A State of Emergency

Posted by Euan Mearns on June 25, 2008 - 9:55am in The Oil Drum: Europe

Click all charts to enlarge, without call out.

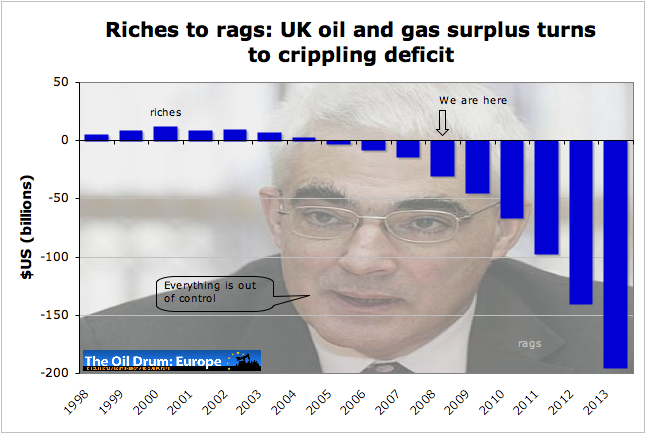

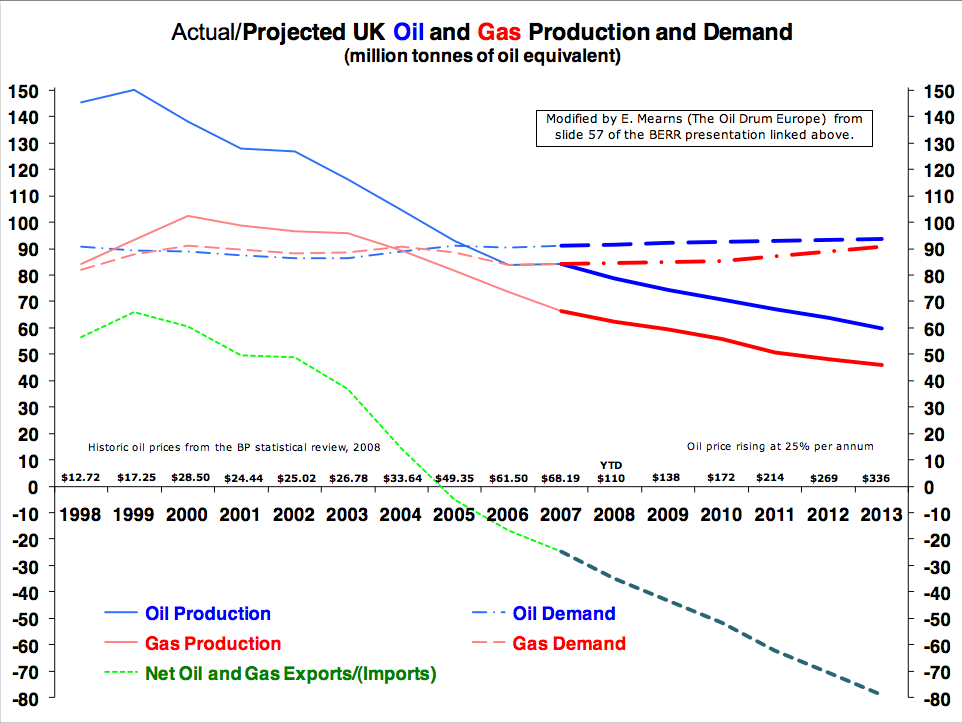

| This BERR assessment (960 kb pdf, 58 slides) of oil and gas production on the UK continental shelf arrived in my mail box last week. It is one of the best summaries I've seen and should be read by all with an interest in the future of UK and European energy security. The chart above is based upon the BERR forecast for UK oil and gas production. It is time for Alistair Darling and Mervyn King to explain to the British people why they see current problems with energy prices and associated inflation as a transient blip when the UK seems to be in a terminal dive towards insolvency. |

Methodology

The bar-charts are prepared from the BERR forecast shown below (slide 57 of the presentation). United Kingdom continental shelf (UKCS) production of oil and natural gas are forecast to continue their decline from their respective production peaks in 1999 and 2000. The decline rate is not given, but it appears to be around 8% which seems about right.

Chart modified from slide 57 of the BERR presentation. Click on chart to enlarge.

Historic oil prices shown on this chart are the annual average for Brent Blend taken from the BP statistical review of World Energy 2008. This year to date (YTD) is about $110 and the forecast uses an annual rate of increase of oil and gas prices of 25% per annum. It is of course near impossible to forecast future oil and gas prices, but with international demand for oil and gas continuing to rise against near static supply, the trend of increasing prices seen in recent years seems set to continue.

BERR forecasts consumption of oil and gas to remain relatively flat. This seems a reasonable first order assumption to make. However, in the real world, escalating fuel and domestic energy costs will lead to widespread conservation. The well-off will insulate their homes and buy more fuel efficient cars. The poor will switch off their heating and take the bus. It is near impossible to forecast the scale of energy demand destruction that will take place in the UK.

Oil and gas are assumed to have equivalent price. Millions of tonnes of oil equivalent are converted to millions of barrels by multiplying by 7.33.

From riches to rags

The bar chart up top indicates the cost of importing oil and gas to the UK ballooning to about $200 billion (£100 billion) per annum by 2013 - just 5 years away. This completely dwarfs the riches of North Sea oil and gas production the UK enjoyed up to 2004, which were exported at rock bottom energy prices. The chart is indicative since it is unlikely that this will ever come to pass. It is unlikely that the UK will be able to source or pay for this ever rising energy bill on the international markets.

Left to market forces, the problem will be solved by spreading energy poverty throughout the UK population. The wealthy who can afford the small amount of expensive energy on offer will be fine whilst the poor will just have to go without - personal transport, heat, light and power.

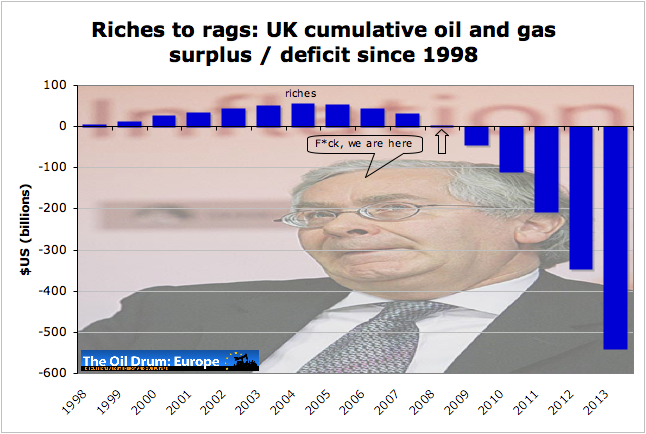

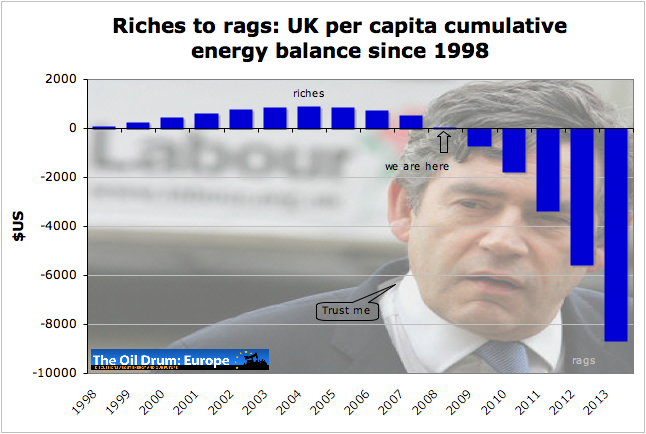

The charts below show the gross cumulative and per capita cumulative surplus / deficit from 1998 which is when the BERR chart begins, which coincides roughly with when the New Labour government (Blair - Brown) came to power. We are currently at the fulcrum of surplus turning to deficit. By 2013, the UK may well run up a cumulative deficit in oil and gas imports in excess of $500 billion - if we can find countries that will sell us oil and gas on credit. This equates to an energy debt over $8000 for every man, woman and child in 5 short years. This is in addition to the already dreadful debts we have run up as a country importing consumer goods on credit (see below).

Mervyn King, Governor of the "independent" Bank of England;-)

Gordon Brown, the most confused man in the world? On his way to Saudi Arabia to beg for more oil to combat global warming whilst promising a green energy revolution at home founded on nuclear power.

Population data from The United Nations.

