Countdown to $200 oil (10) - oil at $115!!

Posted by Jerome a Paris on August 10, 2008 - 6:00pm in The Oil Drum: Europe

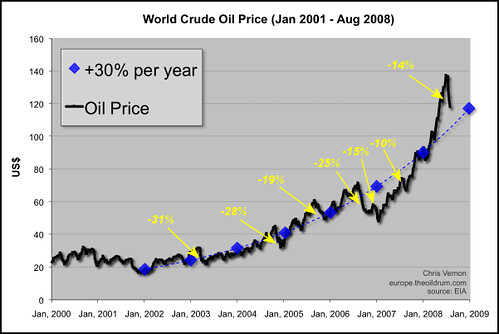

I have been gently chided on the internets for not doing any Countdown diaries since the oil prices have started going down. While the giddiness and glee demonstrated by many in the traditional media and elsewhere invites little but ridicule, as demonstrated by this graph below, prepared for the Oil Drum, some serious questions have been raised and deserve answers.

So, beyond the semi-glib answer that nothing much has in fact happened in the oil markets in the past month (after all, the recent decline is still smaller, in percentage terms, than several others in the past couple of years), here are a few points worth making.

An installment of the Countdown to $200 oil series

"It was speculation and the bubble has popped"

"Such small variations in demand or supply cannot explain such price changes"

"What about the Iran war premium - that's speculation right?"

"Demand is down (in the US), prices will go down back to normal"

"Asians will reduce their demand too"

Many don't agree with my assertion that speculation has little or nothing to do with the run-up in oil prices, and consider that the brutal price increases, followed by just as brutal price decreases, cannot be explained by fairly small changes in supply or demand figures.

Let me try to explain again why, in today's conditions, small variations have precisely such consequences.

In a market where supply is plentiful, balancing the market will be done by supply adjusting, ie the price will be such that just the required volume of oil is extracted to fulfill demand, and no more. In that case, competition between suppliers plays in full, and the price will the be the marginal cost of supply, is the cost of the most expensive barrel needed to fulfill exactly demand. All cheaper producers will get that same price (and will make a nice profit the cheaper their costs are), and those that are more expensive won't produce. In such circumstances, variations in demand (or new supply coming online) can only cause price to move slowly along the production cost curve, and bigger price movements usually come from "above ground" factors, ie geopolitical crises that include a risk of major disruption of supply.

But if you move to a market where supply is fully used to satisfy demand, you enter a whole new world. In that case, if potential demand still increases, there is no supply in the short term to fulfill such demand, and the absolute requirement for physical balance of the market translates (beyond using stocks, which can only be temporary) into a need to destroy demand, ie for some potential users to forego using oil. As we all know, oil is really convenient, and we are all unwilling (and, in many cases, unable) to stop using it. And yet the demand destruction needs to happen. In the short term, that requires prices to go high enough to convince someone to stop using the stuff, either because s/he can't afford it, or because s/he chooses an alternative which is less convenient but cheaper and, at such level of saving, worth the hassle. In such circumstances, short term price movements can and will be quite violent. In fact, any event that disturbs supply, any news that shows that demand was higher than expected, or supply less than hoped, or that suggest that demand will be higher than thought, or supply lower than expected, will push prices up immediately (and the opposite news, down, of course), because thee news translate into a unbalance between supply and demand and a bigger need for demand destruction (conversely, a lower need for such).

- So, a pipeline blows up in Nigeria - bam, 200,000b/d of (high quality) oil off the market, demand destruction is needed!

- Ben Bernanke suggests that a recession is unavoidable - psssh, prices go down as a slower economy will translate into less demand for oil, and thus less demand destruction will be required;

- Oil storage goes up - aha, demand was lower than we thought (or supply higher) in the last month, and there will be less need for demand destruction in the next one!

- Bush agrees to direct talks with Iran - bam, the war premium goes down, as the probability of an oil-supply-endangering conflict (which would cause a massive and brutal need for demand destruction, unless strategic storage is tapped) goes down.

In fact, in the past month, these was a succession of news that all went in the same direction. In the same week, Bernanke was extremely bearish on the economy, oil stocks were higher than expected, and talks with Iran happened. Each of these took about 3-4% each from the price of oil, bring the price down by more than $15 in 3 days.

And any time this happens, speculators are wrong footed and they need to close out their positions, which usually reinforces temporarily the underlying movement (haha! so there are speculators! And they push prices around! Well, yes, there are speculators - but, for the most part, they follow the market rather than driving it. Any price overshoot is usually temporary. And they do provide valuable services, by bringing in liquidity to prices - and by providing willing counterparties to those that want to buy hedges - you know, like airlines that buy futures or options for their supply over the next few months or quarters at prices to protect themselves - and their fares - from yet higher prices).

:: ::

One point that needs to be made again is that demand destruction in the US (or even in Europe, where it is hapoening too) is not enough on its own to bring prices down, because it needs to be larger than the supply growth in the rest of the world to limit the requirement for further demand destruction and price rises, given that production is still largely stagnant. And the problem is that demand is not growing just in China and India, thanks to rapid growth, it is also growing massively in oil producing countries themselves (Saudi Arabia, Iran, Russia, Venezuela), which often subsidize gas and which can afford it given that they have a natural hedge against (the subsidy gets bigger when oil prices are higher, ie when their own income is bigger, and the income growth is larger than the subsidy growth for those that export any volumes). In fact, most of the demand destruction happens in price sensitive places, like the poorest oil-importing countries (but they weren't burning much of it anyway), and the rich world (which can still afford oil, but consumes lots of it). But we can't be sure it happens fast enough to actually cause prices to go down because of what's going on in the rest of the world.

Anything that encourages demand reduction elsewhere (like lower subsidies) helps to bring prices down, but it's by no means obvious that we've reached price levels that are sufficient to cause overall demand stagnation in the face of flat or quasi-flat production. Oil producers have little or no incentive to boost their production if they expect prices to keep on creeping up (and they can help that trend by, precisely, investing less), and it's not clear what substitutes are available in any meaningful volumes.

So, at this point, I'm still happy to continue my "Countdown to $200 oil series" and see no reason why the recent lull in prices would be a sign of a serious trend change in the market.

In fact, I'll say again that our energy policies should focus on one thing first and foremost: demand reduction. Any reduction in demand that we manage in excess of what market forces would (precisely) force us to do will get prices down, and will save us a lot of money - and the smartest demand destruction is the permanent kind, that brings savings every month and every year rather than one-offs like giving up a trip.

