The Fantasy World of the UK Government

Posted by Euan Mearns on July 4, 2008 - 11:00am in The Oil Drum: Europe

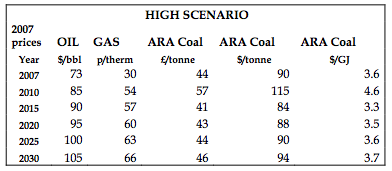

| This BERR report (small pdf) published in May 2008 provides 4 alternative price scenarios for oil, natural gas and coal. The high scenario is shown below. |

BERR are inviting comments and suggestions.

emissionsprojections@berr.gsi.gov.uk

Upstreamonline is a good source of oil and natural gas prices.

On 3rd July:

Brent is trading at $144 per barrel

Tapis is trading at $153 per barrel

UK day ahead natural gas is trading at 62p / therm

Business Enterprise Regulatory Reform (BERR) formerly known as the Department of Trade and Industry (DTI) has responsibility for advising HM government on energy matters (amongst other things). Basing policy decisions upon the figures in this report is unlikely to benefit the UK in the long run. The UK economy is founded upon abundant cheap supplies of fossil fuels. This report carries this trend forward into the future while ignoring a reality that is quite different.

Maybe a good suggestion would be to develop a high high high high high fu*king really high scenario.

But that would probably still be too low.

LOL.

Actually, I think they are wasting our taxes - 'fiddling while Rome burns'.

We are half-way through 2008 and the average price, to date, for Brent must be ~$115 already above the high-high prediction for 2010.

To be in error by such a wide margin in two months is pathetic - I am easily able to predict the actual price within ~$10 in that timeframe (the average moves even less), oil is trading in an escalating range, look at the graph on the Upstream site Euan links to, join all the high points with a curved line and join all the low points with a curved line and extrapolate both two or three months.

In reality nobody knows the future and predictions such as these are of no use to anybody. Best for BERR just to admit it and sack everybody involved and use the money saved to insulate poor housing stock.

What truly amazes me about the assumptions behind the predictions is that no allowance is made for reducing CO2 - all we see is IEA predicted growth despite the Government signing us up to binding severe CO2 reductions.

No cause for concern, they say "Because there is continued volatility in prices, BERR proposes to review these assumptions on a regular basis, annually in autumn (starting from next year), and if necessary bi-annually in spring and autumn."

So, IF NECESSARY they will look at the prices twice yearly starting from next year 2009 presumably. Just how difficult would it be for these civil servants to review the prices weekly?

I think they should develop a high - exponential scenario as this seems to be the shape of most of the curves we see in the prices.

Tell BERR what you think.

I have told them to include a scenario that assumes peak world 'net exports' of oil in 2005 - since that is what has actually happened!

http://netoilexports.blogspot.com/

Euan,

You recently wrote about the UK "State of Emergency", where North Sea depletion is resulting in larger and larger trade deficits which will continue to balloon going forward.

I think I have the answer!

According to BP Statistical review, the UK used 620 million barrels of oil in 2007. Lets assume this stays constant (e.g. economic growth is subsidized by increases in efficiency or energy substitution.) That means over the next 8 years, the UK will consume around 5 billion barrels of oil.

Using the BERR expections for "high case" of oil prices (meaning the risk is to the low side of these numbers), wouldn't it make sense for the energy experts at BERR and UK Finance Ministry get together and arbitrage their expertise vis a vis the futures markets?

To wit, the ENTIRE futures strip from now out to 2016 is above $140. (many of the contracts are above $146). By selling forward what are obviously significantly overpriced contracts compared to the 'high case', the UK Finance Ministry can pocket $275 billion in next 8 years ($142.5-$87.5 high price average times 5 billion barrels).

Much of the above budget deficit then disappears. If they also sell forward natural gas and coal vs their 'high case' as well, then the deficit would turn to a surplus!

Problem solved.

And we americans thought we had the monopoly on imbecility and cluelessness. What is the UK thinking?!! And what kind of deficits will they be running in the future if they persist in thinking they are a world power? Maybe an Irish Sea power.. And 2 new huge aircraft carriers...Jeez...http://www.timesonline.co.uk/tol/news/uk/article4262046.ece

Personally, I doubt whether these aircraft carriers will ever be completed. The French have had enormous problems with theirs and I believe they are heavily involved in this lot.

The "best" thing about them is that they so drain the "defence" budget that there is little left over to start new "fronts against terrorism".

These expensive toys are highly vulnerable to shore-based missiles and so cannot be used properly in restricted waters like the Persian Gulf. They are about as useful as the battleships the Prince of Wales and the Repulse were in 1941

Alfred,

You are right about aircraft carriers being obsolete dinosaurs with HUGE radar signatures. The War Nerd explains this in his usual amusing, snarky style (vulgar language warning):

http://www.exile.ru/articles/detail.php?ARTICLE_ID=6779&IBLOCK_ID=35

Errol in Miami

edited to fix link

Where do you think we Americans got our imbecility and cluelessness? The acorn doesn't fall far from the oak, as they say.

Frankly speaking, I'm not sure whether my brain is wired to grasp the real meaning and consequences following charts like this. But one thing comes to mind : Zimbabwe, but take it easy I don't understand that either.

How and where do they start... to make policy with such a chart on top of your political desktop ?

Ntae, I think this comment explains why you were / are a hedge fund manager and I am / was a geologist. To be fair to Gordon Brown he did sell most of the UK's gold at $10 per ounce just when no one else was expecting that, wrong footing the markets completely.

And back in 1999, when the UK was pumping more oil than it had ever done before we managed to sell some of it at below $10 / bbl proving how liberalised and informed markets can promote and support industrial civilistaion.

You just need to compare this with how the ex KGB Putin scum bag is managing Russian resources. It seems he wants to sell most of what is left of Russia's oil at over $300 / barrel. Talk about clueless commies, eh?

But I gotta say your running a bit close to the mark suggesting that the UK government may be speculating on the futures markets. There's a strange irony about Followers speculating on the future of a country that doesn't have one.

OOOOyn

€,

Sarcanol alert on.

Your comment proves that former British governments cannot be accused of being greedy!

Must those bloody capitalistic commies be damned!

They may be thinking about ……..“Back to the Future”.

Sarcanol alert off.

This illustrates some of the new rules, earlier discussed on this forum, coming into play.

What a brilliant idea!

That would be putting our money where their mouth is :(

Quoted market prices for calendar year 2009 as of 13:30 on 3rd July:

Brent $147.95 per barrel (175% x "high scenario 2010", 138% x "high high 2010")

ARA Coal (API2)$205.50 per mt (360% x high scenario 2010, 178% x "high high 2010")

UK nat gas 101.00 pence/therm (187% x high scenario 2010, 151% x "high high 2010")

My only suggestion to BERR is that if they intend to publish the report for mass market consumption, they should do so in a joint venture with Andrex so that the report will at least have some utility.

Does the UK have a grassroots activist organisation like GetUp which is dedicated to public awareness campaigns through the media?

See the GetUp advert which should hit the Aussie TV screens https://www.getup.org.au/campaign/FuelWatch?id=357 that lampoons the Australian govt's response to have a price watchdog (that at most is talking of tackling a few cents of profiteering at the bowser).

We have government sponsored campaigns, here's a couple to give you a flavour:

Chewing gum litter public awareness.

A public awareness campaign, designed to improve the understanding of the "12A" cinema rating.

It reminds me of that song

We're busy doing nothing

working the whole day through

trying hard...:-(

€, thanks for posting.

This clearly illustrates some of the dire consequences of the unbalances between energy supplies and demand, predictability completely vanishes.

Institutional forecasts are used by many public and private sectors for their long? term planning. With the kind of input now provided by many institutions expect to see some astonishing results.

The world we are headed for will be defined by a completely, and as of now poorly understood, new set of rules.

