The Fifth Problem: Peak Capital

Posted by Ugo Bardi on June 2, 2009 - 9:25am in The Oil Drum: Europe

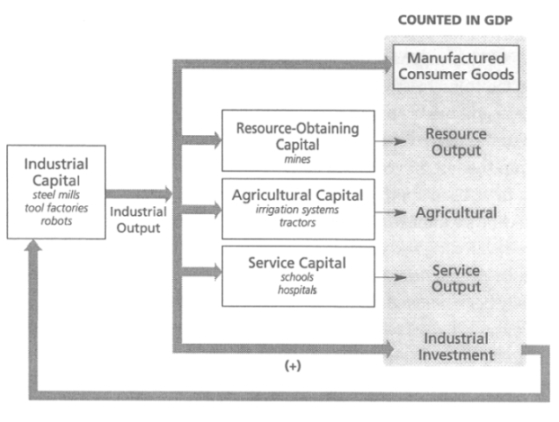

The five main elements of the world model developed in "The Limits to Growth" study according to Magne Myrtveit .

What's happening here? The GPS system is a pinnacle of modern technology, a demonstration that the thing we call "progress" exists. If you have a car navigator, the idea of going back to clumsy printed maps just seems impossible. And that is just one of the many uses of the GPS system. How come that we left such an important system degrade? How can it be that someone forgot that satellites need to be replaced after a while?

The degradation of the GPS system may be attributed to mistakes, incompetence, bureaucracy or even conspiracies. But the problem may lie at a much deeper level. It may be a symptom of the degradation of the whole economy. But why is this happening? People mention evil banking practices, speculation, subprimes, terrorism, and what you have. But, with so many things going on at the same time, what is really the origin of the problems and what is just a consequence of other factors? To find an answer, you need to understand how the world's economic system works. One of the first attempts to do that in a comprehensive way was the 1972 report to the Club of Rome known as "The Limits to Growth" (LTG).

The LTG study was based on a rather complex model which, however, can be summarized in terms of five main elements, as you see in the figure at the beginning of this post. The five elements are 1) population, 2) mineral resources, 3) agricultural resources, 4) pollution and 5) capital investments. This is just one of the many ways to build such a model. Other choices are possible, but the LTG model, improved over the years, is a good way to capture the essential elements of the world's economy. Despite the persistent legend that the LTG study was "wrong"; the results of the study have been found to be remarkably accurate

None of the five elements of the model is a problem in itself. But each one can become a problem. In that case, we speak of 1) overpopulation, 2) mineral depletion, 3) famine, 4) ecosystem collapse and 5) economic decline. Often, these five problems are considered as if they were independent from each other. People tend to attribute all what is going on to a single problem: peak oil, climate change, overpopulation, and so on. In particular, economists tend to see the economy as independent from the availability of natural resources. Of course, this cannot be true and in a "dynamic" model, such as the LTG one, all the elements of the economic system interact with each other; either reinforcing each other (positive feedback) or weakening each other (negative feedback). To understand how the economy behaves as the natural resources are exploited (and overexploited) it is important to consider the role of the "capital" parameter. The behavior of the capital stock directly affects industrial production and other parameters which are counted as part of economic indicators such as the gross domestic product (GDP).

In the LTG world model, "capital" is created by investments generated by industrial activity. Capital is assumed to decay at a rate proportional to the amount of existing capital. This is called obsolescence or, sometimes, depreciation. To keep capital growing, or at least not disappearing, investments need to be larger than, or as large as, depreciation. Since investments depend on the availability of natural resources, the buildup (or the dissipation) of the capital stock depend on the progressive depletion of these resources. In the original LTG model of 1972, there were three kinds of capital stocks considered: industrial capital (factories, machines, etc.), service capital (schools, bridges, hospitals, etc.) and agricultural capital (farms, land, machinery, etc.). In the latest version (2004), industrial capital and mining capital are considered separately, as you see in the following figure ( from the synopsis of the 30 year update of LTG). Note how the "capital" parameter (in its various forms) affects the parameters which determine the GDP.

Here is a very clear description of how capital interacts with the other elements of the world model in a synopsis written in 1972 by the authors of the LTG report:

The industrial capital stock grows to a level that requires an enormous input of resources. In the very process of that growth it depletes a large fraction of the resource reserves available. As resource prices rise and mines are depleted, more and more capital must be used for obtaining resources, leaving less to be invested for future growth. Finally investment cannot keep up with depreciation, and the industrial base collapses, taking with it the service and agricultural systems, which have become dependent on industrial inputs.

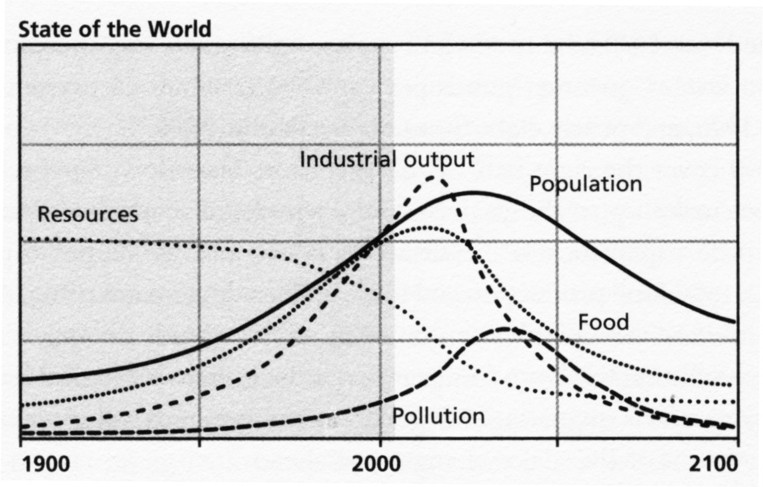

Here are the results of these interactions, expressed in graphical form as what is called the "standard run" or "base case model" of the LTG study (from the 2004 edition)

In the graph, you don't see the "capital" parameter plotted. However, industrial capital follows the same curve of industrial production. The other forms of capital have a similar behavior. All reach a maximum level and then decline, carrying the whole economy down with them. Overall, it is "peak capital."

When do we expect peak capital to occur? According to the "standard run" of the LTG report, it may arrive during the first two decades of the century. It may very well be that much of what we are seeing now is a symptom of peak capital approaching: airports, roads, bridges, dikes, dams, and about everything that goes under the name of "infrastructure" are decaying everywhere in the world. The whole economic system is becoming unable to maintain the level of complexity that it had reached just a few decades ago.

So, the degradation of the world' GPS system is not something unexpected, nor it is unrelated to such problems as peak oil or the depletion of mineral resources. It is just another kind of peak: "peak capital." Maybe GAO has been too pessimistic; maybe we'll decide that the GPS system is so important that we can't let it decay. But, in any case, it is a sign of the times: the fifth problem.

_________________________

Two posts by Ugo Bardi on "The Limits to Growth"

Cassandra's curse: how the limits to growth was demonized

Peak oil and The Limits to Growth: two parallel stories

In that case, we speak of 1) overpopulation, 2) mineral depletion, 3) famine, 4) ecosystem collapse and 5) economic decline.

Let's take them one at a time.

1) overpopulation- compared to what standard. Who's to say there's overpopulation?

2) mineral depletion- none shown

3) famine- only because of deliberate human actions. Plenty of food.

4) ecosystem collapse- What ecosystem is collapsing? There's people who have been deliberately famished who are eating bushmeat. There are fisheries that have collapsed from tragedy of the commons.

5) economic decline- We are currently in a recession but there's always been boom and busts.

A sustainable population means a population that is low enough to exploit Earth's resources at the same rate that Earth is replenishing these resources. Overpopulation means that resources are being used up at a higher rate than this replacement rate.

Then why are we mining/extracting increasingly lower grades of ores and fossil fuels?

Are you talking about the future or right now? Agricultural soil is being paved over and depleted at a higher rate than it's being created. World grain stores are dropping.

You said it, the world fish stocks are collapsing. Species are becoming extinct at an increasing rate, fresh water is becoming less available in certain parts of the world, rainforests are disappearing, ...

