Why oil costs over $130 per barrel: the decline of North Sea Oil

Posted by Euan Mearns on June 9, 2008 - 10:00am in The Oil Drum: Europe

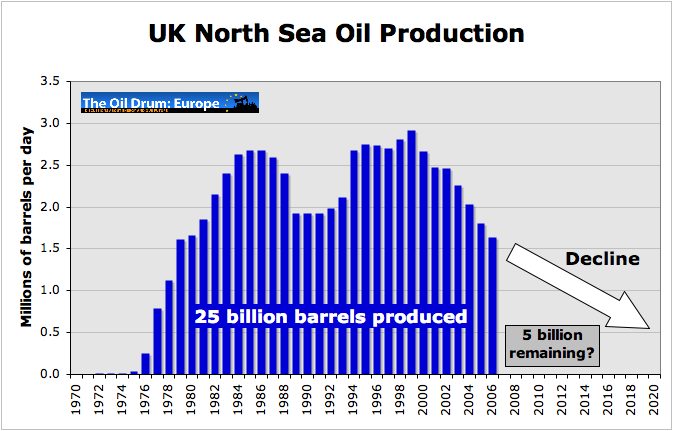

The UK

Crude oil, condensate and natural gas liquids (C+C+NGL) production. Source BP statistical review of world energy published 2007 with data up to 2006.

- UK oil production has two peaks and it is vitally important to understand that the reason for peak 1 in 1986 and peak 2 in 1999 are quite different, since many observers seem to think that production may begin to rise again as it did in the early 90s..

- Rising North Sea Oil production contributed to the oil price crash of 1986. Deferred investment resulting from this is the principal reason for decline in 1987. This was made worse by the Piper Alpha oil rig explosion of 1988. These are above ground factors.

- The all time high of 2.9 million bpd was reached in 1999. Decline that began in 2000 is caused by resource depletion and exhaustion of reservoir energy. It is no longer possible to bring on new small fields fast enough to compensate for natural decline and the trend that has now existed for 8 years will likely continue down as indicated.

From riches to rags

- The UK was an oil exporting country from 1980 to 2005. This had significant positive impact upon the trade balance. In 2006 production dropped below consumption levels and the UK once again became an oil importing country and will be an oil importer from now on.

- High prices will cause consumption to fall through conservation and pricing poor people out of the energy market. Thus it is difficult to forecast what the future consumption, production and price curves will look like. But by way of example, importing 200,000 bpd at $138 per barrel will add $10 billion per annum to the trade deficit.

Throughout this article referring to the North Sea is a simplification. Whilst most UK oil production does come from the North Sea, there are significant fields off south England, in the Irish Sea and on the Atlantic margin, west of Shetland. Norway also has significant production from the Atlantic margin off mid and north Norway. The data from these regions are all lumped together.

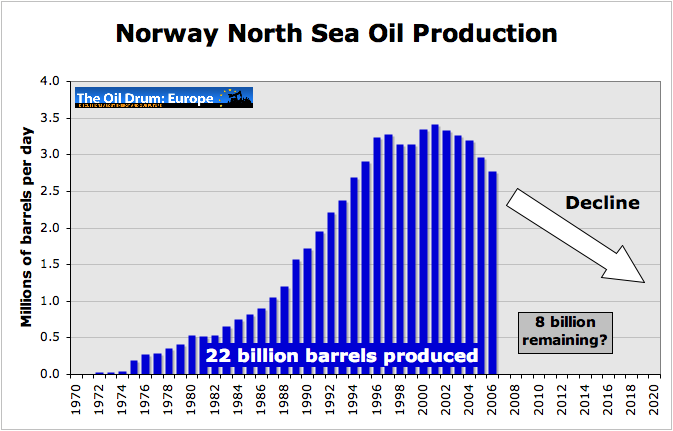

Norway

Crude oil, condensate and natural gas liquids (C+C+NGL) production. Source BP statistical review of world energy published 2007 with data up to 2006.

- Norwegian oil production is shaping up to have a classic Hubbert bell shape curve.

- Production peaked in 2001 at 3.4 million bpd.

- As in the UK, the majority of Norway's giant world class fields have been developed and are in decline. The oil is gone. Smaller fields being developed now are not large enough to compensate for decline which will likely continue as indicated.

- Norway with a population of only 4.6 million, exports most of its oil. These exports are falling

- With a vast continental shelf that extends along the Atlantic margin and into the Barents Sea, the prospect of new discoveries are much better in Norway than in the UK.

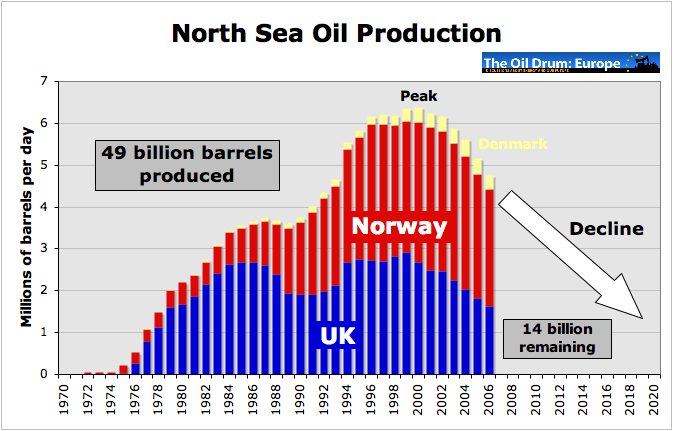

The North Sea

Crude oil, condensate and natural gas liquids (C+C+NGL) production. Source BP statistical review of world energy published 2007 with data up to 2006.

- Adding the small amount of production from Denmark to that for Norway and the UK provides this integrated picture for North Sea Oil production.

- Production peaked at 6.4 million bpd in 2000 and decline will likely continue as indicated.

- With falling North Sea oil production Europe will have to import more oil each year in competition with other regions (the USA and China) from a decreasing number of countries that actually have oil for export. This is one of the main reasons that the oil price is rising exponentially.

A note on reserves figures The remaining reserves figures reported above are for the discovered and developed resource. There may be some incremental growth in these numbers with new discoveries and deployment of Enhanced Oil Recovery (EOR) technologies. These are unlikely to make a huge difference, even if an additional 10 billion barrels are produced between 2030 and 2050. What matters are declining flow rates now that will likely persist for the foreseeable future.

Technology

Horizontal drilling, 3D seismic and dynamically positioned production ships have been deployed for over a decade. The incremental oil these technologies produce are embedded in the production data. Simply continuing to do what you are already doing will not change the decline trends.

The one technology that is not widely deployed that would add some incremental oil is CO2 miscible gas flooding of reservoirs. This would not change the picture very much but would reduce the decline rate and extend field life. The North Sea desperately needs this technology deployed. The UK government failed to support the flagship BP Boddam - Miller scheme and the Miller Field is now shut down. Indifference and ignorance on the part of the British and other OECD governments is another reason the oil price is rising exponentially.

Economists

Steadily rising oil price since 1999 has had little discernible impact upon declining UK oil production. Where economists want to see a positive correlation between production and price the reality in a post peak oil world is the exact opposite - a negative correlation. Annual oil price and production data from the BP statistical review of world energy

There are many economists involved in running UK and European government agencies. Classical economics thinking is that high price will stimulate production and reduce consumption providing an amiable equilibrium between supply and demand.

In natural resource exploitation this rule works during the exploration and production build up where high price may stimulate fruitful exploration effort and new field development projects. However, once past peak, these rules break down and do not apply. It seems there are no economists around that understand this simple point. Once a resource is gone, used up, no amount of money in the world will bring it back. Economists who advise that production will somehow do a U-turn as prices rise are doing untold harm. This false hope, optimistic message grasped by politicians, is blocking the action required to mitigate for peak oil. This is another reason oil now costs over $130 per barrel. Vigorous expansion of all viable alternative energy sources may reduce demand for oil and that will bring down the oil price.

High price may slow the decline of the North Sea a bit but it cannot invent fields to be discovered or alter the rules of reservoir physics that dictate decline. Since high price will not stimulate much new production in mature provinces like the North Sea the only route available is demand destruction. The oil price will stop rising when gasoline gets too expensive and we stop using it.

