What should OPEC do?

Posted by Euan Mearns on December 11, 2008 - 10:54am in The Oil Drum: Europe

When OPEC meet on 17th December, how will they go about deciding the size of the inevitable production cuts?

All OPEC states want the oil price to rise from current $44 / bbl (WTI). Some states will also be concerned that the price target is affordable by their OECD customers. But set against a backdrop of global economic turmoil and volatility in all markets, how do they judge the size of the production cut required to deliver the target price? Saudi Arabia is reported to favor a price of $75 / bbl, just short of the cost of new marginal supply in the OECD. Achieving this price in the medium term would keep OPEC in the driving seat.

This short post is intended to be a discussion thread. Below the fold, I outline one radical idea for OPEC to achieve their goal in the short term.

At this point it is worth recalling that the recent oil shock is fundamentally different, compared to the oil shocks of the 1970s. Back then the order of events was as follows:

1. Strong demand

2. OPEC cut supply

3. Price spike

4. Inflation and recession

And the situation now:

1. Strong demand

2. Price spike

3. Inflation and recession

4. OPEC cut supply

It is also worth recalling that with the passage of every year, the share of global production and oil exports is swinging towards the OPEC countries. If Russia and Brazil, who are both in talks with OPEC over collaboration on oil prices, are included, then the exporting countries are in a very strong position indeed.

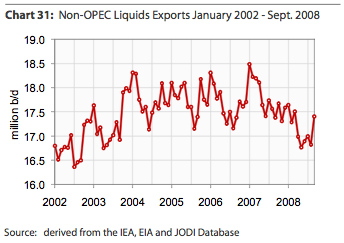

OPEC and non-OPEC liquids exports. Both charts from Rembrandt Koppelaar's November Oil Watch Monthly.

And so here is the not so very radical proposal. If OPEC ± Russia and Brazil want $75 / bbl, then they should consider setting this as a minimum price (adjusted for local variations in crude oil quality). The market would then adjust the call on OPEC crude at that price. OPEC quotas would then have to be set on a % pro-rata basis instead of the current production allocation. And OPEC would be free to adjust the minimum price at any point in the future, although if the price exceeds the set minimum it will mean that the world is once again pumping at maximum capacity.

The risk to OPEC would be that the World cannot afford $75 / bbl, and consumption will continue to fall, thus eroding their market share.

OECD governments may dislike the thought of such a market intervention, but would need reminding that the freedom of our markets is already severely compromised and that a prolonged period of low oil price may jeopardise future supplies and undermine moves to alternative forms of energy.

Food for thought.

Great thought to put in a post. I've had similar ideas going through my head recently.

Having a speculative market in oil prices seems pretty strange when you've got a cartel with spare capacity (which we have again now, after OPEC lost control for the last few years). Seems more like a giant game of poker between OPEC and the oil traders than 'efficient operation of the market'.

It would seem that OPEC would have to step up to the $75 target over a period of time. Or perhaps Saudi is large enough that they could almost achieve this on their own. They might have to content themselves with selling half as much production, but selling half as much for twice as much would still seem like a better deal and the rest of OPEC would soon want in on the plan?

It is a completely crazy idea though.. but crazy enough that it just might work??

Phil, I think this appears crazy because we are conditioned to believe in free markets. However, when you think about it, what is the difference between fixing production quotas and allowing price to adjust and fixing price and allowing the production quota to adjust?

The main difference that I can see is that fixing minimum price will actually deliver the target price and a greater modicum of price stability and remove some of the margin available to speculators. The futures market may still operate - based more on bets of future OPEC price adjustments than future production quota adjustments.

I agree that going to $75 in one step may be too risky and unwise. Maybe $60 in the first instance would allow OPEC to see what their production quota would be at that price.

It's worth noting that "the price the World can afford" is not constant and will vary according to economic activity and growth (economic and population).

No doubt someone will show up and shoot this down as a BSC scheme.

Opportunity is lost/slipping away. The consuming countries should raise taxes and fees and set a floor under prices. Diverting cash flow from end users away from OPEC toward their governments where it can be invested in energy conservation and renewables would be good policy on its face. It would have OPEC reacting to our policy rather than the other way around.

OPEC has a problem with members cheating. With economies in producing countries faltering due to less revenue the incentive for them to 'pump and dump' as much oil as possible onto the market becomes very strong.

http://www.wtrg.com/opecshare.html

Another 'chance of a lifetime', just sitting there, waiting for someone to show some initiative and courage. Obama? Do you have the guts to raise gas prices to $4-6 dollars a gallon? People would hate you ... but you would be doing the right thing for once. It would put a much greater world of hurt onto OPEC ... and buy some time for a transition out of petroleum.

????

SoV: Right, right, right. This is our (USA's) chance to raise gasoline taxes; I suggest 60 cents a year for seven years. And a $7,000 rebate for PHEVs. That would crush the cartel forever.

We could balance it by sharp cuts in personal and corporate income taxes.

A great time to do it: Oil is going to be cheap for five to 10 years. I think we see excess global supply of 8-10 mbd in 2009-10, and slowing shrinking down from there.

Oddly enough, if we actually passed the gas tax-PHEV subsidy plan, it might make oil cheap for 20 years or more, thus undermining popular support for such a tax and PHEV subsidy.

The R-party would go on one of their "cut taxes and hand me the baby bottle" rants.

I hope the D-Party and BOH have the guts to sharply raise gasoline taxes now. I doubt they do.

Steve - I agree entirely but wonder if you don't mean that USA should raise taxes towards parity with Europe and Japan. It is a no-brainer, reduce consumption / imports and improve trade and budget deficits at the same time. Legislation on ensuring that efficiency gains get delivered as better consumption and not heavier vehicles is also required.

Euan, if the United States government raised taxes on gasoline by fifteen cents a gallon, I would take a crap in my pants!

Obama quietly shelved the oil- profits tax last week ... BAM!! BAM!! BAM!! (Head against wall ... )

http://www.reuters.com/article/vcCandidateFeed2/idUSTRE4B206W20081203

What if we had a magic engine which could replace all the engines in every car and truck in America and we could make the switch in just a few years? This engine meant we no longer needed liquid fuel since it ran on unobtainium. The price of unobtainium is the equivalent of $5/gal. What would happen to the price of crude in this situation? Someone pointed out that every 1% drop in demand caused a 15% drop in price. America not using oil means a 25% drop in demand so the price would be slightly higher than pumping costs. People would scream we are throwing away money by buying unobtainium instead of cheap oil. This is why our investments in alternatives and efficiency should not be dependent on the price of oil or any other fossil fuel. We should make these investments because it is the morally right thing to do. It is in our national security interests to make these investments. Eventually oil will become so rare that it will cost too much to use it as fuel. We should be prepared for that eventuality well in advance.

By itself, this is an irrational assumption. Surely there is a supply curve for unobtainium, and $5/gal-of-gas-equivalent is one point on that curve. Now what is the supply elasticity of unobtainium? The answer to "What if we had ... " depends on a lot of extra uncontrained assumptions and could be anything.

If instead of unobtainium, we speculate about synthetic gasoline that is made from biomass via the Fischer-Tropsch Process, I think the scenario is something like this: The current situation is that synthetic gasoline can not be made at a price that competes with real petroleum based gasoline. Over time scarcity rent on petroleum will rise. Eventually, it will make sense for some FT plants to bring synthetic gasoline to market. The synthetic gasoline will gain market share and the scarcity rent portion of real gasoline price will decrease until there is a stable balance or until there starts to be a scarcity rent on the feed stock for synthetic gasoline. The market share for real and synthetic gasoline will be driven by the relative scarcity of the two different feed stocks: biomass and petroleum. The world will be such a different place from what it is now that I think it is useless to speculate on this market share.

