Oilwatch Monthly - August 2008

Posted by Rembrandt on August 18, 2008 - 11:18am in The Oil Drum: Europe

The August 2008 edition of Oilwatch Monthly can be downloaded at this weblink (PDF, 1.34 MB, 26 pp). In this edition I have added more demand, oil stock and production revision data.

A summary and latest graphics below the fold.

Latest Developments:

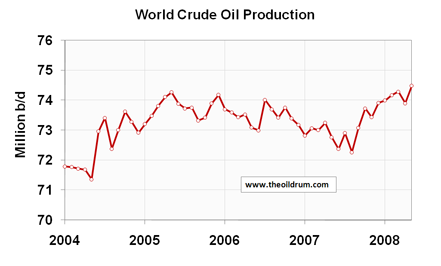

1) Conventional crude production - Latest available figures from the Energy Information Administration (EIA) show that crude oil production including lease condensates increased by 580,000 b/d from April to May. Due to the recent downwards revision of historical crude oil production statistics and the 580,000 b/d increase, the long held May 2005 record of all time high crude oil production has been broken in May. The new record is 74.48 million b/d.

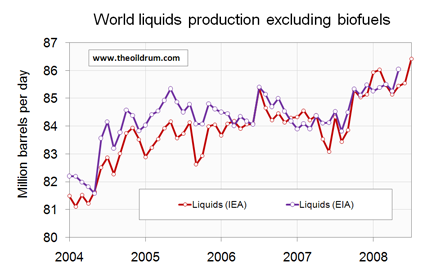

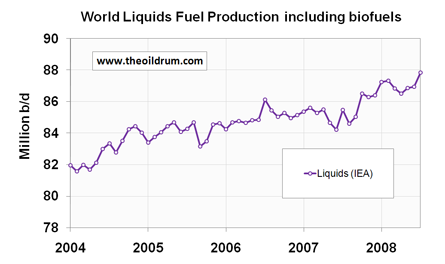

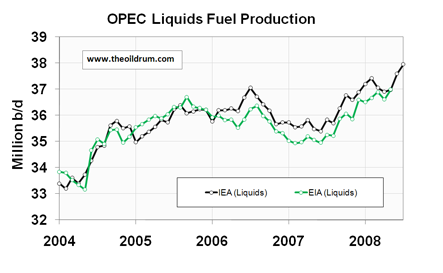

2) Total liquids production - In July world production of total liquids increased by 890,000 barrels per day from June according to the latest figures of the International Energy Agency (IEA). Resulting in total world liquids production of 87.84 million b/d. Average global production in 2007 was 85.41 million b/d according to the IEA. In 2008 an average of 87.08 million b/d has been produced from January to July. The US Energy Information Administration (EIA) in their International Petroleum Monthly puts average global 2007 production at 84.44 million b/d and average productin in the first five months of 2008 at 85.49 million b/d.

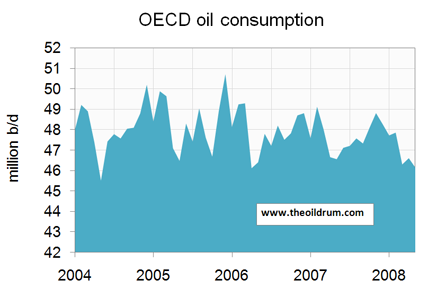

3) OECD liquids demand - OECD liquids consumption in May 2008 was 46.14 million b/d, a decline of 409,000 b/d year on year. Average consumption in 2008 in the first five months of 2008 was 46.92 million b/d, which is 659,000 b/d lower then consumption in the same period in 2007. The decline is mainly a result of a decrease in oil consumption in the United States. Consumption is 757,000 b/d lower on average from January to May 2008 in the US then in the same period last year. In comparison consumption in the rest of the OECD is almost flat relative to 2007 consumption.In the first five months of 2008, 15.15 million b/d were consumed in OECD Europe, slighlty higher than the 15.11 million b/d consumed in the same period in 2007. In OECD Asia consumption averaged 7.75 million b/d between January and May 2007, versus 7.77 million b/d in the same period in 2008.

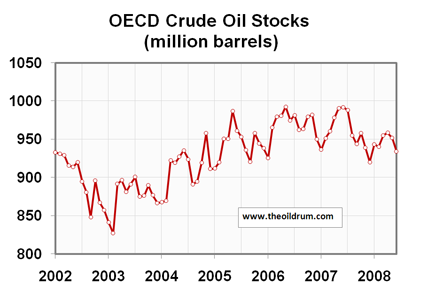

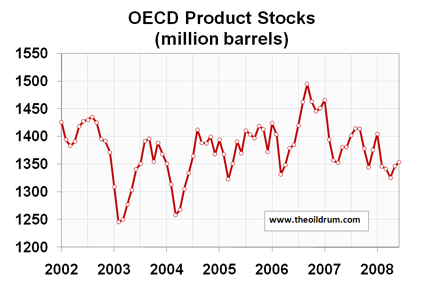

4) Oil stocks - Industrial inventories of crude oil in the OECD decreased in June to a level of 934 million barrels from 952 million barrels in May according to IEA statistics. Total industrial product stocks in the OECD were 1353 million barrels in June 2008, an increase of 6 million barrels from a stock level of 1347 million barrels in May. Total product stocks still stand slightly lower than the five year average of 1379 million barrels. While total OECD stocks are in relatively good shape, oil stocks in OECD Pacific are at a low level. Crude stock levels in OECD Pacific have been residing around 155 million barrels for four months. An event that has not occurred since at least 2002, the first available year of stock data.

A selection of charts from this edition:

This graph shows that, irrespective of downward revisions, the 'plateau-like' pattern from 2005 to mid-2007 was broken with the high prices of 2007-8. Whether this represents a sustained uptrend or blood from a stone remains to be seen.

How much of this is 'new' production (i.e. new reserves found and brought online in last several years)? With deMargeries admission that new reserves cost $80 per barrel (and GOM FUD near $80 already in 2006), at what point in demand destruction (or behavioural change) does a drop in oil prices induce shut in production?

In sum, more oil, but at what cost? The models and forecasters predicting over 90mbpd a few years ago might be right but still wrong....i.e. if marginal barrel costs $150 plus lots of water and environmental damage by 2015 will increased production improve or detract from our energy situation?

@Nate

Given that most of the incremental new conventional production comes from Saudi Arabia, and almost all from the middle-east, I wouldn't be too sure about this being a sustained uptrend. Especially given the production decreases in Saudi-Arabia/Middle-east that preceded this uptrend.

It also makes it unlikely that a large share is from 'new' production.

Given that most of the incremental new conventional production comes from Saudi Arabia, and almost all from the middle-east...

Hm. And we exclude the possibility some (or all) of this is being diverted from Iraq?

If one takes the numbers from the EIA, it looks as if these production increases are only a short reaction to higher prices. They show a peak in october 2007 and during 2008, the production increases loose their speed. I think that with ever higher prices, we will see several of those temporary production increases, which will level of over time and at a certain moment will no longer compensate the underlying trend.

The economic model of higher prices does still equal higher production...in the sense that more people are willing to spend more to produce. However, the resource base which all the oil comes from is eroding, thus modest increases take much more money.

The two big changes in 2008 are:

1. Saudi delivering extra crude, between 500,000 and 700,000 bpd through August, and

2. The drop in consumption in the US of approx 700,000 bpd.

Each one of these moves is close to 1% of production and combined is close to 2% of production.

Looking forward the key questions are:

- Can Saudi continue to deliver at their August rate?

- Will consumption recover as prices drop?

I think very lilttle of the consumption drop will be back in the US but it should be seasonal if I'm right about the housing market. Most of the home building is itself through the summer in a lot of US. So I think its pretty save we have seen a pretty much permanent drop of 700,000 bpd at least from housing. Also as we head into the winter again if I'm right and housing is the major cause we should see winter demand remain robust and close to last years levels.

I doubt it drops much more and we may see some slow growth just from population growth alone.

China and India's economies are slowing but they are still growing plus these new lower prices may cause a rebound in some of the poorer parts of the world. If world oil demand is growing at 1% a year and this winters demand is robust and we simply include export land and continued growth in China/India albeit slower then we probably won't see demand drop at least in the US. However the housing industry throughout the world is finally pretty much slowing everywhere so we should see demand declines say in Europe and Australia for example or at least flattening. So overall worldwide demand should be fairly flat once all factors are taken into account at best growing slowly.

