The financial return on energy invested

Posted by Euan Mearns on June 23, 2009 - 10:41am in The Oil Drum: Europe

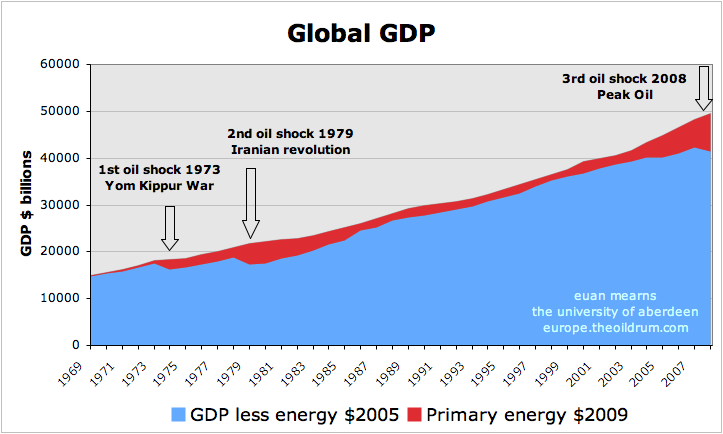

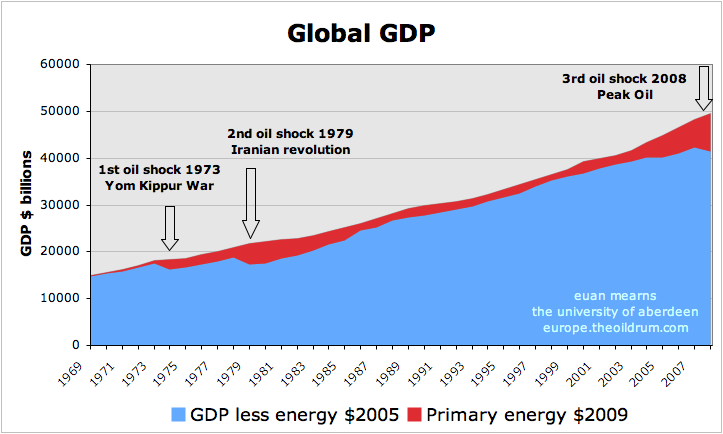

Global GDP has grown steadily and continuously since WWII, in step with a growing global population and primary energy consumption (see below). Oil shocks have caused recessions compensated by higher energy prices that have bolstered global GDP at time of recession in the non-energy economy.

A number of recent posts on The Oil Drum have explored the relationship between energy and the economy. Francois Cellier provided an overview of links between energy consumption and GDP on a per capita basis. This post will expand on the work of Francois taking a somewhat different approach. In a guest post, Ian Schindler provided an overview of the Ayres-Warr model of economic production which I found easier to read and understand than the original Ayres-Warr paper. Ian made some valuable points about the role of energy efficiency in promoting higher energy prices and higher energy production. David Murphy looked at the relationship between oil prices and rates of oil price change in relation to US GDP and growth whilst drawing attention to the view that the current recession was in part caused by high oil prices.

In this post I want to explore further links between energy consumption, GDP and energy prices. But first a quick note on data limitations.

GDP data are taken from the US Department of Agriculture who provide historic data for all countries dating from 1969 based in 2005 $US (table titled: GDP Shares by Country and Region Historical).

Energy data and prices are taken from the 2009 BP statistical review of world energy. Primary energy consumption = coal+oil+natural gas+nuclear+hydro, all re-based in millions of tonnes oil equivalent (mmtoe). A $ value is attached to total primary energy consumption using the historic oil price data provided by BP which are based in 2009 $US. Clearly coal, natural gas and other energy sources should not be priced as if they were oil so this is a gross simplification. It would be a major task to provide true energy costs since there are huge regional variations in the price of coal and natural gas. Using the oil price provides an approximation that likely over estimates the real price.

Furthermore, using raw energy prices does not provide the full cost of energy to society since much of the energy consumed is processed and costs society significantly more; for example gasoline and electricity, and this will lead to an under estimation of real costs.

These two major sources of error will therefore to a degree cancel each other and this imperfect exercise does I believe provide some interesting trends that are useful in conceptualising the role of energy in the global economy.

Energy consumption and GDP

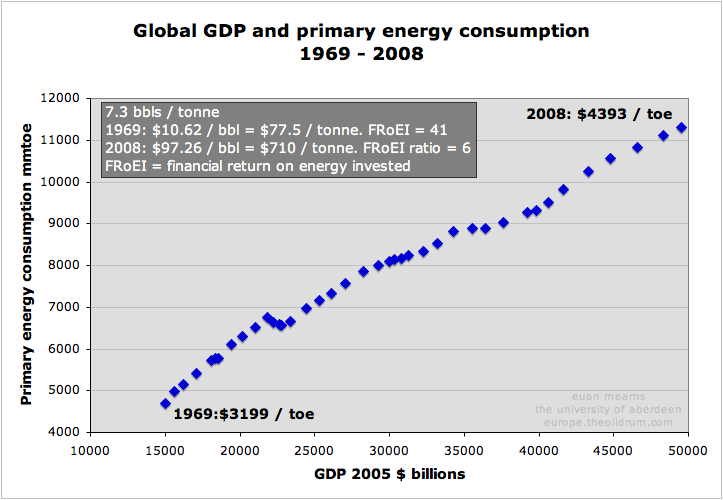

Figure 1 shows how global GDP has marched upwards since 1969 in lock step with global energy consumption. This trend also correlates with growing global population and in simple terms global economic activity has grown with growing population, a larger percentage of the global population participating in economic activity and all of this requires a growing amount of energy use.

The trend is not linear owing to two factors:

1 Energy efficiency gains

2 Phantom GDP (which is discussed below)

The energy - GDP trends for individual countries (Figure 2) are also affected by the energy embedded in imported / exported manufactured goods.

The apparent growth in GDP/TOE from $3199 in 1969 to $4393 in 2008 may be attributed to efficiency gains and phantom GDP.

Energy - GDP national trends

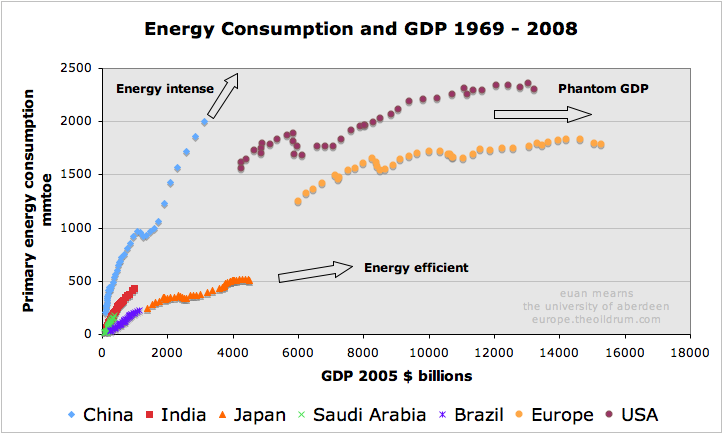

The simple picture of looking at energy and GDP on a global scale (Figure 1) masks significant complexity at national scales. The GDP - energy trends are plotted for a number of key countries and federations in Figure 2 which shows vast disparities between countries. For example, China appears to be using over 4 times the amount of energy as Japan to produce similar GDP.

Figure 2 GDP - energy trajectories for key countries and federations. Europe = 25 countries making up W and E Europe, some small countries excluded. Data sources as before.

The trends are influenced by population size and demographics; the type of economy; trade balances; endowments of natural resources including food production; the % of population involved in economic activity; climate; global power position etc.

