The 2008 IEA WEO - Production Decline Rates

Posted by Euan Mearns on November 17, 2008 - 3:06pm in The Oil Drum: Europe

Report authors: Euan Mearns, Samuel Foucher and Rembrandt Koppelaar

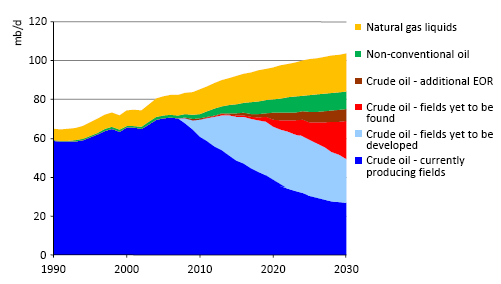

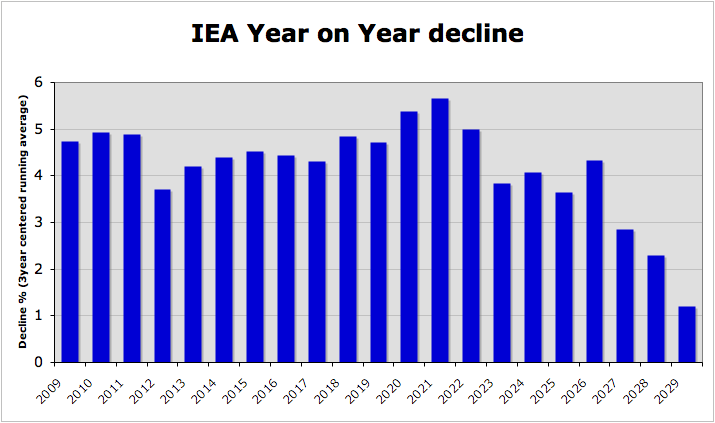

This chart is from a section of the IEA publications called key graphs and appears in Chapter 11, p250 as Figure 11.1.

Chapter 10, p 243 of IEA WEO 2008 says this:

On this basis, we estimate that the average observed decline rate worldwide is 6.7%. Were that rate applied to 2007 crude oil production the annual loss of output would be 4.7mmbpd.

So it seems reasonable to expect the decline rate on currently producing fields shown above should be 6.7%. Not so. The decline rate in the chart above seems to be much closer to 4%. So what's going on here? There's more below the fold.

Chapter 10 of IEA WEO 2008 provides a detailed overview of oil field decline rates based on 798 oil fields, but mainly based upon the IHS data base. It is written by an industry expert and provides much insight as to how decline varies between different classes of oil field. However, when you are working on forecasting global fossil fuel supplies, in the first instance you really want to know just one number. Namely, what is the decline rate that should be applied to current producing fields? Sadly, amongst all the complex detail this vital statistic seems to be missing. Worse than that, several conflicting and ambiguous statements are made. The press reported before IEA WEO 2008 was released, that global decline rates were higher than previously believed, priming readers for a sensational surprise.

The views of many on oil field decline rates are formed by the CERA private report published last year called: Finding the Critical Numbers. I had a long chat with Peter Jackson (report author) last year about this report where the key findings were related to me. In simple terms, CERA divide global production into three main components:

1. Fields in build up phase

2. Fields on production plateau

3. Fields in decline phase

What CERA found was that only 41% of production comes from fields in the decline phase, the remaining 59% from fields in build up and on plateau. A significant proportion of plateau production comes from OPEC super giants. In the decline phase, rates vary from 6% for onshore fields to 18% for deep water offshore fields. CERA concluded that the aggregate global decline rate was 4.5% - and this is the magic number we are looking for in IEA WEO 2008.

Conflicting statements

Here are some of the summary statements made in IEA WEO 2008 on decline rates:

Executive summary, page 43:

We estimate that the average production-weighted observed decline rate worldwide is currently 6.7% for fields that have passed their production peak. In our Reference Scenario, this rate increases to 8.6% in 2030.

This statement clearly applies to post-peak fields, which following the IEA terminology includes fields on plateau (like Ghawar) and those in decline. But what about fields in build up?

Chapter 10, page 243

On this basis, we estimate that the average observed decline rate worldwide is 6.7%. Were this rate to be applied to 2007 crude oil production, the annual loss of output would be 4.7 mb/d.

This statement is more ambiguous, applying 6.7% to the whole stack of current production.

And then in Chapter 11, page 255 we have this:

The overall average annual fall in output at existing fields is proportionately much smaller in OPEC countries, at 3.3%, than in non-OPEC countries, where it is 4.7%, reflecting the fact that most OPEC fields are onshore.

Surprisingly, and very frustratingly the average for OPEC and non-OPEC "average annual fall" is not given. However, weighting these figures for 2007 production (OPEC = 31.1 mmbpd and non-OPEC = 39.1 mmbpd, Table 11.1 page 251) gives an aggregate "average annual fall" = 4.08%. Is this the magic number we are looking for? If it is then it is lower and not higher than the CERA figure.

Chart analysis

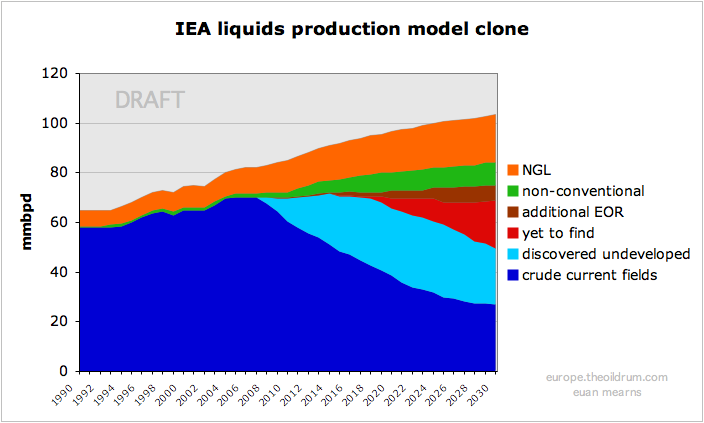

Using Mac OSX Preview grab, we inserted the IEA production model into an XL chart, extracted the data by hand from which this clone is made.

Exponential decline rates were then variably applied to the "current producing" stack to try and replicate the IEA chart. It was not possible to get a perfect fit, but the best approximation was for an exponential decline rate of 4.05%, which is essentially the same as the 4.08% figure discussed above.

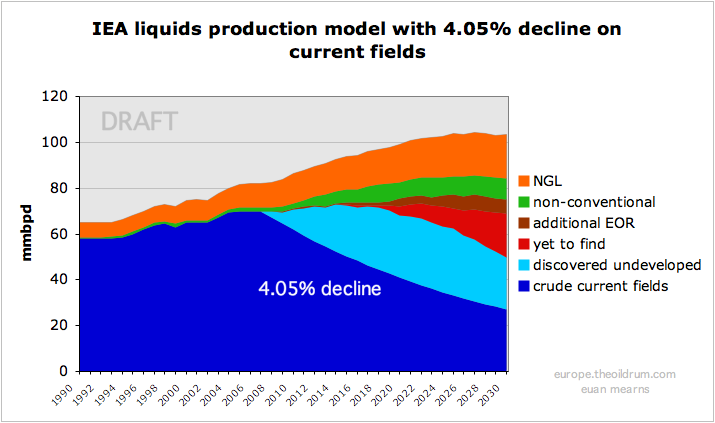

Using a decline rate of 6.7% provides a much more sobering picture of future liquid fuel supplies, especially considering that the natural gas liquid, discovered undeveloped and yet to find components all appear to be rather optimistic.

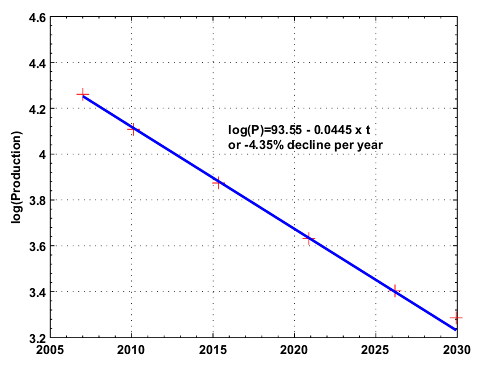

A least squares fit of the IEA decline data extracted from their chart suggests that a decline rate value of 4.35% may in fact have been used. In which case their analysis has reached the exact same conclusion as CERA.

