Fuel duty and the effect of oil prices on the UK economy

Posted by Chris Vernon on December 9, 2006 - 6:12pm in The Oil Drum: Europe

How would Brown respond? Insufficiently, it would appear.

The only "green taxes" were to add 1.25p per litre to fuel duty from midnight and increase air passenger duty from £5 to £10 for most flights. Interestingly Brown rejected demands to re-link petrol prices to inflation.

Gordon Brown, UK Chancellor

Fuel duty

The 1.25p per litre increase on fuel duty deserves some consideration. We covered the structure of UK Petrol Prices earlier in the year. Briefly the price at the pump is:Price of the product + Excise duty + VAT

Before this announcement fuel duty stood at 47.1p per litre, unchanged since 1st Oct 2003. Despite being promised an increase three times since then only now are we seeing a 1.25p or 2.65% increase. It is reported to be an inflation based increase. However inflation over the last 38 months totals 6% (link).

The increased duty is not an increase at all. It maintains the ongoing reduction in real terms, exactly the wrong policy as we approach peak oil and at odds with the requirement for green taxes.

On this subject the Pre-Budget report contains this statement:

It is the Government’s policy that fuel duty rates should rise each year at least in line with inflation as the UK seeks to reduce polluting emissions and fund public services. In Budget 2006, owing to sustained oil market volatility, the inflation-based increase in main fuel duty rates was deferred until 1 September 2006. However, with the risk of volatility remaining high, the Government announced in July that the increase would not go ahead in September and the position would be reviewed at the time of the Pre-Budget Report.I think this is misleading. It correctly refers to the 2006 spring budget increase being deferred to September 2006 and subsequently until today yet it fails to mention the previous "inflation-based increases" of 2004 and 2005 which never happened. There's little point in having a policy that fuel duty rates rise at least in line with inflation if for two out of three years you don't bother!

This reduced fuel taxation along with cheaper cars has reduced the cost of motoring in the UK:

The effect of oil prices on the UK economy and public finances

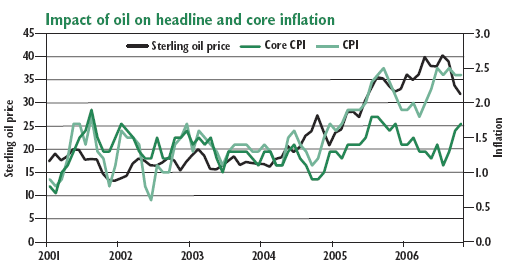

This is an extract from the Pre-Budget Report:Oil prices have increased sharply since 2004, driven partly by demand from emerging markets. Higher oil prices have adverse effects on the supply side, dampening output and demand and leading to higher consumer inflation. Demand is weakened through the erosion of consumers' purchasing power due to higher fuel costs and added pressure on businesses' profit margins in response to higher production costs.Whether higher oil prices lead to a temporary increase in consumer inflation or a more sustained rise depends on the extent of second round effects in wages and costs in response to the original increase in oil prices. The initial impact of higher oil prices led to an increase in CPI, which reached 2.5 per cent in June and August this year, with some additional impetus from higher food prices. However, core inflationa has remained below 2 per cent, in line with the average of recent years. This is consistent with the lack of evidence of any second-round effects from higher energy and food prices in the UK. However, it is important to remain vigilant. As the Chancellor stated earlier this year in his letter to the Pay Review Bodies, "It will be important to ensure that public sector pay increases do not contribute to inflationary pressures in the economy going forwards. To do so would risk converting a temporary increase in inflation into a permanent increase. The Pay Review Bodies should therefore continue to base their pay settlements on the achievement of the inflation target of 2 per cent".