31 Billion barrels per year

With production running at 86 million barrels per day, that means we are consuming 31 billion barrels of oil every year. It is a sobering thought that by the time the Sun sets upon the whole of the North Sea, it will have produced enough oil to fuel planet Earth for just 2 years. To keep the oil party going we need to discover a "new North Sea" every two years and the last time we managed that rate of discovery was in the late 1980s, 20 years ago. We have been living off savings since then, and the bank balance is running down. It is not possible to get an oil overdraft or to create an energy instrument to magic oil and energy out of nothing. There is no choice other than to reduce our oil consumption and it is much better that we do this in a controlled way than to let high energy prices and inflation rip through our economies - which is exactly what is happening now.

The Brent Field. One of the UK's largest producers of oil and gas. Field operator Shell are in discussion with the UK government about decommissioning this icon of the North Sea. Image from Oil Rig Photos

More detailed analysis can be found in the following articles:

EU oil imports set to grow by 29% by 2012

The architecture of UK offshore oil production in relation to future production models

And 25 billion to go at (and thats the worst case estimate). Haley Millar (whatever her name is/was) does not understand the implications of rising oil prices and the concept of flow rates and reducing EROEI. She is a bit of a baffoon!

I think you mean Hayley Millar and this article

Oil reserves 'will last decades'

If it were not so tragic, I would be tempted to laugh.

Good work Euan.

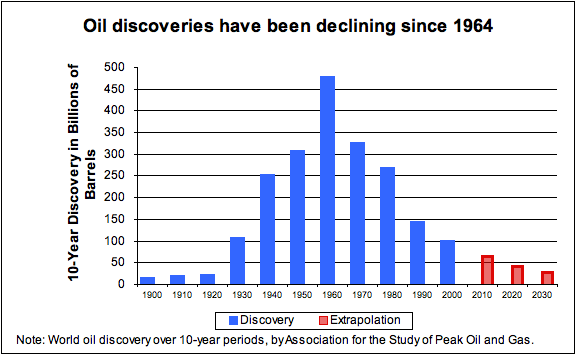

The dots you connect become even scarier when one considers global oil discoveries:

And the fact that many datapoints suggest that NEW oil is very expensive (lower EROI). TOTAL Ceo de Margerie said last week that to replace reserves now will cost a minimum of $80 per barrel. This is all hidden from most market participants as the oil they sell is a combination of new expensive-to-find oil and old $1-$5 oil - e.g. the fixed and marginal EROI is being smushed together to be sold at $130. Once the high EROI supergiants are largely depleted, we will be selling (and buying) predominantly lower EROI (higher cost) oil. Furthermore, this cheap 'older' oil that is still being pumped essentially for very low marginal costs per barrel, is subsidizing the finding and production of the rest. How much cheap oil is left is the $64,000 question? As it depletes, the prices and reactions will not be linear. Positive feedback loops abound...

Nate - I think this is the first time I've seen this version of this data plotted at the decade scale.

So at 31 billion barrels per year we are consuming 310 billion barrels of oil per decade. There are only three decades in human history where we discovered this amount of oil - the 1950s, 60s, and 70s. In the recent past we've gotten nowhere close.

So this has to be the most sh*t scary chart I've ever seen.

I was looking for the time for half measures is over quote but this one from Matt was the one that was live at the time....

That chart would be less scary if our recovery % of STOOIP has been increasing dramatically to offset lower discoveries over that time frame but as you know recovery has been stuck at 35% for a very long time. ( The average global oil recovery factor is about 30-35% , Geologist Francis Harper, BP using IHS data)

New EOR methods (e.g. CO2 injection) hold promise, but need precisely the right type of fields to work economically.

Ergo, I agree with you, it is scary chart.

Haven't the oil gurus set aside $100 billion plus for exploration this year? With that sort of outlay, they must be at the very least a little bit confident about crude's future... Surely?

The TOTAL CEO says replacement cost is $80/bbl. If that is correct, your $100 billion will get you about 1.25 billion barrels, enough oil for about 15 days.

Huh? Thought I said $100B+ for "exploration"; as in, searching for more. They must be somewhat confident in finding "something".

Mustn't they?

I can guarantee you that they will find "something." The problem is whether it will make a material difference. Hubbert found more than 50 years ago that a one-third increase in estimated URR for the Lower 48 only postponed the projected Lower 48 peak by five years.

But, but, but (stammer, stammer)...

Why do the newspapers, the TV heads, radio commentators, presidents of motoring bodies, MS in general rarely talk about this - particularly given recent fuel spikes? And when someone does phone in and drops the line, "the world is running out of oil", why is such a comment never expanded upon? Why don't other listeners phone in and ask, "Did that guy just say, 'the world is running out of oil'? What did he mean?"

Why, after nearly NINE MONTHS of first seeing the doco, "A Crude Awakening" do I still seem to be the only one in my immediate circle who is asking questions?

And, and, and (more stammering)...

Man, I thought marriage was frustrating!

Well,

Honestly it seems to be a variety of things IMO. Politicians are generally very ignorant people, who either haven't heard of peak oil, don't understand it or are in completely denial of it. Many politicians and the MSM have been talking about the falling dollar and speculation mainly. Today on C-Span, Michael Greenberger

http://www.law.umaryland.edu/faculty/profiles/faculty.html?facultynum=059

did a good job of being ignorant of the oil markets in front of the senate who regarded him as an expert. He stated 50-60% of the current price could be speculation, and then Senator Olympia Snow R-Maine, proclaimed this is not a supply and demand issue. When you have lawyers, Politician and Businessmen, trying to mess with energy policy and grasping energy markets, you are bound to worsen the problem. Most people as I have seen many a time again, are simply not willing to sit down and do a small amount of research over the subject. America has two emotions and only two, complacency and panic, we won't do hardly anything till we are on the downside of the curve. It's kind of sad, but as days go by I have a less and less hope for the future seeing our ignorant politicians and stupid people. Good for you though, you sat down and did some research, and you know the future, which 99.9% of people do not, that's an advantage right?

Thanks for the reply, Swords and hello again. Still haven't decided if it's an advantage or not (perhaps if I had shares in Woodside; but a definate NO at parties - "Please, no more red wine for the crazy guy in the corner asking gloomy questions!").

Then again, my dad, who's turning 68, and myself are booked in to get our motorbike licenses in July. Guess that's a start.

Regards, Matt B

Dear Joe,

you can do one of two things at this point:

1. Prepare yourself and your family for the Tsunami (i.e. get off the beach)...

2. Run around on the beach asking why everyone is still sun-bathing while its 'obvious' that the white crispy froth on the distant horizon is "not right"...

I've tried 2 for a while, I'm leaning more and more towards "1 Mode" now...

To get a decade perspective multiply direct fossil fuel cost inputs to your life by a factor of 5 {transport, heat, electricity, food) and determine the effect... Is your life changed? Only the very rich will answer "No".

Nick.

Thanks Nick and you're probably right... Though, I would have flapped my arms about for at least a few minutes before grabbing the kids; and probably would have shouted, "there's a tidal wave coming", in the days before people knew what a tsunami was.

BTW, that's one of my complaints about the term "Peak Oil" (someone once replied, "P Coyle? Who's that?"). A term like, "The world is running out of oil", or something more mainstream should be discussed further.

As for running around on the beach first, I sent the following off this morning to one of the local so-called TV current affair shows, along with an intro, just for the hell of it. But as you say, doubt I'll get a reply...

True or False?

• An estimated 100 tons of organic material must be cooked for millions of years under ideal conditions to produce a single barrel of crude oil.

• Each year, mankind consumes more than 30 billion barrels of crude; or around 160,000 litres every second.

• We use crude for the majority of transport, rubber and plastic (mostly non-recyclable and toxic), bitumen, pesticides, crop farming, to name a few.

• In the last 30 years, few significant new oil fields have been found to replace the aging ones. This year alone, oil companies will spend over 100 billion dollars in exploration, with no guarantee of success. Nonetheless, they will want to recoup their costs.

• Significant fields that have been discovered are deep beneath the ocean and very expensive to get to.

• Within the next decade, most of the 500 largest fields will near their use-by dates for cheap and affordable oil.

• Mother Nature created a limited amount of liquid energy. Man-made alternatives (on a massive scale) are decades away and will cost trillions.