This kind of speculation can be extended to a second substitute for gasoline. It will enter the marketplace when scarcity rents on real and synthetic from FT allow a profit from making it at market price. And also for a forth kind, and a fifth kind, etc. This progression of substitutes must end before the Earth becomes so overloaded that it can no longer support life.

My key point is that we should make investments alternatives to fossil fuels no mater what the price difference is. Which alternative to invest the most in should be decided on according to its cost relative to the other alternatives and on net energy factors and not relative to the cost of fossil fuels. As the use of alternatives increases the demand for fossil fuels will fall eventually to near zero. At this point increases in the price of oil, coal, and nat gas also drive up the cost of alternatives. There will never be an extended time when alternatives will cost less than FFs. There may be short periods of a few months to a year when alternatives appear to have the advantage but as the FF price changes work through to other commodities then advantage evaporates.

Where were all you high price proponents when oil was $147.00 per and gas was $4.50? A few months ago I did not see any of you cheering Exxon for their Eco-Ethics founded in raising the price of go juice for your Hummer to a point where people where actually thinking about investing in "renewables".

It seems your only problem with last summer's prices was that the people that own the crude and the people that work hard to get it out of the ground and into the tank at your neighborhood gas station where getting the money rather than your deadbeat buddies.

How many of you go to work, I mean real work, for free every day? Why should I? I'd like a Lexus LX Hybrid. Which one of you is going to mail me the title and ship me the car for free? That is what you are proposing that Mineral Owners do with the Crude Oil they own.

By the way, all the 'renewables' you like so much will cost more like $10-$12 per gallon equivalent by the time they get to your drive way. On top of that you can drive 40 miles then charge up for 6 or 8 hours for the next 40 miles. You'll love that! Then maybe you're like the accounting intern from New Jersey who flew into Dallas and took a taxi to Midland (check a map, its Texas), or maybe you're the Israeli tour group that was touring in Seattle and wanted to catch the Grand Canyon on the day they had before their flight back to Israel. If so you might like the idea of European solutions.

Then there is always ethanol. Replacing 10% of the gas on the road will only kill 10,000 0r 20,000 people a day through starvation due to the fact that they will no longer be able to afford food. You probably think the worst thing about Darfur is that it isn't coming out of Exxon's pocket.

I have had similar thoughts regarding fixed prices for gasoline - fix the price at $3 a gallon and take everything from the difference between the base and $3 to upgrade transit, bridges, roads, railways, and canals - yes canals

Check out the America 2050 Website http://www.america2050.org/infrastructure.html

There is an article on the first two national planning efforts - one in 1808 under Thomas Jefferson and one in 1908 under Teddy Roosevelt. The 1808 study focused on roadway and canal improvements. THe 1908 report focused on road and rail and discussed how rail commerce was taking traffic away from the canals. I am sure a 2008 study would show the impacts of the Interstate system on rail usage versus trucking.

Looks like the saudis are reading the oildrum, crude up nearly 12% today.

Not radical at all except in the context of history. So, I guess that does make your "modest proposal" radical. But, it's been my view as well.

I also wrote a short piece on my blog a few weeks ago, suggesting that Russia simply make an announcement wrt their reserves, and production capacity, and costs, and tell the world what their floor is. A big part of the downside in price over the years has been that capacity and supply lacks transparency. So, the market historically has always wanted to price in large upside surprises to supply.

OPEC and Russia would be doing the world a huge favor to make a floor at 75.00. Shame that so few would understand it.

G

I need to read the Drumbeats more often to stay in touch. The concept that higher energy prices are good, if not essential, is a difficult one to sell. I'm sure that Nate would explain this in terms of discount rates - better to have sauce today and lets not worry about tomorrow.

Setting a minimum price is such a logical thing to do, one wonders why OPEC hasn't at least tried it before. One way of constraining supply is by raising price, so why not just raise price directly? If the approach were simply raising prices, it seems like other suppliers might be willing to follow along. Why would Norway want to deviate down, or Canada, for that matter?

One could theoretically have a situation where OECD says, "The current prices are too low. They don't allow adequate coverage of oil production costs, so production is likely to fall too far, too quickly. The prices also send the wrong message for alternatives. We support a minimum price level of $75 (or whatever)."

Governments and agencies like OECD should be looking out for their long-term needs. It is hard to believe that the current price levels are supporting their long-term needs. Planning with such huge fluctuations is a major problem.

Most probably missed it because it was late, but we discussed this idea a bit on the 12/4 drumbeat http://www.theoildrum.com/node/4831#comment-440612

An excerpt of one of my comments:

"If I was running a cartel, rather than trying to guess how much oil I needed to put on, or take off the market to reach my price target, I would just set my price, then observe the market and adjust accordingly. For example: OPEC could announce a price of $75 tomorrow.... not a penny less (adjusted for crude quality of course). Of their ~40MM capacity, they may observe that they only have takers for 36MM. They could then adjust production down acordingly. On the other hand, if 41MM was sold, they could bump price up to 80 (or sell to the 40MM highest bidders). Announcing such a policy would be quite a shock initially, but after a while it would work quite well. You could adjust price or supply weekly or bi-weekly as needed to meet your targets. Opec's lack of unity would be problematic,as it is now, but I think Saudi Arabia could pull it off by themselves if need be. Announcing tomorrow that they would not accept less than $75 would probably not reduce global quantity demanded by more than 2 or 3MMbo/d ~33% of current production (9MMbo/d), but revenue, at $75 vs. $40 would actually increase. The current system just seems so clumsy and is clearly inneffective. Setting a price floor really shouldn't be this hard for a cartel with as much cash and as as much market share as OPEC has. The first month might be rocky, but after that the new system would increase revenue, and probably add stability to the whole system.

Moneyman - Would this not just give OPEC control over the value of the dollar?

I'm not sure about that.... out of my league. My point was that there are better ways to enforce a price floor than the clumsy way OPEC handles it now. Setting a price floor isn't rocket science, all it would take is a few weeks of cash on hand and a a little bit of determination. I doubt enforcing a $75 price floor would require more than a few million bbls being taken off the market, which is what they are planning anyways. Saudi Arabia could probably pull it off unilaterally. Yet they don't and they won't. My guess is politics. Right now, the world is blaming the current financial crisis on the bankers, not high oil, and the Saudi's would like it to stay that way. They are willing to "suffer" a few months, of low oil prices while the public frgets that $4 gasoline ever happened.

Moneyman - I sent this idea round TOD email group yesterday and it was suggested to make it into a post. Its comforting to know that others have thought along same lines.

I don't think this type of policy would have worked a decade ago since higher price might have reduced demand and cut into OPEC's market share. But the world is different now.

I'm not so sure that OPEC lack of unity now is the same as in the past. Then, countries would cheat on quota leaving Saudi to bear the brunt of production cuts. Now, I think other countries are more hawkish than Saudi - Iran, Venezuela etc, and that UAE and Kuwait will likely be more willing to play ball since their production capacity is being tested.

And I suspect that Russia may bring a new form of discipline to the table.

And the situation now:

1. Strong demand

2. Price spike

3. Inflation and recession

4. OPEC cut supply

I don't see how these points are clearly present now. Indeed, while inflation may return at some point, deflation reared its head a few months ago. The barrel price has plummeted. Demand, while high, is trending down. Perhaps you meant 6 months ago, or perhaps you're referring to 1980/1981. OPEC is having a hard time enforcing supply cuts.

