Demand Destruction: Myths and Reality

Posted by Euan Mearns on January 1, 2008 - 2:22pm in The Oil Drum: Europe

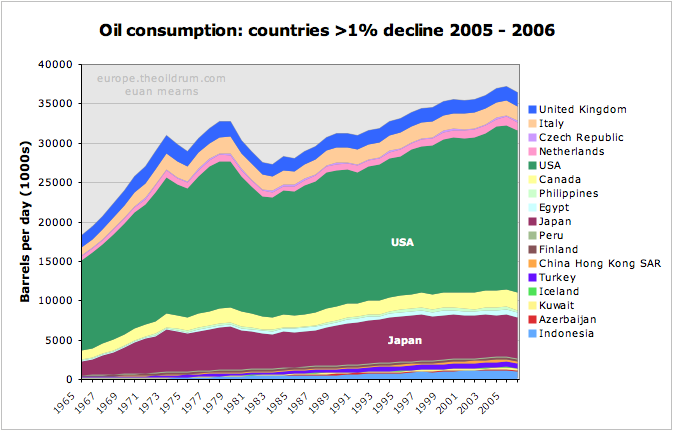

Countries that showed more than 1% decline in oil consumption between 2005 and 2006 as documented by the 2007 BP statistical review of World Energy. Note that 5 of the G7 countries appear on this chart. Click charts to enlarge.

Since May 2005 global oil production has been on a ragged plateau of around 81 million bpd. In that period, global demand for oil has risen and the strain between supply and demand has been met by sharply higher oil prices. Higher prices destroy demand (and stimulate exploration and production) and the conventional wisdom is that the poorest countries and the poorest people will be first to get squeezed out of the oil market.

When I plotted up the countries that have seen the largest drop in oil consumption (more than 1%) between 2005 and 2006 as documented by BP (C+C+NGL) I was somewhat surprised to see 5 of the G7 countries on the list (UK, Italy, USA, Canada and Japan). Others on the list like Czech Republic, The Netherlands, Finland, Turkey and Iceland are members of the OECD. There is in fact little evidence that the poorest countries are being deprived of oil owing to high prices - thus far.

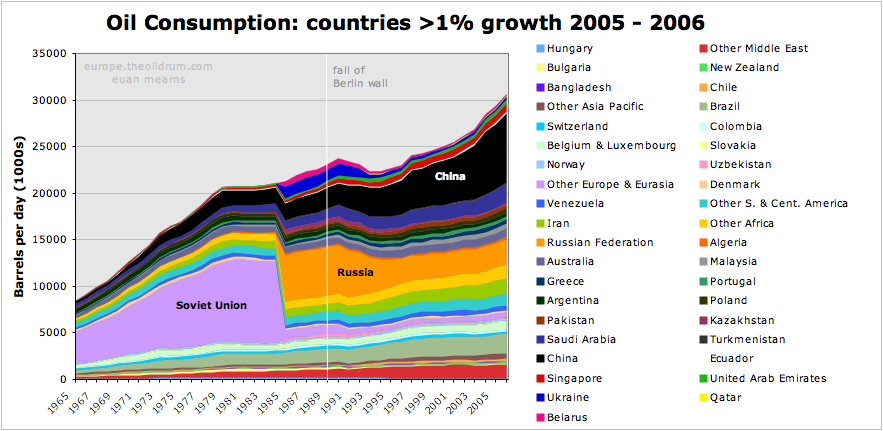

Countries that showed more than 1% increase in oil consumption between 2005 and 2006. The Orwellian fault line in the data in 1984 is due to a change in the reporting standard of BP who lumped the Soviet Union together prior to that date. Since 1965, this group of countries has seen a 4 fold increase in oil consumption compared with a mere doubling in consumption seen in the first chart.

The countries showing greater than 1% growth in consumption are less surprising and include the major Gulf oil producers (Iran, Saudi Arabia, UAE and Qatar), the BRIC countries Brazil, Russia and China, other oil producers like Algeria and Kazakhstan, and former Soviet republics Ukraine and Belarus.

The more striking thing about this chart is that it shows little sign of demand destruction following the 1970s oil shocks with demand and consumption showing relentless rise interrupted only by the collapse of the Soviet Union during the 1990s.

Are we witnessing a change in the world order? Or is the picture somewhat more complex?

Demand destruction in the UK means changing a lightbulb. Demand destruction in a poor country means doing without light.