So you're saying there are no physical limits to economic growth?

You have data showing we are mining lower grades of hard rock metal? I've looked for it on the web and came up empty. Fossil fuel are a special case. It's burnt once and then it is gone. We seem to be running out of light sweet crude which just means our refineries will cost more per barrel.

Robert2734, you must obviously hail from a different planet, one whose radius is increasing linearly with time. If your home planet's radius is steadily increasing, then your planet's surface area is expanding as the square of time, and its volume is expanding as the cube of time. Your planet could possibly sustain exponential growth of population, capital and economic output for a very long time, because your planet has no resource limits to growth. This planet, unfortunately, has a fixed radius and hence there are resource limits to growth that only idiots can ignore.

Didn't you know, the Earth is expanding! It grows for us, to sustain our man-made Cockaigne indefinitely! You can watch it happen here.

Just kidding. We are doomed and nothing can save us. There are simply too many people with their heads in the clouds, unwilling to face reality and act accordingly.

Why do you mock Samuel Warren Carey's work? Have you actually done any real research on it? If planets arent growing, then try explaining this video. I've said it a million times, put your money where your mouth is. At least have the intellectual honesty to try and explain Neal Adam's videos. There are a dozen more that are equally convincing.

I find it ironic that you'd say "We are doomed and nothing can save us." The solution lies along the same path as expansion tectonics. There are whole avenues of science that remain closed off to the scientific community. From the insights revealed by Kirlian photography to the beautiful simplicity of the WSM, the possibilities are amazing. Maybe if you took a little time away from all your doom and gloom...

If people continue to allow themselves to be manipulated into a very limited scientific paradigm, then yes we are doomed. The "powers that be" today are even more powerful that the "powers that were" hundreds of years ago that had everyone convinced the earth was flat. Why people choose to be enslaved by these same forces throughout history is something that I may never understand. But if we are doomed, it is only due to a failure to use our brains.

Not a convincing explanation at all.

How about this? Water ice under high pressure at a potential subduction zone melts - that's how ice skates work - and any water produced would sink below ice without trace through the obvious cracks.

So you don't see subduction zones or need expanding planets, just a simple everyday phase change, all you see is the spreading zones as underlying liquid water freezes as it is exposed in the cracks between the moving plates of ice. The smooth filling of the gaps between the obviously spreading plates of ice is just evidence of liquid water under the ice.

This planet, unfortunately, has a fixed radius...

Anywhere from 50 to 100,000 tons of mass is added to the earth each year. Though this does not appreciably increase the size of earth, it does increase the radius. There is no fixed earth. I thought fixed earth ideas went away with Aristotle's death over 2000 years ago?

As far as resource limits, our technology is relatively primitive and we are unable to penetrate more than 10 miles into the surface. We have no idea what resources the planet contains.

The scientific community has dismissed the "Expanding Earth Theory". The following details are from the Wikipedia entry http://en.wikipedia.org/wiki/Expanding_earth_theory

"Modern measurements have established very stringent upper bound limits for the expansion rate, which very much reduces the possibility of an expanding Earth. For example, paleomagnetic data has been used to calculate that the radius of the Earth 400 million years ago was 102 ± 2.8% of today's radius.[6] Furthermore, examinations of earth's moment of inertia suggest that no significant change of earth's radius in the last 620 million years could have taken place and therefore earth expansion is untenable.[7]

The primary objections to an expanding Earth have centered around the lack of an accepted process by which the Earth's radius could increase and on the inability to find an actual increase of earth's radius by modern measurements. This issue, along with the evidence for the process of subduction, caused the scientific community to dismiss the theory of an expanding Earth."

You're rebutting something completely different from the original assertion.

Oh, boy.... so often I find myself confronting this unbelievably naive argument: "we'll just dig deeper". Do you realize how expensive it is to dig holes miles long? Besides; go back to your geology books. "Ores" are the result of the combination of geological and biological factors and these interactions take place at or near the surface of the planet. Even if you could dig a 50 miles deep hole, you won't find anything interesting in there.

Removing overburden is expensive, but we aren't exactly penetrating down to the mantle and exhausting all the lithophilic ores anytime soon.

Lithophilic ores are a small subset of useful metals. In any case, by definition ore is only "ore" if it can be mined at a profit (positive ROI); you appear to be talking about mining metals at a loss, irregardless of cost. Running out is generally irrelevant for metals; affording to be able to mine or recycle them is relevant, and peak capital (affordability) is the subject of this thread.

You appear to be constructing strawmen. Stop.

Here are a few - Google search "declining ore grades". Many metals are now mined from sands rather than for pure ore - copper for instance - takes more fuel which you admit is declining to do that plus way more waste.

http://www.miningweekly.com/article/northam-continues-to-struggle-with-d...

http://www.onemine.org/search/summary.cfm/Technical-innovations-spur-res...

http://www.foe.org.au/resources/chain-reaction/editions/103/sustainable-...

http://books.google.com/books?id=DsSmPKEOWDcC&pg=PA1373&lpg=PA1373&dq=de...

http://books.google.com/books?id=L9yA5gHwKn4C&pg=PA891&lpg=PA891&dq=decl...

You might want to include "log normal distribution" for why declining ore grades are generally unimportant for most minerals.

Give a look to this article by myself and my coworker Pagani

www.theoildrum.com/node/3086

Bandi is once again reciting the Club of Rome myth that we are running out of resources. This myth was decisive refuted by H.E. Goeller and Alvin Weinberg in their 1975 paper "The AGE OF SUBSTITUTABILITY: or What to Do When The Mercury Runs Out? " Although not well know this paper is accessible online through the U.S. Department of Energy, Office of Scientific & Technical Information database.

http://www.osti.gov/energycitations/servlets/purl/5045860-HVRCd7/

Goeller and Weinberg assessed the catastrophists’ view that is the Club of Rome view. They found that some mineral were so abundant in the earth that they were inexhaustible for all practical purposes. They concluded, "Eventually the society will subsist on renewable resources, and on those elements that are practically infinite, such as iron and aluminum. According to this view the society will settle into a steady-state of substitution and recycle. This asymptotic society is called the Agc of Substitutability."

Goeller and Weinberg argue that the Limits of Growth is incorrect in assuming that "the effect of exponential growth is to reduce the probable period of availability of aluminum from 100 years to 31 years.'' In fact, the amount of aluminum found in the Earth's crust is for all practical purposes unlimited. It was just a matter of extracting it through the use of energy or other technologies. All of the raw materials needed to maintain society in a high level of material civilization could be obtained through recycling or substitution. There are two notable exceptions to the rule: Fossil fuels, i.e, CHx, and phosphorous.

They wrote: "Such a civilization would be based largely on glass, plastic, wood, cement, iron, aluminum, and magnesium: whether it will be anything like our present society will depend upon how much of the ultimate raw material , energy,

we can produce - and how much energy will cost, both economically and

Environmentally."

There is very large amount of thorium in the Earth's crust as Weinberg well knew, and thorium is recoverable with favorable ERoEI ant levels of average crustal concentration. Using Weinberg's favorite nuclear technology the Thorium breeding Molten Salt Reactor (the LFTR), the energy would always be available to

recover thorium at crustal concentration levels with very favorable ERoEI.

Goeller and Weinberg argue that some sectors of the economy would be hard hit by the Agc of Substitutability. But that the economy would continue to function.

There are actually other sources of rare and unsustainable minerals, which would otherwise be un-sustainable. That would be nuclear alchemy, the production of new minerals as a byproduct of nuclear fission. These include Krypton, Rubidium, Yttrium, Zirconium, Molybdenum, Ruthenium, Rhodium, Palladium, Cadmium, Tin, Indium, Antimony, Cerium, Neodymium, Promethium, and Samarium. In addition to these fission byproducts other minerals can be produced through alternative nuclear alchemy that takes advantage of spare neutrons available in Uranium fuel cycle breeder reactors to alter common existing minerals into minerals that have been exhausted in nature.