• By 2050, the world population is expected to be around 9 billion people. To get there, on average an extra 75 million births (that’s on top of those that cancel out deaths) must occur each year. That’s around an extra 200,000 births each day – mouths to feed, clothe and shelter.

So…

Is the world running out of “easy” (affordable) oil?

What will a litre of petrol cost in 2020? Or a plane ticket to Sydney?

Will there be enough liquid fuel to go around?

Is life as we know it today sustainable for decades to come? Or a mere few years?

If there’s a problem with how much affordable oil is left (no-one really knows how much remains!), shouldn’t we be discussing this in a little more depth?

Or are the above points and questions not A Current Affair?

Around 4 years, if you are not too picky about 'as we know it today' would be my estimate.

ACA is far too busy one-upping Today Tonight, defending convicted drug-runner Corby, and castigating single mums, dole bludgers, and dodgy used car salesmen moonlighting as Home Removators who are killing our fat kids to be bothered with such a piddly little item such as Cheap Oil running out.

No, much easier to do an 'expose' on petrol stations ripping off 'working families' by putting the price up the day before a Long Weekend. Damn you, Big Oil! :p

In late 2005 I bought the website: www.megatrends2020.com with the intention of defining the major themes that will impact our lives to 2020. I chose to research Energy first as it seemed to me the single most important theme (I had heard somewhere that the oil price accounts for ~40-50% of GDP swings so that sounded like a reasonable backdrop to the rest of the trends).

So off I went researching...

I got into this one thread so much I never finished the others. The more I discovered the more I realised that none of the others really mattered. This was the one 'trend' that would define the shape of our lives in the decades ahead. The problem was that it wasn't a trend, it was a trend reversal!

Rather than continue I decided last summer to write up all I had learned -I called the result: Peak Oil Joining The Dots:

http://www.megatrends2020.com/Peak_Oil__Joining_The_Dots.doc

I have updated the specualtive timeline and it is now available online:

http://www.flickr.com/photos/8745365@N04/2504887199/sizes/o

Personally I have a very rough 5 year plan that basically involves going 'off grid'/Home food production/no debt and I am now in the process of downsizing to prepare (selling my Thai Penthouse -I live in London, UK). I don't think most airlines will last the next decade, airlines that operate business traveller level fares with passengers packed in like sardines might just survive...

My 'best guess' at when things start to get 'really sticky' -i.e. major amounts of demand destruction kick in- is around 2012 +- a year or two, so not long really...

Regards, Nick.

I'd go along with most of that - fine job, Nick!

Where I differ would be mainly in moving some of the events forward in time.

What would be useful if you have time would be a greatly expanded view for 2008-15.

A lot of 'interesting' things should happen in this time frame.

I would suggest for one that this winter should see an emergency budget in the UK as the balance of payments widens towards infinity and the budget deficit spirals with rising unemployment and low or nil growth.

Long distance tourist destinations should get a huge hit together with property prices there and tourist airlines in the following summer.

Nick, I am thinking that we are about at the stage that a sector by sector forecast could be attempted, although it would be patchy as none of us are full-time on these matters.

To take one example, it seems to me that the age of the Football mega event may be on the wane.

In the UK, major clubs are highly leveraged, with Manchester United, for instance, having large debts after a £790million takeover, requiring an interest payment of £62million pa.

Wages to turnover is over43%:

http://news.bbc.co.uk/1/hi/business/7180767.stm

BBC NEWS | Business | Success boosts Man Utd finances

I would expect that business model to rapidly unravel, with the most highly leveraged clubs having to sell players to reduce the wage bill, as recession means falling ticket sales and prices and reduced sales of replica kit etc.

Nationally backed teams like Real Madrid should do relatively well, as the politicians try to keep the circuses part of bread and circuses going at all costs for a depressed population.

By 2010 I would expect distress sales of large British clubs, and re-negotiation of players salaries downwards.

American football should do even worse, I assume, as large distances are regularly covered to play matches across a much greater area.

Hi Nick,

Are you going 'off grid'/Home food production in London? Would be interested in where and what you are planning to do.

Thai Penthouse sounds like a good central location for a TOD party.

Let's do it! :o)

http://www.knightfrankphuket.com/sale/RS0174.htm

noutram

I think your "joining the dots" document is a nice compilation.

The only thing I think you might want to reconsider is that the current reserves of Uranium should not be considered a constraint on future production.

There is a few orders of magnitude more out there once we bother to look for it (no one has in the past ~15 years due to the Russian nuke decommissioning flooding the market).

Other than what I consider an overly pessimistic view on the future potential of fission, I think you are spot on with the energy analysis.

"the world is running out of oil"

And has been since the first day oil was pumped.

And that's the problem. I'm 40 too. Don't you remember the '70s, when everyone knew that we were running out of oil? Just like Daniel Yergins loves to say: the world has run out of oil five time in the last 150 years. We've gotten an incredibly thick skin to the whole concept. Til, of course, the day it starts to really hurt.

The day I lose my job because of it.

The day I don't get any unemployment..

The day I wait in line two hours to get into the store and don't come home with anything to show for it.

Forget the deap analyses here. Look at perspectives (thanks for bringing it up Westex):

During George W.'s presidency, the world will have used 20% of all the oil IT WILL EVER USE...

Cheers, Dom

A correction regarding total oil consumption during the reign of George Bush the Second, it's about 10% of conventional oil that we will ever use (based on Deffeyes' HL estimate).

In round numbers, we are using about 25 Gb of of C+C per year. Through 2005 we had used about 1,000 Gb, and Deffeyes gave us another 1,000 Gb of remaining conventional. So, during the first four year term we used 100 Gb, or 10% of all oil ever used. And during his second term, we will have used 10% of all remaining conventional reserves (according to Deffeyes). However, this is 200 Gb in 8 years, or 10% of Deffeyes' estimate for world URR (C+C) of 2,000 Gb.

So, pursuant to Deffeyes, in the first term we used 5% of total conventional URR, during second term, 5% of total conventional URR.

...if that increase came early enough to substantially increase the peak flow rate.

If, on the other hand, today's oil production rate is more-or-less as high as it'll get, then increasing URR by 1/3 would enormously slow the post-peak decline rate, making the transition to other energy sources much easier.

Indeed, huge-but-slow resources, such as the oil sands, are great for post-peak mitigation, as they simply can't be drained dry in short order. Not only does that mean they'll produce for a long time, it means they can't make oil cheap again, and hence can't derail price-motivated efforts to switch away from it.

If we assume that we can get another 1000 Billion barrels (about half the total) at $100 that's 100 Trillion dollars.

The total value of the Worlds stock markets in 2007 was 51 Trillion or about half the in-ground value of the oil.

If we are at or near Peak Oil the value of the in-ground oil will climb remorselessly in the years ahead making the 100 Trillion a lower estimate...

Result1: we will go 'to the ends of the Earth' to get this resource out the ground.

Result2: SWFs (Sovereign Wealth Funds) of NET oil exporters are going to 'own' Wall Street...

...and can anyone tell me 'if electricity is our future' why the total market cap of the Uranium miners is just 30 Billion US??

Nick.

For the same reason water was, until recently at least, 'free'.

The only commodities valued are those in short supply.

The price of uranium has halved in the last year - with just a little exploration, vast new finds were made, enough so that even with much expanded plans for nuclear energy production it is darn near a free good.

Dave,

Do you have any sources on the Uranium story ?('scuse the lame pun).

Not that I doubt you, but Anti nuke types spent (again , 'scuse the lamer pun..) most of the last three years telling us that there wasnt enough U for the nuke plans anyway.

Here is the source of my claim that uranium prices have halved:

http://www.business-standard.com/common/storypage_c_online.php?leftnm=10...

Here is the position paper by the World Nuclear Association:

http://world-nuclear.org/info/inf75.html

Bill Hannaghen extensively lists sources and resources amongst the information here:

http://www.nuclearcoal.com/energy_facts.htm

Energy Facts

And Charles Barton deals with the issue here:

http://nucleargreen.blogspot.com/

Nuclear Green

For the EROI and a rebuttal of Storma nd Smith which has been the source of most of the rumours about uranium shortages see here:

http://nuclearinfo.net/Nuclearpower/WebHomeEnergyLifecycleOfNuclear_Power

Nuclear Power Education - Energy Lifecycle of Nuclear Power

If needs be, the basic technology of uranium from the sea has also been tested:

http://jolisfukyu.tokai-sc.jaea.go.jp/fukyu/mirai-en/2006/4_5.html

4-5 Confirming Cost Estimations of Uranium Collection from Seawater

Obviously it is not worth the bother at present uranium costs.