We have to reduce our demand. Let's do it in an organized way rather than a panicked, haphazard, inconsistent way. And that's where government can help, by providing longer term pespective, informing citizens, pushing infrastructure in the relevant direction, and bringing up standards that apply to all equally and guide individual behavior in the right (Energy Smart) direction.

Price mechanisms work, but they are brutal, hurt the poor the most, and cause unnecessary disruption to economic activity, and pain to many. And they are fickle, as the current volatility (which, as I explained above, is likely to remain) causes rapidly changing signals which prevent decisions from being taken.

The Danes, for example, embarked on a relentless qwest to reduce oil consumption decades ago. To be sure, oil discoveries helped, but they could not have come close to reducing their reliance on imported oil without such an effort, an effort which was not dependent upon the day by day or even year by year oil prices.

In the U.S., instead, any progress we are likely to be make will be subject to the daily and weekly gyrations of the oil market. Even if the overall trend is up, every new blip downward will be greeted with the idea that we can drill or talk our way out of the problem, no long range concerted effort and investment required.

What could cause this transformational shift, I don't know. One can always hope that a change in administrations and party in power will make the difference. But that seems to be all that is available at the moment -- hope. But hope is not a policy and in the mean time, Saudi Arabia, for one example, will jerk us around with never ending promises of plenty of oil around the corner.

We need to send a message that what happens in OPEC is irrelevant to our course of action. Integral to that course of action, is a guaranteed floor under oil prices. Not that this is one of my concerns, but this would also be helpful to the domestic oil industry with respect to their exploration and development scenarios.

A chart showing what the price was on this date one year ago might be a way to cool off the unnecessary exhubarance that the pundits have lately shown. How far back do we have to go to see when there was a year on year price drop?

Your mention that if Bush decided on face to face talks with Iran might bring prices down a bit is a fascinating conjecture. Obama has said he is willing to do that which means we may see if the war premium really exists come next January.

I'm looking at the chart in the article ad I don't understand it. I can see what the black line represents (the historical price per barrel). But I have no idea what the blue diamonds are supposed to represent. It says "+30% per year" but what does that mean? Thirty percent of ............ what?

And I'm also hazey on the yellow number markers and yellow arrows.

Most of the charts I've ever seen on TOD have always been very self-explanatory. This one has me baffled.

The blue line is a smoothed curve to show clearly the general trend. It's like those ones you see of global warming, where the month-to-month temperature goes up and down like a yo-yo, but the general trend is upwards.

The blue diamonds look to me like an exponential best fit curve to the data from 2001 to 2008. The "+30% per year" is a growth rate which essentially tells you the shape/"slope" of the exponential fit. I find exponentials are easier to understand in terms of doubling time. Using the "rule of 70" (which by the way, is the natural log of 2 multiplied by 100) 70/30 = 2.3 years. So, since 2001, it looks like the oil price has doubled every 2.3 years.

Personally, I see no underlying mathematical reason why oil prices should follow an exponential trend, but it looks like they're doing just that... I'm guessing that Jerome's fit is an empirical one rather than a predictive one. I don't know if he agrees, but I don't see how the oil price can remain on a simple exponential. At some point it has to rise faster (when production starts to decline). At some point it has to tail off because there presumably comes a point when nobody can foot the bill anymore. But for the time being, it looks like exponential growth, and a rather fast one at that.

The yellow numbers/arrows seem to indicate the sizes of sudden declines in the oil price.

That's right. Of course there's no fundamental reason why it should be exponential, and no reason to think it will continue to be so. The only message is that for some seven years now this simple exponential trend has described oil price. The yellow numbers are just the sizes of past rapid drops, the message being that we got rapid drops in the past too.

So if oil is growing exponentially at the doubling rate of every 2.3 years we can expect $200 oil in spring, 2010. That would be a simplistic prognosticator--but who knows?

There's no reason to suggest the past trend will continue, but if it does, ~$200 would be hit at the end of 2010.

There are some good reasons to think that it won't continue, at least for a few years, - chiefly a global economic slowdown being lead by the USA as a result of popping property market bubbles, and the ongoing credit crisis effecting the global financial/banking sector.

Where I am (if the Spanish Govt supplied rose tinted spectacles are removed) economic growth next year will probably be 0%, plus or minus a fraction. This years growth figure has been consistently revised down as the months go by.

I agree that there "are some good reasons to think that it won't continue".

The statement that "there's no reason to suggest the past trend will continue" is however simply wrong. There are also some (maybe not so good) reasons for the global demand to grow in the coming years. Some of the reasons are

- Most economies in Europe and Asia have proved to be quite robust so far.

- Thanks to the high energy taxes on gasoline in Europe, the demand for fuel has not dropped in many countries. Where I live (Switzerland), the consumption is even increasing.

- Demand growth for oil will also come from China, India and the oil exporters.

- The Olympics will soon be over.

- Let's see where the dollar goes.

$200 a barrel might prove deadly for the US economy, but not so elsewhere.

Then again: What would a deep recession in the US mean for the global demand for oil? 1% down? 10%?

Chris

Much appreciate your chart and explanations.

You and Jerome add value.

Phil

If oil doesn't go up today, then the oil bull market is not only dead, the funeral preparations are being readied. If you want to kill your portfolio, go long on oil.

Making a guess, in the absence of shortages the price of oil can not rise faster than refineries can pay for the next shipment of crude oil. For example, an oil refinery buys 1 million barrels of crude oil for $100 / barrel and has a profit margin of 10%. The oil is refined and the products are sold for a gross amount of $110 / barrel. In the meantime the price of crude oil rises to $110 / barrel forcing the refinery to use all of his profit to purchase the next shipment of 1 million barrels of crude oil. Refinery margins were very small while the price was rising this year. This places an exponential limit on the rate at which the price of crude oil can rise when the supply is insufficient to meet demand.

A 6% increase per month will cause the price to double in a year.

That is what happened between July 2007 - July 2008.

I am not suggesting that this will continue but even a 30% increase in price every year will be very bad for the economies of the oil importing countries.

Wowza, dtbka! That was a SUPER explanation! Thank you!

I want to clarify that I'm "pretty good" in math, but never made it past trigonometry in high school. So this kind of statistical mining for numbers does not come to me as intuitively as it does for people who immerse themselves in numbers and graphs all day long. (I'm actually a writer, so I was always moreso one of those "SAT Verbal Score" wiz students rather than an "SAT Math Score" student.)

Your clarification of the blue diamonds as exponential growth gave me half the answer I needed. But the other half came to me when you explained what the yellow arrows were. So now I totally get the overall gist of the chart, and so now the full weight of just how scary that chart is has been driven home for me. You rock!

