World Oil Exports [02] Libya

Posted by Luis de Sousa on September 18, 2008 - 10:10am in The Oil Drum: Europe

Some History

From time immemorial, the territory that is now Libya has been part of one empire or another--whichever empire had control of the southern Mediterranean at the time. The Umayyad Caliphate reached the area in the VII century. This resulted in the conversion of much of the population to the Islamic religion and culture.

The territory entered the XX century under the rule of the Ottoman Empire, but was invaded by Italy in 1911. A resistance war ensued that would last until the end of World War II. Libya become a de facto colony of Italy during that time.

At the end of World War II, Italy renounced its claims over Libya in the peace treaty it signed with the Allies. The territory was briefly ruled jointly by the UK (with the provinces of Tripolitania and Cyrenaica) and France (with Fezzan).

In 1949, Cyrenaica became an independent emirate ruled by Emir Idris Sanusi (a resistance leader between the two World Wars). Nevertheless, in the same year the United Nations ruled in favour of a united country covering all the three provinces. In 1950, a national assembly gathered at Tripoli and designated Emir Idris Sanusi as the king of the state to be. The following year, a Constitution was established and King Idris declared the independence of the United Kingdom of Libya. Parliamentary elections were held in 1952.

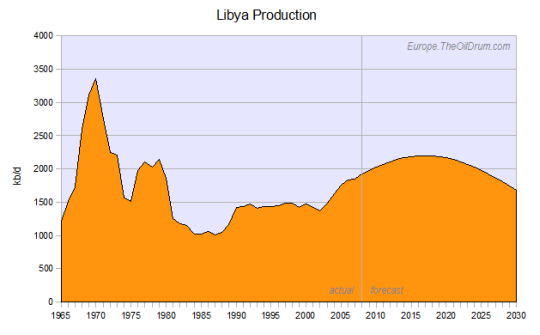

Soon after the new Kingdom was created, first the UK and then the USA obtained rights to build military bases in Libya. In 1956, the first concessions on oil exploration were granted to foreign companies, and in 1959 the first successful drilling was reported. Libya became an oil exporter in 1961 with the completion of a 167 Km pipeline. This started a spectacular production rise that would surpass 3 Mb/d in 1969.

|

| Figure 1 – Colonel Gaddafi soon after taking power. |

Overnight, Libya went from being one of the poorest nations in the World to one of the richest, when measured based on average GDP per capita. But equity was lacking, and popular resentment grew as oil exports grew. In 1969, a small group of young military officers staged a successful coup d'état and deposed King Idris. Their leader, Colonel Muammar al-Gaddafi, became the country's ruler at the age of 28.

Gaddafi intended to build an ad hoc socialist state and promote Arab unity. Banks were nationalized in 1969. The following year, the oil industry was nationalized, all the foreign troops left the country, and a new Constitution established. Plans were made for Libya to merge with Egypt, Sudan and Tunisia, but none of this actually transpired. Between 1969 and 1972, Libya's oil production fell 1 Mb/d. In 1973, Libya played an active role in the oil embargo to the USA, and production dropped even further to 1.5 Mb/d.

Libya's performance during the embargo, its support for Arab unity, and its opposition to western interests in Islamic states made it a pariah to the western world. Libya even supported revolutionary organizations that do not restrain terrorist actions--something the western world could not accept. During the 1970s, Gaddafi successfully dealt with several attempts to undermine his regime, coming from both inside and outside the country.

|

| Figure 2 – Crash site of Pan Am flight 103. The bombing killed a total of 270 people inside the aircraft and on the ground. |

In 1982 the USA imposed a unilateral embargo against Libya, and in 1984 the first serious assassination attempt on Gaddafi took place. Two years later, the USA bombed Tripoli and Benghazi, most likely with the objective of eliminating Gaddafi. One of his sons died in the attack. In 1987, a French airliner was destroyed over the Sahara. The next year, Pan Am flight 103 exploded over the Scottish town of Lockerbie; Gaddafi's regime is implicated on both actions. Oil production declined to just over 1 Mb/d.

As consequence of the regime's involvement in the Lockerbie affair, the United Nations imposed a set of sanctions against Libya in 1992. The country was asked, among other things, to hand over perpetrators for trial and to compensate victims' families. Gaddafi did not comply with any of these requests, relegating the country to international isolation. Nonetheless, oil production grew to 1.4 Mb/d and remained there until the turn of the century.

In 1999, Libya handed over the requested perpetrators. By the end of 2003, the remaining UN requirements had been fulfilled . In 2003, the country also announced it intention to decommission its programs of weapons of mass destruction. Since 2003, Libya has collaborated with several international organizations to accomplish that goal. In 2004, the UN lifted all sanctions against Libya. With these changes, cooperation with International Oil Companies began strengthening again.

By late 2007, Gaddafi travelled to Lisbon to represent Libya at the II EU-Africa Summit. He immediately caught the attention of journalists by taking an active part in the Summit's proceedings and showing great agility in dealing with other heads of state. At the close of the Summit, Gaddafi proposed that Libya host the next Summit, which will take place in 2010.