But to your question What should OPEC do?, I'd say tighten the belt, for the ride will be bumpy. Expensive oil is unaffordable, especially during the recession. And cheap oil will provide little income, especially as aging reservoirs become harder to pump and newer ones more expensive to develop. So we are caught in the horns of the Peak Oil dilemma.

This is playing out roughly the way Simmons, Heinberg, Leeb, et al told us it would.

To ensure their future market, they are going to have to keep the price at the highest affordable price for the most customers, which may be $65-$75. It seems counter-intuitive to induce more demand destruction and transition to alternatives, but most must realize this is inevitable, and it's better to have a smoother proactive transition with stable customers (which means their price stay stable and their own countries are reasonably stable) than it is a rough reactive transition with more market crashes and social disorder in importing countries as well as their own.

They should also curb their demand and begin the transition themselves. They have a vast resource potential for solar thermal power generation and should displace FF generation in their own countries. I remember somewhere back in February, the Saudis were told by their leadership to learn to live more frugally, as the days were coming when that would not be an option.

Not that I can see.

Simmons & Heinberg have been predicting supply shortages and increasing prices for oil. What we have is an oil price crash and surplus production being stored in tankers.

Simmons in particular has been predicting a supply crunch for NG. Wrong again.

IIRC, Doug Noland over at PrudentBear.com has been following the inflating credit bubble for about the past 10 years. And he has constantly been warning about the crash once it popped. Now that it has popped, the current situation is exactly what he was predicting.

Doug Noland's Archive

IMHO, the series of crisis that we are now going though has been caused by financial criminals and government incompetence. Nothing to do with PO.

I have followed Simmons, Heinberg, JHK, etc for the past several years. Read their books, publications, speeches, podcasts, YouTube videos, etc. Saw JHK talking in person.

None of these guys predicted the current situation correctly. Doug Noland (financial analyst) did predict things correctly. Score one for Noland.

We are in the midst of a financial mess which was entirely caused by human stupidity and greed - not by any problems in energy supplies.

IMHO, the series of crisis that we are now going though has been caused by financial criminals and government incompetence. Nothing to do with PO.

I can understand why that seems obvious. However, high oil prices may have been the impetus to trigger the financial collapse, as discussed in Jeffrey Rubin's article What's the Real Cause of the Global Recession? (page 4 in the .pdf). Please share your thoughts.

It's deja vu all over again!

This crisis (in credit) is caused by flat- or declining real wages over time, since the 2001 'Dot Com Panic'. Without hard capital representing aggregated savings of wage earners there is no capital available for investment. Without the earning power of a large number of wage earners, there is little demand for products and services.

Since 2001, the substitute for aggregated savings and wages has been ever cheaper central bank- and checkbook credit. Cheap debt has financed mis- investments in garbage such as SUV's and sprawl as well as in dubious 'investments' such as CDS's. SIV's, CDA's, CDO's, derivatives and other Ponzi schemes. Asset price bubbles were inflated in stocks, private debt instruments, real estate and over the past summer, commodities. Cheap debt also financed shipping good paying jobs overseas. Over the same period, the government allowed the influx of millions of unskilled laborers; Both the shipping and the influx have crushed American wage- earning power, wiping out the customer base for expensive houses and large, gas guzzling automobiles as well as destroying credit used to pay for them.

All businesses are in difficulty, but those closest to liquidation are lenders, 'home builders' and the makers of large, gas guzzling automobiles. Surprise, surprise!

The same conditions existed in the 1920's. The resulting collapse of the buying and investment power of the working and middle claeses caused the Great Depression. None of the 'cheap tricks' with the money supply, interest rates, make- work programs or 'stimulus' solved the problem, in fact they made things worse. Wages and employment declined sharply during the initial phase of the recession and the surplus of labor made wage gains almost impossible for employed workers and left those unemployed destitute. Investment and purchasing power also declined. Only the World War- related demand for workers in defense industries and the call up for military service reduced the surplus of labor and drove wages and benefits higher, which in turn gave workers the means to afford more products.

The situation is the same today. Until workers earn enough money (real money) to pay off their debts and to accumulate some savings (to build some economic security for themselves) there will be no end to the credit crisis.

Stimulus and bailout 'funds' make this situation much worse. The amount of money available is staggeringly large and growing. The $7-9 Trillion US that makes up the various bailouts represents half the nominal domestic GDP! Right now, this money is 'trapped' in the financial system; banks are hoarding it. Good thing; with wages and employment declining, money added to the economy would simply drive prices higher. If wages continue to decline in the face of rising prices all would soon become unaffordable; houses, cars, bread, fuel ... everything. Stores would close and business would collapse completely. Nobody would buy anything!

If wages were to rise along with prices, the 'cash value' of the stimulus would decline in proportion to the amount of it; any stimulating qualities - and the executive pay and bonuses that the stimulus might represent - would vanish. This would be 'classic' inflation and would be unacceptible to the 'investor' class, whose savings would be reduced. Since the mechanism to put money in the hands of working people right now is more and more debt, this is not too likely to happen.

The solution is to RAISE PAY LEVELS and keep prices stable. No other approach will succeed.

Our current policies will never get us there ...

BTW, none of this had anything to do with energy. That is the NEXT crisis.

Exactly what I'm saying but you simply need to add in declining oil supply to prevent any attempt to soak up the extra workers and truncate any attempts to expand production because it hits a commodity price wall and you have the Great Depression II followed probably by WWIII.

If you look back in history with a bit of a eagle eye you will see that its actually Great depression I ( panics of the 1800's) WW I GD 2 WWII GD 3 WWIII we skip over the depressions preceding WWI. Before WWI colonialism and resource scarcity was driving the society to the brink our current situation has far more in common with the pre WWI world then any other as the oil colonialism and the petrodollar fail. I'd argue that the strict gold standard preceding WWI helped

to keep depressions minimal and sharp.

Economy of London 1800-1914

http://www.j-bradford-delong.net/tceh/Slouch_Restoring11.html

The petro dollar and constant slow inflation backed by expanding oil supplies actually matches very well with the pre WWI economy with depression being short and rapid aka recessions before growth returns. Then colonial expansion was the equivalent of oil today and the pound was the petrodollar of today with gold making the different fiat currencies effectively the same. It interesting that people forget that before WWI we effectively had a single international currency in the gold standard for all intents and purposes it was effectively abandoned after the start of WWI.

Raising pay levels particularly when businesses are shedding workers and adding to the labor surplus is almost impossible. In order to be effective and avoid the problem you describe, the entire approach to managing labor must be rethought. We must go back to the future; in the nineteenth century, many hands made the work rather than few hands and computerized, oil sucking machinery.

Much of the productivity gains of the past fifteen years have resulted from automation (with the rest being statistical 'anomalies' - Lies). By substituting machines for workers output remains high or expands while the labor schedule remains constant or falls. Output per worker increases because of machines; the productivity is the result of declining employment per unit of production. This is what has taken place during good economic times; reference Krugman and many others.

For this reason, the BAU make work infrastructure programs will fail to increase employment, because improved techniques and machinery will allow twenty or thirty men to perform the work of hundreds of thousands during the great expansions of the past. The rationalization will be that the finished projects will stimulate 'growth' and employment will magically follow along, some time in the future.

Instead of investment, this is more speculation.

One approach would be to adopt a 'workshop economy'. Instead of centralized enterprises using programable machines making the same units endlessly, there would be larger numbers of skilled workers, in decentralized employment settings making a great variety of prodcuts. Decentralization would encourage trade between regions because the diversity of production would give regions items to trade. Trade between nations of would be of finished goods rather than the mindless looping the supply chain for the uniform products. The diversity of design/purpose would serve to promote innovation and artistry.

