Comments on Scientific American's "Squeezing more oil from the ground"

Posted by Luis de Sousa on October 19, 2009 - 10:30am in The Oil Drum: Europe

This article, put together by Jean Laherrère and edited by Colin Campbell, is a critical review of the recent article by Leonardo Maugeri published by Scientific American.

This article, put together by Jean Laherrère and edited by Colin Campbell, is a critical review of the recent article by Leonardo Maugeri published by Scientific American.

A decade ago, Scientific American published the seminal article by these two luminaries of the Peak Oil awareness movement, that relaunched the debate on M. King Hubbert's finds, Scientific American appears now as a completely different publication. Now, however, scientific content doesn't seem to be a requisite for its articles. Among other eerie details, Leonardo Maugeri goes as far as citing "Common Wisdom" to present erroneous facts.

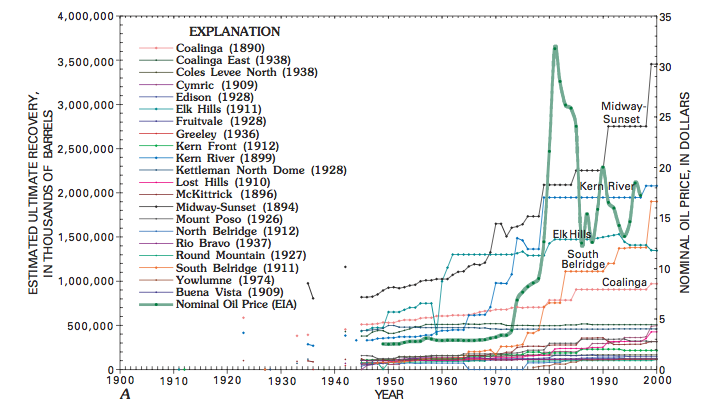

Leonardo Maurgeri starts his Scientific American article by quoting statistics for the Kern River oil field in California, suggesting that its very favorable reserve growth is representative of what can be expected more generally throughout the world. In using this approach, Maurgeri, an economist and vice president of the Italian oil company ENI, follows the work of Professor M. Adelman. The basic statistics Maugeri quotes are shown in the following table:

| Mb | 1942 | 2007 |

| Comulative Production | 280 | 2000 |

| Remaining Reserves | 60 | 480 |

| Ultimate Recovery | 340 | 2480 |

Alderman commented that the field itself had not changed; but knowledge of it had. Maugeri follows the same argument but fails to mention that the number of producing wells had increased from 500 in 1942 to 9318 in 2007 and that as many as 16 000 wells had been drilled in total. In other words, drilling increased by a factor of twenty yet the reserves increased no more than eight-fold.

He also fails to note that published Proven Reserves in the United States are based on SEC rules such that only the developed part of the field could be reported even though its full size was known from geological maps and appraisal drilling. The field was discovered in 1899 by a hand-dug well, no more than 45 feet deep, and has been in production since then. It contains heavy oil ranging in gravity from 10º to 16º API, and steam stimulation commenced in 1963 to improve recovery.

|

| The above illustration, taken from the USGS Bulletin 2172-H 2005 Growth History of Oil Reserves in Major California Oil Fields During the Twentieth Century, shows that Kern River reserves (in blue) were larger in 1923 than in 1937 and 1942. |

The California Department of Conservation reports annually all the details of field production, and it is easy to plot annual oil production and reserves of the Kern River Field.

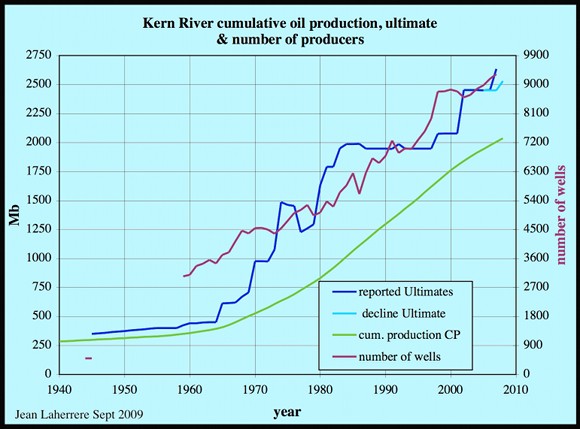

The following graph shows how the reported Ultimate Recovery (cumulative production + remaining reserves) of the field have grown in parallel with the number of wells, reflecting the constraints of the SEC reporting rules. Production began to increase significantly with the steam flooding in 1963, preceded by cyclic steam injection in 1958. These processes, which are well established and normal industry practices, are called technological miracles by Maugeri.

|

The reported Ultimate ceased to grow in 1985, reflecting the peak of production per well at 23 b/d in 1982, being now below 9 b/d. Production per well seems to have been linear since 1996 and could be extrapolated towards zero in 2020, meaning that the field will have to stop production before then.

|

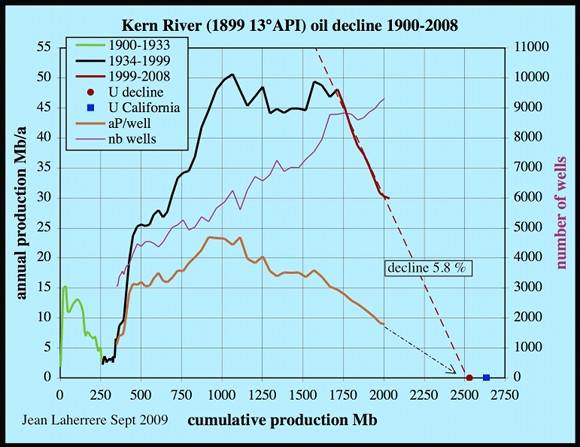

The field covers an area of about 10 000 acres (43,5 km2), and supports 9 300 producing wells, giving a spacing of one per acre. The normal US spacing was one well per 40 to 160 acres, with 10 per acre for infill drilling,. Kern River is a good example of a field that has been over- drilled.

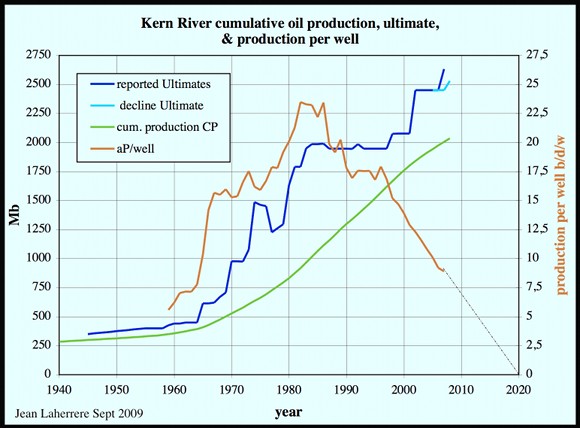

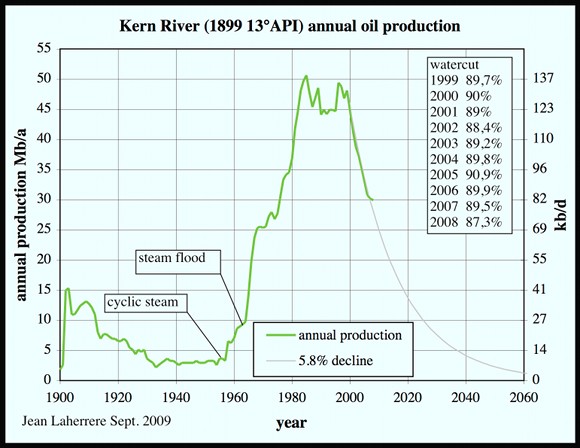

The ultimate recovery is reported to have grown again in 2001 and 2007 to over 2 500 Mb. But plotting annual against cumulative production shows a decline since 1999 of about 6% a year. As illustrated in the following figure, an extrapolation of the 1999-2008 data gives an ultimate of 2 530 Mb, compared with the 2 634 Mb reported by the California Department of Conservation for 2007.

|

It may also be noted that production per well since 1996 can also be linearly extrapolated towards 2 530 Mb. Annual oil production may be extrapolated with a decline of 5.8 % per year, which corresponds with a cumulative production 2009-2060 of 436 Mb. This is below the reported remaining reserves, which with an indicated production of less than 1 b/d are likely to be below the economic or EROI limit, that being the energy return on energy invested, which has to be positive to make sense.

|

The Oil-in-Place is variously estimated at 3 500 Mb by Swartz et al 2008 (Kern River Field: Framework and Future of an Old Giant AAPG Search and Discovery Article #90076), or at 4 000 Mb by McGregor (1996). It means that the recovery factor is over 70%, when Maugeri talks about a present 35% recovery factor for the world.