Measures of core inflation exclude certain items from the CPI basket whose price effects might be considered to be temporary and/or volatile, for example, energy prices and seasonal food prices.Oil prices also affect the UK's public finances. While higher oil prices have a positive effect on tax revenues from petroleum revenue tax and North Sea corporation tax, there are a number of offsetting effects that limit the overall impact on the public finances. The scale and timing of these effects is extremely uncertain, as they depend on the responses of individuals and businesses to rising prices. The offsetting effects include:

- any temporary increase in inflation, which increases the indexation of allowances and limits for income tax and national insurance contributions and of indexation of tax credits and social security benefits. Higher inflation also increases the costs of servicing indexed-linked bonds;

- higher petrol pump prices, which reduces the demand for road fuels and therefore reduces revenues from fuel duties; and

- possible impacts on the wider economy, for example, if higher input prices reduce companies' profit margins, receipts from non-North Sea corporation tax will fall.

Oil and commodity prices

Another extract:Looking ahead, high nominal oil prices are expected to be sustained into the medium term. Oil futures prices have remained high, reflecting continued, predominantly upside, risks and spare capacity below historical norms. Geo-political uncertainties, particularly in the Middle East and Nigeria, and the weather, may contribute to supply disruptions. In addition, OPEC cut production by 1.2 million barrels per day in order to defend an oil price of $60 a barrel. The impact of this cut on oil prices is partly offset by the market’s reaction to a corresponding increase in OPEC spare capacity, which other things equal reduces the associated risk premium. The International Energy Agency’s latest demand and supply projections suggest that market tightness will ease in the second half of 2007.Fuel and many non-fuel commodity prices have increased significantly over the past four years. In some cases, notably many base metals, the increase has been rapid. The rise in metals prices has largely been demand driven, particularly from China and other emerging markets, but has been exacerbated by supply constraints stemming from low investment in productive capacity in the 1990s and early 2000s. The combined effect has been to reduce global inventories, creating tighter market conditions.

Iron ore, zinc, lead and copper prices have risen by between 113 and 255 per cent since 2003. Futures prices have also risen substantially, though markets and external forecasters expect some moderation from current high prices as new supply comes on line.

Changes in metals prices tend to be positively correlated with the business cycle and can provide a useful indicator for tracking changes in global demand. Historically, most periods of large rises in metals prices have been associated with strong world growth. Notably, the recent decline in energy prices has not been matched by metals prices, suggesting that global demand growth is likely to remain strong.

Zero carbon housing

This point has raised a few eyebrows. The Pre-Budget Report outlines an aspiration that within 10 years all new homes will be zero carbon. Apparently we will shortly receive a "Code for Sustainable Homes" improving on current building regulations. The report does not define what "zero carbon" means nor the materials, technology and designs employed to provide it. We are promised: "full details will be published at the time of Budget 2007."The sceptical amongst us may think that given what we know about North Sea oil and gas reserves there won't be enough carbon based fuels to fuel our existing housing stock by 2017, let alone new build. If that's the case then clearly any new houses won't be built to run directly on oil, gas or coal (grid electricity will still make a carbon contribution though). Brown may achieve his zero carbon new homes in 10 years time, not by proactive, designed intent but simply through lack of carbon based fuels.

North Sea revenues

Thanks to rbkpeak who mentioned in the comments that the report also states that forecast treasury receipts from the North Sea for 2007/08 are now some £3bn lower than previously forecast, this is blamed on ”revised production and expenditure forecasts and stronger dollar-sterling exchange rate”. That's quite a hole and just what Euan discussed in this report: Lies, Damned Lies and Government Oil Production Forecasts?The Guardian Newspaper describes it thus:

An unexpected and sharp drop in tax revenue from North Sea oil companies and a rise in inflation have resulted in the chancellor having to raise taxes and borrow more money, the Treasury said today.The Pre-Budget Report has this to say on North Sea revenue:In spite of boasting of a stronger economy in his pre-budget report, which normally would boost tax revenues, Mr Brown has suffered an expected drop in revenues of £3bn in 2007/08 and £2bn in 2008/09 from the North Sea.

