Oilwatch Monthly December 2009

Posted by Rembrandt on December 21, 2009 - 10:34am in The Oil Drum: Europe

The December 2009 edition of Oilwatch Monthly can be downloaded at this weblink (PDF, 1.24 MB, 33 pp).

The Oilwatch Monthly is a newsletter that is available free of charge with the latest data on oil supply, demand, oil stocks, spare capacity and exports.

A summary and latest graphics below the fold.

Subscribe to receive Oilwatch Monthly by e-mail

This signup form no longer exists.Latest Developments:

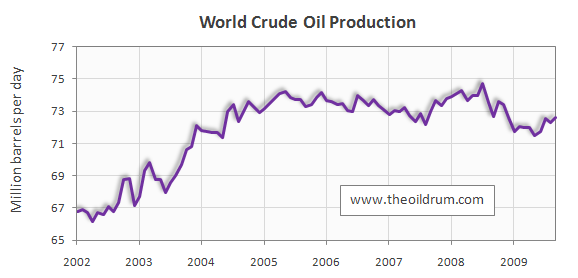

1) Conventional crude production - Latest figures from the Energy Information Administration (EIA) show that crude oil production including lease condensates increased by 261,000 b/d from August to September 2009, resulting in total production of crude oil including lease condensates of 72.59 million b/d.

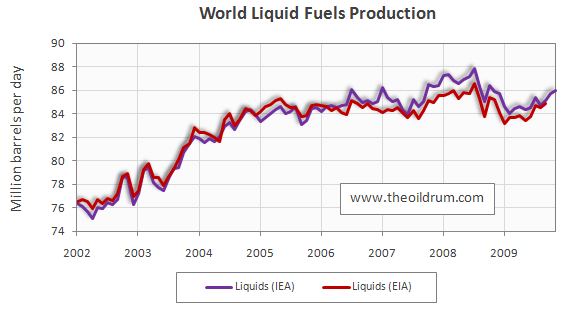

2) Total liquid fuels production - In November 2009, world production of all liquid fuels increased by 200,000 barrels per day compared to October according to the latest figures of the International Energy Agency (IEA), resulting in total world liquid fuels production of 85.94 million b/d. Liquids production for October 2009 was revised upwards in the IEA Oil Market Report of November from 85.61 to 85.74 million b/d. Average global liquid fuels production in 2009 through November was 84.86, versus 86.6 and 85.32 million b/d in 2008 and 2007.

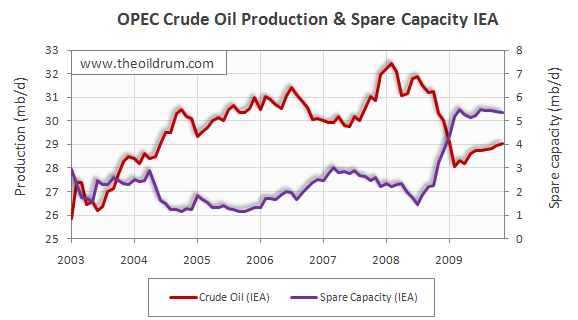

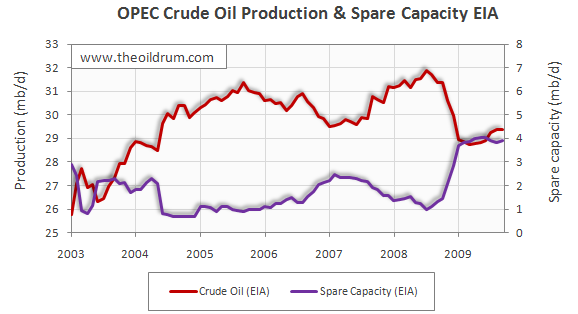

3) OPEC Production - Total liquid fuels production in OPEC countries increased by 60,000 b/d from October to November to a level of 34.21 million b/d. Average liquid fuels production in 2009 through November was 33.66 million b/d, versus 36.09 and 35.02 million b/d in 2008 and 2007 respectively. All time high production of OPEC liquid fuels stands at 36.58 million b/d reached in July 2008. Total crude oil production excluding lease condensates of the OPEC cartel increased by 60,000 b/d to a level of 29.04 million b/d, from October to November 2009, according to the latest available estimate of the IEA. Average crude oil production in 2009 through November was 28.68 million b/d, versus 31.43 and 30.37 million b/d in 2008 and 2007 respectively. OPEC natural gas liquids remained stable from October to November 2009 at a level of 5.17 million b/d. Average OPEC natural gas liquids production in 2009 through November was 4.99 million b/d, versus 4.66 and 4.55 million b/d in respectively 2008 and 2007.

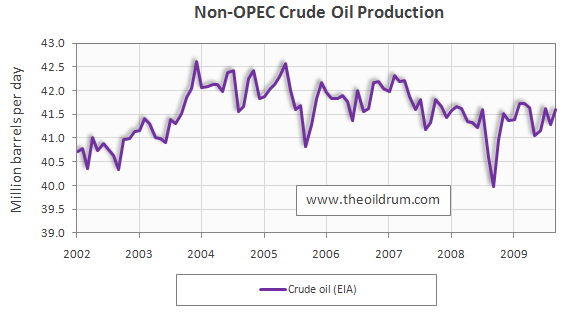

4) Non-OPEC Production - Total liquid fuels production excluding biofuels in Non-OPEC countries increased by 140,000 b/d from October to November 2009, resulting in a production level of 50.04 million b/d according to the International Energy Agency. Average liquid fuels production in 2009 through November was 49.62 million b/d, versus 49.32 and 49.34 million b/d in 2008 and 2007 respectively. Total Non-OPEC crude oil production excluding lease condensates increased by 311,000 b/d to a level of 41.59 million b/d, from August to September 2009, according to the latest available estimate of the EIA. Average crude oil production in 2009 through September was 41.46 million b/d, versus 41.32 and 41.80 million b/d in 2008 and 2007 respectively. Non-OPEC natural gas liquids production increased by 114,000 from August to September to a level of 3.36 million b/d. Average Non-OPEC natural gas liquids production in 2009 through September was 3.36 million b/d, versus 3.65 and 3.79 million b/d in 2008 and 2007 respectively.

5) OECD Oil Consumption - Oil consumption in OECD countries increased by 1.24 million b/d from August to September, resulting in a consumption level of 44.29 million b/d in September 2009. Average OECD oil consumption in 2009 through September was 43.86 million b/d, versus 46.10 and 47.68 million b/d in 2008 and 2007 respectively.

