The Chinese Coal Monster

Posted by Euan Mearns on July 12, 2010 - 10:24am in The Oil Drum: Europe

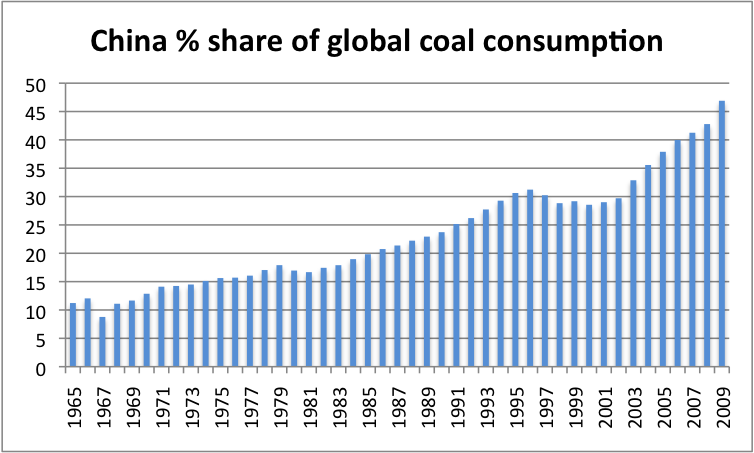

- China set to consume 50% of global coal production this year

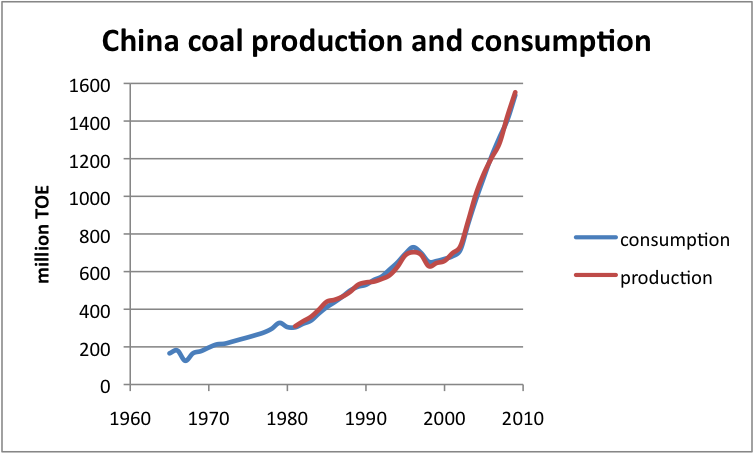

- Production and consumption roughly in balance

- Coal imports used for stock pile growth?

- Consumption growing >10% year on year in line with economic growth

- Rest of world consumption declined 7% in 2009

Figure 1 Chinese coal consumption compared with the rest of the world.

How long can this go on?

Data

Data are taken from the 2010 BP statistical review of world energy - both a priceless but flawed resource. BP provide annual coal production figures in tonnes and tonnes oil equivalent (TOE) from 1981 and consumption figures in TOE only from 1965. Hence to make a production / consumption balance comparison it is necessary to use TOE. In China, 1 TOE is close to 2 tonnes coal - so simply double the TOE numbers to get at the approximate tonnages. Note that the energy content of coal varies by rank and from region to region and conversion factors to TOE vary from 1.5 to 3.

The coal monster

Like everything else in China, coal production statistics are simply immense. China now consumes and produces close to 50% of all the coal in the world. Thus, changes in Chinese consumption and / or production may have a dramatic impact upon the global coal market.

Figure 2 Since 1965, China has steadily increased its percentage share of global coal consumption and looks set to account for 50% of global coal consumption this year. Virtually all consumption is met from Chinese domestic coal production (Figure 3)

Coal production and consumption are in balance

In light of press stories describing rapid growth in Chinese coal imports, I was both surprised and puzzled when I plotted the Chinese coal production and consumption data and saw that these have always been roughly in balance (Figure 3). I sent the chart around the TOD email list and copied to Professor Dave Rutledge at Cal Tech. It was DaveR who came up with a possible explanation.

DaveR pointed out that in countries like the UK, coal stock piles equivalent to roughly 4 months consumption are maintained. If China does similar then stock piles will be around one third of 3 Gt equal to 1 Gt. With consumption growing at 12% in 2009, stock pile growth would need to be around 120 Mt to maintain the 4 month buffer. China People's Daily reported that Chinese net coal imports were 104 Mt in 2009 - barely sufficient to maintain stock pile growth.

Figure 3 Despite stories of ballooning coal imports, China produces as much coal as it consumes. It seems imports merely contribute to domestic coal stock piles.

Global coal trade

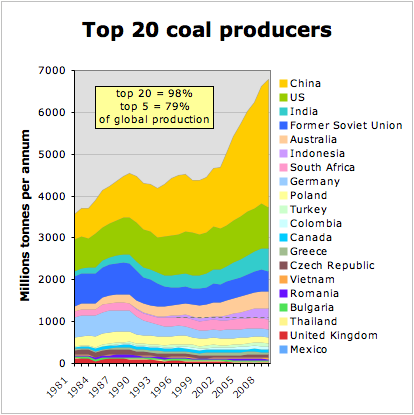

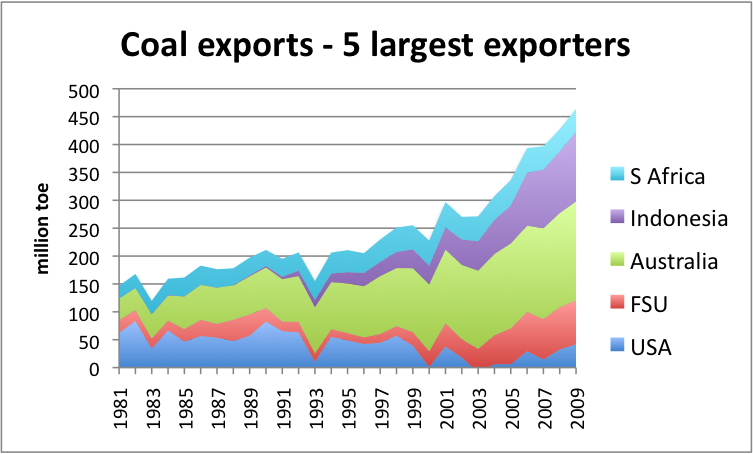

The top 20 coal producers account for 98% and the top 5 producers account for 79% of global coal production. It is therefore possible to get a handle on global coal trade by looking at the top few producers. China as we have already seen is roughly in production / consumption balance, and India is a major importer of coal. The main export nations are the USA, FSU, Australia, Indonesia and South Africa. Looking at the production / consumption balance of these 5 nations shows an export surplus of 450 million TOE (roughly 900 million tonnes coal). Chinese coal imports of 100 Mt therefore account for roughly 11% of global coal trade (contrary to the People's daily report) - and that is just to maintain stockpiles!

