Grangemouth/Forties Update: Forties pipeline remains shut down (Thread 2)

Posted by Euan Mearns on April 27, 2008 - 11:01am in The Oil Drum: Europe

Make sure to check out our Grangemouth/Forties poll--use this thread as the comment thread for it.

Latest:

• Grangemouth oil refinery is shutdown.

• The Forties Pipeline is shutdown

• Over 60 North Sea oil and gas fields are shutdown.

• About 700,000 bpd oil production lost costing £40 million / day @ $110 per barrel

• About 70 million cubic meters natural gas production lost per day costing £42 million / day @ 60 p / therm

• BP, Shell, Exxon-Mobil, BG Group, Conoco-Philips, Chevron-Texaco, Total, Marathon, Tallisman, Nexen, Venture, Dana and many more companies affected

• Global energy prices rise

• Rural Scottish economy hit hardest by fuel shortages

• Risk level is raised throughout the system

• Worker's grievance is unresolved

• Population calm, politicians panic, fuel rationing looms?

While the fate of energy flows into Britain were being sealed on Monday and Tuesday this week, Gordon Brown was pre-occupied with the past, let alone the present or the future, trying desperately to undo tax muddles that he himself created. Gordon Brown will be remembered as one of the greatest Followers this country ever had.

BP have begun the process of closing the Forties Pipeline according to this Reuters report. This is some 30 hours in advance of the planned 2 day strike by 1200 workers at Grangemouth Oil Refinery operated by private equity firm Ineos. The closure of the Forties Pipeline will likely result in closure of around 60 offshore oil and gas fields that feed oil and condensate into the pipeline. Around 700,000 bpd oil and 70 million cubic meters (MCM) per day gas production will be lost costing UK plc around £90 million per day at spot prices.

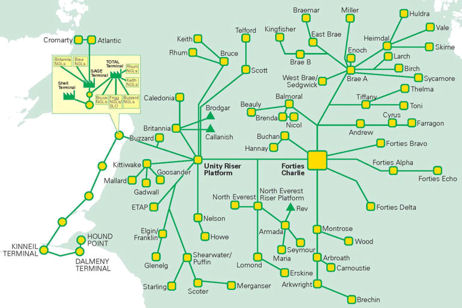

It is relatively straight forward to shut down the pipeline and all the fields that feed it, but the process of restarting production will likely be significantly more complex. It seems possible that up to 6 days production may be lost. BP once owned and operated the Grangemouth refinery and the Forties pipeline in addition to the off shore Forties Field. In 2003 BP sold the refinery to private equity firm Ineos and the Forties field to Apache corporation. This is a tightly coupled complex system best operated by a single responsible owner. The pipeline terminal at Kinneil depends on power from the refinery to operate, hence with closure of the refinery the pipeline and all associated infrastructure must now close. Questions should be asked about the wisdom of allowing the dependency of around one half of UK North Sea production to fall into the hands of a private equity investor.

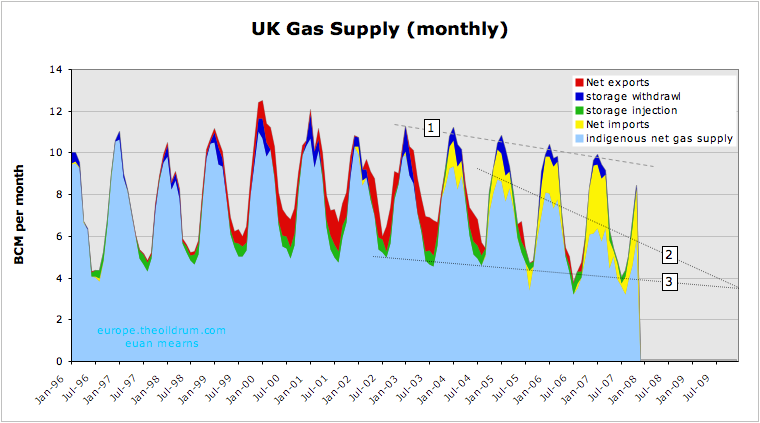

A note on gas supply and demand. Annual gas demand is cyclic reaching a maximum in the winter months Dec-Feb. Since we are now past the peak demand period this will make it easier to source gas by cycling up the remaining UK production and by asking the Norwegians to raise their gas production. However, persistent high spot prices this spring seem to betray un-seasonal tightness of gas supply in the The European Gas Market. 1 = falling demand and 2&3 = falling indigenous gas supplies. Where might this end? See below.

A glimpse of the future:

This is an un-audited draft model showing how UK gas supplies may evolve. In future we need not worry so much about UK strikes since we will no longer be producing significant quantities of gas. We will need to worry about missile strikes in the countries from where we are destined to import LNG. For a number of years Norway will be a vital supplier of natural gas to the UK. But their gas production may start to decline from 2009.

With price of Westexas Intermediate crossing $120 / barrel and UK day ahead gas prices pushing 69p / therm the cost of this action will be felt by all gas and petrol consumers in the UK and further afield. The UK government has either been wholly ignorant of or indifferent towards the consequences of this dispute.

At winters end gas storage is run down. From current stock levels, short range storage may produce 18 MCM per day for 2.5 days, medium range storage may provide about 27 MCM / day for around 6 days and long range storage around 42 MCM / day for about 21 days. Fortunately, mild spring weather will ease the demand for natural gas.

I would estimate the value of potential lost production to be approximately £40 million per day for oil and £50 million per day for gas (at spot prices). Platts report that the Forties Pipeline could be disrupted for 6 days as a result of the strike. The potential losses to oil companies and to the government's lost tax revenues seem wholly disproportionate to the grievance of the Grangemouth workers.

It is the Westminster government that has responsibility for UK energy matters and taxation.

The original TOD thread is here, and thanks to all posters for their contributions and links.

Grangemouth lies at the end of the Forties oil pipeline system that gathers oil (and liquids) from oil and gas fields throughout a large area of the Central North Sea. Whilst Grangemouth processes around 200,000 bpd the pipeline system handles around 700,000 bpd and according to this CNN report, a BP spokesman has said they may have to shut down the whole pipeline system. With the global oil market and European gas market already stretched, the impact of this dispute may reverberate around the world.

Why Grangemouth is important

Grangemouth is much more that an oil refinery. Originally operated by BP, Grangemouth became an integral part of the Forties oil production, transportation, refining and export system. BP has since sold the Forties oil field to Apache corporation and the refinery to Ineos but it still operates the pipeline and a number of the oil and gas fields that feed into it.

Grangemouth oil refinery lies close to the Kinneil terminal and is an integral part of this massive oil and gas production and transportation system.

Ineos have reported that if the refinery is closed it may take over a week to restart. So a two day dispute over pensions may have a disproportionate impact.

If as reported by CNN, the whole Forties pipeline system were to close then this will shut down about half of the UK oil and a significant amount of gas production. World oil supplies are already stretched and this will push prices even higher - but the UK will be able to buy oil on the international market. I have heard that BP is trying to determine whether the Hound Point terminal has the storage capacity to handle the flow and offload from there without taking the system down. The thinking is, if only the Grangemouth refinery shuts down, and Hound Point and its oil storage facility operate normally, oil and gas production losses could be minimised.

The situation with natural gas is much different. Prices have been rising steadily this year betraying tightness in the European and Global gas markets. At the end of the winter UK and European gas storage is run down and the UK may struggle to maintain gas supplies.

This is what one of TOD's many friends had to say:

I don't know about the refinery side, but having worked at St Fergus for a year or so, I can vouch for the fact that the ability to process gas is linked to the ability to export the liquid ends via Mossmorran and Grangemouth. There are three St Fergus gas processing sites and each has different links to the downstream liquids market.

It gets complex depending on exactly what facilities are offline, and there are other things that can be done like shutdown fields producing wet gas and condensate and limit gas coming in to dry gas from FLAGS/Fulmar line and then 'optimise' the gas processing to 'spike' as much of the heavier ends as possible into the gas network. That can limit the volume of liquids they need to push down the pipelines towards Grangemouth but can only go so far if there is a complete shutdown.

