Sadad al-Husseini on Middle East OPEC oil fields

Posted by Euan Mearns on October 16, 2009 - 10:36am in The Oil Drum: Europe

Steve Andrews, co-founder of ASPO USA travelled to London (on his own time and dime) to interview Sadad al-Husseini. The interview has been shown as a series of clips at the ASPO International conference in Denver this week. Sadad al-Husseini is a geologist and reservoir engineer who worked for Saudi Aramco reaching the position of vice president.

Exerpts from the interview are available on the ASPO USA web site. The single quote above was the comment that caught my attention the most.

The comment is particularly interesting in the context of how OECD governments are planning their energy futures based on IEA forecasts such as this:

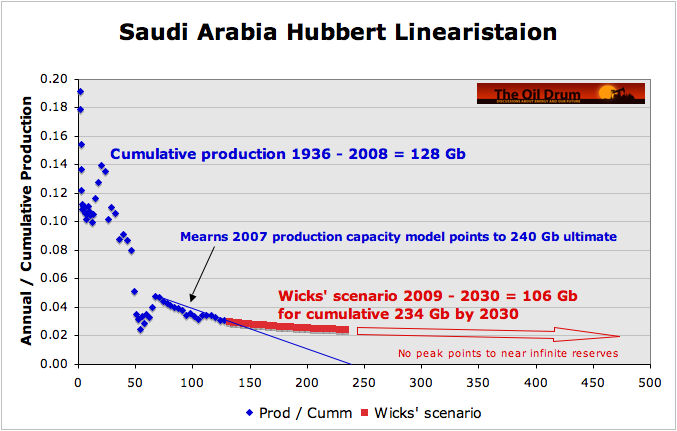

Ramping Saudi production linearly to 15.6 million barrels per day by 2030 has this outcome on a Hubbert linearisation. The absence of any peak points to near-infinite reserves - in a country where there are serious issues of maturity in the reservoirs.

[Note the chart is lifted from another post discussing UK government energy strategy which for various reasons I decided not to post.]

There is also a recent editorial by al-Husseini available from SPE:

http://www.spe.org/jpt/print/archives/2009/08/JPT2009_08_7GuestEditorial...

He has specific recommendations for going forward. Given his views expressed here and elsewhere, it is clear to me that his retirement from Saudi Aramco was not voluntary. He was probably pushing for more transparency and was not sufficiently bullish about the Saudi oil reserve and capacity situation.

The reference to Arabian Gulf fields is interesting because it is clear as to whose fields he is referring to. The editorial has this:

Besides the Manifa field development, there have been two major Saudi offshore projects of recent note:

1) Maintain Production Potential program, centered on Safaniya, Zuluf, and Marjan

2) North Safaniya Artificial Lift program, which involves electric submersible pumps

And which NOC do you think he is referring to here?

For perspective: On February 24, 2004, the Center for Strategic and International Studies sponsored a debate between Matt Simmons and Saudi Aramco about the state of the later's oil fields. The Power Point slides for the Saudi side of the debate are at:

http://csis.org/files/media/csis/events/040224_baqiandsaleri.pdf

In the Saudi slides, slide 23 and 24 show that if the Saudi's maintained a Maximum Sustainable Output rate of 10 MBPD they could sustain that rate until 2042. If they ramped up the rate to 12MBPD, they could sustain that rate until 2033. In the debate, they mentioned that they could output about 16 MBPD in a crisis situation.

Now, we see a **sustained** rate close to that crisis level of 15 MBPD. What have they found/developed that would allow them to do so?

I noticed a couple of other comments from the ASPO summary of the interview, indicating reasons why he thinks that new projects are not likely to make up for declines.

And about Tupi, off Brazil:

It looks as if a few bricks are falling off the facade of the cornucopians house.

More like all that is left is the facade and the house behind it has completely collapsed.

Gail. I'm a rookie at this, and I'm sure there are others just like me. So are you guys saying unless there is a certain amount of Oil discovered, and by that I mean real Oil that can come on to the market. That we have to find has much Oil has were declining right now. Now that's just to keep up with the worlds present usage. so I guess the argument is the GOV say's that its no problem to keep up. And TOD say's LOL. Looking at it from the outside.the questions are these.

1. Can't KSA Russia Mex Brazil Iran pump more.

2. why does the Gov tell us where ok, when our very existence has a country depends on Oil

3. Since PO has been shouted out many different times, what does Joe six pack do to find relevant info.

PS I love the web sight, and the cast of characters.

Rockman

west Texas

Rembrandt

Now a new one Po!! LOL.

pocampo -- though as 'rookie" I suspect you have a fair grasp of the general idea. As to specific answers:

1)As a very general statement the produciton rate from any field can be increased at any time for a limited time. But here's the problems: a) the cost to do so might not be justified. Remember putting more oil on the market can tend to cause a price decrease. That doesn't help the return on investment. b) depending on the reservoir the rate at which you produce will determine the ultimate recovery. Excessive production rates can decrease the amount of oil/NG produced. For years I've heard from expats that worked in the KSA that there have been times when high production rates clearly caused a loss of future oil production. If Ghawar et al are on a downward depletion trend the worse response would be to pump faster. Might get a short term boost but eventually it could cause an even faster decline rate and loss of more reserves.

2)It's simplistic but true IMHO: everyone has an agenda: the gov't, TOD, the Sierra Club, ExxonMobil, me, etc. Unfortunately today with all the "facts" being tossed around it's up to each of us to judge validity with an eye on motives.

3)Warning: a harsh and mean statement to follow. Joe Six Pack doesn't care about relevant facts IMO. He's more concerned about the outcome of the last football game. Certainly there is a smaller segment of our society trying to get their hands around the subject. But they are then hit with all the different "facts" as discussed in #2 above. Unfortunately the vast majority of folks don't have the time to dig too deep even if they are motivated to do so. They have to trust the MSM for the most part to educate them. And that, for most here at TOD I think, is a very sad state of affairs.

Thanks for you reply Rock. Your right Joe 6 pack does not care!! We can never under estimate the apathy of Americans. However when Joe has to pay 5 bucks a gal to fill up his truck he will at least start asking some questions. TOD is a great way to get info, unless you can't figure out acronyms. From the sidelines I can see when oil producing country's start to need all the Oil for there own domestic needs, this can cause a lot of bad things. (When exporters turn into consumers of there own product) So I guess this sight is trying to give a honest evaluation when that will take place.What gets me is we are so vulnerably to the wimms of country's that don't even like us. From what I see a Oil crises can take place in hours not just in years regardless of how much Oil anybody produces. I'm a optimistic guy but Rock I just hope I have the wisdom to survive it. The big thing I see we have nothing that even comes close that scales in proportion of the quantity of Energy That gives us the ability to be Joe Sixpack.

Even worse, old Joe won't ask questions, he'll be looking for someone to blame.

There are 2 real facts: most countries are past peak production and peak discovery was more than 40 years ago. The first fact says that big problems cannot be far away.

The second says the same. Peak production about 40 years after peak discovery is 'normal', generally speaking.

True Han. But the other "fact" Joe hears is that there's a gazillion bbls of oil in the XYZ formation. We can distinguish which facts are reasonable. Joe can't. And each off us will walk away bitter after we fail to convince Joe of the real facts.

I work in the oil patch. I've had such chats with the blue collar Joes I've worked with. They are truly clueless for the most part. And they think they understand oil/NG exploration/production because they draw a paycheck from an oil company.

pocampo - Good to have you aboard. Welcome to your journey.

