Energy Prices, Inflation and Denial

Posted by Euan Mearns on February 4, 2008 - 9:51am in The Oil Drum: Europe

Higher energy prices are feeding through to rampant consumer energy price inflation. And yet the authorities and many investment houses still see energy prices falling in the future. This naive view of global energy supplies is starving energy markets of the capital required to expand conventional and alternative energy supplies.

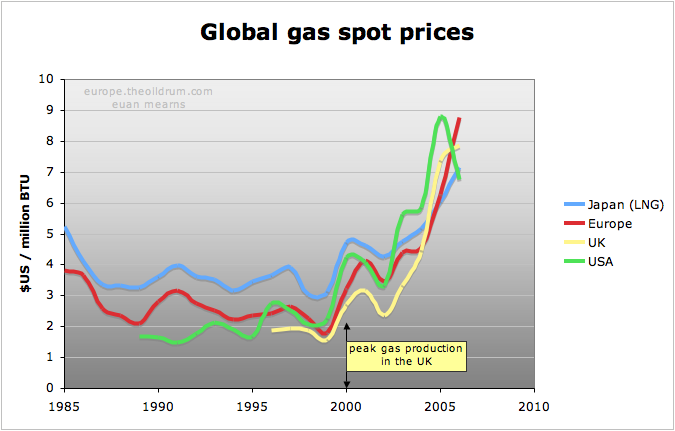

Global annual average natural gas spot prices from the BP statistical review of world energy 2007. Click all charts to enlarge

Global gas spot prices began their sharp up-trend around the year 2000 which just happens to coincide with the year of peak gas production in the UK. Since 2000, UK gas spot prices have increased almost 4 fold and this along with higher coal and oil prices is beginning to have a significant impact upon UK inflation.

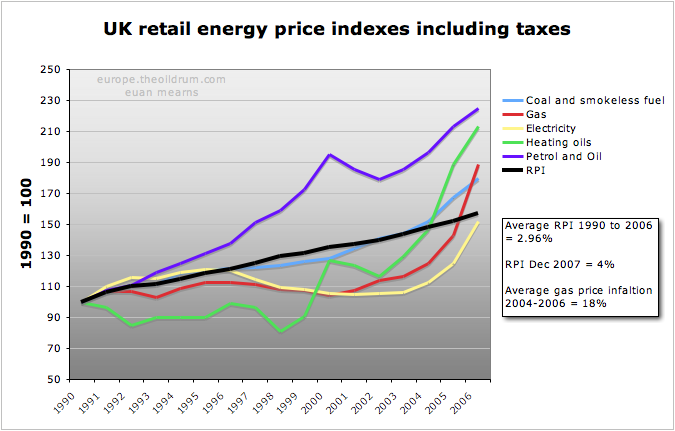

The chart is compiled from Table 2.1.1. from the report Quarterly Energy Prices December 2007 (pdf), found in the Energy Statistics section of the BERR web site. From 1990 to 2000 inflation in most primary energy sources was benign in the UK, excluding petrol (gasoline) which was deliberately inflated by progressive tax increases. Since 2003, however, inflation in gas, electricity, coal and heating oil has taken off. RPI data can be found at National Statistics Online.

Prior to 2003, price inflation in UK primary energy sources was running well below the inflation rate as measured by the RPI (the Retail Price Index is a holistic UK inflation indicator). Since 2003, inflation in all primary energy sources has taken off and for example gas prices have increased on average 18% per annum for the last three years. Prior to 2003, low energy costs had a dampening impact upon inflation but now they are running well above the RPI and this may result in inflation spreading through the UK economy since energy use impinges upon numerous goods and services.

Electricity and gas prices have just been raised significantly in the UK leading to howls of anguish from the public and the media.

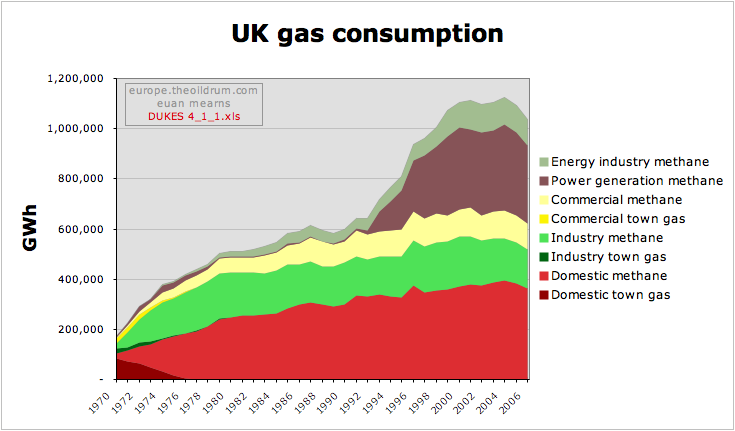

The meteoric rise in UK gas demand was reversed these last two years as amongst other factors, high price has dampened domestic demand. Data from department of Business Enterprise Regulatory Reform (BERR) table 4.1.1.

