Insights Regarding Future World Oil Production Based on ASPO Denver Presentations

Posted by Rembrandt on October 26, 2009 - 10:27am in The Oil Drum: Europe

"Peak oil can be a very tricky topic, the way I talk about it and deal with it at the end of the day is: We need to revolutionize the way we consume and produce energy... We need to really be the leaders in saying: the future for our children and our grandchildren as far as energy consumption and as far as production, it looks like this" with those words Colorado Governor Bill Ritter started his closing speech at the ASPO conference in Denver that took place from 10 to 12 October 2009.

Telling our children and grandchildren where they will draw their heat, electricity and liquid fuels from was not a topic of discussion in Denver. Nonetheless, much information was conveyed on the relationship between the economics crisis and the future of oil. This post is an attempt to summarize the main points on oil and the economy from the conference presentations--concluding that there are three distinct future trajectories as we go forward.

At the Denver conference, world oil production was discussed from both the supply side (what flow rate can be reached) and the demand side (how much can the economy afford). It is really the combination of the two that is important--so I bring together both in this post.

Oil - the supply side - what flow rate can we reach?

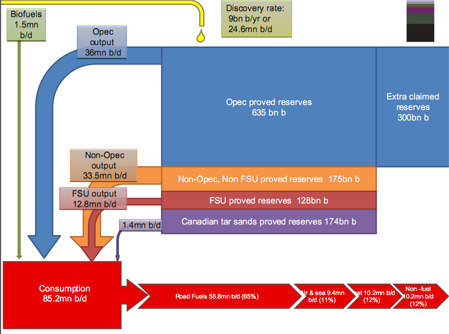

An overview of the future of oil at the conference was given by Ray Leonard of Hyperdynamics Corporation (PDF) and Chris Skrebowksi of Peak Oil Consulting (PDF). Ray Leonard who has extensive experience as former Vice President of Yukos in Russia and Kuwait Energy Company in Kuwait, showed that conceptually dividing the world of oil into 3 segments makes sense:

- OPEC controlling 73.9% of world reserves and 44.9% of worldproduction

- The Former Soviet Union (FSU) controlling 12.7% of world reserves and 15.6% of world production

- The Rest of World controlling 13.4% of reserves and 39.5% of production.

This distinction makes sense from a political perspective, as OPEC and the FSU operate under much different political and economic circumstances than the Rest of the World. Ray Leonard estimates that Russian production could theoretically increase by another 4 million b/d with new field developments but that this is unlikely to happen due to the Russian tax system and Russian firms lacking the necessary capital. OPEC is in a similar situation of not being able to expand production due to a lack of capital as International Oil Companies are barred from investing in secondary and tertiary recovery. In Ray Leonard's words: "Limitation on production level for OPEC is mostly due to politics, lack of motivation, investment level and type of crude; NOT shortage of reserves." OPEC could hence be increasing production greatly by implementing secondary and tertiary production techniques such as water injection but this possibility is nigh impossible in his view. The division Ray Leonard made between these regions was neatly depicted by Chris Skrebowski in a chart reproduced here.

Ray Leonard showed that production in the Rest of the World peaked in 2002 and by 2008 declined by 7%. With OPEC and Russia unable to increase production significantly due to politics and economics, we are nearing World Peak Oil Production. "Production peak of ultra deep water fields will allow 'peak' to be a 'plateau' in the coming decade, followed by a sharp fall" according to Leonard. Unconventional production is not set to change this situation, as his expectation is that the contribution of this category of oil will be less than 3 million barrels per day in the short to middle term.

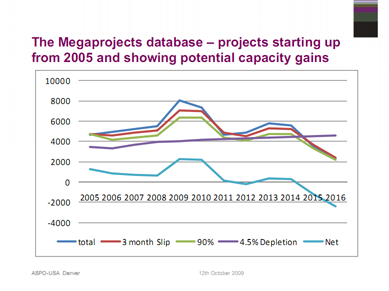

The specific path of future oil production was projected by Chris Skrebowksi using the oil megaprojects approach, wherein all the large fields expected to come on-stream in the next seven years are tabulated and compared with decline rates in current fields. In this approach, only the supply side is taken into account and the demand side is ignored. From that perspective according to Chris Skrebowksi the current plateau will continue until around 2014 when the decline sets in, shown in figure 2 below.

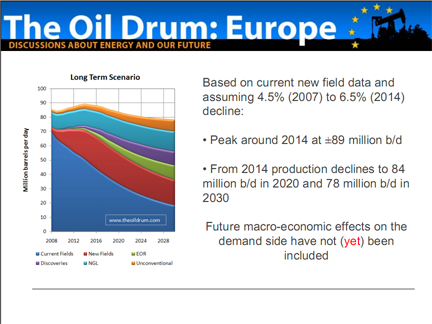

A similar approach was presented by myself in the first update of a new project where I showed a continued plateau with potentially a small increase before the decline starts around 2014. This date is based upon an analysis using a database of individual projects and the assumption that the decline rate will accelerate from 4.5% to 6.5%. The difference between my analysis and Skrebowski's is that I use a more severe decline rate and also include many more projects. There are around 600 fields in my database versus around 250 in Chris Skrebowski's, because he did not include smaller fields, hence the term megaprojects. A post on this is in the works with publication due in November here at The Oil Drum.

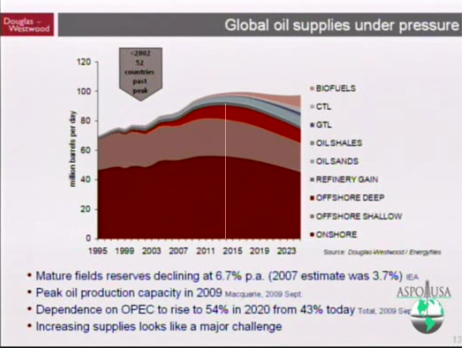

Interestingly another speaker at the conference, Douglas Westwood, presented a similar scenario with a plateau continuing until around 2014, after which the decline sets in:

Such analyses however do not include demand side effects and are therefore limited in portraying an accurate picture of the future. A major factor that was discussed extensively at the conference was fortunately the interplay between supply, demand and prices.

From oil supply analysis to demand analysis - three future trajectories

Steven Kopits from Douglas-Westwood (PDF presentation not available) kicked off the discussion on the role of demand and prices in oil supply by showing that growth in the world economy did not stop despite a lack of growth in oil supply since the fourth quarter of 2004. "Oil supply stopped responding, GDP growth still went up, oil prices rose, and that put us [the United States economy] in a recession, and that's why I argue that this is the first Peak Oil recession," according to Kopits. Based on this reasoning, future oil prices will be determined by how quickly demand will again hit oil capacity limits. Kopits thinks that this could happen quite soon, as he foresees huge growth levels in China. The country is expected to overtake the US in oil consumption by 2018, at 21 million barrels of production per day. The general pattern that he presented is that emerging economies will overtake supply from the developed economies of the world. Oil consumption in the latter will be driven down by high prices resulting in increased fuel efficiency and the development of large scale alternatives. "Belt tightening is expected to happen" says Kopits. So in one future possibility a 'bullish path' emerges where the pattern we just saw happening repeats itself, emerging economies grow, prices rise and developed economies have to give way and are forced to use less oil. The big question in this future is the amount of growth in emerging economies, most notably China. Allen Stevens, of Stifel-Nicolaus (PDF) showed an interesting graph in his presentation comparing per capita consumption in various countries, showing the huge gap between oil consumption in emerging and developed economies.

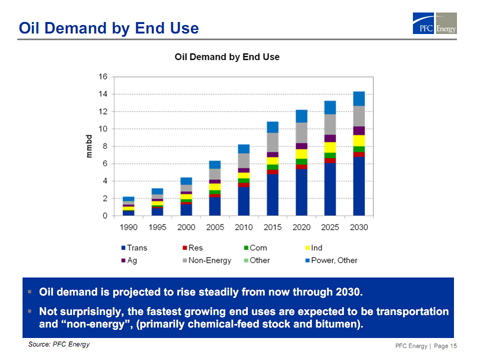

The view that Chinese demand will move up so quickly was contested by Michael Rodgers of PFC Energy (PDF) who gave an outlook on future oil & gas production and consumption in China (PDF). Based on their model that included eight categories of oil demand, energy efficiency, solid but slowing GDP growth patterns, and a similar car trajectory as in developed countries, Chinese oil demand was foreseen to hit 11 million b/d by 2015 and slightly more than 12 million b/d by 2020, shown in the figure below.

