Why UK Natural Gas Prices Will Move North of 100p/Therm This Winter

Posted by Chris Vernon on June 24, 2008 - 9:40am in The Oil Drum: Europe

| This is a guest post from Rune Likvern (nrgyman2000 on The Oil Drum). Rune is an independent energy and financial analyst from Norway who has decades of experience from holding various positions within several international oil companies and also runs a blog called "Kveldssong for Hydrokarbonar". When Rune posts on The Oil Drum we usually pay attention to what he has to say. |

This post presents the development of the energy mix for UK, how UK in less than a decade went from being a substantial energy exporter to a substantial net energy importer. A more detailed look on what to expect for UK natural gas prices in the near term and a brief discussion on the real options available for future UK energy consumption.

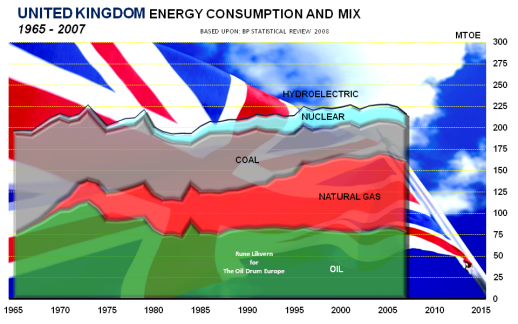

The UK development in energy consumption and energy mix for the years 1965 - 2007 in MTOE. Click to enlarge.

(MTOE; Million Ton Oil Equivalents; 1 MTOE approximates 20 000 bbl/d (oil))

In 2007 UK consumed close to 2% of the global total primary energy consumption.

There are few countries where natural gas constitutes such a huge part of the energy consumption. In the recent years natural gas has made up 36 - 38% of UK primary energy consumption (in the US natural gas constitutes 25% of the total primary energy consumption). Among the countries with considerable energy consumption, only in Russia has natural gas a higher relative part (above 50%) of the total energy consumption. (Russia is now listed to have more than 25% of global remaining recoverable natural gas reserves.)

If time (and the TOD editors) permit I will in a future post look into the real possibilities of filling the emerging UK natural gas supply gap with natural gas from Netherlands, Norway, Russia and LNG which for the medium term (meaning the next ten years) seems to be the most viable future supply sources. This will be depressing reading (if you live in UK), so don’t say you were NOT warned!

The recent decline in UK oil consumption is thought to be related to the recent oil price increases. Natural gas consumption is sensitive to weather (temperature), which means heating requirements, and of course a competitive price.

I am in the process of drafting a post for TOD Europe comparing the development in energy/oil consumption and production for the G-7 countries (Canada, France, Germany, Italy, Japan, UK and US) and the BRIC (Brazil, Russia, India and China) members. One of the interesting observations from this study, so far, is that it looks like the G-7 countries oil consumption is very sensitive to relative high upward price movements of oil, like in the 70’s and 80’s and now most recently.

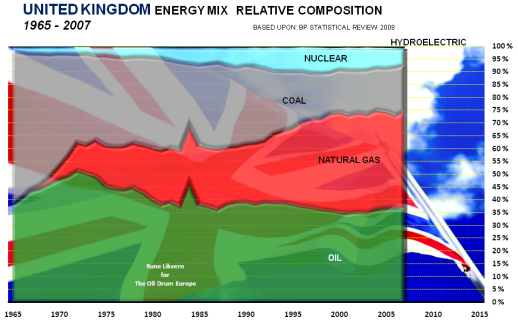

The UK development in energy consumption and energy mix for the years 1965 - 2007 in MTOE. Click to enlarge.

(MTOE; Million Ton Oil Equivalents; 1 MTOE approximates 20 000 bbl/d (oil))

The above diagram shows the relative development of primary energy sources within the energy mix for the years 1965 - 2007 for UK. Back in 1965 coal was the main energy source for UK delivering around 60% of the primary energy consumption. Over the years coal has gradually been substituted with mainly natural gas and nuclear and presently coal makes up less than 20% of total UK primary energy consumption.

UK FROM NET ENERGY EXPORTER TO NET IMPORTER

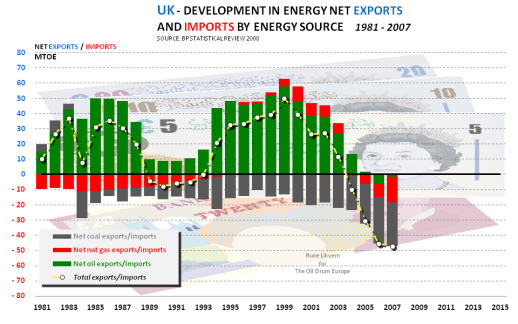

The development in net energy exports and imports split on energy sources for UK for the years 1981 - 2007 in MTOE. Click to enlarge.

(MTOE; Million Ton Oil Equivalents; 1 MTOE approximates 20 000 bbl/d (oil))

Through a period of 25 years the UK was a net oil exporter, which peaked with the production in 1999. 6 years later, in 2005, UK again became a net oil importer and the UK oil production from the North Sea is now generally thought to be in irreversible decline (with expected decline rates of 8 - 10% annually), suggesting future growth in oil imports if consumption stays at present levels. Even if indigenous supplies of oil are in decline, this may be overcome with a combination of increased imports and improved efficiencies in the use of oil.

The real near term challenge to UK energy supplies is identified to be natural gas supplies.

Natural gas has since the early 70’s become the most dominant UK primary energy source based upon indigenous supplies. The UK was a net exporter of natural gas (to Continental Europe) from 1995 - 2003. UK natural gas production peaked in 2000 and the UK again became a net natural gas importer as of 2004 and in 2007 UK net imports was more than 20% of its natural gas consumption.

In 1984 UK became a net importer of coal. UK coal reserves is listed to have a R/P ratio of 9 according to BP Statistical Review 2008, meaning that present reserves will last in 9 years at present rate of production.

NATURAL GAS AND OIL PRICES

It is generally observed (and acknowledged) that natural gas prices tend to follow the path of the oil prices with a time lag. Some analysts have even predicted that natural gas prices could decouple from oil prices sometime in the future.Studying the price ratio of nat gas versus oil on a heating value basis (per million Btu) tells an interesting story.

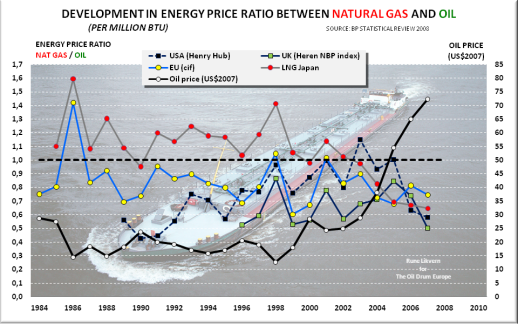

The development in the price ratio between natural gas and oil. Click to enlarge.

The above diagram shows the development in the price ratio between natural gas and oil against the left y-axis for;

- LNG (delivered in Japan)

- Natural gas (cif) delivered to EU

- Natural gas at Henry Hub (USA)

- Natural gas at Heren NBP (National balancing Point) UK

When the energy price ratio is below 1.0 this indicates that natural gas based on energy is cheaper than oil and vice versa when this ratio becomes greater than 1.0.

Japan seems recently to increasingly profit from the run up in oil prices as LNG purchased on long term contracts becomes relatively cheaper as a source of energy based on heat content. Developers of LNG facilities generally preferred long term contracts due to the capital intensive nature of the LNG business as this also increases the predictability for return on the investment and a steady profit flow. This is also one of the reasons why it has been challenging to establish a well functioning spot market for LNG.

Historically, and for those of the readers who are interested, 1 (one) barrel of oil has been converted to approximately 6 (six) million Btu of natural gas based on price. This means that if oil is priced at US$132/bbl, 1 million Btu of natural gas should be expected to cost US$22 at the trading point or beach.

(1 000 000 Btu = 10 Therm; 1 Therm = 100 000 Btu)

The diagram illustrates that the recent years run up in oil prices, as from 2004, have made natural gas increasingly and relatively cheaper than oil (in the diagram it can be observed how the hurricanes Katrina and Rita affected US natural gas prices in absolute terms and relative to oil in 2005). Note also how natural gas became relatively expensive as oil prices fell.