As far as the Saudi's continuing I don't thinks so. But overall from here on out its really supply thats going to be setting the price not so much demand. If supply remains adequate then the world economy probably will basically stagnate however if it drops then we should see much higher prices and the world economy move closer and closer to overall shrinkage.

However the world economy is so large today I'd have to think that it may take several years just to slow down out of shear inertia alone. We are coming off of whats probably the biggest bubble the world has ever seen or will ever see for that matter. Its simply going to take time to deflate it.

Think about it 700,000 bpd ?

Well we saw one of the largest industries in the US tank (housing) and its heavily dependent on transportation. We saw the price go high enough that commuters that could would have switched to a more fuel efficient car. Combined now matter how you weight it these are one time gains. Where would we drop another 700,000 bdd ? Going from 15 mpg to 30 mpg is great but the next step is 30 mbp -> 40mph.

Goldman Sachs in a recent note indicated they are now using 105.00, as the price to bring on the new bbl (marginal bbl, incremental bbl--whatever phrase one prefers). In the comments this weekend from the OPEC Governor from Iran, he flagged 100.00 as a level that could trigger a slowdown, of future projects. I have been using 90.00, which is based on public statements from state oil companies like Petrobras and Statoil, that do lots of expensive offshore work. Also, CERA's cost inflation numbers for oil services gives one a sense of how the oil price is much more volatile than the steady progression of inflation. Russian Export Tax and Extraction taxes are also good too look at. Currently, there is virtually nothing left for the Russian producer were oil to go below 90.00. (The export tax was raised significantly 01 AUG 2008 based on the average price of the previous two months). Overall, so much new supply has come from unconventional, it's also good to see what you would have to spend now in Alberta, to actually get a flowing bbl from the oil sands.

at what point in demand destruction (or behavioural change) does a drop in oil prices induce shut in production?

My answer is that the 100 dollar level for a period of time causes producers to re-think future projects, possibly putting off their start dates. At 90.00, some expensive EOR and some Russian exports go a bit soft. At 80.00, new and proposed deepwater may require a second look. Also at 80.00 coal and NG probably get a bit cheaper as well.

Oil falling to 80.00 would be a boomerang to some new high level, imo. While I cannot know what is in the mind of the OPEC Governor, I would say this: his efforts to keep oil above 100.00 would probably ensure a better stream of supply than were oil to fall to 80.00. Public frustration with OPEC will blur and hide this idea, sadly. Moreover, any OPEC cut will also feed into public perceptions that "there's plenty of oil."

Best,

Gregor

thanks - that makes sense.

Though I understand that onshore wells are much easier to just turn on and off due to market weakness than the more complex (and costly) offshore projects. But, just like with nat gas, there is a rising floor on oil (barring short term hedge fund liquidations or rule changes on who can own futures contracts).

A more interesting question (pertaining to Goldmans comment) is what % of all production is in the neighborhood of the 'incremental barrel'? If KSA has 7 mbpd that costs $5 and 2.5mbpd that costs $105, at $115 they still make a great deal of money. Smart observers will note it is possible for them to LOSE money on their marginal barrel to appease a call for more production, while still making money on the dregs of the supergiants. An important question this - one I doubt many (any?) people have data on....

Hmm I'd be surprised if Saudi had much left thats producing at a 5 dollar a barrel cost. They have put in a lot of very advanced horizontal wells. I'd say that they probably are over 20 dollars a barrel on their cheapest wells. Not that we know for sure but just reading what they are doing seems to indicate that 5 is almost certainly to low and a reasonable guess is say 20-50 ?

I am a bit confused about how far wells cann be turned on and off. Some people say that technically (considering the oil flow?) wells cannot be (simply?) turned on and off.

On the other hand I've heard that some wells are mothballed for a possible later production. And what do swing producers do if not slowing or stopping the pumps?

Great comment, Gregor.

Do you have any time series data from any source for the minimal cost of incremental production (any specific area or worldwide)?

It would be interesting to see how this has developed in the past 10 years.

I've only seem some CERA data from the recent time.

At the moment, when I post and talk about the incremental bbl, I do try to show that my 90.00 level is something that I have cobbled together, and that it's not a hard target. I don't know how Goldman gets their 105.00 level for oil, or their 9.00 level for NG. The incremental bbl is therefore an ongoing work in progress for me.

My thesis is as follows: it doesn't matter that many OPEC producers are still pumping bbls from legacy fields where the cost has fallen towards zero. Or, even, that some of these can bring on new supply at levels that are still pretty cheap. Let's say KSA is bringing on new supply at a marginal cost of 40.00, or even 25.00, or even 15.00. None of that applies to my view of the incremental bbl.

My view is: what is the highest price level needed to bring on the actual bbl that allows the world to obtain a net increase in supply? As we are not currently obtaining a net increase in crude oil supply,(or let's say we are but only in slight upticks that are in the margin of error), then we are currently very much in the zone of the incremental bbl right now. This 100-120 level.

When I try to explain the concept to people in a more general sense, I ask the following question: what happens to the price of oil if we take off all the unconventional bbls, from the Alberta Oil Sands? Then I go on to explain the cost inflation in the Oil Sands to bring on new supply currently, and in the future. Then I go back to the first question: can the world obtain higher levels of oil production if the Oil Sands producers do not increase production?

So this is how I think about the issue in a conceptual sense.

BTW, when TAQA the Abu Dhabi Oil Company invested in the oil sands in the last 18 months, one of the explanations that was given by the investment managers, was that TAQA wanted exposure to the incremental bbl, which they saw as being set at a new high level by oil sands production. In other words, low cost GCC producers with their legacy fields of easy to extract conventional oil need to re-frame the pricing environment, such that while they can enjoy the spread between their cost and the marginal bbl, that is a profit phenomenon now, only. TAQA was looking forward to the re-pricing of oil.

In a specific sense, however, were labor and metals to drop significantly in price, then I think Goldman and others might have have to start lowering their incremental level from 105.00. On the downside, therefore, my view is that labor, materials, and environment are playing an equal role to geology right now, in the mark-up to the new high level of the marginal bbl(this may be stating the obvious). And then of course there is the matter of EROEI, which as others are pointing out, is probably at a rate of decline that probably outpaces our ability to analyze it in real time.

The bottom line is that this is a very tricky thing to quantify.

In terms of market prices and the near term, my view is that if oil can hold above 100.00 to 110.00 in the next 6 months, then the chances of a new spike are reduced. However, if oil goes below 100.00 to 90.00 soon, then I think we could spike to a new high pretty easily before May of 2009, as the lagged negative effects on new supply would kick in starting in late Winter, early Spring next year.

For now, I am sticking with 90.00 as my marginal level, and have new comfort that Goldman is higher and that OPEC is obviously eyeing 100.00. (I also think Petrobras is thinking about 100.00 too).

Cheers,

Gregor

I'd like to see a graph of nth barrel of oil vs. cost to produce. Has anyone seen such a graph? I would imagine it to be "hockey stick" shaped or an exponential curve.

I would like to use a graph as this to make an economic argument.

Note that if we use the 5/05 rate of 74.3 mbpd as the index rate, the EIA shows the average daily rate through May, 2008 to be basically flat, at about 74.2. Of course, we are within the margin of error on these production estimates, but taking the data at face value, the cumulative difference between what we would have produced at the 5/05 rate and what we have actually produced continues to grow, albeit at a slow rate in 2008. What the cumulative difference metric gives us is our cumulative inability to simply match the 5/05 rate, despite the fact that oil prices are currently twice the average annual 2005 price.

And a Saudi net export reminder. Their annual (EIA) net export data and my 2008 estimate follow:

2005: 9.1 mbpd

2006: 8.5

2007: 7.9

2008: 8.4*

*Assumptions: average annual total liquids rate of 10.9 mbpd (versus 11.1 in 2005) and consumption of 2.5 mbpd.

Our economy is based on growth. Economic Growth approximately equals Energy Growth times Efficiency Growth

Since Energy Growth stopped in 2005 economic momentum has been decaying (indicators of foreclosures, growing unemployment and recession). Even if some source of additional capacity comes on line, it is unlikely to counter the momentum loses. Add in the Export Land Model and it seem pretty clear that, economies can no longer grow based on oil.

