The Russian Bear?

Posted by Euan Mearns on January 8, 2009 - 10:54am in The Oil Drum: Europe

With news breaking that Russia has just suspended all exports of gas to and through Ukraine, what will the impact be on Europe and why has Russia chosen once again to take such drastic action?

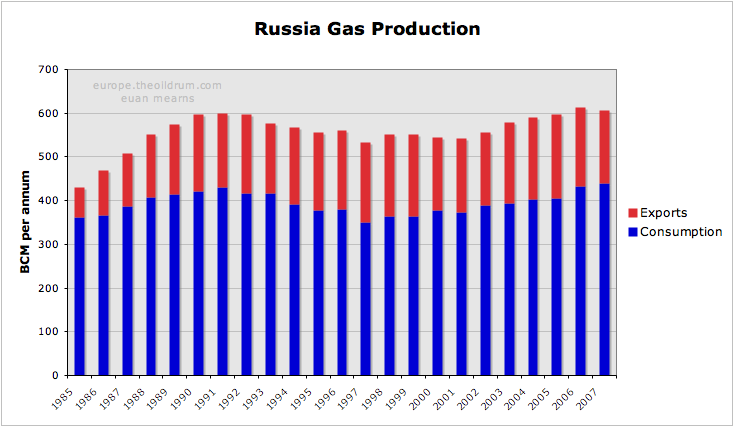

Exports of gas from Russia fell 6% between 2006 and 2007 according to the BP statistical review of world energy. Production fell from 612.1 to 607.4 billion cubic meters (bcm) per annum and domestic consumption rose from 432.1 to 438.8 bcm per annum leading to a fall in exported gas.

Is Russia withholding gas supplies leading to higher prices and manipulation of its market position? Or is the Russian gas supply system unable to meet demand?

A couple of days ago I asked Jerome and Rune to write short posts on the unfolding Russian - Ukrainian gas crisis. Jerome's response was that this is not news - "it happens every year". But with Russian gas supplies now reported to be halted to and through Ukraine in the dead of winter the consequences for Europe are not good. Even if the dispute gets resolved within a few days.

The background to this long running dispute is complex, but put simply:

- The Russian gas supply and transit system is inherited from the Soviet era when Ukraine was an integral part of that system.

- Much of Russian gas exports to Europe must transit Ukraine, placing Ukraine in a position of power and influence well beyond the courtesy of allowing pipelines to transit its territory.

- Ukraine is essentially bankrupt and unable to pay full rates for Russian gas and is thus reported to help itself to some of the in-transit gas.

- Russia has hit economic hardship with the fall in oil prices and can likely ill-afford to subsidise gas supplies to Ukraine.

- Russia and Europe are mutually dependent upon each other in the energy market and both are dependent upon Ukraine for transit of much of Russian gas exports.

Has Russian Gas Production Peaked?

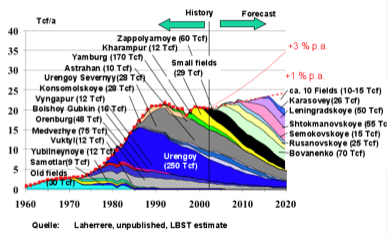

This is impossible to answer. However, this chart from Jean Laherrere shows the three super giants - Yamburg, Urengoy and Medvezhye - in decline and that new projects will only compensate for decline going forward.

Russia planning to develop the remote Shtockman Field in the Barents Sea tends to suggest that all is not well on the supply front.

Falling Oil Production

Russian oil production has shown signs of falling. And this combined with recent moves to cut oil production in coordination with OPEC may lead to a fall in associated gas production. This could add further strain to gas supplies.

Who imports Russian Gas?

The chart shows the destinations of Russian gas pipeline exports in 2006. And so these are the countries that may be affected by reduced gas supplies from Russia. The larger West European nations have diversified sources with Norway and Algeria being the principal alternatives. They also have large gas storage facilities that will keep the gas flowing for a while at least. Turkey receives gas via a separate pipeline and is thus unaffected directly by the Ukrainian dispute.

Its Winter Time

Needless to say these disputes arise in winter when demand is high for heating - in Russia and Europe - and supplies are strained.

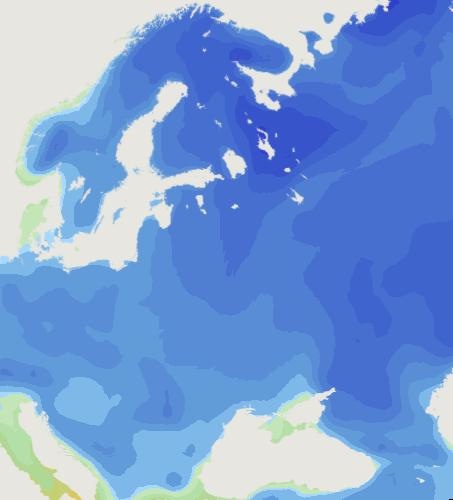

Russia and Europe are in the deep freeze, 7 January 2009. Source BBC World weather and UK MET office.

Conclusion

Russia has been a reliable long term energy supplier to Europe and will likely continue to be so for the foreseeable future. At the same time, Russia has rights to maximise returns on its main asset which is energy.

When Russia and Ukraine go through their annual ritualistic gas spat, analysts should begin to question Russian ability to supply peak gas demand in the dead of a cold winter.

It seems that Russia is ultimately aiming to have the EU countries pay for the gas borrowed by Ukraine in leu of transit privileges. This will lead to Russia receiving full market value for gas exports and rising energy costs in Europe that will of course lower demand making it easier for Russia to meet its export obligations.

Some of Jerome's views are published here on European Tribune.

