Understanding the current energy crisis in South Africa

Posted by Doug Low on February 1, 2008 - 10:53am in The Oil Drum: Europe

This is a guest article by Simon Ratcliffe and Jeremy Wakeford. Simon is an energy and sustainability consultant and is the Chairperson of the Association for the Study of Peak Oil South Africa (ASPO South Africa). Jeremy is an economist specializing in energy and sustainable development and is Research Director of ASPO South Africa.

South Africa has been experiencing blackouts over the last three weeks or so, and is forecast to have electricty shortages until at least 2013, see S Africa eyes rationing to end power cuts (Financial Times, 24 Jan.) for a brief overview. Here Simon and Jeremy discuss the issues in more detail.

Let us venture into a political no-go zone and say that at some point in the not too distant future there is a bitter pill that we will need to swallow and we are getting just a foretaste with the current energy crisis. In a nutshell, our global growth based economic model is fundamentally unsustainable.

This is not a new idea, but one that dates back to the early 1970s. At that time there was much debate around energy and sustainability coupled with a search for alternatives. One seminal work published in 1972 was The Limits to Growth commissioned by The Club of Rome. It was a prophetic piece which was based on some early computer modeling which linked population growth, energy consumption, natural resource usage, food production, industrial output and life expectancy. The authors, an eminent group of highly respected scientists, from the Systems Analysis Lab at Massachusetts Institute of Technology, developed a number of future scenarios based on optimistic as well as pessimistic assumptions. The work was a warning to governments and decision makers to start changing course because the earth’s resources could not sustain indefinitely the patterns of growth that are a consequence of our current economic paradigm. The report has been dismissed by mainstream economists because some of its predictions did not occur in the timeframe they were predicted and because of its Malthusian undertone which modern agriculture had “disproved”. However, it is the underlying logic of the report that ought to give us much to contemplate in a sober and rational manner.

Understanding the consequences of a growth-based model holds the key to our understanding of the current energy crisis. How did we go from a situation of having a huge surplus of electricity to the current situation where the entire country faces regular blackouts and some of our key economic sectors are threatened with an unpredictable and rocky road ahead? Mines have been forced to shut down as their electricity supplies cannot be guaranteed, while energy-hungry aluminum smelters continue to operate so that we can have our beer dispensed in cans. Worldwide, aluminum smelters consume 2% of the world’s electricity.

There are many factors that contribute to the current crisis. We are familiar with the fact that Eskom, the state-owned electricity utility, has been warning of a power crunch for some 10 years now, of the fact that government wouldn’t invest in new power plants, of denial by ministers and other government officials, of hemorrhaging of skills from Eskom, of rain-soaked coal, of allegations of bad planning and incompetence. But while all of these factors may contribute to the problem, they don’t give us a picture of the systemic issues. They are all indicators of how complex the whole system is and consequently how difficult it is to predict how this will play itself out. Perhaps the scale of the electricity issue can best be explained by understanding exponential growth and its implications.

Exponential growth refers to a situation where there is compound growth. For example, our current economic strategy is aimed at achieving an average 6% growth rate over a long period of time. This has been determined by looking at the rate at which we need to be creating employment, by our increase in population, by levels of poverty and the need to alleviate it and a range of other factors. A constant 6% growth rate means that we will be doubling the size of our economy in roughly the next 11 years. Yes, at this rate of growth we will double our economy. What is it we will be doubling? We will double our GDP. This means we will double what we produce. In order to double what we produce we will need to double what goes into what we produce. This includes raw materials and crucially, energy. Yes. Roughly speaking, on this growth path, in the next 11 years we are going to need to double the amount of energy we are currently consuming. The doubling time of anything that is growing constantly can be determined mathematically. (Doubling time = 100 x ln(2) / Growth Rate). This means dividing 70 by that rate of growth. This basic calculation is used constantly with respect to calculating financial returns, but rarely to calculating the rate at which we are growing our need for electricity or the rate at which we are depleting resources. In fact, it can be applied to anything that involves constant growth; population, the rate at which a disease is spreading and so on.

Let’s go into this in a little more depth. Each doubling cycle (11 years, in our case, at 6% growth) is greater than the sum of all previous doubling cycles combined. Let us put this another way. In the next 11 years we will consume more than we have in our entire history. So in order to double the size of our economy, which we will do at 6% growth in 11 years, we will require more resources than we have required during our entire history, including electricity.

Every time we double, that is, when we go from 1 to 2, from 2 to 4, from 4 to 8, from 8 to 16 and so forth, the last doubling cycle is greater than the sum of all the previous cycles. Thus, 16 is greater than 8+4+2+1 which is equal to 15. This is an irrefutable mathematical calculation. This is how very large quantities can be generated in relatively short periods of time from relatively low rates of growth. This is not a fantasy.

This might come some way to explaining why it is that Eskom has been unable to keep up with electricity demand on our current growth path and why we keep experiencing power cuts on such a wide scale and why the scale of the cuts is likely to widen. It also gives us a clue to the scale of the issue we face. So let’s get this right. If Eskom is going to meet demand, it is going to have to generate more electricity than it has in our entire history during the course of the next 11 years in order to maintain our current growth path. What is it going to take to achieve this and is this a path we want to go down? Where will the resources come from? Where is the coal, the uranium, the skilled and unskilled labour going to come from? Who is going to be training the engineers and the artisans required? According to its 2007 Annual Report, Eskom’s timeframe for new capacity shows that it plans to double its capacity to 80 000 MW by 2024, in other words in 16 years time. This assumes an annual growth rate of 3.64%. To do this Eskom is going to have to burn nearly as much coal as we have burned in our entire history. This is a frightening thought, given that per capita, we are among the world’s worst polluters. Hopefully this is beginning to paint a picture of the challenges we face that are consequences of our growth path.

The current blackouts provide us with unique opportunities. Firstly, it is a huge wake-up call. We are being offered a glimpse of the limits of our current models and an opportunity to change course to a more sustainable path. We are seeing too, the consequences of these limits. Mines and factories are being forced to shut down during outages. The cost to the economy is huge. Costs to industry of the blackouts vary, with some estimates in the order of R1 billion (£70m) a day. Large numbers of people have their livelihoods threatened and confidence in the country’s economy as an investment destination is being questioned. The upside is that it provides Eskom and the government with the opportunity to take energy conservation and efficiency, as well as renewable energy sources, more seriously. We have for decades been very wasteful with our energy resources and this must change, for reasons of depletion as well as carbon emissions and climate change mitigation.

The era of very cheap electricity in South Africa is now over. Consumers will face price hikes of between 14 and 20% per annum for at least the next few years. This will encourage necessary conservation and efficiency measures, but will be especially hard on poorer consumers. Thus the government will come under pressure to increase its expenditure on social support programmes and grants. What has happened, has happened, and cannot be changed. We are here, now, in the present situation and faced with the choices of which route to follow going forward. The question we need to ask is, “Will our solutions make us more or less dependent on fossil fuels? Will they take us closer to sustainability or further from it? Are we seeking long-term solutions or short-term quick fixes? What price will we pay in the future if we make the wrong choices now?”

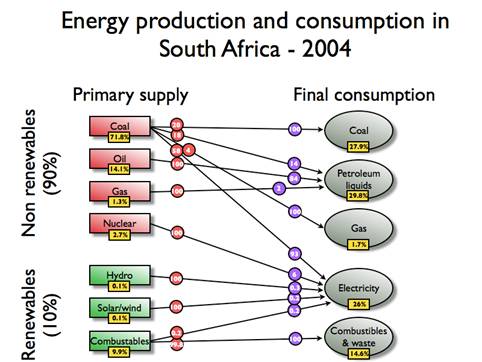

What does our current energy mix look like?

