Half a trillion barrels more than we thought? (Or, "The Tupi Field, the Pre-salt, and the Very Distant Future")

Posted by Euan Mearns on October 13, 2009 - 10:20am in The Oil Drum: Europe

At the end of the first day of the ASPO conference in Denver, we were treated to a fantastic presentation on the oil potential of the sub-salt basins on the margins of the South Atlantic Ocean given by Dr Marcio Mello who presented the evidence for a half trillion barrels of reserves in this new frontier province. So has a new Saudi Arabia been found?

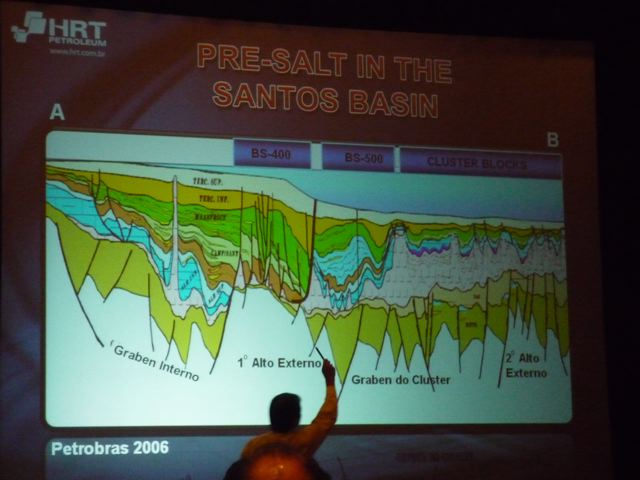

Marcio Mello is president of HRT Petroleum, a Brazillian geological services company. Dr Mello's talk began with some background to the Tupi discovery in the Santos Basin, Brazil, and went on to extrapolate the geological and petroleum systems of Tupi to basins off southern Africa, the Amazon Basin, The Gulf of Mexico and The Congo Basin.

Dr Mello explained how the discovery of "diamondoid" structures in oil at shallow depth in Brazil gave evidence for mixing two types of petroleum, one that must have been formed at great depth below the Salt that blankets this basin. He had for many years tried to persuade Petrobras to drill deep, into the sub-salt strata, which of course they did eventually do leading to the discovery of Tupi.

The Tupi Field occurs in limestone reservoir at extraordinary depths of around 6000 meters beneath a salt layer that is around 2000 m thick. At such depths, temperatures would normally be too high for oil to survive but the secrets here are a combination of deep water and the conducting character of the salt which results in hot but tollerable temperatures at these great depths where the drill bit has proven intermediate grade crude oil to exist.

The geological story

The story starts during the Early Cretaceous when the continents of S America, Africa, Australia and Antarctica were joined in a supercontinent called Gondwanaland. A series of deep lakes formed along an axis of rifting that would eventually lead to the opening of the Atlantic Ocean. This is a tectonic setting similar to the East African rift valley. High levels of organic productivity lead to organic rich shales forming on the Lake bottom that were destined to become the source rocks. With progressive rifting the sea eventually invaded the rift valley lakes and an elongate shallow sea formed in which limestones were deposited. This is a setting not unlike the Red Sea today. The limestone, sitting on top of the organic shales, were destined to become the reservoir rocks.

And then something unusual must have happened to limit open access to the oceans, and with high evaporation rates, saline water built up in this shallow sea leading to the deposition of a very thick layer of salt, which formed an extensve seal, across the seabed.

The perfect geological storm

With progressive rifting, S America was eventually separated from Africa and the Atlantic Ocean began to open. The rift valley strata of black shale, limestone and salt was buried beneath sand and mud eroding off the newly formed continental margin and was buried to great depth, heated and squeezed. Eventually the source rocks matured and oil formed but with the extensive layer of salt above it could not escape and gathered instead in the limestone reservoirs that have now been drilled and called Tupi, Jupiter, Iara and Guara.

A mirror image in Africa?

When the continents split apart, roughly half the rift basin strata followed S America and half followed Africa. Dr Mello then went on to speculate that a mirror image of the Santos Basin may exist on the African side. I believe it has already been identified on seismic. Somewhat higher heat flows on this side would likely mean a gas and condensate play instead of oil.

Mapping oil seeps using satellites

Dr Mello also presented data acquired by satellites that could identify and map ocean surface oil slicks, formed by oil escaping from sub-surface reservoirs. Mapping these slicks with time allows the source on the seabed to be located and if this lies above a geological structure this may suggest a mature petroleum system below. A case study from the Cantarell Field was presented along with prospects mapped in this way from the deep water in the Gulf of Mexico.

500 billion barrels of reserves?

Dr Mello's talk was extremely slick and enjoyable. One has to remember he is a salesman as well as a scientist, accustomed to selling his ideas and reports to the oil industry. He speculated that the sub-salt basins on the margins of the S Atlantic together with the Amazon and Congo basins may contain 500 billion barrels of oil. So is this our oil supply problems solved? If he is right, then another Saudi Arabia may be found, but in much more hostile environment.

Cautionary notes

With a world economy intolerant of oil price >$80, there is a major question whether these ultra deep fields can be developed and produce oil at a price the world can afford. In the future, when our economy has adapted to a higher energy price environment and we are desperate for oil, then it seems likely that they will be developed one day. Indeed Tupi is currently on an extended well test.

Oil seeps sometimes are and sometimes are not good indicators of oil fields below. Explorationists need to be optimistic and there will ineviatbly be many disappointments in the years ahead.

Much of Dr Mello's presentation was extrapolation and speculation, but I will not be surprised to hear about a string of new discoveries from these plays in the decades ahead. 500 billion barrels will likely prove to be a wild over-estimate, but I do suspect that oil from the sub-salt will help soften the decline curve of future global oil supplies.

There is the ever present question of ERoEI, and Professor Hall was on hand to volunteer his services in exchange for a few barrels or their proxy - $$. Personally, I'd guess that ERoEI will not be an issue here since 20,000 bbls per day from single wells represents a very high flow of energy.

It will be many years before significant production volumes comes from the Santos Basin and this will not impact near term oil supply issues until at least 2020.

Finally, Dr Mello seemed very surprised to learn during the Q&A that 500 billion barrels was just 15 years global oil supply.

Euan, Thank you for the interesting article.

In both your lats, and fourth-from-last paragraphs you say 500 trillion barrels of oil, vice 500 billion.

I changed it.

But what are orders of magnitude among friends?

;-)

Excellent post Euan.

The 500 billion barrel number is an optimistic estimate of a known unknown. Good for raising capital.

The most important point you make is about the cost of extraction. Is ultra deep offshore Brazil equivalent to an underwater Canadian oil sands?

Yes, there is a lot of hydrocarbons there. But, as you point out, the cost floor is extremely high ($50-$70 maybe higher) and the tolerance for consumers to bear high prices may only be $80 per barrel.

The bigger issue is the oil accordion.

Now the economy can afford $100, yet oil companies require $60.

In the future the economy will be able to afford $90 and oil companies will require $70.

Then, $85 vs $80 etc.

This inversion may not be that far off.

In the last 12 months, the world has been well supplied with oil, so that a very small reduction in consumption could and did result in a very large price reduction. In 2,008, world oil consumption dropped by only 0.6% according to BP statistics. http://www.bp.com/productlanding.do?categoryId=6929&contentId=7044622 However, if we had a serious supply, problem, there would not be ceiling on the price of oil. It is essential for too many processes in our economy, and those who are still working and producing will pay the market price.

"""In the last 12 months, the world has been well supplied with oil, so that a very small reduction in consumption could and did result in a very large price reduction. In 2008 world oil consumption dropped by only 0.6% according to BP statistics."""

The we can assume small supply drop would have the opposite effect. At $80, $90, $100bbl or more, could deep water oil fields such as the South Atlantic be produced with a profit? It is very easy to envision prices high enough to support this development. If prices are raised in a planned, slow, controlled fashion, the economy will adapt. If we 'let the markets decide', we're boned.

I think there are both short term and long term "accordion" problems. What actually happens to economies when the price of necessities increases beyond their ability to make profits from them, the EROI threshold, is that businesses quit operating.