As a closing remark I want to say that whenever they posted those polls here at TOD asking where we thought the price of oil would go next, I always voted that it would DROP sharply (and yet briefly) before shooting up again even higher. Such as during the recent poll from three weeks ago when oil was at something like $142.00 a barrel, I checked off that I believed it would plummet back down to something like $127.00 before shooting back up to meet/exceed $150.00. And so if those yellow arrows in this chart are correct, then that is exactly what shall be happening at some point between now and November.

Jerome,

many thanks for this olympian perspective on our ongoing energy woes.

The graph, for a start, is a sweetly informative item, since, far from showing a peak price being reached,

thus far it appears to show generally steeper rises after each significant reversal.

Thus the rate of oil price increase/year may itself be accelerating somewhat ?

With regard to the policy priority that should be given to demand reduction,

I would agree that this should be paramount,

specifically in those industrial societies where power & energy use is patently profligate.

However, the fact is (as seen since the sixties) that achieving demand reduction

is disliked by industrial planners & financiers even more than initiating sustainable energy supply.

In addition to which, there are very large populations now aspiring just to get an energy supply,

meaning that the worldwide R,D&D of both village & city-scale sus. energy supply

(without which fossil fuel competition will be all the more desperate)

is the entirely necessary complement to the sufficient demand-reduction that you urge.

You write:

"We have to reduce our demand. Let's do it in an organized way rather than a panicked, haphazard, inconsistent way. And that's where government can help, by providing longer term pespective, informing citizens, pushing infrastructure in the relevant direction, and bringing up standards that apply to all equally and guide individual behavior in the right (Energy Smart) direction.

Price mechanisms work, but they are brutal, hurt the poor the most, and cause unnecessary disruption to economic activity, and pain to many. And they are fickle, as the current volatility (which, as I explained above, is likely to remain) causes rapidly changing signals which prevent decisions from being taken."

All of which I'd applaud as a very succinct layout of the case for proactive national & regional governance,

and against a reliance merely on the application of inequitable, inefficient and unpopular price mechanisms.

Yet I think there is further to go on this,

in that success at the global diplomatic level of governments' agreement on burden sharing -

is plainly a prior condition for successful governance within national borders.

Otherwise, how long would national industries wait for their foreign competitors to invest in the vital changes ?

A further question arises over the potential allocation of national energy usage rights,

since the global climate policy framework of "Contraction & Convergence" [aka: C&C]

which offers a close proxy for energy usage rights in the form of national greenhouse-gas emissions entitlement,

is now under increasingly cogent discussion in the run up to the UN's Copenhagen Conference next year,

having won EU, African & Indian endorsement, among others.

In case this framework may be new to you, here is a banner-scale description, being :

CONTRACTION

of global emissions to respect the Earth's capacity,

& CONVERGENCE

of all nations' emission rights to per capita parity.

(A properly detailed account of the principle & its dynamics, plus analysis, endorsements, etc,

can be found at www.gci.org.uk)

Your critique of price mechanisms is, I'd respectfully suggest, addressing badly flawed models,

than which we can and must do much better.

I say "must", to reflect the urgency of our position -

since an equitable and efficient price mechanism could optimize the viable rate of change

both for oil [fossil-energy] addicts and for impoverished masses in need of basic energy supplies

surely it behoves us to try to advance the adoption of such a mechanism ASAP ?

Sadly there is as yet little open discussion on the web of this need.

The C&C framework was developed around 1990 to facilitate the necessary shift

from emissions (energy-usage) rights reflecting sheer national wealth

with those rights Converging (over a period of years to be negotiated)

to reflect national population size, i.e. per capita parity (at an agreed date).

An annual Contraction in the global emissions budget has also to be agreed by the national signatories to the UNFCCC,

in light of the climate science provided by the IPCC and its researchers,

to achieve an atmospheric CO2 (equivalent) concentration that will avoid further decay in climatic stability.

In light of negotiations to date, those national entitlements would, undoubtedly, be tradeable at least in part,

meaning that industrialized nations would increasingly need to buy entitlement from poorer more populous nations,

with the payments being verifiably ring-fenced to investment in UN accredited mitigation & adaption projects.

Notably, it would seem not beyond the wit of humanity to codify in the forthcoming treaty

poor nation's right to receive sufficient energy supply (at a preferential rate) to meet basic subsistence needs

as part payment-in-kind for emission-entitlements sold.

In this manner the international contagion of social & economic destabilization may at least be limited,

if not actually avoided altogether.

________________________________________________________________________

The above is just a first attempt at utilizing the global C&C framework

in the forthcoming "Treaty of the Atmospheric Commons"

to ameliorate effectively the excess energy demand and supply scarcity -

so I'd appreciate your thoughts on this option.

Regards

Backstop

The Oil Depletion Protocol is another way to achieve this which deals specifically with oil independentley of other fossil fuels.

Contraction and Convergence to achieve carbon reduction goals sounds like a nice idea, where the poor are lifted from their misery and the rich just have to give up a little bit of there energy which should be seamlessly replaced by efficiency technology and new clean green alternatives.

The reality is that even in so called rich countries there is a stratification of incomes which range from extremely wealthy to dirt poor and it will inevitably be the richest of the rich who end up with more energy than the poorest of the rich. It will be a hard sell politically to ask people who percieve themselves to be struggling already, to give up even more energy, for no real gain, to poor people on the other side of the world who haven't "earned" it, particularly from the energy rich countries.

I would be very surprised if any country would ever agree to having mandatory reductions imposed on them and then being obligated to export excess nergy to poor countries for the privelege. More likely that energy rich nations would agree to limit the total emissions (contraction) and husband the remaining fossil fuels for their own benefit in the future.

The idea that you can pay the poor for something they never possesed is ludicrous and will never get up

Whether or not nations will ever agree to mandatory reductions, your last sentence ignores the importance of the concept of negative externalities on the emission of CO2 gases. By definition, a negative externality occurs when two parties engaged in an exchange produce an undesired effect on a third party. In this case, fossil fuel producing and consuming parties are getting wealthy from the use of fossil fuels, with their consequent release of CO2. The CO2 is our negative externality, as it results in climate change that is disproportionately experienced by the poorest people in the poorest nations of the world. The Wikipedia article on negative externalities recognizes four means of addressing them, which I partially quote:

"

* Criminalization: As with many types of environmental and public health laws.

* Civil Tort law: Class action [by the third party], various product liability suits.

* Government provision: As with lighthouses, education, and national defense.

* Pigovian taxes or subsidies intended to redress economic injustices or imbalances.

."