UK "spot gas prices" have been rising steadily for a year as UK domestic supplies continue to run down and a cold winter in N America and E Asia has caused increased competition for LNG deliveries.

Domestic users need not worry since they will always be the last to get cut off. But in the event of a natural gas shortage, those industrial users who pay the reduced interruptible supply tariff may just find their supplies interrupted.

Consequences for fuel supplies in Scotland and North England

Grangemouth is the only oil refinery in Scotland producing gasoline, diesel, fuel oil and jet fuel for the whole of Scotland, Northern Ireland and Northern England. UK has ample stocks of refined fuel and so the real issue for Scotland is the distribution of these stocks. This has been the main focus of the main stream news thus far and panic buying has already led to local gasoline shortages and profiteering at the pump.

Cause of the strike

The strike is about Ineos proposals to adjust the terms of the final salary pension scheme for workers at the refinery. Why then can Ineos not afford to fully fund the existing pension scheme? High feed stock costs for their refining operations, high energy costs, rising interest costs, high inflation throughout the engineering sector, adverse currency movements and zero stock market returns since the year 2000 may all help explain the dilemma that Ineos finds itself in.

FOOTSIE courtesy of Yahoo Finance. In a world that has produced zero to negative stock market capital returns since the year 2000, is it reasonable for any workers to cling to unrealistic pension promises struck decades ago that are founded upon the notion of limitless supply of cheap fossil fuel?

The majority if not all of these factors are rooted in the inability of planet Earth to now provide the growth in low cost fossil fuel energy that powered economic growth and wealth creation throughout the 20th Century. It is no longer a realistic expectation for any workers to be granted a generous pension at age 60 when OECD life expectancy is now over 80. The free fossil fuel energy slaves that created this aspiration in the 20th Century are now getting tired and will soon be exhausted.

It is the failure of government and leadership throughout the UK and the World to recognise and tackle the unfolding energy crisis that has led us to Grangemouth.

With reported debt of around €9 billion, let us hope that Ineos has the financial strength and will to weather this storm.

Of course no one gets the pension that was promised.

Why should the plebes accept this before the carcasses of Lady Thatcher, Lord Blair, The Gordon et al have been fed to the dogs?

Soylent Petfood can be politicians and corporate executives.

Breakdown in Grangemouth dispute talks

Definition of a panic buyer:

The guy in front of me in the queue....

Somethings odd here. Oil and gasoline (RB) futures have both traded down since it was announced that talks had broken down.

Buy the rumor sell the news?

The bearish event that ends the rally?

I'm unsure but would think this would be bullish for oil and gas prices, unless it is priced in. There was a sharp jump in Refinery utilization this week (81 to 85) - and that wasthe week ended 4/18 - might be as high as 90% now - perhaps we are gearing up to export refined product to UK?

In a recent report by Robert Rapier the US imports between 800,000 barrels and 1,200,000 barrels of gasoline per day, so I doubt we can export any product from our refineries. I do believe the US IMPORTS 50,000 or 60,000 barrels of gasoline per day from UK or Norway. Once the strike starts and shortages spread from UK the gas price would climb here as well. With strike the price of $4.00 is very likely by end of May, IMO.

By the EIA data Robert used, the U.S. imports about 69,000 bpd of gasoline from the UK, and 23,000 bpd from Norway (based on annual data).

Since gasoline prices in the U.S. have remained lower than they would be thanks to these imports, I think you're right. If those export levels from UK & Norway are interrupted for very long, it's going to pressure U.S. prices even more.

At this point I'm left to wonder how elastic those gasoline exports are...how much of what is being brought in from elsewhere to cover the loss from Grangemouth is gasoline, and how much is diesel?

On the other hand, if the Grangemouth outage persists, and UK gasoline prices rise sufficiently in response, it should cut back on their exports to the U.S., but it will also restore profitability for the U.S. independent refiners, and they should ramp up their output in response. Supply levels should be restored, but at higher prices.

It is no longer a realistic expectation for any workers to be granted a generous pension at age 60 when OECD life expectancy is now over 80.

Is it realistic to expect the average person's age to reach 80 anymore given what we know is coming soon?

They might as well just promise the pensions. So few will be around to claim them.

Rather like promising the drastic Co2 emissions cuts: it will be accomplished by PO anyway, might as well take credit for having 'legislated' it. [/cynicism]

One reason that final salary pensions have become unpopular in the UK is that the company has by law to have be putting aside enough money (into an independently controlled fund) so that it will be able to meet the projected obligations at the time they become due (underprevailing conditions assumptions on growth of any investments). So if forecasts for longevity are high and market returns currently low, there's a lot of cash that's got to be deposited now. If longevity forecasts go down in the future and market returns improve a bit so the fund is "in surplus" then companies are allowed to contribute less cash until balance is achieved, but that doesn't stop them having to contribute more money now based on current predictions.

So it's kinda the opposite of your thought: although pension funds won't need to be so high if PO leads to a large decrease in longevity, that happens in the mid-term future but as long as the experts are predicting increased longevity companies have to divert more money into a locked fund now.

Ever heard of "reachback" and "afterburn". These are the ways the future and the past, respectively affect the present.

I see this constipation in the Scottish pipelines as "reachback". Perhaps the Scottish actually are an anal retentive society, and this is an exaggeration of what we might expect as the end of the oil age progresses, but certainly it is instructive to those of us who enjoy looking into the future.

Fighting over the remains can easily be observed if you watch the nature programs on the National Geographic Channel as the various species contend over the carcass of a recent kill. Hell, even today news reports circulate on the internet about runs on the rice supply at Walmart and Sam's clubs in response to the perception that world rice supplies are in short supply.

Be aware. Prepare for the worst, and even then consider your preparations as inadequate.

What on earth are you babbling about?

...I agree or disagree...

Still very little mainstream media coverage in the UK, certainly nothing on the front pages of the newspapers or the BBC. Makes you wonder if they're under instructions to avoid raising a panic...

I'm wondering if it's not seen as the first real opportunity to direct the public into different patterns of behaviour and expectation.

Alex Salmond, the Scottish First Minister, is pledging that Scotland has enough fuel to "last well into May" and that there is capacity to "import more" if required (http://news.bbc.co.uk/1/hi/scotland/7364842.stm). This sounds to me like straightforward management i.e. Don't Panic! But perhaps more tellingly, he is advising the public to conserve fuel by restricting travel to necessary journeys only and to take public transport wherever possible.

This is obviously appropriate advice. However, for me, there's something missing. Why, considering the seriousness of the situation, are the UK (who are particularly quiet) and Scottish executives being so seemingly accepting of the stance taken by the parties involved. Why is there no public expression of urgency from them?

harry

Yes, I'm surprised there has been no (visible) pressure from the government on the company or the union.

Gordon is pre-occupied with abolishing the 10p tax band he introduced and trying to reinstate it before he abolishes it.

Its not a crisis yet. No pumps have run dry in London.

yet...

it only takes a small number of people to start panic-buying, then others see the queues and think they'd better fill up. Before you know it you have the occasional garage running out, and then people start driving around in search of fuel.

...yeh, during the oil shortage in the early 70s I had a guy panic and back into me trying to get to a pump that just opened up. (In the end I found a friendly parking lot owner who had his own supply "out back," and he'd allow me to secretly pump 10 gallons each week. We have our ways...)

My folks live in Grantown-on-Spey, a small Highland town (pop. about 3000) not far from Inverness. It has only one petrol station. Apparently a couple of days ago, when queues were long, a punch up broke out when some chancers attempted to queue jump. Petrol is £1.14/litre there, stories in the news of garages charging up to £1.40/litre in the Highlands. Dry run for post-Peak.

Er ... I think you will find that the UK domestically IS post peak!

Oil peak ~1999 (finished ~2020), Gas peak ~2002 (finished ~2020), coal peak ~1913 (current production ~6% of peak), current nuclear, peak <2005 (mostly closed by 2020).

Clearly, even after the strike the situation between the company and the Union won't have changed much - so where do we go from there?