In their high-high scenario they say :

"In the high-high price scenario, strong oil demand, a lack of investment and a fast decline in spare capacity is assumed to drive prices upwards until the point of demand destruction—when alternative energy sources become competitive and oil consumption declines. The oil price is then assumed to remain around this point in the long-term."

We can see in the high-high scenario the price stabilising in 2015 at 150 $

So they assume two things

-alternative energy will succesfully replace oil since the price of oil will not rise further when they will be used.

-They will be used on a large scale (to replace oil) at 150$ for some mysterious reason

Well we will soon see if their previsons are correct, maybe in a few days..........

Duckrichard,

Biofuels will NEVER replace oil regardless of price! Using numbers from Brazil, then a sugar cane field can produce about 0.5 litre of ethanol/m2/year.

To put this into perspective, then different countries will need to plant:

Japan: 220% of total land area

Denmark: 78% of total land area

USA: 34% of total land area

This is just field areas, not including supporting roads and processing plants. In other words we will run out of space before we can produce any serious amount of bio fuels.

In EIA's Mid Term Oil Market Report (released last month) biofuels are seen as growing to max. 2.5 Mb/d supply in 2013.

That's below 3% of what we are consuming today and even less than that, if one takes into the fantastical assumption that we'll have 100-1100 Mb/d of supply by then.

Even that amount of biofuels would require burning 3-5 times as much food to fuel as we are doing today. This comes at a very bad time, now that a World Bank report has just been leaked on food prices rising exactly due to biofuels:

So much for sustainable current biofuels (ethanol out of food grains).

We are burning food for the poor in our tanks and that is look to triple in the next 5 years.

The results will not be pretty if we do that.

Brace yourself for huge food inflation, if we implement this on a global scale. The price rises so far have just been a warm up. Farmers will sell to the highest bidders and with bio-ethanol subsidies in the US... well everybody can figure it out for oneself.

Once again the mistake is made that corn or sugar based ethanol is the only biofuel in existence. Biofuels will soon be made from just about any form of biomass via gasification or simply burned as boiler fuel as a coal replacement. The ultimate biofuel feedstock will be algae grown on land unsuitable for other crops and using brackish or sewage filled water unsuitable for other purposes. An area covering a square only 300 miles on a side could produce enough algae to replace all the fossil fuels used by America with some left over for export. To match current depletion rates we need to build 8 sq mi of ponds every day so we better get started soon.

Love it, "only" 90,000 square miles of dense industrial infrastructure. That's only a patch the size of virginia.

So, how do you DRY the algae?

How do you clean the tubes, how do you keep the wild algae out of the ponds, how do you... oh, never mind.

If the goal is to gasify the algae rather than maximize veggie oil production then open ponds using whatever spieces is natural for that location. Oil bearing algae float on top of the pond and and are easily skimmed off. Once the oil is extracted the remaining biomass could then be fed while still wet to an anaerobic digester. If used as boiler fuel then waste heat from the power plant could be used to dry the feedstock. Experiments with tubes look like an economic dead end compared to pond methods. Energy from algae is still an infant industry and different approaches will be tried to find which method is best. The potential is huge and could meet our energy needs using only 3% of the land.

$150 could be both demand destruction and substitution of unspecified alternatives. If those alternatives include unconventional oil, then their number may not be all that far off. If world consumption is cut 15% over the next five years, seeing tar sands as roaring in rather than trickling in might be a little easier since the market would be smaller.

Chris

Everything is of course possible. At least in fairy tales.

IEA is usually very very conservative and not prone to pessimistic outlooks on price, capacity or supply.

In fact, they have been consistently and with an increasing error on the upside. That is, they have had to repeatedly to cut back on their supply estimates.

What does the watchdogs (IEA/EIA/et al) tell about unconventional oil till 2013?

Biofuels: 2.0 ( or up to 3.5 theoretical potential) Mb/d

Unconventionals: 2-3 Mb/d (optimistic)

Even if all liquids consumption fell to 73 Mb/d (-15%), unconventionals are at max c. 7 Mb/d in 2030 in the optimistic IEA scenario.

I doubt that is enough, considering mature oil field decline rate of 5% p.a. (IEA current figure).

I suppose though that the optimistic 2030 scenario is based on low prices relative to $150.

A high price makes all kinds of stupidity financially attractive. We are willing to pay a high price today to fuel a car that won't even exist in 15 years when we might be much better off cutting back enough now so that we don't encourage tar sands and other foolish schemes.

Chris

Indeed. But there is a huge vested interest in BERR NOT altering its forecasts; when it does so, thousands of plans for everything from motorway widening schemes to village centre speed bumps to new airport runways (one of my pet beefs) will need to be suspended, reviewed, redrawn and in many cases remitted to the waste bin.

That means telling the local stakeholders what is happening to these schemes and why. At that point the Government will have no option but to admit we're facing the national emergency signalled by Euan in his recent post on the future of UK oil and gas.

Given the time needed for the Government to get a very large number of ducks into a row before it can do that, I suspect that BERR will have to carry on gritting its teeth and standing by this patently silly forecast for quite a while yet.

Here's hoping that someone in there is at least trying to get their head round the new set of rules.

I am constantly amazed that people put a lot of faith in the government in reguards to planning for the future.

Governments are consistently BEHIND THE CURVE as one sees in the report above. "Policy" is a response and not a strategy. The governMental question is not: how do we plan our country's future in light of falling FF production, but: how do we react to falling production and rising prices? Since there haven't been major shortages at the pump, there is no reason for the govt to react, now, is there?

Cheers, USDom

That doesn't have to *always* be the case. And it's not even a question of money. Look at Cuba. They managed to restructure their oil use and food production (with pain, but no starvation) after the fall of the USSR. (Contrast to North Korea which doesn't seem to have done so well.) And in 2004 (year before Katrina) they had a massive hurricane (Charley I think) hit the west side of Cuba and destroyed thousands of homes. But they were prepared and moved about 1 million people (almost 10 percent of the population) out of the way ahead of time. Not a single person died. (The contrast here is obvious!)

It's not an issue of ideology, it's an issue of will. It *is* possible to plan ahead, to have standing procedures to deal with problems and to do so even when resources are limited. Some western countries have been capable of this during certain periods as well.

So, the problem isn't government in general, it is government in particular. :)

This being Independence Day it is appropriate that Americans have a long tradition of not doing what the government at any particular point in time tells them to do. The Revolutionary War and the Civil War are two big examples of how far some Americans have gone in defiance of the central government. There is always a certain percentage of our population who will always defy evacuation orders. GOP ideology is rooted in the concept that government is incompetent at doing anything other than punishing wrong doers. It is up to the individual to deal with pending natural disasters in their own way. If what they do or don't do leads to their own death then it not the Governments fault. Their failure to provide evacuation assistance to the poor of New Orleans was completely within accord with GOP ideology.

The history of Cuba has been one of dictatorships going back to the late 1490s. It has not been a culture of freedom of individual choice but one where defiance of governments edicts have led to swift punishment. When Castro gave the order to move out with the government providing nearly all the transportation then the people moved out. Any deaths which happened during the storm then are the result of not following orders and are not counted as storm caused deaths.

I love the way the GOP is selectively picked out here. Excuse me but wasn't all local and State government democratically controlled, or were they all under some GWB hypnotic trance. When will all of you partisan people realize that neither party is willing or able to do the square root of f@#k all about any problem which disturbs the status quo. Westexas is right to advise people to plan ahead. The government will only be in the way.

You seem to be assuming that I am defending Cuba as an ideological example for the world. I certainly am not. (And in case there's any confusion, I have large disagreements with the cuban government if we really need to get into that.)

