The Chinese Coal Monster - running out of puff

Posted by Euan Mearns on November 20, 2010 - 11:32am

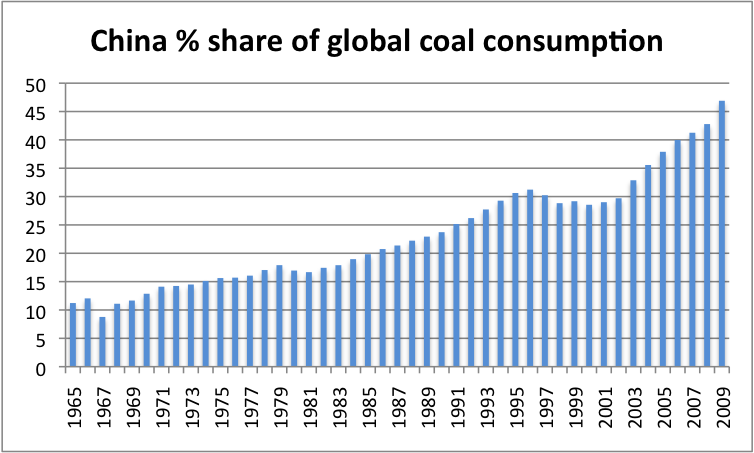

In July of this year I wrote a story called The Chinese Coal Monster drawing attention to the fact that China would soon account for 50% of global coal production and consumption. 10% per annum growth in Chinese coal is clearly unsustainable and I posed the question "How long can this go on?"

An article published in the Wall Street Journal earlier this week called China's Coal Crisis suggests the answer to this question is not much longer.

Policy makers [in Beijing] are mulling an annual cap of between 3.6 billion tons and 3.8 billion tons in the next five-year plan, running from 2011 to 2015, the state-run Xinhua news agency reported earlier.

A Nature publication called The End of Cheap Coal by Heinberg and Fridley was also published this week. This refers to earlier work such as Blackout (Heinberg), Hubbert's peak - the coal question (Rutledge) and A global coal production forecast with multi-Hubbert cycle analysis (Patzek and Croft). The most notable thing about Heinberg and Fridley's (on The Oil Drum known as Sparaxis) comment is that it is published in Nature. More commentary and full reproduction of The Chinese Coal Monster below the fold.

Let's begin with a few excerpts from the WSJ article:

State-run media reported that Beijing is considering capping domestic coal output in the 2011-2015 period, partly because officials worry miners are running down reserves too quickly to meet the needs of a rapidly expanding economy.

Imposing a cap would be significant as China's mining sector is already finding it hard to keep up with domestic coal demand, which has grown around 10% annually over the past decade.

So the cap has been set because the mining industry is finding it increasingly difficult to maintain and grow production.

In the three years to September 2010, Chinese companies spent $20.96 billion on overseas coal-sector acquisitions, according to Dealogic.

Even if no official limits are introduced, China can't keep growing coal output much beyond another decade, analysts say. The mining sector is constrained by chronic infrastructure bottlenecks, especially road and rail, and those coal deposits that are easiest to mine have already been tapped.

Experts are starting to predict when China's coal reserves will run out—a nightmare scenario in a country where 70% of its energy is derived from coal.

This is a key issue. China may well have vast reserves remaining, but these may be further away, deeper down, thinner seams and lower energy content, and at some point it just becomes impossible to achieve what you achieved the previous year when so many variables work against you.

Let's put the 3.6 to 3.8 Gt cap in perspective. In 2009, China produced 3050 million tonnes (3.05 Gt) coal (2010 BP statistical review of world energy). If that increases by 10% this year that will bring production to 3355 million tonnes already suggesting that the lower limit of the proposed cap may be reached in 2011 (next year). At this point it's worth noting that Patzec and Croft (2010) forecast peak coal production in 2011, which I and many other commentators thought was unduly pessimistic.

What I imagine we will see happening is that Chinese production growth in 2010 will be significantly less than 10% and we will see a plateau develop within the 3.6 to 3.8 Gt range in the period to 2015. Growth in Chinese coal production has underpinned their industrial revolution and an end to growth in their primary energy source poses risks to their and global economic growth. But the Chinese are enterprising people and I imagine they will manage their transition away from domestic coal by a combination of increasing dependence upon coal imports, improving energy efficiency of coal fired power stations, and rapid expansion of nuclear capacity.

The Chinese Coal Monster

Published 12 July 2010

- China set to consume 50% of global coal production this year

- Production and consumption roughly in balance

- Coal imports used for stock pile growth?

- Consumption growing >10% year on year in line with economic growth

- Rest of world consumption declined 7% in 2009

Figure 1 Chinese coal consumption compared with the rest of the world.How long can this go on?

Data

Data are taken from the 2010 BP statistical review of world energy - both a priceless but flawed resource. BP provide annual coal production figures in tonnes and tonnes oil equivalent (TOE) from 1981 and consumption figures in TOE only from 1965. Hence to make a production / consumption balance comparison it is necessary to use TOE. In China, 1 TOE is close to 2 tonnes coal - so simply double the TOE numbers to get at the approximate tonnages. Note that the energy content of coal varies by rank and from region to region and conversion factors to TOE vary from 1.5 to 3.

The coal monster

Like everything else in China, coal production statistics are simply immense. China now consumes and produces close to 50% of all the coal in the world. Thus, changes in Chinese consumption and / or production may have a dramatic impact upon the global coal market.

Figure 2 Since 1965, China has steadily increased its percentage share of global coal consumption and looks set to account for 50% of global coal consumption this year. Virtually all consumption is met from Chinese domestic coal production (Figure 3)Coal production and consumption are in balance

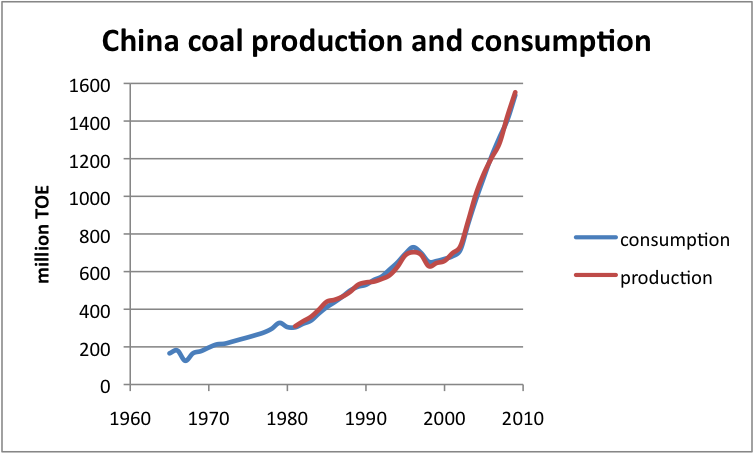

In light of press stories describing rapid growth in Chinese coal imports, I was both surprised and puzzled when I plotted the Chinese coal production and consumption data and saw that these have always been roughly in balance (Figure 3). I sent the chart around the TOD email list and copied to Professor Dave Rutledge at Cal Tech. It was DaveR who came up with a possible explanation.

DaveR pointed out that in countries like the UK, coal stock piles equivalent to roughly 4 months consumption are maintained. If China does similar then stock piles will be around one third of 3 Gt equal to 1 Gt. With consumption growing at 12% in 2009, stock pile growth would need to be around 120 Mt to maintain the 4 month buffer. China People's Daily reported that Chinese net coal imports were 104 Mt in 2009 - barely sufficient to maintain stock pile growth.