A state of emergency

We should hopefully by now have reached a point where all stake holders in UK, European and Global energy are able to grasp the simple fact that we are now in the early stages of a full blown global energy crisis. The focus is currently on oil but this will soon turn to concerns over natural gas and coal supplies.

This crisis has been turned into a state of emergency by the indifference of political leaders in the UK (and throughout the world), fluttering in the wind of poorly informed public opinion while they have prevaricated about expanding renewable energy resources and building new nuclear power stations. All warnings of this pending energy crisis have been ignored in favor of pursuing popular policies that created the illusion of prosperity whilst the fundamentals of our nations security and well being have been draining away.

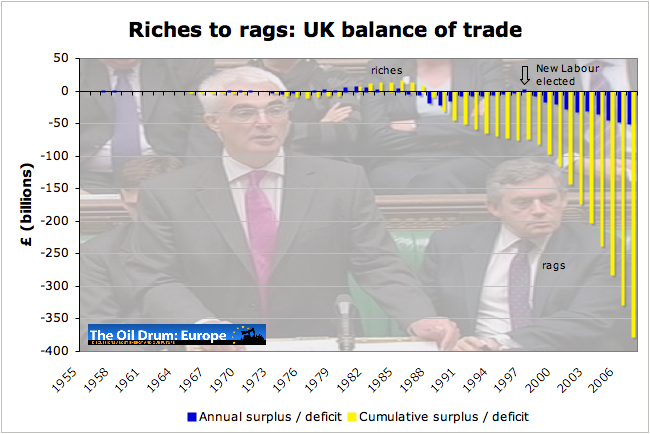

The chart below shows the current state of the UK trade balance. This is the position at the end of the good times North Sea oil and gas have provided. The situation now is about to get a whole lot worse as our energy surplus turns into a crippling deficit with no plan on the horizon of returning the books to balance.

Data from National Statistics Online, table 5050646091.csv, column ikbj.

I have not attempted a forecast since some major changes to UK trading status are to be expected. Higher food, fuel, domestic energy and bank interest bills will squeeze the disposable income of many individuals and families. Thus, instead of buying consumer goods and going to Spain on vacation, families will instead spend this money on food and energy. Thus we can expect the deficit in goods and tourism to reduce while the deficit in energy balloons.

The future

The exchange last week between Mervyn King (Governor of the Bank of England) and Alistair Darling (Chancellor of the Exchequer) suggests that they plan to do nothing about this presuming that the upwards tick in energy and food prices (that began in 2002) will drop out of the annual inflation statistics a year from now. True rabbits caught in the headlights. They have created a perilous situation for the UK economy that they seem not to understand let alone know how to fix.

Here are a few pointers to what I think we can expect in the next 18 months:

- Forever rising energy import bills will pressure Sterling which will continue to fall, pushing up the cost of energy, food and consumer goods even more.

- Public sector workers, no longer able to borrow to supplement income will begin to strike once they discover that 3% wage increases do not come close to covering the rise in the cost of living (the great inflation lie will be found out).

- Unemployment will begin a steady rise as financial services, banks, building sector, airlines, airports, leisure and retail come under severe pressure. They will be joined by public service workers as the government struggles to fund public services with falling tax receipts, spiraling debt and a falling pound. (already happening in Aberdeen with deep cuts in education spending across the city and teacher numbers being slashed).

- I won't go into the spiraling and compounding nature of this on the property market since this is an article about energy.

- The elderly and poor will really struggle this winter to pay their energy and food bills. If the weather is cold, the grid might fail and the vulnerable will begin to die from cold and starvation.

Following that things will begin to get worse as the UK discovers that it is struggling to secure sufficient natural gas at any price, on the liberalised market they helped create. Society becomes more polarised into those who can still afford to drive an SUV, live in comfort and warmth and fill their bellies with prime Aberdeen Angus steak set against a new under class who struggle to feed and heat their families. Welcome to Britain in 2010.

The End

Further reading on UK energy on The Oil Drum

Chris Vernon March 2006

UK Energy GapEuan Mearns September 2006

Oil export - import model for the UKEuan Mearns October 2006

Lies, Damned Lies and Government Oil Production Forecasts?Euan Mearns November 2006

The architecture of UK offshore oil production in relation to future production modelsChris Vernon February 2007

UK Energy Descent ContinuesJerome a Paris June 2007

The Anglo Disease - an introductionEuan Mearns July 2007

UK Energy SecurityJerome a Paris October 2007

Energy: the fundamental unseriousness of Gordon BrownEuan Mearns December 2007

The European Gas MarketEuan Mearns December 2007

Daddy, will the lights be on at Christmas?Chris Vernon January 2008

Nuclear BritainEuan Mearns February 2008

Energy Prices, Inflation and DenialEuan Mearns May 2008

European Gas Security: The Future of Natural GasJerome a Paris June 2008

Countdown to $200 oil meets Anglo DiseaseGuest post Bob Everett June 2008

A Little History of the Affordability of Domestic Energy in Great BritainGuest post Rune Likvern June 2008

Why UK Natural Gas Prices Will Move North of 100p/Therm This WinterI think it is fair to say that we have been beating this drum pretty hard and loud. While the press and television have begun to help of late they could do an awful lot more. I'd like to see Alistair Darling answer questions about the UK energy trade balance on prime time current affairs. And I believe it is time we had some televised debates about this energy issue that is vital to all of us.

The meeting in Saudi Arabia hasn't achieved any substantial results from what I can see. Oil prices are still going up. There must be something else that's driving prices up and I think I know what it is. Contrary to what US Energy Secretary Samuel Bodman says I don't think supply and demand are really causing the problem. There are to many other factors at play here. Too many middle men skimming profits. Too much manipulation of supplies and inventories. Although oil appears to be a good hedge against inflation, a lower dollar and a low oil supply, in reality nothing could be farther from the truth. Our oil supply is becoming less of an issue because inflation is causing a surplus of gas. The main thing driving inflation is high oil prices and as inflation goes higher investors buy more oil driving inflation higher again. Some experts predict this will trigger the worldwide recession. This will result in lower gas consumption and it will free up more gas supplies.. I am no expert but even I can see the writing on the wall. Investors are going to loose their shirts on oil. We may be looking at another ENRON. Hedge funds will topple leaving old age pensioners with nothing. The government won't be able to bail them out this time because the cost would be far to great. The CFTC and FSA will be too slow to react to the cracks forming in commodities trading so the govenment will finally step in. By that time it will probably be too late. www.nbtv.ca

There was a recent chart (maybe on TOD but I don't have the reference to hand) which showed that oil consumption in the oil producers themselves plus China, India etc now slightly exceeded OECD consumption. Extensive fuel subsidies are in place in these countries although India and China are trying to reduce them.

On this basis we can conclude that the oil producers are pretty well immune to recession and that their internal oil consumption will carry on rising. China etc could experience recession although OECD nations will still buy some clothing, electronic goods etc. A recession in China might mean their adding just 8m vehicles pa to the roads vs 10m pa as at present...but oil consumption would still rise.

It would therefore take a disproportionate recession in OECD nations to substantially reduce global oil demand. In any event as far as OECD nations are concerned $150 oil with full employment or $80 oil with 10% unemployed (due to oil price super-spike leading to recession) still means that at least 10% are priced out of the oil market.

According to BP Statistical Review 2008, OECD coutries in 2007 consumed about 48 Mb/d out of a total global consumption of 85 Mb/d.

During the recession in the early 80's OECD countries reduced their oil consumption with about 15 % through 3-4 years.

It would not suprise me to see the USA cut oil consumption by 15-25% over the next 5 years (3-5 million bpd). And it wouldn't suprise me to see China, India and OPEC take up all that slack.

That may seem unrealistic - but I'm expecting a LOT of economic pain, and if people hurt bad enough they will change.

The question is how much demand destruction will be due to rising prices, and how much due to a depressed economy.

If the pound (or the dollar) fall, these two factors may blend together. Very high prices in the local currency, but not so much of a rise in Euros or Yuan.

So the demand destruction gets localised to the Anglo countries.

Of course as Euan implies this can become a feedback loop. Weak currency leads to high local prices, hits economy harder, causes currency to fall further.

This is how we "deal with" peak exports, hey WT?

As soon as we are on the downside of the Peak Oil curve( 2008 to 2010), global demand will always exceed production, and so there will be no demand destruction. Currently demand is higher than supply, so we are there already.

This also means that no matter what the USA does to conserve oil, the rate of depletion will continue at the same rate -- unless we can get ourselves and the other 3/4ths of the global demand to conserve. This is not very likely.

