement I've gotten in the past indicates that people stop reading after the second sentence. Simply saying that a space colony is possible shuts down the doomer mind, completely preventing any point that may follow it from registering. It may even be the simple act of saying "space colony" without immediately ridiculing the concept that inspires the reaction. More research is necessary there.

'Twas brillig, and the slithey toves,

did gyre and gimbal in the wabe.

All mimsey were the borogoves,

and the momeraths outgrabe.

--Lewis Carrol (with apologies for any misspellings...)

Look, you can do a lot of things with other people's money-what you are proposing is just another way to piss it away. We have an overwhelming surplus of land on Earth for humans-this has been pointed out repeatedly but somehow you cannot comprehend this reality. All this crappy land is a paradise for humans compared to the Moon or Mars-period. If you want to spend some money on some wild scheme, start with making this excess land useful in some way.

If DD's frequent assertion that human extinction is not only possible but imminent due to humankind exceeding Earth's carrying capacity is true, then your assertion that there is plenty of space on Earth is not.

And exactly what wild scheme did I propose spending money on this time?

I simply said that making an off-Earth colony is possible, but we probably can't afford to do it right now and would likely fail if we tried.

On the other hand, if DD ever managed to actually convince me of his position on human extinction I would have to put all my resources into making it happen, and anybody else's money I could get my hands on. A thin chance at survival is better than none at all, eh?

it appears that you are unable to comprehend the absurdity of the first sentence you wrote. Again: 1. There is a surplus of land on Earth. 2. A minority of this land is useful, a smaller percentage is useful for food production. All the crappy land on Earth has at least a theoretical possibility of usefulness for human life, something the Moon will never have.

Which is why I am unlikely to ever buy into DD's human extinction idea.

Can people really not see conditionals in statements that contain emotionally charged information?

DD may very well be right-the odds are not bad that he IS right.It's just that his case is not airtight.

As far as carrying on a rational discussion with anybody,all I can say is that you must lead a very sheltered life if you're serious,but most likely you just forget your winky;)

But just in case you know of a place where there are no fools,I want to move there asap;)

There is definitely a finite probability that he is correct. I mostly don't consider his position (as presented) particularly useful, which makes his incessant banging on the topic annoying. The least he could do is defend his case with more rigor, otherwise I have no reason to change my evaluation of it.

As far as a place with no fools, I suspect if I moved to a place where I thought there weren't any there'd be one there as soon as I arrived ;) I worked tech support for 4 years between the Navy and my first programming job. It's simply awe inspiring what you can run into out there.

Darwinian,

It's not directly relevant at this minute but let's not forget the passage about running just to stay in the same place and running REALLY FAST to get someplace.

I'm suprised you haven't brought it up in regard to maintaining oil production.But I'm new here ,maybe you have.

...but if it takes more energy to transport the rabbits from 'Planet Claire' than you get in eating them then they might as well not be there in the first place other than to say 'look, here is a Planet Claire Rabbit bought back at huge expense...'

-The human analogy would be something like fruit grown on the moon or more Energy specific: fuels with EROI < 1.

Nick.

Hydrocarbons from Titan. They're just laying about on the surface up there ...

Ha Ha Ha!!! I remember getting so excited when I read that there were oceans full of liquid methane on Titan until i started to think about how much energy would be required to bring it home!

I've been an Oil Drum reader for several years and this is my first post. Finally have something worth contributing... I think :)

I think Ugo's model is a great explanation for the 1st order cycle of depletion for non-renewable resources. However, xeroid has a good point that simple, single modal distributions don’t fit historical data sets very well.

I think classical economics supply and demand drivers are a good explanation for 2nd order cycles that all of us who have spent time in the oil industry (and/or studied its history) are well aware of.

Perhaps, early in the cycle of depletion, the 2nd order supply and demand effect actually dominates the signal (and is mis-interpreted as the 1st order driver).

Let’s take the predator / prey mechanism further, by adding a classic supply and demand 2nd order effect on top of it. But first, I’m going to make a few changes…

· Fox / rabbit system replaced by human / mammoth, since mammoths were a non-renewable resource relative to the human reproductive cycle.

· Let’s say mammoths aren’t found everywhere, only in valleys, and the number of mammoths in a valley is proportional to the valley size.

So let’s start with the first isolated human population in valley #1, that discovers a way to kill mammoths for the first time. Their population explodes and peaks when mammoth numbers fall-off to a critical point. Some hungry cave man decides it might be worthwhile climbing over the mountain to see if he can find some more mammoths. He discovers valley #2, which has more mammoths than valley #1 originally had. A 2nd order peak in human population beings, as valley #1 continues to deplete and harvesting of mammoths in valley #2 begins.

Using the model above, one can imagine long periods of time, where cavemen put less effort into finding new valleys, because current mammoth discoveries provide mammoths in excess of human consumption, until the human population increases to a critical level.

The human population would continue to go through 2nd order increases and decreases, with an apparent 1st order exponential growth trend, until the biggest valley with the largest mammoth population was found and depleted. Only at this point, in hind site, would it become apparent to the average caveman that mammoths were a non-renewable resource and they’d better put some effort into finding a replacement food source. Whether or not peak caveman population was tied to peak mammoth production, would depend on whether or not the (hopefully) yet-to-be discovered food source could provide the same calorie density per unit effort as mammoths.

Did I pass the test?

Petro, one of the things I sometimes dream about is to have data for mammoth hunting to fit with the LV model. I am sure it would work but, alas, a little difficult. Maybe those little notches on ancient mammoth bones means a kill each one. So, who knows.....