The two critical issues with oil supply are these: 1. flows - it is all about flows, or production. Reserves (other than for the fact they must be there) are irrelevant. If anytime someone says the word "reserves" it is likely they do not know what they are talking about. Note that flows are from the well bottom to the point of use; and there are a lot of players involved, a huge amount of (ageing) infrastructure and immense politics, not to mention one or two wars. All impact production and all are connected. The second factor is net energy. Oil is oil. Oil contributes energy measured in joules (or BTU's in the US) to society at a ratio of around 8:1 currently. That means 1 joule of energy expended delivers 8 joules of useful energy to society. The tar sands of Canada produce synthetic oil, but the embodied energy is actually from natural gas mostly. The net energy is around 3. Do a search on Euan Mearns Net Energy Cliff on this site. Net Energy of around 7-8 is the inflection point for big problems in society.

With flows production is essentially a race against production declines from existing capacity. New projects (measured in barrels/day - i.e. a flow) must match or exceed declines in production (flows) otherwise overall production declines. This site is all about trying to assess when that event occurred/occurs, what the impacts will be; and trying to inform people. It is an excellent site with information produced by very intelligent people to an extremely high standard. I have been PO aware since 2005. I think PO happened in the 2004-2008 timeframe (picking a particular month is pointless and anyway the data isn't good enough) and that we are in the initial shallow decline phase with our politicians desperately doing anything they can to prop things up. The decline rate will likely get steeper and the "recession" will get worse.

Good Luck

Welcome aboard Po:

Something that never seems to get mentioned enough is effect of high technology on the so called Hubbert curve. A particular field has a fixed amount of crude oil in the strata. The older methods could get an X% amount of crude out of the strata at a rather Hubbert curve rate. The new technology can get a bit more crude oil out of the strata and quite a bit faster. The field looks like it is delivering extraordinarily well and then it goes into a steeper decline than would be expected. Mexico’s Cantrell field is an example; after just a few years it is in rapid decline though during its life it delivered amazingly well.

Consider water injection to keep the pressure up is a rather old technology and with a vertical well the water percentage continues to rise until the well is unprofitable. This rather follows the Hubbert curve. But with horizontal wells, the well casing is along the top of the crude strata and the water injection is keeping the well pressure up but the water level in the strata is rising. This is all fine till the water level reaches the horizontal well and then the well is pumping water with just an oil slick on top. So now the Neo-Hubbert curve is more like a sharks fin and the drop-off is very rapid. Most of the computations and reports are based on the old proven technology curves that are no longer applicable.

Some of the new technology is very expensive like drilling 35000 feet in deep ocean places to get some crude but at what price is it worth the expense? Rockman will beat this drum since he is in the industry. It must make a profit or no company will do it. So even if the crude is there and the price is high, it still may not be worth it. Shale oil in the Western US is an example that there is lots of bitumen there but it is in shale rock. The Canadian bitumen is there and it is in sand which is somewhat easier to extract but even that is getting deeper and deeper with greater overburden to remove to get to the oil sand.

Of course these are generalizations that paint with a broad brush the various problems that are not mentioned in the MSM. The devil is in the details and there are several here that can get into the details as far as you want to go. We are fortunate to have many such people on this site in many different fields broadly associated with peak oil, public awareness, climate change, agriculture, finance, etc.

Again: Welcome aboard.

Thank you, all you guys. If we were together I would buy you all a Buttermilk. For the last two years I've been on my ranch here in Colorado licking my wounds. I lost millions in real estate, mostly my money as well as some other investors. It hurts bad, it wasn't I didn't have customers, it was that the Banks would not loan them the money to buy my product. Its my fault for being in the business. But one day the banks were loaning money the next day they weren't. They gave me no wind-down time. Even today its almost impossible to get a Jumbo loan on a nonconforming product. I remember the Fed Chairman looking in the TV saying the problem is contained to Subprime. Meanwhile, I could not even get close to getting a loan done to sell my Mini Ranches. I learned a big lesson - the Government will lie to us. So now I find myself drawn to the subject of Energy.

Now I'm trying to see get my mind wrapped around all this Info. I probably have just enough info to be dangerous. I've always had connections in the churches even though I don't believe a lot stuff they stand for. I'm thinking about bringing the info to some of the Churches in the 'middle of the week' type of platform. Just educating them on the easier stuff and making getting deeper as I feel they can handle. (I speak a lot better than I write, LOL.) Obviously, I will stay away from the PO Argument and just give them the facts and let them figure it out themselves. I subscribe to the theory a little is a lot. If I can just plant the seeds the rest will take care of itself. I'm not into convincing people I'm into making the presentation relevant to their lives. So this is just a summery of what Im going to do the first quarter of next year.

On another note, I made 300 percent on DXO. I did not make a lot of money but it gave me a start, and this web site had a lot to do with it :)

pocampo -- A thought: you might want to read "The Black Swan". The title refers to the inability to predict very impactful events in our future. But it really delves into predicting trends in general. I'm re-reading as I'm not very good at absorbing such matters. One point that's really beginning to sink in: we might not be able to predict Black Swans such as the meltdown of the real estate biz but that doesn't mean you can't adjust your positions to lesson the impact when one hits. Maybe you pass on a few good looking deals. maybe cut your margin a little. Maybe your comtemporaries might look down on your "pessimism" but consider how you might be looking down on them today had you been in a better protected position. It's a heavy and challenging read but well worth it IMO.

Thanks Rock, I'm familiar with this concept, I saw Taleb in a Interview from Newport Beach last year. I meant to get it.I will now for sure. They did the first interview with him, then next interview was a guy from Pimco Bill Gross. Bill Gross is a expert on every subject. LOL. In the past I thought I was hedged, boy was I wrong. In my teaching I will just talk about how much we all use and depend on petroleum products everyday and how vital they are to our way of life. Then build from there on stuff they can verify on there own. I also find it funny the term Black Swan and the word predict in the same Paragraph.

pocampo -- When you read Taleb's full context you discover he is the embodiment of anti-prediction. Not that he thinks valued predictions can't be made but that few understand the process. It's easy for me to empathetic with your predicament. I was lucky in that when my career started in 1975 an oil boom was just beginning. Like many unaware of Black Swans I could not see the possibility of a bust and thus never prepared. And then came $10 oil. Driving a taxi and delivering produce to restaurants taught me to never take such high times for granted again. I hear that same resolution in your voice. Good luck buddy.

Petrobras is saying they can start getting oil from Tupi by the end of 2010. When they can ramp up to full production? I don't know.

http://royaldutchshellplc.com/2008/04/30/petrobras-confident-over-deep-w...

I just read the report and I saw no mention of Peak Oil and declining production. Rather, he emphasizes that without immediate capital investment, the suppliers would be strained and the plateau would be prolonged, with prices rising again.

Would someone please tell me if Mr Husseini has anything to say about Peak Oil.

That's the nature of journalism. Your subject will say what he wants to no matter how skilled the questioner is. I agree there was no direct question about PO, but give him credit for snagging an interview.

I appreciate that Steve Andrews has done all this work pro bono. That is what it will take since no one else (in the industry, academia, or media) seems to dig into the topic.

We also have to understand what else Hubbert Linearization of the logistic can tell us. The classic derivation of the Logistic puts us in a bind since it shows absolutely no flexibility, and further it gives us no additional insight. It essentially requires that exponential search continue unabated at exactly the same compounded acceleration from day one. Why should we believe this?

Indeed, the chart on the SA HL shows a flattening. What else can this mean? I think it actually has to do with a furious pace of exploration and extraction, likely even greater than exponential. The following figure is what happens to the HL curve when an accelerated pace is added to the Dispersive Discovery model.

As you can see, a similar flattening does occur, but it cannot be sustained for any period of time. Of course this is in terms of discovery, but the general idea remains for production as production is essentially a response filter on discoveries.