Finally, it is not very difficult to massively increase the efficiency of burn:

http://nextbigfuture.com/search/label/thorium

Scroll down to the Fuji design.

That's the spot price. The long term contract price varies. Reactors tend to be built after you have signed a thirty year contract or the equivalent. It helps with the financing if you can reassure the bondholders that you aren't going to run your reactor for only a few years and then shut down after you run out of fuel.

It also helps to have a contract to sell the electricity as well...

Fuel costs a tiny proportion of the costs of a reactor, less than 1%. Processing is a lot of that, so the raw material costs are even less.

As a percentage of total costs this will be small item.

You can also buy from France, in a deal which includes uranium, as China recently did.

Of course they expect to find oil and they will. At tomorrow's prices they should make money for awhile yet. However, it doesn't change the point made here, which is that ongoing finds are not large or plentiful enough to prevent the declines stemming from the depletion of the older and larger fields. This makes the smaller amounts found just that much more valuable.

Joe, the easy way of looking at it is to imagine that for a given amount of money spent exploring and developing, to keep it simple let's say $1million, you got an extra so many barrels of oil, say 20,000, and you sell that at $50 plus your margin.

Oil gets tougher to find, so in a couple of years for the same $1million you only get 10,000 barrels.

However, the price has doubled so you make the same!

The oil company gets just as much money, and obviously carries on looking for more oil, but the poor old customer only gets half as much oil for the same money.

So long as the oil price keeps rising, the oil companies keep looking for more oil.

This over-simplifies things, but not enough to alter the broad picture.

You get less and less oil for your money.

Thanks, Dave. Get it! You guys (and gals?) just need to keep whacking me over the head 'til this stuff sinks in.

Now for the other 6.35 billion AJ's...

Regards, Matt B

Of course they will continue looking and all Oil Majors budget for Exploration.

One or two things must be born in mind though.

A modern , deepwater hpht semi-sub or drill ship rents out at circa $500, 000 per day. Thats about 1.5 billion US per operational year.

A less modern offshore rig goes for less, but they too are in short supply.

An Exploration programm is usually 2-4 wells per year , depending upon sea depth and final drilling depth.

So, $100 Billion doesnt actually amount to a massive exploration pulse in real terms. A dollar doesnt go quite as far as it used to.

Compared with the Halcyon days of the 80's, 100 Billion is not translated into a grat deal of new exploration wells. - Admittedly, fewer wells need to be drilled because of advances in Seismics and other techniques, but 100 billion sounds like a lot but it isn't.

100 Billion US = 50 Billion Sterling = Labour's bail out of a half assed mortgage company called Northern Wreck.

The problem for Western Majors is: Where to look? If you want to spend money on exploration, you want to go where you will find an elephant, be able to develop it and not see it nationalised after you have done all the hard work. This too is a limiting factor.

Thanks Mudlogger (and thanks to others for answering my very basic questions in simple terms).

I guess it's the "scale" I'm still trying to get my mind around (like the 200,000 extra humans coming into the world each day to make up the expected 9 billion by 2050); and which of those seemingly huge numbers can be explained away, which can't.

I'm sure I'll get there eventually!

Regards, Matt from Melbourne, Australia

Joe,

Just to emphasize what the Mudlogger said about exploration costs. Last year I worked on a Deep Water well that cost $148 mm. Just one well. And not only did it not find hydrocarbons it did a good job of condeming any future drilling in the immediate area. Of course the operator was optimistic about the potential and all the new technology (very expensive technology) helps. But in general exploration success runs around 10% to 20%. But when the payoff can be huge the players will make the bets. The growing problem now is the diminishing number of places to make the bet. Besides fighting mother nature the fear of nationalization is quickly becoming a dominant factor. All the oil companies in the world now control only 15% of the production. The national oil companies (the governments) control the other 85%. As government revenue drops due to depletion they will be even more tempted to redo the trade and take more of the production stream regardless of the terms of the original concession.

This is a very good example of why you don't invest in the prospectors, but invest in those supplying the picks and shovels--they MUST be paid whether or not the prospector strikes its lode.

For reference, "dramatically" means about 0.25% per year, based on the presentation you linked. (1% increase = ~63Bbbl = 2 years' consumption, and assuming discovery has been half consumption recently)

The presentation you link notes that the UK fields saw an average reserves increase of 25% over the first 20 years after they were booked (slide 13). On slide 14, it says that that growth is both due to there being more oil than was originally thought and to the recovery factor increasing.

It would be interesting to see why you say recovery factor hasn't changed for a very long time, as the presentation you link to appears to suggest the opposite.

No, 'dramatically' would have to offset the 'dramatically' lower oil discoveries in my first graph, e.g. oil discoveries this decade will have dropped 90% from the 1960s.

In the one source I linked, slide 12 the BP geologist states "average global recovery factor is about 30-35%".

But here are other links. This information doesn't exist in one tidy number (much like most of peak oil related data and heuristics), partially because these numbers largely represent CURRENT fields in production and don't include ones already abandoned, and as I'm sure you are aware there is not one international clearinghouse for this sort of data - people can't even agree on reserves within a 50% ballpark.

1. http://www.slb.com/media/services/solutions/reservoir/carbonate_reservoi...

Schlumberger - "The average recovery factor—the ratio of recoverable oil to the volume of oil originally in place—for all reservoirs is about 35%."

2. http://www.eoearth.org/contributor/mamdouh.salameh

Oil expert Dr Mamdouh Salameh said that "And despite the great technological strides by the oil industry, the average global oil recovery rate has been stuck at 32% of the oil in place since the early 1990s. However, rates of 50% and even 55% have been achieved in the North Sea and also in the most recently-developed, state-of-the-art Shaybah oilfield in Saudi Arabia respectively." (Old ODAC May 7, 2007 not working to provide source for Salameh's statement)

3. http://www.bfe.admin.ch/php/modules/publikationen/stream.php?extlang=en&...

http://www.mees.com/postedarticles/oped/a46n51d01.htm

The present “worldwide” average oil recovery factor is just above 29% - Leif Meling, Statoil

(uses IHS data). Meling does think that the recovery factor can be increased to an optimistic 38% by using EOR techniques to increase URR. Eg, for Saudi Arabia he estimates max URR of 460 Gb.

4. Even optimistic ex Aramco Nansen Saleri, now leading his own consultancy

http://www.quantumreservoirimpact.com/

said at 5:35 of this video

http://www.youtube.com/watch?v=KZnkjwBAW7U

that "the industry only recovers one out of three barrels" which is equal to a recovery factor of about 33%. Also, from Harper's presentation which uses IHS data, he says that original world discovered in place volumes are about 5.5-7.0 trillion barrels (Tb). Using a recovery factor of 35% gives a URR range of 1.93 Tb to 2.45 Tb. The world has produced about 1.08 Tb C&C to end of April 2008 which leaves remaining URR range of 0.85 Tb to 1.37 Tb.

For comparison, your neighbor, Colin Campbell's estimate (excluding gas liquids and rounding) is now about URR 2.20 Tb from his May 2008 newsletter.

http://www.aspo-ireland.org/contentFiles/newsletterPDFs/newsletter89_200...

TOD contributor "Ace" also discussed world average field recovery factors in section 3 of his article on Saudi Arabia's Crude Oil Reserves Propaganda

There is more but thats all I could find for you now sirrah. Perhaps if ONCE you would agree with someones comments, I might feel compelled to find 5 or 6 related sources instead of 4. If you have a source that nicely summarizes the historic global recovery ratios of OOIP, I would be grateful, as I've not seen it.

Another important point is that a lot of our remaining reserves are in existing developed fields and have been added because of dubious assumptions about recovery based on technical progress and price. They are dubious simply because these numbers are provided by the same people that also believe we have trillions of barrels left.

But more importantly because they are often in existing fields none of this oil zero nada zip is available for extraction today unless the field can be reworked to take advantage of these reserve increases. This means this oil will only be pumped at some future date and by the time we hit that date total world production rates will be much lower.