It is clearly ridiculous for Maugeri to take the example of this very old field of heavy oil found by a hand-dug well and subject to steam flooding, that peaked more than 80 years after discovery, and is still producing, as in any way representative of modern conventional fields. It is like comparing apples with oranges. The USGS makes the same mistake when it applies US field growth based on Proved Reserves (1P) to the world as a whole that is based on Proved & Probable (2P) reserve reports.

US field growth is due to the outdated reporting practice, based on obsolete 1977 SEC rules. These rules will be changed in 2010, to allow Proved and Probable Reserves (2P) to be reported, meaning the US reserve growth will likely disappear.

Maugeri writes:

According to common wisdom, a field’s production should follow a bell shaped trajectory known as the Hubbert curve and peak when half of the known oil has been extracted.

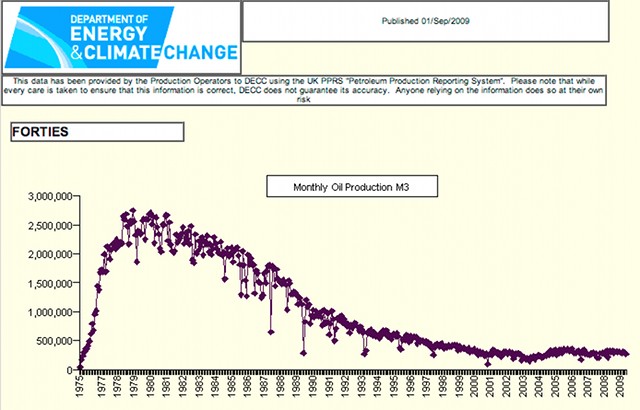

He confuses the pattern of individual field production with that of basin or country patterns. Hubbert was modelling US and world oil production, and not that of an individual field which normally increases rapidly in its early years before declining slowly, with the peak coming before the midpoint of depletion, as well illustrated by the Forties Field in the UK North Sea.

|

Maugeri, as an economist, talks only about Proven Reserves, but he should know that the development of a field, especially offshore is based on Proved and Probable Reserves. The net present value of a development is computed on the Mean Probability value and not on Proved Reserves alone, which have a 90% Probability.

Maugeri writes:

But I believe that those projections will prove wrong, just as similar « peak oil » predictions (Campbell & Laherrère, SciAm March 1998) have been mistaken in the past.

That article was entitled The End of Cheap Oil, at a time when oil was trading at $13/barrel, before sinking to $10/ barrel in the following year. It was in fact ranked by the Sonoma University as within the top 25 most important papers published in 1999. It is hard therefore to accept Maugeri’s claim that it was mistaken.

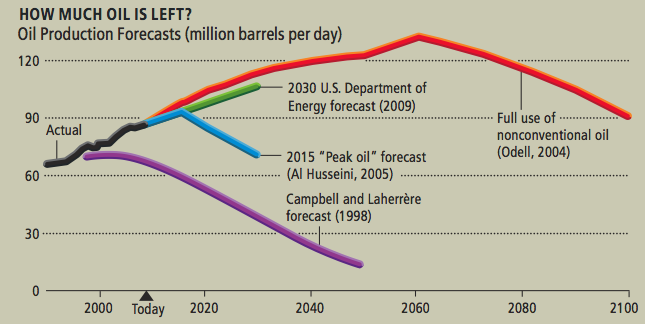

Maugeri’s graph compares the oil production forecast of Campbell and Laherrère 1998 with others, failing to note that the former referred to conventional oil only whereas the others refer to all categories.

|

In fact, Campbell and Laherrère submitted graphs covering all the categories, which were not in fact published. The plot for combined conventional and unconventional forecast 31 Gb/a (namely 85 Mb/d) for 2007, which is close to what was actually produced. The mistake was not in the substance of the forecast but in not having better checked the title of the graph published by the Scientific American.

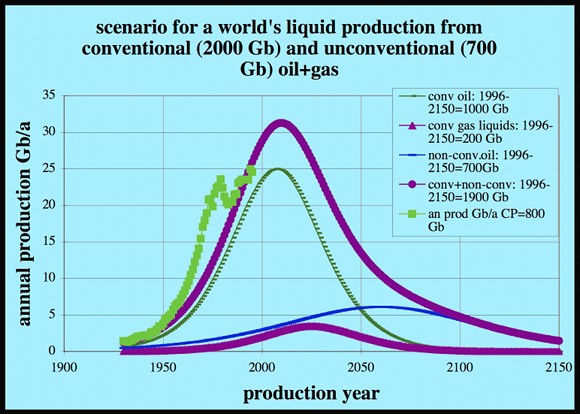

The following graph, for the world’s liquid production, was published in Laherrère J.H. 1999 Assessing the oil and gas future production and the end of cheap oil?, CSEG Calgary, April 6.

|

Recent ASPO (Campbell &Laherrere) forecasts are compared with others (but not those from Maugeri) by the US National Petroleum Council 2007 «Hard truths».

Maugeri writes:

It is absurd to predict a peak of world production because it presupposes that one knows how much oil is in the ground.

On that basis, logic suggests that it would be equally absurd to accept Maugeri’s claim that the peak is not coming until 2030 or that more than 50 percent of the oil known at the time will be recoverable.

That said, we can agree that no one really knows the volume of oil in the ground, meaning that little reliance can be placed upon assumed recovery factors.

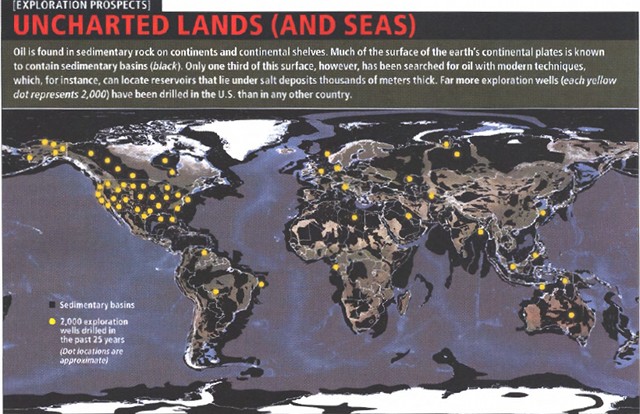

Maugeri believes that only one third of sedimentary basins have been explored, but out of about 600 sedimentary basins only 200 basins have the potential of generating oil or gas for well understood geological and especially geochemical reasons. He shows that for the past 25 years, the United States had more exploration drilling than any other country.

|

But he fails to say that the ownership of oil rights in the United States differs from that in the rest of the world. The United States supports more than 20 000 oil companies, and the economics are also quite different. For the last 25 years over 60 000 pure exploration wells (New Field Wildcats) have been drilled in the United States compared to 5000 in Canada and 40 000 for the rest of the world. The average size of oil discovery is 0.3 Mb for United States, 0.9 Mb for Canada and 740 Mb for the Middle East, 14 Mb for Africa , and 7 Mb for the world outside US & Canada. Again comparing the United States with the rest of the world is comparing apples and oranges!

Maugeri writes:

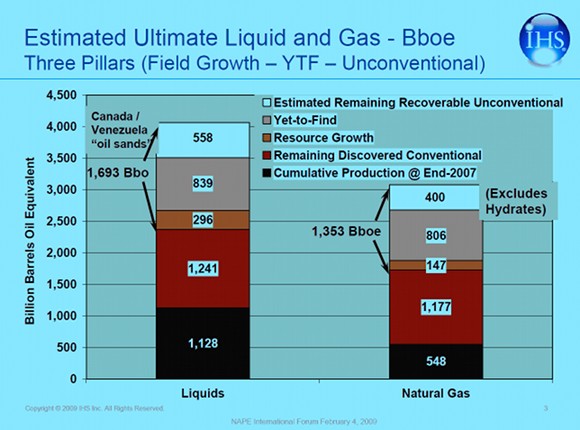

[…] by 2030 we will have consumed another 650 billion to 700 billion barrels of our reserves, for a total of around 1600 billion barrels used up from the 4500 to 5000 billion figure

This implies that today we have consumed less than 950 billion barrels, which is clearly mistaken. Cumulative production is over 1100 Gb according to the industry database produced by IHS (NAPE International Forum February 4, 2009 Where Will Tomorrow’s Oil and Gas Come From? Pillars of Oil and Gas, P.H. Stark and K. Chew).

|

Paolo Scaroni, the Chief Executive of ENI, the company for which Maugeri works received the Petroleum Executive of the year 2008 award. He said in the Petroleum Review of March 2006 [pdf!] in page p25 that replacing reserves is the nightmare of IOCs.

Scaroni’s words seem to be conflict with Maugeri’s statement that most of the planet’s known resources are left unexploited in the ground, and still more wait to be discovered.

