New World Model – EROEI issues

Posted by Chris Vernon on August 24, 2009 - 10:48am in The Oil Drum: Europe

When I published the results on The Oil Drum of my New World Model, based on World3 (the “Limits to Growth” model) – see here, many of the questions and issues that people had were around EROEI. So I’m writing this article to clarify how the model uses EROEI and the results in some alternative scenarios where EROEI is changed in different ways.

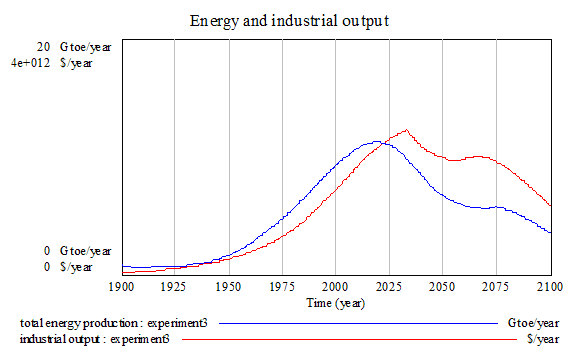

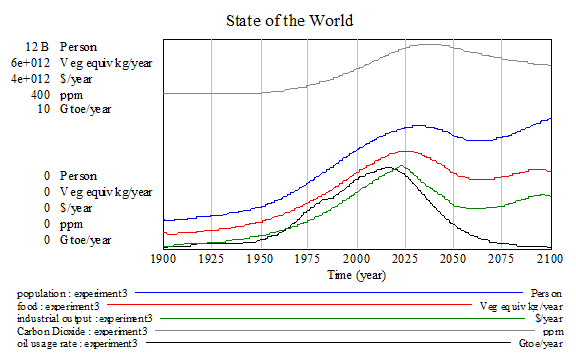

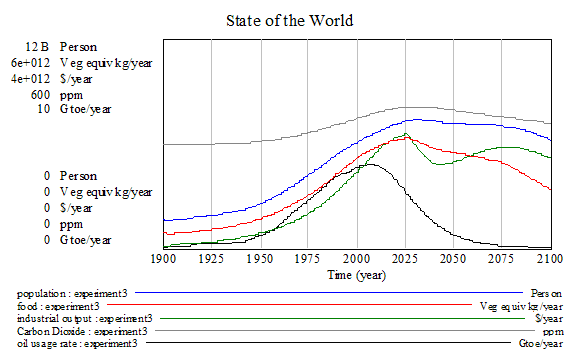

Total energy production and industrial output in the New World Model.

Why are the results so different from the original World3 model? Is it because of EROEI?

The results are different because there are many changes from the World3 model. EROEI is only related indirectly to the difference in results.In the World3 model, industrial output depends on the amount of non-renewable resources available. In the New World Model, there isn’t a “non-renewable resources” variable, but instead there are different energy sources, including renewables, that are also essential to produce industrial output. In the same way that in World3 the amount of industrial output tracks quite closely the usage of non-renewable resources, in the New World Model the industrial output tracks the total energy.

Fig. 1 Resource usage and industrial output in the World3 model.

Fig. 2 Total energy production and industrial output in the New World Model.

As you can see in the graphs, total energy declines much less abruptly in my model than non-renewable resources decline in World3. There are several reasons for this:

- Renewable energy sources

- The decline of non-renewable energy sources follows a logistic curve. The exact equation is:

Increase in production = 0.2*(fraction of fossil fuel remaining-0.5)*current production

In the World3 model, the decline of non-renewable resources happens as fast as people can consume them. In other words, there isn’t any limitation imposed to how fast non-renewable resources can be exploited, leading to a very abrupt decline when it happens. It could be said that one of the conclusions of the new model is that peak oil and peak fossil fuels is good news for civilization, because it gives a natural limit to how fast we can deplete our resources, preventing us from depleting them so fast that it would lead to a complete collapse.

- Switching from some energy sources to others makes for a gentler, staged decline

How does the model estimate historical changes in use of different energy sources? Is it based on historical data or only EROEI?

The model uses only EROEI to decide whether to change the amount in the mix for any energy source and any type of demand (electricity, heat or transport). As I said in my previous article, there are two fundamental ideas that I have used:- Market forces follow EROEI: the most efficient sources of energy are also the most profitable. This seems to make sense intuitively but is disputed.

- Energy companies are conservative: they will not start reducing the usage of an energy source until its EROEI falls below the average of all sources. Also, the reduction or increase in any energy source is gradual.

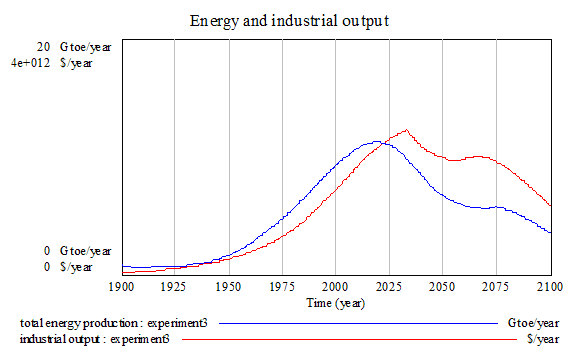

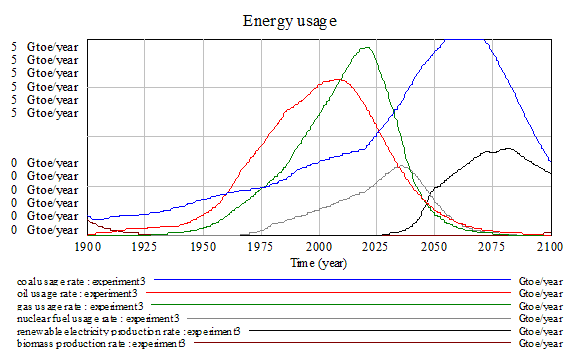

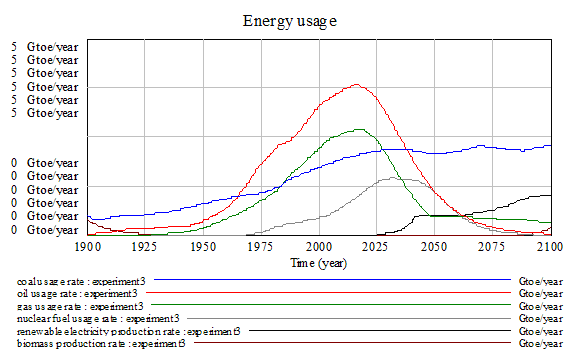

Fig. 3 Energy usage in the New World Model.