So can use the oil that we can buy for risk management, or we can use it to build highways for job creation, or solar and wind, but without oil neither of those has a future. But, this is the direction the USA will take.

Without meaning to be rude, you do not seem to distinguish between a statement and an argument.

You state: 'global demand will always exceed production, and so there will be no demand destruction'

If so, why?

What would be the effect of, for instance, a run on the US currency so that it became effectively worthless - would this not reduce demand?

You also do not distinguish terms tightly enough even in your blanket statements: demand technically always matched supply, it does not exceed it or fall short of it.

The question is: at what price do they balance?

If the price were lower than today following major recession then the statement you make would not be true.

U.S. demand can virtually collapse, and depletion will remain much the same. The U.S. is 1/4th the demand. As supply decreases, demand is progressively higher by comparison.

I'm not sure you understand what "demand destruction" means.

It does not mean "demand falls faster than supply". It means "price dampens demand". Indeed, demand destruction can occur even when demand is increasing - if 2% demand growth is expected and only 1% growth occurs due to high prices, that "missing" 1% is due to demand destruction.

Given that, demand destruction has already been happening for several years, particularly among the rich (and oil-prolifigate) nations; OECD demand is the same as it was in 2003 (by EIA numbers).

So?

Reduced US demand means reduced US money going overseas to pay for imported oil means lower burden on US citizens means less hardship. Import prices will be high (if other nations also conserve) or higher (if they don't), but in either case the US will unilaterally benefit from conservation through the simple expedient of having to pay less.

You keep claiming that; I'm not sure if you realize that that doesn't make it true.

Conversely, it doesn't make it false either!

Ted999, member for 10 hours 4 min = CDJ (Cornucopian du Jour)

There are many here who were/are cornucopians. Remember that. Demonstrate your case. It is the TOD way, isn't it?

I suspect it's the same guy, and arguing the same points over and over again gets pretty tiresome all the way around.

Here's what I'd like to see from those who are proposing that oil prices are largely about "speculators" and/or "middle men": Tell a rational, somewhat simplified, but reality-based story about how a speculator or middle man can pocket half the price of a gallon of gasoline or heating oil. Because that's the common version of this myth - subscribed to by one of my senators, my congressman, my heating oil supplier - that $2 of a $4 gallon is going into the accounts of speculators.

What I don't want is some variation on "Enron did it with electricity, so of course it can be done with oil the same way." Those two markets are just too different. So no hand-waving at Enron or the like, instead I'm asking for a simple story illustrating how it could even be possible for a speculator to pocket $2 out of the final sale of a $4 gallon. I'm betting that if you go from (1) the price of the barrel collected by the producer, add (2) transport and refining, plus (3) taxes, plus (4) the profit such as it is of the service station or heating oil dealer, you will account for better than 99% of your $4 gallon, with only a few cents at best left for even the successful speculator. That's not to say it's not worth being a speculator - if you can keep buying, say, 30-day future contracts, and make 1% on each of them, over a year you're turning a 12% profit - enough to run a business. But you're also only adding a few cents to each gallon - nothing like $2. And you're keeping liquidity in the markets, which actually smooths out price fluctuations, which over time tends to keep prices lower.

Until you can tell me a plausible story about how you could be a successful oil speculator, on the order of $2 a gallon, all I can conclude is that a whole lot of people who should be smart enough to know better are screaming at the moon, demanding free cheese.

What I’d like to know is where are these supposed speculator profits going? What hedge fund or financial institution is raking in a significant share of the total trade in oil every day? This is many billions of dollars. Somebody please let me know I’d love to invest in this company. I’ve looked, Citi Group’s name comes up as a player but this is a company circling the toilet bowl and begging for foreign investments (bailouts with crappy terms) so I know its not them.

Just like with stocks, the profits go to the traders who bought low and sell high. There is a bandwagon effect where investors who dumped stock and bonds are jumping into commodities. It's like an auction. More buyers who want the same thing will bid against each other and end up at a higher price, but in the end, you have to unload it at an even higher price to make any money.

Not discussed in the current round of congressional victization theories: How net long are the speculators? For about the last year, the specs have maintained the same short-long position; the net long positions held have NOT increased. Albeit specs have about doubled their percentage of WTI open interest vs commercials in recent years (allegedly "proof" they are manipulating the market), this in and of itself proves nothing. I find the CFTC COT reports impossible to comprehend, but one analysis of the data I read a few weeks ago stated: In the 2001-2002 period the speculative open interest was 30% net long; in about the last year this number has dropped to 10%; i.e., as prices rose, the specs got less long, not more. According to this analysis, for the reporting period ending 20 May, the specs were net SHORT about a quarter of a million options and futures - not a number I can confirm from looking at the CFTC data. If so, the boys got hammered in the recent spike to $140. Possibly, the recent price strength is not (as Dingell et al allege) more pension funds etc getting more long, but shorts covering?

Much was made of the "Enron loophole", but according to today's press Congress claims this loophole is now closed - how they did it not disclosed. If true, this leaves us with the evils of swaps contracts that allegedly allow Goldman, MS and others to circumscribe position limits to facilitate trades for their clients. Since - to my mind - these brokers are merely conduits executing large scale orders, how are they "controlling" the market? If XYZ Pension Fund wants to get in the game and establish a "large" WTI position, the forward roll strategy would probably be employed. XYZ enters the market and buys the front contract; in doing this prices may (or for argument's sake, do) increase; however, within a few weeks XYZ sells these contracts - unless he wants physical delivery at Cushing, and EIA data shows there has been no increase in storage, rather the opposite - and thereby exerts downward price pressure, a zero sum game when the net effects of buying and selling are added together. Over a period of time, XYZ merely buys, sells, buys, sells, etc. - each time incurring the frictional costs of commissions to hold his position. This may be a tad naive, but for every long there is a short, the net long position of the specs has been flat for about the last year while prices have taken off, so I fail to find any causal effect.

even Enron had too physically effect supply to pull off its fixes.

it wasn't just a manipulation of non physical factors. dealers were phoning up station controllers (corrupt no doubt) and getting generating plants to go off line with bogus maintance issues.

Boris

London

what I would like to see is who they are going to blame the oil price on after congress has passed these new laws to keep speculators out of the oil markets?

I guess they will then blame it on the Arabs :/

There still are many cornucopians here. They believe that solar, wind, nuclear, coal liquids, and other alternatives will yield us fantastic quantities of energy and prevent disaster. They don't realize that oil is the great enabler. Alternative energy sources appear to have a good net energy result, but only oil makes that possible. Without oil, we won't have the highways and the power grid. And that's it. These new cornucopians did not do their science homework, and it shows. They persist in their beliefs, despite the fact the Peak Oil is upon us and there is not even a plan of how the alternatives will fill the gap as we rapidly slide down the slope toward terminal oil depletion. These corucopians avoid focusing where we must, on risk management.

It is hard to give up something you hold dear. Even if that is just an idea.

And the high standard of living that most westerners currently hold certainly applies.

Many people like to live in fairy land and hope for the best. They rather not deal with reality.

I accept the idea of Peak Oil. But I am still having trouble adjusting my thinking to the ramifications of it.

Hope is a powerful thing. It is just a double edged sword sometimes.

Agree ramilehti. And these sorts of reads don't help...

-----------------

Excerpt from The Asia Times (Online), a few days ago:

..."The view that recent US military adventures in the Middle East and the broader Central Asia are driven by energy considerations is further reinforced by the dubious theory of Peak Oil, which maintains that, having peaked, world oil resources are now dwindling and that, therefore, war power and military strength are key to access or control of the shrinking energy resources.

"Not only is Peak Oil theory unscientific, unrealistic, and perhaps even fraudulent; war and military force are no longer the necessary or appropriate means to gain access to sources of energy - resorting to military measures can, indeed, lead to costly, not cheap, oil. In fact, despite the lucrative spoils of war resulting from high oil prices and profits, Big Oil prefers peace and stability, not war and geopolitical turbulence, in global energy markets"...

Full article; http://www.atimes.com/atimes/Global_Economy/JF25Dj05.html

----------------

Regards, Matt B

Found myself in peak hour traffic this arvo. Wouldn't miss it in the slightest!

Peak Oil as fraudulent. Thats the first time I heard that one.

I supose they will blame Matt Simmons for the oil prices next and acuse him of scaring the oil prices higher to make himself rich!