Seen in this light, a cap-and-trade system seems to be a combination of the first and last: Criminalization and Pigovian taxes. Essentially, cap-and-trade is a combination of two processes: (1) creating and enforcing a legal limit to total production of CO2 - that is then distributed equitably on a per-capita basis - in order to keep aggregate releases below a level that would result in dangerous and potentially destabilizing changes to global climate (which is essentially a public good, non-rivalrous and non-excludable); and (2) "taxing" those who release more than their per-capita share of CO2 while redistributing this wealth to (i.e. subsidizing) those who consume less than their per-capita share and who, not coincidentally, are also currently the most common members of the third party sufferers.

No I didn't ignore it, I just pointed out the reality that Robin Hood politics is not something that people in rich western nations will ever vote for. I know I wouldn't be too keen to see my children suffer limitations and then paying people like Robert Mugabe for the privelege.

Unles you are proposing world government, I don't see how you can "enforce" a worldwide legal limit. It nmay all seem very logical and straightforward but executing such a plan is, I believe next to impossible. It's why we get things like the Kyoto protocol, warm fuzzy motherhood statements that lead to no action by anyone.

Tariffs are away to tax foreigners. A carbon tariff equal to or greater than the domestic carbon tax means China can't dump cheap goods on consuming countries. It is part of my contrarian nature to put limits on free trade in order to benefit importing nations like the US. The American middle class grew in an environment of protective tariffs and has shrunk as the tariffs were removed. Somehow the elite forgot that without producers making good wages they would eventually consume less of whatever is imported.

Cap and trade is merely another chip in the financial jugglers casino, dreamed up by bureaucrats, honed by lawyers, loved by poiticians, and the next festering sore down the road on Wail Street as the pension funds suck them up.

This discussion of volatility reminds me very much of Dr. Bakhtiari's work on the four stages of decline [ more at www.samsambakhtiari.com. His first stage, T1, was marked by volatility as oil markets bounced back and forth between supply and demand constraints. T1 ends when the markets are completely bound by supply constraints. Presumably the price of all forms of energy would then stabilize at some much higher level. [Though I do see how various "above ground" factors could now and then drop the price even in such a constrained environment, eg "this tanker just arrived and we have to unload it. NOW."

cfm in Gray, ME

Backstop,

Superficially your argument sound good. Typical bureaucratic jumble of redefining and renaming ideas and mooting ideas which nobody has the slightest intention of following.

"Houston we have a problem" -- lets propose a motion, to elect a committee, to see if there are sufficient grounds, to take any action.

Lets sell carbon credits on the stock market.Lets allocate energy usage to the third world.

In the 70's after that oil crisis I lectured (paid by the Govt) to communities on how to reduce our Canadian dependence on heating oil.

The Govt gave us interest free loans to install efficient thermostat and heating systems (I explained to the people how it would pay off)

In panic, Canada developed an Energy Policy.

By God!! no sooner had the oil problem disappeared, than the financial prostitutes, seeing profits, killed the Energy Policy and lost interest in heating oil conservation, or any conservation for that matter.

I happened to be an infrared thermographic engineer who could quantify any and all heat escaping out of anything.

It was not long before Canada started building Mega-houses that wasted more heat than a chimney stack.

The Government, the Architects, the building inspectors and the builders did not give a damn that we were setting ourselves up for what is finally happening to us.

Bureaucrats, committees and govt. departments only shuffle the papers put on their desks. Policy prohibits actually looking out of the window.

I have no fear that any meeting of any organization will actually cause a solution.

Graham

We have to also remember that the presence of speculator open interest at the NYMEX has been in decline for one year. I actually now believe that the volatility in oil this year, the rise to 147, and now the fall, was made possible in part by the reduction of speculators. Speculators are information aggregators. While they get the story wrong at times, the market does not have other participants whose exclusive role it is to get information. A market that is reduced to commercial hedgers and commercial users may sound all well and good in theory to those who fear speculators. But I don't think it's very good at all. I think the primary role of speculators in front month and near month oil is as follows: to make sure the price on the day of expiration is not wildly out of synch with real world supply and demand, and to try and smooth the pathway so that producers and users settle at a fair price. I also think it's fine to have some fear and greed along the way to expiration, as well. If speculators are doing their job, the price will glide more smoothly towards expiration, starting more than several days out. I am speaking on a relative basis, only. Those wild moves up and down as we went to 147 look awfully choppy to me. Same too, since we started falling.

The media, both print and TV, remains chock-full of those who are absolutely sure this is all speculation-driven. When I do sentiment analysis on investment boards, among readers and writers, in comments section of various newspapers--the overwhelming majority are still very locked into mytholoigies about the oil companies, and speculators. I think writers/economists like Paul Krugman and James Hamilton have done a great job showing that evidence of a speculator-driven market is sorely lacking. In fact, I think those who assert that oil is all speculation are simply telling us how they feel.

If we consider the three strongest points of data, however, I think the action over the last year makes alot of sense. 1. Zero growth in global crude oil production for three years and five months. (It's still astonishes every time I say it.) 2. The very notable decline in Open Interest at the NYMEX, showing the market has literally been transformed on a comparative basis to a market of commercial hedgers and users. 3. The decline in OECD inventories of oil on both an absolute and more importantly on a days supply basis, over the past year.

If I had not seen a single newspaper or internet screen for a year, and someone told me the above, I would know pretty easily that the market was likely quite volatile. (My argument is not without flaws however because the oil market has long been quite volatile this decade--especially starting in 2004, when we re-priced above 40.00)

If my analysis is correct about the structure of the futures market--that it's reduced now to a bunch of commercial hedgers and commercial users butting heads, along with the marketing departments of the integrateds, none of whom are as good at specializing in information--then we could see oil get even crazier. This thing could crash to 95.00 over the next 6 weeks, and then soar back to 150.00 in November as real world pressures of Q4 suddenly sweep, in to the market. In the near-term, we could also see this type of oil market fail to correctly price in impending geo-political events. In a perverse way, I want people to learn a hard lesson, on what can happen with you remove the smoothing function of speculators in front and near month. Again, if I am correct, we are moving farther away from a well functioning market that rations by price. That means in a sudden type of event, shortages would be more of a possibility.

I agree completely with the author of this post that this is a Kill Demand market. The price action has a very different signature to me, than in the last 5 years. My point is that we also have a new price discovery problem laid on top of this Kill Demand market, as speculators in Front Month and Near Month have been chased from this market--likely on the threat of congressional action.

Gregor

US Crude Inventories have been more prone to roller coaster rides in the last decade as well, or so it seems to me. Micro adjustments were more more common, and fewer prolonged slides/builds - indicative of lower spare capacity? Also operating at lower average levels.