Click to enlarge

Eskom provides 95% of the country's electricity. Of this, some 90% is generated in coal-fired power stations, and another 6% is generated by two pressurised water reactors at the Koeberg nuclear power station near Cape Town. There is a small contribution from hydroelectricity and a negligible contribution from solar and wind power.

As we look out into the future from where we are now, do we aim to centralize our energy production or do we create the mechanisms for decentralizing it? Centralising the provision of our electrical power in the hands of one utility makes us very vulnerable to its weaknesses. This is a classic case of poor national risk management. Hopefully we can see what the consequences of this are. Centralising the production of electricity means that solutions will inevitably have long timelines. Many people have started to make their own arrangements anyway and are buying generators, and their own solar water heaters and so forth. The problem is that there are no national guidelines, no goal to which we are aiming, no incentives or dis-incentives and so we could be creating other problems. Installing an emergency generator which uses either diesel or petrol only creates further dependence on another equally vulnerable fossil fuel and is likely to exacerbate our increasingly fragile liquid fuels situation. Decentralising the production of power reduces dependency and enables many people to find solutions to their own energy needs. Do we build more power stations fired by “dirty” finite resources (coal), or do we begin to use the clean solar or wind energy supply that we have in abundance and channel our investment and research resources into harnessing it? Coal fired power stations have high capital costs, long planning and construction timelines and ongoing running costs as its feedstock is continuously required. Coal is a finite resource and could according to the German based research unit, the Energy Watch Group, reach its global production peak by 2025. As we approach that point and go beyond it, coal will begin its production decline and its price will rise dramatically. Is this a resource we want to become further reliant on, even though we do have large reserves in South Africa? Solar and wind power stations also have high capital costs but once complete, their energy feedstock is free. Eskom is planning the construction of a 100MW solar power station in order to reduce our “dependency” on fossil fuels. This represents 0.3% of our current usage.

It is time, too, that we settle the score with the bean counters that tell us that the unit cost of solar and wind powered electricity is higher than the unit cost of electricity derived from coal fired power. Doing a financial analysis of pure costs in this respect is insufficient for making crucial long-term strategic decisions. The financial analysis needs a comparative analysis of the full life-cycle costs, the environmental costs and crucially a vulnerability risk analysis. This would provide us with a more complete picture and allow better decision making. It will provide us with a holistic picture of which path to take as we take this journey from the current crisis we find ourselves in.

Finally, putting growth and sustainability into a global context, let’s look at China and India both of which are growing at a rate of about 10% per year. So, their economies are doubling every 7 years (70/10). Some might argue that this is growth off a low base, but each of these countries has a population of over a billion people, so absolutely their consumption is enormous, even if per capita it is less than ours right now. Both of them will in the next 7 years consume more than they have during their entire histories. Is it any wonder that most of the world’s steel, coal, cement and other critical resources are on ships heading east? China is currently experiencing both electricity and fuel shortages as it begins to experience the limits of its growth. As long as it keeps on its current growth path its energy problems will continue and so will the rest of the world’s. Exponential growth is assured to bring with it exponential resource depletion, the effects of which will look a lot like we are experiencing now. Continued exponential growth will ensure that the experience is long lasting. It will last until we understand that long-term sustainability and growth are mutually exclusive.

The posted article provides a very interesting explanation about the prospects in SA.

However, I think the following words are not correct:

Here you mix the numbers of an increase with the base value the increase represents. If you look on a graph with time on the horizontal scale and the input into the economy on the vertical scale, the consumption is the integral under the curve.

Let us make an example: for 10 years I require 100 ton of coal each year. Thus, I used 1000 tons in these 10 years. Now, for the sake to make this easy, let us assume a 41% increase in the next two years (leading to a doubling in the second year): in the first year I need 141 tons of coal and in the second about 199 tons. Therefore, in the doubling time (two years), I need 240 tons of coal which is not more than I used in all my history up to the time the growth started.

What the authors are talking about is steady growth - the exponential function - 1,2,4,8,16,32,64,128,256,512,1024,2048,4096 etc

Take any of those numbers and sum up all of those to the left of it. The sum will be one less that the number you have chosen:

1 + 2 = 3 (one less than 4)

1 + 2 + 4 = 7 (one less than 8)

1 + 2 + 4 + 8 = 15 (on less than 16)

and so on.

http://www.globalpublicmedia.com/lectures/461

All of these discussions about growth and its resource implications contain a crucial assumption: that the resource intensity of a unit of GDP remains constant. This assumption would be true if growth meant simply more of everything in the same proportions as we have today, and production using the same methods, and inputs. If instead we think of growth, as the improvement of the collective human welfare of the people (this has nothing to do with socialism), then growth is likely to mean that the mix of economic outputs varies with time and level of wealth. For instance a poor family will consume mostly housing, and food goods. If their income doubles, will they buy twice as large a house, and eat twice as much? Or are they more likely to start consuming other things. If an incremental increase of wealth can be spent on less resource intensive goods -say rich people spend disproportionately on DVDs, instead of buying lots of cars, then the link between GDP (and especially GDP per capita) and resource consumption can become less direct. The fact that ESKOM plans a lower rate of electricity production than expected GDP growth rates, imply they think the energy intensity of the economy will be lower in the future (although that doesn't mean that they have chosen the correct demand growth rate).

This should provide us with a different perspective on the meaning of economic growth. I think it is a much easier sale to make, to push growth into less resource intensive directions (say more healthcare and fine arts) instead of towards resource intensive directions. Also if the lifetime of resource intensive products is increased, then the same amount of resource input can provide greater human value.

Robert Frank, in his book Richistan, points out that the super wealthy, those worth between $100 million to $1 billion, spent an average of $182,000 on wrist watches; $311,000 on automobiles; $397,000 on jewelry; and $169,000 on spa services last year alone.

That's a big if....

(p.s. one has to wonder on the 'spa services' figure.....)

Hi Nate,

I am reading "Energy & Resource Quality" by Hall & Cleveland, 1986. One of the main points they make is that GNP and Fuel are directly linked. Fuel use and fuel quality (plus smaller factors) can predict GNP to 97% over the enormous range of 1890 to 1980. That leaves 3% for efficiency at best. They seem to explain it by showing that trying to replace fuel use you use more capital and that capital has high embodied energy and outweighs the fuel use.

Do you know if they have done similar studies since the mid 1980's that might show that fuel and GNP have decoupled in any way? Or even show that it has remained just as tightly coupled. I have to admit, I found the news a bit depressing. ...

Forbes keeps featuring economists who say that fuel and GNP have decoupled to a greater degree in recent years in the U.S. But when you really look at the figures, it looks to me like the economic decoupling was based on increased debt, and is not sustainable. I expect we are reverting to the Hall & Cleveland model you cite.

They cite some efficiency improvements:

1. The switch from coal to oil gives a BTU to GNP boost (not good news for a future switch from oil back to coal).

2. The switch from coal or oil to electricity gives a BTU to GNP boost (great news for wind, nuke, solar PV).

But the main differences are explained away by looking at embodied energy in goods, which economists don't care to track, and household uses of energy, which don't impact GNP as much as industrial/commercial energy use.

So it is part hopeful (the future is electric!) and part not (GNP will decline with lower energy). But it would be very nice to have updated papers. I wish there was a 2007 version of the book!

"The switch from coal or oil to electricity gives a BTU to GNP boost"

This defies logic and is not true for coal. In switching from a primary fuel source, such as coal or oil, to a converted form of energy always results in energy losses. For example using electricty for boiler heat requires twice as much base energy (turning coal's btu's into electricity is only 35% efficient considering steam cycle losses, line losses and transformation losses) as compared with burning the coal for that same process heat. Home heating with electric heat pump using ground source would be about same efficiency as burning coal if heat pump has COP of at least 3.