But, more seriously, what you are describing is very similar to whale hunting. Also in that case there was a spatial part to the story, even though the aggregated data show only the total whale oil production. Whalers started with the whales which were close by, there were "hunting grounds", areas of the oceans that were depleted one after the other, while whalers would wander farther and farther off in the ocean. Nevertheless, the Hubbert curve stands!

Ugo I found your article most impressive. Good luck with your ambitions to explain things to Politicians! ;-)

There is a typo in your link to "The Roman Empire" above - you meant http://europe.theoildrum.com/node/5528 but there was one digit inadvertently dropped off the Node number.

Fixed. Thanks!

I use trees and trees growing in valley and on hillsides.

The reason for the hillsides is it adds in EROEI and money concepts.

So they first hunt the mammoths in the valley and as this resource is exhausted the hunt up the hills and ravines of the valley. If you think about simulated annealing then you can consider it as the valleys filling with a water like substance that turns valleys into hills.

Basically depleting the resource changes the topography such that you loose your deep valleys and the system becomes patchy with many small valleys.

At this point as they search the new smaller valleys or old topography hills they find a new deep valley and exponential growth begins anew.

Thus the search algorithm remains the same its just the topography of the search regions is altered by the search itself. Think of looking for buried treasure digging holes as you search or dig your search region is itself altered.

If you dig a really deep hole you could pile the dirt on top of the real location :)

In any case the issue and in a sense its the one I need to understand with WHT's dispersive discovery model is it seems its difficult to tell the difference between simulated annealing finding different minima and simulated annealing with a variable surface.

They look very very similar on the way up in my opinion and its difficult to tell which process is occuring. Its not even clear if they are really different at least during the search phase.

Of course the difference as you notice is huge on the back side as you end your search phase in the second case where search was efficient once you found mammoths and only then expanded to other regions.

The problem of course is once you searched the last region you have very few mammoths left in any region. For a period of time you have the contribution from all regions providing the last of their mammoths then all are gone.

It pure a pure extinction event and happens shortly after the last valleys are searched. Thus mammoth population drops rapidly to zero in based on the rate the final ones are hunted independent of the original search algorithm.

This is important in my opinion because obviously once a population of mammoths is found the rate its depleted depends on the hunter function not the search function.

In the second case of efficient search once a population is found followed by search of poorer reasons the hunter function steadily dominates the curve and eventually search provides little additional in the form of additional mammoth sources.

This is what I think we have done with oil and as you can see it ends badly.

What I don't understand is how to add this hunter shock to WHT dispersive discovery model I swear to god one day soon I'm going to set down and add this hunter feedback loop. And its a positive/negative feedback slowing and speeding search based on past discovery. And of course underlying this are the intrinsics of pure dispersive aka first order/ second order search.

I define second order search as above where the search itself also modifies further search patterns. In the case of oil we got the easy stuff first but we also developed better search methodology and made new discoveries in old areas I.e the search was repeated. In my water like concept the valley was filled but not evenly leaving often smaller valleys although a big one could still be missed its still intrinsically dispersive with the probability of finding or more correctly missing the big one remaining. In the real world highly unlikely and the big ones are found early during the initial search. Not first but also highly unlikely in secondary "better" searches.

And last but not least in nature the Hunter function is of the same magnitude as the search function if not larger. The assumption that search is the predominate function is in my opinion fundamentally wrong both are at least equal in magnitude or on the same order.

To see why all you need to do is note that production rates become rapidly more dependent on producing existing discoveries and independent of new discoveries as the search peters out. Not only does the original discovery model not tell you the future it should not be able to since it simply does not contribute much to the future overtime and as the date of discovery drops into the past.

Another way to see this is the date of discovery of a resource becomes secondary and its size and production profile dominates future production levels.

Its important of course to determine the depletion level assuming the URR estimates are correct which is highly questionable since URR itself it tied into the Hunter function via technology and price.

Regardless once a finite volume is searched and most of the resources found and exploited in general in my opinion the system reaches a broad maxima or golden age followed by rapid collapse. The golden age occurs as contributions to production change overtime yet production continues to increase.

At first new production coupled with new discoveries cause production increases then new production and search technologies extend both the search and production domains then as search dwindles new technology continues to contribute and searching previously searched regions adds more. In the end your just plain out as technology hits its limit and expanding extraction by poking more holes fails. Note how infield drilling plays a huge role in maintaining and boosting production but its technically just a more detailed search.

This repetition of the search pattern in existing discoveries completely hides the real situation as it does not add new oil it simply increases the depletion rate. And this is where the real problem lies as we actually add these together.

This is URR expansion overtime and later discovers assume that the original estimate was low and tack on more. In reality its not simple addition as you can't easily correct the original estimate for the new one since the original was dependent on the technology and price at the time. Its complex to determine what was really missed.

Thus all of these extensions are for the most part bogus and they are simply the Hunter function posing as discovery its a huge fraud.

Its like a hunter searching a valley thats been hunted for decades "discovering" mammoths they where discovered long ago and their numbers calculated in the original discovery adding them again when you hunt and kill them is simply wrong. Maybe the original estimates where not precise but thats a different issue and not one solved during via hunting and simple addition.

Even including all those you killed in the past with the ones you kill now is not correct.

The correct answer is of course to look at past production plus good estimates of remaining production and total amounts and recovery factors etc. Its a process outside of the actual hunting.

Anyway enough.

Since you suggested simulated annealing, take a look at popcorn popping dynamics. The question is : Why don't all the kernels pop at the same time?