Figure 3 Despite stories of ballooning coal imports, China produces as much coal as it consumes. It seems imports merely contribute to domestic coal stock piles.Global coal trade

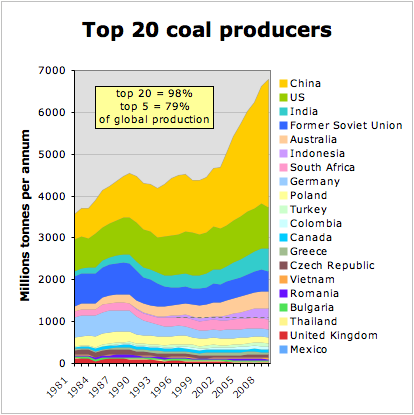

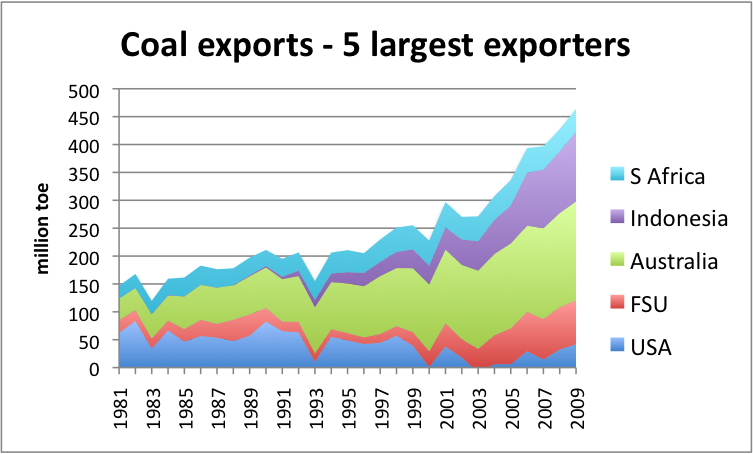

The top 20 coal producers account for 98% and the top 5 producers account for 79% of global coal production. It is therefore possible to get a handle on global coal trade by looking at the top few producers. China as we have already seen is roughly in production / consumption balance, and India is a major importer of coal. The main export nations are the USA, FSU, Australia, Indonesia and South Africa. Looking at the production / consumption balance of these 5 nations shows an export surplus of 450 million TOE (roughly 900 million tonnes coal). Chinese coal imports of 100 Mt therefore account for roughly 11% of global coal trade (contrary to the People's daily report) - and that is just to maintain stockpiles!

Figure 4 The top 20 coal producers. The dashed grey line marks approximate zero growth for the last decade. All the growth in coal supplies comes from the nations above that line with growth dominated by China with contributions from India and Indonesia.

Figure 5 The global export market is dominated by 5 nations. Export growth has come mainly from Australia and Indonesia.Threat to global economy

Should China ever fail to match coal consumption with indigenous production then 1 of 3 things may happen. The first option is that consumption is pegged back to match stalled production and this would stall Chinese economic growth with knock on effects to the global economy. The second option is that China tries to meet any shortfall buying coal on the international market. As already pointed out China is such a huge consumer of coal this would create great competition in the international market for limited supplies leading to severe upwards pressure on coal prices. The third option is that China somehow manages to install sufficient nuclear capacity to plug any energy gap.

The People's Daily reports a doubling of Chinese coal imports for the first 5 months of 2010 and upwards pressure on coal prices and it therefore looks like option 2 may be under way. Should Chinese coal imports double this year and next then China will be competing for about 50% of the coal on the world market and that may be like a wrecking ball going through the global economy that is founded on abundant and cheap supplies of energy.

Reserves and peak production

Finally a note on reserves. BP report China to have 114.5 Gt of coal reserves. BP in fact report coal reserves figures from the World Energy Council and the figure of 114.5 Gt has been reported every year since 1992. Thus we have the same unsatisfactory non-varying reserves reporting for Chinese coal that exists for Middle East OPEC crude oil reserves. Since 1992 China has produced 31 Gt of coal and the reserves should be reduced by that amount leaving 83.5 Gt reserves as of end 2009.

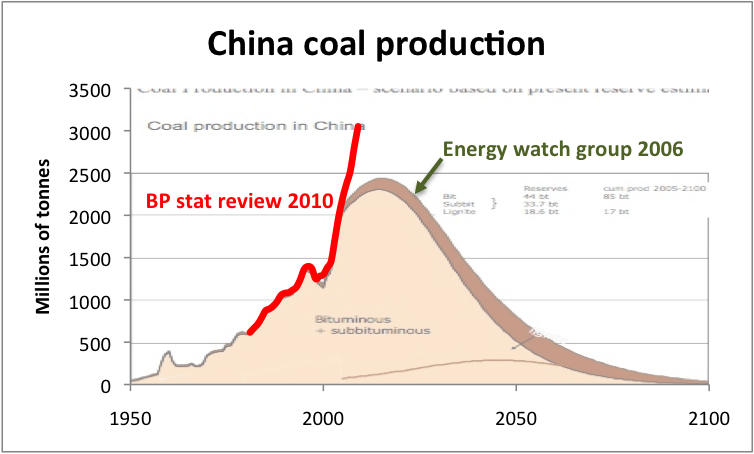

In 2006, the German based Energy Watch Group (47 page pdf) reported Chinese reserves to be 96.3 Gt. They produced a Hubbert curve forecast scenario that has proven to be inaccurate thus far (Fig. 6).

Dave Rutledge is currently estimating 139 Gt for ultimate recovery of Chinese coal. Cumulative production 1896 to 2009 is 51 Gt indicating 88 Gt remaining.

Figure 6 A Chinese coal production scenario produced by The Energy watch Group in 2006 (page 28 of report linked to above) illustrating how difficult it is to forecast production scenarios, especially pre-peak. One possible outcome is that Chinese coal production peaks earlier than shown and then enters rapid decline. Alternatively, substantially larger reserves may produce a taller and broader peak than shown here.Chinese coal production will peak one day but it is very difficult to predict when that day will come based on these figures. The indications are that China has used about 37% of its coal. It has to be assumed that the best resources have been mined first and that for every year that passes the challenge of first meeting and then exceeding the previous year will become increasingly difficult. But the Chinese are an enterprising people.

Useful links

Dave Rutledge: Hubbert's Peak, The Coal Question, and Climate Change

Richard Heinberg: China's coal bubble...and how it will deflate U.S. efforts to develop "clean coal"

China: Summary of Coal Industry

One final note. In response to The Chinese Coal Monster, Jean Laherrere pointed out that BP and EIA production data differ, saying:

It is very important to know that China is importing much more than in the past. In the above graph, with EIA data, it is a cliff, while BP data show a plateau. JL

The comment from Jean can be read here.

I don't know why it struck me this way but I really was taken aback to see the term "puff" when talking about worldwide coal use.

One of the very first things I concluded when I first became peak oil aware was that coal was going to end up being the only available option for mitigating the effects of peak oil. We would shovel as much coal as possible at the problem, climate consequences be damned.

What I didn't really consider at the time was, what if we were already shoving as much coal as possible at the problem of providing enough energy to meet the demands of China's economic growth and adding 100 million or so to the world's population every year? Where is the extra coal for mitigation going to come from? And how do we mitigate the effects of peak coal? What do we throw at that problem? The answer: natural gas, of course. Clearly, the natural gas boom proves we have an infinite supply which will remain plentiful and cheap in perpetuity. And after that, uranium supplies will never fail us. Our children's children will live off plentiful squeaky clean nuclear power. And however old you are right now, you'll live just long enough to read an article about how commercially viable fusion power is a mere 40 years away.

Now you can enjoy your weekend.

And don't forget kenny that there are plenty of resources on Mars we will get real soon. This is why China is very active in rocket science which the U.S. mistakes as building weapons to concur the U.S.

Only a minor remark.

The "shortfall" in Chinas coal production & consumption beetween 1995 and ~2003 was not because of real shortfall, but because of underreporting of small local mines. The central covernment ordered the small coal mines to be shut-down because of severe environmet impacts and accidents. But the local government just reported outright sucess. In reality they just did not report/count the small mines any longer to the central statistic bureau. After 2003 this "underreporting" was gradualy withdrawn for accurat figures.