The country's oil production has steadily increased since sanctions where lifted, now approaching 1.9 Mb/d. In the first part of September 2008, Libya received an official visit from US secretary of state Condoleezza Rice, a moment that seems to have sealed the country's full reintegration with the international community.

Figure 3 – Condoleezza Rice and Muammar Gaddafi in Tripoli. Photo by Mahmud Turkia, AFP / Getty Images.

For a deeper insight into Libya's History:

Libya at Country Studies by the Federal Research Division of the Library of Congress of the USA.

Background Note at the U.S. Department of State Bureau of Near Eastern Affairs.

Historic timeline at the LookLex / Encyclopaedia .

Production

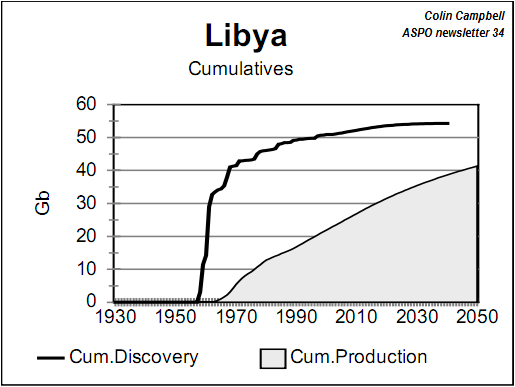

Libya is now a mature oil-producing region with most of its oil fields discoveries occurring during the 1960s. Slowly, discoveries have become smaller, with little oil being found after 1990. In ASPO's newsletter 34 [pdf!], published in 2003, Colin Campbell showed discovery the following way:

Figure 4 – Libya Cumulative Oil Discovery.

Discovery by then summed up to 52 Gb, of which 23 Gb had already been extracted. During the previous years discovery had averaged 0.1 Gb per annum, leading Campbell to point to an ultimate discovery of 55 Gb.

Figure 5 – Libya's oil fields. Source: ENI, click for full version.

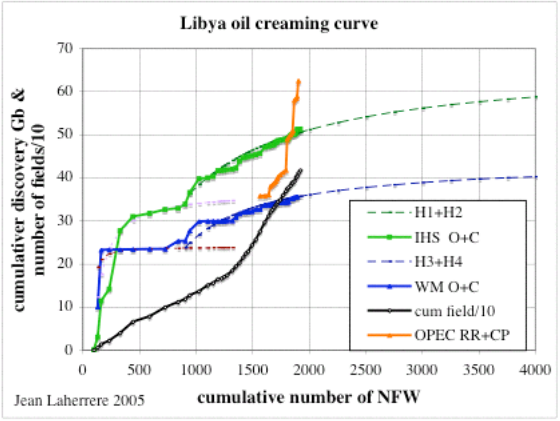

In ASPO's IV International Conference, held in 2005, Jean Laherrère showed [pdf!] an assessment of Libya, noting that different databases were presenting different scenarios. While IHS data trended to an ultimate of 60 Gb, Wood Mackenzie was showing 40 Gb. The creaming curve also demonstrated the unreliability of OPEC's data.

Figure 6 – Libya Oil Creaming Curve from IHS and Wood Mackenzie data.

At the end of 2007, the amount of oil produced by Libya had already surpassed 27 Gb. Considering that production had been in a plateau of around 1.4 Mb/d since 1990 and started increasing after 2003, the lower figure of 40 Gb seems unlikely.

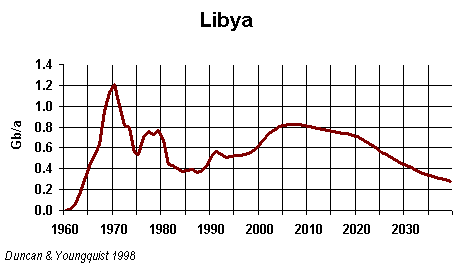

Several production forecasts are available for Libya. Richard Duncan and Walter Youngquist projected a peak of about 2.3 Mb/d occurring about now, after which a slow decline would ensue, accelerating after 2020.

Figure 7 – Libya Oil Production forecast by Richard Duncan and Walter Youngquist in 1998.

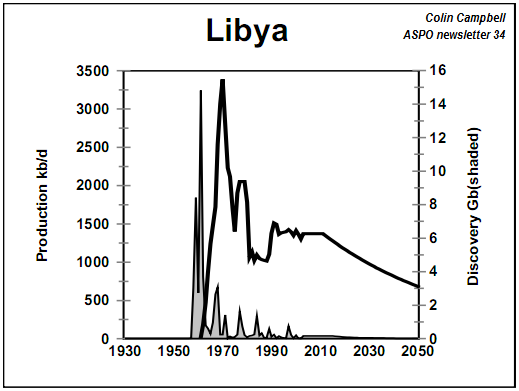

In ASPO's newsletter 34 Colin Campbell projected a production plateau of around 1.4 Mb/d, lasting until 2010, when a gentle decline would set in. For an ultimate recovery of 55 Gb that may seem a rather conservative projection, but at the time the openness showed by the OECD towards Libya in the following years was likely difficult to foresee. (In 2003, the country was still on the US's list of terrorist-supporting states.) In 2007 production reached 1.85 Mb/d.