So far in 2008 the recent runs up in the oil prices have further encouraged an increase in the demand for natural gas. The result from this demand growth may now be observed in the recent price increases for natural gas at trading points like Henry Hub (USA) and NBP (UK)

Consumers who have dual fuel capabilities (like electrical power plants normally used for peak shaving) will tend to alternate between natural gas and distillates based on price.

The UK was a net exporter of natural gas form the years 1995 to 2003 (ref the diagram above illustrating the development for UK as a net energy exporter and net energy importer) and how this increased with the opening of the Interconnector between Bacton and Zebrugge in Belgium in 1998.

For UK owners of natural gas the liquid market of Continental Europe was in close reach and prices on the beach on Continental Europe was on average 20% higher than in the UK (ref the above diagram) and serving this market did not pose any big technical challenges, financial or political risks.

The lower nat gas prices at the beach for UK domestic users, both household and industrial, also gave UK industry a competitive edge (relative to consumers in Continental Europe and even in the US) and made comfortable amounts of energy available and affordable for households.

WHERE IS UK NATURAL GAS PRICES HEADED AND WHY

In 2007 the UK natural gas market became flooded with natural gas thus depressing prices. This flood of natural gas resulted from several sellers, like Norway, Holland (BBL) and LNG traders, had perceived an increased tightness in the UK market (due to declines in UK indigenous supplies and expected growth in consumption) for the heating season 2006/2007 and positioned them to reap the profits from this tightness. What happened, as these players seems to have been unaware of each other (which should be the case in an ideal liberalized marketplace), was that supply increased more than demand grew and in addition the weather became milder than normal, a combination and a recipe for depressing natural gas prices.UK will increasingly have to cover their natural gas consumption through imports, which suggests that an era of cheap natural gas, which has also acted as a competitive edge, increasingly will have to become harmonized with natural gas prices on Continental Europe which UK increasingly will have to bid against to secure supplies. Indirectly this may now be observed as less natural gas is exported to Continental Europe in the summer months through the Interconnector.

- With reference to the diagram showing the development in the energy price ratio between natural gas and oil and establishing a reference to 2007 levels, further assuming harmonization against natural gas prices on Continental Europe, this should suggest that nat gas prices in the UK at the beach has to come up 50 - 60% relative to 2007 levels. On average in 2007 these prices were 30 p/therm at the beach (the natural gas price has huge seasonal swings).

- Oil prices in 2007 was on average above US$72/bbl, and so far in 2008 the average oil price has been close to US$110/bbl and recently it seems like it has found support at US$130 - 140/bbl. This now suggests that the natural gas prices should put on an additional 80 - 90%.

It is difficult to predict the weather for the upcoming heating season and this is often the one factor having the greatest effect on short term natural gas prices. Given the seasonal nature of natural gas consumption it should come as no surprise if UK natural gas prices at the beach move north of 100 p/therm before the upcoming Christmas.

SUMMARY

In this post it has been shown why UK households and industries should expect to increasingly be hammered by growing energy prices.In less than ten years UK went from being a considerable energy exporter to becoming in size a similar energy importer. In 2007 UK imported more than 20% of its energy needs. This import is now forecast to grow at an annual rate of 13 - 15 MTOE (250 - 300 kboe/d; kilo barrels of oil equivalents a day) or 6 - 8% in the years ahead. What makes UK such an interesting subject from an energy standpoint is that the UK has had to transit from a major energy exporter to an energy importer with a speed never seen before for any other comparable economy. There are economies that are and have been more reliant on energy imports than UK (like Germany, France, Italy, Japan to name a few) and these have from these realities developed (seemingly) long term successful strategies involving central government’s involvement to cope with this energy reality.

This post has further shown that the UK energy mix is dominated by natural gas and thus made it vulnerable for potential future supply crunches. To revise the energy mix is a time consuming process and if the world has passed, is on or close to its apex for liquid energy supplies, these will not constitute a sustainable alternative to natural gas for the UK energy mix.

I have been informed that after a coal mine has been closed it may take ten years to recommission it for operations. Coal is mainly used for electricity generation and could of course be used for both heating and cooking purposes, which suggests changing housing appliances and stoves to accommodate this. To base the future UK energy mix on more coal results in future growth in coal imports.

Nuclear energy comes with delicate political maneuvering as the public needs to familiar itself with this alternative. Further needs nuclear plants a lead/construction time of approximately 10 years from approval have been granted.

I have not presented anything about renewables.

(I consequently refuse to use the expression “renewable energy”, as people who are familiar with the laws of thermodynamics know that energy by nature is NOT renewable. Energy may be transformed from one form into another.)

So called renewables will play a role in the future energy mix, but their impact on energy supplies must realistically be viewed against the potent and versatile nature of oil and natural gas.

Like USA talks about its oil addiction it looks like UK needs to talk about its natural gas addiction.

Given the time frame and not least options available to redesign the UK energy mix it looks like the UK “energy supply war” may have been lost before most people became aware that there was one on.

Nature enforces its own limits and a realistic look on the future energy options available for UK, energy conservation and power down now seems the most likely. This is of course a harsh message for any politician to convey to the public as it requires talent and leadership which there generally seems to be a universal deficit of......even in good times.

Many thanks for this Rune. You hit the nail on the head with this: As you say there are many economies functioning fine on large amounts of imported energy, it's the speed of the transition which will knock us out. Whilst North Sea oil and gas production are clearly falling away quickly, our nuclear generation is demonstrating a very similar depletion pattern:

UK nuclear output, forecast based on decommission schedule and 69% load factor. Taken from Nuclear Britain.

At least with nuclear there exists the possibility of building new nuclear infrastructure (though likely not before 2020), in contrast to highly unlikely discovery of large new indigenous hydrocarbon resources.

Thanks for the kind words Chris.

The downslope of the nuclear output in the diagram you have attached is astonishing. Good thing that nuclear only is just above 6 % of UK primary energy consumption.:(

Being aware that it takes +10 years time to have new nuclear plants in operation and bearing in mind the natural gas supply situation and that natural gas also is used for power generation, the future for UK electricity looks worrisome. I learned somewhere that UK now imports electricity from France.

Rune

Like the ancient Roman-era pottery works of the South of France, the UK is becoming increasingly specialised in the arena of 'Financial Services'. Unfortunatley when the Roman empire collapsed there was no longer any mechanism to allow the transaction of pottery and we may find that in future there is no longer any need for our specialised financial services... This is the definition of the saying 'double whammy'...

Lessons from Roman Pottery:

http://thearchdruidreport.blogspot.com/2008/04/specialization-trap.html

Nick.

There is currently a 2GW connector to France, I believe.

I have no information on their contractual obligations, as even France may not be keen to export electricity on a cold winter's day - has anyone better information?

On a brighter note, these prices for gas should make nuclear costs unchallengibly competitive, in spite of rising construction costs.

Of course, the British government has done everything possible to make it difficult to get started on a nuclear revival, as they have turned down a bid for the nuclear sites from EDF, who could undoubtedly have done the job, and now propose to have different consortium;s building at different locations, with all the waste and delay inherent in that approach.

The record time for a build is around 4 years, in the far East - it looks like our establishment intend to add a nought to that.

Chris Vernon's post downthread gives information on 'The French Connection', which shows that it is indeed 2GW, and further shows its availability during a cold winters day - for much of the time is it not available, although it does kick in again at the top peak.

In practise it may be easier to get France to build some more capacity for export near to the channel whilst we await action from our Third-World class government to order and build capacity, not to mention their ability to run them properly.

Four modern Areva twin reactor set-ups would provide around 12GW of power to the grid, and they could be built in perhaps 6 or 7 years - that would, incidentally, be more than the average hourly power projected to come from the off-shore wind build, at a fraction of the cost and a lot faster.

Where I wrote;

”This means that if oil is priced at US$132/bbl, 1 million Btu of natural gas should be expected to cost US$11 at the trading point or beach.”

It should of course read;

”…expected to cost US$22 at the trading point or beach.” [EDITOR: Now corrected]

Based on energy content it looks like nat gas prices still is in for more growth.