Figure 1: Each bin has a width of 10 seconds, and the first kernel popped at 96 seconds. So the overall width is quite large in comparison to the first pop time. From http://www-mariachi.physics.sunysb.edu/wiki/index.php/Statistics_with_Po...

Certainly, if you stuck a thermometer in the popcorn medium you would find the average temperature rising fairly uniformly. Naively, you would imagine everything popping at once or within a few seconds of one another -- after all, water seems to boil quite suddenly. But from the figure above, the spread seems fairly wide for popcorn. The key is the dispersion in the characteristics in the popcorn. This dispersion does not show up in the time but in the activation barrier of the kernels or in the micro-variability in the medium. It gets transformed into something approaching a logistic curve as the medium temperature accelerates in temperature and then keeps rising. You can think of the individual pops as those kernels meeting the criteria for activation. The laggards are those kernels that haven't caught up, either intrinsically or because of the non-uniformity of the medium. (as a counter-example, water is uniform and it mixes well)

This experiment is an example of simulated annealing in action (sorry Memmel, but finding local minimum is a red herring). And it is why that all these Lotka-Volterra and Verhulst formulations are quite useless to understanding the dynamics of real systems such as oil extraction. They simply do not take into account the stochastic environment of exploration and beyond.

If we had applied an LV formulation to the popcorn experiment, what would we get? Since it is deterministic, it would come out like a spike with the cumulative showing as a step function. All the LV can do is work on the mean value, so that it misses the real dynamics of random effects.

I could easily work out the popcorn dynamics from first principles and use that as a predictive tool for some future need. I would tell a politician that I could accurately gauge how long popcorn would take to pop. Unless he had never seen a popcorn popper in action (GHWB perhaps?) he would say, yeah that would make sense -- and it also makes sense how oil depletion dynamics plays out.

This is the kind of mind-sized model we need to work out.

Well using the popcorn model and forgetting for a moment about minima.

I would not go so far as call them a red herring but not needed for the core model.

You can also express it as changing the rate the popcorn is heated. In your example we are assuming the steady application of heat and out pops :) the dispersive model. However if the heat is not ramped evenly then what happens ?

Next assume you don't care if the kernel pop and are turned into charcoal i.e only ones left in the unpopped state. This assumption removes the issue of burnt kernel maybe for a later discussion.

The simplest answer is it depends. The simple model still holds in the sense that your probably not going to get a different volume from the one the dispersive discovery model predicts. For every kernel that pops because of a changes in speed that would not have popped in the steady case you stand a good chance of say drying one out if your heating to slowly at some point.

However the profile of popped vs unpopped is now influenced strongly by how you change the heating rate its distorted and its not clear in the least how to remove this distortion and discern what is heating and what is dispersion.

The extreme cases would be some sort of uber microwave vs a low heat burner that only periodically crosses the pop threshold i.e the function can be distorted to either a delta function or a sort of decaying sine wave like pattern.

Given that any signal can be generated within the constraint of the overlying dispersive integral.

I'm just saying that if the search rate varies in time then I don't think dispersive discovery generates a smooth curve. Indeed the full shock model handles this via its shocks.

Nothing wrong with the model I'm just wondering what happens when the shock and dispersive discovery are of the same order of magnitude and if its possible to discern this i.e pick out the real dispersive curve when hit with a huge shock.

Now the shock model is a perturbation model and these generally don't behave well with large perturbations. I get uneasy about the validity of the model under these conditions esp since I think the shock is itself in a feedback loop with dispersive discovery so they are not independent.

And example of this sort of shock is say a nuclear war after the shock the value of the original dispersive discovery model is questionable i.e its a new problem. Thats extreme but thats the point when is extreme to extreme ?

When does a shock become to big ?

I just don't really know what it means to add a large shock and understand even less if its in a feedback loop. Its not that I don't think I can do it its just how do you know your right ? It seems to me you can plausibly get any answer you want with a range of valid shocks. This forces the problem back towards proving that some sort of large shock is correct yet in the case of oil since the data i.e production and discovery is contaminated by whatever the combo of shock and dispersion is its a bit of a catch22 you don't have a good way to develop a pure if you will large shock. And of course given the nature of the shock I envision it really only becomes large around the peak and post peak.

For oil production it obviously suffered a large magnitude shock in the 1980's.

However the functional form was permanently altered after that. Given I generally end up with the symmetric peak most probably being slightly after 1995 my best guess is still 1995-2000. Oil production at its peak in the 1980's

was not really surpassed until 2000 twenty years later. Given the sharp rise in oil prices past that point I personally question purported production numbers past 2003 an we just happened to invade Iraq at this point the largest known reserve of real oil left. Its twilight zone after this numbers don't add up.

Given the fiasco of Food for Oil production numbers after the first Gulf War in 1990 are a bit questionable as far as Iraq's real contribution. Price suggests the market was well supplied so I suspect production numbers might be a bit low from say 94 to 2003 for Iraq.

In fact price generally suggests that actual production from 1979 to 2000 was probably significantly higher than reported and reported production numbers are low. Given how OPEC quota's worked this makes sense low ball numbers making it into the official books with prices suggesting otherwise. Especially for KSA as it seems the announced one thing and did the opposite. Things make more sense if you assume Saudi Production was higher than reported for quite some time.

The assumption of a low of 6mbd instead of 4mbd actually works surprisingly well if you modeling consumption and price. And back up to eight a lot faster.

From then on out spare capacity of at least 2mbd remained for several decades.

In the past at least it seems Saudi Arabia has actually acted as a true swing producer more often than the official numbers seem to indicate and done a very good job of keeping the market well supplied with plenty of oil in fact more than they admit to.

