The Release of the Industry Taskforce Report on Peak Oil and Energy Security

Posted by Chris Vernon on February 10, 2010 - 1:43pm in The Oil Drum: Europe

| This is a guest post from Erica Thompson, formerly with the UK Energy Research Centre (UKERC Report) and now working on a PhD at Imperial College, London. She attended the ITPOES report launch on our behalf.

Today's (10th Feb 2010) launch of the second report of the Industry Taskforce on Peak Oil and Energy Security (ITPOES) was rather more high-profile than the previous one. After summaries of the report from other contributors, Richard Branson arrived late to read out a short speech and media interest (informally measured by the rate of camera flashes) picked up; we can expect a scattering of news stories about the report to follow, in the usual places.

|

Click to download .pdf |

Protagonists

Involved in the current report are:

- two construction companies: Arup and Foster + Partners

- two energy companies: Scottish and Southern Energy (one of the UK's "Big Six" energy suppliers) and Solarcentury (group convener Jeremy Leggett's solar energy installation firm)

- two companies with a stake in public transport: Stagecoach Group (the second largest transport firm in the UK) and Virgin (which has fingers in many pies but are here under a transport "hat").

The above six firms all have a great interest in advocating action to reduce oil dependence, as they set out in the report and in their presentations at the launch. Government incentives or public infrastructure projects to improve energy efficiency, invest in renewable energy and increase use of public transport would benefit these companies directly. Of course, they also lay stress on the cost and risks to consumers, the need to reduce energy poverty, and in some cases a wish to contribute to reducing carbon emissions. Since the last report was published, FirstGroup (the largest transport firm in the UK) and Yahoo! have quietly absented themselves from the table. Whether or not other companies have been approached is unclear.

What's new?

As before, they offer two "expert opinions" - one from Chris Skrebowski, with updates on the impact of recession and new shale gas developments, and one from economist Robert Falkner on economic consequences and the role of climate and energy policy. This reflects the shift in tone from the more technical first report to a greater emphasis on advocacy, remembering that a UK general election is imminent.

Economic modelling

Perhaps the most useful issues raised by the ITPOES report are the comments on risk to the UK's balance of payments in the next decade:

The UK, because it is now a net and rising importer of oil, gas and coal, is becoming increasingly exposed to competition for supplies from other energy importers. The insulation from international supply pressures provided when the UK was self- sufficient in oil and gas supply is now eroding quite quickly. This is likely to put pressure on the UK balance of payments and in a world of floating exchange rates is also likely to put downward pressure on the valuation of the pound sterling. In other words the positive benefits to the valuation of the pound as a petrocurrency are now disappearing.