The new demand destruction is prices are going higher because the poor live in growing economies and are making energy more expensive because they are plugging in light bulbs. I change my light bulbs because they put in a light bulb.

I move closer to work and save 200 gallons of gas a year because a few million people in a city I can't pronounce trade in their bicycle for a scooter. I call it the global oil arbitrage, similar to the global wage arbitrage.

Did other countries increases make up for the drop in use ?

I guess the percentages your giving don't make it clear what the absolute numbers are. I think your saying that the larges absolute drops in usage have been in the more developed countries thus the higher percentages. For the less developed world it probably more interesting to look at countries with and without subsidies. I think the reason they have not been hit hard yet in general is because they are either oil producers or have subsidies in place that have not been revoked. This will eventually change.

So subsidies are currently distorting to usage picture however from my reading the per capita usage is low in most of the third world countries anyway so even if the subsidies are removed and usage declines the absolute change is fairly small.

Also of interest is the usage patterns in the poorer countries oil is generally used for commerce not personal transportation so we would expect the numbers to be sticky.

What we have seen reported in the press is that these countries are having trouble actually purchasing oil and oil products so are seeing periodic shortages. A short term shortage condition would probably not dramatically change the overall usage.

Also in looking at the charts it seems a drop in Fuel Oil usage played a big role in the US for example its -26.1%

For the world -2.5% OECD -8.7%

What I think has happened is that we have upgraded a lot of our refineries and are producing less fuel oil per barrel sending up the cost for fuel oil. In general fuel oil is the one use case that can often be replaced with coal or NG usage. As far as I know NG usage has gone up worldwide.

So in my opinion whats happened is we have had substitution and thus removal of a lot of existing fuel oil usage. And at the same time better refining so less fuel oil produced. At some point this will no longer help.

Memmel, you hit many of the points I had in mind:

• OECD uses / wastes most oil per capita and therefore has much scope to make painless savings.

• Oil producing countries and some poorer countries are not paying "OECD" market prices, so OECD is encouraged to conserve whilst many others are not.

One point you don't make which I think is maybe highly significant is;

• OECD exporting manufacturing capacity and petrochemicals industries to China and ME OPEC respectively and importing manufactured goods and chemical products, e.g. fertilizer. These are essentially energy imports that don't show on the stats we look at.

Would you care to elaborate on comments you made about fuel oil. Where the stats come from and what the uses are? I always believed that oil fired power generation got substituted by gas, coal and nuclear following the 70s oil shocks. I'm not sure how much fuel oil is used for domestic heating and industrial uses in Europe - not much I believe.

But I'm still intrigued about what evidence exists for demand destruction in poor countries making a meaningful impact upon global oil supply - demand balance.

The fuel oil usage is in the referenced pdf. As usual with pdf no way to link :(

I'd say that the drop is a combination of cases where multi-fuels can be used fuel oil or NG. This is a lot of industrial usage and continued exporting of industry overseas.

I agree with you 100% the energy assesment are a bit whacked since a lot of energy goes into the production of goods in China/India and then these are shipped to OECD countries. So even though the energy usage is counted against China its really underpinning OECD economies.

In many cases this results in more coal usage and less oil so overall it might even lower total oil consumption.

Notice that overall the US has less room to reduce fuel oil usage and I suspect we won't see many more cuts. So I think we are now starting to reach the point that not enough oil is available for those who can afford it at current prices.

http://uk.reuters.com/article/oilRpt/idUKN2742223920071227

Also I might add I predicted that once we are past peak that prices for "cheap" fractions of a barrel fuel oil etc would rise above the price for gasoline. As refiners optimized for gasoline production.

Heating Oil is at 3.30 a gallon which is more than the price of gasoline.

So everyone that laughed HAH !

http://www.oilnergy.com/1heatoil.htm#since78

The other indicator Asphalt is closely coupled with construction and tax revenue so right now its uncertain but in time I expect asphalt to also rise above gasoline on a volume basis.

And Asphalt prices are still increasing.

http://www.wsdot.wa.gov/biz/Construction/CostIndex/CostIndexPdf/HotMix.PDF

Using the CPI Calculator, if heating oil averaged the same as general inflation from that 1981 level of $1.20 per gallon, it should be at $2.77 this year. So up until this last run above $3, heating oil was at or lower than general inflation, which certainly gives argument that oil and energy are in early stages of huge increase.

I'm still convinced that the CPI calculated index of inflation has been understated for quite a while. Though it is obviously more complex an issue than just inflation calculation method, it seems to me we have a ways to go in price of crude to get to an analogous place we had in the 70s with the huge dip in crude consumption.