Given the above ground geopolitical situation the argument that real oil production was systematically understated up to about 2003 and overstated after that is not a bad argument and it tends to do a very good job of resolving price supply and demand. The US does a good job of ensuring that wars further obscure the situation but still it seems to hold.

Regardless at least for oil large magnitude shock seem to be the rule not the exception thus I'm still not quite sure how our ability to model the shocks and introduce speculative ones that may be valid esp if they are large makes sense.

I just don't know and don't have good vibes ...

Its just to easy to get the number you want the ability to prove your right seems to be missing.

Of course the heat applied to the popping process is ramped upwards via Newton's law of cooling/heating. It wouldn't show a strong peak in pop frequency otherwise.

Dispersion is known to play a huge role in popping times as the

distribution of critical pressures is due to variations in thickness. This is amplified by the sensitivity of the Arrhenius pressure to changes in temperature. So in effect what you get is a huge apparent acceleration as the popcorn kernel passes through the activation temperature window. Dispersion creates the fat tails.

I only bring this popcorn model up because I happened to be microwaving some popcorn last afternoon and listened for the popping profile and thought it fit a dispersive model. The fact that it had some connection to your mention of simulated annealing made it somewhat apropos on this comment thread.

It is definitely analogous to an accelerated dispersive search model as the activation energy creates an equivalent acceleration term as the temperature sweeps through the region. Technology and fast adoption provides the acceleration term in oil exploration.

I really don't know why this dispersion argument is so hard for people to accept. As Nassim "Black Swan" Taleb has pointed out, "probabilists are born, not made -- many mathematicians are capable of computing, but not understanding probability".

Relax WHT.

I understand (and like) your dispersion model.

However, the chosen analogy is a bad one.

How about popcorn randomly 'dispersed' on the floor of a totally dark movie theater and clean up crew without flashlights trying to find and remove as much of the popcorn they can --in other words hunting for the big piles first and then looking for unpopped small kernels near the end of the process because all the 'easy popcorn' had been found and picked up?

__________________

Left click on image to enlarge

Those and the unpopped kernels are the "fat tail" bits. The veritable "Black Swans" of the popcorn world.

And my only real argument is this term is large i.e it doubled the rate of search over time. It also doubled the production rate. We found and extracted oil twice as fast vs a dispersive model without this term.

If your running twice as fast then you have half the amount of oil predicted by symmetric solutions.

A very easy way to not that this guess of about 50% is not far off is to note that average field lifetimes have halved over the last several decades from about 20 years in the 1970's 1980's to about ten now.

The problem is it tends to remove oil from the fat tail i.e there is no fat tail

we have burned it up.

Whats really really interesting is because the base equation i.e dispersion has a fat tail if you figure out how to tap this resource then every thing looks great for a long time.

Using the concept of finding all the pop corn in a dark room analogy I'm saying the flood lights where turned on and a high powered vacuum cleaner used. Vs using a small dustbin in the dark.

Its still dispersive discovery sure not a problem but the time evolution of the problem or rate of discovery changed by and amount equal to the original rate.

In fact the large revisions to URR that make the bulk of current know reserves are and artifact of this. Again they are in general on the same order of magnitude as the original discovery but all they really are is double counting the same oil using better technology its just the definition evolved over time as we got better at actually imagining the oil in place. In general before the 1970's the fat tail of oil in reserves was discounted i.e it was not considered economically recoverable outside of the stripper wells.

Maybe one thing thats missing here and this analogy is a good one is a lot of the last pieces of popcorn found are near former large piles. I.e they are found in new regions but by re-visiting already explored areas. The best place to find oil is where you have found oil. The search volume is swept multiple times not just once each time with better technology.

True original discoveries of virgin basins falls off rapidly. I'd suggest that by the 1980's most of the important basins had been found and really by the 1970's.

Virgin search i.e new basins with substantial potential for oil rapidly became a rare problem and now we have deepwater and the arctic but deepwater is in general just finally seriously searching known basins in general.

Regardless if your dealing with major changes in your search methodology then a smooth search algorithm does not seem to be the correct one.

In any case given the magnitude of the shock that technology seems to have caused you don't have to do much math there is no fat tail its gone there is no backside its gone. The original dispersion model with a fat tail ensures that if technology is developed to exploit this intrinsic behavior of search then you don't have it anymore.

Its because it was there in the first place that technical advancement was able to bolster oil supplies so dramatically. We simply figured out how to cheat at the game of dispersive discovery and exploit the fat tail phenomena.

I have some good data for popcorn popping and will apply a dispersive model to show how well it matches to the observed statistics. Essentially a 2 parameter model and the insight it provides knocks your socks off. Contrary to what people think, the envelope is not a Gaussian normal curve.

Hi Ugo,

We met at the ASPO conference in Ireland in 2007, when I was one of those "politicians." I have had years of experience explaining peak oil to politicians. I don't find them any more dense than the average university professor. In fact, I've had some of my most heated conversations about peak oil with one of my former geology professors (we're still friends though).

Someone posted a George Carlin piece several days ago and it is worth a re-post.

I think we delude ourselves by thinking that our political system is capable of doing much to respond under these circumstances. Perhaps you followed the first recall of a California Governor back in 2003. He was largely blamed for the 2001 electricity "crisis" in our state. California's budget crisis will now be blamed on his replacement, the Terminator. But the reality is that the voters are to blame in a myriad of ways. We are asking politicians to lead us across a frozen lake but we aren't willing to follow him unless/until we see they don't break through. And it's not just one lake, every day there is another lake just waiting to drag you to your death.