And bear with me for some minor typos.

Have to straighten up the QA for my future posts.

THX

Rune

Rune - thanks very much for this which I hope is the first of many posts.

I am most interested in your final chart comparing nat gas and oil prices based on thermal content.

If I understand correctly, UK nat gas is still underpriced relative to continental Europe - hence the UK price should rise for price harmonisation in the efficient liberal market so loved by Gordon Brown.

But there are some other points of concern.

My understanding is that much of UK gas is still bought at low contract prices struck many years ago and that many of these will expire in the years ahead to be replaced by spot prices - which as we have seen are likely to rise sharply in the free, efficient liberalised market loved by Gordon Brown. I can see a situation where nat gas currently costing about 10p per therm on contract rockets up to over 100p per therm.

And then the other factor is that nat gas as a whole seems underpriced relative to oil.

So can you see a situation where UK nat gas costs 200 p / therm in the near future, would you care to comment on how this may affect UK living standards (or should I say dying standards) and have you found me a nice 10 acre farm yet with salmon and trout fishing in Norway?

Yoooon

Yooooon,

Thanks for the warm welcome. I certainly hope I will be given the opportunity to post on other energy related subjects on TOD in the future. Some of the posts in my pipeline may give a new angel or renewed insight into understanding what is taking place in a complex and turbulent energy market.

In my opinion, and also described by referred diagram, the UK nat gas prices have to increase to be harmonized with Continental Europe. Another factor is the tight oil supply situation, and thus high oil prices, could favor some users to switch from oil based products to nat gas (also due to availability), thus creating additional upward pressures on nat gas prices. Nat gas is as shown in the diagram presently underpriced relative to oil. Historically nat gas prices have traded at 60 - 80 % of oil based upon heating value (per 1 MMBtu). If the nat gas supplies experiences tightness in supply, nat gas could even go higher than oil in price based on heating value.

I don’t have any detailed knowledge about UK gas supply/import contracts, but generally all contracts have clauses about price revisions related to other primary energy sources, most commonly oil. These nat gas price revisions normally lag the oil price with 6 - 9 months.

I am informed that some of the Norwegian contracts are long term, i.e. 10 years and some may be field depletion contracts. How expired contracts will be substituted will as of now be purely guesswork on my part, this also because Norwegian gas contracts now are owner/company based meaning the owners will (most probably) deliver their nat gas to highest bidder.

I am, from studying the European gas supply situation through some years, of the opinion that the European nat gas supply is about to become increasingly tighter thus creating a continuous upward pressure on nat gas sold in the spot market, which during the upcoming heating season, easily could push UK nat gas prices north of 100p/Therm at the beach or trading point.

Nat gas is energy and almost like food people’s lives and well being depend on it. As I have reason to believe that the European nat gas supplies is about to become tighter I also believe prices will continue to grow. Exception here may be if Europe experienced a full blown recession temporarily reducing demand and thus depressing prices.

With BAU close to normal it cannot be ruled out that nat gas prices in the spot market could super spike and hit 200p/Therm the upcoming heating season. This will sadly inflict a lot of pain and will also affect those most vulnerable (like elderly on small pensions, low income families on small budgets).

There is also other effects which are hard to predict like a critical mass of people switching to electricity during a cold snap to save on nat gas (either due to price or availability) which could overload the grid and bring it down, thus extremely high nat gas prices could have some cascading effects which are now difficult to predict as this involves human behavior which may become unpredictable if confronted with a threat or crisis. It is in this context that I find some of the posts of Nate Hagens very interesting, especially the parts of humans and steep discount rates.

Well I am still looking for a suitable farm for you and your family, it is your requirement about trout and salmon fishing that is hard to satisfy. :)

Rune

Thank you for a very informative, if somewhat depressing, article.

Just for absolute clarity, your figures for oil do include that used for transport?

We are not going to get there anytime soon, and a massive shortfall is now certain, but has anyone got some back of the envelope figures for how much electricity generating capacity would be needed in the UK under the assumption that all heating was by this means, but air-source heat pumps were used with an average efficiency of 2.5, as higher efficiencies rely on new build?

If the presently most inefficient grade F and E houses were brought up to a more reasonable standard of insulation, what would then be the requirement?

As you point out in the post I am replying too, in the UK we could certainly do with a 'New Angel!' :-)

Its all oil consumed in UK.

Rune (or anyone else):

How will all this play out for Ireland? How reliant are they on Natural Gas imports from Britain?

This was a very fine post Rune, I hope you keep them coming.

Hello Luis and thank you.

Nat gas consumption in Ireland has grown steadily through the years and presently nat gas constitutes approximately 29 % of Ireland’s primary energy consumption (which is high). Nat gas consumption in Ireland has shown a strong growth in recent years and Ireland has a small indigenous nat gas production (BP Statistical Review does not break down their production) meaning most of their nat gas consumption is imported (more than 90 % from UK and some small amounts from Norway).

Ireland, also being at the end of the supply chain, could in the near future face many (or worse) of the same nat gas supplies challenges as UK.

I am not aware of Ireland having any LNG regasification facilities.

Rune

A 2006 paper says Ireland imports over 85% of its gas from the UK. The balance coming from Kinsale Head (depleted?) and Corrib (not producing yet?). The paper talks of two years of planning and three years of construction. Which suggests if all goes smoothly it could be open for 2012, good for 400 million cf/d, 40% of Irish demand:

More information on the Hess LNG backed Shannon LNG development here:

http://www.shannonlngplanning.ie/

Seems it's still at the planning stage, application submitted last year . They've drawn some really nice pictures on an LNG import facility, that'll help.

Hello Chris,

Thank you for the links and information.

If my memory does me any justice I seem to recall that Norway sells some natural gas to Ireland related to a power plant (can’t recall the name but it was a joint venture by then Statoil and some other companies).

One of the challenges reading statistics on gas imports and exports is that even if it says x % imports from UK, it is difficult to identify the physical (or more correctly) the contractual origin for some of the gas.

Ref gas imported through BBL, is this all gas from Holland (which may be its physical origin) or could this also include contractual gas from Russia?

Many thanks for this. "I will in a future post look into the real possibilities of filling the emerging UK natural gas supply gap ... This will be depressing reading (if you live in UK), so don’t say you were NOT warned!" I look forward to this article - presumably you will amplify Euan's previous statements that the UK will face a desparate energy crisis in as little as three years as old nuclear stations close, renewables are delayed and gas imports fail to materialise. Maybe you would also update Euan's graph of the impact of energy imports on the UK trade balance, originally posted at: http://www.theoildrum.com/node/2790. In this, he used oil price figures which now look ridiculously optimistic - I think £80/bbl for this year and presumably in light of what you have written here, gas price projections need to be modified in the same way. Maybe it will not just be "depressing", but horrific!

Hello doctorbob

Through the years Euan and I have exchanged lots of e-mails covering the subject of future UK nat gas supplies. From these exchanges it seems like the point in time the energy squeeze could start to bite has come closer in time.

I think (assuming the upcoming heating season becomes “normal”) that UK nat gas supplies could become a severe issue in 2008/2009.

Exports from Norway could increase relative to last heating season mostly due to the buildup of the gas field Ormen Lange.

National Grid recently published an estimate that UK indigenous supplies could decline by 11 % the coming heating season. Possible increased deliveries from Ormen Lange would only partly offset that decline.

Net imports through the Interconnector (Zebrugge to Bacton) have been in general decline through the years according to data from BERR, suggesting a tighter supplies situation on Continental Europe.

I suspect that nat gas supplies through BBL (Balgzand – Bacton Line) will not increase. As of now it is unclear to me who supplies this gas. Holland nat gas production has peaked, thus suggesting declining Dutch exports, ref Rembrandts post some days ago.

This pretty much leaves storage withdrawals and increased LNG imports to cover the growing UK nat gas imports requirements. The spot market for LNG is now very limited.

I’ll talk to Euan about updating his graph.

Perhaps we need to find a new expression to define the near future condition? :-(

Rune

doctorbob - I will update on the state of UK trade balance tomorrow, or the next day. Our scheduling has been thrown out a bit by all the Saudi excitement. If things like debt, trade balance and economic sustainability bother you then you should get a good nights sleep tonight - it may be your last.