In fact I will take a very simple position. The failures and uselessness of the Cubans, surely, can be easily disproven. Let's not waste time talking about it. Money talks. Rather than trying to disprove something through speech, why not disprove it through action? A rich country like the US can surely put to shame the health care and social system of Cuba, no? Enough to make it look pathetic?

Why not setup a superior system to make them look like nothing? No arguments are necessary. Surely a rich and flexible system like you have in the US can make any third world health care system look like nothing?

Why do we need something so costly as universal healthcare for actual conditions, as long as we have plenty of pharmaceuticals to make us feel happy? Medical conditions that are contrived and marketed, and misery certainly abounds enough, and we've got the drugs to make us realize how miserable we were, side effects be damned. Why shop anywhere else?

/sarc etc.

Dictatorship? Really? Back to the 1490s? Seriously? You're going back to colonial times. All the original popluation was actually put to so much slave labour they all died. So new slaves had to be brought in from Africa. I can't believe you'd even think to blame *Cuba* (or any south american country) for the genocide that the western countries caused. (Ok, the US isn't Spain, fair enough, but when they got their turn, they sure made up for lost time.)

Castro may be a bastard (and again, I disagree with a lot of his policies) but even the US has admitted (US intelligence, State Department, etc.) over the years, that as much as they don't like him, he really is *genuine* in his beliefs. (They may be wrong, but he's not pretending.)

Most people in Cuba are doing better than any other Central or South American country. Again, why not disprove them? Show them your system works better? Surely you can, right?

Chris

So, let me get this straight. You're blaming Castro for having sufficient authority to get everyone to move out of the way of the hurricane, and subsequently survive. And perhaps the soldiers weren't always nice about it. I'll grant you that. So, compare that to Katrina? Where would you rather live?

Btw, it wasn't that easy. A lot of the regular Cubans were worried about leaving because they didn't want to leave their fridges behind (worth a lot and they were worried they might get stolen.) So, the soldiers even arranged to take their fridges too (I assume they did it to avoid panic and having to argue with the citizens, but still, kudos.)

We can disagree with the methods, but the fact is Cuba was organized, not just at the federal level, but at the local level. Frankly, this is the sort of thing I could imagine the British doing back in the 40s. You can't get that many people to move without local organization and *support*. (Otherwise people will ignore you or tell you where to go.)

Again, it's easy to criticise any evacuation. But here, everyone lived. In the US, thousands died. They had no plan, or if they did, they didn't know how to do it. I would feel much, *much*, safer as a tourist in Havana (and yes, I have visited there before) than a tourist in Mexico or an American citizen living outside the beltway.

I think you meant "was."

I thought that you put that particularly well and that it is worth restating.

France planned ahead and invested in rail and nuclear. Brazil planned ahead and now: Brazil is the world's second largest producer of ethanol and the world's largest exporter, and it is considered to have the world's first sustainable biofuels economy. Norway planned ahead setting high taxes on domestic oil consumption and saving the tremendous profits for a rainy day.

Whether or not Brazil's ethanol or France's nuclear industries are truly sustainable is of course subject to debate, but the glaring lack of planning by other nations is clearly in sharp contrast.

-Tim

That would upset far too many wealthy people. I can hear Orlov "It may not be profitable to slow collapse".

I think Orlov is on to something.

Yes but doesn't this BERR report have to work on the basis of whatever comes in from it's "call for evidence"? I guess they haven't exactly gone out of their way to call for evidence from Simmons etc or from anyone on this site. But then perhaps we could at least recommend to them that they do add such people to their mailing list and see whether the outcome is an increase of reality?

"High High" is the new "Low Low".

Funny how the BERR mysteriously flattens the price growth curve to turn it into some arbitrary steady-state paradise.

This is a normal economist practice in accounting it seems. In some ways it makes sense, as future is unknowable so the best one can do is guess. They just use a wrong reference framework to guess from.

See EIA for similar estimates from history:

To EIA's credit they've been wrong on the upside and the downside.

Great graphic. It highlights two things:

1)that 'steep discount rates' also work backwards. In addition to discounting the distant future in favor of the present, we also discount the distant past in favor of the present. Its like one of those illuminated maps of the world with a moving light on it showing regions with daylight - we quickly lose our attention to those areas in the dark - just behind us and just before us.

2)As Taleb documents in Black Swan, we collectively don't know how to model 5+ standard deviation events, because by definition, the things that cause such events aren't (and can't be) factored into our models.

The BERR forecasts are not much different than the other global institutional forecasting models, and little different than historical wall street consensus. It's OK to be very wrong, as long as everyone else is very wrong too. Its a career ender if you are very wrong by yourself....

... or very right by yourself.

Considering that even the vertical axis scale of that graph is out of date, I thought I would look for more recent 2008-ish numbers.

http://www.eia.doe.gov/emeu/steo/pub/jun08.pdf

And their short term energy outlook is up to the same old tricks.

TOD sidebar tells me that the price is now pushing $146 per barrel, so this alone pretty well shatters the validity of the EIA prediction. But I'm not sure if you could convince a 3rd grader of these graphs. It just doesn't 'fit'. While there could certainly be other factors that make it right... occam's razor

Do more British corporations/individuals make future plans based on BERR forecasts or theoildrum.com forecasts?

My guess is that most Brits future is based upon data input from BERR. Energy prices and supplies are vital parameters in planning the future.

given every one seems to have been caught out its hard to imagine what they thought was going to happen. the haulage association gets nothing but complaints from its customers on prices so they optimised themselves around this fantasy land.

what is gauling is the lack of influence bodies like TOD and ASPO have. the ideas and analysis have been floating around with increasing precision for decades.

I suggest Berr contract out scenario design to TOD europe.

I'm serious.

Boris

London

I am going to write an energy policy for Europe.

We've just started working in on a Dutch energy scenario as PeakOil Netherlands. It can be interesting to compare notes I think.

if you need donkey work done I can spare a few hours a week.

I'm sure others can as well

Boris

London

I'l publish a draft here with blanks - and so that's a good time for the TOD community to pitch in with their expertise and data.

Thanks

Euan,

I've gotten some good reviews of the production/consumption graphs available at the Energy Export Databrowser.

The graphics for the UK and the North Sea as a whole are pretty compelling:

Feel free to use anything that suits you.

-- Jonathan

From 2006 to 2007 : Imports decreased by 60%

Must be getting tired but I can't see it. Eyeballing the graph it looks like consumption decreased slightly and production also decreased, so do you mean exports decreased 60%??

The red bits are the imports in 2007 a small part of the total consumption, in 2007 we imported less than 2006 - wait, that will soon be rectified! ... despite Gordon Brown's optimism.

Jonathan - its a nice site with good charts. Are you updated to 2008 BP stat review? Are you using BP data? This can save a lot of people a lot of time.

Euan

Euan,

Right now the databrowser uses the 2008 BP Statistical Review Data. You can review my treatment of the data by clicking on the "Data" link on the databrowser page. On that page I also have links to older versions of the Statistical Review and my own ASCII CSV versions of the BP data. It is absolutely my intention to save a lot of people a lot of time by doing a decent job and making it available.

-- Jon

That would truuuuuuuuuuuly be a waste of energy considering the energy illiteracy among European politicians.

And if you write it, it should be complemented with a huge dose of anti depressives, those of the size of hockey pucks and which shall be swallowed whole. ;-)))

Rune

Do it!

When they finally realize that they need a plan and don't have one then high quality, ready made, thoroughly vetted plans will be a godsend.

-Tim

I've already emailed suggesting this and offering my services. I've experience in scenario design and what has been presented are not really scenarios.

It will be interesting to see if a reply is forthcoming.

Let's not be too hard on them. They have not forecast for 2008 prices. So we need to wait till 2010 to see if they were correct:

2010

The report had to have been written by economists. Only an economist would give $45 oil from 2010 to 2030 as a possibility in a report issued when oil is well over $100.