Demand for gas has fallen in the UK over the last couple of years. This may be due to a number of factors such as milder winters, efficiency measures, off-shoring energy intensive industries, switching between coal and gas in power generation and demand destruction among industrial and domestic users. Higher prices and scarcity play a role in four of these five factors.

But note, even though demand has fallen UK spot prices for gas are running about double last year.

National Grid

National Grid is a UK company with responsibility for electricity and gas distribution networks. Their web site is a goldmine of data and reports on the UK domestic energy situation. The next three charts come from their Gas Transportation 10 Year Statement 2007.

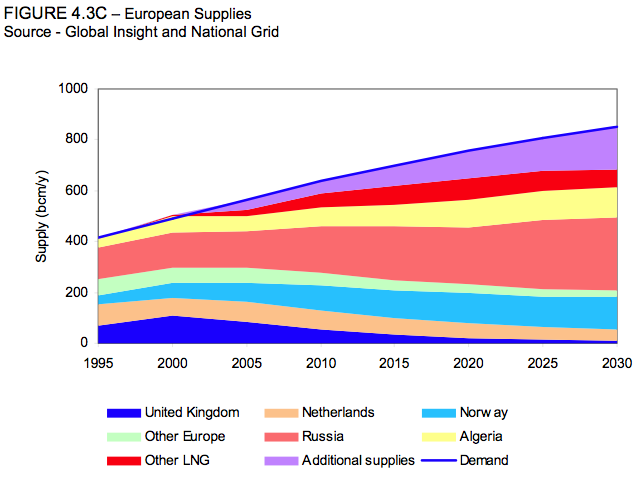

The National Grid view on UK gas supply and demand is shown below. UK domestic gas supplies are forecast to fall, demand is forecast to rise and imports will rise from zero in 2003 to 80% of total demand by 2017. This complies with my own view, and is in general agreement with the official government view expressed by BERR and is repeated in many industry reports. There seems to be unanimous agreement that UK gas imports are going to explode in the coming years.

National Grid paint a sensible picture of falling UK indigenous supply of gas, rising demand and escalating imports. And yet they forecast gas prices will fall. Source is National Grid Gas Transportation 10 Year Statement 2007

Surprising then that the National Grid has forecast gas prices to fall in 2008 and then stabilise for the next 10 years. I find it truly remarkable that a strategic company such as this can foresee a yawning gap opening between UK gas supply and demand and at the same time forecast falling to stable prices. This in my opinion sends out completely the wrong message to government, consumers and to the investment community.

Beach price is presumed to be the wholesale price. Note that this is significantly lower than the spot price since much gas is sold at contract prices struck many years ago. Industrial consumers paying the lower "Interruptible" tariff will be first to have their gas turned off when supplies fail. Note that domestic users pay by far the highest price and will be last to be disconnected.

Prices are struck in 2006 pence hence discounting future inflation which the Bank of England is mandated to hold at 2% per annum. Source is National Grid Gas Transportation 10 Year Statement 2007

Whilst UK spot prices for gas have near quadrupled since 2000 the wholesale and retail prices have risen by more modest amounts of around 50% since these are cushioned by long term gas sales contracts struck at a much lower price many years ago. These have protected UK consumers from the full glare of the gas spot market but with time this position will unravel. As old contracts and supplies expire new contracts for gas will be struck at considerably higher and rising prices. It's possible the retail prices we are seeing right now are the tip of an energy price iceberg that is preparing to rip through the system.

And yet the National Grid forecast prices to fall this year whilst UK consumers have just been hit by 15 to 20% rises.

This extraordinary view on future prices from the National Grid is rooted in their forecast for future European gas supplies which shows Russian Gas, Norwegian Gas and LNG imports expanding into the future. As I discussed in my post on The European Gas Market that was updated here, Russian gas supplies may at best maintain current levels - and not double as shown by National Grid (Global Insight report), Norwegian gas production may actually fall from 2010 onwards and LNG supplies may fall well short of the import capacity that has been and is being built.