6) Chinese & Indian liquids demand - Oil consumption in China decreased by 424,000 b/d from August to September resulting in a consumption level of 8.86 million b/d according to JODI statistics. Average oil consumption in China in 2009 through September was 7.96 million b/d, versus 6.92 and 7.29 million b/d in respectively 2008 and 2007. Oil consumption in India increased by 79,000 b/d from August to September resulting in a consumption level of 2.72 million b/d. Average oil consumption in India in 2009 through September was 2.84 million b/d, versus 2.60 and 2.43 million b/d in 2008 and 2007 respectively.

7) OPEC spare capacity - According to the International Energy Agency total effective spare capacity (excluding Iraq, Venezuela and Nigeria) decreased from October to November 2009 by 70,000 b/d to a level of 5.35 million b/d. Of total effective spare capacity, an additional 3.32 million b/d is estimated to be producible by Saudi Arabia within 90 days, the United Arab Emirates 0.58 million b/d, Angola 0.19 million b/d, Iran 0.30 million b/d, Libya 0.25 million b/d, Qatar 0.13 million b/d, and the other remaining countries 0.58 million b/d.

Total OPEC spare production capacity in November 2009 increased by 11,000 b/d to a level of 4.08 million b/d from 3.97 million b/d in October according to the Energy Information Administration. Of total November spare capacity, 2.90 million b/d is estimated to be producible by Saudi Arabia, 0.21 million b/d from Qatar, 0.17 million b/d from Angola, 0.30 million b/d from Kuwait, 0.30 million b/d from the United Arab Emirates, 0.10 million b/d from Iran, and 0.10 million b/d from other countries.

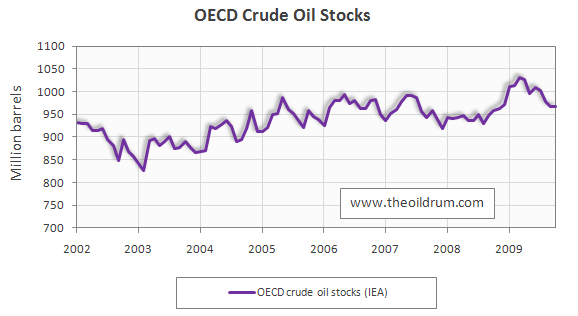

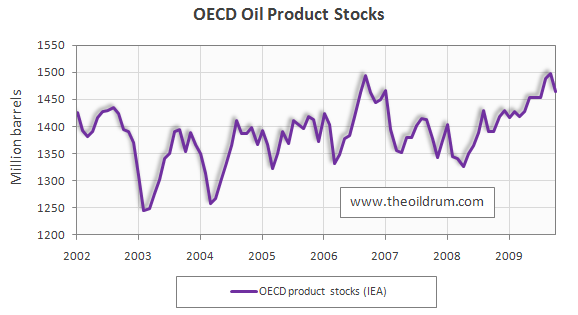

8) OECD oil stocks - Industrial inventories of crude oil in the OECD in October 2009 remained stable from September at a level of 968 million according to the latest IEA statistics. Current OECD crude oil stocks are 6 million barrels higher than the five year average of 962 million barrels. In the November Oil Market Report of the IEA a total stock level of 976 million barrels was tabulated for September which has been revised downwards to 968 million barrels in the December edition. Industrial product stocks in the OECD in October 2009 declined to 1465 million from 1499 million barrels in September according to the latest IEA Statistics. Current OECD product stocks are 63million barrels higher than the five year average of 1402 million barrels. In the November Oil Market Report of the IEA, a total stock level of 1498 million barrels was tabulated for September which has been revised upwards to 1499 million barrels in the December edition.

I repeat my comment from 12/12/2009 "Oil crunch delayed by 11 days since Oilympic peak in July 2008"

http://www.crudeoilpeak.com/?p=812

We see a small up-tick of the growing group but that is offset be decline elsewhere.

My article also contains a link to a Max Keiser interview in which he says his sources in Saudi Arabia said Ghawar declined 10% in the last 3 years

Thanks for this Rembrant. I have a question:

Are NGL's also used to produce gasoline and jet fuel, and if so, to what extent?

Hi Shox --

NGLs hit the middle of the barrel pretty well but they can't make gasoline and I don't think jet fuel either. It helps explain why NGLs aren't a bigger part of the US picture; we don't have much demand for diesel and they don't help with gasoline.

Experts on the topic may weigh in with more, but this is my impression.

The US uses about 40% as much diesel as gasoline. When the economy is better that fraction seems to grow, according to the EIA.

According to Heading Out's article, Produced Water, GOSPs and Saudi Arabia, on Dec. 20, 2009, "NGLs include ethane, propane, butane, iso-butane, and natural gasoline." The natural gas condensate included with most production numbers for crude oil can be readily refined into gasoline.

I have been wrestling with a question, and I can't find a verifiable answer. There is a lot of conjecture and speculation, however:

The oil price was on a relatively steady incline up for most of the early years of the decade. Then in approximately Nov/Dec 2007, the rate changed noticeably. This was the "knee of the hockey stick" for the Canadians.

It continued on this new incline, again relatively steadily, till the Chinese Olympics in roughly August 2008, then crashed.

I am less interested in the crash, than in the cause of the change in Nov/Dec 2007. The supply and demand data above does not seem to reveal anything.

Can anyone point me to some data which would explain this?

You might look at Euan Mearns' post from last week, on the price of oil going forward, but it also relates to the oil price going back.

Over the long term, and certainly in 2007, we are dealing with constrained supply. Two major factors acting to keep demand in line with supply are (1) price and (2) credit availability, although some might argue that speculation plays a role as well. Perhaps people suddenly realized that supply was constrained, and started bidding up the price more, until something had to give, and it turned out to be credit availability, coming at the same time as the Chinese Olympics and the end of their big need for oil, so oil prices dropped. US consumer credit outstanding peaked in July 2008:

NGL barrels are exaggerated as the volumetric energy density of LPG is only 70-75% of crude oil.

17% of NGL is 'natural gasoline'(iso-pentane) that can be burnt in cars.

NGL can be used to make the 'premium' in premium gasoline by alkylation.

NGL could also make 'poly-gasoline'(polymer gasoline) but doesn't.

It's also helpful to remember that in the US only 70% of oil goes to transportation fuels.

http://www.bts.gov/publications/national_transportation_statistics/html/...

As Gail notes in pointing to Euan's article, price increases are not linear. Your assumption appears to have been that because price increases were linear for a period of time that going non-linear is unexpected.

Let's examine the situation to propose an explanation. From 1998-2004, price increased roughly linearly. During that same time, supply increased incrementally in a near linear fashion as well. But in 2004 problems began to appear. Investments in oil fields were not returning the same amount of product as previously. The rate of increase in global oil production began to slow, increasing by only a few million barrels per day from July 2004 through the end of 2007. Yet at that same time, increases in consumption by various nations were noted. The US increased consumption by a bit over 1 million barrels per day. India increased consumption by a few million barrels per day and China increased consumption by over 4 million barrels per day. The sum of this increased consumption by these nations was well over 8 million barrels per day. Yet supply, between 2004 and the end of 2007, only increased by 1.5-3 million barrels per day, depending on your data source.