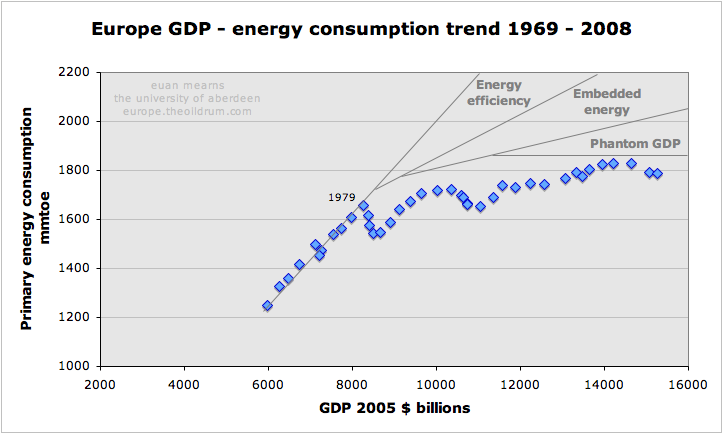

Indutrialising China is on an energy intense trajectory whilst the "post-industrial" mature economies of Europe and the USA appear to be on energy efficient trajectories. This, however, is oversimplified. The flattening of the European and US trends introduces the possibility that GDP may be generated without increasing energy use. To an extent energy efficiency may allow this to happen (Figure 3). However, the mature economies benefit from generating GDP from imported goods, which has also caused growth in unsustainable trade imbalances (Figure 3). The energy embedded in these goods should rightly be added to the importing countries and deducted from the exporting countries to present a true picture. This is averaged out in the global view. The mature economies also benefit from phantom GDP which is described below.

Figure 3 GDP - energy trend for Europe illustrating conceptually how the trend may flatten by the action of energy efficiency, energy embedded in imported goods and from phantom GDP.

Phantom GDP

Phantom GDP as the name implies does not actually exist. It is generated from trading the assets of other countries; trading financial instruments that have no intrinsic value; unmetered inflation; trading on artificial asset values generated from unregulated and unsustainable fractional banking; and GDP generated from unsustainable levels of unsecured debt etc. Phantom GDP may lead to real GDP since the profits produced may be used to purchase goods and services.

Energy cost and GDP

With global GDP, energy consumption and energy price data available, it is worthwhile trying to combine these to further explore the relationship between GDP and energy. The significant limitations of this exercise are discussed above, but the data trends produced are I believe worthy of consideration.

A $US value has been attached to primary energy consumption by multiplying total primary energy in mmtoe by the annual average oil price (WTI). This sum was then deducted from total GDP to produce an estimate for global non-energy GDP and the result is plotted in Figure 4.

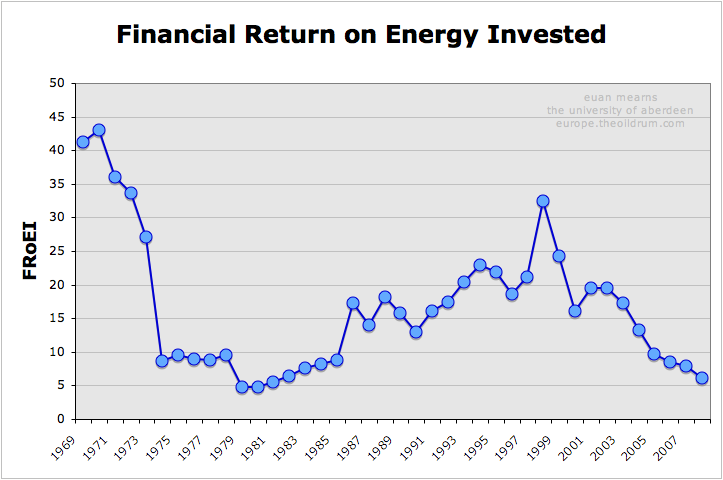

Whilst global GDP has shown near linear growth since 1969, the negative impact of high energy prices on the non-energy economy is clearly shown for the three oil shocks (1973, 1979 and 2008). This exercise also affords the opportunity to plot the ratio of total GDP over total energy cost which I have called the Financial Return on Energy Invested (FRoEI) (Figure 5).

One thing that struck me from doing this was that the FRoEI figures are of similar magnitude and range to ERoEI data. The second oil shock of 1979 caused FRoEI to fall from 10 to 5 and a major recession followed. Since then, FRoEI grew rather steadily to 1998 where values over 30 were once again attained. Since then the ratio has declined registering a fall from 8 in 2007 to 6 in 2008.

The future

As others have pointed out, energy costs and the oil price are limited by the size of the global economy. For example Francois pointed out that $590 / bbl was the theoretical upper limit for the price of oil and that the practical limit was more likely less than $200 / bbl. The average oil price in 2008 was $97 / bbl. Figure 4 shows empirically how rising energy prices flatten growth in the non-energy economy until eventually a negative growth situation is reached. It is tempting therefore to believe that around $100 / bbl may the upper limit for the current configuration of the global economy since energy costs higher than this will push the non-energy part of the economy into recession (Figure 4) which has a corrective influence on energy demand and price. Price volatility affords the opportunity for brief excursions over $100.

A crucial question that follows from this is what energy supplies (fossil and other fuels) can be accessed for $100 / bbl? With reports that finding and development costs for oil are running close to $80 per barrel, it seems that we are approaching the point where new fossil fuel supplies may be too expensive for our economies to bear. I am intrigued by the fact that ERoEI and FRoEI values lower than 7 may represent threshold values for industrial civilistation.

We are not yet at the point of peak fossil fuel supply though we are likely close to peak oil supply and since oil is the most convenient of the fossil fuels to use this is likely to exert a destabalising influence. When fossil fuel supplies do begin to fall, the only way that GDP can genuinely grow is through energy efficiency. As Ian Schindler pointed out, energy efficiency will facilitate higher energy prices and thus energy efficiency will promote higher GDP/ mmtoe, higher mmtoe produced and higher prices.

This may enable the global population and economy to grow beyond the date of peak fossil fuel supplies for a while at least? Herein lies one of the greatest paradoxes and threats to the human race. Improving energy efficiency is arguably a major part of our salvation from fossil fuel energy decline but this will merely allow population to grow to higher unsustainable levels. In arguing for energy efficiency measures one must therefore also argue for measures to ration energy use and population management. What chance in a world obsessed with extending life expectancy, reducing mortality rates and averse to birth control?

End note added 21st June

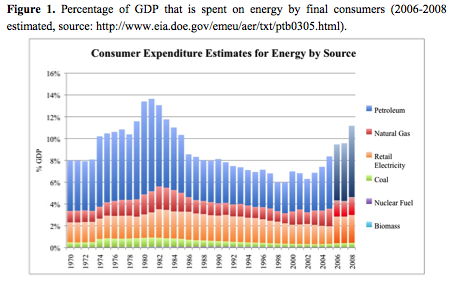

I was reminded about the paper by Hall, Balogh and Murphy (pdf from TOD server) who deal with similar issues to to those dealt with here for the USA. In particular, their Figure 1 (below) provides in greater detail the % of US GDP spent on energy and this provides an opportunity to compare with the somewhat cruder approach adopted in this post.The 1981 peak from Hall et al of 14% translates to FRoEI = 7. The 1998 trough of 6% translates to FRoEI = 17. And the 2008 peak (estimated by Hall et al) of 11% translates to FRoEI = 9.

The comparability is open to debate. Both data sets I believe need to incorporate energy embedded in imported goods.

Euan,

Thanks for the post and this is great stuff.

You are now fighting both permabears and another strange animal............the GDP (Gross Domestic Product).

A common equation for GDP;

GDP = C + I + G + (X − M)

GDP = consumption + gross investment + government spending + (exports − imports)

For economies being net energy importers they need to export, and the higher the energy prices the higher the export (meaning production of more goods requiring more energy) needs to be to balance trade. The other way around is to specialize in products needing highly skilled labour and little energy input.

Phantom GDP; excellent expression.

The equation shows that GDP grows when consumption grows. What happened in recent years was that a lot of consumption was based on issuance of debt which entered the economies as mostly consumption.

What I found doing some research on US economy was that if GDP also was adjusted for the growth in debt since 2000 ( plus inflation and energy imports), the real US economy would have been in decline since 2000.

Going forward it looks like debt needs to be repaid (meaning less consumption having a negative impact on GDP).

Further it looks like repaying debt needs GDP to grow, meaning more energy input and as some of the sources seems to be close to capacity (like oil) increased energy demand will drive prices up thus worsening the trade balance for energy importers.

Heads you loose, tails you don’t win.

That is an interesting question.

We may find that one of the paradoxes we will be facing is that shrinking GDP (price of energy is GDP constrained) will set an upper limit for what oil/energy may be developed/accessed in the future.

Could we end up in a future where resources requiring $150/bbl never will be developed simply because the economies cannot afford it?