Exceeding that sustainable price for businesses and consumers with inflexible high overhead just cuts them out of the markets.

The way markets allocate resources there are two 'dieback' options. When supplies are inadequate you either shed parts so the food chains just gets leaner, or you shed whole food chains. It's like "wilting".

I think the latter is what we just saw last year, that speculators had found the supply of necessities insufficient and bid up the price till the economies shed enough demand. That was large sectors of old growth economic food chains and many millions of people turned marginally unproductive by it.

In the long term, if we avoid these short term risks of real whole system collapse, there's the continual slow improvement in the productivity of technology and economic systems to steadily lower the EROI the economies can afford. That learning takes time, though (improving ~1.2%/yr at present), and having an economy not able to wait as ours seems to be, could be fatal.

One thing I'm trying to figure out:

Good evidence has been presented for "vast" oil and gas resources - thinking shale gas and sub-salt. But the cost of development is high - maybe higher than the configuration of the global economy can curently afford to pay. So you bring on significant high cost production, and no matter what happens the result is a drop in price - either through the increase in supply or high price killing demand, resulting in recession, and the high cost production becomes uneconomic and gets shut down - leading to higher prices.

The oil accordian?

Euan -- "Oil Accordian". Sounds like a better title then any other I've seen. In my mind's simple eye it does capture the dynamic nature of the relationship: Diametric but an absolute and unseverable connection. Perhaps we'll chat about the AO aspect of PO ASAP before TSHTF. If that's OK with U.

Is the "oil price accordian" partially due to the mismatch in the way supply and demand evolve? Changes in supply tend to be discrete incremental steps (see below) whereas changes in demand tend to be smooth (growing with population and income) with very rare step changes.

The accordian results from the required price per barrel to justify supply costs forming a stairway pattern as new frontiers are reached? As demand grows relatively smoothly to justify transition to each step, some of the supply steps are found not to be so fruitful or cannot be brought online at a quick enough pace.

1. Land based: $10.

2. Shallow offshore: $15-25

3. Enhanced onshore: $30

4. Enhanced shallow offshore: $40

5. Deep offshore $50-$70

6. Oil sands $60-80

7. Ultra deep offshore: $70-$90

How will they know when to develop deep offshore oil if one month the price is $120 and six months later its back down to $70, then six months after that back to $140?

Oil producers can lock the price in at any time they want with futures.

Unless who ever holds the futures goes bankrupt and goes to Argentina...

Buster -- Locking ina price doesn't guarentee a profit...just the price that you'll sell th oil for. For every $ made on an hedge a dollar is lost by someone. Long term develoment projects are judged based upon a price model for the price of the project. Granted accurately predicting such a model is damn near impossible but that's how it's done regardless.

Not just that, but to do any selling (or buying for that matter) beyond the first couple of months out is going to be hard. The liquidity simply isn't there.

One contract is for 1000 bbls

If you produce 100,000 bbl/day you have to sell 100 contracts per day / 3000 per month. When you go past May 2011 you would be the entire open interest--> severely depressing prices.

Hedging works if it is relatively close to the current date and if your quantity to be hedged is relatively modest compared to the outstanding hedges.

Rgds

WeekendPeak

All of the preceding comments from Nate's onward illustrate the failure of the current cash- flow pricing model. It simply doesn't work any more.

At $90 a barrel, all profit resides with the producer, the refiner is underwater, the retailers and other users who kick small profits to the refiner (or producer if it is an integrated company) are squeezed out. Economy of scale cannot take place; there is no downstream income for marginal participants. Right now, these are going under @ prices far less than $80 a barrel. $40 a barrel is fatal for businesses whose productivity is structured around a lower price.

Oil will sell @ two hundred dollars a barrel, but not as motor fuel, or for recreation, for convenience, for waste and 'cruising' and the other uses that are economic only at a very low wellhead price.

Oil will be a chemical feedstock and high quality lubricant. It might be priced at $500 - 1000 a barrel and be a bargain. Oil might contain a cure for cancer or propel a space ship to Mars. It won't fuel jalopies in Ukraine or SUV's in Kansas ... or in Brasil. It will be too expensive. Welcome to the new oil age.

At the same time, oil at high prices cannot equal an economy. France's economy is not supported by wine at high prices, but by the productivity of its citizens leveraging cheap crude. Brazil (and other high- cost producers) have what else to offer besides (potential) crude, exactly? ...

Exactly, not much, and that is a big problem for Brazil ... and Canada and others stuck with the high cost oil. A high price use might not materialize. Even lower cost producers are in the 'price vice', including Saudi Arabia which is blowing through its legacy of accessible crude; breakneck depletion will leave it with little but regrets.

The auto age is dying right at our feet. If I didn't have to work tomorrow I would run out and buy a bottle of wine!

Brazil is the world's #2 agricultural exporter, it has some high tech (Embraer aircraft), a variety of raw materials and it's electricity is about 90% hydroelectric.

Best Hopes for Brazil,

Alan

Brazil is also a prime location for growing sugar which produces a good EROI compared to other crops when converted to fuel.

Thanks to it employing uneducated native indian labour at near slave wage rates. It high EROEI comes at a large social cost.

The wage rates may actually be worse than slavery-as the former owners of draft animals, we provided them with food and shelter in the off seasons and had a powerful incentive to take good care of them in all respects-horses and mules represented a considerable investment.

There are so many desperate people in places like the sugar country of Brtazil that there are apparently people willing to work for less than slave wages-a slave's "wages" in food and shelter cover the entire year, not just the busy season.

An injured horse or mule almost always got some health care, even if only very crude , in hopes of saving it for further work.

This said,what else can all those people do in the short term?Except maybe use thier machetes on the ruling class someday?

In the US when we make ethanol from corn we count the fuel for the machines that plow the fields and harvest the corn as part of the EI. In Brazil the cane is harvested by hand and the food calories to run those human machines is not counted in the EI, thus creating an unfair comparison of ERoEI. The workers cut as much as 12 TONS of cane a day. http://www.oilcrisis.com/BR/SugarCaneWorkers.htm

It is my belief that we should count the caloric EI of every human worker in every type of energy project as part of the EI for ERoEI. When you count the EI to ER of a cheeta chasing a gazelle the food calories are all that matter. When a subsitence farmer grows food he better grow at least as many food calories as he expends growing them and staying alive.

We have had our lives subsidized by cheap high ERoEI oil and thus have forgotten that humans are machines as well that need energy. Paying for stuff in dollars disconnects us from reality and makes it hard for us to think in terms of energy needed to do work. We put gas in machines and money in workers palms and think that those are different transactions, but money is just a way of paying the worker energy to feed himself, clothe himself, transport himself, house himself etc.

Think of it this way, if all those Brazilian workers were replaced by machines that used diesel wouldn't you count that diesel as part of the EI. If so why not count the energy needs of the Brazilian workers?

Sure,

I can see the injustice of how workers are treated in 3rd world countries but that wasnt my point. Pound for pound sugar will always give a better EROI than corn no matter how it is harvested. This combined with their deepwater oil finds means Brazil will, from a financial perspective, withstand any downturn in the world economy better than most.

Plus they are six time world soccer cup champions and there is always Carnaval!

I keep reading here that petroleum will have all sorts of uses after the "end of the automobile age" but according to the EIA something like 95% of the petroleum processed in the US goes to transportation fuel (gasoline, diesel, aircraft kerosene) or asphalt:

http://tonto.eia.doe.gov/dnav/pet/pet_pnp_wiup_dcu_nus_w.htm

"Locking ina price doesn't guarentee a profit...just the price that you'll sell th oil for."

That sounds simple but is actually great words of wisdom ROCKMAN. When you lock in a price, your essentially saying, "I can live with energy at this price" IF (and here is the big IF) you are buying the oil (or nat gas or coal or whatever) for use, not as a speculation on higher prices!

It is almost EXACTLY comparable to buying a home. Most folks who bought a home to live in, not as a speculative investment, have not been hurt by the recent "collapse" (unless, and this is a big UNLESS) they bought the home on very unfavorable terms (some call it usury).

