Energy Prices, Inflation and Denial

Posted by Euan Mearns on June 11, 2008 - 10:15am in The Oil Drum: Europe

Higher energy prices are feeding through to rampant consumer energy price inflation. And yet the authorities and many investment houses still see energy prices falling in the future. This naive view of global energy supplies is starving energy markets of the capital required to expand conventional and alternative energy supplies.

UK National Grid, with responsibility for the distribution of natural gas and electricity in the UK, see flat to falling natural gas prices to 2015 and beyond. Comments welcome!

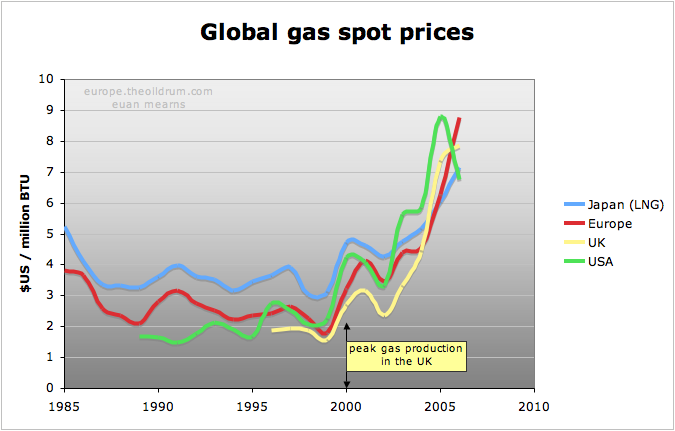

Global annual average natural gas spot prices from the BP statistical review of world energy 2007. Click all charts to enlarge

[Editor's note: this story was first run on 4th February 2008]

Global gas spot prices began their sharp up-trend around the year 2000 which just happens to coincide with the year of peak gas production in the UK. Since 2000, UK gas spot prices have increased almost 4 fold and this along with higher coal and oil prices is beginning to have a significant impact upon UK inflation.

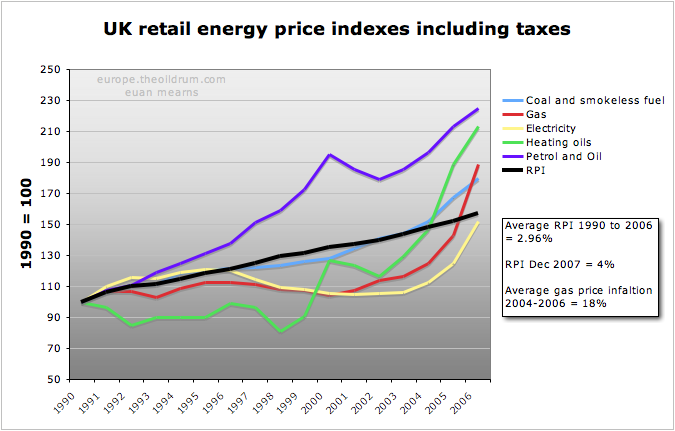

The chart is compiled from Table 2.1.1. from the report Quarterly Energy Prices December 2007 (pdf), found in the Energy Statistics section of the BERR web site. From 1990 to 2000 inflation in most primary energy sources was benign in the UK, excluding petrol (gasoline) which was deliberately inflated by progressive tax increases. Since 2003, however, inflation in gas, electricity, coal and heating oil has taken off. RPI data can be found at National Statistics Online.

Prior to 2003, price inflation in UK primary energy sources was running well below the inflation rate as measured by the RPI (the Retail Price Index is a holistic UK inflation indicator). Since 2003, inflation in all primary energy sources has taken off and for example gas prices have increased on average 18% per annum for the last three years. Prior to 2003, low energy costs had a dampening impact upon inflation but now they are running well above the RPI and this may result in inflation spreading through the UK economy since energy use impinges upon numerous goods and services.

Electricity and gas prices have just been raised significantly in the UK leading to howls of anguish from the public and the media.

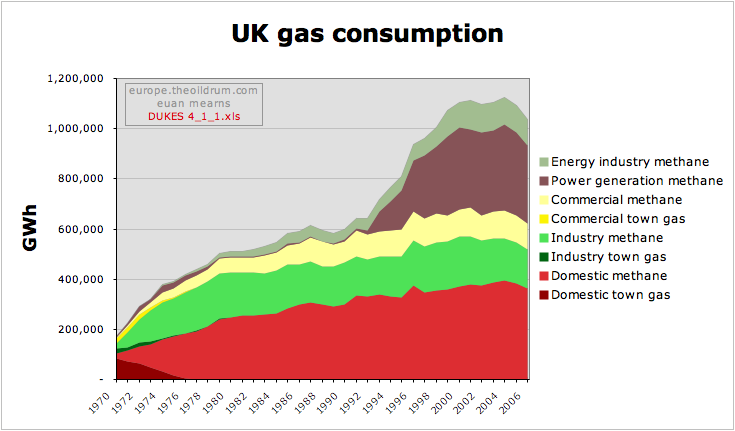

The meteoric rise in UK gas demand was reversed these last two years as amongst other factors, high price has dampened domestic demand. Data from department of Business Enterprise Regulatory Reform (BERR) table 4.1.1.

Demand for gas has fallen in the UK over the last couple of years. This may be due to a number of factors such as milder winters, efficiency measures, off-shoring energy intensive industries, switching between coal and gas in power generation and demand destruction among industrial and domestic users. Higher prices and scarcity play a role in four of these five factors.

But note, even though demand has fallen UK spot prices for gas are running about double last year.

National Grid

National Grid is a UK company with responsibility for electricity and gas distribution networks. Their web site is a goldmine of data and reports on the UK domestic energy situation. The next three charts come from their Gas Transportation 10 Year Statement 2007.

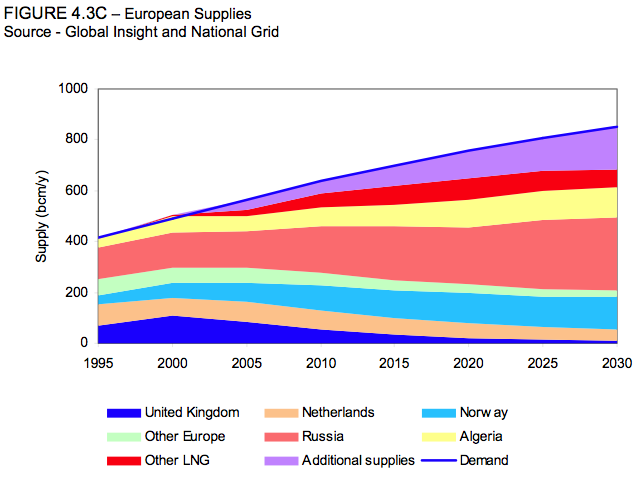

The National Grid view on UK gas supply and demand is shown below. UK domestic gas supplies are forecast to fall, demand is forecast to rise and imports will rise from zero in 2003 to 80% of total demand by 2017. This complies with my own view, and is in general agreement with the official government view expressed by BERR and is repeated in many industry reports. There seems to be unanimous agreement that UK gas imports are going to explode in the coming years.