One could argue that by 2010-11 that GDP since 2000 will have been revised downward so much (since 40% of US corporate profits this decade are in financial sector - and liabilities are still extant), that the energy per $ of GDP is actually much higher than commonly expressed - so the corrolary to 'phantom GDP' is 'zombie energy intensity'...

energy and natural resources are what we have to spend....(dollars are just who controls the energy, for now)

My simplistic view is that debt is borrowing from the future, when this is done to wisely invest in a productive asset (e.g. a rail network) then it is good, when it is done to provide say a lifestyle totally beyond one's income or to buy the voteriat then it is a bad thing. Since the borrowing countries have generally indulged in the later then they will have to cut down on non-essentials to get back on an even keel. Personal savings have started to rise as consumers try to pay down debt but most governments are not there yet since they don't like giving bad news to the voteriat.

I think using GDP is not a perfect measure since what does it really represent, we live in a closed eco-system (the world) so what's increasing? population, fossil fuels burnt/CO2, seas emptied of fish, plastic junk created and shipped.

tonyw,

I think you are mixing up GDP with sustainability. Both low and high GDP countries can be either sustainable or non-sustainable.

To go to the core of the issue, is it conceivable that a society can have a high GDP using renewable energy and recycling or harvesting in a sustainable fashion? It's clearly not possible if all energy comes from FF's whatever the GDP/capita. I see no reason why we cannot have goods that are made from 100% recyclable minerals or derived from sustainable agro-forestry. I also see no reason why energy/GDP cannot continue to decline. Many of the things we associate with a high standard of living, such as health care, education, arts, gourmet food, don't have a high energy content. Just a few are very big energy users such as tourism/travel , personnel transport, but in spite of it's high automobile use, California has a state average 4.7MJ/$GDP compared to the average of the US of 7.4MJ/$GDP, are we saying that Californians don't really have a high GDP/capita its a "Phantom high standard" or do Californians really use much more energy?

It is not particularly informative to look at individual US states or countries as examples. Texas has a very energy-intensive economy, but they refine the oil used by a lot of other states. There is nothing about California that screams efficiency. The mild weather helps a lot. Information technology on one level (game programmers, system designers) might use relatively little energy, but the overall system (Si refining, chip fabrication, etc.) uses a lot. The US and Europe have outsourced much of their energy-intensive industry, providing services in return. Yes, there are real efficiency gains that have been and will be made, and a really good meal might not take that much more energy to make than a bad one, but the idea that the electronic age is one of lower energy intensity is a myth with a capital M. As for arts, if we all painted, wrote poetry, or strummed guitar in our spare time, that would definitely be a good thing.

Well not quite the web of per capita energy usage eventually makes most activities quite even.

If you split energy usage into two parts energy to make stuff and energy to consume stuff.

On the consumption side most people are equal regardless of the industry they work in.

Next of course depending on the per capita consumption level you need X amount of core or industrial energy usage.

If you write poetry and grow all your own food etc then you make a difference. Just writing poetry alone really does nothing to change the equation since its your personal consumption not your output thats the issue.

Put it this way manufacturing cars is energy intensive. If you attribute this energy to each autoworker fine but to reduce it you have to reduce the consumption of cars by everyone. It really does not matter if the car consumer is writing green poetry about a beautiful world and is a vegan. He either must use a car or not.

And of course he can decide to practice what he preaches i.e say ride a bicycle but Jevons paradox ensures these efforts are at best symbolic.

I'm not saying don't work to reduce your own lifestyle and become both more efficient and self sufficient but unless it becomes widespread its a personal choice and ensures your lifestyle is buffered against shocks.

Its not wrong to do the right thing in your own personal life but its not correct to expect your choices to change society until it forms a significant minority.

Obviously I think the most important thing is to really work on your own supply chain if you will and reduce and shorten it and localize it. Withdrawing your own personal consumption is actually more important than the job you do. Its in a sense unfair to burden someone who produces wanted goods with the manufacturing costs and consider the poet someone special. Thats not the right answer.

And Joules I'm not saying your wrong I am saying that its the big picture that determines if a certain form of work or lifestyle results in a net reduction adopting a lifestyle is required but not sufficient to reduce the overall energy intensity of the system. Even your poet is sadly a Myth.

I'm not talking about poetry as an occupation, but rather what people do in their spare time. Perhaps actually taking the time to learn to play an acoustic guitar instead of buying Wii Guitar Hero in front of a big screen TV. We can't all be professional poets, but we could all do it on the side.

Due to the scarcity of punctuation in your prose, I sometimes think you channel ee cummings. Nix the caps, though.

JoulesBurn,

There is nothing about California that screams efficiency.

See this post about the energy efficiency measures in California. It also helps to have high electricity prices, but most of these measures cost 3-4 cents /kWh saved, a lot less than anyone pays in US.

http://climateprogress.org/2008/07/30/energy-efficiency-part-4-how-does-...

The US and Europe have outsourced much of their energy-intensive industry, providing services in return.

I maintain that nearly all energy is imported into US as oil, even motor vehicle imports use a lot more energy in their life-time than embodied in manufacturing. In US 100% of vehicle steel is recycled, most of the energy in manufacturing vehicles in US(or Japan) is used by the employees at car assembly plants going to and from work and energy used at home. none the less >75% of the energy used by a car will be from gasoline and the energy used to refine transport and sell that 7,500 gallons of gasoline used over 15 years.

China's energy usage has been increasing dramatically along with their exports and GDP, and the majority of that is industrial usage.

Automobiles are a special case, since they directly consume a huge amount of energy in use.

It's almost certain that California gets its low MJ/$GDP by outsourcing the energy consumption to Mexico and China. Selling wines and being the entry portal from China for all import goods helps too. I'd need to see contradictory detailed breakdowns to change my opinion.

The last 2 comments have it correct.

GDP is a very poor way to "measure" economic gain since all it does is track money.....which in and of itself is a poor way to represent true wealth or productive endeavors.

All the last boom was about was taking from Peter(the future) to pay Paul(the present).

Just a big swindle.

Not only did the activity not represent capital investment but it was misreported deliberately by showing "profit" and hiding losses.

This has been the crime of the century and should not even be discussed in the manner of business practices.

I hear "Oh it was human fallibility this and we didn't see it coming this." BS everything was obvious as it was occurring and it is an easy conclusion to draw that criminals have gained control of all the institutions both public and private and systematically looted any and all treasure of the Nation.

Our financial and monetary systems are jokes and need to be destroyed and replaced by a system that does not allow concentration and control.

The absolute worst thing that we can allow to occur is a system based on plastic cards as the medium of exchange and hence a non private system.

That would enslave all to the whims and caprice of the handful of aberrant megalomaniacs that mean to rule the masses.

"criminals have gained control of all the institutions both public and private"

Gee, I wish I were one of those criminals in charge, so that I could reap the profits.

Or maybe the problem isn't with the criminals themselves but with a system which rewards "optimizing profits" at others' expense. I don't btw think that it has been much different since civilization set root thousands of years ago...

Cheers, Dom

I don't disagree that this is the same repeating cycle of any civilization..........and you know what the next phase is based on history.

Yes, the golden era;-)

How do you figure Nate? Corporate profits at their peak were about 1.6 trillion. If forty percent of that was via the financial sector, then we're looking at about .6 trillion for that, and after adjusting for the market correction, we lost about half that, so .3 trillion. Keeping in mind this only happened over the past five years or so (~2002-2007), so we're probably looking at an average of ~.1 trillion/year in terms of a GDP correction when comparing GDP in 2010/2011 to GDP in 2000.

NGM2

I agree entirely here, the debts of the US and the UK can never be repaid since to do so would require us to import energy at inflated prices that our economies could not afford.

I think that's exactly where we end up. These are the resources that will likely have ERoEI < ~ 7 and which will never be converted to reserves. This is one of the most important messages to deliver right now - but which will likely fall on very many deaf ears.

Big question - what is the price of nuclear electricity and other alternative sources in this framework?

€

Euan!

Thanks for a very interesting work regarding an immensely important discussion. Obviously if we (the world) have to spend more and more resources (human work and capital) to obtain the energy necessary sustain our life-style less and less resources will be left for the other things we (really) want. Things that energy consumption is just a means to reach.

You cite figures of about $ 100 / bbl as a limit for what our economies can bear.

I wonder if there might not be a important flaw in your reasoning (and also the others of a similar kind). If I understand it correctly you compare GDP-figures with the value of energy production. The latter based on the WTI-price. However, as I see it the important thing here would be the cost of resources (human work and capital) that is necessary for “production” of energy rather than the market (!) price of energy. If the employment of resources to produce energy becomes to large this will diminish the possibility to employ resources to produce the goods or services that we actually desire. (And for which energy is just a means to obtain.)