Always? Surely it depends on the end use. Consider a train hauled by a coal fired steam locomotive, a diesel locomotive and an electric locomotive.

If the power station has a higher eficiency than an internal combustion engine or an open coal fire...

Most important.

Electricity is a carrier.

Like Hydrogen.

""The switch from coal or oil to electricity gives a BTU to GNP boost"

To which mbnewtrain replied,

"This defies logic and is not true for coal. In switching from a primary fuel source, such as coal or oil, to a converted form of energy always results in energy losses."

Correct. The primary fuel switch was the one to attribute the gain in BTU to GNP boost, i.e., natural gas.

RC

More recent work by Ayres (1,2) suggests the link is 70% with exergy, which is the amount of useful work derived from the input energy source (meaning 10btu of coal can provide 0-10btu of exergy, depending on how efficiently you use it). It's similar to "fuel quality", in some sense.

He also notes that the exergy-based analysis explains much more of GDP growth than energy-based analyses, so it's likely that the "smaller factors" you mention were pretty significant.

You can see it for yourself in the EIA's data on energy intensity of the economy. The amount of energy required to produce a dollar of GDP fell only 20% from 1949 to 1980, but has fallen by about 45% since then -- nearly triple the previous rate.

You think that might have something to do with the offshoring of US industry?

That's certainly a factor, but far from the only one. Indeed, the tales of US manufacturing's demise are greatly exaggerated.

See also here or here. US manufacturing is still 20% of the world's manufacturing, commensurate to the US economy's 20% share of the world economy.

Of course, it's worth noting that the world's energy intensity (btu/$ of GDP, inflation-adjusted) has fallen 7-15% in the last 10 years (same EIA data, 15% based on PPP, 7% based on market exchange rates), so it's not like the energy consumption has simply been pushed elsewhere.

Thanks! Good links. I had meant to read that paper by Ayres. He does not quote Hall, Cleveland, Odum, or Constanza in any of his references. It seems he discovered the relationship independently. He found the link between quality and GNp but does not have the two other correction factors that they discovered: product mix and household use. I need to read the longer paper. Thanks again!

It's an interesting paper, but obviously it's only one look at the situation. I imagine that both his "exergy" approach and the earlier "quality, product mix, and use" are attempts to quantify the fact that a fixed amount of energy can be used in very different ways to produce very different amounts of things. It's a key thing to examine, but I'm not sure how best to do so.

At any rate, you're more than welcome - finding, exchanging, and disseminating information is, IMHO, the most important (and bestest) function of the internet.

Indeed! Spa services can run quite a spectrum! I think the quoted figure may be too low.

Seriously though, where in hell do these figures come from? I suspect a deep reach into somebody's behind. When I go in to buy my Rolex the salesman doesn't ask my income and I assure you all that if I had that kind of income I wouldn't be wasting my time filling out surveys. And I'd instruct my personal administrative assistants not to do it for me.

I wish we would all ask the simple question, "From what I know of the world, how would these numbers be generated?" There's a lot of BS out there.

There are 57 communists in Congress.

I call it the "Heinz effect."

well Robert Frank is a respected economist (I know, oxymoron..;), that has written about luxury and the rising GINI coefficient and happiness, not linked to money etc for decades - if it was some random journalist I might agree with you, but he, if anyone could get this data. Your greater point of accuracy is valid, but the even greater point that when people have billions, its like water - they don't 'reduce' their expenditures, in energy or dollar terms, on average. I will have a post on Monday on this precise topic which Ive been working on for weeks so will be happy to have it finished so I can move on to the next....! (will have spa services in between tho)

Er - your data supports his hypothesis.

Luxury items consume very few resources per dollar of cost - a $5,000 wristwatch has no more metal than a $50 one - making them in very large part services. And services are the least resource-intensive goods of all - a $500 massage and mani/pedi from Jenni consumes little more than time. Compare that to the resources required to build a $400 lawnmower and its $100 of gas.

Indeed, the broad trajectory of almost every rich country's economy supports his hypothesis - they've all shifted heavily into services, with the large majority of economic activity representing these low-resource activities. That's likely to be one big reason why the energy consumption per dollar of GDP has been falling for years in the rich nations.

would you hypothesize then that if everyone was worth 100 million that energy use would go down?

also there is the ripple effect of all that money down the line. $200,000 on spa services has a hell of an energy multiplier...

I never meant to imply, that higher wealth means decreasing energy use. I meant to imply that higher wealth probably implies a lower ratio of energy use to wealth (or income). I also meant that a strategy we should be using to change things, is not to try to end economic growth, but rather to steer it towards less resource intensive things. I think the relevant examples are not so much the super-rich, but people not too far from the median in their societies, and how does their energy (or insert favorite other resource) use scale as their income increases. If we can steer them away from say hummers, speedboats, racing-cars, etc. and towards less energy consuming lifestyles, it could start to make a big difference. That is the sort of directional change we need to start making. Trying to sell zero growth will be nearly impossible, but growth with change of lifestyle emphasis might be doable.

www.siam.org/news/news.php?id=377

"Trying to sell zero growth will be nearly impossible, but growth with change of lifestyle emphasis might be doable."

By the time the sale's completed, the product sold

will be obsolete.

The idea of "collapse as economizing" is the model

to be "sold."

SA is instrumental in this. How many times have you seen SA

in the MSM lately?

Zero.

Or Kenya. Or Pakistan. All with the same problem.

Load Shedding.

Is there a price that gold/platinum/diamonds rise to that

will make their mines more economically competitive to

coal mines?

Resources per dollar and total resources are different measures.

Yes, obviously; however, if the original product's cost is 50% for production of raw materials and 50% for social costs (labour, advertising, etc.), then there's a great deal more money being spent directly on highly resource-intensive activities (production of raw materials) than if it's a 5/95 split.

I think you may be getting carried away with the large numbers involved. Consider spending $200,000 on "spa services" - massages, saunas, mudpacks, trainers, etc. Certainly some of that money will be spent on resources (to heat the rooms and saunas, to drive the trainers and masseuses to work, to build the spas in the first place), but only a little - maybe 5%.

Now consider spending that $200,000 on 10 new cars and a year's gas for each. Enormous amounts of that money go directly to pay for production of new resources (steel, aluminum, plastic, rubber, oil, etc.), although some will be social costs (like wages). Is it not obvious that the cars would be a much more resource-intensive purchase than the spa services?

If it's not obvious, well, it's still apparently true nonetheless - the EIA cites expanding service sector as one of the reasons for decreasing energy intensiveness in modern economies.

Problem is you're not looking at the bigger picture.

The $5000 watch supports a large but different industry. It may support precious metals and stone extraction. High cost marketing and media relations. The $5 watch might support an equally large industry but hundreds of low paid labor with no marketing.

It would be interesting to see which item on a dollar basis would consume more energy.

I'd bet the $5000 watch and associated inputs. Say you need Tiger Woods, Brad Pitt or some other high profile individual to place your product these guys are not energy frugal.

I think you are right Pitt. It is necessary to compartmentalise stages of economic growth. Once all the roads and houses and offices and airports are built and most folks own a car and a flat screen and population growth wanes and recycling takes hold then the amount of energy required per unit time to replace and maintain these items must be substantially lower than during the initial construction and stuff accumulation phase.

Folks then may be satisfied with service based consumption - of which tourism is one that does consume / waste energy.

Problem is that we have billions in the developing world that have just got their foot on rung one of the consumption ladder and who have high hopes of climbing higher.

$500 - wow!