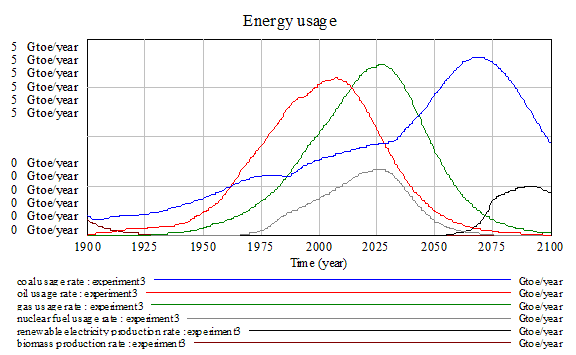

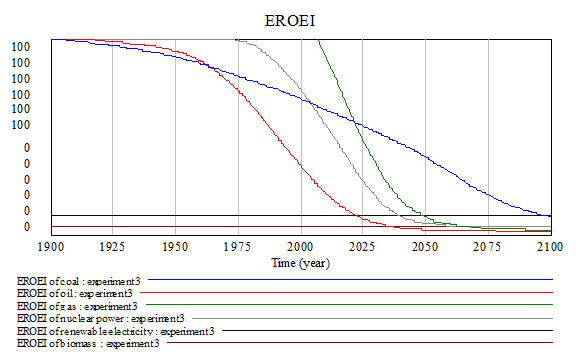

Fig. 4 EROEI in the New World Model.

Do the production profiles depend on EROEI?

No. The shape of the production curve for non-renewable energy sources depends on two factors:- Demand.

- The maximum production, defined by the formula:

Increase in production = 0.2*(fraction of fossil fuel remaining-0.5)*current production

Is there a clear point when EROEI has fallen so low that it causes a collapse?

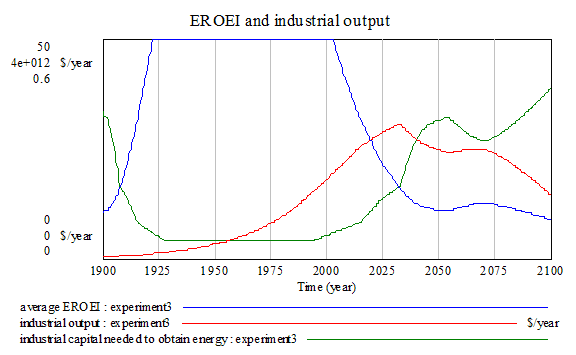

If one had to give a date in the model for that, it would be sometime around 2030, around the time when the peak of industrial output is reached. The graph below shows industrial output, average EROEI and the amount of industrial capital needed to obtain energy, which indicates what happens.Note: The reason there is a kink at the peak on industrial output is partly because of the sharp increase in the industrial capital needed to obtain energy, and partly because the table that estimates the industrial capital needed to obtain energy is a bit sparse on data points.

Fig. 5 EROEI and industrial output in the New World Model.

Where does your formula for EROEI come from?

The formula I’ve given for EROEI of oil (other fossil fuels are similar) is:EROEI of oil = (fraction of oil remaining^2)*100

This comes from an approximate fit for the data points given by Charles Hall, 2008 for oil in the USA:

1930 – About 100:1

1970 – About 30:1

2000 – About 11-18:1

An additional reason to go for this simple relationship is because it has the following property: it takes the same amount of energy to extract the first half of the oil as it takes to extract half of the remainder (a quarter), and so on. This fits well with the intuitive idea of declining EROEI.

Clearly, the data is too limited to tell if this formula holds true with any certainty, so an obvious possible set of scenarios to try is changing it to other possible curves and see what happens in that case.

What happens if you choose EROEI curves that decline faster or slower?

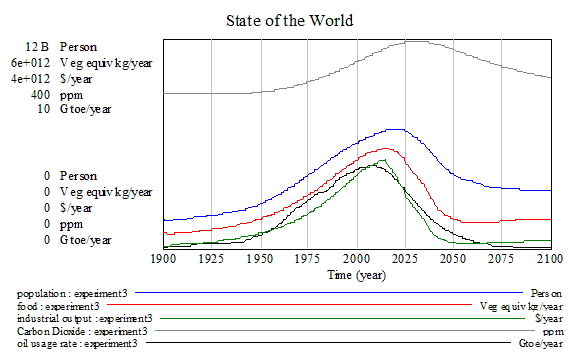

One can change the curve for one that declines faster, such as a cubic. In this case, the world doesn’t even have time to adapt to the first peak in production of a fossil fuel (peak oil), and industrial production collapses before there is time to switch to another source.

Fig. 6 Key variables in the New World Model for a scenario with rapid decline for EROEI, following a cubic curve.

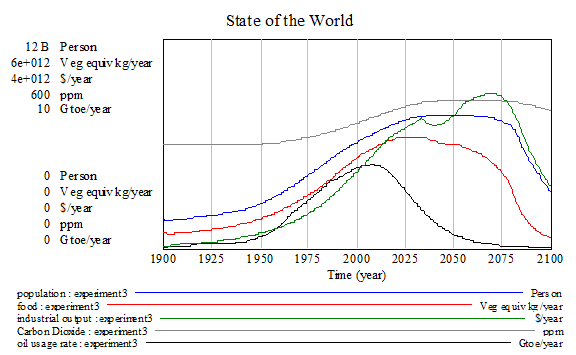

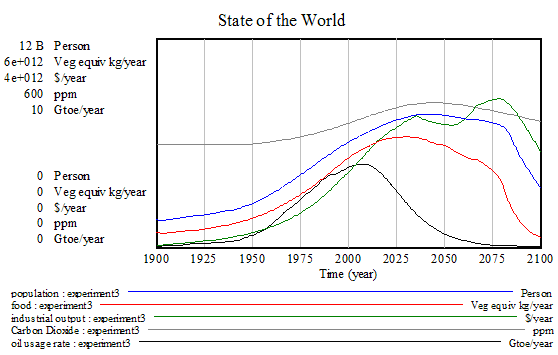

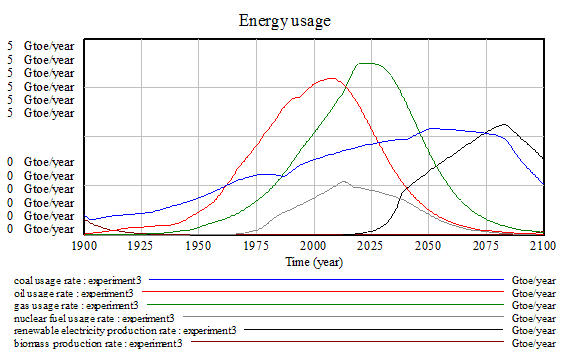

If one changes to a curve that declines slower, such as a linear curve, an interesting thing happens: collapse happens later, but when it does, it’s much faster and catastrophic. The world has time to adapt gradually to each of the peaks in each fossil fuel with not too much disruption, but when it reaches the final one, it affects food production in a catastrophic way. Climate change has been making it harder and harder to get adequate crop yields, and this world compensated by more and more industrial inputs to agriculture. When the final energy crisis hits, a significant portion of the world industrial base is dedicated to try to keep at bay the food crisis, and when that fails, everything else does.