In a market situation where supply is (perceived as) to small compared to demand the price is set by the cost for the marginal production (barrel), i.e. the market prices becomes very much higher than the average cost of production. Thus if the market price is taken as a measure of the cost of production of energy this cost will be greatly exaggerated. This might produce a very large bias as to the perception of the point when energy production takes too much of our total resources as to sustain the capitalistic economies need for more or less constant growth. Thus I wonder if it might not be that the limit of about $ 100 / bbl is too pessimistic.

English is not my native language but hopefully I’ve managed to express my thoughts in an understandable way.

Elm, good points and there is undoubted much room to discuss the issues surrounding this complex subject. Here's how I'd argue my corner.

True that it is the cost of the marginal barrel that sets the price for all production. But in order to grow production it is our ability to produce these marginal barrels that counts. Without that production growth we "cannot" have economic growth. And it is striving to produce these ever more expensive marginal barrels that sets the price for all production. For now we don't have the same need for these expensive marginal barrels and the price of energy has fallen - dramatically.

I think your main point would be valid if we abandoned the free market and paid Saudi Arabia $10 / bbl and the Brazilians $150 / bbl.

Another way to look at this is how the vast financial surpluses are spent in countries like Saudi Arabia. One consequence is a population vastly larger than the country can support from its own resources of food and water. And they have in effect financed the massive debts of some countries that have been used ultimately to consume energy.

However, I will not nail myself to a cross and say that FRoEI of about 7 is a definitive limit. At that level we are spending about 14% of GDP on energy. If an FRoEI value of 3 were possible that would mean we could have economic growth in the non-energy economy and energy consuming about 33% of GDP and to achieve this would require an enormous surge to in total growth (energy + non-energy economy) and it is difficult to argue for that surge in circumstances where the cost of energy has just doubled.

Euan,

thanks for your comments. If you allow me I would like to try state the state the theory you propose in other words than those you use. Maybe that will result in me missing the point. If so it is not intentionally and in such case please excuse me. Thus the theory would sound somewhat like this:

The production of energy that can be used by society demands more and more effort in the form of human work and capital. Therefore such efforts will increasingly displace other activities that produce the things we want in life. (And for which energy is just a means to reach an end.) At some point this will put such strains on the economies that it will have a more or less deleterious effect on them. If this is a correct representation of your hypothesis we agree in principle.

If so further questions becomes: How do we measure the amount of such displacement? When will we reach a limit where energy costs become so large as to seriously harm the possibility to grow the economy or even sustain it at a given level? (In a capitalistic economy the possibility of just sustaining the economy at a given level might not exist. Either we have optimism and growing economies or contracting economies and pessimism!? )

I will stick to my position here, namely, that you if you want to calculate the part of available resources that gets allocated to energy production the data from your figure 4 overestimate this part. This is because a large part of the producers make immense profits at e.g. the prices of 2008. It is only a minor part of the price we pay e.g. the Saudi-Arabians that goes to cover the costs to produce/extract the oil they sell. In this way the high price does not imply that activities to produce other things wanted will be displaced. The high prices will mainly effect the distribution of wealth produced. One may also look at your figure 4. For example the Iranian revolution seems to have had a dramatic effect on the part of total resources that is used solely for energy production. It would appear that the part of the total resources that were used for energy production approximately doubled after the revolution. It is likely that some effect of this kind occurred but the data in figure 4 must greatly exaggerate it. Obviously if easy to produce Iranian oil was substituted by more difficult to produce oil from other areas this would increase the part of total resources used for energy production. However, it is very hard to believe that the effect was of the magnitude indicated by the data in figure 4.

Still it appears to be data that indicate that when the expenditure for petroleum become about 5 or 6 % of GDP this slows economic growth, se for example the post by David Murphy you referred to. I believe I have read other articles talking of something like 8%. There may be a statistical correlation here, but it does not prove a casual relationship. Probably the greatest effect of a run up in energy prices has to do with the imbalances that they create if the increase is rather swift. For example the price increase may result in large amounts of gas-guzzlers that are no longer in demand, in large number of houses with very long commuting distances that no longer are demanded, increasing indebtness of consuming countries, etc. Thus, while hikes in petroleum prices might very well have been at least part of the cause of the present and/or earlier recessions this is not evidence to the fact that the actual level of energy costs caused these recessions or that the actual level of energy costs are/were to expensive bear.

You also propose a remedy for increasing energy prices, namely increasing energy efficiency. Obviously this is one way to handle the problem. Increasing energy efficiency would allow the part of total resources that goes to energy production to remain tolerable even in a situation when the cost of producing one unit of energy steadily increases. I am not updated on where ERoEI lies for the marginal barrel today. But I find it hard to believe that projects with an ERoEI of about seven (or even lower) should not be possible to execute. In line with this it also follows that I do not believe there is evidence that some $ 100-150 / bbl would constitute a level which is necessarily to expensive for our economies to bear. It might have been too much last year, but I believe it should be possible to adapt to such a price level.

All in all I think we agree on the problem, though I believe your calculations/hypothesis give a too pessimistic result. It is probably extremely difficult to pin-point a limit where the cost to produce energy is of such a magnitude as to have a deleterious effect on our economies. Such a limit will to a large extent be fleeting depending on how a (the) difficult situation is handled. Here, I am very pessimistic. The problem receives too little (almost no) attention. Measure to remedy our critical situation most likely need more or less immediately to be taken – so little is done.

Elm, I think we are going to end up disagreeing on this. The Saudi Arabians may make huge profits but OECD consumers end up paying much more for all their energy - gasoline, nat gas and electricity. The rise in this part of consumer spending means they have less to spend on everything else, especially since the banks removed the option to simply borrow more to fund this. Consumers forced to spend less on everything else - like new cars, vacations and new houses, force non-energy parts of the economy into recession. But then the corrective part of the demand supply loop licks in.

I don't think my estimation of costs of energy consumption are over-estimated in Figure 4 - these are costs of consumption. You seem to be talking about the costs of production - which I agree are much lower.

The FRoEI threshold value of about 7 is an empirical observation and I agree that economies may adapt to allow values lower than this in future - but I'd also argue that adaptation will be via energy efficiency gains.

Euan,

I agree with you that costs of energy consumption may be (has been) very troublesome. (Though, I would prefer to put more emphasis on production costs.) Also agreeing that it seems a good time to rest our discussion for now.

Best regards,

Euan,

Great post. It confirms the problem that technotopians will have, the inability to build an energy intense infrastructure and society using solely the energy productive alternatives themselves to power that construction and maintenance. As long as there are relatively cheap energy subsidies, then an alternative energy buildout appears (in a hallucinatory fashion) to be feasible. All we need do is build a few flexible film solar cell factories and wind turbine shops and we will be set. The implication is that the energy produced will be enough to replace the entire cheap energy base that allowed us to build out the alternative energy system. As the ERoEI of <~7 indicates, a continuing industrial civilization will be problematic.

Chicken and egg my friends.

I love it when boffins catch up to lunatics. Everyone is happy!

Hey, don't mean to hijack the thread with a specific question but I'm researching these guys...

http://www.enerkem.com/index.php?module=CMS&id=6

They basically are scavenging by doing "waste" to energy with biomass and municipal solid "waste" including C&D wood and (likely) food and yard "waste" compost.

What do you guys think of the ERoEI of this ethanol/methanol operation? Can this be considered renewable energy? I think so, but I don't think it works a century from now without the ability to build/maintain whatever digesters they use.

Thanks!

I've not looked at your link. But from my own experience at home where we now recycle paper and card, glass, tins, plastic bottles and most recently food waste, all that is left is some very light and bulky packaging. When I look at the weekly volume of this I imagine it might keep us warm for less than a day in winter.

So sure, this is worth doing, but it is a slice of a multi-solution problem.

I'm sure there are studies done that quantify this.

Thanks Euan, same thought that I had.

Good luck with your preps!

Hi Euan

Thank you all your work.

Regarding nuclear electricity. This is not a field I am familiar with, and by my gut feeling I am suspicious of it, particularly the ability for it to be scaled up quickly enough to enable a smooth transition, but also the wildly varying figures for how much usable uranium and thorium will be available, and how much that will cost to mine and process. Then there is the waste issue.