Conclusion

The IEA are to be applauded for conducting and reporting a detailed analysis of global oil field decline rates. This is truly vital data for understanding and predicting the future course of global energy supplies upon which the future of Mankind is based. No doubt the mainstream media, international policy makers and politicians will be suitably impressed by the rigor and detail contained in this report, that they do not understand.

As far as we can establish, the IEA analysis shows that global decline rates are actually lower or the same as those reported by CERA last year. We have sent two emails to Dr Birol requesting clarification on the points raised in this report and are awaiting his reply.

The key information required is this:

What % of current production comes from fields in production build up phase and what decline rate (presumably negative decline) is applicable to that production increment?

What % of current production comes from fields in the post peak / plateau / decline phase and what is the weighted average decline rate applicable to that production increment?

How have these variables evolved in the past, and how are they set to evolve in future?

[Editor's note added around midday, Monday GMT]

Full credit to GaryP who in this comment spotted this:

On page 221, the IEA says this:

Our reference scenario projections imply a one percentage-point increase in the global avearge natural decline rate to over 10% per year by 2030 as all regions experience a drop in average fields size and most see a shift in production to offshore fields.

Note that natural decline is the decline rate without field investments and most of this discussion here has centered upon observed decline rates which include field investments and are therefore lower than the natural decline figure. But the point is the IEA are forecasting decline to increase by 1% point forward to 2030, whilst their chart has a very substantial drop in decline rate, within currently producing oil fields, embedded in it. This is why it was not possible to replicate their chart using a single decline figure.

Good analysis, however, one more piece of data is needed. Does the 4.5% decline rate apply to TOTAL liquids production or to just the crude oil, excluding NGLs?

Since NGLs are increasing this could make a difference to the aggregate decline rate.

This analysis applies only to the crude oil + condensate (C+C) from fields already on production in 2007 (the dark blue field).

The evolution of NGLs will be the subject of separate report later this week by Rune Likvern that will amongst other things examine liquid : gas ratio evolution as well as gas production forecasts.

Euan,

Very good points and related questions!

As I understand, the IEA decline rates apply to conventional crude and condensate (C&C), for which 2007 production was about 70 mbd. Unconventional crude production from oil sands would be excluded, as the IEA would probably assume oil sands production rates would not decline.

The least squares fit of the IEA decline data suggests a 4.5% decline rate for existing fields in production (FIP), which agrees with CERA's number. However, the IEA average observed decline rate for post peak fields is 6.7% which is about 10% higher than CERA's estimate of 6.1% (Table 1 CERA report Oct 2007). This should imply that the IEA's decline rate for FIP should be about 5%, higher than the year old CERA figure of 4.5%, but it's not.

The IEA WEO 2008, released in Nov 2008, uses 4.5% FIP decline rate whereas the IEA MTOMR 2008, released in July 2008, used a higher decline rate on slide 23 of this presentation by ex IEA executive, Lawrence Eagles.

www.iea.org/textbase/speech/2008/eagles_mtomr2008.pdf

The suggested translation of Mr Eagles statement "just to stand still" is "just to remain on peak plateau".

My cynical view of the 2030 IEA 105 mbd liquids forecast is that it had to meet two key criteria to satisfy political objectives. First, the forecast had to be at least 100 mbd in 2030. Forecast production below 100 mbd would be seen as too pessimistic, although more realistic. Second, no peak in the production could be shown. Both these criteria were met by the IEA's forecast.

In order for the IEA to meet both of the above criteria, they had to be overoptimistic not just on production increases from NGL, non conventional, EOR and yet to find, but also had to use an artificially low FIP decline rate of only 4.5%.

In my opinion, the world average FIP decline rate is somewhere between 5% and 7%, applied to conventional C&C of 70 mbd. As more countries enter decline, the FIP decline rate should increase. For example, Russia is now in decline, after ending its C&C plateau in 2007.

A key reason for increasing FIP decline rates is the recent oil production from offshore basins such as the North Sea and Gulf of Mexico, both of which are in decline now. Deepwater oil decline rates can be very high. Deepwater C&C production started about fifteen years ago. Many of those mature deepwater fields are now declining at rates of around 20%.

The IEA also agrees that deepwater FIP decline rate are high but uses different rates for different reports. Table 10.8 of the WEO 2008 report shows deepwater post peak FIP decline rates to about 12% on average. In contrast, the IEA OMR March 2008 report stated the following in relation to offshore oil on page 23

The chart on page 23 showed decline rates for UK at over 20%.

Deepwater oil FIP decline rates are high and this explains why Brazil is struggling to increase production. Brazil has added about 500 kbd new deepwater capacity in late 2007.

http://en.wikipedia.org/wiki/Oil_megaprojects_(2007)

Unfortunately, Brazil's C&C production only increased from 1.75 mbd in 2007 to 1.80 mbd in 2008 (YTD avg Aug 08).

http://www.eia.doe.gov/ipm/supply.html

Assuming that Brazil's non deepwater oil is about 0.3 mbd, this implies that Brazil's deepwater oil FIP decline rate could be as high as 30%.

Due to high decline rates in deepwater oil, I am forecasting that world deepwater oil production is now a peak plateau of about 7 mbd shown by the red line in the chart below. Colin Campbell, has overestimated deepwater oil production due potentially to underestimating decline rates. In Apr 2007, Colin Campbell forecast a 12.4 mbd peak and just last month revised the peak downwards by almost 4 mbd to 8.6 mbd. For the reasons given in red on the chart, I believe that deepwater oil is on a peak 7 mbd plateau now.

Deepwater oil production to 2030 - click to enlarge

source of unmodified chart http://www.aspo-ireland.org/index.cfm/page/newsletter

The IEA WEO's use of a world average decline for FIP of 4.5% is too low. It's even lower than the 5% number used in the IEA MTOMR July 2008. The IEA is overoptimistic and has probably not taken into full consideration the impact of very high deepwater oil FIP decline rates. I believe that a more appropriate world average FIP decline rate is between 5% and 7%, but probably closer to 7%.

Ace - thanks for much additional insight. I'll try and answer the main points:

Everyone needs to be wary of comparing segments of IEA with CERA. They use the same terminology as each other, but apply different definitions to that terminology. CERA Figure 5 shows their definition of "build up" - zero to 80% of peak, and plateau - 80% of peak either side. CERA Table 1 is for Post Plateau - so that is all fields that have already declined beyond 80% of peak. The IEA definition is given in Box 10.3, page 235. Their definition of plateau is 85% of peak. But they start to measure decline from peak - Decline phase 1 is form peak to 85% of peak. CERA decline phase 1 is from 80 to 50% of peak.

But this doesn't explain your observation since the IEA definition is more conservative and should be lower than CERA - but as you point out, its not. From memory, CERA Table 2 provides an excellent summary of their findings that is lacking in the IEA report. The latter contains so many different definitions, for me it is near impossible to follow.

On the same theme, the IEA say this, page 221.

On the same page they note that the post-peak decline rate is 5.1% for their data set, and so they are adjusting this upwards by 1.6% to account for higher decline rates in the myriad smaller fields not included in their data base. This seems a very reasonable thing to do. I don't believe that CERA made such adjustment, and so on this basis one may expect the IEA decline figure to be higher than CERA - but its not.

IMO it is a pretty straight forward exercise to calculate decline rates from this data set of 800 fields and to then apply the results consistently. I'd estimate its 1 to 4 weeks work and the results could be summarised in a 2 page report. So I understand your cynicism born out of reading hundreds of pages of technically detailed prose that do not stand up to scrutiny and cross examination.

In deep water:

Table 10.8 p 238

Post-plateau average estimate for deep water from the IEA is 11.2%. CERA table 2 quote 17.9% decline for deep water fields. The IEA post-plateau figure should be broadly equivalent to the CERA decline figure.

Last time I looked at UK North Sea decline rates (Nov 2006) the underlying decline rate was 13% moderated to an observed decline rate of 7.6% by new field developments. The underlying decline rate incorporates operating activities like in fill drilling and EOR, thus the natural decline rate will be somewhat higher than 13%. But for the purpose of production forecasting it is a figure close to 8% that should be applied.

http://www.theoildrum.com/story/2006/11/19/135819/75

One big problem I have with these decline numbers is that the returns on in field drilling are expected to be constant. And in field drilling itself is expected to occur at a constant rate.

It makes more sense to assume in field drilling is influenced by price and the field decline.

Higher prices accelerate in field drilling and declines accelerate in field drilling.

Also in field drilling by definition is finite and can only expand until the field is fully drilled.