The National Grid and Global Insight paint a rosy picture of gas supplies to Europe that does not seem to take into account falling production in Russia's largest gas fields, the reality that associated gas production from Norwegian oil fields will follow their oil production down and that Global LNG supplies will only meet around 50% of import expectations. Ironically the LNG import / export capacity offset is described in a report by Global Insight (large pdf). Source is National Grid Gas Transportation 10 Year Statement 2007

The harsh reality of this situation should be self evident from the fact that UK spot prices for gas have doubled again this year. It's really time for The National Grid, The Markets and The Government to waken up.

Denial and deprivation of investment

I mention our markets here because, since I started to follow energy markets and companies in 2003 the expectation for the future has always been that prices will fall - even though energy futures prices switched to contango.

This century, energy companies have bought back stock on an unprecedented scale whilst contemplating their corporate navels and avoiding real investment in future energy supplies. No wonder then that energy supplies are waning and prices are going through the roof.

Energy companies like BP find their stock valuations languishing at the same level of Jan 2005 and trading on a lowly PE multiple of 9 times historic earnings despite the meteoric rise in oil and gas prices over the same period. Whilst it is true they are struggling to grow production and reserves they have also done all they can to talk down future energy prices and to avoid investing in our energy future. The market is pricing in a future fall in production and oil price and terminal decline of global energy companies like BP at a time when we need these companies to display creativity, imagination and leadership.

The chart is from Yahoo. Disclaimer - I do not own any BP stock though I do invest in energy companies.

When an energy sector presides over falling production whilst forecasting prices for their product will also fall it is little wonder that their stock values are priced in the bargain basement of Global Stock markets. It is high time that the energy industries, capital markets and governments recognise that falling production and rising demand are not compatible with falling prices and that they come together to invest this profit bounty in our energy future. That future does not lie in low eroei liquid fuels like ethanol and syncrude but in solar energy, wind energy, electricity, batteries, electric transportation and global scale HVDC grids.

It is time to invest and build.

Previously on The Oil Drum

UK Gas and Electricity Prices by Chris Vernon

Natural Gas - A Tale of Two Markets by Nate Hagens

A Closer Look At Oil Futures by Nate Hagens

That sounds grim. I suppose we should be grateful that the UK has not been wasting money on doing things like installing adequate insulation in new builds over the last 25 years! ;-)

I wonder if in fact the National grid and so on calculate that an energy shortage and very high prices will increase their profitability?

NGC are technically a non profit organization

As far as I know National Grid are a FOOTSIE company (NG.L) with a market cap of around £20 billion - though I suspect subject to a fair bit of regulatory control.

http://uk.finance.yahoo.com/q?s=NG.L

The lack of investment is the real reason why the rosy scenarios of Yergin's CERA et al are not credible. It doesn't matter how much might theoretically be in the ground, if money isn't spent to get it out, it will stay in the ground. Investment is already lagging significantly behind where it needs to be, and this has been in an economy that has not yet really begun to be strangled by high oil prices. Once the economic pain really kicks in, that will be the hardest time to try to come up with the needed investment capital.

WNC Observer said,

Roger this one reason I've been focussing on European and UK gas of late. The global oil market is a huge unwieldy beast to analyse in detail but the UK gas market is not. Here we know a number things with some certainty:

1. Gas production is falling and in this offshore environment will likely continue to fall.

2. Demand is more tricky to forecast - it may rise with expanded power generation or it may contract a little more if high price destroys demand - in the form of pensioners.

But no matter which way you cut the numbers the UK is in the international gas market for around an additional 80 BCM per annum by 2020 - and that is a market that will be increasingly pressured by a large number of countries that are hungry to import gas.

The energy companies are applying the Precautionary Principal to their balance sheets at risk of security of supplies - whilst it is national governments that should be applying the Precautionary Principal to securing future energy supplies.

If 1/6th to 1/3rd of housing goes empty and we see 20%+ unemployment that'll knock overall consumption right on its behind. Could be the combination of much trouble in other market segments are distracting the finance people and the strategic people are saying "Wait and see"???

SCT - whilst I do expect house prices to fall by 35 to 50% in the UK, I very much doubt many of these will stand empty. A huge segment of the UK population has been excluded from the property market for years - mainly public service workers - and they I imagine will be queueing up to buy once prices fall far enough.

No MSM articles on limiting new residential and commerical construction for electric power and natural gas load limitation.

No PNM programs to discourage new residential and commerical construction either.

What's going on?

Hmm

target="_blank"

Maybe what's his name's disease?