This raises the question of where did the remaining 5+ million barrels per day of supply come from? It came from other users who were outbid in the market. Some poorer nations were left with very little access to oil compared to before because that oil had been sold to the highest bidders on the open market, or was already locked into prior contracts. This problem, flattening oil supply against increased desire for oil, led to the bidding war. I personally believe that once $100 per barrel was breached that "speculative froth" entered the system in a large way as well as financial traders tried to get on board the oil price train before it left them behind entirely.

The above is how I view the run up in prices through 2007. The subsequent crash in prices appears to be largely an artifact of reduced consumption, especially in the United States, but elsewhere in some places in the world as well due mostly to the economic crash.

There are numerous theses out there about what caused the crash but my own belief is that it was a classic financial credit bubble. All bubbles eventually burst. The price of oil may or may not have been the pin that pricked the bubble but I have seen no evidence that convinces me that this was anything other than a classic financial credit bubble, which has been seen historically before.

For data on US oil production to support this view, I recommend reviewing Total Oil Supply: All Countries, Most Recent Annual Estimates, 1980-2007 from the US Energy Information Agency. Oil was priced near $10 per barrel in 1998 and total about 74 million barrels per day. Oil supply increased steadily from 1998 to 2004 from 74 million barrels per day to 83 million barrels per day, a 12% increase in oil produced with oil reaching a price in the $40 per barrel range. Then, from 2004 to 2007, total production increased by only a very slight amount yet prices shot clear to $147 per barrel at the peak.

I do not have the link handy but data from the International Energy Agency will show similar trends. The numbers are not the same due to different ways of counting product and other discrepancies but the trend remains the same - 1998 to 2004 shows production increases of over 10% and a price increase from $10 to roughly $40 per barrel. Production increases from 2004 to 2007 will be very small and show explosive growth in oil prices.

Both of these data sets support the idea that finding more oil was possible but at increasing costs from 1998 to 2004 but thereafter finding more oil became prohibitively expensive or just not possible resulting in much smaller increases at much increased costs. If you visit the EIA web site, you can also get more recent monthly and quarterly data that shows that consumption and therefore production fell as the economic crisis began.

David, Saved me a lot of typing. Couldn't agree more. The hockey stick , IMHO was the result of the big boys getting into a bidding war after the third world demand destruction had run it's course. Remember that from 2004 to 2007 there were no less than thirty third world countries that had energy riots or other forms of civil unrest based on lack of fuel availablilty or price or both.

Do we know how trustworthy those spare capacity numbers are?

Looking at it we are 1Mbpd up on production from the lowest post crash level, but spare capacity is essentially the same. Now I know certain new developments have come online, but mature fields have also fallen away over that time.

Is that spare capacity number based on hard facts, or is it just the expected linear growth in supplies minus production? The cynic in me thinks it might well be option 2.

Couple it with Euan's graph and it would tell us how close we were to another spike in reality.

To answer my own question, a little reverse engineering of the total possible OPEC production (supply + spare) reading off the graphs for 2008 to date shows a rapid fall off of ~1Mbpd (within a month or two); a noisy signal for just over a year, then a rapid climb up to an essentially flat production capability since the middle of this year.

Ignoring this one year dip in supposed productive capacity yields a gradually declining productive capacity between 1/2008 and now (~0.2Mbpd).

Hypothesis 1

A 1Mbpd field was rested and then bought back into production.

Hypothesis 2

A 1Mbpd field was taken out of production, and another 1Mbpd field started, so there is the potential for another 1Mpbd to come back onstream.

Hypothesis 3

The data is junk, based on guesses of production and capacity which someone is calculating rather than measuring.

Personally I go for option 1, which means we're no better off in reality than we were at the last spike and a recovery in demand of 1Mbpd would put us back in the same situation of $120+ oil (from Euan's graph).

Anyone care to redo my work and see if you reach the same conclusion?

The 1 Mb/d dip in world crude oil production in August 2008 was caused by a fire in the BTC (Baku–Tbilisi–Ceyhan) pipeline in Turkey and Russia invading Georgia shutting down the BTC and Baku-Supsa pipelines for a portion of the month.

The reduction of about 1.5 Mb/d in September and October 2008 was caused by hurricanes Ike and Gustov blowing through the Gulf of Mexico, LA and Texas.

The noteworthy observation is that the price of crude oil continued to fall despite those large disruptions in crude oil supply. Either the data has been falsified or demand fall rapidly in July 2008.

But neither of those would show up in OPEC data...

Apologies, I misunderstood you.

My guess is that OPEC's reported spare capacity is bogus. Saudi Arabia's crude oil production has never been above about 9.7 Mb/d while they currently claim about 12 Mb/d of production capacity.

In 2009 the person who helped me most to raise the aesthetic level of my own chart-making was a guy named Rembrandt, from the Netherlands. True story. :-)

G

Haven't seen any comments on Rembrandt's paragraphs on Iraqi oil production. Most notably:

What ranges of outcomes are possible from Iraq? Obviously continued strife and failure to improve oil output is one, but what if development occurs? How much development and bbl/day is feasible?

Matt -- IMHO I think the variables to that answer are so wide ranging as to make any attempt to answer pointless. First, all kinds of "experts" will predict how much oil is under Iraq's surface. Even a honest appraisal will offer a wide range. And then the next part of the question critical to PO is how much max production rate could we expect. And that second question depends upon how quickly these oil fields will be developed. And that part of the equation has its own set of variables: 1)how fast will the Iraq gov't want to develop these reserves; on what terms will they offer concessions; how much capital will the Iraq gov't have access to; will Iraq be stable enough politically and militarially to allow unrestricted development/production; how will the Iraq gov't and Kurds come to an agreement; if US forces are significantly withdrawn from Iraq will Iran attempt to influence oil development.

The nice thing about TOD is that all opinions are welcomed. Likewise we are each allowed to ignore those opinions. If the early reports are accurate then Iraq may have significant reserves to be developed. But the existance of those reserves seems almost secondary to all the political and economic factors that will determine how much oil Iraq exports in the next 20 years or so IMHO.

Interesting - and thanks for the response. I guess the answer might be different for the Kurdistan fields, which might be subject to less turmoil. Another interesting thing about Rembrandt's comments were that they implied that significant increased production could happen before 2015. But is that reasonable for megabarrel production rates? If the increased supply doesn't come on line before 2015, it may slow the decline rate for the world at large, but I don't see how it really moves the peak.

http://www.businessinsider.com/attack-on-iraqi-pipeline-halts-oil-export...