Figure 4 The top 20 coal producers. The dashed grey line marks approximate zero growth for the last decade. All the growth in coal supplies comes from the nations above that line with growth dominated by China with contributions from India and Indonesia.

Figure 5 The global export market is dominated by 5 nations. Export growth has come mainly from Australia and Indonesia.

Threat to global economy

Should China ever fail to match coal consumption with indigenous production then 1 of 3 things may happen. The first option is that consumption is pegged back to match stalled production and this would stall Chinese economic growth with knock on effects to the global economy. The second option is that China tries to meet any shortfall buying coal on the international market. As already pointed out China is such a huge consumer of coal this would create great competition in the international market for limited supplies leading to severe upwards pressure on coal prices. The third option is that China somehow manages to install sufficient nuclear capacity to plug any energy gap.

The People's Daily reports a doubling of Chinese coal imports for the first 5 months of 2010 and upwards pressure on coal prices and it therefore looks like option 2 may be under way. Should Chinese coal imports double this year and next then China will be competing for about 50% of the coal on the world market and that may be like a wrecking ball going through the global economy that is founded on abundant and cheap supplies of energy.

Reserves and peak production

Finally a note on reserves. BP report China to have 114.5 Gt of coal reserves. BP in fact report coal reserves figures from the World Energy Council and the figure of 114.5 Gt has been reported every year since 1992. Thus we have the same unsatisfactory non-varying reserves reporting for Chinese coal that exists for Middle East OPEC crude oil reserves. Since 1992 China has produced 31 Gt of coal and the reserves should be reduced by that amount leaving 83.5 Gt reserves as of end 2009.

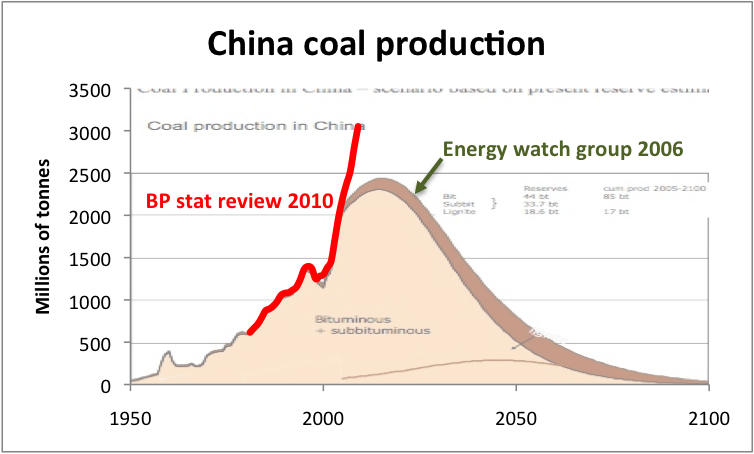

In 2006, the German based Energy Watch Group (47 page pdf) reported Chinese reserves to be 96.3 Gt. They produced a Hubbert curve forecast scenario that has proven to be inaccurate thus far (Fig. 6).

Dave Rutledge is currently estimating 139 Gt for ultimate recovery of Chinese coal. Cumulative production 1896 to 2009 is 51 Gt indicating 88 Gt remaining.

Figure 6 A Chinese coal production scenario produced by The Energy watch Group in 2006 (page 28 of report linked to above) illustrating how difficult it is to forecast production scenarios, especially pre-peak. One possible outcome is that Chinese coal production peaks earlier than shown and then enters rapid decline. Alternatively, substantially larger reserves may produce a taller and broader peak than shown here.

Chinese coal production will peak one day but it is very difficult to predict when that day will come based on these figures. The indications are that China has used about 37% of its coal. It has to be assumed that the best resources have been mined first and that for every year that passes the challenge of first meeting and then exceeding the previous year will become increasingly difficult. But the Chinese are an enterprising people.

Useful links

Dave Rutledge: Hubbert's Peak, The Coal Question, and Climate Change

Richard Heinberg: China's coal bubble...and how it will deflate U.S. efforts to develop "clean coal"

China: Summary of Coal Industry

The third option is that China somehow manages to install sufficient nuclear capacity to plug any energy gap.

The 4th option is to expand renewables to fill the gap or a combination of renewables and nuclear. This seems to be happening

Expanding renewables also expands coal consumption.

And as you noticed, despite growing renewable and nuclear electricity generation the consumption of coal continues to skyrocket.

And it will continue to do so.

This post totally explains why China stonewalled at Copenhagen. THEY KNEW THAT THEY HAD NO HOPE OF CONTROLLING GHG'S

Goodbye 350 Wishful thinking.

One interesting factoid I read (no proof if it is true) is that China's coal mine fires equal the CO2 output of the entire US auto fleet. We could "buy" carbon offsets by just putting out those fires.

I read that too Deadman. Somewhere.

Mind you, let's be fair.

The USA (pop 300 mill) at 4.4% of the global population consumes 25% of the world's oil.

So at this ratio China (pop 1.1 bill) at 18% of the world's population would need to consume 102% of the total Coal.

Let'em catch up surely. Only fair.

(Not sure where the other 2% is gonna come from)

There's a very well presented site on coal seam fires (natural + man-made)

here:

http://www.gi.alaska.edu/~prakash/coalfires/coalfires.html

It's worth noting that the U.S. has it's own share of the problem.

http://www.gi.alaska.edu/~prakash/coalfires/global_distribution.html

So the world as a whole would need to consume over 600% of the total Coal.

Let'em catch up surely?

Chinese production is going to peak somewhen within a decade, followed by world production. That at a point, where the world is probably well beyond peak oil. Ever more economies competing for ever less resources - with paper money whose value is based on the productivity derived from those resources. How will that all work out? We're not the Club of Rome predicting our children's or grandchildren's future. We're talking about things that are going to happen very soon.

Wonder if the U.S. will end up leveraging its much larger coal reserves to get China to relinquish its stranglehold over the world's rare earth metals supply, essential to virtually all cleantech. Ironic...doncha think?

Do they need to ?

http://www.businesswire.com/portal/site/home/permalink/?ndmViewId=news_v...

Sounds suspiciously like PR, the site in question contains only a small fraction of the minerals that would be needed for expected growth in renewables, as well as other technologies that use rare earths (based on my brief discussions with someone working with the White House Office of Science and Technology Policy on the issue now). There are other sites to be potentially developed in Alaska and Canada, but the primary issue with other mines is the project lead times of 10-15 years and ramping up production, while the boom in demand is already occurring.