Perhaps Maugeri should tell his Chief Executive where all these unexploited and undiscovered oil reserves lie to help ENI replace oil reserves. Its 2008 Annual Report shows that both its oil reserves and production have fallen compared with 2006 but that its gas has increased. It may prompt the cynic to ask if whether Maugeri can distinguish oil from gas.

Luís here again: Maugeri's article has some similarities with one penned by Peter Jackson of CERA a couple of years ago; in both cases the authors do not seem to understand what the Hubbert Method is. But while Peter Jackson definitely showed some scientific objectiveness, the same can't be said of Leonardo Maugeri.

I agree with the response to the article in the Scientific American, however it would seem like how much oil is recoverable vs. how much flow can be achieved is more important. If the world economy needs 95 mbd to maintain momentum and expansion, but 85 is all it can muster, and as a result the price goes high enough to cause a recession, then how much is eventually recoverable starts to become irrelevant, don't you think?

No, they are both important (not to mention linked). I would take a 1000 years of 50mbp over 10 years of ever increasing reserves followed by a crash... wouldn't you?

The world does not "need" 95 mbd... even if it really wants it. This is a matter of infrastrucutre and current expectations (the classic example is Europe that uses half as much oil for a comparable lifestyle to the US). The price is telling us to use less. Infrastructure and lifestyles are changeable, but few are willing to make major changes for what they (falsely) see as short term events.

The problem as I see it though, that I think you're pointing towards, is that the economic system we have is not well-equipped to deal with this problem. Our response to recession is to use less oil, but when it ends, we go back to out own ways. If people understood the problem, maybe they wouldn't? I think greater transparency and awareness is needed.

Hi, Earl. I suppose that, given enough time and money, eventually 90 to 95 per-cent of the available oil could be recovered. If you wanted it badly enough, and were very, very patient.

And, isn't that the real problem, and the point of PO?

I would expect new techniques, or patient application of established methods will succeed in eventually extracting a lot of oil. I just don't see it happening at greater than 85MBD ever again. And, as that super extraction technique plies the wells, they may hold on a bit longer, only to drop faster later in the cycle. All of which, when plotted on X and Y gives that sad but familiar Hubbert Peak.

One would think that SA would understand this and report it correctly, but one would be wrong. Which makes one ponder the reason. My take on it is that people very high up in finance and politics recognize how disasterous things are going to become and want the common man to have a few years of hope, at least, before TEOTWAWKI.

Sad what Sci. Am. has devolved into.

When I was a kid I loved it. The Amateur Scientist, Mathematical Games, bleeding edge articles--stuff to dream about.

I gave up my subscription to SA a couple of years ago. It became obvious they had a Libertarian/Business bias.

Speaking of liberterian bias-this is off topic but I just cruised the news and there is a new federal policy on medical pot.

Legit medical users in the states with medical use laws are not to be arrested henceforth by federal agents and charged with federal crimes.

Maybe there is a certain amount of sanity in Washington these days after all.

This is a very positive step in the right direction.

Maybe if there is enough favorable publicity we will see more such steps toward a sane and workable drug policy.

Unfortunately I need to be in class in a few moments, but I saw an article in the MSM about how the greatest threat to mexican drug cartels is American pot growers. Of course, some of those American pot growers might be involved with gangs. Up here in Canada I know of quite a few pot growers who are not involved in criminal activity beyond growing and selling marijuana. Growers like these are doing a public service by supplying drugs to people without fuelling real crimes...

I wonder if the plan is to legitimize recreational drugs so they can lay the ground work to start cashing in on a very lucrative currently untaxed portion of the economy. Money makes the world go round...Maybe I'm just too cynical!

A couple years back I read the U.S. was the world's top agricultural producer, California was the top ag producing state in the U.S. and that marijuana was the top cash crop in California (always wondered where they got that figure without tax receipts). Interesting pyramid none the less. No doubt California needs a new tax base.

Much like the demographics will push some sort of health care change in the U.S. (the workers expected to fund the boomers medicare bill ain't gonna do it without being covered themselves) tax needs will push changes in the drug laws. Eventually those profitting from the status quo won't be able to herd enough public opinion their way to maintain the critical mass needed to keep things as they are. Assuming some sort of BAU is maintained at all that is.

Allow me to bring it back on topic. We're in for a period of high unemployment. What's a better personal palliative for unemployment? We had a Whiskey Rebellion in this Country once, but I don't ever recall a Weed Rebellion.

Yes, Sci Am used to be quite a stimulating publication when I was growing up, practically a peer-reviewed journal that stretched one's young mind and imagination to dizzying heights. Now it's little more than a sensationalistic version of Popular Science.

New Scientist, published in the UK, has pulled ahead of Scientfic American in recent years IMO.

That's not saying much IMO, I've just cancelled my subscription to New Scientist after reading it for 42 years. To me it looks like the various specialist don't see the big picture, so proposed 'new science' devlopments like the fusion reactors featured this week are unlikely to be developed due to lack of funds.

The author obviously did not follw the advive on the cover and take his get Smarter Tablets. He might need to buy tablets in bulk.

Rib

For the USA the top 3% discoveries by volume contain 70% of the oil. One would think that since the average size of discovery in the Middle East is so large (740 MB), that they may have a significant fraction left if the Pareto law holds.

I can give an estimate if I can get a value for the total number of discoveries in the Middle East discovered so far. The formula is very straightforward. Total = Number * C * ln (MaxSize/C) where C is the characteristic size, which is about twice the average.

You did what Leonardo Maugeri failed to do: presented a production curve of the Kern River oil field. When reading the article in Scientific American, I was disappointed the production curve was omitted and suspected Maugeri was hiding the data because it did not support his conclusions. It looks like the number of wells drilled was the principle factor in raising the production between ~1955 and ~1983 rather than the steam injection.

I did not know they ignited the oil ?

I have been digging hard for a good link without success but Kern River has always been a bit of a R&D project field. I wish I could find some juicy links but alas nothing super promising.

Maybe the statistical distribution of review articles about Kern River vs other fields would be neat to know :)

Given I'm not at all apposed to questioning the Oil Industry. One has to wonder if Kern River production does not have some serious value from the PR perspective.

Its hard to gauge its value as a advertising campaign disguised as and oil field but one has to think that keeping the old girl going has motives besides just oil.

In fact it may well be politically difficult to shut the field down at this point.

http://online.wsj.com/article/SB1000142405274870425200457445912352014740...

So is it a laboratory and PR stunt are a valuable oil field ?

Just after I posted I too looked unsuccessfully for verification that in situ combustion has been used at Kern River. All I could find were references to steam injection. Since I am probably misremembering something I have read, I deleted the question.

Obligatory "but the worst thing we can do is exploit the stuff" comment.

http://www.ipcc.ch/

Is this and article about a oil field or about a NG fired electrical plant that uses steam to extract oil ?

http://www.theoildrum.com/node/5023

Gail has other articles but certainly the economics of the Kern River field are unique.

Although Gail's article did not go into detail on the amount of NG consumed one has to imagine is a fair precentage on a BOE/BTU basis.

Steam flooding is almost a variant of GTL.

Certainly it works but its not clear how often all the variables can be brought together to make these sorts of operations profitable and of course how long they will stay aligned.

In a post peak oil world Natural Gas will become increasingly valuable we can assume that at least some conversion to natural gas will happen either directly or indirectly via electric vehicles cheap abundant NG sources are probably not a viable long term proposition after oil peaks. Assuming we do the usual and wait till the last minute we probably will see demand rising for natural gas faster than the supply side can keep up.

In general it seems reasonable that as Natural Gas substitution proceed the price difference on a BTU/boe basis will steadily narrow between oil and NG. At some point one would think that simply selling the NG directly will become preferred over high cost EOR methods. The profit margin need not become zero just small enough to no longer justify the capitol investment vs say a new LNG plant. So it seems that as time moves forward EOR methods will increasingly find themselves in competition with direct users of NG with market dynamics increasingly favoring NG.

In the end we can live with expensive oil but not without electricity so at some point if NG becomes a issue I suspect that the electricity market is far more resilient than the oil market. Certainly we will move to conserve electricity and look at alternatives if it becomes expensive but if your forced to make a choice then electricity and NG for heating and other essential activities are a more basic need than using NG in oil production.

In fact given this depending on how future NG supplies play out you could well see NG actually being sold at a premium to oil if it becomes scarce enough. Obviously if this happened where possible flexible users would switch back to oil but these days a lot of NG use cases are not as flexible and don't have the oil option.

I don't know if this would happen but certainly forces exist depending on how things play out that could readily result in at least regional price premiums and or parity between NG and oil on a BTU basis. The historical reasons for NG being the cheaper fuel may or may not continue in the future. I just don't see any sort of intrinsic reason why NG cannot approach or like I said even surpass oil on a BTU basis its now actually more critical and less easy to substitute then oil is. Seeking alternative transportation is a solvable problem freezing to death is not.