I applaud your effort in attempting to develop an appropriate message that people will grasp and heed. It has been my experience that too many of these exchanges turn out to be more like trying to convince someone that their god is not the true god. It has also been my experience that most of the politicians who do get it say to me, "What am I supposed to do about it." Even here at TOD, I think we'd be hard-pressed to come up with a plan and then get a majority to agree to it.

OK, defense rests. Now all you politician/government haters, tell me how stupid I am...

But when it comes to the god of the "wise and free marketplace", that is exactly what we need to do.

Otherwise we are all doomed.

Recall however, that our current monotheistic religions began with someone (e.g. Abraham) trying to convince idol worshipers that there idols are false and that the Invisible White Bearded Rabbit is the real thing instead?

By defintion, my God is the true god because she is in my corner and she has my back covered. Period.

Debbie, first of all apologies if you felt included in the "politicians" category - I wasn't thinking of you when writing my little piece!!! If all politicians were like you, the world would be a very different place.

But you are perfectly right to say that politicians are not more stupid than anybody else. There is Sturgeon's law that says that 99.9% of everything is crap. And Peter's principle that says that people rise to their level of incompetence and stay there. These laws apply to politicians as well as to university professors. No evidence that professors are smarter than politicians - perhaps the opposite is closer to truth. Actually, professors have a capability of muddling issues with appropriately academic gobbledigook that is unrivalled in any category on this planet, except perhaps lawyers. Trying to explain peak oil to a professor can be much worse than to a politician.

Anyway, I emphasized the concept of trying to explain peak oil to politicians as the result of a personal frustration with the political debate as it is here, in Italy. But I subscribe completely to your statement "the public sucks". Absolutely.

I think we can apply (with some changes) my model to the public/politicians relationship. Politicians are predators, the public are the prey. Now, of course, politicians don't eat the public (although, sometimes, I have this sort of feeling that maybe, given some special circumstances.........), But they are predators of the public's minds. They absorb the public's fears and feed back these fears to the public. That is a positive feedback that makes a few issues grow out of control and shuts off the debate on everything else. There is a basic problem with the way "mass media" work.

Eventually, politicians mirror the public and the public mirror politicians. Our politicians can't solve our problems for us. Nor can the public. And so, what do we do? Oh, well......

Hi Ugo,

I wasn't fishing for an apology--just trying to point out a trap (or sport) we all fall into. Anyone who tries to serve in public office is called so many names that you either develop the appropriate self-preservation skills, or you get out. There are very few politicians that I admire, but even those can disappoint us on particular points. If anything, I hope my comments cause a few here to pause and consider an attitude that can poison our ability to find productive discourse. I keep putting off writing a piece on governance because it brings out the worst in bloggers--it is almost a "third rail" issue. Perhaps I'll make some time after ASPO conference...

Your predator/prey observation is interesting. I agree, the public does feel like "prey" and hence their attitude toward government. With great effort, it is possible to be more inclusive at the local level, but it takes great effort. For anyone who has ever participated in a homeowner's association, they can probably testify to how quickly relationships break down over seemingly meaningless issues. Transition towns will suffer these same challenges. So now imagine the issues at a state, national, or world level, and it is amazing anything works. Essential to governance is a well-informed populace and that isn't possible as long as the MSM sees their role as protagonist/entertainer/gotcha machine.

Debbie, I know that you weren't looking for an apology; I just felt that I owed one to you :-). Incidentally; I have been a politician for a short time of my career. I have been engaged with the Greens. I even got some kind of high level (maybe) position in the party's hierarchy. That was when the Italian Greens still existed; now they are way post peak. Apart from that, I think there is space for a politician to do good work, it takes nerves of steel and a certain ability of dodging blows (metaphoric but, sometimes, even physical). It is not very different from being a university professor. But I found that being a professor is more fun; so I gave up with politics!

I'm more than willing to cut George Carlin some slack he was a great comedian!

However when a politician stands up and says "'The Public Sucks. Fuck Hope.'" Then I have a problem with that. It sounds exactly like the arrogant stereotype we have come to expect our politicians to conform to.

Foreperson addressing the court: Your Honor the jury has reached a verdict.

Judge to Jury: Ladies and Gentlemen of the jury, Is this your verdict?

Jurors respond: Yes, your Honor.

The Foreperson hands the court clerk the verdict...

Court Clerk reading: We find the Politician guilty on all counts!

Debbie,You have got your head on nice and straight.

Another way of expressing Carlin's point is to say we get the government we deserve.

If you present a "liberal" position to a "conservative" dressed as a conservative idea ,the conservatives will embrace it like a long lost favorite child.

Ditto the liberals.

But everybody in an advantageous position is sure that if things change he will lose,and so we manage to turn lots of win -wins into LESS THAN zero sum games because not only do we get no change-we expend a lot of effort fighting to make sure there will be none.

I'm too tired right now to put up and explain a good example but someday soon when the subject turns to politics again I will.

Yes. That first.

Second. Extraction and production become ever more capital intensive as we go deeper. Therefore rapid extraction is required to get timely payback on investment, i.e. an adequate IRR. Rapid extraction stretches things out, but results in a steeper decline when it does occur. I think this is being seen in shale gas.

There are of course a lot of different routes a depleting resource can take. Take a glass of water. It can go down in one gulp, i.e go from 1 to 0 in a vertical drop, or one can sip it steadily until it is all gone, which means we have a straight line going down from 1 to 0. (Picture time as the x-axis, quantity the y-axis, 1 as full, 0 empty.) One can also picture the resource depleting very slowly at first, but picking us steam in proportion to the amount already consumed, that is sipping in proportion to the amount already sipped -- but also sipping in proportion to the amount remaining, which in the latter half causes one to sip ever more gently finishing the glass off without a slurp.