Euan, many thanks for updating what was an excellent article.

As someone who has spent time procuring both domestic and imported coal for the UK, the Chinese coal story of the past 5 years or so has been the single most fascinating/alarming/impressive/terrifying story in global energy, much more dramatic and with far greater global consequences than shale gas or oil leaks in the Gulf of Mexico.

It is only a few years since China overtook the UK in terms of economic size. In that time our total demand fluctuated between about 55m tonnes per year and 70m tonnes per year, and that seems like a reasonable amount of coal to us. To be talking about annual volumes in excess of 3.5bn tonnes and annual variations of the order of 400m (and similar order of magnitude in variation of net import/export volumes) is mind blowing.

No matter who you are, that order of production is going to be hard to sustain over a long period let alone to achieve continued growth, and it strikes me almost immediately that for the Chinese government to announce a cap stinks of a communist device that is supposed to imply: "we could produce more if we wanted to but we don't" to prevent the external conclusion of "they are right up against their limit and may have a problem soon".

As usual, and as you also said, logistics is often more of an issue than actually digging it out of the ground. The freight market, which I am still involved with, believes that one of the main causes of the 7 day traffic jam was a massive over-concentration of coal trucks on a part of the road network. For obvious reasons, the freight market is obsessed with China, their recent shut downs of steel and aluminium plants (supposedly for failing to meet energy efficiency targets) had a massive impact on global sea freight prices, and I believe is itself is likely to be an indication of considerable strain in energy supply.

As someone said above, it is impossible to escape the conclusion that China will soon turn its attention to significantly increasing LNG imports for power generation. That could have very serious consequences for the UK's energy supply, with our ever-increasing dependence on LNG. Here's hoping for a big UK/European shale gas find some time soon...

I agree completely. Here are some of the predictions I made at the end of my ASPO talk: Natural Gas Net-Export Trends.

While the world may produce enormous amounts of natural gas over the next decade, LNG importing nations will probably be paying significantly more for it than today.

Jon

That would raise NG prices in the US, right?

Do you think the US might become a net NG exporter?

I think there is a potential lot of interest in exporting US shale gas to the UK. The UK has lots of LNG import capacity and can probably pay a much higher price than on the US domestic market. We will also have ~40GW of CCGT's that could really do with a reliable gas supply.

OMG - Could be possible except a few of complications. First, here are no existing LNG export facilities in the US. Our LNG is a local product. Second, those export systems could be built if there is enough confidence in long term local supply and export market. But they'll have to have a long term NG supply of very significant volume under contract in order to build such facilities. It will be very difficult, if not impossible, to buy that NG directly from producers: typical onshore fields don't have a sufficient deliverability. When NG prices again rise we'll see a ramp up in SG drilling. But SG wells have a very short life with respect to significant volumes. To supply a long term NG contract from SG wells to a LNG facility will require a huge drilling commitment spanning at least 10 years IMHO. Given the last SG boom busted in less than 5 years from its start, that fact won't be forgotten by any of the players. I doubt any operators would make such a commitment. Additionally that NG will have to be transported by pipelines to the liquification facilities on the coast. Pipeline fees are very high in this country compared to virtually no transport fees in many overseas facilities. And lastly, the major source of future large NG fields will be offshore. But oil/NG produced from federal leases can not by law be exported from our country.

Bottom line: the LNG export biz from a 500 bcf offshore field in the ME or offshore Africa is a very different animal than trying to transport, liquify and ship 4 bcf from a SG well in east Texas. At the moment I know of no one in the oil patch that has any interest in trying to ship LNG overseas. In fact, the big concern is not being able to compete with imported NG on a price basis. If domestic producers are concerned about having domestic markets being undercut by NG imports that should tell us something about the poor economics of try to export our NG.

the big concern is not being able to compete with imported NG on a price basis.

Well, the question is whether expanded Chinese LNG imports (and expanded coal imports, which will indirectly create more demand for NG) will change the price of LNG.

Nick - there are a lot of oil patch hands who dream about the Chinese soaking up all that LNG out there so the domestic NG improves as we go down the road. I don't have the link but I've seen reports that the LNG export market is going to be over supplied for as long as 10 years. One reason is the scale of the LNG projects. Those plants cost billions of $'s and can take 5 to 7 years to just recover the initial investment. Once those plants are built they'll keep putting out supply even as prices collapse. Even if NG prices fall to less than half the expectation they'll keep shipping. I've read that operational costs + shipping costs for LNG to the US runs between $3-4/mcf...a little less to the EU. Low prices would eat up potential profit but in the end the system demands cash flow as much or more than profit. Just my WAG but I don't see the Chinese eating up too much of the LNG market for at least 5 to 7 years. But I'm also starting to wonder if the British/EU LNG consumption might start pulling a good bit from the market place in the next 5 years.

I don't have the link but I've seen reports that the LNG export market is going to be over supplied for as long as 10 years

Wow. 10 years.

That's important. That's worth an Original Post (key post?) on TOD.

ROCK,

I can't see the LNG market being oversupplied that long. The site globallnginfo.com has a table of LNG Liquefaction Plants and Regasification Terminals where we see a lot more regasification terminals than liquefaction plants. Of course we would need to know the capacity of every single plant or terminal in that list to come up with hard numbers. But my sense is that the current LNG oversupply situation will alter dramatically over the course of the next decade. I have several blog posts to back up my assessment and spoke on this topic for my ASPO presentation.

I see LNG as being significantly more expensive by 2020.

Jon

J - Only saw that one prediction so I can't back up the claim. I also have my doubts about that claim also but I've seen no credible data base. But I do know there is a huge amount of stranded NG with no local market. And I still assume that cash flow desires will keep the NG flowing even at low prices. In the end I still suspect it will be a foot race between demand for and depletion of NG reserves that determines pricing. Given current conditions it's difficult not to expect the drop in consumption both in the US and globally will continue to control prices for an exteneded period. IOW demand destruction will rule the market more often than depletion.

Jon - a guest post on global LNG with numbers on would be most welcome for anyone who has time to find the numbers which I'm sure exist.

I just done a comprehensive forecast on Norway gas that will post here in a week or two. Norway still has a bit of spare capacity and future will depend on political decisions. I see "peak" in 2012 followed by plateau at around 112 bcm per annum to around 2020, then decline. The cessation of growth will be one shock, decline another.

I would speculate that the Chinese have no real option other than to develop Iran's neglected gas resources.

I'm trying to figure out why Europe continues to expect gas supplies from Siberia.....

The second option of buying more coal from exporting countries has its limits, and they're probably close by.

Here is the typical situation outside Newcastle, Australia (the world's largest thermal coal export port), where according to Bloomberg there are now only eight ships lined up with the waiting time less than eleven days.

Australia (and probably the other major exporters) is exporting coal at the highest rate possible, a rate set more by port facilities rather than coal reserves, mine capacity or shipping availability.

A major expansion of a coal export terminal is 5-10 billion dollar project, and would take 5-10 years.

Queensland is expanding the coal terminal in Gladstone: http://www.couriermail.com.au/news/queensland/nod-for-new-cq-coal-termin...

Our Federal Environment Minister gave the nod to export yet more dirty coal. Talk about "beds are burning".

The same Ms Bligh(t) mentioned in the article is busily selling off Queensldna rail infrastructure. The coal companies put in a bid for the coal network, some Au$5bn, finally got a look at the books, and then backed away as fast as they could. QR National has now been floated at $2.55 (a whopping 5c over the Prospectus minimum), valuing the [i]entire company[/i], coal, intermodal, below-rail, rolling stock, at some $4.6bn ($6.7bn total, including 40% govt-retained). It is unknown if Warren Buffet bought any shares. At $4.6bn, he could have bought it with the loose change from his BNSF purchase. Judging by a comment in one of the News articles, maybe he did:

Of course, the focus on Coal (QR float, QLD economy, NSW GFC infrastructure spend) as a 'good thing' will probably come back to bite all those involved. Good.