The only reduction in the Kurdish areas is in the reporting of turmoil.

Add in Iranian warning messages in the south, and I see very little production expansion in Iraq within a decade.

The Kurdish Territory is of particular importance since some argue that the KRG has little incentives to accurately report proved reserves or encourage oil investment while the U.S. draws down its forces in Iraq.

It could be argued that "a priori" many in the KRG never had any intention of cooperating with the central government, but were forced to by outside pressure. When some in the U.S. were encouraging partitioning Iraq several years ago, one could only imagine that the Kurds where not exactly disappointed at the prospect of having sovereign control over their oil reserves and exports.

Because the U.S. is drawing down its forces and turning internal conflict matters over to the Iraqis, we might conclude that this gives some in the KRG territory hope that they could ignore central government authority once the U.S. is gone. Moreover, evidence suggests that this is true when we remember that the KRG ignored the central government's authority in 2007 and signed contracts with Hunt Oil and several Korean companies including SK Energy. When Iraqi further stabilized in 2008, the contracts were ruled illegal by the central government. Perhaps the KRG will have greater incentives to encourage wild cats when the U.S. leaves and the central government's ability to exercise influence over KRG affairs diminishes.

Regardless of one's arguments on how irrational it would be to ignore the Iraq Central government after U.S. forces leave, or the Turkey and Iran factor with the KRG, we must remember that nationalism can be a calculation-limiting force, and the KRG has its share of nationalism and personal ambition after being dominated by occupying Iraqi forces for so many years, perhaps in the same way Koreans feel anti-foreign sentiments to their previous occupier: Japan.

Very nice summary Kevin. I haven't seen a break down of how all the Iraq oil potential is distributed but I get the sense that much lies in the Kurdish areas. With such a potential huge monetary value involved it's difficult to imagine a heavily armed central gov't letting it go to any significant degree. I can still clearly remember the video images of a Kurdish village hit with nerve gas by Sadam. Add that potential to the visceral hatred of the Kurds by the Turks and it's difficult to not imagine a violent future for that region once US forces leave.

Please allow me to add a couple of follow up points.

While Turkey prefers a unified Iraq because they might see a sovereign KRG as a domino for autonomy in Kurdish dominated regions in Turkey, they also are investing millions of dollar in the KRG area because of Kurdish neo-liberal policies. The KRG territory is perhaps the most pro-Western region in the gulf.

“Turkish companies are the main investors in our Region (KRG territory) and we have many social and cultural ties with Turkey. We are against the use of our region for attacks against Turkey,” KRG Deputy Prime Minister

The KRG is in a tight spot with the PKK and some Kurdish ethnic nationalists who implicitly support them. Certainly, ethnic-wide ambitions for Kurdish unity outside of the KRG make it hard for Iran and Turkey to support a sovereign Northern Iraq.

Regarding the threat of the Iraqi central government to a potentially sovereign KRG after U.S. forces draw down or pull out of Iraq, it might be the other way around this time, meaning that the KRG might have a more organized military force than what the Iraqi central government can muster. This becomes more apparent when we consider a violent dictator is not forcefully unifying the Shia and Sunni Arabs.

The KRG have a tight grip on their territory, far more than the rest of Iraq--no roadside bombs or suicide bombers. I'd bet there is even a Stabucks on its way to KRG territory, and if not, someone is planning it right now.

To enter KRG territory from the rest of Iraq, one needs permission, a de-facto Visa. An Iraqi simply cannot walk into KRG territory. It might as well be another country. The KRG have tight border control.

If the KRG remains strong and supported by good governance should the rest of Iraq fall apart, Turkey and Iran will gladly take KRG oil and gas through their pipelines.

Like Israel after 1945, the KRG have not waisted anytime to ensure they are powerful enough to never be occupied by another force again. They also have support from a large international business community since Kurdish Iraq is potentially the fastest growing economy in the gulf, which means an attack on the KRG could be argued as an attack on foreign businesses. And we know from lessons in history--Kuwait 1992--what that could mean for the home countries those foreign companies lobby.

Whatever the outcome, we must remember that asking the Kurds in Northern Iraq to remain unified with the rest of Iraq would be like asking Koreans after 1945 to remain unified with Japan because they shared common territory, culture (Japanese), and language (Japanese) for over 30 years, only the Kurds were forced to learn Arabic instead of Japanese against their will. It just don't see a unified Iraq lasting should the Kurds have their day to decide for themselves, and that day may soon be coming.

This is not the outcome that I necessarily desire. Rather, I simply write this conclusion because I write objectively enough to remove my personal values and beliefs from my analysis, as all scholars should do as far as I am concerned. Too often people cannot separate what they want to happen from what their objective observations tell them will happen because they lack the stomach do it.

Kevin -- You certainly have great insights into the politics of the region. I hope you can keep an eye on it for TOD and update as the drama plays out. Sounds like the situation will have potentially much greater impact then our MSM seems to offer at this moment.

del dup

What caused the oil price spike and bubble burst - usually requires a perceived future shortage of oil, and you lot at the Oil Drum were the ones banging on most about that. You probably caused that part of it yourselves.

You can thank the oil companies and nations for not being open with their reserves and production data. That is the real 'climategate'-style of hiding the decline.

So true Web. But with the US military presence in the Gulf and our apparent willingness to persist there despite global opinions, you would think the US could bully at least the Persian Gulf countries into giving the data up. And the fact that the US gov't hasn't done so makes me wonder if our political leaders really want the data out there for all to see. I know such thoughts push me a little closer to the tin foil hat crowd but it does make me wonder.

It's not about tinfoil. It's about the basis for the majority of foreign policy decisions.

IMO, the fatal flaw in your reasoning, summarized above, is that you have as a critical premise to your syllogism that "the U.S. government" doesn't have the data.

From where I sit, it is virtually inconceivable that GWBII and BHO, as well as anybody in the top brass, aren't well-apprised of the EXACT status of oil production and reserves in the top 20 oil producing countries.

Of course they are. Particularly given that GWBII was an oilman, it's hard to believe that he wasn't well aware that PO was going to occur in the 2000-2010 range.

From where I sit the order of operations is as plain as it is manifest . . .

1. Awareness of criticality of oil and the probable 3-5 year date span for PO well established in some political circles before 2000 election. Awareness of impending devastation also well established

2. Awareness of the criticality of the ME to the next 20 years also well established by 2000 election.

3. Casus belli established within 1 year of election. Casus belli not directly related to oil, but is close enough to allow invasions without public outcry, and serves the useful purpose of suppressing the actual reason for invasion.