I am sure it was never the intention for just one person to own such a large chunk of a PLC, no doubt many bankers have become millionaires off the back of Jim Ratcliffe becoming a multi-billionaire.

This is a wet run for post peak, and in the medium term if the world's economy does require growth of oil supply to grow the economy (as we on TOD expect) then there will be a loss of all those things that require growth - eg: savings and pensions will not work for starters, Unions get used to it! The rest of us need to come up with a plan 'B' real quick!

Hi Doug

If I was still living in Aberdeen I think I'd be getting a little concerned by now. But it's still the gas situation that threatens the UK as a whole more..

cheers

Phil.

I heard unofficially that the whole pipeline is to close - its dependent upon power from Grangemouth.

This has barely made it onto the main news in the UK. I'm away to work out how much gas production might be lost. I very much doubt that the system can bear it - power cuts may loom?

The UNITE union has confirmed that the strike will go ahead (according to Reuters)thereby shutting the Grangemouth CHP station and shutting down the 700 kbpd Forties pipeline. No reaction to this news in the Brent oil market although the Reuters headline came out eight moneutes ago.

I think Forties associated NG production is something in the region iof 70 MCM/day, whihc is about 25% of current demand. To add to the concernt here have been unscheduled outages or trips at Teesside, Barrow, Bacton and Easington/Dimlington import terminals in the last week. The system does not look very robust.

NG for the weekend is trading at 71 p/therm and 74 p/therm for next week.

UK gas consumption runs at about 100 BCM per annum, translating to 274 MCM per day. So your calculation is spot on. With storage running on empty I don't see how the system could survive such a shock. So I'd guess we'll see interruptible contracts interrupted and perhaps some power stations having to close.

What is the max deliverability of long and medium range storage when full in MCM per day?

Pretty high for the first five days (in region of 85 MCM/day total in theory), but dropping quickly after that.

18 MCM/day deliverability from LNG and short range storage (5 days)

27 MCM/day

from medium range storage (about 20 days average when full)

42 MCM/day from Rough long range storage (67 days when full)

The short term facilities are full, the medium range about 35% full and Rough is 27% full.

Ther is also 50 MCM/day import capcity through the Zeebrugge/Bacton interconnector

The waether is for once looking kind for a few days, so I think we could cover the outage from storage for 5 -10 days. The interconnector is already running at 40MCM/day, so not much extra headroom there. I think we will not see major interruptions from this strike, but it will pull our storage down to critically low levels.

All we need now is for Russian natural gas exports to peak and we are heading for a cold, dark winter.

If the supply does fall off, you can watch it happen live here:

http://www.nationalgrid.com/uk/Gas/Data/efd/ezgraph.htm

(only works properly in IE, sadly).

The Scottish administration says it has contingency plans for this strike. Actually, it has nothing of any substance beyond tinkering powerlessly at the edges of a serious and damaging collapse of a central pillar of the Scottish economy. If the Scottish National Party wants independence for Scotland (other than just a slogan), how about restoration of a nationalised oil and gas company? We lost Britoil years ago (yes, a state oil company), time for Scotoil (a new state company) to take care of ensuring Scottish citizens are not held to ransom by private equity buccaneers from England. Let Ineos play pirates in some other market like video games. Energy, like water, health, education and the environment is an affair of state, not just a poor state of affairs.

BBC Scotland just reported on the lunchtime news that Edinburgh city buses will stop running on Sunday night as their fuel supply has been "re-prioritised".

Buses run out of fuel by Monday

Wow that REALLY is going to INCREASE demand, as all those bus passengers get into their cars and drive into total gridlock on monday morning. That is the sort of contingency planning this country really needs....

Agreed. Surely emergency services, public transport and freight should take priority over private cars? I would have thought that's a no-brainer?

Scottish Finance Minister John Swinney just said in a BBC News interview that fuel would be supplied for Edinburgh buses and he blamed the initial reports on a "mis-communication" between BP and Lothian Buses.

Naah:

From Aunties Scottish Website at 16:45 -

At lunchtime on Thursday, Edinburgh-based Lothian Buses announced that it did not expect to be able to run any services after Sunday evening because BP was prioritising deliveries to petrol stations instead.

But a short time later, the Scottish Government issued a statement saying there had been a "misunderstanding" and the bus company would receive diesel from BP.

Lothian Buses then gave reassurances that its fleet would be fuelled and services would run as normal.

Sounds like an initially idiotic decision has been changed. But probably by elements outside of BP.

A few relevant news stories from the BBC Scotland website:

The petrol picture in Scotland

No problem with fuel for public

Salmond in pledge on fuel stocks

In addition to the question of gas in BP Forties Pipeline system, there's the question of what happens to gas processed through the three gas terminals at St Fergus. Here's a quick snapshot of where the products from the gas go:

C1 (methane gas) goes into the national gas grid at St Fergus. Everything else (NGLs) goes in a pipeline south to Mossmorran.

C3, C4 and higher (propane, butane + ) get separated at Mossmorran and loaded into tanker at Braefoot Bay.

C2 (ethane) goes to the Exxon operated Fife Ethylene Plant (pretty much next door to Mossmorran) and the BP operated Grangemouth refinery.

My guess is that the amount of ethane going to Grangemouth is quite a bit smaller than that going to the Fife ethylene plant. Assuming that Fife is operating below design capacity, it might be able to pick up some spare ethane? Otherwise they can flare ethane although that's not a pretty outcome for anything more than a short plant upset.

The BP gas terminal (part of the Forties Pipeline System) is located a little further south of St Fergus at Cruden Bay. It looks like the impact will be much greater on BP than the other operators.

And in case anyone was wondering, the oil production from almost all the other UK North Sea platforms not exporting to BP Forties Pipeline System goes to the Sullom Voe oil terminal on Shetland (far northern end of Scotland), which is also operated by BP. From there it is shipped to refineries anywhere in the world.

cheers

Phil.

http://www.shell.com/home/content/uk-en/news_and_library/press_releases/...

http://uk.reuters.com/article/oilRpt/idUKN2434348720080424

http://uk.reuters.com/article/oilRpt/idUKL2489630420080424

Hello Euan and thank you for keeping us posted.

The chart ”UK Day Ahead Natural Gas Price” shows an intersting change in trend…the price trend.

Normally it looks as of the end of the heating season (normally ends by March 31th ) the price in the previous years have tended to retreat or at best remain flat. This year at the end of the heating season 2007/2008 the nat gas prices have started to head north. The good news is that this seems to attract LNG cargoes towards Grain.

With respect to storage data, National Grid data gives a slighter grimmer picture, as of April 24th than conveyed by this post.

SR at 60 % (of full capacity) or 2,5 days

MR at 32 % (of full capacity) or 5,7 days

SR at 27 % (of full capacity) or 21,2 days

Euan,

What do you mean with “Anyone wish to calculate the daily cost of lost production?”

The oil and gas companies will see this as deferred incomes; it will of course impact their cash flows and have a negative effect on their NPVs as economists will tend to look at this deferred production and thus income as something that now will prolong the expected (economical)tail life of the fields.

Are you trying to get an estimate of the total sosio economic costs associated with a shutdown of the refinery and associated installations?

NGM2

Hi Roooooone,

You're a better chart reader than I if you can read the tea leaves in that chart - and I normally take pride in my chart reading skills. But yes, assuming that the heating season should have ended it is strange that prices have been rising steadily. And refilling storage will keep the pressure on for a while yet. I think the market is changing - there is a very thin line between glut and scarcity.

Income deferred from this year is in fact income lost. I estimate the turnover loss for oil cos and UK plc to be £40 million / day for oil and £49 million / day for nat gas (at 70 p / therm). This of course hardly registers being only about 0.01 Rocks / day.

Just as well we are a super wealthy country with a sound economy that can afford such trivialities without noticing.

€

Yooooooooooooooon

First of all, where I wrote; Normally it looks as of the end of the heating season (normally ends by March 31th ) the price in the previous years have tended to retreat or at best remain flat.

I meant to write;

Normally it looks as of the end of the heating season (normally ends by March 31th ) the price in the previous years have tended to retreat or at worst remain flat.