Meanwhile, here's the gas model I was working on months ago. This was quite a bit of work, but its wrong. I realise now that the demand consumption growth shown here will never happen as high price will destroy much demand for nat gas - exactly how that manifests itself is open to debate.

LOL

But sadly contains more truth to it than most would care to admit.

Euan

Imagine you had got hold of Gordon for half an hour, had spent 10 minutes showing graphs and explaining the bind we were in, and he had accepted it all and asked "so what do we do?"

What would your answer be?

In the short term, as far as I can see the major problem is a cold snap across Europe. Not only does the price soar, the amount available to the UK is curtailed and difficult decisions have to be made. It looks to me as if the immediate action is to limit electricity generation, shedding high loads so domestic supplies can be maintained. There is no way domestic supply can be cut, its just not workable. So its an electricity problem, not a gas one.

Of course this does nothing about the run up in costs (we can see where that 40% energy rise quote came from), but Gordon as an accountant doesn't really care about that, he considers it to be the great god of the marketplace and won't interfere.

In the long term there is a need either for a secure supply of gas, or a swift move away for both power generation and home heating. Neither seems to have an obvious answer - nuclear stations take too long to build and what are the alternatives for winter home heating?

Politicians want answers with their problems, what would yours be?

As an emergency measure, rationing, adjust systems to easily allow this before they are needed, be proactive.

The simplest way is to change the pricing structure - at present my gas, electricty and water all get cheaper the more I use, this is exactly the opposite of what is required. The regulators, such as OFGAS, could be authorised to enforce this.

The first chunk of energy should be priced at a rate all (including pensioners) can easily afford - enough energy to cook, shower, and adequately heat one room?

After that, the price should escalate exponentially so people (like for example those who are living one person to a large badly insulated house) can decide what lifesyle changes they might want to make, if any, or pay substantially more for the resource - we live in a 'free' country so you can't expect the government to dictate what you should do.

I proposed in another thread a 'One Warm Room' program, to insulate as cheaply as possible one room in each house to a very high standard, often simply putting in lining and plasterboard on the inside of the walls, so sacrificing space to heat.

Out of around 24 million homes in this country about 3 million are band F, the very lowest standard of insulation, and a further 9 million are band E.

In addition under our wonderful free market system, poor people who pay be key meter rather than direct debit are differentially charged around £400 extra a year for the privilege, and the most recent price rises were loaded against low users, some paying up to 70% more for their electricity, penalising the poorest and the conservation concious.

Since the Labour party is sure to be booted out, there does not seem much hope of the Tories even attempting equity.

Shame we haven't got a socialist party.

My idea is that every house built, sold, or renovated starting at $1,000,000 (or in this case, pounds) are required to incorporate solar hot water, micro-CHP, or heat pump. Have that $1,000,000 figure decline by 5% per year, and before you know it, everybody will have one. This would also allow time for the production capacity for all these things to be developed.

"..we live in a 'free' country so you can't expect the government to dictate what you should do."

I don't see why not - as a retired Shell director I think it was pointed out when saying SUVs should be banned for being immoral to drive now oil is becoming scarce. Burning coal was banned in towns whether you would be prepared to pay a lot or not.

Mark

The most important thing that Gordon -or any politician- could do is blow the whistle on the problem at hand. We are in a sort of 'Apollo 13 crisis mode' but no one as yet is saying 'Houston we have a problem'.

I would suggest that he immediatley convene a meeting of all heads of state and ask the UN to do a "Global Energy Audit" as input (forcing all key players to divulge their reserves and peak extraction capacity -any country not doing so would have its credit rating downgraded as a 'stick').

There's a big UK Renewable Energy report coming out later this week -The Guardian got hold of it last weekend.

Its scratching the surface but some things:

Massive 30 fold windpower expansion

Insulation

Solar hot water heating.

All this to get to 15% by 2020...

In addition we need to double nuclear, give rebates for PHEVs, increase investment in the railways and city trams + electric buses. Etc, etc.

Nick.

"If things like debt, trade balance and economic sustainability bother you ...". I walked past the wondow of a local estate agent today. About a third of the cards for houses had "sold" on them but God knows when they were sold, probably last year, so I'd guess that was just a con. All but about 3 of the rest had various price reductions marked on them and many had two reductions with the old prices crudely crossed out - which is maybe not so clever. Typical reductions from the original asking price averaged about 10%, with many being 15% and the odd one over 20%. Another year or two of this on its own IMO, would be enough to spark a long and deep recession without the galloping increases in food, fuel and energy bills. One wonders how much time one has to make preparations - Euan jokes about his Norwegian farm but presumably he and others like myself who want out, will have to sell something here to enable the move and maybe in a couple of years no-one will be able to sell any sort of "average" house at all.

Nick wants the UN to convene a global energy audit, but from a more local point of view it might be more reasonable to hope that the EU might do this and get itself an energy policy that makes some sense instead of faffing about with treaties that benefit no-one but the Brussels empire-builders.

http://www.marketoracle.co.uk/Article5121.html

The really cheery part is that this is just based on conventional economics, and does not take account of damage from peak oil.

I read today that out of 15 million homes with cavity walls 11 million are unfilled. I find that shocking. Fill 11 million walls and that should shave several % points off gas consumption.

Here is a full assessment of current UK housing stock and standards.

http://www.eci.ox.ac.uk/research/energy/downloads/40house/chapter05.pdf

chapter05.pdf

It is not pretty reading, but I suppose at least it shows the vast economies possible.

The figure it gives for cavity walls are 11 million uninsulated out of 17million.

The problem with all these assumptions about take-up of measures is it utterly ignores the cosmetic aspect of housing renovation.

It assumes that 100% of windows will be U 0.8 by 2050 ? Absolutely - if you rip out every leaded light window, every Georgian sash, every Edwardian casement and replace with fibreglass quad glazing. yes, that will look nice on your thatched cottage :)

In fact we would have to not only repeal the conservation laws but totally change the mindset of period housing as a living ideal.

Mind you on my wanders I did find this :

http://www.redbloc.co.uk/cladding.html?menu=120&head=8

Looks like you can keep the brick exterior and add phenolic insulation to the outside of solid walls.

If we are going to get the problems we think in this thread, worsening progressively, by 2016 I can't see anyone including the Government giving a fig for cosmetics - the only issue will be finding the insulation materials.

In a battle between the cold and aesthetics the cold wins every time.

Actually though, I can see a lot of innovative solutions coming through, providing that the economy is not so collapsed that no-one bothers.

The gain from double glazing is not so very great. Certainly not great enough to destroy our historic and cultural heritage. There is much that can be done to improve the energy budget of historic housing stock and ripping out old windows is about bottom of the list. When energy is rationed, whether by prices, TEQs or whatever, many will prefer to pull on the thermal undies before destroying their built environment.

Its too late already.

http://www.timesonline.co.uk/tol/news/politics/article4200817.ece

From The Times

June 24, 2008

CBI warns of power cuts if Planning Bill is defeated

Siobhan Kennedy and Francis Elliott

Britain will face severe power outages by 2013 and run out of energy altogether two years later if plans to build nuclear and wind energy facilites are delayed, according to business leaders.

The Confederation of British Industries (CBI) has warned MPs that any watering down of a new fast-track planning system will have disastrous consequences for the country by slowing down the construction of new power plants and renewable energy sources

Actually, I think this also has severe implications for any fast ramp up of alternates or replacements, go too fast and there is no net energy or commission/decommission at the same time - it makes the energy gap situation worse not better, right at the time of most stress!

One thing which is bound to be done in the scenario of power cuts is to extend reactor life.

In my view this will be done regardless of safety.

Should an accident occur it would doubtless be blamed on the evils of nuclear power, not on a system which does not provide for timely replacement and provide reasonable energy security.

Here are some links to the possibilities of the extension of reactor life:

http://www.bellona.org/articles/articles_2007/uk_extentsions

British Energy begins extending engineered life-spans for troubled reactors

http://www.newscientist.com/article/mg13518394.500-can-old-reactors-take...