Isn't this tantamount to a declaration of war? If one nation takes an action that is guaranteed to lead to the death of thousands or millions in another nation (in this case by freezing), what else can you call it?

My first reaction was, "Poor Obama is going to enter office with conflicts igniting into wars all over the world."

I doubt that this represents peak gas for Russia, but I haven't been following the history of their production figures closely. Are their numbers reliable?

Russia is realizing that it's possession of a third of the world's NG reserves can give it great political power over its neighbors. It is testing this power out on one of its nearest neighbors.

And of course it is in relatively recent, living memory of most Russians that Ukraine (and many other neighbors) were part of their empire.

A blockade is an act of war. An embargo is not. Ukraine (and Russia) have no duty of care to see that Western Europe doesn't freeze.

And nobody is placing an embargo. It's EU issue for EU to resolve. Russia already proposed numerous pipelines that would allow higher supplies during very cold periods and would increase reliability of supplies overall. It's was EU (not all, but some of EU countries) that was delaying North Stream. EU at this point has nobody to blame but itself.

As far as Ukraine it's has a horrible goverment that choose to try to blackmail EU and Russia yet it quite possible that it's actions will backfire. Russia offered gas to Ukraine below the cost that Russia itself is paying for imported gas. I think Putin mentioned that Russia was willing to subsidies Ukraine due to their tough economic situation. But after Ukraine tried to blackmail Russia and blocked EU gas, all goodwill on part of Russian goverment is gone and now they are demanding full market price. I believe EU officials have already stated that if Ukraine ever wants to become part of EU it must stop it's current actions and allow Russian gas to pass though unobstructed.

Europe has certainly brought this on itself by simply assuming the contracts will be fulfilled. I can't for the life of me understand why the EU wouldn't step in to help Ukraine pay a sensible price for the gas they use from Russia unless they thought it was just a bluff on Russia's part. But then the EU does not act as one. Though as a critical transit country for natural gas, you'd think Europe would care what happens to Ukraine. Now things have got out of hand it will take more than a quick sit down meeting to sort things out. What a pickle!

However hifi, you sound less than objective in the tone you use to express the issue. What Russia has done *does* amount to an gas embargo even if they don't cast it as that. Fine, it's an indirect embargo and they felt their hand was forced, but either way they risk letting thousands freeze in Eastern Europe over this - that's pretty serious. The alternative pipelines are not built. The Baltic option will take a while yet and the capacity of the belarus and Turkish pipelines is insufficient.

At a time when energy suppliers in Europe were set to lower gas prices, it seems all too convenient timing that this comes now. Obviously it was planned long in advance by Russia. Each party has its role to play here. Germany has avoided taking sides with either Russia or Ukraine and is leading the discussion nowhere. They should have stepped in far earlier but then they have the storage capacity - it's not Germany's population that stands to freeze. They can just sit on the sidelines.

Russia has no viable way to deliver gas to Europe. It can't force Ukraine to let that gas pass though.

You can call it an embargo, but it's clearly not an embargo by Russia. Russia is doing everything it can to send gas over (maxing out it's other pipelines to Europe and Turkey), but it can't control government in Ukraine. You can say that Ukraine government closing off it's transport network is effectively enforcing an embargo against EU. Yet even that is not 100% correct. EU is the party that choose to delay (indefinitely?) construction of North Stream. And as such it is EU that effectively choose (it clearly had a choice here) to be in a position where transit country can blackmail it. I know it's easier for EU to look for villain elsewhere then to admit it's own failures. But how can a reasonable person accuse Gazprom of not doing enough, when it was the very party that probably fought the hardest to ensure reliable gas supplies to EU, while EU was working hard at blocking that? Seriously, credit due when it's due. And people freezing their asses off, should know who to thank for that.

I also do not get why would you say that it was planned by Russia. It reminds me of people who would claim that Russia somehow forced Georgia to attack S. Osetia. Russia does not control government of Ukraine (or Georgia since I brought it up). All that Russia can do is respond in situations like that. It was pretty clear that this would happen for many months now. Russia constantly had to fight battles to get Ukraine to pay for the gas that it used. It was not unexpected that Ukraine would blackmail Europe and Russia when new prices would be applied for the new contract. Russia certainly tried to avoid that by offering price below it's own cost (effectively subsidizing a rather incompetent government in Ukraine) but Ukraine's government refused. I believe that most EU governments have way more influence over current government of Ukraine that Russia does. Why didn't EU forced Ukraine not to interrupt gas flows is beyond me.

You might say that North Stream would not be ready by now. But if it was being build it would be a very different situation.

"I can't for the life of me understand why the EU wouldn't step in to help Ukraine pay a sensible price for the gas"

ROTFLOL, Ukraine has been charged less than half the going rate and they haven't even paid that on time as per contract. We know what happens when gas or oil etc are priced too low; it encourages demand and discourages efficiency - see SUV. should we be subsidising the cost of oil & coal elsewhere? give me subsidised energy and I will run plenty of energy intensive businesses and undercut those paying the market price.

Of course Ukraine should receive something for the transit but this must be a relatively small part of the overall cost. Typical rates are around $4 for 1,000 cubic metres of gas per 100km against a cost of say $400 for 1,000 cubic metres of gas.

Preventing your goods from being stolen is not an embargo.

The EU should be applying maximum pressure on Ukraine to agree to pay the market rate for gas, not steal any and agree the correct rate for transit. Otherwise why on earth should the EU want as a member a state that will not follow normal rules?

How is 400 USD/mcm consistent with market? At current FX rates this translates to 27-28 EUR/MWh which is about 20% *over* western european prices for the next 3 years.

400 USD/cm = 294 EUR/cm /10.4 = 28.3 EUR/MWh

Cal 10 TTF ~22.60

Cal 11 ~ 24

Can someone explain how this is "at market?"