I'm not sure the 'Boom' in demand is going to be for renewables ...

It would appear the 'Boom' in destructables is going to prove a far

more powerful driver of demand and then development.

http://www.technewsdaily.com/us-military-supply-of-rare-earth-elements-n...

It may be PR, but I don't think it's just PR. The rare earth metals are not really particularly rare. Hard and costly to isolate from one another, but not actually rare.

China cornered the world market simply be establishing themselves as the low cost producer. That's partly a matter of cheap labor, and partly a matter of some admittedly high quality ore deposits. As much as anything, though, it's a matter of loose environmental regulations for discharge of processing wastes.

There are former producers elsewhere who were put out of business by Chinese competition, who could and will reenter the market if prices rise sufficiently.

The US could indeed leverage its massive coal reserves for some of its massive debt to China.

But,

The global export/import market will determine the price of coal. US coal companies will sell to the highest bidder. China has the cash. Domestic coal consumers in the States (electricity generators) will have to pony up.

China coal imports could cause massive increases in electricity prices stateside.

Which could, in turn, prompt further (and massive) growth in U.S. (and Chinese) renewables. Perhaps some silver lining in the situation if China hits peak coal sooner rather than later.

The USGS are currently reviewing US coal reserves. The existing figure I believe is likely more akin to resource than reserve and so I'd expect a substantial downwards revision. Hopefully DaveR will call by later today and clarify this.

A case again perhaps for that useful word 'occurrences' that popped up in an interesting discussion with DaveR on Chris Vernon's recent post http://europe.theoildrum.com/node/6656#more

Clearly, there has been a massive link between China's industrial growth, urbanization and coal consumption. Presumably relative cost structures in China, closeness of industry to the mine-mouth (reflected in transport costs/infra structure, including electrical power generated 'locally' to the mine-mouth), and including relatively low wages of very large numbers of mine workers, will play a part in the continuing relative utility of coal in 'stoking' (or enabling) China's 'growth'?

Reminds me a bit of the UK's Scottish and Durham coal fields (and mining villages) up to circa 1959. We were well-past 'Peak' by then (287 mt/y in 1913), but still produced a very large tonnage; 700,000 miners producing >200mt tons annually for several decades on a highish plateau. If memory serves, coal and in those days an extensive rail network, had kept us nearly self-sufficient in electrical power and heating, before North Sea oil and gas.

Need to check on UK coal production / consumption balance.

Euan, point taken;

if it helps the comparison, UK exported around 100mt/y in 1913, but very little from WWII onwards. The highest UK coal production post WWII was matched by highest consumption (almost no export) around 1957, when production was something a bit over 200mt/y. Thereafter both production and consumption decreased pretty much in line with one another until imports began to appear around 1990. Consumption now requiring significant imports has been fairly level since 2000.

I am indebted for the UK import / export data since 1930 to Paul Mobbs' presentation to a Parliamentary Group and have eyeballed his Fig 5.

http://www.fraw.org.uk/mei/papers/appgopo_presentation-20091124.pdf

Hi Euan,

Thanks for a great post. The US is not particularly well placed as an exporter. Australia passed the US as the world's leading exporter in 1985, and more countries have passed the US since. The export market is mostly low-sulfur, high-energy density coal. In the United States, the Eastern coal has high-energy density, but also high sulfur. The Western coal has low sulfur, but also low-energy density. The Alaska North Slope field has extremely large coal resources, but this land is under federal control, and my guess is that environmental restrictions will greatly restrict its development.

Dave

The idea that renewable energy needs rare earth elements and will grind to a halt without them seems to be spreading around without comment.

Wind turbines do not rely on rare earth magnets. Although some turbine firms are going over to synchronous permanent magnet generators, Vestas, the largest producer, uses asynchronous double fed induction generators that use no permanent magnets. It is likely that there will be a continued swing to permanent magnets while the cost advantage (largely down to eliminating the gear box) exists, but there will be a swing back to asynchronous generators if the costs of rare earth elements rises too far.

Photovoltaic and Solar thermal systems use very few rare earth magnets and the few that they do, such as for tracker motors, can be replaced.

Hydro, tidal and Geothermal systems use few as the the weight reduction that offers substantial cost savings in wind turbines does not apply to these.

Most pure electical cars designs have used permanent magnet motors to reduce weight. This is a particular advantage for designs with a motor mounted on each wheel where the weight of the motor is un-sprung. Although it would be a set back to go back to iron and copper motors I doubt it will kill the idea if oil prices rise high enough.

The idea is that serial production of permanent magnet generators will gradually bring down capital costs by eliminating bulky and costly gearboxes, particularly in larger offshore turbines. At least GE seems to think so, and turbine manufacturers are buying large shares of the California site's production already.

No, not essential and not used in a lot of current generation designs, but wind power is all about the future anyway, and improving the range of designs available beyond current generations. There are alternatives, but they might be more expensive and slower to deploy.

Nd magnets are used in large quantities in today's hybrid-electric vehicles as well as EV's. A Prius contains about a kilogram of neodymium.

I imagine there will be considerable interest driven by the electronics industry as well as cleantech, and, as mentioned above, the military.

Photovoltaic uses indium and gallium, both metals in no great supply. Solar thermal only need something shiny, for the reflection.

Also tellurium.

Indium and Gallium are used in the extremely expensive solar cells such as those on satelites.

Cadmium telluride is used on a substantial scale by First Solar which has about 9% market share. But a 9% share in a over supplied market that grows about 50% per year is something that can be easily missed.

The rest is mostly Silicium. Either mono, multi or amorf. (Sand is SiO2, so we have plenty.)

market share: http://www.photon.de/presse/mitteilungen/marktanteile_10_groessten_herst...

market growth: http://www.photon.de/presse/mitteilungen/solarzellenproduktion_1999-2009...

FS is the only substantial TF player: http://www.photon.de/presse/mitteilungen/10_groessten_duennschichtherste...

34,1% mono Si

46,9% multi Si

9% CdTe

6,1% Amorf Si

4% Other

http://www.photon.de/presse/mitteilungen/anteile_verschiedener_Zelltechn...

*THIN FILM* PV uses Indium and Gallium. Silicon PV uses only the most abundant material in the earth's crust.

And some phosphorus, and boron, and the components of solder (silver, lead, also palladium in some cases). And aluminum is also essential, for frames.

None of these are very rare though, so your point is well taken.