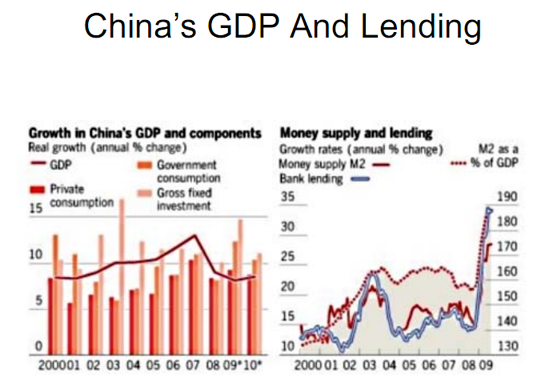

This slower growth was also portrayed in Dave Cohen of ASPO-USA (presentation found here (PDF). Cohen showed a second type of future with a more protracted economic downturn--either a very long slow recovery with many up and down patterns or a more L shaped depression similar to the great depression of the 1930s. The underlying mechanism for this pattern would be the inter-linkage between the Chinese and United States economy. It is clear that Americans must repair their balance sheets and are in deep debt trouble, but also the Chinese economy is not faring so well according to Dave Cohen. He showed that China's GDP numbers are inflated because of the way output is calculated, and that recent GDP growth in China is (almost) entirely due to a huge internal governmental stimulus which is not a sustainable economic investment pattern. "The Chinese, traditionally a nation of savers, needs to build up their domestic demand. This requires steady “organic” year-over-year growth over the next decade or longer. Otherwise, the economy overheats and you get mis-allocation of resources (capital) and bubbles (like now)," according to Cohen. He concludes that China will not provide the consumption engine the world economy needs for sustained growth as their economy and domestic demand is too small, and because of these factors, that Chinese oil demand will not grow in the future at the levels seen pre-2008. The implication of these factors is that there will be a much slower return to high oil prices and several cycles of contraction before the world's balance sheets are again at a reasonable level.

A third possible future which looks at the financial system as the driver of our current situation was shown by Nate Hagens of The Oil Drum (PDF1), (PDF2). Hagens disagrees with Kopits in calling this the first peakoil recession: "I do not think peak oil caused this financial crisis; peak oil is one of many symptoms of an exponential growth based system running into finite limits." Due to continued exponential growth in our financial system that was not based on accumulating sufficient resources, we have accumulated so much debt that this can no longer be paid off under any scenario. "We have an amazing overshoot of debt, by my calculations the total amount of debt, not derivatives but total debt, is between 230 and 290 trillion dollars...That's beyond the ability to pay back...Basically we have overextended the relationship between debt and real assets." according to Hagens. He showed the amount of debt accumulation in the United States shown in figure 8 below, but it isn't just the United States. "The whole world is around 300% to 400% in debt relative to GDP."

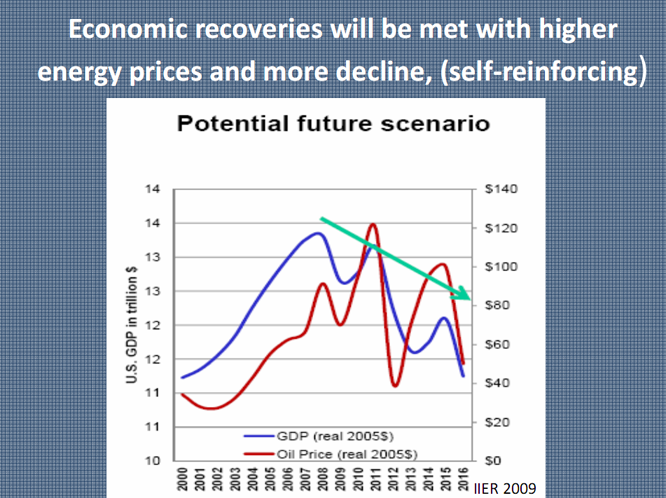

As money is a claim on future resources, and these resources cannot be forthcoming due to limits of growth, a debt deflationary spiral will ensue, resulting in a downward trajectory of GDP, causing a decline in resource prices that results in further underinvestment in resource production. As the world comes out of this deflationary cycle, the physical resource basis for renewed growth will have degraded significantly, higher prices will kick-in again and GDP will be affected. There was no comment on how long this reinforcing cycle would continue or where it would end. Under this scenario we would have already reached peak prices according to Nate Hagens because the future economy can sustain only much lower prices due to the erosion of resource capital. Conceptually this trajectory is shown in figure 9.

Synopsis - uncertainty over our future path

Although supply side analyses show that oil supply can remain on a plateau until around 2014 and would decline relatively slowly afterwards, the picture may change significantly because of the current disconnect between levels of debt in most economies of the world and the physical resource base. Several future scenarios could emerge as a result of this situation. In one future scenario we will witness continued high oil prices as emerging economies are able to sustain renewed strong growth and thereby outbid developed countries with respect to future oil consumption. The resulting decline in consumption in OECD countries will be relatively smooth as high prices induce massive investment in energy efficiency and alternative fuels. This assumes that such fast growth is possible on the existing physical resource basis and that the current debt situation can be managed in some way. In a second future scenario, we see a much slower growth scenario in emerging economies as they too suffer from overhanging debt and are too interlinked with developed countries to be able to sustain high growth levels. The future will in that case be more like a U shaped or even great depression like L shaped situation; oil (and resource) price cycles will occur with high price volatility and a lack of sustained investment. We can muddle through, but at significant reduction in GDP as huge shocks ripple through the system, and also huge risk of political and geopolitical cascades. In a third scenario, the debt situation has become too big to solve globally, and we enter a deflationary self-reinforcing spiral. GDP will spiral downward, resulting in much less investment in the physical base of our economies. In this scenario, even when the economy recovers, resource scarcity kicks in due to a serious lack of investment, and GDP again declines under the pressure of very high prices.

As to which of these futures (or variants) will occur, I have not made sufficient analysis to offer an opinion, but I am sure that collectively there is sufficient knowledge to point to which direction is most probable.

Thanks to ASPO-USA

I want to expressly thank ASPO-USA for organizing this great conference in Denver which has brought me many useful insights in the relationship between oil and our economy.

What is interesting to me is that America has over 2-trillion barrels of oil in its Utah oil sands and Colorado oil shale -- yet all official U.S. government figures plot a very slow and relatively insignificant addition of this oil to the national oil mix.

The oil industry and government officials seem to blindly accept that the only way to extract oil from oil sands and oil shale is to heat it, to boil out the heavy oil so it starts to flow. Obviously, by using heat, there are unintended environmental consequences that only Canada has been willing to accept - the consumption of huge amounts of riverwater, burning of half the natural gas in the North country, emission of more green house gases than an oil refinery and the creation of effluent waste tailing ponds that pollute the groundwater.

But now in the 21st Century, using American ingenuity and geochemical science -- there is a new, improved, zero-discharge, environmentally-friendly way to extract oil from rocks -- using a tested, demonstrated and proven technology: EncapSol solvent.

Check out these videos to see the potential future of clean oil production -- this technology obsoletes all the government and industry projections based on the inferior heat-based technologies with all their negatives...

www.EncapSol.com/media -- to see oil sands dissolved cleanly in ice water... and

www.EncapSol.com/tar-sands-and-oil-shale-extraction/ -- to see scaled-up equipment proven to extract oil from tar sands / oil shale without emitting any pollution or consuming any water or natural gas.

With its delivered production cost of <$33 a barrel -- I believe EncapSol may be the one true game-changing technology that can help America produce the 10-million barrels a day that it would need to totally replace oil imports within the next decade.