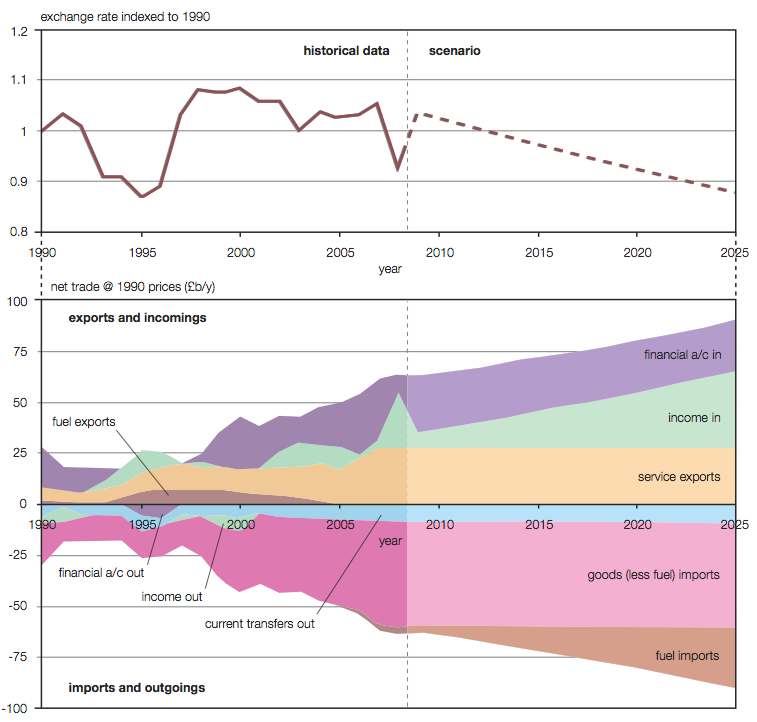

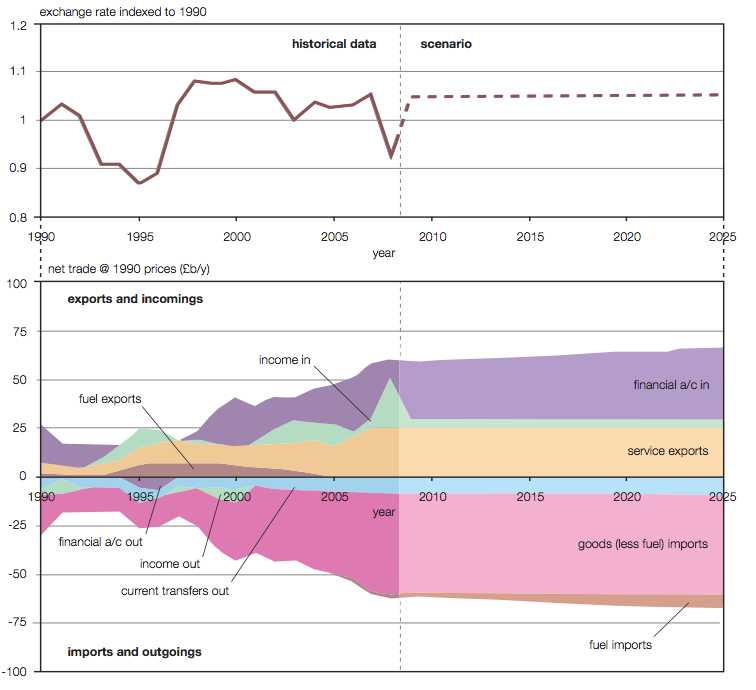

Appendix D to the report considers this in more detail, with an (illustrative rather than predictive) model of the UK economy to 2025, developed by Arup. They consider two scenarios: one reactive (BAU) and one proactive. The proactive scenario assumes that some industrial output to consumer goods is diverted to investment in energy efficiency and renewables, and passenger car and freight oil consumption is reduced, so that total demand for fossil fuels is reduced to about 2/3 of the present level by 2025. The modelling is also interesting in being the first economic model I have seen which values both energy flows and capital stocks in energy units (petajoules and "virtual petajoules"). The result of a BAU reactive approach is "a continuous devaluation of sterling at an average of about 1 percent per year".

Despite the somewhat simplistic modelling, there is a useful point here which is often unremarked; that the UK's declining North Sea production threatens the balance of payments quite drastically in the next decade or so unless domestic energy demand can be reduced or, equivalently, domestic energy production increased. Even if, as in this analysis, the effects of volatility in oil prices and the possibility of supply shocks are neglected, there are clearly medium term structural problems with current UK energy policy which have further consequences for national energy security.

Recommendations

The recommendations of the report are divided into the categories of "general", transport, retail and agricultural, power generation/distribution and heating policies. In most areas the recommendations are rather vague and and may be criticised by the cynical as self-serving (however, in what instance would we expect a company to make any other recommendations?). Actual reductions in service demand are skirted around carefully. Conspicuous by its absence is any mention of a carbon price, which was only mentioned in passing by Brian Souter (of Stagecoach, and clearly the most environmentally motivated of the group) at the launch.

Government response

A recurring theme of the morning's speakers was the need to move "from recognition to action". This was echoed by a representative of the UK Department for Energy and Climate Change (DECC) in an official response to the report, emphasising their own commitment to move "from strategy to delivery". The response was muted in tone, sticking to the party line that DECC "are already taking action" and citing a list of their projects from last summer's Low Carbon Transition Plan - which did not mention oil depletion, even obliquely. It seems that peak oil, though evidently recognised within DECC, remains somewhat unutterable as a specific motive for action. Whether or not it still influences policy decisions remains to be seen.