Any other pacific rim coal exporters to help service China?

Any other pacific rim coal exporters to help service China?

Canada has about 190 gigatonnes of coal in place with no market for it. That's probably more coal than China has, and somewhat less than Australia has. Most of it is in the country's two western provinces, Alberta and British Columbia, and the rail lines and port facilities are already in place. It would cost a lot of money to mine it and move it to market, but if China has the money, the coal is there.

Canada's oil sands are about the size of England, and its coal formations are about the size of France. China is more interested in the oil because it is, after all, a more strategic resource.

Yes large reserves in Alaska, environmentally sensitive and far away. USA still has ample reserves closer to hand and so unlikely to touch Alaska for a long while yet, if ever.

What about Alaska? I thought there were massive untouched coal reserves there.

We should expect the following forgotten countries to ramp up production to help meet Chinese demand:

Anyone remember this article from last January?:

Chinese back Mozambique coal project

There are lots of countries with coal that would love to get in on the export-to-China game. Many will only ever be minor players but there are a few up-and-comers we need to keep tabs on. If you add up enough of these you may actually be able to feed the Chinese Coal Monster for a surprisingly long time.

Jon

Newcastle has a 4 billion dollar expansion plan to increase coal exports. Australia's terms of trade according to an article in a Sydney paper I read last month (SMH IIRC)are the best in a century. If China Stumbles economically then Australia will face ruin due to our reliance on the Chinese for our coal, iron ore and base metals exports. Our current unemployment rate is 5% and there are concerns about labour shortages in mining and infrastructure.

I am getting conflicting messages here.

On one hand China is going to increase its imports to 50% of world coal traffic, and on the other coal exports out of Newcastle have fallen by 1.2%?

From your Bloomberg article.

I interpret this to mean that China is up against another limit already. I am guessing that it is environmental and/or food security.

Edit: Or Australia's contribution to China is insignificant. It is just noise on the graph.

There is still a queue so 1.2% is just noise. There is a limited number of vessel and even the ships are equal in size and take exactly the same time there is almost certainly some noise because the number of ships vary.

It could easily be visualized by using a ruler and cut a paper strip or something similar. Move the paper strip and count the number of millimeter or inch marks or what ever you use for different positions. There is a discrete number of lengths that will result in no noise so you may be lucky in the experiment and produce no noise. The risk that you will be lucky for a randomly chosen length is theoretically infinitely small.

If China likes to have 4-6 months of supply of coal stored at its power stations, then Australia's increasing exports are enough to fulfil that role :)

What I am getting at is that the scale of China's increasing demand for coal is absolutely staggering.

The quantity of coal produced in the US has increased at 1.32% per year but that rate is decreasing:

At the same time the BTU content has dropped from 24.7 to 19.7 - a decrease of .373% per year:

Rgds

WeekendPeak

The US has enough wind and natural gas capacity to reduce the amount of coal required (down to 20% of electrical generation) by 2030.

Natural Gas and Renewables: A Secure Low Carbon Future Energy Plan for the United States

DB Climate Change Advisors is the brand name for the institutional climate change investment division of Deutsche Asset Management, the asset management arm of Deutsche Bank AG.

I figured that Chinese coal production/consumption would be come difficult to measure as they peaked. I'm not shocked that this has happened.

Indeed I've been mulling for some time if we have reached peak energy. I think we are effectively at peak now at best some incremental gain in natural gas but its not clear that they would lead to any significant increase. From here on out supply problems with one energy resource results in supply problems in another. Rising costs make it difficult to expand. Shortages like China is seeing for diesel at the moment impact coal consumption. LNG facilities and refineries go unbuilt as capitol is not invested. Indeed the vicious cycle of lack of growth followed by contraction followed by lack of investment in new costly production should take hold. This leads to rising prices at least at first but it simply results in existing production being extracted even more rapidly. As prices fall the strain on existing production increases as producers attempt to make it up in volume. The net effect is the depletion rate steadily increases basically regardless of how the price moves yet no new investments are mode. At some point the depleted mines, fields become marginally economical and are shut down during contraction phases when prices drop. When prices rise many are not reopened as again you capitol costs become a problem.

Global peak energy does not seem to be purely geologic its a function of the underlying nature of the financial system which is sensitive to EROEI not absolute resources left. Once total energy approaches its maximum we simply become unable to fund expansion because of declining net energy leading to further declines. Wealth creation declines far more rapidly than the underlying potential for production.

Given our debt/fiat monetary systems this means investment collapses first and actually drives depletion of existing resources and thence eventually accelerated decline rates as lack of investment in previous years finally bites.

As growth stalls in energy production the single most telling feature is that the data becomes increasingly unreliable. Given most of the data is produced by people with a vested interest in not reporting bad news, accuracy deteriorates rapidly.

Lets focus on what we know i.e. energy.

If I thought you where right I'd agree.

However consider a simple example. Two cars accelerating down a road the lead car perhaps going slightly faster. Fairly suddenly the lead car is forced to slow down. The physics of the situation changes dramatically with a fairly small change in the derivative of one of the variables. I'm simply saying that the peaking of chinese coal production is very similar. Indeed in general my argument could be cast as the formation of a traffic jam on what was once a free flow.

That traffic jam is not a simple function of energy supplies alone even though it was induced by the initial peaking of energy supplies.

I'm arguing its forming right now and thus the theoretical maximum speed of the various cars taking part in the traffic jam becomes irrelevant. That theoretical maximum speed would be equated to remaining energy supplies. The jam itself ensures they will never be reached.

I could as always be wrong but my point is that energy, economics and finances are going to become increasingly intertwined with interesting and potentially counter intuitive results.

Same situation is also occurring on the climate side of the equation with the peaking of Chinese coal we lose the effects of ever increasing sulfur dioxide and particulate emissions from china. What this means is certainly less clear simply that one would expect that this change will also induce changes in our climate as the onset of the lack of growth in SO2 and particulate is a similar braking action. If its important then it will also play into the above traffic jam. Or it may not.

How exactly this plays out is difficult to determine but the onset of this rapid increase in the complexity of the relationships between various aspects of our economy caused buy peaking of Chinese coal seems to me at least fairly clear and important.

Simple expansion of energy to induce growth is no longer possible. What happens next is murky at best but its going to get a lot harder to predict future energy production simply based on geologic fundamentals.

Perhaps the Oildrum will choose to simply focus on energy as you suggest if so then as a forum it will miss out on this fascinating interplay of complexity. Attempts to predict future energy supplies that ignore the onset of complexity will fail.

Heck the interplay of Chinese coal production and diesel shortages seems to have been missed. Situations like this will become the norm not the exception.

Well if this thread goes very far off topic - which is Chinese coal, I will just delete the whole thread. Not that there isn't an interesting debate to be had, just that this is not the time (Friday evening and I have guests) and place to have it.

We do know that the Chinese are:

1) installing more wind than anyone else (13 GW last year, wind generation in 2009 was double 2008)

2) Major solar PV projects announced

3) more solar hot water heaters everyone else combined

4) more hydro than anyone else in the world (from 197 GW in 2009 to 330 GW in 2020)

5) building one 44% efficient coal plant per month while retiring 70 GW of low efficiency coal plants

6) Announced plans for 100 new nukes, with "over 70 GW of new nukes" (up from 9 GW today) on-line by 2020. 200 GW by 2030 and 400 GW by 2050. 8 new nukes under construction in mid-2010

7) Enforcing energy efficiency with "an iron fist" as promised (i.e negawatts)

8) Increased natural gas imports, both LNG and by pipeline.