National Grid paint a sensible picture of falling UK indigenous supply of gas, rising demand and escalating imports. And yet they forecast gas prices will fall. Source is National Grid Gas Transportation 10 Year Statement 2007

Surprising then that the National Grid has forecast gas prices to fall in 2008 and then stabilise for the next 10 years. I find it truly remarkable that a strategic company such as this can foresee a yawning gap opening between UK gas supply and demand and at the same time forecast falling to stable prices. This in my opinion sends out completely the wrong message to government, consumers and to the investment community.

Beach price is presumed to be the wholesale price. Note that this is significantly lower than the spot price since much gas is sold at contract prices struck many years ago. Industrial consumers paying the lower "Interruptible" tariff will be first to have their gas turned off when supplies fail. Note that domestic users pay by far the highest price and will be last to be disconnected.

Prices are struck in 2006 pence hence discounting future inflation which the Bank of England is mandated to hold at 2% per annum. Source is National Grid Gas Transportation 10 Year Statement 2007

Whilst UK spot prices for gas have near quadrupled since 2000 the wholesale and retail prices have risen by more modest amounts of around 50% since these are cushioned by long term gas sales contracts struck at a much lower price many years ago. These have protected UK consumers from the full glare of the gas spot market but with time this position will unravel. As old contracts and supplies expire new contracts for gas will be struck at considerably higher and rising prices. It's possible the retail prices we are seeing right now are the tip of an energy price iceberg that is preparing to rip through the system.

And yet the National Grid forecast prices to fall this year whilst UK consumers have just been hit by 15 to 20% rises.

This extraordinary view on future prices from the National Grid is rooted in their forecast for future European gas supplies which shows Russian Gas, Norwegian Gas and LNG imports expanding into the future. As I discussed in my post on The European Gas Market that was updated here, Russian gas supplies may at best maintain current levels - and not double as shown by National Grid (Global Insight report), Norwegian gas production may actually fall from 2010 onwards and LNG supplies may fall well short of the import capacity that has been and is being built.

The National Grid and Global Insight paint a rosy picture of gas supplies to Europe that does not seem to take into account falling production in Russia's largest gas fields, the reality that associated gas production from Norwegian oil fields will follow their oil production down and that Global LNG supplies will only meet around 50% of import expectations. Ironically the LNG import / export capacity offset is described in a report by Global Insight (large pdf). Source is National Grid Gas Transportation 10 Year Statement 2007

The harsh reality of this situation should be self evident from the fact that UK spot prices for gas have doubled again this year. It's really time for The National Grid, The Markets and The Government to waken up.

Denial and deprivation of investment

I mention our markets here because, since I started to follow energy markets and companies in 2003 the expectation for the future has always been that prices will fall - even though energy futures prices switched to contango.

This century, energy companies have bought back stock on an unprecedented scale whilst contemplating their corporate navels and avoiding real investment in future energy supplies. No wonder then that energy supplies are waning and prices are going through the roof.

Energy companies like BP find their stock valuations languishing at the same level of Jan 2005 and trading on a lowly PE multiple of 9 times historic earnings despite the meteoric rise in oil and gas prices over the same period. Whilst it is true they are struggling to grow production and reserves they have also done all they can to talk down future energy prices and to avoid investing in our energy future. The market is pricing in a future fall in production and oil price and terminal decline of global energy companies like BP at a time when we need these companies to display creativity, imagination and leadership.

The chart is from Yahoo. Disclaimer - I do not own any BP stock though I do invest in energy companies.

When an energy sector presides over falling production whilst forecasting prices for their product will also fall it is little wonder that their stock values are priced in the bargain basement of Global Stock markets. It is high time that the energy industries, capital markets and governments recognise that falling production and rising demand are not compatible with falling prices and that they come together to invest this profit bounty in our energy future. That future does not lie in low eroei liquid fuels like ethanol and syncrude but in solar energy, wind energy, electricity, batteries, electric transportation and global scale HVDC grids.

It is time to invest and build.

Previously on The Oil Drum

UK Gas and Electricity Prices by Chris Vernon

Natural Gas - A Tale of Two Markets by Nate Hagens

A Closer Look At Oil Futures by Nate Hagens

Euan,

A vision of a low gas price future does indeed create the wrong impression. Last week I went to the launch of campaign to insulate existing homes. See

http://www.existinghomesalliance.org.uk/

The aim is to insulate 'up to half a million homes ...to cut UK carbon emissions by the necessary 80% by 2050'.

Yet this is totally inadequate because we will probably need to cut our gas demand by 50% in the next decade or so to prevent the UK's balance of payments going down the pan.

What's needed is a brutally honest discussion about future UK gas prices. I'm glad to see that the new BERR fossil fuel prices document at

http://www.berr.gov.uk/files/file46071.pdf

has a 'High High' category with gas a 92p/therm.

This price needs to be fed through the policy mill. It would make an awful lot of energy saving technologies (decent retrofit german Passivhaus insulation and perhaps even solar water heaters) cost effective, even taking into account the increased production costs.

(I have more to say on the historical affordability of domestic energy back to 1914, but that needs a bit more research and some pictures.)

Bob E

Euan, Thanks for another fine summary of the UK gas situation. Looking from the other side of the North sea I can already see the rising energy costs seeping into all parts of society. At the moment some food prices are skyrocketing. Natural gas primary products - plastics, chemicals, etc must follow soon driving the increased price level into our wallets :-).

We are going into new territory- economically, security of energy supply wise etc. Lots of trouble ahead.

What our societies should do now is to reduce the society "energy base load" giving us more fredom to act and adjust on situations we cannot foresee yet. Save, improve energy efficiency etc.

Society energy main end users are : building energy use 40% af societal energy use, Transport- some 25-30% and food (incl food industry) some 5-10%.

So we must start a permanent reduction there. As Bob mentions, some solutions are known- Passivhaus, but it takes time and money.

What is needed is Political leadership more than anything else.

As BoB E mention, Authorities are slow to adopt changes in energy prices in their modelling. I Can add that in Denmark the Ministry of finance presently use the IEA 2006 estimate for oil of 65$ in 2030-Fixed prices.... http://www.fm.dk/1024/visPublikationesForside.asp?artikelID=9763&mode=he...

Hopefully the IEA will publish more realistic guidance for our governments in the future.

Kind regards/And

Bob, having used up most of our own nat gas in record time, it is mind boggling for me that BERR can now produce a High, High scenario with gas at 92 p / therm in 2015. With spot price 62p / therm today I imagine this represents a below inflation rise in nat gas price - an explanation is required why a finite resource that is running out that is vital to UK and everyone else's interests should suddenly start appreciating in value below the rate of inflation.

Energy prices are rising exponentially - and I gotta assume that no one in government actually understands what that means.

I approach the energy depletion problem exclusively from an energy depletion and energy efficiency angle - for both energy production and energy consumption.

The only power we have in the UK over energy prices is to reduce demand and so I wholeheartedly support your initiative on home insulation. But the bar needs to be raised a lot, lot higher. I don't know how many homes we have, but I imagine we should be targeting 20 million.

The government needs to understand that this investment is a mighty tool against inflation.

The house I live in, in Aberdeen is pretty well insulated with decade old Douglas firm framed K glass windows. I will fit a wood burner and new condensing boiler this summer. The latter will cost £5K - Scottish Hydro Electric - why is it soooooooo expensive? This cost needs to come waaaaaay down - £2K and I'd order it tomorrow. I'll also add some more insulation.