To the extent that PO having become (somewhat) mainstream has changed the psychology of the market, one could blame it's proponents. If producers are noticing that their finite fields are depleting, and choose to limit their rate of production (rather than letting geology be the only limitation), then the "theory" is in fact a major driver in bringing about the current supply shortfall. That doesn't mean that the producers are not doing the future a favor, by saving some for the future. But given the enormous discount rate apparent among the political and financial sphere, anything which prevents maximum current production is considered to be an agent of misery. Of course if you believe reserves are really trillions of barrels (and don't factor in the fact that most of these are really difficult to extract), then wanting to pump it out faster is rational.

The best I can say about that column is that it was a guest column by a supposed professor at a minor school in Iowa. So, it was not an article at all, but a column. The man obviously knows next to nothing about oil. Also, I fear he will not teach his students much as he makes loads of assertions without making much effort to demonstrate or prove them. The PO as fraud one was nice. Hell, he couldn't even get the provenance right. He stated it started in the 40's, I think, then came up "again" in the '70's and claimed world decline within a couple decades? Well, um, no...

It came up in the 50's and remained an issue until proven in the 70's by the same man who had brought it up in the first place. But that dimwit tried to imply it had been raised and refuted over and over, even prior during those early years!

Etc., etc.

Idiot.

I have no respect for people who can't get past their agendas.

One of you better writers should do a rebuttal to that twaddle.

Cheers

Hi Cliff,

re: "...focusing where we must, on risk management"

What kinds of things are you referring to when you talk about "risk management"?

Hi Aniya,

Short term preparations for power failures, family planning for this, what you need for months with nothing from the outside, food, and with no heat super warm clothing, FEMA has stuff on this, storing all the potable water you can as soon as there is a black out, like filling everything you have including the bath tub, then no baths ): and saving clean plastic milk containers, 5 gallon buckets, water necessary for months.

Mid term for guarding financial resources and making locally what comes in on the interstate and over wires and pipes. Avoiding wasteful investments like gold and solar panels. Relocating if you need to and can do it.

Long term for carrying to the other side useful technology for after "the last black out." How do you irrigate without power? You can make cement and penicillin if you know how. One book example: "Where there is No Doctor," there will be docs, but they need to know how to work without all their hospital stuff. How to make IUDs.

Then there is community planning: water, heating, shelter, farming, transport, mutual info/tech sharing, mutual neighborhood defense as the police will not be ready unless you begin to educate them. Educating family and people about: peak oil impacts, google those words, and you get my report, the best source explaining the Peak Oil catastrophe ahead, but TOD won't post it (:

I'll have details on my blog, "Surviving Peak Oil and Peak Oil Preparations" when it goes up soon, I hope. The preparation//planning/survival stuff on the Internet needs some improvement.

I took your advice on many short paragraphs :)

Hugs, Cliff

That would be because nobody has presented a strong case for oil being fundamentally irreplaceable.

Care to try?

Why, specifically, is it not possible to produce alternative energy sources without oil?

Note that CTL and GTL can be used to create oil, so there will be some oil available for many decades to come. Accordingly, any chokepoint for creating alternative energy has to require not merely some oil but lots of oil. Any lesser requirements won't prevent their construction.

So why, specifically, does the construction of alternative energy sources require lots of oil? Just making claims doesn't constitute an argument.

Why not?

Highways can be made with concrete, which doesn't need oil (recent developments have made concrete highways more resilient to freeze/thaw cycles, at least those seen in Germany).

I assume you aren't suggesting that oil is important for direct generation of electricity (in the OECD, at least), and that your concern is infrastructure upkeep. For the same reason as above, though, that's only a concern if it requires lots of oil, not merely some oil, so that's what you need to show.

It's a mistake to assume that people disagree with you because they're ignorant, or even because they're wrong.

Oil is replaceable, but not easily and not quickly.

The fundamental problem is that with a growing world economy largely based on oil and a steadily decreasing supply of oil there will be pain in making transitions. Enough pain that in some areas the transitions to alternates will fail.

Some alternates, like fusion power, may prove to be impractical or even impossible. Others, like solar-electric, may not scale as well as we would like.

Then there are the ones like direct wind (sail, wind-driven pumps and mills) that require looking at the world in a different way.

The only thing that can be said for certain is that the world in 20 years will look a lot different than it does today.

(I geek on energy, so my examples are all based on energy, but the same principles apply to fertiliser and plastics)

Your evidence for this assertion is...?

I agree that such an outcome is possible, but it's a leap of faith to declare it inevitable.

Indeed, they may not. Or they may.

All I'm saying is that if someone wants to assume that "may" will work out to be either "will" or "will not", it's an assertion that needs to be backed up.

The balance of evidence is that there are no technical barriers to scaling up alternative sources such as solar or wind. The US DOE recently released an extensive analysis of what would be required to replace 20% of US electrical generation with wind power by 2030, so that gives us a fairly solid base from which to examine constraints such as steel use or manufacturing capacity (neither are even close to being an issue).

Fundamentally speaking, replacing the world's energy supply is a fairly small problem. At $2M/MW (current price of wind, probable near-future price of solar) @ 25% capacity factor, replacing the world's 20,000TWh/yr of electrical generation with renewables would take about 20,000TWh/yr / (8800hr/yr * 25% capacity * 1MW/$2M) = 20,000MMWh/yr / 2200MWh/yr * $2M = 20M / 2.2 * $2M = ~$20MM = $20T = ~15 months of global manufacturing output.

The bigger problem is replacing the things that use energy - particularly cars, but also space heating - to run on electricity. That problem's roughly 10x the size (estimated about the same way), meaning it'll be the work of decades.

I only declare it as an inevitability because history shows that when people have needed to make major changes in the past some groups make the transitions and others don't.

The challenges upon us are already causing major upheavals in some areas, and it is unrealistic to assume that this will not continue to be the case for the forseeable future. I am fortunate enough to live in an area blessed with a temperate clime, good resources and relatively low population density. I have great hopes for this part of the world. Other places without these benefits: outlook uncertain.

Converting space heating? You might be right, but I don't see it locally. In Northern New England most residential heating is currently oil. At current electric rates here passive electric space heating will become cheaper per therm if heating oil goes above roughly $5 a gallon (currently it's about $4.40). What would it take to do that conversion in a typical residence? If there's 200 amp service into the home, and adequate wall circuits, you can go out and get a half-dozen 1500 watt (12.5 amp) space heaters for as little as $20 each. On a typical winter day, in an insulated house, that (in my experience) can be enough to keep things warm.

The electricity won't be cheap. But the conversion to electric space heating for a typical New England residence is. Then again, the aggregate electrical demand that will create (which could well be this winter if oil does crest $5 a gallon) will be beyond what the transmission lines can support. And the demand will ultimately raise electric rates. Still, most Northern New England households already have several space heaters. So if your equations are right for a generating capacity substitution build out, and if a transmission grid improvement is possible, converting every oil-burning residence in America to electric heat should be doable within two years (allowing for those residences that still need the upgrade to 200 amp service and modern internal wiring).

In my experience with electric space heating (Wisconsin, USA, outside temp -30) you don't heat the whole house to a comfortable temperature, you heat the kitchen primarily by cooking and the living room with electric.

The bedrooms use electric heat, but only at night and only to a temperature that is comfortable for sleeping with a heavy quilt, somewhere in the low 60's (or maybe 50's, we didn't keep thermometers everywhere).

As I mentioned in the first post I made, some of what needs to be done involves thinking about solutions differently. Not trying to do everything to the same standard we do today, but falling back to earlier ways of thinking about time and space when getting things done.

Heat bedrooms? Why? Just grab your clothes and run in the morning.

(former New England resident)

It will typically be better to use heat pumps rather than resistive heating, as you get 2-4 times the heating value per kWh, even in Canadian climates.

As compared to oil heat, and using Halifax as a proxy for New England, the systems would pay back their installation costs in 2-8 years (longer for more efficient systems). (With Canadian electricity costs, but with 2003 oil prices.)

Better insulation is probably the first order of business for many buildings, though; it's amazing what sealing drafts can do.

The Office of Energy Efficiency booklet uses a 10kW system for a 2000sqft house as an example. That appears to be 10kW output, so about 3kW input. At 240V, that's about 12 amps, which isn't a big deal.

You're right that it would be expensive and hard on the grids if everyone used resistive heating, but that should be used as a temporary measure at best. Heat pumps are much better for any period over a few years.

The long-term answer, I posit, is to convert structures to passive solar whenever and wherever feasible. Alas, this, too, takes money and resources. Perhaps doing it by attrition... but by then we might have those renewables...