The facts seem pretty clear that we must either increase efficiency by 2-12% per year or accept economic and population carrying capacity declines of 2-20% per year.

It seems unlikely any new oil production peak, based on price and size, will reverse current, and growing, negative economic momentum. It seems that policy makers should regard 2005 as Peak Oil or at least Peak Growth and change assumptions to radically increase Efficiency.

It is possible for 17X (4% to 70%) efficiency gains in urban transportation but to do so requires change government's management from Planning to Standards. Here is an example of a shift to 100 mile per gallon standard.

The problem with efforts to count economic decay is they take time. Even planting Victory Gardens will take several years to make an impact. "Plateau" means we are out of time.

If we acts agressively, those actions may extend the plateau and restrain the panic that will accelerate post plateau declines.

It looks like total world liquids produciton is up about 1.5 MMBPD since March. At the same time, OECD consumption is down by over a MMBPD. And yet OECD Crude and Product stocks are flat or have even fallen a tad.

Pray tell, where has all that oil gone?

There is, afterall, something called mass balance:

Somewhere outside the OECD somebody must have one hell of a lot of oil stored up. Either that, or the non-OECD countries must be burning one huge amount of oil.

It would seem like we have several options:

1. Non-OECD is using (or storing) a lot of oil, suddenly.

2. World production is overstated.

3. OECD consumption is understated.

4. OECD reserves are understated.

5. Some combination of the above.

With world prices dropping recently, I am a little suspicious that it is (4) predominantly. With the Olympic, there was probably some stockpiling before the Olympics, so their may have been some (1). If recent patterns hold, there may be a little of (2) as well.

I expect that all these numbers have quite an error range about them. Even looking at US EIA data we sometimes wonder how the reported flows possibly match up with reserve balances.

Hello Gail,

I am certainly no expert, but it takes energy to extract the sulfur from sour natgas & crude. You could potentially 'store' a lot of barrels of crude equivalent in all the sulfur refinery blocks worldwide. Then hire some clever accountants to hide these barrels....

Huge sulfur stockpile photo:

http://www.airphotona.com/image.asp?imageid=3874&catnum=5200&keyword=&co...

Are just these two piles = 100 million barrels of transformed crude? They are currently selling this at a price/ton like it is raw crude oil.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

I'm looking at the tanker report right now from oil movements its not public unfortunately.

In my opinion its worth its weight in gold.

From the tanker report we did get a big surge at the end of July/August. However its now dropping off.

Before that the overall traffic pattern matched well with 2006. So OPEC did not ship any more oil by tanker this year then they did in 2006 except for a brief surge. The OECD stock levels and tanker traffic are in excellent agreement for the three years I have tanker traffic 2006-2008.

2007 was low second half of the year and this matches well with OECD stocks getting drawn down through 2007 and most of 2008. So two number that we can think of as reasonable tanker movements and stocks point out to only a sharp almost dumping of oil in July/August.

As far as where the oil went eastbound traffic was well over 2006 for most of the year with westbound traffic actually below both 2006 and 2007 this matches well with the price action we saw on the markets assuming that China was stocking up for the Olympics. Then westbound just briefly touched the 2006 levels over the last two months but its coming off the lowest levels ever shipped west through May, June and July.

Eyeballing the graph for two months July/August exports from OPEC went from about 34mbpd to 37mbpd while in 2006 it was closer to 35-36 mbpd before the dip and surge in 2008 it was running basically at 36 mpbd.

If it does not show up in the tanker report then the oil probably does not exist. If it does exist and the totals are real then all this extra production is going into internal use in the exporting countries. Accounting for oil usage internally in these countries is probably poor.

Finally I'd like to add that the recent additional exports fit well with the emergency 60 day extra supply that the Saudi's claim they can deliver and I've personally never doubted given their production capacity that they could surge temporarily for 60 days at least 1mbpd. So at the end of the day as far as I can tell 2008 has so far been a repeat of 2006 with a brief extraordinary surge on the part of KSA that seems to be ending.

So using two pieces of data I actually trust the production numbers from OPEC are highly suspect for most of 2008. Overall we seem to be on the same bumpy plateau we have been on since 2005 nothing has really changed dramatically.

There's some pretty graphs here, including OiT changes.

I especially liked the 'miscellaneous to balance' graphs which varies upto 800k brls/day...

Hi Memmel,

I am not sure to understand your conclusion. I would think the current plummet in tankers rate as disclosed in TankerWorld should reflect a decrease in the oil exported to OECD. I suspect this decrease should be visible in the forecoming weeks.

The current decrease of tankers prices contributes to the oil price fall as the price of WTI includes the cost of freight to the US. So the current market suffers different negative forces:

1. crude oil stocks have gone up recently

2. freight cost have gone down and exacerbates the fall

3. momentum has turned negative for financial players

But I would personally see the current situation as bullish since the tanker rates hints a decrease of the oil exported to OECD. The price should regain some strength by the end of the year, which was not the case in 2006.

I'm super bullish predicting 160+ by December.

If the KSA surge was what it seems to be and and emergency surge then they will have to rest their fields over the next several months. Further more they may be in real decline in Ghawar so the percentage of light sweet may drop from them going forward. And finally overall production may drop. And on top of all of this they may withhold what ever real production they have claiming that the market is swamped and they want to put a floor on prices.

The important point is for them to keep bluffing they have to have real extra capacity in reserve otherwise the game is up.

This all adds up to a really steep drop in future production in the coming months.

I could see price hitting 160.00 by December as long as price hits a lower number first, like 100.00. My view would be gasoline below 3.50 in the States, say for 4 weeks, plus some relief on European NG and GASOIL heading into late September would provide the set-ups for the new spike. Renewed demand combined with a fresh drop off in supply, such that demand is responding to lagging price created by the previous demand-suppression, would be the set-up.

To wit: I think these N.A. NG prices are already at the set-up level for potentially new ATH in NG this Winter. I think we're going to see some current production go off line, and I definately think we will see some intended production get shelved. 7.75/MMBtu is simply not enough.

There does appear to be am overshoot taking place right now in the commodity futures prices that may have gone farther than the physical market warrants. In the Grains, and in the precious metals, there may be some signs here. Hey, it's a credit crunch and leveraged players have to raise cash. The USD strength only exacerbated such.

SEP Oil expiration is Wednesday. NG expires a week from Wednesday. Then we move on to the OCtober contracts. I have a hunch all these questions will start to be answered when the October contracts become front month. When the next move(s) higher come, I also think the rate of change higher could be just as fast if not faster than before. This is a very unusual market right now, operating after a one year decline in Open Interest. Price is moving around in accordance with the choppiness that comes with actual users and producers showing up. Specs are out of front month--the front month is operating with fewer, much fewer, information aggregrators. Though, the ETFs are having an effect, and I do think we are getting periodic liquidations from larger players out the curve.

G

Yep the drop in futures out into 2010 etc are almost crazy.

This is why I think its a concerted effort to make things look rosy for a brief period of time at great expense. To get the kinds of moves we are seeing SWF with OPEC being a big player have to be making moves no way can they not be involved at a financial level. I'm sure KSA is correct in the sense that they don't play the oil markets directly but they can have a large influence by liquidating positions held under hedge funds.

The combination of a slug of oil when demand was declining and the way the financial markets have moved across the board is just not normal. The world economy is simply too screwed up for happy times on all major economic indicators to hit at the same time.

My god in the news Fannie May and Freddie Mac have all but admitted to being bankrupt and are on the road to being nationalized this is a huge blow the stock market is finally declining but its weak.

Its like we are having a whole flock of black swans flying overhead but no one is looking.

Crazy.

I think at least some of that futures strip selling is producers selling forward production - at least this has been case with CHK, XTO and some others nat gas producers - can't get loans on unhedged production

Don't disagree but that should be the normal market functioning. However if production costs are skyrocketing and they hare having to borrow significant amounts then they could be hedging a lot more. Given the full court press on speculators the market may be a lot less liquid so that attempts to hedge by big producers are causing the out contracts to fall because the market is no longer liquid. Consumers such as electric utilities don't generally hedge a great deal several years out so basically you don't have anyone to buy the futures.

I think your probably right but this is a secondary effect the speculators left the market because it was going down and we ended up with the above situation.

However just because its a secondary condition does not mean it may not be growing to have a large effect on the market esp longer term futures.

In general I agree that now producers seem to be in a situation that as they hedge forward in time they are no longer getting any premium.