If there is another half trillion or more barrels that can be accessed at any price below $150 per barrel (inflation adjusted, mind you) it completely "re-rolls" the dice...but I will deal with that in a post at the bottom of this string...

RC

The other side of this is that substitutes are roughly in the same cost range: PHEVs like the Volt* become economic at about $3.35/gallon gasoline ($90 oil?), in the longer-term (the time it takes to ramp up PHEVs) this also puts a cap on prices.

In roughly 5 years economies of scale will reduce the cost of PHEVs to the range of $80 oil, and we'll see a race between oil depletion and EV growth.

http://energyfaq.blogspot.com/2009/07/volt-battery-costs-part-3.html

*Pure EVs are cheaper, but much less convenient.

Are you aware of the price of gas in Europe?

Ok, if plug-in's and EV's are such a good idea, and if they're competitive at, say $3 gasoline prices, then why aren't they used more in Europe, where gas prices are higher?

There are a number of factors:

1) A different capital cost to operating cost picture.

EVs and PHEVs trade a higher purchase price for lower fuel consumption.

In Europe, fuel prices are 2-3 times as high as in the US, but due to historical factors (shorter distances, higher fuel taxes due to the high % of imports), average car in Europe uses about 1/3 as much fuel as one in the US. Further, European taxes on new cars are generally much higher in the US.

Thus, the economic case for EVs and PHEVs is actually worse in Europe, and the lack of EVs and PHEVs in Europe really doesn't add any useful information to the question of how competitive electric powertrains really are with oil in the US.

2) Pure EV's still can't compete on convenience with ICE vehicles. Even in Europe, fuel costs are only a part of driving costs, and the lower cost of an EV hasn't been quite worth the inconvenience. The logical transition from an ICE to an EV is the PHEV, which for some reason wasn't explored seriously until very recently when GM took that path.

3) Europeans have fewer garages, as their housing is much older.

4) Tax preferenced diesel occupies the high-MPG niche.

and perhaps most importantly,

5) there were large barriers to entry (billions in R&D and retooling, as well as resistance from ICE oriented manufacturers) for PHEV's, and there wasn't an obvious need for them. There was resistance from people in the industry who's careers would be hurt. This ranges from assembly line workers and roughnecks to automotive and chemical engineers. And, you've got to give them respect and compassion: they're people, and deserve to be helped as much as possible during a necessary transition away from oil.

Until we find a way to help these people, they're going to desperately fight any proposals to transition away from their industries, by honest attacks or dishonest: whatever works. You can't really blame them: they're just trying to protect their lives and families.

The alternative to buildinga new fleet of EV/PHEVs is to rebuild local towns and cities to drastically reduce the need for car use by US citizens so that they have equivalent living arrangements as Europeans. I suspect that will be an a accompanying trend to short range electric vehicles anyway.

Should be lots of batt-powered surplus golf-carts in the years to come:

http://www.peninsuladailynews.com/article/20091013/news/310139993

----------------------------

Golf course's money woes splitting quiet Sequim enclave

..The club has suffered from plummeting membership and revenue, losing half its players, including 48 who quit just this year, general Manager Tyler Sweet said last week.

..A golf course, Karr said, is one of the most harmful, wasteful land uses there is. Pesticides, herbicides and lots and lots of watering make it so, he said.

Karr would consider a return to a natural Sequim prairie ecosystem far more valuable than the putting greens, sand traps and fairways.

Tall weeds?

Meanwhile, in recent meetings with SunLand homeowners, Ratliff and the nascent SunLand Preservation Project have held up the spectre of a closed-down golf course, overrun with tall weeds and small animals.

Sweet has said that if the course goes without mowing and other maintenance, coyotes and rodents will move in.

Karr doesn't see this as such a terrible scenario -- and he calls the country club's argument, that property values will drop for everyone in SunLand while weeds and vermin take over, "fearmongering."

---------------------

http://www.cbssports.com/golf/story/12337350

--------------------------

Olympic golf a winner only with an attitude adjustment

..For the past three years, more golf courses have closed in the U.S. than have opened.

.. So let's take this show on the global road, shall we?

China, an emerging economic power, already has hundreds of courses, all but a couple of them private. That isn't doing much to dispel the notion that it's an elitist, expensive game, unavailable to the proletariat. It's exclusionary.

So, what are we really exporting? Bulldozing another 150 acres of Brazilian rainforest to build another golf course, erected primarily as a means of selling expensive view lots, doesn't sound like such a great idea, to be honest...

-----------------------

http://www.timesofmalta.com/articles/view/20091013/local/bleak-situation...

--------------------------

'Bleak' situation for northern hotels

Hotels in the north of Malta struggling to make ends meet are considering transforming their business into old people's homes, a hotelier has told The Times...

--------------------------

Man, Bob.. interesting stories.

Reminds me of the bumpersticker that says, 'Wouldn't it be great if our schools were fully funded, and the Navy had to have a bakesale to build a battleship?'

But I do want one of those carts!

Bob Fiske

That would be a nice way to live, but it would take 10 times as long, and cost 20 times as much.

It may take 10 times as long and cost 10 times as much to rebuild our shatterd towns and cities into something sustainable. It also may take several generations. But the end result is going to give so much more joy and comfort to the generations of the future than your techno-fantasy of PHEVS/EVS.

That's fine, but we don't have that kind of time.

We need to eliminate coal in the next 40 years - 20 would be better. We need to do do the same for oil, and just as quickly.

We don't have the luxury of doing this over 100 years.

BTW, PHEV/EVs are here now. Heck, the Prius has a complete electric drive-train - slap a plug on it, and a slightly larger battery, and you're there.

They were here before ICE vehicles - they just weren't quite as cheap as dirt cheap oil. Now that oil is no longer cheap, they're quite competitive.

See http://energyfaq.blogspot.com/2009/08/can-plug-in-hybrid-compete-on-pric...

Why don't we have time? PO does not mean no oil and the fact that a lot of driving is discretionary or wasteful commuting will be solved almost instantly once a price threshold forces people to behave more efficiently. Re-engineering neighbourhoods to accomodate alot more people who will be staying put on a daily basis will happen as result.

Saying they are here now doesn't make it so. The fact is you cannot buy a factory fitted Prius PHEV(that I know of) yet. Citing your own blog is hardly proof.

Cars are are mostly a luxury for the vast majority of people and they can make other arrangements. Jobs will disappear and businesses fold but new ones will open. I don't care if you think your current job is vital to the world - it isn't, get over it.

Trucks and heavy freight transport however are a much different story as they are the vital link that feeds most westerners anyway. I've yet to see Kenworth or Cummins propose an EV semi-trailer. We need to keep that fleet on the road and tractors in the fields to keep the food system going before we waste any more time trying to keep the whole consumer/commuter

Lots of other things will be quite competitive against expensive oil too and I'd suggest that investing in even more complexity will have rapidly diminishing returns whereas simplification is going to yield dividends long into the future.

Why don't we have time?

I think you agree that time is short.

once a price threshold forces people to behave more efficiently....Cars are are mostly a luxury for the vast majority of people and they can make other arrangements.

Yes, they'll buy more efficient cars. If they can't afford to do that, they'll carpool long before they move.

Re-engineering neighbourhoods

Is very, very slow and expensive.

Citing your own blog is hardly proof.

Oh, I don't expect you to take me as an authority. No, I was hoping you'd actually read the blog, and be convinced by the well-referenced information.

I've yet to see Kenworth or Cummins propose an EV semi-trailer.

See http://energyfaq.blogspot.com/2008/09/can-shipping-survive-peak-oil.html

investing in even more complexity will have rapidly diminishing returns

Priuses have much less than average maintenance costs, and carpooling is cheap.

If so, only for political reasons. Financial, too, in that people don't like to share, but a national plan for relocalizing/redistributing population and arable land similar to what is (sort of) happening in Detroit would really get things going.

This is why I advocate at the grassroots level. The changes we need are drastic, but freakishly simple. The idea it would cost more to power down and relocalize is just ridiculous when you can build a home out of scrap, and much of that scrap is in empty McMansions, etc.