I got my figures from platts

"... Last year Ukraine paid Russia around $179.50/1,000 cubic meters for gas supplies, compared with an average price for European importers of around $400/1,000 cu m. Gazprom had offered to supply gas to Ukraine at a price of $250/1,000 cu m in the first quarter of this year in last-minute negotiations at the end of 2008, but this was rejected by Naftogaz. Dubyna {the head of Ukraine's state oil and gas company Naftogaz Ukrayiny} said part of the dispute centered on how much money Ukraine receives for its services as a transit country.

Ukraine consumes around 6.4 Bcm/year of gas to maintain pressure in the transit pipelines, he said, which would become more costly if Ukraine has to pay Russia a higher price for its gas.

..."

Sounds like a lot of gas just to maintain pressure, maybe they're not stealing the gas it's just leaking :-)

Here's a free article

http://www.platts.com/Magazines/Insight/2008/dec/2e0qZ08120812BS0sQ92P0_...

Wouldn't it be nice if all the prices for gas were quoted using the same measure rather than say (USD/MMBtu UK: GBp/therm, Alberta: CAD/Gj) from upstream, $179.50/1,000 cubic meters ... I suppose that's the beauty of standards, there's so many to choose from:-)

One of the problems is that the whole russia/ukraine deal is murky involving third parties, so who knows what is being creamed off. I would like to hope that Putin is cleaning up after the criminal years of Yeltsin, but who really knows?

There's a good schematic map on the FT site that shows gas movements - principally from Russia and Norway - with production, consumption and transit figures for every country in Europe.

http://www.ft.com/cms/s/0/ceba9530-dcef-11dd-a2a9-000077b07658.html

Obviously Europe should not be reliant on one shaky source for a critical portion of its energy. After a few days of cold even the Germans might be in favour of some nukes, everybody will be willing to pay more for e.g. wind power, home solar water, European electricity grid linked to North Africa...

Are their numbers reliable?

I have recently evaluated (for a potential purchaser) a number of oil and gas fields in the Former Soviet Union. Based on this experience, I would say that Russian numbers for reserves are about as reliable as Enron's accounting. While estimates of initial recoverable reserves do appear to have some basis in geology and petroleum engineering, the figures for subsequent production appear to be largely works of fiction (at least in the fields I have examined). There is no way of determining whether the production has been larger than that recorded (due to theft of production, accidental loss in blowouts, or just failure to record data) or lower than recorded (due to cooking the books to meet planned production quotas, inaccurate recording, or faulty measuring equipment). On a typical 20-year-old field it is not unusual to find claims that the recorded production to date is 500% of what appears to be the initial recoverable reserves, or at the other extreme to hear that the production over the first 19 years for the field is less than the production in the last year.

Some facts:

1) On Tuesday Ukraine closed off three of the four gas pipelines transiting Russian gas over its territory.

2) On Wednesday Ukraine closed the last pipeline.

3) Russia stopped bothering to send gas to Ukraine since NONE of it would go to the EU.

So bitch and moan at Yushenko and not Russia. They say the truth is the first casualty of war and it sure looks like the west is in a perpetual information war against Russia.

Agreed here for sure. If the US "media handling" of the S. Osetia issue is any indicator, I'd guess that there appears to be some sort of need to re-start the cold war, at least among present administration in US. All media talkers presenting a consistently obviously biased or worse take on the affair. "Georgia attacks S. Ossetia, problem is Russia's fault" indeed! I'm to the point where I only believe BBC, and that only half the time.

Believe the Beeb HALF the time, Len. Blimey! No disrespect but -- aren't you being a bit trusting? Never believe a word of their 'news' and current affairs ouput unless it can be confirmed by somewhere a long way away. Al Jazeerah or Asia Times, maybe, for example.

This is my vote. Also, this is the richest gas they have, with the highest NGL content, so they would also see a disproportionate decline in NGL production, increasing domestic demand for refined liquids and for natural gas.

Does anyone know if there is any information on Russian long term gas storage and its recent daily draw rates? I know that information is available on a daily basis for many countries so is there any Russian info?

Gazprom says there has been no reduction in gas production as it is all being stored but declines to say how long it could keep filling storage on the grounds that would be useful information to the Ukraine (news report I saw earlier somewhere but cannot immediately find link). So just how long can Russia keep storing 80% of its normal supply to Europe. One thing definitely implied by the Gazprom statement is that long term storage was not full before the cut. Another statement I saw suggested that Ukraine has a lot of long term storage capacity and has filled it to the brim with Russian gas. Anyone know the details on that?

It is interesting that the full cut was initiated on a day with demand probably around the peak daily demand for the winter - unless it turns into a really bad rest of the winter of course...

As pointed out by xeroid in the drumbeat, the UK has drawn down from long term storage at greater than the published maximum possible rate for the last two days in a row. If European problems caused a cut in imports of Norwegian gas it seems to me the only way the UK could make up the shortfall in cold weather would be with immediate LNG imports.

It would be bad business if long term storage was full on Jan 4. With normal weather (last century) which they've had they should have been sucking on storage for six weeks or so. Eyeballing Euan's graph, Russia exports about 25% of production. With other pipelines running flat out they've got what, 15-17% extra right now. In a cold snap I'd not be surprised if they could burn all of it with nothing left to go into storage.

Undertow,

don't worry about the UK, our great leaders are on top of it, no problem here move on

"no risk to the UK since we receive very little gas from Russia - none directly and at most two per cent indirectly in the mix we receive from continental Europe. UK gas storage stocks are at healthy levels for the time of year. There is an improving outlook of UK security of supply for the remainder of the winter. We continue to have healthy North Sea supplies, as well as access to the large gas reserves in Norway via pipelines, and to the global liquefied natural gas market via National Grid's terminal at Grain - which is soon to finish commissioning its second phase operations."