We have the same problem with conventional oil we face with unconventional the extraction rates are going to be a lot lower than what the reserve estimates indicate. We simply don't have enough manpower and time and money to rework these old fields to maintain much less enhance extraction rates to any significant degree. So even assuming we have 1 trillion barrels left does not do us a lot of good since we have to pump the first 500GB before we can get to the next 500GB since its in already fully developed reserves.

And if you break int up into increments like this its obvious that the cost and difficulty will only increase over time.

My estimate of 150GB of reserves that can be extracted within 15-20mbd of todays extraction rate is not bad this is what

people should focus on. Later we will have to deal with a world thats pumping oil at a lot lower production rate than we do today and its almost certainly a very different world. What needs to happen is focusing on how we make that transition.

Given the situation we could have already started seeing steep declines in production worldwide we need to focus on getting the governments to deal with every 1mbd drop in production in a smart manner. The news overall is not good very every country that drops subsidies another increases them or uses some other means to cushion high fuel costs. The world is already made a number of potentially deadly mistakes by not recognizing peak oil and adopting a depletion protocol. If your in North America or Europe you better consider how your going to heat your home through the next winter not worry about recovery factors.

But he did not say that it was stuck at a fixed level, just that it was currently at that level. That is your claim, not his. In fact, he says the opposite on slide 14!

Let's look at your other references:

So of your five references for the claim "recovery factor has been stuck...for a long time", only one actually says that, and three say either that it can be increased or that it has been increasing.

Doing some searching of my own simply bolsters this consensus. For example, Norway has seen its recovery factor increase by 20% (from 34% to 41%) since 1991. BP estimates a recovery factor of 49% for its portfolio of resources, and says it's working on increasing that.

So the evidence really does not appear to be supporting your claim that recovery factor has been stuck for a long time.

Indeed he does, but he doesn't say that they aren't increasing. That's your claim, and - other than Salameh - apparently only yours.

What is the point of posting "me too" comments?

If I have something to add, I do so.

If I see something to correct, I do so.

If I agree, I do so. I just don't feel the need to tell the world about it.

However, you're wrong. I do indeed note agreement with people, and even thank them for pointing out errors I've made. Finding a recent example of that means going all the way back to Friday.

Are you objective enough and honest enough to not only admit when you're wrong, but thank people for pointing it out? If you're not afraid, it's a fantastic way to learn.

Pitt my Elder,

Heres the deal. I spend a great deal of time on this site. Sometimes I don't see that all of our efforts have made much progress in the greater sphere at mitigating upcoming oil depletion, so I get frustrated. Today was one of those days, and I was distracted by much more unpleasant items than ducks on a pond and singled you out with an accusatory tone and for that I'm sorry. However, I must say that when I see your login pseudonym, I have come to instantly expect a criticism or a pointing out of an error, so this has obviously become a knee jerk defensive pavlovian response, especially in my own interaction with you (n>30). Don't get me wrong. This community needs 'cleaner fish'/border collie types to reign in any BS and call people on unsupportable facts - it keeps the discussions high level and credible - but there does exist a fine line between correcting and searching/heckling minor errors when the larger point of the comment is valid.

In the current example, I admit to not being an expert on historical recovery rates, though in talking to people in the field I've been led to believe rates have been roughly in the same range for a long time, with very gradual increases. The BP slideshow showed they were increasing marginally, not dramatically - which was the initial point of my comment to Euan - the drop in discoveries would NOT be that alarming if recovery rates were keeping pace. Furthermore, the discovery graph I posted includes backdated reserves that were added to initial discoveries. Ultimately, a large part of the Peak Oil story WILL be about recovery rates, as the difference between 35% and 50% recovery could be hundreds of billions of barrels and moderate global decline rates. I know Gareth Roberts at Denbury Resources is shooting for 50%+ using CO2 injection and there are other EOR techniques that offer promise as well. As is usually the case when the stakes are high, there are many claims that recovery rates will dramatically increase in the future - the problem is we can't really know recovery rates until a well/region is finally abandoned. I listed the recovery rate sources I had available not as definitive answers but as datapoints I had read and learned about.

I have a low tolerance for misinformation, even when it's inadvertent.

It's easy enough to avoid having me correct you, though: don't be wrong. Thanks to the web, it's pretty trivial to check your facts before posting them to the world. If someone doesn't respect their argument or their audience enough to spend three minutes checking their facts, how am I as an audience member supposed to feel about them or their argument?

A great many people here say things that they wish were true as if they were true, and that's an enormous cognitive flaw. If you believe this to be an important issue - and I suspect most people here do - then it's important to avoid faulty reasoning about it, no?

(In general, I'd far prefer not to have to correct people; the modeling and numeric discussions are much more interesting and personally informative.)

Yet, as you say:

"the difference between 35% and 50% recovery could be hundreds of billions of barrels"

That may not be best characterized as "minor".

Moreover, let's get something straight: there were two points in my original post, and only one of them disagreed with you. Saying that recovery factor would have to increase by 0.25%/yr to make up for discovery shortfalls in no way makes those shortfalls irrelevant; indeed, 0.25%/yr increase in recovery factor strikes me as somewhat optimistic, even in the medium term. All I was doing there was putting a number to what you were saying.

The second point, however, was that your link said the opposite of what you were saying. Most people don't read links, and your word tends to carry some weight here, so I thought that difference was important to clarify. That kind of situation is how something wrong becomes "common knowledge".

Euan,

This is an excellent post. It shines because of its simplicity.

Have you sent it to Ms Millar and Gordon Brewer of BBC Scotland?

Maybe they would go home and thing again.

The email starts:

I actually thought Gordon Brewer did a good job. Hopefully next time they return to peak oil they will be better aware of the issues and what questions to ask.

In a recent discussion with a friend who works in the finance industry I made the point that discovery peaked in the 60's, referring to a graph like this, and he pointed out that it was backdated, which distorts the true picture. I remember reading about this a long time ago, and also an explanation (from Colin Campbell I think) about why backdating was the correct method. Could anyone remind me of the paper, or the rationale from the paper, as to why this is considered the best way to characterise the history of oil discovery? (By 'backdating' I mean that gaining more oil from a particular field at a later date, eg through more development or more technology etc, is dated back to the first discovery of the field as a whole.)

Good question. Campbell and Laherrere argued in their 1998 SciAm article that backdating is the correct way to go about assessing future discoveries, but do not fully explain why.

Bob Lloyd explains this in more detail in his article The End of Oil.

Prof Aleklett discusses this further in his OECD discussion paper 2007-17 on page 21.

Another reference for peak in oil discovery in the 60's using the backdating method comes from Campbell who references article by Longwell of ExxonMobil The Future of Oil and Gas Industry (World Energy vol. 5, no.3, page 101, lower right graph) in the Oil Depletion protocol (page 3).

Thank you for those links. The Bob Lloyd article link seems to be dead, it is here:

http://www.physics.otago.ac.nz/eman/The%20End%20of%20Oil%20essay%201.pdf

Or rather this one which loads the pdf properly:

http://www.victoria.ac.nz/chaplains/issues/bob-lloyd-the-end-of-oil.pdf

Backdating is not always the best way to look at oil reserves. The main reason is that the backdated reserves are different from new field discoveries. As and example take two fields with 10GB each vs one field with 10 later upgraded to 20.

The larger 20GB field would have 10GB left at 50% and at this point production would be declining. While if you did the two 10GB field in series say starting the second one when the first was at 50% then production would increase or remain flat till the second one hit 5GB. The production rate is lower than the 20GB case but you keep the same production rating till your 75% depleted.

I've been arguing that we have effectively done both. The serial case is small fields with short lifetimes and the bulk of the reserve additions are in older fields and won't keep production from declining. In fact the addition of the small fields worked to hide to a large extent the advanced depletion levels of the larger fields.

In any case you can see how backdated reserve additions can give you a way to rosy picture about future production once growth stops.

Most of the remaining oil if its extracted at all will be produced at production rates much lower than today. And finally even if EOR methods add to the final produced volumes the chances of them also getting a high production rate are slim.

All EOR methods I'm aware of either give brief increases or rates less than 10% of the maximum production rate the field achieved.

Nice work Euan.

Nate...great article on applying reflexivity to the commodities market. I have to eventually finish that book...damn.

I wanted to make sure that my numbers were correct so I sent the charts to Mike Earp (today Sunday) and he responded with this chart.