Figure 8 – Libya Oil Production forecast by Colin Campbell in 2003.

Jean Laherrère's projection is more reflective of the new reality that emerged after 2003. Two logistic curves give shape to the different ultimates given by IHS and Wood Mackenzie, one peaking by 2010 at 2.2 Mb/d, the other by 2020 at 3 Mb/d.

Figure 9 – Libya Oil Production forecast by Jean Laherrère in 2005.

While 40 Gb now looks like too small a figure for Libya's ultimate, a production peak of 3 Mb/d would probably represent too much of a departure from Ghadaffi's long lasting conservationist policy towards oil. In that sense, Duncan and Youngquist's forecast seems to be the one better reflecting Libya's strategy, even if probably presenting a production peak too soon.

In light of the information gathered here, an alternative projection is proposed, trying to both reflect the country's policy and the favourable developments in latter years regarding foreign relations. The 55 Gb ultimate is adopted, meaning that Libya is passing its mid point of depletion in 2008. Production is allowed to rise slowly towards a peak of around 2.2 Mb/d a decade from now after which a gentle decline sets in (with cumulative production reaching 35 Gb by then). To describe this profile a logistic curve is used (if for nothing else, for historical reasons). The model proposed shows Libya continuing to produce over 1.6 Mb/d in 2030.

Figure 10 – Libya Oil Production forecast. Click to enlarge.

Consumption

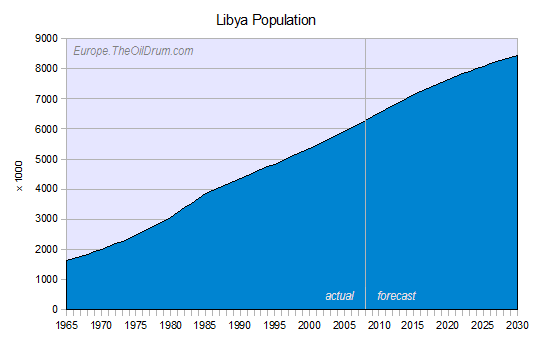

After World War II, Libya experienced incredible population growth. The population grew from 1 million in 1950 to 5 million in 2000, and presently tops 6 million. This represents a six fold increase in less than sixty years. The UN forecasts this growth (that has followed a nearly linear trend) to continue until 2020 before slowing down. In 2025, the country is expected to reach 8 million people, and by 2030 will have close to 8.5 million people.

Figure 11 – Libya Population forecast, according to UN's forecast.

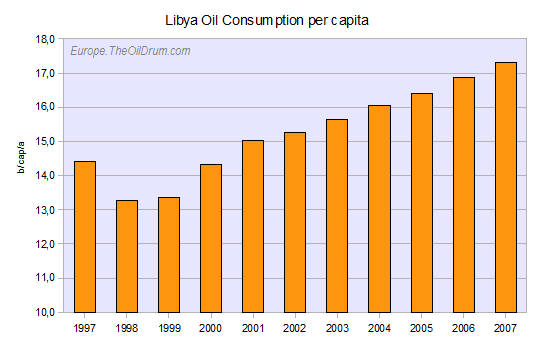

In spite of political turmoil and difficult foreign relations, Libya has shown a stable path of oil consumption, growing from 5.5 b/cap/a in 1965 to over 17 b/cap/a in 2007. During times of low oil prices this trend slows down or stalls, just to return to the previous pace some years later. During the price crash of 1998, consumption per capita receded, picking up again with the first hikes after 2000. Since 2003, oil consumption per capita has steadily risen around 2.5% per annum.

Figure 12 – Past Libya Oil Consumption per capita.

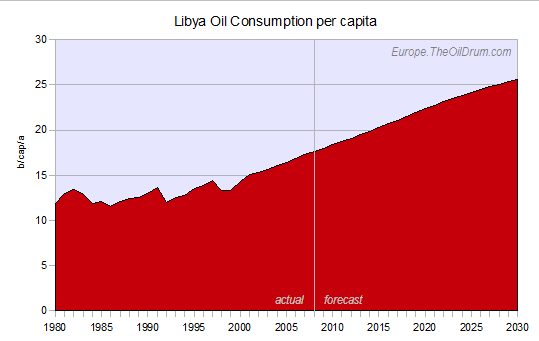

Consumption per capita is forecast to continue to rise at 2% per annum until production peaks. By then this trend will start slowing down due to depletion concerns, falling to 1% per annum by 2030. This projection takes consumption per capita to over 25 b/cap/a in 2030, still below many of the rich exporting countries, but equalling US consumption today.

Figure 13 – Libya Oil Consumption per capita forecast.