Crude Inventories 1982-2008.jpg:

Can you provide that curve expressed in weeks of consumption? Murray

You explain a lot of useful stuff about the futures market (albeit with no data or references).

However, I'm still missing the causal mechanistic link that explains how futures prices dictate spot prices (or long term oil contract prices for that matter).

Unless that is given, all the world's speculation about futures markets mean nothing to me. It's a bunch of speculators hedging on a market that means fairly little to me, as long as I don't use the services of those commercial hedgers (like airlines, etc).

Do you think there is such a causal link? Can you show evidence as to the existence of this mechanism and explain how it works?

Steven Koonin, the chief scientist for BP and former provost of CalTech, describes the energy challenges facing the world and suggests the development of advanced biofuels and a new generation of nuclear power as alternatives to fossil fuels. Series: Helen Edison Lecture Series [8/2008]

http://www.youtube.com/watch?v=JAPP7o6uG8Y

... apologies for repeating this - trying to locate my comment better:

Can someone please comment on Steven Koonin's (youtube) video which seems to fly in the face of everything TheOilDrum stands for? How is there such a huge disconnect between what Matt Simmons says (for example) and what Koonin outlines. It's not that he is obviously putting a spin on things. I watched all 58 minutes of this and, though he perhaps glossed over some of the problems, it was nevertheless an intelligent and closely argued refutation that we face an oil crises any time soon. Help ...

I would suggest you search the TOD archives. I doubt there is anything in Koonin's video that isn't covered here already. The both subjects were done to death in recent months. Or, it might be faster to google Best of the Oil Drum and look there. It's also linked from my blog.

Cheers

... ok, but let me be clear. I'm not a complete novice with this. I've read all the books done the research have the facts (or what I think are the facts) up to my eyes, and yet I watch a video like this with its confident stats, numbers and analysis and I'm just amazed. Why is there such a disconnect between both sides of the PO argument. The fundamental argument seems to be over just how much oil/energy is available to us and how it can be accessed, or not, and this is what's amazing about Koonin's analysis - it's so radically optimistic and seems grounded on hard facts. I appreciate that there are obvious answers to this but Koonin appears to deal with them.

What this illustrates for me is how difficult it is for the outsider - the non-technical, person who is not an oil geologist or the like, to get a hold of what the facts are. From that it follows - how difficult it is to communicate with others about this issue. In fact I'm getting to the point where I'm not going to speak to anyone about it until such time as the facts are obvious.

Ah. I see. I tool your comment as novice-like. My bad.

My answer: Absolute faith in technology. Also, I've been trying to, but haven't had time to watch the video. I'm betting he didn't get into issues of collapse, eh? If not, he's not yet got all the pieces on the chessboard. Same goes for the economic collapse. Etc.

It's actually not hard to come up with a positive spin on this problem if you only look at oil, don't mind billions being hungry for a decade or more, and think technology is god.

Cheers

Giddaye Jerome,

I like your graph. To the start of next year, it'll be interesting to see if the price trends down by a largish percentage (say 30% to under $100), or a lesser one. And then what? Bubble along for a few years; or pierce back through your blue diamonds?

Whatever the case, I still get the impression the powers-that-be are many steps distant from the PO table - they barely sit at the GW one! (That's another interesting graph, a decade of near flat global temperature rises. A new trend?).

I still believe, as long as OTHERS believe more massive finds are still out there (Iraq? The Arctic?) - or coal/shale/whatever-to-liquids is doable - it'll sadly be BAU for some years yet.

Regards, Matt B

The period since early 2007 seems to have either entered a new exponential rate or had a long-term random jag. I too am curious to see how long it takes to catch the diamond line again.

Of course, if there is no physical reason for the exponential curve(s), then the curve is really just a smoothing function and the rest is mere happenstance. Exponential curves are quite frequent in reality though, so maybe it's valid even if not quite proven. Time will tell.

Now we can observe the impacts of demand destruction.

Demand is down, but oil is now being extracted at the same rate as if oil was $140 per barrel.

Because the demand for oil is so high, it will always be higher than production; thus the depletion rate will continue until all recoverable oil is extracted.

We cannot conserve our way out of this catastrophe.

I'm not sure demand has had time to repond that quickly to high oil prices, or that supply can be turned on and off in response to rapidly falling or rising prices. There is also the question of rebuilding inventories if there is a perception that prices are falling because of increased capacity. If inventorys start rising over the next few weeks this could give more impetus to prices to fall even further.

That would be a handy thing going into the Novemeber US elections as it will take the focus off energy as a crucial debate which neither Obama or McCain really want to have.

Another thing the demand destruction pundits overlook, global auto production is up!

source:

http://oica.net/category/production-statistics/

This actually proves the marginal-cost theory. Supply and demand haven't really changed much in the last few years, and neither has world politics - yet look at the rise in the price of oil! So, how to explain the drastic rise in price? The economic fundamentals don't really explain it. The only factor that does explain it - is if the marginal cost of oil just went up big-time in the last 10 years. And, it sure looks like that is the case. 10 years ago, the marginal cost was a Middle Eastern barrel, so oil prices were extremely low. Then, as we hit peak, there was no more cheap oil, so the marginal price moved to an off-shore barrel, and then a deep-sea barrel. Now, the marginal cost is even more expensive - an oil sands barrel (or worse yet, a biofuel barrel). After that, there's nowhere for price to move to, except to the ultimate user-utility value of that barrel ($$$$$). This all implies that we've gone over the peak already (perhaps 4 or 5 years ago even), and the only thing keeping us from the crash are the advanced recovery methods and non-conventional production. Uh oh...

'which often subsidize gas'

This formulation is getting increasingly disturbing, at least in terms of a country like Russia, and to a lesser extent, Saudi Arabia.

The Russians produce and refine their own oil - that they sell their own product at their own price within their own borders is not 'subsidizing' the price of oil.

Instead, it merely reflects the fact that they have it, and we don't - and that the Russians are willing to use their own oil at a price which the mythical market considers too low - because that mythical market wants to burn the oil.

Of course, we can talk about inefficiency, misallocation, and general wastefulness as not being good in the long term, but this is not the same as saying the Russians are not playing according to the rules the market expects. It is just that in this case, the market is in the loser's seat.

A graph is supposed to be a model of reality which of course the historic part of the graph is exactly that.

The graph is one variable along a constant line ... i.e. the price of crude vs. date line. Smoothing into an exponential or using a 100 or 200-day average or a WAG to predict the future is quite valid.