For silicon PV, only thin film cells use indium which is used for the outer transparant outer electrode of indium tin oxide. Thick silicon,

crystalline, polycrystalline or amorphous use thin metal fingers or in the case of Sunpower Corp have both contacts on the back.

Like the argument about rare earth magnets in wind turbines, Indium is not essential for PV. CIGS cells containing Indium and gallium may at present provide a cost advantage but if supplies get scarce, we can go back to silicon with only a minor hit. Indium or Gallium shortage will not bring the PV industry to a halt.

Fair ? Psychopaths driving side by side towards a cliff, whilst killing countless pedestrians and cyclists.

But our saviour is at hand!

And just where is China going to get the land to produce all these renewables?

Agriculture in China

China's land already feeds twice as many people per acre as the average for the rest of the world. But not for long.

Water Tables Falling

With water tables falling and rivers drying up China is just about to hit a brick wall in food production. And yet there are still some people who believe China will use part of their land and precious water to produce renewable fuel to replace coal and oil after they peak.

Yes, and there are still some people who believe in the tooth fairy.

Ron P.

Ron,

I'm playing devil's advocate here, but what has potable water got to do with renewable energy?

1. biofuels

2. hydro electricity

Not all renewables, but some.

Water for irrigation does not need to be potable and a lot of it is not. However a lot of those so-called renewables are supposed to come from biomass. A lot of it does today. Palm oil production, a renewable, is devastating the habitat of the orangutan in Indonesia. They will soon be extinct because of "renewables". Then there is ethanol...

If you were not talking about that type of renewable you should have stipulated only wind and solar. China has already exhausted their hydroelectric power and a lot of what they do have now is disappearing as many of their rivers are drying up.

Ron P.

The actual turbines on wind farms don't take up all that much space. China has vast potential to develop offshore wind and wave resources as well, which don't take up any land at all.

How many wind turbines would it take to replace even a fraction of Chinas coal powered electricity? The answer for them is nuclear and probably why they are building reactors as fast as they can. When you have a billion+ people and are running out of land, nuclear is the answer because of its small footprint and huge output potential.

I do agree that wind offshore would make a lot of sense for them.

You are wrong to make it an "either/or" solution.

Quite frankly, it is "All of the Above".

Wind can come in fast (China is surpassing the USA for new wind), nukes take longer (China asked for international help for nuclear inspectors to assure what is built is safe). New hydro in China is comparable to their nuke build-out (more MW, fewer MWh last time I looked) and they signed a deal for a 2 GW solar PV farm some months ago. New natural gas generation too.

PLUS burning coal more efficiently.

Alan

And they could stand to do a lot more demand side efficiency too, which they seem intent on doing.

I meant to go back and add that.

I think the Chinese premier said that he would use an "iron hand" to force efficiency.

When Chinese Communists promise to use "iron hands", I tend to believe them.

Alan

Chinese wind power will probably see another doubling in the next few years, but I expect it to taper off beyond that. Not because of lack of good wind sites, but just because it won't be cost-competetive with alternatives.

In three years, a lot of new Chinese nuclear capacity will be coming online, and their cost are nothing like those that are bandied about in the West. As they gain experience and advance along the technology transfer curve, I see no reason for them to pull back. In five years, they'll have twice as many new plants under construction as they have today.

Of course, China is hardly putting all its energy eggs in one basket. On the solar PV trajectory that they've been blazing, solar kilowatt-hours will become cheaper than wind power kilowatt-hours in just a few more years. After that, most of their investment in renewables will be going into solar, not wind.

This is good news surely? It suggests that either though changing agriculture practices or diet, the world can feed a few bn more people. The rest of the world just needs to become as good at feeding people as China seems to be.

Well not really. It simply means rice produces more food/acre than wheat or other cereals. We can't simply plant rice in acreage currently growing grain.

But we could eat a lot less animal product and high fructose corn syrup.

China also has lower heart disease and obesity rates than the United States.....

Win win then? Everyone knows the western diet is both inefficient and bad for us surely?

China has endless deserts for solar power, and lots of windy mountains and coast. By the way, it has one of the largest territories of the planet, why would you make such a question?

+1

An interesting note: the more water China pumps from its rivers, cuts it forests, and farms dry land; the more desert they have available to build solar and other renewables. Their desert is growing at an alarming rate. Most likely due to the unsustainable nature of their natural resource utilization in combination with climate changes.

Renewables include biofuel which Darwinian indicates can not be expanded due to limited arable land and depleting aquifers.

Delivered coal price in the U.S. is dominated by transportation, not production, cost. Export to China would impact U.S. prices only to the limited extent delivery is constrained. Powder River Basin Coal costs less than $10/ton at minemouth.

Most U.S. steam coal is purchased under long-term contracts. Raising the spot price has little effect on short-term generation cost.

In Richard Heinberg's book 'Blackout' he mentions that a good reason for China importing so much coal is because it is quicker/cheaper to get imported coal to the population centers on the south/east coast. The large coal fields are far away from where the coal needs to be burned and the transport infrastructure is poor betwixt the two.

You miss the point. China imports hardly any coal relative to consumption.

Euan,

point taken. But are you suggesting that China is unlikely to be able to raise internal production to meet growing demand and thus will be turning to imports on an increasing scale?

The assumption that China will need more coal production or coal imports is based on the premise that economic growth will continue in China. I question that premise. Exponential growth cannot continue indefinitely; we all know that. Hence, at some point the real GDP of China will level off and perhaps decline as coal and oil become more expensive.

I know I'm alone in right field here, but I expect a decline in China's real GDP over the next two years because of financial problems related to their real-estate collapse.

If something cannot go on indefinitely, then it won't.

I imagine there will be a collapse at some point, but predicting timing turns out to be notoriously difficult.

Back about 2001(??) I was studying Mandarin, and I got to the point where we were reading articles about modern topics. I remember discussions which at the time sounded like a housing bubble with people flipping condos and all that. Here we are nearly 10 years later and it hasn't happened yet.

Rapid growth hides a lot of sins. I think it will be a slowdown in the Chinese economy that will trigger a real estate bubble collapse rather than the reverse. In fact a Chinese slowdown will provide a severe test for all of the economic institutions in that economy. It may also test their governmental institutions and put the ideas of liberalization on the back shelf.

I think the causation goes this way:

Bursting of real-estate bubble=>economic slowdown=>further lowering of real-estate prices=>worsening economic slowdown=>financial collapse=>decline in real GDP.

In otherwords, economic decline results from the positive feedback loops of declining real-estate prices, increasing burden of debt, decline in real economy which worsens decline in real-estate prices and so on and on for several cycles until financial collapse triggers a severe recession or a depression.