Mike has been extremely helpful to me in providing all sorts of data and reports. His chart is based on EIA data and is up to date to end 2007 - one more year than mine since I am using BP data.

Mike's estimate for the North Sea is 50 billion produced + 13 billion remaining = 63 billion.

My estimate for the North Sea is 49 billion produced + 14 billion remaining = 63 billion.

These figures do not include yet to find.

Any estimates on the costs of the 'yet to find', holding everything else constant? (see my comment up top)

Nate, technology has allowed the oil industry to become very discerning about what they drill. Inverted seismic data and controlled source electromagnetic imaging actually allows companies to image oil and gas in the sub-surface - they can actually see the stuff. This makes companies much more risk averse to drilling. In the old days it was a gung ho approach. Today its much more sophisticated. The success of this technology is clearly visible in your decadal discovery chart posted above (I think) (sarcasm alert). There is very little left to find and it costs a fortune to drill it.

I think you are spot on about comments of a huge but rapidly depleting inventory of high eroei oil and gas subsidising todays E&P effort. The real energy costs involved are hidden. No one knows the energy balance of satellite field developments with 2 long reach horizontal wells linked back to a massive steel jacket platform producing just a dribble compared with its design capacity.

This is the sort of work that BERR should be funding with some urgency. Taxation and decommissioning costs also distort the picture. Companies will do anything to defer the costs of decommissioning large offshore structures. Hell, they'll even build wind farms to defer decommissioning. I'm afraid this is where energy economics and conventional economics collide.

No doubt we are using more and more energy to produce energy and the share of GDP assigned to energy production is escalating. Bring on the ecologists to explain the consequences of this for society.

Euan, the 'share of GDP' in your last paragraph was referenced very recently by Kenneth Deffeyes: Oil Production, Oil Price.

KD points out that at $130/bbl oil production already represents 6.5% of GDP. I was trying to figure out if there's a direct correlation between ERoEI and the percentage of GDP taken up by oil production, for example if overall ERoEI were to fall to 6.5 would we then hit the 15% of GDP solely to extract and refine oil? As the old, mature fields with high net energy returns fade and are replaced by smaller substitute (or more accurately part-substitute) oil sources I'd expect overall ERoEI to fall below 6.5.

This is very complicated. First of all $130 oil may represent much more than 6.5% of GDP if oil stays the same and the economy tanks.

More importantly, we basically have TWO energy banks that the economy draws from - liquid fuels and electricity. So while increasing EROI of electricty based renewables is great, it must be matched at same time by infrastructure change that can use electricity for the basic goods we get from cheap oil, otherwise the new energy surplus won't be beneficial. We therefore either need to find higher total energy gain liquid fuels (EROI x Scale x Flowrate), or change the way the global economy works (or else...). As was pointed out in "At $100 Oil, What Can the Scientist Say to the Investor?", declining EROI means the energy sector continually requires a larger % of the total energy pie for themselves, taking it away from non-energy society. The mechanism of this in a free market is higher prices. One possible benevolent exception is if the 'economy' itself was heavily devoted to high EROI alternative energy deployment. More jobs, more surplus energy, more options, etc. But if this happens with a low EROI source, we are doing worse than spinning our wheels.

The Gordian Knot is that there doesn't seem to be any high EROI liquid fuel options. Let alone those that are scalable and environmentally sound. Since liquid fuels are currently the limiting input, this means barring a crash conservation/efficiency plan, we are going to go for the low EROI and/or non-scalable and/or non-environmentally sound options (biofuels, Fischer-Tropsch, shale oil, etc.)

FYI - Refining oil itself takes about 20% of the energy content in oil (e.g. refining is about 80% efficient). Though this isn't technically an EROI (energy harnessing) but an energy conversion (efficiency), we can't put crude directly into our cars/trucks so it might as well be. IOW, whatever the EROI of the oil becomes, we have to lop off 20% from that number before it is usable (though this could come from the second energy 'pool' as much of this is natural gas/electricity and could be generated using renewables.

Re: Refining oil itself takes about 20% of the energy content in oil.

From an oil importers perspective then the EROI of imported oil has got be to less than zero buy a substantial amount. IMO it is negative 100 percent. Lumping all oil together, i.e. the EROI of domestic oil with imported oil, does a disservice to the understanding of the EROI situation. EROI is only valid when comparing like and like in tightly controlled comparisons.

While imported and domestic oil may look and test the same, they are different. In the case of imported oil the energy gain goes to the seller. The buyer receives the economic gain minus the cost of energy inputs he must make such as refining and distribution. To claim that there is a net energy gain for the buyer on imported oil is preposterous.

To hold that biofuels, Fisher-Tropsch, tar sands etc. have inferior EROI compared to imported oil is fallacious reasoning. They may have lower EROI compared to domestically produced oil, but that is irrelevant since we are slowly running out of the stuff.

I find it unreasonable that ethanol is repeatedly condemned for it's low EROI when in fact the EROI of imported oil which makes up the majority of oil consumed in the USA is even lower by a couple of orders of magnitude.

As long as the EROI of imported oil is blended with domestic oil and assigned the same value as domestic oil, EROI arguments against ethanol can not be taken seriously.

X/practical

We have disgreed in the past, but these comments by you are beyond the pale.

After 3 years of bashing EROI and supporting corn ethanol, one would think you would understand the formula for EROI, which is energy output / energy input. It cannot be less than zero. It cannot be negative at all. An energy breakeven process would have an EROI of 1.0 - a terrible energy sink might have an EROI of .2 or .3

Wrong. First of all you calculate the energy gain - it is what it is, without dollars. Then the buyers and sellers split the energy surplus. I would argue that the sellers have gotten a much lower % of the real energy gain for a long time because oil is cheap. If the OECD importing nations can buy oil cheaper than milk or Gatorade, they are buying high energy gain for virtually nothing. In any case, high EROI/low EROI, from a planetary perpsective is a discrete number - what is done with it after it is produced is another argument entirely. The great giant oil wells that have probably had EROIs of 1000 continue to subsidize tiny EROI prospects such as corn ethanol, AND with very small comparative externalities (e.g. they are have high energy returns on land, and the land (Saudi desert) has few alternative uses, unlike your land that you grow corn on, which has multiple other uses.

This is ridiculous. The 'net' energy we get to use is EROI-1. The net energy for corn ethanol is about .3 - and that is aggressive because we give dry distiller grains a full energy credit, when if all we talked about was ENERGY, those would be backed out. International EROI for oil, while declining is still 10+:1, meaning 9:1+ net. 900% gain vs 30% gain and somehow the 30% is 'orders of magnitude' lower? Are you growing anything else on your land, and possibly smoking it?

You do realize that if society ran on corn ethanol, we would not have ANY excess energy gain for hospitals, roads, infrastructure, etc. Each increment of double digit EROI we replace with .3 gain, we price out some other aspect of society. We need much much higher EROIs than 1.3:1 in the current system. IF corn ethanol had no negative externalities (and it has HUGE ones), and IF corn ethanol had an EROI closer to what the average annual energy gain needed by society, then it could reasonably be considered as a small part of a solution to peak oil. As it stands, it is one of the most disastrous allocations of scarce resources (diesel, natural gas, and land) that I can imagine. I know your heart is in the right place, but your head is somewhere else entirely.

Here, among the oil-ignorant masses, we are looking at $5 a gallon gas, and $100 fill-ups, and that's by July of this year. The conflicts between the "there are undiscovered reserve" people, the "got ethanol?" people, and the "it's speculation" people are getting us nowhere fast, and we need to find some consensus about all this NOW, not in a year's time or in a decade. Is there any hope that will happen?

There are none so blind as they who will not see.

I think the vast majority of regular contributors to this forum will agree that there is no supply side solution to this problem. The solution therefore must lie on the demand side within the OECD. And since most of the oil we use goes into transportation, if we want an immediate fix the only one available is to impose speed restrictions and enforce them throughout the OECD. That will work a little for a little while.

Looking beyond this summer a strategy for reducing oil consumption needs to be planned with some urgency and that will mean legislating on car / engine size and power, single occupancy commutes etc. But again that will only work a little for a short while.