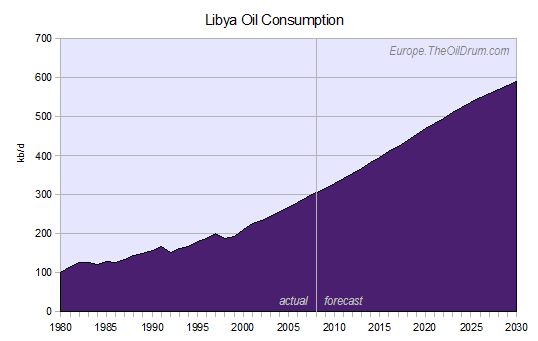

Using this consumption per capita model and UN's population growth projections, the country's oil consumption is set to increase two-fold during the next two decades. While consumption growth will visibly slow down, it should top 0.6 Mb/d soon after 2030.

Figure 14 – Libya Oil Consumption forecast.

The country's maturity both as an oil producer and as an integrated member of the international community assures a minimum degree of accuracy of the projection made here. Historical data does show, however, that a marked and prolonged fall in international prices (for example, imposed by recession) could change the picture markedly. Being a member of OPEC, production quotas could be lowered, and as seen from past data, low oil prices usually have a visible impact on consumption.

The Macroscopic View

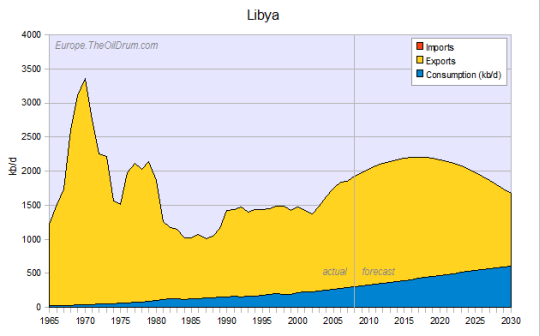

Even with the increased consumption projected here, Libya remains as an important oil exporter for the period considered.

Figure 15 – Libya Oil Exports forecast. Click to enlarge.

There is much irony in Libya's history as an oil producer. If Colonel Gaddafi hadn't reached power, the country probably would have extracted most of its oil during times of cheap energy (as happened in most of Europe). While the country was forced into isolation for decades, Libya now reaches the XXI century with half of its oil reserves to extract and healthy foreign relations, looking set for what maybe the country's Golden Age.

With one more country assessed, World Oil Exports (WOE) remain little changed. 2005 continues to be the peak date, now with nearly 39 Mb/d of oil traded internationally. The fast decline in the second decade of this century continues to be present, falling from over 36 Mb/d in 2011 to under 26 Mb/d by 2020.

Figure 16 – World Oil Exports as of September 2008. Click to enlarge.

Previous analyses of WOE:

WOE [01] Angola

WOE [00] Introduction

Luís de Sousa

The Oil Drum : Europe

Thanks, Luis!

Could you please tell me the data source for your statement: "In 2007 production reached 1.85 Mb/d." Maybe it includes NGLs?

The EIA says 1.7 mbd crude/condensate for 2007.

http://www.eia.doe.gov/emeu/steo/pub/3ctab.pdf

The IEA and OPEC August OMR both state 1.71 mbd crude for 2007. The OPEC 2007 Annual Statistical Bulletin states 1.67 mbd average for 2007.

I found Libya confusing so I did two scenarios, like Laherrere, URR 60 Gb (blue lines) and URR 40 Gb (black lines). I admit that the URR 60 Gb scenario should give Libya the ability to increase production further to perhaps over 2 mbd. However, my own view is that Libya's URR is probably closer to 40 Gb because IHS tends to be overoptimistic and thus I give more weight to WM's 40 Gb creaming curve.

There are also few projects which provide Libya with an ability to increase production which could add more weight to the URR 40 Gb scenario. OPEC only has Amal in 2008 and beyond, at 40 kbd.

http://www.opec.org/home/PowerPoint/Supply%20and%20Capacity/upstream%20p...

Wiki Oil Megaprojects also has only one project for 2008 and beyond, in block NC 186/115 at 90 kbd.

http://en.wikipedia.org/wiki/Oil_Megaprojects/2009

click to enlarge

Ace thanks for the added insight.

WOE reports to crude plus condensate plus NGL, because the BP statistical review is its base data source. I'm not exactly comfortable with this because in effect NGL is a by-product of Natural Gas exploration, not Oil. With time I'll have to deal with this issue, but the BP data is very useful especially on the consumption side.

I gathered three ultimates from three different sources: 60 Gb, 55 Gb, and 40 Gb. In Campbell's cumulative graph 40 Gb are passed still in the 1960s. Also, with just 40 Gb it would be very hard to reach productions levels in excess of 3 Mb/d. So I just skipped out this ultimate and worked on with 55 Gb.

As for the potential for growth, I expect Libya to tie closer with international oil companies, especially from Europe. Also take into account that NGL production will likely grow.

It might be worth reflecting also on water.

MENA region is going to hit water shortages, especially as populations increase (perhaps double by 2050 with concomitant industrial growth - and deficit of agricultural products).

Libya, has large reserves of fossil water - the man made 'river' pipeline project supplies 2 cubic Km per year, 85% used for irrigation. http://www.dlr.de/tt/en/desktopdefault.aspx/tabid-3525//5497_read-6611/

but is expected to encounter an increasing deficit, only exceeded by that of Egypt among the N African countries.