You actually get Hubbert's curve by saying that the rate of sipping is proportional to the product of the amount in the glass times the amount already sipped. That seems to be a very natural compromise between the gulp and the steady sip. And maybe one could prove it results from some kind of average over all possible paths from full to empty. But I agree with Gail that global depletion isn't obliged to strictly follow Hubbert.

The depleting resource is not the water in the glass, but the water in your body. The water was not depleted from the glass, it was depleted from your body, that's why you drank the glass of water.

Now suppose you are on the verge of dehydration in the middle of the desert, and there is an oasis of freshwater on the horizon -- about 20 km away.

There's plenty of water, and you won't get it, because you don't have enough right now to get there.

There's plenty of oil in the ground, just like there's plenty of gas at the station, which is no good if you run out of gas before you get there.

The current machine of global civilization is like, well, one big machine, and the machine is oil-dependent, like a car is gasoline dependent. If you want to switch out the gasoline tank for a propane tank or electric batteries, the entire car goes offline during the transition. You can't drive home, to the store, to work, to your girlfriend, or to your other girlfriend. You are now also offline.

The only reason we can do any fuel source switching now is because it takes a few hundred to a few thousand cars out of circulation at any one time, out of over 800 million total cars, plus buses, trains, ships, and airplanes also still in operation.

Hello Ugo,

Thxs for the keypost--I greatly appreciate your efforts. I tend to agree with Gail and the other commentors that the backside of Hubbert will be different than the frontside; more like a sharkfin than a smooth rolldown. Of course, I am also partial to my 'Rogue Wave Theory'...

http://www.theoildrum.com/node/5482/512259

...whereby we race to get all we can now because we want it all now [Hat tip to Nate H]. In short: we build a giant house of cards as high as we can until it collapses downward to get the sharkfin curve:

http://img16.imageshack.us/img16/6686/sharkfin.gif

[source: http://www.theoildrum.com/node/5258/489050 TODer WebHubbleTelescope]

This Sharkfin has been much discussed by Memmel and WHT plus others. It also figures into my predictive thinking for my 10-year WAG of [19 @ '19]:

http://www.theoildrum.com/node/5795/541926

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Yep; it is easy to modify the model to make the curve look like a sharkfin. I didn't do that in this paper just to keep things simple - but it may well happen. And notice that the model doesn't assume anywhere that humans are smarter than bacteria!

As the link concerning carrara marble is in Italian, an english translation link might be useful.

I had written up an even simpler explanation for this phenomenon. Ugo's explanation is more precise, nevertheless I list mine here:

You can simplify the wave function by a triangle:

1. In the beginning someone discovers the resource, then business is picking up and as a consequence of the plentiful supply an increasing demand is developing.

2. Eventually the physical limits of this resource becomes noticeable (the peak point) and the production cannot be increased any more.

3. After this point the production declines. Even higher investments cannot prevent the decline due to at least one of the following reasons:

- this resource becomes more expensive than alternative resources, by which it is being substituted (smooth transition) or

- the rise in exploitation investment is limited by the purchase power of the resource consumers (supply crisis).

This mechanism has probably much to do with Kondratiev waves or Supercycles (although I disagree with Kondratiev in that the real waves are not regular but irregular).

In fact it is probably related to any business cycle as all economists know them: after discovery phase the business becomes a "rising star", later a "cash cow" and then declines as a "poor dog". (Which phase do you think the international oil companies are in ;->)

BTW: The weblink about Carrara marble is dead, can you fix it Ugo?

I am sorry, but the paper on Carrara marble exists only in Italian. I linked it anyway because I think you can still give a look to the graphic with the Hubbert behavior. BTW, I fixed the link.

Thanks. As far as I know the problem about Carrara marble is its declining "quality": Carrara was famous for its pure white marbles, but these are completely mined out since about the 80s. They were substituted by the white marbles from Estremoz, Portugal, which meanwhile are exausted too. Nowadays pure white marbles are shipped from Brazil (Espírito Santo?).

I don't know if there will be a substitute when the brazilian mines are exhausted. Otherwise white marble may become pretty expensive...

Hi Ugo. Thanks for that easily digestible foray into portraying peak oil. If we take this to the global, human scale, we can see that the predator (mankind) has just about devoured all the prey (Earth's resources). I also think that we would get some interesting correlations if we paired mankind off with other essential resources, like water, arable land, fisheries, forests, and biodiversity. These would even make the most lame minded politician peek over his glasses, be them reading, or containing spirits.

Yes, Drillo, Carrara marble shows the same behavior as oil: the best quality is extracted first. In the case of oil quality is defined as EROEI, in the case of marble as other properties; color, purity, etc. The interesting thing is that, while we can substitute oil with other energy sources (I think it is the meaning of the world "fungible") there is no substitute for good marble. Once it is broken/cut/used it is gone forever. Or, at least, for the geological time it will take to make it again.

Drillo, I think your explanation is substantially equivalent to ours, although, as you say, we tried to make it quantitative. About Kondratiev, I don't know. It has always seemed to me something arbitrary; but perhaps it is because Idon't know enough about the idea

One of the assumptions for a symmetrical bell-curve is reinvestment of profits made from production. But a lot of expensive off-shore wells are developed very rapidly with up-front funding and, as a consequence, end up producing in a non-symmetrical manner.

Given that a large % of new production is offshore this assymetry may impact on the global bell-curve going forward?