Art and craftsmanship are missing from our commercial culture. From Phillipe Stark and Frank Dehry it is long way to ... Walmart and 'Jiffy Lube'. Increasing the artistry of our products doesn't require any more btu's. It does need a change of attitude, that citizens have something to offer if they are both challenged and given the proper tools; they can outdo themselves and be more than buying/shopping 'droids.

You nailed it.

Exactly !

This is why Westexas's ELP plan (Economize Localize Produce) is so increadibly cool it solves this problem. We don't need more crap we need better hand crafted goods to "Grow" we need to move to refinement not mass production.

Either WT is a brilliant economist or he did not fully work through all the implications of his proposal.

I'm pretty sure it solves a lot of problems he did not think about. Really really good ideas are like that

they tend to have implications that the original person that thought them up did not think about.

I'd offer the laser as and example of a really good idea thats been used in ways the original creators

would never have dreamed of. ELP is really that sort of revolutionary idea. The only problem is the French

generally think this way so I suspect it will be pretty hard on the rest of the world to admit the French where right all along :)

The problem I see with your solution is it really does take us back to the 19th century, in both lifestyle and product quality, which means there is little incentive to purchase these "new" artistic products that lack in the quality we've come to embrace. Substituting oil btu's for man btu's will only come about as a necessity, not a voluntarily change. Your plan to employ people will simply be "make-work" to decrease people's overall standard of living (physically, though perhaps not emotionally). It may become necessary, but until it does, very few will embrace it willingly. They'd rather do nothing and eat up government cash than work and get paid to purchase less than they were used to. This simply can't work as a program. Its a fallback position that may arise naturally, but not deliberately.

Real human progress is made by growth and increasing productivity. If we truly do run out of an increasing bucket of "energy", we're doomed to a decline until we break free of the energy crunch once again. In the past, it was a land and travel constriction that brought down centuries of growth and prosperity. This time it will be a mineral exhuastion. The only solution that gets us going again is a new source of energy. Otherwise, we're just a another species that ran out of time and food and dwindled back into obscurity.

Memmel sez:

The hazard of industrial production is (industrial) overproduction. This results in all the inventory ills; the press downward of prices which requires further 'adjustments' in labor schedule and in order to maintain market share. Industrial methods create the 'Scaling Trap' ... where a fixed and large volume of sales is absolutely necessary to maintain or service sunk capital. This is the predicament the auto industry finds itself in, currently. It has to sell more cars every year in order to pay the preceding years' production costs.

GregTX sez;

Well ... helicopters and Bentleys are made by craft methods, so it is hard to see where quality would suffer if craft methods were applied economy- wide. The difference is how labor is deployed and at what level labor benefits. Industrial production discounts skill in order to reduce marginal labor costs to the benefit of capital. Paying customers are essential for capital; the hazard of diminishing purchasing power isn't subtle. It can disguised by lending and bad accounting ... but only for so long.

The labor force is the only group which has the means to purchase the products of capital. Allow labor to earn more and labor will buy more.

Industrial production is what is depressing overall standards of living.. If one unskilled worker can be replaced with another, there is no incentive to increase wages. The search for ever cheaper labor has sent purchasing power overseas, where industrial production there has given Americans a wide variety of poorly- made products ... low quality ... in exchange. It would certainly have been much better for those who are being foreclosed out of their houses or losing their jobs to have if some of the trillions of dollars - in earned income - sent to China and Mexico had remained here as savings.

Basically I agree this does not mean for example we quit using mass production to say make wire nails for example or bolts. Between going all the way back to making everything by hand and massive companies capturing economies of scale lies a vast range of alternatives that have barely been explored.

There is no reason for example that robotics cannot take on the most mundane tasks they become more flexible every year.

Or people can do stuff by hand its not wrong to go back to hand made nails for example. If we can produce the volume of nails we need by hand why not do it that way. Making nails in your spare time is a source of income.

This brings in traditional cottage industry concepts but upgraded with our current knowledge level. I'd argue given the right set of tools and materials that all kinds of stuff could be made in small home workshops.

I'm in agreement with everything you have said in this thread except this. Wage growth stagnated because energy growth stagnated. Real growth per person hit an ecological glass ceiling with 6 billion people on the planet.

Money doesn't make the world go 'round, energy does. Money is like a derivative to energy.

Calgary - I certainly admit that this has not worked out according to the way I saw things - learning all the time. I also agree that PO is not the sole cause of current circumstance but do believe that resource constraints are implicated in bringing the credit binge to an end. And that they will also be implicated in stalling any future recovery.

Financial criminals - what we do in the UK is to grant them a knighthood, or make them into a Lord. We need leadership from the USA (or Canada) here to bring to justice the architects of this system.

I'd also point out that we are in a new phase, in territory where few of us have been before, and that the current situation will evolve. Too soon to call Simmons, Heinberg and Kunstler wrong. Noland may be right, now - and good for him. But as the situation evolves the others may have periods of also appearing to be right. And I'm sure they are all right in some respect or another.

Yep, I suggested it on here a few months back.

The price becomes $x, or more probably €x as 'offers over'. You can also make it so that the extra is food or know how or security pact or anything you particularly want. In essence its an auction where the users bid against each other for supply - which fits much better with a declining supply world.

My guess is it will happen within a short timeframe because it makes so much sense from a producer PoV. Income is known and you can 'buy' things that are not available with only cash.

Once you own the chemical industry you can move the same model there ...

Gary - re other comments, comforting to know others have thought the same way. Radical thinking has become hum drum oil the here.

With everyone saying they've thought of it too, I thought I'd trawl back and find my original comment (back on 20th Oct):

http://www.theoildrum.com/node/4669#comment-424112

Anyone with an earlier comment?

The bigger question this all alludes to is the changing of the nature of the game as we move from a supply-rich to a supply-poor scenario. Changing the mechanism for setting prices is one aspect, where what's being suggested is akin to DeBeers control of the diamond market. That's a scenario that bears comparison for clues as to the future. There are other aspects which change as we push over the cusp, the main one being that not producing pushes up your short, medium and long term returns. The opposite of the past. Against that is the security issue.

I'd like to propose an alternative definition for world structures in the post peak world.

Its a titanic upheaval in the order of things and the rules of the game. It really is nothing like what we understand from today's world, and virtually nobody is ready for it.

And that's something I've been banging on about for years now.

Could an effective top and bottom price come in simply by countries moving more and more to long term contracts?

The pain for consumers on the upside, and producers on the downside, has been intense.

The volatility is the killer.

At the moment the price is low, but the futures market clearly shows that it is expected to rise.

Moving more towards Chinese-type deals where very little of the oil or gas actually reaches the market would seem to be attractive to both.

Of course, if it is strained too much than such systems break down, as for instance may occur when oil gets short when and if the world economy ever recovers.

I think this is what's needed, but that the financial oligarchy really hate the idea since it robs them of their speculative commission! Because of this, it's obviously hard to put such sensible agreements in place.

It seems likely that no universal agreement will be needed to achieve this result.

With currencies oscillating wildly and causing ruin, it makes sense to arrive at an agreement to trade, say, a certain quantity of wheat for a fixed number of years for a fixed quantity of oil.

The Chinese are already moving to this type of system, and it seems likely that although the spot market will continue to exist, it will represent less and less of the market, rather as the spot gas price in Europe is subsidiary to long term contracts.

This will be a rather unstable system though, as interruptions in supply of many products will effectively tear up the contracts - for instance, Russia may not be able to deliver it's contracted exports of gas as early as this winter.