Ah, the real issue is time. If peak is any time in the next ten years, the pain will likely be great. If it it's now, the pain will be likely be disastrous for many.

Cheers

"Fundamentally speaking, replacing the world's energy supply is a fairly small problem. At $2M/MW (current price of wind, probable near-future price of solar) @ 25% capacity factor, replacing the world's 20,000TWh/yr of electrical generation with renewables would take about 20,000TWh/yr / (8800hr/yr * 25% capacity * 1MW/$2M) = 20,000MMWh/yr / 2200MWh/yr * $2M = 20M / 2.2 * $2M = ~$20MM = $20T = ~15 months of global manufacturing output. "

Your personal opinion Pitt, do you believe the above will be achieved?

Why don't you give us an example of how you see the the world economy to progress between now and 2030, so we can be heartened.

And you say others assume, why don't you look at yourself first.

Hi Pitt,

[[[[CTL and GTL can be used to create oil]]] >>>>> at most few million barrels a day, not much, according the National Coal Council, General Accountability Office and the U.S. Army Corps of Engineers.

[[[nobody has presented a strong case for oil being fundamentally irreplaceable]]] >>>>> The National Academy of Sciences, U.S. General Accounabitly Office, Congressional Research Service, DOE, and U.S. Army Corps of Engineers have done so. Everyone on this site should be familiar with these studies. If not, the links to all of these are found by Google or Yahoo searching: peak oil impacts there you will find my report on Peak Oil Impacts, Alternatives and Renewables.

[[[is it not possible to produce alternative energy sources without oil]]] >>>>> all energies require energy to produce them, even oil. alternatives are manufactured, transported and maintained with oil.

[[[concrete, which doesn't need oil]]] >>>>> concrete requires much natural gas, coal, or oil (heat) to manufacture and oil to transport.

[[[[your concern is infrastructure upkeep. For the same reason as above, though, that's only a concern if it requires lots of oil, not merely some oil, so that's what you need to show]]] >>>>> trucks use oil/diesel to transport, thus no trucks = no infrastructure.

Where are the plans for electrifying everything: the infrastructure to electrify hundreds of thousands of miles of the highways and many thousands of recharge stations, and the same for rail and the mines and mechanized agriculture, and please don't just show us a photo of some small electric truck, tractor, train (let's see the plans and cost for the infrastructure), and how much oil, natural gas, and coal is it going to take to get there, and how will that be done with oil at $500 and $1,000 a barrel, and most people who would do this are unemployed and the US is bankrupt.

I want to see you reference to the specific plans for all of this.

There are no such plans, and the people who talk about these dreams are cornucopians. There are many here at TOD, including some of the editors who constantly feed us technofixes. They can accept peak oil, but not the impacts. For them the energy to transport, farm, and heat homes will come from somewhere to save us. You can dream on, but risk management might be more realistic.

A few million barrels a day is quite a bit. How much oil is used by essential services, in particular grid maintenance?

Even 2Mb/d would give the US about 3x the per capita oil consumption that India has, and India has a fairly well-functioning electrical grid (and is building locally-designed nuclear power plants, and developing its space program, and has a burgeoning tech industry, and is a big steel producer, and... That level of oil can go a long way).

Accordingly, it's almost certain that "a few million barrels a day" is more than enough to keep the lights on, provided it's used in a reasonable manner. The only questions are whether it will be used in a reasonable manner, and what exactly "a reasonable manner" is.

Don't assume everyone will be familiar with your writing, and don't fool yourself into thinking that "go google for my stuff" is anything approaching an argument.

If you've written this up, it should be trivial for you to concisely address the problem here. If you can't, I have no intention of sifting through the internet for something you can't even be bothered to link.

Hasty Generalization fallacy.

Alternatives use oil as an input now because oil is readily available now. That does not mean that oil is necessary for their construction, transportation, or maintenance. In particular, electricity could replace every one of those three (with the possible exception of gear lubricants, although those can be sourced from biomass gasification).

So you need to make your argument: what specific part of the process cannot be completed without oil?

Moreover, as you've noted, there will be some number of millions of barrels of oil per day available even after "oil" per se is gone; accordingly, saying "they use oil" is not a valid argument for their being impossible to construct, transport, or maintain.

You can't be serious. Are you not aware that it's possible to obtain heat without fossil fuels?

Or is this another example of your myopic fixation on how things are currently done?

Have you not heard of trains? Electrified rail? Are you really so blind that you believe "transportation = trucks" is a valid argument?

Some fraction of transport miles will be most efficiently done with trucks; fortunately, we've already agreed that there will be some number of millions of barrels of oil per day available, so the modest fraction of industrial traffic that is best done with oil will have it available.

Electrifying highways is a nonsensical straw man. Cars will be progressively electrified as oil becomes progressively more expensive; that process is already under way (witness the Prius, Th!nk, Volt prototypes, etc.), and alternatives such as mass transit and electric bikes are already being used in place of cars (China will buy more electric bikes this year that the US will buy cars).

Space heating will be lessened with insulation and converted to electric (heat pumps) progressively as the economic incentive increases, spurred along by government mandates in places (e.g., Sweden).

These aren't "plans"; these are things that are already happening to move away from oil, despite there being no "central master plan" dictating them. Insisting on seeing "plans" is largely silly (although some do exist; my understanding is that Alan has some fairly detailed plans for electrifying rail).

Nonsensical request. I don't have access to plans for building a single wind turbine, but that doesn't mean it isn't happening.

Moreover, you're trying to dodge the question.

You've made claims; I'm asking you to back them up. Insisting I should prove you wrong is a standard tactic of people who can't back up what they say. If you can't - or won't - back up your claims, don't be surprised when nobody believes them.

Dear Pitt, Please believe me when I tell you you are making an unflattering exhibition of yourself here. You are one of those people whose high IQ and creativity enables them to squirm with infinite success around the forewarnings of reality, right up until the day when they crash into the actual unsquirmable reality itself.

No one here has a duty or need to spend all day answering your infinite capacity for "yes but"s. You have a problem (1) with failing to appreciate the scaleability problems, (2) with failing to research the basics before coming to this site and demanding to be handed free basic tuition, and (3) an emotional denial problem.

Yes we need challenging discussion on this site. But please understand that not all challenging or discussion is useful. Yours isn't. Please don't waste your time and that of the valuable experts we have here. Spend more time asking "might I be wrong" and researching the facts.

(P.S. - I don't propose to get into a discussion of any of this so don't expect any reply if you are foolish enough to post any sort of rebuttal to this "last warning".)

What exactly is the purpose of your post? I cant tell if its a refutation, a rebuttal, a condemnation or just rambling displeasure. It certainly doesn't adress Pitt's objections to the imminent collapse thesis.

Scalability problems have been claimed, but not demonstrated. Forgive me if I don't take claims from anonymous internet posters at face value.

You're new here, so I suppose I can't have expected you to notice that I tend to provide a whole lot more factual and quantifiable evidence to back up my arguments than most people do. Browse through my posting history and you can see that for yourself.

I can expect you to know the difference between "research the basics" and "swallow the party line", though.

False again. I have no problem accepting the idea that society might collapse; my problem is with people using shoddy arguments to insist that it will collapse.

I'll go wherever the evidence takes me; all I ask is that others make arguments based on evidence rather than faith in their intuitions.

Ironic, considering that's pretty much what I'm asking others to do.

Might I be wrong? Of course. I've been wrong before, on this site, been corrected, and thanked the person who corrected me (and provided enough evidence that I could see they were correct, of course). I like being corrected, since that means I learned something.

By the same token, though, I expect others to be willing to take corrections and to challenge their beliefs. That's why I'm asking what evidence argues oil cannot be replaced; it's been asserted quite frequently, but when the assertion is challenged - and not always by myself - all that's been behind it has been weak, hand-waving arguments and a lack of evidence.

Maybe the assertion is right, though, which is why I'm pressing for evidence.

"Last warning"? What, do you think you have any influence over the internet, or anyone on it?

You're funny, kid.

Sad are those who don't know because they weren't told. So much sadder those who still don't know even after they have been told. You ignored my warning and just wasted a whole load more of this valuable space, to say nothing of your credibility. End of "discussion".

PS - ok, one last point -- the supposed need to demonstrate the problem of scaleability. If you really need this to be demonstrated, I'm sorry but I can't help you, any more than I could help someone to understand "why" 2 + 2 must = 4. Those who don't want to understand something never will. Emotional problem as aforementioned.