The idea of achieving a state of economic maturity in which we strive to provide ourselves with a constant material standard of living with the most efficient possible use of resources is a good one. Personally, however, I do not see much sign that we are converging toward such maturity. In the U.S., at least, the tendency is toward bigger houses, bigger higher performing automobiles, a larger variety and sophistication of electronic toys, more automobile miles, jet plane miles etc. Furthermore, there is the minor problem that if a true state of economic maintenance were achieved the stock market would go belly up.

Also, as you point out there are many billions of people living in relative poverty today, and if we are unwilling to give up any wealth, then no reason exists why they should desire a standard of living less than what we have, thus guaranteeing continued pressure on the earth's resources for many decades to come.

Trusting that private finance capitalism is going to evolve toward some natural endpoint of stable self-sufficiency strikes me a highly questionable strategy. I make no categorical statements about what standard of living can be achieved in a post fossil fuel economy, but if we hope to create a sustainable economic system which can support the entire population of the earth in reasonable comfort, then we must create economic institutions that can tolerate constant or even contracting output if necessary, rather than ones which create suffering and misery the minute growth start to slow down.

There would be a race between reaching the relative end of stuff accumulation and the increasingly throw-away quality of the stuff we are accumulating. Another case of receding horizons?

Pitt,

The service industry itself may be low energy consuming, as is retail. The problem is that it relies on extensive use of a transport infrastructure to support it, which is energy intensive. Most people I know will drive to the gym,shops etc plus lorries to deliver goods. In the uk we now have several "out of town" shopping complexes that people drive miles to visit. Meadowhall, near Sheffield is one example where 1000's of cars travel every day to visit and nothing material is gained, just money changing hands.

You will probably ask me for data to prove the vehicle numbers, I don't have any, just observation and extrapolating on my own activities. If you pull me up, I may motivate and search for some data!

The service economy relies on people having disposable income. The cost of fuel is straight off the bottom line of spare cash.

In terms of lower energy consumption per GDP, this is another area that the books can be cooked. The four tyres I have just bought for my car are made in China. Does the "embedded" energy go onto China's books rather than the uk's? The same applies to all imported manufactured goods purchased by rich countries.

Ha! My wife would consider that amount 'just about right'.

(grumble)

The hope for indefinitely continued growth through ‘dematerialization’ of economic output is referred to by economist Herman Daly as the fallacy of the angelized GDP. In this vision of an endless economic bonanza, the material component of economic output becomes vanishingly small, and we are able to go on exponentially increasing our life satisfaction forever, without increasing our consumption of energy or other resources.

Of course I realize that you probably did not mean that the material component of economic output could become vanishingly small or that exponential expansion of GDP could go on forever; You meant small enough and long enough that you and I won’t have to worry about the end of growth. Let the future worry about the end of growth. Even though ‘human nature’ makes it impossible for you and I to take any practical steps to end the emphasis on endless growth, people in the future will somehow miraculously figure out how to do so.

The idea of stabilizing our consumption of energy and other resources and, instead, focusing pyschological satisfactions (i.e. intellectual and aesthetic pursuits) is actually a good one. However, I have yet to see anyone present a convincing argument that such a goal can be pursued with the context private finance capitalism.

My favorite response to the suggestion that growth can go on forever if appropriately "dematerialized" is "So, how many movies can *you* watch in a week?"

It's a good response.

If you watch a football game on the tube, you are not driving to the stadium...

Yes. But can television watching by itself without the constant introduction of new technology (plasma screens, HDTV, digitial video records, etc) and without the huge flow of adverstising dollars encouraging people to buy the latest, hottest toys, really be the basis of a growth economy?

I will give you another thought on this problem. You have to factor in corruption, bad central planning economy and white flight to any analysis of southern Africa. South Africa will be in the same shape as present Zimbabwe 10 15 years from now.

I completely agree. Will it even take that long?

Unfortunately, you are absolutely correct.

Over Christmas, a married couple we know who were born in and had lived until recently in South Africa, returned to visit their parents. They were at the house of one set of parents when a home-invasion took place. They were lucky to only get a severe "bashing". They lost all their valuables and documents. Now, they are back in the UK and trying to work out how to get their respective parents out of South Africa.

It is worth recalling that in 1900, more than half the population was white. Today, it is only 9%. The population then was 5 million, now it is 48 million. It is really several societies barely coexisting in the same geographical area.

nice clear writing , especially for us marginally mathematical. i think extrapolating to our global problems is right on.

pain is a natural part of life ; but we are headed towards creating a multiple of such.

A summation is that the World is on a path of exponential, unsustainable growth. The talk in the 70's (although I was just a young teen) was a conscious look ahead based on huge growth at the time. That if population was left unchecked it would baloon out of control consuming all finite resources available. If energy usage increased to meet that burgeoning population the growth would be unsustainable. That period of conscious considerations was rejected by those in power as the product of wild imaginations from an out of touch, rebellious generation.

Fact is, humankind must always remain conscious, self reflective of the end result of our actions. Global warming is the result of a failure to consider what would happen from unrestricted carbon outputs. A 6.5 billion population is the result of unrestricted size of family. And depletion of energy is the result of an unsustainable economic engine that must always be expanding to avoid recession.

We have built an infrasture of enterprise that is gobbling up energy while spewing carbon on a scale that even a specie that rejected conscious introspection must now face and solve, or suffer the consequences.

So where are all those people that said we could always grow and expand? Maybe they should step forward and explain why there is no such thing as global warming, or explain to us again how the Earth manufactures oil, that it is not a finite resource like most of us realize. Come on, let's hear how we are wrong again and how you are correct.

If pressed, Peter Huber will admit that discrete sources of energy will peak and decline, but he asserts that our aggregate energy consumption will always increase.

This is analogous to saying that individual oil wells will eventually peak and decline, but the field--the sum of the discrete wells--will never peak and decline.

Of course, Huber by and large still represents the "conventional wisdom" worldwide.

His book:

The Bottomless Well: The Twilight of Fuel, the Virtue of Waste, and Why We Will Never Run Out of Energy by Peter W. Huber and Mark P. Mills

This is analogous to saying that individual oil wells will eventually peak and decline, but the field--the sum of the discrete wells--will never peak and decline.

That's a silly straw man. It's more analogous to saying that the peak and decline of oil wells will have little effect on the growth of non-oil sources of energy like nuclear and solar. There is no good reason for either nuclear or solar to decline for thousands of years. Consider this figure, drawn by M. K. Hubbert in his 1956 paper Nuclear Energy and the Fossil Fuels(pdf):

Hubbert would later reject nuclear power. Now why would he do that do you think? Why has the world shuttered all the breeder reactors?

As for solar, your right, but we don't have any. Not yet. How fast can we get the cost down. That is the question. The answer did not come out in Stuart's last post. It would make a good topic.

I took a look at how solar/wind would need to grow to continue BAU out to 2050. Such growth needs to be stupendous.

http://www.geocities.com/rethin

"For example, even with the conservative growth scenario 2.0, we'll demand wind/solar to grow nearly three times as high and in one half the time as oil historically has."

You got it with your comment right enough. I just have trouble believing that growth rate is possible. Nice looking charts.

I have starting thinking of the "Energy Gap" that will end up forming between the decline of fossil fuels and the growth of alternatives. And what people can do to bridge that gap. How do we keep our technical infrastructure intact long enough to grow the alternatives.

Have you considered doing a chart where wind and solar grow as fast as oil and see what that looks like?

You can just dl GG's spreadsheet and plot it yourself. Its a great tool for playing with future scenarios.