Water prospects for the region are reviewed in detail as background in report on use of Concentrated Solar Power for de-salination.

Phil

Thanks for a very interesting and well thought-out article. I learned a lot from it; I hope others will also.

Very interesting, thanks.

It's easy, in the Western media, to ridicule and demonize leaders like Gaddafi. His primary 'crime', in the eyes of the West, is that he's a fiercly 'patriotic' and nationalist leader, who for decades has steered his country in an independent direction, always putting, what he percieves, as Libya's interests first. Leaders who follow this course and oust pro-Western regimes are never going to be popular in our part of the world.

He isn't a democrat, but then, who really is? He's more like a knight who kicked out an old, incompetent and deeply corrupt, king; and Gaddafi, the new 'king' set about building a new country virtually from stratch. Such a task, as one sees from European history, isn't easy and certainly isn't pretty, absolute monarchy is a risky business. A good king can reform and strenthen a country, a bad one - like George Bush - can lead it to disaster.

Whatever one thinks of Gaddafi's politics and form of government, he has proved, on balance, remarkably successful in steering his new 'kingdom' forward. He is also incredibly popular with ordinary people all over Africa and the Middle East, who look with envy towards Libya. I've talked to people in Saudi Arabia, Egypt, Jordan, Morocco, who dream of the day when a 'hero' like Gaddafi will appear and sweep away the corrupt and incompetent old guard and finally make their countries independent of Western domination.

This is, of course, something of a nightmare scenario for Western leaders and economic interests, a free and independent Middle East, but it really is what the vast majority of the ordinary people want, which is why we support and arm the various dictatorial regimes spread throughout the region. Gaddafi, is also a kind of dictator or absolute monarch, the main difference being that he is a nationalist ruler rather than a controlled client or vassal, content to reap the benefits of serving the primacy of Western interests.

Sorry, but that is incorrect.

Qaddafi was ostracized by the United Nations and the West because he supported and participated in terrorism, including support for the Irish Republican Army, the Palestine Liberation Organization (PLO), and other extremist Arab and Islamic groups..

Qaddafi has been linked to the 1986 Berlin disco bombing (http://en.wikipedia.org/wiki/1986_Berlin_discotheque_bombing), the bombing of Pan Am Flight 103 (http://en.wikipedia.org/wiki/Pan_Am_flight_103), the bombing of UTA Flight 772 (http://en.wikipedia.org/wiki/Pan_Am_Flight_73), and the hijaaking of Pan Am flight 73 (http://en.wikipedia.org/wiki/Pan_Am_Flight_73).

These actions resulted in United Nations Resolution 748 (http://www.cfr.org/publication/11211/) as well as others.

And don't forget the tanks in the desert in Chad for instance with Qaddafi's name written all over them.

At the same time, it seems he has quite matured, at least on the international scene. Before that, he was like a Mafia Boss he surely took good care of his own family.

Plays very well not only to the Arabic culture..

Cheers, Dom

Peakplus,

I'm not really a 'fan' of Gaddafi. I think most leaders of countries pretty much resemble Mafia bosses competing with one another over 'territory' and 'protection money'. Especially the leaders of 'new' countries. I don't think I was defending Gaddafi.

People interested in Lybia need to read some history, especally pre-Qaddaffi. This note on Quaddaffi's motives is enlightening.

January 29, 1970: Negotiations with the oil companies begin in Tripoli for the raising of prices. Libya asks for an increase of 40 cents a barrel. The oil companies agree to only 10 to 13 cents; Gadhafi threatns to break off negotiations, declaring: "My country has done without oil for five thousand years and can do without it for a few years more. http://ourworld.compuserve.com/homepages/dr_ibrahim_ighneiwa/libyans.htm

I simply cannot find the reference, but I clearly recall reading a book about the founder/owner of one of the US oil companies who played a large part in development of oil in Libya pre-Quaddaffi. The author interviewed the former CEO of the company (a career employee) who described the founder a "essentially amoral", without concern for right or wrong, and strictly focused on getting the a good deal for his company from Idris, whether through threats, bribes or whatever.

Those who condemn Quaddaffi for some of his offenses need to recall that his son was killed in an unwarranted air attack on his compound by representatives of the oil companies he hated and fought much of his life.

GeoPappas,

Being a supporter of 'terrorism' has never been a disqualification for receiving support from the West, at least not until we need to label some leader this season's Hitler. If Gaddafi had been 100% our SOB he could literally have gotten away with murder, like they usually do, until they outlive their usefulness. His primary 'crime' wasn't his support for terrorism, but that his terrorism was directed at the wrong people.

Remember we liberate, they terrorise??

Don't forget the West has done it's fair share of terrorising. One example, In 1898, Hawaii was annexed to the United States after Queen Liliuokalani was overthrown in 1893. This was brought about by American sugar interests who wanted to avoid the import tariffs.

Writerman

What this guy did with his country, I guess is up to him and his people. But he sponsored and supported the blowing up of a civilian aircraft. Is this any different, except in scale, to Osama Bin Laden's activities ? It is astonishing, and morally disgusting, that the West has decided to kiss and make up.