Can old reactors take the strain?:

Well reading some of the excellent comments on this thread its clear there are concerns about the integrity of the UK grid, so the first thing that we must do without any delay is to build another 12 CCGT power stations (combined cycle gas turbine). These are already on order, so I think we need to bring their construction forward a bit.

Someone also mentioned that the trains were crowded so I think we need to accelerate the road building program to alleviate this problem.

The high cost of fuel is also crippling the airline industry and so I think the government should provide subsidies here. Ideally the government should cut the tax on jet fuel, but since there is no tax on jet fuel straight fuel subsidies will be required. If we don't do that then British tourists will no longer be able to fly to Spain to catch skin cancer - and then the NHS may have too little to do.

The poor and the old will struggle to pay their energy bills so they also need subsidies to help bolster energy demand from that segment of society and I 'd propose to pay for that by taxing the offshore oil and gas industry even more. As you are aware they are making obscene profits, and the fact that most of that profit comes from overseas doesn't matter. Pension funds are obese at present so I say f*ck those who have tried to save for their old age and tax the oil companies till their pips squeak.

Based on its utterly appalling safety record I don't think we should risk new nuclear power stations, especially since the general public , who as a result of all the extra money spent on education in recent years, are pretty expert on engineering aspects of nuclear power plant and on the clinical dangers associated with radiation leakage. So if the public says "we don't want nuclear" I think the government must listen to that well informed opinion.

I think it is also imperative that we place the well fare of some ducks ahead of the well fare of the population in general and need therefore to be very wary of building too many windmills or tidal barrages since this could do untold harm to the habitat of said ducks. And in any case, windmills produce more CO2 than burning coal.

We must also take our national security very seriously indeed, and so when the MOD says you can't build any windmills anywhere since we like flying low - (a tactic proven to be very popular with Iraqis during GW1 who discovered they could shoot down our Tornadoes with bows and arrows) and we must be very wary of the Russian threat. Ever since the Crimean War the Russians have threatened our national security with only two short periods during the 20th century where they changed sides and were our allies (WWI and WWII). So we must stay vigilant. After all, the Russians are likely short of nat gas, and may invade Britain at any moment to seize our oil and gas fields.

Finally, I think the government should be doing much more right now to blame other people for the energy crisis. It has been totally impossible to predict that north Sea oil and Gas production would fall the way it has. This is largely the blame of the oil companies, who as you know are also among the biggest speculators in the oil and gas market. I foresee a grave threat that Gordon Brown and Alistair Darling may become extremely unpopular, so much so that they are not made Knights of the realm for all their good service to the UK. So maybe they need to bring back someone like Alistair Campbell to ensure that those who are really to blame for this catastrophe, get blamed. Its obvious that greedy poor Americans taking on mortgages they can't afford is the root cause of the Brent Field now being empty.

I blame the Ethanaaawl.

LOL

Well spoken.

But you forgot something Euan.

The Gov should also throw even more money at the Olympics because by 2012 we will badly need cheering up.

Euan,

LOL

Remember growth is good, hence consume more! ;-)

Cheers!

WTF?

Sarcanol, my friend.

urbangardener,

I forgot to issue a sarcanol alert.

Rune, excellent and most informative post, thank you. I'm one of the 1.5 million UK households with no access to mains gas thus, electricity apart, I'm watching from the sidelines.

From what I understand the Langeled pipeline from Norway can supply a maximum of 20 BCM pa to the UK (I'm not sure if this is a contractual or physical limitation) i.e. around 20% of gas consumption which I saw recently was 101 BCM pa. To this 20 BCM UK can expect additional supplies via the Interconnector provided there is surplus in mainland EU.

As UK N Sea declines further increasing volumes must be imported via LNG, primarily from Algeria, Libya and ME. UK has constructed new LNG capacity at the Isle of Grain and Milford Haven, for example, in anticipation of such imports. From what I've read on TOD, unlike Japan and other Asian countries UK has not entered into enough (any?) long term LNG supply contracts and is thus reliant on the spot market. Once at sea LNG cargos can, and will, follow the highest bidder which might increasingly be US given that N American gas supply situation is also tightening.

Gordon Brown's reliance upon the market for energy supplies may well come back to haunt him - with very low storage capacity compared with France and Germany it could well be 'lights out' if expected LNG shipments don't show up.

Hello zceb90,

Langeled has an official capacity of 70 Mcm/d or 20 Bcm/a. To what extent that this capacity will be fully utilized is a little hard to predict now. According to data from National Grid Langeled was flowing at 60 Mcm/d during lengthy periods last heating season. In other words it should not be expected a huge increase in Norwegian imports thorough Langleled the upcoming heating season.

The Norwegian owners/companies are free to sell their gas to the highest bidder, suggesting that even if there are available transport capacities, this does not constitute a guarantee for increased flows.

UK net imports (in the heating season) through the Interconnector have in recent years been in general decline according to data from BERR.

National Grid recently published an estimate expecting a 11 % decline in UK indigenous supplies the upcoming heating season.

As I commented on some other threads further up the LNG spot market is very small, and yes chances are that UK nat gas supplies could (at best) run very tight the upcoming heating season.

Rune

Whilst I get the point you are making, I don't think this is down to Gordon Brown per se, he has been lucky upto now and is going to be unlucky from now on (poor sole). Margaret Thatcher was plain lucky, she walked into north sea reserves, poor Gordon will walk out of them!

The Anglo Saxon minset seems to be that the world owes us a favour. Our history is one of exploitation and violence. Unfortunately we have lost our grip on the world a little bit, our leaders fail to recognise this minor point. We are rapidly becomming insignificant in the scheme of world affairs, we believe we are a financial power. I can't help laugh as I write this, but laughter is tragedy and timing after all!

The uk is going to be in serious trouble because we have squandered manufacturing, relied on "free energy" from the north sea and "money for nothing" finance. The latter two are now looking to be a dubious source of income, the former will take years to rebuild. Meanwhile, the government increases taxes by imposing ever more regulation on business and citizens alike.

Kære Rune,

Tak for et godt stykke arbejde.

I often wonder if there really is a difference between the 'Anglo-Saxon' mindset and the outlook and attitudes formed around the culture of Rhineland in central Europe? Is it something to do with higher level of co-operation and planning, or is it possibly connected to the creation of higher level of concensus about the fundamental structure and direction of society; contrasted with the Anglo-Saxon model, where an ideological minority is given the power to rule over the majority and push through a narrower social/economic agenda?

Whilst Britain and the United States seem so heavily burdened with the baggage of inequality and class, the 'Rhineland model' appears to emphasize the collective interests of the 'volk' to a far higher degree.

It really is shocking how little longterm planning there has been for Britain's energy future by successive governments, so my criticism isn't politically partisan. The British way seems strange to me. Some people say that we just 'muddle through' and things have a tendancy to work out in the end. I've never subscribed to this attitude, probably because my father was prime example of the belief in efficiency and planning inherent in the Rhineland culture of central Europe, in fairness one should probably include the people of the Danube as well.

On the other hand this is a rather old-fashioned way of looking at the differences between peoples, and can be pushed to extremes; however there do seem to be differences in the way 'Anglo-Saxons' think and organize themselves, compared to, for example, the Germans. Is it just a coincidence that there national side in football is so successful? Perhaps their measurable success is symbolic and indicative of deeper cultural differences?

What's tragic is that Britain has arguably wasted and squandered a fantastic enegry legacy of collosal value and worth for relatively little longterm benefit. Thirty years ago I argued that the the bounty, or windfall, from the North Sea, should be sctrictly controlled and conserved for the future. The revenues should used sparingly and directed at specific areas of the economy and society where they could do the most longterm good; like public transport, education and health, and should mostly not be used to finance a temporary consumer boom or even asocial tax cuts.

I always thought that the North Sea oil and gas finds were a once in lifetime miracle, a kind of lifeline, for a small, crowded, island with very few resources appart from the genius of its people. Instead of consumer party, invest the revenues wisely in educating the people and planning for the kind of Britain that would emerge on the other side of the oil boom and the dash for gas.