My native language is not English, which I still am in the process of learning.

Prices will see to it that demand always equals supplies. The wonders of markets.

Your estimate assumes substitutes will be made available at present prices. …………and if they don’t?

1,00 ROCK

The Bank of England offered to swap government bonds for mortgage securities to kick-start bank lending, with Governor Mervyn King pledging to meet demand even if it exceeds an estimate of 50 billion pounds ($100 billion.) "There is no arbitrary limit on this so it could well go higher," King told reporters in London today. He said the plan aims to restore confidence to the banking system and the most important aspect is that "everyone needs to know this is there for them to access as needed."

The measures, backed by Prime Minister Gordon Brown's government, mimic a swap of $200 billion of securities by the U.S. Federal Reserve last month as central banks around the world struggle to prop up financial markets. A surge in borrowing costs prompted U.K. banks to withdraw their best mortgage offers, threatening to exacerbate the worst housing downturn since 1992. "This package may help ease money-market strains, and provide a welcome route to liquidity for some particular banks and building societies that otherwise may face extreme difficulties in obtaining funds," said Michael Saunders, chief western European economist at Citigroup Inc.

Financial institutions will retain responsibility for losses from the assets they loan to the Bank of England. The swaps will be for a period of one year, renewable for up to three years. Only assets existing at the end of 2007 can be used in the swap.

The Bank of England won't announce how much money has been tapped until the borrowing window closes in six months. The swap is double the value of loans King extended in September to prop up Northern Rock Plc. The government nationalized the mortgage lender in February, the first U.K. bank to fall victim to the credit freeze. That stemmed from the collapse of the U.S. subprime market, which has now cost more than $288 billion in bank writedowns and credit losses.

From the above I deduce that 1,oo rock approximates £100 billion (todays value).

Whats the worry, the money seems to be there. ;-)

Roooooooooooone

BP Says Forties Crude Output Faces 6-Day Disruption - Platts

All seems a bit fishy to me, someone gaming the system? Its like TPTB want the disruption. All stops were pulled out for Northern Rock, but they can't be bothered to lift a finger to prevent a petty strike from shutting down major portion of the North Sea oil and gas production. Is the power station closure really necessary?

Something just doesn't seem right about this. By doing nothing presumably the vested interests can then lay the blame at the target's doorstep. The unions, workers who strike, activists concerned about pensions, Scottish Nationalists? Just conjecture, but I get the feeling something is wrong here, someone is being set up or the fallout is required for some purpose.

And what happens next if this remains unresolved? Presumably another strike will be called then another then another...

Obviously, the target gets hit with a propaganda blitz that lays the blame squarely at their door and forces them to quit the arena due to public opinion.

We will soon find out, once the propaganda blitz gets going.

Hello,

My theory is probably bunk. Grangemouth located here:

http://virtualglobetrotting.com/map/22030/view/?service=1

right? All the Forties pipeline network is to the right according to the map above. Doesn't seem like high waves would impact them much.

They seem to be dissipating also. Theory appears to suck.

f3

Hello Burgundy,

Your a poster after me own heart. I have a theory. It goes like this

http://query.nytimes.com/gst/fullpage.html?res=950DEFDA153FF936A35756C0A...

"But the North Sea development in the mid-1970's was on an entirely different scale. Some of the platforms stand in 500 feet of water; they are as tall as the 984-foot Eiffel Tower; they weigh 250,000 tons, and they are battered daily in the rough North Sea. The rigs may have a design life of 30 years or more, but those are only estimates."

Mighty strange wave action out in the North Sea.

http://www.oceanweather.com/data/NATL-Northern/index.html

Time will tell. I am no climatologist. Is that enough information to form a theory?

f3

I read it more as a general fixation that "higher turnover = more important"

The daily turnover of the financial markets is £n billion

The daily turnover of the refinery is £n million

So, in the minds of TPTB, the money markets must be "more important"

Gold may be more expensive than bread, King Midas found that gold tended to lose its worth...

AKH

I'm amazed there has been hardly any news about this, yet the coverage of the teachers strike is everywhere. Maybe it's not worth reporting until the teachers can't make it to school due to lack of fuel??!

I also find it wierd that there appears to have been very little serious attempt to stop the strike going ahead, if the consequences are as bad as it would appear they might be.

Of course, nearly 120 dollar oil seems no longer particularly newsworthy anymore, not in the UK at least.

It's all so quiet, it's all so still...

It seems totally incredible to me now that everyone spent that evening as though it were just like any other. From the railway station came the sound of shunting trains, ringing and rumbling, softened almost into melody by the distance. It all seemed so safe and tranquil.

-The Narrator, "The Eve Of The War" The War Of The Worlds

This is quite off topic, but I've wondered about those lines as a Eugene, Oregon jazz band named 11 Eyes uses them and more in one of their tunes. I knew I'd heard them at sometime in my youth, but just couldn't place them.

It isnt biting in Political Circles in Westminster yet:

1. Its impact is largely in Scotland. Why would a Westminster Labour Government help out an SNP Government? Salmond's stock and popularity in Scotland is rising. Why would Gordon help him out?

2. The Teachers strike was largely and England and Wales event.

3. The 10p Tax rebellion has been a more immediate threat to Gordon and has probably taken up all of Labours time.

It will all depend upon how long it takes to get Grangemouth back up and running and the oil flowing.

It will probably be a quiet weekend on the roads this weekend.

As for panic buying: a) its not panic to fill your tank when empty and b) most people I know will / are cutting out discretionary driving.

It will bite if it affects the Westminster Village in LondonMediaLand

What's the probability that we'll see disruption in the South of the UK? Is that disruption most likely to be caused by the 25% reduction in gas production rather than oil?

If Scotland does start running low on refined product then will product be diverted from the south of the UK?

Possibly, but I think it would have to go on longer than a 2 day walk out.

I understand that the personnel are keeping a skeleton staff on in order to get the plant up and running quicker.

I suppose supplies would get diverted or finished product shipped in from Europe.

Compare it with the 2000 fuel protests: This is 1 refinery for a restricted time; in 2000 it was all refineries at the same time and indefinately. And Blair only really started to react after scenes of chaos and a crowd in an ugly mood while in his presidential motorcade.

Remember: Gordon doesnt / cannot even drive. He has never had to queue up to put a fair slice of his weekly earnings into a petrol tank. And like I say, Gordon will love to see Salmond discomfited.

Right now, Gordon has got to worry about next weeks elections, rebels, striking teachers and some time soon a whole bunch of other public sector types.

I would be more concerned about the damage it could do to UK North Sea. £50 Million a day stopped because of one single choke-point may mean the oil companies decide to take there money elsewhere.

That may be a major concern were I Chancellor or Prime Minister if the strike went on or we see a repeat later on.

For a group with ill will in mind, it's nice to be shown a very easy target that can inflict a lot of damage. The IRA would have a ball with this back in the day.

Grangemouth: Ministers fear panic at pumps as oil workers strike

http://www.timesonline.co.uk/tol/news/uk/scotland/article3812010.ece

There's a nice summary of the oil situation this year and the current market uncertainties here:

http://www.fcnp.com/national_commentary/the_peak_oil_crisis_the_case_for...

At any rate I'm closely watching the market on a weekly basis and planning on getting some oil drums ready to tide me over. I was anticipating another 2 years at least to finish my relocation to a sustainable property and work situation, but I might have to make a change faster if this year gets any worse...

Terribly sorry to hear about the arguments with the wife over the reality of peak oil. Reminds me of the violin players on the Titanic. A few lines from the movie seems appropriate. While the nature of peak oil can be debated, human psychology's response to peak oil can be predicted...

On increasing production

Ismay: So you've not yet lit the last four boilers?

Smith: No, I don't see the need. We are making excellent time.

Ismay: The press knows the size of Titanic. Now I want them to marvel at her speed. We must give them something new to print! This maiden voyage of Titanic must make headlines!

Smith: Mr. Ismay, I would prefer not to push the engines until they've been properly run in.