Conclusions

Although there is little new analysis, this report marks a further milestone as energy security issues continue an inexorable rise up the national agenda. Coming on the heels of a new consultation by the energy regulator Ofgem on energy security and longer term energy policy, and in the run-up to a general election, the report is what it set out to be: a well-timed wake-up call to British industry and government. Whether it will be heeded remains to be seen. Criticism is likely to focus on the (unavoidable) specific motivations of the partner companies, the (perhaps necessarily) simplistic approach to analysis and the (very much contestable) implicit assumptions. Nevertheless, the high profile of the companies and individuals involved is a marker of the increasingly widespread, if overdue, recognition of the UK energy dilemma, and the fact that DECC were represented at the launch event of a report with Peak Oil in the title is certainly a step in the right direction.

The first report (2008) was discussed on The Oil Drum here:

UK Industry Taskforce Sounds Alarm on Peak Oil

And Leggett provided further comment here:

Jeremy Leggett discusses the UK Industry Taskforce on Peak Oil and Energy Security

Speaking explicitly about Peak Oil would anger the Americans. As we have heard from the IEA whistleblowers. The Brits are nice puppies. ;)

Act now: Well, its TOO LATE now.

One comment on style over substance. Nothing says 'give me a migraine' like 44 pages of double column sans-serif type.

Firstly the UK Government has never had a 'coherent' energy policy, as it cannot offend the coal miners (Drax Power station emits 22million tons of CO2 per annum all Coal with No sign of Combined Heat and Power (CHP) that we see on the continent; This is only ~22% energy efficient and all those mining community votes to keep the MP's in expense fiddles), the gas lobby (remember that British Gas was only privatized in 1986 but has partially retained the mind-set of a nationalized industry; so the "rush to Gas" we saw in the 1990's has resulted in a future dependence on Gazprom!), North Sea Oil (just another tax collection exercise without any real thoughts of the future) or the nuclear lobby (what can anyone say about Windscale or now renamed Sellafield), I remember the message of the 1960's of free power for all.

It has also squandered all North Sea oil revenues on vote chasing. As we have "had it so easy" over the last 50 years UK never "needed" an energy policy - just bumbling along in the dark.

Whilst there are lots of alternative energy proponents in the UK, talk a great 'Carbon Talk', and plenty of energy efficiency experts, the conventional wisdom is predominantly still that of oil, coal and gas fired power stations without CHP. Now there are some exceptions but they are not Government led. And with respect to Oil and Petrol for transport, there is certainly no coherent transport policy in the UK either. Just tax revenues; thats all Government of any colour seem interested in.

So forget Peak Oil the UK it's heading for ruin on the civil service pension scheme future liabilities alone.

All this in a nation with some of the world's most beneficial wave and wind power resources. That's why I am devoting my time to the emerging nations in Africa. They can learn from the mistakes of the West, are rich in resources and are (often) willing to listen to alternative and integrated policies. So I will be leaving shortly!

But Britain has had an energy policy, and it been implemented for decades; it just wasn't a policy based on the needs of the country as a whole, rather it was designed to benefit the interests of a tiny fraction of the country, at the expense of everyone else.

One could say the same thing about the dire industrial policy, or crazy economic polcies that were followed, for example sacrificing a skill-base and manufacturing infra-structure, in favour of inflating the importance of the financial sector. The people in charge of the country aren't fools, that's way too comforting a thought, though I suppose it's preferable to seeing them for what they really are; part of a criminal gang dedicated to looting the place for their own selvfish benefit for as long as possible, until there's not much left to steal.

Hmmm...some would argue that the UK Government has made quite a point of offending coal miners since the 1970s. Anyway, we now import rather a lot of coal - over 70% of what we use.

Scrap UK's wind farm plans, says Gazprom boss

The UK's energy policy is one the same levels as Homer's 'hide under a coat and hope everything works out'

From your link

And yet Moscow failed to supply contracted gas to Europe last year and ever since the European gas companies have apparently declined to take their pre-arranged share. How does that work? Maybe Simmons is right and everyone involved closely enough on both sides knows Gazprom didn't actually have the gas to supply. Anyway we already have gas fired power stations coming out of our ears and whatever Gazprom is selling in 2020 it is likely Europe will be buying - as I'm sure Medvedev knows.

OMG,

Did you read the article? Offshore Wind = $$ in UK economy. Gas fired power = $$ exported from UK to Russia. The point of the article is balance of payments of the UK economy.