This was due to a bigger-than-expected drop in oil production, a fall in the value of the dollar in which oil is priced, and a rise in investment by North Sea operators, which reduces their taxable profits.

The significant increase in oil prices since the start of 2004 has led to large rises in the profitability of North Sea companies. The net rate of return for UK Continental Shelf companies was close to 40 per cent in the first half of 2006, substantially above the 13 per cent return recorded by other non-financial companies. Given the upward shift in the expected price of oil in the medium term, oil and gas companies should continue to register strong profit figures over the forecast period.North Sea revenues for 2006-07 are expected to be close to their Budget projection at just over £10 billion. Oil prices are likely to average around $9 a barrel higher than the $57.4 assumed in Budget 2006 and this would be expected to result in higher tax revenues. However, while North Sea profits remain very strong, the further boost to taxable profits from higher than expected dollar oil prices is being offset by a stronger dollar-sterling exchange rate (which reduces the rise in the sterling price of oil), lower than anticipated production, higher capital investment and increased operating expenditure. The forecast for North Sea revenues assumes a further rise in receipts to £10.7 billion in 2007-08, but this is a much more modest increase than assumed in the Budget 2006 forecast and reflects developments in prices and production as well as continued downward pressure on profits from higher capital and operating expenditure. The projections for North Sea revenues use the NAO audited assumption on oil prices. In line with the average of independent forecasts, oil prices are expected to be $60.3 a barrel in 2007, around $2 higher than assumed in the Budget 2006 forecast. However, the stronger dollar-sterling rate means that oil prices in sterling are lower from 2007 onwards than assumed in Budget 2006.

Investment in the North Sea has continued to increase and is now substantially higher than the capital expenditure projections incorporated into the North Sea revenues forecast prior to the announcement of the increase in the Supplementary Charge. This demonstrates the continuing attractiveness and competitiveness of the North Sea as a place to invest. However, despite the highest levels of investment this decade, North Sea production has been lower than expected in 2006. This seems mainly due to rising maintenance requirements for North Sea infrastructure, with further pressure created by increased global competition for equipment and skilled personnel pushing up costs as operators everywhere try to maximise production. Production is expected to rise in 2007, with a number of new developments, including the Buzzard field coming on stream. However, the overall level of production is expected to be significantly lower than assumed in the Budget 2006 forecast reflecting the lower starting point and more modest increases expected by operators. Beyond 2007-08, production is expected to gradually return to its previously assumed levels, helped by the higher levels of capital expenditure. This reduces the shortfall in revenues relative to the Budget 2006 forecast.

And why's Gordon looking so happy - has he been reading TOD? :-))

Most metals prices crashed in May along with equities - but not oil at that time. Metals are just off their May lows now.

U - that energy metal - just keeps going up - I wonder why?

But I agree global demand has stayed strong. Brown is forecasting 2.75% growth next year.

As for green fuel taxes - who is gong to be put off flying by an additional £5 on air passenger duty?

- current demand for uranium exceeds production. World production of uranium ore only accounts for 60% of consumption, the rest comes from dismantled bombs and from existing nuclear fuel units.

This state of affairs is likely to continue for some years as

- there have been no new uranium production facilities of size opened for some years

- a third factor is the flooding of the Cigar Lake facility (Cameco) which was to be as much as 10% of world supply, when completed

There has also been a lot of hedge fund activity, going long in the uranium metal, for the reasons as above.Demand from new civilian nuclear facilities is at least a decade away, in most cases (there are a number of units being built in China, I believe, and also Finland has one under construction).

Let me expand a little.

LCA - cradle to grave on new Scandinavian buildings show an energy use for construction materials and erection of the building of approx 1 barrel oil energy per square meter ~160 liter oil energy/m2(1 liter fuel oil= 36 MJ/liter). And 1 square meter single family home weighs approximately 1 ton.