We can do this cheaply and quickly, but it means moving forward with a new vision of what can be.

Cheers

The idea it would cost more to power down and relocalize is just ridiculous

Well, if you really want to go low-cost, wouldn't it just make sense to carpool? And, if HVAC is a problem, just turn down the thermostat and get out the down vests and comforters, and put an electric space heater in the room you're using?

You've got the tip, but what about the rest of the iceberg?

Cheers

Well, again, we're talking about the viability of suburbs.

How might energy scarcity make the suburbs non-viable? Well, the argument is that commuting and HVAC costs would become unaffordable - that's what's relevant to the suburbs vs urban areas.

So, carpooling solves commuting cost problems in the short-run, hybrids/PHEVs/EVs solve them in the long-run.

To solve HVAC in the short-run: turn down the thermostat and get out the down vests and comforters, and put an electric space heater in the room you're using. In the slightly longer-run, insulate, replace windows, go to air-based heat-pumps (or ground-based in the far north).

These would be much faster and cheaper than moving*.

*We should also note that existing multi-family housing is less energy efficient than single family housing.

I think you are not looking at the whole picture. Hybrids don't have much to offer on highway driving, and only offer significant improvements for city vehicles. They are expensive and complex, and fit into the jack-of-all, master of none category. I don't think they are a very good option for anyone except US-ians who want to appear 'green'.

Full-on electric hasn't caught on because of technology, not because of sinister oil executive plotting. It has taken a while to develop safe battery packs that don't explode when they have thermal issues, motors and motor controllers have not been very available, and the existing sales aren't enough to improve design or reduce prices through economies of scale. The only semi-successful EV has been the Tesla. They have had quite a few issues in their short life. More options are coming out as technology progresses, but you are still looking at high price, low utility vehicles while EV problems get solved.

Hybrids don't have much to offer on highway driving,

The Prius gets 55 MPG or better. The Volt will use zero fuel for the first 40 miles, and get 50 MPG after that.

They are expensive

The Prius is less expensive than the average US vehicle.

and complex

The Prius has much better than average reliability.

It has taken a while to develop safe battery packs that don't explode when they have thermal issues

True, but they're here now.

the existing sales aren't enough to improve design or reduce prices through economies of scale.

Of course - they haven't been for sale, except for the Tesla, which is being manufactured by people who had no experience making cars. I applaud Tesla for inspiring people, but let's be serious.

The only semi-successful EV has been the Tesla.

That's because it's pretty much been the only one. The EV-1, Rav4, etc were never intended for full production. GM plans to make 2-3,000 pre-production Volts - they only made 1,000 EV-1s. The EV-1 wasn't even a beta testing product - it was more like an alpha.

EV's are a solution to what!??? We have the 'V' sorted, the post-peak issue is the 'E'.

Now i wonder where the 'E' comes from? I wonder where the all the car's plastic bits come from? I wonder where the wire insulation comes from? I wonder where the steel and aluminum comes from? I wonder what condition those sources, those industries, will be in come the end of oil.

If we want to be producing something lets produce stuff that is pretty secure from degradation post-oil. A simple solar PV panel will last for a long time as an electricity generator. If we want to have electricity post-oil then lets churn out 5 square metres of PV per household fast. That will be our ration.

Electric vehicles to save the world? Don't be silly.

Nigel

EV's are a great fit with PV, and scads of them could be very simple refits from existing gas cars, and so reuse the parts that will otherwise soon be sent off to scrap.

Electric Motors for EV's have a very long life expectancy, with generally one moving part and a fraction of the caustic/acidic environment and vibration that eats up ICE cars.

Why are you willing to have a single item be your proposed solution? It will take many things all together. I'm all for the buildout of PV, but don't get simplistic with your conclusions.. there's a lot we need to use wheels for, and Electric is the cleanest and most durable way to do that.

Now i wonder where the 'E' comes from?

That's the easy part, at least in the US. Wind power is cheap and easy.

The problem is more about what goes into making a Prius than how little fuel it consumes.

I highly doubt that if one were to look at its Life Cycle Analysis data it would look any different than this one for Mini Cooper. Let's face it the sooner we get off the car kick the better off we will be.

http://www.scientificamerican.com/article.cfm?id=green-is-a-mirage

It's an interesting article.

Here's the relevant quote for EVs:

"An LCA reveals that in terms of global warming effluents, for example, everything in the car's life cycle from manufacture to getting scrapped pales when compared to the emissions while it is driven."

So, it really is the fuel used for driving that matters.

Even if the assessment got the ballpark right, the quote gives one no information whatsoever because the critical assumptions are not disclosed.

What matters depends.

And regarding your reasoning a few posts above... are you selling $80 strike 2015 oil calls? If you're right, there's free money waiting for you. :-)

Well, the striking thing about the article is that it didn't support the point made by the person who referenced it. It's surprising how often that happens...

I haven't looked at futures lately - what's the current price for 2015 calls?

I'm not seeing $80 calls for 12.2015. But I looked at the $100 strike which is a better bet if you think there's a cap at $80 anyway: they're at 18 now, up from 7 in mid-February. They were over 50 at one point.

EDIT: It's no surprising to me that people don't understand the links they post. I know why I'm loathe to post links. :-)

Well, what I said was "In roughly 5 years economies of scale will reduce the cost of PHEVs to the range of $80 oil, and we'll see a race between oil depletion and EV growth."

That doesn't tell us whether oil will exceed that price, only that there's a good substitute at that price, so that it will be hard for oil to stay above that price for long. Of course, it could easily stay high for longer than I stay liquid....

Yeah, I know... which is why it used a ":-)" after mentioning the calls.

In all seriousness, you don't know what the price of any substitute might be in 5 years. If you actually did, while that would indeed not enable you to make 100% reliable price predictions, you'd still have much better odds on the derivatives market than at the casino. There are ways to make sure you'd stay liquid.

Oh, I'm quite confident about the price of substitutes - the fundamentals here are quite clear (as I explain on my blog). I called the oil price peak last year (as you can also see on my blog) as did Richard Rainwater looking at much the same data.

I'm not so confident about the time before another price peak ends - the next peak is likely to be longer and lower. Things depend as much on the willingness of oil exporters to recycle petrodollars, and the willingness of oil importers like China and India to subsidize their price controls, as they do on the speed with which substitutes replace oil.

If exporters get as smart as China and Japan, they'll finance exports just as long as exports exist: that could support much higher prices for quite a while, if the US was stupid enough to continue borrowing to support it's addiction to oil. OTOH, if China, India and other importers with price controls wise up and eliminate price controls & subsidies (or, even better, replace them with taxes and import controls), the price could drop sharply.

EV/PHEV substitution will happen incrementally. Lifestyle substitution, especially carpooling, could happen quickly with the proper "victory-garden" promotion (although it's hard to see that kind of realism in US politics at the moment).

Predictions are hard, especially about the future.

You confidence is unwarranted. For one thing, you can not predict the price of batteries.

I've been using such batteries on laptops for a long time and there's no way I'd amortize them over 10 years.

you can not predict the price of batteries.

The price-performance improvement of batteries has been very consistent for quite some time, and it's accelerating. Those improvements are based in new tech (lower cost materials in newer chemistries), larger formats (which eliminate the overhead of packaging and controls per cell), improved manufacturing, and economies of scale.

I've been using such batteries on laptops for a long time

You're using out-dated battery chemistry, with inadequate temperature and charge-discharge management. Look into the newer li-ion chemistries being used by A123systems and LG (and many others).

In the marketing article you link to, the guy doesn't want to stick his neck out and articulate a price. Yet you do.

Not only that, you seem to be proposing that the future can readily be extrapolated from the past. You're essentially assuming economic BAU while calling for changes that would invalidate that questionable assumption.

In the marketing article you link to, the guy talks about putting in 250% of nameplate capacity, which would bring the effective cost to 875$/kwh. With the out-dated battery chemistry I'm using, charge-discharge management requires one to use considerably less energy than the battery is capable of delivering. And the guy is apparently proposing the same thing... yet you seem to ignore this.