Fig. 7 Key variables in the New World Model for a scenario with slow decline of EROEI, following a linear rate.

What if the model underestimated EROEI for renewables and/or overestimated EROEI for fossil fuels?

There were several complaints that my estimate of EROEI for renewables was way too low and/or my estimate for fossil fuels was too high. I’ve ran a few scenarios with different values for EROEI to see what happens.A scenario with a higher EROEI for renewables (30:1 for renewable electricity and 15:1 for renewable thermal) is similar, except that renewable energy sources start getting used sooner, and the final decline that comes with the decline of coal also happens sooner, because renewables helped this world live with a higher energy usage rate than the “business as usual” run.

Fig. 8 Key variables in the New World Model scenario with higher EROEI for renewables.

Fig. 9 Energy usage in the New World Model scenario with higher EROEI for renewables.

If one assumes both lower EROEI for fossil fuels and higher EROEI for renewables, we get a world where the energy crisis is a serious bump, but does a partial recovery eventually. The main reason that this world manages to recover is because usage of coal is kept at moderate levels, due to its relatively low EROEI, instead of being ramped up after oil and gas peak.

Fig. 10 Key variables in a New World Model scenario with low EROEI for fossil fuels and high EROEI for renewables.

Fig. 11 Energy usage in a New World Model scenario with low EROEI for fossil fuels and high EROEI for renewables.

What if a new technology for renewable electricity is discovered that has very high EROEI?

It was suggested that some new technologies for renewable electricity, for example high altitude wind power, have extremely high EROEI. Wouldn’t that resolve all our problems?The answer, surprisingly, is “no”. A scenario where a high EROEI (100:1) technology is discovered for renewable electricity on 2010 produces similar results to the scenario with high EROEI for renewables above. The fundamental problem is that just because there is a high EROEI technology available, market forces are still conservative, and the change to a higher EROEI, more profitable technology only happens when the old technology has dropped below a certain level of EROEI. Market forces as simulated in this model eliminate the worst energy sources, but don’t reduce the share of energy sources that are still able to operate a normal business. People still burn fossil fuels even when there are better alternatives available. This causes to climate change, a gradual decline in food production, and a final collapse when it’s impossible to keep food production going.

Fig. 12 Key variables in the New World Model scenario with a very high EROEI renewable electricity technology.

Fig. 13 Energy usage in the New World Model scenario with a very high EROEI renewable electricity technology.

What if things aren’t left to market forces and/or EROEI, and there is a policy decision to ramp up renewables straight away, whether it makes sense financially or energetically or not?

This is an interesting scenario to model, because it could be said it represents what seems to be happening currently. Policy decisions are being made to encourage renewables, often with little concern about practicality. Is this a good decision?A run with a scenario that forces renewables to go online produces a definitely better result than the “business as usual”, the energy crisis doesn’t last as long it and has a higher standard of living for a longer period of time than the optimistic “high EROEI renewables / low EROEI fossil fuels” scenario described above. Problems start appearing towards the end of the run, but they are only the food crisis that this model will always show if there are no policies to take proper care of the soil.

It’s important to note that there is no need to assume optimistic EROEIs for this scenario. There is no need to be hopeful if we can be smart.

Fig. 14 Key variables in the New World Model scenario where renewables are encouraged regardless of EROEI.

Dolores,

Thanks for this post.You have incorporated many of the suggestions of the earlier post. It adds great value to see how the output varies with different input assunmptions.

I am not sure why renewable energy would decrease even in the low EROEI scenario for renewable enrgy? Would it not always increase?

The assumption of EROEI of 30:1 does not seem to be very high for present wind turbines.

What happens when it takes more than $10 in energy to extract $10 of oil?

Does oil become obsolete at that point or just more expensive?

I guess it is like the old gold mines where it costs more to get it out than it is worth......

Until the price goes much much higher....

delete

My model doesn't deal with energy prices at all. It operates at a more basic level, it simply assumes that market forces will follow approximately EROEI, in other words, that something with high EROEI is going to be more profitable than something with low EROEI, and when EROEI approaches 1:1, you can't make business.

in the medium/long term you stop to make businnes when the ERoEI approaches about 10 not 1, I think there is a lack of understanding of the real meaning of ERoEI.

The reason usage of renewable energy eventually decreases in all the scenarios that collapse is because industrial output and food production are collapsing. Basically, people are too busy surviving to cope with maintaining their renewable energy infrastructure.

Which is another assumption of the model, its not shown by it. Sheesh.

You say it, but you sure as hell don't show it, and the models of climate change and food production are outside of the scope of the model anyways.

And the Rossing mine data is abundantly clear that we already have very high energy return technologies avaliable to us.

Yes, I am very surprised too, but for the model inconsistencies or its misinterpretation. I’m sorry but Doly Garcia cannot infer from the model that the market forces are conservative, it is the model that project, by default, a conservatory policy, this in order to figure out a forecast in lack of actions or novelty.

If the model have to be arranged for a real forecast, are missing a lot of complex and not linear forcings.

The extensive use of only proportional forcing of the current model imply resulting behaviors that are strongly low pass filtered, that isn’t true.

Into the model are not included a lot of foreseeable and threshold driven switches, for example:

Human activities will switch from the use of fossil energy assisted services, becoming too expensive, to pure human/animal force powered operations, that could represent, as consequence, the sudden fall of all the industrial organization and the pouring of a planetary starvation.

Market forces could be conservative as they needs, but they can't operate a normal business, the first evidence is the current economic depression.

I think, it is also missing the concept about energy and its convertible and fungible nature, an high ERoEI energy allow almost everything:

with a very cheap renewable 10 GW AWE, with an +300 ERoEI, we can extract alternatively:

800 billions cube meters year of fresh and drinkable water from the sea;

300 tons of uranium each year from the sea and a lot of other mineral in good quantity;

1 MToe of idrocarbons leaving at least an ERoEI of 20 to the resulting liquid fuels;

5 Mton of food, artificially produced underwater or underground or in the deserts.

So if we need a real forecast from the model, it must include all these plain and straightforward opportunity, in defect of that it will become an inaccurate and unhelpful exercise.