Absolutely not!

There seems to be a total lack of understanding at the board on unconventional(for which I blame the editors).

Consider what is happening. You are merely heating the ground so the oil flows freer; a heavy oil API 16 600?cp centipoise viscosity that is at 60 degrees may flow at 300 cp at 200 degrees(it flows like syrup).

A hundred feet of earth is a good insulator even when wet.

The energy required to heat 3 barrels of cold water to 1500 psi for injection is .56 mmbh.

The efficiency of steam boilers is ~80%.

The energy in a barrel of oil is 5.6 mmbh.

Therefore the heating EROEI is 5.6/(.56/80%) or 8.

Gas to liquids is very net energy negative; EROEI is less than 1,

probably .5.

It is a chemical process. Chemical processes are always less efficient than simple heating.

Syncrude which is turns 'bitumen'(a misnomer as it is more oil-like than pure tar) into synethic petroleum is partially a chemical process as is oil shale production that changes kerogene into petroleum.

The volumetric energy density of natural gas is terrible and even LNG is only 2/3 the energy density of gasoline, so it can't surpass oil as a transport fuel.

The dangers of freezing to death are greatly exaggerated. Just turn down the thermostat and put on a sweater.

Hmm your not going to get the energy balance this way.

Its a chemical plant you need to look at the inputs outputs and processes you missed tons of stuff.

If NG is 50% of the budget then the overall energy expenditure for extraction is much higher then your simply calculation illustrates which it should be given its a process.

For starters they are running a 90% water cut on extraction the steam injection is probably even higher but 10:1 so at least ten barrels of water as steam to one barrel of oil.

In any case this is simply not even close to the correct approach.

Kern River is of course about as simple as you can get but its still a process plant.

http://www.nae.edu/Publications/TheBridge/Archives/V-39-2EnergyEfficienc...

And objecting to the lack of a chemical reaction well chemical plants heat stuff up if a reaction occurs its a mass balance issue and the heat of reaction otherwises at the most basic level they generally are just heating the crap out of something the reaction just complicates the issue.

Regardless what you presented is not even close to what you need to do to figure out your process efficiency. A very easy place to start is simply looking at inputs and outputs.

With only phase change issues to deal with it makes life easier but you still have to deal with all losses through the plant. Heat loss along a pipe for example etc.

I'm guessing at the injection point this is probably very wet steam with a significant amount of water more steam and boiling hot water injection than dry steam but I don't know. I'd be surprised if it was actually dry steam injection but could be.

In any case you could start with this paper to at least understand the problem.

http://www.onepetro.org/mslib/app/Preview.do?paperNumber=SPE-121489-MS&s...

But knowing that 50% of the cost was related to NG is sufficient in a "real" chemical plant the ammonia plant example NG is 80% of the cost and this is a endothermic reaction so its only 30% more efficient than a known expensive reaction. I don't need more that this to suggest that a steam extraction process is inefficient from the energy view.

It would be interesting to know if the same amount of NG was more profitable used to make ammonia vs steam extraction of a heavy oil field. Even these simple numbers suggest its marginally competitive if at all with other uses. The cogeneratin of electricity then has to play a large role in making the overall system viable.

But this is of course the sort of issue I'm writing about the oil industry as it moves to energy intensive tertiary extraction methods will find itself in competition with a wide range of industrial processes which already use all the NG we produce. There simply are not large chunks for the energy pie left for the oil industry to leverage its all spoken for. In many cases you have the interesting case that they are in direct competition with down stream operations such as ammonia or other critical chemical production.

I suspect when push comes to shove the oil industry will lose and find out the hard way that oil extraction is simply not a competitive use for NG vs making fertilizer.

Ok so maybe your not worried about freezing to death but you do like to eat right ?

Of course underlying all of this is EROEI*value add how much energy did the process use and how valuable are the resulting products as energy becomes constrained the higher value most critical products can and will increase in price to ensure their energy needs are met. Lower value products will have to compete for the remaining energy pie but the price is set by the most valuable products. On a large scale where it matters I'd say ammonia and electricity generation are near the top of the value chain in both volume and demand. The oil industry is simply unable to compete with these two for natural gas.

Bottom line is there is simply no large source of energy for the oil industry to tap on the scale it would need to to engage in large scale EOR methods. It can't be done simply because we literally don't have the resources to do it. Its basically a wood fired steam locomotive that runs out of wood in the middle of the Arizona desert. Sure its technically feasible to run the locomotive on wood but there is simply no wood available.

And as far as the NG glut coming any day now for the Shale plays well I'll believe it when I see it and leave it at that.

From your source

http://www.onepetro.org/mslib/app/Preview.do?paperNumber=SPE-121489-MS&s...

But we aren't even talking about SAGD on supervicous Alberta Tar Sands API 9 we're talking about heavy oil maybe 17-22 API.

As far as oil refinery operations go, they are very efficient. BTW,

oil refineries use plenty of natural gas now for alkylation and hydrogenation.

I think they are injecting 1500 psi steam which is produced by

putting saturated steam into a superheater to get high-high pressures so it would be dry, but I expect it would condense rapidly

on colder surfaces.

Natural gas for hydrogen (for ammonia fertilizer) is a net energy negative chemical process.

It takes 200,000 cubic feet of natural gas to make 1 ton of hydrogen

and that makes 5 tons of anhydrous ammonia or 40000 cubic feet to make 1 ton of fertilizer. The US uses 12 million tons of ammonia fertilizer a year so that's .5 Tcf of natural gas;<3% of US natural gas consumption. Fertilizer fanatics worry too much.

Pay for the paper and get the number its not in the abstract unfortunately.

I'd love to know the actual balance from steam alone I'd have to imagine its at least 10%.

But thats a pure guess. Interesting they are injecting super heated steam so its condensing basically on injection I wonder what the pressure profile is after injection.

So the steam is condensing out and your pushing whats probably super heated water through the rock at pretty high pressure from the uncondensed injection steam.

One has to imagine that the energy balances changes pretty quickly as the oil is depleted.

It probably works for a oil saturated reservoir and doh it should because its used however I wonder what the cut off point is. It seems to be a process that makes the most sense for cases where you have saturation or high oil content but its immobile primarily because of the oil API. This is of course solved in Kern River with a crap load of wells so maybe the well spacing is not so crazy.

In any case I like to consider a process that takes 30% of its energy from NG on a btu basis vs the liquid btu content a variant of CTL over 10% is putting you into the partial CTL range. Under 10% is probably reasonably conversion factors i.e the original source is viable as a bona fide source of liquid fuels. Obviously setting on the maximum end is a true CTL conversion process. Other process that I consider partial CTL processes are hydrogenation that uses external NG sources this is a chemical reaction. Also coking if its fired using external NG this would be considered a thermal process and of course the steam requirements of a refinery depending on how they are met.

Note refineries that process light sweet crudes even to mid weight crudes often don't need external NG inputs however they might use them depending on NG prices vs selling the volatile fractions. The model strait run refinery processing a light sweet grade of crude needs no external NG inputs to produce liquid fuels. Every other case is generally some variant of a CTL conversion with the NG inputs required for a viable conversion.

If NG ever became problematic refining these oils would require combustion of some significant fraction of the oil to drive the process and replace NG or use of coal.

If the price of NG goes high enough that it became viable to burn your oil inputs in the process then the total liquid fuel output would fall accordingly.

http://www.ers.usda.gov/data/fertilizertrade/

We just as well start talking about fertilizer if your serious but the total NG inputs are much higher than you suggest. Probably a 6%. Just because its imports of finished products does not negate the NG input.

Your missing my point completely if we are going to extract oil and it requires energy intensive processes eventually powered by NG then this NG has to come from somewhere.

The fertilizer industry will obviously continue to use what ever it uses on and absolute basis at just about any price point same with electrical generation etc. The question is what industry can be displaced to allow more NG to be devoted to oil production. I'm arguing simply that if you look not much. They are all either producing higher value products with NG and can pass on the price increases to retain their absolute market share or are critical enough that the same holds higher prices for NG are absorbable by the markets they serve i.e electricity.

The only way out is of course if a slight increase in NG prices results in a substantial increase in production of NG allowing for more to be diverted to the oil industry without impacting other NG markets unduly.

I simply don't see a viable solution where the oil industry can grow its NG usage by any large amount without a resulting growth in NG production without leading to a price war between the various NG markets. The volatility of the NG market itself should be sufficient to make it obvious that plenty of consumers are willing to pay practically any price for NG if supplies are the least bit tight.

Nothing wrong with assuming bountiful supplies of NG and nothing to worry about however its not clear this is true.