For the consumer, the bottom-line is: are they issuing 10-year warranties for their batteries that one will be able to exercise if the capacity drops by over 20%? These new batteries are untested.

In the marketing article you link to, the guy doesn't want to stick his neck out and articulate a price.

I'm not sure what you mean. The CPI CEO is quite specific about what they're charging GM.

you seem to be proposing that the future can readily be extrapolated from the past.

Not at all - that's my point: we can see the outlines of what has to happen in the long-term, but timing cannot be "readily" identified.

You're essentially assuming economic BAU while calling for changes that would invalidate that questionable assumption.

hmmm. Could you elaborate?

the guy talks about putting in 250% of nameplate capacity

No, it's 200%. 8 KWH is used out of 16 total.

With the out-dated battery chemistry I'm using, charge-discharge management requires one to use considerably less energy than the battery is capable of delivering. And the guy is apparently proposing the same thing

Yes. GM is being extremely conservative. They don't have the luxury of the kind of risk that Tesla is taking. They're putting their reputation and company on the line with the Volt. They expect it to be their "halo car", as the Prius is for Toyota, and they hope to eventually use it as their core technology. This kind of conservative engineering doesn't tell us anything bad about the cell chemistry.

are they issuing 10-year warranties for their batteries that one will be able to exercise if the capacity drops by over 20%?

Yes.

These new batteries are untested.

Not really - more later...

Lithium ? That element that will have a peak production also and present in high concentrations in only a few countries ?

We have plenty of lithium - see http://energyfaq.blogspot.com/2009/02/could-we-run-out-of-lithium-for-ev...

Nick, that is one opinion (yours ?), although there are others with the same conclusion. I don't say that couldn't be the right one, but it's not for sure. To give an extreme comparison: I can find sites that claim that smoking doesn't cause lungcancer.

Like with oil, it's about the speed of extraction. The places with high concentration of lithium, such as in Bolivia, are the best. Other places are problematic and need a lot of energy for the extraction process. I read in an article that a maximum of 6 million cars (with lithium batteries) per year could be produced. Six million/year is not bad though. Recycling give large amounts if there are a lot of batteries available for that.

that is one opinion

I don't expect you to take me as an authority - I don't even tell you anything about my background (even though there's a lot there) because it's irrelevant. You should read the articles (and I give a lot of references and data) and form your own conclusions.

Other places are problematic and need a lot of energy for the extraction process.

Did the article give quantitative data, and references, or just state an opinion? Do you have the link?

As an example I bought a small (by US standards very small) car about 8 years ago for £7500 cash. Depreciation was about £1100 a year.

Tax £140 servicing/spares/tyres £200 insurance £250 petrol (at $8 a gallon) about £1000.

So petrol was about 37% of the cost of ownership, not including finance, even with three times the price you pay in the US.

I would love to buy an PHEV or EV, but I cannot justify the cost or inconvenience, and anyway they are simply not available in my town.

and carmakers won't make them while these sorts of market conditions prevail. If we can't afford to drive petrol vehicles at $80 oil, what makes you think we can afford to drive elctric ones at the same net cost that have much lower performance and convenience. I suspect that the threshold price for PHEVS/EVS is much higher and may never be reached due to the oil accordian effect. Eventually even the accordian will wither and die, along with the rest of the economy.

Euan

I suspect this is (going to be) the best short hand explanation of how EROEI manifests itself economically I have seen to date

back in july 2008 someone screamed EROEI (majoran IIRCr WT?)

the problem can be traced back to the original pricing of oil when EROEI was high back in the day. it was too cheap and the economy was optimized around the unstated notion of infinite resource. Depletion was never addressed in the price and the price adjustment required by the market NOW results in the "oil accordian"

a similar event to the 1980's except higher EROEI sources were available

the original price per barrel had to include the replacement of the resource with a (more)sustainable source.. if you don't do that from the get go the market('s invisible hand) has essentially shot too low.

we were doomed (corny but "the major short coming of the human race is etc etc ")

Gail's global reset button looks more attractive every passing day.

You've hit it exactly. if you don't do that from the get go the market('s invisible hand) has essentially shot too low. All the prizewinning economists and their fancy theories missed the obvious issue of pricing a depleting resource, which issue is of course cost of replacing the resource when it runs out

I think we may already be there, the oil cos need maybe $70 a barrel for new production, some, like oil sands, needs $80+ but the world went onto peak plateau somewhere around $45 - IMO there is no believable evidence that the world economy can afford to expand with a price around $70.

Don't forget, the most affordable oil was way back in 1998!

China and India can surge forward while OECD counties contract.

Less than 3 orders of magnitude :)

( or 6, using the UK version of Trillion)

you mean: 6, using the version used in most of Continental Europe

From your Tupi link above:

But from a link posted on Drumbeats two days ago:

Now I am a little confused. Will 2,000 barrels of oil per day eventually ramp up to 15,000 bp/d? If so why is the initial flow so slow? Is it thick like molasses at first but will, after a few months, warm up and start flowing over seven times faster? Is this normal? Does oil really flow slow at first then speed up? Why?

Ron P.

Very nice Euan. The man does have a basis for such optimism although it does strike me as being a tad too optimistic. He has the advantage to predict a future that is seldom available when a new play is discovered. Such new plays develop late because it's difficult to image the geology and/or generate an oil source/trapping model. In the case of DW BZ it's almost as simple a 1950's Texas baby geology. With modern seismic it's very easy to image the reservoirs now that they've proven the oil window. It was the water depth that prevented development. Had the WD been 200 m the play would have been developed decades ago IMO.

How obvious is the play now that they've proven the presence of oil? If I recall correctly the first 14 wells drilled down there discovered commercial oil reserves. Compare that to the N Sea where I believe it took 92 wells before the first commercial oil discovery was made. Another KSA? Maybe...time will tell. But given the engineering/economics involves it's very difficult to expect they'll ever approach the flow rates or recovery % of Ghawar et al. Unfortunately the public can't distinguish between high oil reserve numbers and delivery rates. Their view is simple: if there's lots of oil there just drill enough wells to produce the volume we need.

Rockman,

"Time will tell" is hard to refute for sure.

Stick your neck out a little farther and tell us roughly how many years minimum it will be before we know for SURE either way-several millions of bopd or just a meaningful dribble.

If you are all that old you will be retired anyway probably so it won't hurt your rep if you're wrong;).

Hell Mac...I'm a petroleum geologist. If being wrong bothered me I would have change professions years ago. But seriously, they'll start getting a handle on the total reserve picture relatively quick compared to other plays like the DW GOM. We have a technical term we use for plays like the DW BZ: "cookie cutters". I.E. the next 10 prospects we drill look a whole lot like the last five good ones we drilled. So in that sense they get some idea not too far down the road but even then I would guess a good 10 years before a solid regional picture comes together. Maybe 20 years before the corner the small fields. What I don't have is a sense of the sizes of the remaining ID's prospects. You naturally drill the bigger ones first. But in most trends the cumulative effect of the smaller fields is often greater than the biggies. OTOH, many of the smaller fields might not be commercial given the water depths. And in some plays you develop the big fields, deplete them and then use the infrastructure/sunk costs of those projects to supplement the development of the marginal projects. Floating production facilities are very expensive and take a while to build. But when you deplete that first field you just pull up anchors and tow it to the smaller field. But that's also a good reason to not use the size of the BZ ult recover to offer a sense of max future flow rates. I'll make a totally unverifiable claim (I am a geologist after all): Even if DW BZ develops as much recoverable oil reserves as all of the KSA I doubt they'll ever have half the max flow rate as the KSA. And they'll abandon that production at higher flow rates as Ghawar will be eventually abandoned.

Half a trillion more barrels?!?! There is climate change you can believe in. We should be able to ratchet the global temperature up at least another two degrees Celsius with that.

The more oil we find the longer we'll see business as usual and the faster we go back to the Jurassic as described here in this series of videos:

Crude - the incredible journey of oil

http://www.abc.net.au/science/crude/

My assessment of the triple whammy peak oil (2005-2008), the financial crisis and global warming can be found here in my submission #103 to the Australian Senate Inquiry on Fuel and Energy:

http://www.crudeoilpeak.com/?p=34

We need now legislation to set aside oil & gas for the sole purpose of serving as an energy input into all projects to get away from oil and to reduce our CO2 emissions

Yes, this would be some of the worst news I've heard - even in a long period of very bad news.