The information that people would not migrate from fossil fuels even if there were better alternatives was there inside the definition of the behaviour of the energy producers. It didn't come from the model and, thus, really wasn't shown. That said, it does fit with experience, as you said, there are already hight EROEI alternatives that aren't being explored (but I don't know how they scale).

So, if one ever get in the business of creating a silver bullet, he should wait for the disruption's climax to release it to the world. That is interesting, and non-trivial, but, unfortunately, probably also useless knowledge :)

I'd feel a lot better if there was more than one mine in the world successfully operating at Rossing's ore grade.

You can look at Olympic dam or the old phosphate mines that had lower ore grades, that were only closed because uranium is so damned cheap. The energy numbers for Rossing are pretty convincing however, especially since Rossing is a low grade hard rock mine.

If thats not convincing enough, you allready have the conclusion you want, its just time to go shopping for figures.

With oil and fossil fuels we have come to think of the energy of the oil and not the extraction, although that is changing. Solar panels and windmills are the extraction devices for solar and wind power. They are made of minerals which are limited and deplete. So with oil the depletion comes first from the source itself and then at the end the cost of extraction begins to impact (deep sea drilling, oil sands). It looks so deceptive with solar and wind as those energies are current energies and expected to supply at an endless steady rate, so we forget that they require minerals to make and those minerals are taking more and more energy to extract thus changing the ERoEI of alternatives and creating new Peaks to deal with. - see http://www.theoildrum.com/node/5559

One example here http://www.treehugger.com/files/2009/06/goodbye-fossil-fuel-dependence-h...

One Wind Turbine = 700+ Pounds of Rare Earth Metals

To put this all in perspective, in terms of what this means for products you may own, OnEarth says,

A single three-megawatt wind generator (modest, as utility-scale wind turbines go) contains more than a ton of super magnets, more than 700 pounds of which is neodymium. A typical hybrid car, such as a Toyota Prius, contains around 25 pounds of rare earth metals -- mostly lanthanum in its rechargeable battery and neodymium in its drive motor. "The global annual production of neodymium, essentially all of which is mined in China, is today at an all-time high," Lifton says. "There is no surplus -- the existing demand uses up all that's produced each year. So to build more wind turbines and hybrid cars, you'll need more neodymium. Where are you going to get it?"

But it's still a different kind of peak than that which guides Oil, Coal and Gas..

as with the error in that standard debunkers line 'The Stone Age didn't end cause we ran out of stones' .. The materials required for PV or RareEarth Magnets are not being burned up like the expendible fuels that we oxidize into the atmosphere. I don't know how recyclable a Neodymium Magnet is, but the materials are still there in one place, ostensibly available for another go-round.

There will be limits and increasing costs to extracting these materials, but with a declining world population (my own assumption), I have to believe the materials we have already extracted and built into other equipment will also be increasingly accessible for transforming much infrastructure over into Wind, CSP or whatever. I know there are plenty of rare earth magnets and polysilicon nuggets being used for thoroughly unnecessary tasks today. Raise the price a bit and watch people scamper around and sell countless buckets of it to dealers.

For any of you electrical engineering types:

How much does the use of the rare earth elements add to efficiency and output of a wind trubine?

Is it possible to build a good reliable generator to be run by wind power simply by increasing the size and wieght?

I realize that the tower must be stronger if the dead wieght is greater but this would seem to be a minor extra expense,given the fact that the tower must withstand various dynamic loads any way.

Now actually getting that sucker UP THERE might require an even more capable crane.Are the cranes currently available working at thier limits erecting wind turbines?

Does it seem likely that newer designs can economize on the use of these problem metals to any significant extent ?

The advantage of using permanent magnets in wind turbines is the very high part load efficiency that can be achieved (about 90%) and the possibility of using direct drive thereby eliminating the gearbox, a major source of failures.

The disadvantage is that conventional generator topologies generally have high internal forces due to the magnets being opposite steel. This mean large amounts of structural material is required which also adds weight and cost. However, it is possible to reduce these problems by considering the structural design of the generator earlier in the design process. This would seem obvious, but the typical industry approach is to optimise your electrical model and then design a structure around it as a bit of an afterthought. By optimising the whole system you can find a better design trade-off.

I'm currently part-way through a PhD looking at these issues for direct-drive linear generators for wave energy.

Crobar,

Thanks!

Even a layman can understand the need for good low load efficiency,given the fact that there is usually less than the optimum amount of wind to drive the generator.

Ps Is your handle crobar as in hand held lever?That would be a good one for an aspiring engineer looking to push the enevlope of small scale machinery- wind turbines versus coal fired plants etc

I suppose reducing the power output is also necessary make it possible to maintain a nearly constant rotational speed under varying conditions wind conditions,which would seem to be an important consideration given the fact of an ac system.

No I'm afraid it's just because my second name is Crozier! But I do feel it fits ok with my current occupation.

As for maintaining one speed, this is not necessary, you simply process the power output with power electronics (an additional expense of course). This is achieved by converting the variable AC input from the generator to DC then back to grid quality AC at the output. I do not know an awful lot about aerofoil design, but I would not want to dictate the speed the wind turbine rotates at as this will have a bearing on the amount of energy you extract from the air flow.

Well actually the newest designs use about 0.5t of NdFeB per MW (that's 1100ish pounds per MW), but about 70% of all the NdFeB produced is used in hard disc drives (although this ratio is changing). The market for Nd is still very small, only 17000t of Nd were estimated to be produced in 2008 97% of which came from China as you point out. Now that the companies have seen demand is rising they will respond by increasing production elsewhere. It is inconcievable that there are not significant deposits elsewhere and it has more to do with the fact that the Chinese government controls the mining industry to ensure that it's other industries are supplied with product to which they can add value.

Another point is that actually not many wind turbine producers use permanent magnet generators yet. I can only think of one or two. The rest use conventional generators and gearboxes.

p.s. pounds? Get with the metric people!

You make a good point that the EROEI of renewable energy will also decrease over time, because of the raw materials needed. My model currently doesn't take it into account, it takes the EROEI of renewables as fixed. I think it would be difficult to forecast what the EROEI curve will be for renewables, because they are still developing.

Interesting and excellent analysis. A few questions if I may?:

1. How accurate is the EROEI assumption and increase in production formula? You say this fits to the data, but how closely? These assumptions are pretty much central to the forecasts.