But then Gaddafi has loadsa-oil, so that makes everything OK.

Maybe if Bin Laden takes over Kuwait in 10 years time, it'll be kiss and make up, too.

"......he sponsored and supported the blowing up of a civilian aircraft."

that is right, the cia would never sponsor the blowing up of a civilian aircraft like for example the cuban olimpic team. or assasination of a foreign leader or the bombing of hundreds of thousands of civilians in the search for wmd's.

damn, i hate it when these discussions turn political.

Two wrongs don't make a right...

which two wrongs are you talking about, i think i listed three individual incidents. how 'bout hundreds of thousands of wrongs don't make a right ?

Yeah, but two wrong-doers kissing and making up is hardly a surprise, is it?

It is far from clear whether Libya was actually involved in the Lockerbie bombing. The US initially blamed Iran, but it then became more convenient to blame Libya. Libya was offered lifting of sanctions if they admitted to doing it. The evidence in this case was extremely dubious.

Many people believe it was revenge from Iran for the US shooting down an Iranian plane.

http://news.bbc.co.uk/1/hi/world/777974.stm

http://en.wikipedia.org/wiki/Alternative_theories_of_the_bombing_of_Pan_...

The Gander air crash is more likely the Iranian response to shooting down their Flight 655 in 1998. Most people don't dispute Libya's involvement in Pan Am 103, if for no other reason than their shielding of the perps.

The one thing that always goes unoticed in these types of discussions is remebering which side of the line you are one. There are tons of "wrongs" on both sides, but all countries deal with their own self interests. In this case, both Libya and the US figured out it was in their self interest to kiss and make up, just like it was in their interest to antagonize each other in the 80s. From watching the Euro news, it looks like Qaddafi's son has long term plans to actually democratize the country and he is gaining his father's ear in all affairs. Slowly of course, to allow the institutions and ideas to develop otherwise it would be chaos like Russia in the 90s.

"Never appeal to a man's "better nature." He may not have one. Invoking his self-interest gives you more leverage." Robert Heinlein

Sorry, I'm not familiar with the Gander air crash - the only hit I got in Google was a crash in 1985 which the US and Canadian authorities denied was anything to do with terrorists; and it was 3 years before Flight 655 (in 1988).

Whilst most people don't dispute Libya's involvement, that doesn't necessarily mean they were involved - and many people do dispute that the perpetrators were actually Libyan, which is why I took issue with comments stating this as fact. Most people only know what they have read in the MSM.

Hinson,

That's an astute comment. Historically yesterdays 'terrorist' usually evolves into tomorrows 'statesman', and both labels are inaccurate. I remember Thatcher once called the sainted Nelson Mandela a terrorist in the House of Commons!

Two "above ground" comments on some very good work:

First, The interplay between politics and rates of discovery and production is especially informative for those who believe, as I do, that political decisions make more difference to the actual year to year shape and slope of these curves than underlying geological bell curves. Spikes, canyons and even flatlines.

In effect, the guy who made some of the worst decisions a leader can ever make, bombing civilians etc... made some good decisions for his country by husbanding oil resources. Could we not expect more of these decisions on the part of other exporters? When you think of it, some kind of natural, you might even say God-given, version of the US SPR makes sense. Hold back a portion of productive capacity (not just reserves) until it's really needed. Maximizing production of a finite resource is cornucopian thinking at its very worst. Why we're at it, why not just drain the SPR?

Drilling and infrastructure investment rates and foreign investment policies as well as production/export rates, especially domestic oil and other price subsidies are all political decisions. This is especially the case with the large amount of foreign content, including employees, Libya will require to hit the targets in Luis' article.

Second, the history of Libya brings the depth of historical grievance and related political instability into sharp relief. Whether you think it was justified or not, the tactics and rhetoric of Libya's Jamahyrah drew equally on 20th century popular movements and political and "military" actions straight out of the middle ages. Describing Qaddafi as a knight is indeed appropriate. Black or white depends on your perspective. The chequered cloak of all rulers.

Subsidies betray political weakness as well as a cornucopian taint to policy-making. Did I miss a discussion of local motor gas, diesel and power pricing? The remarkable rate growth of per capita oil consumption all the way to US levels implies pretty good consumer prices!

IMO, Luis excellent analysis falls short on politics. The "golden age" he foresees may give way to chaos and/or palliative domestic price subsidies. The rate of growth of Libya's population is extreme and food is almost all imported. But most of all, Libya has no succession or transition plan. Qaddafi's older son recently renounced a claim to his Dad's populist throne. No mention. The Colonel is a little behind Castro, but starting to fade. As an aside, I wonder if the Colonel might help persuade "el jefe" to leave a legacy that is a little more pragmatic?

If Libya is to become a "normal" country, stable and democratic, it will need to emulate countries other than its erstwhile colonial overlord, Italy! Otherwise, there may be quite a struggle post-Qaddafi. In the absence of courageous leadership, Libya's golden age may only prove to be a golden age for motoring. Exports may suffer accordingly.

That's a very interesting set of comments.