I agree but its not all that important by almost all measures energy costs are now a lot lower part of the overall GDP. I think that most people incorrectly calculate the velocity if you will of higher energy costs since oil is like money oil inflations leads to broad overall inflation.

In anycase we would need to see a lot higer prices in the US 5 dollars plus a gallon for Gasoline to even begin to get the demand destruction effects like the 1970's this implies oil needs to rise to 180+ before we can assume serious demand destruction is possible.

However we seem to be on the verge of a big debt deflation and a lot of people or moving to progressively lower paying jobs so don't discount salary deflation as we enter a recession.

In real terms few Americans have a lot of excess cash over their fixed expenses such as mortgages and car payments. So in terms of disposable cash income not credit I'd not be surprised to see us at the lowest levels since the last Depression. I significant percentage of Americans can now nolonger meet their monthly debt payments. CPI calculations don't capture this and its the BIGGEST factor.

The fact that demand in the US has even stagnated at prices well below those which caused destruction in the 1970's indicates that we are not as rich as simple measures indicate.

I think the bottom line for Americans at least is it really depends on lifestyle. Someone who owns a underwater McMansion with a reseting ARM and several large SUV's say dependent on sales commission is very sensitive to oil prices since they effectively have no disposable income.

The opposite end is some who drives seldom if at all and they are just affected by general inflation from higher oil prices.

Unless you have a good grasp of how much disposible income people have and how much flexibility they have to do substitution such as car pooling etc its almost impossible to guess what the magic price is that causes demand destruction. At least in the US we can probably figure 10% of the poor are sensitive and 10% of the middle class (McMansion owners) further say we have 5% that fall into this class periodically because of job loss etc.

Thats potentially 25% of the population that cannot handle todays prices long term much less increases.

Better understanding of who is at risk and the actual numbers seems critical to understanding how price will effect the economy. As in most financial situation's prices and problems are set by the marginal players not the majority.

My interpretation of this factoid is that today a much larger percentage of GDP is dependent on a smaller amount of crude. One result of this is that a smaller dip in crude availability will likely affect a larger portion of GDP, opposite of what many pundits are implying.

The other implication of this factoid is that in the 70's, since less GDP was dependent on each barrel of crude, a greater cutback in crude consumption could happen with a smaller impact on GDP. I believe that the statistics bear this out. In fact many optimistic economists point out this fact about the 70's 'big dip' in crude consumption without making the connection that now things are different and a given drop in crude consumption will affect a large portion of GDP. This pressure, along with the decades of cheap credit, is keeping our consumption high in spite of the prices.

This may be a reason why the economics of the situation are going to reach a different kind of breaking point than we reached in the 70's. A family's actual cash available to spend is easy to calculate if there is little or no credit involved, and spending stops abruptly with a drop in consumption like the 70's crude oil 'dip'. With lots of credit, a family (or society as a whole) can continue spending until the whole credit structure freezes up. We seem to be approaching this point rapidly. It is economic overshoot.

Nice concepts. Maybe it makes sense to take a harder look at other countries say Japan ? Europe's a bit warped in a good way because of the high fuel taxes. I think Japan/Korea might have similar dynamics to the US but both places in general have better public transport and thus substitution.

I think maybe one of the big issues that your saying in a round about way is the US may be sensitive to oil prices since it has a small cushion for substitution. Substitution includes conservation and alternatives. So the real issue is as oil prices rise how well can a given economy substitute and keep its economic vigor if you will. Off the top of my head the US and Australia are probably the least flexible economies vs oil.

Europe can at some point start scaling back taxes or better aggressively pour gasoline taxes into mass transit and localization.

I think that increasing oil prices are going to uncover structural problems in various economies over time. Even though the OECD economies are similar the ability to substitute for oil seems to vary fairly dramatically across countries and even regions.

Take Arkansas my home state a lot of the poor people live in rural areas with inefficient large trucks as transportation. These people will be hard hit by rising fuel costs. The inner cities and even close in suburbs are in poor shape and this is in general where a lot of the black population lives. Something called white flight played a large role in the shifting demographics of the cities and its still a force.

What I find interesting is that fuel prices will force the poor whites to move back into and integrate with the poor black population. Also the wealthy will reverse their migration back towards the close in suburbs.

You can see that attempts to move to lesson dependency on oil can have some real social implications esp in areas that have large rifts.