Of course this led me into direct confrontation with the narrow and shortsighted, dogmatic and intensely destructive, class-war politics of the right-wing Thatcherite minority counter-revolution. When I tried to push a totally different agenda, a consevationist agenda and insisted on talking about the necessity of planning and thinking about what would happen when the oil and gas ran out; I was greeted with open hostility bordering on contempt. The very idea of planning seemed to be regarded as close to heresy, let the market take care of all that, the market knows best.

We are no seeing the consequences of allowing 'the market' to decide and rule over us, and the future is bleak and uncertain. We've slaughtered and eaten the fatted calf, and now what? What happens in the lean years to come?

But it's probably wrong to suggest that there was no real planning, there was, only it was planning for exploitation and channeling the benefits of the North Sea to serve the interests of a minority of the population, with enough 'crumbs' from the table going to others to keep them quiet and passive. What happens now, when the party is over and the table looks increasingly bare, is another story.

Writerman

I can really feel for your angst in observing the stupidity of your politicians. You had Thatcher, the Yanks had Reagan, we here in New Zealand had Roger Douglas (supposedly Labour, but actually New Right Stupidity followed by Ruth Richardson (extreme Right Lunatic Fringe)). We still have the New Right (Labour) (actually the OLD Wrong repainted) which will this year be replaced by the extreme right once again.

Sadly we will follow the collapse of the US and UK economies. There is no intrinsic reason why this should occur, it is merely that our incredibly stupid politicians have been outright leaders in the free market, free trade insanity that will lead to the destruction of our society.

New Zealand is roughly the same size as the United Kingdom, has a better climate for agriculture, and at present has a much lower population (4.2 million VS 60+ million). We also have a better energy structure , in that about 70% of our electricity is from renewable resources. We also have large coal reserves, and modest oil and gas reserves.

Sadly our Governments for the past 25 years have been the worst imaginable, and have thrown away all our natural advantages in the interests of the "Free Market Religion". This might not have been so bad if the actions had been on a bilateral or multilateral basis, but they have unilaterally chucked away our advantages whilst assuming that other trading nations would do the same. Naturally, our trading "partners" have taken advantage of our stupidity while laughing all the way to the bank.

Our insane governments here in New Zealand have allowed unfettered sale of land and productive assets to any foreign buyers, privatization of state assets at throwaway prices, and totally unrestricted immigration of utterly inappropriate persons. We have dropped from 3rd position in the OECD rankings to the point where we would not even qualify for admission over the past 30 years.

The Thatcherite problems that you are experiencing in the UK are a tragedy that is totally unnecessary. It is based on sheer greed of the ruling class. The UK cannot support its current population as fossil fuels decline, but the present population could be gradually reduced if there was a more equitable allocation of the available resources.

Thanks a lot for this masterpiece, Rune!

Yahoo is grabbing the phone , and crave more Likvern at TOD. This is where your throughout and utter quality essays and analysis belong!

Your message here is of outmost importance for the Britons, I myself simply cannot imagine how bad the situation is for them. I have to echo you and Chris Vernon over here, that the speed of transitions is the scary factor, further on I can foresee a lot of retooling of existing heat-power plants to be oil-feed in the years to come – electricity before private cars you may say…

The private car will be forced under a mandatory “neighbor- and workmate-cars”-scheme in a few years (what is few these days?) – No seats wasted…, before necessary collective slash mass transport possibly can be brought in place to maintain BAU.

I reckon the nat.gas infrastructure in the UK for cooking and heating (?) is so widespread that it will take …(fill in the blanks)….. to change, and what can they use from local sources long term given their own reduced coal-stocks is at r/p 9 years

Probably imported coal is part of the “energy master plan” – but isn’t coal import in the master plan for most countries - and how much is there available worldwide??? (Tip, do not read the recent Coal-report from the Energy Watch Group, but if you read it DO NOT BUY into that story, to stay sane I mean)

Obviously whatever measures the UK has to take, it will domino the rest of Europe in a short rather than a long time thereafter. All in all, I can see the Britons be the first “genius” trendsetters in this new but very real unwanted situation. Britannia did it before …. But this time around her population has become large … too large? (Too large … for what?)

This reality check of yours concerning UK’s (nat.gas) energy-future should be tagged onto the walls in Gordon Browns bedroom, bedtime read over the summer if you will … and on top of that the best philosopher in UK should be engaged to explain Mr. Brown what it all means ....

Anyways a very good idea to bring “the lullaby over hydrocarbons” out to the masses !

Cheers, yours Yahoo :-)

There are around 22m households in UK of which some 1.5m don't have access to gas. I don't have exact figures to hand but let's assume 75% of households with gas have a gas boiler (furnace in US) for central heating i.e. 15 million boilers. The appliances are quite expensive to buy and install and can have a 20 - 25 year working life. In the event of a gas supply 'crunch' boiler replacement would be anything but trivial....and recession would likely accompany the supply crunch thus leading to many not being able to afford the change.

In any event what would they change to? If millions were to switch to electric heating the grid and generating capacity would be inadequate. Most houses built in last 30 years don't have chimneys suitable for coal fired boilers and smokeless zones are in force apart from in rural areas.

In the even of a shortfall in gas supplies industrial customers are disconnected first, power stations would take the '2nd hit' and domestic customers are never disconnected unless it's totally unavoidable (due to need for individual gas engineers' visits before reconnection for safety purposes). Instead, by reducing gas supply to power stations any resulting rota electricity cuts have the effect of reducing domestic gas consumption as almost all boilers depend on electricity to run). In this way domestic gas is effectively 'cut' but no engineering visits are required afterwards as pilot lights stay on.

To me UK Gov't would have 2 choices in the event of supply shortfalls - 1) let the market take price to whatever level it takes to destroy demand or 2) impose some type of rationing. Option 1) is brutal to the elderly / vulnerable and option 2) would be very difficult to implement.

The problem is that I don't think the UK Gov't is even taking this issue seriously - it thinks by allowing some LNG terminals to be built 'the market will provide'. I think they are in for quite an awakening...and their electorate will for some cold houses in winter!

In order for the market to provide, our utilities need to change the way they purchase gas on long term contracts. Currently all long term contracts are "index-priced" using the Heren Day-Ahead gas price. European contracts are priced with a direct tie to oil prices (the Troll Formula used to price gas delivered from the field of the same name and more recently other similar style formulas allowing for the pricing of Russian gas).

The UK is literally at the end of the pipeline for Russian gas, and though we are directly attached to Norwegian fields like Ormen Lange, the Norwegians can (and do) move that gas to higher priced continental European markets using the existing infrastructure of the Sleipner field. Until we find a new pricing model that clearly prices our demand at a higher level than continental European price formulas, we will remain the market of last resort. Even in the case of higher prices for UK gas, we have seen (in Ukraine so far, but no doubt elsewhere in the not too distant future) that pipeline gas can be siphoned off by countries through whom the pipes transition - so logistically we have a problem beyond price. We need to pay up to ensure Norwegian supply where we at least have a direct pipeline link.

On the LNG front we have plenty of regasification capacity: Isle of Grain, Dragon and South Hook (both in Milford Haven) and the Teeside Excelerrate facility. However, LNG is now a global commodity and we are going to have to outbid not just our neighbours in continental Europe, but also some or all of Japan, South Korea, Taiwan, China, Dubai, India and the USA to secure supply. There is too much regasification capacity and not enough liquefaction for LNG, and we are nowhere close to competitive in our pricing. I would be surprised if the UK has imported more than 3 LNG cargoes in the past 12 months.

If we get caught short in a cold winter, 100 pence/therm is going to look cheap - I think we are going to have to pay in excess of 300 pence/therm to get hold of whatever marginal LNG cargoes may be available.

The situation is really quite scary and our government and utilities are doing NOTHING about it, despite BERR making abundantly clear the scale of the problem.

Hello bunyonhead

I agree something will happen to UK nat gas prices……..and the direction will be northward.

Total UK LNG imports from April 2007 to March 2008 was around 800 Mcm according to data from BERR, suggesting 5 – 8 shiploads depending on the size of the LNG carriers.

About being at the end of the pipeline for Russian gas, do we know that the Russians will have any spare capacity for UK by 2010 – 2015?