4. Invasion of oil region completed within 2 years.

5. Occupation of oil region maintained for going on eight years, with no conceivable reason for maintaining a presence other than to safeguard the oil.

6. New POTUS, despite his protestations to the contrary, continues - NAY - improves the on the ground security of the oil. Lies about withdrawal from the caspian basin are transparent to all who care to look.

7. Reigning power is in position to determine the fate of the majority of the world's remaining oil.

8. When it gets tight - and I can feel the pressure increasing as I type this - the U.S. public won't care what the official reason is for controlling the Caspian - they will willingly accept any excuse, as long as they get their fix.

It all seems pretty obvious to me. Biggest wolf in the pack is hunkering down on top of the last remaining edible carcass.

As for whether the U.S. ops know the status of Ghawar - of course they do. If you consider how critical the information is to the U.S., and you consider how many people have access to the information, and that there is much inferential information that can be drawn . . . it seems to me an extreme outlier to conclude that the information is not known.

Iraq was the low hanging fruit - unpopular and stupid dictator. Lots of great oil. A population that was primed for living in a smaller version of the U.S. corporatocracy. Perfectly positioned as a staging ground for controlling the region. Beautiful.

If it was 1989 and you were asked which country would give the best cost/benefit for an invasion, you would have said Iraq. Of course.

Many may look at these bits of information and find them unrelated . . .

Iraq perfect takeover target with large oil booty.

WMD charged but never found.

Terrorist attack on U.S. soil occurs before invasion.

It's like finding your kid in his room with chocolate on his face, a swollen belly, and an empty cookie jar and not thinking that the three might be related.

So here's my conclusion.

We know, we've known for a long time, and the foreign policy decisions you've seen over the last 8-10 years are what you would expect if you took as an assumption that we had all of the oil data and that we were not shy about - ehem - getting our way.

There was a day a long time ago when a bipedal hominid used a bone to defend a watering hole from other hominids, as in 2001, the movie.

This is nothing more than that. We haven't moved at all.

Avatar - "When people have something we want, we make them our enemy and then we take it."

As for them "not wanting us to know."

Of course they don't!

It's the same reason most people don't know that 70% of commercial hamburger in the U.S. is washed with an ammonia wash.

If "peak oil" ever comes into the main stream, it will be world chaos.

Ergo, they will never let PO come into the main stream.

As I posted elsewhere, a well-timed war in the ME will prevent PO from being recognized for what it is, and the 50% drop off of oil production can be blamed on the rag-heads.

Wow Andrew...you sound like you're ready for your tinfoil hat fitting. Unfortunately, you may well be right. I'm constantly torn between our gov't being that covert or that incompetent. I also think your wacky idea about a ME war being used to cover the realities of PO may also come to pass.

I run a tin foil haberdashery. "From the nape to the chin, we shield you with Tin," is out motto.

With regard to a ME war, the benefits to the powers that be are very obvious, especially if you take it as an assumption that, without any war, US and West GDP drops at 5% a year for 20 years:

1. Get Muslims fighting amongst themselves or taking sides with the U.S. infidels.

2. Destabilize surrounding oil countries, frightening them into accepting Western protection.

3. Troops on the ground ensure that China and Russia will have little or nothing to say.

4. Increase U.S. citizen anger with Islam/Arabs, focus anger on war.

5. War good for economy.

6. Israel benefits enormously from any war involving Iran.

7. Western world will beg the U.S. to seize control of the region as soon as petrol triples in price and expressos are being served cold for lack of heating material.

8. Attention of the few U.S. citizens paying attention is strongly diverted away from things like the erosion of civil rights, the poisoning of the food supply by corporations, the degradation of the education system and infrastructure, the exploding debt, and on and on. Nothing takes the attention off your 200 pound wife like a 500 pound, oreo eating bison walking down the aisle next to you.

9. many many many more.

Keep in mind - IF the U.S. is going down economically because of PO (which it is), THEN there is virtually nothing to lose by propagating war in the ME.

Well.

As long as you don't think about right and wrong.

Love the motto Andrew. You appear to be a good student of history. The accents and uniform colors might change but the strategy varies little over time. As do the results unfortunately.

Actually our presence in on the ground in the ME is an indicator that Israel is no longer considered a reliable proxy in the region and their fate (demographics don't look good for those trying to pen the Palastinians) is an assumed done deal, just a matter of timing.

How much influence we exerted at the beginning of the Iran/Iraq war is certainly not well known to many of the living, but ME local wars aren't the exception when an large empire is not there to hold sway. GH certainly played Sadam perfectly when he pulled the fleet out of his sensor range after we had told him we considered his dealings with Kuwait a neighborhood problem. Kind of like the way 'Da mare' handled errant precinct captains in my boyhood Chicago. It isn't that tough to play the block bully when you can see and work the whole city.

Then there is the other item, it appears the military needs real work about every ten years to keep a veteran core sharp. There is a huge difference in the carriage of the average grunt on and around post in my neighborhood when comparing now to ten years ago, the difference in the officer corp has to be at least as great.

Not sure what you're trying to say here. Israel certainly could never have invaded Iraq or mounted a war against Iran.

Not sure what you're trying to say here.

Did you mean to say we're not in Iraq to guard the oil?

That was not my intent sorry it seemed to come out that way. I was pointing up that the region (like about any other in the world) tends toward conflicts unless some overarching power holds sway and keeps its foot on the potential combatants throats. War is not good for commerce in the regions doing the fighting. Plenty of empires kept the peace in the ME and profited from the commerce thus enabled throughout history, but when they weakened turmoil followed.

We don't really have to do much to keep the Arabs fighting among themselves, the trick is to limit the conflicts so that the oil trade is not heavily impacted. As best as I can tell the Iran/Iraq war came about because we lost much of our clout in the region when the Iranian clerics threw out the Shah we had put in power a couple decades earlier. No doubt we do not really want to see a truly strong power in the region, we want even less to see the conflicts it would likely take to allow such a power to emerge.

'Troops on the ground' in the ME is not our most favored strategy, but without a reliable ME oil country ally that has actual military strength, proxy outpost Israel and our offshore fleet don't appear to give us sufficient presence in that turbulent region to insure oil flow. If we are stuck putting our troops on the ground (best, of course, if those troops have a solid combat hardened core) Israel becomes of less value. I don't really think Israel's well being is going to be that important an issue as oil gets tighter, they don't control any of it. Now if we quit using one out of every four barrels of oil pumped planet wide we just might be able to get loose of that region and stem our hemorrhaging, of course I don't see that happening and while there are still fleets of tankers floating.

ROCKMAN email me and I'll send you a draft of my paper.

It still needs a LOT of work but I have I think two or three more drafts left.

But I think you will both be interested and willing to comment on it.

mike.emmel@gmail.com its also in my bio.