It smacks of total complacency to me, our gas storage is pathetically small and the North Sea output does not meet our winter requirements (we sell gas in the summer when it is cheap and demand is low import in winter when expensive and demand is high!!) Why should Norway sell to us in particular at a time when demand is likely to be higher?? In fact is there not a "problem" with a pipeline that is taking months to fix, so is it even possible?? Whilst the second LNG terminal might soon be ready (after the cold weather??) is there any guarantee we will get supplies?

"suggested that Ukraine has a lot of long term storage capacity and has filled it to the brim with Russian gas."

Unless the Ukrainians are totally stupid and incompetent they will have completely filled their storage before the contract expired at the end of last year so they could be ready for any problems.

Didn't we learn from Jerome's article that one of Gazprom's problems is that most of the storage apacity is actually in Ukraine?

Again a timely post Euan,

Perhaps we will be able to present some facts about Russian nat gas production in this post.

The diagram above shows Gazprom’s production which now is approximately 85 % of total Russian production for the years 2000 - 2007. Further in the diagram is shown Gazprom’s upper and lower forecast for their production towards 2030.

Gazprom’s own forecast does not signal an imminent decline in Russian nat gas production.

NOTE: y-axis not zero scaled.

Data from Gazprom.

The diagram shows that Gazprom now expects a modest growth in their production towards 2020 of 30 - 40 Gcm(Bcm)/a.

Some of this growth is intended for domestic consumption and some for exports to both Europe and Asia.

From Gazprom’s forecast it looks like they are prepared to increase deliveries with perhaps 20 Gcm(Bcm)/ to Europe towards 2020 and at the most a growth of additional 20 Gcm(Bcm) to Europe towards 2030.

Knowing that Europe’s nat gas production will be in sharp decline towards 2020 and beyond it presently does not look like Russian nat gas will be able to completely close the growing gap in European declining supplies and growing demand.

Declining supplies yes, but demand for heating has been declining for years (less severe winters and much better home insulation) and energy intensive industries have left Europe probably for good. The only reason why the IEA scenarios point to rising demand is the assumption that a massive shift from coal and nuclear to gas-fired power generation will take place over the next 20 years (esp in Eastern Europe where old nukes need replacement). This scenario looked likely a few years ago, but less and less so today with the explosion in installed wind capacity and the renewed interest in nuclear.

I would actually say that European gas consumption is trending down (the odd cold winter notwithstanding of course). This has some serious implications for Russia. By shutting down exports they're foregoing about 200 million dollars a day, something that on a structural level would hit Russian finances hard.

In the UK there has been strong growth in demand in nat gas for electricity generation the recent years due to retirement of nuclear nad coal plants.

Nat gas consumption is also temperature sensitive, which may explain some of the year over year variations seen for some countries.

Rune - Jean's forecast also shows gas production rising slowly - a long controlled plateau. The question will be if investment is forthcoming to develop all these new fields in remote areas. And if the analysis of decline is accurate and not over optimistic etc.

Come what may, there is no sign that Russia will be able to raise production to plug the gap left by declining UK, Norwegian and eventually Dutch gas production - as many would hope.

If Russian gas production does start to decline then exports will quickly disappear.

Euan,

That’s presently the golden question about future nat gas developments in Russia.

Will the credit (in form of capital or financial vehicles) be there?

I see speculations that start up of Shtokman may be delayed until 2020 or beyond.

I notice from Jean’s excellent chart that he has assumed start up of Shtokman by 2012/2013 and a delay will surely have an impact on the build up on Russian nat gas deliveries.

From what I have seen so far I find it hard to believe that there will be any possibilities in closing as from this year the growing gap between nat gas demand and supplies.

This will most probably and soon catch most institutional energy planners by surprise.

Just watch nat gas prices at NBP this year and in the years ahead.

Nat gas was seen as the bridge away from nuclear and an energy source to reduce greenhouse gas emissions by substituting for coal.

Surely the real problem is RUSSIA HAS PEAKED in both gas and oil..

This fact should concentrate the European mind because Russian gas will not be an alternative to energy declines in other areas...

At best it is a stop gap..

Do a deal with Tunisia - make it part of the EU and fill it with thermal solar, and start NOW for the sake of the good god and yourselves.

If that were true it could explain the strange reticence of European leaders to criticise Russia. After all many here believe these same leaders are doing their best to hide the truth about peak oil and gas from their voters. Better not draw attention to Russia peaking.

I hope that's not the situation though as we in Europe are even more screwed if Russian gas has already peaked.

My thoughts exactly. It's kinda funny, our main newspapaer (central europe country) printed a map of european pipelines on the front page of the leading newspapar on Wednesday. Which makes me think that in the reality the whole gas dispute is interesting only as a media story. In February, when the conflict will be probably solved, people won't care about gas anymore. Yeah, we are that stupid.

Exactly, it won't concentrate the minds since it is too long term for most politicians to think about. Politicians dont' get elected by predicting problems and encouraging cutting back, just look over the last year how many politicans said the financial problems would not affect their country or the problems had bottomed out...

What's cheaper, to build a pipeline directly to the main consumers or subsidise those along the way who want a cut and can hold goods to ransom? e.g. on Monday 5th January Ukraine unilaterally annulled the transit agreement between Russia and Ukraine. The transit contract is annulled so what should Russia do, continue pumping gas into a black hole without a contract? If you agree please send me some money and we will agree a contract sometime later - maybe:-)

You may be on to something.