I would encourage my fellow climate doomers not to toss the baby with the bath water and think 7, or 70, or 700 generations ahead. The trick is to get these plays not developed by offering better solutions.

Just because we have a carbon problem now doesn't mean we always will. We are in a pattern of ice ages and warm periods and there is no reason to think that won't continue. There will come a time in the future when humanity will **need** more carbon in the air to fight off an ice age. This, in fact, is one of the better arguments for not using it now.

I realize this makes too much sense for the average person/politician/businessperson, but we gotta try.

Cheers

Well, that's a theory that I have not heard, unless we are talking about a very, very long time in the future. I'm not sure where the carbon would be expected to go to, at least in time frames meaningful to present human civilizations. But we will burn what we can get to.

I'm of the opinion the only way you get past greed/discount rates is to turn thinking from immediate to very long term. As they say, (some/a/an?) Native American tribe(s) managed things well for this reason. Seven generations and all.

There are human populations still extant that do think this way about their environment. If they can, we can - even if not likely.

Again, we gotta try.

The carbon presently in the atmosphere *will* eventually get taken up by the oceans, dead plants, etc. When that happens in conjunction with a Milankovitch (sp?) cycle, things will get colder. Very cold. Ice Age cold. Pumping some carbon into the air at that point should avoid or mitigate the ice age.

Some think we are already short-circuiting the current fall into an ice age. The time frames are not exact, but there does appear to have been 2k years of cooling trend prior to this current fossil fuel-induced spike.

I think we can get ourselves to think in terms of thousands of years. In theory.

Cheers

Welllll...

In the REALLY long term, we are getting a hotter and hotter sun, so C sequestration is going to be the optimal strategy over a multi-million-year time frame.

I like your approach, but I'm not sure it will sell any better in Peoria (so to speak) than anything else we've tried.

Somebody wrote a novel based on this premise ten years or more ago-the co2 saves our buttts fron the glaciers.

I threw it away after a few pages-the premise was interesting enough but the authur was worse than mediocre.

I think we humans are overcompensating with greenhouse gases both in the cumulative amount and the rate of emission compared to the reduction in insolation in the northern hemisphere due to Milankovitch Cycles. The acidification of the ocean is a catastrophic consequence.

A bit like PO - it is not the total emissions it is the flow rate that is the killer. Even more so for methane emissions.

This is all very well described in limits to growth - written over 30 years ago.

Very good insight ccpo. This is why we should be spending huge money on R&D to create energy sources cheaper than carbon, rather than wasting money reproducing expensive impractical energy systems.

http://www.theoildrum.com/node/5144#comment-476522

There are plenty of compounds that pack a much bigger incremental greenhouse effect at current concentrations. There's so much CO2 out there that you need to emit a mind-bogglingly huge amount to make a difference. My guess is that the rarer GHGs have more promise for Milankovic cycle management. The ones which have relatively short atmospheric residence times would also be safer to use.

Factually wrong. We have kicked planet Earth out of that pattern. The maximum CO2 concentration under natural climate change (Milankowitch cycles plus CO2 feedback) was never higher than 280 - 300 ppm. We are now approaching 390 ppm.

NASA climatologist JAMES HANSEN: There are two things that are cause of concern. First of all, if we look at the history of the Earth, we know that at the warmest interglacial periods, which were probably less than 1 degree Celsius warmer than today, it was still basically the same planet. Sea level was perhaps a few metres higher. But if we go back to the time when the Earth was two or three degrees Celsius warmer, that's about three million years ago, sea level was about 25 metres higher, so that tells us we had better keep additional warming less than about one degree. And the other piece of evidence is not from the history of the Earth but from looking at the ice sheets themselves, and what we see is that the disintegration of ice sheets is a wet process and it can proceed quite rapidly. We see that the ice streams have doubled in their speed on Greenland in the last few years and even more concern is west Antarctica because it's now losing mass at about the same rate as Greenland, and west Antarctica, the ice sheet is sitting on rock that is below sea level. So it is potentially much more in danger of collapsing and so we have both the evidence on the ice sheets and from the history of the Earth and it tells us that we're pretty close to a tipping point, so we've got to be very concerned about the ice sheets.

http://www.abc.net.au/7.30/content/2007/s1870955.htm

A good description is here:

http://www.scoop.co.nz/stories/HL0601/S00001.htm

No irrelevant link has ever turned an opinion into a fact.

The future does not exist yet and no one has been able to make reliable social forecasts so far.

Dude, do I really need to say, "except for human intervention?"

You must not have read many of my posts on climate.

Cheers

Tipping elements in the Earth's climate system (National Academy of Sciences of the USA)

"We conclude that the greatest (and clearest) threat is to the Arctic with summer sea-ice loss likely to occur long before (and potentially contribute to) GIS melt. Tipping elements in the tropics, the boreal zone, and West Antarctica are surrounded by large uncertainty and, given their potential sensitivity, constitute candidates for surprising society"

http://www.pubmedcentral.nih.gov/articlerender.fcgi?artid=2538841

The Limits to Growth

1972 Club of Rome Report

We end on a note of urgency. We have repeatedly emphasized the importance of the natural delays in the

population-capital system of the world. These delays mean, for example, that if Mexico's birth rate gradually

declined from its present value to an exact replacement value by the year 2000, the country's population

would continue to grow until the year 2060. During that time the population would grow from 50 million to

130 million. We cannot say with certainty how much longer mankind can postpone initiating deliberate

control of its growth before it will have lost the chance for control. We suspect on the basis of present

knowledge of the physical constraints of the planet that the growth phase cannot continue for another one

hundred years.

Again, because of the delays in the system, if the global society waits until those constraints

are unmistakably apparent, it will have waited too long.

If there is cause for deep concern, there is also cause for hope. Deliberately limiting growth would be

difficult, but not impossible. The way to proceed is clear, and the necessary steps, although they are new

ones for human society, are well within human capabilities. Man possesses, for a small moment in his

history, the most powerful combination of knowledge, tools, and resources the world has ever known. He

has all that is physically necessary to create a totally new form of human society--one that would be built to

last for generations. The two missing ingredients are a realistic, long-term goal that can guide mankind to

the equilibrium society and the human will to achieve that goal. Without such a goal and a commitment to

it, short-term concerns will generate the exponential growth that drives the world system toward the limits

of the earth and ultimate collapse. With that goal and that commitment, mankind would be ready now to

begin a controlled, orderly transition from growth to global equilibrium.

Am I way off or would fully burning 500Gb translate into less than 30 ppm, even with the preposterous assumption that all of it would remain airborne?

There's no way you'd get even 1C from that.

We have to get back to 350 ppm, if not 300 ppm, so +30 ppm means going in the wrong direction

http://www.350.org/

Thanks, Euan, you've put this into its proper perspective. So this could be a pipe dream like the Bakkens, and regardless it is self-limiting due to the expense of pre-salt extraction. Odd that Dr. Mellow has an extensive understanding of the formations and reserve potential, but was unaware of demand.

Well, it's a good thing we're getting these people together at ASPO then.

We really need to get more geologists and resource specialists from the USGS and influential institutions like the Colorado School of Mines in on these "debates". Maybe then we can iron this "theory" of depletion out a bit. (Our "ammo" is already soaking wet, Robert.)

It's also a bit odd that the slide is labeled "Petrobras 2006". Significant exploration has taken place since 2006.

Here's some more perspective: by 2020, when Tupi is supposed to be producing well, assuming 71,500,000 b/d current production, flat oil consumption rate and 6.5% avg. decline rate, we will need @40,000,000 b/d new oil production. That's **four** Saudi Arabias.

With 1%/yr. avg. demand destruction/shift to renewables? Still need @31,500,000 b/d new oil production. That's **three** Saudi Arabias.

With 2%/yr. avg. demand destruction/shift to renewables? Still need @24,000,000 b/d new oil production. That's **2.5** Saudi Arabias.