Ok Pitt, perhaps I should be a little more patient with your frustrated quest. The thing is that proving that something can be done can be proven by showing how to do it. But proving that something can't be done cannot be conversely proven by failing to show how to do it. In fact it's the wellknown impossible proving of a negative that you are demanding of others. With such problems most people can arrive at a reasonable conclusion by going through loads of options in turn and finding them all wanting. But to lay out a full demostration of such would be too big a task to fit within one of these discussion pages. Most people here have already satisfied themselves of the no adequate substitute thesis. Your trying to force people to justify it on this page just wastes everyone's time. Not because it isn't an important question, or because a proper answer has been given, but because a proper answer cannot be given here. So please accept the apologies of myself and others that we are not going to answer your doubt. And we just have to move on.

Breath-taking arrogance from the Kid, not to mention futility. Aren't you aware that "end of discussion" foot-stamping has never, ever ended a discussion on an Internet forum? And least of all from the person who says it. Ha!

Settle down fellas!

As a Joe Shmoe, I realise I'm way behind on the learning curve (decades, I would say!). I visit here to grab the basics and have a few "What The?" questions answered - so I don't look so stupid when I talk about PO with my immediate circle or anyone in passing. This sort of stuff just takes up everyone's time, which is THE most precious thing I would have thought.

Regards, Matt B

PS. Just saw the latest seasonal forecast map for Adelaide/Victoria (Oz)... Dry, dry, dry! Isn't talk of ramping up energy from current power grids a bad thing, with Mankind's so-called influence on Climate Change beginning to show its head (seemingly)?

This is not an honest statement. 1. Why must a case be strong? It need only be right in the end. Tell me, when there's no more oil, how am I gonna get my plastic chairs for my lawn parties? Can you make a strong case for every use of oil being replaceable by some other material?

2. More important than, but strongly connected to, #1 is, your question dishonestly asks one to make a strong case for the "fundamental" irreplaceability of oil. That is not really the conversation, now is it? No. The conversation is about the economical replacement of oil.

"...so there will be some oil available for many decades to come."

"Some" decades? Well, damn, how freakin' many? My kids, grandkids, great grandkids... etc., on down the generations, wanna know. It is as short-sighted to think a few decades is meaningful in terms of mankind as it is to plan your oil use as if it can never run out. Further, the sources you mention can last "some decades" if we want to turn the world into a wasteland. (I don't recall, but perhaps you are also an AGW denialist? If so, you've not much useful to say on either topic, frankly.)

Incumbent upon you, if you are going to rebut, is to also show your proofs. How much oil do we need for the future? How much environmental loss can we suffer and not fry ourselves? What can replace oil in terms of ALL its uses, and do so economically, and in the possibly very short time frames available? Or is "someday" good enough? That is, it's OK if a few billion die while we figure out how to fully replace oil, and economically so?

Enquiring minds want to know...

ccpo - On internet discussion sites one not infrequently encounters people who are absolutely rigidly convinced of their superiority over other contributors. In reality, as you say, they don't have much useful to say - even though they take up an impressive volume of space with their words. They have a striking tendency to give themselves grandeuresque historical pseudonyms. This particular genius's speciality is demands for impossible proofs of negatives. Learn to ignore!

The death of all reason.

Presumably at trial evidence would be superfluous, as it would be possible to adjudge guilt by the look in the accused's eye.

And how do you know that it is correct in the absence of strong argument?

Divine dispensation?

EDIT: That sounded more huffy than I intended, but really......

Perhaps you missed, "...in the end...", or perhaps you think the process of figuring out and dealing with PO and CC are finished, or that no action should be taken till we have 100% certainty on what to do?

Seems we've tried that with CC already, have we not? And failed miserably?

Fact is, we are often forced to take action before having certitude about a situation. This is essentially what leaders do, no? They synthesize, make their best guess and trust their instincts. How is this different? It is not.

All that is to say, consider the context, friend, for it is everything. My post did not need this explanation. But then, I teach language for a living and may be making some assumptions about what others ought to get from context. And, we are not *in a court*, but are posting to a message board.

Still, keep in mind, within the context of what to do about CC and PO, we do not have the luxury of "proving" all before acting, nor will we know whether we have made the right choices until it is past the time for action to have been taken.

The real issue here is the poster I responded to. He continually attacks. Yes, attacks. His joy apparently comes from trying to poke holes in others' posts while offering nothing to them in the way of direction or suggestion. It is all confrontation, all the time.

I detest small people. Such a person is small.

This is a bit huffy, and deservedly so.

Cheers

I find Pitt the Elder both stimulating and productive, with his emphasis on the need for precision.

And yes, he has in the past criticised some of my posts - where needed, I corrected and thanked him for his input.

If a case is correct, then the opportunity to examine it should be welcome, and as Taleb argues in the 'Black Swan' what we should always be trying to do is not to confirm our position, but to look for anything which falsifies it.

It seems unlikely that anyone who doesn't already agree with a position will be persuaded by repeating the assertion that it should not be questioned.

I certainly welcome criticism of any of my positions, hence my welcoming Pitt's posts.

Yes. You can talk to Sasol about how they make it from coal. Its just using syngas (CO + H) over various catalysts to make whatever hydrocarbons you need. You can get hydrogen from water and CO from limestone if you dont want to use coal.

CTL is profitable now. It takes a little while to build the infrastructure.

Well long enough that we'll be able to build replacement infrastructure is all that is important.

I think oil is replaceable. World War II was fought with under 10 million barrels per day of world production.

This is an intereting statement and holds great truth. It also disguises the problem; experts rarely agree on a unified solution.

eg, The pro nuclear experts (Royal Society for example and, I think, The Royal Institution of Chartered Surveyors has a similar view)tell us wind cannot replace conventional generation. The wind lobby (David Milborrow, BWEA for example) tell us wind can. From reading D Milborrow's article on "assimilating wind" he puts a very strong case for wind that debunks the "winter anticyclone" senario many talk about.

Both the Royal Society et al, BWEA and D Milborrow are respected bodies, with opposing views. They can't both be right and none of them are ignorant, I would like to think in any case. My belief is no one knows the solution to fossil fuel depletion. When we started using oil and other fossil fuels, we evolved at a rate that we could extract them at. We now have the possibility of a discontinuity in energy supply and the proposed solutions are currently speculative. By speculative, I mean we don't actually know how they will hold without a fossil fuel platform to fall back on. To hold, they must be sufficiently energy positive, affordable to all users and make adequate profit to encourage investment. They may do well, they may not.

Making concrete is very energy intensive. I think 10% of the world's energy consumption is consumed making it. I have to admit I have not checked my facts here, which is rather complacent of me when tackling Pitt, but I'm sure he will correct me if I'm wrong.

no we don't, that is a straw man. there is a lot of renewables out there but I wouldn't call it "fantastic." there is lots of conservation out there that can happen.

oil is not the great enabler. oil can be replaced. we can use electricity is move cars. it's as simple as that. it's already happening.

No, It isn't happening, and that's because it isn't "as simple as that".

Changing millions of cars (and countless other machines) from oil can't be done just by clicking fingers or by making ultra-brilliant decisions in boardrooms. It would be a massive task which would require huge amounts of energy and time. Which we haven't got. So it will never happen. When the transport system collapses all those grand projects of new infrastructure will collapse with it too.

My advice above to Pitt the Elder applies to you too.

Yeah it is. The first step is taking the honda instead of the jag to the office. Choosing the train instead of the plane. The next is carpooling. After that is public transit. All these can be done very quickly with just some price pressure and thats allready happening.

Some larger scale infrastructure adjustments are also happening because of the new price regime of oil. CTL for instance is gaining momentum and market share, and higher milage cars are being more rapidly produced. These take years, but we have years because we waste so much.

But only on an absolutely piddling scale relative to the problem. On a practically meaningful scale it as near as matters is not happening and never will for reasons already stated. Please spend more time reading/thinking and less assuming you know better than those who have typed before you!

You are a very slow learner, I have to say. But learn to debate and discuss, not make unsupported assertions (ie, opinions and beliefs paraded as fact), and learn to hurl less abuse at those who question, disagree with you, or do wish to debate. End of discussion!

Disclaimer: Occitan - member < 2 hours.

Ted999 said "The main thing driving inflation is high oil prices and as inflation goes higher investors buy more oil driving inflation higher again."