However, Prof Barry Brooks in Australia has become a proponent of incorporating nuclear power as part of the carbon emissions mitigation, in particular with Integral Fast Reactors. He said at a recent lecture in Adelaide that although 4th Gen reactors have not been built yet to a commercial level, they could be working within 25 years, and maybe within 8-10 years if there is a major acceleration R&D and build out programn.

For Prof Brooks' views, here is his blog http://bravenewclimate.com/integral-fast-reactor-ifr-nuclear-power/

I have not read through it yet in detail, but I will do so in order to have a more informed opinion of the feasability of nuclear power in our future.

cheers,

Sophia

I have been saying for some time that it does not matter how much oil is theoretically and technically recoverable in the ground, what really matters is how much we'll actually be able to afford to extract.

I've also believed this to be the case for some time now, though I also believed that the price would be somewhere higher than $200 / bbl. This exercise suggests that the actual sustainable price over any length of time will be substantially less than that.

I think this is a very important point to refine since this is the main barrier to getting the resource optimists more aligned with the views of "peak oilers". Agencies, companies and governments that point to vast resources need to understand the limitations of converting these resources to reserves if the costs are higher than the economy can bear. Reducing ERoEI (energy efficiency of energy production) pulling one way and increasing energy efficiency of energy use pulling the other.

One question that comes to mind is what the upper limit on natural gas price is. If we can't afford to produce oil above $100 barrel, what does this mean for natural gas? Energy-wise, the equivalence is about 1/6, but natural gas requires more pipeline infrastructure, so is worth less than 1/6 of the oil price. Also, if it were to be used more for things such a bus transportation, we would need to build the busses and refueling stations to make this happen.

With US natural gas prices in the range of $4 mcf, it would seem as there is might still be quite of upward room in prices. At higher prices, it seems to make sense to produce shale and tight gas. I would think the Europe would have unconventional gas that could be produced at higher prices also.

Gail,

Natural gas has some advantages over oil, it's energy loss is much less than oil from well head to consumer( more efficient transport and low refining losses).

When we generate most electricity from wind or solar, NG will be very valuable for peak power( as it is today) so may be priced much higher but used a lot less.

Clearly we can afford to use oil above $100/barrel but not with vehicles that get <20mpg. Once 2016 CAFE laws take effect new vehicles will be averaging 39 mpg, so fuel costs will be 50% of the cost of a 20 mpg vehicle . For PHEV owners getting >100 mpg they can afford $500/barrel oil( but only use 1/5th the amount). It does need time for drivers to switch to new vehicles, but the higher the price the faster the switch, Prius and Chevy Volts will be back-ordered, SUV production will close down.

Euan

Great analysis but I don't think you should be so quick to dismiss the magnetude of the transient effects on the system.

You say that the current analysis leads you to believe that an upper limit of $100/bbl exists for us to maintain a steady state economy. The recent events GFC would tend to reinforce that position. The problem we have, is that the major devices whereby we transform energy into productive output (GDP) have considerable usable life expectancies. These vary from a room heater that may last for 3 years to a power station that will operate for 40 years. For that matter, suburbia is also in effect a user that has an investment horizon of perhaps 100 years or more. If you weighted these energy users by investment value (either money or energy) I expect they would average out at around 10 to 20 years, maybe more. The economy therefore has to deal with this investment lag when responding to the impact of higher energy costs. If we had an inexhaustable supply of energy at $200/boe then I think that we could probably learn to deal with this and still have a stable system. Getting to that point while maintaining a reasonable level of system control will not be easy.

To your last question, the clear answer is "yes" if what you mean is whether growth is limited by increasingly expensive resources.

You could say it's because the ratio EROI (energy returned for energy invested in natural resources) needs to be bigger than what I call system overhead, SROI (energy needed for energy available to invest), a balance of productivity and costs.

see also my comment with links below

Rune, wrt:

-I read somewhere that the next great wheeze to keep the wheels falling of was that the US is going to start 'exporting' debt to places like India and China in order to turn them into Consumption orientated countries. These 'products' (the facilitation of debt amongst newly affluent Asian Coinsumers) might fall into your definition of something that will enable imptorters to continue importing...

-Kills two birds with one stone and leaves us all birdless...

Nick.

I'm trying to boil it down to a single idea. Something like;

Wall St (the phantom economy) exists because of fossil fuel. (EROEI>7)

The corollary is no high yield energy no Wall St. Could be why the suits are fighting tooth and nail to deny or prevent any fossil fuel slowdown. Or create a new phantom industry like carbon trading. In a couple of years people who lost their jobs in the phantom economy may realise those kind of jobs are never coming back.

the simple idea is that energy gain (in the tainteresque sense) combined with natural resource gain and technology (clever apes with #millions of iterations and materials) to produce monetary gain. As energy gain declined, in a fiat marker 'belief' system, wall st replaced energy gain with higher octane derivatives of natural resources (after all, stocks, bonds and commodity futures are ALL derivatives of nature). In the past decade the disconnect between energy and money became extreme - now on the downslope (and I am in deflationary camp), much of the lower energy gain stuff left won't be economic, leading to very real observed declines.

I think the "phantom GDP" is nonsense, actually, and I don't agree with the argument that current GDP is based on debt. Debt is red ink on a paper matched by black ink on another paper. It doesn't really change the global economy's productive capacity in goods and services.

Also, the author states that sustained growth by energy efficiency will make the world's population continue growing unsustainably. This is simply untrue. On the contrary, sustained economic growth ensures that the population growth abate, and in a business as usual scenario, the world population is to peak at around 10 billion.

Jeppen, I agree with this part:

that's why the global picture is well correlated between GDP and energy use. It's in sub-sets, mainly the OECD, where phantom GDP appears - and that is GDP growth that has not used energy. We have effectively taken goods from China and have not paid for them - and never will.

If you believe its possible to generate GDP without using energy can you give us some examples - bearing in mind that people use energy.

With respect to population of 10 billion by 2050. Energy efficiencies may enable that to happen, but then you end up with 10 billion mouths to feed and water, that have by and large been fed and watered on the fruits of fossil fuels, and then you discover that the lifeblood that enabled that miracle to happen starts to run out.

How would you propose to sustain 10 billion in the second half of the 21st century?

Euan,

If your graph is correct, FF energy will decline by about 25% in 40 years, so we need to either increase energy efficiency by 0.7% per year( last 40 years has been 1.3% per year) or add renewable/nuclear energy at rate of 0.7% per year, or reduce GDP. Any are possible, but we could also have GDP increasing, renewable energy increasing and energy/GDP decreasing, as FF decreases.

If you believe its possible to generate GDP without using energy can you give us some examples

Not necessary, only have to create same GDP with less energy, lots of examples, email versus post, digital camera versus film, automatic teller machine transaction or internet transaction versus driving to bank and using employee time. Probably only some of the value is captured as GDP, certainly lower energy not quite "no energy" but close.

Neil - I agree with your various points on energy efficiency, and in particular efficiency gains in power generation. My Figure 3 does attribute a portion of the flattening of the OECD energy-GDP trends to energy efficiency gains.

I'm not sure we have any major disagreement. There seem to be those who believe that all the GDP growth in the OECD in recent years is genuine and those that believe a portion of it is phantom. I certainly belong in the latter camp. If it were demonstrated that it is all genuine I'd have no problem with accepting that the flattening is due to efficiency gains and importing energy embedded in goods.

The energy efficiency argument is not so easy applied to the developing countries where efficiency gains may get cancelled by a larger % of the population participating in economic activity.

The slight flattening of the global trend of Figure 1 likely reflects efficiency gains. $50,000 question is can that global trend ever flatten?

Neil

I don't think the situation is quite as easy to solve as you indicate.

The problem is that the published GDP numbers include this "phantom GDP". Some of the examples you quote above could well be on the edge of or included in this category. 50 years ago the average person would only do 1 or 2 bank transactions a month. Now they do 20 or 30. The costs associated with these transactions are counted in our GDP but does this really provide an improved standard of living ? There are numerous similar examples, food packaging, advertising of all description, etc..

To me there seems to be a strong correlation between the improved energy efficiency components of our economy and those activities that are really froth and bubble. I am not saying that there has not been energy efficiency improvement in the real economy. These are occuring and will continue, but I think your quoted figure of 1.3% pa. improvement overstates what can be achieved when it comes to the production of "real" goods and services.