Another possibility I would expect to see increasingly used is the use of a basket of the Yen, Euro and Dollar to price contracts.

I expect we're quite likely to see a major war take place before such long-term agreements become the norm for all commodities. I see it as one of the anglo-american establishment's principle aims, to cause friction between potential trading partners, to keep them 'locked into' the market system.

I agree with what you say about long-term contracts being unstable too, and can imagine them leading to severe geopolitical tensions themselves when parties renege on big deals.

What about the IMF's Special Drawing Right (SDRs), might they ever become a currency in their own right? or is that impractical for some reason?

I posted that idea on the Opec web site two or three weeks ago! It just shows that every one is having the same idea, and obviously Opec is thinking about it. The advantages are many:

1 for OPEC, why would a few traders influence there seeling prices? after all it is their oil, and they don't have to let a few guys in CHicago or London set their prices. Opec could decide to make reasonnable money, and avoid excesses, which is lot good for them anyway long term

2 for the consumers, every one could start to plan in advance their costs : airlines, trains, taxi drivers, all of them are sometimes losing a fortune because of price changes

3 for renewables and new capacities: a fixed price would give visibility to every one. as a whole a fixed price would be good for humanity

I never received any reply from Opec, but you can go on their web site and post your idea, may be it will help hem to react!

The idea of a price floor is so crazy, that it might actually work. Again I wonder why OPEC hasn't done this before? Is it afraid of bad PR?

Is it afraid of bad PR?

Yeah, I can imagine the howling around the OECD. You already have poltroon columnists and pundits who want to sue OPEC; I guess they'd go around calling this a casus belli.

But nobody would be able to do anything about it.

As for the idea itself, it is obvious. I've thought about it myself. I imagine all the free riders would quickly adopt the price. (Why sell for less when you don't have to?)

As someone said above, only someone brainwashed into the "free" market religion would find this even odd, let alone radical.

I was under the impression that OPEC is having great difficulty on agreeing on hard cuts in production targets, since different members have different ideas and interests regarding production quantity.

Be it a price floor or production targets, both require full cooperation of all the parties involved. The inability of OPEC to enforce such rules has always kept it from being a truly functioning cartel. Word on the street is that Venezuela and Iran have been over producing. A couple of weeks ago the KSA issued a statement that they would consider further productions cuts ONLY if they can verify that all members are following the rules. Perhaps we'll get some hint from the pending meeting whether the cheating members are taking the KSA threat seriously.

The primary determinate should be "how much of a cut can we expect to enforce?"

Their most recent cut was little more than "stop producing more than your quota", and even then (IIRC) they recently determined that only 2/3rds of the cut actually happened.

If they announce a massive cut and the market doesn't believe that it will actually happen they will lose crediblity and will be unable to support price levels. It only gets worse as OPEC nations that are observing the cuts see that the cartel overall isn't sharing the pain.

I've also seen little discussion over HOW they should apportion the proposed cuts... which itself determines how successful they will be in enforcing discipline. Whill the cuts be from current production levels or from existing quotas? They aren't at all the same. Some OPEC nations can't hit their current caps anyway. If they agree to a 10% reduction in quotas, it costs them nothing... but would be a far larger cut for other members. Of course it works the other way too.

OPEC is certainly suffering. But who is suffering more? But they might be able to get the production cut by just waiting it out. A lot of expensive oil production out there and no credit to use to float over a bad year. In another 12 months, a lot of non-OPEC production could be off line at these prices.

If I was working for a non-OPEC oil company, I think I would be lobbying for a production cut! OPEC setting a price floor is the best thing that could happen to Exxon Mobile.

Except that that would be illegal, right?

I agree with JonFreise. OPEC and the Russians cutting exports (and production) and thus raising the price of oil is benefitting tar sand, deepwater oil and GOM production first and foremost. I'm not saying a cut is not necessary. It is. But it serves non-OPEC at least as much as it does serve OPEC.

This was underlined by Birol yesterday, as you can read it downthreadish.

If OPEC keeps production where it is and price stays <$50, then global cap ex declines. OPEC probably has the lowest production costs in the world, and while they don’t like $50 oil either they are not losing money. So what is the result if that persists for another 6 months? Alternative are dead. And all of there “competition” cuts way back on cap ex leaving them with an ever increasing market share in the future. If you think they drive the bus now, have production outside of OPEC really get whacked. Heck the IEA just told them that everyone else’s decline rates are north of 10% without massive cap ex.

Eastex, this may actually happen.

Russia may join OPEC.

http://www.moscowtimes.ru/article/600/42/373090.htm

Rgds

Dropstone

eastex is a different poster

I'm eastender. :-)

Nope...it wouldn't be illegal for Exxon to lobby OPEC as long as Exxon didn't offer to hold any of their production off line. OTOH, OPEC could care less about what ever Exxon might want IMO. But consider this odd circumstance: the Justice Dept could file anit-dumping charges against any US oil company (as well as against any country with whom we have anti-dumping treaties)that is selling it production for less then its development costs. We've done this before when some countries started dumping steel on the market. But I wouldn't bet you lunch the gov't would ever do this. They have know interest in protecting US oil companies from unfair trade practices.

So in your mind "price fixing" is illegal (it is), but conspiring to fix prices isn't?

I think it is worth considering the idea that price fluctuation may be precisely what OPEC wants. Constant low prices are bad for them. Constant high prices kill demand. Volatility gets them to a middle ground or average price and keeps us from effectively planning movement away from oil.

I would happily pay for a gas tax and hug the politician who implemented it.

First considering that non-OPEC production probably can no longer surge to overcome and sort of OPEC cut as in the 1970's when large increments of non-OPEC supply particularly the North Sea came on line one can be fairly certain that OPEC could set a minimum supply level that would result in some sort of price change.

I'd suggest from all the evidence this summer that a "surge" that fits the definition of KSA's spare capacity happened this summer this as far as we know is not sustainable and we have no reason to believe otherwise.

With a bit of thought given KSA's base production level and the fact that they use well rotation resting fields which has never been disputed and other probably true facts I don't think anyone would argue that KSA does not have the potential to surge exports by 1-2 mbd for 30-90 days.

Next despite claims of production increase any day now non-OPEC is in an overall decline the combination of finanical issues and current low price will have a very long term effect on future supply regardless of if we see a price increase especially if its felt that its the result of OPEC cuts. Thus almost regardless of what the price of oil rises to from now on out very few high cost marginal production projects will be brought online and those that are in progress will be slowed.

Peak Oil in the form of peak production is now almost certainly in the rearview mirror we will never see production as high as over the last several years. So yet again its a pretty safe bet to assume we are past peak production.

If you agree with the above at this point it makes sense to start talking about price.

The first thing we know about prices during a peak event is that volatility increases as you slide over the peak in production. Volatile prices are indicative of a market that is not doing a good job of matching supply and demand. Obviously looking at this years price chart reveals immense volatility. I'd argue that this volatility is a symptom of a market that is missing a fundamental constraint. Some major shift has happened and the market participants have not figured it out yet. Very volatile markets are uncertain markets uncertain markets do not correctly price the supply and demand equation. If the market is not sure about the price of oil how can you use the markets price to bolster supply and demand arguments ?

Next understand this extreme volatility entered the market only in late 2007-2008 before then the market was doing a fairly reasonable job of signaling the need for more supply. I'd argue that this signal sent over several years was repeatedly ignored by the suppliers out of necessity they had no more sustained production to put on the market.

So the market is no longer telling us it needs more oil its telling us it has no fricken clue.