Yikes, this group is about ten years late:

The question I have is what happened between 1999 and 2008? Answer is that oil prices increased from $12 a barrel (with some grades priced lower) to an annual average of $99 a barrel nine years later.

Peak oil is constantly being equated with increased prices, yet when sharp increases take place over a period of years, the cause is always suggested to be ... something else???

The transport sector has already been hard hit, with GM and Chrysler bankrupt, airlines on life support or out of business (Japan Air Lines) and the vulnerable members of society in most countries enduring unemployment that shows no sign of ending. Hello! In the down- to- Earth, real world of dollars, cents and pounds sterling and other currencies which is how the bulk of the world measures the goods it uses Peak Oil took place - peak CHEAP oil that is - in 1998.

The cheap stuff is what the real world we've gotten used to living in was built upon. It's gone. Gone, Baby gone!

The suggestions are silly; biofuels and 'green transport' initiatives. Ronald Reagan- style energy conservation dies hard. I don't know why they don't suggest inflating another property bubble; the perfect supply side 'solution'.

The first thing all of these groups have to acknowledge is the time to leisurely amble toward non- solutions is past. The second thing is a kind of ruthless honesty about our aggregated consumption. The third thing is to craft a conservation plan that works.

Any report, like this one, that does not feature these elements - particularly conservation - isn't worth the paper it's printed on.

I'm not sure what year Simmons book 'Twilight in the Desert' was published, but he stated in the latter part something to the effect of, if efforts for a plan B are not undertaken quickly enough, there will be huge economic and transporation problems.

Well, there still isn't a coherent plan B and the clock is ticking oh so much louder now.

North Sea oil production is half what is was in 1999!

Here is the visual review of the situation from the Energy Export Databrowser:

(Note: Vertical scales differ.)

Let's state the facts that are immediately obvious from these graphs:

Not visible in the graphs but obvious to anyone who pays bills is:

Really, what more does one need to know? How much more obvious do things need to be?

The seemingly obvious conclusion from these simple facts taken together:

Anyone who actually looks at the data doesn't need a fancy report to determine that energy supply and use is the UK's #1 issue for the next 10 years. (And for probably a lot longer.)

For policy makers I have what seems like obvious advice:

Just stating the obvious.

-- Jon

When I first saw the graph of UK energy production over the last 10 years I was shocked. All their forms of energy are falling off a cliff, and to make it worse their imported NG is from LNG--even as they become more and more dependent on NG. Very dangerous situation to be in.

Paul Mobbs has an excellent graphic showing the UK energy balance sinking beneath the waves in his article:-

Face up to natural limits, or face a 70s-style crisis

Why the depletion of Britain's energy resources represents a fundamental shift – for better or worse – in the operation of the UK's economy

A "comment" piece for The Ecologist by Paul Mobbs, January 2010

http://www.fraw.org.uk/mei/papers/ecologist-201001.html

Erica wrote:

Oh look, UK trade deficit widens in December:

Charts from 25th June 2008:

Click all charts to enlarge, without call out.

Mervyn King, Governor of the "independent" Bank of England;-)

Gordon Brown, the most confused man in the world? On his way to Saudi Arabia to beg for more oil to combat global warming whilst promising a green energy revolution at home founded on nuclear power.

Population data from The United Nations.

And yet, like the credit crunch they will say "no one saw it coming".

A State of Emergency

Seeing as you referenced Mervyn King in there, I thought you may find it useful to find out what he said in a paper called No money, no inflation—the role of money in the economy.

We can always print more money to buy the goods we need to import, for a while anyway. I've got a feeling this decade isn't going to work out quite as planned by business or politicians!

Euan, two questions please!

1. Would there be any change to our energy current account deficit if we were in the Euro (I am guessing not)

2. Can you shed any light on the potential of the Falklands. I am assuming that even if there is oil down there it will not be as easy as the North Sea. I also would assume that we would require Argentinian assistance in some way, even if only to use their mainland facilities. Do you see the Falklands as a game changer?

Thanks

Hugh

There's recent Rigzone article here:

http://www.rigzone.com/news/article.asp?a_id=87285

Short answer is that no one knows what potential the Falklands holds.