TW

Good point, TW. Indeed the "zeroth order" model assumes that a constant fraction of profits is re-invested in new exploration. But that is - obviously - an approximation, albeit supported by historical data. If the economic system decides to pump a lot of money into finding and developing new wells, then the real curve will be asymmetric. It will be sharkfin shaped. And, of course, it will be an extremely bad idea to try to squeeze as much oil as possible out of the earth: the decline will be very rapid and will take us by surprise. I have sort of a feeling that this is exactly what is going to happen.

Not to mention that it would be one of the worst things we could do. We need to substantially reduce fossil fuel consumption as soon as possible, not increase it.

You speak in the future tense? Isn't the evidence that the world economic collapse was preceded by an "unexpected and unexplained" six year escalation at ~25%/yr in the prices of our two universal resources, food and fuel, a little suspicious? I think what you're predicting already happened, didn't it?

Humans do tend to reason cause and effect as determined by what news stories are popular... but why would this most extraordinary event demonstrating that earth was in fact lagging in producing supplies for our growing demands not being inquired about? I offered a model in Profiting from Scarcity for why people are missing it, that it's profitable to miss it. That seems consistent with the rest of the discussion here on the the whole resource bind, and EROI traps, and why so much of our whole technological society seems blissfully unaware of them even as issues, let alone things to act on.

I see your intention Ugo of finding a simple way to explain to a politician what to some may seem a difficult topic to grasp in a brief period of time. However, politicans pivot to the whim of their constituency and not to anything else. Peak oil, as real as it is geologically, with implications across the economic spectrum, is only going to be important to a politician once the masses are engrossed by the topic. Once that happens you'll be able to explain it to a politican in great detail and he'll get every drop of it. Of course it may be too late then, but anyway.

Like my Father who was born in 1927 says, "Developing situations always have to reach a crisis before anything is done about it." And peak oil is a developing situation, much like the increasing temperature of the water in a pot with a frog in it. I guess the question is: Collectively, are Humans smarter than frogs? I suppose time will tell, but in the meantime simpler explanations of peak oil will achieve nothing more than more involved explanations. Either someone is motivated to understand or they are not. Motivating someone is much more difficult than explaining something. So maybe we should be discussing how to motivate politicans to discipline themselves to understand peak oil.

Well, Cslater, what I said, actually, is that it is hopeless to try to explain certain matters to politicians. The model I have developed is more for the intelligent person willing to learn. Sometimes, these people are put off by the impression they have that the Hubbert curve is arbitrary. Unfortunately, anyway, your father is perfectly right: nothing wiul be done until it is - probably - too late

Crude price as predator? Posters as prey?

That find took extra high cognitive skills! Awesome! Hah!

Thank you. Your kind words are appreciated at a veritable asymptote of gratitude.

Interesting graph!

What is the base that the percent refers to on the vertical axis-population American, all isp addresses,etc?

Re: "He said that complex problems can always be broken into mind-sized blocks, and so can be grasped by the human mind."

This is a very important concept that is often ignored by those following Peak Oil IMO. It is the reason there are so many doomers among us. If a difficult problem is attacked all at once as a whole it overwhelms. The key is to break it down into manageable pieces that can be worked on.

We do not have to solve the world's energy crisis in one fell swoop or alone. We just need to work on our piece of it. Others can work on their piece as they see fit or as they are forced to deal with it by circumstances.

And we do not have to solve our individual energy problem all at once. We just need figure out a part of it as it presents itself.

Slowly, overtime as we deal with our own piece and others work on their piece, the Peak Oil dilemma will resolve itself. The outcome is unclear, but life goes on. The clock does not stop even for Peak Oil and that is why I am not a doomer.

I think this is one of the statements that sounds reasonable only because there's an unstated assumption in there. If almost everyone were working on a real problem in the world (one of which being energy issues), then I'd be quite confident that a BAU solution could be engineered. However, there's a huge number of people who take the view "there are some super-smart other people who will work on the incredibly hard and effectively on the technological aspects of the problem (even if they're mind sized), whilst my part is to trade stocks, or write op-ed pieces, or lobby for my favourite subsidy, or build a real estate empire, etc, etc." There's a great tendency to convince oneself one's issues are part of the solutions to small problems that make up the bigger problems, rather than at best tangential to it.

I tend to count myself as a "big changes" guy rather than a "doomer", but whether there's a distinction probably depends somewhat upon your point of view about what's desirable in life. I take this view partly because almost everyone expects other people to display ingenuity and solve the hard, relevant stuff in solving the big problems; if more people were actually involved in attempting to come up with solutions to "mind-sized" problems I'd actually be quite optimistic.

For a post that I started off agreeing with, I don't think I have ever made a quicker about face. I am a doomer pure and simple and primarily because most people are like X or Embryonic. That is, they see "solutions" for every problem, if only we would just put our shoulders to the problems that face the world and fix every one of them, or most of them at least.

Sevareid's Law: The chief cause of problems is solutions.

We had a world food problem. We solved it with the aid of irrigation and the Green Revolution. Irrigation has caused the world's water tables to drop by meters per year in many areas of India and China, and feet per year in most other areas of the world. Irrigation, to help cotton growers in the Former Soviet Union, caused the destruction of the Aral sea and the fishing industry there. Hundreds of thousands were displaced because their livelihood disappeared as the Aral Sea dried up.

The same can be said about Lake Chad. It is almost completely gone now along with the populations it supported. Rivers are drying up everywhere in China. Indian farmers are committing suicide because they cannot support their family when their irrigation water disappeared.