Now lets do a small amount of charting its fairly easy to pick off "fundamental" price points after the fact these are prices they remained relatively stable for a long period of time within a 5% or so range. I've picked off 3 stable price points that are relevant to our current situation 30 50 200.

The 30 price point if you look at the charts pops out as a fundamental price that indicates the market is well supplied with maybe some of the supplies being slightly difficult to purchase. I'd argue this signals problems with light sweet crude supply. We have had numerous discussions over the years highlighting that cheap light sweet crude supply was probably strained. The 50 price point is one in my opinion where supplies of the heavier sour grades become somewhat strained leading to some additional pressure on light sweet.

The next price point 200 has not been reached its one I calculated would lead to real conservation efforts in the US. 5 dollar a gallon gasoline would impact enough consumers in the US that it results in some real behavioral changes.

This is not a market peak but a hard floor price which makes it difficult to continue wasting oil.

Now depending on market perception the current market price can move anywhere within this range these are just some reasonable fundamental constraints. All kinds of other factors will determine where and when the market will move between these price points. Perception changes are very powerful esp given the large gulf between the low prices and the "peak" price. Using concepts from quantum mechanics and even classical we would expect that as long as the market is undecided that it will explore a range of possible prices. This is the volatility raising its ugly head the fundamentals simply work to bound the market if it makes excursions beyond these bounds by a large margin its being unreasonable and will return quickly.

Give the broad span of possible prices I'd suggest that you have little information in peak turns i.e these can be fairly erratic this is one reason I don't call any fundamentals between 50 and 200 non of those semi-stable points on the way up or down had any staying power as people found out.

At this moment the erratic market has probably given us a fundamental signal. It has so far not been able to reach the 30 price point signaling plenty of light sweet oil. This is important if it holds because it means despite all the claims of demand destruction and worries about OPEC cutting the market is telling us its not well supplied. Using fundamentals this early turn is incredibly powerful if you adjust it for the current strength of the dollar its a huge red alarm. If demand destructionist's are correct and the market is well supplied with no cuts then we would have hit 30. That conjecture is almost certainly false. We would need to see a bit more movement to put the 30 turning point safely behind us but given the early turn the chances of it breaching and reaching 30 on a later turn downwards are slim. You can think of it this way the more times the market tries to reach a price and fails the greater the chance this price is no longer viable.

The stability of the next price point i.e supply constrained on light sweet ample supply of heavy sour grades is dubious but still strong we held it to some extent on the way down it probably will hold a bit on the way up.

However 2009 is not 2007 its fundamentally different !

With heavy sour grades from the tar sands upwards you are generally looking at complex refining to maximize the output of gasoline and diesel per barrel this complex refining requires extra NG. The problem now is oil prices have fallen to the point that NG prices and oil prices are very close on a per btu basis. If you take the fuel oil fractions then the are effectively equal per btu to NG. Natural Gas is no longer a significantly cheaper energy source vs oil.

But NG and oil prices are intertangled because they act as substitutes for each other in a number of use cases. The two prices do not move independently. Worse the current NG prices coupled with the financial turmoil have resulted in serious cutbacks in drilling by many NG players and many unconventional source have sharp decline rates. In short we can expect going forward for NG prices to have a very strong floor.

From fundamentals I'd argue that the early turn was the result of NG prices not declining because of supply shortages and thus not allowing a further decline in light sweet prices since complex heavy sour refining was unprofitable with the mix of NG and oil prices. In any case as the price of oil declined it has become entangled with the formerly cheap NG market and seems to have been unable to push North American NG prices down to the 2-4 dollar range that would match with 30 dollar oil. With NG if you correct for the stronger dollar one would see that NG prices have remained fairly sticky. The correction is not super important but it does help if you think a fundamental signal may be weak. I.e if the dollar was falling and NG prices not falling as fast inflationary forces can be argued. If NG and the strength changes of the dollar are roughly equal one can argue that the fundamental signal is fairly strong.

In the case of the price runnup the falling dollar coupled with rising prices served to add a premium to the oil prices. Again its not super important but it helps.

Back to now. So we are pretty sure that light sweet crude is not in abundant supply NG prices are indicating that overall energy demand is still robust and cannot be met by traditional cheap NG sources. The collapse of the UNG plays ensures that NG prices will remain fairly strong for the foreseeable future.

Now we turn to heavy sour crudes again 2009 is not like past years the tar sands where ramping up the entire time that supplies of even the heavy sour crudes where signaling they where in tight supply. The effective collapse of Canterell was to some extent offset etc. In 2009 given the current economic condition and rapid price changes we can assume that supplies of heavy sour probably wont be as plentiful the tar sands are done expanding.

The entanglement with NG ensures that NG prices will almost certainly rise as crude prices rise putting further pressure on light sweet prices.

And finally given all this we can talk about OPEC cuts. This fundamental situation is very unstable and despite the calls of demand destruction it seems to me at least the fundamentals will lead to a significant price increase soon without any external forces. OPEC cuts will simply serve to fan the flames and cause the market to misunderstand the real reasons for price increases. They will blame OPEC and thus assume the prices are artificial leading to continued slowing of projects ensuring we never get adequate oil supplies or recognize that peak oil is here till its to late.

KSA is playing with fire and attempts to control the market will eventually backfire in spades as it becomes clear that they are actually unable to set a floor price. Any moves by OPEC now to cut oil supplies can only serve to move the market towards 200 faster than it might have otherwise moved "maybe" in my opinion it will resolve the issue and head there quickly without help.

So can KSA and OPEC set a floor price on oil or any price I doubt it they are no longer in control all they can do is misguide the market a bit more. In this case upwards but for all the wrong reasons.

Good thoughts, Memmel. I've been thinking that 2009 would be the year that our "past-peak" condition would become undeniable. Is that what you're saying?

Yes but I'm also saying it will be misinterpreted as OPEC cuts. Thus obfuscating the real situation.

The deep underlying rule is that complex systems in collapse act to hide there real condition as long as possible.

This is general for all complex systems not just ones that contain humans. In aggregate its not clear that humans are smarter than yeast :) So intelligence is not necessarily part of any system that has more then a few hundred human players.

Paradoxically by lying the system ensures its utter collapse if the conditions that caused the lie in the first place do not change rapidly. The market was unable to prove that ample supplies of cheap light sweet crude exist to meet current demand and thus it acts to cover the real situation.

Understand I'm not including humans in this scenario humans are just justifying the actions of the market they don't control it. Humanity is actually very aware of the fact that complex systems tend to hid there internal state we have known this for thousands at years at least. We take advantage of this fact for our own posturing. If you look the shamans of old worked there magic by creating complexity then "interpreting" it.

I'm of course making the bold claim that I think I've figured out what the market is calculating right now. Of course the fact its about to collapse right when I think I've got it figured out is a bit disconcerting.

But this just means I'll have to find other complex systems to follow in the future for my studies.

Decent thoughts memmel, though I think that ignoring monetary inflation and currency exchange fluctuations in discussing price over any time period makes the points almost moot.

I mentioned it several times.

Look oil is money or more importantly its wealth its the modern worlds equivalent of gold and slaves.

Both stored wealth and the true means of production. Or fiat money systems are tightly coupled to oil and thus

tend to move in concert with oil. I mentioned that strong prices when the pricing fiat currency was strengthening

are important. In concert moves like whats starting to happen i.e oil gets more expensive and the dollar weakens

are not important. The fiat currency can devalue rapidly against oil and thus its purchasing power for the goods

and services used to produce oil.

Lets consider what happens during deflation in a highly leverages society with declining energy supplies.