2. Perhaps I'm missing something, but with the very high EROEI for renewables (100:1), then fig 4 suggests that one would transfer all production to renewables - whereas fig 13 suggests that coal usage continues to rise for many years after 2010? I would argue that EROEI is set to rise substantially in renewables for the next 10-20 years, and this needs more careful modelling.

3. Looking at Fig 13, the black line tails off after 2080. I take it you are either assuming a) that new renewable power generators cannot be created with renewable energy; or b) that there is an eventual decline in the EROEI of renewables; or c) there is a finite limit on the supply materials for renewables. Can you clarify this a little?

It seems that the broad conclusions are:

- Coal usage quickly becomes attractive in most scenarios, which is bad news for CO2 emissions

- The future EROEI characteristics of renewables are unknown, and since long-term forecasts become increasing reliant on these variables, the longer term forecasts are inherently unstable.

Do you think this is fair?

Figure 12 shows the problem is related to declining food production which forces population down. The high ERoEI renewable energy source did not cause people to stop using fossil fuels and thus stop polluting the environment.

My answers:

1. The EROEI isn't a very close fit, simply because there is little EROEI data around. That's why I did scenarios under different EROEI assumptions, to see what would happen if my initial assumptions were incorrect.

2. I know the result in a scenario with a discovery of high EROEI renewables is very counterintuitive. I was surprised myself! The reason coal usage keeps rising is simple: the assumption in the model is that the energy business is conservative, in other words, people will keep using old energy sources as long as their EROEI isn't worse than average. As long as the EROEI of coal is acceptable, it continues getting used.

3. I'm assuming none of the things you suggest. What the model assumes is that with a collapsing food production, industrial output also collapses and there is little left for maintenance of the renewable energy infrastructure.

I wouldn't say my broad conclusions are as you say. My broad conclusions would be:

- If there is no policy against the usage of fossil fuels, the usual market forces will drive business to continue using fossil fuels, especially coal.

- The future EROEI characteristics of renewables are unknown, but one can still say that under a very broad set of assumptions, including the discovery of very high EROEI renewables, there is an eventual collapse of industrial civilization if the choices of which energy sources to use are based simply on decisions maximizing short-term gain, as it happens under our current market system.

Chris, this is a very nice and thorough study! Thanks so much. My approach to the same set of questions about the EROEI bridge to the future and the whole system steering problem is in my recent article "Profiting from Scarcity", other recent comments on this site and below. I look mainly at the added dynamics that come from economies being "learning systems" full of "learning parts". Two of the main ones for when growth naturally becomes a zero or negative sum game, for a growth driven system like ours, are that 1)the interests of all the parts of come into conflict, and 2)whole system overhead maintenance and conflict management costs balloon, raising the need for technology to maintain high EROEI resources as that becomes naturally ever harder to meet.

Why, if people are so very good at learning, do they still run into fairly obvious traps like these and not see what to do is one of the great mysteries of the fate of past civilizations that vanished. My general view of that is discussed at some length in a recent paper in Cosmos & History, called "Life's hidden resources for learning". In a "one line view" it's that learning comes from exploring the real relationships between things around you, and people get stuck on only exploring their own belief systems as the reality they need to deal with. One example is how science tends to treat the world as made of facts and formulas, omitting the communities of learning systems nature is made from on every scale, so we don't ask what they're learning. Another example is our culture's misplaced faith in compounding investment to maximize short term financial gains...

There is a possible added variable to throw into your equation I might suggest, that might make it much more possible for the present economic system to bridge to the next, without an extended gap. That's for us to mimic nature's method for steering economic learning systems at climax, switching investment resources from multiplying the scale to completing and streamlining the design, as it seems she does with every growth system that stabilizes.

For economies the steering mechanism is how it chooses what new stuff is built, using a bit of the resources of the old stuff. That self-investment choice is what determines what they become. There's a fairly direct way an easily understood policy could steer the whole economic system into making the better choice. It would steer the system away from multiplying ever more unfinished and unsustainable parts toward starting and completing sustainable ones. From my 8/22 comment:

We also would need to learn how to measure "sustainability", and start the way physics does with "what you can know when you don't know much". There are major problems with how green design and humanitarian assistance are mostly promoted as a way to sustain growth... and not sustainable resources and populations... It's importantly because people have not realized that efficiency and productivity enhancements are profitable because they are reliable growth and stimuli... In natural systems you really must look to see what's holding all the parts together and making them respond as a whole!

Doly,

Doesn't the model more or less assume an operating international banking system? It seems to me that if there is a crash in the financial system at some point, followed by much more barter and other disruptive behavior (wars (?)), there could be a downward spiral, at some unspecified point in the middle of the graph.

I think that's about right, but can become more informed by watching the dynamics of current events. The point in "Profiting from Scarcity" was partly that, and what you describe in the future already happened, and certainly could happen again, taking us over the next cliff into the next deeper trench.

The pointers seem very strong that the financial collapse of 2008, the "black swan" of rare coincidences that "no one could have seen coming", was precisely the 6 year long whole system resource price bubble. Commodity prices were following a "law of ever escalating price" due to physical system unresponsiveness to investment (i.e. whole system declining ROI) with demand growing on auto-pilot driven by the limitless earth theory.

no?

My personal opinion is that it's perfectly possible that the current financial crisis is the financial crisis predicted by my model to happen at the same time as peak oil. But I don't have enough information to be certain that this is the case.

Doly,

There is more than coincidence to link the 6 year system wide commodity price spiral and unresponsive oil and other commodity supplies and the financial collapse. I look it from a whole systems view, understanding that the system as a whole is a stress equalization system, and relieves shortages in one place by finding substitutes and exchanges from "elsewhere". So when all resources are showing signs of shortage at once, it's apparent that the whole resource network is not successfully finding substitutes, and "elsewhere" is running out.

What means do you use to predict a collapse from peak oil? Don't you need to show somehow that other substitutes would be unavailable?

Following are notes related to my research for Profiting from Scarcity

A March 23, 2009 paper from Brookings Inst. seems to support the view that the oil price spiral 2007‐08 was due to diminishing resource response to oil investments, the main symptom of "peak oil". That implicates resource depletion as the trigger for the speculative surge, and its "material contribution" to the recession and financial collapse. The paper doesn't make the further connection to the price spiral starting in 2003, or for why other commodity supplies would stagnate at the same time, as I do. I suggest that for major resources to all meet limits at once is expected for a stress equalizing market system meeting whole system limits. It's the primary symptom of diminishing ability to find substitutes for resources in shortage.