Gazprom has a monopoly on Russian nat gas exports and Gazprom controls 85 - 90 % of Russian nat gas production. In 2007 Russian nat gas production increased, but exports decreased due to increased Russian domestic consumption. According to Gazproms most recent published forecast they expect to grow net gas production by 15 - 25 Bcm/a by 2015. Gazprom exports both to the East and West and assuming continued growth in the Russian economy, Russian domestic gas consumption should be expected to continue to grow.

Bottom line is it is difficult to see that those numbers gives support for a sharp rise in Russian nat gas exports to UK. This could of course change if UK and Russia was to enter into some future strategic preferred partnership, which given todays climate between Russia and UK is hard to spot.

But OTOH, who can predict the future?

Rune

nrgyman2000 thanks for a good article, with enough warning and thought we can alter individual plans and assumptions to mitigate the consequences a bit.

To the rest of us, watch how other countries deal with energy shortfalls and learn. Often they have rolling electricty blackouts, IMO from a safety point of view this is the best way to deal with a shortage of gas - electricty cuts to domestic customers can be made by professional power workers who know what they are doing and industry can still function (though some industry like fertiliser is likely to stop altogether, yet more stuff to import at great expense!)

If you use gas for heating and want to continue BAU during the electrical power cuts you will need backup electrical power of some sort - if you need to run pumps any inverters should be 'true sine wave' and batteries should be 'deep discharge'.

All we need now for a perfect storm is the Gulf Stream to slow and change our climate to the much cooler one that it should be at our lattitude!

This is an interesting and scary part. During a conference break I came in talk with a professional from Aberdeen (NO I am not talking about you Euan) who told me that a study had been conducted to study amongst other things how long it would take to bring the households back on line if there had been a major gas supply disruption affecting many households (specific numbers was not discussed, but I understood it to be more like some hundred thousands or in the region of millions).

The answer he provided threw me completley off, he referred to the study and the need for engineering visits would make the complete reconnection take 3-4 years.

This was based on present engineering capacities to conduct such visits.

Rune

We have the same problem after earthquakes and hurricanes, when everybody needs to have their natural gas set up again without explosions from residual air in the pipes. We have to do it when 'snowbirds' shut down their water systems during winters when they are living in the south, and don't want their pilot lights running all winter. Shutting down houses for the winter is much more predictable and easier to schedule for the gas companies.

It's serious business. You don't just have someone spend half an hour showing you how to do it. You have to know what you are doing.

Britain could have gas off for weeks before the got everybody up and running again. Better make sure you know how to shut off the water supply so the pipes don't freeze.

Is there any way that the gas system could be protected from this breakdown?

For the electricity grid rolling blackouts can protect the grid, is there an equivalent for gas?

What would cause such a break?

Would it be a lack of supply - that the pipelines are just not kept full?

Or excess demand during a cold snap?

Sorry for the basic questions, but this is all new to me, and I suspect a lot others.

What proportion of gas is used by CCGT power stations, industry - large suppliers that can safely be cut off? The question is how large a shortfall is needed before the residential grid is threatened. Also assume that residential demand could be cut by maybe 10-20% by a serious government information campaign during the cold week.

There are industrial users who pay a lower interruptible tariff - so we have to assume that they are first to be cut off. This will make little difference to them since their workers will likely be on strike.

Come, come, look on the bright side. The aluminium, steel, cement, lime, glass, fertiliser etc. industries will take their annual holiday in January, works outings (by bus) to the Costas, leaving just the maintenance staff to enjoy the frosty weather.

The heating and lighting of most of the estate agencies, financial service industry and airports seem likely to become surplus to requirements shortly...

I'm so glad they managed to complete building Terminal 5, as it may be useful for something or the other, although what seems difficult to determine.

Shame that they didn't manage to improve the rail network:

http://business.timesonline.co.uk/tol/business/industry_sectors/transpor...

Network Rail forecasts overcrowded trains, longer journeys and no new lines - Times Online

Digging out the government data produces:

So there is scope for losing some usage before the pilot lights go out.

Check out Euan's post showing the decline of nuclear power within the next few years.

A lot of our coal fired equipment is also due to retire, whilst the EU's latest regulations would also lead to a lot of equipment being retired:

http://www.dailymail.co.uk/news/article-1025586/FUEL-CRISIS-Forget-warni...

Not only do new nuclear plants need around 10 years to build, but build times for coal plant are nearly as long, aside from the difficulty of obtaining imports or the long time leads needed to reopen mines.

As for renewables, for a definitive appreciation of the limits of their contribution in the UK, see David MacKay's report here:

http://www.withouthotair.com/

Sustainable Energy - Without the Hot Air (withouthotair.com)

It is clear that whilst they can help, it is in no way realistic to expect them to provide power for 60 million of us - and money is going to be tight, so there are not huge amounts of it to throw at developing them, the physical constraints outlined by MacKay aside.

So in the short term it appears that the only way to make up the shortfall in generating capacity would be by building more - natural gas plants.

In reality it appears that homes and businesses simply will not be adequately heated, and that only a fraction of present power supplies will be available.

What's the distinction between 'generation' and 'energy industry'?

Peter.

Generation is making electricity, energy industry is powering oil and gas production I believe.

Not sure about the gas proportion, but the proportion of the electricity supply is high enough to pretty much ensure that cutting off the ccgts would mean blackouts.

In answer to my own question we have Dukes 4.1.

It says we use 1,047,500 GWh of gas per year (2006):

So, I'd suggest that all the "transformation" and lets say two thirds of "industry" is connected to the network in such a way that disconnection is easy. This gives us a buffer of some 40% before the domestic grid is in danger.

Of course this data is annual averages and the problem is the very cold week where these proportions will not be quite the same.

Chris, Gas is ~ 40% UK electricity generation - you can't just disconnect them without complete chaos. I remember reading somewhere that the time to get the UK electricty grid back up after total blackout (which is basically what taking out the CCGT's would cause) is measured in weeks!

Lesser of two evils, lesser of two evils... taking gas generation offline results in peak, rolling blackouts, not total blackouts. Hardly any gas is used for the other 16 hours of the day. Keeping the domestic gas network pressurised is a far higher priority than maintaining 100% electricity supply.

AND - blackouts from turning off the generators also 'helps' by turning off all those central heating boilers, further saving on gas (albeit not entirely kindly).

If you took all the CCGTs offline in the middle of winter the lights would go out.

There was 27,000 MW of CCGT in the UK in 2006 (http://stats.berr.gov.uk/energystats/dukes5_7.xls) which represented 32.5% of total installed generating capacity of 83,000 MW. To the best of my knowledge, though I don't have the most recent figures to hand, peak winter power demand in the UK is higher than 56,000 MW, meaning we could not just switch off the CCGTs even if we knew that all other plant would be able to operate at 100% capacity.

There would be scheduled rolling blackouts without CCGT, but it wouldn't be the end of the world. A far more palatable situation than the domestic gas grid being depressurised.

This chart shows the electric supply by 30 minute settlement period on a cold day in a severe winter:

It's from the latest Ofgem Winter Outlook report for 2008/09.

Losing the gas, means losing ~15% (by eye) for half the day. That is EASY to absorb with a single 2hr rolling blackout across the country.

It's [b]very interesting[/b] to note how on a cold day however, that electricity generation from gas [b]is already[/b] dramatically reduced from average. Meaning a lot of gas has already been moved from electricity to the domestic gas network. Therefore there isn't much more 'slack' to keep the domestic network pressurised. This is a very bad sign.

We do have plenty of import capacity to import the necessary gas, we just don't have the necessary price signals or contract structure. Our prices are below European contract prices with the result that we do not have secure long term guaranteed supply. We feed off the scraps thrown to us (in winter) down BBL and the Interconnector and by the Norwegians flowing Ormen Lange gas through Langeled to Easington. In the future, with supply dropping as steeply as it appears set to do, the only pipeline gas we can rely on is Ormen Lange, and then only if we can be sure that we will outbid Europe for it.

Much has been made of the import infrastructure that has been built to cater for our future supply shortages, particularly the LNG import facilities (Isle of Grain, Dragon and South Hook [at Milford Haven] and Excellerate's Teeside facility) but for them to serve their purpose they need to attract supply - which means the right price signals must be given.