Problem is, here in Scotland at any rate, the government has built vast amounts of sub-standard housing, and also poor schools, hospitals and public buildings. So while we try to conserve, the government will most likely be wasting like hell keeping energy prices high. Best sign off now before I go off on a rant.

We live in a free country with free markets - that means that the Government policy is to allow us, within the law, to make our own decisions about what to do with our futures - we can live where we want, work where we want, say what we want, buy what we want.

Even if they know that the gas or oil is running out in the UK, the Government assumes (since it has worked well for a very long time) that 'the free market will provide' by reponding to price signals. The UK Government promotes a climate where energy research can be carried out since they do not know which future technologies (if any) will be adequate.

When we wonder about the future price of energy the true answer is NOBODY KNOWS, but, rather than plainly saying that, people such as BERR or CERA give us predictions that are obviously wrong (to anybody, like you and me, that thinks about it) ... as you say, in the case of BERR not even meeting the government inflation target of 2%. The Government wants the people to think it is in some kind of control for as long as possible otherwise they will be voted from power - for better or worse it is the British way whichever party is in charge.

We get the governments we deserve unfortunately, but the alternative is worse. Politicians who ring alarm bells about this simply won't get elected and those who think they can sneak into parliament and then boldly leap out as peak oil advocates soon find the party system does not allow them a free voice. Perhaps democracy as we have known it is about to undergo it's own radical adjustment as it moves from a manager of consumer-industrial society to whatever comes next.

>>TO WHATEVER COMES NEXT<<

Aye, there's the rub.

What comes next could be extremely unpleasant and we now head into uncharted waters.

It is possible that Democracy and the rights of man are less to do with the enlightenment and more to do with access to energy.

Wood based societies such as Medieval Europe and Edo-Japan were highly feudal and rigorously class based. Coal, and later oil came hand in hand with Democracy as cheap energy enabled the common weal and an emergent middle class to spend time on other things than back breaking work and a dawn to dusk work pattern.

I would specifically refer to such things as the 'Mechanics Institutes' of industrial towns where young men , who left school at 13 were able to improve their lots by learning after factory shifts.

- Both about Engineering and politics and philosophy.

I would hazard further that the lot and empowerment of women is distinctly related to cheap energy and a the liberation from place by access to goods that run on cheap energy.

We could pass through one of many of several future states:

- Establishment (Army) Coup

- Elected and then perpetual National Socialism

- Dark age, later emerging as feudalism.

I doubt that OMOV democracy with consensual or even civilised adversarial politics will make it. It is simply unaffordable and it is a very recent flirtation conjoined with cheap energy.

Today, the nation that brought you the Magna Carta, the Forrest Carta, the Glorious Revolution, basically pissed on Habeus Corpus.

42 days for a FILTHY STINKING TERRORIST ! - sounds acceptable. Wait until they do you on some jumped up charge - maybe for reading this site, or disagreeing with the PM?

Who knows where this could lead...

We already know that Local Councils are using RIPA Terrorism legislation to snoop on rate payers. Britain is not immune. For every free-born Brit against these impositions, there is an anal, furtive, control freak who goes to bed at night wondering if someone, some where can be stopped from doing what they are doing and controlled.

Our same betters also left a folder full of Al Quaeda fun and naughty secrets on a train today. (Brutality + Incompetence is very Nazi...)

Do not expect things to stay the same.

That is true for Liberal, enlightened democracy as it is for energy and the economy.

Hey, enough of the mindless optimism!

Society in the middle ages just like that in the Ancient world was dependent on mining high grade resources, which are now gone.

Of course, it could be argued that the remains of our civilisation would provide an equivalent resource, but during the descent they would likely have rusted away.

Civilisation if a one-shot deal.

Of course, we might eventually reach the level of the stone age - shame that we used most of the best flints.....

http://www.oilempire.us/brazil.html

Brazil (the movie)

Monty Python meets the Department of Homeland Security

http://www.oilempire.us/peak-fascism.html

Peak Fascism

Of course this is the same BERR that forecasts that oil will be something like 70 dollars a barrel in 2020, with traffic levels 30% higher than now - hence the Department of Transport's bizarre determination to press ahead with more roads and runways. At least the UK airlines will have somewhere to park their redundant aircraft.

traffic has already "peaked" in the United States

http://www.road-scholar.org

despite this, no level of government anywhere in the US is calling for a moratorium on highway expansions

A 'One warm room program?'

From Mudloggers link to the Mail article

It is apparent that we will now in the UK whatever measures are taken have a massive energy gap, which will cause great suffering.

So how can we reduce this suffering?

It is too late to retrofit houses to Passivhaus standard, or to build out the generating capacity we need without using gas we won't have, so I am just focussing on emergency mitigation measures, rather than looking at loner term policies.

We have around 24million households in the UK, 3 million of which are in band F, the lowest insulation standards, and 9 million in band E.

There is no way we can bring this stock up to survivable levels in the time available.

What we could do is to bodge up insulation so that one room in every dwelling could be kept at acceptable temperatures - in Japan only one room is normally heated, so it is survivable.

This would have to go with a rationing system, so that the little heat we do have does not go to large houses of wealthy people, but keeps the general population alive.

This means the end of the 'free market' - Each house has a cut-off on energy.

Here is what we could do:

Loft insulation

Plastic bubble for windows:

http://www.simplycontrol.com/catalogue/insulation/default.asp

Greenhouse insulation, bubble insulation, snap mini kaps

Interior cladding, which reduces the usable space, but keeps you warm:

http://www.celotex.co.uk/

Celotex Insulation | High Performance Thermal Insulation Boards

These are not very Homes and Garden measures, but if just one room in each house is insulated the cost should be reasonable.

The bubble wrap for windows is very cheap, around £1.50 meter, so all the rooms in the house could have their windows sealed.

The greatest expense would be dry-lining the walls.

In an environment of high unemployment and hence low labour charges I would guess that about £2k might be enough to insulate.

Not every house in the country would need to be a public charge, so for back of the envelope you might have to pay publicly for half the stock.

So the total cost might be £24 bn or so, and it would not happen overnight, and would take time to get going.

Assuming that our masters realise that something is going on by around 2010, and taking 2015 as then year when we have lost really huge amounts of generating capacity, then a 4 year program night be realistic, so you are talking about £6bn a year.

At later stages then the use of air heat pumps etc could further reduce energy use - this would just be a basis on which to build.

What do you think?

Gardening leave for Gordon and 644 of his colleagues at Westminster (I'm letting Michael Meacher stay), and for most of the civil service that has advised them?

I would suggest garden leave - Bob tells us that fertiliser is in seriously short supply, and they have been one of the main sources of bs for years.

As part of the compost they would actually be of benefit.

Hi davemart,

This has all been done in Canada in the late 1970's energy shortages. Lots of lessons learned including that most heat loss is through cracks under doors and around windows, causing 100%air exchange in 30mins( easily fixed with silicone cement) and through ceilings and windows. In Winnipeg( can be as cold as minus 40(C and F) they add about 60cm(2 feet ) of insulation in roof space, while windows are double or triple glazed( can use plastic sheeting or buble wrap) but looks lousy.

The big problem with a very well insulated air-tight house, that requires almost no extra heat, apart from body heat, lights and cooking, is the build up in humidity, causing condensation and ice build-up on the insides of windows, requiring a heat exchange fresh-air circulation system. Paybacks were only one or two years in natural gas savings, at much lower gas prices in 1970's.