Ismay: Of course, I'm just a passenger. I leave it to your good offices to decide what's best. But what a glorious end to your final crossing if we were to get to New York on Tuesday night and surprise them all! Make the morning papers. Retire with a bang, eh E.J.?

Ismay: [Smith nods reluctantly] Good man.

On being prepared for the crisis

Rose: Mr. Andrews... I saw the iceberg and I see it in your eyes... please, tell me the truth.

Thomas Andrews: The ship... will sink.

Rose: You're certain?

Thomas Andrews: Yes, In an hour or so, all of this will be at the bottom of the Atlantic.

Cal Hockley: What?

Thomas Andrews: Please, tell only who you must. I don't want to be responsible for a panic. And get to a boat quickly, DON'T WAIT. You... remember what I told you, about the boats?

Rose: Yes... I understand.

Rose: Mr. Andrews, forgive me. I did this sum in my head and with the number of lifeboats times the capacity you mentioned, forgive me, but it seems that there aren't enough for everyone aboard.

Thomas Andrews: 'Bout half, actually. Rose, you miss nothing, do you?

On panic solutions

Thomas Andrews: Mr. Lightoller, why are the boats being launched half full?

Second Officer Charles Herbert Lightoller: Not now, Mr. Andrews.

Thomas Andrews: Look, 20 or so in a boat built for 65? And I saw one boat with only 12, 12!

Second Officer Charles Herbert Lightoller: Well, we weren't sure of the weight, Mr. Andrews. These boats may buckle.

Thomas Andrews: Rubbish! They were tested in Belfast with the weight of 70 men! Now, fill these boats, Mr. Lightoller, for God Sake's Man!

Second Officer Charles Herbert Lightoller: Please, I need more women and children, please!

On the scientific certainty of disaster

Thomas Andrews: The pumps will buy you time, but minutes only. From this moment on, no matter what we do, Titanic will founder.

Ismay: But this ship can't sink!

Thomas Andrews: She is made of iron, sir. I assure you, she can. And she *will*. It is a mathematical certainty.

On the oblivious public

Ruth: Will the lifeboats be seated according to class? I hope they aren't too crowded.

Rose: Oh mother, shut up! Don't you understand? The water is freezing and there aren't enough boats. Not enough by half. Half the people on this ship are going to die.

Cal Hockley: Not the better half.

Molly Brown: Come on Ruth, first-class seats are right up here.

Cal Hockley: You know, it's a pity I didn't keep that drawing. It'll be worth a lot more by morning.

Rose: You unimaginable bastard!

On not willing to fix the situation

[being offered a lifebelt]

Benjamin Guggenheim: No, thank you. We are dressed in our best and are prepared to go down as gentlemen. But, we would like a brandy.

Tommy Ryan: Music to drown by. Now I know I'm in first class.

On expecting someone else to solve the problem

Jack: I don't know about you, but I intend on writing a strongly worded letter to the White Star Line about all of this.

On Human Stupidity

Lewis Bodine: Incredible. There's Smith and he's standing there and he's got the iceberg warning in his fucking hand, excuse me, his hand, and he's ordering MORE SPEED.

Brock Lovett: 26 years of experience working against him. He figures anything big enough to sink the ship they're gonna see in time to turn. The ship's too big with too small a rudder. It doesn't corner worth a damn. Everything he knows is wrong

You know, the really funny thing about all this is that the government is not just going to print more worthless bonds to put into the union pension fund. They keep acting like their government bonds in their retirement accounts are going to be worth something and the unions pensions aren't. These people know a lot about their own tiny areas and don't see the big picture.

I've used the Titanic Analogy this way.

Immediately after the ship hit the iceberg, Thomas Andrews knew the ship would sink. Soon, everyone would know the ship would sink, and some realized it as they were drowning or dying from hypothermia.

In a sense, we hit the iceberg when we started using fossil fuels, and Hubbert is analogous to Thomas Andrews.

This bit is the Peakists Dilemma:

Thomas Andrews: Please, tell only who you must. I don't want to be responsible for a panic. And get to a boat quickly, DON'T WAIT. You... remember what I told you, about the boats?

This is a little different. You and I both know that they could have kept the pipeline complex running with the refinery shutdown if they really wanted to. Backup power and steam could have been arranged, it just would have cost a lot. I'm thinking that part is just a hard-ass tactic.

Different Shmifferent..

Out of ONE labor dispute, in a time and a place without resilience or alternatives can threaten a chain reaction to disrupt the pipeline, those fields, that many consumers..

You seem to be saying 'In a slightly more perfect world..' where the corner we've painted ourselves into is rife with these kind of dependencies, while the veneer makes it look 'like a real Hollywood town'

(The WACO KID tells his tale in the tiny town of Rockridge..) http://www.youtube.com/watch?v=Y4YLuv0k4jk

'The little bastard shot me in the ass!'

Bob

1200 UK time (GMT+1) and the BBC news website has this story as its main headline on the front page:

Strike to close key oil pipeline

And this story is also linked to on the front page of the BBC news website:

Strike could cost UK '£50m a day'

And over on the front page of the Guardian's website, the main story is:

Minister warns of pump shortages as refinery strike bites

And over on The Independent (this story is a little lower profile... it's only a one-line link from the front page)

Minister: 'No guarantees' over fuel supplies

And top story on the Daily Mail website:

Fears grow of fuel shortages as Minister warns petrol supplies can't be guaranteed

and top story on the Daily Telegraph's website:

Minister warns over petrol shortages as oil pipeline set to shut

Seems the UK media is starting to wake up... is it coincidence that crude prices started climbing at about 0900 GMT?

1300 UK time (GMT+1)

The "World at One" news programme on BBC Radio 4 is leading with the Grangemouth story right now.

It should be possible to listen to the show online from the show's website.

Does anyone know if the gas pipeline from Norway will be affected by the strike?

Here in Ireland, 60% of our electricity is generated with gas turbines, the gas being imported from the UK, and originating in Norway, so I believe.

Do I need to buy some candles for next week? :)

I think gas supply will be ok. Weather forecasts are for a brief colder spell next week, but there is enough gas in storage to cover that. At the same time Statoil Hydro has increased flows through the Langeled pipelone into Easington from 35 MCM/day to 46 MCM/day and could, in theory, increase to 70 MCM/day if prices warrant it.

There are three gas pipelines that transport gas form Norway to the UK (FLAGS / Tampen, Vesterled and Langeled). These all transport dry gas and will not be affected by the closure of the Forties pipeline. What is of relevance if UK supplies run short, will we have sufficient surplus gas to pipe to the Emerald Isle? I suspect these supplies are bound by contract.

First to get cut off are UK industrial users who pay a reduced tariff for agreeing to have their supplies cut at times such as this. First time around I suspect we get through this OK. But if BP have trouble restarting the pipeline or if there is a repeat performance at Grangemouth - then all bets are off.

Its worth noting that some Norwegian fields in the Heimdal area (see map) feed into the Forties system. So that Norwegian production will likely have to be shut.

Some Union Rep was on World at One and said (in the inevitable scouse-militant accent)that if management dont come around there will be more walk outs.

Quite why UKPop should feel sorry for workers on a final salary Index linked NON-CONTRIBUTARY pension scheme will be tested to its limit soon.

Also, platforms cannot be turned on and off at the flick of a switch. Shutting down can be easier than starting back up.

No wonder BP sold it on in 2003.

Your emphasis on non-contributary is misleading - implying something for nothing. The pension scheme is simply a part of the overall renumeration for the work done, and has been for many years. The new owners of the plant are attempting to reduce this renumeration - and plunder the funds already set aside, something which I suspect most of us would resist strongly, particularly at a time when salaries (and profits) in most oil related businesses are rising strongly.

Having said that, there is a definite case for compulsary arbitration to resolve such disputes which can have a disproportionate effect on the wider population.

Plunder the funds?

You're claiming as fact something which is unproven. The company says it never had any intentions of raiding the funds, and is so sure of that, is suing the union for making such claims.

Well of course not since they want to make these changes before they expose that the pension fund has suffered massive losses in the US MBS market. So no they are not going to plunder the fund but are you sure the fund even has the money ?