In fact my opinion is the situation will turn out exactly the opposite not only will the oil industry find itself unable to grow its NG usage but it will be forced to burn more of its oil inputs in refining despite this leading to lower total liquid fuel output.

Obviously this means that I'm predicting that NG and oil or at least a reasonably combustible fraction of a barrel of oil will reach parity on a price basis. Probably heavy fractions such as fuel oil will be the first to be reused internally for example for steam generation and firing of cokers. Hard to say exactly how this would be managed but its doable at the obvious expense of lower liquid fuel output. Thats at the refinery level looking out into EOR methods I don't see a lot of on the extraction side.

It will be interesting when the Oil Industry finds out that we are willing to only pay for them to wind down there operations but are simply unable to pay for them to do more than that. We literally can't afford it. This of course mean NG is going to get expensive until the oil industry gives up and admits its gotten the smack down but ohh well.

And of course there is a way out and thats reversing the move to NG across many industries and reverting back to coal esp for electrical generation knowing the US we could well take this road and extend our coal usage to give us the overall energy balance we need. It would allow us a few more years of growth depending on the rate of expansion maybe even decades. Thats one of my biggest concerns that we will be faced with giving up on BAU or a massive expansion of our coal usage.

In this case I actually hope that things collapse fast enough to prevent a whole scale return to coal we have done enough damage to the world.

In this case I actually hope that things collapse fast enough to prevent a whole scale return to coal we have done enough damage to the world.

Ah but selfish me has so enjoyed the long autumn up in the subarctic (the ice edge is still a couple hundred miles off Alaska's northern coast a month or two after it is usually shore fast, that makes the whole place somewhat balmy).

Speaking of the north slope, watching the stop/start, sinuous, 30 year path of the potential gas pipe to the midwest could be instructional to all. The $20 billion needed to build it (current estimate) always seems to find a place to go where the profits are more predictable. When that gasline finally makes it down the road to construction something in the market will have changed significantly.

It seems like there's quite a bit of angst here over limited NG supplies. And while it could be painful for some, this is something that will simply be worked out by the market, just like it works out in a million other free markets every day. Demand can't create oil and gas that is not there to be extacted. But whatever gas supplies can be delivered, will be arbitrated among the various potential NG customers by the price mechanism. Those with the "best" use of the NG will be willing and able to pay the highest price. The possibilty of a "price war" is mentioned as if it were a worst case scenario. Like it or not, all free and competitive markets are essentially price wars. What are stock markets but a free-for-all price war over billions of small ownership shares in the nations biggest corporations? Of course the various parties will always try to protect themselves from short-term NG price volatility by use of fixed-term contracts. But even such contracts are themselves subject to trading on the commodity exchanges.

Among the most common forms of irrational emotional denial, which are not based on objective data –as far as geology permits- and that are looking for a posteriori the reason justifying what it is wanted a priori –post hoc ergo propter hoc-, the following can be found:

1. Skepticism: “This cannot happen” “This can never happen” This will never happen”

2. Faith in demiurge: “They have something in their forecasts”

3. Faith in progress/eternal growth: “A technological fix will save us”

4. Disqualifying: “You are a catastrophist” “You are apocalyptic”

I will place Maugeri in between 2 and 3 with some pints of 4 for ASPO/Campbell/Laherrere and some implicit 1 reasoning.

What I like most is the following Maugeri’s remark:

‘It is absurd to predict a peak of world production because it presupposes that one knows how much oil is in the ground’

To later go on predicting peaks or estimate volumes (which will anyhow give a peak), but much beyond in time. In Argentinean soccer terms this is named “to kick the ball forward” or postpone a problem by pushing it in time.

In all the works of Campbell and Laherrere, one of their most clear statements is the lack of certainty in all types of reported reserves, the caution to take the published figures for granted; the footnotes to take them only as best estimates of the industry itself.

Even admitting that some things are changing in the media (Oil Task Group in the UK, the IEA last warnings, etc.), still some inertia appears from time to time as the case in Sci Am; a scientific magazine opening doors to economicists (very inaccurate social sciences) to opine on physical sciences. Another good example is Mr. Birol (IEA) converted into a meteorologist and preaching in the WEO 2009 more about global warming than about primary energy forecasts. Here are some of the most common behaviors:

a) Anumberism: the new found deposits, as the last big hope, whose numbers are given as a global solution and are de-contextualized from the present world consumption/extraction. I.e. The discoveries of Tupi (oil), or in Venezuela (gas)

b) Geology ignorance, ignoring the depletion rates the problem of flows, the problem of timings for field developments and the need of continuous growth for the economy.

c) Net Energy denial: the diminishing though ignored ERoEI. Helium 4 in the moon as proven a reserve.

d) Providencialism: alternative sources (shale oils, ultradeep waters, polar, methane hydrates, etc.) will come to rescue.

e) Geopolitical alibis: Prices led by local events (hurricanes in the Gulf of Mexico, Nigeria guerrillas, Venezuelan instabilities, Iranian atomic true lies, etc.

f) Economic crisis from effect to cause: if oil production is down, is not because there are extraction flow rates problems and therefore, economy can not grow at foreseen and needed rates; it is because there is an economic crisis. Never the contrary. Thus economists may continue on command some time more.

g) Climatic Change and Global Warming alibis: First Kyoto and Bali targets of CO2 emissions reductions, very well accomplished the former IEA foreseen oil depletion rates. Now Copenhagen will accomplish very well the new 6.7% depletion rates to CO2 emissions reductions. Chicken and egg or chicken or egg? See Mr. Birol last change of charter. Much better to say/to sell to the public that we are fat and need to be on diet for our own health (positive view/Climate Change/Global Warming approach) than to tell them that we have to accustome to eat less and distribute better what exists, because there will be less and less food, as the fields have been exhausted and the crops will never be like in the past (negative view /Peakoilers approach)

Good night and good luck to all of you.

5. Greed. Oil companies are financially interested in keeping consumers addicted to their product to the last drop irrespective of what else may come. It is impossible to make a man understand something when his paycheck depends on him not understanding it.

This is called cognitive dissonance.

Energy analysis is plagued by too much emphasis on numbers and not enough emphasis on logic. I think it's because people who are doing the analysis are technical/engineering types who skipped out on Composition 101 or at least didn't pay much attention.

Comparing, adding substracting etc. things that are different such as conventional oil and non conventional oil leads to invalid conclusions. Hubbert's Peak Oil thesis is about conventional oil only because it is based on how conventional oil wells deplete. It is not valid to add in non conventional oil or extreme measures to recover the last drops as in the Kern River Field described. These measures are expensive and outside of Hubbert's contemplation of the normal production/depletion of conventional wells.

Another false comparison is stating non oil production in terms of barrels of oil equivalent. Can't do that. Natural gas has a different price, is used differently and is not used much for transport. It is not equivalent to oil.

But the most egregious one is comparing across different forms of energy as is done when EROEI is applied to ethanol. Forms of energy are each unique with different prices, utilities and availability among other things. They can not be compared. EROI is only valid when the input and output are of the same form as in oil production where the main input is oil and so is the output.

But the biggest energy fallacy is the reification fallacy:

http://en.wikipedia.org/wiki/Reification_%28fallacy%29

It is the fallacy of misplaced concreteness. Energy is taken to be concrete when it is in fact an abstraction. Energy exists only in its various forms. There is no such thing as generic energy as all the mathematical/engineering calculations we often see imply. Energy can not be added, subtracted, multiplied or divided across its various forms any more than grain or metal, which are also abstractions, can.

x -- All good points but I'll take advantage of your post to emphasize an issue which is often a source of confusion. I had to re-read Hubbert's work to confirm a point brought up by another: Hubbert was not predicting the shape of the post peak curve. He specifically says he can't predict that segment...that it can be constructed only as actual production declines are measured. I don't recall if he specifically distinguishes between new conventional and new non-conventional reserves. But in one sense it doesn't matter. If he included non-conventional fields like Kern River then they are already on his curve. But how much oil is coming out of this field today or in the future are not represented on his curve. As he says, he just drew the post peak sections for the sake of symmetry and not as a projection. The goal of his work was to emphasize the declining potential of production rates from NEW FIELD DISCOVERIES and not secondary recovery efforts from existing fields. Of course, this doesn't prevent others from drawing their estimate of the post peak curve. A potentially critical effort to foretell our future.

Back to the report: any effort to take the results from Kern River and project such potential to other global fields in general is beyond misleading. It's fraud IMHO. Anyone (who proclaims expertise in such matters) who can't see the obvious error of such an effort couldn't tie their own shoes. The vast majority of existing oil fields are not applicable to steam flood. Other types secondary recovery efforts could be applicable and, if so, have been applied for decades. Ghawar and Cantarell are obvious examples. I've worked steam floods. There are not a miracle cure. They are complex and very inefficient. They are used in those fields because there are no better alternatives. Steam floods are the lesser of two evils: produce inefficiently or abandon the field.