That leaves most gas for hot water and cooling, much harder to save if solar is not practical.

Solar thermal is practical even at the latitude of London, capable of generating around 50% of hot water needs, and it is further North than the heavily inhabited areas of Canada.

It would perhaps not be easy to prevent freezing in the climate there though - the person on this site who is likely to have information on this would be Paul in Halifax.

In Europe where they live at high densities hot water is pumped to the houses from co-generation sites.

A possible solution, although one I would not put my money on, is fuel cells in the home:

http://www.msnbc.msn.com/id/23451723/

Japan plugs into fuel cells in homes - Green Machines- msnbc.com

Euan, top marks as usual.

I also find it staggering/depressing that only the so called high-high scenario bears any relationship to today's prices. All figures for the low, central and high scenarios for oil and gas have already been exceeded for all dates. The gas spot price has doubled in the last year to 62p/therm and the high-high scenario uses 67p up to 2010 and only a maximum of 92p up to 2030, an increase of about 37%.

The insulation also needs to be applied to commercial premises not only housing stock. Highest standards need to be mandated for all new builds starting from now not 2015, builders have little incentive to make their houses more efficient than the minimum legal standards.

Similarly for appliances, there is no reason for builders or landlords to provide anything other than cheap appliances that use more electricity over their lives since they will not be paying the electric bills.

"new condensing boiler this summer. The latter will cost £5K - Scottish Hydro Electric - why is it soooooooo expensive" Condensing boilers are available from around £600 so some £4,400 is for labour unless you are having additional work done. As a landlord I find the lowest quotes for registered plumbers to be around £1,000 per day for labour:-(

The latest BP statistical review is out today on their website, free to download:-)

You are correct that energy standards will have to be tightened.

It is rather simpler to force upgrades in Commercial buildings, as it can be mandated more easily - the waste is vast, with lights left on all night and so on, which in one way is a good thing as savings will be simple.

Street lighting would also be a major target.

The rental market is also easier to legislate for than the private sector, as the assumption is that the landlords can finance the change, which may not always be true but is a working assumption normally used.

Looking further ahead for new builds I would argue that standards should also have the assumption that no or very little new build -over should be acceptable - IOW greenroof technology:

http://environment.newscientist.com/article/dn12710-green-roofs-could-co...

We would also benefit from a lifetime energy consumption assessment, so that the energy cost of concrete etc should be taken into account.

Regulations should also be tightened on the insurance market to ensure that non-traditional builds such as Cob houses are insurable - they are only non-traditional in the modern world, for hundreds or thousands of years many houses were built from mud and straw - this can probably be achieved through agreement with the insurance industry rather than direct legislation.

Settling on triple glazing would also reduce costs.

"the high-high scenario uses 67p up to 2010"

Oops, shouldn't have posted that as the spot price has today just gone to 67p and we are in the summer when prices are normally lower! so one more litle jump and the high-high price will be exceeded, wonder what they will then call it, unfeasibly-high, high-high-high??

I think they are calling it: 'I am going to stick my fingers in my ears and sing la-la-la-la - can't hear you!'

Hi Bob,

I wish you luck. 30 years ago when we were still fresh from the 1970's energy crisis the Canadian government had me give a series of community lectures in the prairies to make houses energy efficient.(We are talking minus 40*C)

The responses where people had to pay for improvements themselves was not very good. When the Govt offered to pay a percentage it did better.

Condo's and regular Builder built houses did just the bare minimum cost efficiencies so as to get the places sold.

The latest Canadian trend when credit became easy was for all the Immigrants to build Mega houses with massive window spaces and thousands of square feet of floor space, never a thought to having one day to pay a premium for heating them.

I think what we're seeing here in New England (I relocated last month) is instructive. I'm doing a mish mash of tasks for a small company that sells outdoor boilers and people are scared silly of oil prices. I believe at least 90% of the homes here are oil heat primary/wood supplement with the occasional propane powered setup seen here and there. Normal summer sales would be one unit a month at the $10k to $15k installed price and right now we're seeing a run rate close to one unit a day as people do the math on $5.20/gallon heating oil, which is the current forward contract price.

We've done things like putting a plan for a 3.0MW electric generation/wood pellet production facility in front of the governor and the federal delegation (well received all around) and we're working on a financing setup as credit dries up for many. The plan is to take 1/3rd down which would cover install and sunk cost and finance the easily retrievable, hard to abscond with outdoor boiler ... I don't have a good sense of what the repo rate will be but one can not plan in this market without taking such things into account.

So ... all this will come to pass in the U.K., too, only I think life is much harder there, as you don't have the situation we see here, namely the wood lot owner heating with oil, who really only needs a few gallons of gasoline and a bit of time with a tractor in order to get the year's heating needs met.

The Royal Navy has ordered two massive new aircraft carriers (that's cos we Brits are so rich) but to save a bit of cash these will run on oil instead of U. We've really come full circle - back to Churchill's decision to convert the fleet from coal to oil back in the 1920s (?). Maybe the carriers can be converted to run on biomass instead - hahahha. "The first environmentally friendly and sustainable WMD ever built"

There is going to be an immense amount of angst from all quarters - the housing industry is imploding, it's going to drag everything else down with it, the world will be inflamed due to peak oil concerns, and we'll still see everything via the idiot's box but our oil age ability to project force is going to be dramatically curtailed. Our expectations got reset via the "white glove war" - Desert Storm, and Iraq and Afghanistan are the norms going forward; boots on the ground, forget about tidy nation state oriented disputes, and we'll get jacked with like cops in South Central L.A., putatively in charge but never able to turn our backs.

What is wrong with tall ships and white (or any other color if you like) sails?

What fuel will the planes on the future aircraft carriers use?

Worthless notes and a huge dose of thought power (which surely works if you guys would be a little more positive).;-))

Yes - well now that the BP stat review is out I'm expecting 1 guest post per week from now till the power goes off.

And the answer is cola. USAF are testing new long range strike aircraft that run on gassifed cola. These new Coke planes flown by Coke head pilots is America's real choice.

Its the real thing, planes go better with cola.

I am in the process of updating illustrations based upon BP SR 2008 and translating text into English.

Any reason whiskey will not be used to fuel the planes?

There is no reason at all for not using whiskey in the planes apart from the results of a 1996 survey of planes conducted by (UKPPU) which showed that the planes thought that running on whiskey was sh*t. And that they preferred the real thing:-)

Good for us!!

For a moment I really was getting worried!!;-)

Shh!! A bottle of Lagavulin is already quite expensive enough on this side of the pond, thank you very much!

And if it gives you any comfort Euan and the Brits in general, the BC Hydro natural gas price outlook is a carbon copy of the National Grid report. They must be using the same consultants.

Same consumption expectations, same price variation, same assumptions about imports and LNG, and people with the same reliance on NG for heating. As you can imagine, in parts of Canada this can mean real trouble in the winter. I am equally concerned these reports are sending the erroneous message to consumers and government while the current prices exceed their high-high scenarios already. One can't help but draw the well worn Titanic analogy once again - are these reports the band playing on...?

I contacted BC Hydro to enquire about their use of EIA data as their foundational premise and forecast. I got a nice long, well written supply saying essentially, "Thanks, but how can we be wrong, we've put so much work into this?" I think we have an inertia problem.