Knowing the south what will probably happen is the government will mark a neighborhood as being revitalized and will emminent domain most of the homes and take them at low prices then the builders will refurbish and sell them to the wealthy. I can't imagine that the poor blacks will be allowed to profit by this change of fortune.

I too am from Arkansas and have seen the same trends.

Reverse white flight from Benton, Conway, and Cabot?

Everything from Shackleford out to Pinnacle and Ferndale

will die on the vine.

Asher, University, to Baseline and Mabelvale will be

refurbished.

I got that right?

Yes thats pretty much what I figure.

My parents live out Col. Glenn :)

I grew up in Twin Lakes for example and I think that area would grow.

When I was a kid white flight was at Baseline for example.

And sorry to the rest of the world but Southern Racism is complex.

Now wealthier blacks and whites are pretty much fully integrated and not a lot

of racism outside of the older people. But the poor have some serious racism poverty issues.

The white flight situation in Little Rock is also closely tied to some very messed up

schools. You have something similar in California actually but at least CA kept neighborhood schools so its possible to have decent schools if a area gets refurbished.

I was actually surprised to find CA had problems similar to Arkansas.

In general public education and our "hidden" class system have never worked well together.

One reason I like smaller towns is the rich and poor are forced to work together since they

cannot afford two schools. Anyway suburbia and class problems and education and tax revenue are tightly linked. At least in the South the suburban sprawl is driven by white flight and associated attempts to localize tax money.

The whole cesspool is going to be forced open as peak oil advances.

And gasoline prices will cause further division between classes and damage tax revenues.

I don't think Americans realize how much rampant suburban expansion has allowed us to avoid dealing with our internal problems. Now not only will we have to deal with them but they will worsen.

Small cars are cheaper than trucks. Motorcycles are cheaper still. Scooters are even cheaper. I do not see how poor people will be unable to adapt.

Plus, rich people selling big cars will have to sell them for less in order to sell them. That'll cut transportation costs for poor people.

People have many ways to adapt.

I would say that in many ways the economy is less vulnerable because we waste more. Look at car fuel efficiency, vehicle size, and acceleration. If we returned to the average vehicle weight of 1985 and to 1985 average acceleration with today's technologies for using fuel efficiently we could probably boost fuel efficiency by 30% to 50%.

We have lots more technologies available to use energy more efficiently. We have new types of insulation. We have much more efficient ground sink heat pumps. We have hybrid technology and much better batteries coming.

I'm more optimistic by nature. I see big problems and wrenching adjustments coming. But I also see vast capabilities we can bring to bear and lots of ways we can adapt.

But 70% of the American people have not kept pace with inflation.

As they were not supposed to.

We don't have a ways to go because Americans have

been crushed since 1974.

Note the first chart above.

The downdraft in demand that "ended" at 1985, the year the US went bankrupt.

Debts and imported oil are the only things that have grown in the US since.

Top Story of 2007

Russia, Iran tighten the energy noose

By M K Bhadrakumar

Schroeder pointed out that energy rivalries lie at the core of the US policy of encirclement of Russia and behind Washington's persistent attempts to denigrate and isolate Moscow. He warned of dire consequences if Washington persisted with such a course, as Moscow is "certainly not happy about it".

Iran factor becomes important

In such an overall context, during the months ahead Moscow can be expected to make robust efforts to coordinate with Iran over its oil and gas output and exports. The rationale for such a coordinated strategy involving Iran is very obvious. First, Moscow is intensely conscious of the Western awareness of Iran's enormous untapped hydrocarbon reserves as an alternative to Russian supplies. Russia will strive to stay ahead of the European, and eventually American, overtures to Iran.

Second, the hydrocarbon sector in Iran is firmly under state control and Moscow and Tehran are in harmony in this regard. Third, the two countries will be coordinating their energy policies for wider geopolitical purposes within the broad framework of their strategic cooperation. Furthermore, market forces dictate the rationale of Russia-Iran cooperation.

http://www.atimes.com/atimes/Central_Asia/IL22Ag02.html

We tend to think of poor nations as "price sensitive" but when oil is being used to transport food to consumer or exports to world markets, many nations are not going to be in a position to cut back without going hungry. I agree that the demand destruction is most significantly going to come in nations that are more wasteful now and can cut back without meaningfully impacting lifestyle.

The other side of the "subsidization" issue is that subsidization is just a way of distributing oil wealth to the people. So, it reflects the increased wealth of oil producing nations and will create a greater share of global consumption for those nations going forward.