First and foremost debt of all forms esp long term debt is defaulted on. This dwarfs the currency economy or daily economy. Some real loss of money coupled with storing real cash causes the actual money supply to shrink but its actually a small part say less then 10% of the overall monetary collapse the vast majority of the collapse is in debt.

Now depending on the details of the situation this can readily lead to a small oversupply and price declines for oil. Coupled of course is a flight from all commodities futures markets for two reason those that had entered the markets and now need cash to deleverage sell liquid assets and next users of oil pull back and effectively buy on the spot market price. This tends to cause a drop in price and as prices are falling futures markets tend to simply be less useful as only producers want to hedge but few are willing to lock in prices. If you think about it a bit if the price is always falling why by futures unless the market is in backwardation. All the people that have claimed demand destruction have completely ignored the fact that the oil market remained in strong contango conditions.

If oil was really in a deflationary price collapse the market would have moved into strong backwardation as producers sold forward to hedge and buyers accepted the offer. The overall monetary collapse simply moved the price of oil downwards for both financial reasons and because of uncertainty in future demand collapsing any interest in buying into a contango futures market.

Thats pretty much it for deflation since we are rapidly approaching the point that monetary policy will lead to inflation for better or worse.

Now that the world is becoming flooded with dollars we have a serious problem. The conditions that caused the collapse of long term debt have not changed we still don't have enough oil and to much debt or more correctly lack of credit worthy borrowers interested in borrrowing. Monetizing the debt does nothing to solve this problems it simply leads to collapse of long term debt ( debt deflation ) occuring at the same time the money supply is expanding.

The goal of course is to blow another bubble any bubble to increase the velocity of money so debt can get repaid.

However any attempt to increase the velocity of money via injection of money into the system results in to much money chasing oil to produce goods to sell and increasing the price of oil. Since we don't have enough oil. This price increase increases the cost of manufacture and cuts off any wage increases to cover rising price inflation. Goods get more expensive esp core goods such as food and gasoline and the consumer still has no money to service his current debt load much less take on new debt. This is actually the situation we just left.

However like I said business will now contract regardless of money supply playing monetary games can't change the situation. Wages will no be dropping while prices are increasing. Most of the cost increases going right into commodities.

Why does this happen ? Well the real wealth is oil its decreasing its value is always increasing regardless of tricks we play with the money supply. The situation is really simple you can't get blood out of a turnip nothing you do via monetary games. The basic problem is that the precentage of the consumers income stream dedicated to purchasing commodities increases regardless of what you do and no real wage inflation is possible since production cannot be increased faster then commodity prices increase to reach the point that workers are in short supply. Commodities remain in short supply we have plenty of people.

So now you see the big picture it has nothing to do with money the problem is we simply have to many people chasing to few resources. Variations in money supply do nothing to remove the intrinsic contango position of oil vs population and this is reflected in the constant contango of the oil futures market.

Obviously for the financial pyramid based on debt they have no choice but to monetize the debt and inflate the money supply otherwise the banking system collapses and the society collapses. We are damned if we do and damned if we don't. So finally you can see that the relative collapse of fiat currencies vs commodities is not really all that important in fact its natural. Commodity prices resisting overall deflation are far more interesting in the current case the constant contango of the oil and NG markets and the relatively minimal decline in the price of NG despite the strengthening of the dollar indicate to me at least we never reduced the economy enough to cause a oil glut.

As these facts sink into our rather dim market we will see money flow back into commodities to hedge agianst devaluation of many asset classes and inflation of the money supply vs oil regardless of the overall state of the economy.

What we have is stagnant wages because of a excess of workers permanent contango in the oil market reducing purchasing power relentlessly vs stagnant wages and either debt deflation or monetary inflation or both going forward.

Checkmate

Thats pretty much it for deflation since we are rapidly approaching the point that monetary policy will lead to inflation for better or worse.

So sure about that are you ?? Sounds like speculation to me. What if the US enters a long term depression ? I think people forget how much demand can be destroyed. Peak oil may have come and gone but I think some people need to get a grip on reality predicting triple digit oil prices in December. Reminds me of all those denying speculation; harping on about "fundamentals". I wonder how many people were convinced to go long on oil based on those predictions ?

Triple digit oil prices occur when OECD countries start competing with each other for oil to keep their economies afloat. Once the "deep pockets" need oil then price is not and issue China and to some extent India needs to be included. This is a pretty sharp division when it happens we will see triple digit oil prices again.

As far as time goes well if you have not noticed the world is suddenly starting to get a bit worried about OPEC cuts and oil supply. Psychologically the concept of a return to high prices is already starting to play out. Its simply a matter of time before the market responds how long who knows. Right now is the first time that I predicted we could see a price spike I think that if you look around a bit you will see that the conditions are turning rapidly positive for such and event. And god only knows I've explained numerous times that getting the time right using fundamentals is voodoo.

We will see on Jan 1 how far off I am on the time. Personally if I get within 2-3 months using fundamentals I feel pretty good about it. And personally using this approach you know what I did bought a few oil options for 2011.

If your going long on oil based on fundamentals then you better pad the hell out of the time factor.

The main issue is not timing its the fundamental argument that oil can and will reach 200 plus a barrel in the very near future. Fundamentally nothing prevent oil from hitting 150 by the end of the year. Look at how the oil prices are moving right now we continue to have a chance they can pop before the end of the year.

I see no reason to change what I'm saying because the conditions are still relevant to lead to a major price spike.

When only the market knows as far as to the first chance of a probability of a spike I think I did a pretty good job of nailing it.

Quote of the day. (Except you spelled 'frickin' wrong...;-)

"Next understand this extreme volatility entered the market only in late 2007-2008..."

i think you missed the beginning of the recent crude oil price volitility.

the 1-07 price was 29% below the 6 yr long trend. compared with 42% above in 7-08 and the current 47% below. in other words, the price volitility, imo, began with a drop in price beginning about 8-06 until late -07.

the period of the fluctuations appear to be getting shorter and the amplitude greater.

this is based on eia's monthly wti prices.

If they did that, it would be the straw that breaks the camels back. Demand destruction incentives like gas tax and alternative fueled vehicle incentives would be politically popular in the US.

No politicians in a democracy has the balls to do something as radical as a price floor. Please prove me wrong.

I have to apologize for repeating myself from yesterday, but I'm not sure how many of you guys read my comments, and I think it is a very-very important issue. With that said, I'll repeat it. Sorry if you find it irrelevant.

http://www.theoildrum.com/node/4856/442615

---------------

This is extraordinary BREAKING NEWS

http://www.bloomberg.com/apps/news?pid=20601072&sid=aV0wbL7Jbyqo&refer=e...

What's extraordinary about it?

Not the news directly. We knew this. What's more, we knew they had known this. They may have known we know this. So far so good.

But at this very moment they acknowledge defeat. Our collective. We have all been defeated. The game is up. We can do nothing. We ask OPEC to help. It doesn't matter any more how much anyone earns. We have to do it collectively. In case we do not, we are about to go extinct. And that's what the IEA says. The energy watchdog for the OECD. For you and me.

That's a nice piece of information to know, isn't it?

This is something entirely different than 'the end of cheap oil'. This is the end of free trade as we know it.

In order to have free trade you have to have individual participants, with their respective decisions. Their decisions are linked to what they think the price will be. The IEA's statement is this: Forget about speculation. The price has to be this and that in order to avoid this and that.

That is called central planning. In other words: not free market capitalism.

This is notesworthy, people!

The OECD is the yo-yo here, and Saudia Arabia is just toying with it. The name of the game is busting the competition, and Rockefeller and his Standard Oil Company couldn't have done a better job.