For SacredCowTipper, wow $5.20/gal for heating oil! Based on figures provided by Halifax (HereinHalifax), the average American could be seeing a heating bill exceeding $5,000 this year. If we thought last year was bad, this one is going to be downright scary if it is a cold winter - or any winter for that matter.

On Monday we did the first public showing of our enhanced gasification plant and it was covered by the CBC since biomass energy has a big interest in BC now. The plant produces clean, dry syngas, bio-oil, and bio-charcoal. The charcoal has double the Btu of wood pellets. We believe this technology will be superior to standard pelletizing by magnitudes since the energy density of the finished product is much higher, the gas output clean, and we get to make bio-diesel and other heavy oil substitutes. So if you want to do a 3 MW plant, look me up. (end of shameless commercial pandering).

BC_EE,

The enhanced gasification plant sounds very interesting. This is probably not the thread for it, but I would love to learn more about the prcess, inputs, costs, etc if they are publicly available.

Hi BC_EE,

From what I understand, the average home in Maine uses about 1,000 gallons/3,800 litres of fuel oil a year and with fuel oil currently selling in the $4.50 a gallon range, with the expectation that it will run closer to $5.00 by this fall, that sounds about right.

As of June 10th, fuel oil in your province is now priced anywhere from $1.32 to $1.40 a litre -- $5.00 to $5.30 per US gallon -- before taxes, and has been steadily creeping upward.

Source: http://www.mjervin.com/WPPS_Public.htm

I believe as of April 1st, BC Hydro customers pay 6.55 cents per kWh, so the cost of electric heat is the equivalent of fuel oil at $0.575 a litre, assuming an AFUE of 82%. That means for most BC residents, fuel oil is 2.5 times more expensive than electric resistance and seven times more expensive than a good quality air source heat pump. It's safe to say this gap will only widen over time.

Cheers,

Paul

Must be pretty small homes they're using as an average. We only spend about half our time at our house in Vermont which is generally warmer than Maine. While we're gone, we keep the thermostat at 55 F. Over a year, we use about 1250 gallons of fuel. I'm not looking forward to this years pre-pay amount, but I'm certainly going to take it.

Hi Art,

It's hard for me to say, but I recently received a pamplet from my fuel oil provider telling me their customers use an average of 2,800 litres a year (740 U.S. gallons) and in terms of heating degree days, we're roughly equal to that of Bangor, ME.

FWIW, my home is a renovated 230 m2/2,500 sq. ft. 40-year old Cape Cod and prior to installing our ductless heat pump we used about 2,000 litres/530 gallons for space heating and domestic hot water purposes. Last year, we consumed 702 litres/185 gallons and having installed a small electric water heater to pre-heat our DHW, I hope to get that down to less than 400 litres/100 gallons and, at the same time, keep our electricity usage in the range of 10,000 kWh/year (as of my May 28th billing, our 12-month rolling average is 10,245 kWh and by curtailing our use of the dehumidifer during the summer months we might just squeek under that).

Cheers,

Paul

Its really hard to come to terms with the number of corporations, government agencies, consultancies, civil service departments and politicians who seem incapable of comprehending a trend break or trend reversal. Collectively they would have been incapable of working out that the wheel may change transport.

Can you post us some links to your enhanced gasification plant.

Euan,

As always an excellent piece.

But we may be past last orders.

http://www.dailymail.co.uk/news/article-1025586/FUEL-CRISIS-Forget-warni...

It will take a massive re-allocation of resources and taxes to re-order our capacity.

Hi Mudlogger,

I was surprised by

"...There are only a handful of companies equipped to build these nuclear power plants, and countries all over the world are queuing up to place their own orders.

Until October 2006, the British Government itself owned one such firm, Westinghouse, but in an act of supreme folly we sold it to Toshiba in Japan for a knockdown £2.8 billion - and it has 19 new orders on its books already. ..."

So another great piece of timing from the same guys who sold the gold reserves when it was at a low! Prudent economic policy - I think not. I think history will judge Labour's vast social experiment at our expense to been a catastrophic failure. The politicians will simply walk away to their feather bedded retirement and enjoy the fruits of the trough in which they've had their collective noses, because they have given individuals the idea that taking responsibility for their own actions is no longer required. So why should they?

"...It will take a massive re-allocation of resources and taxes to re-order our capacity..." It was recently reported that £100 billion/year is now being spent on quangos (vote buying IMHO) so cut out some of these and spend the money on insulation and electric rail.

At least the Japanese might build them properly.

Which would you rather buy, a British reactor or a Japanese one?

Er, tough question!...:-)

Yes,

Great forward planning:

Gold Sales

Pension Raids

The Dome,

Quangos and the payroll vote

Iraq

Afghanistan.

The London Olympics

Terminal 5

Didnt we do well?

Nothing much else to say really. All the main headlines today could be straight out of the 70's.

Too bloody depressing for words.

In 6 years time we will not have the loot to do just about anything wrt Power stations, public transport, retro-fitting insulation.

Dave Mart's One Room Policy may well be all there is. Not because of policy, but out of shear Survival.

UK with Gordon Brown as then Chancellor sold half its gold reserves at what turned out to be bottom of the market.

It's also interesting to note that several billion barrels of N Sea oil were exported when prices were at times as low as $10/bbl. A decade or so later we are now proceeding to buy it back....at $137/bbl (or $250/bbl if you use Gazprom's latest forecast)!

Inflation is caused by an increasing money supply. Blame the BOE and fractional reserve banking for that.

The uk money supply has been running at close to 14% per annum for the last 10 years. NOT 2-3%. Gas just happens to be the Trigger this time.

Britain really hasn't had, in my opinion, a 'rational' energy policy for thirty years, unless one is a fan of benign neglect, or letting 'market forces' take the longterm, strategic decissions for the country as a whole. Whether private corporations actually have the ability, duty, or are really interested in taking on such enormous responsibilities, planning for Britain's energy future, is, another story. Surely 'planning' for the longterm is the role of central government, isn't allowing the interests of the 'market' to become the 'policy' of the government or country highly problematic, unless one subscribes to the dogma that the 'market' is the country?

On balance I think oil at $250 dollars a barrel might not be such a bad thing seen in a larger and longer perspective. It would really wake us up and shake us up to the core. We would be forced to change the way we live, we would have no choice. It might cause a massive, world wide, economic slump; but perhaps that would be preferable to the current unsustainable model of turbo-capitalism gone wild? Still this is a massively complex subject to dive into and is necessarily highly speculative.

Britain could make choices, sensible ones, yet the debate is very narrowly focused and defuse. For example the government has recently annouced that it plans to build a whole new fleet of nuclear attack submarines at the astronomic cost of around 60 billion pounds over a twenty year period! Only a few days ago it was decided to build two new aircraft carriers at 5 billion a pop! The UKs military budget is collosal, perhaps the second largest in the world, only exceeded by the United States, and don't get me started on the size of the US military budget!

The point is, this allocation of resources is not only unecessary, it's also incredibly wastful and the UK cannot really afford it. The resources pissed away on the military could be used far more productively and efficiently in other ways. Like upgrading the housing stock, building more railways and trams, investing in alternative energy sources...