If Bandi has seriously investigated the literature on long term resource availability, he would be aware of both the Goeller and Weinberg hypothesis, and the potential of nuclear alchemy. The Goeller and Weinberg hypothesis and the case for nuclear alchemy would constitute a null hypothesis for Bandi’s hypothesis. In which case his failure to acknowledge support for the null hypothese would amount to an academic covertup of conflicting information. If Bandi was unaware of the Goeller and Weinberg hypothesis and the potential of nuclear alchemy, then his scholarship is clearly inadequate. In either case failure to mention support for for the null hypothesis indicates that Bandi should not be taken seriously.

Yes, and he forgot to mention all the metals in the Moon and other planets and asteroids, and all the metals in planets circling other stars, and all the metals constantly being formed in stars by fusion reactions and super-explosions. How could he possibly have been so derilict in his duty to preach abundance?

metalman, you haven't the slightest idea what you are talking about.

Thanks, I choose to regard that as a compliment. In any case, the subject of this thread is supposed to be peak capital, and mining is perhaps the most capital-intensive industry (it takes a lot of money to start a new mine). The extraterrestrial examples I gave (somewhat like the reactor examples provided by you) were metals that we could perhaps recover if we had infinite capital to invest in the attempt. Do we? Does anyone?

""(it takes a lot of money to start a new mine). ""

Sorry, wrong. It takes very little money to start a new mine. Just pick up a shovel and get with it.

Slavery has been around for thousands of years and will make a slow but steady increase as time moves on. Look at a little history. Look around at what is going on today. What you are talking about is typical BAU, that we needs lots of new machines and a huge supply of energy. All we need are a few slaves.

Sorry for the misunderstanding. I was talking about a large industrial-scale mine, with an expensive exploration/drilling program, roads and railroads, energy supplies, townsite, schools, offices, environmental permits, waivers, land exchanges, open pits or mineshafts, explosives, trucks, pumps, crushers, conveyor belts, mills (concentrators), tailings ponds, stockpiles, tank house and/or smelter, etc. These constitute the capital that must be constructed or bought. Human capital that must be hired, trained, and housed is equally critical. You can of course dig a pit in your own back yard and mine plain dirt, or feed (or starve) hundreds of slave miners with gold pans along a river, but total production will probably be limited.

In the distant past I visited numerous Chinese mines where human and animal labor, insofar as possible, was used ingeniously as a substitute for capital expenditures, but even those mines made extensive use of capital (mines and mills) inherited from the Russians after the Russians were expelled around 1960. At the same time, I saw highways being built by thousands of laborers with hammers used to make gravel from stones (as a substitute for a crushing plant). I agree with you that such a time may lie in our own future, but I am in no hurry to see it.

Sure, over long time horizons. The notion of 'peak' capital seems a bit unfounded, along the old limits to growth arguments. I dont see why we wouldn't exploit extraterrestrial orebodies in the next two or three centuries, especially for siedrophile ores that happen to be stuck down at the core on earth.

At the time of the moon landing in 1969 this was the vision of the future. No one would have believed at that time what very little would be accomplished in space exploration over the next 39 years, as they were extrapolating the incredible gains made over the previous 39 years (1930-1969) into the future. It does appear that the Star Trek fantasy dies hard, but it is dying none the less.

I'll let you propose anything you like over the next two or three centuries or millenia, although I'm no longer as optimistic as you. For practical reasons, most people on this board seem worried about getting through the next two or three decades.

Yes we do.

Take a look at this copper mine in Utah and listen to Chris Martenson's description.

If that doesn't clear it up for you then nothing will.

http://www.chrismartenson.com/crashcourse/chapter-18-environmental-data

What is not said is why copper is cheaper now mining 0.2% ores than it was 100 years ago mining 5% ores?

Could be the acid leach and solvent extraction technology( certainly energy wasn't cheaper). In the old days ores were heated with wood or coke and copper ran out, used a lot of energy, left a lot of copper behind. High grade ores were rare, so copper was expensive. Low grade ores are 100 times more abundant, prices are lower.

I certainly haven't done the research but I strongly suspect by looking at the video of the Bingham Canyon mine with those giant trucks looking like tiny ants in a crater, where there used to be a mountain, that the true costs of energy and ecological destruction are not being accounted for. I also suspect that if we continue on our the present path, even the costs as calculated by currently accepted accounting practices will probably not stay cheap for long. Just a hunch.

Ditto to no formal research, but a trip to Jerome, AZ a few years ago was instructive. Some of the ore in Jerome had as much as 40 to 60% CU. An amazing amount of copper, silver and gold were pulled out of the ground, both in open pit mining and following veins underground, between the 1890's and the 1950s. Decades later Phelps Dodge corp came back to see if they could squeeze anything from the tailings heap. There was barely anything worth leaching out with any amount of love, money, acid or prayers. The old miners did a thorough job of extracting the minerals from the ore.

Jon.

It is not cheaper in terms of energy required.

http://www.mining-technology.com/projects/bingham/

The bad news is we are mining 0.8% copper. The good news is that we have plenty of 0.8% copper. I read somewhere (how's that for a source) that copper is the only metal that had a noticeable decline in ore concentraton. I now have a source that in the 19th century we were mining 10% copper ore so thanks for that.

The Bingham project is 0.54% copper today. It was never a rich ore but it is ginormous. During WWII, it produced a third of this nation's copper. It also produces more gold than a gold mine and more silver than a silver mine. In 2006, it produced more molybdenum by dollar value than copper. Admittedly the price of moly went wonky.

Somebody is trying to open a new 1.5% copper mine here in Santa Rita. This is an admittedly a rich ore (for today). Arizona just has oodles of copper porphyry orebody that is the Bingham's geology. Most of it is not economical (yet).

We took the hit of declining copper quality early in the 20th century. Going forward we can mine 0.8% copper as far as the eye can see.

Robert a Tucson

Yeah, you're probably right, the only thing is, some of us are not particularly pleased with the view.

Well, I take issue with the concept that we are simply running out of metals. Here in Arizona, we have kids falling into abandonned mines. Mines are built on federal lands according to the mining act of 1872 and the locals can just lump it. I don't want a mine in my backyard including the proposed 1.5% copper mine but that's a different issue.

I think its a matter of taste. I think the giant open pit mines are awesome in scope and magestic. Your milage may vary.

What is that photograph? An ancient Roman Colosseum or Greek amphitheater?

Robert - Not sure where you are getting 0.8% copper from, especially as far as the eye can see. The web site lists reserves of 0.54% copper and a deep resource of 0.7%. Typically, the deeper ore is not reserves (cannot be mined at a profit)because mining it is too expensive in terms of waste rock that must be moved to access it (too high a stripping ratio). And that's at today's energy prices. Keep in mind that Bingham is a very old, comparatively high grade open pit mine (mined in the early days with rail cars, inamuch as trucks were not yet available). It and Freeport's Morenci, Arizona are the two ancient U.S. super-giants of copper. New U.S. open pit mines (e.g., mines near Safford, Arizona recently opened by Freeport) are typically much lower in grade (0.1-0.2% comes to mind).

In any case, I agree with you that we are not likely to run out of most metals before we run of cheap energy to mine them in increasingly low-grade or deep deposits. We are also likely to run short of demand, if expensive energy causes the world economy to suffer more than it already has. That web site mentions that Bingham Canyon, despite its relatively high grade ores, was driven out of business in the 1970's by unexpectedly high costs and low demand (and copper prices). And that oil crisis was ephemeral. Peak production of copper could be caused by a variety of factors other than declining ore grade. It will still be peak, though.

Finally, I caution you about obtaining all your data from company web sites. These generally do not state explicitly the future straight-line assumptions (regarding all types of costs, metal prices, government regulations, etc.) built into their projections.

http://en.wikipedia.org/wiki/Porphyry_copper_deposit

http://www.mindat.org/loc-53634.html

Safford mine is 0.37% copper. The wiki lists copper porphyry deposits as 0.4% to 1.0% copper which begs the question why Freeport decided to build a 600 million dollar mine there.

Copper porphyry can be mined cheaply by open pit heap leaching despite low grade ore so they do.

There's plenty of copper porphyry deposits in the ground. I'm not prognosticating about peak production. The stone age didn't end because we ran out of stones and the bronze age didn't end because we ran out of copper.