Your ability to expand and maintain your infield drilling campaign is limited to the size of the

field.

Given the above we would expect that over the last several years in field drilling campaigns have been steeped up and at some point will result in steeper decline rates as they have increased the depletion

rate.

You saw a similar pattern when the US peaked except without the technical advances that keep production higher to greater depletion levels.

Whats really needed to understand our future oil supply given that discovery is well in the past is a understanding of the infield drilling campaigns and their effect at the field level.

Given that most infield drilling campaigns implicitly work to keep production at its peak design level and generally don't exceed it by to much. One would expect that producers of existing fields will do whatever they can to keep production close to peak but the pressure to increase production in existing fields is low simply because of constraints on the above ground oil gathering infrastructure. You can have production decline and deal with that fairly easily but expanding production is exponentially more expensive then maintaining the current production rate.

The overall effect is you have an unknown change in the depletion rate driving a constant production rate.

However one thing is for sure if production remains constant then the depletion rate is increasing in developed fields.

Next we know for a fact that our technology is capable of extracting oil at high depletion rates 20-25% is not unknown and in some fields even higher. Thus our ability to deplete a oil field with modern technology is probably close to physical limits increasing depletion rates beyond 20% or so becomes limited by EROEI issues.

This can be seen in the steady decline in field lifetimes over the last few decades generally blamed on finding smaller fields but we know from WHT's work that discovery does not follow field size so this is a incorrect assumption. Instead given everything we know we should expect that field depletion rates have been climbing on average for decades. And further more we know that the maximum depletion rates possible are high.

Now the way around this situation is to increase URR and thus decrease the calculated depletion rate

the easiest way to increase URR in existing fields is to type a new entry into a computer database.

Problem solved.

Memmel, this is similar to what I thought: The IEA numbers only distinguish natural decline and observed decline. But for a forecast (or scenario) both are only theoretical numbers, which provide an orientation:

Natural decline only happens if there is zero additional investment. But in reality this rarely happens as long as the field isn't hopelessly depleted - except for serious above-ground problems like in Iraq.

Also the "observed decline" only gives an orientation from the historical development, as the future decline doesn't simply depend on *if* investments will be made but also *which* and *how many* investments are made. For example future decline may depend on if the remaining reserve of a region will be tackled by vertical or horizontal wells. Much of this will depend on the future oil price, which may determine if more expensive methods will pay off - or also if sufficient capital, equipment, personnel etc. are available. In their scenarios this is partly addressed by the the IEA as they distinguish between conventional crude and "EOR" reserves.

So I don't think that the IEA's decline numbers can only be used as a rough orientation but not as a forecast as future production depends on many more parameters.

NGL’s (Natural Gas Liquids)

I am now anticipating a future post on IEA WEO 2008, which will be about…… NGL’s.

NGL’s are mainly proceeds from Natural Gas production. IEA combines NGL’s and condensates in their projections.

NGL’s normally have a volumetric energy/heat content in the range of 70 - 75 % of crude oil.

To describe the “wetness” or “dryness” of Nat Gas from a reservoir, it is common within the industry to describe this through a parameter that shows the development of the ratio between NGL’s and Nat Gas with time. The “wetter” a Nat Gas is, the higher this ratio is, and vice versa.

It has been observed for fields, areas and regions that the Nat Gas normally becomes “drier” with time, i.e. yields fewer liquids per unit of Nat Gas produced. If this is plotted onto a diagram, it shows that the ratio of NGL’s (liquids) on Nat Gas over time has a downward slope.

Click on the diagrams for larger versions.

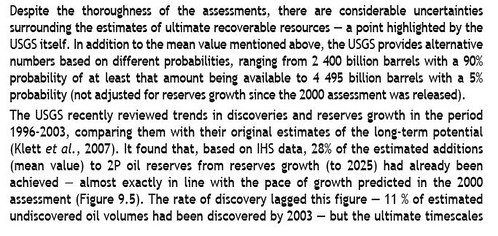

The above diagram shows IEA WEO projections on NGL’s production. The blue area shows the projection from IEA WEO 2008, the yellow line the projection from IEA WEO 2006.

It is worthwhile noticing that the IEA in their most recent WEO projects a stronger growth in NGL’s towards 2030, while they simultaneously have lowered their projections on growth in Nat Gas production from WEO 2006 to WEO 2008. This suggests that IEA in WEO 2008 projects higher liquids (NGL’s) to Nat Gas ratio than in WEO 2006.

The diagram above shows the parameter of NGL’s to Nat Gas ratio with time. The red line is derived from IEA WEO 2008, the grey line derived from IEA WEO 2006, and the blue line has been derived from BP Statistical Review 2008 (Nat Gas production) and form EIA International Petroleum Monthly Table 4.3 which only lists NGL’s that is without Condensate.

Here it is worthwhile to notice that IEA now projects a higher world NGL to Nat Gas ratio towards 2030. In IEA WEO 2008 there have been found no explanation for this.

Actual figures, though only on world’s NGL’ suggests that this ratio has been running flat through the recent years.

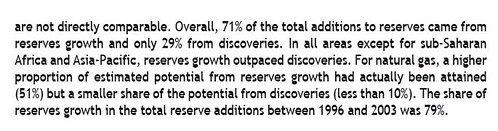

The diagram above shows OPEC’s NGL production (light blue area) stacked on OPEC’s Condensate production (darker blue area) based upon EIA IPM tables 4.1, 4.3 and 4.4 for the years 1980 to 2008YTD (YTD; as of August 2008, from EIA IPM Nov. 2008) plotted against the primary y- axis.

In the same diagram is OPEC Nat Gas production from BP Statistical Review 2008 (for the years 1980 - 2007) shown as a red line plotted against the secondary y-axis. BP SR does not yet list Nat Gas production for Angola, Ecuador and Iraq, and judging from BP data the contribution from these 3 is estimated to be around 2 % of present total OPEC Nat Gas production. Angola and Ecuador are presently listed as having relatively small Nat Gas reserves.

In the diagram note how Nat Gas production for OPEC is growing faster than NGL’s and Condensate’s production. This suggests that the Nat Gas within OPEC is becoming “drier” with time.

Again, IEA defines NGL’s as NGL + Condensate.

As NGL’s and Condensate’s are not part of the OPEC quota system, OPEC members has an incentive to produce these as it generates additional revenues.

It is also worth to take note of that OPEC NGL’s and Condensates continued to grow during the period of the mid 80’s that by some has been referred to as the “quota wars” within OPEC. OPEC lost market shares (both relatively and absolutely) for crude oil to growing production from Alaska, the North Sea and Western Siberia during these years.

The above diagram shows the actual development in liquids (NGL + Condensate) to Nat Gas ratio for OPEC based upon data from EIA and BP (and derived from the tables listed further above in this comment) as white circles connected with a black line.

The actual NGL to Nat Gas ratio for OPEC is based upon actual data from presently two of the world’s present most acknowledged and respected data sources.

The light green circles connected with a black dotted line shows the NGL to Nat Gas ratio derived from IEA WEO 2008.

NOTE: The diagram of the actual NGL to Nat Gas ratio for OPEC shows a downward slope over time, i.e. the Nat Gas becomes drier. This is in accordance with what has been observed as “normal” for fields, areas and regions, and OPEC as a group does not, as of now, represent any exemption.

(More on this in an upcoming post about NGL’s and IEA WEO 2008 on The Oil Drum.)

What is interesting is what has made IEA in their WEO 2008 assume that Nat Gas within OPEC will become 30 - 50 % “richer”/”wetter” towards 2015?

IEA have in their reference scenario forecast a strong growth in Nat Gas production from OPEC (inclusive Middle East) towards 2030, but they have come short of explaining why OPEC Nat Gas grows “richer”/”wetter” in their projections.

This is important as IEA have balanced their liquids supplies towards 2030 in WEO 2008 with an increase in NGL’s supplies, while crude oil supplies has been revised down relative to earlier editions of the WEO’s.

Perhaps some of the readers can help out in explaining this?

I don't know the answer to the question of "wetness" vs. "dryness" of OPEC oil/gas as it relates to NGL, but I am looking forward to any upcoming posts on NGL production. Does anyone know what the "wetness" of the NGL is in the various Saudi megaprojects, or does the IEA claim to know things we don't about the laundry list of Saudi megaprojects? And what of the two new refinery additions that KSA is working on? Will KSA simply keep more of their production at home and sell the finished product of natural gas abroad (natural gas being difficult to move in gas form)?

http://www.hydrocarbons-technology.com/projects/khurais/

http://www.bloomberg.com/apps/news?pid=20601072&sid=a.558dKzK2NY&refer=e...

http://www.gasandoil.com/goc/company/cnm54378.htm

http://www.energybulletin.net/node/4785

Either way, I have become more interested in the ways in which NGL and natural gas product can be used in transportation, through propane, compressed natural gas and even methanol.