Variation is from timber houses approx. 135 liter/m2 to concrete/ brick approx 160 liter/m2. However if you add durability of materials and maintenance into the calculation there will not be much difference in energy use/ CO2 seen over a 50 year span.

Then what is the actual CO2 of 1 m2 building(for construction materials)?

Source 1)+2) together

1 m2 building = 1 ton ~0.160 m3 * 0.86 ton fuel oil/m3* 3 ton CO2 per ton fuel oil = 0.41 ton CO2 per ton average Scandinavian building.

But heating energy use in the average EU building(and Danish also- cold climate but relatively well insulated) is approx. 140 kWh/m2/y= 14 liter fuel oil energy per m2/year.

So, heating buildings equals the construction materials energy cost in 160/14

= 11½ years. If you add cost for hot water and Electricity - typically 50% on top, then it is clear that the energy use in buildings are dominating.

In fact 3) some 40% of the present EU energy use is spent for heating, hot water and electricity in buildings. Transport is some 30% of the EU energy spending.

Therefore the EU commission 4) is concentrating on energy efficiency in buildings and transport togethher with energy efficency in energy supply.

Sources.

1)P.Steiger;R. Frichknecht et al. "Hochbaukonstructionen nach ökologischen Gesichtspunkten" SIA dokumentation D 0123 Schweizerischer Ingenieur- und Arkitekten - verein September 1995. (encyclopedia ( bible)of LCA data for construction materials and constructions).

- Sverre Fossdal Energi- og miljöregnskab for bygg NBI-projektrapport 1995 (Norway) ISBN 82-536-0481-5

- http://ec.europa.eu/environment/climat/pdf/official_sec_2001_2053_en.pdf

(energy use in buildings = 40% etc.) section 4.3 page 85.4) http://europa.eu/rapid/pressReleasesAction.do?reference=IP/06/1434&format=HTML&aged=0&la nguage=EN&guiLanguage=en

regards / And1

The other thing that has happended in the UK is the government obsession with tertiary education for all. This has led to a big migration of young folks from country areas to the University cities - like Aberdeen - and that means even more young people chasing 2 bedroom flats. And the country schools are half empty.

The EU statistics show a steady growth in m2/person and it is the same trend all over europe. In Denmark there is an average 55 m2 / person and the rest of Europe is closing in on that number. Luckily the improvment of building standards has kept the heat loss in check. In Denmark the energy use for heating per person has been the same for 25 years.

As once a farmers boy I pity the depopulation of the countryside. On the other hand I cannot blame people for seeking well paid jobs in the city- and for the remaining farmers to merge farms to make a living?

As many have mentioned in TOD there will, at some stage be a reversal of the trend - but possibly not before biomass/ renewables are dominating energy supply and will need a localized workforce.

In terms of energy use, cities are usually more efficient than living in the countryside. The " compact city" with short distances, piping, sewers, wiring and the relatively lower heat loss from apartment buildings compared to single houses ( volume/area) will possibly mean that people will be better off in cities. As long as there is work there.

But what is important to me is to reduce the base energy consumption in society. Ideally by incremental steps year by year. As I have mentioned before, Denmark 2005 used 840 PJ/year. In a post fossil scenario Denmark can sustainably produce some 250 PJ energy with biomass and full use of renewables ( solar hot water PV, Windmills etc.

So sustainable " forever" energy consumption should be 250/840 ~1/3 of 2006 for Denmark. The big energy consumers are building energy use plus transport- together some 70% of all energy use, and we should concentrate on reducing them.

For buildings a reduction of energy use to 1/3 for buildings over a 50-75 year time frame is possible and demonstrated already- both for new- and old buildings. For transport it should be possible also in shorter time frame.

So I am quite optimistic. There is no easy fix- but a lot of changes.

In order to prepare society for this future it is important to improve energy understanding on all levels in society and for this education and "visibility" are important ingredients.