Nations that will be relatively poorer (e.g. post real estate bubble OECD, and especially the US with its massive current account deficits) will naturally consume less.

Really, the idea of a 3% overall decline in petroleum production is not so troubling. A fuel efficient vehicle can use a quarter of the petroleum that a big inefficient vehicle does. This buys a lot of time to develop alternatives while allowing individuals to get to work, etc. The real problem is the distribution of the remaining 97% each year.

I just purchased a 42 mpg hybrid that uses a third the fuel of my 14 mpg SUV. Thus, I was able to reduce my fuel consumption by 66%. That is a lot of years of 3% annual declines. One might say that not everyone needs a new car every year, and indeed this is one of the key points of the doomsayers, "17 year vehicle lifespans." But it is easy to substitute an efficient vehicle for an inefficient one for tasks which they do equally as well, such as transporting me to the office every day. The free market will encourage the individual with the inefficient vehicle and high usage to swap vehicles with the individual with a more efficient vehicle and low usage.

For deep snow, and those difficult to get to Sierra Nevada trailheads, the big SUV will still have its uses. But most of the time, it will probably just sit in the garage.

lots of doomers don't want to hear you say that.

John,

I'm one of the biggest doomers on TOD and I don't give a darn what people do vis-a-vis vehicles because I'm not counting upon them or their actions to "save me."

In my case, I'm currently considering whether to buy a used full sized 4x4 with a stump pulling-sized engine rather than having my old, small 4x4 engine repaired. Why? I need a 4x4 in the boondocks and I don't drive much. Gas mileage isn't important for my usage. And, if TSHTF, I'll convert it to wood gas.

Todd

You should get something you can run off propane.

The old big strait sixes actually made a better 4X4.

I actually like a old jeep or ford bronco with a trailer

vs the modern trucks.

If your serious I'd get the really old ones refurbish the drive train

and engine. These can be worked on basically anywhere and most machine

shops could make all the parts.

But how would that benefit the individual with the more efficient vehicle? Assuming they still need to drive the same distances (albeit short ones), all they've done by swapping their vehicle is to is increase their cost-per-mile.

The vehicle they've acquired would also, in a world where petrol is scarcer and more expensive, be less attractive on the open market (i.e. intrinsically worth less and faster-depreciating) than the efficient vehicle they gave away.

Just a thought. I don't think it makes me a doomer.

Is it OK to break in? I'm new to this.

this would be a great use for the cheap SUVs that flood the market when high gas prices cause a glut of used SUVs for sale. have them sit for times when you need a driveway plowed or some other sort of work where an SUV would be a good tool.

Do the math:

A quick back of the envelope calculation for consideration:

Current US daily gasoline consumption = apprx. 380 million gallons a day

Gallons in a barrel = 42 gallons

Barrels of gasoline consumed in the United States daily = apprx. 9 million barrels of gasoline a day

Total current world production of crude oil + condensate = 73.1 million barrels a day

Now of course one barrel of oil isn't exactly one barrel of gasoline but close enough for a rough approximation.

Assuming a 3% decline yearly in world crude oil + condesate production results in the 9 million barrels of crude oil dedicated to producing that ENTIRE 9 million barrles of gasoline used by the ENTIRE United States fleet being off the market in about 5 years after peak. Even faster for U.S. actually since imports will drop quicker.

We probably can outbid poorer countries for the those barrels for a while but all in all it might not take too long. Reducing consumption like you did is bright and so is being prepared even if you don't actually need the preparation. Are you an idiot for buying a life insurance policy even though you didn't die during the term?

This is an over simplistic calculation. The US will still easily outbid many poorer countries, and there is no way that

100% of the world's demand destruction will take place in the US. That said, there is huge inertia on the demand side. A relatively wealthy and aware American can easily trade their SUV for a hybrid, but they are very much the exception. The largest part of the populace will not consider trading in until they are so far in debt that they cannot afford to. There is virtually no domestic production of hybrid vehicles in the US, and with the falling dollar few will be able to afford imports, even if global production of hybrids could be ramped up to meet the demand. Here in Europe, hybrid technology is rare because we prefer small, low power diesel cars which get better performance at lower cost.

Europe as a whole will fair well for a good few years, but are already so efficient that future demand destruction will be painful. The UK will not fair so well, we have high debt and relatively poor and overstretched public transport. The road lobby here is rabid, and every government eventually buckles under the pressure and starts building more roads.

We sound like were on about the same page. The calculation was stated to be simplistic. Of course all demand destruction won't be in the US.