Next I agree that the primary reason they would be hedging is to get loans.

But this means going forward in time these same producers are going to be in serious trouble if NG prices increase strongly.

Its a bit funny but this short term play to force out the speculators and drop prices may well cause some serious longer term problems esp for the shale NG producers.

I've given up on making predictions for the time being. There are too many seemingly contradictory things going on. Of course we lack perfect knowledge, but concerning a lot of what has been happening... it just doesn't make sense. Lately I tend to believe there is some manipulation going on for short term political purposes or the gain of financial insiders.

I've been reading up about naked short selling lately and some of what I've found scares me. There are estimates that NSS has caused between 300-1000 corporations to collapse for reasons they shouldn't have. Knowing that hedge funds along with corrupted financial media have largely hidden this problem, it makes me wonder if we're also being played by similar interests when it comes to peak oil.

I know some people say the oil market is too large to manipulate... but the mainstream financial media also will largely dismiss the problem of NSS. So I'm distrustful of claims that say manipulation is out of the bounds of possibility.

I agree that you are wise to be very skeptical of everything. The vast extent of the NSS fraud does give one pause. Re oil market manipulation, I think the MSM tries to convince the sheeple that manipulators only go long, which is ridiculous.

I think this would only be the case if the recently announced delay had a major impact on their production. Overall, the external evidence supports their ability to get near to 12mb/d over the next two years. So, I don't think they are bluffing, per se. I am concerned about them being able to get to between 11 and 12.5 mb/d only if they get unexpected losses from Ghawar.

Now, if they *are* finding larger drops in Ghawar than expected and those are continuing or accelerating plus delays in projects, then, yes, they may well be trying to bluff their way through.

The above ground factor of wanting to keep a floor under prices probably has significant relevance.

A political consideration: knowing the close ties between this administration and the KSA, it is entirely possible there is some collusion to keep any systemic problems from public view for as long as possible. Bush's responses back in January and February to the KSA saying they couldn't raise production were so mild as to be beyond belief.

Cheers

I had also noticed the discrepancy. Aside from the data error margin I have been suspicious that some of production data from exporting countries (especially KSA)are "managed" especially between production and consumption. Of course "managing" data is easy in the first period. But you have to live with the history from then on and lies become more difficult to cover up.

I have also noticed a change in tone (with the data) from the IEA since the leadership change. They have adopted an overtly more political stance and their data is no longer as trustworthy.

Much of the discrepancy is probably due to the Export Land effect. Every month that passes will demonstrate bigger discrpancies beween production, stock and consumption. Someone will have to "come clean" sometime. My guess this will happen in the next year or so.

The data is definitely very poor and internally inconsistent.

But, some things you can be sure of are ... the price you pay at the pump, oil is finite, the people of the world with the power over how much oil is produced are not stupid, and the Export Land Effect is real.

The IEA says we need ~1.6% a year growth of consumption for BAU ... Europe and USA have either flat or declining consumption and the OECD in general looks to be flat ... if the IEA is correct there will not be BAU in our economies ... and the real world economic situation is? ... hmmmm!

The next time you are wondering where all the oil has gone you should have a look to the world's (still second?) largest consumer:

China is now building its national oil reserve - and will certainly fill it up.

The first four reserves are expected to maintain strategic oil reserves equivalent to 30 days of imports in 2010. Their total capacity will amount to 16.4 million cu m.

This is only a starter: The central government is now selecting locations for the second batch of strategic oil reserves.

http://www.chinadaily.com.cn/china/2008-08/19/content_6948054.htm

Giddaye All,

Forgive my re-posting of this query, however this video - http://www.youtube.com/watch?v=JAPP7o6uG8Y - still has me a little stuck. As an Average Joe-ster, continuing to raise a family in MS and trying to come to grips with possible impending doom for us all, my question remains... How much energy (oil, coal and/or gas) needs to be consumed to extract the so-called 4.5 trillion doable oil barrels described in the video (presented a month ago by BP’s chief scientist – the relevant graph is at 08m38s). Dr Koonin claims another 41 years of oil at 100mbpd – plus unproven/unconventional – and 67 years of proven gas and possibly 1000 years of coal, at current consumption levels (though he also admits by 2050, with BAU and a 9B population, energy consumption will be TWICE what it is today!).

I understand the Energy Invested/Return argument, that only so much oil can physically and economically be extracted and that producing nations may at some point start hoarding for themselves (and that’s fair enough), but is there a best-guess number out there: “At a sustained 100mbpd, we need to burn ‘this much’ (oil/gas/coal) to extract the Earth’s remaining fossil fuel resources available to us”. And how long might it take? 50 years? 100 years?

Apologies that my research lacks any prowess, but at the end of the day, it’s really just the basics I’m after – so I can make some REAL plans (must I know my computer’s history, or even how it works, to use it?). Thanks in advance for your time.

Regards, Matt B

BTW, Dr Koonin’s presentation is well worth a watch. It seems to reinforce the idea that we have plenty of time to sort out our energy woes. Indeed, it has me back on the fence again (in the respect that PO still seems a few decades away).

Would you please stop spamming this?

You have your self-derived answer, so why pretend otherwise? If others felt it worth their while to respond more than they have, they would have. I think you know this. Your agenda is noted.

So far as I know, it is strongly recommended to not keep re-posting the same article to the Drum Beats.

Cheers

"Spam"? "Agenda"? "Self-derived answer"? Huh?

I'm just looking for answers that, as a simple kinda bloke, I can more relate to. That's all. And I re-ask questions sometimes, because I think perhaps I haven't asked them the right way first time around.

Sorry if I've offended.

Regards, Matt B

PS. Did you really think that video was spam? Now I am confused!

If I've misread you, fine, but when I see someone seemingly pointedly post the same info repeatedly, I wonder. Like I was always told, watch what people do, not what they say. Search here on nuclear power and you will find answers to anything in that video, guaranteed, so there's not really much reason to keep posting the question.

And, no, the video isn't spam, it's your posts that I would characterize as spam. Repeated and unnecessary? Sounds like spam.

Whatever. I'm not on the staff here, so take my comments with a grain of salt.

cheers

Thanks CC.

I'll confess, as I continue along this bumpy PO-awareness road, that I keep hoping resource depletion is merely a bad dream and my kid's futures will be bright and rosy for decades to come. And no doubt, I'll probably continue to try and grab onto anything anti-PO - even a video from a BP scientist - for a little while yet. Probably for as long as my immediate family and friends refuse to join the ride.

Which could be some time.

Regards, Matt Blain from Australia

Now to start thinking about a plan B! :)

Just bear in mind that peak oil has NOTHING to do with how much oil is left in the ground, so if somebody argues against peak oil by pulling some reserves figure out of the air (nobody knows how much there is left!) you know for sure they don't understand peak oil.

Anyone that claims coal will be an important global energy source in 3008 AD is not being honest with the uninformed listener.

I guess it's time to give you the benefit of the doubt. What you need to do to understand the systemic problems with BAU is to watch Al Bartlett talk about exponents. If you can watch that and grasp what he's saying, that will inform everything you read, hear or think about in terms of resources and production of them. It should be in the background of your thinking on all these issues. You can google bartlett, search here on TOD, or follow the link on my blog.

Next, you need to understand clearly flow rates with oil and replacement/build out rates on new technologies and how long it takes to replace, for example, 200,000,000+ vehicles.

And that is just getting started.

Let me say this: in a broad sense, it doesn't matter what is happening with PO in terms of preparing for the future because what is happening with climate change will trump all in the end and the wisest choices in dealing with PO will keep this in mind, thus, they will be the same for both. So, localizing, reducing, recycling, growing some or all of your food, living in super efficient (and hopefully renewable) housing and micro energy solutions are musts. Period. So, at the end of the day you don't really need to believe PO is the Big Bad Wolf to get your rear in gear and start protecting your family.

Cheers

Thanks CCPO,

Coincidentally, I watched a 2004 Al Bartlett video a few hours ago - on Seadragon's recommendation. You'll find my response a few comments down-thread.

It hit me like a thunderbolt!

Regards, Matt B

This is a Big Picture type question of the sort already tackled at TOD.

On a personal level it's largely irrelevant. Although its good to know what could be coming over the horizon.

One need only consider the effects of rising fuel prices on family, job and local economy to assess the prudences of BaU or a Plan B.