Why are US spot prices dropping in the first chart?

US nat gas prices are still falling from the Katrina spike. Removing that, the baseline trend is up. As in the UK, US nat gas consumption has fallen these last two years - so there is substitution / demand destruction set against a backdrop of rising price.

your us spot prices must be some sort of average price. spot ngas prices in the us, post katrina, were around $15/mmbtu.

Yes - its the annual average that is plotted.

Not per the EIA: 2007 with Dec. Est.

Gas delivered to customers is up 1 trillion Cu. ft.

Imports are up 400 billion Cu. ft.

Production is up 500 billion Cu. ft.

Unconventional plays a big role in the United States - perhaps Canada, also.

Unconventional has been rising while conventional declines. Unconventional is very much tied to technology. There is a lot of unconventional out there (like shale gas), if we could get it out without too much cost.

Lately I have been thinking that maybe we need a price floor for natural gas in the U.S. Let's say it is set at $1.00 per therm wholesale. That would allow substitute natural gas to be made by gasifying biomass like rice straw, wheat straw and corn stalks. The producers might make 20-30 cents per therm with wholesale price at $1.00 per therm. That could encourage investment in the creation of gasification plants near biomass sources like farm fields. I would much rather that we make methane from biomass instead of bringing in large and expensive LNG.

CalGuy said

"Lately I have been thinking that maybe we need a price floor for natural gas in the U.S."

Lately I have been thinking about the concept of "floor prices" across the energy spectrum, from crude oil to natural gas to propane, and especially to all non-renewable carbon based fuels.

As I said in my post above, one of the factors that is keeping investments out of the energy industry (both fossil and renewable) is the fear of a repeat of 1982 (when oil and gas prices did collapse), or of the late 1990's (when oil and gas prices tried to collapse).

A floor price could provide stability to the energy markets, and make long term investments much more viable. It is almost impossible to get long term investment when you are basing your projections of ROI (Return on Investment) on a short term commidity price, and that is the bane of the energy industry in the modern JIT delivery world.

A floor price on oil, coal and gas, and a carbon tax that fairly reflects the liability of carbon release are not radical proposals when compared to historical examples of market manipulation in favor of oil, rail and steel and internet industries, and would change the energy industry in fundamentally positive ways.

RC

In The Prize, Yergin gives a vivid description of the battle the oil companies fought trying to find oil and gain market share set against a back drop of prices that were always ready to collapse at the drop of a hat.

There is no doubt that high oil, gas and coal prices suit the industry - IOCs, NOCs and OPEC alike. Not a problem if their production falls 5% YOY if prices rise 25% - though service industry inflation eating away at the margin is an issue.

So the incentive for the IOC's to invest heavily in the future needs to come from Government. Here in lies the dilemma though. Most governments probably view higher energy prices as a bad thing - gives rise to inflation and disadvantages the poor. So they will likely favor low energy prices (even though this is bad for CO2 emissions) and we are stuck in this loop. Governments need to recognise that historic energy prices have been ridiculously cheap and need to suffer the economic pain of realignment that is necessary to provide the investment for the future.

The global spot price for LNG rose from near 10 dollars mmbtu to 18 dollars per mmbtu in January.

http://www.downstreamtoday.com/(S(awaxnb45czh01xfqjp0mwhuj))/news/ArticlePrint.aspx?aid=8291

The high spot price were paid by a group in Japan where there was a shortage of electricity due to some nuclear reactors down for maintenance and repair after the earthquake.

Currently there are shortages of electricity in South Africa and China as well as Japan. Natural gas fired generators were easier to build than coal fired generators and responded better to peak demand spikes. There is a shortage of seaborn coal and shipping. There were not enough new coal carrying ships and rail/port capacity in coal exporting areas was bottlenecked.

Last week Platts reported that the spot price Japan was paying for LNG was $20/mmbtu:

High Asian prices lure LNG away from Europe (Platts, Thu 31 Jan)

http://www.platts.com/weblog/europower/2008/01/31/post.html

"European countries like Italy and the UK are busy building new liquefied natural gas terminals in the hopes of diversifying their gas supplies and boosting security of supply. But there is a real risk that some of these shiny new LNG regasification terminals could lie idle because of the increasingly global nature of the LNG market and the fact that consumers in other parts of the world are willing to pay much more for LNG.

Spot LNG prices are thought to have risen close to $20/MMBtu in Asia, driven in large part by a rash of nuclear outages in Japan that have increased the country's use of thermal generation to meet record levels of power consumption. Spot cargoes from north and west Africa, which might otherwise have headed for Europe, are reported to have been sold into Japan at these levels.