And by what I saw in the videos -- EncapSol may also be a better EOR method to employ than CO2 or steam-injection to dislodge and recover the stranded, immobile oil that water-flooding fails to free.

So how does this magic EncapSol manage to chemically convert the Kerogen in 'oil shales' into oil before extracting it?

Sounds to me that they don't even understand what oil shale is and this is just a marketing device. TBH I seriously doubt that this would help much; solvent/detergent extraction is fine under highly controlled conditions, which is the case in cleanup and possibly surface mined oil sands - start using this stuff underground and it'll probably just vanish into the rock.

Terrific trader. Please be sure to report back when EncapSol's production reaches 50,000 bopd. I wish them well...really. Because at that point much of our energy problems will have been solved. But until they reach that point nothing is proved. Video's are wondeful. I especially like the ones Disney puts out.

I dunno. I kind of like the Shrek line of videos. I suspect that these Kerogen production facilities will be located in Shrek's swamp, where other fantasy creatures hang out, and where Michael Lynch lives.

I know this is kind of crazy, but would nukes be able to convert some of the shale to oil at a reasonable ERORI?

Definitely possible - you could then chain two (relatively) low EROI techs together to add some decent energy gain to system. But then you'd have to contend with non-energy input limitations - for example how much free water is there in Colorado region for nuclear cooling? I don't know.

Estonia burns crushed oil shale to generate electricity, they do not have to worry about upgrading the kerogen. Most of their electricity is from oil shale.

Estonia has close to the highest kerogen rich shale in the world -- also possibly the easiest/cheapest to mine. Still many problems such as pollution ash from burning etc. The Estonian word for shale translates as 'burning stone'. http://en.wikipedia.org/wiki/Narva_Power_Plants

If you're willing to accept minor reductions in efficiency, you don't need all that much water. How much water does your water-cooled car use per mile? Same thing -- a "radiator" -- can be done for nuclear power stations.

I cannot remember the state in which it was done (I'm thinking New Mexico), but the DoD conducted an underground test in which they used a low yield fission device to fracture formations and liberate NG.It was successful and the extraction of natural gas was done with relative ease; the only problem - it was highly radioactive.Not really sure why they expected any other outcome, it is axiomatic.All those craters in the NV test site are still hot and workers (must) wear badges to detect radiation at all times in those areas to this day.

Some people in the general public might object to burning radioactive gas refined from nuclear liberated oil shales in their autos...

Perhaps those pesky Prius owners!?

Alberta was looking at this back in the ~30s, too (can't remember exactly when). Never happened for the same reason: your oil comes out radioactive.

'the ~30s'?, you wouldn't be from the future and be talking about the 2030s :-)

That was certainly the kind of thing the U.S. nuke boys were looking at in the 1950s and early 1960s. "The Firecracker Boys" by Dan O'Neill is worth reading. 'Project Chariot' fortunately was never brought to fruition. The idea was to blow a deep water harbor out of the earth at Point Thompson, AK using different combinations of hydrogen and fission devices (depending on at which plan was being considered as time went by). The whole project was to be a pilot for blasting a sea level canal through the Panama isthmus with fusion devices. We get a big new toy and we want to see what we can do with it.

Sorry, you're right. (I did put the ~ sign there, in my defense, and I actually had 50s first, but then convinced myself it must have been earlier without thinking about when nukes were developed.)

I didn't remember the exact date; I just remembered reading about it somewhere... probably even on TOD...

My apologies for the brain fart.

No apologies for making me smile, please :-)

I'm hoping your pushing nuke a decade or two back means your a bit younger than me, that all those decades were way before your time. Thinking younger folks are always good to hear from. If your a bronze age relic like me the slip is equally understandable though :-)

I'm in my late twenties, so I suppose that still makes me a young'un! ;)

The thing is, I knew that nukes were developed during WWII, but I wasn't thinking about that considering when people were contemplating using nukes to liquefy oil in situ, as silly as that sounds!

How does this work? Kerogen is insoluble in normal organic solvents.

Sounds a lot like these old detergent ads to me...

EROEI?

-- can't possibly be as good as just sticking a staw in the ground and slurping it up --

Not to burst any balloons or anything, but by the time you dig up the entire formation, crush it to a fine powder, treat it with detergent or whatever, then separate the powder from the kerogen (and recover the detergent?), you may have a useful product. But it isn't going to allow the exponential growth to continue exponentially. And I sort of doubt that it will allow for a flat plateau.

** watches videos **

So you're selling carbon tet?

DIY -- I suspect he's more likely buying options on EncapSol. Not realy a bad play IMO if we see oil spike up this winter. Not my type of game to play but to each his own.

Rockman, Are you expecting oil to spike this winter?

CRM -- It might surprise but I don't spend time contemplating such matters. If I were an oil speculator trying to make money on such a possibility I would. If I think about future prices at all in more in the time from of several years down the road.

But since you asked I make a guess: it's possible. But that's based on expectations of unpredictable events occuring. Is that a confusing statement? Is to me also. Guess that's why I don't try to make a living guessing oil price movements.

I continue to think that burning the stuff in situ and capturing the heat to drive a generator is going to be the best strategy. One might actually get a good positive EROI with that approach, and the capital investment and environmental impacts would probably be more manageable as well. Whether the EROI and ROI would be better than renewables like wind or solar would determine whether or not such a scheme would actually fly.

This looks a little strange.

If this process works both with raw Utah tar sands AND with Colorado oil shale(type 2 kerogene) it seems to use a solvent to remove only bitumen from the both. Bitumen amounts to only a 2% part of Colorado oil shale hydrocarbons(kerogen) which is 50% of raw oil shale. Heat would then be required for cracking bitumen to make syncrude.

http://pubs.acs.org/doi/abs/10.1021/i460003a029

OTH, the government is backing reseach into sequestering CO2 back into in-situ oilshale retorts after oil/gas extraction.

https://newsline.llnl.gov/_rev02/articles/2008/dec/12.12.08-shale.php

If that gentleman giving the demonstration wants to really impress with the evironmentally friendly aspects of EncapSol extraction - he should extract all of the dissolved bitumen from that glass of cold water and drink what remains.

Don't mean to be a smart ass here; a little more transparentness on your part would make your sales 'pitch' go much further.

btw...All controversy aside, it is an impressive bit of chemistry.

Rembrandt - a wonderful summation which will take me a while to digest, many thanks.

I like Chris Graph.

I'll go through my interpetation of the world using this graph.

For the Non-OPEC non FSU case.

Production 33.5 mbd or 12GB a year.

Reserves 175 GB.

At a constant production rate then the reserves would be empty in 14 years or a 7% depletion rate.

Next assume that a lot of the remaining reserves are not going to be produced at this high production rate.

Say 50% will be at a lower rate. This puts you at a 14% depletion rate for the "fast oil" or your out in 7 years.

Next of course I think this is itself no longer true since we are declining already i.e the fast oil is much closer to gone or these numbers where true about ten years ago not today. So the fast oil is closer to zero.

Next assume the world actually produces the same way from its reserves as the better documented Non-OPEC Non-FSU

Using this chart and adjusting the reserves to match output gives.

OPEC 182 Bnb

Non-Opec Non-FSU 175 Bnb

FSU 66.5

For a total of 432.

And as I said this number is dated i.e it was true ten years ago effectively non of the oil produced in the last ten years has been removed from reserve claims.

At 30GB a year globally then you run out in 14 years.

Assuming production rates decline rapidly say 70% of the way through the 432GB of fast oil suggest you decline about 10 years after you maximize your depletion rate.

Now this is really rough obviously regardless assuming a 10% depletion rate and using this sort of argument that everyone is producing oil the same way therefore the supporting reserve levels are the same then noting that they haven't changed much in years despite the high depletion rate and low new discovery rate.

You get the same answer. And no reason to believe the 175GB number for Non-OPEC Non-FSU has not been inflated some its almost certainly high not low.