However, we are not in such a simple real world. The de-valuation of homes, subsequent layoffs, interest rates, hard credit application, massive retooling, war(s), etc. etc. all happened in the last month are going into incremental demand destruction not just the price of oil. Should any one of the above reasons fail catastrophically demand destruction can accelerate greatly and the expoential curve will be invalid and a moving average will be way behind reality while the WAG may be right on kinda like pin the tail on the curve.

If we plotted the price supply demand and date curve through 1990 it would be perfectly reasonable (graph wise) to continue the graph ad infinitum though reason dictated a important finite resource must at some time become critical.

If the world would be shrunk to the size of an orange, it would be smoother than an orange but as I look out my window I see mountains several thousand feet higher than my valley. IMHO Dr. Ali Morteza Samsam Bakhtiari was right, that the time of graphing is over. It is a time of action. What is your action?

I just burned a huge amount of oil getting to Scotland from Australia and back, flying with Emirates Airlines. En-route I noticed news stories about Emirates Airlines buying up big on Airbus A380 super-jumbos. You would have thought that they would have a good idea of oil supply constraints. Perhaps OPEC really do have plenty of the stuff after all. On the other hand maybe they know all the other airlines are doomed and that they can carry on regardless by subsidizing their national carrier with cheap fuel.

I dropped into the Dubai on the way back. Along with the other Emirates states they're going nuts with construction of futuristic sky-scraping cities, designed to be luxury tourist destinations, plied by freeways carrying the most ridiculously over-sized cars I have ever seen. I've never seen such an unsustainably designed place! Their water is all desalinised (fueled by oil) and every indoor space is airconditioned without adequate insulation or due care for heat leakage. The population is increasing through immigration by 5 to 10% per year. Are they deluded, or are they confident that they have plenty of black muck on which to keep themselves afloat into the foreseeable future?

At the other extreme, I was impressed to find that in Scotland people were getting around in small cars that get 50 miles to the gallon. Hired one myself. Mind you while I was there the major Scottish energy retailer announced a 30% hike in natural gas prices and a 7% increase in electricity prices. Their superior vehicle fuel economies won't save them from freezing in winter.

Well, of course they're building with abandon in the middle east! They know that oil=stuff. And, oil is running out. So, if they want stuff (buildings, desalination plants, roads, infrastructure, etc...), they'd better start now because soon it will be too late...

Yeah, but you need oil to run and maintain your stuff. Especially if you build and buy stuff that is super inefficient at using oil. Either they think they have plenty of cheap oil to last for a long time to come, believe that they can afford to switch to alternative energy sources when they need to with minumum fuss (one thing the UAE has more of than oil is sunshine), or they just haven't thought it through very well.

Or do they have a secret super-stash somewhere? Or a trillion-barrel reservoir they've managed to hide from the world for decades?

Do we REALLY know enough about the middle-east oil-princes and their mates?

Regards, Matt B

But they will be the last to run out of the stuff. Their exports will stop before they radically alter their own consumption. Maybe they are hoping that solar power and some storage system will be viable by the time that happens.

If their exports come close to stopping so does their income and with it imports of, well, everything. Their on consumption will be radically altered when their BMW imports stop. For this reason countries what derive most of the foreign exchange from oil exports won't let their exports drop to zero. Internal consumption will reduce long before exports fall to zero.

They will be in trouble before then.

Dubai, seems to be pursuing two economic strategies i) to become a luxury playground for wealthy visitors and ii) to become a financial-commercial hub like Singapore, Hong Kong, London or New York. It manufactures nothing and it's only agricultural production comes from a small fishing industry and a meager production of dates which is dependent on rapidly dropping water tables and increasingly on recycled waste water that is in the first place produced by desalinising seawater.

The tourism is dependent on the cost of airfares not going too high. The finance-commerce depends on the World's economy not going pear shaped. The whole thing is dependent on a rapidly growing migrant population (citizens are now about 10% of the population). And with no home production of anything, everyone is dependent on imports. It seems like a giant house of cards sitting on a foundation of cheap oil.

The other Emirates are following similar strategies it seems, but with more focus on the luxury tourism, less on the finance-commerce, and a less gung-ho rate of emigration and construction.

And to make things worse, it seems that much of the construction boom is dependent on wealthy Europeans and others investing in property on the understanding that in booming Dubai etal. prices will continue to grow - i.e. it is the mother of all property bubbles which will go bust as soon as oil prices get too high.

(Caviate - I got these impressions in a 4 day visit from chatting to friends who live there as expats. I might have it all wrong. One way or another is is an extraordinary place.)

Occam's razor. Maybe their leaders are simply no smarter than our leaders (I live in Canada, by the way).

And what if they did? Although you don't say it outright, it sounds like you think that THEIR oil belongs to YOU!

Huh? Big assumption there, sunshine!

If the oil stopped flowing tomorrow (the stuff we waste for trivial A to B transport), I couldn't give a toss. As long as there's something to replace it with; I've said many times I'd prefer a "slower" world, with solar-charged golf-carts and motorbikes leading the way. But at the moment, without MS media onboard, I don't see that happening.

Further, I have some idea of the lifestyles my neighbours lead - I live in a friendly court with lots of kids about. There's also plenty of regular street-talk amongst the parents. But I have no idea what their financial positions are (I can only guess), what they have tucked away for a rainy day, whether there's any marital problems. Frankly, it's none of my business.

But the neighbours don't keep my family's world turning, the Saudies do (or whoever). It would be nice to know ahead of time if PO's going to be a problem sooner rather than later. Not too much to ask, is it? For the sake of my children's future...

Regards, Matt B

Funny old world isn't it. A couple of months ago there where people that predicted that oil would neve rise beyond $100 per barrel.

Now here we are after $147 oil and $115/barrel seems as cheap as chips.

Amen.

Locally( MI,US ) $3.74 gasoline is bringing out all the pleasure craft again, especially the ones with "For Sale" signs on them.

The oil price price pattern of sawtooth up, then down a good bit (but never below the last dip), then back up to well above the last price peak seems like a darn near perfect way to facilitate a continual upwards price trend without pushing demand off the cliff (consumer sticker shock)or inciting some kind of threatening political/military response, even preventing a concerted long-term effort to pursue alternative energy. As we can see now, and have seen for decades, the American consumer has nothing more than a very short-term memory about prices. We are the perfect suckers for the game. Cornucopians and Joe-Lunch-bucket know-nothings, rejoice for now....you'll probably want to buy that second Hummer or Suburban or Escalade or Tahoe you were craving.

And another thing, the Emperor of the World (with no clothes) gave Bob Costas an interview at the Olympics Sunday during which he said (after smirking at Bob's question)that he didn't think America had any problems...

http://thinkprogress.org/2008/08/10/bush-i-dont-see-america-having-probl...