It is clear from above that the alternative to coal is not nuclear as stated in the article, but an "attack on all fronts" with new nuke just a mid-sized part of the total.

OTOH, the co-incidence of policies supports a fear of "Peak Coal" in China.

Unlike memmel, I can see total Chinese energy increasing after oil & coal have peaked. And if one considers "effective energy" from gains in efficiency (see negawatts and more efficient coal fired plants), the peak useful energy may yet be far away.

Best Hopes for Chinese Alternatives,

Alan

Alan, you got a link for your new nuke statistics?

I got much of what I posted from:

http://www.eia.doe.gov/cabs/China/Electricity.html

such as

China’s government forecasts that over 70 GW [nuclear] will be added by 2020.

State Energy Bureau announced plans to increase hydro capacity to 380 GW by 2020.

and the rest from a variety of sources.

This China Daily article of a year ago assumes only 61 GW added by 2020 (plus 9 GW operating). However, I suspect a translation/poor reporting error

Interesting article none-the-less.

http://www.chinadaily.com.cn/china/2009-11/04/content_8914645.htm

Any particular datum ?

Alan

I note that I mistyped 330 GW hydro when it should have been 380 GW. I usually double check my numbers after typing but I missed that one !

It doesn't seem like nuclear is going to make a big dent in their power requirements. Scotland currently gets about 38% of electricity from nuclear - and planning to allow both nukes to close within 15 years:-(

Labour will likely win the Scottish elections in May though if the polls are to be believed. And it's Scottish Labour Party policy to build new nukes. The Scottish Lib Dems are still officially against but at a UK national level are now for. However I expect the Lib Dems to be virtually destroyed at the Scottish election as "punishment" for the national coalition with the Tories.

http://www.electoralcalculus.co.uk/polls_scot.html

Yes, I expect Labour majority government and new policy - but for how long? Something needs to be done to provide a stable investment platform that looks decades ahead in multi billion £ investment is to be made in new nukes. Scottish and Southern Energy just announced they are pursuing plans to build a nuke a Sellafield (England).

I have a somewhat different take.

Any shortfall in coal production by 2020 (perhaps even a deliberate scale back before infrastructure limitations bite too hard) will be taken up (in order of importance)

1) Reductions in growth from 8% annually. 5% annual growth is "not bad" and can support social stability. Some slowing is inevitable for a variety of reasons.

2) Negawatts. LOTS of low hanging fruit for greater efficiency. Gov't mandates plus market incentives and public information are a powerful combination.

3) New hydro. Add 183 GW of hydro with, say, a 55% capacity factor and that is most of the likely growth in demand till 2020 (see slower growth and negawatts).

4) More efficient coal burning. Replace most of the 27% to 31% efficient coal fired plants with 44% efficient ones (say 250 to 350 GW worth) and coal demand drops. Only slightly less savings than new hydro.

5A) New nuclear power plants coming on-line. I think the published schedule will slip a bit. 80 GW total (new + existing 9 GW) nuke by 2022 instead of 2020.

5B) New wind. More transmission and pumped storage needed (from memory 30 GW of new pumped storage by 2020, 50 GW by 2030). Hard to say whether new wind or new nuke will be bigger in 2020. New nuke bigger in 2030.

6A) Solar PV Coming of economic competitiveness before 2020. If supported, can be big by 2020.

6B) Natural Gas fired electricity. I think China will divert most NG to other uses. Fertilizer, direct home heating, factory processes, refining and petrochemicals and a substitute for oil in transportation (CNG) and not for generating electricity.

7) Coal imports. I just do not see the leadership wanting to go that route in a big way. Especially post-Peak Oil. Do the above instead.

Best Hopes for Chinese alternatives,

Alan

Well, the capacity factor makes a huge difference for technologies other than thermal and nuclear. According to the page you posted hydro cf is around 32% and i would give wind 40%. If current trends (110% increase in a decade) continue then in 2020 China will be producing more than 7000 TWh, up from 3446 TWh in 2009. So that gives:

* Hydro: 380 GW (32% cf): 1065TWH (15% same as today).

* Wind: 100 GW (40% cf): 350 TWh (5%)

* Nuclear: 80GW (90% cf): 630 TWh (9%)

* Solar: 20GW (15% cf): 26 TWh (0,4%) Source: http://www.solarplaza.com/news/china-solar-pv-installed-capacity-set-to-...

So we 're talking about 30% coming from renewables but still around 5000 TWh from thermal when the produced electricity from fossil fuels was 2800 TWh in 2009 (almost half). I can't see China getting off coal any time soon, unless it slows it's economy down a lot. Increasing coal plants efficiency is probably the only way forward. Since coal accounts for 80% of power generation that corresponds to around 2700 TWh in 2009. Even if we account for efficiency gains from 31% to 44% that's 3800 TWh and 1200 TWh short of the 5000 TWh target for 2020. Really huge numbers. By the way are 44% efficiency coal plants mature enough?

According to the EIA, the recession and the preceding several years of high energy prices knocked U.S. per capita energy consumption back to 1967 levels. One very simple way of looking at U.S. recessions both now and in coming years as a means of shifting available energy supplies to China.

The U.S. hit peak per capita energy in 1979, with a slightly smaller peak in 1996-2000. The decline since 2000 became a route when the recession hit. Sure, improved energy efficiency has played a part, and improved vehicle mileage efficiency will again play a role. But a bigger part is just declining intensity of economic activity. Millions of unemployed aren't very energy intensive.

Whatever efficiency gains have to do with it, the U.S. per capita energy peak coincides fairly well with the U.S.'s peak share of the global economic product.

I suspect that a significant part of the per capita drop is because energy use is outsourced. In 1967 we produced many more goods in the US than we do nowadays, and that can skew numbers significantly.

Rgds

WeekendPeak

Current US manufacturing production is 50% higher than it was then.

Manufacturing employment is what dropped dramatically, due to higher labor productivity.

The german Energy Watch Group conducted a study several years ago in 2007. If we thought oil reserve reporting was bad coal is much worse.

Here is the link www.energywatchgroup.org/.../EWG_Report_Coal_10-07-2007ms.pdf

This is well worth a read in conjunction with Euan's article. My company wishes to invest in china but I keep warning of the energy bust that will hit the Chinese market soon. This will help me.

Do not ignore India either. The situation there is nearly as bad.

EWG's analysis isn't very thorough. They tend to confuse peak supply with peak demand.

Recall about a week ago Obama said the US must increase exports to China. Does that include coal?

In Australia there is a proposal for carbon tax to replace the doomed cap and trade scheme. If it was added to the price of export coal, say $50 a tonne, it could add to China's woes if alternative suppliers like Indonesia struggle to fill the gap. Note also the coal mine accident in New Zealand yesterday was at a mine intended to produce coking coal for India's steel industry. Generally speaking Asia seems to be living beyond its carbon budget.

China and world Peak Coal also nixes IPCC projections of man made CO2 increasing beyond 2050. The boffins should have listened to TOD.

The deaths caused by King Coal make me bitter. Nuclear is bad, but compared to what?

I guess miners are men and therefore expendable.

And thank FSM for The Greens, for essentially demanding that the ALP consider such a scheme.

Amazing what happens in politics when it's not a Duopoly (Green support in Vic may hit 20% at their upcoming state election, and the Liberals are putting The Greens last on their How To Vote cards.

I heard Jonathan Watts speak at U.C.Berkeley recently about his new book "When A Billion Chinese Jump: How China Will Save Mankind -- Or Destroy It". He mentioned the Chinese have plans to liquefy and pipe coal gas from one of their furthest regions where coal is abundant but transportation costs would be prohibitive. Long before they run out of coal you have to wonder what other resource they might run out of first.