And I am disregarding a lot of oil thats probably real and booked as reserves right now but this is oil that is expensive or slow to produce are generally both and the production rate for this oil will be low. Notice I completely ignore tar sand production as being irrelevant to our future. It literally does not matter if oil production falls 50% over a span of a few years the tar is not going to save the day.

In any case its not that hard to pull my scary scenario out of the graph all your really doing is assuming OPEC is lying and same for the FSU countries and to much smaller extent even the Non-OPEC Non-FSU group.

I think the graph should be renamed the stack of lies :)

Whats funny is simply assuming everyone is actually about the same and the Non-OPEC Non-FSU is close to reliable makes the situation interesting and thats not a bad assumption to make at all.

It alone is sufficient to decide no way can the world produce at its current levels for much longer and probably it will decline rapidly.

Then all you do is recognize that if thats true these numbers are time shiftied i.e given what happened in 2008 you know the "decline" is in the past.

That's nonsense. You have to get your terminology right. Depletion rate = Common or conventional definition of depletion rate which is annual production as a percentage of remaining reserves (assumed to be the same as total reserves less cumulative oil reserves produced). Or Aramco's definition of depletion rate which is annual production as a percentage of total reserves (assumed to be the same as initial proved reserves). See Sam's definitions: http://www.theoildrum.com/node/2476

In this case, 14 years at 7% is (1-0.07)^14=0.36, which means 64% is depleted after 14 years. It sounds like you are multiplying 0.07 by 14 and getting close to 1. That is within an order of magnitude but anything is within an order of magnitude when talking percentages in this way.

I am with elwoodelmore on this one, and agree that we have to use terminology correctly. I use this all the time in the Oil Shock Model, and would be way off if I made these kinds of mistakes.

Crazy.

Why would oil production fall like negative compounding interest?

Does oil production follow the laws of radioactive decay;

N=No*exp(-t/T)?

Please explain your reasoning without falling back on definitions.

How about some observations? The Lower 48 has fallen at about 2%/year since peaking in 1970. Texas, about 4%/year since peaking in 1972 and the North Sea at about 5%/year since peaking in 1999. There are of course fluctuations from year to year and even occasional year over year increases in production.

In any case, the crux of our argument regarding Net Oil Exports is that once production peaks in an exporting country, the net export decline rate tends to accelerate with time.

You can model it as a linear decline as well.

[(-3.1) +(-5.9)+ (-1)+(-.3)+(-1)+(-1.1)+(-4.6)+(-4.4)+(-1.5)+(-.7)+(-2.2)]/10 = -2.58% US average

10th root of 96.9 x 94.1 x 99 x 99.7 x 99 x 98.9 x 95.4 x 95.6 x 98.5 x 00.3 x 97.8 =96.7 or -3.3% geometric decline.

http://www.eia.doe.gov/emeu/steo/pub/gifs/Fig13.gif

I agree that oil is declining but the overall declines are smaller than is presumed by many here, so the assumption of large extraction rates in a plateau followed by a cliff seems more logical to me than a smooth continuous decline.

Depending on the decline rate the functional form will be obvious in a matter of months or years.

The question is did we globally maximize our depletion rates to maintain a high production rate as a side effect ?

If we did then with a very broad view the production curve for the world should approach a shark fin like curve.

Since the depletion rate depends on remaining URR its a bit of a catch 22 to figure it out your forced to guess esp if published URR are themselves suspect.

Hueristics like HL that use changes in production to model the underlying URR can't detect acclerated depletion rates they are assuming in essence a constant depletion rate. This is a constant technology solution.

Most other models include reserve estimates esp backdated reserve additions to model future production but obviously if the expect URR is wrong then these models are including bad data and eventually have the wrong answer.

I see no reasonable way to solve for real depletion rates since you have to have real URR's which is what your interested in.

However you can readily assume that global depletion rates i.e remaining oil is closely related to the average lifetime a field remains in its primary production phase. If fields on average produce at their peak production level over ten years then the depletion rate of the "fast oil" is 10% and this is what I'm focused on.

Field by field production tends to be effectively a square wave the field is rapidly brought online produces close to its maximum rate for several years then goes into a steep decline that eventually slows at a much lower production rate and can remain there for many more decades.

So certainly there is a floor to global production even after most fields have entered decline and its not small but also not close to todays rates where fields in their mainline production sequence make large contributions to overall volume.

Rockman mentioned it and I've seen the numbers but a substantial amount of the US production today is coming from a small number of fields most deep water plays that where brought online from a late round of discovery and are in their mainline production phase. If these fields are not replaced with new production then you should see a steady decline in overall production as the aggregate get smaller and a sharp decline as the last fields in mainline production decline.

Assuming a low discovery rate and maximum depletion rate then without significant replacement if your mainline depletion rate is 10% you have ten years from the time you maximize depletion rate until the onset of rapid decline.

And easy way to think about it is to take every field in production today remove those being produced at high water cut and low depletion and production rates.

For these fields map them 1:1 with the replacement field given a ten year time of maximum production then their replacement fields should be in some stage of development. Where is thunderhorse's replacement for example or Cantarells ?

I argue you better have a large number of fields coming online to offset the decline of fields running in mainline production just to ensure that the overall production decline rate follows the lower decline rate of depleted fields.

No real equation just a mapping. I've looked and in general most of the worlds fields go into decline without replacement. Once the last of the "fast oil" is gone which supports the worlds fields that are in mainline production then its gone.

Next of course as a field leaves it primary production time generally you have a flurry of work that often arrests decline for a few years this is common enough that you have a sort of second level. But the time at this level is even shorter and generally the next onset of decline is even steeper.

Next in many cases remedial work thats profitable onshore is simply not worth it in offshore fields over the last few decades offshore fields which tend to have even steeper decline rates and less workover have made and ever increasing percentage of total oil production.

Now there is no real synchronization of course fields are brought online randomly however as discovery fails to replace fields even though their is a spread in when fields where brought online the discovery profile is assumed to be heavily weighted towards the begining of the period providing effective synchronization of the last group of "fresh fields" brought online. Basically the last set of decent size reserves in well explored regions are identified and brought online in a distribution heavily weighted to the end of the last discovery sweep. Also of course as discovery ends fields that had been previously found and had their production delayed as being uneconomic are brought on at this time.

Overall you get a sort of surge where all remaining assets or fields tend to be developed over a fairly narrow time span as discovery across all basins reaches its mature phase.

Its important to understand that actual discovery plays a very small role in all of this the contribution of fields from the last round of discovery is small the vast majority of these fields consist of resources that had been known for a very long time decades in many cases yet for a variety of reasons the production was delayed. In many cases they are reasonable to produce simply better opportunities existed. Think of someone moving slowly in a line with people constantly cutting in front of them or a slow moving car in traffic. They are not exactly bad fields just never managed to make it to the front of the line until no one was left to cut in front of them.

Discovery or rather the tail off of discovery thus primarily acts as a trigger event and tends to cause the last set of fields to be brought online in a fairly tight group.

Next this is not based on some sort of financial signal i.e oil prices did not suddenly rise when this happened its just that for oil producers to maintain current cash flow they had no choice but to develop the less desirable assets that they had put off for a rainy day. In fact as they bring these marginal fields online they actually book steady if not increasing proved reserves.

Next in our particular case extraction technology had improved rapidly a lot of the improvements driven by operators that reached bare cupboard stage first i.e the first to be forced to do this spurred the technical advanced ensuring that the technology was ready and waiting when the majority of field operators started to get pinched.

In fact it was a very smooth handoff as we had to develop less desirable reserves early marginally profitable work in doing this had already solved the technical problem of developing them at high production rates.

Everything looks fantastic ! The oil flows reserves are ample the ability to extract marginal reserves is seen as a new lease on life the only mistake is ignoring the fact that your bringing online fields which had been repeatedly deferred as previous rounds of discovery found better opportunities.