I'll not forget the run-up to $148, and now the damage is done. We've been a given a brief respite, more time to prepare ( or not ).

Fare Thee Well.

Very good advice.

Who cares if peak is officially all liquids of 92mbd in 2009 or it was crude only of 74mbd in 2005?

You seem to be in the bargaining phase.

Consider the role of net export declines.

http://www.energybulletin.net/node/19420

And don't forget RR's peak lite

http://i-r-squared.blogspot.com/2006/04/peak-lite.html

The effect for you, Joe Average, is pretty indistinguishable from peak c+c.

"Above ground" issues are always a factor. Be they war (in Georgia or Iran) revolution (in SA), hurricanes in the gulf (Fay) etc etc.

Remember what WT says about ELP.

http://www.theoildrum.com/node/2446

There is very little down side to applying ELP a year or two early. It will be very painful if you try it even a month too late, ie lose your job/default on your mortgage.

On the economy side look at what $100 barrel oil is already doing, whether or not we've actually peaked.

Read

theautomaticearth.blogspot.com

or

http://globaleconomicanalysis.blogspot.com/

Look at the shape of the US economy, the housing bust, the credit crisis. The imminent failure of 1 or more of the big three. The insolvency of 1 or more major airlines.

There isn't much time left to delude yourself. Depending on your plan B it might already be too late.

Tar sands and oil shale are not crude oil. The speaker lectures about the amount of resource that is in the ground but does not consider the rate of extraction. Peak oil is about the rate of extraction reaching a maximum and then declining. He also overestimates the amount of ultimately recoverable crude oil (light, heavy & sour) at 3 trillion barrels. We will be lucky if it is 2.3 trillion barrels. The ERoEI of tar sands in Canada is supposedly about 3.5 and oil shale is likely around 1. Crude oil is currently being extracting with an ERoEI between 20 and 30.

When you can successfully explain why this statement proves that he does not understand peak oil, you will have your answer.

A general rule tossed around for extracting oil sands is every three barrels produced took two barrels in energy to get in usable form. Oil shale, so far as I know has yet to be produced with a net energy return, though Shell has said or maybe implied it may have created an in situ process that works - working from memory so if you want to see for yourself, theres a starting point. I'd estimate few here believe it will be done in significant quantities in any of our lifetimes. So, ballparking the actual energy we can get out of the last 2 trillion barrels he talks about is maybe 400 million barrels worth of energy at significant costs, both economical and environmental (look around on the site for receding horizons in "economical prices" of oil). Compare this to a ballpark figure of every ten to twenty barrels of OPEC oil take a barrel's worth of energy to produce.

The trillion barrels the video says OPEC has is suspect, as has been discussed here and in the book "Twilight in the Desert." In short, OPEC may, and is likely, lying about their reserves, and they have a financial motivation to do so, as quotas are based on reserves. What it really is is anybody's guess, but the betting types are playing under. So that figure is exaggerated but the oil it does produce will be fairly cheap in terms of cost and energy. The other figures have a varying degree of reliability, like Artic oil is a guesstimate.

And a key thing to remember is that while we do have a solid 40 years' worth of proven oil in the ground, it isn't going to be a straight line of production, it will have a peak in production, and of course a decline. In other words, the production won't be a flat line for 40 years and then immediately drop to 0 in year 41.

Finally, him saying that peak oil has nothing to do with below the ground factors is total junk. What above ground factors are keeping the Pennsylvania oil fields from producing like they used to? What regulation do we need to get rid of to get Texas pumping out crude like it was in the 70's? Above ground regulations and factors might shift the date of the peak around a couple years, but I doubt many would notice the difference.

But if you want to know a timeline so you can plan ahead, and you adhere to the more Apocalyptic school of thought, there's no time like the present to get to work. Thats my two cents'.

Thanks boiler (and Myrddin, Rethin and Blue) for your feedback. CCPO had me on the backfoot there for awhile.

For the record, I'm still trying to come to grips with all this and videos like the one above simply give me pause (I'm sure it would seem perfectly credible to any PO newbie, official policy-makers included)... And I wonder, is there still a bit of time for our government and business leaders to save the day?

Most likely I am in the "bargaining" stage as suggested. Who knows.

Regards, Matt B :)

Now, to re-read all your posts and try and soak some of it up...

Well considering the Hirsch report said we'd need 20 years I doubt it.

But even if we did do you really think our government and business leaders are doing to "save the day"?

Remember what happened to Carter when he gave his sweater speech. And what did Raygun do right after that?

Elected leaders only do what the people who elect them want them to do.

Joe: Potential Ground Water and Surface Water Impacts from Oil Shale and Tar Sands Energy-Production Operations

In case you're not familiar with how sensitive an issue water is in the US SW: A permanent drought seen for Southwest - Los Angeles Times

To cite just the first link I came across. Water alone will be such an issue with shale as to prevent it from ever amounting to much, assuming voters still have a say in the matter.

Joe,

I think you should watch this video, if you haven't already...

http://globalpublicmedia.com/dr_albert_bartlett_arithmetic_population_an...

It should help you "decode" cornucopian claims made by supposedly learned "experts."

Am I allowed to swear? (I haven't thus far and now seems like a good time). Please, can I?

BLOODY NORA AND DAMN IT ALL TO HELL!!!

OK, calming down...

Now can I make a suggestion to TOD staff? Any newbie here should be immediately directed to this video (or something like it) so that dopes like me don't waste everyone's time, as well as their own, with dozens of lame questions.

This video, even though it's shot on VHS and the framing's rubbish, is something I can even show to the wife and kids!

Thanks, Seadragon. I am now officially PO aware!!!

Regards, Matt B

PS. Just a technical observation on the video (there's probably another path somewhere, so I can download and burn to DVD), I had to install "real player" on Seadragon's link, which was a chore. And the "risk" warnings might put some off - indeed, I almost didn't bother. And that would have been disappointing!

I am afraid to tell you that this only helps to see the video.

If you want the BP story come true you need "real PRAYER".

Joe, it's a nice discussion of exponential growth. It has several important weaknesses, however: the discussion of population is misleading (his solutions are bad); there needs to be more discussion of natural logistics curves, such as we see with population and mature markets; there's no discussion of efficiency; and the discussion of substitutions (a la Julian Simon) is misleading. Those weaknesses make this hard for me to recommend.

Giddaye Nick,

This presentation was like a slap across the face... Doesn't the basic reality of exponential growth - even if it's only a fraction of a percent - supercede EVERYTHING? A year ago, in attempting to understand a little more on rising fuel prices and thus stumbling across this site, I'd thought PO might be one of the root causes. Now I see PO is a mere "effect" of Al Bartlett's pretty basic math and reasoning. Am I on track in this thinking?

Frankly, I feel the video should be shown and discussed in EVERY highscool on the planet! For me, as one of the flock, it's miles better than anything I've seen from Simmons and the like.

But thanks for your feedback nonetheless.

Regards, Matt B

"Doesn't the basic reality of exponential growth - even if it's only a fraction of a percent - supercede EVERYTHING?"

No - see my comments a couple posts down. Temporary or transitional exponential growth is a very different animal.

Nick,

Of course exponential growth is temporary. Nobody in their right mind claims it can go on forever (unless they are predicting the growth rate of renewables that is).

It doesn't really matter if pop isn't growing exponentially anymore because we're already past the overshoot points (and still growing).

And you are missing Barlett's point. He's challenging the notion that growth is good by definition.

Yet again Nick you are fighting demons that don't exist.

Joe,

Have you read "Limits to Growth" yet?

http://www.sustainer.org/pubs/limitstogrowth.pdf

Just printing off a copy (of the synopsis). Thanks.

"Of course exponential growth is temporary. Nobody in their right mind claims it can go on forever "

I'm glad to hear it. Perhaps we've seen the last of those tag lines about infinite exponential growth...

"unless they are predicting the growth rate of renewables that is"

No, no one is predicting that either - just growth until demand is satisfied, then a levelling off.

"It doesn't really matter if pop isn't growing exponentially anymore "

I'm glad to hear that you agree that (large) portion of Dr. Bartlett's presentation is out-dated.