So the question remains, is the Wicks scenario a realignment of the logistic curve and the underlying URR, or is it a signal to indicate that a brief frenzied activity is taking place? Unless the data is completely made up, I would bet on the latter.

Another possibility is that the entire SA discovery production cycle is very erratic and it goes through acceleration fits and starts and possibly other laws such as power-law acceleration apply. This behavior is not covered by conventional HL, but is amenable to analysis via Dispersive Discovery.

Ultimately, we need more info on the Wicks extrapolation since it looks very strange.

It's not true to say that nobody else in the media has reported his words. Peter Maass, who spoke at ASPO, flew to Dhahran and interviewed al-Husseini. He wrote about this in his book Crude World. In fact, Steve Andrews credits Maass with paving the way for his interview. And last year, Neil King of the Wall Street Journal had a good article contrasting al_Husseini's views with those of Nansen Saleri.

Independent journalism is a bit different than the regular media, and so Maass fits in with Andrews.

I was just trying to give them kudos. But now that you mention it, journalists have limited skill in doing anything truly analytical as they essentially relate stories from different perspectives and try to find contradictions or reconcile the views. They don't actually take a theory and try to verify it as a mathematician or analyst would. So the next step is pretty obvious. The journalists really have to start referencing the analyses on TOD, since this stuff is generally newsworthy, even though it won't always reference a Saudi prince. Don't hold your breath though as it will likely take a while, and would really take some guts.

If you really want to see some crappy journalism, watch how the next Freakonomics book -- SuperFreakonomics -- takes off. The tandem of guys who write the series and also have a blog on NY Times consist of a math-oriented economist and a science journalist. That should be a good combination, but they fail on epic terms IMO. They apparently bash climate change in the new book, uh oh. But before that they got the topic Peak Oil completely wrong. They do not understand the fundamentals at all, which ultimately surprises me since oil depletion analysis is nothing more than probability and statistics, which they purport to be authorities on. I myself consider it no more difficult than bean-counting.

This is what they have said in the past:

That was in 2005. At one time I almost bought their approach, I thought Freakonomics was all about looking at the statistics and basic math underlying a premise and trying to debunk or support that premise. They have often been able to do this by demonstrating how that almost certain correlations between cause and effect were simply anomalies that could not overcome the null hypothesis. But here they say “I don’t know much about world oil reserves.” So, with that, how can they predict anything, one way or another, on how things will turn out?

And this is a case of journalism that purports to do some original analysis. There is really nothing out there that has any degree of rigor and formality. The real go-to people would be someone like Laherrere who actually has studied this in depth and cranked the numbers in original ways. (likely on his own dime as well) He definitely doesn't fall into any of the categories I mention. And that is who we will really have to depend on.

Hey, they're economists. That's about all you need to know about them. Very few economists are willing to even consider that there are real limits in the world, whether on the resources side or on the pollution sinks side.

I'm in a Statistic class now. One thing I've noticed is that "math people" see the world conforming to math when in reality is exactly the opposite. Math is an attempt to understand the universe through numbers. In my experience, the universe is going to do all kinds of crazy things; you can describe them with math but that doesn't mean your description is what's happening.

Maybe I'm just bitter because I had to listen to my prof. go on a 45 minute tangent about "two different sizes of infinity". The whole time I'm sitting there wondering what difference it makes? These people spend to much time trying to stuff the world into their formulas and not enough time trying to learn from the world.

Edit: I just want to make sure you know this isn't pointed at any of the modelers here. I thoroughly enjoy your posts and am taking the stats class so I can better understand what you guys are talking about.

You have that absolutely right. The Verhulst equation leading to the Logistic and Hubbert Linearization is a perfect example of that perversion. The Verhulst as applied to oil depletion is what is called a pure heuristic that explains absolutely nothing from a fundamental point-of-view. Yet it is placed on Wikipedia as "the truth". Not to say that the Logistic does not match the empirical observations, it just doesn't explain mathematically what is happening. You will often see this under the category of mathematical degeneracies, see http://en.wikipedia.org/wiki/Degeneracy_%28mathematics%29. In some ways using the Verhulst is akin to flipping a two-headed coin. It is simply a mathematical identity that does not tell you anything. It only tells you that it comes up heads, because it comes up heads. In other words, it won't make sense to you no matter how hard you try, because it wasn't put there to make sense, only because it fits the data .. occasionally. Does that make sense?

You will go far if you continue to question what you are taught, as that leads one down the road of enlightenment.

WHT,

Verhulst's equation is a totally straightfoward first order differential equation. The equation is based on a linerally reduced k. You can see that at t=0 when cummulative production is 0 k=K but at URR K is 0 and at URR/2 k=K/2.

diff(x,t)/x = k*(1-x/URR). Where diff(x,t)=the production rate and x, the integral of diff(x,t) is the cummulative production. It is wholly DETERMINISTIC. Solution is of the form x = 1/(1+exp(-kt))

and the differential diff(x,t) is production = k*exp(-k*x)/(1+exp(-k*x))^2.

If you get rid of the reduced K and use a constant k=K

diff(x,t)/x = k the solution is exp(k*x), the simple exponential growth function and the production (diff(x(t)) would be k*exp(k*x).

Do yourself a favor(I'm not very good at solving diffeqs).

Buy an old version of Maple, Matlab or Mathematica on Ebay and you can solve and graph all the equations to your heart's content.

Verhulst is a non-linear differential equation. It has no resemblance to 1st order linear differential equations. You completely misinterpreted my comment about it being degenerate. It has nothing to do with determinism, but everything to do with it just being a curious mathematical identity that we continue to misuse.

Check out Project Tuva:

http://research.microsoft.com/apps/tools/tuva/index.html#data=4|0||6b89dded-3eb8-4fa4-bbcd-7c69fe78ed0c||

Richard Feynman: The Relation of Mathematics and Physics

For Saudi Arabia its fairly safe to assume productive search is well in the past.

http://www.aaee.at/2009-IAEE/uploads/fullpaper_iaee09/P_6_Salameh_Mamdou...

I agree with this paper and in my opinion Saudi URR is in the realm of 160-180 gb.

So we have dispersive discovery probably slowed dramatically vs production they found the largest field in the world and many giants. The distribution is warped when 50% of your production comes from a single field.

Next they are probably simply lying about production which is one reason for the hump in the HL curve. I assume the Saudi's can perform similar URR estimate and can tailor their reported production to reflect their reported reserves.

And last but not least even with this they would have been pumping like mad to keep production up even if they are inflating the numbers so a quite frenzy is also part of the equation. They repeatedly employ the most advanced extraction technology and indeed lead the world in their investments.

Last but not least I also think their internal consumption numbers are fudged on the high side to hide some production loss but even with this a linear increase in internal consumption still results in a very large and reasonable increase.

So if the above is correct the Saudi exports should be tanking right now.

My best guess is a 15-20% decline rate in exports depending on what the real factors are.

I'd be surprised if its less than 15% if the above rough guess are valid.

A similar argument applies to many of the OPEC producers in the gulf region all of them are in my opinion playing variants of the same game with the possible exception of Iran which has not made the investment in infrastructure and Iraq which probably damaged its fields under Saddam. Iran should be the only one of the group exhibiting a steady decline rate in production but it also has the largest internal demand.

So you have decelerated search with aggresive extraction actually pulling a lot lower real URR up to be overstated using HL. On top of this you have inflated production numbers making it look even larger.

And last but not least I think Saudi oil production was understated by 50% for almost a decade during the late 1980's so when they where reporting 3-4 mbd they where really pumping closer to 6mbd with the additional oil revenue going entirely to the royal family.

So the total production numbers are actually not that far off just the oil was really produced decades ago.