I suspect they have other scenarios and contingency plans that are not made public so there is no way to know for sure if they are really in a fantasy world based on what is released for public consumption. The sudden embrace of nuclear was definitely a radical departure on what had been the norm over the previous 20 years. Also maybe worth bearing in mind that after the market adjusts to a higher price regime and alternatives are found for a lot of current oil use and waste and inefficiency is eliminated prices may drop again somewhat even if the longer term trend is upwards.

Prices will ultimately drop if we manage to move to a sustainable renewables based economy.

Right now that future is vaporware.

But let's assume it's not:

Is it likely we can seamlessly shift from where we are now to where we want to be, in TWO years?

I think the chances of that happening is similar to the chances of aliens landing and offering us dilithium crystals to power our civilization.

Ummm, pretty funny.

Is that dollars or pounds? If it's pounds,they aren't far off.

dollars, pence, pounds, dollars dollars

right?

Well, clearly the thing to do is get as many eyes on this "forecast" as possible. Folks need to see how feckless the government is.

Then you must hope the locals won't remember the oil was sold for $10/barrel...

When you prepare a forecast that suggests a radical break from past expectations, full of bad news, that shows no evidence of copying the projections of popular thinking (including trendy analysts that copy one another), many will want to trash it. --It doesn't matter how right or logical it is, people see it as a thought crime, a personal threat and feel threatened. There are brilliant British analysts who can give you a proper oil price forecast --and they were not allowed anywhere near the office that prepared this report.

Having interacted with so-called analysts from China, I once thought it was only they who parroted the 'party line.' Truth is, we do the same in democracies too.

Gordon Brown & Co. are intelligent and aware of the real petroleum supply situation. Surely, they know better than we do that this forecast is pure, politically-driven bollocks -- but Gordon Brown, Bush, Obama, Sarkozy, etc. don't have a clue how to control the people if they dare tell them the truth --so they outsource oil price forecasts such as these to intellectual sell-outs, who are then paid handsomely to put the public to sleep. The public, always an ignorant animal at best, fully appreciates being patronized in this way.

Just count yourself as being among the 1% that uses humanity's gift of self-awareness and know that this is just the way things are, unfortunately.

How do you know they are aware? There are intelligent people on this site who share the same information but come to starkly divergent doomster or cornucopian conclusions. Neither intelligence nor information nor their combination can logically necessitate awareness in the sense of understanding and coming to terms with the implications.

In my experience the authoritarian mentality would not know what the truth was if it was within a second of smashing into their nose. Their mentality does not ask "is this true or false?", as the scientific mentality does. Rather it is totally preoccupied with "is this friend or foe?", or "is this convenient or inconvenient to my personal advancement?". This is the sort of person that makes up the dominant elite of a decadent society and thereby damns it to all but certain inevitable doom.

What do you think, will the price have spurt up - and then plateau for 1 - 2 - 3 years, and then again spurt up, or will there be more gradual climb up ?

Or is predicting this as difficult as predicting the price for Berr ?

I think the precarious state of the financial system itself is becoming the more dominant factor in determining the price of oil. The massive inflation of the US money supply of the last decade (or more) is now coming home to roost in the form of a collapsing dollar.

In predicting oil prices, you are predicting not only demand/supply fundamentals as we reach peak production, but also speculative effects (small) and above all, fiat currency fluctuations/collapse. It's very difficult I think, and depends on things like interest rates as much as production figures.

One may recall that the UK wants to tear down a bunch of houses North of Heathrow to add the 3rd runway, by ~2020 to handle the expected large increase in air travel.

At least these estimates are higher than a few years ago, in which they said:

"A2.12 Aviation fuel prices

The price of oil is assumed to stabilise around its current value of $25 a barrel, although in the longer term it may decline. As fuel is approximately 10% of costs even a 50% change in the price of oil has a modest effect on air fares but nevertheless a significant one compared to other drivers."

Sounds like an "instant stranded asset", unless they want to close the other London airports about that time and centralize all air traffic at Heathrow.

If 50% is "significant", what does that make 600% (and counting)? Apocalyptic?

12 times significant! ;-)

These sort of forecasts feed into each other, the costings the Government suggests here will have been based on IEA forecasts, and ignore the fact that they were heavily leant on to produce the figures they did.

In general, it works like this: Governments set up and finance an intergovernmental organisation, which of course since it is financed by them is subject to their pressure, so it turns out pretty much the result they want.

Because these are the figures used by major governments, they become the official forecasts, so any presentation of planning has to be based on the medium case to be considered.

The relevant departments then make their own forecasts based on these, so for instance there is a 'demand' for a new runway, as central forecasts influenced by the IEA's erroneous oil price forecasts show an increase in air traffic, so the traffic forecast then will automatically be wrong, and the runway planners are obliged to base their build on this, as they do not have authority to substitute more realistic projections.

This sort of institutional problem has been known for many years by military planners - those who do not at least partially correct for this institutionalised wishful thinking are known technically as 'loosing armies'.

In any case, it is clear that oil prices must fall, as projections indicate that several trillion barrels of oil are due to be pumped from the North Sea, problem solved!

The UK's transport planning is presumably based on BERR's mid range forecast for oil prices, which supports projected road transport growth of 28% by 2025. Fat chance.

But building roads and bridges to nowhere is standard operating procedure for countries trying to stimulate their way out of recession.

What will the UK do this time - aircraft carriers? Perhaps insulating the housing stock would be a wise move.

In a transport debate in Nov 2007 (which I've referenced before) Gov't oil price assumptions quoted for long term transport planning were $65/bbl in 2006 falling to $53/bbl in 2030. Enough said.

Yet more North Sea nonsense, this time from Malcolm Bruce, Liberal Democrat. Quote from today's P+J:

We might expect this kind of statement from current Gov't but Lib-Dems recently showed a little more understanding by stating in Radio 4 interview a few weeks back that "Gov't long term oil price assumtion of around $70/bbl in 2020 for transport planning was ridiculous." Looks like New Labour are not the only UK political party taking Peter Odell's numbers at face value.

zceb90.

Do you have a link?

Bruce is my local MP.

I will contact him next week.

No link unfortunately - P+J online appears to only cover selected columns from the hardcopy version. Column is on top left of page 12 of Press and Journal dated July 04, author is David Perry, title of column 'Offshore Industry Hopes of Incentives.'

If you send me your email address I'll scan it in for you, my hotmail addr in my TOD profile.

Chris

Thanks.

Mike dot Core at hrhgeology dot com

The Upstream Online table shows prices in 3 years around $55. Is this where BERR get their numbers from?

If I understand this future price correctly - and I probably dont - , the UK could buy ahead all the oil it anticpates needing in 2011 at this price. Civil servants pension funds and maybe even thier bonuses and raises could be linked to the success of this strategy. They could put their money where their mouths are, walk the talk?

Fat chance? Slim chance?

Ramps! Du you refer to this table?

http://www.upstreamonline.com/market_data/?id=markets_crude

That is moving average prices. A barrel of Brent has cost $56 on average the last three years. This has nothing to do with future prises.

Yes, that was the table, so thanks for pointing out my mistake Olle. Never again will I give the UK government the benefit of my own doubts!

This is apparently pulled out of a hat.

What is most surprising is that this joke is published by the same department that published the report behind your State of Emergency post not long ago. Apparently they must be written by different people that don't talk to each other.

And in Sweden, the rising oil price is always (for the past year or so, at least) because of the falling dollar. Against which currency has the dollar dropped 50% the last year?

"And in Sweden, the rising oil price is always (for the past year or so, at least) because of the falling dollar”

...and political tensions in Iran-Israel, underinvestment, the growth of China, the new Government and of course also the mother of all evil; The Greenhouse Effect. A useful scapegoat for everything from ingrown nails to the big bang…

But there is at least one exception. In DI (www.di.se) for a couple of days ago. Jeffery’s ELM took centre stage as explanation for the escalating prices. For some reason this article is not on line, but I can e-mail (I scanned it) it to you if you like.