The Wikipedia article is dated and states at the top that it needs professional input. About what you'd expect from a 20 year old textbook. The Safford article quotes data on reserves and grade from 1988, also about 20 years ago. The company web site here:

http://www.fcx.com/operations/USA_Safford.htm

does not give an ore grade, somewhat curiously, but does state that the mine is currently operating at 50% capacity, owing to current economic conditions. This suggests that the ore grade is marginal at current prices (about $2.00/lb, half of what they were a year ago), and that the company is high-grading (selectively mining) some of the better ore in order to maintain at least some production.

A professional level talk I attended about a year ago stated that Safford ore of greater than 0.1% is sent directly to the leach pads, whereas ore above 0.2% (a distinct minority) is crushed first, to improve recovery. Lower grade mineralization was waste even at $4/lb owing to the high cost of sulfuric acid.

The ore grade changed by sitting in the ground for 20 years?

Sulfuric acid is cheap. Sulfer is a byproduct of oil refining that is burnt and reacted with water to make sulferic acid. You can have it for the price of shipping.

If civilization is about to come to an end due to no more copper, isn't it curious we just opened the first copper mine in thirty years? And even more curious they can't sell all they can mine.

No, but the ready availability of higher grade ores changed. That deposit was discovered in the 1950's and had to wait 50 years until copper at such low grades was profitable, because copper at higher grades (and profitability) could no longer supply increasing demand. Somewhat analogous to putting tar sands into production.

If prices drop they can still sell all the copper they can mine. They just can't sell it at a profit (they lose money on every pound). Only governments seem to like that type of economics.

The production ore grades are different (lower) than was reported 20 years ago because they are mining what is currently accessible near the surface. The possibly higher grade ores present at much greater depth are, for the moment, irrelevant, and may never be mined if costs rise too much.

Your inferred data on the ready availability of sulfuric acid, and its cost of shipping, seem to need updating too.

http://www.soyatech.com/print_news.php?id=11703

That's true. H2SO4 went for $90/ton to $400/ton to $90/ton. Rail costs are a penny or two a ton-mile or maybe $20/ton but if you're along the Gulf coast it can be moved by barge.

If nobody openned a new mine in the US in 30 years, how does ore quality change? At least nationally. It seems like before the recent rise in copper prices, mines were closing. Which isn't the behavior you expect if a shortage of copper was causing civilization to collapse.

Good luck on moving acid to Arizona by barge.

Regarding ore quality, I'm not sure I understand your question. Ore quality is constantly changing with each new blast, even in an open pit mine, and must be constantly monitored and adjusted for in the mill. Open pits that once mined 1-2% ore (now fully depleted) are mining 0.2-O.5% ore, using a fully paid for plant (preexisting capital) or different technologies. At a given time in the life cycle of a mine, lower metal prices will cause broken rock that once would have been milled or leached to be sent to the waste pile, probably raising the apparent ore grade of the mine (and lowering ultimate production at the same time). That is, a drop in metal price causes ore to become waste. Is this so complicated?

Any statement of ore grade and tonnage, such as the one you cited from 1988, contains implicit assumptions about future metal prices and mining costs (including the cost of debt). These should always be stated explicitly, but commonly aren't, especially when reserve data is quoted in secondary or tertiary sources. Each long-term change in metal price or mining costs will cause a change in reserve grade and tonnage, even in the absence of depletion (i.e., of actual mining). With the advent of specialized mining software, these calculations have become easier to make, but reserve data still isn't published more than once a year, in general, and may not even be changed that often. Nevertheless, if you think that ore reserves are a constant, you must be thinking of published Saudi oil reserves...

The close dependence of ore reserve calculations on assumptions regarding future prices and costs makes me uncomfortable when people regard them as written in stone. Add to this the fact that drilling out ore reserves is extremely expensive, and generally is stopped as soon as sufficient reserves (say, 20 years worth) are delineated to satisfy prospective lenders or investors, and I cringe when well-intentioned people on this board use published ore reserves as definitive indicators of an impending future shortage of metals.

No one, least of all me, claims that a shortage of copper is causing civilization to collapse. Mines are always opening and closing, because the metal price adjusts much more rapidly than the effort and costs associated with opening a new mine (with opening delays of 5 or 10 years to, in the case of Safford, 50 years). It is very easy to get the timing wrong, as happened with Safford opening just as the copper price crashed. Closed mines may reopen many years later, at a time of very high demand, unless they closed because they were completely depleted (which, so far, is comparatively rare, although there are examples). Another "terminal" circumstance would be if the government, through ignorance of demand cycles or overzealous environmentalism, forced the mine to permanently fill in the pit and dismantle the mill because the the mine had closed solely owing to a drop in the metal price.

That said, U.S. and Canadian miners are still taking lower grade or deeper ores than ever before, because the highest grade, most accessible (i.e., most profitable) ore is always taken first. Higher energy (or acid or other) costs will close the marginal producers first, because metal prices, at a given demand, are always determined by the costs of the marginal producers. Unless there are breakthroughs in technology in the future analogous to those in the past, this effect is eventually likely to raise prices at the same time that production is decreasing (because the marginal producers can't continue). That is, peak metals production. This would not necessarily indicate that the planet was "running short" of metals, only that the marginal costs of production were approaching the prices that people (or governments) could afford to pay, for any of a variety of reasons (including, of course, peak oil).

By "Somebody is trying to open a new 1.5% copper mine here in Santa Rita" I presume you mean the proposed Resolution Mine more than a mile roughly beneath the old mining town of Superior, Arizona (Santa Rita being an old mining town in New Mexico, now mostly swallowed by an open pit copper mine of the same name).

The Resolution company web site is here:

http://www.resolutioncopper.com/res/whoweare/1.html

The proposed underground mine would be about 7000 feet deep, where, according to a talk I heard, temperatures are not far short of boiling (owing to the high regional heat flow in central Arizona). A major expense will therefore be air conditioning and backup, because a failure could cause the heat death of all miners within minutes. In the overlying, now virtually exhausted Magma Mine, where the shaft was about half a mile deep, the rocks were notably hot to the touch when I was underground there, like standing next to a furnace. (It was the first mine in the USA to install chilled air conditioning, in the 1920's.) Ground control (prevention of rock bursts and slabbing) and high-volume hot groundwater pumping will presumably also be headaches. (Note: the Magma Mine, where I believe copper grades reached 10%, permanently closed somewhat earlier than planned owing to a water pump failure, and resultant catastrophic flooding.) Deep production at Resolution is optimistically planned to begin in 2020, if all of the feasibility tests turn out favorable.

The fact that this is considered a feasible mine for copper, not gold or platinum or diamonds, may be telling us something about the inferred future status of shallower copper orebodies.

http://www.bellcopper.net/s/News_Releases.asp?ReportID=300700

That's it. Rock temperatures of 185F according to the company Rio Tinto. Pressures that exceeds rock strength. They think there's a billion tons of high grade copper down there plus coproducts. Nobody said it is going to be easy. Maybe they can produce geothermal power while they are down there.

Maybe they can get some Finnish miners and tell them it's a sauna.

Screw gold and copper. What about phosphate and potash?

In another discussion on another forum, we reached a conclusion that phosphate has ultimate hard rock mining costs of around 50 times todays price for the effectively inexhaustible resources, which means the problem is ultimately one of demand management (recycling and different farming techniques) if these prices are too steep to continue current practices. Draw your own conclusions as to what that means; My opinion is simply infrastructure adjustment.

Since phosphate mine often yield recoverable thorium and/or uranium at ERoEI levels that are highly favorable there would be no problem with the energy expendatures required to recover the phosphate, because the energy return from the thorium and/or uranium would be far greater.

Agreed, but the notion of farmers paying 50 times their current price for fertilizer makes some people balk at its economic viability. I dont think that it would actually come to a 50-fold price hike on fertilizers however; Farming systems that require less fresh phosphate would become more common as prices rise.

Robert-

The sky is blue here on Earth-- What color is it on your planet?