In the UK, during the peak winter season, the price of month-ahead gas at the UK National Balancing Point was at 52p/th ($10.30 MMBtu) on January 30. With this disparity in price between Europe and Asia, the possibility of spot LNG imports being used to cap European gas prices appears remote..."

Energy Intelligence, meanwhile, reported last Wednesday that the extra demand for spot LNG from Japan is likely to continue thro to 2009:

Japan Costly LNG Flight

World Gas Intelligence (Wednesday, January 30, 2008)

"Tokyo Electric Power Co. (Tepco) is on track to import a global market-moving 2.5 million tons of spot LNG in the fiscal year ending Mar. 31 to make up for the closure of its huge eight gigawatt Kashiwazaki-Kariwa nuclear plant -- an outage that now looks set to extend into 2009. Assuming that the nuclear outage continues, Tepco expects to procure 25 to 30 cargoes outside term contracts in fiscal 2008, either from existing term suppliers or the spot market."

An interesting thought is if Japan can take spot LNG to $20/mmbtu now, what will the UK take the price to in a few years time when the spot LNG market is 'tighter' and the UK requires say 5-10 million tonnes of spot LNG? The IEA's Natural Gas Market Review 2007 incidentally forecasts global LNG supplies to remain flat 2013-2015.

Doug

Stock Manipulation?

In this case, when a company buys back stock "on an unprecedented scale," knowing full well that shortages are in the offing, while at the same time predicting prices will fall, I can conclude only that this is stock manipulation. Buy low. Do what you can to keep the stock prices down while you buy them up. We...and the company...know where those prices are really going.

Additionally, the lack of investment will put further increase future prices, creating severe shortages. I hestitate to say whether this is additional stock manipulation or just stupidity. I suspect the former. Greed is greed, especially when you hold all the cards. It certainly does not take a genius to figure out how best to butter this toast.

I suspected the same, and tried to check the futures market to see what people 'really' thought.

Not only was I hampered by my lack of expertise, but the first thing I came across cautioned that the market did not seem to be properly liquid - in other words, it did not work!

Perhaps we are now going through the same process as when the banks periodically lost fortunes in the Third World - everyone knew the loans were dodgy, including the individuals who made them, but they could not stand out from the herd, as if they were wrong they were in big trouble, but if they just went along and lost a few million like the others they would be safe.

Perhaps no-one dares call shortages and high prices, as a lot of money was lost the last time prices crashed.

Well I gotta admit I hadn't thought of it in those terms before. I'm glad only non-geniuses know this.

The logic is undeniable. If you know for sure you are going to buy huge chunk of stock then the last thing you would do is talk up the share price.

I support battery research, but why are we investing in a solution that will only increase congestion and cost? It is time to invest in technology that is practical, cheap and solves congestion. The cost of replacing the fleet with PHEV or EVs is far more than personal maglev.

http://reddit.com/r/science/info/67m87/comments/

http://digg.com/business_finance/Energy_Prices_Inflation_and_Denial

Thanks for your support!

Figure 4.3C is just wishful thinking. What the hell are "additional supplies" that exceed Norway's output? Since it is not LNG then it must be locally piped. Are they expecting the UK to find new supplies in the North Sea? Why are Algeria, Norway and Russia all showing increased output in the next 22 years? Russian and Norwegian gas production will most likely peak in the next 10 years. North America is the closest analogue for Russia and it will have a serious decline problem by 2015.

It would be interesting to calculate the effect it will have on our already awful balance of trade figures.

Isn't it great to know that there are 9GW of wind power stuck in planning.

I did those calculations in this post here:

http://www.theoildrum.com/node/3130

I was pretty conservative and only inflated gas prices at 5% per annum. Time to sell ££££ and leave the country!

Oil is going to hit $12-$15 barrel according to Maxwell, one of the most respected energy analysts:

http://thefraserdomain.typepad.com/energy/2008/02/oil-shortages-s.html?c...

http://energytechstocks.com/wp/?p=819

http://energytechstocks.com.previewmysite.com/wp/?p=824

With oil and gas dear, that would also put pressure on coal prices.

Not quite Dave - that's $12 to $15 / gallon for gasoline with oil on $180 to $300 / barrel

Sorry about the typo!

Perhaps it would be good idea to have an article about this on this forum?

It seems very relevant to our concerns, and goes hand in hand with the article on the availability of natural gas.