I'm more comfortable (less uncomfortable?) projecting net exports than politics. For me the main difference with Libya is that its population and population density is smaller than most other oil producers, and the growth rate is already easing down. Hence the projected consumption growth – still short of the Middle East benchmark.

Agriculture may not be fluorescent in Libya but the temperate climate is just across the Mediterranean. As long as good relations are kept with Mediterranean European states, food is guaranteed to some extent.

I agree with you that replacing the Colonel will be the hardest obstacle to overcome for XXI century Libya. That's why the post opened with the words it did – his personality has mingled with the country's identity itself. Another figure like him is unlikely to emerge soon and the alternative might only be a fast switch to representative democracy with its associated problems (especially in oil endowed countries).

Still, “el jefe” is pretty much out of the equation and Cuba has held. So far.

Luis,

Good work, as usual. I guess that the only difference between your work and ours (Khebab/Brown) is the slope of the net export decline by some of the top net oil exporters. We agree on the final destination. Here is a little missive I wrote last night regarding current events:

Jeffrey J. Brown

P.S. The actual EIA net oil exports from Saudi Arabia are shown, along with my 2008 estimate:

2005: 9.1 mbpd

2006: 8.5

2007: 7.9

2008: 8.4*

*Estimated

Note that the cumulative shortfall--between what Saudi Arabia would have exported at their 2005 rate of 9.1 mbpd and what they have actually exported--will almost certainly cross the one billion barrel mark next year. These are the numbers that no one in the media talks about when they talk about the rebound in Saudi production (to an annual production rate below their 2005 rate). IMO, declining net oil exports should be the #1 story in the world.

Jeffrey, a few things come to mind reading your comment:

Luis,

The HL plot for Russia, which admittedly only addresses their mature basins, is beyond scary. Our middle case has Russia approaching zero net oil exports in about 17 years. My guess--and it's only a guess--is that Russia's frontier basins are to Russia as Alaska is to the US, i.e., not a panacea.

IMO, just about the only thing you can do with Iraq is to ignore it. Who knows what will happen?

One point to keep in mind about the Eighties is that the big price break didn't occur until 1986, when Saudi Arabia increased their production. Also, consumption in 1990 was higher than in 1980. An interesting "What if" is what would have happened to oil prices in the Eighties if oil production had continued to decline. Of course, the big threat from the net export model is that we are probably looking at an accelerating decline rate.

BTW, Venezuela is difficult to model, because of the unconventional production and political instability, but their net exports have fallen at about 100,000 bpd per year for 10 years. Extrapolated out, they would be approaching zero net oil exports in about 20 years, and their recent rate of increase in consumption, about 10%/year, is certainly not helping.

This is a very important point. Even with demand going down, high prices were needed to develop those new oil provinces.

As for Iraq I intend to look into it in one of the next numbers. I don't yet know how to approach it, maybe I'll open an exception and use two alternative scenarios; there is an ocean of uncertainty on its reserves.

As for Orinoco I incline for Colin Campbell's plateau of 600 kb/d. They are teaming up with international companies to develop it. And as long as oil prices keep high the Bolivarian Revolution is here to stay.

Well, actually, it looked like oil was beginning to run out, like our friend Yergins likes to point out. My familiy (small producers) mentioned those days with pleasure. EastTexas was discovered in 1932 sending prices into the basement.

To give you some idea of our current rate of consumption, in the three years since 2005, Saudi Arabia will have produced the equivalent of about twice the URR of the East Texas Field, the largest oil field in the Lower 48, which took decades to fully deplete. Worldwide, in four years we will have consumed the equivalent of about 20 East Texas Fields, which based on Deffeyes' estimate, is about 10% of our remaining conventional crude oil reserves.

Of course.

Now calculate: how much more oil came from Texas than the Pensylvania/Ohio basin (important before Texas)?

And in hindsight it all makes sense.

Just like PO might just make sense to the larger population (like evolution or plate techtonics took a while/are taking a while to make sense) *after the fact*. For Luis it's obvious that there was plenty of oil and coal in 1929. For most producers in 1929, however, that was not obvious, just like it was not obvious that stocks were about ready to fall over 90%. Especially because there was enough of everything else around (which, btw was one of the biggest problems of the economy at the time - horendous oversupply of everything, starting with farm produce arising from mechanized ag. and ending with factory products off the assembly line). Repeat in the 2000s. Too little demand for everything (baby boomers going into retirement and sitting on a load of debt) and an overabundance - the market being swamped with Chinese goods..

Except this time resource scarcity is beginning to rear its head. Depression (a winding down economy) will meet basic scarcity (food, energy, minerals and water). Who knows how this coctail is going to explode? Who knows how a Libya or even US might react? And what is going to save us if the Almighty Dollar is not? Two world wars and depression destroyed the Pound. How is the Energy Empire going to crash and burn? Goldman Sachs et al has been working many decades to destroy the economies around them and are now being destroyed themselves. What will remain for the next round of turbo-capitalism?

You might see where we're going now with the simple EL-Model in terms of oil consumption. But does it take all our genius just to come up with something as simple as that? You might view the world in terms of PO, but what about demographics and monetary contraction? These are going to be the three things that are hitting us like a baseball bat the next two decades or more. First USSR then Japan, now slowly Europe and quicker than anyone can imagine the US, the real problems beginning after 2010.