The market seems to be assuming enough supply of raw product to satisfy the markets of the world (at least in the near term) given the current price of petroleum products across the board (nat gas, propane, crude oil, gasoline, even methanol) all down by huge amounts and still falling as of today, (only a few dollars above the $50 flat mark for crude oil), and if KSA were to actually be able to deliver the 12.5 million barrels per day that they had earlier said they could do, and actually delivered, at this time of economic

contraction we would be awash in oil and NGL.

Should I just go ahead and buy that discounted Mercedes S-Class? Hmmmm....:-)

RC

Rune - Good work on the "wetness" question. My sense of the report is not that IEA did detailed and defensible calcs to come up with their projection for growth in NGLs (or EOR, or other new supply), but rather that they attempted to kick the question of additional supply into areas where the data is fuzzier and projections are harder to prove or disprove than regular conventional crude. I'd be willing to bet that they had no such explanation for increasing wetness of produced gas. But that's just a gut level guess.

ChrisN, thank you.

I think you are on to something when you refer to possible more “fuzziness” surrounding NGL’s.

From what I have seen of documentation on NGL’s (and there is little available in the public domain) it should be expected that Nat Gas will become drier with time.

The other factor affecting NGL production (extraction) is volume of Nat Gas produced. Towards 2030 IEA projects a big increase in Nat Gas production from Middle East (and other OPEC members). This could happen, the reserves are there, but Nat Gas in the Middle East is increasingly sour (H2S and CO2) which requires treatment before it enters the market (either by pipeline or LNG).

This suggests heavier investments in the production of Nat Gas, and with the ongoing credit crunch in mind, it might also be that the capital will not be there at the pace desired.

Here are three comments from Oil company CEOs from recent conference calls, giving some support to the higher decline rate theme:

"depletion rates for oil and gas production have surged in the past decade. Because of faster resource recovery drilling methods and lower overall quality prospects, annual oil depletion rates have grown from 4% annually to about 7% today. We need to find and produce an additional 6 million barrels of oil per day worldwide just to compensate for this depletion. The natural depletion story is even more compelling. This is why rig count reductions shouldn't last long."

Doug Rock

Chairman and CEO, Smith International

“… we see overwhelming empirical evidence that suggests the present level of drilling and production enhancement commitments are not sufficient to arrest accelerating decline rates in oil, let alone secure the targeted one plus million barrels a day capacity increase per annum the industry plans on”

Bernard Duroc-Danner

Chairman and CEO, Weatherford International

"I would say that overall we are probably slightly more pessimistic, in other words we think the client rates are slightly worse than we would have thought two our three years ago."

Andrew Gould

Chairman and CEO, Schlumberger

Nate, I imagine all these statements apply to parts of the global production stack that matter most to those who made the statements.

It is not possible to make coherent sense out of Chapter 10 of this report because it is incoherent.

Two things though that bother me:

1. IEA make an allowance for higher decline rates in the 69,200 fields not included in their data base and this seems a reasonable thing to do that sets them apart I believe from CERA. Its just that this allowance of +0.9% disappears in their final analysis (Chapter 11) and in their charts.

2. IEA are forecasting decline to accelerate going forward by 1% (on part of the stack) while CERA concluded that decline was constant.

So my best guess right now is that 4.5+0.9 = 5.4% may be a good figure to use right now and that this may increase to 6.4% by 2030. I think it unlikely that the current observed global average is much higher than 5.4% or it would not have been possible to have grown production this year.

What is the Liebigs Law of the minimum for accurate oil supply forecasts?

Is it data, or politics?

I'm very curious about the 30m bpd (more or less) of crude yet to be found plus the crude oil fields yet be be developed. in light of the statements of the companies that are charged with the development of these fields, the amounts seem extremely optomistic.

Since any 'great finds' are likely to be offshore in very deep water or in arctic regions, I don't see how the 2030 production targets could be met with less investment.]

So ... my question is ...

what are these dudes smoking?

What really strikes me is that light blue "yet to be developed" area.

How much of these are difficult/expensive to develop fields like Tupi? How many are likely to have been mothballed due to the global financial crisis and plummetting oil price? In other words, what feasible proportion of that light blue area is likely to actually undergo development?

Take that light blue away (or significantly reduce it) and we're looking at an imminent slide down the dark-blue hill...

... "Yet to be developed".

Access to reserves and uninterrupted access of crude to the production chain are big question marks and are basically non- calculable.

- There are reserve and discovery areas that are inaccessible because of political/treaty disputes such as areas of the Arctic, the Antarctic, 'borderland' areas surrounding Russia, Taiwan Strait and the oceans surrounding the Falkland Islands.

http://www.worldpoliticsreview.com/Article.aspx?id=1019

http://www.articlearchives.com/environment-natural-resources/ecology-env...

http://www.pinr.com/report.php?ac=view_printable&report_id=439&language_...

- There is supply that cannot be delivered efficiently because of interception risks, or where (substantial) risks are added to costs such as increasing piracy and militancy within and offshore Nigeria, offshore Somalia and Kenya, West Africa, and Indonesia. Piracy seems to be increasing worldwide demanding increased resources from developed countries to combat it. There is another discussion regarding piracy here on TOD;

http://www.theoildrum.com/node/4778#comments_top

- There are attacks on pipelines and other petroleum installations by militant groups; in Turkey, within the Caucausus region, Central Asia, in Iraq and occasionally within Saudi Arabia, itself.

http://www.twq.com/08spring/docs/08spring_riedel.pdf

- There are reserve areas that are questionably accessible because of climate; besides the polar reqions, the Gulf of Mexico and offshore South East Asia have been swept by increasingly powerful storms. There was a cyclone in the Arabian Sea last year, the most iontense ever recorded in the Arabian Sea, which cost significant loss of life and property in Oman and Iran.

http://en.wikipedia.org/wiki/Gonu

All of these non- geological forces work to leverage the physical extraction, refining and delivery process. Costs are costs and have to paid from somewhere, including less funding available for exploration, or exploration/development is postponed until an area is pacified.

Euan,

The WEO08 report has a table, 10.9, on regional decline rates that looks very interesting. For all regions, bar the OPEC Middle East one, giant fields have larger decline rates than super giants, and large fields even higher rates than giant ones. BUT, for the OPEC Middle East, the large fields are given a decline rate of just 4.4%pa, compared to 2.2% for supers, and 6.3% for giant fields. This line in the table is the only one (out of 12) showing this relationship- any idea why?

Table 9, p239

IEA definitions, all 2P initial reserves:

Super-giant >5 billion bbls

Giant - 500 million to 5 billion

Large - 100 million to 500 million

The rule of thumb is that decline is higher in smaller fields, and so I cannot explain why ME OPEC Giant fields are declining faster than ME OPEC Large fields. Other factors such as onshore - offshore also impact data, so perhaps this is just one of those statistical outliers. ME OPEC production is of course impacted by political field management that clouds the decline story.

More important is a concern I have about forecasting decline in the ME OPEC super giants. The way these fields are developed, they are held on a suppressed plateau for a long time since only parts of these huge fields get drilled and produced at any one time. However, once they run out of new dry oil areas to drill then the fields will fall off plateau and will decline like other fields. This accelerated future decline may not be captured by the historic production data.

For what it's worth, I have a very simple model for calculating and projecting this decline rate. (And I've done it with ZERO real-environment measurments... ;-) )My model is purely theoretical in nature, and it tracks the aggregate decline with all the EOR involved. It is indeed simple, but I’m sure it works to an extent – I’ve been using it for predicting supply and the results it has provided were in good agreement with the data.

Bearing in mind that the present credit crisis and (supposed[?]) demand issues have altered the validity of [some but not all of] the numbers as far as projecting the future goes, I’ll hereby guide you guys through the main assumptions and projections of the model – if for no other reason than for the sake of you telling me what’s wrong with this.

It gives us decline rates with EOR and a possible maximum of C&C production. So here it goes.