The calculation simply makes the point that large amounts of barrels will be moving off the market quickly and multiple years of 3% oil decline will not be simply be mitigated by everyone in the U.S. switching from an SUV to a hybrid. A better plan than that might need to be considered.

The one assumption you make that I question is your faith that the entire U.S. citizenry will continue to outbid. Probably can, but I won't take that as written in stone.

The U.S. is not the center of the world and the entire U.S. fleet consumption is only about 12% of world oil consumption. And its getting to the point that a growing upper middle class in Russia, China, and India are weathier than the average American and European. In fact, at my old firm, one of my co-workers and her rich doctor husband left the U.S. to return to Shanghai since he could now make just as much money and have a similar lifestyle there.

Over 10 years, that is 30%. You see your car in isolation to everything else. You probably want to have the same amount of food on your table, so you can't save any fuel which goes into production and transport of food. Similarly, you want to buy the same number of consumer goods and also fly the way you are used to now. So if you want all transports to continue business as usual YOU will have to save for that to happen. In the Australian context I have calculated that Capital city motorists would have only 20% of current fuel supplies for their cars by 2020. Happy motoring. You would need more than mandatory car pooling to achieve that sort of saving. Once peak oil damages the economy, the purchasing power to buy new cars will go down. The financial system is weakened already from the subprime crisis. Some car manufacturers may go out of business. We have no idea what will happen. In the worst case scenario we'll be stuck with whatever car fleet we have when the crunch time comes.

No, it is actually 34.39%. That 3% over 15 years turns into 55.79%. And 3% over 20 years is not 60% but rather a whopping 80.61%. What was it that Bartlett said about human beings not understanding exponential functions?

Actually a 3%/year decline after 10 years is a 26.26% decline and after 20 years it's a 45.62% decline.

If you start with 10000 and decline 3%/year after 10 years you have 7374.241

A percent decline decelerates as a fixed percentage of a decreasing number decreases.

--

JimFive

From the World Energy Outlook 2007 (pag 290):

As may have been stated before, many of the countries showing demand increases are subsidizing the fuel costs for average citizens. At this price level, strain is placed on subsidizing countries to lift part or all of the subsidized expense.

In this case, subsidies do two things:

1. Artificially stimulate demand in the face of struggling supply.

2. Create strange distortions in a high price environment.

In the end, subsidizing countries will face shortages and rationing in a constrained supply situation. Those without subsidies suffer demand destruction.

In non-subsidized nations, you will see a rise in efficiency as systems are put into place to deal with increased costs. In subsidized nations who import a substantial portion of their oil, long term shortages will cause a destructive period of shocks to economies and efficiency gains will be delayed. In a final case, subsidies in producing nations will further constrain supply for importing countries resulting in increased geopolitical tension between producers and consumers.

I think the trends will be complicated by different levels of fuel saving. I'd suggest there are at least 3 thresholds;

Level 1 discretionary cuts or painless savings ie fewer shopping trips, less recreational travel.

Level 2 crossing the comfort zone such as car downsizing or taking the bus, perhaps reluctantly.

Level 3 acute financial hardship such as a cut in income (eg job layoff) or budget reallocation due to loan repayments or expensive groceries.

The question is whether the third type is going to put a ceiling on oil prices eg $200 per barrel.

Level 2 should include car pooling, even before taking the bus

2 additional levels:

Level 4 fuel shortages at filling stations make buying gas an unpleasant experience and cut into the time budget to such an extent that alternative transport arrangements are organised

Level 5 fuel rationing

The speed at which we'll go through these different levels will solely depend on the average behaviour of motorists. The more inelastic the bahaviour, the quicker we'll reach level 5.

When you look at the top ten reductions, you get a different picture:

While these might not be the most obvious expected cases (eg Bangladesh = +1.7%) there is generally an explanation for why.

Its also important to note that the key factor is easily disposable income in the driving classes - not absolute wealth. That's why I suggest high debt countries will low oil taxes will be hit early on (such as the US).

What's happening with Hong Kong being so high on the list? Car ownership is famously low here - only about one in seven families has a car, and those people are affluent. I don't know anyone who curtails car usage because of fuel price. Public transport costs have remained the same, and in any case for public transit users that use is mandatory (getting to work). What would cause the reduction?

First up, if you're already a low oil user, it may be easier to drop use further. Secondly, not all oil use is for transport - sure, about 60% worldwide is for transport, but that varies from country to country, most of Cuba's oil consumption is for its electricity generation. Apparently HK's electricity comes from a coal and gas plant, but still... use of oil varies from country to country.