Olle, can you also mail it to me: rekkaa at gmail dot com

Thanks!

SamuM, I've mailed it to you now. It is 6,4MB. I hope g-mail can handle that. I think it is a major break through in Swedish MSM. Can it be put on some sort of “document farm” or something like that?

Thanks Olle! Maybe you can put it as a pdf to:

http://www.sendspace.com/

There probably are some online pdf viewing databases as well, but I'm not up-todate. I save everything locally as I'm not convinced stuff will always be online when I need it.

Hey hey Olle,

You might give these guys a shot The Memory Hole, Rescuing Knowledge, Freeing Information. They mainly do political work but it's worth a shot.

-Tim

Can you also email it to me at:

copeland@pt.lu ?

Thanks in advance,

Carolus.

Done! Hope you can read Swedish :)

What began as a half joking comment that I may have to buy an electric-assist bike for the commute to work is starting to look like a near term nessicity.

We're boned.

According to "News at Ten" last night the only thing we need do to reduce oil prices is to sort out Venezuela, Iran, Iraq, etc. Seemingly it is their (those bad corrupt foreigners) inability to manage their production correctly due to political malfeasance that is at the root of the energy crisis.

Interestingly, the reporter gave three options for reducing oil prices; conservation (yeah! good, but, not really practical), reduce speculation (minimal effect) and sort out the bad guys (bingo!, the solution).

The other interesting tid-bit (or meme) from the report was that thanks to future technology, today's difficult to get at/expensive to produce oil, will be tomorrow's cheap energy.

So there you have it, everything's cool, the BERR forecast's fine, no problems to be concerned about that can't be fixed by political will and human ingenuity :)

IN a local paper about technology and economy here in Finland, an editorial columnist is saying that oil is expensive, because US inventories are low and tensions in Iran are raising the premium. But fear not, FT syncrude is just around the corner!

Good grief.

I didn't know whether to laugh or cry when I read that.

How can these people earn their pay, being so far removed from the actual numbers on the ground and completely cherry picking their 'analyst' opinions which they quote. It's as if they are trying to consciously perpetuate a world view that suits their dogma - damn the reality and those pesky numbers. Measurements are all lies anyway, right?

I guess it could also explain part of the reason why some of the politicians in UK and elsewhere are so complacent: there's always a group of consultants and experts available who will tell you just what you want to hear, and nothing else.

Then it's easy to say you listened to the experts, and it was the experts who were wrong. Plausible deniability.

SamuM! Our media are usually as "brilliant" as our eastern brothers', but there seems to be a shift now: Read this one:

http://www.e24.se/branscher/ravaror/artikel_564653.e24

MSM has awoken.... to late as allways, but maybe we should be glad that the do not do a "Bagdad Bob" at least... :)

I reckon syncrude (CTL) will end up being a bit like ethanol/food for fuel. They'll be producing one or two million barrels per day by 2020, which will make little difference to fuel supplies, but because the BTUs will be worth a lot more as liquid fuel they'll bid up the price of coal deposits - in order to consume maybe 100 million tonnes of coal per year for feedstock - and thus make the coal used for electricity generation a lot more expensive.

Little effect on diesel costs, but higher electricity bills.

Hey hey SamuM,

That is exactly right, it cannot be put more precisely. The MSM is not consciously spewing out garbage that suits their dogma, but it is as if they are. There are several structural reasons that have driven news media to report in such an obviously flawed way.

The first is advertising and the profit motive. The MSM is a for profit business and it makes it's money from advertising, not subscriptions. That means that the product they sell is the audience, we are that audience, not the content. MSM produces an audience, us, and then sells it to advertisers who are looking to sell their own products, again to us.

This drives the MSM to create content that produces ratings which takes the focus off investigative journalism. Well researched pieces into complicated matters are boring, boring is bad for ratings. Juicy celebrity scandals and cheap sentimental tripe are the antithesis of news; it is mindless entertainment, this is good for ratings.

The advertising link also drives the MSM to produce a higher quality audience which is inversely correlated with high quality news. A high quality audience is receptive to advertising. The audience needs to be put in the mood to buy product. Critical thought is bad for advertising as is unpleasant news, it puts the audience in the wrong state of mind to buy things.

The second things is deregulation with particular emphasis on mergers. Fewer players has created more homogeneous news. The massive consolidation of news outlets in the USA has lead to a thinning of the costly support staff, investigative journalists, and an increase in free press releases from government, industry, and politicians being broadcast as if it were news. This helps the bottom line quite a bit, but it is undesirable for us

consumers, urr... I mean citizens.Lastly self censorship thins the heard of responsible journalists. Dedicated journalists who are committed to a free and open press are expensive to keep on the payroll and they don't drive ratings, thus they never get promoted while pundits and hacks rise through the ranks in direct proportion to the showiness of their show. People who want to make a career of it adapt to the environment, people who want to make a difference find something else to do.

There are some other factors, but I think that covers it pretty well. As a corollary, politicians are driven away from boring and responsible positions and toward smart sound bites and flashy slogans. It's the system that we have built that creates these results, if we want different results then we need to build a different system.

Sorry for the lengthy post but a sound bite was insufficient for this involved and complicated issue.

-Tim

Peak oil and global warming are not the problem, they are the result. The problem is a collective action problem and an inability to make good long term plans

Euan, off-the-cuff, where do you feel (gut-wise) the UK will be regarding energy, in say 2010, 2015 and 2020? Not so much in terms of price, but in terms of availability and affordability (ie. manageable, unmanageable, out-of-control, unavailable regardless of price, etc.).

As I understand it, the UK is on course for a 40% reduction in its electricity generation capacity within 6 years. Have they any chance of filling that gap within the time-frame?

Burgandy, by 2010 I'd say full blown recession and chaos. Trade balance so bad that the pound is in free fall - the only glimmer of hope here is that we join the € - likely at parity of worse. Unemployment significantly higher, wide spread strikes as workers can no longer afford food and electricity and gas and fuel. Memories of holidays in Spain will fade as a large tranche of the population working in public services and the poorly paid part of our service economy struggle to survive.

One positive point though is that affordable housing will be available in abundance - so nurses that couldn't afford a bed sit two years ago may be able to pick up a trendy 2 bed flat for less than £40K.

The only hope is that beyond then the "government" identifies the problem and places the country on a "war footing" to rebuild our energy and food producing infrastructure. So 2010 to 2015 could be the birth of a new era. Failing that, power shortages, rolling blackouts, fuel and food shortages and lawlessness.

The seriousness of the decline in UK plc is obscured by adjustments to the make up of the FOOTSIE. Banks, builders, retail, leisure etc have all taken a huge hammering - the UK stock market has crashed. This is masked by the huge number of very large energy and mining companies that now dominate the UK market - these international companies have very little to do with the health of the UK economy.

So, I assume that was your positive-looking scenario-

What's your middle and negative one?

Cheers from Munich..

Made me laugh. Sad as it is, it made me laugh.

I completely agree.

But you left out one troublesome little thing and that could be a wave of resentment leading to a serious rise in the BNP. I do not doubt that they know they need economic hardship to make serious headway.

This is a very possible scenario as people will ultimately feel betrayed by the Major parties (Lab,Con, LibD) - Especially in England. Scotland at least for now has a more civilised form of Nationalism.

If that kicks off in England, it will very very bad.

On another point, the only way that BERRs prices can come even close is if demand destruction and conservation is so great that it gets beneath the depletion curve.

I've been thinking lately that oil prices probably won't get any higher that $150 - in 2007 dollars, that is. But it wouldn't suprise me to to see $300 oil in 2010, thanks to a sliding US dollar.