Russia looks a lot like a prototypical Exportland in terms of natural gas. It produces about 21 Tcf of gas and uses almost 70% domestically. They can pretend that they are the Big Bad Exporter but profits from high prices charged to Europe are what bring Russian citizens their gas (infrastructure). Given that Russia is eager to get off dirty coal which can be seen from orbit, I expect the domestic use to rise.

It may not be a geologic peak but more of a political one.

The new Arctic natural gas reserves are literally frozen under the Barent Sea or on the quicksand-like tundra in Yamal. They need Western oil companies to develop it but in their greed and bullying frightened Big Oil developers off.

Given that Putin (with cute little Mini-Medyedev) is arranging to become effectively Czar for life, it is doubtful that Russia's bullying behavior will change. I expect Russia to increase gas prices at every possible opportunity as an

unstable rentier-state.

http://en.wikipedia.org/wiki/Rentier_state

Europe needs to focus on imports from more reliable sources.

Why would you say that Russia is trying to switch from coal when actually the opposite is happening? Currently Russia is working on increasing it's share of electricity produced by coal (away from gas).

Dirty coal seen from the orbit? What is that about? Are you sure you are talking about Russia? With it's small (compared to land mass) population and mostly gas fired electrical plants which coal are you talking about?

Why would Russia need western firms? It's not 1990's and Russian has enough money to meet the demand at the right price.

Actually you post seem to be filled to the top with misinformation. Do you really believe that Siberia is so cold that methane is freezing there? I am not sure if you know it, but Siberia is on Earth, no on outer fringes of the solar system. Methane becomes liquid at -162 C (you can then search for temperatures around the earth to get an idea what the coldest temperature is in Siberia).

Hi hifi,

You seem unaware of Russia's serious air pollution problems which are in part caused by coal.

http://www.american.edu/TED/russair.htm

Why would you say that Russia is trying to switch from coal when actually the opposite is happening? Currently Russia is working on increasing it's share of electricity produced by coal (away from gas).

Yes, it seems that the Russian government

is expanding coal electricity specifically to free up gas for Europe and put more money in Kremlin pockets. This won't help Russia's terrible air quality. Still overall domestic consumption of natural gas is projected to rise. If the standard of living is to rise they have to do something about their pollution and cleaner burning natural gas makes sense.

Dirty coal seen from the orbit? What is that about? Are you sure you are talking about Russia? With it's small (compared to land mass) population and mostly gas fired electrical plants which coal are you talking about?

www.ametsoc.org/sloan/cleanair/siberia.jpg

Why would Russia need western firms? It's not 1990's and Russian has enough money to meet the demand at the right price.

Artyom Konchin, an analyst with Aton Capital, put Russia's oil supply lull down to high taxes and insufficient reinvestment into infrastructure that could increase production from existing fields.

"It's not that we don't have enough oil," he said. "We just don't have enough capital going into developing the fields."

http://www.iht.com/articles/ap/2008/04/15/business/EU-GEN-Russia-Oil-Slu...

Actually you post seem to be filled to the top with misinformation. Do you really believe that Siberia is so cold that methane is freezing there? I am not sure if you know it, but Siberia is on Earth, no on outer fringes of the solar system. Methane becomes liquid at -162 C (you can then search for temperatures around the earth to get an idea what the coldest temperature is in Siberia).

Hmmm...I should have said 'metaphorically frozen'. The development of those areas is

in suspended animation(metaphorically).

Talking of coal China aims to increase coal production 30 pct by 2015:-(

http://uk.biz.yahoo.com/08012009/323/china-aims-increase-coal-production...

"Why would Russia need western firms?" ... "We just don't have enough capital going into developing the fields."

Majorian, last time I looked I hadn't noticed a huge amount of free capital in the West, but maybe you haven't noticed the "credit crunch" :-) Many projects have been canned in the West so no spare money to invest in Russia right now.

Majorian, you wouldn't happen to be a speech writer for Bushco would you? "To every thing (spin, spin, spin) there is a season (spin, spin, spin) and a time to every purpose..."

Clean Skies, anyone? Or how about No Child Left Behind?

That's the first time I've been accused of spinning for Bushco.

Hifi was correct in saying that Moscow was favoring coal-nukes over natural gas

for electricity, but I still think the point I was making is true--that Russia

is using a huge amount of natural gas domestically and is a perfect example of the Exportland phenomenon--where domestic consumption reduces future exports and the Europe would be foolish to trust in receiving the benefits of future gas developments.

The attitude of the Russian (permanent)leadership is more about projecting power than satifying customers.

If Russia offered secure long term development leases to Western companies you'd see developments like that of Snovit in Norway, instead they were punished for Sakhalin and other joint ventures IMO. You may remember that the Alyeska pipeline was built during the oil spike/recession of 1974.

I post this as my opinion so not to be accused of 'spin' by lengould. :-o

Seems to me majorian takes the view russia is guilty by default. Sure, they're not whiter than white unlike say Tony B liar, Bush, clean coal, Madoff, Ponzi scheme, Satyam, Berlusconi ...................

Our (Khebab/Brown) outlook for net oil exports from two key proximal oil exporters—Norway & Russia. The projected initial 10 year decline rate is shown:

Norway:

Russia:

http://www.energybulletin.net/node/38948

Is anyone else seeing TOD go into "basic" text (looks like no style sheets etc) mode when posting in this topic or getting messages about the board offline randomly? If so can someone ask SuperG to look into it.

Probably because the style sheet GET is returning 404 or 500 error (due to technical difficulties)

We are having some intermittent technical problems this evening. If you ever get a message about the site off-line, try clicking reload in your browser. Sometimes those off-line messages get cached.

I made a few graphs using BP 2008 Statistical Data.