50% of their water is not drinkable, 25% is so polluted it’s not suited for any use. A saying in China is “we will have clean water when we have clean officials”.

In the Great Leap Forward, Mao set scientists to figuring out a way to melt China's 36,000 glaciers to provide more water to farmers. They tried bombing them, etc,the most effective melting technique was coal dust...fortunately the experiment wasn't continued, but China is still suffering the consequences of Mao's experiments. Below is my book review of Mao’s War Against Nature: Politics and the Environment in Revolutionary China by Judith Shapiro. 2001. Cambridge University Press.

Coal is the least of China's worries -- the Great Leap Forward continues to destroy China today

The main thesis of this book is that when free speech is squelched, the consequences can be dire for the environment.

Mao was a military leader. He saw that he could defeat the technologically superior Japanese by sheer force of numbers. In the fifties, demographers and other scientists became alarmed at the quickly expanding population and started speaking and writing about the need to practice birth control. Mao stopped them. He didn’t think you could have enough people.

Mao saw people as being extremely expendable. He shocked Nikita Khruschev in 1957 while visiting him in Moscow when he said: “We shouldn’t be afraid of atomic missiles. No matter what kind of war breaks out – conventional or thermonuclear – we’ll win. As for China, if the imperialists unleash war on us, we may lose more than three hundred million people. So what? War is war. The years will pass and we’ll get to work producing more babies than ever before.”

Mao’s “Great Leap Forward” led to the greatest loss of life in history – it resulted in 35-50 million deaths from starvation. This came about because of various campaigns. One of them was to make China a steel-producing nation within five years. The implementation was a surreal nightmare: people had their cooking pots, the nails from their homes, and other metal that held the infrastructure together melted into steel bars at the village square to meet the production quotas. The “steel” that resulted was useless. The metal was such a motley mix, and wasn’t forged at high enough temperatures.

Firewood was used to melt the gathered metal. This resulted in the devastation of forests across China as millions of trees were cut to fuel the forges.

Simultaneously there was a campaign to rid China of the Four Pests: Sparrows, Rats, Flies, and Mosquitoes. Schoolchildren were the main actors in the anti-pest drive. One child recalled: “The whole school went to kill sparrows. We made ladders to knock down their nests, and beat gongs in the evenings, when they were coming home to roost…” Millions of children went into the hillsides at dusk, there were no tranquil places for the sparrows to retreat to.

Mao thought sparrows were eating grain. When the sparrows were destroyed, it was discovered that they were the farmers’ best friend, eating scores of insects. The crops were devastated. Not all of the crops were harvested because people were too busy finding steel to melt and chopping trees down to melt the steel. Much of the crop that was harvested was appropriated for city dwellers. The resulting famine lasted for three years.

This disrupted the ecological balance of many of the agricultural areas. As people starved across china, in labor camps and interior villages, any creature that moved, mice, lizards, birds, rats, deer, moles – anything alive was hunted and eaten. Plants were decimated as people ate tree bark, seeds, roots, and anything else that was remotely edible.

Mao issued a new offensive to feed people, his “Take Grain as the Key Link” policy, implemented during the “Learn From Dazhai” campaign. Dazhai was place where miracles occurred in growing grain. Miracles indeed, this was a carefully staged Miracle that millions made pilgrimages to and tried to copy in their own villages.

By growing grain everywhere famine would be overcome. In Dazhai, famous fruit orchards were cut down to grow grain. Across China, lakes were completely or partially filled in to grow grain. Trees, tea plantations, medicinal herb gardens, grazing land, all types of crops were torn out and landscapes planted with grain, only grain. Deserts were planted with grain. Not only was grain planted, it was over-planted, and expected to produce 10-fold over what had grown before. Farmers, plant nutritionists, soils engineers, and many other people knew this was insane, but could do little to stop it.

The slogan, “Get Grain from the MountainTops, Get Grain from the Lakes” resulted in inappropriate terracing on steep slopes and areas with thin topsoils, which brought deforestation, erosion, and sedimentation. The filling in of lakes resulted in microclimate changes, increased flooding, and vast filling of wetlands. In some places, hills were built on flat land so they could be terraced. Millions of acres have been permanently turned to desert, there are now sandstorms so severe that Beijing is brought to a halt.

Zhang Xianliang writes of his time in a labor camp in barren Ningxia province: “The grassy plains had already been destroyed by those who “Learned from Dazhai”. On the land before me abandoned fields stretched in all directions. Now covered with a thick layer of salt, they looked like dirty snow-fields, or like orphans dressed in mourning clothes. They had been through numerous storms since being abandoned, but you could still see the scars of plough tracks running across their skin. Man and nature together had been flogged with whips here: the result of “Learn from Dazhai” was to create a barren land, on whose alkaline surface not a blade of grass would grow”.

Mao thought China could conquer nature. In addition he would remold their souls. From a newspaper of the time about filling in part of one of China’s largest lakes (p128):

”This great revolution of launching an attack on nature subjected each Revolutionary Committee and the broad revolutionary masses to tempering. It both created land and tamed people, and greatly promoted the revolution in people’s thought. In launching an attack on nature, this great revolution promoted a new leap in each line of revolutionary production. In all Kunming District there occurred a leap like that of 10,000 horses rushing forward, its greatest lesson being: if you do everything according to Chairman Mao Thought, then “mountains can be moved, seas can be filled in, and any miracle among men can be created.

In 150 days of struggle, the mountain changed, the water changed, and the people’s though changed. People said, “We not only pulled lake water from the reclamation area, we also took out the muddy wastewater of capitalism from the deep parts of our souls…we not only built 10,000 mu (= ? Acres) of farmland, we also built a brand new proletarian world in ourselves.”

The death rate on road building, mining, and the industrial aspects of the revolution reached as high as thirteen percent of the workforce in 1965. From 1966 to 1975, the annual rate of death was 5.42 percent. Vast steel mils were built to win the “battles” of road building and other projects. Their placement often was such that they polluted vast rivers downstream below them, and the cities around, the air choked with pollution because the plant was in a valley surrounded by mountains or other poor geographical locations.

About three thousand dams were built during Mao’s reign, most of them were poorly constructed or caused more harm than good. Then and now those brave enough to speak out against these projects are silenced, usually by being sent to prison camps. The Three Gorges dam is nearing completion, sure to wreak more environmental harm on vast areas of China.

Mao left a horrible legacy that is felt to this day. But even now China is not able to move in an environmentally sound direction. Greed has replaced revolutionary fervor. Vast unresponsive bureaucracies make change almost impossible. Corruption, lack of information, and the inability of environmentalists to communicate problems to the public from suppression of free speech continue to make progress difficult.

P80: “Perhaps the oddest challenges to nature’s laws arose from the effort to “Break Through Superstition” by encouraging untrained people, even schoolchildren, to conduct far-fetched experiments in grafting and interbreeding. Claims reached the fantastic. In Shaanxi, a rooster was made to bear chicks; at Northwest Agricultural University, a pig was created without ears or tail. A sheep was caused to bear five lambs instead of the usual one to three. A bean was weighed at more than 50 grams, a pumpkin grown as heavy as a man. Persimmon trees bore grapes, pear trees yielded apples. Rabbits were bred with pigs and pigs with cows.

Millions of young people were ripped from their homes and sent to the countryside. City born and bred, they unintentionally wreaked further havoc on the environment as they desperately tried to survive in alien places.

The Shapiro book is good, but if I recall correctly she only focuses on in-country effects. China's foot print is very big and getting bigger, and must be included in any full assessment of their total ecological impact.

(Not that Americans have much of a leg to stand on in this regard.)

Although a really long insert from Ardnassac, It was Riveting.

Mao didn't defeat Japan. He sat around until Japan was defeated by another power.