As a result of decline in real GDP, the Chinese economy may transition away from a market dominated back to the command economy of a generation ago.

Yes, at some point it seems likely China will need to import to satisfy demand and owing to the vast scale of China this will send a tidal wave through coal market. Much will depend on the ability of Australia and Indonesia to raise production - but that will likely require major infrastructure expansion.

I thought their imports were for coking coal - used in steelmaking. Lower grades of coal can't be used for this purpose, but they can be used to generate electricity...

China imports metallurgical (coking) coal from US producers and other countries. Recent world wide demand for coking coal resulted in high profits for US coal mining companies particularly for spot prices. Coke plants usually use a blend of coal types to produce the desired coke qualities. Blends can be modified so diversifying supply sources enables buyers to play one against the other to keep prices lower in longer term contracts particularly when demand lowers. Since many types of coking coal can be used to generate electricity steel demand would have some effect on energy prices. Some coking coal is not or less suitable for electricity since boilers are not designed to use them.

That's been my impression too. However, China Daily reports that gross imports last year were 130 mt, of which just 34.4 mt was metallurgical coal.

The Chinese swing from exporter to importer has indeed had a massive impact on global coal trade. Despite pitiful European demand, CIF ARA prices are now stuck in the $90-100 range, well over double "business as usual".

In addition, it is not possible to buy coal FOB RBCT (South Africa's main export terminal) at the index price, ship it to Europe and sell it at the CIF index price without making a loss. In other words someone else is paying more for South African coal than Europe (it's mainly India actually and China a little). This is incredible given the entire massive South African export business was established almost completely to serve Europe. Europe doesn't particularly need the coal at the moment with gas so cheap and Russian supplies plentiful it is not hurting all that much, although some generators are missing the high quality South African bituminous. And of course quite a bit is still coming over here on "off-market" deals.

Other weird and wonderful things are happening as well, such as Columbian coal going back through the Panama Canal to China and other Asian buyers. A rare of example of inter-basin coal trade and possible one of the first Atlantic to Pacific that I am aware of (treating South Africa as both ATL and PAC).

For those predicting imminent peak, beware. Indonesia is only just getting started and its reserves, although largely unproven are probably humungous. The environmental destruction that will result will see us all weep bitter tears. Less tragically, Australia still has barely touched its reserves, the only thing stopping it from exporting more and more coal is lack of demand.

China probably will peak within decades, but also know that coal is not like oil. There is no pressure drop in each well, one mines the seam until it is complete and then stops. Of course there is still the effect on a regional level of having to move to poorer and poorer quality seams, further underground or with greater overburdens or lower CV, but still, as long as demand remains strong one would expect the bell curve to be heavily weighted to the left. In other words, it will run on for much longer but crash more steeply.

Lastly, if anyone is still reading, Europe needs to be careful of Russia supplies. The only thing stopping the Russians from shipping all their coal east out of Vladivostok has been lack of eastern capacity on the Trans-Siberia railway. However the Russians are working hard to resolve the problems, which could have nasty consequences for European (especially UK/Danish) coal supplies. Also the Russians swing their own consumption between coal and gas, right now they are burning gas and selling coal due to low gas prices. Should gas prices rise above coal that will reverse and a lot of coal capacity will disappear from the world market (albeit that there will be more gas around). This is not as mechanistic as I have made it sound - there is a lot of politics and unpredictable Russian decision making involved.

I think you mean bell curve skewed to right, and I'd tend to agree with that, they will keep production going longer than most believe humanly possible and then a crash - would need much more detailed knowledge of the distribution of their reserves - it seems coal is everywhere at many geological levels.

I think Russia is currently main source for UK coal imports and we / Europe are becoming increasingly dependent upon Russia for energy.

You've got it. I mean the area under the curve to the left of the peak will be great than the area under the curve to the right - i.e. the peak will come at a point of consumption much greater than half way through the ultimate.

For an individual mine, it may well be that production remains close to constant until the end. But there are a multitude of mines, and each will be exhausted at a different point in time. Total coal production is of course the sum of them all, and I suspect you will end up with something similar to the Hubbert curve.

I was under the impression that production can be kept relatively stable with open pit mining but with deep shaft mines there is a discernible decline in production the deeper one goes, and further from the mine shaft one traverses. The rate of production decreases as the mine requires more remedial work to maintain structure and 'habitat'. While this is not completely equivalent to pressure dropping in an oil well, it will impact on production.

HAcland, it rather depends on how the mine is working. In the UK for instance, all our remaining deep mines are single face, and they all suffer a "face-gap" of several weeks when moving from one face to another. It doesn't have to be that way though, it's only because of the dire state of our industry and the precarious financial situation of UK Coal (along with very patient and forgiving customers). In most places the next face will be cut and prepared before the last one has been mined out, and the transition will be fairly seamless (please ignore appalling pun).

Of course the deeper one mines the more expensive it is and the more maintenance that is required, and energy to transport the coal out, but that in itself does not necessarily mean a drop in output, just the need to invest more and spend more.

Maybe the equivalent to oil would be the use of seawater injection.

ericy, I agree that we will see something roughly in the shape of a bell curve - of course not all the mines in the world will be be exhausted at exactly 12 noon on a given date.

I just think there is far more potential for the bell curve to be skewed (whichever way you describe it) than there is with oil so that the decline on the right hand side is much steeper than the increase on the left, i.e. so that it doesn't peak until well after half of ultimate is used.

Hi Hoover,

"Australia still has barely touched its reserves, the only thing stopping it from exporting more and more coal is lack of demand." I had the impression Australia is using its export terminal capacity 100%. If Australia wants to increase its exports, it essentially needs a whole new port and railroad connections to it. This is a 10-year, multi-billion dollar project.

Fair point and quite right.

I guess my main point was that Australian coal reserves are still massive and the potential to increase supplies still huge. You are right that the physical logistics capacity isn't there in either rail or port slots right now, and yes that has been the limit not demand as queues of 60 or more ships outside Newcastle can attest, although those days have gone.

Ultimately though, that capacity can and will be built and there is nothing really to stop much more coal from leaving Australia and the same goes for Indonesia.

Is this a small side effect of de-colonisation.?

I don't see how the loss of access to 20% of the worlds rescources (Africa) will pass unnoticed.

Europe's guilt orgy handed Africa to the Chinese.

We had the most magnificent railways in the world.

Arthur, personally I don't think so, although it could be open for debate.

Richards Bay handles nearly all the coal exported from South Africa and it wasn't built until the late 70s, well after South Africa had become fully autonomous. I think it's just a reflection of competition and commercial reality - in the past there was no way that India and China could afford to pay to import coal. Now they can and so they are competing with Europe for those resources.