Can I lay claim to the concept of "Localised Demand Destruction" - the sliding dollar and sliding pound (products of triple crashes in housing, stockmarkets and credit markets) create very high nominal oil prices in the US and UK, while prices stay put in other currencies.

This creates rapid demand destruction in the US and the UK, while the rest of the world takes up the slack. Once started it becomes a positive feedback loop as increasing oil prices lead to accelerating economic collapse, and further falls in the dollar and pound.

Eric Janzen at itulip.com has some flow charts illustrating this concept.

Hi mudlogger,

I agree, since typically when economic conditions deteriorate then people look for scapegoats and it will be groups that are readily differentiated by any means.

Tonyw

I monitor their site on occassion. You need a clothes peg and a handy bucket.

1. They have one of the most accurate and realistic sub-sites on Peak and its consequences.

2. They relish the coming downturn and realise that nothing will happen while there is enough money and growth around.

3. It is the fastest growing political website in Britain and now routinely has more hits than than any of the other websites of the major political parties and it is clearly being increasingly viewed by hitherto 'small c' conservatives. Where before, such people would hardly ever bother to have tuned in to main-stream politics, they now look at this site. This is a common refrain: 'I used to vote Labour since it was the party of the common man, but now I will vote BNP'.

4. It has cleaned up its act (a veneer)and is almost certainly going to grow in size and support.

5. I blame Labour for this. They have essentially disenfranchised, nannyed, patronised and walked all over the bed rock of its constituency. Which was the former White Working Class Male, while Labour went looking for a more sophisticated constituency - basically to win votes in the South East. It also believed they were so loyal that they would vote for a donkey if it wore a red rosette. It looks like they will lose on all fronts: The South East will abandon them, The north is being driven to the BNP and Scotland tipped up the apple cart.

6. This is a greater problem in England. Scotland's Nationalism , though is more civilised, but Labour in Scotland screwed up royally, loosing power because in its arrogance, it thought it was the automatic and natural party of government.

A major recession could seriously mobilse futher and wider support. The rising anger is palpable and will spill over.

And this is only the beginning...

I (and Chris V) attended the 1 day depletion workshop in Edinburgh in April 2005 where Campbell, Simmons and Skrebowski were among the speakers. The audience I recall was a bit over 100 of which no less than 6 were BNP.

Yes,

They understand Peak Oil better and deeper than any other party and that includes the Greens.

I think they rank it as their best weapon: They understand that old northern saying:

'when poverty knocks ont' door, love flies owt' window'.

They are also patient. They will wait on the election after the next (circa 2015) because by then, we will be deep in the midden.

Assuming we are still allowed elections by 2015...

Euan;

I think of this as the "Argentina Scenario".

What happens when your debts are over 100% of GDP, you no longer export anything of value, you are dependant on imports of food and energy to survive, and a crisis then leads people to abandon your country as an investment destination?

What is the pound worth when nobody wants to invest in Britain anymore?

I think that's where the € option can save us.

I don't have figures to hand, but I think UK government debt as % of GDP is below that of Italy and Spain - so by that measure right now we are in better shape.

Problem is I don't believe the GDP figures since inflation seems to be running over 10% much of the illusory growth is cost increases.

High trust used to be a cornerstone of Britain and I think this is one of our major assets that Blair, Brown and New Labour have pissed away with spin, lies, smoke and mirrors. The subject matter of this post being a good example.

Euan, do you think the Government will actually acknowledge the real source of the problem in 2010 (and it's at or near election time which will complicate things)? My feeling is that Gov't and MSM will continue to pretend that it's and economic crisis rather than an energy crisis...and probably well beyond 2010.

thx Euan, scary visions you relay here.

This BERR report how does that correspond to the good-intentions and seemingly awareness of the All Party Parliamentary Group on Peak Oil and Gas, with their own web-page and all : http://www.appgopo.org.uk/

It seems like the authorities in UK is suffering from a severe attack of cognitive dissonance , any reflections ? Are BERR aware of something called "APPGOPO" and what it's purpose is ?

That is just what I was thinking.

And one of Labour's slogans was 'joined up government'...

It is exemplified by one branch pursuing carbon reduction and yet another branch pursuing the building of a 3rd Runway at Heathrow.

Joined up government? Just join these dots.

Firstly, NuLabour is a front in secret alliance with the BNP to generate the needed economic downturn. Secondly, to minimise the expenditure on the radiation chambers (or whatever the 2010 equivalent of gas chambers will be), the more runways the merrier for all the Muslims handing us their money to get the hell out on one-way tickets.

You don't seriously think it won't be the Muslims who'll get the blame for the oil shortages? Expect a sharp decrease on uk streets of niqab'ed women and burly men sporting black beards with white shalwar kameez. And in the absence of advanced religion-detecting software, even the most Gandhian of Hindus will be sadly caught in the deadly crossfire too. Oh, I've just woken up....

Paal,

I think that BERR is actually saying that they have no idea what the future will be - in a 'politically correct' way. Just like the KSA indicating that they can't pump any more oil by offering an extra 200,000 bpd.

I have been to every APPGOPO meeting and I am sure that the people in power know about an eventual peak oil, the problem is they don't know what to do about it, the free market has always worked in the past - they just hope that the current situation is caused by every other possible explanantion of the current ongoing rise in oil price - I do not expect a UK government to admit to world peak oil, our Prime Minister still thinks there is more oil left in the North Sea than we have consumed so far - and he will probably won't admit that it is flow rates that are the problem and that the reserves have nothing to do with peak oil.

In reality, most MPs don't have any power, and the free market probably won't allow us to carry on as we are used to.

A few MPs of the group with a majority, currently the Labour Party, do have some power - they are the 'ministers', and they usually react to problems as they occur and pass laws to ensure a free and fair, non-corrupt, marketplace.

The various political parties each have a manifesto of good things (mainly resulting from economic growth) that will happen to you if you vote for them - except for fringe parties that don't get voted into power these lists do not promise things like peak oil + gas + coal, falling house prices, recession, failing banks, no pension payout etc. BTW the UK BNP party is VERY Peak Oil aware!!!!

In short, the main UK political parties will never align themselves with bad things until the bad things happen - eg: the MPs know that the third runway at Heathrow will never be built but they have to try and make the economy grow until it won't, because growth is what allows us in OECD countries to live the luxury lifestyles we lead and is the only thing the people will vote for.

In the UK we live in a free country and the Governments don't tell us what job to do, where to live, which car to buy, which fuel to burn, what to use to insulate our houses etc - the decisions are left to the individual and it is the individual who will have to make appropraite changes in the future and it is the individual who will ulimately have to pay the bills.

It is the individual, not the Government, that we need to quickly educate - but I have no idea how.

This is a solid answer xeroid, thans very much !

I believe there is some truth in all of your reflections above.

Todays governments are way to "advanced" one may argue, it's not like the good old days when the king "knew" everything worth knowing/deciding. anyway

Your conclusion is "king" .... it has to come down to the Individual ......b/c governments are made up of such.

OTOH what amazes me is that the fringeparties that has little to loose in todays situation, are not playing this Peak Oil-card a little more noizy, b/c they should know that they will be decleared "gods" in the span of few years, WTSHTF for real.

For one thing - http://transitiontowns.org/

For another, an entirely new party, which I am working on. Could be called the, oh, I don't know, perhaps the Arggghhh!! Chaos!! Party?

That's only two years away.

The inertia of the UK economic & social system is immense, so surely this huge change in just two years is unlikely?

Five or ten - maybe.

Euan, you are a serious poster / observer in the energy field ... if two years pass without Mad Max arriving then the opposition will claim that your opinions are worthless.

Eaun would appear to be quite safe.

Apart from any considerations of peak oil, the projected Government finances are in an entirely unfit condition for this stage of the economic cycle - the wheels will come off.