I saw this recently Amazing Pictures, Pollution in China

This is a very interesting comment. We can clearly see how the maoist idea of progress is totally a fake and how much USA and Europe had used this ideology to switch China into their own big big forge and/or slot machine.

Such insanity is only possible given a population that is both conformist and credulous. The ornery nature of European (and especially English/Scottish) people appears to help limit the damage that crazy leaders can do. A leader going too far gets pushback, and as long as that pushback isn't blocked by other reality-disconnected leaders (e.g. Neville Chamberlain), things don't get nearly as bad as they did in China and Japan.

Chinese will undoubtably absorb a Mongolian coal resource of 152 billion tons of coal(not included in EIA proven reserves) not to mention huge nearby Siberian reserves.

Needless to say I have no confidence in minimalist Peak Coal resource estimates and neither should you.

http://www.southgobi.com/s/OvootTolgoi.asp

http://en.wikipedia.org/wiki/Siberian_natural_resources

Could you explain the origin of your "152 billion tons?" I've gone over the SouthGobi page a couple of times, and I see numbers like 181.7 million tons (Total (Surface and Underground) Ovoot Tolgoi In-Place Coal Resource), and 114.1 million tons (surface reserves at Ovoot Tolgoi Mine) and 21.4 million tons (Central Soumber in-Place Coal Resources). Combined, these resources (even counting "indicated" or "inferred") come to less than 500 million tons -- roughly 1/300th of the figure you gave.

Mongols say 152 BILLION TONS.

http://tiny.cc/hpjq1

The Australians are worried.

http://www.watoday.com.au/business/rio-tinto-warns-on-cheap-mongolian-co...

... and why do you think that the Mongolian forcasts are any better?

"Reserves" depend on a lot of things, including mining costs and the costs of the competition. Just because official reserves change doesn't mean that there was a revision in the resource estimates.

Nick. The question was "... and why do you think that the Mongolian forcasts are any better?".

Mongolia is located between(as the crow flies) the Siberian Kuznetz field (725 billion ton coal resource)

http://encyclopedia.farlex.com/Kuznets+Basin

and the Shanxi 'Seal of Coal', estimated at 200 billion ton resource

http://mams.rmit.edu.au/9tqqzgfj9oks1.pdf

Are you incapable of believing in geological estimates(unless they are made by non-geologists--Aleklett, Rutledge, Heinberg)?

If their are huge coal deposits on either side of the Mongolian border isn't logical to conclude that a good supply lies between them?

Majorian. The question was "... and why do you think that the Mongolian forcasts are any better?".

I am more enclined to believe the Soviet geological surveys, rather than the estimates the Mongolian Natural Resources Ministry has come up with. Please let me know if you have any evidence from geological surveys that support the 5 fold increase in reserves since 1983!

LOL

Mongolia considered a second Powder River.

A single mine, the Tavan Toglio has 6.5 billion tons of high grade coking coal in it, which are the same as Germany's proven coal reserves (lignite).

http://www.export.gov/china/policyadd/2.%20Peabody%20Presentation%20-%20...

http://community.nasdaq.com/News/2010-11/coal-mining-in-mongolia.aspx?st...

100 billion tons is the estimate in the above story is as big as the coal reserves of South Africa and Australia combined.

I would think the largest limiting factors are going to be less about the quantity of potential resource to be tapped and more about production lead times, declining resource quality, and increased distance of untapped resources from markets. From the OP:

It's also quite possible that China has reached or is very quickly reaching ecological limits to its consumption as well; it may not matter in the short term that Chinese coal consumption is becoming a major obstacle to achieving climate stabilization, but it certainly matters if poor air and water quality constrain living standards in its cities and mining regions. And earlier this year, and now again with diesel shortages, we saw what can happen when robust consumption and growth collide with the physical limits of infrastructure:

http://online.wsj.com/article/SB1000142405274870412560457544917398974870...

Given such constraints it is far from unthinkable that China has reached or will soon reach its maximum rate of coal consumption. Mongolia and Siberia may be rich in resources but they are also remote and in many cases harsh operating terrain, and road and rail infrastructure is poor which will increase the costs of sending coal for Chinese markets. That is also different from saying China is running out of coal to burn, but in itself still troubling. China still has reserves of its own, and imports from Mongolia or elsewhere could add to the mix if the price is right, but the more immediate limit is not reserves but throughput capacity. Further upthread someone used the example of a traffic jam introduced into a free-flowing system with regard to the effect on the economy, which I find appropriate given the ways the Chinese "economic miracle" has literally begun to choke on its own coal consumption (in more ways than one).

If China decides to burn Mongolian coal (and they probably will, despite their enormous Renewables and Negawatts programs), they'd be well-served to build the power plants in Mongolia, as close as possible to the coal, and then just sending the electricity down to the coast, rather than transporting the coal itself.

On a large scale, finding enough water for cooling the power plants in Mongolia may be an issue.

Alan

They can always use closed loop cooling. More expensive, but they seem to have cash to burn at the moment.

How much would that hurt efficiency?

Some, but they could make up for it using e.g. air-blown IGCC to capture more energy with the topping cycle. IGCC would also make it easier to scrub sulfur, which may be more of a political factor going forward.

Not much help if they are using it for steel.

NAOM

deleted

It's hard to see the bottom billion or their descendants in both India and China making it to the middle class. Say 2 billion out of a combined 2.5 billion population staying poor. Come to think of it may be hard for many in the West to remain middle class. Some will say the West has much higher per-capita emissions. Maybe but no western country has such large populations. Those countries did their growing when resources seemed unlimited.

I suspect that every continent has large but overlooked outback coal deposits. Definitely not the low hanging fruit. If the West did get some kind of carbon rationing system it might feel morally entitled to slap carbon tariffs on goods imported from greenhouse rogue nations. It would have to be somewhat arbitrary (say 20% of FOB price) covering everything from steel ingots to call centre services.

Anyways I think short term oil supply problems could restrict long term coal demand. It's hard to see coal-to-liquids scaling up after all the climate conferences. Angry mobs could destroy the facilities. EVs may also increase demand for coal fired electricity, with 40% being the biggest increase I've heard. That's assuming people have the jobs and spare cash to buy EVs. For a while coal exporters will make good money. Sooner or later a general world slowdown seems inevitable.

The Economist magazine had an article on the growing middle class in emerging markets last year.

There are various definitions of "middle class". One definition is that it includes people who have at least a third of their income left for discretionary spending after the necessities have been paid for.

By that definition, over half of the population of China is already middle class. India is not as far advanced yet, but a rapidly growing percentage of India's population is becoming middle class. It takes a lot less money to be "middle class" in a third world country.

In reality, many people in China now have a great deal of discretionary income to spend.

What does that say about the Middle Class in places like Australia, American, and the UK...

It says that it takes a lot more money to be middle-class in Australia, the US, or the UK than in China or India. For the amount of money the average middle-class American makes, the average Indian family could have a nice big house in an upper-class neighborhood with servants to do all the work for them.

I think by the definition of middle class as people who have at least a third of their income left for discretionary spending after all the necessities have been paid for , many Americans and Brits have been backsliding into lower class status in recent years. OTOH, Australians are holding their own, and we Canadians are doing okay, too.

By the same standard, most Chinese and a lot of Indians have become middle class in recent years, and their numbers are increasing rapidly.

Two years ago, I looked at the figures for Chinese coal reserves, production and growth on the EIA's web site. The calculation I came to is that China runs out of coal in 2038.

http://www.theoildrum.com/node/3784/323467

Prof. Aleklett, President of ASPO, has a coal peak around 2025, slide 35:

http://www4.tsl.uu.se/~aleklett/powerpoint/20100609_Aleklett_kva.pdf

He is in Australia right now. Here is his blog:

http://aleklett.wordpress.com/2010/10/29/2003/

In the meantime, I have written a satire:

11/11/2010

Tollopoly on Sydney's orbital

http://www.crudeoilpeak.com/?p=2131

The average BTU content of US coal is falling. No mention of average BTU content of China's coal, or how fast it is changing. Anyone know the numbers?