Another Option - Burn Coal More Efficiently

http://www.nytimes.com/2009/05/11/world/asia/11coal.html

China is building about one 44% efficient coal fired plant/month. (World's best are at 45%) and trying to replace, or at least mothball plants in the 27% -31% range.

Same electricity, less coal.

Best Hopes for Light Green Strategies,

Alan

PS: Since "we" are going to be burning coal for a long time for electricity, why not burn it as efficiently as possible ?

I have no doubts we will burn coal until its not economical to mine it any more... Global warming? please...that is what central air is for!

Eh. I've been trying to figure out where I am going to move to when I retire.

Now I know it's going to be north and inland.

I use to recomend Sweden and our neighbours. Please move earlier then retiremet and backpack some knowledge and intellectual properties like a business ideas and preferably a manufacturing line for some electricity intensive goods or an interest in farming or forestry. Finding a job in Sweden is basically enough for migrating here, this opportunity will hopefully stay open a long time but it is very hard to predict the future.

That is why it is a given the survivors (if any) will need to sort this out on the other side of the wall we will crash into.

This is pure madness!

Just as an exercise, suppose that in a few years (2015 ?) half of the GWh of Chinese coal fired generation came from their standardized 44% efficient plants (which replaced generation from the least efficient, say average 30%) and the other half of the GWh came from 32.5% efficient plants (comparable to US average).

How much less coal (in %) would be burned ?

16.5% less coal would be burned.

This is the quickest way to significantly reduce their coal consumption.

Using the SWAG #s above, a 100% 44% efficient coal fired generation would reduce coal consumption by 29% for the same GWh. (The second half displaces more efficient generation).

Best Hopes for Practical Solutions,

Alan

however, with GDP rising at near-double digit rates, so is the demand for electricity. Result - net increase in coal consumption by 2015.

China will continue burning coal as fast as it can dig it out of the ground.

Alan,

I read the claim that they have developed production capacity of 3.6 billion tonnes coal(a bluff perhaps?), so enough for a couple years economic growth above current usage ca. 3 billion tonnes. I suspect the central planner for energy has to look at it as you are saying, how to stretch out the available capacity (can they increase it?) to maintain current growth in usage for x years without expensive imports, they know how much is on the free global market so that must worry them and the costs and time to invest in export countries similar to nat gas and oil countries they invest in with concomitant political sensibilities. So, yes, get rid of inefficient plants and replace with efficient ones. However how many plants do they have and how much do they need to replace at what rate to make up the gap in supply that is coming on them in 2-3 years? And after they have converted all of them they have a 1/3 more supply freed up which has oif course by then alreaady been consumed by new growth (Jevons principle). So really they are running to stand still. This is similar to USA in 80s with switching to NatGas. Eventually they will do that too, after coal is tight. that will then make enormous price problems in the LNG and piped gas market, not to mention price pressure in Uranium coming along. The total enrgy needs of China just keep growing and the mix will change, but a constant growth at this pace will just outstrip what is poissible to supply on the world market for all fuel types unless their economy crashes, which is increaingly likely, as with japan in 1989, who would have thought it possible?

Agree entirely that efficiency is King - I think they need to go furher and use waste heat some how also.

USC(ultrasupercritical) is an awful idea.

The plants use hard coal will burn thru high rank coal quicker.

These ultrahigh temperature plants run best at +80% capacity factors which mean they have to run like nuclear plants running 24/7. We need to replace fossil fuel with wind and solar and make coal a backup fuel.

They will be much more expensive to later convert to CCS than IGCC which has about the same in efficiency as USC.

Denmark has 3 400MW USC boilers(they run coal boilers in tandem with natural gas boilers to get high efficiencies of 47%).

Supercritical plants are considered more risky than subcritical PV plants and ultrasupercitical are generally regarded as experimental. There are 86 GW of supercritical coal plants in the USA with 1 more in Texas being planned and some older ones are being closed down.

The US is choosing to use up its lower rank coal and looks to IGCC for efficiency.

Coal importers find USC attractive as a replacement for old plants.

Japan has a 30 GW of supercritical plants and a 600 MW USC boiler.

Germany has 5 GW of supercritical plants with four 800 MW USC plants in Germany.

China has 8 new 1000 MW USC boilers now maybe 10 GW of SC.

The Chinese will not build IGCC until after 2020.

http://gcep.stanford.edu/pdfs/RxsY3908kaqwVPacX9DLcQ/niweidou_coal_mar05...

Korea has 10 GW of supercritical/USC boilers now.

USC is less expensive than IGCC but does nothing to control emissions.

There are places for USC, including the USA.

Example Kentucky, about 93% coal fired electricity, hydro most of the rest. Even some aluminum smelting there (almost last in USA). Produces about 10% of US coal.

No wind potential, very limited solar PV, state law forbids nukes (coal industry political influence). LOTS of undeveloped small hydro, but 15% hydro would be a stretch. Even if law is revoked, new nukes there are decades away.

Why not build USC coal generation in Kentucky, enough for base load, and hope to retire them in 30 years ? Use pumped storage for both storing excess imported wind and for peaking ?

IMHO, Kentucky will be burning coal for at least that long, no matter what. Why not burn less ?

Alan

BTW, please contact me Alan_Drake at Juno dott conn (change to standard form).

Actually Kentucky is better for IGCC(~45% thermal efficient with no CCS) but with CO2 burial in saline aquifers, coal seams, etc.

Another advantage of IGCC is it uses 75% of the cooling water that pulverized coal technologies like USC(more AGW drought resistant?).

IGCC also produces syngas that can be piped to natural gas-loving, decentralized CHP plants.

http://www.netl.doe.gov/technologies/coalpower/gasification/pubs/pdf/Wat...

Kentucky produces .1 billion tons of CO2 per year from 50 CO2 sources. It has between 8 and 30 billion

tons of CO2 storage capacity.

http://www.netl.doe.gov/technologies/carbon_seq/refshelf/atlasII/2008%20...

It is insane(or irresponsible) to contemplate expanding coal use at all without requiring carbon sequestration on new plants.

First, you have to get away from the idea of increasing centralized power ad infinitum.

I'd like to see a LOT of rooftop solar(excellent for peaking). Kentucky gets a respectible 4.5 kwh/m2-day

of insolation.

http://www.kysea.org/clean-energy-resources/solar

Kentucky could also produce LOT of sustainable biomass (25 million tons) which could be conceivably co-fired with coal---but not in UCS(hard coal only) or converted to cellulosic ethanol(at 80 gal/ton).

http://www.energy.ky.gov/NR/rdonlyres/EB1A582B-7FC4-440D-A697-D673929A5B...