Brown has spent the financial legacy of this country.

They can't even get their accounts passed by the auditors.

Add peak oil and 2010 is a very long way away.

A few points to consider:

1) UK public finances are stetched.

2) UK trade deficit is around £5bn per month and rising.

3) Families in the UK now owe a record 173pc of their incomes in debts.

4) UK Manufacturing base has largely moved 'offshore'.

5) Tourism has large net deficit - aviation is estimated to account for £19bn pa net deficit.

6) UK has to import nearly 50% of food.

7) The once 'bright spot' for UK trade balance, financial services, is very vulnerable to the credit crunch and global economic downturn.

Don't forget that the above is the position at the end of 3 decades of high North Sea oil and gas flowrates and following a decade of economic growth (New Labour's 'miracle economy'). Unlike Norway, for example, nothing has been put aside in the good years to ease the situation in a downturn.

Before N Sea oil and gas production UK endured a series of economic crises in the 1960's and 1970's which involved draconian exchange controls (max of £25 or around $70 could be taken abroad at one point), emergency loans from IMF etc. These problems arose despite UK still having a large manufacturing base at the time. Today that manufacturing base no longer exists, the trade deficit is unsustainably large even without large scale energy imports and a whole generation has grown up who have never known hardship and who expect the welfare state to take care of them whenever they need it.

I'm with Euan on this one - the 'wheels are going to come off the UK economy and its energy security'...big time. I agree the exact timing is uncertain but once the process gets underway things could well unravel fast (just as they did in the IMF loan crisis decades earlier). This time, however, there's one big difference - N Sea resources can no longer come to our rescue - we have burnt our way through them in just 3 decades!

AND,

We've got the private equity bubble yet to go pop. This will be an interesting mess to pick up.

Not to mention PPP (public / private partnership) whereby many billions of pounds of debt which should be on Gov't books has been 'hidden'...for the next generation to pickup.

zceb90,

I mentioned that on another post, regarding the NHS. They used to be called PFI's i think. The deeper one digs the worse it gets. It really does make you wonder whether it is worth bothering with a pension plan. But the uk economy is fundamentally sound (or flawed).

Here is Sunday's Independent on the UK economy:

http://www.independent.co.uk/news/business/analysis-and-features/were-ri...

It could have been written by Euan!

there just going to have to keep those old plants going come hell or high water.

Boris

London

Hmmm.... Some of the nuclear plants are already mysteriously making unscheduled shutdowns. Hinckley, which provides upto 16% of the Grid's power, went down for some reason the other day. Keeping all the power plants running may not be quite as easy as it seems (especially when there's profits to be taken into consideration).

IIRC, if it wasn't for the availability of imported electricity from France, Britain would already be suffering periodic power shortages. More pressure on the Trade Balance.

It seems that the various problems (finance, energy and climate change) are bifurcating into a myriad of interconnecting problems. All attempts to solve the individual problems and their offspring seem to cause further bifurcation. It's like civilisation has caught a virus which is multiplying chaotically through out its system.

come hell then.

I was hoping we were all going to be proved wrong.

Boris

London

Hell AND High Water.

(Hell tends to melt the ice caps.)

Perhaps the real 'problem' with climate change is that so few members of the educated public realise that energy scarcity is a far bigger one. Alas, for every article in the MSM on peak oil there are still over fifty on global warming.

My hunch: in five years time the ratio will have been reversed. Though the party may well be over by then anyhow.

Carolus>>>Thank you for your comment. Now would you please tell al gore to stop wasting everybody's time with clearly a problem of much less importance!

"Energy scarcity is a far bigger one"(than climate change).Energy(lack of),population(too much of)and climate change(main joker in the pack)are all part of a monster shit happens scenario.They are all interconnected.No use tackling one at a time.

Climate change is creeping in through the back door while nobody is noticing, while the energy crisis is knocking on the front door and has a gun pointing.

Put another way, climate change is not perceived to be costing us anything (yet), but is generally accepted to be happening. The prospective oil crisis has been so far been denied by most, but is suddenly biting without warning.

The oil situation is more complicated because folk cannot distiguish between easy cheap oil, hard to get expensive oil, reserves and flow rates. I have personally given up trying to explain to people that the problem is flow not reserves.

I think all one has to do is look at discovery data. If memory serves me correctly, something like 14 fields (out of 1000's) produce 20% of all our oil pumped today. All but three of these are over 50 years old. Canterell is the latest, and that is 30 years+ old. This data is available in the back of Matt Simmon's book TITD, which I have lent to someone so can't check the numbers.

As thirra noted above, you are seeing through a glass darkly... or not at all.

The burning of fuels is the cause of Climate Change.

Climate can flip by 7C in a decade.

Peak Oil cannot and will not destroy mankind or result in our extinction. Climate Change CAN. At 6C higher, it's something that becomes fairly likely.

The Arctic melt going on since 2005 is resulting in the release of methane from the permafrost and ocean, unexpected till the *end* of this century. This melting of the permafrost extends up to 900km from the coast.

The solutions for both are basically the same, so ignoring one over the other is really stupid since we can solve both at the same time, and by doing so concurrently we can be more assured of making the right choices. That is, choices that address both and not just one.

Simple logic says your comments above make no sense.

Cheers

Time for an Oil Drum report on the likelihood of electricity blackouts in the UK in the coming winter.

In 2015 the UK has serious capacity gap in generation. The loss of generation capacity from the closure of nuclear and coal plants gives a big drop then. If one allows for a maximum possible (supply chain constrained) build of renewables we will still need some 30GW of gas or distillate powered generation to meet demand for a cold winters day. I believe that the Government fully understand the situation, and hopes that new gas fired statiosn will plug the gap. The availability and price of natural gas is critical to the UK over the next 15 years. I hold out little hope for business as usual for us.

Please remember to hit the Digg button above. It is important that as many people as possible can see the assumptions behind a lot of government thinking.

Most of TOD's UK-focused articles are posted at http://www.housepricecrash.co.uk/newsblog, where the audience is already of a bearish mind and thus quite receptive to the ideas herein. Hopefully you're getting a few hits from them.

Euan, it's only fair to mention that the projections also include - for the first time ever - a "High High" scenario which sees prices rising to $150/bbl by 2015 and staying there. This might be closer to a "Low Low" scenario for most people on this forum, but it's a radical change from the previous projection published just in February . My guess is this move was finally triggered by the forthcoming IEA forecast update.

There's a huge amount of institutional and political inertia behind the Updated Energy Projections (UEP), despite the fact they've proven laughably wrong in recent years. However, this High High scenario will now need to be considered in almost every UK government cost benefit analysis and policy impact assessment. They might not be going as far as TOD regulars would like, but I think this is potentially a very significant step.

As it happens, I was browsing through earlier forecasts just yesterday, and thought I would share this quote from a report published in 2000:

Fair comment Munin. But the fact remains that the Government and government departments remain so far behind the curve of this very rapidly evolving situation that we as a country are effectively screwed by their ignorance and indifference.

This notion that energy prices are going to stabilise in future at some higher or lower value relative to today betrays a staggering level of ignorance about how prices have evolved in a finite, vital resource that once upon a time was available in glut quantities with prices controlled by cartel and the switch now to market prices dominating in a scenario where demand is likely always to be in excess of supply.

Had there high, high, scenario even included a 10% per annum increase that would have at least shown a rudimentary understanding of the dynamics of supply, demand and growing world population.

Euan, I share your frustration. But like you I'm not interested in moaning about the stupidity of the government - I want to change it's course. And these UEP figures, hopelessly optimistic as they are, give us a tool to influence them.

Have they revised their existing policies to take the latest projections into account? Judging from the news on airport expansion today, have they b*llocks. But we can now encourage the government to reassess their policies in the face of their own evidence.