Regards And1

I couldn't agree more - but getting our politicians to acknwoledge there is a problem is no easy thing. In the UK, where in a few short years we have gone from being oil and gas exporter to an importer of both you would think the government might take note - no chance I'm afraid, they think energy grows on trees - and now we've used up all our own we'll just go use some one elses instead.

I always enjoy your postings..!

That coupled with the low hanging fruits theory, everything remains very botanical!

Just what is the expected lifespan of new Nordic housing ?

I would have expected a "half-life" of 250 years or so. Well insulated means that they would not be scrapped prematurely.

What I have seen seems to be first quality construction (unlike US !) that should wear well.

Best Hopes for High Quality, Energy Efficient Construction,

Alan

I'd like to stress that 43p is about € 0.65 (or $ 0.85), a full half of what I pay for a liter, VAT and duty included. It is a big number and I'm not seeing any politician being able to push that forward without raising popular turmoil.

Now let me take a favorable word towards Brown. The policy up to date has been favorable to high interest rates to control inflation keeping it circa 2%/a. That's why the £ is nighing the double against the $, in practice meaning that the duty is in fact increasing - in July the duty was equivalent to $ 0.795, less 5 $ cents than today. As long as the UK keeps itself on positive economic growth, allowing for high interest rates, this policy is in fact increasing the toll on oil consumption.

The problem is that this policy is not sending the right message to public, a signal the we need to veer consumption; in fact it is signaling the opposite. This is what the politicians need to do in the future, but it requires courage. If Chancellor Brown arrives at the Prime Minister post will he have that courage?

Cost of services also seems to be way up - getting a car serviced or repaired, eating out, staying in a hotel. 2% seems a fantasy to me.

Aaaah, "lies, damn lies and statistics". The "new" way of calculating inflation is by comparing apples and oranges, known as "sample substitution", or something like that. An example: if the price of a shirt is moving too high at a name brand store the government substitutes it for a cheaper one from WalMart. That is old hat already - but it gets more insiduous: if olive oil, for example, gets too expensive vs. canola oil....statistics says you will alter your eating habits.

Et Voila... 2%.

The best case scenario was if you lived at home and scrounged off your parents, in this case you may actually experience deflation (thanks to all those cheap ipods...)

The worst was if you were a pensioner, due to the very real cost of fuel costs rising.

Me? I'm being hammered by huge increases in housing costs (relative to older folk that purchased a decade ago) especially compared to my income. Rents around here are rising faster than the rate of inflation....

Of course Brown changed which measure of inflation he uses, to the one where housing costs are not considered. This was to prevent house price increases from causing runaway inflation, and to prevent public sector workers from demanding payrises to pay for more expensive housing. This (along with a multitude of other reasons) is why I'm far from impressed with our so-called "prudent" Chancellor.

I don't believe the 2% inflation figure for one second.

Plus, I have to comment on fuel duty. Although the real cost of motoring has decreased, that's mainly due to cheap credit and cheaper cars.

The cost of FUEL has increased above the rate of inflation. I don't see how it is fair that the Chancellor can increase his tax take on fuel pushing the total cost up beyond inflation.

Plus no one ever mentions that there is a component of tax on fuel that increases with inflation. VAT.

In late 2003, I could buy petrol for 77p/litre. VAT accounted for 13.475p

Now in 2006 petrol is 85p/litre. VAT accounts for 14.875p

That's a 10% rise on VAT receipts. In a period where inflation has supposedly been 6% So the Chancellor has already had his inflation busting increase in VAT receipts from fuel.

The price of fuel, as mentioned, has already gone up beyond inflation. The excuse that the treasury receives less total cash (adjusted for inflation) because there has not been inflation increases on (fixed) fuel duty just will not wash with the public. Especially considering the vast increases of Stamp Duty receipts, North Sea revenues and VAT recipes on home fuel (5% of a 30% rise in consumer costs).