Unfortunately I don't believe we will choose to allocate our resources sensibly and for the common good. I think the ruling elites 'answer' to the energy crisis will be to use violence to gain control of the world's remaining energy resources, in a word - war! That's why they are spending such astronomic sums on the military and new weapons. Over the last thirty odd years the elite have done very nicely, and they have absolutely no intention of changing their non-negotiable and incredibly lavish lifestyle.

But are they going to succeed in convincing the rest of us to do the fighting and dying to maintain their way of life? Her the massively effective propaganda arm of the corporate, totalitarian, state comes into play. The socalled 'war on terror' is a plausable cover-story to justify massively increased military budgets, enternal war, imperial grabs for scarce energy resources, and growing control and repression on the domestic front of 'opposition'.

This isn't a pretty picture and it implies that we are already moving out of the democractic era into something else entirely; a new form of totalitarianism, controlled and managed 'democracy', where alternatives to the war strategy are increasingly going to be characterised as a form of appeasement, subversion, or even treason. And all the while we are being duped, fooled and misdirected, by constant references to a virtually non-existant 'threat' from 'terrorists' whilst we, in contrast, seed huge armies across the globe to invade, occupy, re-colonise, level cities and slaughter tens of thousands; and all in the name of 'democracy' and 'freedom'! It's like we've stumbled into a bizarre, violent and grotesque hybrid of 1984 and Alice in Wonderland.

Can we delay, stop or reverse this drift towards totalitarianism and eternal war for profit? Possibly, but it won't be easy or without sacrifice. Basically we are talking about changing the direction of society and confronting the disproportionate distribution of wealth and power that exists and is accepted under our current political paradigm. This is probably a struggle of historic proportions, comparable to the battle to broaden the franchise and introduce more democratic forms of government. Those who believe we can change the way we live, and our crazed consumption of the world's resources, not just energy, and not fundamentally redistribute wealth and power, simply do not understand the nature of our society or power relationships.

I'm sorry to be so political, but I often feel we simply underestimate and ignore the political aspects of Peak Oil and the hard stuggles and challenges that loom on the horizon.

I don't think that you have to apologize, since politics will soon become the main PO focus. It would appear that the battle over the fact of PO is now more or less won; what we (or perhaps TPTB) do about that now moves to centre stage,

Peter.

Here in Texas, it is fairly common for large urban assault vehicles and trucks to have "Support the Troops" bumper stickers. I've always thought that this was appropriate. The vehicle owners should show gratitude to those who are fighting and dying to keep the oil flowing to the US--to preserve our non-negotiable way of life.

BTW, very good essay.

"...The UKs military budget is collosal, perhaps the second largest in the world, only exceeded by the United States.."

The UK's military budget is exceeded by US, China, Russia and is on a par with France and Japan. China and Russia get "more bang per buck" since their personnel costs are much lower. The US's military budget exceeds the rest of the world combined.

Not only does the UK not have a rational energy policy it doesn't have a rational defence policy. Money is spent on "trophy" projects such as the carriers and subs mentioned but falls way short on helicopters and body armour that are actually needed by front line troops.

It was recently reported that the UK spends around £100 billion on quangos and this is about three times the military budget, so very little "rationality" all round.

Carriers and submarines are just as important as helicopters and body armor if they're used correctly. Without the first two, it's damn near impossible to fight a war overseas. Without control of the sealanes, deployment and resupply become very difficult. Take a look at what happened to Napolean's army in Egypt after the Brits cut off their supplies. I find it more interesting that the UK wants to build air craft carriers at all. Normally, they would leave securing the sea lanes to the U.S. Maybe, they aren't expecting the U.S. to fill that role in the future.

I was chatting with a friend yesterday about the value of currencies in light of Peak Oil and pointing out that the US dollar and the pound sterling were in risk of collapse, if things carry on the way they are now. He responded that he thought they can not collapse because of what they are backed by.

When I questioned him about that, he pointed out that these two currencies are backed by the biggest, most powerful military alliance in the world. When I argued that this military complex can not operate without massive quantities of oil, his response was that, this is why their military might was so important. In times of crisis they can just take what they want by force.

Could this be the reason for all this crazy military spending?

Well, they have been taking what they wanted for the past 40 years, and are currently in Iraq and Afghanistan, neatly surrounding Iran, which they are targeting, so the answer seems clear that that is it's rationale.

Excellent rant. BTW(anyone): what the heck are "quangos"?

Quasi governmental organisations.

Unelected tossers who are appointed and have vast powers, otherwise known as a boy's club or one of Adam Smith's conspiracies against the public interest.

A good example would be the Football Association - they authorise vast sums of money to be spent, for instance on the new Wembley stadium, dish the work out where they see fit, grossly run over budget and then get a playing surface which is not fit for purpose.

There is no way of kicking them out - they voite each other in, so the watchword is 'don't rock the boat, old boy.'

A couple of examples:

£85m is given to the Carbon Trust to advise businesses and government bodies on becoming low carbon, £22m is handed over to Envirowise to do almost exactly the same thing. There is also the Energy Saving Trust advises homeowners on reducing their carbon footprint. Not forgetting NISP, "a free business opportunity programme that delivers bottom line, environmental and social benefits and is the first industrial symbiosis initiative in the world....."

The Food Standards Agency extols the health benefits of a low-fat diet and yet millions are being spent on food promotion bodies that implore the public to eat more sausages and chips such as the Potato Council.

This is despite the call by Gordon Brown in 1995, when he was the shadow chancellor (i.e. opposition or out of power), for a “bonfire of quangos”. So say one thing do another.

QuANGO = Quasi-Autonomous Non-Governmental Organisation

Organisations created by the government but kept at arms-length, supposedly to maintain their objectivity. In the energy field alone, we have a plethora of bodies:

- Advisory Committee on Carbon Abatement Technologies

- Civil Nuclear Police Authority

- Coal Authority

- Committee on Radioactive Waste Management

- Energy Saving Trust

- Fuel Poverty Advisory Group

- Gas and Electricity Consumer Council (Energy Watch)

- Natural Environment Research Council

- Nuclear Decommissioning Authority

- Renewables Advisory Board

- Sustainable Development Commission

- Sustainable Energy Policy Advisory Board

- UK Atomic Energy Authority

Some of these are year-round organisations with permanent staff, offices, desks, computers, telephones, photocopiers, etc. Others are just a fancy name for a regular set of meetings, with miniscule budgets.

The primary complaint is their unelected and unaccountable powers. For example, construction companies have to give their employees Ladder Safety Training (how to use a ladder, seriously). This requirement wasn't a law passed by parliament; it was a rule written by a quango called the Health And Safety Executive.

The second objection is the burden they pose on business. Individually the rules are small, but over time the cumulative effect of all these petty rules amounts to a formidable bureaucracy.

The third objection is their cost (£170bn a year according to some estimates) and their overlapping functions. Those of you in America calling for Big Government, be careful what you wish for!

More on Quangos.

Remember - they aint useless to the people who are on the payroll...

UK's 'useless' quangos under fire

The size of the public sector is a key election issue

The UK has 529 quangos financed with billions of pounds of taxpayers' cash - many of which are useless or duplicate each other's efforts, a report claims.

Essential Guide to British Quangos 2005 author Dan Lewis said at least 111 of the appointed bodies had been set up since Labour won power in 1997.

He urged a limit on the number of quangos that could be set up by any individual government department.

Tories and Lib Dems welcomed the report and called for a "slimming down".