Don't inconvenience JD with facts. He's doing what he has done for years, throw a volatile comment out exactly as a troll then running away from any response that counters him. Then he returns and throws some other volatile comment out, repeating this juvenile behavior over and over and over. I've watched him do this for years. To expect him to show any responsibility at all is about like expecting the US government to react to peak oil before it hits - it will not occur. JD's function in his current pseudonym is precisely to be a peak oil troll.

The old adage "Do not feed the trolls" applies to JD more than almost any other person I have ever seen.

Pitt, on the other hand, is worthy of dialog if you are in the mood. He doesn't usually run from a discussion although he can be excessively pedantic. And he's even rarely backed away from some of his positions when given alternative information. I find his pedantic approach annoying at times but others do not. Thus I view Pitt as someone genuinely interested in the discussion.

The difference is thus obvious - JD is a classic troll. Pitt is simply a counter voice on many issues. The peak oil debate needs more Pitts (and Alans and Jeffreys and Euans and Stuarts, etc. etc.). The peak oil debate doesn't need JD. He should "retire" again, silly pest that he is.

Reader Guidelines:

"4. Treat members of the community with civility and respect. If you see disrespectful behavior, report it to the staff rather than further inflaming the situation.

5. Ad hominem attacks are not acceptable. If you disagree with someone, refute their statements rather than insulting them."

Whether or not you dislike JD's behaviour, the response required by the user guidelines of this website is to (a) refrain from insulting him and provide information that counters any claims you think are wrong, or (b) report his behaviour as disruptive.

JD posted a relevant figure from a relevant paper to rebut a point made by a prior poster, without being insulting in any way, so (b) isn't an option. If you have trouble with (a) - in particular, refraining from insulting people - perhaps you should find a website whose reader guidelines are more to your liking.

***

In this particular case, JD is quite right in pointing out that westexas's analogy is flawed, since we know of several energy sources (solar, wind, arguably nuclear) whose production curves are fundamentally different than those of fossil fuels.

In particular, wind and solar appear as if they could be taken to high levels of production and held there for long periods of time, since the "fuel" providing their energy - sunlight - will be available at a near-constant rate for millenia to come.

Just a note: you've rarely seen me change my view on positions, and that's exactly as it should be: I check the facts before I post, and surprisingly often I find that the data does not support my first thoughts on the issue.

I then change my views before posting, in light of the available information.

In my opinion, that's how it should work for everyone - check the facts, change your views based on the evidence, and do all that offline so you don't have to be educated about the basic facts of the matter (and don't have to dig in your heels to protect your wounded ego).

It's a win-win situation - fact-checking before posting makes you look smarter and saves everyone else's time. Highly recommend it. If you're not changing your mind sometimes while doing it, though, you're doing it wrong.

Currently the world uses--from fossil fuel + nuclear sources--the energy equivalent of one Gb of oil (one billion barrels) every five days, or we burn through the energy equivalent of the Prudhoe Bay Field, the largest oil field in North America, about every 60 days.

Huber's position is that our total energy consumption will increase--forever--from a base of a billion barrels of oil equivalent every five days.

Regarding the increase of wealth, a decrease of energy use per unit GDP and a shift to services.

Haven't the wealthier nations merely exported a lot of more energy wasting, energy intensive manufacturing to developing nations and so don't have to count it?

For example, I bet there isn't any brand of TV or DVD player built in the US, so we don't have to count the energy used to make them

that doesn't mean we don't use the energy

this is similar to argument that wealthier don't pollute as much because they have move polluting industries overseas

Right. You have to count embodied energy in the products consumed. If steel is milled and formed in one country and assembled into products in another, the second country does not use less energy. The energy just arrives in the form of steel parts.

In "Energy and Resource Quality" by Hall & Cleveland, 1986, they state that 27% of the variation between countries can be explained away by product mix. Correcting for fuel quality, product mix, and personal energy consumption explains away 85% of the differences between countries in fuel/GDP ratio.

You also have to include production "reverberation" delay - something which I think is often grossly underestimated.

If your steel parts were bought 1 month ago from a supplier who bought them 2 months before, from a manufacturer who shipped them 1 month before, who had them sitting about 1 month from stamping, from a steel bar he received 1 month before, which took 2 weeks to arrive from the stockholder order, who had it 2 months, from the rolling mill who made it 2 months prior to the stockholder order, from a steel billet cast 1 month prior, from scrap steel in the yard which was an average 1 month old.

All the capital equipment in the steel mill averaged 3 years old, with spares say an average 1 year old. Now put the steel mill spares [steel parts] back another 12 months as in the above scenario [because that is the time the energy was used to make them]...

Consider that specialised parts will probably sit on a shelf longer, and critical spares may be sitting there for years until required.

Now remember things were 10% cheaper 3 years ago..

Right. Time was not as critical when energy supply was changing slowly. As it changes quickly, those values will not match.

I think all the stored up and embodied energy will actually help cushion us a bit on the down slope. We did the hard work of extracting all those minerals while energy was cheap. After it gets expensive, the decline will be a bit softer because it is easy to recycle those SUVs into bicycles....

True, it may soften the slope, and it may cause embedded energy and therefore EROEI to be underestimated.

Charcoal furnaces were used to cast Bessemer ladles, which cast Arc melting furnaces etc.

There is no prediction of Limits to Growth(LTG) that has been falsified by the passage of time. No prediction in LTG can possibly be falsified by the passage of time before 2072.

The canard that LTG made predictions that have failed to come true was a lie repeated so often and so loudly that even many of those who believe its conclusions have come to believe it.

Oil consumption per capita peaked in 1979. We are now about 28 years post peak per capita consumption of oil. During this time overall economic growth, except in certain disastrous areas of Africa, has been generally good. Some formerly poor areas like Russia, China and India have made great strides. It is not clear to me that growth can not continue if consumption is reduced in one area and increased in another area. For example if the USA is forced to reduce consumption by the current recession and the oil is sent to China where due to cheap labor it is more productive, it seems to me that physical growth could continue for some time. That appears to be what has happened in the last 28 years of declining per capita consumption.

Practical: Strong global economic growth can definitely coexist with a declining standard of living at the median. In fact, this is what is happening currently.

Of course:

6.5*10=65

5*12=60

Population*output=GDP

GDP is up 8%

Output/person is down 16%

Less output, lower living standard.

The extra output goes to the OECD, the rest of the world is screwed.

Just a thought.

That's not true.

the Bottom 80+% of Americans have been in a Silent Depression since

1974-when weekly wages bought the most gasoline.

Increasing when Reagan raised paycheck taxes.

Accelerating Summer 2007, when housing defaults/foreclosures

increased.

Then Official Depression hit XMAS Day. The day of Maximum Credit

Card debt and minimal ability to pay it off.

"China where due to cheap labor..." China has maxed out it's cheap labor.

Go here:

http://www.investmenttools.com/futures/bdi_baltic_dry_index_bdi_crb.htm

This is the Baltic Exchange Dry Index (BDI)& CRB Index overlayed.

The BDI tracks large raw commodity shipping cargoes.

To places like China. The boom is over.

Correct LTG postulated that growth based industrial society had a life span of a hundred years or thereabouts.

Limits to growth revisited published in 2003 confirmed the 1970's work,

Are humans smarter than yeast? Hehe

Clearly exponential growth of any kind has a finite time span. In the most developed parts of the world, growth rates are perhaps 2% per year, so the total effect over a human lifespan isn't that great -if substantial dematerialization of the economy can be made to occur, we can probably continue with something not too different from the current model for 50-100 years. Of course economic growth is mostly a function of productivity, and that is primarly a function of improving technology. Clearly there are limts to such processes. Most technologies plotted on a time versus performance curve show an S curve, innovation rises, but eventually slows down and flattens out. Clearly that sort of curve is the best case for the longterm history of the economy. The only way I can see exponential growth continuing for any log period of time, is if productivity/economic output is created by self autonomous nonhuman systems (robots), and the population being served is in exponential decline.