I'm becoming increasingly frustrated with cornucopian claims that secondary recovery will save us. It's as if they believe the oil industry had not heard about SR. The US is the third largest crude producer in the world. I don't have specific numbers but the great majority of our oil (which is coming out of the ground at a rate of less 10 bopd from the average well) is being produced from fields which have been utilizing SR for decades. In many cases since the 1950's. There is no big inventory of old fields just sitting there waiting for SR. New discoveries are evaluated for SR from their initial development. But, as most of us know, these are coming in at an every decreasing rate. And that was Hubbert's point in the first place.

A personal view of Hubbert: two weeks ago I brought in a consultant to advise me on a new project. An old fart even older than me. Turns out he shared office space with Hubbert while he was generating his model. This guy dropped some interesting points. He was till sharp as a tack and I trusted his memory. Hubbert said he didn't really expect management to make use of his model. Not so much that they wouldn't understand it or accept it but that the time frame was far too distant for management to be concerned with. He apparently didn't expect the public to be aware of his work. And if they did read about it they wouldn't be able to comprehend the implications. He said neither Hubbert nor any of their cohorts considered his curve to be any big news. They had all been experiencing the ever increasing difficulty in exploring for new discoveries. As I've mentioned before PO is very old news inside the oil patch...decades old. We never called it "PO" though. It was just the reserve replacement problem. Essentially a no brainer since at least the 1970's when my career began.

Unfortunately, people like Michael Lynch base many of their arguments off of the miracle of reserve growth. Every time there is an anomalous uptick in a reserve growth curve he and the other cornucopians claim that there is some sort of breech in the asymptotic behavior. The only problem we have is that our use of heuristics largely prevents us from disproving what the actual asymptote is. Margueri and Lynch and others essentially feed in this uncertainty. It is cornucupianism based on reverse FUD.

WHT,

You or one of the other knowledgeable regulars will know of Margueri and Lynch have ever acknowledged or mentioned the "growth" of reserves in the quota setting environment inside OPEC when they were alloting market shares.

I'd be willing to bet a few beers they have managed to overlook this too.

Back when I was a kid there was a cartoon character "Mr Magoo" who only opened his eyes at intervals and consequently managed to completely and totally misinterpret the crisis of the moment.

Perhaps we should christen Margueri and Lynch the Magoo Twins.

Maybe it will go viral!

As far as Scientific American goes, it used to be a truly fine publication,and I read it regularly.

It truly is a shame that they have lowered thier standards to the extent that thier reputation among the energy literate now view them as bent over wih thier standards around thier ankles. I guess maybe the guys who pay for the advertising have been playing golf with the management or something, or maybe they have just hired some idiot as an editor and they can get rid of him.

For those in need of a laugh and a little insight into the nature of commercial publishing,I strongly reccomend that you type "Twain" and "Agricultural newspaper" into your favorite search engine for a timeless five minute joy ride thru the mind of an editor.

WARNING:KEEP YOUR COFFEE CUP WELL AWAY FROM YOUR COMPUTER AND SMALL SIPS ONLY OR YOU WILL DRENCH IT IN A FIT OF EXPLOSIVE LAUGHTER!!!!!!!

That's a good story. Thing is, it seems like harmless fun that Mark Twain was having.

The editorial "lapses" seem so much more purposeful and sinister nowadays -- a really cynical bunch is in charge of the media, and their job seems to be to twist and confuse our understanding so that we will feel helpless and completely disempowered.

I can't think of a better way to destroy democracy than to deliberately confuse the citizenry.

Neverlng,

Yes, good fun but as a social commentator Twain ranks as one of the best of all time-and never forget that sometimes it is the court jester who is the only one in a position to point out the truth.

Most people don't realize it but a huge amount of what he wrote as caricature has turned into day to day reality and the process continues.

I can't immediately remember which book contains most of his comments on the taming of the Mississippi but every body who lives in the old flood plain would be well advised to read it-the next "Katrina" may approach from the north.

I'm most assuredly not bs ing!

A ways off topic but does anybody know how the recent weather analomies such as drought, flood, early snow,late frost, heat waves, and so forth of the last year or two stack up as statistical proof of early evidence of global clinmate change?

I'm sure it's coming but I suspect that lots of people are talking up ordinary bad weather as evidence which will do the cause of raising public awareness no good over the long run.

I agree completely. About Mark Twain as a social commentator. And also that the Mississippi is a danger from the north as well as the south -- deliberate failure to understand natural processes-- through cupidity, not stupidity-- led to the great Mississippi flood disaster of 1927. John Barry does a great blow-by-blow which could be a blueprint for our own developing disaster.

a really cynical bunch is in charge of the media, and their job seems to be to twist and confuse our understanding so that we will feel helpless and completely disempowered

this is new behavior?? Well maybe the disempowered part. The idea used to be to twist things to make us feel falsely empowered (what the SA article really looks to be doing). Twain was just a lad when the media pushed the Mexican-American War but his friend later in life, U.S. Grant, stated the American Civil War may have well been a penance the U.S. had to pay for the 1840s media hyped war with Mexico (Grant saw his first combat in the M/A war, and was far more gung ho about it at that time). The Civil War was quite a penance--hate to see the one we are earning now.

Media twisting to support special interests in a way that can be dished up for popular consumption is as old as media. And violent crime stories have been huge part of media forever, so the push to instill a powerless, helpless feeling doesn't look all that new a media behavior either.

Well, I think that it is critically important that Western oil companies be given unrestricted access to the world's oil producing regions--so that they can keep the decline rates down to the 4%/year and 5%/year decline rates that we have seen in Texas and the North Sea (the lands that time forgot insofar as major oil companies and cornucopians are concerned).

Regarding the model debate, I don't think that Deffeyes is given enough credit for his prediction for a world peak in the 2004-2008 time frame, most likely 2005. This is primarily because of his erroneous observation that world production peaked in 2000, but at the time he said that it appeared that his (logistic based) model was wrong, and he never backed away from what his model predicted. And EIA data show that world C+C production was down in 2006 & 2007, and flat in 2008. Note that the Texas, overall Lower 48 and North Sea declines did not really kick in until the fourth year after their respective peaks, which would be 2009 for the world. I suspect that the decline in demand has been masking an accelerating production decline rate, especially an accelerating net export decline rate.

And whatever the failings of the logistic (HL) method, it at least has the virtue of being relatively simple to explain and use, and numerous regions are approximately following the predicted logistic curves.

I would say that the logistic is easy to use, yet it is hard to explain. For example, it does not explain the shape of the Forties curve, all the other North Sea curves (shown elsewhere on this thread), the North Slope shape, etc. etc.

The commonality between all these is that there is an initial discovery followed by a quick maturation and slow decline. The key thing to realize is that to get a logistic out of an aggregation of all these asymmetric "kernel" profiles, you cannot use the Verhulst equation. Instead, you need to use a generating function like what is found in the formulation of Dispersive Discovery. I consider this easy to explain and understand but that is my perspective and we need other analysts to back up the science and form a consensus. Unfortunately, we won't get a consensus as long as people think the old way is correct. I guess that is the failing to which you refer; it is a heuristic that often works in spite of itself.

Help me out here... I am a bit new to this. It looks like rate of decline can be steady, but when expressed as an annual rate based on remaining oil, it will increase. Is that right?

For instance, 2002 to 2007, production fell from 400 to 300 MBPY, or 5% per year. Projected drop from 2013 to 2018 from 200 to 100 is 10% per year. Double the rate. Exact same fall off [100 MBPY].

Just trying to make sense of many articles that give the decline in percentages that might be misleading if steady declines result in more dramatic fall off percentages. Also, as production falls off, doesn't it become ever more difficult and expensive to recover the rest? Another way of saying the EROIE declines as well?

The essential parameter to consider is the proportional extraction rate relative to remaining estimated reserves. According to the Oil Shock Model this should stay relatively constant unless perturbations occur due to fluctuations in demand.

In the adjacent Abqaiq thread, I produced a very well behaved example of this. http://www.theoildrum.com/node/5882#comment-552073

The red dotted line is the Oil Shock Model cumulative production curve which takes the reserve estimates and applies a constant extraction rate of 4.5%. (not surprisingly, this is also a quite close to the world average)

I realize that people like Memmel criticize the use of an extraction rate in this way (for some inexplicable reason), but a good logical understanding of what is happening coupled with a good model does wonders for actually predicting what will happen in the future.