The model predicts a partial collapse of the economy from peak oil. This isn't because there aren't alternatives available, but because they take a while to become available in the amounts needed.

You are right, we all expect a lot of glitch on the graphs.

This kind of model can work only distant from the future events under exam, we are now in the full storm. The volatility, the shortages, the gov reactions, the people reactions, the industrial productivity, the inflation, are variables much more important in this moment than population, pollution, resources and so on. To attempt a dynamic and (multi)predictive forecast all these variable have to be indipedentely treathed with well calibrated PID error followers, it isn't the case of the World3. In absence of actions, the fatal response of the Doly's model could be much more close than reported.

Yea,.. the whole system is primed for more panics to trigger panics... Is anyone else but me here talking about the natural cybernetic system steering that would be needed to calm the panics and set a true course? Don't we need a strategy to minimize the waste of resources from lurching in false directions as we attempt the turn?

This is exactly why I do modelling: to try to figure out what is the best strategy under the circumstances. What the model is currently saying is that the best strategy is going all out for renewable energy, and forget about what's best in the short term.

What specifically are you assuming are the characteristics of renewable energy?

It seems to me that even if some renewable energy allegedly has high EROI, if it requires massive investment in new infrastructure to support it, then on a net basis, it really isn't a worthwhile investment.

Or if the renewable energy can't be repaired because of other missing elements from the system, and falls apart quickly, the renewable energy is a waste of expense now. The EROI calculated on a 40 year life expectancy is very wrong for a 10 year life expectancy.

Also, it seems to me that renewable energy is not really substitutable for fossil fuels. For example, I have a hard time believing renewable energy will be replicable with renewable energy. Once a given wind turbine or solar PV loses stops working, it seems to we will not be able to replace it, unless there is an adequate supply of other sources of energy.

You must devote an awful lot of imagination to how things cant work and an awful little to how things can.

I prefer to imagine working with nuclear reactors because they are demonstrably scalable to thousands of times our current power consumption for millions of years, so scalability isn't an issue.

You could make the same argument theoretically with wind turbines and solar power, though scalability isn't quite so reliably demonstrated to quite an absurd height. For a wind turbine, you can devote a fraction of its power to electrolyzising hydrogen for steel production and cement production that go into its parts. Its not as straitforward as using coke for metalurgy but it certainly works in principle, and if there are no other options present (don't count on that) people will do that rather than turn off their lights.

The main characteristic of renewable energy in my model is that it's renewable, in other words, it doesn't run out with time. Also, EROEI remains constant.

The model estimates the investment needed to keep the energy infrastructure going as depending on EROEI. High EROEI needs less industrial output than low EROEI.

The model doesn't really assume an operational banking system. But it does assume that financial disruptions won't cause by themselves catastrophic and permanent falls in industrial output or food production. History seems to suggest that a mere financial crisis is unable to do this, unless it's the symptom of a much more serious underlying problem.

This Verhulst equation has essentially stunted our collective understanding of how constrained resources deplete. It does not describe the situation at all, but only forms a mathematical identity that generates a logistic sigmoid. This can happen in mathematics, but usually the alternate (i.e. correct) formulation wins out because it tends to explain the situation more generally and thus one can gain a better understanding.

The correct understanding centers around applying the idea of a dispersive search to a volume. The determinism of the incorrect formulation gets replaced by a collection of largely independent prospectors nibbling away at a constrained resource at different rates. The collective as a whole shows an acceleration in search rates, yet it correctly replaces the determinism with a stochastic element that every real macroscopic process expresses.

The problem with the New World Model is that it is pure heuristics and does not get us the insight that a more realistic model would provide. For example, we should be able to detect the potential deviations from Hubbert Linearization that will likely occur in the near term.

http://mobjectivist.blogspot.com/2009/08/deviations-from-hubbert-lineari...

What happens if the search acceleration increases? What happens if the search acceleration decreases?

The bottom-line is that we cannot do this kind of analysis if we continue to use the incorrect Verhulst formulation.

Won't you invariably get both, first accelerating and then decelerating search?

The disturbing thing I've been trying to explain in the sustainable design community, or to anyone else who will listen, is that sustainable design, as creatively inventing your way around natural limits, can only only create an illusion of stalling the exhaustion of finding new environmental opportunities. As you start to run out of new finds "accelerated search", as an added effort, first helps you discover more new ways to use up the remaining ones... and that's naturally how fighting natural limits with efficiency or productivity goes. That "accelerated search" itself runs out, though, when its returns start running out even faster. The added effort and creativity will then become not worth it relatively suddenly, resulting in your "decelerating search" path. Right?

You are indeed right. The problem with accelerating search in the face of diminishing returns is that it doesn't get you anywhere and at some point the "worth" of that effort doesn't matter. And so the switch to a decelerating search path becomes a viable option.

Conventional Hubbert Linearization allows only one acceleration profile, that of exponentially accelerating search. Nothing else is allowed since it doesn't fit the posted Verhulst equation. This is similar to stating that all triangles must be right triangles since A*A + B*B = C*C holds as an invariant, never mind the fact that isoscelese and equilateral triangles exist that don't obey that rule (and don't forget scalene!). These other options that I show are analogous to the other variants of a triangle.

So,... since this applies to any resource, it also applies to the diminishing returns of resource substitutions generally as well. Several things prevent the exponential search from working, though.

One is that there's a super-exponential that kicks in where a system meets general limits of growth, i.e. the limit of accelerating resource substitutions. All the accelerating searchers start searching for how to divert each other's reserves, and you get price spikes and market collapses as nature's way of deciding how to allocate resources between growth sectors in a non-growing economy, thrown into what amounts to mortal conflict if any sector has a grow to avoid failure, as you have with finance and business in general.

If you do see how economic relations are undergoing continual change, and that the limits of driving them to change exponentially are not benign, you can see the need to understand how some kinds of natural systems solve that problem easily, and others only struggle mightily till collapse. They very simply change to another search pattern. The search pattern for any system in contained in how it uses its surpluses to build new adaptations of itself, the investment cycle. How it needs to change for us to survive is what I discuss in my first comment to this article.

I could easily change the formula for a decline different from the logistic, but unless the difference was huge, the results of the model wouldn't change substantially. A declining production curve is a declining production curve any way you look at it.

Another question I have--that shows my lack of familiarity with your model. It seems like the renewables generate electricity--and not particularly at the correct time of day. Does you model reflect all of the secondary costs (in materials or $) of having to store electricity, improve the power grid, and convert current cars, trucks, rail, etc to electric?