The problem with regards to say carbon emmisions in the USA for example, is not that the economy isn't improving its output to energy consumption ratio. But it is that this improvement has been slower than GDP growth. Reversing that trend might be doable by a combination of rapid technological improvement, coupled with a societal change of attitudes. I doubt either process by itself would be sufficient.

I have been trying weekly to keep the South African story in the TOD consciousness and thenit got more MSM attention in USA/Europe and Leanan started plugging it on the drum beats. Our company in Germany has a small subsidiary factory in South africa and they have backup diesel generators but the energy problems are a bit of a problem. One article I cited a weekor so ago mentioned a whole package of proposal like investment, rationing, cooking fuel subisies, solar water heaters manufacturing subsidies of 20-30%. I think the panic and then "blueprint" reaction is going ot be typical everywhere. Regarding Limits to Growth concept, having read the last several weeks alot of Stuart's stuff I sort of got into the crazy mmindset and wrote up a small presentation myself:

Ok,

So I am global emperor by divine right(perhaps Jesus returned or the Mahdi or an alien from a spaceship so everyone sees in me what he wishes and has total respect so the world obeys my orders and wishes unquestioningly) and decide I have to do something as I am bored.

What are my priorities:

1)Stop/reverse environmental destruction/global warming

a)Stop all carbon/methane release

i.Eliminate automobiles

ii.Eliminate coal power plants

iii.World population becomes vegan and uses minimal insect proteins

iv.Renewable energy built up in appropriate places and distributed from net on intermittent basis without FF/nuclear base load support with appropriate day / night pricing to stagger usage and additional local/individual production of household solar/wind to reduce strain on net.

v.Everyone gets a bike and walks.

vi.Universal electric transport systems in/between cities.

vii.Restructure of living/working arrangements - Transport Oriented Design to avoid transport of people goods where avoidable.

viii.Insulation, passive solar, triple thick windows, etc.

ix.Everyone gardens vegetables/fruit trees personally or in community garden and / or helps out in planting/harvesting in local farms seasonally as needed. Quotas fopercent of regional diet from local farming/gardening depending on climate and soil in area (100 mile diet idea).

x.Industrialized agriculture maintained where and when appropriate (for limited direct human grain consumption perhaps) with use of renewables /ethanol to power farm machinery instead of mass horse/oxen power.

xi.Abandon unsustainable areas immediately– Phoenix, etc. sorry Totoneila.

xii.Total human waste recycling back to land from cities to avoid long term degradation, artificial fertilizers overuse which then destroy rivers, etc. by runoff.

b)Stop all soil erosion, deforestation, overuse of water tables, overfishing, mining without cleanup of tailings.

c)Rebuild eroded soils, reforest, huge special fish and wildlife habitats created

d)Remove carbon from atmosphere by various technical and agricultural, reforesting, techniques back to pre-industrial levels but not enough to trigger a new ice age(we must manage this permanently by studying milankovitsch cycles vs. CO2 and methane levels-thanks Beachboy)

2)Relative equality for all (not communist) with incentives for creativity – stated goal Zero Growth/Circular Economy to avoid repeat of current exponential growth problem

a)Eliminate interest charges on loans and bank savings account interest.

b)Eliminate private personage of corporations- individual risk for investor remains unavoidable.

c)Eliminate fiat currencies – replace this with gold or other similar foolproof standard.

d)Central banks stated goal becomes Zero Growth/Zero inflation steady state economy.

e)Eliminate fractional reserve banking.

3)Sustainability of system

a)Birth quotas/rights determined according to current global or regional sustainability at current time- some years no births allowed even globally- other years more - rights determined by lottery or similar as to who gets to have kids at that point- This reduces population until sustainability is achieved.

b)Prebirth high priority care for mothers – every birth counts – no preemies with high costs due to overworked under cared malnourished, overworked, stressed out mothers- no crack babies, minimal under 5 death rates. Goal – avoid standard birth pyramid with high death rates.

c)Elimination of artificial life sustaining methods and medications for very old. Nature should have its own way. Avoid living beyond genetic limits, tinkering with nature and having a reverse population pyramid with extreme aged decrepit population.

d)Priority on prevention of illness through mandatory sport, nutrition – elimination of sick making foods sold by advertising. – twinkies, etc. Alternative is fresh, organic, nonindustrial, nonprcessed, homecooked or raw foods with maximum biological value to avoid massive medical expenses and to optimize life satisfaction (good ood is a major source of culture and social and personal satisfaction) thereby reducing general population physical and psychological disorders leading to aberrant behaviour and eventually to war or similar mass psychoses.

e)Food surpluses globally stored – all food will be my property as king- all food will be rationed according to scientifically determined nutritional need of each individual. Death penalty for blackmarketeers/profiteering.

f)Education and economic/work economy based on study of circular stability of economy/Gaia and human part in it to minimize disturbance to total system. No mass manufactured products allowed in production which do not have a total neutral lifecycle system analysis in terms of environmental and health impact, i.e. product has no waste, is energy neutral, has no bad health impact to human or environment (cigarettes, autos, twinkies not allowed). Individual homemade articles exempted (moonshine/downhome rolled tobacco/coca leaves??).

Long term survival on earth is an option for humanity as long as we wish it. The trend for many thousands of years has been less individual rights towards more conformism generally due to population density and systematizing of culture. Whereas in the middle ages one could wander around and play the mad holy man sitting on a trash heap, this was later deemed unacceptable and nowadays the slightest odd behaviour calls for medication and internment. With a much higher population and much lower level of total general resources (topsoil, minerals, forests, water tables, fisheries, wildlife) and energy per person the controls on the individual must be increased to the point where very little freedom is allowed, if the group is to survive. Wild West USA or stone age warrior man vs. highly complicated Japanese culture where subtle nuances in language, body language show happiness or displeasure.

The situation is becoming akin to a space ship on a long journey where any false move can disturb/destroy the whole system. Essentially it is unlikely that a stable system can emerge without a very large change in culture. Either humans stabilize per capita resource use and learn to reverse the damage already done, i.e gardening the planet on a permanent basis sustainably or population must be reduced permanently to far below theoretical carrying capacity. So if 2 billion humans were carrying capacity in a steady state post peak FFs world occupied by EDO Japanese vegans alone then a purely ego based USA/Australian/stone age warriors type population post peak steady state global population might be several hundred million or less due to lack of self control and cooperation.

Not to get off the South Africa topic with a crazy presentation I have nowehre else to throw in, but the problem is Growth everywhere like you guys say and if Stuart and others don't recognize that we got turn the system around and that starts at our bankingsystem and "below the belt", controlling population and controlling debt or money growth. It is all a paradigm thing. If we rationed away births for 10 years and let people die natural deaths we could cut out a billion or more population per decade. If we cut the footprint of each person by 90% (at least in the norht of the globe) then that would hep enormously too. Thenwe have to make this a permanent way of life.

I think you understand the source of the problem. Population times per capita consumption will eventually hit some limit, as predicted in The Limits to Growth. Energy may be that limit, but in some areas, the limit might be something else, such as lack of water or inability to produce enough food because there isn't enough fertilizer, pesticides or herbicides available.

Trouble is, as always, who is the "we" that will run the show? Both China and India have tried serious initiatives to reduce population growth, with some success. The methods used weren't what would work in the Western world, especially the individualistic U.S. The philosopher kings amongst us know how to tackle these problems, don't "we"? So, is it possible for "us" to gain control, especially as society is likely not to change until TSHTF? The inertia of society toward BAU is massive and there are still folks actively trying to live with 2000 year old myths (the Christians) or fighting over 1200 year old schisms (the Muslims). I've become more of a "doomer" as I continually see little concern of these problems after 35 years of awareness. Hell, I moved out to the boonies to build my solar heated survival space starting 10 years ago. I may not have moved far enough away to avoid being crushed from the side effects of the collapse. Scary stuff, indeed.