Euan Mearns -

How to generate GDP without using energy?

Simple: there are already many components of the GDP which have little or nothing to do with energy consumption. If I am not mistaken (someone out there correct me if I'm wrong), such things as real estate commissions, legal fees, and many other non-physical 'transactional' activities count toward GDP.

So, If you should sue me and pay legal fees to your lawyer, you are contributing to the GDP while virtually using zero energy. And if you and I sell our houses to each other and pay real estate commissions, we are both contributing to the GDP while doing little more than moving some papers around.

Then we have the entirely separate problem of having the revenues from the sale of a product assigned to one country's GDP, while the energy consumed in manufacturing that product assigned to another country. The most notable example of this is the huge importation into the US of goods made in China for sale in the US by US companies. Much of the revenues get assigned to the US GDP while the energy is not consumed in the US, thus giving the illusion of increased energy efficiency in manufacturing for the US.

My own personal view is that it's a very dicey game trying to closely correlate GDP with something physical, due to the many accounting artifacts causing distortions such as in the above examples.

Agreed that correlation does not = causation. So would you care to offer an alternative explanation for the data shown in Figure 1.

Euan Mearns -

Well, I am rapidly getting in over my head here, but about the only things I can conclude from Figure 1 are:

i) That sudden oil price shocks do act as a drag on the economy, and

ii) That when energy prices are high, more of a country's total GDP goes into the energy sector of the economy. (If I have to pay more for gas, then I have less money to pay for something else, say restaurants, though my total household expenditures will probably be more or less the same. So, one sector benefits, while another sector gets hurt.)

I know that neither are hardly astounding conclusions, but that's about the best I can do.

One other comment: It is tough enough getting a handle on what GDP really means even for a country swimming in statistics, such as the US, but I would think that estimating the global GDP is more of a guessing game rather than an exercise in adding up reliable statistics. Really, how much faith can one have in GDP numbers for say Paraguay or Upper Volta?

... is a good example. The fees are paid for from the capital gain that was produced by the bank lending a higher multiple of salary funded by the bank lending a higher multiple of its depositers and shareholders capital.

Is this real or phantom "wealth"?

Euan Mearns -

Don't know if it's real or phantom wealth, but it sure ain't the same type of wealth as owning a bunch of oil wells or productive farm land, that's for sure.

In the example of you and I selling our houses to each other, I would view the real estate commissions more analogous to the friction losses in a mechanical system. If we keep repeating the exercise, before too long the real estate fees will exceed the value of our houses. All of our collective monetary wealth formerly present in our houses will have been consumed by this financial 'friction'. By this reasoning, I think a good case could be made for subtracting things like real estate commissions from the GDP rather than adding them to the GDP.

But perhaps I don't have a clear idea of what this indicator called GDP is really supposed to show, but I get the impression that a good chunk of it merely represents various forms of unproductive 'churning' rather than real economic output.

Joule:

That last comment is in keeping with Herman Daly's notion that GDP often includes costs as income - a factory which produces waste which has to be hauled away is overstating GDP by adding the income of the waste hauler to the factory's income rather than allocating a COST to the externality.

Though in theory substitution of consumption (spending less on restaurants because the i'm spending more on gas) is GDP neutral it very well may not be.

A dollar spent on making solar panels has different "echos" as a dollar spent on making the next version of Grand Theft Auto. The solar panel will produce something of value for year to come whereas Grand Theft Auto will be taking up hard disk space after a few months, and have zero (material) added value - though the emotional value derived from playing it is real also, it doesn't reverberate through the economy.

Just some thoughts- I should make a bit more coherent at some point.

Euan and Jeppen, I do not agree with this part:

Money is loaned into existence. That money is re-deposited and loaned again. Then that money is also re-deposited and loaned out again, and so the story goes.

This newly created money goes into building houses, building small businesses and into building all kinds of new goods and services. Debt changes dramatically the global economy's productive capacity of goods and services. The world economy, whether capitalist or otherwise, is based on debt. Without debt the world GDP would shrink to a tiny fraction what it is today.

Ron P.

Darwinian,

I just got my "ah ha" laugh of the day reading your all too true comment that debt dramatically changes productive capacity.

I cannot fathom why huge amounts of debt MUST be NECESSARY given my limited knowledge of economics but I can easily envision a benign command (I know this is a contradiction) economy wherein every thing is pay as you go.(Command might be necessary to prevent the growth of the debt monster)

Growth might necessarily be a lot slower but it should still be possible.Public works could be financed out of current taxes,which would eliminate really large projects probably but smaller ones-and ones that would be extremely long lived especially -could be practical.Ditto personal consumption-one could buy things that are affordable only out of current income or savings but every thing else equal,once debt free could easily save enough to buy the equivalents of washers and dryers if not suvs.

Such an economy might have no problems with keeping impossible promises ie unfunded mandates.

Such an economy might have a strong tendency to shun the throwaway and spend only on the efficient and the durable.

As a practical matter I am well aware that debt financed consumption is what keeps the wheels of modern economies turning.

Unfortunately current debt based consumption bears an altogether to remarkable resemblance to the early payouts made by the operators of successful ponzi schemes -and ponzi schemes as such are necessarily doomed to failure within a few years at most.

Since total debt both acknowledged and "off the books" is so big,and the scheme has worked so well so far,it might be that it will succeed for a for more years.

The suckers are of course the holders of all long term debt;most creditors are surely going to

default,including Uncle Sam.Oh,he'll keep selling bonds and mailing checks but the checks will buy less and less and the default will be spread over the whole federal debt rather than concentrated on individual bonds and pensions,etc..

But some of the debt is getting paid,or at least unloaded onto other suckers.The Chinese are buying everything in sight and I presume they're paying with dollars that will be depreciating sharply soon.

But I've been rambling.My ah ha ha ha was this.

Pa's old mule was never easy to catch when plowing was to be done,and he( born that way at least) knew very well the farm routines involving HIM.

But he could never resist a helping of "sweet feed"(a grain mix with molasses by product) or a few apples or ears of fresh sweet corn.

He had to work his ass off for the rest of the day for those treats.

Debt financed consumer consumption is both the apple and the scourge that keeps the mules od society working.

So we may or may not be smarter than yeast but we are not any smarter than that old mule.He at least had to be caught again on a daily basis.

Well it might be possible, and it would be very slow growth for sure. But the problem is that we are stuck with the current debt based system and we could not possibly get from here to there. That is, if debt dried up, meaning money dries up, the economy would see a crash that would make the Great Depression look like a Sunday picnic.

Perhaps 99% of all homes are built with borrowed money. The percentage of cars and trucks bought with borrowed money is almost as great. Even private systems like the giant megaprojects in Dubai and Abu Dhabi are all built with borrowed money. Oil sheiks, with their millions, invest in local projects hoping to have their money make more money. That money is borrowed by the builders. Without debt there would be no more megaprojects anywhere in the world.

Think about it, if there were no debt at least half the world's current employed would be without a job. There would be no way to finance anything. And since nine tenths of the money in circulation was created with borrowed money, the money supply would shrink to one tenth its current size. There would be no money for anything and even those still employed would likely get laid off.

So your scenario of public projects being paid with the tax base would be impossible because there would be no tax base.

Like it or not, the world's population of almost 7 billion people are alive largely because of debt. If there never had been any debt based system then there would have been virtually no growth over the last two hundred years. There would have been no jobs and no money to buy food. Most of the world's current population would simply have never been born.

Those who cannot see the importance of debt, and the fact that it completely drives the capitalist system, simply have little knowledge of how the system really works. But not to worry, if you are among those who think that debt does not really add to the production of goods and services then click on this link, watch the course, (it is about 3 hours long), and you will never make that mistake again.

Chris Martenson.com Then click on: Click Here to watch the crash course.

Ron P.

Darwinian,

I am in wholehearted agreement with your reply from the first word to the last.

I should have stated my case as a theoritical possibility of intellectual interest only rather than carelessly writing my piece so that one could draw the conclusion that I think such an economy is an actual possibility in the real world given current conditions.

It might be that such an economy will come to exist, however, in the future at least in a few places if we crash and revive on a local basis.

Your understanding of debt as driver only works if there exists vast unexploited resources. Extending credit to develop those resources creates the wealth and productivity to satisfy the debt in the future.

All debt does is allow an acceleration and increased velocity of economic activity. When the underlying real resources become scarce or used up it all falls down.