'Explosion'

Conservative deregulation spokesman John Redwood said: "The research endorses our policy of destroying unwanted and unnecessary quangos, and slimming down the rest.

'Most expensive quangos'

Legal Service Commission - £2.1bn

Scottish Education Funding Council - £800m

Northern Health and Social Services Board - £550m

Teacher Training Agency - £514.6m

"A Conservative government will axe 162 quangos, as part of its drive for more efficient and more accountable government."

Lib Dem spokesman Ed Davey meanwhile said instead of the "bonfire of quangos" New Labour had promised, there had been an "explosion" of them.

"For over two decades, under both Tory and Labour governments, these unaccountable agencies have mushroomed.

"Liberal Democrats would abolish many, merge others, and make any that remain properly accountable."

Labour representatives were unavailable for comment.

The quango guide follows last year's government-commissioned Gershon Report which recommended significant cuts in bureaucracy across the public sector.

Time limit

'Most useless quangos'

British Potato Council

Milk Development Council

Energy Savings Trust

Agricultural Wages Committees

Wine Standards Board

Westminster Foundation for Democracy

Football Licensing Authority

Investors in People UK

Economic and Social Research Council

Mr Lewis wants a public inquiry into regional development agencies which cost £1.8bn a year - cash he says which "appears to be almost entirely wasted".

As well as a departmental limit on quangos he also wants a statutory five-year limit on any such body with executive powers.

He also listed what he dubbed the nine "most useless quangos".

They were the British Potato Council, the Milk Development Council, the Energy Savings Trust, Agricultural Wages Committees, the Wine Standards Board, the Westminster Foundation for Democracy, the Football Licensing Authority, Investors in People UK and the Economic and Social Research Council.

Mr Lewis branded the existence of the 60-employee Potato Council, set up in 1997 to research and promote overseas potato markets, "surprising". He said the £80m spent annually on the Energy Savings Trust, which promotes renewable energy, would be better spent on eight million boiler jackets for British homes.

Euan, your first figure for various countries’ gas prices looks like the recent crude oil curve, an exponential function. Given what we can expect from that, and the fact that folks are worried and scrambling now about winter prices in the $5+/gal range for heating oil (prices here in the US per SCT) what will be the plan for winter 2009, winter 2010? Everyone moves to Iberia or Greece for the winter? I doubt that improved insulation will suffice, and you clear cut your forests long ago to build that magnificent Navy. Pray for Global Warming?

E3PO - I think I posted my comment meant for you in the wrong place - its up the thread.

Great to see BobE weighing in with his expertise in energy issues and highlighting the desperate need to insulate GB. To give it it's due, UK Parliamentary Committee, in 2005, was pointing to woeful GB planning on retrofit house insulation compared with Germany. With rosy National Grid assumptions however we paddle on into the sunset.

I have become a bit of a Japan watcher recently.

They (Mitsubishi etc) with Gazprom have 45% stake in Sakhalin, NG island pipeline and LPG terminal to feed China and Japan. With Shell being forced to make arrangements about its share, the strategic thinking seems straightforward. A senior Shell person told me years ago that lovely Joe Japan was not the same as senior J Industry. For latter think Samurai, he said.

We will shortly (5-10 years) be in same position as Portugal with insignificant domestic fuel production of all kinds. Their economics Minister was last week giving UK friendly advice about getting into renewals. I suppose official and mainstream UK circles just had a laugh about it, and the "it's Scotland's oil (and gas)" crowd and the Daily Mail produced a big fiction for popular consumption?

Thanks Euan

Phil -- being a "Japan watcher" you might be interested in yesterday's press release. The Japanese have just commited to building a $20 billion LNG facility in offshore Indonesia. This particular field has a recoverable estimate of 14 trillion cubic feet of NG.

The British Pound has been appreciating relative to the pathetic asymptotic US Dollar, however the following entry from Wikipedia suggests that it was once worth a pound of silver.

-------------------------------------------

The term sterling is derived from the fact that, about the year of 775, silver coins known as “sterlings” were issued in the Saxon kingdoms,[6][dubious – discuss] 240 of them being minted from a pound of silver, the weight of which was probably about equal to the later troy pound. Because of this, large payments came to be reckoned in "pounds of sterlings", a phrase that was later shortened to "pounds sterling". After the Norman Conquest, the pound was divided for simplicity of accounting into 20 shillings and into 240 pennies, or pence.

Thank Charlemagne. Up till the Euro, Austria used the Schilling and Italy the Lira. Up till the revolution France used Livres. Hint, Librum is Latin for pound.

Euan, I take it that you aren't hopeful about LNG meeting import expectations. Here in Ireland, an LNG terminal is being built near Shannon, and our energy regulator (www.cer.ie) seems to be expecting a substantial amount of Ireland's gas requirement to be supplied from here from 2010 onwards. What do you think?

Any available gas will go to the highest bidder -- so maybe we'll be bartering our shannon freshwater for the LNG - we could use the same ships ?! :)

We could barter Kerrygold butter for Saudi oil too maybe !

Hasn't it become apparent to all these countries that they are building LNG facilities for the same supply? How many times over can the same LNG be figuratively sold?

Now I can add to the previous comment: We have an inertia problem and we have a simple arithmetic problem.

The Great Majesto gazes into his crystal ball and sees there are going to be a lot of underutilized LNG terminals throughout the world.

"How many times over can the same LNG be figuratively sold?"

For a good salesman many times over:-) it's the prospect of LNG rather than the actual stuff and remember that the prospect is often better than the reality. If I were selling LNG then I would like to have as many potential customers as possible to bid against each other for the finite supply I had. Similar to the 1930s when Chevron joined forces with General Motors to buy up the suburban electric railway around Los Angeles, and then closed it down to create dependency upon their products.

I would guess that to see where the LNG might end up, as a starting point we could see if any of the producers are investing their money by building the terminals without forgetting to check for subsidies. It would not surprise me to find out that many terminals had been built on the promise of deliveries without any long term contracts being in place.

Of course at the end of the day the highest price will win regardless of any sunk costs in the refineries.

Can The Great Majesto gaze into his crystal ball and see that if we have a finite supply of, oh anything, it must eventualy run out? If so he is doing rather better than our so-called leaders:-(

A few key points about LNG.

According to this report (large pdf), LNG import facilities are double export facilities. Universal focus on building import infrastructure and totally ignoring suppliers ability to supply may leave many importers disappointed.

By 2020 LNG production is forecast to rise from 150 to 600 bcm per annum. Compared with current nat gas production of 2865 bcm, LNG is relatively small.

In the UK, this is how I see things panning out:

In the years ahead we will use only a fraction of the import capacity with the current expansion of Norwegian gas taking the slack in UK nat gas decline. Then around 2012 we really really begin to need LNG and then by 2019 we won't be able to get enough. So the relatively small global LNG trade will plug a hole for us for a few years - I trust this has all been worked out in advance by the banks - those pillars of OECD commerce.

Data from both BERR and BP Statistical Review 2008 shows that UK LNG imports dropped in 2007 relative to 2006.

We're relying on Norwegian gas to plug the gap for the time being. And as my model shows, we will likely use hardly any LNG until 2012 - its difficult to see a scenario where LNG is cheaper than Norwegian pipe gas. Any thoughts?

I know Exxon / Qatar gas have contracts to supply South Hook - but imagine they will be equally happy diverting that gas else where in the interim.