E. Swanson

Just reading some news about South Africa it seemed pretty obvious what the problem was. they didn't build any new plants, they added customers and they wanted to keep electricity rates low. pretty obvious what was going to happen and it has nothing to do with peak oil or anything.

it's not complex. don't give the government an monopoly on electricity generation. they are incredibly inept.

I bet they had a no blackout strategy too.

how do you know this, even roughly?

Roughly, if it takes X BTU to refine a ton of steel, and you need twice as many tons then twice the energy.

There is a very strong (over 90%) correlation between fuel and a countries GNP.

If you want a detailed answer, I recommend cracking a text book or two. Your nearby university should have a copy of "Energy & Resource Quality" by Charles A.S. Hall and Cutler J. Cleveland.

Or you can pick up a copy of "Limits to Growth: The 30 year update". Read it cover to cover. Don't just take your friends impression of what they heard 10th hand it says. Actually read the book. They do a very good job of laying out the worlds limitations, economic sector by economic sector. Lots of graphs and charts and computer models. After you understand what they did, then you can choose if you still disagree.

Just so you know, that's in large part an American mindset.

In many or most other western nations, there's not this blind faith that government cannot be competent. Indeed, it's seen as being quite appropriate for some tasks, and objective assessments demonstrate that it does indeed do some things quite well (such as healthcare, at least as compared to the US).

So it's not entirely an obvious question how much governmental control over electricity generation is optimal.

France is in a very strong position in the event of an energy crisis - perhaps stronger than almost anywhere else.

Their nuclear energy industry is very much a creature of state, and in fact owes it's existence to the same factors as many of us feel will come into play in the near future - a shortage of oil and gas, and little indigenous supply of either.

Given a high priority, a lot can be done fairly quickly.

"Just so you know, that's in large part an American mindset."

Its also the UK's minset. We will find out wheather dispanding the CEGB was a good idea or not fairly soon. The UK government gets very upset that Europe won't open its energy markets as the UK has.

1964 (or there abouts) was the year of maximum electricity infrastructure construction in the UK, 1973 was the last coal project DRAX. Nuclear dribbled on a decade after that. Then came the dash for gas.

The dash for gas was known by many in the industry as short sighted policy at the time. The chickens are now comming home to roost. The market is profit driven and does not care about social welfare (emotions don't rule the heads of business men). IMO the UK's assets where sold of to raise government revenue which gave Margaret Thatcher's goverment a windfall together with the North Sea; we now have neither.

We will soon see how the private sector responds to nuclear tenders. Its a huge gamble putting the life support system of a nation in the hands of the market. May I'm wrong, I surely hope so.

south africa goes for the techno-fix.

South Africa may increase solar power

http://www.upi.com/International_Security/Energy/Briefing/2008/01/24/sou...

peak tech what?

"A new material -- copper-indium-gallium-diselenide -- offers a drastically reduced manufacturing cost," the university said.

Checked out the reserves numbers on indium and gallium lately? It won't scale. The future is solar, but not yet.

I hadn't, but the USGS was happy to oblige:

Indium:

"The world reserve base for indium is estimated to be about 5,700 t, which is far in excess of probable consumption over the next several decades; the United States has about 11 percent of this base. The sustainable production and consumption of indium appears to be no impediment in future years."

Gallium:

"in 2006, world primary production was estimated to be about 69 metric tons, the same as that in 2005....World primary gallium production capacity in 2006 was estimated to be 160 metric tons; refinery capacity, 152 tons; and recycling capacity, 73 tons.

Most gallium is produced as a byproduct of treating bauxite, and the remainder is produced from zinc-processing residues....World resources of gallium in bauxite are estimated to exceed 1 billion kilograms, and a considerable quantity could be present in world zinc reserves. The foregoing estimates apply to total gallium content; only a small percentage of this metal in bauxite and zinc ores is economically recoverable."

So indium is "no impediment", and gallium reserves are centuries of current production levels (1Bkg = 1Mton, 1Mton / 70ton/yr = 14,000yr, meaning ~140 years per percentage that's economically recoverable).

So evidence suggests that reserve numbers on gallium and indium aren't a problem. It may have "felt true" that their reserves would be low, but that you believe something doesn't make it so.

Hi Pitt,

I don't think those numbers leave room for growth. Here is the New Scientist article discussing the resource limits that made me realize the difficulty NanoSolar would have in the future. We might need to regulate the use of Indium if we are going to free it up for solar cells.

http://www.science.org.au/nova/newscientist/027ns_005.htm

Interesting article - thanks - although I was a little disappointed to see they didn't include any numbers in their arguments.

Reller's conclusion may be that we're running out of indium, but what are the assumptions that underly his analysis? How is one to square that prediction of imminent lack with the USGS's analysis, which says essentially the opposite? In particular, from the USGS paper on indium:

"The reserve base could be extended, however, by the additional reserves that exist in copper, lead, and tin ores, although little is being extracted in 2001."

I wonder how does Reller's analysis approach that, or the general question of additional deposits becoming available as technology improves and/or prices rise. It's obviously a key consideration if you're going to be making statements about the for-all-time potential of gallium-indium solar panels, but - based on the errors in the Energy Watch Group's analyses of coal availability - I'm not at all convinced that he'll have taken into account the difference between "currently economic reserves" and "total accessible reserves".

Of course, all of that is kind of beside my original point, which was simply that the reserves data alone doesn't tell us much about whether indium and gallium will be available over an extended period. More detailed analyses - such as Reller's - are necessary to say anything about that with confidence, but those analyses need to be carefully done, as there's a history of highly biased estimates (both low and high).

John;

Try breathing through a straw while sitting quietly. That's solar and renewable electricity.

Then, try to 'Run to keep up with crumbling infrastructure' while breathing through a straw.

Solar is great, but tiny so far. I'm all for it, but that doesn't mean we can shrug our shoulders and go 'Problem, what problem?'

It's all about Flow rates.

Bob

this really is a fundamental topic, and a conversation in reality which our society needs to wake up to fast. Just to comment on another aspect of this. As much as there are many fools and those in denial out there in the world of politics and economics, there are i believe also a great many of influence who know the unsustainability of infinite growth within a finite world (and perhaps even a finite universe). But perhaps exponential growth was never the goal, but mearly a mechanism to accumulate a huge resource base in as short a time as possible and simply cheat future generations out of energy. Perhaps the illusion within an illusion is the sustainability of exponential growth. It is obviously a flawed model, so perhaps it is a system design to fail. The common misconception i think is that people view a system failure as a universally bad thing, but fail to appreciate that humans often think not of the universal success of a system for the greater good, but the potential for the individual gain.

So perhaps capitalism was designed to fail, and those who understand this, and who play a hand in its success, it's growth, it's propaganda , and it's collapse, are those who will also benefit because they know the course it will take and when it will break.

If growth is the increase in expendable income then surely it is an increase in wealth, i.e. money. If money = energy or a promise of energy in the future in some form of resource or service then since resources and services have a finite level of existence in either raw form or availability then there are indeed limits to growth. It is also true that renewable technologies that harvest renewable energies will not sustain a exponential growth model, as they are also of finite availability - again our world is finite so this model will never work. That said however, there is a great room for growth in models for expanding our social, cultural and ecological wealth. Perhaps we should all be taxed an exponential amount of our income towards replanting forests, at least this growth will have more benefitial outcomes until it reaches it's limits to growth than the cutting of forests...