" we're already past the overshoot points"

Well, 1) that's not really part of Dr B's presentation (though it's certainly very closely related), 2) I'm not sure what you mean - humanity had already extinguished a lot of species 100 years ago, and dramatically altered the face of the earth, and 3) assuming you're referring to human carrying capacity - if it's true, it's not due to either energy or food production limits (heck, we could easily feed 15B vegetarians). It's certainly a deep tragedy that we're extinguishing so many other species, but that's different.

I have seen troubling arguments that species extinctions will threaten the biosphere's carrying capacity, but it seems extremely speculative. I would agree that climate change is the biggest problem we have, much bigger than PO - who knows what that will do to carrying capacity - there's a real risk that it's effects on carrying capacity will be very, very serious, but it's still very far from proven. Finally, I would note that humanity's major mistake was not to grow, but to burn too many fossil fuels: 1B people would certainly have overloaded the biosphere's CO2 absorption capacity on a time-scale that is very, very short - it would have simply taken a few more decades, which is the blink of an eye in geological terms, and it's very likely that we wouldn't have noticed it until most of the damage was done, as is true now. All in all, I'd say adding the context of exponential growth is somewhat helpful, but if it takes center stage it mis-frames our problems (and their solutions) quite badly.

"missing Barlett's point. He's challenging the notion that growth is good by definition."

Yes, that does seem to be one of his points, and it's a pretty weak one - he presents no evidence except to suggest that people have no inherent value (He asks "what's improved by more people?").

"Yet again Nick you are fighting demons that don't exist."

I'm glad to hear it - please tell the many people on TOD who make comments about exponential growth (It being impossible, it being necessary to our economy, etc, etc,). Please tell Average Joe, who was quite struck by the presentation, and it's apparent implications for PO/energy.

Giddaye Nick,

Hey, this academic learning stuff is pretty interesting (should've started years ago!).

Just visited here, on population growth http://www.globalchange.umich.edu/globalchange2/current/lectures/human_p...

and noted the declining rate out to 2050 (0.5% by then, currently 1.3%, from a peak of 2.04% in the 60's - US Census Bureau, June 2008).

The site goes on to predict that a pop of 10-20B is possible (9B by 2050), but not at today's BAU (as you said, we'd all have to become vegetarians, or something).

And that's the thing I keep getting stuck on. Though MS media reports financial losses and struggling airlines, there's no real talk about any of the things discussed here (my brother-in-law just returned from China... 64,000 factories closed on Australia raising its coal prices this year - or was it steel? Will we hear about that?).

BAU, I fear, will continue until Al Bartlett's one minute to twelve.

Say 2030? When should I jump in the doomer's camp?

Regards, Matt B

Now even MORE worried about my kid's future!

Joe,

You are not alone in this. There are a lot of us with families trying to figure out what's the best thing to do.

And its tough to wade through it all. Just for some perspective, Nick tends towards the cornacopian/optimistic side of the spectrum.

I tend towards the doomer/pessimistic side of the spectrum.

We'd both tell you we're really the realist!

I've been peak aware for a couple of years now, so I've had longer than you to wrap my mind around this issue and make plans.

Just recently I pulled the trigger and am in the process of hugely changing my life (and my family's life) in preparation of what I see as a major recession/depression in the near term (1-2 years away).

It was a tough choice. It was done reluctantly.

But I feel better now about it having done it.

Its still not easy.

I wish you the best of luck on your decisions.

My advice is not to worry so much about peak date, population overshoot, or mad max like doom.

Try instead to imagine a pretty severe near term economic downturn and the effects it will have on your career and life. And make plans accordingly.

It doesn't really matter who is right, the doomers or the techno cornocopians (the camp I place Nick, though he might object to that label). Just about everybody agrees the transition (whether we move to mad max or electric wonderland) will be a period of rough economic times (at the least).

In other words, nobody really knows what 12:01 will hold. But just about every one agrees 12:00 will suck.

Does this help?

It does, Rethin and I greatly appreciate your time. One to Two years? I better get moving...

I have one last question though (possibly the most obvious): In taking your tough steps, how'd you convince your wife? I'm married to a maths/science teacher (to boot, her father's a retired environmental scientist, Shell Australia - and PO aware himself). Can't even get her to watch "A Crude Awakening" with me. Thinks she'll find it too depressing - though she did watch the first half of Al Bartlett's video... Looking at material for her students, I guess.

As I did with the motorbike, do I just keep nibbling away?

Thanks again and regards, Matt B

Luckily, we have little debt (I've always run the business on a shoestring - paying off the mortgage has always been a priority. Plus I've plenty of DIY skills - added a second storey recently, own hands). But will it be enough?

Shoot me an email (address in the profile).

I hesitate to talk about personal things on an open forum.

Peak oil may be a hard sell.

An economic downturn anyone can get their head around.

Never oversell - work out what objective actions you want to take, and what you need to do to provide persuasive evidence that the actions you want to take are advisable.

"there's no real talk about any of the things discussed here"

Yes, it's a different perspective at TOD. The information is useful, but many of the pessimistic perspectives not so much.

The problem is, as Seadragon is kind've suggesting, that "predictions are hard, especially when they're about the future."

Things could be fairly smooth, with only a bit of stagnation due to money transfers from oil-importers to oil-exporters; there could be serious stagnation; there could be frank economic decline. Which of these happens depends mostly on social issues, such as how oil exporters handle the recycling of petrodollars, and how aggressively importers reduce demand, thus it's very hard to predict. Again, I agree with Seadragon - by 2030 Peak Oil will be a non-issue - probably climate change will be much more important.

I'd suggest www.econbrowser.com (two very reputable & competent, PO aware economists), and www.energyfaq.blogspot.com (my draft of a blog) for further reading.

Ultimately, I think the kind of prudent economic management you talk about in your most recent post makes the most sense. That, and good personal energy management: getting a Prius, insulating your home, getting an air or ground-based heat pump, etc, etc.

Thanks Joe, just trying to help out. Few (very few) people are able to argue successfully with Dr. Bartlett, although it doesn't stop some optimists (yes, Nick, I'm talking to you) from trying.

An optimist says: glass half full; a pessimist says: half empty; a creative realist says: the glass is twice as large as it needs to be.

I think we need a little creative realism.

Creative realism reframes the problem, something Dr. Bartlett has trouble with, as the world has changed in the last 30 years, and he hasn't changed his message with it. As one small symptom of this, I note that he describes electrical generation growth as being 7%: it's actually about 1.8%, and hasn't been 7% for quite a few years.

For another, more important instance, if we're in a plateau, then we're not in exponential growth, are we? (though I think we'll be in Peak Oil Lite (supply growth substantially slower than normal demand growth) for a little while longer still).

Similarly, we're not in exponential population growth, we're in arithmetic growth. Dr. Bartlett doesn't seem to have noticed the Demographic Transition.

So, I think Dr. Bartlett's discussion of exponential growth is great - who could argue with that - but it frames the problems improperly. Let me put it this way: it's overly simplistic to suggest that mainstream economics believes in endless exponential growth in commodity consumption (especially any single commodity, like oil), and it leads to silly discussions of how our world economic system will break down due to stagnant or declining growth in oil consumption.

I do give him a lot of credit for noticing that renewables are now proven to be practical, where they weren't when he started. This presentation is pretty good, but it isn't quite where I would want it to be to present to someone new to energy issues - I'd have to correct too many details and overall impressions.

Joe,

I already posed you an answer of sorts the last time you asked.

Look at the flow rates, forget about R/P, they mean nothing.

Koonin does not touch flow rates, because he can't. Why?

Peak oil is about flow rates, not just about reserves.

Thanks again Sam,

I re-read my original question yesterday and thought it a little vague, so re-worded slightly (being new to this, I'm worried any question that reads non-sensical - or just really dumb - will be instantly avoided). I know I'm treading water here.

And no doubt I'm still grasping with the basics. I feel I need to be well enough prepared when others start asking questions... For example, (though I get flow rate - kind of), when someone argues, "Can't they just drill more holes? I've seen the Koreans (or whoever) on Sixty Minutes building those big drilling rigs". Would I be confident in my answers?

Would I have been confident with your answer, if I myself had been asked?

Regards, Matt B

Still working on it - tough though, with a family to raise (and wondering what the immediate future holds for them).