Legend

Using the above acronyms, we can state the following:

Y1 + M – D = Y2

D = (Y1-Y2) + M

DR = ((Y2-Y1) / Y1) X 100

Creating a sheet we arrive at these numbers for 2003-2007:

And we can create the corresponding graph:

Now let’s plot the decline rates of the different years, and on the same graph let’s also calculate a moving (rolling) average, shall we?

(Not so) surprisingly, the decline rate and both the rolling averages point to 5.5% in 2008. (In fact the number is 5.7% with H1 2008 data included.) What are we to do next?

Let’s assume we can project the decline rate in the coming years. It has to increase, due to the fact of more and more deepwater fields, less and less giant fields, and lack of EOR (not included yet in the charts). Once coupled with the megaprojects data for the following years...

...we can create a new set of numbers in our next sheet (for 2008-2015)

And we can make this fun graph:

And another graph:

It comes down to a C&C production of 60 mbpd as a maximum in 2015. Should I include lack of investment in new fields and EOR in the coming years, it will most certainly be well below that. (Including lack of investment will lower the number coming from megaprojects and increase the decline rate as there is less EOR.)

So what I basically say is this:

What do you guys think? (I could give you some more numbers and details, but enough is enough….)

(Note #1 I've found EIA data to be more reliable, so the graphs contain EIA data, not IEA data. Note #2 The negative decline rate in 2004 is the result of two things: EOR must have been pronounced that year being the first of the two. The second is that megaprojects come in increments whereas the decline is a never-sleeping process. Once you do a month by month table, negative decline disappears. I'm not going to post that fairly big table now, but it inded disappears, trust me...)

Eastender, I think you need to give some thought to two variables which I'm not convinced are handled correctly in your analysis:

OPEC spare capacity

Global Total Liquids production and oil price, January 2002 to present. Production data from the IEA, data files supplied by Rembrandt Koppelaar. Monthly average WTI oil prices from Economagic.

Global spare production capacity from this presentation by Lawrence Eagles of the IEA (link lost). Note how 8mmbpd spare capacity in 2002 had all but disappeared by 2004. It has since then grown slightly but is once again in decline.

Bringing spare capacity on has the effect of lowering observed decline rate and vice versa. If you could incorporate ± spare capacity into your analysis it would likely provide a better picture - I think.

http://www.theoildrum.com/node/4007

Megaprojects planning horizon

The fall off in mega projects post-2012 is almost certainly influenced by a 5 year planning horizon.

Project slippage is also very important and results in over-estimation of new capacity in the near term.

Euan,

you got the spare capacity part (partially) right. I didn't include it in the model and I'm sure you have a point: I should have. However, to my understanding most of this spare capacity Saudi Arabia has is heavy sour crude and we didn't have the refineries to be able to buy it. Jamnagar in India and the new Chinese faclities being built right now address (a part of) this issue though. I'll try to find a way to include spare capacity in the model, thanks.

On the other hand, I did think about the megaprojects addition profile, as indicated by this graph:

The additions I used in the tables above are represented by the black line, not the original columns. As you can see, the black line gives a lower value in the near term (slippage) but a higher one later on.

I'd like to note another thing: as far as I know something not even planned for cannot be done soones than 6-7 years, especially the big projects. So AFAIK a project not in the pipeline NOW will not come on-line before 2015.

Is this interpretation false?

Euan,

I did something very similar to your analysis when the public graphs were released. As I pointed out in Nate's previous article, the graph you refer to at the top of the page has been edited by hand.

It's there just above the 2020 point if you look closely. There maybe other edits that were more accurately done. Certainly when you read back the figures and calculate the YoY decline rate, its all over the place.

My feeling was that most of what you see corresponds to a semi-back-of-the-envelope type calculation rather than anything bottom up. Increases in new developments and new finds follows simple curves, etc. rather than anything more realistic and fractal.

In short, unless the IEA makes available their base data, I don't think this should be given too much credence. Its a political document, not a scientific one.

You're not suggesting that the IEA liquids production model upon which multi-billion $ investment decisions will be made is little better than a hand drawn sketch, are you?

Perish the thought.

However there are very few ways in which a vector cut'n'paste from Excel could end up with that kind of tweak in the line by accident. You would have to load it into a vector editing package and 'edit the points' to make it do that - then re-export to the main report and PDF.

If you take the data derived from the graph and plot the YoY decline rates of the currently producing fields, you get a graph something like:

Noisy data from image I'm afraid.

None of which either makes sense, or ties in with the statements made. Decline rates dropping post-2020 isn't physically possible is it?

I think the IEA needs to make their base data available, since their analysis leaves much to be desired.

Gary - first class observation. I made my own chart from the data I extracted and see the same thing - I used a 3 point centered moving average to smooth the noise:

I've added an editors note at the foot of the article. It begins to smack of scandal that IEA put out a report that says decline is accelerating - yikes - and then stick out a chart with decline decelerating beyond 2021.

If you continue the 2008-2020 trend you find a discrepancy of about 5Mbpd by 2030. That's enough to pull everything up to and including new EOR onto a post-peak decline, even given the overly optimistic views taken on new field developments, etc.

Also, note those little bumps in the line about every 3-4 years? Look closely and they don't continue through to the non-conventional or NGL lines as they should, AND they correspond to yet more edits in the vector data.

In short, I think the graph isn't constructed from calculated data, stacked in Excel. Something else is happening (I think they started from the top line and worked down) and the graph has then been edited after creation to make it 'better'.

Gary - Rembrandt pointed that Figure 11.1, page 250 in the report lacks some of the aberrations present in the Key Graphs version. Lets say the Key Graph is a work of art which in Figure 11.1 has been restored. Click on chart for a larger version, I made it as big as I could.

I overlaid the the insets from the 2 versions of this chart and made the top one 60% transparent. Picasso's handy work is there for all to see.

Just what I've been doing, but looking at the 'difference' instead.

As far as I can see there is the big difference you have highlighted. Plus there are lumps and bumps differences in the top of the 'discovered' area (~1-2Mbpd); differences in the non-conventional in history (~1Mbpd) and some very small differences in total magnitude of NGL (~1Mbpd).

However the nonreadthrough of the bumps highlighted above remains.

My guess is this is a slightly earlier/later variant of the same graph, but still with major questionable elements. Either way, I don't feel its safe to treat this as reliable data - too many questions. I'd want to see the working that gets to this before either could be considered anything other than 'artistic'.

Edit: Just realised that the Fig 11.1 graph is later - they went in a fixed the obvious graph errors. How do I know? Well the new bit of line on the 'current' wedge is dead flat over about a decade, no curve to it.

OK, you are going to love this.

The key graphs PDF is totally unprotected. Therefore you can load it up in a full PDF editor and pull it apart. In particular you can find that the presentation was put together in Powerpoint and then converted to PDF in Illustrator I think (the vector package in question) on the 3rd November (after the leak to the FT). You can also find that the reason the graph shows signs of so many edits is that it was. However the little edits are still there in the file and with a little use of the "TouchUp Object" tool you can find and remove the additions to yield:

Its obvious why it was edited, the curves don't look tidy or right with strange zero decline bits and changes in rates for no apparent reason. Note all this proves is that what you saw was 'artistically' modified from what was input to Powerpoint from Excel/model. It doesn't say that other fixes, fiddles and political modifications weren't done before that stage, and indeed the lack of the small peaks in the non-conventional & NGL remains to suggest all is not well.

Pawel Olejarnik its time to come on down...

Nice discovery GaryP, I checked it out and there are indeed three strange triangles (one blue, one light blue). Used to make the chart look nicer.

Beautiful piece of detective work.

what i don't understand is... if one was faking it why not just increase the red "yet to be found wedge" inside excel and press graph?

or if you did that the red wedge would be too obscene?

Boris

London

I believe GaryP had pointed this glitch out in comments to a previous post.

Weird stuff can be caused by graphic arts departments, where after all they are artistically rendering data.

Could not data discepancies also be caused by different team members working on the same report? It is difficult to maintain consistency in that type of environment.

If you look very closely at the PDF you can see that the graph you are seeing is vector data, and that the points 'go back on themselves'. No copy of Excel, etc. is going to do that, and neither is a whole graph edit that might be caused by translation, team member communication. You have to go in the edit the points to get that to occur.

One possibility, if you are being kind, is that the base data was created by hand and then someone traced it in for this graph - but then why would that happen if its complex model output?

Whatever, its not going to be trustworthy unless traceability through from model to graph is demonstrated.