Do you work for the Fed? I ask because this is their excuse too. Until you look into the easiest to understand definition of inflation (my personal example is this: increased inflation = a decrease in goods & services relative to money & credit supply OR an increase in money & credit relative to goods & services).

So we may have too many $dollars chasing a stable amount of oil supply, or we could have a stable money supply and a diminishing amount of oil. Worse case scenario is too much money and credit chasing a decreasing supply of something important. Speculators are not in this equation in meaningful way, unless if they are members of the Federal Reserve. It would also help for someone to understand how futures contracts are written for "speculators". And let's not confuse investors with speculators while were at it. My take is that for every buyer of a contract there has to be a seller. In other words for every speculator" that thinks prices are going down there has to be a counterparty that thinks prices are going up. How does this drive prices in a meaningful manner long-term in any direction?

As for the theory of investors buying more oil, what are you talking about? Do you know of any endowment or large enough institutional investor buying and storing oil somewhere? If so where is it? Even the Strategic Petroleum Reserve is a drop in cubic-mile bucket. The only ones I know that are large enough (sovereign wealth funds) already have oil. But surely you don't mean the rest of us through USO, DBO, or UCR? The only way I'm aware of actually impacting the price of oil worldwide is to affect supply (of oil and/or money & credit) OR demand (for oil with money & credit) . Easiest is to affect the supply of money through the electronic printing press. More difficult to affect the supply of oil by intercepting the delivery through purchase and by storing it somewhere. Both can only drive the price up. Are you aware of any ETFs that let you do the latter? Perhaps the folks in the Nigerian delta are the only ones right now intercepting delivery in a meaningful way, but one could definitely argue that they were not as motivated when oil was $30 bbl.

Perhaps the Fed and the member banks' excess credit creation had something to do with this bubble. Did those that complain about oil prices and blame speculators lament when their dot com stocks were increasing by 5% a month in 1999? Did those same "investors" complain about "speculators" when their home price were increasing by 5% a month more recently? No, or course not. Did any of those increases make sense? No one asked. Yet the supply of homes and dot-com stocks seemed to be increasing almost as quickly as the supply of money and credit. Interestingly now we seem to have too much paper money chasing after a seemingly diminishing supply of something critical to modern life.

What we are experiencing is the result of hubris ongoing since long before most of us were born. So, just maybe, folks had better gain an understanding of what inflation really is. It's not always something that gives you an early retirement, or turns your home into an ATM. Sometimes it takes away what you worked for. A few hours on Wikipedia will help, but luck perhaps will be of most help this time around for the clueless (present company excluded).

Occitan

Occitan - I think this is a very good summary of where we are. In particular like your definitions of inflation, and no doubt where we are right now is too many $ chasing a static supply of oil.

On the speculator front, futures contracts were normally driven by "commercials" wanting to hedge against changes in the oil price. For example, airlines hedging three out at $50 / bbl have actually been kept afloat by these wise hedging moves. The speculators on the other side of these bets have lost their shirts. Notably, many airlines kept afloat in this way are now hitting the fuel price wall as they are moving into the real world of $130+ / bbl oil.

Another major group of industry hedgers are small oil cos with borrowing, forced to hedge by banks, and many of them have lost out in recent years, forced to sell future production at low price. Now that's just what we want isn't it. Oil companies losing out on hedging and airlines winning. So if there is a problem with speculation, this is it.

The political and media focus right now on speculation is part of the blame game. OECD political leaders have done nothing to prepare for this energy crisis and now its here they want to blame everyone but themselves. The media have also done a sh*t job of covering this crisis as it has brewed for 6 years now and they too seem too willing to opt for the easy explanation rather than focus in on the real issues.

Welcome to TOD

Euan

Giddaye Euan,

"The media... opt for the easy explanation..."

I hear financial commentators and DJ's try to explain the "reasons" for rising oil prices on morning radio - quite often it seems. A few one-liners that sound straight forward, sure, but unless we Joes and Janes know the basics, the answers (whether true, part-of or whatever) sound like gobble-de-guke (sp?).

"Planet Earth is running out of 'affordable' oil", SOUNDS easier to me - that's why I'm here.

Regards, Matt B

PS. Latest humming and harring by a city council (Melbourne, Oz): Should they spend $10 billion on a new road-connector tunnel just north of the city; or upgrading and adding to a railway system that's been in place for more than seventy years. Hmmm...

Ted,

Oil is expensive, because of reserve production capacity has diminished and continues to diminish:

and because oil exports available to oil consuming countries are shrinking:

and because demand mainly from Asia is outstripping global oil supply:

and because tight refining capacity is causing distillates to rise in price even further:

That much is certain and undisputed.

However, some seem to think there is also a speculative bubble on top of the fundamental supply-demand crunch causing the initial price rise. George Soros is one of these people, so if you believe this yourself, you are certainly within esteemed company.

So, who are the people making this bubble?

Are they the commodity speculators, who buy up oil?

Well, they would need to store it somewhere (inventories) to cause a global shortage, which in turn would raise the price, allowing them to speculate with crude oil futures contracts.

But inventory levels show this is not the case:

So, if the inventory data is correct and there is no significant difference in the Asian inventory data, commodity hoarding is unlikely to have a great influence on the price currently. Speculation in general may have some effect, but it is unlikely that it accounts for $80/barrel out of the current price, like some are claiming.

Now, if not oil hoarding speculators, then who could it be?

Maybe those 'evil' (sic) Arab OPEC countries are behind it? They are an oil cartel after all, right?

That theory is again hypothetically possible, were it not for the fact, that they all publicly say that they are uncomfortable with the price, they do not want demand destruction, which is already happening:

Further, considering the infighting amongst OPEC countries, it seems unlikely on the surface at least that they would act in unison to raise the prices by not producing what they can, especially when it would be to their detriment by causing diminishing demand in the future.

Historically oil prices have always crashed, if they rise much too fast. This has never worked to the advantage of the oil producers, but has in fact put them in debt. They have publicly stated they will do anything to avoid this scenario repeating.

So, what other possibilities are there?

Those big oil corporations! ExxonMobil, Shell, BP and the rest. Maybe we should tax them, because they are behind this?

Not so fast. This is the amount of oil flow in the world they control:

While it is theoretically possible that in a very tight demand situation (like now), they would be able to raise the price somewhat by not producing that which they've got, it doesn't really make economic sense in the long run (cf. above). However, they are not a cartel and as such do not act in unison.

So, in the end, the only thing left is to accept that the fundamentals and acceptance of most probable things to come are the reasons driving the price:

If not, we can of course conjure up strategic conspiracy theories, which are always nice, but very, very hard to prove:

"Maybe the price rise doesn't reflect cost structure fundamentals"

"Saudis themselves prefer a lower price"

"Saudis are cutting production to put a squeeze on the new US president

While ideas like presented in the last three slides are perhaps possible, there really isn't fundamental data to back them up. As such, I would leave them for what they are - possible, but highly unlikely. As to refuting the argument itself, it can only be done by waiting till the new president comes to power. If KSA suddenly starts pumping oil from some hidden reserve capacity and crashes the price of oil after the first visit by Obama to KSA, then this theory might be true. Or not. As a theory is impossible to prove, it can only be refuted if the prices do NOT crash.

Personally I believe the real answer is staring us in the mirror:

It may take a while to accept, but in the end it will sink in.

We drive up the price of oil, by using more and more of it (us humans, globally). And it doesn't help blaming the Indians or the Chinese, because they are using the oil, in order to build us all the goods (and much of the food) we consume.

Blame game in this situation is neither truthful nor helpful. Only accepting the facts of oil depletion and acting on it going to help.

Hello SamuM,

Great post--thxs! Your Quote: "Only accepting the facts of oil depletion and acting on is going to help."

As explained in this posting....

http://www.theoildrum.com/node/4207/367863

...I am hoping the 'acting on it' to help ourselves is a massive ramping of global organic topsoil restoration, habitat enrichment & protection, O-NPK recycling, and I-NPK hoarding [while we still can], to help bridge the transition gap.

The problem appears to be that Overshoot effects are currently overwhelming the efforts to ramp global NPK topsoil injection rates and I-NPK hoarding efforts. I hope continued Peak Outreach* can turn the tide. But, if not, I remain a fast-crash realist.

* which includes birth control

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Siwmae (Hiya) Bob,

I've been savouring your subscript -- "Are humans smarter than yeast" -- for some time now. Makes me smile grimly every time I see it.

I still teeter round the answer that, probably, in the aggregate we shall prove to be no brighter than any other species that ramps up its population and then crashes.