BTW, a Dispersive Reserve Aggregation model can be applied to the reserve data to extrapolate what the final asymptotic value will likely be. It is a simple C/(1+k/time) hyperbolic least squares fit. I didn't want to do this at this time since I wanted to show the effects of extraction rate alone.

If there is interest, I can do this.

LOL :)

To be clear all I'm saying is its difficult to determine the difference between a accelerating extraction rated against a smaller resource and a constant extraction rate against a larger resource.

If the extraction rate is accelerating then something somewhere is causing this acceleration i.e its and external force on the system. If this is wrong or its simply not present then the assumption of a constant depletion rate is sensible.

However any basic view of our economic system indicates its been pumped tremendously to continue to grow at all costs. So we have and obvious external force that could have resulted in acceleration of the extraction rate. At the technical level we have known methods to actually accomplish such accelerations. I argue we have both the smoking gun and the bullet that accomplished the deed. Tying that to the murder scene is somewhat difficult as the interaction between the variables is complex. The murder plot is a bit convoluted even though the prime suspect and method of murder of fairly clear.

As with any murder thats premeditated one key element is the murder does his best to cover his tracks i.e it can't be to obvious what actually happened. One of my biggest problems esp if I turn out to be correct is this seemingly basic fact that complex systems can only collapse if they are reasonably successful at hiding the fact that they are going to collapse.

Even something as fundamental as a transition from laminar flow to turbulent flow gives the barest hint that a major state change is happening. Another example is say melting changing from a solid to a liquid. Its only because we actually have measurements of the right values that we know when these state changes happen. For say ice we have the obvious temperature measure but we also have well developed models of the hydrogen bonding from basic principles to guide us.

For abstract complex systems no such measure exists or its not obvious in the least what the right measure is to determine if the system is close to a major change.

And I have this sort of law that says the system itself is certain to make it non-obvious what the right variables are.

If you figure it out its obvious if not then ...

For oil extraction I've come down to the key variable being the connectivity between the well bore and the oil reservoirs. Or the exposed surface are if you will. This seems to be the key parameter that was accelerated in order to allow accelerated rates of extraction to masquerade as the steady extraction of a larger resource. Theoretically this could have resulted in a rapid jump in production levels however the ability to do this was driven by outside economic forces and these forces have their own control parameters and of course feedbacks loops with the rate of resource extraction. This gets into the non obvious connections between the real driving force and the results.

In the end its either completely obvious what happened ( or a huge error in understanding)

Or its not.

The only way I know how to explain is to simply ignore reserve growth as if we are crashing it obviously contains huge errors.

But of course some of it is real and everyone clings tightly to the real cases to justify the dubious cases. Nothing I can do about that and thats the lie if there is a lie that allowed the charade or murder to be executed.

The two poster children for reserve growth that have been recently posted Kern River and Abqaiq have some rather obvious special features. Abqaiq was developed as fast as possible in the midst of WWII by a skeleton crew. And further more its connected by fractures to a lower reservoir. Its a complex situation. Kern River benefits from being used as a propaganda piece and favorable NG/Electric situation that makes the needed steam super cheap. For that matter just like the NG supply is critical to the viability of the oil sands in canada. Hopefully we can get a more typical field posted that exhibits real reserve growth. They certainly exist but only by developing a representative set can you ever hope to determine if the reserve growth is indeed grossly overstated or not. In my opinion only a real audit can determine the true situation.

But this is unlikely to happen since it seems only the lunatic fringe is worried. Everyone is quite happy to accept that a few sample cases are sufficient to justify the whole.

And in the end it does not matter all that much I'm happy enough with my results and if I'm right we are already collapsing and if we are then the truth cannot be hidden.

Assuming that its possible I'm very comfortable to simply sit and wait until the outcome is obvious either in support of my theory or not. Given that my crappy theory predicts that it will be proven or dis-proven now why not wait and see the results of the experiment ?

If it turns out to be correct then it makes sense to understand why it could not easily be put on a firmer mathematical basis I've found it exceedingly difficult. Not surprising since a well played fraud lies at the heart of the problem. The catch 22 is of course the exact size in nature can only really be determined after the fact. I.e as far as I can tell you can only get the right numbers after its been fully exposed. And fraudulent claims distinguished from fact. In the case of oil this is only obvious after production rates fall significantly.

If I'm right then after the fact the correct type of equation is obvious any thing flexible enough to exhibit a shark fin like profile. Plenty exist with enough parameters to generate that sort of curve. And of course a multi spline bezier fit is a good approximation.

If I'm wrong I'm wrong.

Whats left unanswered of course is at what point in time can you show that the shark fin is the right solution and more symmetric approaches wrong esp since both are reasonably plausible right up until the end. The divergence happens at the end before that the curves are really not that distinguishable. The only way is to detect the fraud that was perpetuated to allow the symmetric curves to be admitted as plausible. Which of course send you right back around in a circular argument :)

The only way out is of course to do what I did and throw out reserve growth even if there are a few babies in the bath water does not matter you have to eliminate it since its easy enough to see if there is a mistake or fraud thats where its located.

If you don't throw it out then you can't even start to consider if the reserve estimates are wrong. No one wants to even take the first step so nothing I can do except wait and see if I managed to deduce the right answer and guessed right.

At the least some decent posts on examples where reserve estimates proved way off would be cool. You would think the oildrum would consider the opposite side. And not just the flagrant increases in OPEC for this theory to be correct artificial reserve growth has to be rampant.

Not that we don't have a high profile case handy.

http://royaldutchshellplc.com/2008/05/22/jeroen-van-der-veer-and-the-she...

Where there is lots of smoke and a really big fire could there be even more ?

Probably but few even want to look.

All sorts of rhetoric and not the least bit of acknowledgment that the plot shows a constant extraction rate. Not that I should really care but others have to wade through this as well.

People have to realize that focusing in on "special" features is completely misguided. The whole purpose of stochastic modeling is to essentially cancel out these special features.

Besides how can Abqaiq be considered "special" if the extraction rate matches fairly well the world average?

But it does seem to work well for regions, e.g., the North Sea EIA C+C data show that the North Sea peaked right at about 50% of Qt.

Yet the North Sea shows a double peak. That in no way represents a Logistic curve (maybe 2 curves, but then how does HL work?) That's what I mean that it often works in spite of itself. It has more to do with the general properties of a convex surface than the fact that it has anything to do with a Logistic curve. This is a real mathematical quandary.

I suspect that you are thinking of the UK. The total North Sea data base shows a very small decline (primarily a result of the Piper Alpha accident) prior to the final peak, from 3.54 mbpd in 1987 to 3.44 mbpd in 1989, 10 years before the final peak.

http://www.eia.doe.gov/ipm/supply.html

But in any event, even in the case of the UK, the early peak P/Q intercept was clearly not reasonable.

Web, it is interesting that your Alasko Oil Production graph stops at just over 100,000,000 barrels a year in 2020. I've read here (though it was just hearsay) that 300,000 barrels a day is just about the minimum flow needed to keep the Alaska pipeline functioning-close enough to your 2020 number. Was that intended or just a coincidence.

No doubt remote fields will encounter substantial delivery difficulties at flow rates well above those that keep the likes of Kern functioning. Just another little wrinkle the SA article totally ignored.

The year 2020 is arbitrary. Most graphs are cut off arbitrarily.

Thanks, that is what I thought, just a happy coincidence that your graph was cutoff at about the same level that the 48" pipeline used to deliver north slope crude won't have enough oil put in it to let them push it through 800 miles of usually cold always mountainous country to port. I believe the current contingency plan is to tap ANWR to keep the flow going a little longer (we will know when minimum pipe flow level is nearing because the pressure to develop ANWR will increase big time), but at some point smaller pipes, northern ports and storage (even the warmest predictions expect the arctic to be ice bound winters for decaces to come) or railroad tank cars (no railroad there to date) will be needed to ship the substantial tail of oil left when the big pipe quits. Big remote fields present big problems when trying to get the last economical drop of oil delivered.

Web, I realize you posted your graph to make an entirely different point, but as the pipe I speak of is less than a mile from where I sit, the concrete reality of the situation is ever present to me.

Agreed that we don't have a good handle on the logic behind reserve growth. It is interesting that the Kern River situation is the biggest anomaly in the reserve growth data. When Attanasi and Root did their study of reserve growth a few years ago, they considered the Kern River as huge outliers on the general smooth trend line. See the upward glitches on the following curve:

This data includes all the data that USGS had at their disposal but the glitch between years 80 and 90 is predominately the Kern River data.

What Laherrere and Campbell write is closer to the truth. Reserve growth is a very smooth evolution of updated estimates contributing to better reported reserves according to SEC regulations (for the USA at least).