And my email address is splattered around in a bunch of opensource code so hiding it is fruitless.

One aspect of putting your email address in your work I did not consider :)

I'm a sitting duck :)

Although still unpublished probably one of the biggest issues I've dealt with as far as peak oil was concerned was developing a way to test oil production that bypassed Oil company propaganda. The result is your suspicions are almost certainly fact not fiction. A very similar situation occurred back in the 1980's as land based oil production peaked and it was not yet clear offshore would keep us going.

The bread and circus approach is in my opinion the most insidious and despicable way to destroy and corrupt a government.

Its one thing to consider the implications assuming your wearing a tinfoil hat but I assure you quite different when your forced by the facts to take it off. I felt like the guy waking up in the Matrix. The shear depth of the lies and corruption have shaken me. I hope to get my paper out soon but all its not fun to find out how late we are in the game and that our governments have chosen to try and maintain BAU to the point collapse may well be certain.

Of course most of the people who read the oil drum have benefited from the bread and circus side show so I suspect many simply cannot believe the truth but thats what makes what has happened so awful the technique used as I said are the worst ones imaginable because they are so seductive.

We have been so duped few can even understand the nature of the con as it undermines their very existence.

And this applies directly and brutally to my own life. I used to think I had a good grasp on whats happening however when confronted with the brutal truth I'm not sure I do any longer. And worst its rather obviously to late to do anything about it in the current social context as the thief's have literally gotten away and there is nothing that can be done.

Perhaps this is why the looting of wealth is becoming more obvious as our leaders know they have already won and taken full control of the economy and the governments and will not suffer any consequences for their actions.

Realizing we have already lost and few even know that a coup was in progress was a real blow.

Of course this means that over the coming months and years our leaders will find it less and less necessary to hide the real situation as we are already stripped of our power. The need to masquerade and hide the truth becomes less and less important. Right now I think that the only real reason why the game goes on is more because it continues to work and does not matter than that its needed. Why give up playing the perfect con until its convenient ? But as its no longer needed I suspect the truth will become brutally honest and the system will probably rapidly convert some some sort of nationalist corrupt regime with little attempt to even support a show of democracy. Moving to a more basic and brutal approach branding anyone that stands in its way a traitor and terrorist.

I wish I could put my tinfoil hat back on as it allowed me the freedom to always believe I might be a nut.

It sucks to find out your not crazy after all.

I'm not sure if I was a member of your reference to "both" when you indicated you wanted paper review.

If I am, let me know. If I am not, I'll find a way to fill the time :).

Human psychology is easily predicted.

Human group psychology is virtually algorithmic.

We all operate within a paradigm that has been formed by our brains based on the hard wiring we received at birth and the perceptions we have had since then.

The paradigm is like a ball rolling down a rut that is formed in a mountainside that gets deeper the further you go down the mountain. There are other ruts here and there, similarly running down the mountain, some parallel, some diverging. All have in common that they get deeper as you go down the mountain.

When you are young, it is fairly easy for new experiences to bump your ball into nearby ruts. With the correct force and persistence, many ruts can be traversed.

As time goes on, the ruts get deeper, and consequently, the force of experience required to move the ball into a new paradigm becomes greater.

At some point, the rut is so deep that only the greatest of life shocks could hope to move it.

For most Americans, the concept that the government is incapable of operating covertly to do things to control other countries wherein said covert activity includes the direct or indirect killing of Americans or the fabrication of information and events for the purpose of coercing consent or complicity for immorality from the citizenry is . . . a very entrenched part of a very established paradigm.

I have tried many times to help people to change ruts on this matter, but to no avail, and the older they are the less I can even get the ball to rock back and forth.

Those who control the direction of the world - generally, like you would a runaway vehicle - have used this human failing repeatedly over the last 10 thousand years.

That is the challenge.

How do you get a sufficient enough number of 300 million Americans to consider, even briefly, that their paradigm is far from the truth?

GWBII was not exactly a resounding success as an oilman. If the Saudi royal family had not bailed him out when his company fell on hard times, he would have gone bankrupt. I think he took whatever they said at face value, which is not always a good idea dealing with some of those people. They are past masters of deceit and misdirection.

He also was notorious for ignoring anything that didn't coincide with his pre-conceived notions of what was going on. The flooding of New Orleans came as a complete surprise to him, despite that fact that he had visited the city in the past. If he had staggered a little further from the bars, he might have noticed that the ships going by were floating in water that was higher than the buildings, and thought through the implications of that.

But, no, he said that nobody had told him that New Orleans might be flooded in a hurricane. Actually they had, but he had not been paying attention. I think Peak Oil was a similar kind of situation - he had been warned, but he didn't want to believe it so he ignored it.

Irrelevant to the issue of how versed he was in PO.

None of us know whether the flooding of NO was a surprise to him. If you believe what these folks say on TV, then you believe that Gitmo is closed, we're on schedule to be pulling out of Iraq by August 2010, and Clinton never got a hummer. You hear what they want you to hear. They say what they want you to hear. The words they choose are carefully selected. You believe he was surprised because you were provided with words that said he was surprised.

My opinion is that he knew that NO was likely to sustain damage, he knew about how bad it was after it happened, and he either:

1. Couldn't give a rat's ass less about NO.

or

2. Was happy to use it as an opportunity to force LA to beg for the Feds to take control.

In any event, the thought that nobody advised him that NO would be flooded by a Cat 4/5 hurricane is, to me, unimaginable, and the thought that he simply ignored such advice is equally unlikely.

Words words words. GWB also said, about 90 days after 911, to a large audience, "I remember when the first plane hit the towers and I was watching it on TV. I thought, "what a lousy pilot." " Just words, offered only for the purpose of getting you to believe something is true, whether it is or not.

This is in sorry disconcert with the known facts. We invaded and occupied Iraq under his watch and at his demand. If he didn't think Peak Oil was an issue, then it would not have been logical to go into Iraq.

PO prompted Iraq.

Too many people let their political dislike of GWB affect how they perceive his knowledge - as if he was a dumb monkey letting events pass without notice. He knew what was going on at all times, and his behavior as president was perfectly executed if his goal was to invade and occupy the last oil rich region of the world - NO was irrelevant to that goal and unimportant to the direction of the country.

Your are a truly a tinfoil merchant if you can't read GWs perception issues better than that. He repeatedly showed the inability to work well with abstract ideas. Anecdotal knowledge was his forte, he would certainly generalize from his anecdotal base but that is not the same as having a good grasp of abstract concepts and PO is relatively abstract to a person who can really only get a good grasp of one individual well at a time. The way his wife would repeatedly emphasize that GW was 'focused' said much to me.