Nope, Gordon has massively increased tax take, and we've got little to nothing to show for it. Especially as most of our new schools/hospitals are now PFI, which is the government equivalent of buying it on a credit card and only paying the interest charges.

Not impressed

Andy

Can't believe I did that.

Ironically petrol prices are rising above inflation.

At 77p/litre petrol is 18.4p for the actual petrol, the rest is tax.

At 85p/litre petrol is 25.2p/litre

That works out at 11% per year inflation over the last 3 years on the cost of the actual petrol.

So the huge duty actually acts as an insulator to the product costs.

Oh, the irony....

Andy

My personal feeling is that the affluence has gone way up with the arrival of the €. In the 1980s people started to afford a house, in the 1990s it was the private car and multi-car family. Lately it has been vacations in the Caribbean or Brasil and for some lucky ones Seychelles or maybe Mauritius.

We live incomparably better than 20 years ago. So those inflation numbers are not much of an indication of what's going on. Since we have high tolls on gas we haven't felt that much the gas prices, although last Summer they were almost 50% above early 2004.

I do feel the hike on manual labour services like you say, mechanics (my bike mechanic earns more than I), restaurants, house keeping, etc, mainly due to lack of supply of such workers. But these hikes have been offset by the growing affluence brought be the €. In 10 years the minimum monthly wage in $ almost doubled (from circa 270 $ to above 530 $).

The real big concern here is that people went like crazy into debt, which went over 100% of house income 3 or 4 years ago. Today even families with annual income above 35000 € are flocking into protection in face of Trichet's rate hikes. So basically debt crunched families are feeling great pain in a time like no other here. My parents could only dream of the life middle class families now have.

The euro has not "brought" affluence, but it has allowed interest rates to come down, all other things being equal, of course. And even that is relative: your viewpoint if from the perspective of Portugal, a country which (like Greece) would never have had such low rates, were it not for the euro. That does not apply to more fiscally conservative countries like Germany, Netherlands, etc. In fact for them the euro is a very mixed blessing.

In any case, the ability to borrow more money is not affluence, but the ephemeral spending of future earnings. After a certain point, we are in reality spending our children's incomes as well as our own - and that is why we "feel" richer. We consume more and we condemn our children to a pauper's life.

Just think of it like Peak Oil: burn it now like it will always be there and our children will go back to a life of gathering wood.

Regards.

I guess you're right. Sometimes these things aren't easy to percept.

There's one thing I didn't mention, during these last 20 years Housing went through the roof. My house cost something like 50 years of minimum wage, and the minimum wage isn't enough the pay the mortgage of a decent place in the Lisbon. Right now some banks are making way for 80 years mortgages that after the death of the contractors automatically fall on their heirs.

Still my point was that life is much easier and with a lot more comfort than what it was 20 or 25 years ago. And to someone with no major debt obligations is incomparable to the 1980s.

This has to do with the turbulent fall of the fascist regime in the 1970s that drown the country in problems, eventually exploded in the 1982 recession in the wake of the Iran-Iraq war. The EEC in 1986, the free market in 1992 and the € in 1999, all brought (in my view) the country a bit closer to European standards.

Also when you say debt over 100% of house income - does that mean 1* combined sallary. In the UK we're now on 5* sallary for mortgage debt alone - with some rediculous 30 to 40 year repayment plan.

Here we have monthly wages and mortgages. During the year folks pay 12 times the mortgage and get 14 wages - twice in July (so they can go to Brasil) and twice in November (so they can go to the Pyrenees).

Meaning that debt is over 100% is the same as saying that folks need more than 12 wages to cover yearly debt repayments. So instead of going to Brasil they will settle for the Algarve, and instead of the Pyrenees if they stay at La Covatilha it'll be great.

for what it's worth, in the UK, "wages" tends to imply "paid weekly", while "salary" tends to imply "paid monthly" (although the two do get used interchangeably)

What Euan meant was that a typical mortgage is currently 5* annual salary. So, if you earn £20,000 per year, then you could get a mortgage of £100,000. Which is still not enough to buy even a one-bedroom flat in some parts. (For reference, many public sector workers - nurses, teachers, other civil servants - earn significantly less than that, although more senior ones do earn more)

"Ofcourse it depends where you shop - ASDA / Wallmart you can pick up "trash" dirt cheap."