Does Georgia have any oil or oil pipelines that the West would be interested in? Good thing our Army and Marines are busy in our 51st and 52nd states, or else GWB would have them parachuting into South Ossetia right now and start WW III. As is is, he is content to lecture the Chinese about religious freedom, and how, when it takes hold, it is unstoppable. Expect many more Party crackdowns on underground churches after the Olympics are over. Way to go, GW!

Georgia is the basic outlet for Caspian Sea oil. Ww'll see in the next 10 years or so whether it becomes the third largest oil producing region in the world as some have predicted. Russian interference with this thru put would essentially allow them to control the EU economy. That's just one a several possible motives. Or it may just be a lucky coincidence for Russia.

I had commented earlier that oil seems to have become the chastity belt on the world economy. Get too excited and you know what happens. Oil prices will shoot up and put the brakes on growth again.

Crude averaged $72 last year. At a 30% growth rate, we should expect it to average $95 or so this year. That would have been a shocker in itself had we not seen $140 this year. Now $95 seems cheap.

It might also be instructive to break up that graph into two trend lines. From Jan 2000 - Jan 2005 (when oil prices doubled from $20 to $40 or about a 16% growth) and then from Jan 2005 to Jan 2008. I use Jan 2005 as data suggests that crude production has remained pretty much flat from then on. Oil prices have increased 2.5 times in 3 years or a 36% growth YOY.

From the graph, oil price volatility is increasing at least in USD terms - not sure if the same is true in %age terms. This means that uncertainty around future prices is increasing.

This will have some serious implications for investments. Capital investment decisions happen when companies feel they can predict the future for 5-10 years. Sourcing and manufacturing decisions depend heavily on transport costs. If one cannot predict reasonably well where fuel prices are headed, it makes it very difficult to make good sourcing decisions. Two of the BRIC, I&C, economies depend very heavily on imported crude. Their growth stories are threatened by rising crude prices. All this spells a difficult environment for firms trying to make investments.

Srivathsa

In stock and commodity charting it is common to a logarithmic scale for the price and linear for time( semi-log paper). The advantage is that this makes equal percentage moves the same size on the chart . Semi log plotting will often remove the undesirable appearance of an exponential increase that appears if a linear price scale is used.

See this link for a discussion and examples under the Price Scaling section at the bottom of the page :

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:wh...

Quote:

"

This time next year somewhere in the neighborhood of $200 - $300 a barrel, if there is any semblance of an economy at that time.

SHTF soon!

No disrespect, Sam, but I really, really hope you're wrong... Will you drop your pants at your local mall and sing your national anthem if you are? :)

Regards, Matt B

Great article and even better graph Jerome. The most telling part of the graph in my opinion, is the 14% percent change downward recently as compared to five other higher percentage changes in earlier years. The News was so exhaulted by the dollar descent from 145 to 115, that they never bothered to compare it as a percentage change versus earlier points in time. The hyperbole was fervent, wrought with phrases that included words like, 'historic price reduction', and 'never have we seen such a drop in the price of oil before!' It's called news, but it's obviously not researched very well, and they pretty much say whatever they want.

Secondly, the upward +30% increase in price per year since 2000 has a consistent upward slope. In the context of percentage changes, the upward slope has not been breached by the recent drop in price, and the bubble has not popped as so many news people have claimed.

Scarcity of a finite resource, sold as a base energy product for consumption (primarily for transportation), has reached the maximum level producible (based on extraction, exportation and refining capacity), and the world must now reconcile the need to continually expand the economy while competing for a limited energy flow. Since that is not possible, recession is inevitable for those countries with a net importation of oil. Since the US has the greatest quantity of importation, our economy will slow the most.

The alternative is to quickly as possible initiate a transition to renewable energy. Put solar panels on every new home, and promote their installation on existing homes with rebates, and tax credits. Install wind turbines per Pickens plan and convert some percentage of the transport fleet to NG. Make the transition to hybrids and electric, giving tax credits for dumping the ol' heap. Drastically reduce our dependence on oil.

What do you think of Sampson's post, just above:

"This time next year somewhere in the neighborhood of $200 - $300 a barrel, if there is any semblance of an economy at that time.

SHTF soon!"

$200-300? Possible? Probable? If it happens, will it help with the "transition to renewable energy"? Or do we all once again cross our fingers and toes and hope the price drifts back to $150? (which will no doubt be reported as, "lowest level in fifteen months"!).

Regards, Matt B

Strewth, even after forty-something weeks visiting here, I still haven't seen a hell of a lot of change in the living patterns of anybody - my immediate family and circle of friends included! - I still observe one car for each of the kids at local basketball on a Friday afternoon. That's over 100 cars.

Those are my observations(and postings) exactly.

And it appears that you were so "exhaulted" by something to grasp at that might refute that... that you never bothered to compare the claimed 14% to reality (more like 23-24%).

The graph is incredibly deceptive (though I doubt it's intentional). There's a massive difference between a 28% decline (2004) when a commodity has run up 50% over about three years or a 31% decline from a virtually unchanged point (2003). You can't make an argument that that might be a popping bubble. The price can easily recover from that point (and could be expected to).

A 700% run-up over five year, OTOH, most certainly could be a bubble (but doesn't have to be).

The problem everyone here needs to grasp is that those who are caught up in the psychology of a bubble rarely, if ever, see it as such.

Great article! Your graph inspired me to hindcast and forecast the gas prices in Switzerland, based on two simple assumptions, namely a 30% annual oil price increase (as you suggest in your article) and a devaluation of the US dollar compared to Swiss Francs by 5% per year.

Here is the result:

The blue line shows the calculated prices. The red symbols represent nation-wide averaged gas prices (reported by Shell).

As you can see, the price for crude oil has had a small share in the gas prices up to now. Taxes etc. (black dotted line) are still dominating. This might explain why the rising of oil prices had no noticeable effect on traffic in Switzerland and elsewhere in Europe.

Do you have a Plan B for your life?

We are building a community. A solution for peak oil, the unfolding financial and economic crisis, climate change and the pursuit of authentic happiness.

Please visit our web site:

www.relocatenow.eu

One of my comments on a Drumbeat thread:

Some perspective on (WTI) oil prices & oil exports

First, I think that we get a better idea of what is going on in oil markets, especially regarding fundamental supply & demand factors, by looking at average monthly prices. From May, 2007 to June, 2008 oil prices increased at an average rate of about 6% per month, from $63 to $134. It was not straight up. There were two down months, August and December. July, 2008 was basically flat, down 50¢ from June, and we are obviously down in August--similar to, but sharper than, the August, 2007 decline.