How about to 2030?

Assuming 71,500,000 b/d current production, flat oil consumption rate and 6.5% avg. decline rate, we will need @55,000,000 b/d new oil production. That's **five-and-a-half** Saudi Arabias.

With 1%/yr. avg. demand destruction/shift to renewables? Still need @41,000,000 b/d new oil production. That's **four** Saudi Arabias.

With 2%/yr. avg. demand destruction/shift to renewables? Still need @29,500,000 b/d new oil production. That's **three** Saudi Arabias.

Oh, and given the typical curve for DW wells Tupi should already be in decline by this time, right?

Cheers

Those are some really amazing figures. Do you know how many Saudis we need if oil consumption/demand continues to grow? I think I saw that other than last year, total world demand has been growing steadily at 1 1/2 million per year. What happens if demand grows at just 1 million per? My guess is that China and India and other emerging countries will continue to grow demand quickly especially since their development and growth will compound. The non-OECD countries climbed from 29 per day to 38 in 2008 and were just essentially flat to 09 and likely are headed higher again.

Also, I am curious about your selecting a 6.5 decline rate? I see projections all over the map but don't know what to believe.

Thanks, Peter

The numbers are all over. Essentially, and I'm sure I'll be corrected if even slightly wrong, 4.5% or so is net decline (all wells?). Around 6-7% is decline from all wells at or past peak (or is it all wells?). Natural decline, i.e., what would happen if we didn't do all sorts of things to enhance recovery is about 9%.

These from IEA last November, but about what many of us had been guessing long before that.

Cheers

Put me in the skeptical camp, but I was reminded of Dr. Hubbert's two If, Then statements about the US Lower 48 in 1956. If the Lower 48 URR are 150 Gb, then we peak in 1966. If the Lower 48 URR are 200 Gb, then we peak in 1971. In other words, a one third increase in URR only postponed the projected peak by five years. Proportional to Deffeyes' estimate of 2,000 Gb for world conventional URR, a one third increase would be about 700 Gb.

Regarding Brazil's status as a net oil importer, at their recent five year rate of increase in consumption, they would be consuming another 1.2 mbpd in 2018. So, to maintain their 2008 level of net oil imports, they would, at their recent rate of increase in consumption, need a net production increase of 1.2 mbpd by 2018.

and that strikes you as unlikely?

lets say there is 500GB under there what sort of lead times are we looking at?

a lot of the technology already exists..no?

I'm not pretending to know or second guess but do we have some idea or map of how the scenarios (high low mid) play out... the sort of thing TOD is good at?

I'm sure that there will be a post on Matt Simmons' presentation, but one of the points that Matt made was the wide gap between projections and reality. He stated that of the most recent 100 large oil field projects, only about 8 had met or exceeded their projected production rate.

A recent example is Thunderhorse, in the Gulf of Mexico. I am informed by a reliable industry source, who says he has seen the data, that Thunderhorse went from 200,000 bpd of crude oil to 60,000 bpd in one year (note that you need to differentiate between crude oil and barrels of oil equivalent in production reports).

Regarding the 500 Gb estimate, a well known scientist at ASPO suggested it might be a three letter word beginning in "L."

http://www.reuters.com/article/rbssEnergyNews/idUSN0837991820090708

UPDATE 2-Dry hole in offshore play shows Brazil oil risks

Wed Jul 8, 2009 11:27am EDT

the thunderhorse thing was not katrina related I take?

anyways cheers

You are talking about two different things Midi, WT is talking about depletion and you are talking about hurricane damage. But no, it was not Katrina, it was Dennis. But what WT is talking about has nothing to do with Dennis, all this has happened since the hurricane.

But the damage to Thunderhorse was not entirely due to the hurricane, it had something to do with valves left open when the platform was abandoned due to the hurricane.

Ron P.

Actually a design fault, rubber seals in bulkheads blew out owing to tremendous pressure differentials allowing water in - and the near catastrophe.

If WT's data are correct - and I've just been speaking to him - then this could kill off deep water developments - once bitten twice shy - or maybe even bankrupt.

What I don't understand is how it could be producing so much gas - unless super K zones have allowed water from below and gas from above to flood the perfs.

What data would that be? All we have here is a news piece and a projection. That's one dry hole among many wet ones: Integrated services yield efficiency in development

What I'd like to know more about are the major differences between the North Sea and Brazil deepwater - distances to fields from shore, depths, operating conditions on and below surface, difficulty of implementing pipelines; all of this to get a better handle on what we can expect in a development timeline. Because, barring lack of credit being an impedance, I don't see why these fields won't be developed to their fullest. Other lags might include a lack of semisubs and drillships, geopolitical interference, or lack of materials/manpower.

Darwinian

my stupid...cheers

There are technical problems in Australia's North West offshore fields as well. Can you comment on this:

Brazil was compared to KSA in the way that maybe they could become a major exporter of oil. If they ramp up their production with 1,2 mbpd and all is needed for increased own consumption than this makes no sense, that's the point.

If things go on like the past decennia, then oilproduction decline from a country goes together with much more export decline from that country, as many times written by westexas. But it is possible that oilconsumption goes down in almost every country when economic depression follows. In other words, ELM (every year more oil used by an oilproducer) could disappear then.

The price of the crude oil will remain high even if demand declines in oil importing countries because the oil producers will be able to reduce production to set the price where they choose, just as OPEC is currently doing. The oil revenue flowing into the oil exporting countries will invigorate their economies at the expense of the oil importing ones.

Also exports will still decline as long as domestic oil consumption declines slower than production. I think the chance of domestic oil consumption declining faster than oil production while oil revenue flows into the country is minimal.

UK consumption hit a peak in the early 70s, plateauing thereafter, even as their oil production and revenues therefrom hit its apex. Why wouldn't Brazil's consumption flatten out as well? What are the distinctions that would direct Brazil in a direction of ever-expanding consumption? They already drive very fuel efficient (=small) vehicles by and large, perhaps the population will develop a taste for the good life in the form of massive gas guzzlers.

Brazil is a developing nation, not a developed one. I am not aware of any developing nations where consumption has flattened out short of the type of internal social collapse that happened when the Soviet Union and its satellites fell apart.

Brazil's "ever-expanding consumption" will be driven by the same thing that drove increased OECD consumption: an expanding middle class. And there is much room for expansion in Brazil.

See the chart in my post down-thread to understand the scale of consumption in the US compared to Brazil. I see no reason for Brazilians not to consume every last drop of the oil they produce.

-- Jon

Of all this oil, what is the proportion that belongs to Brazil ?

45% to Brazil and the rest to British Gas and Repsol ?

very interesting post.

I hope that this does lower the decline rate when we go into Terminal Decline.

Maybe the curve will resemble the U.S. with production in alaska after Peak in the U.S., only, more gentle.

Actually, the average recovery rate of actual oil fields is 22% of OOIP so 500 Gb for the entire South Atlantic province is probably 110 Gb.

The world uses 31 Gb/year.

Offshore oil now accounts for 33% of daily oil production.

------------------------------------------------------------------

“Globally, a total of 500 billion barrels [bbl] of offshore oil has been discovered, of which 200 billion bbl has already been produced,” Sandrea said. “The ultimate recoverable reserves for the global offshore could be near 850 billion bbl.”

Offshore oil production will continue to grow strongly in the medium term and is expected to reach 35 million barrels per day (b/d) by 2015, up from 24 million b/d in 2005, he estimated.

The disparity in discovered vs. produced reserves is even greater for offshore natural gas, Sandrea said: “In regard to offshore natural gas reserves, more has been discovered (580 billion bbl of oil equivalent) than oil, and barely one-sixth has been produced.”(2008)

http://www.tulsabeacon.com/?p=413

that's one to commit to memory

Theoretically, offshore deepwater[DW] platforms should be easier to defend from insurgent attacks than onshore FF-infrastructure. What is not a theory is how very, very expensive these DW-platforms are to repair/replace if an attack is ultimately successful.

Thus, it seems plausible that the weak link; the infrastructure most likely to be future-targeted, is the crude & natgas pipelines coming ashore, and/or VLCCs and LNG-ships, plus anything further downstream in the FF-flow process to the end-consumer.