Nicely put together article Euan

Having been peak oil aware for some time the first time I saw Albert Bartletts explanation of the exponential theory brought it all home from me in that Growth is a dream. ( Remember if CHINA were to suceed in doubling production they will need to dig as much coal every year as they have dug in total for the last 3000 years)

Recently I sent an hour explaining to a work mate who was seriously worried about the rise of the Chineese Dragon and how it was hovering up all the manufacturing worldwide and that we had no future. I used the coal numbers Euan has just gone overagain to explain how coal/energy production in China just cant continue at 10% per anum, doubling every seven years. He got the idea fairly quick but just could not reconsile it with all his experience ( some miracle new suply will come along). Spare capacity in world supply just cant fill the vacuum either. Does any body think Nuclear is seriously going to fill the gap !

Unfortanatly I think China is going to explode after Pakistan and India caused by China, in futile attempt to buy up spare capacity in world coal supply drives the price of coal trough the roof. India being the most depenent on coal imports/price will be hit the first. and hardest.

It is all going to end in one sorry mess.

Hi Rib. How long was your friends attention span?

I am lucky to get 15 seconds before they try to upstage me with meteors destroying all life.

I feel like an alien on a strange planet.

The problem they have is the shear scale of coal production and dependency. Looking at the nuclear numbers posted by Alan up thread, I realise that nuclear will be a sticking plaster on a gaping wound of energy deficit. Tend to agree that China venturing deeper into global coal / energy markets has potential to send prices much higher - then repeat 2008 - OECD losing ground with every cycle.

OECD losing ground with every cycle.

I don't know - peak Chinese coal will cause very different winners and losers. Oil exporters and importers are very different from coal exporters and importers. The US will fare well, China will be slowed. Europe, of course, will be hurt somewhat by either. Australia is helped much more by peak Chinese coal than by peak oil.

I can see the Persian Gulf becoming a significant coal importer. Specifically, Saudi Arabia, UAE and Kuwait (perhaps Oman).

KSA plans to burn 1.5 million b/day to generate electricity in 2020. Unpublished but comparable/capita in Kuwait and the Emirates. At some point (say $195/barrel) the idiocy of this will become evident.

New nukes, yes, but too few and too slow. Some solar PV, but that has not captured the decision makers imagination (wrong IMHO). So new coal. New plants running in 3 or so years after a decision is made.

Add some coal demand in Egypt, Syria and Jordan as well.

Alan

I believe KSA has a lot of NG which isn't being developed because they insist on controlling prices at a very low level, in the belief that this helps domestic industrial production. A very bad idea (on the order of wheat production in the desert), which they are slowly recognizing.

CSP is being developed, as well. I suspect that will do better than PV in the ME.

I'm sure you're right about some coal, though I suspect that coal exports will rise sharply in price, which will slow that down greatly.

Why would Middle Eastern nations build all the infrastructure to import and deliver coal when the region has rich natural gas supplies and much of the infrastructure already in place? Coal to the Middle East seems very unlikely to me.

Coal is the cheapest fuel.

Burning oil or natural gas for electricity is idiotic.

Economics is not the only force driving human behavior.

Qatar and Iran have surplus NG in the Persian Gulf, no one else does. Iraq perhaps a small surplus if they stop blowing up bombs, etc.

Iranian NG has several problems associated with it. Reasons not to rely on it to keep the air conditioning humming when it is 50 C.

Emirates does import Qatar NG, but they use an undersea pipeline although a land one would work as well and be cheaper. It would cross KSA, so spend the extra $ to avoid that.

Several comments indicate that UAE would prefer not to rely on Qatar NG. KSA is unlikely to import much Qatar NG. Loss of face (I guess) and they do not like to be dependent on each other for survival related issues.

Besides Qatar has all new gas projects on hold (last I heard).

Kuwait has imported LNG but no talk of a pipeline AFAIK.

Alan

US produce about half of its electricity from coal and if the Chinese if running low on coal they will rise the price either until demand is lowered or the price become comparable with other ways to generate electricity. The US could be hit really bad.

The US is a net coal exporter. If Chinese demand for coal grows, US coal exports are likely to grow.

If the price of coal rises, it won't raise the cost of electricity to consumers very much. Remember, there's a big price differential between domestic coal and exported coal, largely due to the cost of shipping. Further, even if the price of US domestic coal rises, it won't hurt the US trade deficit. Finally, the US can move to NG and wind power for electricity.

I do not beleive US could move most of their electricy generation away from coal since coal is almost 50% and price is set according to marginal cost not average. Price of coal is global it cost some money to transport but it is not like liquid natural gas.

price is set according to marginal cost not average.

I think you're thinking about spot markets, either for coal or electricity. Most US coal is sold on long-term contracts. And, IIRC, despite deregulation most electricity in the US is still consumed by the same entity that provides it to consumers. IOW, most electricity in the US does not go through spot markets.

Beyond that, I'm not clear what you're trying to say.

Price of coal is global it cost some money to transport but it is not like liquid natural gas.

Rail and water transport adds a substantial amount to the cost of coal. I don't have precise numbers at hand, but US Powder River coal can sell for less than $20, while export coal costs much more than that.

China could wind up being a market for coal from e.g. Alaska, which does not have access to markets in the US Midwest. That's pure export revenue with no domestic price impact.

Helped? Australia will come between a rock and a hard place. On one hand Australia is connected via coal and iron ore exports to the growing economies of Asia requiring increasing amounts of oil along with coal and iron ore, on the other hand Australia is a member of OECD and must save in order for Asia to grow. There will be an oil import crisis. Have a look at Australian oil production graphs here:

http://www.crudeoilpeak.com/?page_id=1225

How long the coal business can continue is another question all together.

I meant that peak Chinese coal would help Australia, while PO would hurt it.

Are you kidding? We're probably screwed six ways from Sunday! Oil won't be available to import, a crash in the Chinese economy will rip the guts out of our terms of trade. In a military sense India has a straight run to our north-west coast if they get desperate and China has a big enough military to practically walk here (fwiw, I don't think either will be interested in military adventurism, as they'll both be too concerned with internal unrest, but as mental exercises go, it's an 'interesting' one). Australia has lost pretty much all its manufacturing capability apart from locomotive bodies (and we're importing those from China now as well) to the point there's probably not a single full in-country supply chain from source to consumer left.

I meant that peak Chinese coal would help Australia, while PO would hurt it.

To me it is all about the exponential function.

In 56 years China's economy is going to be 128 times as big as it is now?

How can I express my reaction to that notion without offending sensitivities?

How about "Hornswaggle"?

I hope Gladys is not offended by that.

If King Coal does not get them with the left fist, then the right one will.

(Metaphor. It is a right-brain thing.)

To me it's all about playing catch-up. After about 60 years of hard work, Taiwan and South Korea have caught up to the economic per-capita levels of old EU nations such as Italy, with democratization around year 40. I expect China to follow much the same pattern, with democracy around 2030 and having caught up in about 2050.

...2011 will be the first year in last 30 with a decrement in electricity production per capita in China. This could clearly wipe out the financial markets even if China will keep a thin GDP growth. I write a comment with evident numbers on "chinese electricity production rate decrement" here :

http://www.theoildrum.com/node/7124#comment-745069

I read an increase in energy efficiency, at long last. An economic positive (reduce input waste), not a negative.

Alan

Isn't that funny? People have a hard time recognizing consumption declines as a good thing.

For instance, US oil imports have dropped sharply. That's partly because of a hit to the US economy, of course, but I see it as a positive.