Long before fat Michael made a movie (which I have no interest in ever viewing) I drew all the conclusion I needed to about GW ability to act on new information, his sitting there in that kindegarten classroom for however long with a dazed and fearful look on his face gave a lot of insight into how he ticked.

I don't know what sort of 'dietary' habits Barbara had when George was in vitro but George certainly shows many traits that are regularly observeable in people affected with FAE and FAS. I lived and worked where I have had a great deal of contact at work and socially with people carrying those effects and syndromes, so I can pick up the nuances quickly. Of course the traits can have entirely different causes but the behavioral results are related.

That said, GW is considered extremely skillful in working a room and an excellent judge of what strings are best pulled to manipulate individuals toward the outcome desired. One would be a fool to consider GW an idiot but one would be an equal fool to consider his grasp of the abstract to be comparable to that of a grand strategist.

Having seen those ships floating high above the NO streets back in the sixties I will have to go with RMG on that one. Seeing them up that high makes an impression, but the significance attached to that vision is very dependent on the observer's abstract thinking processes.

The unstated assumption in your argument is that GWBII was thinking and acting alone. I disagree that that assumption is accurate. I think he had few independent thoughts. I think he was part of an extended cabal that included many handlers, not the least of whom was Cheney. Cheney stated, on the record, that the "real prize is the Middle East" and that "we need a new pearl harbor." GWBII was along for the ride as an electable front man. All of your psychoanalysis is only relevant if it is believed that GWBII was making decisions. Beyond what he was having for lunch, and maybe not even that, he didn't make decisions, he followed orders. The man could barely speak English - somebody was speaking through him.

I disagree he had a "dazed and fearful" look on his face. He might be pretty slow for a president, but he wasn't a child.

The look I saw was a man desperately attempting to don a look that he thought was appropriate after being told something he already knew, which eliminated his ability to act normally. What would a normal response have been? Surprised. Shocked. Upset. He displayed none of them.

He was not sharp. He was not intelligent. He was not a good liar. But he didn't have to be - he was never alone.

I think the real problem is in the phrase "GWBII was thinking". I think the problem was that he wasn't.

He can't really have been as dumb as he seemed, but he certainty came across as being as dense as a bag of hammers. I think that wasn't the full explanation.

Reports from his advisers seem to indicate that he invariably made his mind up too soon, on the basis of insufficient information, and then never changed it even in the face of new evidence.

Also, he simply wasn't interest in a lot of things - and those things he left to other people. Since he wasn't interested in most things, Chaney and the rest of his neo-con group ended up doing most of Bush's job.

On the other hand, a good leader would have gathered he had enough information to make a decision, made the decision, and then if it turned out to be wrong, would change his position fast enough to keep his opponents off-balance. Of course, you have to be a really good, sharp, effective leader and a convincing speaker to get away with that, and GWB wasn't one.

My reply was to you assessment that dislike for GW is the source many people's poor opinion of his decision making skills. I was in no way implying that some strategy roughly based on the Wolfowitz Doctrine was not in play in a big way during GWs administration.

I've never been head honcho of an outfit as big a the US executive branch, but I have run a thing or two and had some big surprise emergencies come my way. George's long 'reaction' was nothing like any I have had when things have gone south quickly--George's expression showed a fearful anxiety overlane with a habitual studied blankness in my opinion, and subsequent appearances by him only confirmed that interpretation of his initial response for me. As for childlike, when Cheney was the one hidden away whose security seemed to be getting all the attention George staged the choking on a chip incident to put his health and well being back in the center of things--at least that is how I read it. Do not underestimate GWs ability to manipulate. I could be off the wall on all this, I'm making these interpretations at quite a distance, but I have been served fairly well by my interpretive skills thus far.

I never meant to imply GW was acting alone on all the big strategies but sometimes the buck did stop with him and RMGs assessment how his major decision framework worked seems accurate enough. Obama has a reasoning process I can identify with, GWs is different but it appears to have much in common with the processes used by many in vitro alcohol damaged individuals I have had to deal with. Like I said in my earlier post these types behaviors can have other origins but the results have a great deal of commonality.

Then you have the classic 'dry drunk' behavior on top of that. Laura Bush confirmed that in no uncertain terms with a story she told on the Leno show. One time, when she and GW were campaigning together for his run at a Texas congressional seat, as he was pulling up into his driveway George asked Laura how she thought the speech he had made that night gone. Her reply was something to the effect of 'not that well,' whereupon George immediately drove the car through the garage and right through the back wall. Quite the reaction to criticism! When you are at a distance you have to put together the pieces as best you can when assessing what someone is made of. George is not stupid, or simple, but he does appear damaged.

Of course none this negates your point that some strategic thinkers were at work and pulling the big strings. But the president's decision making process still has to be taken into account, just how much in which situations is impossible to tell at this distance.

GW has annoying habit of almost getting you to like him until you step back and realize all the damage he has been instrumental in bringing about.

It's hard to bully religious fanatics. They can be counted on to do something drastic, even suicidal, if you push too hard. Common sense and rational thinking are not their strong suits.

But what's the use of spy agencies if they don't spy? I've always thought that if the CIA doesn't have a few dozen agents riffling through Saudi Aramco's well files on a regular basis and transmitting the data back to the US, their top brass should be fired for incompetence.

The CIA's problem is that they hire Ivy League School types, not swarthy ethnic-looking people that can slip into a middle-east organization unnoticed. They have very few Arab speakers, and they don't trust the few they have.

In regard to net oil exports, I think that the future has already arrived.

Here are US annual oil prices (vertical scale) versus net oil exports from the combined (2005) top five net oil exporters:

Sam Foucher's best case is that the (2005) top five net oil exporters are currently depleting their post-2005 Cumulative Net Oil Exports (CNOE) at about 9%/year, so a plausible estimate, IMO, for the global post-2005 CNOE depletion rate is about 5% to 7% per year, which suggests that oil importers worldwide have burned through 20% to 25% of post-2005 CNOE in the past four years, 2006-2009.

Note that the initial post-1996 CNOE depletion rate for the combined output from Indonesia, the UK and Egypt (IUKE) was 25%/year from 1996-1999, while the annual volume of their net oil exports fell at only about 3%/year over this time frame.

I think that the recent US and China case histories are examples of what we can probably expect for the next several years, to-wit, non-OECD countries taking a bigger share of declining net oil exports, with OECD countries being forced to take a smaller share of declining net oil exports.

If TOD and other peak oil groups created a perceived future shortage that caused a price spike then what caused the decline since TOD didn't change it's tune.

IMO, the price spike was about fundamentals and if the economy recovers quickly then a spike will again happen next year. If the economy slides down further, which I think will be the case, then oil prices may not increase at all until demand exceeds supply again.

I'm beginning to realize its more complex than that.

I'll try and give the short version.