Continuing to extrapolate this thought: A continuing series of suicide bombers inside explosive rigged vehicles can certainly turn a lot of gas-stations into roaring infernos. Not to mention the added flaming danger of the detonation occurring when a 5,000 gal tanker truck is currently refilling the storage tanks. The logical security response to this is to make consumers park far away from the gas-pumps, then having to schlep 5-gal jerry cans back and forth until the vehicle is topped off again.

On the plus side: this physical exertion will give owners of large ICE-gas-hogs a much greater appreciation of their profligate energy usage. Also, perhaps it will encourage more ICE-owners to purchase wheelbarrows versus having one's arms strained by carrying two heavy 5-gal jugs a considerable distance. YMMV.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Additional thoughts that occurred to me:

We have had many prior weblinks on TOD disclosing the closing of thousands of gas-stations worldwide from their profitability detonating to nothing; they maybe going financially defunct faster than golf courses or nursing homes. Recall my prior weblinked post on 17% of Wisconsin nursing homes declaring bankruptcy this year.

A suicide bomber detonating his vehicle by a crowded, open-air farmers' market makes a hell of a mess in dead & maimed bodies, but actually destroys very little in the way of expensive infrastructure. It is an easy task, although very emotionally upsetting, to hose away the blood and small body bits. Then, bringing in new display tables and crates of new goods quickly restores the foodstuff operation.

Thus, one wonders if those in charge of picking out targets for their mostly young, detonating-charges will be profitably shifting to gas-stations versus farmers' markets. Picture a Taliban/AQ chieftain going to an owner of a string of gas-stations in Iraq and/or the 'Stans, then for a reasonable fee, offering to take-out his fuelish competition once and for all.

Playing the postPeak game of Monopoly the hard way? This might help explain why the racecar piece is so popular [link has photo of racecar, too]:

http://john.xanga.com/630410080/monopoly-on-monopoly-pieces/

-----------------------

Monopoly on Monopoly Pieces

When we were playing Monopoly this weekend, my wife said she was the car because she was always the Car growing up. I chose the Shoe because I have always liked the Shoe. But once she picked the Car, I kinda wanted to be the car too...I guess this is evidence that as much as I try to follow my own path, I am swayed by societal popularity.

I did some research to find what the most popular Monopoly pieces, and in 1998 Hasbro did a survey on exactly that:

Most popular @18%--the racecar. Least popular @ 3%--the wheelbarrow.

------------------------

Best postPeak hopes that the wheelbarrow becomes the popular choice:

http://web.archive.org/web/19960101-re_/http://www.uni-kiel.de/sino/ar/s...

IMO, the wheelbarrow is already the default gamepiece choice for those banksters living on Park Place as they cart countless loads of cash home from Wall Street and Washington, DC.

You can now buy a Prius gamepiece for your home game:

http://www.edmunds.com/insideline/do/News/articleId=116864

-----------------------

New "Monopoly" Ditches Racecar Game Piece for Prius

..the Monopoly game was created by Parker Brothers more than 70 years ago, during the depths of the Depression. More than 250 million copies have been sold since then.

What this means to you: Guess you'll have to bring your own thimble from now on. As far as the Detroit automakers are concerned, the updated Monopoly game is being launched amid a New Depression.

----------------------

I hope there will be a SpiderWebRiding railbike gamepiece in the postPeak version as it is much more efficient than the shoe gamepiece:

http://www.daylife.com/photo/0bLmcaEcFm97s

No sense in blowing up these grocery stores:

http://www.prosefights.org/pnmelectric/rateincreases/shoppingcarts.jpg

I could easily create a postPeak version of Monopoly, but I don't wished to be sued into penury worse than I already am.

Edits for further emphasis.

Monopoly was based on an earlier game called "The Landlord's Game" (patented by Lizzie Maggie 1904)the was intended to show the working class how "rents enrich property owners and impoverish the tenants." The fact that it has become such a popular game speaks volumes about how eager Americans are to envision themselves as wealthy no matter what the consequences are to others.

http://www.ideafinder.com/history/inventions/monopoly.htm

See the Pareto law mentioned elsewhere on this thread (with regards to oil sizes). Money squeezed in one area pops out in another area, which causes income disparity.

I wrote this from memory - so I hope I have recalled the numbers correctly. I can't recall if Dr Mello was talking oil in place or producible oil, but I suspect the former, in which case your comments about adjusting this down for recovery are entirely valid.

100 billion barrels recoverable - great news for Brazil and other countries with these reserves - but at that level we're down to 3 years consumption spread over 40 years - starting in 5 to 10 years time.

What is also missing is the quality of Brazil's (South Atlantic province) undersea oil.

The reason Tupi is so exciting is that it is at least intermediate crude. Most of Brazil's underseas discoveries have been viscous,heavy crude which is why it pumps slowly.

http://energy.ihs.com/News/WW-News/news-2008/Petrobras-using-FPSO-to-pro...

Hi,

Is there a way to get hold of the presentation Dr Marcio Mello made?

Thanks

I believe an edited version (with some slides removed) will be made available on the ASPO USA web site in due course.

I wonde if there is a mirror image off Africa's coast..., and what it looks like.

it's not going to be cheap oil obviously..., but flatening ut the decline rate during terminal decline would be nice.

That was a big part of his story. More heat over there, though, so perhaps more condensate and gas.

Here's the reddit and SU links for this post (we appreciate your helping us spread our work around, both in this post and any of our other work--if you want to submit something yourself to another site, etc., that isn't already here--feel free, just leave it as a reply to this comment, please so folks can find it.):

http://www.reddit.com/r/Economics/comments/9tmd8/half_a_trillion_barrels...

http://www.reddit.com/r/reddit.com/comments/9tmdb/half_a_trillion_barrel...

http://www.reddit.com/r/energy/comments/9tmku/half_a_trillion_barrels_mo...

http://www.stumbleupon.com/url/www.theoildrum.com/node/5867

Find us on twitter:

http://twitter.com/theoildrum

http://friendfeed.com/theoildrum

Find us on facebook and linkedin as well:

http://www.facebook.com/group.php?gid=14778313964

http://www.linkedin.com/groups?gid=138274&trk=hb_side_g

Thanks again. Feel free to submit things yourself using the share this button on our articles as well to places like stumbleupon, metafilter, or other link farms yourself--we appreciate it!

It was my understanding that the thickness of the salt layer made seismic imaging problematical because of the fluid nature of the salt. Is this true? If so, how might it affect this extrapolation?

I saw part of a show on the history channel (??) the other night where a guy was using silicon gel on a grid to model the behavior of salt domes. Apparently domes are fluid-like and the modleing worked very well for predicting extent of salt and what was beneath it. "Earth series?" just caught it by accident. Pretty cool though.

Sterling -- what makes salt such a unique rock is its density. It's so much lighter then the rocks which surround it that it will "flow" when the pressure of the overlying rocks push down on it. Just like those old lava lamps from the 70's. But all rocks, even igneous, will "flow" given high enough temps, pressure and time. Salt just does so at lower temps. In the last 10 years new seismic data has changed the standard view of salt domes in the Gulf Coast. Unlike the simple "mushroom" shape many were presumed to have. We now see many look more like a tear drop "floating" in a sea of other rocks. The mobile salt has completely seperated from the basal portion.

Thanks Rockman, I can appreciate the analogy to lava lamps. It reminds me that our lifetimes are just a blip in time. The fossil fuel age is just a blip in time. The idea of flowing rocks is one that really speaks to that. I won't get all nihilistic though.

S

ET -- I've seen the seismic sections in the DW BZ. Imaging through the salt is rather easy. It's rather thin (a couple of hundred feet) compared to the sub-salt plays in the GOM. last year I worked on a well which drilled through 24,000' of salt before getting to the rocks. And there are no salt domes in the DW BZ that I'm aware of. The BZ pre-salt is just a layer of salt sitting beteen the rock layers at a certain depth. The difficulty in developing this play was the water depth and the concern that it was too deep (hot) for oil to be anticipated.