We (OECD governments) are way behind the curve and so I fear that high price will be the mechanism for rationing supplies. This I imagine may mean hoards of disenfranchised poor people wrecking cars and stealing gas. Global oil production is still rising slowly, so what we have now is a mere foretaste of what is to come - when production actually starts to fall.

The other thing that could be done is a 100% tax on jet fuel imposed throughout the OECD. The vast majority of airlines will go out of business in any case - its already happening so this is not some reckless forecast.

In ASPO Boston Randy Udall gave a talk titled "Living Like Gods" - one of the most passionate talks I ever heard. Once the population at large finds out that they are not Gods with rights to fly and do whatever they want whenever it could get ugly.

Glenn has a post in preparation addressing the issue of what should be done Now

Euan,

As you also point out in the article:

there is a need for control. But, you suggest legislating efficiency and increasing prices through taxes. Ending aviation immediately could help a bit, but the sector does not consume that much energy presently. It seems to me that we should avoid price as the rationing mechanism and simply have a per-person oil ration. This can aviod wasting effort on seeking ever more expensive-to-produce supplies by driving the price of oil down to a level where investment in exploration will not pay at all. If we keep demand well below supply through rationing, then prices will fall and the economic impact of reduced supplies will be minimized.

Edit: During WWII, US rationing was set at 4 gallons/week. This mainly to conserve rubber. Currently the per capita

use in the US is about 9 gallons/week. Cutting that to 7 gallons/week would entail much less hardship than during WWII and would reduce the price of oil by quite a lot since world consumption would drop by about 6%.

Chris

Chris - I agree entirely and did not write that since suggesting such may be too far off field for many to grasp. Yesterday Glenn sent around an email asking how demand could be reduced in order to bring down prices and this was my reply:

The only way to fix this problem is by reducing demand for oil. But I'm afraid that it seems the huge vast majority of people just don't seem to see that current high price is due to supply / demand imbalance and will look for any other reasons apart from those which are staring them in the face.

Euan,

I also see tradable rations as a currency, though an extra one like postage stamps rather than a replacement. The risk of seeing energy as a basis for a replacement currency is that there is so much available that inflation would be inevitable rather than controlable.

The military currently gets its fuel on the open market, but they don't use that much. In the US the Air Force is moving pretty quickly to get synthetic fuel supplies, the Navy is looking at producing fuel at sea using nuclear power, and DARPA is aiming at deploying 40% efficient solar panels in the next couple of years to reduce the mass burden and logistics issues for soldiers on the ground from generators and fuel.

It is not really military energy use that drives the current policy on keeping oil supplies available but rather domestic energy use.

Rather than a step towards an energy based fundemental currency, I would see (tradable) fuel rationing as a step towards carbon rationing at a more general level that could move us all towards energy independence more quickly: http://www.theoildrum.com/story/2006/8/4/163554/8625

Chris

My first reaction to this assertion is 'Huh!?" But on further reflection, basing fiat on energy would be an excellent way of getting a real market definition of the differences in the quality and availability of energy. Some dude claiming he has tons of energy for sale would get nothing when it turns out the energy is sunlight falling on a few acres of desert land, while someone else with a stripper oil well would get $$$$$ for each barrel squeezed out of the well. We would get to see real quickly how bogus (or real) claims of a massive energy surfeit are by (mostly) 'renewable' energy advocates.

Yeah that kind of worries me.. I'm still out to lunch as to whether the whole solar/wind/geothermal paradigm is worth pursuing.

The contribution renewables can make to energy supply is vast.

The problems only start when the present level of the technology or where it is suitable is distorted.

It is the nature of renewables to be very localised and specific in it's application.

Most sources are also intermittent, and exaggerated claims of our present storage capabilities should also be viewed with scepticism.

On areas like the great plains in America though the wind resources provide a magnificent alternative, and gas prices are rapidly making it one of the cheapest sources save for carbon intensive coal.

PV costs are now dropping to the point where within the time frame of 2012-15 they should be a very economic source of peak power in hot climates.

If all this seems like very luke warm endorsement, it should be remembered that a reduction in use in one area means that more is available at lower cost elsewhere.

Geothermal may also be effective in some areas, as might solar thermal - we should know more and be able to be more quantitative within five years.

For base load at the moment though nuclear is king of the low carbon sources - that may change, but at the moment it is certainly the case.

I've just done some BOTE calculations on another fourm, and the numbers I've come up with suggest that with CSP we can generate 1400MWp in an area under 10 square kilometres (assuming all the mirrors but up against each other, which won't happen in the real world) , all the way out to 45 degrees londitude, at a cost of about Au$4.4Bn. This compares to a new FFF plant with a rating of 500MWp that cost NSW Au$6Bn. We could build four CSP plants for the cost of three FFF plants (which are already a third the capacity) and use the 'spare' CSP plant to pump water into dams for hydro use at night/on cloudy days. Back it up with rooftop PV for charging your EV, and Wind producing Anhydrous Ammonia for heavy freight, and we have both clean power and clean transportation.

Never happen though. Even if the calculations are right, the Coal Lobby has too much leverage. :(

I'd be interested in a link - I'd like to take a detailed look.

How does the water consumption look? That seems to me one of the biggest things to get over in arid areas.

If you want to mail me privately I am on brittanicone2007 at yahoo dot co dot uk

I was thinking of the Douglas Adams story of leaves being adopted as currency by a bunch of account executives and telephone sanitizers who became our ancestors. Your point about easy energy and difficult energy is important, but the rationing I'm suggesting would aim at ensuring that we don't waste our efforts on difficult oil. It also buys us time to extend the life of easy oil. During that time, if alternatives do not turn out to be easier than difficult oil, we'll at least have a little space to think about the implications. No matter what, the EROEI of oil gets worse with time while that of renewables improves so there is a crossing point.

There are serious reasons to consider energy as a currency. Hubbert considered the possibility. But, it is the scarcity of money which gives it value and energy is not scarce. By the time we get organized around the idea, there will be much more energy available to us than we can use. Thus, it suffers from the same problem as the leaves.

Chris

The problem is there are lots of uses that are vital, but can't afford to pay alot (farming is one). Once you start wrapping lots of special cases for who get first dibs on the oil that is around, the percentage of 'special cases' grows (can you see a politician saying they are less important than a farmer?). Road vehicles are less than 50% of all usage.

Once that happens you get 'rationland' a multiplier on the decline rate similar to exportland which steepens the decline rate (see my graph from a few drumbeats back for an image of this). Net effect is to reduce the likelihood that people can adapt, since there is less time to do it in.

Call it an example of the law of unintended consequences - rationing can make things more likely to collapse unless you can really cap it to few vital users (and probably to less than 10% of current usage).

Oh, and you get a roaring trade in oil tanker hijackings.

In a tradable ration scheme, commercial use of fuel would need to get its rations from the consumers. So, if you want a tomato, you need to supply the farmer with the rations needed to get you the tomato. Farmers don't get special rations just to farm. Now, it might be simpler for them to buy rations than to charge a fractional ration for each tomato but it comes to the same thing. Government activities might get rations or they might also be supplied from the market. If supplied from the market, that gives a nice indication to tax payers how well government is doing on energy efficiency.

I don't see how tanker hijackings would increase. The product would be worth less rather than more. In fact, one hopes that the rationing would drive prices so far down that even Bakken oil would not be developed. We want the cheap oil to be cheap and not to waste resources on expensive oil since we are going to have to make a switch in any case. Keeping the cheap oil cheap makes more money available for switching to other energy sources. Time=Money so by avoiding the expensive oil, we win.

Chris

Wouldn't rationing destroy the US manufacturing sector even more quickly than a hands-off (ie. "free") oil market? I mean, if the US implemented your rationing scheme, and Canada didn't, that would be a definite insentive for energy-intensive manufacturing to head north.

Not that I don't find the resource redistribution that you are talking about attractive, but it would seem simpler, especially politically, to just tie up any development of oil/NG importing infrastructure in red tape. Just quietly and indirectly cap how much can be imported and let the droplets of oil fall where they may.

US industry is not all that dependent on oil for energy. There should be no objection at the WTO to requiring rations be used to allow the import of goods that use oil for their production or to leave that function up to countries which import US goods: that is: do not charge rations for embodied oil in exports.

Chris

If you look at the history of rationing it is very effective in the short term, but rapidly deteriorates as people find out the wheezes to get around it.

That is not to say it won't happen, likely in the context of nationalisation, but it has substantial difficulties.