What we can say with some certainty is that even with a good resource, significant extraction rates are at least five years away. Even if it achieves a million barrels per day within a decade, that's only compensating for North Sea decline. It's not a game changer but has the potential to be very useful to the UK (assuming there are no political problems). It's also quite possible that there isn't a good resource able to support hundreds of thousands or even a million barrels per day in which case it is of little national or international importance but could still offer healthy profits for the companies involved and the Falklanders.

http://twitter.com/BreakingNews/status/8973797490

Renewables are too puny to help in the next decade.

Take a page from Brazil.

UK should put their money into developing the Falkland Islands offshore oil and gas--60 GB boe OOIP. If they don't do it the Argies will.

The purpose of fossil fuels is to buy time for adoption of renewables.

As you say the purpose of fossil fuels is to buy time.... Something not done in the North Sea Oil "boom years". There is no Energy Policy.

Renewables are mired in the "Not in my Backyard" mindset of the so called 'thinking classes' in the UK even if enough real effort had been put into promoting them. Wave power in the UK is practically non-existent, so much wasted time on pilot studies and research and not enough on development. In the 1970's there were floating wave doughnuts, but where are they now? the Severn Estuary has had so many tidal barrage proposals that we could use them to make a weir for power generation. Nothing happens.

How long could Falkland Oil last: Not long enough!

I am going to switch the lights out when I leave the UK, which will be in less than 12 months.

Supposedly the Falkland Islands are a Second North Sea.

If this really is the Peak then a dying Britain will lose the Falklands Islands to nearby Argentina anyways.

The UK uses 2 mbpd of oil, which represents 35% of all UK energy(10 quads/yr). Angola, which produced 750 kb/d in 2003 now makes a 1800 kb/d. With a big effort perhaps UK could secure their 2 mbpd from the South Atlantic in a decade.

http://news.yahoo.com/s/ap/20100211/ap_on_re_la_am_ca/lt_argentina_uk_fa...

Some 96% of our energy consumption is coal, oil, gas and nuclear. All in steep decline. The average annual decline rate of our indigenous production of these four from 2000 to 2008 was 6.1%. 2005 was the crossover from major energy exporter to major importer.

There is no possibility for the oil and gas situation to change, some potential to improve coal (at the expense of climate) however as we are currently 71% reliant on coal imports that's not going to change significantly. It might be possible to bring new nuclear power on-line in the post 2020 time frame, but that is unlikely to do much more than offset the existing nuclear decline. Renewables? The target is 15% by 2020. A seven-fold increase and a bigger ask than any other country in Europe. Even if we make it, it doesn't change the game significantly.

Our foreseeable future is one of major energy imports, that much is clear. That bounces this problem into one of economics and geopolitics. How sustainable is such a trade deficit? Do we forego other imports in exchange for increased energy? How secure our this imports?

My first post on TOD, four years ago next month was on exactly this issue: UK Energy Gap

The risk exists that the energy collapse, on top of our existing trade deficit and large debts incurred over the last two years tip the economic system over the edge. What's sterling got going for it?

I find it sad to see how the clearly identified trends back then have continued exactly as expected, driving today's challenge. Yet where is the response? Our government are a large part of the problem. In comparison to other countries in Europe we languish at the bottom of the renewable energy league table yet at the top when it comes to potential resource. It's just sad.

In closing, here is this morning's speech from Chris Barton, Head, International Energy Security in the Department of Energy and Climate Change. This man has some responsibly for this mess, together with the Director, Director General and Permanent Secretary above him. In my opinion, they aren't doing their jobs.

A weasel, they are starting to get worried that they will lose their icy grip on us, ~"we must all work together" - right on upper middle class safe job brother, LOL.

H Chris,

I hope this is not too far off topic, but I wonder if you could comment about Ireland. I've logged a couple thousand miles cycling in Clare, Galway, & Mayo - mostly along the coast. It seems that Ireland would be at a significant disadvantage in trying to compete for FF in the years to come. It would also seem that past practices have very much depleted their supply of "Turf" (peat) that was a traditional source of home heating. Also the forests have been greatly reduced in size from past centuries (although there are some nice reforestation projects).

On the other hand, cycling along these coastlines is always a battle with the wind - and I mean real wind! Are there any significant plans for wind turbines along the western Atlantic coast? My last trip there was a couple of years ago, but I don't recall seeing any windmills?