Edit: See above

Euan - thanks for all this sleuthing. I am not an energy expert and don't know the history of the IEA. Perhaps someone at TOD should accompany this series with an explanation of who the IEA is and what is the impact of their reports on corporations, governments etc?

I do however have a business background. Who audits these IEA reports? If this was business and what you say is true, it would be fraudulent. But perhaps the IEA is 'too big to fail'?

Thanks again.

J

Hello Jones, welcome to TOD,

This is a great idea. I'll suggest someone does this. It would be really interesting to know how many people work there and what their annual budget is. In the UK we have a freedom of information law that would make all this information publicly available - I'm not sure if that stretches to an organisation we pay for that is located in Paris though.

I suspect in the past no one did. But from now on we'll be keeping and eye on what they publish.

I've been looking at the decline rates briefly myself, but haven't had the time to read the whole WEO yet.

My take was that their decline rate average was based on historical trend (it has been accelerating) and that their forward looking decline rate curve is what it is : a model based on data now available, e.g. an estimate.

These do not need to be contradictory, because they are different. One historical, another one future estimate (and bound to turn into an accelerating rate, mind you).

And yet you are 100% correct that the wording or verbal phrasing of the decline rate part in the documents could have used more accurate wording.

Then again, I could be wrong as well, I'd really need to wade through the whole document to be even remotely certain. However, that's how I just assumed the difference myself.

Howdy SamuM!

Care to revisit our discussion of "fundamentals" vs "speculation" of 60-70 dollars ago?

Sure looks like a bursting speculative bubble. But hey... wat do I know? :)

Is this a speculative bubble then?

DJIA

It's certainly a boom/bust cycle exacerbated by speculation (in both directions)... but a "bubble"? Hardly.

If it had run from 10,000 to 35,000 in three years and then lost most/all of that gain in a year or so... THEN it would clearly be a "bubble" (as with the NASDAQ collapse).

Not all price increases are bubble and not all price declines (even sharp ones) are bursting bubbles. A bubble is characterized by uncommonly dramatic (seemingly unsupportable) price increases followed by the loss of substantially all of that gain. There's nothing uncharacteristic about a 40% stock move over three years... that happens all the time.

cmon - get serious. this IS a speculative bubble, but not in oil - open interest since oil was $90 has all but dried up other than day traders and hedgers. The 'bubble' is financial assets, not oil. Due to all the rule changes scores of large players have left the playing field, leading to forced margin calls and crazy volatility- the entire unwind is based on financing in Yen and dollars -the correlation between virtually all world equity indicies and commodities have been over .85 with Euro/yen since July. If this was a bubble in oil, it would be down more than everything else, and stocks would be rallying. This is something else. The volatility due to lack of market participants is amazing.

Got this from an analyst friend of mine today. I completely concur:

This is not an oil bubble, but a once in an era (species?) deleveraging that has yet to run its course. The oil 'bubble' part was from maybe $120 to $145. IF the world economy recovers, oil (and gas first with cold winter) will outperform all other commodities (with possible exception of grains). Deflationary depression with oil stabilizing at $80-$90 is my best guess for 2009 - but give me 6 more weeks of datapoints. The deeper the chasm now, the worse oil will be in future and higher likelihood of nationalization of oil sector and demise of futures trading in oil..

In my opinion futures markets are poor indicators of price when the price is falling.

The liquidity is provided by consumers hedging against rising prices. Producers trying to lock

in profits have a very tough sell in a falling market.

When consumers finally become interested in hedging against prices then we will again see the futures markets actually perform price discovery.

I think this is intrinsic in any futures market that they overshoot heavily when you seen a decent fall in prices.

Why would any consumer lock in prices now given everyone so far thinks they are falling.

This is about expectations not bubbles and expectations can change rapidly.

You can get the same sort of overshoot on the upside but when prices are increasing I suspect you see the consumers hedge up earlier on and thus for a pure futures market you tend to lose momentum on the upside this overshoot is more limited going up then going down.

The futures markets are intrinsically designed to hedge against price swings on both sides except in my opinion they are weighted towards working better when prices are increasing. Thus they work fairly well in allowing both producers and consumers to lock in know profits or costs in a generally rising price situation.

Think of it like buying a home now why would you unless you had to your not going to "lock in" a home price thus no reason to take a bet on homes futures work in a similar fashion and sellers are forced to take what ever price the spot market offers.

Unlike housing where we know how many houses are out there the supply and demand equation for oil is murky to say the least. The moment producers begin rejecting low offers is them moment the futures market heats up.

For example

http://www.commodityonline.com/news/OPEC-basket-price-falls-below-$-48-12796-3-1.html

Spot prices are still falling the moment they stop falling is when the futures market starts to heat up you don't have to watch these for the most part since a lot of people do.

But I bring them up because Saudi Arabia sets the price of the crude they sell at a premium or discount vs NYMEX prices this they can unilaterally increase the price of the crude and don't have to cut. If the prince increase sticks then we are off to the races.

Or try to lower it.

http://www.energybulletin.net/node/45483

Yes, I can revisit the discussion.

I've been trying to read some new stuff that has come to light since the fall of oil price. Haven't had enough time due to other commitments.

With that said, my current understanding, not a hard stance is as follows:

1. Yes there was *probably* some financial speculation that somehow affected the price rise of oil from Fall of 2007 to Summer of 2008. How about price manipulation? I'm not so sure about that.

2. I still don't have any believable data on who, how and using what mechanisms was this achieved, which is quite unnerving for me, but not a proof it didn't happen. I'd be willing to get any pointers to data on this if anybody has such. To me correlation is still not causation. Call me thick, but I'm taught that way.

3. As for the all in price of oil since July, several factors may have contributed:

3.1 Strengthening of dollar (22% rise in USDX)

EDIT: Borrowing from cryptogon.

And yes, there is a causation not just correlation. Ask ME finance and oil ministers.

3.2. Rapid fall of economic activity, esp in Sept/Oct as almost all of OECD officially entered recession and China/India/Russia slowed down considerably.

3.3. Somewhat related: a crash in worldwide shipping activity and closing of dozens of thousands factories in China alone (major users of local electricity produced with mid-distillates, which were particularly squeezed this year)

3.3. Changes in commercial hedging in the futures market due to rapid fall in spot price and negative differential compared to earlier long hedging positions (i.e. these had to be compensated)

How much did each of these affect the price? I don't have enough data and probably not statistical skill to deduce this.

Summa summarum: Was it all a financial speculative bubble from c. $50 level upwards? Possible, but highly unlikely. How about from $70 level? A bit more likely, but I don't think it still explains all. From $100 upwards, much more likely, in fact quite so but exacerbated by other financial (USD) and commercial (hedging) activities as well.

What was the final nominal USD size of the financial speculative bubble on top of a fundamental/base-financial price?

I'm afraid we'll never know, unless some traders come clean after 20 years, but I remain in belief will get more of the same - regardless of the causes - in years to come, when we finally come out of the coming global [r|d]epression.

That is, the increasing yo-yo-price effect in oil has now been activated, possibly for the final run until the peak and beyond.

That's my stance now and as always I retain the right to change my opinion if new corroborated evidence surfaces.

In the meanwhile, let's get back to IEA numbers, shall we.

I commend you for being open to revisiting your assumptions when facts change.

I caution you against drawing conclusions from that graph. You've heard the old "lies, d@mn lies, and statistics" no doubt? Playing fast and loose with the Y-axis falls into that third category. That's an incredibly dishonest graph. You can't graph a 22% increase up against a movement three times as great in that way. The correlation is only partial and, if anything, the causation is likely to be in the other direction (lower oil prices improve the US balance of trade which in turn strengthens the dollar)

That isn't necessary... I'd suggest just looking at the last time energy/opec/whatever did this. OPEC's stranglehold on production caused spiking crude prices which simultaneously encourages non-OPEC nations to ramp up discovery/production and drove economies into the wastebin (restraining demand). OPEC couldn't enforce discipline as members outproduced their lower quotas (needing more funds as their existing production was worth less each day) which caused a relative glut and collapsing prices.

The mistake too many make is to assume that it's "different this time" because there simply isn't any oil left to pump... so prices would continue higher despite demand destruction.

Hmm as far as the 22% change in dollar strength leading to a larger reduction in price.

And example at the peak of the bubble housing prices went up their standard 10% just like every other year since the bubble started but resulted in a fall in price of right now about 40% and still falling.

Your wrong to equate a certain relative change in price with the overall move of a market.

It does not matter if its a strengthening dollar asset valuation what ever.