Another often cited consequence of resource depletion is the difficulty of getting to available resources and in this case, the trade offs required to exploit them. Why in the world would we want to exploit this place for copper if we weren't running out of "easy" options elswhere?

The Source: The fight is brewing over the last great salmon headwaters.

http://www.nature.org/magazine/summer2009/features/art28511.html

Frugal, I wouldn't have wasted the cyberspace. We clearly have a troll here.

You would waste cyberspace, however, to state that you wouldn't waste cyberspace. :-)

There is also a factor called "Quality of Life". You can increase the food output for example by using artificial chemicals (fertilizers, pesticides) but that decrease taste, diversity and smell. You can place people one over another (apartments) but that decrease personal open-air space, sky view etc. You can convert forests into farms but that decrease number of wild animals, plants and hunting and beauty. It not mean that we humans should not alter any natural things, we can and we do, advent of agriculture is one example. In my opinion this also follow the normal curve, at first when we humans have started shifting from hunting & gathering life to growing our crops we have increased quality of life by storing food, domesticating animals, increasing our numbers, building empires, building better homes, increasing our knowledge about medicines, time and metals. This kept going on for several thousands of years. Even at time of alexander it was really a service to humanity by knowing about maps, sindhi cotton etc. I think the peak came about 1500 ce. Then there was a plateau till 1700s. The problem started when industrial revolution started. For the first time we humans have started polluting the world more than it can clean by using fossil fuels. The automation of cotton and textiles production changed the whole game. All of a sudden very important and useful art of weaving goes to near extinction. Many other romantic arts were also destroyed. Still some very useful inventions did took place like binoculars, telescopes, glasses, anti septics, anasthesia medicines, pencilin etc but in totality we humans were going towards the worse. It was, taken together, a loss. Borned in 1600 ce in an advanced city of the time such as Delhi is a thousand times better off than being borned in 2000 ce in newyork or london. In short, at some point, the so-called development must be stopped. Even till 1930 it was not too late.

The Earth in ecological terms has a certain "carrying capacity" -- that is a maximum number of people it can sustain for the long-term. There is a graph at http://www.paulchefurka.ca/Overshoot_2.jpg which shows what happens when population (or consumption) exceeds the Earth's carrying capacity. As the graph shows, when overshoot occurs we are taking from the future so we can consume in the present. This degrades the Earth's carrying capacity so that eventually population or consumption has to fall significantly for demand for natural resources to be in equilibrium with the Earth's natural resources.

Ofcourse whenever any number of people are living at any place (or the entire planet) the place (or planet) do have the carrying capacity, that is why they are carried (living). The problem is two fold. One is that the quality of life would be drastically reduced, people may have less quantity and quality to eat, wear, house and see. Second is that when the earth is pressed to produce more resources than it can regrow in the same duration of time then the future carrying capacity is reduced.

Factfinder claims

This well may be true, but advocates of the Club of Rome hypothesis have yet to seriously investigate the Earth's carrying capacity yet. Silly graph's on paper, do nothing to prove the idea. The earth may be capable of supporting 10 times its current population.

Possible, but given the trend of environmental degredation, highly improbable. Not to mention fish stocks, fresh water and waste disposal. 65 billion humans to share the planet with? I wish you luck!

Actually the trend in developed countries is toward less environmental degredation. Impovrished societies and underdeveloped economies are likely to cause far more harm to the environment than advanced economies. Make everyone on earth wealthy if you want to improve the environment.

Largely via outsourcing their environmental degredation to the Third World...

A person in a poorly-developed country uses next to no resources compared to a person in the First World.

Thankyou Bellistner, Absolutely. I can't believe people don't relise this point. It shows how naive people are.

I flagged that as inappropriate because it's taking the discussion back to an assertion that 1+1 != 2 and I think we're beyond that here. Do editors see those flags?

You can check this article, referring to a 2007 study (available at PNAS, Proceedings of the National Academy of Sciences of the United States of America), that estimated a man usage of 25% from the earth primary biological production. Hardly a sustainable amount, considering that there are other species in this planet.

http://www.life-of-science.net/environment-and-ecology/news/homo-sapiens...

You can check other sources, like: Vitousek PM, Ehrlich PR, Ehrlich AH, Matson PA (1986) Bioscience 36:368–373

They estimated that ≈30% of Earth's terrestrial net primary productivity (NPP) is used by human actions.

So I guess that 10 times 30% exceeds the size of the earth... Three times....

The GPS story highlights another vulnerability with our modern world - the loss of common, basic skills. I learnt not only to read a map at school but also enjoy activities such as orienteering and basic map-making. The thought of letting my car tell me which roads to take is abhorrent to me. If that means I have to stop sometimes and take a few seconds to check where I am then that's a small price to pay to retain a skill supports so many others (spatial awareness, literacy, modelling etc, etc).

And to draw a parallel with the perils of GPS and modern globalisation....

http://www.gpsdaily.co.uk/off-road/bmw-driver-follows-gps-off-cliff/

Happy with my maps

TW

I use a GPS when I kayak on the open ocean, however I do carry a compass as well and know how to navigate my local waters with dead reckoning. I have serious qualms about people who venture out and depend solely on electronics to get back. If the GPS systems becomes unreliable I will still be able to find my fishing spots out on the reef and will be able to get out and back without the benefit of fossil fuel. I'm hoping I will have less competition for the remaining fish.

Unless we have something like a magnetic reversal of the poles and it screws up compass navigation and I then have to resort to navigating by the stars and the sun with a sextant... ;-)

I went to Ground School in Raleigh, NC some many months ago. This was in preparation for a PPL(personal pilots license).

The instructor gave many examples of why one should not rely on modern electronic navigation systems.

One was very interesting. A middle aged female had joined the flying club there and asked to rent one of the Cessenas. A 172 I believe or maybe an 152. The chief pilot asked for her qualifications. She said she had full training and was just getting more flight hours. She somehow convinced the club that she knew exactly what she was doing and so she was allowed to rent one.

She became airborne. She got into trouble. She could not radio anyone. She couldn;t find the mic switch. She flew until almost out of gas trying to find where she was. She ended up in Virginia and it was dark. They later followed her course and she flew right over 8 airports. She never issued a Mayday(call for immediate help). She apparently could not naviagate except by some method she relied on.

She soon seen some lights and assumed it was a highway. Landed on a dam of a huge lake and crashed into the shallow waters nearby. The plane was half submeged so she walked away from it. Called the club's chief pilot and said she was going to sue them for an enormous sum because it was there fault.

The mic button had a problem. Had been 'placcraded' as required. The hand mike was hanging on the dash with a PTT(push to talk) button as all have on it. She never radioed.

She was totally clueless and lived. She was extremely lucky.

This is a true story. The club still has the aircraft and repaired it and it is still used as a trainer.

The instructor had many more stark tales that involved large passenger aircraft and those who rely on 'glass cockpits.

The FAA has to retain the older electronic navigation technology just becuase it is felt that the GPS system would and could fail.

Yet its my opinion that in the near future we will no longer fly large passenger aircraft for several obvious reasons. GPS being one of them.

I was an aviation eletronics technician. I maintained 'com/nav' equipment. I was before that a Mech E&R at McDonnell Aircraft.

I have flown small aircraft.

I am somewhat worried about its future. Todays pilots scare me. I would trust yesterdays pilots with my life and have many times. I know some Ex-Military pilots from my past and they can tell some very good stories but that was loooonnnngggg ago. When men knew how to fly without 'glass'.

We flew over vast oceans for 14 hours inflight time. There was no rescue available then. If you ditched in the cold Pacific even with exposure suits you lived for 15 minutes at the most.We flew 7 aircraft, 24 hours a day, 7 days a week for years and never lost a crew and aircraft in the middle of the Pacific. Landing? Yes , several. Takeoffs? Yes a couple. My first aircraft exploded and burned on the flight line. I boarded another an hour later and flew the mission.

Those were iron men back then. I think most have gone on and there are few records of their feats. A woman in a Cessna over land with dozens of airports manages to crash in a lake. With functional radio at her finger tips. Amazing.