Peak oil is about peak flow rates (oil is not alone, it is the same for all 'mining' industries) ...

and the flow rates are about profits for the producers (and affording the price for consumers) ...

and the profits are about individual oil wells ...

if you spend, say, a million $ drilling the well, in order to make a profit you have to wait for a million $+ of oil to come out of the hole ...

if you have to get a million $+ out of the hole you can't put the holes too close together since the pool of oil being drained is limited in size ...

which limits the maximum flows from the whole oil field ...

rinse and repeat with lots of wells and you end up with whole country's flows reaching a limit then declining (peaking) ...

and eventually ... the whole world peaking, and all because of the need to make a profit from difficult geology!

Just watching it now.

Remember he's the chief scientist of BP. He's talking in code. First of all he presents a "BAU" scenario and says that there is enough oil in the ground for that. True he doesn't mention flow rates but he explicitly includes "technological" factors as a reason why PO will occur (curiously crediting a colleague with that observation) as opposed to geological factors. Well yes if you had a Star Fleet transporter that could lock on to every molecule of oil and beam it into a tank we've got no problem for decades (the dilithium crystals might take a bit of a hit). He knows this (EOR - enhanced oil recovery - is only 4th on his list of actions).

Next he switches to climate change (which is real and a problem we must solve he says) and that therefore we must not try for the BAU scenario but must switch to renewables, and conservation with nuclear and "clean carbon capture" where appropriate.

He also describes Jevons as one of his heroes. Jevons was to coal what Hubbert was to oil and even has his own paradox

In other words don't rely on fossil fuels is his message decoded. Or, as he puts it himself, "(we must) decarbonize the energy supply".

Haven't watched the whole thing but from skimming it that's my take.

Edit: Watched it all now and, right at the end out of the blue, he brings up the "Club of Rome" (seemingly agreeing with Limits to Growth). He knows we're in the shit.

I'm guessing (Joe Average) you didn't watch the whole video (or even beyond about 10 minutes in). Otherwise your statement: "(it) seems to reinforce the idea that we have plenty of time to sort out our energy woes." suggests a serious problem with your comprehension, which I wouldn't have expected from your previous posts.

Giddaye Undertow and thanks for your comments.

With respect to my "plenty of time" comment, it continues to be my sticking point, even after nearly a year down the track ("how long have we got" was the cruxt of my original thread: Do we have years of BAU, or decades?). It's the only point I sit on the fence for.

And I'll keep asking, I guess.

BTW, I am a sucker for videos (it was a lone copy of "A Crude Awakening" at Blockbuster that started me on this in the first place) and I did watch the whole thing. I even made notes! But I keep forgetting stuff, which I put down to my average IQ (105, at last test), past ignorance (living in MS) and newbie status.

Regards, Matt B

Ok, I'll try drawing a stick cartoon (verbally):

R/P is supposed to imply what exactly?

Reserves to current production rate is a completely theoretical number, which gives a number of years current reserves would last if we had as much reserves as imagined and we could produce them at a steady constant production rate.

Three problems why this number is completely meaningless and should not be used, unless one is deluded, brain dead or wants to mislead:

1) Our consumption growth is tied to economic growth. We cannot stay at current level of consumption, it must grow. There goes the ratio. Growth rate would theoretically dictate how long the reserves would last, if we could produce them at will. And we can't produce theme at will..

2) Our production cannot physically stay at the same current level until we run out of resources. It will drop as time goes by, because geology, technology and resources available make it harder to get each new barrel out. So production will go down.

This raises the R/P ratio, but it is completely meaningless. What's the point of having a gazillion dollars in your bank account, if you can draw $1000 today, $950 tomorrow, $900 the day after tomorrow, etc (approaching zero). After 20 days or more you've gone being able to withdraw near zero amount of money out of the bank. You starve with lots of money left in the bank. This flow of money in this example is roughly similar to how flow of oil happens. Reserves in the ground do not matter at all. Only getting them out at an increasing flow rate (barrels/day) matters and this is physically impossible to accomplish.

3) Reserves are funny numbers. They may be Proven, Proven & Probable, Proven & Probable & Possible and even Proven & Probable & Possible & Pulled-out-the-hat. With each P more, you get a smaller likelihood that the resources actually exist in the real world, instead of being only numbers on a paper conjured up by somebody's simplistic mathematical model.

We all know it is very likely that OAPEC resource numbers are of the last variety, i.e. pulled out of the hat and do not really exist (or more than half of them do not).

So, these three things alone should make it really easy to understand, that R/P means nothing and that it guarantees NOTHING about BAU continuing for any number of years.

Only ever increasing flow rate at c. 1.8% per annum (minimum) guarantees currently any sort of BAU scenario (with our current consumption model, economy and energy infrastructure).

And peak oil is about flow rate becoming really hard to increase (e.g. past 3 years) and the time when that flow rate starts to shrink (currently looks very likely to happen within a few years).

That completely destroys any and all BAU scenario for liquid fuels and starts a non-BAU scramble for natural gas and coal as well, destroying BAU for those fuels as well.

So, repeat after me:

I shall never ever use R/P figures again, they are meaningless

I shall never ever use R/P figures again, they are meaningless

I shall never ever use R/P figures again, they are meaningless

:)

If we go back to the Koonin video he presents NO model, NO data, NO guess, NO proofs, NO estimates of what primary fuel production flow rates could be possible. As such, he tells us nothing about BAU possibility in the future. Nothing.

(Don't get me wrong, the video has many other points of merit and I recommend watching and thinking about it, but it doesn't tell us anything useful about primary fuel production peaks).

Actually, I saw an Al Bartlett video yesterday on Seadragon's recommendation (comment and response above) and everything's changed. Today, your "stick figure" words make complete sense to me.

Thanks. I finally get it.

Regards, Matt B

The question not so bad it deserves that at least one person try to explain it and you could read more here http://www.theoildrum.com/node/3839.

I have not watched the hole movie but I assume that most of the oil they are talking about is from shale.

I will not mention any of the problems and just try to place an upper theoretically limit:

1. Using eletricity to produce oil from shale will imply an eroi of close to unity (see above), so there would at best very little energy.

2. Using natural gas will result in an EROI of 6:1 I can't understand this how are they able to put more energy down in the ground by burning natural gas? I assume that they are able to transform all electricity into heat down in the ground but if they use natural gas they must burn it and use some material to transport the heat down into the ground and there should they get the natural gas? The natural gas production in US which has largest amounts of oil shale is already used for other things.

3. Burn the produced oil to produce oil.

According my not so good analysis that also lack references (you have to do some research yourself).

1. is not useful to produce any large amounts of energy and is therefore probably almost useless to produce oil for transportation.

2. could not be used in large scale because of lack of enough natural gas.

3. could be used but will result in much smaller quantities of oil than they claim.

Observe I have not mentioned anything about economics and that are a lot of problems.

Chart 14 shows the most recent demand for liquids in Iraq dropped from ~.5 Mb/d to close to zero. What happened?

Which country applies to Chart 38? At about 2.6 Mb/d I do not think it is USA?

>Chart 14 shows the most recent demand for liquids in Iraq dropped from ~.5 Mb/d to close to zero. What happened?<

An error from my side, thanks for noticing this wrong tabulation!

>Which country applies to Chart 38? At about 2.6 Mb/d I do not think it is USA?<

Canada, thanks for noticing

Rembrandt

Are the monthly production figures for peak production for that month or are they average production for the month?

This seems a pretty important question that nobody has asked.

Marco.

They are the reported total volume for that country for that month divided by the number of days in that month. There are no countries as far as i know that report on a daily basis.