Laherrere himself has described the evolution profile as "hyperbolic". The hyperbolic profile is relatively easy to understand as a stochastic process of incremental knowledge updates, see here:

http://www.theoildrum.com/node/4311

not to flog the ubiquitous horse, but that uptick in reserve growth % near the end coincides with the flood of easy/cheap credit, making a temporary disconnect between what reserves seem affordable and what really are (if true then the red blocks will overshoot the blue line on downside in next 5 years so that area above and below blue line are of equal size - one hypothesis in any case).

Not sure its that simple the credit increases also concided with the development of expensive horizontal wells and other expensive extraction methods which needed more credit to exploit. Its a who's on first issue.

It would be nice if someone deeply knowledgeable about SEC rules would post on the issue of reserve definitions since heresy is rampant regarding the issue.

My own understanding is proved reserves can only be booked when they are produced with a real well or close to production here I'm not exactly clear it seems a production plan is needed and some already producing wells.

I think this is the canonical link and of course the rules have just recently been changed dramatically.

http://www.sec.gov/interps/account/sabcodet12.htm

What important to understand is this reserve definition is really about wells not the formation depending on what you want to do to book reserves at the end of the day you need X number of wells producing Y amount of oil. If you do this you can claim reserves to be some estimate of how long you can do this.

So SEC reserves are in my opinion simply a estimate of future production based on current production plus reasonably near term planned drilling.

Which means if you drill the wells and your current ones are producing then you can book reserves.

If it looks like this approach effectively follows HL then you made the same conclusion I did. Its interesting that it seems to be intrinsically assuming a logistic production pattern.

One has to assume that as you move away from oil producers that follow SEC guidelines that if they don't simply forge their reserve numbers then they are probably using a similar but looser procedure.

Obviously I don't see this as particularly helpful in predicting future oil production as intrinsically as far as I can tell oil industry standard approaches depend on assuming the future will be like the past until one day they are forced to announce a surprising and unexpected drop in production from a field. But this will be quickly remedied with some alternative approach not to worry or we will increase our activity elsewhere.

I don't know everything thats happening now but my basic understanding is probable reserves are now allowed loosening this proved restriction and also it seems BOE is now allowed making the situation even murkier. One has to imagine that as the SEC loosens the rules non reporting producers will then loosen their already looser definitions.

Overall I expect us to see some serious inflation of global oil reserves in the near future. My best guess is that 4 trillion barrels of oil remaining will increasingly become the industry standard claim for projected oil reserves.

But this is really simply using methods developed for fractional reserve lending and fiat money to resource estimates. I'd not be surprised in the least to see reserve claims approach a ratio of 10:1 probable to proven inline with accepted banking practices.

http://www.eia.doe.gov/emeu/international/reserves.html

This suggest proved reserves not just probable are aroung 1 trillion barrels of oil so given the new rules and my assumptions of how they will be applied we may well see the world oil reserves grow to 10 trillion barrels with my 4 trillion being way to low.

The underlying issue that needs to be solved is that we have produced a bit over one trillion barrels of oil to date and the 1 trillion barrel estimate results in the symmetric peak oil claims of production declining at 50% of URR being true.

The easiest way to solve this problem is of course to overhaul the reporting infrastructure to allow reserve estimates to climb to several trillion barrels. Four should be more than enough but one has to imagine a steady climb out to ten trillion may be required to squash peak oil theory.

Regardless I expect a rapid increase in reported oil reserves fairly soon.

I've not seen any recent reports but the ME wants to double its oil reserves along with a lot of OPEC producers I have to guess that the only issue is to ensure everyone gets a chance to inflate their reserves within legal constraints so the constrains need to be weakend significantly.

I'm sure the Majors have been pissed for a long time that OPEC gets to pick whatever number they want while the Majors are left with these restrictive rules.

Its nice to see the SEC finally giving in and allowing Non-OPEC producers to compete on a more level playing field when inflating future reserve estimates.

I think that uptick was real and as I have said previously "The Kern River field remains a huge anomaly that even Attanasi & Root kept off their reserve growth prognostications."

BTW, I consider the paper "The enigma of oil and gas field growth" by Attanasi & Root one of the most important papers to study, even though they basically misinterpreted many of the results. They were USGS cornucopians, yet even though they knew better than to claim that Kern was anything but an anomaly.

If things that I can touch, taste, smell, see, and hear are abstractions then the whole universe is an abstraction. You are just putting out post-modern nonsense philosophy where the facts don't exist but only the models that are formed by our collective consciousness. If we just change how we think as a group then solutions will pop out of the space-time fabric. No need to actually do any work. Those starving refugees will be fed if they would just meditate on their chakras long enough.

Hm, maybe you've gone a tad too far there. There is such a thing as abstract energy. There are of course conversion costs, and can sometimes be substantial. And sometimes conversion is irrelevant because particularities of its form -- e.g. coal powered flight. So it is often possible and desirable to do arithmetic across forms so long as one aware of discounts and sometime showstoppers.

It is true that there is no "generic" form of energy which just delivers abstract energy without the particularities of form.

Reread Hegel. :)

The problem which we fase is what has been discussed at lenght.

EROEI For the whole quantity is becoming negative.

But the search for improvements will never stop, that's why we got here. And this will always continue, our brains evolved that way.

On hindsight .... But decisions aren't made on hindsight, it's just tacling the problem at hand.

I too have recently canceled my subscription to Scientific American.

However I would recommend that Mr. Maugeri read this other article from Scientific American...

http://www.scientificamerican.com/article.cfm?id=the-economist-has-no-cl...

That is a good read, indeed. It reminds us that we should stay vigilant with respect to the way we read and understand the numbers. The economists are essentially guilty of falling prey to the sunk-cost effect together with the powerful force of group-think. The sunk cost comes about because they have invested so much in their economic models that they could never think of backing out. They also get so much positive reinforcement from the other members of their group and the media and industry, that it becomes very difficult to change the momentum. The sad part of this is that economists practically invented the study of sunk-costs, yet they can't even tell that they are soaking in the sunk-cost dilemma themselves!!!

Further, the sad case is that we have the same thing happening here with respect to oil depletion models, albeit on a much smaller scale. The oil depletion analysts also use long out-dated models based on predator-prey relationships devised by scientists of the 1800's. Like the out-moded physics models used by the economists which feature largely discredited ideas, the classic oil depletion models were generated from ideas that came well before the stochastic revolution of the middle 20th century. The Verhulst equation that leads to the Logistic model of Hubbert is the best example of this. It is quite a slog to convince our small world of peak oil thinkers to reverse their own thinking. Fortunately, the circle is small enough that we can potentially overcome the inertia of these ideas. On the other hand, the smarter economists have an almost impossible task on their hands, just ask Steve from Virginia.

Sadder still are reader comments such as this one:

The above really just supports the assertion that SA isn't worth reading. The following isn't even correct:

Earlier in the decade Omani liquids production was plummeting. Since then the production decline was reversed. Shell has been using steam flood, chemicals, and gas injection to get more oil out of the reservoirs.

So, do you get a larger URR or a larger depletion rate with these techniques?

LOL it depends.

In general I'd say that approaches that work on solving pressure problems and even water cut problems can be classes as larger depletion rate approaches.

If its a chemical or steam flood and your really increasing the mobility of the oil in the system then your also probably increasing URR but this is not absolute. If the oil was mobile before then your simply increasing the rate. As far as I know in general if your persistent enough you can eventually get all the oil out of a field thats going to be produced via water injection. This at its base is simply physically stripping or washing the rock. To know for sure the real URR increase you would need to take a field that used water injection to the point that oil was very dilute say 99% water cut or more then apply the new method and this gives in my opinion your real URR increase. The difference between this and switching off mechanical removal is simply getting it faster.

Underlying is of course the concept that if the oil is reasonably mobilized at all it can be produced at some rate down to the lowest one acceptable to the industry. Additional recovery claims should be made against this baseline.

My opinion is if you simply accept the situation and focus on washing rocks like the US has then you get a fairly stable steady supply of oil from very old oil fields.

Regardless of how you do the definition there is technically a lot of oil left extractable at a low production rate and high water cut. We do this day in and day out in the US and the production decline rates with this method are very low. As far as I know we generally abandon a well when its production falls below 1 barrel a day or I think like 98% water cut or so but I'm not sure on that. Rockman might know what the economic cut off point for stripper wells.

Many of the worlds oil fields are already being produced this way a good bit of the US and Russian production is from exactly this process along with China. So three of your top oil producers are producing using a method that provides a very steady and slowly declining production profile. We are not close to running out of oil in this sense.

And obviously we get a lot this way its not small. I had a paper I use to link which stated the global water cut was close to 70% so we already get a lot of oil production using a method thats very good at extracting pretty much all the oil thats reasonably extractable. I'd have to dig for the paper but water cuts for various large fields around the world are fairly easy to find.