Money and hence debt is nothing more than a proxy that is an attempt to represent the objects of real value and that is the inherent problem.

I think that a better way to measure and account for the economy would be a resource based value system and maybe even specifically energy as the master resource that way everything is linked to the real physical world and not some abstraction that can be manipulated.

I must disagree with the thrust. You imply that only unexploited natural resources can support economic activity. Untrue. An obvious example of the error might be economic activity generated by incurring debt for constructing schools, paying of professional teachers to teach people how to produce food sustainably with recycled or natural NPK and water condensed from the air and setting up zero-till organic farmland to grow crops, then taxing the products to pay the teachers and pay off debt incurred to construct the schools and growing facilities. At no point does oil enter that cycle.

Touche. But, how do you build the schools? Also, I never limited the resources to natural resources. You could include human resources ie. idle hands and minds.

I do get your point though and I would love to see your hypothetical example become a reality. It may actually be the only type of economic activity in the future. Low energy and sustainable.

I'd add that debt is also and estimate of future earnings. I.e its a promise to earn at least X in terms of money and some expectation of the value of money in the future aka inflation.

In our current system resource issues simply are not even part of the equation any more than pollution issues are.

Eventually you reach the point where both pollution and resource constraints can no longer be ignored.

A obvious example of a place where this has already occurred is commercial fishing and forestry. These are leading indicator industries. Whats interesting is oil is actually more similar to the above industries than others thus its also an early collapse industry.

The difference is that trees/fishery are self-renewing (assuming a reasonable rate of extraction). FFs are used once never to been seen again.

Rgds

WeekendPeak

deleted as OT

The 'money as debt' and Chris Martensen videos are informative but I don't think they tell the complete story with debt. Specifically, it is important to remember that the assumption of debt is mirrored by the accumulation of credit elsewhere. It's not correct to conclude that everyone can be in debt at the same time, something I got the sense that the videos imply. Think about it - if someone takes out a loan for a house they then pay that money to the seller who is now in credit to the same amount as the purchaser is in debt.

As I see it the problem with excessive debt is therefore not really about how much debt there is but more about the degree of imbalance between debtors and creditors. The larger this imbalance, the more the negative effect on gdp. The mechanism is a subtle one and operates through the decreased purchasing power of debtors. In a society in which debt is small and income distribution fairly equal (low Gini coefficient) a far larger % of the population are able to indulge in discretionary spending than in a society in which income distribution is very unequal (high Gini) and large debt levels persist - made wose by the likelyhodd that debt and low income go together.

Growth of overall income and reduction of income and debt/credit imbalances work to increase gdp. Watch as govmnts attempt to address the imbalances by trying to transfer money from rich to poor through monetary and fiscal policy. The rich may squeel but as their wealth is largely the result of the creation of debt/credit imbalance they should really be thankful the imbalance is not addressed more ruthlessly in the form of outright default.

Diminishing natural resources is a slightly different issue to debt in that the whole systems gdp will decline as a consequence, rather than 'merely' an imbalance being created. So whilst debt and resources are linked they should not be overly conflated IMO. One can be addressed (and is as a part of the normal business cycle) whilst the other cannot be solved so easily. Business cycles may well continue even as gdp falls - oscillations on a downslope rather than an upslope. Of course they may not if collapse happens!

Just some random musings,

TW

Well, I think the videos do tell the true story and they do not imply that everyone can be in debt at the same time. They do imply that most everyone can be in debt at the same time. The same money is loaned out over and over. Debt can be a ratio of ten to one to debtors. And I think that is the part that you do not understand. The lenders are the banks who are loaning the same money out over and over and it is not their money!

And this is very important. You last sentence above is very incorrect. The seller, in no way, in credit to the same amount as the purchaser. The seller had what is called a builders loan. Now he must pay his loan and he must have made enough to also pay the interest on his loan.

I wasn't ever aware anyone was discussing a problem of excessive debt. And the imbalance is not the a problem. The videos is to show how money is created. And the point of the videos, or one point, was to show that over the long run this system is unsustainable because nothing can continue to grow forever.

Watcher, I am now convinced that you completely missed Martenson's point. He never talks about a problem of imbalance. There were several points in the videos. After all he talks long and deep about Peak Oil. However one of his main points, in fact probably the main point was the fact that, over the long run, growth is necessary or the system collapses. That is the system must grow because population is growing, and because technology continues to improve and therefore require less people to produce the same amount, and it must also increase in order to pay interest on the debt.

The system must grow or collapse. Without growth and if the population continues to grow, more and more people are out of work. Without growth technology continues to put more and more people out of work. And without growth borrowers can no longer pay interest on their borrowed money. Therefore the system collapses!

Ron P.

Hi Ron P (not Ron Paul perchance ;-)),

"Well, I think the videos do tell the true story and they do not imply that everyone can be in debt at the same time."

It's a little while since I watched the 'money as debt' videos but I'm pretty sure they quote something along the lines 'ever wondered how we can all be in debt at the same time? Well, now you know'. To be fair I'm not sure the CM videos make the same statement but they are telling the same story and it would be easy to draw the same conclusion.

"Debt can be a ratio of ten to one to debtors. And I think that is the part that you do not understand. The lenders are the banks who are loaning the same money out over and over and it is not their money!"

Yes i do understand fractional reserve banking, although I confess it took me a little while to get my head around it at first!

"And this is very important. You last sentence above is very incorrect. The seller, in no way, in credit to the same amount as the purchaser. The seller had what is called a builders loan. Now he must pay his loan and he must have made enough to also pay the interest on his loan."

OK, but then the builder is the one in credit. Bottom line, no matter how many people you include, overall it's a closed system. One persons debt is another persons credit, whether that money has been created as debt or pre-existed. If the debt cannot be repaid then there will either be default or inflation - the latter if money is printed to prevent default.

And imbalance is THE problem, whether between individuals, between households, companies and govmnt or between nations. Just because the videos don't pick up on it doesn't mean it's not relevent. As I say, the videos are good to a point but the story they tell is incomplete. Economics is a pretty big subject!

I agree growth is implicit in a debt-based system but understanding the nature of the problem (i.e. as imbalance and not just debt per se) is important to understanding how to resolve it.

Another 2p

TW

NO, that is simply not correct. The credit is not to the builder but to the bank. The builder is usually up to his eyeballs in debt and to imply that every house he sells is a credit to him is just wrong. The builder is always in debt because that is how he makes money. He borrows to build, rolls the money he collects into new houses. While of course taking some for living expenses and to pay interest on his loans.

And Chris Martenson and I must respectfully disagree with you. Imbalance may be a problem between nations but it is not the problem with the debt based economy. THE problem is that the system requires constant growth else it collapses.

I would suggest you watch the videos again. Thanks for the exchange.

Ron Patterson

Yeah, and the money supply increase that way. So? If fractional banking didn't keep up with the production of wealth, then central banks would increase money supply themselves - or, in a non-fiat currency system, the value of gold, or whatever the currency is based on, would increase. Money supply should and does follow production, not the other way around, even if some bubbles may make it look otherwise.

Why? Money is just tokens - the productive capacity is there anyway. Sure, debt is convenient, but you would create substitutes if you weren't allowed to use it. In fact, muslems do, in a way. It does hamper them somewhat, but not that much. Also, the fractional banking money creation you talk about is something many economists want to abolish. If they believed the world GDP would "shrink to a tiny fraction" if it were abolished, they wouldn't want to.

Someone posted a common definition of GDP:

GDP = consumption + gross investment + government spending + (exports − imports)

Please note the " - imports". So you taking goods from China is of no consequence for your GDP. If anything, you being in debt will make you produce a bit more in the future to repay.

Also, I don't see much difficulty in matching fossil decline rates with increased efficiency and increased production of nuclear and renewable energy. The market will take care of this in due time, btw - we don't need much political action except perhaps cutting some red tape.

Jeppen -

Regarding imports, I suspect you're referring to one of my comments above.

True, if say Black & Decker imports electric drills from China at say 40$ each, then that amount is subtracted from the US GDP. However, when Black & Decker then goes and marks those same drills up to $60 each and sells them in US retail outlets, does not that extra $20 that Black & Decker makes on the drills increase the US GDP by that amount? If so, then the act of importing the drills from China would increase the US GDP by the amount of mark-up (i.e., $60 in the plus column, and $40 in the minus column).