Looking at these graphs, it looks like Russia is producing the vast majority of the gas for these four countries. Production from the Ukraine has been in decline for many years. It imports close to 50 bcm a year, which is more than any of the countries Euan shows on the graph above. The exports from Turkmenistan have been quite variable. In 2007, the exports of Turkmenistan were approximately the same as the imports of Ukraine. Uzbekistan is consuming almost as much as it is producing.

My impression from the graphs is that it will probably be difficult for Russia to increase exports. Exports for the group of four countries have been on a plateau since 2003, and dropped a little in 2007. The only country that looks like it might be able to ramp up exports a bit is Turkmenistan, and the amount of ramp-up is likely small. Between 2003 and 2007, Turkmenistan only ramped up production by 5 bcm, so the future ramp up is likely to be slow as well.

Why would Ukranian natural gas consumption be declining so considerably compared to the other countries listed - Is the data reliable?

And doesn't their post-soviet production look suspiciously flat after a previous period of decline?

Undertow,

well observed.

BP Statistical Review 2008 lists Ukranian total primary energy consumption has fallen from a high of above 270 MTOE in 1990 to just under 140 MTOE in 2007 (actually exactly 50 % decline).

Also Russian total primary energy consumption has dropped from approx. 887 MTOE in 1989 and had a low in 1997 of 612 MTOE and had grown to 692 MTOE by 2007.

I think that the Ukraine did a lot of heavy manufacturing back in the days before their own gas production declined. Now that it has declined, some of that manufacturing may have moved elsewhere.

The drop in Uzbekistan consumption caught my eye. I wonder if that is an error?

So you don't buy the idea Ukraine is syphoning off Russian transit gas as Russia claims (ie - it's not just about pricing, they are using considerably more internally and producing less than claimed) and that explains much of the difference? I think I do but I could be convinced the other way given known good data.

If there really is a Ukranian (and possibly others) gas black hole in currently reported figures how might that affect future production projections?

I am just showing what was reported to BP. I don't know if they are cooking the books.

Of the countries listed the Ukraine is the only net importer of gas - and a big importer at that. Rising prices are killing demand.

Euan,

The next biggest importers of Russian gas after Ukraine are Belarus, Hungary, Czech Republic, Slovakia. All are massive net importers and all show an increase in gas use since 1990. Ukraine stands out like a sore thumb. If Ukraine is really using today only 50% of the energy it was using in 1990 then I'm a banana. Ukraine's GDP has increased from $81 billion to $141 billion in that period. That's a neat trick almost doubling GDP while halving energy use.

I wonder if we had the real figures for FSU European gas production and consumption it would really be an "oh shit" moment.

Gail - thanks for the charts - it would be interesting to see them as stacked area for production and exports - would give a better feel of proportion.

The S Asian states do have significant stranded gas reserves that have never been developed cos it had nowhere to go. This has led to speculation that they could get linked into the Nabucco pipeline (not yet sanctioned as far as I am aware). Its always been a catch 22 question - spend money to bypass Russia and Ukraine and risk the wrath of the former - or stick with an easy but uncomfortable option using the existing network.

http://www.nabucco-pipeline.com/

There has been speculation that one of the reasons Gazprom has been willing to pay good price for nat gas from Uzbekistan and Turkmenistan has been strategically motivated to reduce nat gas available for Nabucco.

Some may be aware of the faith of Nabucco, both the historical figure and the figure in the opera by Verdi, which Russians make references to when they are asked to comment about the Nabucco pipeline.

These are a couple of stacked charts for the total of the four countries. The first shows total production split between consumptions and exports:

The second shows the percentage split for the same countries:

It is clear from these graphs that these countries primarily produce for their own use, and export a relatively small percentage of the total. Exports briefly hit 26% of the total in 2003-2005, but were back down to 24% in 2007.

Between 2001 and 2007, natural gas production grew at an average of 2.2% per year; consumption grew at an average of 2.0% a year; and exports grew by an average of 2.8% per year (including the bump in the 2003 period). If we compare 2003 and 2007, we find that production has only grown an average of 1.3% a year during this period, while consumption has increased by 1.8% a year over this period, leading to a slight decline in exports over the period.

Unless this group of countries can get their natural gas production to increase by more than 1.3% per year, it seems to me that exports will be in trouble. Their internal demand is growing at more than 1.3% per year.

Seems something important has been missing from the discussion so far, namely the implications of the supply shutoff for the gas pipeline infrastructure. Could someone with a background in such matters weigh in? I wonder how the current low temperatures across Europe may complicate the situation and hinder the restarting of supplies.

According to the following article from Der Spiegel (in German) the infrastruture in the Ukraine is decrepit. It will have to be slowly brought up to temperature again before the gas can then be forwarded from compressors at the right pressure.

Russia warns of damage to pipeline

The implication is that even if the gas is turned on again now (which seems unlikely though they are set to meet Thursday), it will take several days or even a week to have things running close to normal - under the best circumstances. If any serious damage is done to the infrastructure then it could presumably take longer.

For countries like Germany this is not of great concern and I assume they are well informed of Russia's intentions. They are provided with some Russian gas via Belarus and have huge storage capacity. For Serbia, Romania, Bulgaria and others the situation is much more serious. Shows how much EU membership has brought Romania and Bulgaria. As the poorest countries in the EU they seem to have little support.

Here is a map of the pipelines across Europe:

Weather looks set to remain cold for the next few days at least, although things are warming up again in the Balkans now - lucky for them.

There are no real problems here in Romania , because we have some domestic production and some "strategic" deposits but I wonder how the bulgarians cope with this . Electric heaters ? I live in a small two room house, with gas central heating making plans for a (now astronomicaly expensive in my country ) heat pump .