Till recently LNG was more expensive than pipelined gas, however looking on data from BP Statistical Review 2008 nat gas to EU (cif) has for 2006 and 2007 been running higher than LNG (cif) to Japan.

LNG producers prefer long term contracts (due to the heavy capital investment), and to me it looks like many Asian countries have been clever in establishing long term LNG contracts.

Your reference to Exxon/Qatar is this a deal with Centrica?

I think many LNG cargoes will change owners many times after being loaded in the near future. Yes, I think the cargoes will go to the highest bidder.

Fact is that the spot market for LNG is very small, and probably will remain so, due to the capital intensive nature of LNG business.

But who knows, Catton refers to something he defined as “Cargoism” in his excellent and highly recommended book “Overshoot”. In this context it looks like someone thinks that if they build enough LNG receiver capacities …………….the LNG ships will show up.

Please keep in mind that LNG import facilities should be twice as large as export facilities. LNG is used for peaking and depending on rainfall the local demands for LNG peaking power will go up and down with the levels of water in the hydroelectricity reservoirs.

Virtually all global LNG is used in the N hemisphere. And so, Dec-Feb, if it is cold, everyone will want to import LNG at once. We saw a little of this last winter - linked to a nuke going down in Japan. The rate of import will be determined by the rate of production of LNG - supply.

Nordic Mist - I had to delete some spam - and your post was lost - you need to watch what you reply to.

Please post again - cos what you had to say was interesting. Use the post a comment button to start a new thread.

This is a good article on Peak oil that came out today:

http://seekingalpha.com/article/80919-bp-ceo-three-oil-myths?source=yahoo

Another view as to why oil is so dear From PAUL CRAIG ROBERTS writing in COUNTERPUNCH It is all due to above ground factors

(not my opinion)

http://www.counterpunch.org/roberts06112008.html

viewpoint.

1) Evidence, finally of demand crush due to high oil prices (see reports of UK gasoline consumption declining 20% yoy), ford comments on dramatic shift in consumer behavior (suv sales vs small autos), airline mothballing of aircraft in US (capacity cuts ranging upto 17-18%)

2) inventory declines in US may be driven by inventory managers selling off stock at high prices, rather than demand - note inventory estimates up until now is an issue of monitoring inbounding cargos - but if demand crush is underway, dramatic potential going forward for inventory number errors, caused by consumption strike

3) IEA declares crisis, ready to release stocks - 180 degree U-Turn on april reiteration that stockpiles will only be released in supply shortfall - IEA considering demand curbs

- note IEA charter/mandate strongly pressures iea not to declare crisis because member states -signatory countries - are under obligation to curb demand to avert crisis

4) US investigation in speculator role indicates "position" limits (margin hike) may be imminent - IEA chief says today - wants to know "who" is active, and to what degree

5) This follows Russia long awaited announcement to switch to RUBLE pricing for exports, and efforts to depose USD as global reserve, wall street-London as center for global finance (MEDVEDEV ST PETERSBURG weekend speech)

6) Gazprom forecast appears to discount Ruble moving to PPP on fx (i.e Necessity to pay for oil-gas in rubles, forces down dollar, dollar price of oil up)

7) response from west since medvedev speech suggest preference for OECD recession - FED signals hike, IEA signals crisis, Saudi calls emergency meeting of all concerned parties (consumer, producers, traders), bp REVIEW signals output in decline

EXPECTATIONS Now

1) Severe threat to OECD STOCK MARKETS

2) IEA to announce intention to supply x mbpd to the market in order to create spare capacity (if producers wont produce - consumers must curb)

3) IEA members to implement demand curbs (speed limits, ship steaming limits, etc) within x days (i.e. 30-60-90), sufficient to create excess capacity and displace need for emergency stockpile releases

4) us-uk regulators to tighten "speculative trading" limits on financial derivatives (energy futures) to ensure, effort to create spare capacity, sufficient to deter large price moves on every single piece of negative data, is not mopped up by speculative buying to neutralize efforts

5) OECD prepared to induce economic slowdown, and prolonged effort to realign energy mix, in preference to massive capital transfers to non-OECD and deposing of the USD

6) Expecting IEA action in coming days, now Russia has played its cards at the ST peterburg meeting which have been 5 years in making...

Euan,

A few words on energy prices and inflation/deflation (and I am not trying to nitpick!!).

Inflation is a pure monetary phenomenon and occurs when too much money is chasing too few goods.

It is the central banks that regulate the circulation/flow of money within an economy.

What we are witnessing is price growth for energy. If the money supply is constant (could happen if there were no growth within the economy) more money (from the households and industries) will be allocated towards purchase of energy, meaning less money available for other purchases, like air transport, computer/video games, espressos, Big Macs stuff etc., suggesting that providers of products and services on top (or rather above) of the Maslow pyramid will suffer and eventually go out of business. This increases unemployment.

The growth in energy prices is inflationary, meaning it will show up on the consumer price index (CPI) and growth in energy prices will also affect food prices (also whiskey!!) thus introducing an upward spiral of the CPI and eventually leading the central banks to increase interest rates in an effort to drive down what is commonly referred to as inflation but which in reality is price growth.

Interesting to see that National Grid forecast an increase in Russian nat gas deliveries.

According to BP Statistical Review 2008, Russian production fell from 2006 to 2007, while Russian domestic consumption increased, suggesting declining nat gas exports from Russia.

Well thats the key - high international oil prices (paid by the OECD) spur state controlled growth in the non-OECD which are dominated by subsidized energy prices, and result in petro -exporters having reduced petroleum for export, and in turn propel international OECD oil prices higher, exasperated by the declining OECD output and need for additional imports irrespective of changes in OECD GDP. A huge re-bound effect is in play, across the basic industries, transportation, as a consequence of OECD depletion, which feeds into energy insecurity, resource nationalism and is accentuated by climate change policy..further stimulated by the exhaustion of existing OECD energy and infrastructure (i.e nuclear power, old conventional reservoirs)..and need for new energy (renewables) and non conventional infrastructure (lng, tar, deep water etc)...we are in a vicious circle and it wont stop, until the OECD curb demand (stifle growth) or a genuine, full blown supply shock causes demand crush - either way the outcome is stagflation : the need for capital stock replacement prior to economic lifetime expiration, and rising costs. We have just managed to go global when we must needed to go local - the whole supply chain, just in time delivery business plan is the complete opposite in an environment of resource constraint and high transportation costs...a perfect storm is upon us.

Note - finally the analysts are swinging "en masse" their forecast up into the 150 and 250 and 500, when at 20 dollars to discuss 40 or 50 was "crazy". This swing is a positive signal that finally people "get it". yet those same analysts really havent crunched the numbers on the damage of 100 or 120 or 140....

In the next month into OCT the impact of this 70 to 140 price spike will emerge, and the inflation combined with a nose dive in OECD activity will become apparent- whether that will slow non-OECD stockpiling of strategic reserves is another matter

Apparently, we are not going to get coal plants here either:

http://www.guardian.co.uk/environment/2008/jun/13/carboncapturestorage.f...

The Tories should win the next election, and won't authorise coal plants without CO2 capture.

Companies won't build those until the technology is approved and unless cost guarantees are given.

Here is what the utilities say:

So unless we figure out how to power our society on pure thoughts it looks like the lights should be going out.