Prices are set on the margin in the case of oil if two things hold the dollar strengthened devaluing the hedge contracts and supply exceeded demand then you set the conditions up to pull the rug out from under the price. If a speculative bubble exists on top of this then the price fall could be even more dramatic esp if external market forces are putting pressure on the speculators to sell liquid assets to raise cash. This is true even if the speculation has valid underlying fundamental reasons if the fundamentals change then the speculators are hosed. The fact that a number of airlines where heavily hedged agianst rising oil prices indicates that actual commercial consumers did not feel the price was a pure speculative bubble.

As far as looking at last time well to some extent history can and will repeat itself but on both the oil front and the economic front we are entering a different era. A lot of people can see a depression is probably on the horizon but few think it will be exactly like the 1930's.

But I don't want to debate you on the subject I just hate to see people use this flawed form of logic both of your statements esp when put together result in a flawed conclusion that has no merit.

Worse both are technically wrong. A small change in one variable can lead to a large change in another we have this concept call non-linear behavior mathematics beyond strait lines exists and is alive and well. Next although history serves as a guide a perfect repeat of history is the least likely event to occur thus you assert the one situation that has the lowest probability.

This is a general problem I've seen with a lot of ant-doomer arguments what you find is that the proponents have not done a very good job of building up a complete argument. The method of attack is fragmented "truths" coupled with potentially erroneous conclusions.

Personally I'm tired of seeing this approach it get old quickly and drowns out people that actually make really good points. Off topic but a good example is Wind Power which has some great and real support behind it.

The sad thing is that if oil prices rise quickly and begin to approach 200 starting in the next few months like I predict then people like you will just disappear you won't stand up for your argument.

If I'm wrong then I'll admit figure out why I was wrong and continue to try and understand the problem.

And obvious problem is your assumption that non-OPEC nations can ramp up production I think the possibility of that is low given all the work thats been done on the oildrum and elsewhere. I could go on and on but your offhand comment falls apart with even a small amount of scrutiny. And guess what I've actually looked at what happened then and whats happing now to see if we will get a similar situation.

Garyp & Euan,

I appreciate your observation but:

"You would have to load it into a vector editing package and 'edit the points' to make it do that"This is not true. This pattern can result from normal Excel spreadsheet data. Of course they are not a natural sequence but rather bad data, but they don't need manual editing. Try yourself this series and plot a graph of connected dots:

80 6

70 8

60 10

0 18

40 14

30 16

20 18

10 20

If you are plotting a stacked area graph in Excel you are not plotting 2D points. You are plotting an ordered list of data against a list of labels. Thus it doesn't matter what your list label is, just where it is in order. Try it.

In short, nope, you don't get the opportunity to go backwards in x value.

Anyway, as is above demonstrated, its proved that they added little triangles to the graph to attempt to smooth things out. By taking it apart in a PDF editor you can not only delete these, you can tell what package was used to put them in ("Illustrator" it appears).

Correct, you cannot do this with a stacked area graph in Excel.

Now I've checked the pdf myself and found the 3 triangles they added.

The next step is to wonder why they did it, as it doesn't change much the entire picture.

One explanation could be that the wanted to have the graph looking nicer - literally. In also had worked for people who wanted graphs for things like a powerpoint presentation and they didn't like the ugly zigzag I had but wanted something that looked nicer (literally). This happened rather with high-level executives who wanted to have a nice presentation, but not with other scientists. This is probably not a major issue if such a presentation only gives a general idea to other executives.

But of course it may be a major issue if the concept of making scientific results look 'nice' goes down to the scientific work itself. If the scientific data, methods or results themselves were manipulated by design (for whatever reason) the entire scientific work may be devaluated.

You can also plot a circle going back to the origin:

0 0

10 0

20 0

30 0

40 0

40 1

40 2

40 3

40 4

30 4

20 4

10 4

0 4

0 3

0 2

0 1

0 0

No, the IEA are not to be applauded for any decline rates, 'business as usual' scenarios, forecasts or projections, since they do more harm than good and are inherently of limited use in the first place. Basically, the IEA partially acknowledges the literature on peak oil, and then suddently flushes most of it down the toilet via a large number of assumptions.

They are to be applauded for their excellent data and statistics, and some policy analysis etc. That's the good stuff. The 'business as usual' scenario contains some pretty darn unusual assertions!

This shouldn't surprise anyone. Whenever the IEA starts making assumptions, the marginal usefulness of their analysis becomes negative.

I am still curious where that red piece of the pie is coming from.

and the yet to be developed fields, how do they manage to ramp up so quick then sustain for so long.

sounds like finance, they just keep rubbing the figures until it fits.

I was waiting for someone else to open that can of worms, since it smacked me square in the eye, and yet all the pros are chewing over analysis of minute discrepancies in what looks like unreliable data. Not being from the oil patch, I feel like my job is to read and be quiet -- but you opened the box.

The "red" area is almost 5.5MBD by 2030, and its slope almost exactly mirrors the decline of "conventional" crude. The sum of Crude, currently producing, Crude, yet to be developed, Crude, fields yet to be found and most mysteriously Crude, additional EOR maintains an absolutely flat slope from its peak of 2005!

Is that pure fantasy, or is there some hopeful expectation that the recent signing of the "Status of Forces" agreement with Iraq will finally allow a great deal of crude to be "found" in Iraq?

I went to a play about the life of Buckminster Fuller last night -- I think there is a lot of reason to be hopeful about the world and its people, but I don't derive any hope from CERA, IEA, or their client organizations. But then, I'm not an oil specialist, and I really should just keep my head down.

We're going to have a post every day this week and next dealing with some aspect of WEO 2008. This post is about decline rates. A post later on will deal with the discovered undeveloped, yet to find and NGL slices.

Thank you in advance, Euan. I will keep silent until the end of the series.

Fine. Don't forget the EROI of the unconventional resources.

It's about 20Mb/d; onscreen, at least, it's roughly the distance between 40 and 60Mb/d.

To-be-found oil seems to increase from roughly 4Mb/d in 2020 to 20Mb/d in 2030, or an addition of 1-2Mb/d per year. Considering that megaprojects amounting to 4-5Mb/d are currently added on a yearly basis, finding the to-be-found oil is likely to be a bigger challenge than producing it. (All things being equal, of course, which they're not; the to-be-found oil is likely to be more expensive to produce than current oil. Still, the scope of the projects that to-be-found curve entails is not unreasonably large relative to the current scope.)

In terms of finding this to-be-found oil, a production plateau of 3% of URR (roughly what the US North Slope saw) would suggest ~200GB of URR would need to be found and brought into production between now and 2030. Assuming all back-dated oil discovery is taken into account under the "currently producing" and "yet to be developed" categories, ASPO estimates that this "to-be-found" oil will fall short by about 80GB, or about 8Mb/d by 2030.

One explanation for that is simply that oil will be found and developed as needed.

If the total production represents estimated demand (conditioned on price estimates), and if NGL/unconventional/EOR are all price-insensitive, and if sufficient to-be-found oil exists, then we would expect to see exactly this pattern, where new oil is found to replace old oil that goes away. We would not expect to see more to-be-found oil added, as there's no demand for it.

I'm not saying I agree with this model, as there are significant questions about the quantity and flow rate of to-be-found oil, but I do suspect that's the basic underlying idea.

I've been out of the loop for a while, but it occurs to me that it might be interesting to calculate the decline rate for several large oil fields that have peaked, where we have reasonable data, e.g., Prudhoe Bay, North Sea Fields, some large Russian fields, etc.

Also, it would be interesting to look at what Simmons calls net decline rates (declines from existing production plus the effect of workovers, enhanced recovery, plus new fields, etc.) for discrete regions, e.g., Texas, Alaska, North Sea, Indonesia, Mexico, overall US Lower 48, etc.

Hi Westexas,

PEMEX says that Mexico can get production back up to 3 million barrels per day.

http://www.canada.com/calgaryherald/news/calgarybusiness/story.html?id=e...

What do you think?

Cliff Wirth

I have frequently mentioned a comment made by the Texas State Geologist in 2005 at an industry conference, in response to a question from me, after he presented the "Undulating Plateau" theory of world oil production (I pointed out that discrete regions like Texas, the overall Lower 48, and the North Sea had not shown undulating long term plateau patterns).

In any case, he said that while Texas may not be able to match its 1972 peak production rate, it could, with the use of improved technology, significantly increase its production. So, delusional thinking is common regarding post-peak regions.