The increase in Bangladesh may have 3 reasons:

(1) population growth

(2) increased use of diesel driven deep tube wells for irrigation of rice during the dry season

(3) affluence in parts of Dhaka, the capital of Bangladesh, including construction activity.

Watch this:

Traffic Jam in Gulshan, Dhaka

http://www.youtube.com/watch?v=bPDixVDkaq4

Gulshan Avenue

http://www.youtube.com/watch?v=d7iD_iDktMM

Gulshan was a quiet diplomatic area in the 80s but the upper and middle class of Dhaka have moved in since then, transforming the whole area.

Demand Destruction down in the outback.

I am currently using LP gas to heat with. I use it conservatively as well. In the last 6 weeks I used exactly 250 lbs. At about 4.5 lbs /gal thats about 55.5 gals.

I paid $132 for that amount. This is from a guy who used to deliver a lot of LP locally in this area but no longer does yet he will sell you some to fill portable cylinders with.

I did own my own 500 gal tank and filled it more reasonably but its gone now so I use smaller tanks.

Last summer around Sept I asked my previous supplier for the price and he quoted me $1.97 if your own tank. $2.07 if his tank. He will sell you a tank for $850 or rent one for free on contract. I demurred on that..for he looked far far too hungry and lean. I caught on to his lame schtick right off.

Two days ago I refilled my RV size cylinders and the price was the same as before and this was not from my previous supplier since they will definitely refill small tanks. The guy I got this LP from was on a forward contract and his delivered price had therefore not changed of late. Next year? Likely a whole lot higher. He uses a lot for his chicken houses. Takes a lot to heat those huge structures.

There was a big changeover in the type of valves used and now many tanks are not compliant anymore. Big hassle there.

Now when I filled my tanks two days ago the guy told me that the suppliers are now testing peoples lines from the tank to the house and even though you own your own tank(500-1000 gal) if they find a leak(even though there may not be a real leak) they will not fill your tank!

And he said that the some residents had told him that when they tried to buy from other suppliers that they were quoted prices ranging from $2.65 to $2.85...a huge increase since this last Sept.

So I figure the suppliers are tightening their customers up substantially for some reason. Perhaps to make more profit and demand higher prices. That sort of cutthroat business is becoming more pervasive of late in all forms of business IMO.

That supplier made a list of all that I had to do in order to get my own tank and have them service it. Before this last summer I never had any hassles. Not a one. They fired the old driver they told me and now a bunch of young sheiks are running the place and I think all they can think of is $$$$$ signs.

So here then is my part of Demand Destruction written in bold.

I will convert all the way to wood. First for heating and later for cooking. Then they can kiss my ass and I will have done my part to reduce FF consumption.

The wood I will be burning is mostly deadfall or what I pick up from trees fallen over on cropland and other here and there as well as thinning out my own woods as need be. I intend to concentrate on maple since its fast growing and there is a lot of it to thin out plus its dense.

I have 4 or 5 chains saw and many good double bit axes as well as mauls,wedges, etc. I used to cut a lot of my own firewood in the past. For my cooking I am getting a wood fired range and building an outdoor Pompeii style masonry oven on my back screened in porch where I will also have my fish cooker and bbq smoker. Non-gas fired.

I suggest those who look to the future find some good land with lots of woodland on it and think seriously about doing their part for 'demand destruction'.

airdale

Euan,

(C+C+NGL) is only part of the story.

I think you need to look at total primary energy supply to see if substitution is going on.

Or, if just considering oil, at least also consider the bit which makes up the difference to total liquids - availability (or not) in each country of these 'crude alternates' are the marginal barrels determining the price and consumption of 'conventional' crude.

I'll take my techno fix with fries please.

New energy uses for asphalt

http://news.yahoo.com/s/ap/solar_roads;_ylt=ApuDgDZXFRlQkd.nho4n4GcDW7oF

PO means that oil prices will go higher and stay there probably for longer than most think. higher prices boost all the solutions we have.

we still have old fashioned solutions.