Using the paper I linked and the above correction for hot oil production then the final number for 2009 is probably not all that far off its just the oil was not produced when they say it was.

So given from the paper a culmative of 123 and a URR of 180 puts them at about 68-70% depleted. I've used 70% depletion as what would happen if a region was following a shark fin production profile. Oil production starts declining rapidly at the 70% or greater number then falls to a very low production rate for the remainder of the oil.

This is of course a situation thats impossible to hide for long so no sense in arguing if its correct or not if its right then Saudi production is crashing now and the effects will soon be obvious if not then any other model has them remaining fairly close to their peak rate for several more years and their announced cutbacks are fairly real and KSA should have at least 2mbd of spare capacity for sure at the moment. And of course the flip side of the sharkfin production profile is if until now production was actually following a smooth symmetric decline then extraordinary effort should boost it to at least cause some asymmetric production around the top thus again its tough to see how KSA can decline much if at all over the next several years.

One can assume if OPEC has substantial spare production they will at least open the taps some as oil climbs into the 100 dollar range therefore the time scales can readily be pulled of the futures market once we see 100 again on the futures curve you simply have to watch and wait until it meets the front month. At the moment despite the sharp rebound in oil prices the day of reckoning is nowhere in sight.

http://finance.yahoo.com/q/fc?s=CLX09.NYM

The the conjecture that KSA is crashing is correct you should see 100 not only appear on the horizon soon on the futures curve but rapidly move down it towards the front month on steepening contango. If this starts to happen then the "moment of truth" is coming.

They may very well have what they claim however this time around only KSA opening the taps for real will prevent another serious spike in oil prices.

Now with all this said if they really are in bad shape they also know the day of reckoning is approaching so I suspect that they are actually holding some real reserve capacity of at least 500kbd with say 30 days at 1mbd or so something like that so I think they will actually show a decent real surge but it will be short lived and fall off fairly quickly. Basically they will show the world some increased production then claim a much higher production level but under the covers start pulsing production. So they will surge a bit leading to a slight moderation in oil prices then cut back below their old production levels quickly oil prices start going up and they pulse again with another real surge but this time only reaching the pre orginal surge levels and again and again.

More that likely claiming ever higher production numbers after each surge. At some point they then start pointing finger heavily at other producers and say they need help and of course blame the lack of investment back when prices fell etc.

So although it won't really help much on the price front I don't see them going down without a fight. And as I said in another post the world economy and esp the US is in such poor position financially all the Saudi's need to do is last long enough for the world to start falling apart at that point they can do whatever they want. Its a fairly safe bet that even as the world comes unhinged disruptions will hit oil producers as much as consumer nations and overall oil prices will remain high and of course a very good chance that a petroleum backed currency of some form will play a big role in whatever the next monetary game will be.

Its the story of two people chased by a bear where one says we can't outrun the bear and the other replies true but I only have to outrun you.

Thus if Saudi Arabia plays its cards just right it should be able to bluff long enough to allow them to survive very well even if oil exports fall to say 2mbd or so. And of course if the world gets crazy enough you could well see Saudi Arabia itself become a bit of a local military power and seize some of its neighbors if esp if they collapse politically.

I could easily see them considering taking over parts of Iraq and say Kuwait or other gulf countries to "restore peace" later on. So in a shattered world if they do keep things together they their are longer term options that may well open up that allow them to bolster their dwindling production. One can expect many will be willing to bargain with them and allow just about anything to transpire to get the oil flowing again.

http://www.defencetalk.com/forums/military-defense/saudi-arabia-russia-s...

Note given the situation with the US if the US fails to corral Iran obviously an agreement between Saudi Arabia and Russia to split Iran would work very well esp if the Chinese are payed off. This fits very well with Saudi Arabia hoping if not planning on eventually being effectively the only major oil producer in the Middle East. A interesting side deal with Israel is even possible. Underling this seems to be a sort of conviction on the part of Saudi Arabia that the US is doomed. Now of course if their own production is crashing and they know the rest of the world is going down fast whats really interesting is this move with Russia to curtail Iran is not a head fake they know the US is going to go down.

"Now with all this said if they really are in bad shape they also know the day of reckoning is approaching so I suspect that they are actually holding some real reserve capacity of at least 500kbd with say 30 days at 1mbd or so something like that so I think they will actually show a decent real surge but it will be short lived and fall off fairly quickly. Basically they will show the world some increased production then claim a much higher production level but under the covers start pulsing production. So they will surge a bit leading to a slight moderation in oil prices then cut back below their old production levels quickly oil prices start going up and they pulse again with another real surge but this time only reaching the pre orginal surge levels and again and again.

More that likely claiming ever higher production numbers after each surge. At some point they then start pointing finger heavily at other producers and say they need help and of course blame the lack of investment back when prices fell etc."

This sounds like a plan to me. They have to keep the confidence of the importing nations. The party must keep going at all costs.

If dispersive discovery proceeds with an exponentially accelerated search over a spatially dispersed volume then we see the classic Hubbert curve -- a Logistic sigmoid for cumulative growth. Applying the technique of Hubbert Linearization to that formulation, we plot a straight line, as in the figure I showed (plotting cumulative production U against fractional production P/U). Shift discovery into a production to maintain the general shape.

What happens if at some point in the accelerating search we apply an even more aggressive search policy? Say that we super-accelerate by applying a Gompertz-like growth term exp(kt2) instead of the linear exponential in the constrained Logistic. The previously straight line develops a bulge that initially looks like a shallower HL slope but which eventually slopes downward to the URR cumulative intersection U0. Note that the URR gets normalized to 1 in the figure and amounts to a geological limit.

Conversely, what happens if the accelerating search stabilizes and transforms into a steady, linear growth? In this case, the HL linearization plummets before asymptotically approaches the same URR.

Whether this deviation has happened already, don't know as noise can obscure the effect. In terms of the deviation direction, it could always go either way. An aggressive search acceleration would come about if the operators had confidence that they could apply a huge, albeit transient, investment into their infrastructure. On the other hand, the deceleration would obviously come about if the industry started to give up and thus either reduce their search effort or resort to maintaining their previous rate.

Information also found here in a post called "Deviations from Hubbert Linearization":

http://mobjectivist.blogspot.com/2009/08/deviations-from-hubbert-lineari...

The math behind this is ridiculously easy.

Hmm well if you except the URR estimates from when the US was running things and I see no intrinsic reason why they are wrong plus some small additions from later search activity and the critical fact that most of the oil in KSA is concentrated in a small region that was easily searched then you get all the above as and answer.

The physical size of the oil rich quadrant of Saudi Arabia is so much smaller than Russia or the US that the search portion could have easily ended quickly. Not that Saudi Arabia has not searched in other areas and found some oil and its a big country its just that nature both blessed them with a immensely rich region and it seems not much else.

Geology is geology and if the above is correct then fruitful search ended very early not only for Saudi Arabia but for a good bit of the Middle East. If you simply look at the size of the worlds best oil producing regions vs the overall search area they actually are not a large precentage of the total. I don't know the exact number but its very small probably close to say 1-2% of the worlds surface has basins producing more than 1mbd.

Realistically outside of the arctic regions we probably found most of the worlds oil a long time ago esp in the Middle East.

If you split oil discovery at say 1980 and look at discoveries before 1980 vis after 1980 ignoring completely reserve additions its very clear that by 1980 actual true large new bona fide king size large oil discoveries had dropped of substantially. I'm actually not aware of a single giant or super giant field discovered after 1980 although I'm sure a few might make the cut say maybe in Russia this would be a field producing over 500kbd or so.