Not doing their job, indeed. Natural Resources Canada is the agency responsible for assessing the global energy situation. The Deputy Minister of NRCan actually heads a board, the Energy Supplies Allocation Board, which is to assess the global supply situation and report to the Minister "from time to time". According to NRCan, that Board has not actually *met* since 1993.

Details on the research process are outlined here, in my letter to NRCan: http://www.postcarbontoronto.org/2010/02/06/post-carbon-torontos-iea-let...

I'm onto FOI/ATI requests - just had a call today telling me I'd reached my max - 5 hours of NRCan time - on a request for internal documents discussing "peak oil", "peak production" and the like... and they are still looking at 2009! (My original request was 2000-2009).

And NRCan tells me - and everyone else - that they don't study peak oil.

Not doing their job, surely... but they're doing something.

bioprospector

If you send me the details of what you want, I will use up to my "max" hours of NRCan time to get the information you want. I am a Canadian and am deeply interested in what my government is(n't) doing, so am willing to help out.

You can contact me at dspady (at) ualberta.ca

Don

I personally would like to know what he is going too do. As far as I can see he is kicking the problem farther down the road by forming another committee of interested parties to decide what too do, whose only conclusion will be to form another committee to discuss what they are going to do ad infinitum. I wonder what Churchill would have though, if one of his ministers had suggested it would have been a good idea forming a committee in 1940 on what to do about the threatened German invasion. Action today is what he usually wrote on the bottom the reports that came across his desk. I really do despair for my country.

Everyone seems to be missing the significant point of this report. It's not so much the context that's important, as it's all been said before. It's who's saying it that's important.

The business leaders who initiated this report did not do it to persuade governments to act. They did it for their own information, and to persuade their peers in the business world to act.

Organizations such as Virgin are 100% reliant on cheap fossil fuel energy. It is in their interests to be prepared for it. It could be argued that they have the most to lose.

Crucially, I think that big businesses, particularly if banded together, are far better placed than governments to make the transition to a low carbon society more comfortable, and even prosperous. Compared to governments, their hierarchy means major decisions are easier to implement, and their funds are easier to mobilize.

If Richard Branson were to decide to make all Virgin industries un-reliant on oil, he will struggle yes (an understatement I know!), but he'll do a far better job than if Brown were to decide to make the UK an oil-free country.

If 'the world as we know it' is to be 'saved', it won't be by the governments, it'll be by the people who have the real power.

Who has "real power" in the UK, I wonder? It's somewhat of an over-simplification, but, here goes. The UK for decades has had a policy of sacrificing the interests of the country as a whole, for the benefit of the financial sector which has grown out of all proportion, why? Because the financial sector has power, far more than it should have. So the priorities of the financial sector came to dominate society at the expense of everyone else.

Successive governments bowed down to the financial sector and allowed manufacturing to wither away. For a long time the fact that the UK was underming its longterm chances of prosperity was hidden from view due to the collosal revenues from the windfall coming from North Sea oil and gas. Alas that is all over.

Instead of using the revenues from the North Sea sensibly, it was wasted on a very long party, designed to confuse and disguise reality, now the party is over and the bill for it, increasingly financed by excesseive borrowing, has to be paid.

Writerman

you are spot on the financial tail has been wagging the industrial dog, instead of the other way round for the last 50 years. Even before the oil boom brought its untold millions into the city they were forcing a high interest rate policy on Britain to keep the value of the pound high. It meant that could borrow short term to lend long. The results were just as disastrous in the 60s to British industry it was hollowed out for the benefit of the city. Manipulating currency keeping it low always gives your industry an edge, it was one of the reasons Japan industrialised so quickly after the second world war, it is one of the reasons China is doing so well now . Manipulating your currency to keep it high has the opposite effect. The only ones to benefit are the banksters.

Writerman, Yorkshire Miner,

Our Government expends most of its political efforts obfuscating our real energy predicament, and our real financial predicament, rather than coming up with workable long term, sustainable policies. Its a case of spend now - worry later.

Since the discovery of North Sea gas in 1965 (the year I was born) we have had 40 years of energy mismanagement.

We all remember the power blackouts of the early 1970s and the oil crisis, which took buses off the roads, and led to the 3 day week.