From this point on the clock is ticking. Real discovery cannot hope to replace these fields that where brought online. The extraction methods ensure maximum depletion and when they are gone oil production falls rapidly. The gaggle effect if you will caused by the desire to maintain production levels ensures greater synchronization in the timing of decline then you would expect. Certainly at first some fields can be mapped to replacements i.e at the field level you have serial replacement maybe one or two rounds but this generally only serves to cover the most rapidly depleting fields. Say you have in your group of last fields a number that decline in five years instead of ten. Given you goal is to keep production levels constant your simply covering early decliners with later developed fields most often getting another five year field to replace a declining five year field.

Here you can think about a number of queues with a small bunch of people held from entering a queue if one of the lines moves faster you send the people in your group to the fastest line balancing the queues until you run out of your bunch of people. This is of course generally accomplished via the transfer of productive assets and potential fields between companies. For the NOC's its similar except your simply bringing on more assets faster if needed and if they exist.

On the technology side its obvious that we have the technology to develop basically any field from the Bakken to deep water plays technology for the most part lead the need to develop marginal fields so its not restrictive. Certainly in some cases we hit new extremes but the basic technical capability existed to do it.

Then you just wait the first major price spike signals that the game is over you can then pin down the exact situation very well after the price spike discount fictional reserves as not contributing to high future production levels and your done and oil production is done.

I too was wondering whether to be 'reassured' that oil would plateau and taper off, but a couple of the PDFs I looked at left out:

- slow ramp-up from deepwater plays

- disappointing flows from new fields

- faster fall-off from mature fields

- Net Energy

- ELM

.. and dificulties refining heavier sourer crudes (around which there were fascinating discussions a couple years back..)

This intuitive grasp of whats going on appeals to me, and left me wondering what they missed in the presentations I looked at.

But there sure remains the possibility that for whatever reason we won't see a severe drop-off for a decade or so..

Well first and foremost is the simple lack of understanding about how horizontal wells mature not that they don't fall off rapidly when the water hits or gas depending on the field thats known but when a horizontal well is going to water out of fail in some manner is difficult if not impossible to judge.

Next as far as I can tell mundane well workovers not something most people think about seem to be the culprit if you will. In the good old days often when primary production ended or a well became problematic you just shut the field down or capped the well and went on to something else. This is say back in the 1930's. Of course people without other fields to exploit took time to try and fix the field and get the oil flowing again even back to the very dawn of the oil age workovers where by no means unkown.

However over time of course we got better and better at managing fields slowly at first then better and better overtime. Something hard to quantify but true. As we got better the general effect was to maintain high flow rates through a good bit of the fields lifetime. Its something that looks innocuous at first but lets say you have a problematic well and you do some sort of workover and the well flows at its past production rate or higher for say two more years. Then multiply that buy several thousand wells all producing at higher flow rates for a few to several years after workover when they would have been capped without the workover.

If they had been capped the oil would not have been lost to production maybe produced later in the high water cut phase or produced via a horizontal well drilled as the oil column fell etc.

For us to have a fast collapse in oil production while the oil industry is claiming production will climb out into the 2030 and most models predict a slow decline then it means something or probably several basic things have been overlooked about oil production.

1.) Horizontal drilling (super straw ) Known but not quantified in any oil depletion model I know.

2.) Well workovers extending the productive life of the well. ( Probably first time this has been discussed)

3.) Advanced remedial action including infield drilling (horizontal)

4.) Better imagining technology i.e we drill the wells in the sweet spots less guessing.

5.) General advance in field management and monitoring.

6.) A slew full of technical advances in all phases of production not easy to categorize.

7.) This is HUGE the artificial cutbacks in production also resulted in a higher price for oil then geology would have dictated this of course acts as a tremendous driver to expand extraction as fields that should not have been profitable perhaps for decades are brought online profitably because of the artificial price support.

Associated with artificially high prices for oil was a related expansion of credit and fiat money system that allowed the economy to readily absorb the high prices indeed despite the large jump in prices after the 1970's vs before oil was considered cheap and not a big expense in the overheated fiat money economies. Of course this easy credit was just as available to the oil industry as any and the fairly steady growth ensured future demand so drill baby drill.

Look at the insanity of the housing boom which resulted from artificial market conditions. For a very long time the artificial price support made most reserves profitable many decades earlier then the would have otherwise been.

8.) How much did OPEC really cut back ?

The following offered without a shred of proof but just consider if its correct. Consider how things would have

played out if the following was true vs known history esp recent history.

My own research indicates that "hot oil flows" remained high for decades.

Hot oil is oil sold without being officially recorded. So much was sold out of Texas that the official number for Texas production are practically useless. I've looked at texas several times and as near as I can tell over the course of about 50 years from 1920-1970 it looks like 40-60 GB of oil was probably extracted and sold outside of official channels or about 200-300kbd or about the production of Thunderhorse today. Texas peaked at about 3mbd so about 6% to 20% of its production was not going through official channels. This is hard to figure but the lowest reasonable result I could get was at least 10GB of oil was sold illicitly in Texas. Even with that figure your talking about 10billion high power gold backed dollars many earned at the height of the depression and later during WWII. And this is on top of official production. A fairly small number of primarily Texans controlled enough wealth to basically buy any government they wanted to purchase and then some. This is power beyond anything the world had ever seen. The railroad barrons of old don't even hold a candle.

http://en.wikipedia.org/wiki/United_States_public_debt

To give you and idea the entire US budget deficit in 1930 was 16.2 billion dollars. If illicit oil sales out of Texas in 1930 totaled to even 500 million dollars in 1930 thats huge ! Inflation adjustements don't do justice to the real buying power of cold hard cash and large amounts of it back during this period (If not today).

Next as far as I can tell these Texans primarly having made enough money to practically rule the world for all intents and purposes played the same game later with Saudi Arabia after Aramco was nationalized. Certainly Saudi Arabia pulled back in production to support prices but no where close to the amounts claimed again this is hard to figure out but my best guess is they where shipping at least 2mbd more oil than they claimed for decades. Again we are talking about amassing immense fortunes on both sides of the world at the production and distribution end and this is of course on top of normal production.

Later on yet one more time this exact same game was played after Russia collapse again with real oil flows lower than before collapse but much higher than the official number. The Russian Oligarchs are rolling in cash to rival the Saudi's where did all of it really come from ?

In all cases overtime maintaining the hot oil flows became increasingly problematic and your beyond filthy rich and have money to the point of controlling or swaying large parts of the world from business to politics.

What government can resist concerned super powerful citizens willing to support activities that it wishes to engage in but are difficult to fund even through secret budgets ? Esp ones already corrupted ?

If I'm right then the hidden wealth from oil has had a very profound and corrupt impact on the entire world for decades small wonder the US is not well liked.

Maybe I'm crazy maybe not however it does explain to some extent why peak oil is something the oil industry and government does not take to seriously if real oil production has routinely averaged higher then reported would you believe in peak oil ?

Knowing this makes it difficult to support peak oil even though you can't explain why of course :)

I could see some super rich Texan scoff at peak oil.

I know there is plenty of oil around heck back in the 80's I brought in almost 1 million barrels of day from Saudi they never claimed they produced. From Nigeria over 200kbd plenty of oil boy plenty ..

Opps maybe I should have not said that :)

Who knows the exact numbers but I'm pretty certain they where fall from small and more than enough to ensure the worlds oil supply was ample.

As a side note during the oil embargo of the 1970's official production did not drop all that much in fact many conspiracy theorist point out its difficult to get the gas lines and other problems associated with that period from the small change in oil production. However if what really happened was a much large cut off of illicit flows then it makes more sense and also a much more powerful political statement.

http://en.wikipedia.org/wiki/1973_oil_crisis

If you included the cessation of potentially substantial backroom deals for large quantities of oil then things begin to make sense. If for example you assume hot oil flows out of OPEC where and additional 5% over official production and the cuts where actually 10% of real production off the top with the sweet under the table deals ceasing then the resulting economic fallout becomes sensible.

And last but not least if this is even close to correct even if my guess about the absolute flows our wrong it does not matter. If this hot oil trade exists and is large enough magnitude then at some point of course around the world reported production began to exceed real oil production and the flow of hot oil dried up well before the official number ever reflected even a decline. Obviously this served as a loud and obvious signal right to the top most powerful people in the world that the real situation in the oil patch hand changed and the flows of oil had changed for the worse. So consider this when you ponder the above ground events.