Most US pension funds are setting on huge losses that have not been reported I can't see why this one would be any different. And I'm pretty sure management will hang tough since they are already toast.

If the employees are smart they would force a external audit of the pension fund to determine the losses and this will layout the real situation.

Whether the fund has lost value due to outside economic influences is beside the point. We all know that ALL pension plans are going to be worthless if the national and global economies cannot expand.

If the union cannot come to grips with this, then the strikes will continue and the situation will deteriorate.

By the way, I have not seen any reports saying that the fund has lost value, so where did you get that info?

Look the US pension funds are setting on huge unrealized losses this is fairly well known. Once these losses are realized the company will have to set aside sufficient cash to make the fund whole. If the company is highly leveraged which it looks like Ineos is this is probably sufficient to force it into bankruptcy.

I'd be very interested to see the current status of Ineos investment portfolio for the pension fund I suspect its in the crapper. You have to ask why they are trying to change the terms of the pension fund and this is the obvious reason.

Look for a lot of US companies to eventually book major losses when they are finally forced to correctly value their pension fund investments.

I would not be surprised if Ineos is technically insolvent because of pension fund losses coupled with high leverage.

http://freedomainradio.com/board/forums/thread/102829.aspx

http://thebankwatch.com/2008/03/10/pension-fund-sues-banks-over-sub-prim...

The whole US population should strike for the reasons listed above. How is that

set up any different than MCI, ENRON or entire US social service net as a whole? this strike seems a microcosm of society.

cfm in Gray, ME, Milliways

Hans - it would appear you are absolutely correct, the union have clarified this in a statement to Ineos:-

http://www.ineos.com/new_item.php?id_press=213

As to intentions - that is something else, which I guess we are all entitled to our opinions about.

Having an opinion is fine and dandy. Stating your opinion as fact is not.

They are being asked to contribute a measly 6 percent.

And one of the reasons they are fighting for it for new entrants is because they get jobs for there kids there.

Wont matter a damn in 15 years anyway.

They wont have much more than a few pints to refine and they will all be out of work.

"Fortunately, mild spring weather will ease the demand for natural gas."

Not quite. Temperatures to drop to around 10 degrees C after the weekend.

http://weathernews.co.uk/

The refinery shutdown is now #1 spot on the BBC TV News...

They are talking about 1/3rd of the UKs oil being stopped -I predict the panic buying will spread far beyond the local stations in Scotland. I told most of my friends to fill up yesterday while it was just a footnote in the papers, they have put on their lipstick and dresses and have moved to stand next to the life rafts :o). Big up TOD.

Nick.

A summary of where I think we are at and where we are going wrt "Peak Oil":

"Peak Oil -Joining The Dots": http://www.megatrends2020.com/Peak_Oil__Joining_The_Dots.doc

I spend a good deal of time on the Medialens message board, and it produces over time some interesting hunches about the nature of the average corporate media hack.

I suggest that we should never underestimate the depth of technical ignorance, about any given subject at all, that's rife amongst hacks, since it's no part of their job to know very much about anything. You get a powerful impression that the hacks really don't get just how serious, and how close, is the PO catastrophe, and all it's entangled sister catastrophes that are now synergising together so unpredictably.

Meanwhile, the perception-management system -- which of course is a much more crucial purpose of the corporate media than any mere dissemination of reliable news -- seems to be under a slightly distant, allegedly hands-off, level of control by its real masters. Thus, unless actual, unmistakable 'three-line-whip' orders come down from on high, the editor hacks are supposed to know for themselves, without formal guidance, what needs to be said, and -- equally important -- what needs to be ignored.

I can't prove any of this, but I'd take a bet that the editors aren't saying much beyond the standard knee-jerk union-blaming responses to strikes simply because they just don't know much more than that hallowed requirement of their masters. They just don't see the connections between the dots.

According to the BBC, Ineos have announced that Grangemouth is now shut down.

And BP have started to shut down the Forties pipeline:

Reuters: BP begins Forties oil pipeline shutdown

Game start.

I really find your top chart quite telling and amazingly crafted! we clearly see the storage withdrawal increasing and injection decreasing while exports are rising on a dwindling domestic supply. Superb work.

Radio4's "PM" news programme is leading with the Grangemouth story.

More details and listen online here:

http://www.bbc.co.uk/radio4/news/pm/

The report is underlining that the main issue leading to the strike is pensions.

While the fate of energy flows into Britain were being sealed on Monday and Tuesday this week, Gordon Brown was pre-occupied with the past, let alone the present or the future, trying desperately to undo tax muddles that he himself created. Gordon Brown will be remembered as one of the greatest Followers this country ever had.

And with the refinery shut and half of UK oil and gas production in the process of being shut down, Scotland's First Minister Alex Salmond now calls on Management and Unions to meet to settle their differences (C4 news this evening). I'm sorry Alex, the plant is shut and the workers are off down the pub (or in this case the wine bar) - the time for stirring words like that was last Monday!

Euan,

this map looks suspiciously like one of those filthy euro-maps where the uk is divided up into regional units of production.

Gordy appears to have done what boney, little bill and the corporal failed to achieve.

This hits the nail on the head, but the rot started when M Thatcher became obsessed with privitisation of the UK's critical infrastructure and "gave it away" to private investors to raise easy capital for the government. Private equity was the next logical step to this subtle process of asset stripping. The next step is the mess we're in now!

By the way, Ineos are not a private equity company they're the 3rd largest "chemical manufacturing" company in the world. (this was the reply when R4's Eddie Mare asked a senior Ineos manager about the origins of Ineos)

It will be interesting to see how the private sector bails us out of our energy conumdrum!

Chaps and Chapesses:

Of course all here will have followed UKGov advice a few years ago with the pamphlet that was the heir of 'protect and survive' to whit:

-Lay in 21 days of preserved foods for you, your family and pets.

-Lay down a decent wine cellar

-Get Grandad's old Webley out of the loft

-Make Tea

-Be British

-Tune into Auntie

Latest from the Daily Mail:

Petrol stations run dry as minister sparks fuel panic by admitting: 'Supplies can't be guaranteed on every forecourt'

http://www.dailymail.co.uk/pages/live/articles/news/news.html?in_article...

bugger!

you beat me to it:

Petrol stations run dry and we are all going to die:

well...at least according to the daily mail , that is...

http://www.dailymail.co.uk/pages/live/articles/news/news.html?in_article...

Nighty night

Some nice pics...

Mang, you guys are hosed. Appreciate the stiff upper lip an' all tho-- very, um...British. Good luck. Careful with the Webley.

And not a peep about the situation on CNN. Al Jazeera, which is where I go to get my news these days, is covering the story.

The last few years UK extraction has been pegged and they are hitting the rails. All this other stuff does not matter.

http://mobjectivist.blogspot.com/2005/10/uk-north-sea-simulation.html

WHT offtopic but I use the resources on your site quite a bit and its hard to find your previous papers. Not sure what the best organization would be but just a page with all the titles on it would be useful. By date is tough to figure out.

Fantastic work and I hate to complain but I like to link back to your work all the time and its tough if I've not saved link. I do searches with the oil drum and google on your site but this can miss some later related work.

I was wondering just how stretched that company is. It's not an old company with lots of assets and built up equity. Perhaps the reason the company is striking the workers is that they have loan covenants. If the profits drop because they have to make the pension deposits, or if the pension assets have dropped because they have invested them in dodgy thirteenth mortgages, they may be up against the wall and have nothing to lose.

The question I would ask is what has happend to the assets. Ineos may be a new company, but the huge assets acquired from ICI and BP are certainly old. The 9 billion euros borrowed to buy these old assets have ended up in someone's pocket somewhere and will be squandered. It took a century or two of hard work to build up the UK's industrial infrastructure and only a few years to sell it all off. It takes over a billion pounds to develop a new model of car. China got MG Rover's model range, a new common rail diesel engine (the G series), and an entire production lines for 60 million, Price Waterhouse Coopers got 10 million pounds for shutting MG Rover down. Tata get Jaguar and Land Rover for about 1 billion. You have to remember the Tories sold off the utilities in the same way. If you tried to set up any of these companies up from scratch 9 billion euros would probably not touch the sides.