When we finally got the oil and gas to flow from the North Sea, we squandered much of it, letting it go for $10 a barrel.

Then Thatcher got a bee in her bonnet about the power of the coal miners. Seeing that natural gas and imported coal could replace indigenous coal, and dissolve the miners, she and her henchmen set about their foolhardy venture.

Having smashed the British mining industry, she set upon the power utilities and broke them up - making a hefty profit at the time (1990). In order to sweeten the deal, she lifted the restriction on burning natural gas for power generation - and so started the dash for gas.

You could now put up a £5million shed with a gas turbine and a staff of 10, rather than spending £50million on a coal fired thermal plant - with a workforce of 300 - and the fuel was significantly cheaper. The efficiency of electricity from gas at 50% was a great improvement on that from coal - a lousy 30 to 35%. It all made great business sense and a great investment opportunity for the shareholders.

However, 15 years later, gas was no longer the cheapest fuel, and the utilities started looking to coal again (Kingsnorth 2). Having nearly drained the North Sea of 50% of its gas reserves and burned it away in power stations at 50% efficiency - whilst that gas could have been retained for domestic central heating - and burned at 90% efficiency in a modern condensing gas boiler.

We now have to import much of our gas - from whoever is friendly enough to sell it to us, such as Norway and Qatar. However we are dealing with global market place, and we cannot expect a special price from those luck enough to have a surplus to sell. We will have to compete with all the other countries that are gas-starved.

Had Thatcher not permitted usage of natural gas for power generation, we would have been forced to extend our Nuclear Industry and build more plants 15 years ago. Instead BNFL/British Energy went bust twice. We would also have a lot more gas left in the North Sea, and Irish Sea which would have kept our central heating going till 2030 or 2040.

So were are almost out of gas - and 60% of our power generation and 90% of our home heating reliant on it

No new investment in coal since 1974 - and several older plants to end life in 2012

No new investment in nuclear - existing plants running at <70% output

North Sea Oil - fallen of the cliff and into terminal decline

Pitiful progress investing in renewables

Utilities all sold off to other countries (EDF, EON, etc)

Britain really is in a mess. How can Milliband junior put positive spin on Britain's Energy Security??

Someone has to take this situation seriously. How are we going to keep the lights on and our homes warm for the next 40 years - following 40 years of squandering and mismanagement?

Here's some ideas.

Perform a new geological survey of UK coal reserves. Invest in new coal fired plant

Commence a crash course in new nuclear power plant - we'll need them online by 2020

Terminate the hostilities in Iraq/Afghanistan and start making some new "gas buddies"

Begin a well managed program an invest in renewables

Start a programme of work to upgrade Britain's housing stock for energy efficiency - create jobs

Kickstart British Industry

Claw back some power from the Banking Community. Force them to finance in energy security construction projects - such as coal and nukes, tidal barriers and offshore wind, HV supergrid etc etc.

Renewable Ali,

Thanks for pointing me towards Paul Mobbs excellent piece

http://www.fraw.org.uk/mei/papers/ecologist-201001.html

His one graphic, clearly shows that the situation that occurred in ~1974 when UK imported 50% of its energy is going to occur again by 2020.

Britain was in a mess in the early 1970s because we spent more than our GDP would allow. With the coming of North Sea oil and gas we went from rags to riches reaching a peak of indigenous production of 11,000PJ/yr around year 2000.

Now 10 years later our production is down to about 6000PJ/yr and declining quickly. By 2020 our indigenous production will be down to 4000PJ/yr and that is only if we now ramp up renewables to produce 1PJ/yr by 2020 - providing 25% of out home generated energy.

Half of our total energy will have to be imported - from who ever is willing to sell. What will we have left in industry to pay for this imported energy - almost nothing.

So perhaps, whilst we are not yet energy broke, we should be building the powerstations, windfarms, tidal barriers and renewables factories that we will need for the next 50 years. Clearly a country that has to buy in 50% of it's primary energy, but has little to offer in payment is heading for a major crisis.

Paul Mobbs sums up this opportunity well in his last paragraph:

The next 5-10 years are going to be make or break for the UK. Which way will the next government take us following the May election? They cannot afford to bury their heads in the sand - these issues need sorting.