Now as far as overall oil production flows go I doubt the illicit flows ever exceeded 5% of total oil production for the most part if that in the big scheme of things they are not that important their importance lies in if I'm right about their existence then the politics around oil are different from whats commonly assumed and obviously I think it explains the reluctance of the US to "get off oil" even foreign oil as for all intents and purposes we have paid a huge hidden tax directly to the wealthiest people in the world for decades.

Of course I could be completely insane except once you put it all together like this to much makes sense.

This is the basic game that underlies all the others played out on top and neatly explains why we did what we did.

It provided for a few wealth and power beyond imagination on top of public wealth and power that was barely conceivable and of course resulted in a very warped and corrupted world.

In fact I'd not be surprised in the least that sometime from 2005-2008 if we did not briefly have one or a few trillionaires in existence. We may never know but that gives you the scale of what I think the financial clout of the true wealthy is and of course puts working class stiffs like Bill Gates in their place.

Whats funny is if you take the global economy as being being about 30 trillion a year and consider the accumulation of wealth into the hands of a few over decades and in some cases centuries then it actually fits fairly well with the size of our economy. Its not as crazy as it looks esp of course as you consider the many other ways money makes money the oil money simply worked to create the seed insane billions.

So I think the super rich know whats going on via their early warning hot oil network that probably basically gone now however I think they are arrogant enough to think they also know how to profit even more from the situation.

That was indeed a roller-coaster.

In my experience, most things offered without proof are automatically correct. That is why the bible is correct, for instance.

Usually if you are not sure if you are crazy, it means that you are not crazy. Usually.

Wow, you personally brought in 1 million barrels from Saudi Arabia? Color me impressed.

I am even more impressed, kind of like the daily double.

Smart thinking. That's the way to profit while at the same time consider the needs of the world.

TOD really likes conspiracy theories.

Indeed, sound logic is the perfect antidote to prevent the onset of insanity.

All this talk of craziness and insanity has me rethinking my entire strategy. I will invert all my models to return the negative of the square root of the result to account for this. Pronto.

BTW, has anyone ever heard of Phil Hendrie?

Um US oil production peaked in the 1970's we had wars embargoe's etc etc.

And of course Jimmy Carter urging us off oil. We adopted a financial model of infinite growth that will obviously end in disaster. Deficit spending etc etc.

Why ?

It was done for reasons and near as I can tell damned good ones if your at the top. Once you understand it despite the evilness of the decision it has to be one of the greatest con jobs ever.

At the end of the day its nothing more than a fancy variant of selling bootleg liquor or any sort of drug. The basic business model is pretty simple it even includes having the most and best armed thugs on the block.

So in the end it nothing more then a bunch of mafia thugs running rackets except perhaps deeper involvement on part of the banks.

I am not talking about a business model. We are discussing a physical depletion model and how you are interpreting the data. The fact that economists always want to turn everything into a fiscal model is why we never made any progress in modeling in the first place. Only a few people ever wanted to discuss resource constraints and the impact that by itself has on the evolution of peak oil.

The lineaments of why only a few people wanted to discuss resource constraints, was for the simple demonstrable fact - it is not the policy of our government to consider conservation.

In point of fact, these policies of wastefulness are surrogates and substitutes for the real purposes of organized warfare (as a means of controlling the population).

These surrogates must meet two principal criteria:

1. They must be watseful, and

2.They must operate outside the normal supply-demand system.

The surrogates must not be accessible to the whims of the people.In other words, the people must not be able to demand that their government stop spending their tax money or allow natural resources to be used in a watseful manner.

A viable substitute for war as a social system cannot be a mere symbolic charade.It must involve real risk of real personal destruction and on a scale consistent with the size and complexity of modern social systems.Unless it provided a believable life-and-death threat it will not serve the socially organizing function of war.

Memmel is correct in discussing social trends and political agenda in regards to resource constraint; for this is the core root of the current dilemma.

This is why someone of Matthew Simmons caliber can make a perfectly logical argument for conservation on national television and have his pleas for sanity fall upon deaf ears.

People in the industry such as yourself are the real experts, and it would behoove the general public to stand up and pay attention.Unfortunately this is not the case, and the reasons why should be part of the discussion.

May I just add that prices can be discontinuous at the margins, so it's not necessary to postulate conspiracies to explain large jumps in prices for oil/gasoline during the 70s as a result of very small changes in production.

Your right its not but you need a tremendous money pump to create a fiat currency you can print at will out of a gold standard reserve currency. The petrodollar was created from petrodollars.

The Petrodollar - One of the pillars of American hegemony.

Any move away from the petrodollar recycling system by a nation is tantamount to a declaration of war.Just by coincidence when Iran made steps to eviscerate itself from the system Faux Pas News reported that a "new" uranium enrichment facility was found.

Fair and balanced indeed.

In a sense, the American Dollar is backed by oil; it is the oil currency.I believe de Gaulle made a remark on the wonderful advantageous policy that the petrodollar system provided for the United States economy.A PHD in economics is not required to assess how the US acquired such an advantage over the nations of the world:It is axiomatic.

I'm sure winning WWII--after letting GB dangle in the wind until they had accumulated enough debt load to insure U.S. world economic dominance would have no rival for decades-- while not suffering ourselves by being invaded or nuked (geography having been one our greatest allies), had nothing to do with our gaining such an advantage in the world. Our guns economy went to producing record amounts of butter in a hurry, and U.S. business reaped the real spoils of war by grabbing a good chunk of the west's and Japan's industrial profits while our capital did a lot of the heavy lifting required to rebuild those devastated economies. I guess we should have just taken all as tribute and kept those countries on their knees as long as our might would let us. Growth would have been much slower...oh well we blew that one big time.

No doubt our behavior has left a lot of room for improvement, but many, many big victors have acted much worse. I felt we took a major wrong turn when we turned Carter out for Reagan. I truly hope there is still time to make right much of the wrong we have set in motion since then. The arrogance winning the cold war let us assume has set us up for the nastiest of falls.

Question: if the petro dollar system didn't come into effect until after the U.S. once and for all left the gold standard in 1971, and de Gaulle died in 1970 did he make those remarks during a seance? De Gaulle did trade all France's dollars for U.S. gold he could, though. The old Vichy boys who really held the power weren't going to give the U.S. any edge they could avoid giving it, that is certain.

Let me restate that - I believe de Gaulle made a remark on the wonderful advantageous policy that the Bretton Woods USD system provided for the United States economy as all major currencies had to be pegged against the dollar to America's (corporate) economic advantage.That is why I put the disclaimer - I believe - but I knew his discrepancy was against the USD directly.

And just how did the USD become the worlds reserve currency?

The reason why Hiroshima and Nagasaki were nuked was more for the show of insuperable power since all of the generals knew the war was already won; confer with The Joint War Plans Committee.This is the real and tangible reason America imposed its will on the world at the close of the war - lets be realistic here.

"...No doubt our behavior has left a lot of room for improvement, but many, many big victors have acted much worse..."

Is this a good reason to oppress Luke?

I'm sure all empires fed that line to their subjects.As we debate America has upwards of 800 military bases all over the world - Rome could only dream of having that kind of influence.

I suppose entertainment and vise (bread and circus) keep most Americans from contemplating we are an empire.As Carter's reasoning showed us, most of us really don't give a crap; and you obviously are aware of this.

r

Got a couple bases in my town, and telephone solicitors often ask 'what the country of Alaska is like" so I might be the foreign oppressed. Except I just happen to make a good chunk of my livelihood building stuff for those bases. I'm sure we spend plenty locally in 'other' foreign countries. That doesn't mean I think our military is sized properly or that the money couldn't be spent much more productively. One sign of an empire failing is inordinately high military expenditures, the debate lies on the definition of inordinate right now. The U.S. can only dream of having the tenure of Rome, heck we don't even have our own language so our influence will be truly fleeting.