1. Using more efficiently- buying a higher MPG car, hybrid or a PHEV.

2. Not using as much- walking, biking and car pooling more.

3. Not using at all- getting rid of the car.

something like this could be attached to your roof. it need not be very efficient because it would be collecting power all day and feeding it into your PHEV for later use. something like this could also be used for your roof on your house if it costs less and you can just roll it onto your roof while covering more space and not needed as expensive an installation.

http://www.solarbuzz.com/News/NewsNAPT78.htm

Year on year numbers can be somewhat misleading, since oil is used in heating and power production as well. Both of these can have relatively large yearly fluctuations despite their smallish overall contribution. These fluctuations depend on coldness of the winter and other factors. However, for many countries the drop seems to be significant enough that it can't be explained by those factors (and of course a country might have had an increase in the use of heating oil in 2005-2006 with a drop in the overall oil consumption). In my opinion ground transportation fuel consumption would give a more reliable picture of possible trends.

So are we seeing demand destruction in OECD countries, or are we exporting heavy industry from rich countries to poor ones (along with the energy requirements)?

Mike

Those of you that have travelled in 3rd World Countries may remember how some of the countries have very bad roads. People drive older vehicles that have their suspensions beefed up, newer models with off road suspensions, and motorcycles. Some of the cities have some good roads and you therefore may see somewhat less capable off road vehicles. Two wheel drives in many areas are fine, as long as they are bad road capable.

I sincerely think that some of the vehicles people are buying could be the worst for bad roads. Many of these vehicles can have their suspensions beefed up. I wonder how the fuel cells will handle rough

road conditions?

The data relates to countries and tries to suggest that the wealthy are being more impacted by high oil prices than the poor. But the data does not and probably can not distinguish within a given country as between poor and not poor people. So the point cannot really be made using this data. It could be that the poor people in wealthy countries are the ones whose demand is primarily being destroyed. It may also be, as suggested in some comments, that oil price subsidies in some poor countries are skewing results because their demand is not impacted by higher global market prices. This is a topic that needs a lot more data.

Someone pointed out the difference between demand destruction and affordability destruction. Demand destruction says that I do not need it any more. I found a substitute or it is not necessary nor desired. Affordability destruction says that I still want it, I just can not afford it. There is a difference.

http://www.nytimes.com/2008/01/02/opinion/02diamond.html?_r=1&ref=opinio...

OP-ED CONTRIBUTOR

What’s Your Consumption Factor?

By JARED DIAMOND

Published: January 2, 2008

Thank you for the link:

You might like to look at this.

It's I=PAT expanded.

STIRPAT is an acronym that refers to a statistical model for assessing environmental impacts at virtually any scale and to a research program in structural human ecology (SHE). The STIRPAT model was recently utilized by the research team in an article titled "Driving the Ecological Footprint" (Frontiers in Ecology and The Environment 2007; 5(1): 13–18). This comparative analysis shows that population size and affluence are the principal drivers of anthropogenic environmental stressors, while other widely postulated drivers (e.g. urbanization, economic structure, age distribution) have little effect...

http://www.stirpat.org/

Good points.

A couple of possible reasons for this picture:

1) Oil intensity in OECD countries is much lower than in developing/non-OECD countries, which results in stronger substitution in OECD.

2) Oil products are subsidised in "demand-spots", such as China/India and the Middle East, which together will account for the vast part of the demand growth in coming years. Subsidies result in unchanged demand patterns.

3) The oil shock in 1979-80 was a "shock", i.e. it was very sudden compared to the rise in 2007.

On average, WTI rose by (a rounded) 19% in 2003, 33% in 2004, 36% in 2005 and 17% in 2006. Comparing the demand growth between 2000-2005 and 2005-2007, it becomes clear, that high prices between 2000-2005 started affecting demand growth negatively with a lag of 2-4 years. Demand growth between 2000-2005 was much stronger than last 2 years.

Regards,

Cüneyt

Over the past few months I've been working to develop an oil depletion model for the US and Canada (at www.dynamiccities.org) that can be used as an infrastructure planning tool. To those ends, I've been wrestling with some of the distinctions between global peaking and decline rates versus what might be experienced in individual nations.

In particular I've been making the assumption that demand destruction in poorer countries will roughly offset declining net exports such that the US and Canadian experience will be fairly close to that of the world on average.

This assumption contrasts our experience with the experience of poorer countries - who will peak earlier and decline faster while, on the other end of the spectrum, some OPEC countries will likely experience a long plateau in subsidized domestic oil consumption.

Any thoughts on the respective impacts of demand destruction vs. declining net exports?

In the early stages of oil scarcity demand destruction result from conservation, whether voluntary or forced. In the middle stages demand destruction will result from deprivation. In the later stages demand destruction will result from deaths.

Somehow demand destruction does not seem to adequately convey the reality of what now is or is to come.