Asset stripping. Or "Disaster Capitalism". Thatcher sold off (gave away) what was a commonwealth asset to private interests. If this were happening in US I'd expect to see a default insured by taxpayers with a subsequent renationalization of the debt (Bear Stearns) and a busting of all unions in that industry sector.

cfm in Gray, ME, Milliways

Off topic , but somewhat pertinant in these hard times:

What Kind of Poor are You?

http://www.telegraph.co.uk/news/main.jhtml?xml=/news/2008/04/26/npoor126...

Find yourself in the list.

Just heard a snippet on Auntie that BP are trying to find a way of ensuring power and steam remains available to the pipeline.

No proper link yet.

Sorry to say Mates, you Sheeple in the UK are floating down Sh*t Creek and have dropped your Paddle....

Ain't Life Grand.....God Save the Queen.

BZ

In Great Britain people queue without being herded by ropes or security officers, and they will respect the limits asked for on the fuel pumps. I know because I worked the BP40's off of Aberdeem, Scotland in the late 70's. They use to burn the gas then because there was no pipeline. The gas burned a few hundred feet about the rig and if you looked up towards it the heat was too you could only do that for about 10 seconds. Meanwhile on shore there was no central heating. People kept warm by sleeping under 6-8 wool blankets. It works but weighs a lot. Feels like your being compressed into the bed, which was rough cheap nylon sheets - yech!

Anyway, so glad they finally put a pipeline in for those good folks. Hope they get it back on line soon.

I'm based in Edinburgh which is about 20 miles from this plant, also quite close to the Forth so I can sometimes see the flames from the tops of the chimneys from my front windows.

So far I haven't seen any major effects - two Shell garages were closed this morning, but on my way back one was getting fresh supplies from an unmarked tanker.

We have heard news of queues but my Wife filled up on Thursday at a supermarket with no problems at all.

Most people in the UK have grown used to the effect of high fuel prices and so we tend to drive smaller and more economical cars (plenty of diesel) than those usually found in the US, Canada or Australia so the effect of this is blunted somewhat.

Some people have been topping up, sometimes only buying a few litres to get the last drop into their tank. I have about 2 weeks of fuel in my car so its no problem, only those people who decided to buy stupidly thirsty cars are now feeling the pressure as they have to plan where to go to get fuel - these are a few of my neighbours too.

My only concern, but I think its unlikely, is disruption to supplies to shops. At the point when this happened during the fuel protests a few years ago support for them went away quite quickly - the sight of empty food shop shelves was quite sobering.

So as Mr Melencamp once sang, this is not the end of the world but I can see it from here.

Sky News has a map which tracks fuel prices in the UK.

http://news.sky.com/skynews/fixed_article/0,,30100-1313802,00.html

Fuel in and around Elgin in Moray is being rationed to £10 on 26/04/08 and a lot of stations have already run out of diesel! 20 mile trip for us into Elgin. Is it worth it when you can only get £10?

Buckie, Banffshire, AB56, Scotland. Diesel 121.9. Petrol 111.9 on 25/04/08. More fuel due tonight and the price is going up. Restriction £20 per customer and no cans allowed."

IN KELSO ON 26/04/08, PRICE FOR UNLEADED 1.11 AND DIESEL 1.22 LIMITED TO £10.00 PER CAR FOR AN AREA POPULATED BY COUNTRY DWELLINGS

Sky News also has other info and videos about Grangemouth.

http://news.sky.com/skynews/home

The average european car owner uses a 1000 Liters a year, the tank holds 50 Liters. So you call at your petrol station roughly 20 times a year or about every 18 days. So if "panic buying" could really make petrol stations run dry, that implies that stocks don´t even cover 20 days consumption.

It's probably averages closer to 30 fills a year (as folk tend to fill at 1/4 tank and not all people fill right up). So roughly every 12 days which squares a bit better with he habits of folk I know.

Marco.

Sorry this is funny no cans allowed and 20 pound limit.

Hmm.

1.) Drive car to station 1 fill up repeat till tank is full.

2.) Go home siphon fuel into can

3.) goto step 1 next day.

Memo to self:

Figure out how to siphon from my car later on not sure I have anti theft baffles.

Don’t worry.

We are saved.

http://www.telegraph.co.uk/news/main.jhtml?xml=/news/2008/04/27/npipe127...

Emergency fuel tankers set sail from Europe

By Andrew Alderson, Jasper Copping and Richard Gray

Last Updated: 1:54am BST 27/04/2008

Emergency supplies of fuel will be shipped in from Europe this week to prevent pumps in Scotland and England from running dry. · Your View: What is the sensible response to the fuel strike? A convoy of seven tankers carrying 65,000 tons of fuel, mostly diesel, will arrive in the next few days, following today's oil refinery strike.

Dry run: A near-deserted Shell station in Edinburgh

The shipments from Rotterdam, Amsterdam and Gothenburg will be unloaded on the river Forth, Scotland's busiest shipping lane.They will provide enough fuel to keep Scotland running for nearly 10 days. Officials hope that the deliveries will avert the panic buying that was spreading south of the border yesterday, with the first pumps running dry in the north of England.

You should be alright... unless some French fishermen go on strike again as they did in Sep 2000...

Hey - I thought we had our own reserves of fuel - maybe they're stored in Grangemouth?

LOL

And I am sure this will affect diesel here in the US, as the price is already far past records and areas have had supply concerns already.

Fine as long as your car is quite economical and the pump is not too far out of your way :)

Oh no!

May be the Euro-Tankers wont be enough!

According to the Sunday Express:

http://www.express.co.uk/posts/view/42609/Labour-plan-to-ration-petrol

Rationing!

Note: Reporters are called Jason and Tracey. So caveat emptor.

Petrol went up by 5 euro cents (1.47 -> 1.52) overnight here at my pump in the Netherlands. Could be that we are shipping ours to Britain

I live in Vancouver, Washington, USA and am getting a huge laugh out of all this (no irony here, just real guffaws). And I'm thinking, this is going to effect the price of gasoline here starting tomorrow, and there isn't a livin' thing any of us can do about it! We saw PO coming, but the way events are unfolding is nonetheless weird and facinating...

This is a above ground event but what your seeing ins a disturbance ripple outwards. So although this shortage was man made if you will it shows how tight oil supplies are and the problems real shortages can cause. Thats why I've always felt the biggest problem post peak won't be price but shortages.

Well put memmel. I think that is basically what the Oil Shockware Report says too!

http://www.secureenergy.org/reports/oil_shock_report_master.pdf

If they had waited 8 weeks, their Oil Shockwave was for real, as Katrina lapped at the shores of the Gulf of Mexico.

Did they learn anything worthwhile in their simulation exercise that they could hope to deploy to aid the situation that unfurled post-Katrina, or was this all too little, too late?

Interesting that most of their scenarios in the Shockwave report involved terrorist activity or political unrest in unstable countries (Nigeria cited). This was probably just the mood of the administration at the time, terror attacks were still being planned (London Underground 7/7/05 and 21/7/05) and it was easy to identify foreign elements as the bogeyman.

It was obviously off their radar that a storm in the Gulf in Aug 2005 or 1200 union workers in Scotland some 30 months later would have such a profound effect on the global oil production.

Quite right Memmel. We can complain about prices, nothing new there. We can even adapt to $200 oil by voting with our consumption behaviour. But physical disruption is a completely different story. Since we are running the global liquids supply system at close to 98% (nobody knows exactly of course), the prospect of physical shortage for a day, a month or six months is no phantom threat. The sudden shock of empty tanks, flight cancellations and road haulage shutdowns is the point at which semantic discussions about commodity speculation, geopolitics and peak oil are left behind in the drawing room and when the aircraft carriers get moving. Quite how the fickle, fragile and vast financial markets would respond is a bit frightening too. Badly I would say. Oil is oxygen. If we can't breathe, we stop. A few more small scale Grangemouth events and somebody in power might start to get the point and do the homework.