Whether it's fast crash, slow crash, or -- as John Michael Greer argues, multi-step-crash, I would now give you odds-on that human population will stop its ramp-up soon, that many of us are going to die untimely and nastily, and that it's probably too late to do much about it on the wide-scale.

All each of us can do now, after doing what we can to secure things for our nearest and dearest, is to be good to each other, as far as we're able, and do what we're able to help the victims who happen to come within our reach. I absolutely don't believe that the die-off will be conveniently confined to the distant hyper-wretched of the Earth, as we of the Pampered Twenty Percent are all quietly hallucinating at the backs of our minds.

At least yeast probably can't peer into the future and know what's coming to get them.

Cofion gorau (Best remembrances), RhG

Bob,

you are way ahead of the curve from me on this one. Phosphorous systemic depletion and potential peak production are just something I'm starting to grasp. I'm not there yet on the whole systemic NPK issue, although I've just started reading your backlog of posts and outbound links :)

I was looking at a presentation by Folke Günther just yesterday and it's slowly starting to sink in.

Thanks for keeping posting about this. Now that I begin to correlate this with all the fertilizer/agri news, it's starting to make sense.

What is your take on the Malawi experience?

As you know, it was all achieved with heavy I-NPK fertilizer subsidies, but it is now being touted as the success story that needs to be copied all over the world, esp. in the light of the recent agri-commodity boom.

Personally, I'm not so sure that following this idea is a very good one in the long run, but I fully admit not having figured out much of the issue yet.

Hello SamuM,

I-NPK handouts are better than food handouts-- it's important for people to know how to grow food. But I-NPK subsidies will eventually prove postPeak unsustainable. Therefore...

...O-NPK recycling is better than I-NPK. Cheaper & healthier too, in the long run, for the people and ecosystem. I-NPK, and the other trace elements [sulphur, manganese, etc] should be imported and used sparingly only when native sources prove insufficient to keep native crops above a Liebig Minimum. Again, the goal is to make balanced, mulchy soil full of micro-organisms and worms best suited to the climate and matching acclimated crops.

All of the above is important, but if the population grows: Malthus eventually invites the Grim Reaper to do his duty. IMO, I would somehow like to see aid and fert-subsidies linked to full-on Peak Outreach, which if successful to create deep understanding, would make the population deeply accept the need for birth-control, thus shrinking the pop. back to a 'full-quality of life' vs the stupid 'full-quantity of misery'.

Samum - a great summary hitting all the main points. In particular I like the quantification of demand being 5 mmbpd higher at $20 / bbl. I suspect the figure may actually be $50 / bbl but that is largely irrelevant.

The point is, all those who want lower price must point to where that additional 5 mmbpd might come from. And the answer is it just isn't there - anywhere. The Saudis are offering up 200,000 bpd - a drop in the ocean.

The other point you make about blame game is also spot on. The thing that really, really surprises me here is that we have on the one hand an energy crisis and on the other hand a theory (peak oil et al) to explain it - but the powers at be seem incapable or unwilling to accept the obvious.

Euan,

I think that depends on the reason for wanting a lower price. If you want a lower price to be able to use more oil, then yes, people have not explained where 5 million barrels per day will come from. But, if you want a lower price in order to forestall exploration for pointless, expensive, low EROEI oil, then the source of the 5 million barrels per day is pretty obvious: US conservation. A 25% reduction is US consumption brings the price down to the bottom. It is worth remembering that the oil embargo fell to the oil boycott so it is pretty clear that the political will to avoid using oil can be stronger than other forces.

http://mdsolar.blogspot.com/2008/06/oil-is-too-expensive.html

Chris

Let's see, that is about 5 million barrels a day. If the rest of the world then resumes its pre 2004 yearly rise in demand, that gets eatten up in 2-3 years. What mechanism produces that miraculous result? How do we maintain what would be for many very painful if the price goes down to bottom. Would not American just raise their consumption again?

I think the best case for conservation in this situation is that it slows the price rise somewhat. The only true solution is building a new energy infrastructure.

If you read the link, you'll see that the proposed mechanism is rationing and further annual cuts keep the price low until we end our use of oil.

Chris

The blame game is not in play here. One axiom of the blame game is that the only people who don't want to play it are the ones who deserve the blame.

In this case we have everyone playing, especially the ones who are to blame, i.e. the politicians and the media. And, to some extent, the public who only listened to what they wanted to hear for a couple of decades.

Anyway, in my experience that axiom is a universal truth whenever the blame game is being played, ergo what is going on now is not The Blame Game. It might be the scapegoat game, or that chapter of crisis management called, "The Search for the Guilty". But the blame game it ain't.

It's always refreshing to see people use concepts accurately. Thanks for the correction. Difference noted.

SamuM

Great post!

But it provides some relief for accumulated frustration.

My goodness I seem to have caused a stir. Love all those pretty graphs and pie charts. Here is another pic to ponder.

Euan, excellent article, as always. A stark message...and to think it's based on Government's own (BERR) forecasts. This point leads to the question - 'does Gordon Brown know and understand these issues and if so is he clinging to the hope that Prof Odell's 30 Gbbls from UK NS are about to come to the rescue?

With the demise of the majority of UK manufacturing base in (and since) the Thatcher era, the inability of UK to grow enough food for 60m population, an estimated £19bn pa tourism deficit pretty well the only success story is financial services i.e. the City of London including large investments in overseas corporations. There's another big problem here - that's about to go downhill rapidly as the global credit crunch and ongoing debt deflation bite deeper (although I guess there's some commission to be earned for all those sterling sell orders).

I don't know where we go from here - it's as if our politicians are living on another planet. They seem to think that a combination of asking KSA to 'open the taps' and economic growth will permit BAU...at least that's what they are saying publicly. A list of excuses will already be in place - speculators, OPEC, world food prices etc but at some point soon Joe Public will expect politicians to take ownership of UK's economic mess and come up with a credible action plan; more likely that will mean making way for someone who can.

I don't know how deep the downturn in the wider OECD will be, although the omens don't look good. For the UK I can only now envisage a full blown economic depression as I just don't see how the type of energy, transport and other infrastructure changes can deliver sufficient mitigation in time to avoid the type of economic and sterling crisis which will exceed that of the 1970's when UK was forced to borrow from the IMF. To make matters worse debt levels in UK are, from what I've read, among the highest in OECD and a property 'bubble' has taken prices to around 6x earnings.

I also think it's only a matter of time before this whole matter gets into the markets at which point sterling and equities would unravel quickly. In short a big mess...and the UK election in around 2 years' time will offer a poisoned chalice to subsequent Gov't.

Actually, they will likely have to make way for someone who can't - Cameron, who displays even less awareness than the current Government, and is currently involved in trying to block the passage of laws to enable the swift building of wind and nuclear energy by simplifying the planning process.

His idea of energy policy is to slap a ludicrously inefficient and expensive eco-bling wind turbine on the roof of his London pad.

Still, doubtless he will allow pensioners to freeze in peace without the introduction of bothersome rationing.

"Eco-bling"! Beautiful put-down word. Thanks Dave!!

David Cameron, possible next Prime Minister of the UK

It is hard to believe at this time that the Tories seem to know less about the realties of UK Energy than the government. Which brings us back to that bye election.

Alan Duncan MP is the Conservative Shadow Secretary of State for Business, Enterprise and Regulatory reform. He worked for Shell and as a trader of crude oil and refined products. When I have heard him speak about oil, which admittedly isn't very often, he seems to know what he is talking about.

Good point, I just emailed him with the link - maybe he'll call by?

I've been e-mailing Johann Hari, of the Independent, with links - silence so far.

I emailed a link for Euan's post to David Smith of the Sunday Times.

A couple of years back, Smith put together a piece questioning if Sterling would survive a downturn in oil production in the UKCS.

It seems he has no trouble with a regional peak (UKCS + Norway) but couldnt quite get a feel for Global Peak.

So, this excellent piece by Euan may fit with his own earlier piece in the Sunday Times and kick start another look.

Either way, it is becoming quite clear that the UK is in for a horrible time in the next decade.

We will be lucky if rationing and Martial Law are the least of our problems by 2020.

Frankly, I think the current crop in Government know what is coming and are just dazed by the horror of it. But since they know they will be opposition and Cameron , Duncan et al will be carrying the can it will be an SEP.

I doubt any current leader of any major party could handle what is coming using any aspect of what they consider normality - Free Market, Liberal Democracy and elections .

Mudlogger, I wonder if you would give contact details to Euan?