That's probably the same sort of people who keep thinking we can colonize other planets as soon as this one is exploited.

One of these things is not like the other.

TROLL DECLINE RATES

Troll production Jan. 1999 - Sep. 2008.

Development in Troll decline rate.

Like the above?

Some of this can be calculated easily enough from the EIA data. Most of the series start at 1981, so since then net decline rates have been:

Using the EIA's international total oil supply data and from each country's most recent peak year through 2007 gives:

For those who prefer to exclude certain parts of the oil supply, note that looking at BTU-valued C+C production gives quite similar results:

"net decline rates"

This should be the same as what the IEA calls "observed decline", isn't it?

I think that the various deline parameters and its values could be clearer.

I'd wish very much to see a table like this (template with random numbers):

+ perhaps a column with the overall decline from all fields.

Thank you for a fine deconstruction of the report.

After the IEA have been allowed a suitable time to respond to the points you make, may I suggest that you send a brief article showing what appear to be the contradictions in their report leading to an over-optimistic projection to Bloomsberg and to the Economist?

Bloomsberg as they have recently shown that they are no respecters of persons in their challenge to the Fed to specify how they are spending money, and legal action - in fact behaving remarkably like proper journalists - and The Economist as they seem to have recently come to suspect that all is not well in the garden of oil supply projections whereby demand always calls forth supply, judging by their recent respectful treatment of Simmons.

One or the other might introduce to a wider audience that this report seems to be grossly over-optimistic.

Davemart,

do you mean the article "Cold black gold" in the Economist? If not, could you send me (or post here) the weblink to the article you mean? Thanks a lot!

Here is the article on Simmons I referred to:

http://www.economist.com/people/displaystory.cfm?story_id=11702995

Cheers!

Hi I am a Danish communications student currently doing research about the reputation of Exxon Mobil in the eyes of the American public. I need your help filling out out a short survey in order to complete my research. the questionaire has 13 questions and will take only five minutes of your time. The link to the survey is this: http://aln.asb.dk/StudSurvey/survey.aspx?surveyid=xf5v53980gbo2m3

Thank you very much.

Readers of this site are probably not a very representative sample of the American public.

Do not discourage students. You do not know what other groups or sites that he/she has posted on - Daily KOS, Moveon.org, etc.

{redundant comment deleted)

Euan,

How do we know that the decline rates for OPEC are accurate?

It seems very surprising that OPEC would share that data

Can we put as much faith in their stated decline rates as in their published reserve estimates?

also,

How does the analysis above square with Slumberger's comment that decline rates are about 8%?

finally, can we say that with ELM, on average on a global basis, we just add 2% to the final number? or is that too simplistic?

thanks

polytropos:

We don't. Even IEA admits this to a certain degree. See more details e.g. at

Fuzzy Focus on Saudi Arabia

I don't now the right number but I think yes.

See also the most recent posting on ELM in TOD.

Does anyone know if these production declines assume that OPEC reserves, for example, are taken at published values, or if there are factors applied to provide a more realistic assessment of remaining resources?

Euan,

First, a question regarding your statement that “The IEA is to be applauded for conducting and reporting a detailed analysis of global oil field decline rates”. I have only read the summery and have not seen the section on methodology so please correct me if I’ve interpreted the summery incorrectly. Accepting, for the moment, that the IEA’s decline rate model is correct, do they not apply this decline model to recoverable reserves amounts that are supplied by the producers? In other words, the IEA has not made an independent study of the proven remaining reserves in any of the fields they’ve modeled. They ‘ve modeled their decline assumptions based upon unverified proven reserve values.

Secondly, I’ll offer a rather brash statement that any effort to offer a “decline rate” on any of these fields based on each field’s historic decline rate is rather futile for the most part. I do not condemn the effort to make such generalizations as it’s the only approach available since the producers (especially the KSA) won’t provide the necessary data. Above all else, there is no such number as a single decline rate for any water drive reservoir. Many of the largest oil fields, such as Ghawar, in the world fall into this category. Just for the moment, let’s ignore water injections methods and look at the typical decline rates of such fields. First, there is no such thing as a typical FIELD decline rate. Let’s look at a typical WELL decline rate. Initially, little decline is seen in fields with strong water drives. As the oil is produced the oil/water interface rises and thus maintains a fairly consistent flow rate. But eventually the interface approaches the perforations in the particular well bore. At this point declines rates of 10% to 30% are not uncommon. The total volume of produced FLUID might change little, but the production stream now contains an increasing percentage of formation water. A well originally may be producing 5000 bopd but some time after the water hits the perfs it may still be flowing 5000 bbls of fluid a day but only 2500 bopd since it is now producing a 50% “water cut”. In very efficient water drive reservoirs the well may go from 0% water cut to a 90%+ w/c in just a couple of years.

But even two fields with identical water drive characters, reservoir characteristics and ultimate recoverable reserves may have drastically different FIELD decline rate PROFILES even though the all the wells in both fields have IDENTICAL decline rates. In Field A all the wells have perforations approximately the same height above the oil/water interface. In this situation, the field decline rate would increase very rapidly. In Field B the wells are a different height above the interface and thus individual wells begin the rapid declines in a staggered order. Thus this FIELD’s decline rate would be combination of wells ranging from high decline rates to little or no decline at any one point in time. Field A may enter a decline rate of 35% while Field B may never exceed 10%. Yet the fields are identical except for the locations of the perforations in all the wells.

But there is also a third decline phase in such reservoirs. Once the water cut has reached a high level (75%+) the oil production decline rate will drop to perhaps 1% t0 3% for decades. I work with fields today which were first produced 60 years ago which are still commercial even though 98%+ of the production steam is water. For the last 20 years many have shown decline rates under 2%. And even thought the net oil production is relatively low, many fields have produced the majority of their ultimate recover at water cuts above 70%.

Hang in there if I haven’t sent you into a comma already. This lesson in reservoir engineering is critical to appreciating a POTENTIAL huge underestimate of future maximum global oil production rates the IEA has offered.

Back to Ghawar. This field has not been allowed to develop a natural decline profile thanks to the massive effort by the KSA to inject water into the fields reservoirs (I’m not an expert on this field but I do know it is actually made up of several different “pools” which, though connected, exhibit different flow characters). The water injection program has allowed the high flow rates we’ve seen for decades. It has also greatly increased the ultimate recover of the field. But there is one very critical aspect that this water injection has not changed: the very high decline rate every individual well experiences when the water hits the perfs. In fact, the water injection often results in even higher decline rates then would have been seen under a natural production profile. This is an irrefutable law of petroleum reservoir engineering: at some point in time each well in Ghawar will go into a high decline rate profile. An individual well may jump from a 3% decline to a 30%+ decline in as little as a year. The only technique which can lessen this impact is to reduce that wells total flow rate. Though this would allow an improved ultimate recovery, it obviously reduces the net oil production. Regardless, each well in Ghawar Field, as well as in every other major water drive oil field in the world, will slip into a high decline rate profile. How quickly the ENTIRE Ghawar Field decline rate falls will be a function of how quickly the water interface reaches the various wells in the field. Given the complexity of the multiple pool aspects of the field as well as the very high original oil column, it would be a difficult model if we had all the detailed data the KSA has. And we don’t have it. But that lack of detail doesn’t change the fact that each individual well in Ghawar Filed will enter a high decline rate phase at some point in time. How this fact will affect over all field decline will be a function of how quickly X number of wells reach this point.

Though we can’t verify the fact but let’s assume Ghawar Field is experiencing a decline rate of 3%. This decline rate CANNOT be used to predict the field’s future production rate profile once the water/oil interface begins reaching the perforations in the different wells. It should also be noted that there is a relatively small number of Ghawar for a field its size. This greatly enhances the impact on the FIELD production rate as water reaches more of the wells. But I will repeat myself because it’s that important: there is no such thing as “decline rate” for any water drive oil reservoir in the world. There are at least three distinct decline phases in each field’s life. If one had access to all the data as well as a great deal of man power, one could generate a “production rate profile” for future oil production across the globe. This would require production rate profiles for each major field which would then be combined. But again, there is no such thing as a CONSTANT decline rate which can be applied to today’s rates which would predict future oil production rates at any one point in time. But given the averaging effect we might come close. But that could only be done by generation a complete production profile for each major field over its ENTIRE life. Every water drive reservoir produced be man has generated three unique decline phases: a low initial decline followed by a significantly higher decline followed again by a relatively low decline rate.