It appears as though your trip down Sh*t Creek without a paddle continues as of this Sunday...OHHH NOOO..There are Rapids ahead...(not to worry, the Military will be on the scene come Tuesday)...Better call the Queen on the line and request a new paddle.

BZ

From the Sunday Times today.

http://business.timesonline.co.uk/tol/business/columnists/article3823656...

This man predicted oil would fall to $5 / bbl and stay there for about 10 years.

His address is: stelzer@aol.com

For those who can be bothered to debate with him.

From The Sunday Times

April 27, 2008

It’s a myth that the world’s oil is running out

American account

Irwin Stelzer

THERE are more misunderstandings about the oil market than perhaps any other. In America, drivers are fuming and politicians are demanding explanations because petrol has hit about $3.50 a gallon. That’s 47p a litre, less than half the 105p-115p being paid by British motorists. So “high” in Cambridge, Massachusetts, and Oxford, Mississippi, is “low” in similarly named cities in Britain.

But assume that prices are “high”, which indeed they are by historic standards. We are mistaken when we think these “high” prices are causing inflation. High oil prices can force consumers to spend more on petrol and heating oil, at the expense of other purchases. Ask any suffering restaurateur or clothes retailer if you doubt that. But high oil prices can’t trigger a rise in the general price level – inflation – unless someone pumps money into the economy so that, to use an oldie but goodie from the economists’ lexicon, there is more money chasing the same amount of goods. If you want something to blame for inflation, don’t look at oil prices, look at the billions the Federal Reserve’s monetary policy gurus and their confederates at the US Treasury are pouring into the economic system.

Another myth: we are running out of oil. According to WorldPublic Opinion.org, “majorities in 15 of the 16 nations surveyed around the world think that oil is running out . . . only 22% on average believe that ‘enough oil will be found so that it can remain a primary source of energy for the foreseeable future’ ”. Those majorities who think we are running out of oil include 85% of the British and 76% of the American citizens polled. Luckily, they are wrong.

Production of oil is being constrained by several forces, none of them due to God’s failure to put enough of the black gold under our feet. Several countries that are important sources of supply are in political turmoil, and unable to bring to market the oil they are capable of producing. Think Nigeria, where security problems have shut down about 20% of the nation’s capacity of 2.5m barrels a day and discouraged new investment, and Iraq, where political paralysis and terrorists have kept production at less than half its potential.

Those cursed 'above ground factors' just keep oil above $20 / bbl dont they? Every dang small hiccup....

Wonder why that is then? Maybe God did fail to put enough of the black gold under our feet after all....

Yes. Stelzer used to run an outfit in Washington called NERA (National Economic Research Associates) that was always flacking for the nuclear power industry among others.

What do you mean by "running out"?

Since there is only a finite amount of the stuff, and the natural replacement rates are in terms of geological time, and we are using it far faster than new stuff is produced, then we are, strictly speaking, running out.

Wow. I mean... wow. Gentleman is entitled to his opinion (as are all the folks here at TOD), but I go back to a little something that a colloege professor once told me...

"Show me the data!"

Ok, here we go...

Where is this oil that is supposedly beneath our feet? New discoveries somewhere that we don't know about? If this were the case, the rate of new discoveries would be going UP, not DOWN.

"Show me the data!"

By pure logic, we must be running out. Why? There is only a finite amount of oil embedded in the planet, and we have been pumping it out for gosh near a hundred years. A great example is an apple tree... If you start out with 100 apples on the tree, remove 50 of them, you will only have 50 left. By definition you are 'running out'. In our case, the question is WHEN do we start to run out, and WHO will end up going hungry when there are no more proverbial apples left on the tree...

And here's a counter-argument to 'running out'- the classic US oil production chart... If we weren't 'running out', at the very least the chart would trend horizontal, if not show an increase over time...

"Show me the data!"

Oil hasn't been at that price... Ever. Logic would dictatae this is HIGHLY unlikely for it to do so now. Here's REAL oil prices for about the last 150 years or so...

"Show me the data!"

“Data always beats theories. 'Look at data three times and then come to a conclusion,' versus 'coming to a conclusion and searching for some data.' The former will win every time.”

—Matthew Simmons, ASPO-USA conference, Boston, MA, October 26, 2006

So, send the AUTHOR of my clip an email.

His address is: stelzer@aol.com

For those who can be bothered to debate with him.

I will be interested in your post regarding his reaction (if any).

rgds

After the East Texas field started producing. the price of oil fell to about 10 cents a barrel.

http://www.time.com/time/magazine/article/0,9171,745531-2,00.html

OK! Someone SHOWED ME THE DATA.

That was 1933 when it was $.10/barrel, inflation adjusted to $1.50 in 2007 dollars...

But sill, $5/barrel is something we haven't seen in a LONG time, at least WAY before I was born...

Oy!

Tell it to Stelzer: HE was predicting $5 / bbl (actually parroting the Economist) in the Early 2000's when Oil fell to about $10 / bbl - albiet briefly.

He is now saying that Peak Oil is a myth.

Contact Stelzer. I am sure his mailbox is pretty full this morning.

Something heartening for a change.

Well. I will eat my hat.

I was under the impression that Hydro power in Scotland was pretty maxed out.

Not so , according to this article.

This bit is probably important:

‘’Of the 102 sites identified in 1944, only 29 were developed, as other forms of energy - nuclear and gas - became more popular.’’

http://www.timesonline.co.uk/tol/news/uk/scotland/article3821800.ece

From The Sunday Times

April 27, 2008

Hydropower might be the renewable answer

The Lewis windfarm has been vetoed, but Scotland could hit its green energy targets by looking again at water power

Richard Wilson

It was to be Europe's biggest on-shore windfarm and would have powered one in every 10 Scottish homes. But the islanders of Lewis did not fancy their unique peatbogs marred by 181 turbines. They objected in their thousands and last week were rewarded when the Scottish Government vetoed the scheme.

Environmental groups, along with the renewables industry, are devastated, claiming that the UK will be unable to meet its target for 15% of clean energy by 2020. With hundreds of windfarms held up by planning disputes, doom and disaster is forecast.

Is the future really more black than green? Some experts claim we already have an abundant, untapped supply of green energy and the technological expertise to develop it. It's not in the air - it's in the water, something Scotland has in abundance.

Hydropower is a tried-and-tested method of generating electricity and is an area in which Scottish engineers traditionally excel. In the 1940s and 1950s, it was seen as a way to modernise the then remote Highlands. It was embraced by Tom Johnston, the Labour Scottish secretary, to bring heat and light into dark crofts and to provide skilled jobs in rural areas.

RELATED LINKS

· Wind farms could be moored off Scotland

The schemes built under Johnston's stewardship have lasted well. Almost 12% or 1.3GW of Scotland's electricity comes from hydropower. It could be much more. Less than a third of the lochs and rivers identified as suitable for dams in 1944 have been developed. Only one significant hydropower plant has begun construction in Scotland in the past 50 years, at Glendoe, near Fort William. It is due for completion next year.

The Scottish Nationalist government has an even more ambitious renewables target than Westminster - 50% of electricity by 2020 without any help from new nuclear stations. So it is perhaps time for Alex Salmond to go back to the future and draw inspiration from Johnston.

Tom Douglas, a consultant at the engineering firm Mott MacDonald, is one of the few professionals still working who has personal experience of Scotland's hydro heyday. As a young engineer in the 1940s, he worked for the firm tasked with identifying potential hydropower sites. Asked why Scotland had embraced the technology with such enthusiasm, he replies: “The real reason was one man: Tom Johnston. He was the champion.

“It was very well organised by the Hydro Board. You didn't have this wretched business of European Union rules. We had a sense of mission. It was done without the constraints of today's world.”

He remains evangelical about the potential of hydropower. In a study paper he wrote for the then Department of Trade and Industry seven years ago, he calculated we could double the power we generated in this way. He said Scotland had 1.4GW of undeveloped capacity in “technically feasible” locations.

Of the 102 sites identified in 1944, only 29 were developed, as other forms of energy - nuclear and gas - became more popular.