My main point, though, would be that while some of the value of the imported drills would contribute to US GDP, zero of the energy required in their manufacture would be charged against the US, thus giving the appearance of causing electric drills to come into existence in the US with zero expenditure of energy. I strongly suspect that this artifact is one of the reasons that the US appears to be growing more and more energy efficient in its manufacturing. Of course much of it is real, but there is a certain component that appears to be the result of essentially exporting energy consumption to places like China.

This is interesting and I think you are on to something here.

If embedded energy in imports was added to energy consumption with the importer could it actually be that estimates would show declining efficiencies?

It's almost certain that that factor + imported fuel energy from eg. inland N Gas and oil fields entirely explains California's "more efficient economy".

Rune

It is possible that for many industries we would be showing negative energy efficiency improvements over time.

We structure the production of goods to optimise the cost efficiency. Because traditionally energy has been so cheap relative to human time, the most common optimisation in production has been to increase energy consumption in order to decrease human involvement. This driver is now being questioned in many parts of industry but it will take much higher costs of energy for the balance to swing the other way.

phoenix,

good and interesting point. As long energy is abundant and cheap it can be used (where applicable) to substitute for more costly components.

US also (I assume) also exports (like I-NPK based on nat gas, aluminum etc.) products with energy embedded which should be adjusted for.

Added as consumption, subtracted as imports. Net contribution zero.

Yes, it does. So there may be a "net imports markup effect" to GDP - I hadn't thought of that. But balanced trade doesn't have that effect, for obvious(?) reasons.

Probably true, but the world is becoming more energy efficient as a whole.

That's only the case if you assume renewable energy will not grow in the next four decades. It's far more likely that efficiency improvements will continue and renewable energy production will increase than for just one or the other to happen. If anything, synchronous adoption is likely because efficiency improvements make it easier to adopt renewable power sources.

Part of that "Phantom GDP" versus energy use is because electric energy from renewable and nuclear is used more efficiently than any FF energy and NG energy is used more efficiently than coal or oil. In electrical production expansion has come from wind and NG replacing fuel oil that requires more energy to refine plus is burnt less efficiently than NG and a lot less than an electric heat pump.

Two examples CFB lights replacing incandescent lights and new refrigerators compared to 40 years ago, both use X4 less energy, so energy /GDP should be declining. The big potential gains remaining are vehicle mpg and home insulation. Even reducing VMT ( as has occurred) is going to reduce energy/$GDP.

Euan,

Some of the inconsistencies can be explained by the different types of energy and their price.

For example Japan uses oil, LNG, nuclear( all expensive) and some thermal coal(relatively less expensive). China uses almost no NG very small amounts of nuclear, modest amounts of oil but very large amounts of inexpensive thermal coal in inefficient power plants, so although energy consumption is high they may be paying a similar price/$GDP.

This statement is ignoring renewable that energy, coal and NG are all cheaper than oil.

It is tempting therefore to believe that around $100 / bbl may the upper limit for the current configuration of the global economy since energy costs higher than this will push the non-energy part of the economy into recession

For example oil accounts for 42Exajoules of US energy(40% by energy) but 6% of economy, while coal 24EJ(24%) but only 1%of economy. If oil prices go to $100/barrel(7-8% of economy) and stay at that price a big shift in vehicle fuel economy will reduce that back to 4-5% over time, as occurred from 1980-1990.

When fossil fuel supplies do begin to fall, the only way that GDP can genuinely grow is through energy efficiency

ALSO expanding nuclear and renewable energy for today's 5EJ by 8EJ can replace 24EJ of coal.Half of the oil used in transport:21EJ (by cars and light trucks) could be replaced by 5EJ of renewable or nuclear using EV and PHEV's.

A more sensible analysis would be to compare the EROEI of petroleum products paid by consumers with nuclear and renewable energy. Because of the very efficient use of electricity and the low transportation costs, these energy sources require a smaller % of economy to maintain than oil even if oil at well head has a reasonable EROEI, most is lost(refining, transport,low efficient ICE) before it gets to a car or truck's wheels to perform work.

Neil, here's what Europe's energy consumption mix looks like. Data for renewables apart from hydro are not readily available - and are still small in the whole mix.

OECD governments seem pretty obsessed with energy inefficiency at present.

OECD governments seem pretty obsessed with energy inefficiency at present.Well, this is true concerning their speeches on Sundays. But they don't seem to get too serious about this.

Take for example the new EU energy efficiency directive (I don't have the exact name rigth now): All EU states shall reduce their electic energy consumption by 1% per year. But they are not really obliged to comply to reach this target, the EU governments only agreed on that each state shall do *something* about energy efficiency.

But although investments in energy efficiency are even the most cost efficient way of climate protection even this lax regulation has little response in the state governments so far, and many will even face penalties for not complying. For example parts of the German government tried to add a binding percentage to the national legislation, but no agreement was reached, so that Germany will almost certainly miss the EU deadline.

Well actively promoting and subsidising bio fuels and carbon capture seems pretty serious to me. I agree entirely that the most cost- effective way for "climate protection" short term is via energy efficiency, though as Ian Schindler pointed out that might lead to higher energy prices and greater exploitation of FF in the long run.

And the UK government introducing £2000 scrapage premiums on cars over 10 years old and the German government help bail out Opel (GM) are actions counter to market and energy efficiency.

Subsidising biofuels, wind power and carbon capture are serious actions, in terms of money spent by some, and earned by some others. However, I think that the main effect of subsidising new energy sources is to increase or maintain a high energy consumption. As for 'carbon capture' - does anyone have an overview of how much burnt carbon has actually been captured and stored to date? (The CO2 separated from the Sleipner gas production and reinjected into the reservoir is a showcase in the North Sea, but should of course not count in this connection. Such capture may actually contribute to increase the gas production and CO2-release).

Increasing energy efficiency is an old medicine (The Coal Question,1865). Improving the efficiency of energy use makes products cheaper, and may in turn lead to increased consumption. See about Jevon's paradox and Kazzoom-Brooke's postulate on http://en.wikipedia.org/wiki/Jevons_paradox.

"OECD governments seem pretty obsessed with energy inefficiency at present"

And yet...oil consumption in Europe now back to 1971 levels. Gee, wonder what they could do it they even cared a little about efficiency. :-)

RC

Roger, if you look at the per capita energy consumption in Europe it has been constant since 1980:

But if we set our minds to it I do wonder what we could achieve from efficiencies. 1.5 tonnes oil equivalent per capita per annum should be achievable given time. But if this were to happen, the impact on higher FF prices, growing FF consumption, growing population and environmental issues need to be addressed.

None of this stuff matters much unless applied worldwide. Allowing Germany of etc. to achieve some mandatory efficiency goal is pointless if the means to meeting that goal is to offshore energy-intensive production to overseas countries. Think worldwide, people.

Euan,

I think the figure for Europe above is increasing primary electricity(hydro and nuclear) by about x3 as is also done by EIA and Shell, to put these on an equivalent basis, ie most coal is used to generate electricity.

The US figures according to EIA give nuclear 8.6QUADS and renewables 6.8QUADS of the 100QUADS( ie 15%) similar to Europe, but in the figure you used for US these are 5%( ie true value on MJ content).

In the most recent EEA posting about wind energy potential in Europe it states that wind energy now accounts for 4.2% of the EU's electricity production, still small in overall energy but not far behind hydro. See executive summary

http://www.eea.europa.eu/publications/europes-onshore-and-offshore-wind-...

What needs to be kept in mind is the energy delivered to consumers as goods or directly as NG or electricity or gasoline and diesel at the pump. Then you find a lot more hydro, wind and nuclear energy gets to the consumer rather than being lost in the distribution system. An electric vehicle the contrast is even more extreme if you measure MJ/tonne/kms , electric being x5=10 more efficient than gasoline, with 30-50% losses from crude oil to gasoline at the pump(refining and transport) and another 80-85% loss in the ICE engine(90-95% loss in total). Compare this to a 5% loss of electricity in transmission a 5% loss charging a battery and 5% loss in an electric motor( 15-20% total). A home hot water or A/C heat pump can be 300% efficient compared to heating with oil or NG, so it is valid to use X3 in factoring primary electricity.

In the UK wind and hydro are now about equal in terms of GWhrs. A surprise to me is that about 50% of our hydro comes from pump storage - which is recycling coal and nuclear. The other big issue is that hydro gets switched on when you need it most whilst wind is on when its windy.