I noticed you didn't rise to my Vichy bait though. As for the nuking, its a shackle that those who are more aware drag along. My father was in the invasion force staging off Japan when the bombs went off. He'd already done somewhere around seven beach assaults, his original platoon had lost over 80% of its personnel and his H.S. graduating class didn't end up faring much better. Whether or not I'm here typing this because those bombs made it so so many others never could is an unanswerable question.

And finally, in answer to your question Just how did the dollar become the world's reserve currency? I'm guessing the normal way. We cheated.

To add since I've not mentioned it. The US left the gold standard in the 1970's we screwed over the entire world beyond imagination and we pulled it off. And on top of that we peaked in oil production ourselves at the same time.

Somehow we managed to not only pull it off but come out on top. The games with oil played a huge role in stabilizing the new fiat money regime.

Crazily enough our oil consumption literally backed our currency. If we had gone down then obviously the worlds oil prices would have collapsed without oil consumption from the US the worlds oil producers had to accept our money but we also had to sweeten the deal.

Certainly it was a rough start the 1970-80's was not a lot of fun but we pulled it off.

I've focused on oil in this thread but the move off the gold standard and establishment of a fiat currency as the reserve currency of the world is the real coup. I'm of the opinion that oil and esp games with oil played a big role in pulling it off it was and is petrodollar standard powered buy US consumption.

Also of course the fact that inside the US we continued to export goods for dollars helped a lot they where not suddenly worthless. However of course to do that we needed oil.

So certainly there is more to the story but for now it makes sense to focus on one important part which was using US consumption to create concentrated wealth in our fiat currency. By literally stuffing he Saudi's with dollars that of course had some value we kept the oil flowing or like I said got it flowing again after some rough patches :)

The key is to appreciate what we managed to pull off the move to fiat technically if you don't look at the debt it bought us forty years of prosperity ( if you look with the right rose tinted glasses :)

Now as far as the US playing games with oil well I doubt you ever find much on Saudi Arabia however we have this.

http://www.washingtonpost.com/ac2/wp-dyn/A58701-2005Feb2?language=printer

And the Shah ?

http://www.britannica.com/bps/additionalcontent/18/34793330/Showdown-at-...

In any case plenty of evidence that the type of actions I argue happened have happened.

The Saudi-US connection remains opaque but ...

And of course the petrodollar part

http://en.wikipedia.org/wiki/Petrodollar_recycling

Evidence of opaque observations without a formal argument does not constitute anything and it likely signifies nothing.

I agree that there are likely errors or biases either way. Depletion rates may well be higher than estimated.

However, it is common to assume in all these projections that whatever the deplation rate is for a country or region, that same depletion rate will continue into the future. However, if the price of crude oil doubles and then doubles again, then existing technology will be used and new technology will be developed to produce more crude oil from existing crude oil fields. These crude oil fields will produce more crude oil. This is called the elasticity of supply. Thus, in addition to an elasticity of demand (as prices increaes, demand falls), there is an elasticity of supply. This fundamental aspect of capitalism needs to be incorporated into these models or else they risk being biased low.

A good example is natural gas from shale. Several years back several individuals hypothesized that natural gas supply in the US would plummet and prices would skyrocket. Natural gas prices did increase which was the likely driver for producing natural gas from shale. Shale gas has increased our natural gas supply, which has caused natural gas prices to fall. Of course there is now debate on whether shale can provide a significant supply of natural gas looking towards the future. But the point is that 5 years ago, this development in natural gas from shale was not forecasted by people within the peak oil community. We may underestimate the ability for increases in crude oil production in response to higher prices.

Retsel

Ambiguous. Please indicate the functional form you are referring to.

Why is high production rate a side effect? Production rate is the MAIN effect.

I have yet to see your shark fin like curve. We have all been imagining it yet you have not shown a GIF of one.

No such thing as a remaining URR. As Elwoodelmore says, we have to get our definitions right so that we can communicate.

No, the logistic curve that is the basis of HL is an exponentially accelerating technology solution.

Backdated reserve additions can be included in the maturation part of oil production no problem.

Wrong, as old mature parts of the discovery curve can be used to fit to a Bayesian-compsited and modeled discovery curve, which then provides an accurate way to estimate depletion rates.

This is in contradiction to your previous statement. See my discussion of the work by Hook, Aleklett, et al elsewhere in this thread where they can estimate the depletion rate form big oil fields with a small variance.

That does not describe a square wave, the real curve is much more continuous and looks more like a 2nd-order gamma function (i.e. the convolution of 2 exponentials).

That is a non-sequitor. Of coarse a "floor" to production is zero, since you can't have negative production rates.

Excepting for the new discoveries that come on line due to the natural dispersive discovery envelope.

10% at 10 years brings it down to 35%. I feel like I am talking to a wall here. This is the second time in this thread I have had to correct your depletion rate definition.

Can't argue with a hypothetical.

A tad pedantic.

OK, I see, the pedanticism is a form of hand-waving. Some of us actually use "real" equations and spend some time doing real modeling.

What is a "sort of second level"? The use probabilities correctly precludes the appearance of any kinds of discernable level transitions. It's all a continuum, for example the transition from an exponential decline to hyperbolic is very smooth.

That is likely correct.

All discoveries are dispersed over time. A good model does wonders to explain this. I use the concept of convolution so that somebody else that wants to investigate this themselves can go ahead and work out a simulation.

This flies in the face of the maximum entropy principle where you should assume a high variance in dispersion unless you have clear evidence that events cluster. In other words, don't assume a synchronicity of events when a stochastic spread applies.

So you say that actual discovery plays a very small role in all this? I really don't know how to respond to this as it seems to push an "immaculate conception" version of oil production. Perhaps what you want to say is that the discovery peak occurred more than 40 years ago? And that new discoveries can't make up for the maturation of those fields?

Wrong, dispersion of various discovery efforts world-wide precludes a "fairly tight group". I might perhaps believe what you assert if you had some evidence or a model of this occurring. What could happen is that production can be throttled or gradually increased depending on global socio-political events.

Reading too many tea-leaves here. Reserves don't necessarily need to be developed to be booked.

A illustration of a cupboard or something might help with your analogy.

This is getting to ba a bi of a slog at this point.

Congratulations on a double-reverse layout with a 360. I have no idea what you just said.

That description is the best reason for using probabilities as replacement for logic (don't laugh, ET Jaynes says that probabilities forms the basis for all logic). Anything that you can describe as a typical field or decline, you can then model as a probability acting on an ensemble. With that you can actually show a graph that people can perhaps understand a bit more readily.

Yes, and queues are best modeled as probability flows. Although I really don't understand the significance of this.

Is this merely a platitude? Otherwise I don't understand it.

"Game over, man! Game over!"

You know that was just a movie, don't you?

Well Web lets give it 3 months then another 3 then another 3.

If I'm right about where we are at there is a reason for me suggesting three three month intervals.

But first and foremost for the first 3 months lets see what the price of oil is January and what storage levels are at.

My best guess is oil should be in the 90-120 range by Jan and storage levels at least in the middle of the five year range by then. Sorry for the spread in prices for Jan but there is some financial games that can still be played that effect pricing at that point. If we aren't at this level by then then even at that point I think a shark fin collapse model becomes highly doubtful. The recent price action of the last week allowed me to narrow down a bit where we might be during a fast collapse.

My point is I don't really care that I'm being "stupid" if you will does not matter much to me. Either TSHTF for oil over the next several months or it does not.

I feel like a real discussion should wait either I'm full of crap or I'm having a hard time explaining myself.

Or probably both which is of course worse.

We are either crashing and burning right now or we are not. Regardless of how messed up I make my presentation of what I'm trying to explain it does not matter.

I'm comfortable enough to instead simply suggest lets see what happens over theses sets of 3 month intervals.

If production started crashing then it was obviously on its way down by 2008 I think that single "fact" is all you need to know. And if its crashing its also obvious that the economic crash bought a very small amount of time thus we hit the wall again rapidly. If we do then and if things turn out reasonably close to how I think they will then I'd argue that my position of lets let the experiment run for a bit and check the results then discuss how to model it.