Even if reserve growth is true its not a new discovery simply a revaluation of and existing discovery and very different from finding a Ghawar despite the large amount of incremental reserve additions from reserve growth.

I'd argue that basic search and discovery and the bringing online of new basins and then new oilfields was fairly complete by 1980. After this lots of things happened but finding lots of new virgin basins and fields was not one of them. I don't question the dispersive search model however if you follow the strict definition i.e a true new discovery and a true search of a region then we passed it a long time ago and for the most part with a few exceptions time shifting this true search and discovery forward does not explain current production levels you must bring in backdated reserve growth.

Now with that said time shifting of these real discoveries does and excellent job of explaining oil production up through the 1980's and maybe as late as 1990 even depending on how you do it. However as you enter the later 1980's reserve growth makes a ever larger contribution to in effect rationalizing the production levels.

Now the discovery date of most of the worlds production is so far in the past that the actual sizes of the fields as they have been produced over the decades determines the worlds production levels. In this I include the identification of small fields in well developed basins like the Gulf of Mexico even into some of the deep water plays if they are following geologic formations that have already been heavily developed. Finding a new small field in the shallow water off Texas is basically infield drilling into a fragmented field its tough to treat this as equal to when the basin was orignally developed.

I know this is a fairly strict way of looking at things but the difference between pre 1980 discovery and post 1980 is striking indeed even as early as 1975 you can do this sort of division and the differences are obvious.

Using this approach you can see that discovery was very successful and the point at which the various regions was well searched is fairly abrupt it seems to have obviously finished. After this sure there was a lot of mopping up to do if you will and refining and exploiting the discoveries but we really did find most of the worlds oil for all intents and purposes. Thus true dispersive search is in my opinion well in the past whatever the additional oil found after this is who knows for sure yet ...

However it was found operating under a very different set of conditions from the original dispersive discovery period and its far from clear that applying dispersion to later developments is correct.

The math of this is not even math just a good look at historical finds and the trends are obvious

I think this graph is probably the clearest.

http://www.mbendi.com/indy/oilg/p0070.htm

After 1980 simply is not the same as before its very clear to me that meaningful or fruitful search was simply over by 1980.

Maybe I'm the only one that sees this damned if I know but I think its the right way to treat true dispersive discovery and I think everyone should agree at least until 1980 dispersive discovery and time shifted production was the absolute driving force in oil production the model is perfect. Afterwards ...

I see this (UK?) analyst Wicks supplying a future rather optimistic scenario in the context of HL.

Euan says that he doesn't want to discuss it right now -- that is fair since he is also probably working this stuff out on his own dime and time.

I just want to point out that HL as currently understood is based on a rather shaky premise, that of assuming a non-linear chaotic differential equation completely governs the oil production cycle. This equation is so constrained that it only allows one solution, and it forces people to look at the implications of the results in a very narrow focus. This I believe is dangerous as it leads to a likely unwarranted interpretation leading to an extrapolation for URR that may prove ultimately incorrect. It is clear that we have never seen a HL that works over the entire range of cumulative production. Granted it might work in historical cases over a range of cumulative (such as the USA) but this is in spite of itself, as we clearly don't understand the premise from which it arises, or perhaps rather, we don't want to. So I ask the question: How do we argue with Mr. Wicks unless we have a solid foundation to argue from?

Good post, memmel.

I always enjoy reading what you have to say.

But don't hold your breath waiting for the resumption of stability in the region if Saudi Arabia gets involved with its neighbors militarily. I recommend, "The Siege of Mecca". In spite of all the fancy weaponry the Saudis have purchased from the West, the Saudi military is basically completely incompetent.

Jabberwock,

I noticed that you commented on the difficulty you have with your coworkers, who are largely geologists, in trying to convince them of the peak oil issue. I am curious how you would even attempt to explain the conflict that SA presents in respect to justifying your own argument. In the field I am in, demonstrating weakness from a mathematical or statistical footing and I would be skinned alive in presenting an argument. I couldn't get away with pure rhetoric or hypothetical premises.

Perhaps that is what your colleagues are having issues with? Just curious.

I'm more of an historian.

I don't mean to be rhetorical, certainly not hyperbolic.

But the book I recommended is a good historical account of what actually happened when the Saudi military was given a military problem to solve. The results were not encouraging.

Indeed - if I recall the incident correctly they had to call on westerners to fly helicopters for air support purposes.

Another telling incident is the Persian Gulf crisis in 1990/91 - Saudis were completely incapable of protecting themselves from Saddam Hussein.

It's important to understand that the Saudi military and security apparatus is, much like in many authoritarian countries around the world, primarily a system designed to keep the existing rulers in place and secure from INTERNAL opposition. The external protection role, though ostensibly the reason for the Saudi military/national guard, is really a Potemkin one. The real purpose is to ensure the regime against internal rebellion or coup by a faction of the royal family. This is why they are so incompetent on real battlefields - they aren't staffed with professional soldiers but with loyalist yes-men.

Yes, exakaticly.

The likelihood (under any circumstances) of autonomous Saudi military operations outside the Kingdom's borders I think can be safely placed at zero.

Well to date the Kingdom has for obvious reasons not developed a strong military despite its prodigious purchase of equipment. Now either its been buying equipment as show toys or it buys it for a reason.

As far as the military personnel go well a coup is a problem for KSA without a real war to fight I see them as being smart enough not to build up a big military. Instead of manpower they would focus on the technical side i.e basically a lot of equipment and people trained to take care of it.

I'd class the current Saudi military as equipment maintenance staff. However its never wise to look to shallowly at history culturally and historically the Arabian peninsula has produced some of the best fighting forces in the world you can't dismiss the original Moslem expansion and this same culture is responsible for some the best "freedom fighters" or terrorists on the planet depending on your point of view.

Next they now have a huge population problem with the demographics favoring support for a large military.

If Saudi Arabia felt it could keep a large military engaged in patriotic war I suspect you could see things change rapidly.

If anything in my studies of Saudi Arabia I've gained a considerable amount of respect for the ability of the Royal family to do the right thing at the right time sure they make a few mistakes but overall despite the obvious trappings of wealth its a true old style royal family with cold hard steel hiding beneath the wealthy exterior.

If I'm even reasonably close to right its clear your dealing with a country that has steadily followed a roadmap through the last decades that was centered on ensuring Saudi Arabia would grow to be a powerful force in the world especially after peak oil.

One thing that seems to be seldom considered on the oildrum is a simple what if.

What if Saudi Arabia was very aware of its true URR and true situation and fully aware of the nature of peak oil and its implications for the world economy and Saudi Arabia in particular ?

This is a variant of the quote from Dubai.

http://en.wikipedia.org/wiki/Rashid_bin_Saeed_Al_Maktoum

Peak oil awareness is so pervasive in the ME that a peak oil saying is cultural lore in the region.

I've come away impressed with what Saudi Arabia has accomplished and with a healthy respect for what they may do in the future. I'm not at all complacent and dismissive.

And last but not least the Saudi Royal family is quite capable of implementing plans that take decades and even generations to mature I think we are blinded but our own experiences with variable popular governments and miss the truth behind royal rule and how it works simply because its uncommon today. Sure its ruthless at its heart but on the same hand the country itself is the source of power so the national needs are the royal family needs. Think of a farmer willing to do what it can to maximize his own wealth but also working to ensure his farm remains productive for as long as possible. Buried inside a royalty based government is nationalism that surpasses anything seen in the 20th century.

"Buried inside a royalty based government is nationalism that surpasses anything seen in the twentieth century."

Memmel, I've got to hand it to you-sometimes you come up with a single sentence that says more than most of us can say in a whole essay.

The simple fact that the house of Saud is still in power after three generations says a lot, considering the situation in that part of the world.