Assume that OPEC was pumping at capacity even as prices continued to rise through 2007. This means they where unable to surge to dampen prices. Plenty of evidence suggests this is true.

What can they do ?

Certainly demand could have collapsed on its own accord and OPEC now has ample spare capacity and a big part of the price rise was really speculation etc etc etc. Just believe everything you read pretty much verbatim.

Or a different approach was taken that makes a lot more sense.

If you cannot increase to control prices it turns out you can cut production and control prices.

Instead of fighting a losing battle you can cut exports and store oil even though this leads to a serious price spike.

Since you need a lot of storage your going to have to use oil tankers which will also spike tanker rates.

So what if the floating storage was filled not after the price collapse but as the root cause of the price spike ?

Also of course if your customers work to put the breaks on their economies as your spiking prices and storing oil your set up for a way to bring matters under controll. Economic activity contracts. Extreme prices force conservation then you hit the world with your stored oil collapsing prices and softening the collapse with plenty of cheap oil.

Not that everything went as planned but my opinion is the above provides a excellent answer to the events of late 2007-2009. Of course if nothing was done then prices would have reached high levels anyway and the inability of OPEC deliver and peak oil would have been obvious.

Despite the fact things probably got a little carried away I'd argue overall such a plan worked out beautifully.

Esp if you consider that during the resulting chaos a huge consolidation of power away from various governments and into the banking community was accomplished. Our real masters the bankers now have overt control that would have been unthinkable even a few years ago.

Now thats not to say that real oil production has not also collapsed over the same time period. In fact I suspect the timing of the decision to store and spike had a lot to do with and underlying alarming increase in the basic depletion rate forcing a now or never decision as attempting to withdraw oil for storage later would have sent prices even higher as it would have to have been done against a rapidly falling base production rate. Other factors are important but the onset of even more rapid declines had to have been a factor.

Now I think the attempt to cool the economy spun out of control and the hurricanes causing shortages in the US added and unexpected windfall and more games where played later almost certainly including additional storage builds after the first surge to collapse prices. But this was as I said not really planned just taking advantage of the situation as it unfolded. Geopolitics aka squeezing Iran and Venezuela probably fit into the picture also. Given and attack on Iran is probably certian one has to think that the low prices played a role in deferring such a decision to see if they would remain low enough to cause collapse Soviet Union style the US elections also played a part although it now seems Obama was not a real change in leadership just a different figurehead.

Whats really interesting now is not the past two years but what happens next ?

We have managed to squander two years of respite doing basically nothing.

Will they attempt another store and surge ? Given a lot of people are now willing and able to store oil if its surged I doubt much will make it to end consumers this time around middle men will jump in and trickle it onto the market blunting the price drop from a surge. For all kinds of reasons it was pretty much a one shot deal.

Esp since the economy is weakened and no longer in a bubble it may well be unable to withstand another artificial store and surge wave even if one was possible.

Thus if that was the game then its been fun but its probably come to and end. At the moment I simply don't see what card can be played next. The US could go ahead and allow its housing market to collapse but will this really cause a dramatic drop in demand ? The housing industry is already on its knees a collapse in home prices will simply force more and more people to take the loss and write off the debt however its not clear how much this would effect actual oil usage.

Obviously we could start a war with Iran or Venezula or some other above ground event if prices spike again and the real geologic situation will again be lost in the chaos of above ground events.

Hard to say and I suspect I'm not the only one who does not know what to do next.

I don't think what happens next is planned at all outside of continuing to shore up the situation and prevent failure.

Certainly all kinds of crazy things are possible however I've not come up with any that look effective.

Whats interesting is that perhaps the attempt to bring things under control succeeded to well. Too much fat was taken out of the system to fast. If so the remaining economy is far less elastic than it was despite the resulting longer period of relatively low oil prices allowing stabilization.

A less drastic drop would have left more room for a slower squeeze at more moderate price levels which is what I think was intended originally.

Of course our leaders feel like they did far better than expected and according to the MSM everyone is confident that a price of around 75 a barrel can now be maintained years and we can make it till the miracle in Iraq is online.

However I disagree I think they are making a huge mistake the inadvertent success in slowing the economy yet not collapsing far more than expected is not the victory they think it is. Instead the real situation is a lot more desperate and the elasticity is gone from the system.

Because oil got so cheap a lot of it was literally wasted where a softer landing would have succeeded. Instead of success I think we failed big time. If so it should become increasingly clear that the situation will be worse than if nothing was done.

Its a long time between now and when manna is supposed to drop from heaven or Iraq in 2015.

But what I find really amusing is if Saddam was setting on this virtual sea of oil why on earth did he invade Kuwait ?

He has to be the dumbest dictator on the planet making Bush look like a genius. According to the current spin on Iraq Saddam was setting on the biggest prize in the world. All he had to do was play along just a little bit and the world was his. Instead he invades Kuwait ? Worse most of these fields are not new discoveries but ones supposedly well know even by Saddam.

The fact that no one seems to even ask this question is one I find funny. Saddam may have been crazy but if so it was crazy in the Stalin sense which makes you very dangerous not stupid. I don't think he was the type of man to throw away one of the richest oil provinces in the world to invade Kuwait. Instead I suspect his desperation was real and although the reserves in Iraq are substantial not anywhere close to whats claimed and Saddam knew it and we know it but also there simply is nothing else. The spin hides the fact that the previous ruler of Iraq was desperate to find other oil sources the fact that despite this we are so desperate we are willing to take a declining source speaks volumes about the real situation. When you steal from someone who is also so desperate he is willing to steal from others then things ain't looking so good.

Memmel,

I would just add that there may not be a zero-sum relationship between smart decisions and crazy. Saddam may have simply miscalculated in the way that General MacNamara advocated an invasion of Cuba on October 23 during the Cuban Missile Crisis because he was unaware that there were over 100 nuclear war heads already on the ground.

Misinformation creates miscalculation = irrational decision from the point of view of the person with the correct information.

Saddam invaded Kuwait with the wrong information that he could get away with it since he had interpreted an American government representative that he spoke with about the matter as agreeing to his plans simply because the representative didn't clearly object to him.

Ranjit Singh Kalha, former Indian ambassador to Iraq, quotes the US envoy in Baghdad April Glaspie as telling Saddam on July 25, 1990: “We have no opinion on Arab-Arab conflict, like your border disagreement with Kuwait.” Quoted in the book "“The Ultimate Prize: Oil and Saddam’s Iraq”

This can also mean that, miscommunication can create misunderstandings that create incorrectly analyzed information which creates miscalculation = irrational decision from the point of view of the person with the correct information.

Two final words for Heath-Caldwell -

AS IF

It sould be very viable to order the dissertation just about this good topic at the thesis writing service especially when you do not have time.