Airdale-how did we fly thousands of miles with no land in sight on each mission? We used Loran. We used dead-reckoning. We used stars if need be. We had a few other tricks up our sleeves.

Loran is now due to be phased out. This is a sad shame. Somebody is making a huge mistake.

As a non-pilot, perhaps I don't know much about flying, but wouldn't one normally verify the functionality of everything (including the radio) before leaving the ground?

Your story doesn't surprise me though. I remember reading stories about the so-called "Bermuda Triangle" - ships disappearing and all that. The Coast Guard has stories about people they have rescued who are using the maps in an encyclopedia for the purposes of navigation. There are stupid people everywhere..

We have a friend who is a pilot for one of the majors. He used to fly the MD-80, but those are being phased out, so he just retrained on the 737. The whole thing is apparently fly-by-wire with heads-up display and all that. He was showing me a simple version of the simulator software that runs on a laptop. The plane can apparently land itself, but I believe he was saying that the level of maintenance required to be certified for this is higher than for a plane that isn't certified for this, and the airlines don't want to pay, so they still have pilots to land the things..

So was the Air France Airbus that just went down the other day. I know these planes are supposed to have multiple redundant backup electronics systems and also mechanical systems that allow the pilots to fly manually. However at the risk of sounding like a luddite, (I spent enough of my professional life dealing with problems caused by malfunctioning control systems),plus I have a deep respect for Murphy's Law, so I have to wonder if that plane didn't crash because of its fail safe systems encountering a completely unforeseen scenario. Sure a mechanical linkage can fail too but it is simple straightforward to understand and maintain. There seems to me, to be way too much faith in very complex systems that no one individual completely understands much less can predict.

The reports that I have been reading are that the Airbus automatically radioed back a number of status reports over several minutes, reporting numerous failures including decompression in the cabin.

Airplane Seats, Debris Found Off Brazil

If true, the loss of cabin pressure suggests a far more serious failure of some sort, that probably can't be blamed on fly-by-wire.

There's a report on the local news this morning that Air France recieved a bomb threat last week dealing with a plane from Brazil...

airdale -

I've never used a GPS navigational system, but I'm not sure I'd ever trust it enough to cause me to throw away my maps. GPS will get you where you want to go, but often not by the easiest or most desirable way.

As an example, several weeks ago, a couple visited us who had never been to our place before. When talking to the husband over the phone, I wanted to give him directions, but he wouldn't hear of it, proudly claiming that his new SUV has GPS. No problemo.

Well, they got to our place about 45 minutes late because the GPS system for some reason had sent them on a roundabout route through the bowels of the bad part of Wilmington, DE, from which they were lucky to come out alive.

I can relate. I was walking along the sidewalk in front of a cafe when a man pulled up and asked me where so-and-so office was. I said I'd never heard of it. He said, "My GPS says it's here." I said, "Your GPS is clearly incorrect. This is a cafe." A look of incomprehension came over his face as he said, "That's impossible."

I walked on while he sat there looking like he was waiting for the curtain to rise revealing the office he was looking for.

Big airliners do not rely on GPS; they have inertial navigation systems. The navigation error that led to the shootdown of KAL007 was one reason for making the future GPS system available to civilians, but ground beacons and inertial navigation systems will otherwise work fine for airliners.

Fuel, disposable income, and the breakdown of complex supply chains will be much bigger problems for aviation.

Not sure I believe your point on IGS.

We had that back in the 60s in Naval Aviation. We didn't rely on it though. Just used it to keep the radar platforms fixed on a horizon.

Actually I am certain that the real reason for GPS was to replace the Omni and VOR as well as beacons of normal oldtimey Com/Nav gear.

Yet my instructor who had many hours in commercial as well as Gen Av

was adamant about a good flight plan and not absolutely relying on GPS.

A gyro is a nice thing. For an autopilot but can fail easily.

In fact the plane commander once called me to the flight deck to complain about the gyro and it failing. I went back and gave the rack mount a good shake. In that instance I was in control of the AC and it edged over on its wing rather alarmingly. I heard from the cockpit "hey it work so leave it alone".......just another sea story but true.

We carried a full blown navigator all the time. He took several 'fixes' then put a dot in the center of all them and said "here is where we are"....well the problem soon was apparent that we were on a head on collision course with a sister AC dead ahead and closing fast. The nav threw his pencil away. Good thing my radar was working., else we wouldn't have painted his IFF signal....(Identification Friend or Foe) and agreed to communicate and diverge.

Airdale- Or I could speak of the mechs in the radome on the ground when the techs fired up the 2.5 MegaWatt PeakPulsePower radar and microwaved them. They were dead men walking as they left for the sickbay. A lotta sea stories like this. This once was real. We had to ferry them back to Oahu. Pretty bad deal. NOTE: It was NOT my aircraft that the maggie was fired up on when that occurred

Yes I know,,definitely Off Topic. I will quit.

Fifteen or so years ago, after takeoff from SFO at cruising altitude heading to HNL in a Continental DC-10, the plane my wife and I were on had to dump fuel and return because - according to the pilot - both inertial nav units were dead. The pilots were apologetic, saying that they could find Hawaii with their eyes closed, (it was daylight, a clear day, and with other contrails drawing a line to Hawaii) but that it was against the regs to try.

Airdale,

I was a Naval Aviator from 1984-1992.

We used INS at sea and Tacan on the airways.

I have a bunch of sea stories as well.

The INS tended to pick up drift way too often. We had 2 inertial systems on board and cross checked them with each other and the wet compass.

"A man with one watch never knows what time it is. A man with two is never sure. But, a man with three watches can be reasonably certain of the time."

Well, Basic Skills have been shifting through human history. Once upon a time, warrior or haunting skills were essential. So, how do you define a "Basic Skill"?

"Once upon a time, warrior or haunting skills were essential. So, how do you define a "Basic Skill"?"

The ability to get from A to B without electronic assistance.

TW

A long thread of people asuming long-term importance of aviation, here. I thought it was a given that aviation is dead because of peak oil?

I think we are just indirectly bragging.

For mineral depletion, give a look to

europe.theoildrum.com/node/3451

http://www.metalprices.com/FreeSite/metals/hg/hg.asp

With the exception of mercury, production of those metals is rising or flat in the 21st century. That's what your data shows. Drawing a bell curve doesn't make it so. I don't know how much detail to into about mercury. It's been phased out of batteries and paints because of toxicity concerns. It's phased out of the electrolysis of chlorine because the membrane process is cheaper because it uses less electricity. That has freed up a lot of metal to be put on the market.

Gallium we know is junk metal the aluminum producers don't bother refining. Selenium is used in semiconductors but they don't use as much of it as before.

Not depletion. Demand side economics.

Agree with you on that. Most on this site tend to emphasize only supply and ignore the flipside, demand. A peak in metals production, especially for the relatively common metals, is more likely to be caused by demand than by supply. The by-product minor metals may see their production drop at the same time, unless their prices rise out of sight.

Above is the graph for “services per capita” for "limits to growth" (LtG)— the upper purple curve [actual observed result is purple, green is the prediction] is electricity, the bottom ones are literacy. This parameter shows again just how lousy LtG is as a model of any kind of causality. Literacy rates are strongly affected by worldwide religions which prohibit the education of women; electricity rates, and thus usage, are affected by everything from resource depletion, which they are trying to measure, to political distortion of technology substitution. Even so, the real-world graphs are just as consistent with a slow-growth or leveling-off null hypothesis as they are with LtG. No hint of a collapse is to be found.

The points are made in an article by J Storrs Hall of the Foresight Institute.

http://www.foresight.org/nanodot/?p=3034#more-3034

http://nextbigfuture.com/2009/05/limits-to-growth-examined-by-j-storrs.html

GPS

Europe has the Gallileo navigation system so it would not be dependent on the US GPS system. To be operational by 2013

http://mae.pennnet.com/display_article/244492/32/ARTCL/none/ONEWS/1/Euro...

http://en.wikipedia.org/wiki/Galileo_positioning_system

http://en.wikipedia.org/wiki/Global_Positioning_System

Russian Glonass to be restored to full operation and coverage with the help of India by around 2009-2010

http://en.wikipedia.org/wiki/GLONASS

http://en.wikipedia.org/wiki/Global_Navigation_Satellite_System#Comparis...