They are probably two or three moves ahead of almost everybody else in the chess game of survival.

But my impression is that they are sitting on a powder keg-which is not a good place to be especially when you consider the old saying about keeping your powder dry.

Memmel, in a court of law the judge would tell us that he is not interested in what we think but only what we know. However given that Saudi is so secretive about everything we can know virtually nothing about the internal workings of ARAMCO. Nevertheless that does not mean that we are left with only wild speculation about anything that concerns Saudi ARAMCO. So what do we have?

We have what we can legitimately glean from the reports and data we do have. We have the interview with Sadad al Husseini, we have the actual production data collected from many sources, we have reports from the Society of Petroleum Engineers, we have reports from Petroleum Intelligence Weekly quoting Aramco Senior Vice President Abdullah Saif stating that the decline rates in Saudi's giant fields are running from 5 to 12 percent and from time to time we get reports from people who have actually worked fro ARAMCO. And of course we also have very good reasons to believe that Saudi, along with other OPEC nations, inflate their reserve numbers in order to increase their OPEC quota. These are things we do have!

Wild and crazy speculation about Saudi underestimating production in the past so the Royal Family could pocket the difference or speculation that they are currently overestimating internal consumption to hide actual decline in production and other such imaginative speculation adds nothing to our actual knowledge about Saudi Arabia nor does it do anything for the credibility of The Oil Drum.

Ron P.

P.S. I apologize for being such a bitch this morning but I really think we should avoid wild speculation comes only from the seat of our pants.

Darwinian,

How much do you suppose the other major oil companies know about the Saudis that they aren't telling?

I will hazard a guess that employees at all levels from common laborer to head engineers move around a lot around and can be easily convinced to tell what they have seen -are in fact usually eager to talk.

Then various govt agencies from all major govts are in the habit of buying information.

I would further guess that a person who buys a lotof oil field equipment can find out a lot just from the friendly salesmen of oil field equipment and the shippers who haul it around all over the world.

So while we peons don't know the score, maybe the big boys do.

I continue to be interested in the Saudi stock market chart, a rather odd looking chart for a country with a "1,000 Gb of Resources," especially as oil prices went from an annual price of $56 in 2005 to $100 in 2008.

The sharp decline in early 2006 may be related to a lot of things, but it also correlates with the ongoing annual decline in Saudi oil production, relative to 2005. This was the time period in which the Saudi oil minister complained that they could not find buyers for all of their oil, "Even their light, sweet oil."

Richard Heinberg's August, 2006 observations & comment:

http://www.energybulletin.net/node/18904

Its a striking chart that can be found here:

http://www.tradingeconomics.com/Economics/Stock-Market.aspx?Symbol=SAR

Note the 10 fold uplift in 6 years (00 to 06), I imagine the crash is related to that.

How much an oilfield decreases is often estimated by the water consumption needed to be pumped into the wells. It has been reported that Ghawar increased water consumption during 2008. Same goes for using NG to pressurize the capillaries in the rock.

...Ghawar is now down to less than three million barrels per day...

I don't believe this quote from Richard Heinberg for one minute simply because I don't see how the other fields could possibly close the gap between 3mbd from Ghawar and overall Saudi production. Sounds like a product of the rumor mill to me.

I'm still bullish on Ghawar. It has a hump down the middle where you would normally put the producer wells. The water injection wells at the perimeter would then have to mobilize all the oil in the field but it's too wide for that. So it is being produced from the sides towards the middle. The outer ring are water injection wells. The next ring in are producer wells. A lot of water cut is accepted in order to flush out as much oil as possible. I don't think there would be any water cut it the opened the crown. Hence I believe recovery is much better than normal. Just my WAG.

Well, that was then...

Pre-2000 wells in the left image, red and blue placemarks indicate locations of oil and water wells respectively. 2000-2006 wells in the right image, green circles denote recent well locations and diamonds indicate drilling rigs in 2006.

The "outer ring" of producer wells only describes the lower third of Haradh (Haradh III). Elsewhere, they've long since had to drill everywhere -- and then redrill with horizontals/MRC wells -- as the water moved in.

I don't know if WT was referring to Richard Heinberg in this case or not. When was first reported as saying this, KSA had not yet brought many big ticket items online. With these, it is now possible that Ghawar is producing less (or much less) and they could fill in the blanks. They have in fact stated that with Khurais coming online, they would rest Ghawar. That can be read different ways, of course.

Ghawar has been turning on the spit for awhile on TOD. See:

http://www.theoildrum.com/tag/ghawar

or my work here:

http://satelliteoerthedesert.blogspot.com/

Money buys a lot of silence. If you want work or purchases from Saudi Aramco, it's best to clam up.

The Saudis still perform beheadings on a regular basis, for capital offences. Strangely, everyone 'questioned' about serious offences ends up signing detailed confessions. They rarely get time to recant.

Mac, you are correct in that what you know depends on who you are. The publication "Petroleum Intelligence Weekly", and a few other publications, know a lot but they are subscription only. However occasionally someone leaks what they publish, like here:

Or here:

I have several pages of saved URLs that point to such information. Bottom line, what we do have is plenty of very good information. We don't need to make up stuff of which we have no source other than our own imagination. Not that there is anything wrong with speculation, but speculation can occasionally just get wild and crazy, like accusing Saudi of producing a lot more than they stated and the Royal Family is pocketing the difference. After all, even then we did have tanker counters and reports from other nations as to what they imported from Saudi Arabia.

It would be very difficult to over report or under report what you are producing. As an example Venezuela is trying to do that today. They claim they are producing over half a million barrels per day more than even OPEC reports in their Oil Market Report. Venezuela makes production claims that cannot be verified therefore everyone goes with what can be verefied. The same would be true for Saudi Arabia or anyone else.

Ron P.

Darwinian,

Thanks,your reply jibes with the impression I have formed over the last several months following TOD and reading the energy related books often mentioned here.

I believe there may be,more likely IS, a strong parallel bewtwen the energy intelligence situation world wide today and the military intelligence situation situation just prior to the outbreak of many wars-the essential data were there and plain to be seen , but tptb higher up in the chain of command often as not discounted it to near zero value simply because it did not jibe with thier own preconcieved notions and biases.

In this case tptb are congress critters and cabinet secretaries rather than generals.It sure would be interesting to be a fly on the golf cart when the biggest of the banksters talk among themselves.

Apparently they must believe that the US will survive the coming secondary peak/price spikes and the associated crash and that they will still be in the catbird seat.

As I see it, there will be nowhere safe to run to if and when tshtf world wide-thier fiat money won't buy any thing.And the deals they have cut with the local ptb in other places probably won't be worth much either-even a low ranking officer in charge of just a hundred well armed and trained men can probably take out any sort of multi millioniares personal security force in a few hours with very little effort.

A few weeks ago I listened in on a conversation between a moderately wealthy woman and the owner of a second hand book store where I am a regular.Her husband spent his career with the World Bank or some such organization and they traveled a lot.

They went in with friends and bought a ranch somewhere in Central America as an investment and as refuge-I will give them credit for seeing the need!She was talking seriously about troubles here in the states and moving down there.

After she left the owner asked why I had to go off into a back corner to keep from laughing at her to her face-she seems to think that the locals are fond of her and her husband, and that they ill be grateful for the opportunity to wait on her hand and foot if tshtf.

The giy who runs the store is not a reader and I had to explain to him that her property would be confiscated within less than a year for sure in the event of any sort of major international upheaval and that she would be very lucky to retain as much as a marked grave out of her investment.

mac -- I'll offer a speculation. I doubt the majors know agreat deal more. Not that they couldn't if they really tried but I don't think it's critical to them. OTOH if, let's say, the CIA wanted to get a good handle they could hustle together all the expats who have, and continue to work, in the KSA and generate a picture. Much of both the high and low end engineering is done by those folks. I haven't bumped into one in a quit a while but 20 years ago there was a lot of scuttlebutt from them about excessive production rates damaging Ghawar's ult recovery.