The most worrying factor is the percentace of domestic consumption in Russia's gas production. Any development hickup and ELM will take the exports to "crisis" levels.

Here in Serbia we just run out.Our media claims that soon it would be fixed and everything would be fine(we produce in total 8% of our needs and its not enough to keep the pipelines flowing, no reserves(ok one place called beli dvor but its insignificant).ironically i live in town 15 km of the greatest natural gas find in serbia (kikinda, 38000) and there is no gas here. me personally have heat(wood thanks to TOD) but my family and friends are on gas. at least i dont have to go to work to day.

A much more accurate map here:

http://www.gie.eu.com/interactivemap/index.html

click "launch interactive map"

Indeed, on the map above all the pipelines from the Norwegian/Dutch/German/British North Sea fields seem to have disappeared.

Also the WAG pipeline (vienna > germany) is completely missing. i think its quite old.

Yeah, I should have said, the map is of 'Selected natural gas pipelines in Europe'. In particular those pertaining to Russian supply routes.

This point caught my eye has having the seeds of the solution within it. It's not as if the west and Russia have no experience with carving up territories when realpolitick demands it.

It's about money. As I noted on Boxing Day, this is the natural follow-up by Russia to the Georgian war and oil pipeline there - after the game is won, all bets must be paid.

And what do we see in your linked news article?

So, Europe gets chilly, Ukraine and Russia turn off the gas, Ukraine by an AMAZING COINCIDENCE just happens to be asking for a big handout from the IMF, and who should have a good chunk of the votes at the World Bank but those western EU members.

Solution? IMF hands over the cash, Ukraine passes a cut onto Russia, everyone's happy.

From this 2007 report to Congress(data EIA), here are two tables showing dependence of Europe and FSU countries on Russian natural gas.

I see there is a note (a) on the Ukraine figures which says (in the original document) "estimate by CRS based on several disparate published and Internet sources." No other country has such a qualifier.

Perhaps this is the combination of countries I should have added together with respect to production and consumption: Russia + Turkmenistan + Uzbekistan. (See other charts above. I have converted to cu feet/yr from cu meters/yr.)

It is clear from this graph that even with the inclusion of Turkmenistan and Uzbekistan natural gas production, gas for export has been close to flat since the late 1980s. With consumption heading up recently, it looks like gas for export will be flat at best, possibly declining.

The numbers Nate shows above total 3,292 billion cu ft a year for the first list of countries (former Soviet Union) and 3,692 billion cu ft a year for the second list of countries (other European). Japanese LNG imports would presumably be in addition to this. Total exports in 2008 from the three countries shown seem to total about 8,000 billion cubic feet a year in 2007.

Here is a survey -

Why will Ukraine not pay Russia for the gas?

A. They do not have the money?

B. They think the price was too high?

C. They think Russia will cave in anyway?

D. They want to start a war with Russia?

E. All of the above?

Options for Russia -

A. Stop payments for goods coming from Ukraine to Russia.

B. Turn the gas back on, and build a new pipeline that does not go thru Ukraine, then shut off Urkraine only.

C. Build a coalition of other countries to pressure Ukraine into paying the debt.

D. Invade Ukraine, and take their money.

Sounds good. Invading Ukraine... above all let's take all the money away from Jushenko and his mafia gang. The Ukraine is lead by gangsters. In my view, there is no big city in the world, where you cann see more of those above 100'000 Euros vehicles in the streets. It's just staggering! They seem to be especially goog customer of Porsche. Since Porsche Cayennes, not the regular ones, but those turbocharged monsters are just everywhere.

Hello TODers,

This seems like a pretty good write-up:

http://www.istockanalyst.com/article/viewiStockNews/articleid/2937787

----------------------------

Brinkmanship in Kiev and Moscow Can Only Last so Long

...From Kiev's perspective, the gas prices being proposed by Gazprom would undoubtedly cripple an already nose-diving economy. GDP has contracted an agonizing 15% since November 2007 and the hryvnia has tumbled in value. The $4.5 billion loan from the IMF in December came on the condition of a current account surplus in 2009 and strict foreign reserve requirements, such that government social-spending has effectively been frozen.

..Steel and fertilizer (both gas intensive industries) account for over 40% of the export currency inflows and 20% of tax collections alone, but at such a gas price (and in the context of stiff Chinese competition) the industry will become unviable...

------------------------

Until the Ukraine goes to full-on O-NPK recycling to enhance their national security: they will inevitably, and eventually be forced to buy their I-NPK from Russia. Europe, the USA, and other big H-B nitrogen importers need to consider their increasing dependency on imported ammonia and urea products as we go postPeak.

Some more evidence on growing I-NPK dependencies:

http://www.agweb.com/get_article.aspx?pageid=148215

-------------------------

Shaky Ground: Russia-Ukraine Gas Dispute Could Affect U.S. Fertilizer Supply

..While the event is still unfolding, concern has already been raised on how this will affect U.S. fertilizer availability this spring. Chrislip says it is likely U.S. fertilizer supplies could be affected.

“Some of the nitrogen production in some countries has already been shut down,” he says. “It looks like it could very easily shut down additional urea capacity in the world, at a time when urea stocks are going to need to be built up before the spring season. It certainly could have an impact on supply availability for spring.”

--------------------------

"..Steel and fertilizer (both gas intensive industries) account for over 40% of the export currency inflows and 20% of tax collections alone, but at such a gas price (and in the context of stiff Chinese competition) the industry will become unviable..."

As I said in a previous post higher above "...give me subsidised energy and I will run plenty of energy intensive businesses and undercut those paying the market price..."

So not only are they broke but they are broke having had cheap energy. Now they will have to pay more or less the market price then 40% of their income is no longer viable!!!