We might bemoan the fact, but many people in power are still unwilling to seriously consider the possibility of peak oil. However, it's harder for them to ignore their own figures.

I would encourage a two-pronged approach. By all means we should argue with BERR to make future price forecasts more realistic. But at the same time we can take the current UEP to, for example, the DfT, our MP or the media and ask "what do these projections do to the demand forecast in the 2003 aviation white paper?". [Answer: Fuhgeddaboudit] And that's an example we can repeat for dozens of policies.

We're not going to persuade the government of peak oil overnight; you know better than I do that this is a war of attrition. In this context the UEP is a weapon, and it's becoming more powerful every year. Don't just try to fix it - use it.

Hi TOD Folks,

You have no idea how profoundly and effectively governments and Industry have shielded their populations from reality. It has been a magnificent triumph for the dark forces of Power.

I have an interesting IQ and intellect, I am extremely well scientifically educated and very broadly well-read.

Since the 73 Oil Crisis I have been calling Doom.

Before I came upon TOD by accident, only a very few months ago I had absolutely no idea we really had a serious problem. I had been completely lulled into a false sense of security. Sure! I understood things were tight. All our family vehicles had been put onto propane, House heating conservation had been implemented and all the little things for conservation taken care of.

I must say I was totally pissed off that I had been proven WRONG for 30 years.

Before TOD I truly had no idea we had run to the edge of the cliff.

My Point: The combined Conspiracy "out there" is seamless and consistent. Even I, looking for the cracks was fooled.

THANK YOU TOD for saving me.

Graham

Reindeer: I have been preaching the TOD Peak Oil doctrine relentlessly and I recently returned from a meeting in Bozeman Montana. The majority of the people were probably smarter than me and rather wealthy. I sat in a large group and brought up the PO subject and saw only blank stares but by way of patient and careful explanation, the folks started to get it. Unfortunately at the end some common comments were"Why have I never heard of this before?" and "Hugh, this is such a gloomy perspective of life and I hope you are wrong".Of 20 couples, NOT ONE person had even heard of the word PEAK OIL! Many of these folks had masters and doctorates in a variety of disciplines as do I and they were completely unaware. Simply amazing.

Usually people hold on to a theory or worldview in say, science or politics, until they die and then the younger people who have gotten exposure to the new concepts take over power and the new ideas become normative.

Seeing as how FF energy has been cheap and readily available for the lives of anybody around now practically they cannot imagine it being otherwise except for extremes like in a short term embargo situation. Unfortunately PO is happening rather quickly and is not evolution or plate tectonics or relativity so it really matters who is in power and their level of flexibility in accepting new paradigm changing concepts.

The population admittedly also has the same problem. My family members say in 50 years, 60 years, there could be some change but certainly not in their life times. I think this sort of thinking is almost universal.

Take the holocene. Realistically speaking we are going rapidly beyond it now and in 50-60 years it could be difficult to do massive farming in currently temperate climates due to instability in weather patterns or constantly rising sea levels. Even in the Bible agriculture was a given. We have no concept of life being different except from texts about neanderthals and cro-magnons or dinosaurs. PO is similar.

"Progress" to most people has been due to our smarts, what we figured out through people from Newton to Newcombe, etc.("standing on the shoulders of giants") Cheap and easily accessible FFs and high level ores had nothing to do with all that of course (to say nothing about the stable holocene).

So Hubbert was sort of Noah, ignored, maligned and right. There will be no Moses to lead us through the wilderness. It is too late for a savior. Run for the hills with the clothes on your backs.

Human history and prehistory seems to have been building up to this point, higher exploitaiton of resources at every point like yeast in a dish till earth is exhausted with our games and turns off the lights till we are dead and then turns them on again so someone else more capable can have a go.

Jack be nimble, Jack be quick, Jack jump over the candlestick.

Certainly individuals have the quickness and flexibility to plan and particularly younger people without investments and committments to the status quo and ingrained habits. Bureaucracy at a national level and big corporations do not have these capabilities and advantages of noncommittal and ignorance of what is socially correct and "normal".

Localize and ignore the bastards,I say. Economic collapse is coming qickly with oil prices climbing $10/month/barrel so that tax receipts will evetnually become negligible. If no deliveries of stuff can be made to stores how can we all work? If there is no work then noone can pay rent or mortgage or income tax. Then they will be forced to accept a new system and boot out anyone not flexible enough to accept that.

So I think that only economic collapse will force realism in government projections(20 USD through 2050) and those of average joes(in 50 years maybe PO), nothing less. It will be useless by then of course as the damage will have been done. So "Off with their heads" screams the mob before parliament.

Eyes wide shut!

......published in May 2008.....

BERR is responsible for crime against humanity or something down that alley, if Britons indeed are part of humanity, that is.

These sort of public reports are the main reason why I'm in progress of adopting the Olduvai-theory. Idiocracy seems to have NO limits at all in society's MOST important circles. I call it idiocracy, b/c the time-window for ignorancy is now closed!

***) Someone should e-mail BERR and link to this very discussion here at TOD. My mail is down right now.

Paal,

It’s not necessarily stupidity. One of my colleagues at the European Commission is a very intelligent chap who has recently written a two-volume book on the geopolitics of energy (in French). He also teaches energy geopolitics at a major Belgian university. As a reference work, his book is in many ways excellent.

Yet here is what he wrote about oil in July 2007:

http://www.leonardo-energy.org/drupal/node/2040

Which reminds me to contact him again and ask him whether he still adheres to this viewpoint.

At any rate, you can be very smart and yet believe quite a lot of dumb things.

I changed Stupidity to Idiocracy, before you were able to reply :-)

I agree with some of your takes here, but the BERR report uptop is "not of this world". It is steaming-fresh as of may 2008 and we are approaching $150 for oil and they dream of $ 105 in 2030 .

There is something VERY WRONG with this report and I'm out of words .... TOD's readers know it, but Joe-average does not...

If Euan's reply just upthread here http://europe.theoildrum.com/node/4248#comment-374106 bear any validity .... then what to call the actions of the UK government, et al ?

It's 'very wrong' only from the fuddy-duddy perspective of objectivity and truth-seeking. But from the perspective of preconceptual science it's a masterpiece.

http://www.globalicwarming.com/forum/viewtopic.php?id=212

thx Carolus, your cartoon strip is spot on :-) this is how it all works together in a beautiful symphony of delusion and relaxation. One report over here knocks down the report over there, thus maintaining status quo. Nature is again brought into harmony and equilibrium .... and everything is again so cozy.

Preconceptual Science has afterall a bright future IMO. That's a fact.

It has a bright enough present as witness my reply to the chief dental officer (or should that be cheating denial offender ...

Dear Dr Cockcroft,

Thank you for your reply dated 21st May 2008.

Your letter begins with the irrelevant fact that “Dental amalgam has been used as a dental filling material since the 1800s”. Why should you mention that but fail to mention the infinitely more relevant fact that the modern standard non-gamma-2 amalgams, which emit 30-50 times as much mercury vapour, were only introduced from the 1970s onwards? And anyway, just because people were using asbestos for many decades that did not constitute evidence of safety.

More importantly, you would have me believe about the SCENIHR 2007 report that “This report has superceded all of the publications that you have cited.”

Included among those cited publications were the review of 25 studies “Effects of Amalgam Removal on Health” by Mats Hanson, 2004, and the later Wojcik et al 2006. That is 26 studies comprising nearly 6000 patients, and the results strongly indicate that “there is hardly any medical treatment that gives so positive results on so many health problems as amalgam removal.” This is damning evidence that amalgam is very harmful and has caused exactly the symptoms with which I am afflicted, and that removal is a most effective treatment.

Now turning to the SCENIHR report, its 71 pages completely fail to even mention those 26 damning studies. Indeed it does not include any review of removal studies at all.