It would be nice to think of the CIA being on par with James Bond. But I don't.

Rockman, I don't believe much of that James Bond type stuff-what I envision as the reality is a couple of guys with pocket protectors eating cheetos sitting in a stuffy office going thru various data bases and pulling out names of people who might have once had some access of one sort or another-as an engineer, truck driver, salesman, or technician-especially keeping an eye out for bean counter types who might be short of money and recently retired or forced out for some reason.

Then they send somebody to talk to these people-maybe offer some money if they're broke, or a little help with a visa, etc.

These guys could work for military intelligence, a multinational oil company ,somebody like Simmons,or the CIA or nearly outfit with tons of money-such as gold in sacks.A good inside source able to throw some light on the situation would be a real feather in the cap of a manager in any one of these organizations.

I know in the past some really great spy work has been done. There was a book out some years ago titled, I think, "East Minus West Equals Zero". In it the authors described how the US had set up an office in Israel and interviewed Jews emigrating from the USSR. They got a wealth of information from them for nearly nothing. The issue that made the emigrants so valuable was the Soviet universal conscription. Virtually every male interviewed had spent time in the Soviet military.

So it's possible, by interviewing a large number of ARAMCO expats you could get a really good idea of what's going on there.

But I think that the barrier is that the entire US govt apparatus is so sweet on the Saudis and the certainty that something ("the invisible hand") is going to produce whatever energy we need that it simply doesn't occur to them that it is important to look into Saudi reserve numbers.

edited for clarity

Mac -- I would like to think your scenario exists out in the hinterland. This is an old anecdote so it may not fit well today. About 30 years ago I met a geologist who actually worked for the CIA. A friend of a friend. Sort of a light interview. I'll skip many details of our conversation and just suffice to say this guy couldn't find an oil spot in his driveway. And he had at least 20 yrs experience. And the fact that he thought I might be a useful asset also speaks volumes: I only had a few years experience and was just barely getting my hand around my craft. Georgetown did look like a nice place to live but I finally decided there were just too many Yankees up there.

Nothing personal, Yankees.

One of the problems that the Peak Oil movement/community/sect suffers from is the public assumption that it doesn't have the facts and doesn't account for such and such and are amateurs in oil. Al-Husseini's concerns expose the (Saudi , at least) cornucopian argument for what it is: a bias toward believing that all problems regarding the production of difficult petro accumulations will be solved in due course. He knows the cards that Saudi Aramco is holding and, while not saying exactly what they are, is saying they are bluffing. I agree that wild speculation beyond that isn't necessary.

Well is it all wild speculation ?

http://www.wtrg.com/prices.htm

And

http://en.wikipedia.org/wiki/Early_1980s_recession

http://www.kc.frb.org/PUBLICAT/ECONREV/EconRevArchive/1985/4q85mill.pdf

And plenty more about the economic situation during that period.

Now the claim was a 3mbd increase in crude production tanked the price of oil in 1986.

Lets see if it passed the sniff test.

1.) US economy weak extensive globalization undercutting job growth high unemployment. Claims the recession has ended.

If it sounds a awful lot like 2009 then your on track to understanding the economy during that time period.

Now looking at prices.

http://www.inflationdata.com/inflation/Inflation_Rate/Historical_Oil_Pri...

And look here remember there is a FLOOD of oil entering the market right 3mbd.

http://tonto.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCESTUS1...

http://tonto.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=W_EPC0_V...

So 3mbd *365 days = 1 billion barrels of oil.

Show me the data that accounts for this billion barrels of oil and I'll agree I'm speculating wildly.

If you actually LOOK at the data its nowhere to be found.

So 1 billion barrels and not a trace of them ...

Find them and I'll withdraw my "wild" speculation.

And of course the next issue is how much excess oil is required to drop oil prices significantly prices are set on the margin it does not take a lot of excess oil flooding the market to have a strong impact on prices esp if the world economy is weak when it happens. Looking at it from a supply demand angle anything from 500kbd to 1mbd is more than enough excess oil to significantly effect prices depending on the demand side a 50% drop in prices is reasonable. We saw a dramatic change in oil prices by at least 50% in the second half of 2008 with a slight change in the rate of decline of demand etc.

Next the paper I linked claimed that Saudi Revenue remained constant during 1986 offseting the drop in oil prices.

There is zero evidence of this.

http://books.google.com/books?id=bekED50mOJAC&pg=PA552&lpg=PA552&dq=Saud...

Plenty exists to show that the Saudi's finally decided to change direction and deal with internal problems that where becoming serious at this point.

http://countrystudies.us/saudi-arabia/34.htm

This should read that by 1985 it became obvious that blatantly stealing the oil revenues and pocketing the money was going to lead to internal revolt. Under the cover of increasing production by 1mbd and claiming 3mbd the Saudi's skillfully managed to to hide the end of of the the largest graft operations in history. One can suspect that the devaluation of the US dollar played a large role in Saudi Arabia ending the flow of illicit oil into the large US market. We effectively did not pay for it.

The fact is was primarily a book keeping revision can be seen in the fact that this flood of oil is very difficult to find in practice. Not that oil production was not increased just the truth seems to be far less than the claims.

However prior to this a immense amount of wealth was generated and for the most part flowed directly to the pockets of the elite. The US via prostituting its large consumption of oil was able to operate the biggest money laundering game in history dwarfing the illicit drug trade.

This massive direct injection of wealth from the oil trade radically and fundamentally changed the global economy indeed as the new ultra wealthy class reinvested its illict gains it sparked the rapid growth of globalization. As large scale infusion of funds from the illict oil trade dried up the ultra wealthy increasingly looked for other means to expand wealth and increasingly impoverished the consumer class as its oil addiction became distinctly less profitable.

Whats interesting is that this game was repeated again following the collapse of the Soviet Union resulting in the creation of the Russian oligarchs as the new Russia opened up a similar trade.

Similar smaller scale examples exist in Nigeria and Venezuela for example.

Ironically Chavez's attempts to assert Venezuela's real oil production levels are met with skepticism if his claims are even reasonably true what happened to all the oil produced before he took power as certainly production capacity declined after he took over.

Call me a lunatic if you will but I've had no choice but to finally conclude that what really happened during the oil age is far less pleasant than we believe.

The US has been dramatically corrupted by money and power as it turned the liability of a massive oil addiction into the greatest source of wealth ever seen in the world.

I don't think you are a lunatic. Rather, I think you are a prophet. The only thing missing is the goat-skin clothing and sandals.

I agree that it is all less pleasant than we believe (read Peter Maass' book), but there is enough stuff to be concerned about without going over the edge. I don't believe everything SA says, but I don't disbelieve it all either.

:)

Thanks !

Seriously it means a lot.

However to repeat a bit from what I just posted really underlying every thing is this sort of natural outcome of technology its a generalization of Moore's law or observation which itself can't really be proven.

What happens if you look at practically any field is once we start applying the scientific method and resulting engineering is that we rapidly take the area to the extreme. The green revolution to genetic modified crops. Kitty Hawk to spaceflight. Same for oil technology. However in many ways its not clear for a very long time if this extreme was helpful or harmful or all the possible secondary effects. Generally it feels good and looks good at the time its only when you wake up the next day that the truth is clear.