However to make renewables economic we must charge a hefty carbon tax. A $43 carbon tax($12 per tCO2) would

be the same as an addition .4 cents per kwh.

In the Kentucky area the levelized price of solar is $.20 per kwh and falling.

The real problem is that Kentucky's politicians are owned by Big Coal(production about 120 million tons per year) and Big Coal don't want to see anything making their favorite fuel less desirable.

A very similar situation to sun rich, biomass rich, CCS rich, and fossil rich Louisiana but rich also in Big Oil politicians, IMO.

You know it doesn't work out that way. Try this instead:

Yes, certainly. But 44% is not "as efficiently as possible". That's what supercritical steam plants can manage, and they're admittedly the "state of the art" in terms of mature technology that can be deployed today. However, not too far away are plants that will manage 75%.

The technology for 75% efficiency is coal gasification to produce synthesis gas, which fuels a gas turbine with a bank of SOFCs as the "combuster", with a conventional steam bottoming cycle. The SOFCs deliver about 50% of the fuel energy "off the top" as electricity; the combined cycle gas turbine then converts about 60% of the remaining 50%. That would be 80% net -- except that the gasification and clean up take a tax.

I don't know how soon this technology will be ready for rollout. DOE investigated it years ago, built a prototype, and concluded that the technology was "promising". But then (AFAIK) they didn't follow up. They may have felt that SOFC technology was not yet up to the job. In any case, the focus was put on IGCC. I suppose it was felt that any progress in gasification and cleanup technology for IGCC would automatically carry over to the SOFC-GT option.

Before you conclude that China is going to use its dollar reserves to import coal from the US and drive up the domestic cost of electricity, consider a few basic facts:

Coal is not oil. The energy density per pound of Wyoming brown coal,which constitutes the majority of US reserves, is about the same as oak fire wood- 1/2 that of high grade coal. Rail transport to the Midwest or Southeast where the current generators are located already costs as much as mining the coal. US reserves numbers are largely fictional. On the same day the governor of Wyoming repeats the "200 year supply" mantra, his chief geologist estimates a 37 year supply.

As an export commodity, coal will continue to come from a country like Australia where reserves are far greater than domestic needs and land transport distances are reasonable.

Just imagine the number of VLCC ships to transport such low density coal across the Pacific continually. The higher the energy density and the closer to Asia it is the better. Otherwise shipping construction will boom and rates will go way up in the meantime.

What happens in Chinese coal cannot meet demand ?

We know last time what happened when the grid fell short of demand. Factories turned to diesel generators to cover rolling blackouts. World demand for diesel spiked.

Post-Peak Oil that new demand will be "interesting".

"May you live in interesting times",

- An old Chinese curse

Alan

My recollection of the ancient Chinese curse is that it goes:

"May your children live in interesting times." Or, in other words, not only are you cursed but so are your children for all of their lives--a stronger curse than the version you quote.

Longer version:

"May you live in interesting times,

May you come to the attention of important people,

And may you achieve your heart's desire."

Or not: http://en.wikipedia.org/wiki/May_you_live_in_interesting_times

posted in error

I can't believe there hasn't been a single mention so far in this thread of the most obvious substitute for Chinese coal (aside perhaps from nuclear), if and when the Chinese should need it.

Natural gas.

India and China Will Soon Produce Natural Gas From Shale

In addition, they've got the Russians to the north, who are awash in natural gas, they have recently started importing gas via a new pipeline from the Caspian region, and last but not least, plans are afoot to build a gas pipeline from the Horn River and Montney shale areas of NE British Columbia to a new LNG plant in Prince Rupert. No doubt they will import LNG from other areas, too.

Well for us to be able to consider this seriously we need to know how many long horizontals in shale gas plays are required to substitute for coal and how many kms of pipeline will be needed and how many CCGT's?

Its easy to say "lets just use gas" - but in the real world, how practical is it?

I don't know what those numbers might be, but I hope you don't seriously think it would be an obstacle for the Chinese. Here is a nation which, in just the past 20 years or so, has built hundreds (thousands?) of miles of freeway, builds high-rise offices and apartments the way Americans build single-family houses, are now the world's largest automobile manufacturer, and so on, and so forth. If it was practical and/or desirable for them to construct them, they will do it.

Australia's current 'get the money' attitude to coal exports could be tested if the Greens Party does well in the election likely soon. It is hypocritical if not weird to talk about domestic carbon caps then export 4X as coal to countries with no carbon qualms eg China. The Greens proposed domestic carbon tax of $20/tCO2 in effect adds 2.4 X $20 = $48 to a tonne of thermal coal. If levied on export coal, spot price around $100/t it would increase the price about 50% so it probably won't happen.

An odd development is that for the first time pelletised brown coal will be exported to Vietnam which used to supply coal to China. Only 20 Mt at first but Australia has centuries of brown coal. So Australia is like a vegetarian working in a slaughterhouse; we say one thing but practice another.

And the money is wasted on yet more carbon based, oil dependent projects, continuing the vicious cycle:

19/6/2010

M2 widening: Primary Energy Dilemma for cars

http://www.crudeoilpeak.com/?p=1631

1/3/2010

Hunter Expressway: yet another peak oil ignorant project

http://www.crudeoilpeak.com/?p=1203

The possibility of China's (and the world's) economy collapsing and ratcheting down coal use is a feature, not a bug.

When your accelerator gets stuck and you're heading for a cliff, turn off the engine.

"china coal embargo" has a nice ring to it.

just saying.

Man, it's hard to know what to hope for these days. This would mean appalling suffering and death in China I would imagine, assuming civil war and probably famine? Yet, I could cheer for the relief of CO2 emissions.

Still, one look at the graph and you know the reckoning is unavoidable.

It's useful to look at how coal is used in China to assess what future demand may look like. Unlike the US, less than half of China's coal is used for power generation, so while important, electricity demand is not the sole driver of coal demand. China uses almost half as much coal for coking to drive its huge iron & steel industry, so that portion of demand will depend on the outlook for steel, half of which is now used in buildings and infrastructure. Also unlike the US, China devotes a lot of coal use to district heating ("other transformation" in the graph) in the northern cold climate zones, and that portion is expected to grow only modestly as building reforms increase the efficiency of heat use in buildings. For direct end-use of coal, that is almost all in industry, particularly the cement industry (residential use has fallen to about 80 million tonnes).

Given many saturation effects driving both construction and end-use of electricity by 2020, we don't see coal continuing its dramatic rise of the last few years. 2010 probably marks the peak of cement production.