Long term gas supply contracts in the UK are indexed to the Heren Day-Ahead gas price average for the period in question - there is no future guarantee of that price and the trading market liquidity is nowhere close to sufficient to allow for large-scale hedging. European prices on the other hand are indexed to oil or distillate prices, both of which have deep and liquid markets for hedging purposes.

If an LNG producer wanted to lock in a future revenue stream to build a new LNG supply train, they would have significantly greater chance of locking in a flat price contract (with inflation indexation) in Europe than they would in the UK. That is one of the main reasons why the UK has no long term LNG supply contracts.

The Heren market gives very strong short term price signals when the market is undersupplied. However these signals are so short term that there is a serious risk that there will few, if any, LNG cargoes available to make up shortages in the time frame required when they occur.

Bunyonhead

You are right about there being a lot of transport capacity available, but will the gas be there?

Langeled (according to data from National Grid) was during several days last winter flowing 60 Mcm/d of an official capacity of 70 Mcm/d. In other words Langeled could at best add 10 Mcm/d during the upcoming heating season.

National Grid recently published figures where they expected a decline of 11 % in domestic supplies the upcoming heating season (11 % should roughly equal 25 Mcm/d).

The UK net imports through the Interconnector during the last heating seasons have been in a general decline according to data from BERR.

I would not expect imports through the BBL to increase the upcoming heating season (perhaps Rembrandt is able and kind enough to fill out more details on this).

Assuming a “normal” heating season (without any significant demand destruction through pricing) this would result in the balance coming from storage and LNG.

Your comments about LNG and UK is very interesting, and I also believe true, as LNG suppliers due to the huge capital investment and operational expenditures would favor long term contracts (with some form of indexation against inflation) for most of their capacity all year round. This guarantees a steady income flow to recover their investments and guarantees a profit margin.

In many ways LNG developers and customers looking for stable long term contracts have concurrent interests.

Rune

Chris,

This is important information that advances the understanding and debate.

I will just mention nat gas storage facilities role in the supplies chain.

Nat gas consumption is all about flows and it is highly seasonal, and during a cold winter day more than 100 Mcm/d of a total of 500 Mcm/d should be expected to come from storage facilties.

What if (and i repeat if) the storage facilties were completly run down?

Rune, ss you said elsewhere in the thread daily gas supply is all about instantaneous flow rates.

Gas from UKCS last winter was forecast to achieve 246 mcm/d, the winter of 2008/09 we're forecast to lose 33 mcm/d (and gain 5 mcm/d) to produce a maximum flow rate of just 221 mcm/d. Derating this to 90% leaves us with just 194 mcm/d. That's not a lot considering demand on a cold day could be considerably more than twice that!

Storage is critical to making up the flow rate shortfall. Three grades:

That's 140 mcm/d for 4.2 days, falling to 91 for the following 14.3 days.

Rough should be able to run through most of the winter (unless it catches fire again).

I'm worried about the storage, after a fortnight of cold weather our gas supply is down by almost 100 mcm/d. If that very cold fortnight comes early in the winter it'll be incredibly hard to refill in case of a second cold snap.

Paragraph 180 in the Winter Outlook says the best case non-storage supply is 422 mcm/d, reduce Norwegian a bit and take out the LNG and we're down to just 304 mcm/d.

Last winter the average demand was nearly 350 mcm/d, 9 days exceeded 400mcm/d. The average demand for the highest 100 days was 362 mcm /d. Paragraph 59

Chris,

Thank you for your information.

I seem to recall that National Grid announced that they have had their biggest send out

a couple of years ago of 491 Mcm/d.

Let me try a different angle;

At end of March 2008 total nat gas in UK storage based upon data from BERR just above 1 300 Mcm.

Assuming the heating season is 160 days, this makes available on average 8 Mcm/d extra from storage that may be supplied throughout the heating season.

Now assume that domestic supplies declines with 25 - 30 Mcm/d, this (assuming every else with last heating season equal; i.e. mainly neglecting effects on consumption from price increases), clearly the remaining nat gas in storage is not sufficient to cover the shortfall.

Another thing is that decreasing domestic supplies could make it necessary to start storage withdrawals earlier and end them later (all other things equal).

This is a simplified way to illustrate the challenges facing future UK nat gas supplies.

First of all thanks for all the kind words, and not least excellent and good comments advancing this important debate and drawing attention to the challenges.

About interruptions in UK (other nations as well) nat gas supplies.

I take it that some regions are more vulnerable than others.

Let us look into, as of now a hypothetical scenario, but which is much closer to reality than most would like to think about. Nat gas consumption is highly seasonal.

SCENARIO

During a cold snap nat gas consumption in the UK can reach about 500 Mcm/d.

Nat gas consumption is all about flow.

Some 100+ Mcm/d (during this cold snap) would normally be supplied by storage withdrawals. Nat gas storage in UK is split on three categories, long, medium and short term and total capacity is 4 200 Mcm. During a cold snap the households’ relative part of the nat gas consumption increases while industry (may be assumed constant) and electrical generation increases.

What if the storage facilities for all practical purposes where completely run down (i.e. nil nat gas in storage) by say late January (which is a scenario that has a likely degree to happen the upcoming heating season).

Obviously there will not be enough interruptible supply to cut off, so households and electrical plants will also see their flow curtailed or completely cut off.

Some of the users with reduced nat gas flow might try to substitute with electrical power (which is highly available), creating a situation where demand grew while supplies were shrinking (due to curtailed nat gas flows to power plants).

In this scenario it is not difficult to imagine the tragic effects from the cascading events.

One of the Achilles heels in UK nat gas supplies system is storage capacities, and during the last heating seasons the UK has only been some heating degree days away from having this scenario being played out in full.

Given time (and not least the mercy of the TOD editors) I might develop a future post (most of it already developed based on historical data from BERR and forecast developments on domestic and imported supplies) looking further into the details of the UK nat gas supply system and which would illustrate the role of the storage systems in the UK nat gas supplies system. The forecasting tool developed for this purpose illustrated how vulnerable the UK nat gas supplies system (especially on the down slope of UK domestic supplies) with is present storage system is.

Rune

We need to discuss rock bottom PRACTICAL solutions here. In practical terms people need to keep warm and cook.

Assuming an escalating domestic gas price we need to figure out the elasticity on that.

For a start energy density of modern housing can be radically reduced. Uncomfortable, yes, but not deadly. I found this very interesting table :

Degree celsius

Internal temperatures: External temperature

CentrallyNon-centrally

heated heated

homes homes Average

1970 13.8 11.3 12.1 5.8

1971 14.5 12.0 12.9 6.7

1972 14.3 11.8 12.7 6.4

1973 14.1 11.6 12.7 6.1

1974 14.8 12.3 13.4 6.7

1975 14.3 11.8 13.0 6.4

1976 13.6 11.1 12.4 5.8

1977 14.6 12.1 13.5 6.6

1978 14.7 12.2 13.6 6.4

1979 13.9 11.4 12.8 5.1

1980 14.4 11.9 13.4 5.8

1981 13.9 11.4 12.8 5.1

1982 14.6 12.1 13.6 5.8

1983 14.9 12.4 14.1 6.2

1984 14.4 11.9 13.6 5.8

1985 14.0 11.5 13.3 4.8

1986 14.8 12.3 14.1 5.2

1987 14.4 11.9 13.8 4.9

1988 15.5 13.0 14.9 6.2

1989 15.8 13.3 15.2 6.9

1990 16.7 14.2 16.2 7.6

1991 15.9 13.4 15.4 6.0

1992 16.0 13.5 15.5 6.1

1993 16.2 13.7 15.8 6.1

1994 16.9 14.4 16.5 7.2

1995 16.4 13.9 16.1 6.9

1996 17.1 14.6 16.8 5.7

1997 17.4 14.9 17.1 7.3

1998 17.9 15.4 17.6 7.5

1999 17.5 15.0 17.3 7.2

2000 17.9 15.4 17.6 7.1

2001 18.1 15.6 17.9 6.6

2002 19.3 16.8 19.0 7.7

2003 18.4 15.9 18.2 6.7