This extremism embedded in a technological civilization naturally in my opinion takes the entire system to a sort of threshold or edge or envelope. And this by its very nature can cause wildly divergent views about the nature of the envelop or edge when you begin to hit it. Its clear to most people that we have hit a sort of boundary however the problem I think most people miss is this boundary is not embedded in the system thats being refined it can be one or many external factors.

As and example for computer chips heat has increasingly turned out to be a serious issue along with clock timings and electro static discharge. For a long time these external forces where considered problems to be overcome but its becoming increasingly clear that they represent a real wall or envelope constraining further improvements in traditional chip design. Thats by no means saying we can't figure out a way around these problems but now development is increasingly focused on finding if routes exist around this barrier.

With airplanes the barrier is of course very real and its the speed of sound and friction heating at supersonic speeds and fuel use. Can we build faster planes certainly do they make sense outside of a very small number of military applications well history seems to say no.

In the medical field we increasingly see tremendously expensive treatments which often do little to enhance either quality of life or longevity. I'd have to find the stat but I saw a number that said that 80% of medical expenses occur during the least two years of a persons life on average. A tremendous expense for little real gain.

Of course you can find similar examples across practically every advanced area.

Of course your technical expert will claim this is rubbish and its just a matter of money and all these problems can be solved but thats not the point I want to argue. Its not if these boundaries are temporary or serious it that technology intrinsically approaches what ever the limiting boundary is.

With oil I believe we have hit the boundary and that it seems we either did one of two things that are effectively mutually exclusive either we have greatly increased our ability to extract oil or our recovery rates and also found significantly more oil than we though existed and its simply a matter that oil will be slightly more expensive going forward or we actually simply managed to extract the amount that was discovered during the primary wave of discovery at a furious pace.

One or the other of these two things have happened. It can't be both since then oil production would have continued to increase exponentially as oil reserves expanded.

At best production capacity is then limited by slow financial growth and as demand grows oil production will readily grow to reach it.

The both viewpoint or pure cornucopian view seems to be easy to dismiss living the a or b choices.

Now this problem is simply the same exact problem we see everywhere else and its the oil variant of the technology problem. The argument remains across the board in all cases that the system as it hits the wall also clarifies what its real choices where and what was really optimized regardless of what people thought they where doing.

In the case of medicine it seems clear that the taking of money from the elderly is what the US medical establishment has optimized itself for this is closely linked to the aging baby boomer population.

In another case agriculture the green revolution has optimized unwittingly rampant extraction of groundwater and destructive fertilizer and pesticide usage. Its simply optimized the use of these inputs to maximize output.

So if you buy the argument then one has to wonder what the Oil industry has really done.

The two above examples I use argue the truth is dramatically different from what most in the industry would claim was done in fact almost all participants in these industries are blind to the truth often only outside observers seem capable of pointing out the obvious.

I of course don't know for sure what we have done but I'm very comfortable in saying look people we have done in oil what we have done in almost every single other area that been technically optimized we have hit the wall and only then does the real situation and truth become obvious.

Almost across the board in a wide range of industries once you look in my opinion the truth turns out to both be very unpleasant and offers a bleak future. Sometimes its not really bleak like with airplanes it really seems they are what they are certain sizes work and sure the engines can be made more efficient and refinement continue but I'd be surprised if normal airplanes ever fly a lot faster than they do today for quite some time if ever. Its not all doom and gloom but this is more and exception than rule.

So thanks !

And so there is a strong logical process underlying this refinement to a set of choices it could well be wrong but I don't think so it seems to be to general to be seen as trivially wrong.

Yes, and for the first time I heard Matt Simmons say that when he visited Al-Husseini just before the publication of Twilight In the Desert, Al-Husseini told Matt that he had the SPE papers published so that someone could assemble the clues.

And don't forget that SA accounts for only 20% so the errors on getting this absolutely correct amounts to an unbiased 20% error on global extrapolations. And this is likely a worst case, so that if we are only off SA by 50%, then the global error is just 10%.

I haven't racked my brains over SA because the data isn't there and I essentially treat it as a statistical hole, much like you don't have to count every vote in an election to get a good handle on what the final election outcome is. It's what most people would call statistical sampling or stochastic modeling. That is what Dispersive Discovery is all about.

Thats funny thats the sort of error range I get with my convoluted witchcraft tea leave reading approach :)

Even though I'm assuming different numbers and a whacked model the error term seems really tenacious. The slop if you will is itself interesting.

For the cumulative production the error seems to be as large as the entire oil production for the United States. You can drive a truck through it or damn near make any model work for a very long time.

External factors or shocks are critical to elimination of alternative models.

Even now all I can really tell is that either the shock model is correct i.e its done all the right things or its missed some large shocks that are really really hard to quantify.

Despite everything I'm deeply impressed with the model its right on.

Maybe a fairly esotric example will help I'm learning machining right now.

If you have a long thin rod in a lathe and you want to machine it down to a perfect cylinder is very hard as obviously the rod flexes in the middle. There are special follows and other tools to handle this flex but there is also a neat trick.

Instead of trying to cut the rod to size using a tool you simply use a file with very light pressure to true the rod.

A practical end run around a really narly problem. For me at least the shock model and dispersive discovery is like a lath or mill capable of really solving complex problems.

However every now and then you have to cheat and break the rules and figure out a practical solution to a really hard problem.

I'm absolutely at a loss on how to calculate the magnitude of complex shocks that may be large but depend on economic factors and technical factors.

I'm certain that there is a not small number thats really important and just as certain I have no clue on how to solve for it.

So screw it where is my file :)

memmel, you just placed a bomb with some of your numbers and percentages.

Awesome Mike.

Thanks for your thoughts on this.

I decided when oil was tanking into the 30s that I was going to hold all my long positions - I cashed out a lot in July 08, but left a whole bunch on the table.

As it is now, it's becoming more like "wait till you see the whites of their eyes." As oil creeps up, my portfolio numbers shoot up, and every day it gets harder not to pull the trigger.

But I have decided, no matter how tempting the alternative is, I'm holding my fire until I see a number I like.

Your posts, in part, have helped me gird myself mentally.

Thanks.

Be careful !

Absolutely no telling whats going to happen going forward. If I'm even close to correct and if you consider the current state of the world financial system we are sitting on the edge of an literal unknown. Its impossible to predict whats going to happen.

My conclusion has always been that a intentional collapse of the system is the only real way out if the underlying oil situation is degrading rapidly. One could readily argue that the actions of the Feds in pulling the plug on Lehman and Bear Stearns was and attempt to do this sort of controlled collapse in my opinion it did not turn out quite as expected.

I think the US is still capable of adjusting demand downward or attempting to. I fully expect the US to be forced to increase interest rates in the near future shocking many and putting the kebosh to housing. This could readily send oil prices tumbling again. At some point of course the US will have no choice but the kill suburbia and pull the plug.

Although talk is growing about the end of the dollar i.e its certainly increasingly in sight in many circles way way way to many financial assets are held in dollar denominated accounts today. Its death may be on the horizon but the olde dollar still has a lot of life left in it. This suggests that at some point the US will step in and defend the dollar.

Also of course if you think about peak oil up till now exporting countries have worked hard to devalue their currencies as the price paid in consumer nations was the driving factor however as the price of critical commodities such as oil increases a weak currency approach starts to fail and you need to appreciate your currency against others to offset the cost of raw materials esp oil. And if your a food importer food.

So all kinds of currency situations that have held for decades are changing now and will change faster in the future esp as countries are increasingly struggling to simply keep their internal economies afloat much less export.

At any point in time this massive financial volatility could easily spill over into oil esp if a major economy such as say Britain or Italy or Spain collapses.

Plenty of ways exist for a situation to develop which again results in a temporary oil glut certainly the scenarios are more extreme then what we have seen to date but volatility is the key word.