True. Or you can shop at the upmarket stores, and pick up "trash" way high! :-)

RC known to you as ThatsItImout

The more you beat them the better they be

Time for some re-education Euan, pretty little M&S morsels do not make sufficient food for a hard working man.

IMO the government needs to introduce "draconian" legislation aimed at reducing consumption of fossil fuels and consumptive waste. How they achieve this and emerge with an intact economy is another matter. Consume less and be happy does not equate to economic growth.

I'm with you on this one. Whatever happens, the vast majority of people always have and always will operate and make choices to their own short term (predominantly financial) benefit. It's how the world works. Perhaps this situation erodes a little when a nation is at war?

It's up to Government to construct a framework whereby many individuals, each acting selfishly can collectively achieve something great. Depending on your understanding of "great", capitalism is such a system.

The challenge for the future is to rearrange the rules of the game such that individualistic and selfish behaviour can deliver a sustainable future. Any ideas?

I have pondered this question. The thing is, the rules of the game have not been imposed on us by some outside entity. We chose them. We chose them because they meet our desire for personal gain. If someone tries to impose different rules, we will seek ways to revert them back to preferred rules.

So the question becomes how do we change our desire for personal gain? This is derived from our genes, we are programmed by evolution to acquire wealth, in order to promote our chances of passing on our genes.

Humans however also have an exceptional capability to cooperate. It is really this feature and not just desire for personal gain that has enabled us to get were we are today. We normally only cooperate when there is a win/win outcome, we don't cooperate if there is a lose/win outcome. That is, cooperation is applied where it satisfies both parties desire for personal gain. Without advanced cooperation, we would still be at the level of familial hunter/gatherers.

Therefore the problem is that if we conciously choose a different, low-growth system, we risk being outflanked by people who stick to high-growth system, unless we can get the whole world to "play fair". This is the problem with Kyoto. No-one wants to concede advantage.

So in order to rearrange the rules to create a sustainable future, we need everyone to agree to a concious decision to override our inbuilt programming, and accept some lose/win. Getting such a level of understanding and agreement is quite a tall order. Perhaps when the situation gets so bad that everyone is losing, then we will cooperate to minimise a lose/lose situation. Cooperation got us into this mess, perhaps it will get us out of it.

http://www.simpol.org.uk/simpoluk.php

to pressurise politicians worldwide into cooperation.

Push comes to shove when its no longer tax, its subsidy.

If you are looking for modification of the habits of civilisation, look elsewhere. Discover why normal people might want to change, because tax is a blunt and ineffectual weapon.

These aren't Green Taxes, they're just more Stealth Tax.

Talks about production being lower than expected, despite increased investment, but expects production to increase again next year.

Umm...

Richard.

The Stern Review contains a stabilisation path for 450 ppm CO2e which shows that annual emissions must be made to peak around 2010, then decline by 60% up to 2030, not 2050. That would be 3% pa.

http://www.hm-treasury.gov.uk/media/987/6B/Slides_for_Launch.pdf

Incidentally, this is the same annual decline rate as in Bakhtiari's WOCAP model which declines by 30% by 2020.

All other stabilisation levels much higher than 450 ppm CO2e come too close to dangerous climate change as defined by J.Hansen in:

http://pubs.giss.nasa.gov/docs/2005/2005_Hansen1.pdf

As I understand it, our situation is as follows:

We had an average warming of 0.7 degrees since the industrial revolution. This temperature increase is NOT yet the full response of the climate system to the amount of CO2 currently in the atmosphere which is another 0.6 degrees, to make it 1.3 degrees relative to pre-industrial. Temperatures in previous interglacial periods were 1 degree higher than today and sea levels several meters higher. We are now at 430 ppm CO2e, so we have VERY LITTLE room to manoeuvre between the 1.3 committed from past emissions and the 1.7 which will bring dangerous sea level rises. It is 1 minute to twelve!