The world just ain't that simple. And mitigation from our oil hungry society is only one (small?-) piece of the puzzle. It was the last piece that I put into my worldview not even a decade ago. It's hardly the cause of everything else going on, but it certainly plays a big part.

Anyhoo. Enough ranting. My point was that we view 1929 from a wonderful perspective. We view 2008 from a much poorer one..

Iraq is difficult to forecast. I don't think it will reach 8 mbd but in an optimistic case it might reach 4.5 mbd by 2014.

On June 30, 2008, Iraq Oil Minister Shahristani hoped that Iraq's production will reach "4.5 mbd by 2013 from its current level of 2.5 mbd".

http://www.upstreamonline.com/live/article158317.ece

Only a few days later on July 3, 2008, Shahristani "told lawmakers that short-term technical support contracts worth around $3 billion may not get signed" which will limit Iraq's ability to increase oil production.

http://www.upstreamonline.com/live/article158500.ece

Iraq may have significant remaining oil reserves but extracting that oil is not easy.

Iraq has produced about 32 Gb of crude & condensate to Dec 2007.

OPEC Annual Statistical Bulletin http://www.opec.org/library/

The creaming curve for Iraq below indicates a total URR of 130 Gb.

source http://www.oilcrisis.com/iq/iraqLaherrere.pdf

The black line in the chart below shows that Iraq could produce up to 8 mbd peak plateau, assuming no constraints. This is highly unlikely.

Colin Campbell has dropped his forecast peak production rate for Iraq from 4.5 mbd in December 2002 to only 2.65 mbd in June 2008. Campbell's peaks are assumed to peak plateaus in the chart below.

http://www.energiekrise.de/e/aspo_news/aspo/Newsletter024.pdf

The Iraq Oil Minister hopes that 4.5 mbd can be reached by 2013. The forecast below delays this production rate of 4.5 mbd by one year to 2014.

Given the instability in Iraq and the need to drill production wells and build necessary associated infrastructure, an upper bound peak plateau of 4.5 mbd for Iraq seems reasonable.

Iraq's importance in world oil production is stated by IEA's chief economist, Fatih Birol, in June 2007:

http://www.energybulletin.net/node/32242

Judging by the economic catastrophe underway, the whole world is going to be using a heck of a lot less oil. The real fun begins when the government takes on so much debt and prints so much money that the dollar is repudiated and has to be revalued. Then we'll be paying $4 to the Euro to buy oil priced in Euros or whatever new regime the Chinese and Arabs come up with. Did you catch the article in China Daily News calling for a new monetary order EXCLULDING the US dollar? That is the growing sentiment as they watch us go down the toilet.

Libya broke the monopoly held by the "Seven Sisters" over the development of ME oil. Instead of offering a single national concession, Libya forced oil companies to compete for exploration blocks. Occidental was one of them. This allowed smaller companies to break into the ME and resulted in the rapid acceleration of Libyan output in the late 1960s.

Indeed, before 1973, oil prices were on a downward trajectory thanks in no small part to this policy.

Then, everything changed.

Look at all that debris from Pan Am 103! That stuff must have been planted because we all know that plane crashes do not leave wreckage, and they certainly do not produce holes bigger that 20 ft.

Difficult to plant bits of humans all over a 10 mile countryside. They found them by watching where the crows were feeding.

Jim Swyre (lost his daughter in the outrage) is sure the Libyan did not do it.

Phil

(Scotland)

Is NATO member Spain a potential threat to the US? McCain is not sure.

http://www.usnews.com/blogs/robert-schlesinger/2008/09/18/john-mccain-ge...

Libya recently signed contracts for exploration and redevelopment of blocks with known reserves. They did not have access to technology during the years they were suffering sanctions. It is known production is scheduled to rise above the 1.6 million barrels of daily crude production recently cited as from a Libyan national source. The NGL's add to this figure. The EIA indicated that Libya was considered not fully explored as defined by current exploration standards.

Its funny, China alone might well gobble up the entire 2020 export volume in a scenario of 60-70 dollar oil that was forecasted a year ago for the next decade. Yes, thats right, China could well gobble up 25 mb/d by 2020. It would be about 7 barrels per person annually, which would be well below what Japan and Korea consumed at the same development level. The car culture hasn't really started yet in China, they are at a level of cars per 1000 people where America was in 1913. So the price has to go through the roof to prevent China from consuming anywhere near 25 mb/d.

I wonder what the chinese authorities are thinking...Surely they must be aware that the oil consumption is about to go through the roof with all the cars hitting the road at this stage of the development level. Do they feel comfortable that the oil production can reach 125-130 mb/d by 2020 to meet the global demand? It seems like they do, because they are promoting cars for the people, and those cars are ICE cars, they do not go any different path than what Europe did or Japan and South Korea. We are looking at a 500 cars per 1000 people scenario in China 20 years from now, that's where the current trend s are leading us to, 700 million cars and trucks on chinese roads. What are the chinese authorities thinking?