The Green Revolution has allowed our population to more than double in the last half century. More agricultural products required more water, more pesticides, more fertilizer and more fossil fuels to grow and transport it. Those extra people are drawing down the world's resources at an alarming rate. Because of the Green Revolution, at least three billion more will die when the crash finally does come. Because the Green Revolution feeds people, not animals, and because people take habitat from other animals, most of the world’s mega fauna will become extinct before and during the crash.

If we all put our shoulders to the grindstone and help solve this energy problem, we may put off TEOWAWKI for another fifty years. By then we could add another three billion to the world's human population and kill off what remains of the world's animal kingdom. That way, many more billions of humans could suffer miserably and die when the crash inevitably does come.

Ron P.

Hubbert on the Hubbert Curve, according to Ivanhoe.

--------------------------------------------------------------Quoting Hubbert:

“The curve does not keep going up, but passes over a hump and then goes back to zero. This is the one

future point on the curve that you definitely know and it greatly facilitates the mathematics. The area

under the (production) curve is graphically proportional to the amount of development. The area under

the curve cannot exceed your estimate. It is a very simple, but very powerful method of analysis.”1 “This

complete cycle has only the following essential properties: The production rate begins at zero, increases

exponentially during the early period of development, and then slows down, passes through one or more

principal maxima, and finally declines negative exponentially to zero. There is no necessity that the

curve P as a function of t, have a single maximum or that it be symmetrical. In fact, the smaller the region,

the more irregular in shape is the curve likely to be. On the other hand, for large areas such as the United

States or the world, the annual production curve results from the superposition of the production from

thousands of separate fields. In such cases, the irregularities of small areas tend to cancel one another and

the composite curve becomes a smooth curve with only a single practical maximum. However, there is no

theoretical necessity that this curve by symmetrical. Whether it is or is not will have to be determined by

the data themselves.”2

http://hubbert.mines.edu/news/Ivanhoe_97-1.pdf

Yes that is the real world, I think Hubbert actually made a mistake by drawing symmetrical bell curves on his diagrams, people look at pictures and gloss over the words - the only thing he got correct was the timing of the US peak, the important bit, the actual flow rates at peak, were way out. By claiming Hubbert knew what the future would be (when we all know that nobody does) does the peak oil story little favours IMO.

Our politicians, given presentations on Peak Oil, assume that any peak when it comes will be symmetrical. But for importing countries that will not be true because of ELM, the recent use of techniques that deplete the oil wells faster in the second half of world oil etc.

Since demand and supply are equal I think politicians might understand PO better by talking about it from the simpler consumer's point of view, not the producer's, also we are actually able to use real world historical data now that shows we are several years past peak - stop being theoretical, use the data.

Not too long ago, I took some of Hubbert's curves where he "predicted" when the peak would occur. His assumptions about the production growth in his graphics suggested that the "halfway point" in his summetrical curves would be reached about the year 2000.

If you look carefully, you will see that his estimates for the rate of production growth of oil (not all liquids as is often reported by the media) reached a peak of nearly 45 GB per year. We have never come close to that. That lower production rate extends the time before the "halfway point" is reached. But, in terms of the area under the curve, which is what he was really stressing at the end of the day, we are currently traversing through those volumes NOW when he estimated the peak would occur. Furthermore, with the exponential growth (and the amount of time you spend near the peak before decay), being off by 100-200 GB does not really buy very much time.

If you are way off (say 2-6 trillion barrels) AND all that oil you did not know was there was of the same quality and extractability as the first trillion barrels, then and only then could one guess that peak might be a bit of a ways off (but exponential growth shortens that dramatically). There is no empirical data that suggests the Jed Clampett is going to shoot his way into the next megafield.

Hubbert had a true scientific mind. He was well aware of his predictive limitations. According to the late L. F. Buz Ivanhoe (personal communication), Hubbert made no true predictions for world peak oil. He did make projections using assumptions for total endowment - the commonly used 2 Trillion barrel estimate for example. He was pressured for predictions from various publications, including Scientific American, which may have led to misinterpretations. His US prediction was for the lower 48 states and included no estimate for Alaska or Federal water. Michael C. Lynch has expressed differing views - both on the USENET during the 90's and more recently on Yahoo energyresources and elsewhere.

Well peak capacity ala peak cheap oil was pretty much right on target around 2000.

Production numbers or total production estimates much after 2003 when wall the space capacity was brought online are dubious at best flagrant lies at worst.

In any case because of spare capacity issues peak oil production and the true peak are not simultaneous. For global production I like to think of it as a peak band extending from 1995 to 2005 where productive capacity ability to expand production and actual production changed overtime. Somewhere in this band was a maximum in total possible production without good numbers 2000 is as good a guess as any. And given that regardless of the model one would expect both the decline or increasing rate on both sides of peak to be small the actual peak year is not all that important.

Next because of the existance of both spare capacity and also production that could readily be brought online within a 2-3 years or so via infield drilling or acceleration of the development of known fields. One would expect the true peak to be more like a lambs shift and occur when prices reach their minima not maxima since this represent fairly well the maximum capacity which is whats important when production capacity is higher than the production rate.

Of course prices have inflation etc issues but looking here.

http://inflationdata.com/inflation/images/char/Oil/Inflation_Adj_Oil_Pri...

Oil prices bottomed in about 1998 well inline with peak being about that time.

Thus its fairly safe to put peak oil at 1998-2000.

Now actual production will continue to rise after the real peak but this is just eroding spare capacity and near term capacity as current production declines. The final maximum in production is significantly lower than what could have been obtained at peak. Probably to the tune of 10-20mbd lower.