Yet again, the everyday people suffer while the gangster robber barons steal nearly everything:-(

WE ARE DEALER OF OIL COMPANY,

WE SELL EDIBLE OIL.

WE SELL BIODIESEL FOR $400 USD PER MT.

WE SELL IN LARGE AND SMALL QUANTITIES

We feel that olive oil consumers value a moderately priced, real extra virgin olive oil as an alternative to the poor quality, over priced products that have saturated the market but that are adulterated with pomade, seed or hazelnut oils.

At our website we provide an extensive 'Health/Fraud' resource page that documents the health benefits of extra virgin olive oil as well as the pervasive fraud that exists in the market. We also have a documentary style video on the 'Media' page that shows the the entire process from harvest to bottling to alphabetization.

We have distribution in nigeria and seek to explore relationships with food importers & distributors in the US. Our labeling is attractive, pricing very moderate. As producers we are also a guaranteed source of supply.

I would like to express my appreciation to the owner and members of this forum for the opportunity to join and I look forward to participating in it with you.

WE ARE THE PRODUCER Quantity: Minimum order - 4 MT per shipment WE OFFER FREE SAMPLES BUT YOU ARE ONLY GOING TO PAY FOR FREIGTH TO YOUR DOORSTEP Maximum order - 25,000 MT per shipment

Date of First Delivery: By agreement in Contract Delivery Method: Bulk by vessel, ship to tank ETC DELIVERY TIME ......3 TO 5 WEEKS SAMPLES DELIVERY TIME ......WITHIN 48 HOURS Packing: IN CUSTOMER PREFFERED METHOD Price:$250 USD per Metric Ton,

Payment:L/C, T/T ( Bank Transfer ), WIRE TRANSFER Inspection:

The quality and Quantity of Goods will be confirmed for each shipment on a certificate issued by the SGS at discharge port at buyers account which shall be binding on both parties in all respects.

Specification Testing

Reduced specification testing shall include testing performed on the composite sample (except as noted) to each of the following limits:

Property Test Method Limits

Flash point, °C per ASTM D 6751 per ASTM D6751

Water and Sediment, vol.% per ASTM D 6751 per ASTM D6751

Cloud point, °C per ASTM D 6751 per ASTM D6751

Acid number, mg KOH/gm per ASTM D 6751 per ASTM D6751

Free glycerin, % mass per ASTM D 6751 per ASTM D6751

Total glycerin, % mass per ASTM D 6751 per ASTM D6751

Testing

Visual appearance ASTM D 4176 Procedure 2 2 max (outlet sample)

If a diesel fuel tank outlet sample has been taken, it shall be tested for moisture and sediment per D 4176. If moisture or sediment is detected in these samples, corrective action should be taken to remove the contaminants and the action documented. If multiple level samples are used to assure homogeneity, the specific gravity (D 1298) of each strata of the blended product should be determined. The range of results across the three samples shall be less than 0.006 and be visually examined for water, sediment and particulate matter by D 4176. If the product is out of specification then corrective action shall be taken including documentation. The outlet sample taken from the blend tank (when there is no activity over a thirty-day period) shall be tested for moisture and sediment using D 4176, Procedure 2. If out of specification, corrective action with documentation is required.

WE SELL PER METRIC TON(MT)

Biodiesel Oil Per Metric Ton Cost :$400USD

Jatropha Oil Per Metric Ton Cost : $200USD

Vegetable Oil for .....USD200 Per Metric ton

Sessame Oil for .......USD200 Per Metric ton

Corn Oil for ........USD200 Per Metric ton

Vegetable oil for ....USD200 Per Metric ton

Soya bean Oil for .......USD200 Per Metric ton

Sunflower oil for ........USD200 Per Metric ton

RBD PalmOil for ...........USD200 Per Metric ton

Palm Oil for .........USD200 Per Metric ton

Rapeseed Oil for ...........USD200 Per Metric ton

safflower Oil for ..........USD200 Per Metric Ton

We are producing and selling the following products and more.We sell on per metric tons.

REBCO-Russia exportable blend crude oil .

SLCO-saudi light crude oil BLCO-bonny light crude oil .

Gasoline-gasoline Asphalt-asfalt betumen MAZUT-100, 75, 99, etc.

LPG-liquefied gas of petroleum LNG-natural gas Jet fuel-airplaine kerosene.

D-2-Diesel and Products Crude Oil.

SLCO Saudi Light Crude Oil.

SHCO Saudi Heavy Crude Oil .

ILCO Iranian Light Crude Oil.

IHCO Iranian Heavy Crude Oil.

BLCO Bonny Light Crude Oil.

OLCO Oman Light Light Crude Oil.

OBCO Oman Blended Crude Oil.

BLO Basra Light Crude Oil.

KLO Kurkok Light Crude Oil.

VLO Venezuelan Light Oil.

REBCO Russian Export Blend Crude Oil.

Refined Products, Gas Oil "EN-590".

RGD Regular Grade Diesel.

PGD Premium Grade Diesel (HSD).

SGD Super Grade Diesel.

Regular Petrol RON 87 Premium Petrol RON 93.

Unleaded Petrol RON 95.

Super Premium RON 97.

HFO Heating Fuel Oil.

HSFO High Sulphur Fuel Oil LSFO Low Sulphur Fuel Oil.

Kero Kerosene Bitumen.

Base Oil.

Mazut M-100 WW.

AND MANY MORE.............

WE LOOK FORWARD TO HAVE A SOLID BUSINESS RELATIONSHIP WITH YOU IN THE NEAREST FUTURE.

EMAIL : dealerofoil@gmail.com

CONTACT NUMBER : 234-806-027-5939