Under a depletion curve defined by China's declared 189 billion tonnes of reserves from the 2003-2005 National Resource Survey, China is currently on what I call a "sharp peak" production profile that could reach 3.6 to 3.8 billion tonnes, but not for long.

The units in the following graph are in China's standard measurement of "tonnes of coal equivalent" where 1 tce = 1.37 tonnes raw coal.

Thanks very much for this - it makes much sense. Presumably commercial, industry and agriculture are using coal for raw heat.

When you say "we" what is your source?

Chinese agriculture has used urea (nitrogen fertilizer) produced from coal in most regions, because they are 'coal rich' and 'nat gas' poor. There has been some some shift in relative cost structures and internal trading of N fertilizer within China, and some shifts in the balance of the use of coal and nat gas.

Making fertilizer from natural gas would seem to be the first use of increased NG (pipelines from Central Asia and Russia, LNG imports).

Coal is NOT just carbon, but a mixture of hydrocarbons. A source of hydrogen, but not nearly as good as CH4 !

Best Hopes for Low Hanging Fruit,

Alan

It's a lot more complicated than that. NG is the main fuel for fertilizer production in Sichuan, China's original NG center, but given the concern for food security, fertilizer prices are kept low through keeping the price of the raw material low, and pipeline gas and LNG are far to expensive to use in that manner. Though coal is less efficient than NG, China has made some great breakthroughs in coal gasification that now allows them to use a variety of lower grade coals instead of the single grade that previous gasifiers had required. Gas is prioritized for residential and commercial use and demand far outstrips supply at this point.

This is work we do in Berkeley Lab's China group; we've been working with China on energy for about 22 years now.

Sparaxis,

Can I give a little vote of thanks to your China group.

Particularly for:

The China Energy Primer

http://china.lbl.gov/research/china-energy-databook/china-energy-primer

China’s Coal: Demand, Constraints,

and Externalities

http://china.lbl.gov/sites/china.lbl.gov/files/LBNL-2334E.pdf

Energy Use in China: Sectoral Trends and Future Outlook

http://china.lbl.gov/publications/energy-use-china-sectoral-trends-and-f...

and the CD of the China Energy Databook.

(I'm afraid I'm a dreadful data nerd)

BobE

BobE

Thanks for posting that. I would like to add my appreciation of the group's work.

Agricultural fertilizer in China is a bit of a footnote in the context of overall coal use, (this interesting post by Euan) but I would value Sparaxis opinion on the brief analysis that I quoted in my guest post on ToD March 10 2009.

The article I quoted from is at this link, and I quote further below:-

http://www.marketavenue.cn/upload/articles/ARTICLES_1384.htm

Sparaxis, Bob and Phil - thanks very much for these contributions, I learned lots - including how little I know.

Sparaxis - on your chart, is the top "blue" band agriculture or industry? (I'm a bit colour blind). I'm guessing industry, and that fertliser production uses little coal? You know, if you ever wanted to write a guest post all you have to do is conatct prof Goose or Gail.

Phil - sounds like you already did a guest post - you have the link?

Euan,

The big blue band is industry. There appears to be a very thin line of purple at the top which is agriculture.

I would agree about welcoming a guest post from Sparaxis. Thanks for all your contributions!

Glad to contribute. Globally, fertilizer is supposed to take-up around 5% of all NG usage. Agriculture's use of coal in China, as you say, looks from the chart to be very small compared with massive consumption for all purposes.

It is a bit buried in my guest post of last year, but I did a brief section on N fertilizer production and included what had been for me an interesting revelation - that urea had been produced on a large scale from coal in China.

http://www.theoildrum.com/node/5181

I went on to say though

Bob,

Thanks for the links. I read a lot of those PDFs and they fill in a lot of the blanks. Apparently China is a maturing economy. As the population stops urbanizing and everyone has their AC, etc. growth in electrical should slow down considerably. Efficiency is a help in e.g. fridges but people just get bigger fridges (according ot the report they were quite thorough on residentila use bby appliance). Office space growing like crazy and there and in older schools and hospitals AC and heating being installed growing energy usage, also heating in the south where they never used to have it. Lesse usage of AC and heating in rurtal areas, also other appliances, lots more biomass usage, noncommerical but common electrical zusage has surpassed biomass despite the larger rural population (725 million rural vs. 650 million urban).

All sorts of infos on coal coming from north to south on trains and displacing other goods to trucks, increasing diesel use or the idea of sending coal by wire (as electricity) to the south. Electricity is of course cheaper nearer the mines. The regulatory framework has changed over the last 20-30 years for electrical prices, coal and oil and gas prices to be more market oriented.

The buildings in China leak heat like crazy. Lots of room for efficency if they can just get up to Japanese standards. Also industrial production of cement and similar is more energy intensive than in Japan (nice tables on that point). So China has lots to do in terms of making thmselves more efficient but usage just keeps growing as they urbanize and build out standard of living to western levels for lots of high energy stuff, AC, fridges, heating. The transition beyond coal seems pretty hard as no alternative can keep up in any way as the report on coal shows. I suspect a big crunch will come leading ot a 70s style efficiency drive with smaller high efficiency appliances, buildings getting weatherized and bikes becoming very faddish if not mandatory. They can turn on a dime I hope.

A large enough recoverable shale gas resource base to have some left for electricity would be very good. Idem if they would be able to proportionally match what the US recovers from coalbed methane. Still you would logically not expect that to happen on a larger scale until the country has solved the transport fuel riddle or needs natural gas generation for load balancing purposes.

Quoting from memory, new build seems to have been below plans in recent years, as existing plants struggled with prices and access to CNG supply, and I couldn't find any big announcements of intent for the near future. Thus coal generation would continue to match marginal demand for electricity for the time being.

Roughly in agreement with Alan's earlier comments this would require subtantially more of it than provided for in the demand graph above given medium term socio-economic momentum and current income at 7 to 8k international purchasing power parity dollars; even if providing for efficiency gains.

Provisional thermal electricity statistics for this year (close to the bottom of the link) back up the claim. Noteworthy here is the bump same time a year ago and how it has been shrugged off.

Curiously enough, my expectations were similar to the graph value for 2030, as I had speculated on a peak for coal based electricity before ten years time and roughly a plateau during the twenties with other generation taking over market share. Without having a clue on the actual efficiency distribution of additions and assuming close to optimal, I get a ceiling near to a two thirds increase in electricity coal demand over 2009. With recoverable reserves figures mentioned herein, China would then have to be in the process of obsoleting coal usage in twenty years time.

Like a volcanic eruption shutting down.