This assumes some sort of "Intelligent Design" with a malevolent pay day at its end, no?

I very much doubt that capitalism was "designed", let alone by "intelligent" beings. I haven't observed evidence of such beings on this planet. Have you?

No one is going to "benefit" from collapse of civilization. No man is an island. When those around us go down, we go down too. The circle of life is actually a downward spiral and we are all tied to each other by six degrees of connectivity. (Achoo, achoo, we all fall down. Ring around the Rosie, pocket full of posies ... repeat)

It absolutely makes me crazy when people say that the Limits to Growth report made predictions that didn't come true:

THEY DIDN'T MAKE PREDICTIONS!!!!

READ THE DAMN DOCUMENT BEFORE YOU CRITICIZE IT.

The most powerful force in the universe is compound interest

--Albert Einstein

Interesting that you brought up China because I was doing some calculating yesterday. I get clobbered sometimes for not making calculations explicit so I'll try to do so now.

China likely produced more that 800 MW of solar panels in 2007 and has has at least a 250% annual growth rate in in production in the last two years. China's electricity consumption grows at about 11% annually.

So, the 2004 average power consumption was about 220 GW which should come out to about 300 GW in 2007. In 2013, they should be at about 530 GW of which 59 GW will be new consumption in that year. If the growth in their solar industry settles to 200% annual growth, They'll produce about 580 GW of solar panels in that year and at a 20% capacity factor can meet about twice their new demand. If they then stop building factories, they'll be able to cover half their total consumption with solar in the next few years after that. Will their solar growth slow below 200% before 2013? It seems unlikely since demand continues high so that factories pay for their construction in less than a year.

It seems to me that the mining sector in South Africa would do well to assure its electricity supply by looking to China to provide solar panels.

Here in the US, it was sad to see Governor Schwarzenegger together with Senator McCain at a solar factory when it was McCain's absence for the Senate vote on RPS that torpedoed the measure. The US is falling further and further behind in a technolgy it originally developed.

Chris

mdsolar: I too hope for a rapid solar rollout. I think growth rates of 200% are unsustainable however. In order to sustain growth of production, capital must be raised, people must be trained, factories built, supply chains etc. The rapid short term growth rate is more likely just the effect of a few venture capitalists discovering that China can be the low cost manufacturing center for PV.

A recent study by Sandia Labs put energy payback time for polysilicon solar cells at 2.8 years. If I take this figure as correct, and invest ALL energy output (and no more) in producing more PV, it will take 2.8years to increase production and installed base by a factor of e (roughly 2.71), the doubling time would be just under 2 years (40% per year). Remarkably this is not much diferent from longer term growth rates of PV. This is probably a coincidence, there is no reason why PV should grow at an energy neutral rate in the early phase. But once penetration of the technology becomes substantial, it becomes an upper limit for the rollout rate. That doesn't mean we won't find better PV technologies, with faster ERoEI, which might enable a faster rollout based upon generated energy. The difficulties of building up production capability, including trained personell are real however. Few enterprises can grow at rates of 100 to 200percent. Most of your employees would have been present for only a few months, it takes time to educate the new employees, who must educate the next batch etc. So the rollout is likely to have much lower growth rates. My best guess is to take the earlier mentioned 40%/year rate as a reasonable sustainable growth rate. The bottom line, the rollout will take several times longer than your estimate.

In the case of China, I'm not so sure you are correct. They are expected to be the top producer this year, it is true, and that means that their growth will soon dominate the growth curve. But, it is not just one company that is responsible for the growth, but rather a growth in the number of companies as well. If the question is can they supply the energy to meet new demand in 2013 using solar then I think this is not a big issues since some of the energy will be imported as polysilicon. And, most of what they produce now is for export so that the money is available for increasing capacity. The real question is when will they start to meet domestic needs in a big way, and I would guess that this will happen once factories have paid for themselves a few times over. At that point, a volume domestic market will look profitable at lower prices. I suspect that a lower growth rate may occur elsewhere though the US may get by with thin film growth for a while owing to the stucture of the US domestic commercial market, but when silicon drops by a factor of two or so more in price we'll see China's investment move rapidly into the larger residential rooftop market. This should happen in about 2010, so contiued growth to 2013 seems pretty likely. The currently known boost in polysilicon production out to 2010 looks like it can sustain 90% growth worldwide so China should be able to do 200% growth in at least some of the years 2008, 09 and 10. I think that there are some startups as well in polysilicon which may not have been counted in yet.

That does not mean that they'll be in a position to meet world new generation demand at that point, but it is interesting that they can meet their own so quickly. I suspect that having a good share of IC production makes it possible to find skilled workers fairly easily.

Chris

That's 2.8 years for panels of polysilicon. Concentrated solar photovoltaic has EROEI measured in weeks. You can use polysilicon there, too, but for financial reasons we use multicrystal or crystal silicon.

Chris, I am a strong supporter of solar power, and feel that it is going to pay a very major part in our energy future in areeas where the main need is for cooling and solar incidence tracks well with use.

So big a part, in fact, that on it's own it will falsify the more extreme predictions of collapse around here.

If you cater for a large part of world demand, and most people live in hot parts of the world, then you don't just affect the supply there, as resources are not being taken which can be used in parts of the world with cooler climates where the main need is for heating, not cooling, and such need is very seasonal.

In my view though it is completely invalid to take just one metric such as solar panel production and expand it to the extent you have here without reference to the overall environment.

You give no consideration here, for instance, to the need for storage or peak power supplement in the winter months in cooler areas.

http://energy-futures.blogspot.com/2008/02/solar-energy-for-uk-and-north...

Stuart in his recent work also in my view wrongly extrapolated too far, for reasons I will give later in this post, but he did at least recognise that there was a major issue of either storage or transmission.

In his attempts to solve it he in my view demonstrated conclusively that the solution he preferred was not possible, as in spite of hugely favourable assumptions he came out with costs which were a factor of twenty more expensive than alternatives!

Surely he should have recognised an absurdity.

Both yourself and he seem to think that because you have had a fast historical expansion rate, that can safely be projected into the future.

The only certainty is that it will slow down, the question is when.

Alarm bells should ring when you come out to massive figures which take over everything in next to no time - you should then check your assumptions.

Not only have you not taken account of the issue of winter variation, or allowed anything for overnight storage, which is not in your costings or ramp up figures and would on it's own slow growth, as at present little or no storage occurs, and that can't continue at very high penetration rates, but also the costings for price reduction will surely slow.

Cost of solar energy broadly comes in several elements, which consist of production of the cells, their mounting into panels, cost of ancillary equipment, installation and maintenance.

Overwhelmingly what has been dropping is the price of production of cells, so it is completely invalid to use the overall rate as a surrogate for the curve in future price decreases.

As overall costs get lower, the stickier elements in the price play a larger part, and one gets the familiar bell-shaped curve, instead of receding indefinitely upward.

Overall costs now are probably low enough that we are not far off that point now, I would estimate.

A lot of demand to date has also been caused by huge subsidies, especially in Germany. Subsidy levels cannot continue ever upwards, and that alone would probably dent the curve of production.

That is not to say that further cost reductions will not occur, and your point is well-made in that respect, for instance there was recent work enabling the use of much lower grade silicon, which is far, far cheaper:

http://www.news.com/8301-10784_3-9803094-7.html

It does seem however that the rate of price reduction will slow for the reasons given above.

Stuart's analysis, although not yours, also in my view greatly understated the present cost for solar power, quoting Nanosolar at $1 watt.

This claim is in no way substantiated, and what they have actually made is three solar panels, cost unknown, by means unknown, and likely so as to hit funding target points.