I'm actually hoping some facts get shaken out during the process that will help matters immensely. I've had to guess way to much but with luck perhaps we either get facts or more likely some blatant lies that are highly questionable.

So many numbers have been fudged in different directions over the last several decades nothing is clean enough to be useful. We went from massively understating oil production to massively overstating it over a span of 40 years.

To the tune of 4mbd or more understating real production to eventually overstating it by that amount or more.

Thats enough to muck everything up. If that alone is true then our "numbers" are themselves basically junk.

Its guess work on guess work to even guess what real oil production was the only reason I'm comfortable with it is its amazingly self consistent. Once you figure out the fraud then turns out everyone played the same game for the most part over and over again. Not surprising since most frauds are simple variants of known approaches.

You don't really care and given before you even start you have to "uncook" the books. I don't know what to tell you once you have the model then you can see where the books where cooked for me its now obvious esp since everyone generally does it the same way but it went from understating oil production to overstating it. So worse not only are the numbers cooked they are cooked in two different directions over the last 40 years.

This off course leaves evidence one you think you know the game being played with the numbers then you can detect the fraud its actually not all that hard once you dig but your never ever going to take this step unless you believe it needs to be taken. If you don't take this step then your never going to develop away to uncook the numbers to figure out reasonable estimates for real oil flows and without those numbers never ever even come close to considering a shark fin production curve.

And see my long post above if I'm right then it was all done for a very good reason it made a few people beyond filthy rich. The fact that the end result is really all about money is what matters so where is all the money in the world and how did it get there ?

I think it does matter. Do you realize that lots of people read this stuff and try to make sense of it? And they do it because they want to understand what is happening? Not that I am any great shakes, but I spend lots of time doing math modeling and creating charts, and it has given me some insight into some of the fundamentals of discovery and production. Since only a few people do the analysis from that perspective, I feel almost obligated to correct the misinterpretations of opinions stated as facts that I see posted here on TOD.

Once again, where exactly is this model that you speak of? If it is all in your head, then just say so.

Linked up thread nothing more than Ivanhoe's model with some adjustments aka fraud needed to bootstrap our fiat currency system.

All Ivanhoe's model says is that the area under the discovery curve is equal to the area of under the production curve. That is perfectly fine with me. However, this does not say anything about a shark-fin. An infinite number of curves will obey the area equality, and he just apparently chose an arbitrary one. In fact, by making a discontinuity at the cusp, he can more easily prove that the areas under the two curves are equal. He simply has to choose a decline curve that can be integrated analytically. Even though this does not match reality, it will prove his equality point. Does everyone now get it? It is actually quite obvious what he intended by drawing the shark-fin.

Otherwise, please give a reference and perhaps a quote for where Ivanhoe discusses the cusp in the profile which supposedly gives the shark-fin. This is starting to feel like a big run-around and the emperor's theory has no clothes.

This is funny.

I've really never said anything different the question is whats the area under the curve.

The analytical integration method is a result of realistically no other choice on how to connect the curves.

How can it happen ?

1.) Aggressive extraction.

2.) Claimed reserves becoming increasingly poor quality from watered out fields.

The general observation is all oil is not equal small reservoirs can be extracted rapidly and the production of the giants declines significantly after passing about 50% URR.

It really depends on the nature of remaining resource production rates post discovery financial model driving demand and thus consumption and thus investment in oil.

If the area under the curve is made up of a relatively small amount of oil that can be extracted at a rapid rate and a much larger volume that might be extracted at a lower production rate at high prices and lower rates then the curves that contain the overall production adopt a shark fin like profile. Other solutions don't work.

Intrinsically of course this is related to EROEI changes which feed back into the economic model since ever more debt is required to force growth therefore you need a economic system that can drive such and extraction profile.

What really intresting is of course that the only economic system that seems capable of driving resource utilization to the point where you accomplish aggressive extraction is exactly one like what we have.

Any sane economic model would have resulted in demand being constrained and a much more sedate symmetric production profile as debt is needed to keep demand expanding past when simply price increases would have indicated supply was not sufficient.

No, you said that Ivanhoe came up with the shark-fin model.

Explain how he came up with the shark-fin. You ascribed the model to Ivanhoe, but now you are backing away from that. It is apparent that you really do not have the courage of your convictions.

This is funny because elsewhere in this thread you said some depletion analysts who were doing some good deep digging lacked "cajones".

Only way to think about it is to consider decline rate from current reserves. That is the abstraction that fits the best.

Deleted due to misunderstanding

Web, it appears to me if the production rate is constant and the reserves (reserves means recoverable reserves I hope) don't magically grow the depletion rate accelerates. Seems clear enough from the definition. Say you started with 100 units and produced 10 units a year steadily for ten years. The first year the depletion rate was 10% or 10/100 the second year the delpletion rate is 11.111111% or 10/90 third year the depletion rate was 12.5% or 10/80 and so on up to the tenth year when the depletion rate is 100% or 10/10. If the depletion rate remains constant and the reserves don't magically grow the oil will never be fully depleted but less will be produced each year. Do I have it right?

I know field's don't produce at constant rates from full to zero (like draining a fuel tank by running an engine at a constant work load and a constant rpm) and that reserves can grow as a field's full extent becomes revealed over time or by new tech allowing a greater % of the oil in place to be recovered (again I hope reserves here means recoverable) but I broke my example down as simply as I could to try and make myself clear.

The idea of proportionate draw-down is a fundamental property. You can't go wrong with this assumption, since it matches physical phenomena like transport drift and Boyle's law as well as human attitudes. To change the mean rate, it does require application of new technology or very greedy drawdown pressure. The average drawdown has been very constant at 4% over the last few decades after coming down from 7% over the bulk of the last century. So the idea is that extraction from an estimated reserve amount stays constant over time.

For proportionate drawdown, the depletion profile is exponentially damped. If there is an entropic disperion about the mean the profile is hyperbollically damped.

Web, I try to follow you as best six hours of statistics and just touching DifEQ during Nixon's first term lets me (not very well)

Drawdown is defined as the change in the head, which in the case of my water well in the yard would be the number of feet the head dropped (probably would it be better to use the gallon and a half to a foot volume measure instead) in the casing as water was pumped. If no more water was entering the entire system my well and all my neighbors wells are draining the drawdown would be the volume that left the system (per time), right? When you state the average draw down as 4% is that the percentage the drawdown (per time) is of the remaining reservor? It appears to my unsophisticated eyes that that percentage would be the same number as the depletion rate. If I have it, please tell in simple terms, I'm a more than a little out of my depth when trying fathom

For proportionate drawdown, the depletion profile is exponentially damped. If there is an entropic disperion about the mean the profile is hyperbollically damped though I think I've a vague idea of the concepts.

Thanks for your patience, Luke.

Precisely

Yes, the same as the depletion rate. I used the term proportional drawdown because in my experience it works better as an explanation for people that have hands on experience. Everyone seems to expect that you get less of something when you have a smaller volume to draw from ... except for oil reservoirs. I suspect people think that reservoirs are so big that this kind of proportional rate does not occur, yet it does.

Thanks, glad to know I was following the right trail :-) I know that plenty of savvy people around here have no trouble understanding accurate math/stat terminolgy, if it sails by me that is my loss. I just want to try and keep myself aimed in the right direction so I can at least see the dust cloud being raised.

You can't just assume straight-line declines because 1) oil fields don't decline in a straight line, and 2) new oil will come on-stream as existing reserves decline. This includes:

* New discoveries (primarily deep-water offshore and Arctic frontier)

* Enhanced production (secondary and tertiary recovery, infill and step-out drilling)

* Unconventional production (oil sands, the Bakken shale, etc.)

* Substitutes (biofuels, gas to liquid, coal to liquid, etc.)

The real question is: "Will these compensate for the exhaustion of existing reserves?" and the answer is "Probably not."

So, what we can look forward to is a long, slow, painful decline, but we won't just fall off a cliff.