Rembrandt thanks again for this most valuable publication on Planet Earth. A few observations and questions:

chart 9 - it would be good to see a version of this that was zero scaled

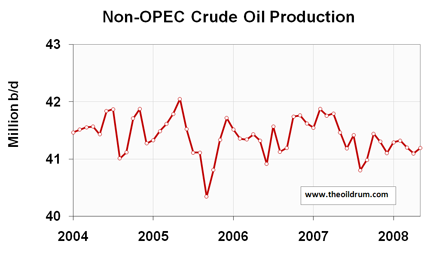

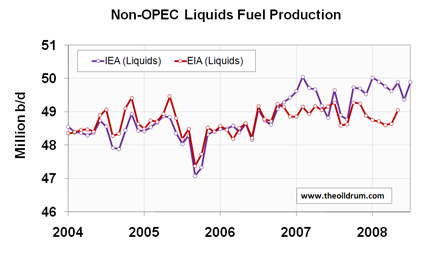

chart 12 - non-OPEC production has now been flat for 4 years

chart 16 - OECD liquids demand highest in winter and

chart 19 - very marked seasonal demand for liquids in Korea and Japan

16 and 19 kind of negates all the chat about US summer driving season - liquids demand is highest in the N hemisphere winter. Any specific idea on Korean and Japan. Do they still have oil fired power generation back up. Or is this domestic fuel oil heating?

chart 31 - non-OPEC liquids exports are sharply lower

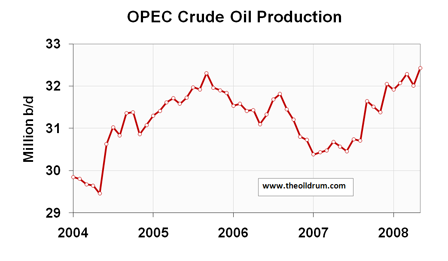

charts 33 & 34 - OPEC spare capacity is down as production has risen = no net new capacity has been brought on

charts 85&86 - the BTC pipeline has capacity of 1 million bpd but seems not to have produced in excess of 700,000 thus far. Have they reached a reservoir threshold or are the ACG fields still ramping up?

chart 90 - Russian production ticking up again - this surprises me. I wonder if Russia may join KSA as swing producer. I'm quite sure they would prefer to produce less and get paid more.

chart 101 - US production decline has been halted.

All in all lots of evidence to suggest that $100+ is stimulating production and dampening demand. At some point the strain on production will just get too much. All this activity building rigs and drilling will drive consumption, and I suspect we may sleep walk into an eroei sink.

Quote of the day...

We should really look this critically.

What dat should we be getting, IF we are going into an eroei sink?

I'll try, experts can correct me:

1) Crud oil API gravity for produced oil for the whole world should be going down (as a function of time, rapidly)

2) Oil sulfur content for global oil production should be going up (as a function of time, rapidly)

3) Minimum cost of incremental production should be going up (at an increasing rate)

4) Average drilling depth, number of well bores, number of rigs and other upstream production effort indicators should be going up

5) Time/cost should be going up

6) Number of refineries retooling to cater for lower quality crude should be increasing

These are most somewhat crude oil demand independent figure and swings in crude oil or distillate prices should not mask them completely.

If we have a theory, it should have predictive power AND it should be backed up by real world measurements (when available).

I can get data for 4, but not or 1-3 or 5-6.

Is there data the proves or contradicts the theory given?

I would say that 3) is the only one that has to be true. E.g. we could have equal API or sulfur oil that for whatever reason requires more energy to harness. Your other suppositions are likely true.

The only hard data we (publicly) have is Cutler Clevelands analyses of 1930, 1970 and 2000 EROI for domestic crude declining from 100+:1 to 30:1 to a range of 10-17:1. But the DOE has since stopped publishing data in energy terms (to save money).

This is why we are sleepwalking - we can understand the concept of total aggregate EROEI decline, but we can't quantify it, at least not without a Herculean effort. I know Prof Hall is working on a global EROI analysis, but we can't even get reserve data from OPEC countries so I don't know how we are going to get energy used.

From todays Drumbeat comment by "Downsouth"

We can back into testing the hypothesis with data like this, but it still is in dollar terms.

I hypothesize we hit peak net energy in oil in 2000-2001, but I can't prove it. Putting all data aside for the moment, what would declining net energy look like to you? Oil has gone up in price from $10 to $115 in 9 years. What has the cost of the marginal barrel done over this time? Declining net energy suggests that energy companies are using more of the energy that non-energy sectors once used. Price is the mechanism by which third world countries, marginally profitable businesses, and eventually non-essential industry gets 'un-allocated' energy resources.

I agree with you - this hypothesis urgently needs testing. But interested parties have been saying this for decades - the problem is that none of these interested parties have money or resources because a global decline in net energy doesn't make anyone a profit. It's a commons problem. Give me a team of analysts, some hard energy data and I will answer your questions, for free.

Urgh... what a horribly garbled post I made above. Sorry. Should make a mental note not to try and write in English, while talking in another language over the the phone :)

Thanks for your comments Nate. I think 3) should be broken down to

3.1) Financial costs increasing

3.2) Energy costs increasing (i.e. EROEI decreasing)

3.1 may include heavy and even increasing externalities, masking real aggregate financial costs, if not properly aggregated from all sources - IF indeed EROEI is decreasing. I believe also Cleveland et al. suggestive data is correct and EROEI is indeed decreasing for the world (not just USA). But for me this is mostly proven by model and selective data sets, which makes me a bit uneasy in academic terms. That's why I'm calling for any additional data sources people have on this. In real world, I don't worry so much :)

As for other suppositions (1-2, 4-6) I have hard time thinking of situations where they would not be correct at near peak. Perhaps there are situations, but I can't find them.

What I'm in effect trying to do, is to prove myself wrong.

Can I find data that strongly suggests we are not peaking, instead of just looking at data that suggest we are?

For me the almost non-existent changes in light-sweet to heavy-sour ratio is a fairly big anomaly I can't explain.

This could be easily refuted, if somebody showed me that the light-sweet/heavy-sour ratio of Lower-48 didn't drastically change in late 60's and in 70's. I can't find this data, I'm sure it exists.

To me a steady rise in the aggregated oil price (includes externalities) is necessary, but not necessarily sufficient evidence of steady declining net energy for global oil production.

Because I can't get externality data as a function of time (to any meaningful accuracy), I tend to skip the whole price hypothesis making part. Too high probability for me to start chasing phantom correlations. More skilled people than me can play that game.

That's why I think the minimal marginal cost increase over time is just part of the puzzle (or proof).

Assuming that the increasing in drilling depth, number of well bores and other physical efforts is not just an expression of oil industry turning into an "investment phase from exploitation phase" for which a pay-off will come later (like Goldman puts it), then I think net energy is definitely in decline in many areas for which public data is openly available.

But I still covet for that crude-quality data and cost of finding, acquiring and developing of new incremental barrels.

This exists, in dollar terms only. I will try and hunt down sources and aggregate them. Jon Friese recently did such an analysis on (conventional) canadian natural gas - look under my stories.

Is there much heavy sour crude in the lower 48?

The heavy sour problem is most evident in KSA where they have sat upon many billion bbls of heavy sour in Safaniyah, Marjan and Zuluf. Not much point trying to produce that when you have light sweet in abundance - but all that is in the process of change.

Good question. I don't know.

another relevant question is how much natural gas is used internally by worlds top 20 exporters...

2007 was new record for US nat gas production, but use for electricity was up over 25% in last 4 years...

(*relevant because NG by far largest energy input into crude extraction/refining)

This might not happen until the cost of crude oil declines for a few months. While the price of crude oil rises quickly, the refineries spend their profit buying the next higher priced shipment and may not have the money to retool, especially while credit is tight. When the price suddenly declines like it has for the last month, they should make profit.

Rembrandt

Re China demand on page 6.

You say demand in 2007 was 7.29mbd for the year and now for the first five months of 2008 demand is 7.28mbd.

I understand on a equal time period comparison, growth is 3.7% (first five months 7.02 > 7.28)

This implies one of several things;

- either there is real seasonality in China, and the second half will have a large increase to bring total year growth in line with previous full years

- there is a significant slow down in China

- China is becoming more efficient oil/GDP

- the numbers are wrong

Given real GDP growth is still at 10%

@Polytropos

Important points you raise here. I think it is impossible to say at this point due to the Olympics which is likely leading to lower demand then usual for oil.

>- China is becoming more efficient oil/GDP<

You can rule this one out given the current situation and Chinese reports on the issue.

>- the numbers are wrong<

Thats quite likely.

First thx to rembrandt for the data. If I had no knowledge of reserves (which is true) and had a completely open mind as to when PO was going to occur then I would conclude from the data presented that we were not there yet. The all-liquids plateau between 2005-8 seems to have been left behind as production appears to now be responding to the Asian growth surge of the last few years. Not unreasonable that there should be a time-lag (and consequently a period of high prices) for this response when there was, and still is, little spare capacity available. But now, even crude oil production seems to be piercing the old highest level.

Furthermore, the Saudi data does not yet contradict what aramco are stating publically. Whilst they claim to be husbanding their reserves sensibly they have managed to increase production, and a post on TOD recently suggests that there has been no significant decrease in the % light sweet crude in the total. Any clear evidence that KSA are at or close to peaking is IMO not there yet.