There are currently 31 operational GPS satellites.

If needed European or Russian launchers could be commissioned if there is a problem with launchers for the US Airforce and the satellites do start failing. There is ZERO chance that we will fall below 24 working satellites for any more than one year. The reason being is if the satellites start failing fast enough then the US military will throw money and the problem and get the launchers and some more version II satellites up to maintain performance for the US military.

http://www.insidegnss.com/node/1484#Baseband_Technologies_Inc_

Perhaps, if it is just that single turd that has hit the fan blades. That is essentially the "all else being equal/remaining constant" assumption. The problem is, all else doesn't. "Stuff happens", and the whole point of this thread is that more and more stuff is going to happen, faster and faster. At a certain point, probably coming soon if not already upon us, the problems overwhelm the resources available, and then we have to start doing triage and letting more and more lower priority things die while we try to keep up fewer and fewer high priority things.

I have been saying that the 21st century was going to be one long exercise in giving up things. This applies just as much at the "macro" level of nations and the entire globe as it does to the "micro" level of individuals and households.

I am thinking that it is a pretty safe bet that GPS will someday just be a memory, and GPS devices will be useless trinkets. A map and compass will still work, though.

WNC,

In a good flight school in Geneneral Aviation you will have to meticiously file a flight plan and have very full details on each waypoint or the check rider /examiner , will usually flunk you really fast.

Of course a lot depends. The club/school at Sanford,NC was very very good.

The one day that satellite GPS will be a memory will be because we have chip scale atomic clocks. Military receivers and civilians that have atomic clock enabled receivers could have 24 satellite accuracy even with 21 or possibly fewer satellites. Also, regional GPS could be broadcast from towers.

TV Towers for GPS alternative

http://arstechnica.com/gadgets/news/2009/02/tune-your-tv-into-gps.ars

chip scale atomic clocks

http://www.darpa.mil/MTO/programs/csac/index.html

The goal of the Chip-Scale Atomic Clock program is to create ultra-miniaturized, low-power, atomic time and frequency reference units that will achieve, relative to present approaches:

* >200X reduction in size (from 230 cm3 to <1 cm3),

* >300X reduction in power consumption (from 10 W to <30 mW), and

* Matching performance (1 X 10-11 accuracy ⇒ 1 µ/day). Example of future payoff is wristwatch size high-security UHF communicator / jam-resistant GPS receiver.

50

Chapter 4. Benefits of Atomic Clock Augmentation

4.1 Background

Most GPS receivers use inexpensive quartz oscillators as a time reference. The receiver has a clock bias from GPS time but this bias is removed by treating it as an unknown when solving for position. In effect, the receiver clock is continually calibrated to GPS time. If a highly stable reference were used, however, the receiver time could be based on this clock without solving for a bias. "Clock coasting" (with no clock model), as it is referred to, requires an atomic clock with superior long term stability. The analysis in this chapter shows the

potential for clock coasting to improve vertical positioning accuracy.

4.2 Atomic Clock Benefits

Currently, GPS receivers need four measurements to solve for three-dimensional position and time. The receiver clocks are not synchronized with GPS time which necessitates the fourth measurement. Using an atomic clock synchronized to GPS time in the receiver would eliminate the need for one of the measurements. Clock coasting has been shown to provide a navigation solution during periods which otherwise might be declared GPS outages. Misra has proposed a clock model in order to make the receiver clock available as a measurement continuously. Although five or more satellites are visible at any time with the current 24-satellite constellation, availability can be compromised by satellite failures. Therefore, the negative impact of satellite failures could be reduced by atomic clock zugmentation. Redundant oscillators could be used in the receiver to lower the probability of a receiver clock failure. Thus, availability of GPS positioning would be increased. van Graas has noted that adding an atomic clock improves availability more than adding three GPS satellites or a geostationary satellite. Also, a perfect clock helps more than including the altimeter as a measurement.

http://74.125.155.132/search?q=cache:yaL6ez2CXFIJ:scholar.lib.vt.edu/the...

While it is true that there are alternatives to the GPS, they don't work with most people's receivers, (again: yet, that of course could change.) However, what I don't see changing is the US Air Force suddenly switching to using the GLONASS system for missile targeting. And given that that was what GPS was originally designed for, (not for helping BMW drivers find cliffs,) that failure is arguably more interesting...

The failure of GLONASS back in the 1990s is a very good analogy to what it happening with GPS. The economy collapsed, and sending high tech chunks of metal into orbit became less important than say, getting enough to eat, so people focused on the whole eating thing instead.

Your link leads to an unfinished report (for example, all the figures are "Figure 1 about here" placeholders). Is there a version with the data in it?

It's also worth noting that previous claims that the LTG predictions matched observed values contained significant errors. In particular, reported values for birth rate and resource depletion did not match publicly-available data. Overall, LTG predictions had significant differences from values available in public data sets, substantially undermining the original thesis of the article.

Based on that prior experience, you can see why there would be some reluctance to taking at face value the conclusions of an unfinished article that has virtually no data in it. Is there a more finished resource you could reference?

Scroll down to the bottom of the PDF for the figures/tables/etc.

[Some comment about person named boy telling someone named elder about how typesetting used to work edited out by boy.]

Thanks; that's the strangest typesetting notation I've ever seen.

***

Based on those figures, it's hard to see how the LTG runs can be claimed to match the current state of the world.

Figure 2 (population) matches the Standard and Tech runs; it doesn't match the Stabil run, but it was never going to, thanks to world demographics. It also matches simple exponential growth, though, so it's not clear how much predictive power this demonstrates.

Figure 3 (birth rate) matches the Tech run, and is consistently different from the other two. Figure 4 (death rate) matches none of the runs, although recent the Tech and Stabil runs have caught up with it.

Figure 5 = Figure 3 - Figure 4; no new information.

Figure 6 (services per capita) isn't useful at all, as it's not clear why literacy, literacy, and electricity are valid proxies. The heavy dependency on literacy as a proxy is particularly odd, as by definition its increase is sharply limited. Literacy was roughly 63% in 1970, meaning it could never be expected to increase more than 50%. Moreover, given how population increases have largely been in areas with relatively low literacy, it's a measure that is inherently biased low. Both of these make it a very poor proxy for "services per capita".

Figure 7 (food per capita) again doesn't fit any run, but does fit a simple growth model.

Figure 8 (industrial output per capita) is similar to the Standard run, and nowhere near the Tech run (although looking at the graph it's not clear how that run was expected to be remotely realistic).

Figure 9 (nonrenewable resources) has such a wide range of uncertainty that it fits all runs simultaneously (although the Standard run seems to be falling under the minimum range), and hence tells us very little.

Figure 10 (pollution) is close to the Standard run and far from the others.

Overall, there are 5 values which potentially can be nontrivially matched:

- Standard run: 3 matches (2,8,10)

- Tech run: 3 matches (2,3,4)

- Stabil run: 1 match (4)

- Simple growth: 3 matches (2,7,8) out of 3 comparable measures

I don't see how this can be considered "remarkably accurate". Sure, the Standard run is closer to the data than the other two runs in an RMS sense, but "bad" can be better than "very-bad" without being "good".

Of course there are such resources: the discussion about the LTG study is very lively now. There is the article by David Murphy you cite, a paper by Charles Hall on "The New Scientist", the paper by David Simmons at www.greatchange.org/ov-simmons,club_of_rome_revisted.pdf, my own papers cited at the bottom of the post. If you search the internet, you'll find a lot of data. ANd, of course, the latest version of LTG, the 2004 edition, contains an extensive discussion of how the original 1972 scenarios compare with the real world. Of course, scenarios produced more than 30 years ago can only be seen as qualitative predictions. In this sense, I think the work of the LTG has fared well over the years - that is, if we don't ask to it a precision that it can't have. The main point I wanted to make with the statement that the study was "remarkably accurate" is in comparison to the many claims that it was "wrong" because it had predicted a collapse that should have occurred decades ago. Then, the collapse seen in the LTG scenarios is still in the future; so we can't say when (and whether) it will occur. I think what we are seeing are ominous hints that the start of the collapse is around the corner, but I understand that not everybody will agree with me.