I know there are alternate ways around storing electricity, but these likely reflect costs as well--such as building transmission lines connecting wider areas and balancing with hydro or gas.

My model takes into account these things in a very basic way, it just calculates that a certain fraction of the industrial output is needed to obtain energy. For this calculation it doesn't take into account what sources of energy are being used, it only considers the average EROEI, with lower EROEIs needing a greater fraction of industrial output.

If you have a better suggestion on how to calculate how much industrial output is needed to obtain energy, I'm interested.

Dolores: first a minor issue: The above is an "assumption" of the model, not an idea, correct?

Second, efficiency is a difficult and confusing word to use when discussing energy and EROI. What do you mean by "efficient" sources. Do you mean "efficient" in the sense that they have the highest EROI? If so, then state that, but leave out the word efficient as some might interpret it as the thermal conversion efficiency of energy sources - i.e. not EROI.

Third, and potentially most problematic for your model, is that the market does not follow energetic efficiencies or EROIs. I would like to think that our energy decisions are based, at least in part, on EROI, but one needs to look no further than corn-based ethanol to be dissuaded of that idea. I don't think that this point necessarily invalidates your model, rather it is something that should be stated clearly as an "assumption".

-Dave

I think the market success of light water reactors with respect to CANDU's, and the dreadfully long time it took gasseous diffusion to be replaced by centrifuge enrichment seem to indicate energy return is not as highly sought after as claimed. Its of diminishing importance the higher energy return you get and then you're swamped by other scarce resources such as capital, labor, etcetera.

If an energy producing process has a positive energy balance, then the input stream of energy is effectively part of the output stream. Therefore the input energy does not represent the external input of a scarce resource. This way of viewing the energy production process is incorrect. Understanding the economics of energy production always requires accounting for non-energy inputs to the process, even in a low order analysis.

Consider the following fanciful, but conceptually simple example. Suppose that I can produce energy by waving my magic wand at a batch of gasoline causing it to disappear, and after a short pause twice the original amount reappears (EROEI=2). Further suppose that the amount of time required to work this spell is directly proportional to amount of input energy. For simplicity I will suppose that the time required is one second per gallon of gasoline. If I work my spell on one gallon it takes 1 second. Two gallons takes 2 seconds, and so forth. Then my rate of net energy production is 1 gallon/sec or 3600 gallons/hour, independent of batch size. That is to say there are no economies of scale in this production process. I maintain that net energy/magician hour is the right parameter for characterizing this process and not EROEI.

If a second magician exists who can also cast a spell at a rate of one second per gallon of input gasoline, but who can turn that one gallon into 4 gallons (EROEI=4), then his production rate is three gallons per second or 10,800 gallons/hour. He beats me by factor of three rather than by a factor of 2 as would be suggested if EROEI was used as a figure of merit.

The labor efficiency of net energy production is what really matters in this example. It can be shown that under the specific assumption that the input energy and the input labor are strictly proportional, the labor efficiency of net energy production is proportional to the net energy over the input energy, a parameter which I call NEROEI (=EROEI-1). However, if the input of the non-energy production resource is not strictly proportional to the input energy, then NEROEI is no longer a good figure of merit for the resource efficiency of energy production.

The economics of energy production is determined by labor efficiency, capital efficiency, land efficiency, fresh water efficiency, etc, not by EROEI per se. Of course it is true that in a general qualitative way EROEI correlates with these other resource efficiencies, but it is conceptually a less fundamental parameter. Of course I realize that people who are attempting to do biophysical economic analysis do not like hearing this assertion since it complicates the analytical process; How do you compare the economics of biofuels and nuclear energy if the required input resources are different in kind and not just in quantity? Unfortunately, the world does not behave simply just because we want it to.

The world obviously is very complicated. When you are trying to do global modelling as I do, the only way is to simplify it a lot, and some may seem like brutal simplifications. The thing to bear in mind is that I'm not aiming for anything very accurate, because it would be impossible. I'm just trying to get some qualitative pointers of where we might be heading to.

Yes, going down the route of estimating every single type of efficiency would be more accurate for the section of the model that tries to calculate the economics of energy production, but that gets compensated by the fact that other sections of the model aren't that accurate. A chain is only as good as its weakest link. Instead of trying to be very accurate in some sections, you have to try to have roughly the same level of uncertainty in all sections. Looking at it that way, using EROEI as a combined figure that reflects in some way all the types of efficiency is reasonable.

NO! NO! NO! this is a really wrong example of ERoEI, your magic wand or the magician doesn't enter in the ERoEI computation.

Imagine to have a cellar with your magician inside that is vanishing the 1 gallon/sec to produce the 4 gallon/second, the energetic cost of the gasoline extraction from your cellar are the steel barrels cost and the effort to climb the staircase with the filled ones and bring them to the market. So with this good magician in the cellar the ERoEI of the whole process should be 100-200, or even more if you recycle the barrels.

It is not a wrong example. It is simply an extreme case illustrating the importance of non-energy production resources to analysing the economics of energy production. It is true of course that the consumption of energy effects the economics of energy production only insofar as it reduces the output of useful energy. The rest of the economics are determined by the value of the other production resources that are consumed in addition to energy. If the the value of those other resources is extremely small then energy could be very cheap even if the fractional consumption of energy during the energy production process is relatively highly. This is the source of your perception that magician "doesn't matter".

However, such a conclusion is incorrect. If such a production process as described above were possible then the hourly wages of magicians would be a determining factor in the economics. Please explain to me how you can reach any other conclusion.

Your example with the barrels is no different. The energy consumed in constructing them has to be subtracted from the four gallons as well as the one gallon consumed by the magician. You then have to add on the labor of the people who run the winches to get the barrels in and out of the cellar. What matters is net energy/value of non-energy resources consumed. Only if the magicians wages are neglibly small compared to the other emloyees are you justified in neglecting him.

Dave, you're right that how the system as a whole follows EROEI values is mysterious, but as a whole, the experimentation with energy sources and uses clearly does in fact choose a very smooth global energy productivity path. That the economic productivity of energy has been very steadily improving is clear. What isn't clear is how the whole system works to do that. Isn't what one would need to understand that be the market forces that distribute energy uses to the least cost suppliers and things?

All your nit-picking on my language is correct. Yes, I say "efficient" meaning "highest EROEI".

On the issue that market forces follow EROEIs: this is one of the points that gets most disputed. This comes from the empirical observation that, in the long run, this seems to be the case. Corn ethanol was done for a while, but I don't think anybody would claim it's a long-term trend.