At the end of the day essential uses get allocated for because the price gets paid, for instance diesel for agriculture to eat.

Socially though I would not fancy living in a society where the fat cats continue to drive their limos, and we should work t get the industrialists out of their Mercs and bureaucrats from their Zils.

David,

I don't know of evidence of rapid deterioration. Do you have some? Again, the tradable approach answers the issues you raise. http://www.teqs.net/indepth.html

One very clear aspect of rationing is that prices are kept down.

Chris

My information is really pretty anecdotal, as rather like the drugs trade black marketeers do not publish their figures!

When I was a boy in Britain though, rationing was still in for a few items, and the talk was all of the fortunes which had been made in the Second World war.

Almost everyone got some of their supplies through the black market, and in places like Germany after the war the economy such as it was was almost founded on the black market.

In more recent years agricultural diesel was also sold at lower prices, and led to substantial criminal involvement - it was one of the chief sources of funding for the IRA.

The longer it goes on the more work-arounds people find.

It is not surprising really, as in essence it is an attempt to provide supply at a below market clearing rate.

I should emphasise that I am in favour of it, but our eyes should be wide open and just like the drug trade, which led to criminal activity when they were banned, extensive criminal activity will follow as night follows day.

Germany has perhaps the best documentation of the workings and history of the black market:

http://www.zum.de/whkmla/region/germany/ger4548west.html

As far as possible I would go for an indirect approach of differential and very heavy taxes on large house, large cars, meat and so on - and large incomes.

This takes away a lot of the 'fuel' which drives the differential consumption - if you have two people who have identical incomes, in the event of fuel shortages they will always prioritise food.

It is only where you have very large income differentials as in South America that the rich will prioritise fuel for their Mercedes.

You have to watch it then though, or the fuel ends up in the 'essential' car of the bureaucrat who runs the tax system - the Soviet syndrome.

In the US, at least, fuel distribution is pretty strongly regulated in terms of weights and measures. It is also taxed. Imposing rationing has an extant plan for carrying out rationing including a ration exchange white market: http://www.osti.gov/energycitations/product.biblio.jsp?osti_id=6307185

Thus, a program could likely be in place within a few months. It might be a few months from January '09 though.

With that kind of flexibility together with a habit of regulation and taxation, I doubt that a black market would be all that active.

Chris

Also see Memmel's link on Hot Oil, that is, crude oil procured and sold on the black market. The notion that oil can be made cheap by rationing strikes me as totally absurd.

Prohibition has criminal aspects by definition. I don't see agricultural diesel as rationing but the big difference in price comes of having high fuel taxes. This is not really a market issue.

Now, it is possible that we would get some kind of black market delivery system. But, almost by definition, it will have to charge a higher price than the rationed fuel, and it would be hard to do illegal fuel at lower cost than the bid up rations. So, I would think that the market share would be pretty small.

Remember, all we want to do is keep consumption far enough below world cheap oil production capacity to keep the oil price very low. This does not entail all that much rationing if we start now. It is true that consumption in non-rationing countries will jump, but it should be fairly clear to policymakers in those countries that increasing reliance on oil may not enhance future security. But, if the largest consumer nations are reducing their use of oil faster that it is safe for the producers to reduce production, the price will drop to a very low level. That sets the market price. We are not prohibiting the use of oil, we are just extending the period of time when it will be available at a low price. Because this is not prohibition, and because the price differential works the wrong way, a large black market would not be expected.

Chris

It's worth noting that tradeable rations are economically equivalent to a tax that rations by price.

In this case, I think that there is not an equivalence. If we ration a scarce good, rather than imposing scarcity for another reason, the price of that good will drop. It is true that the rations will be bid up, but for those who use exactly their ration and no more, they will be paying a lower price than if there had been no rationing. For the government, there will certainly be less need to provide finacial assistance to those who use very little fuel owing to poverty since they will have some income from the rationing. So, government spending would go down somewhat.

What you say could be correct for carbon trading but I would want to see the analysis done on TEQs rather that top-down cap-and-trade before going along with that.

Chris

I tend to think in slightly different terms: it is likely enough that there is no supply side solution to this problem that we ought to be implementing demand reduction options now, since they won't deeply deleterous if it turns out that in five-ten years something comes along to save current usage patterns. (As analogous logic, if I'm a couple of months away from the end of a fixed term job contract it's possible that I'll land a new job that starts the day after my current one finishes. But I ought to reduce my discretionary spending now in case I have a few months of unemployment until I find a new job. Relying entirely on the JIT job fairy is generally seen as foolhardy.)

This viewpoint has one big disadvantage from a communications point of view: it diminishes the force of the message. This is sometimes referred to as the Overton window

( http://en.wikipedia.org/wiki/Overton_window )

in public policy making: having people making more extreme statements than they necessarily believe legitimises people in the audience holding what had previously been extreme views, as no-one in the crowd wants to be seen as the guy with the fringe views, but if you shift the fringe even further out...

Your suggestions are practical and needed, but won't happen, at least in an orderly manner. Eventually, and perhaps sooner than we think, rationing will be mandated, as suggested later. The alternative is social chaos when average-Joe driver sees his financial betters running around in gas guzzlers while he/she is barely able to make the drive to a car-pool parking lot. Getting to the rationing point isn't going to be pretty, but pain seems to be the last available mechanism for bringing about change.

I think this is going to come as the most major shock to a lot of people who are currently 'Spoon fed' in the welfare state or have come to rely on 'Star Trek' technology saving the day... After 5 or 10 miserable years of 'no answer on the horizon to the energy crisis' the sales of Prozac are going to be through the roof... (I read today the the US military has already started to hand it out to their troops like candy, nice, maybe the US armed forces motto should be 'making war feel better'...)

Nick.

Or non-liquid-fuel options, such as electrified rail, electric cars, and electric bikes, of which more were sold in China last year (17M) than cars in the US (16M).

Avoiding liquid fuels entirely appears to be possible for an increasingly-large segment of the transportation market.

zceb90 - very perceptive comment. When I saw the Deffeyes article I sent an email round the TOD group posing the exact same question.

My current thinking is that GDP encompasses a very broad bound eroie. And so infact encompasses the huge amounts of energy that society wastes. What is happening just now is that totally pointless activities like flying jet loads of N Europeans to Spain to catch skin cancer is pushing up the price of oil making it too expensive for oil companies to explore for and produce more - not that there's much to go for here.

Deffeyes is a geologist who relies on gut feel - like me, and like I do. And I'd like to believe that the larger the gut the more reliable that feel should be.

In very crude terms, 15% of GDP translates to a maximum bound eroei of 6.7. And plotting that on my eroei energy distribution chart it lies close to the tangent of the cliff. Deffeyes is wise.

I suspect the connected monetary economy can only function to the left of the cliff. To the right of the cliff is a return to the Neolithic where the concept of GDP is meaningless.

It should be noted that "Energy for Society" includes contributions for coal, nuclear, wind, solar, biomass, ethanol, bitumen scraped off roads after the collapse of civilisation, cow dung, burning scavenged wood from the derelict foreclosed houses, etc. (or as Zoolander would say, derelicte)

To reach the right side of that chart we would literally have to be back in the stone age. Worse than that, actually. We would have to forget how to make fire. If civilisation had collapsed, 99% of humanity had died off, and the 50 million survivors were burning wood from re-growing forests & jungles, wouldn't EROEI be that of gathered firewood? Which is not bad actually. I'm pretty sure it's above 10.

So it's kind of misleading - just as you were about to "fall of the EROEI cliff" your population would crash, "Energy for Society" would crash, and your actually EROEI ration would rebound even as total energy fell to levels not seen in milllenia.

”KD points out that at $130/bbl oil production already represents 6.5% of GDP.”

So assuming that oil represents approx. 50 % of the global (US?) energy bill, then energy now is alarmingly close to 15 % of GDP (assuming that oil prices pulls the prices of other energy sources with it).

World GDP: $48 trillion

World Energy Consumption: 475 million trillion joules

GDP Density of Energy Consumption: $1/10 million joules

Energy in one barrel of oil: 6,667 million joules

Oil's Contribution in GDP: $667/barrel (take it $640 for convenience)

Considering a ROI of 1:2 gasoline price must be at or below $320/barrel for it to be economically useful.