The myopia of the leadership class of the United States is unfathomable. In the long run $40 oil will prove even more devastating to the United States than $140 oil.

One big risk to Saudia Arabia is that if it overshoots with its production cuts, it could send the price of oil spiraling out of control again.

However, even though SA might sacrifice a little control by not overtly setting the price of oil, by giving lip service to the fiction of "free markets" it gains plausible deniability of price fixing. Just like the U.S. use of extraoridinary rendition, it allows it to claim it is someone else who is causing the pain.

A cartel is all about price manipulation, not about free market forces. Expect the supply crunch; it would have happened anyway, and now it will be disguised within the "investment slowdown".

It is interesting to see the chief economist of the IEA, Birol, to ask OPEC to make a big cut. As far as I know, the IEA is the energy advisor of the OECD... not that of OPEC.

Why, then?

Because OPEC is a cartel and that's what we need. Some central planning and common action. The IEA is well aware of the fact it could not convince the OECD members of a voluntary production cut, even though it would have an even bigger effect than a cut arriving from OPEC and Russia.

But at this time, urgent steps are needed, central planning is needed and (there not being a better institution) a cartel would work best. Let them carry out what we all need: higher prices.

What I don't understand is why OPEC is not just fixing the price of oil at $100/barrel (for now). Since non-OPEC has no spare capacity, oil importers cannot go elsewhere. Even if there is some reduction in demand, they will still make more money compared to selling it at $45/barrel. So what am I missing? Why is OPEC being nice to us?

HAHAHAHAHAHAHAHAHAHAHA, nice to us, that's a good one. I'm sure when oil was $10/bbl, that was just their generosity in effect.

OPEC is a group of suspicious, bitter countries whose goal is to maximize their own wealth. they also sit on some of the cheapest manual labor in the world and the easiest oil to get out of the ground. they were selling by the boatload at $10 because their lifting costs were <$5/bbl and they each wanted to maximize their profit over the others. They did this by playing games with reserve numbers. Now, they're playing the same game of chicken, driving prices down to slim margins so they can sell as much as possible. None of them want to cut, but some have higher lifting costs than others. I'd wager that KSA, being the most advanced technology wise, has the highest lifting cost of the group and is most eager to get prices to a level at which they're making money again. The other OPEC members want a free ride because they operate alot cheaper. Greed isn't what drove prices up, its what's driving prices down.

Fatih Birol's statements are contradictory. Considering the fragile state of the world economy the very LAST thing everybody wants at the moment is $80 oil. Be careful what you wish for, you just might get it.

Opec should cut production by 10-20% which will raise prices a bit to raise their profits.

That will completely screw the US oil companies.

Then Russia seeing the opportunity will start pumping like mad to raise cash and Opec will gain a smaller profit.

If they cut too much the world economy should contract much more(bankrupt transport companies, many countries, etc.) and since Saudis usually makes more in OECD investments than in selling oil, all this will actually hurt them the most.

An upside would be if the cut brought rationing to the OECD and a 'permanent' decline in world oil demand.

If we're lucky it could change a 5 year recession into a 50 year depression.

It would also be marvelous for biofuels.

The premise of the original article is correct in its aims, but wrong in its means. As long as we are abandoning a free market set price for oil and replacing it with a fixed price, then we should be advocating that it be done on our end, not on the supplier end. A government set minimum price of crude oil, enforced by a varying tax on (?imports / local production?), with the tax proceeds either rebated to the broad population evenly, used to reduce government debt, or used to invest in alternatives, is far smarter. Obviously the tax should adjust according to product quality as well.

Perhaps a problem then would be "consumer cartel cheating", similar in effect to "OPEC quota cheating"? What would be manifestations of that? Do we wind up needing to create an "OCEC" cartel of cuctomers rather than producers?

This bit about having the world divided up into 200 "independently governed" entities just doesn't work, in a whole lot of ways.

What OPEC should do is demand gold for their oil.

Of course, we would immediately realize that we would soon be broke. Then we would act responsibly and do everything within our power to not use oil. This would be painful in the short run but would possibly prevent the great collapse. However, it may already be too late.

There may be alternative mechanisms to achieve a similar result since cartels or coalitions like OPEC are inherently unstable. Governments in net oil importing nations could set a price floor and perhaps pocket the difference if the import price was too low. Thus if the refiner pays an audited $55 then the government says we're taking another $20 so the real cost is $75 per barrel. Another approach would be an import quota. I believe the US currently imports about 20 mbpd. With a declining quota that could be 20 a day for the first year, then 19, 18 and so on. Note the quota may not be needed in a recession and after a few years post peak.

Of course some will say that the oil importers who don't do this get the advantage of lower prices. They are also the ones who will eventually be caught short.

I understand your aim Boof. But if the US gov't were to put a price floor of $X for every imported bbl of oil purchased by a US refinery, why would any exporter sell that oil to the same refiner for less then $X/bbl. There would be no competition with other exporters since the refiners are going to pay $X/bbl to who ever.

Or did I misunderstand your approach?

I see the same issue with that approach.

I'm waitin until very late in the thread to say this out right.

Several comments have danced around this but...

with the implicit agreement between KSA and therefore OPEC and the US, The question should be what would the US allow OPEC to do?

Let us not be naive here. You all are acting as if they could simply decide to do what ever they want.

Oh! I wonder why they never thought of placing a price on oil? Gee, why didn't they think of that?" Hmmmmmmmm?

pulling protection?

bombing into stoneage?

The poor US has been at the mercy of OPEC for so long please help us. wtf?

I may be a bit slow, but what are you trying to say?

The US and the KSA may be on friendly terms (i.e.: oil for your kingdome), but what about the rest of OPEC and the US? There is Iran, Ecuador, Venezuela, Nigeria...

So would you please elaborate on your thoughts?

I don't know if I'm one of those you say "danced around this".

I didn't. I directly said the US can't effectively do anything about it.

"Bomb them into the Stone Age"? I don't know which US you're talking about. It can't be the absurdly overextended and financially insolvent one which is already fighting two wars it can't win, whose military might Russia recently laughed at, and which will soon be compelled for energy and financial reasons to start unwinding its presence everywhere.

Yes, America can still bomb places. All that could accomplish is to topple governments and ruin infrastructure America is dependent upon and replace them with Islamist governments who may or may not be able to repair that infrastructure, and whose willingness to sell oil to America later on would be questionable at best.

I think that also takes care of "pulling protection".

they should give green stamps with every fill and maybe a tigers tail for the antenna.

then get inside, sit down , hold on and shut up.

nothing more.

sorry ,could not resist.

as a "billy beer keg" average kinda guy , I have read through this and wonder to myself

what price democracy ?

I have a party that speaks for the rich

I have a party that speaks for the poor ( alleged)

neither is concerned that much on energy supply at all

I have seen on this site and others we can live without oil for transport but not gas for food . each party does not seem to notice whats going on.

then I read about Athens and , cant remember who, but its democracy was tied to the silver mines near by , once gone Athens went to dictatorship - no "free" money if you will.

I see this with Oil , once gone or going then can we really have a democracy?

cartels instead of free trade or just mercantilizism ?

at least the States has a bill of rights, we have the parlement to defends ours - oh god help us........

Forbin

guess I just a ramblin' ... :)

I guess the first question I have is what is OPEC thinking. The world economy is in a state of total failure and OPEC wants oil prices to go back up! Why? To keep the economy from any type of recovery? No The problem lies with the Opec countries that subsidize there programs to stay in power. and now that oil is low they cant afford these programs and civil unrest is at hand, along with not being able to sponsor terrorism to keep the rest of the middle east uneasy.