Second, the media have generally asserted that this price increase made no sense. In fact, we have seen an accelerating annual decline in total world net oil exports--from a 1.1%/year decline in 2006 to a 2.2%/year decline in 2007 (EIA). Simply put, we have seen importers bidding for declining net oil exports.

Third, we are going to see declining demand as higher prices allocate the declining net oil exports to the high bidders. So, prices are a manifestation of a "horserace" between declining net oil exports and declining demand--with a wild card being the deflationary effects of the credit contraction. What I don't expect to see is a long term positive supply response. I expect to see a continued decline in net oil exports, that with time, will almost certainly show an accelerating decline rate.

People are grasping, and will continue to grasp, at anything that suggests that we might be able to have an infinite rate of increase in our consumption of a finite fossil fuel resource base.

And China just keeps rolling-exports up 27%, imports up 33% http://biz.yahoo.com/ap/080811/china_trade_surplus.html

I'm not so sure.

IMO people are interested in keeping the status quo going as long as possible.

Whether or not their children or grandchildren will have a life equal to ours doesn't enter their sphere.

Recently however, my father-in-law,a WW2 veteran, lifelong cornucopian and champion stockpicker was concerned what would be left for my son.

Not having known either of my grandads, I told him that the best gift he could give my son was his time.

Jerome,

Your point about making a transition off of oil at a lower cost when government intervention is used is very important. It is also important to note that we have little time before the oil that could be sold cheaply in not the largest part of the market. So, if we want to intervene, we need to do it soon. Thus, I think that intervening is most important to avoid investment in oil that will be expensive to produce since the benefit you consider of transitioning a low cost will not be possible once the new junk oil has a larger market share. http://mdsolar.blogspot.com/2008/06/oil-is-too-expensive.html

Chris

Jerome,

One small remark:

True and I would wish we could go back to a lower oil price so everybody has a little bit time to adapt.

However, this is not how people think. If prices fall, people will not change their behavior, but go back to their old ways. I'm afraid we need high prices for much longer to keep the pressure on to force change.

And politicians won't help out either. Their first priority is to get elected, their second priority is to get reelected.

I think that looking at the government for help is nothing else but wishful thinking. We should concentrate on what we as individuals, or as a group can do, despite the fact that governments are counterproductive. And maybe even stronger: Any involvement of the government should be regarded as counter productive.

We as a group elect polititians, so the first and second priorities of politicians should be to do what we want.

We just need to make sure we are a big enough group.

This is an excellent post, thank you for it. Because production is now geologically limited and demand is, to a large extent, decoupled from the US economy I think that your estimates are highly accurate. The past is a useful guide and your graphic was bang on. Two hundred dollar a barrel oil, here we come.

Jerome,

Your graph appears off. Oil got up to $147 before it began the slide.

It's the (weekly) all countries spot price weighted by estimated export volume, the $147 WTI peak would only be a partial contribution to that peak.

Kurt Cobb, in a recent post, points out that queuing theory predicts wild short term price fluctuations, when demand approaches system capacity. He also points out the relationship to leveraged speculation:

Common sense is beautiful.

Jerome - Chris, excellent chart! A few of my random thoughts:

• The period below trend (06-07) is perhaps compensated by the period above trend in 08. I'm guessing we see a bottom at around $112.

• I think unmetered inflation is masking recession in the UK that likely started 2 to 3 years ago. Perhaps the same in the US? So recession and demand destruction are well underway and its continuation will unlikely alter the up trend.

• New demand in export lands and Asia seems more than capable of compensating for demand destruction elsewhere.

• If prices threaten to go too low - sub $110 - we'll see Saudi and other OPEC countries cutting production - and I just don't see that scenario unfolding.

• What happens to price when max production capacity starts to fall? I'm still waiting to see falling production (production not demand constrained) and exponentially rising prices. You get the feeling we are getting close

• The next up trend could be very very brutal

Can someone please comment on Steven Koonin's (youtube) video which seems to fly in the face of everything TheOilDrum stands for? How is there such a huge disconnect between what Matt Simmons says (for example) and what Koonin outlines. It's not that he is obviously putting a spin on things. I watched all 58 minutes of this and, though he perhaps glossed over some of the problems, it was nevertheless an intelligent and closely argued refutation that we face an oil crises any time soon. Help ...

http://uk.youtube.com/watch?v=wt_mluFK7xk

This one?

I've just watched 12 mins so far - we may have a TOD thread on this.

The first 18 mins was enough for me! Impressive presentation, lots of nice graphs, good speaker...

"Proven reserves; oil 41 years, gas 67 years, coal 164 years (perhaps up to 1000 years, when we start really looking for it). Plus yet-to-find and unconventional.

"Oil; another 4.5 trillion barrels all up... Not running out anytime soon".

If he's right, no wonder MS media has no interest in Peak Oil discussions!

Regards, Matt B

Confused again!

... no, this one:

http://www.youtube.com/watch?v=JAPP7o6uG8Y

This chart is great. It is interesting to see how the troughs reduced in depth as oil continued to increase. Also this chart seems to suggest that oil will fall somewhere below the 30% line at $110 and then jump back up, that is if the trend continues.

Jerome, my "eyeballed" trend line starting in 2002 agrees perfectly with your trend. If I start in 1998, the future trend is quite a bit lower, and the 2008 spike a larger overshoot. I suspect that the real case is an increasing exponential, (with speculators being a significant contributor to the increase), with the correct value for mid 2008 a little below your trend line. $200/b looks like somewhere between mid 2010 and late 2011, given a smooth curve. An earlier spike is always possible.

Your % drops data is interesting, but would be more meaningful if we also had the preceding rises. the current spike is a much larger rise than the prior ones (by eyeball), and ceteris parabus would suggest a bigger drop. An overshoot below the trend line should be expected.

Given that recent prices have generated some demand destruction, and that there is considerable new capacity coming on, at least to mid 2010, the 30%/yr exponential may be in for a short rest. That's my best guess anyway.

Overall I agree with your logic, but I suspect that speculators are a factor also, that aggravates the underlying mechanisms. Big speculators like hedge funds are a very recent entry on the oil scene, so to the extent that they do not withdraw, (having been blodied, but maybe not enough), the future will not be like the past. Murray

China's July Oil Imports Decline to Lowest This Year (Update1)

By Winnie Zhu

Aug. 11 (Bloomberg) -- China's July crude-oil imports fell 7 percent from a year earlier as global prices increased to a record, discouraging refiners from purchasing raw materials to process into fuels for sale at a loss.

Oil is dumping becuase demand is dumping.