Scientists just found dead corals near Perth, Western Australia, from the last interglacial period, 2-3 metres higher than current sea levels:

http://www.smh.com.au/news/science/reef-insight-on-global-meltdown/2006/11/09/1162661830501.html

In a dramatic appeal to all Governments J.Hansen demands that coal fired power plants without geo-sequestration of CO2 be bulldozed, starting already in 2025.

http://www.columbia.edu/~jeh1/wsf_09nov2006f.pdf

In Australia, global warming is on top of the agenda. Massive crop failures (wheat down by 60% from last year), unseasonal heatwaves, permanent water shortages and now bushfires in the State of Victoria advancing on a front of 100 kms demonstrate every day what global warming really means.

The Age: Blaze will burn for months.

http://www.theage.com.au/news/national/blaze-will-burn-for-months/2006/12/09/1165081201762.html

Australia should introduce an immediate cap on coal exports.

You might want to post the differnce between the 450 & 550 and your text on the matter, which you sent me on 2/12/06 when we had a discussion about this. The stern review with your remarks.

Don't forget we have a real water problem in our cities becuase of this drought.

City in hot water: dams at record lows

http://www.smh.com.au/news/national/city-in-hot-water-dams-at-record-lows/2006/12/07/1165081092048.h tml

You may also want to look at this from the Murray Darling Commission at the recent water Summit to see that 07/08 if it does not rain sonn will be very challenging.

http://www.mdbc.gov.au/__data/page/54/First_Ministers_Briefing_7Nov06_MDBC.pdf

Matt in Summer months Adelaide nearly totally dependent upon the Murray River for water. Next year this time could well be very interesting.

Note it says if dry continues by 07/08 there will be no reserves and we are in new territory.

This is also feeding into food prices

Meat prices to soar as drought drags on

"The minister said he expected meat to be in very short supply in January and February, leading to "significant" price increases that could be in the order of 25 per cent rises"

http://www.smh.com.au/news/National/Meat-prices-to-soar-as-drought-drags-on/2006/12/10/1165685543340 .html

David Bell

AKA Beacon Boy

As I understand it, there are plenty of examples in the last few hundred thousand years of even drier spells in Australian history.

Australia cycles from being mostly covered by forest, to being a dry desert.

The history of the aborigines tells us this. There were fewer than half a million (?) when the white man arrived, having been resident for 30,000 years. This, as I understand it, is simply a consequence of the fact that Australia is a harsh and unforgiving place.

The presentation assumes a 'long term average' that may, in fact, have been a historical anomaly (or at least simply the end of a relatively wet period in Australian climatic history).

I know only a tiny bit about Oz, but my general impression is that the country is struggling with a situation that may be only the beginning of a far dryer period in its history.

Analogy: I read a piece once (can't find it right now) by a biologist about Californian droughts. He had more or less shown that Southern California goes through periodic droughts one or two centuries long. Where it doesn't rain. He did this by looking at tree rings.

For all our ingenuity, a century long drought would tax the ecological and human system of Southern California.

I suspect Australia would be no different.

Did you see The Oil Drum's coverage of Hansen's position we had a couple of weeks ago: Dr James Hansen: Can We Still Avoid Dangerous Human-Made Climate Change?

When you say "now", when do you mean? We are now (2006) at 381 ppm, I thought.

http://www.globalpublicmedia.com/lectures/795

You'll find links to the report there, though I haven't made the time to read its 600 odd pages yet. It may be 1 minute to 12 but we won't hear the bells until too many minutes too late. It may actually be past 12 already on climate change, but it could be decades before we really know.