Pitt the Elder and Ugo,

Here is a recent paper by my advisor published in the American Scientist, unfortunately you need to be a member to gain full access, but nonetheless the work is being done. I will see if i can upload a pdf of the paper that we have, but i need to check copyrights etc...

HERE is the copy of the american scientist paper.

This is a widely circulated distortion of the original aims of Limits to Growth. There are no 'predictions' in LTG, only scenarios. The World3 model was never intended to be a crystal ball, providing a minute-by-minute account of the future. Instead its purpose was to provide a better understanding of the behaviour of a complex global system with multiple feedback loops.

This is central to understanding the purpose and limits to the original study. Both its detractors and a fair number of its supporters miss this crucial point and become obsessed with trying to prove or disprove the 'predictions' of the World3 model. Critics often like to point out that the scenarios (particularly the 'standard run') do not match observed reality exactly. The assumption then made (either or explicitly or implicitly) is that LTG is 'wrong' and there is therefore no need to worry about constraints on the growth of the human economy.

This completely misses the larger picture; like viewing a Seurat through a magnifying glass. It is also an evasion of the main issues raised by LTG, which concern the relationship between the human economy and the earth and the likely consequences of leaving positive feedback loops in the human economy to continue unchecked.

Due to understandable simplifications and limitations to the model (which the authors of LTG acknowledge), exact timings and figures are irrelevant, it is the overall trajectory of the model which is crucial.

One of the great strengths of LTG is that the World3 model did not produce a single 'prediction'. Rather, a set of scenarios which used different parameters to see how the system behaved under different conditions. One of the most important points to arise from LTG is that if growth in any area of the human economy continues unchecked, the system shows a general tendancy towards overshoot and collapse, regardless of the quantity of resources humanity is able to exploit.

If people want to evaluate LTG they should criticise it on its own terms rather than fabricating 'prediction' straw men which bear little resemblance to the aims of LTG.

I recently read the 1972 edition of LTG looking for all the predictions "Club for Growth" types love to list as proof that the book was a collection of "liberal doomer debunked nonsense".

For instance, the predictions that oil, or gold, or mercury, or whatever would run out by year X or that the world economy would collapse by the year 2000.

I didn't find any. I did find a list of known static reserves of a few dozen industrial resources and the at the time number of years those reserves would last, along with an explanation about what growth in consumption does to those predictions. This was immediately followed by an explanation about what happens when one resource gets scarce and the is replacemed by other, less scarce resources.

The lesson I took from LTG was: Unless we limit both population and industrial growth to zero at some point in the next few decades, industrial civilization will collapse before 2100.

I did notice one "prediction" that didn't pan out: the authors assumed that USA nuclear energy capacity would continue to grow rapidly to 900 GW or so of capacity by the year 2000.

In short, we're playing Wack-The-Mole. More and more moles are popping up, but we have fewer hammers. Proposed solutions only address the moles we see.

The LTG battle was lost. We failed to act in time. This cascading series of unfortunate events was entirely predicted but it didn't help. Now it is too late. Learn the lesson and move on.

The lesson learned is that the leaders today will act just like the leaders of yesterday and fail to act in time. As a consequence, it is time to abandon ship. Otherwise you're like the preacher on the roof ignoring rescuers while the waters rise.

That the captain (TPTB) refuses to admit that the ship is sinking is probably a good thing. The crew and other passengers are not panicing. That gives each one of us the chance to save ourselves.

Or you can remain in the ballroom, discussing the problems that be with others that refuse to acknowledge reality.

Get off and away. With a little bit of time, a little bit of money, and lots of imagination thanks to TOD, you will do fine. But only if you act before it is too late.

Don't say you weren't warned. Thanks Ugo.

Cold Camel

Ditto................................

Ugo,

"In the graph, you don't see the "capital" parameter plotted. However, industrial capital follows the same curve of industrial production. The other forms of capital have a similar behavior.

Are you saying in the model capital growth follows industrial production or is it a law of economics?

This is a quote from the 30 year update you provided:

"The production and allocation of industrial output are central to the behavior of the simulated economy in World3. The amount of industrial capital determines how much industrial output can be produced each year. This output is allocated among five sectors in a way that depends on the goals and needs of the population. Some industrial capital is consumed; some goes to the resource sector to secure raw materials. Some goes to agriculture to develop land and raise land yield. Some is invested in social services, and the rest is invested in industry to offset depreciation and raise the industrial capital stock further.

I don't see a statement saying what % of economy has to be capital expenditure

And here is what you say:

"airports, roads, bridges, dikes, dams, and about everything that goes under the name of "infrastructure" are decaying everywhere in the world."

Someone needs to tell China that they can't have capital investment at 50% of their economy and they cannot have growth rates of >6% in the middle of a world recession. China is constructing 100GW of hydro power( dams) roads, bridges, nuclear power plants, wind turbines etc etc. Similarly for India, Australia.

Where does this infrastructure is decaying everywhere come from? surely not the US, that has just built 100GW of natural gas power plants in last decade, and is building 8GW of wind capacity per year.Perhaps coal and oil infrastructure are aging, so they should, they are old mature technologies that will be replaced by renewable energy.

Why does the model 3 assume capital investment will decline?

Lots of questions; let's see if I can answer.

1) Capital is defined as a "stock" in the model. Industrial production is calculated as proportional to the amount of industrial capital. It is a pretty reasonable assumption

2) The condition of the economy is normally measured in terms of GDP. I never say that it is 100% capital expenditure; but a large part of it, yes.

3) China is still a growing economy - the statement that infrastructure is decaying refers mostly to what we call the "Western world". You are a bit optimistic about the conditions of the US economy. Just take a ride in your car and see the conditions of roads and bridges. But that doesn't mean that everything is collapsing at once - it is just that we are slowing down and, probably, start declining.

Ugo,

Thanks for your answers. I have been living in Australia for 10 years, but know that much of the US interstate was built in the 1950's and 1960's, and concrete does deteriorate with salt de-icing steel rusting etc.

You need to judge infrastructure on its capabilities not looks. As far as I know you can still move goods throughout the US and Canada( and Europe) by truck relatively quickly. The problem in the future will be the availability of diesel and need to replace long distance truck transport by rail, so would be more concerned by the rail system to take more freight capacity. A decline in coal use should help.

What are the other critical infrastructures, ports, canals, hospitals, schools, oil and gas pipelines, the electricity grid, power plants, local transport, telecommunications. In a post-peak oil world probably the electricity grid and telecommunications are the most critical, and steps are being taken to upgrade long distance grid links. It would be hard to argue that the US hasn't invested in telecommunications over the last 40 years.

Since 1970 there has been good investment in electricity generation, agriculture and food processing, construction materials, home building( perhaps too much). The poorest investments in the last 20 years have been in oil refining, coal and nuclear power plants. The US and EU economies are service based, most people are employed looking after each others needs not making products apart from building motor vehicles and houses. The primary needs are food, shelter, heat and light, entertainment, transportation. You could make the case the US has a super abundance of all those things except oil for transportation. Moving from ICE vehicles to EV will only require fairly small changes in existing vehicle manufacturing the capital plants are in place, the trained labor force is available. In WWII the US shifted from manufacturing motor vehicles to tanks and ships and planes in 12 months, moving from ICE to EV is surely possible in a decade, without any massive new capital infrastructure. There is a high degree of metals recycling( 78% for steel). China is using 40% of all the worlds metals because it's starting from a very low base making recycling impossible.

So I am saying low investment in infrastructure doesn't mean a decline in the economy providing new non-FF energy can be developed to replace declining oil and later on gas and coal. Many services require little energy or resources, mainly skilled labor.

The critical test for TLG was always the prediction of a decline in GDP/food etc, it's too early to judge the 1972 predictions because they were always predicting this to occur after 2010. All we know so far is most resources are not more expensive than in 1972, and except for oil are not going to run out in next 25-50 years.