When I tried modelling under this assumption, the results I got reproduced fairly closely the historical production of energy. I haven't seen anywhere another explanation for the world production of different energy sources that will predict approximately when the main changes in the energy mix happen. If you know of a better explanation, I would like to know about it.

I have long thought, and said so on TOD before, that the EROEI of crude oil, natural gas and coal is overestimated by orders of magnitude.

There is more than a century of sunk cost in oil, and even more than that in coal.

The Oil Drum is responsible for one of the most "paradigm altering" revealations I ever recieved regarding energy:

Think for a few moments about all of the infrastructure built worldwide for the purpose of extracting oil. All the drills and platforms, all of the refineries, all of the tank cars, all of the oil pipeline and port facilities, all the tanker tractor trailers, all the retail outlets, all the storage tanks. How much steel and other raw metals, how much concrete, how much has been invested in the construction of all of this infrastructure, some of it now aged out to 50 years and more, but still part of the production and distribution of crude oil?

All of this, scattered all over the world is built for one purpose: To extract, move, refine and make marketable approximately ONE CUBIC MILE of crude oil per year. In many of the last 50 years, it was being used to extract and refine considerably less than one cubic mile of oil.

The investment in material is only a fraction of the picture: The investment in human labor and intellectual effort has been nothing short of staggering over the last century, all for the one purpose of making crude oil marketable.

The investment of humans and material in the crude oil industry is almost vast beyond measure. If these sunk costs, human hours, and volumes of patents, developments, and hours in the labs and workshops designing and constructing the crude oil industry (never mind trying to calculate the monetary expense) the idea that renewables (which can produce energy at or near where it will be used) are worse than crude oil on an EROEI basis is questionable at best and completely non viable as an idea at worst.

And one thing still stands, even if we dismiss the massive largest in history undertaking we call the "fossil fuel" economy:

The EROEI of crude oil is going down, while the EROEI is going up. This is why the fossil fuel industry is doing everything possible to discredit renewable energy. But the numbers are against them. They know this, or otherwise they would not be so vocally opposed to alternative energy, they would simply say "let them go fall on their face." The crude oil has a century of sunk cost to extract the last dime from. They will fight change that threatens that industry to the last possible second. Saudi Arabia has recently invested million s in research funding a "green" internal combustion engine in a bid to keep the current technology viable long enough to sell the oil they have invested billions in infrastructure to extract.

The fear of peak oil, along with the massive "driver" called climate change is pushing technology faster and faster. The oil producers are on a sinking ship and they know it, at least the alert ones in the industry do.

We are entering a new age, fast.

RC

It's great that you mention all that historically accumulated investment, that most people ignore, that our mature oil industry depends on both as material structures and accumulated knowhow. I think the investment cost of that is, or could easily be, roughly included in the EROEI estimate Dave Murphy did, because he uses cost measures which already do or probably could include the amortized cost of repaying those investments as an energy equivalent.

I very interesting article. I find your graph Figure 4 on EROEI values against time fascinating. It appears to apply that EROEI is higher for renewables than that for fossil fuels. Curious to know what assumptions are used to determine the EROEI values, especially those at base.

These two points seem to be contradictory, unless I am missing something.

I would also like to see some data supporting these claims, particularly the second one. (Not that I am necessarily disputing them, but they hardly seem agreed upon or proven). It seems like it would imply that the market would not go after oil sands, which is not the case.

ERoEI gets a lot of play here, for good reason, but net energy matters too and, theoretically, more in some possible cases. It may not matter if HYPOTHETICAL TURBINE X had an EROI of 1.1:1 if they were the size of atoms and could be built out as fast and numerously as needed. An extreme (stupid) example, but the concept makes me question your numbers (though, honestly, I will admit, the charts are a little confusing/vague to me, and that might be my fault).

Late to the discussion but I'll toss in a few facts I've mentioned before. Not disputing the value of EROEI but the FF industry has never and will never utilize this metric. Accepting this fact might help explain some of the odd circumstances we've witnessed. What really clouds the issue is the way publicly companies are traded and how they typically respond. The easiest example to explain this apparent illogical approach is to consider the recent boom in shale gas drilling. Many before have commented how the economics of this play seem to defy EROEI and, more basically, the profit motive. Almost every company involved in the play was public owned or pushed by promoters who were making their profit on the front end. The driving force in the shale gas play expansion was the ability to quickly add to a company's reserve base. Wall Street views such additions as THE future value of a company. Whether the EROEI (or even the profit) was there or not was of little consideration. Until recently I consulted for one of the big publicly owned SG players. Though the newer wells were coming on much better than the initial efforts the cost of these new wells had risen so high that profitability even at the higher NG prices became questionable. But drilling grew even faster because the companies, thanks to Wall Street valuations, were able to leverage the in ground reserves to values well beyond their true worth. But throw in the big price drop in NG and even this approach failed big time. My company went from 18 rigs to 4 in just 6 weeks. And paid $40 million in penalties for that privilege. Can we say exploding EROEI?

Again, I'm not saying EROEI isn't an important factor. I'm now with a privately owned company and EROEI (or profit) is the only consideration. Fortunately for us the industry collapse has made such goals easier to attain. We are buying into prospects in which the sunk costs (low EROEI efforts) are being absorbed by the generators. Additionally drilling costs have dropped significantly...as much as 60% for some wells. We still don't calculate EROEI for our projects but intuitively it's there behind our economic analysis. But as the industry rebounds, in time, trying to understand it's renewed efforts through EROEI glasses will be somewhat confusing. As long as the Wall Street mentality controls the action of the big FF companies there will be a continued disconnect with EROEI IMO.

I agree that there are all sorts of reasons why, in particular circumstances, the EROEI of an energy source has little to do with its exploitation. What I say is that, in the long run, it's the sources with the highest EROEI that will get the most exploited.

I wouldn't argue strongly against your view Doly but you have to keep in the back of your mind the power of Wall Street to skew logic when it comes to FF investments. As an extreme example I once drilled a series of wells which actually produced a net decrease in value to the company. But by increasing the company's production rate by almost 400% Wall Street reward us with a stock price increase from $0.75 to over $5. Sort of like the old joke: watching sausage being maade can ruin your appetite for it. Or another worn out saying: Wall Street sells the sizzle...not the steak. And it can happen on a major scale and not just in isolated cases. WS continued to sell the hell out of the sizzle of the shale gas players even as ever decreasing meat was left on the bone. The many billions of $'s spent in the SG plays could have been directed to better EROEI projects but those were boring and didn't have the sizzle needed to push the stocks. In the end Wall Street makes its profit by the number of trades made and not if the buyers make a profit or not.