A Tuppence Extra?

Posted by Chris Vernon on October 2, 2007 - 8:00pm in The Oil Drum: Europe

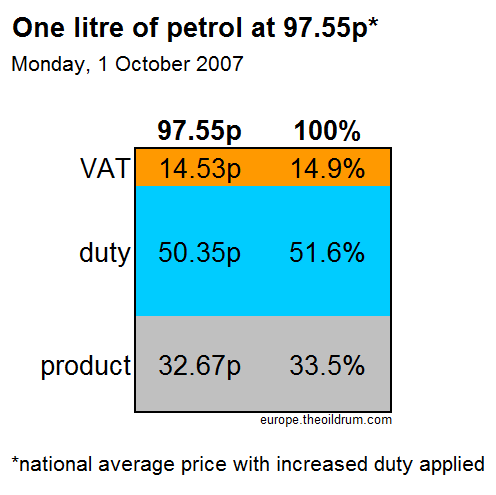

On Monday the 1st October 2007 the UK government increased the duty on a litre of petrol and diesel by two pence taking the duty to 50.35 pence per litre (ppl). This is the first of three increases announced in the last budget. Duty will be increased by a further 2 ppl on 1st April 2008 and 1.84 ppl on 1st April 2009 (Duty Rates .pdf).

On Monday the 1st October 2007 the UK government increased the duty on a litre of petrol and diesel by two pence taking the duty to 50.35 pence per litre (ppl). This is the first of three increases announced in the last budget. Duty will be increased by a further 2 ppl on 1st April 2008 and 1.84 ppl on 1st April 2009 (Duty Rates .pdf).

The increase has been almost unanimously criticised by the UK motorist, not just because it’s a tax but because it takes UK fuel prices perilously close to the psychological barrier of £1 per litre. On the www.petrolprices.com site a survey receiving 80,000 votes in just a few days indicated 90% in favour of the following statement:

Should the government do a U turn and scrap the extra 2.35p tax on fuel because of unexpectedly high oil prices already hitting motorists hard?Despite everyone talking about petrol prices it seems that many people don’t understand how that price comes about and certainly have no awareness of the approaching decline in global oil production.

- Price of the product

- Excise duty

- Value Added Tax (VAT) - a percentage

The price per litre at the pump is simply:

- Price of the product + Excise duty + VAT

In September 2007 the UK national average price stood at 95.2 pence for unleaded 95 octane petrol (AA fuel price reports). With an exchange rate of $2.04 to a pound that is equal to $7.39 per US gallon. Working backwards we can see how the UK price is arrived at:

First the VAT at 17.5%, which on 95.2p is 14.2p.

Second the duty, which until 1st Oct 2007 stood at 48.35 ppl.

Subtracting the two forms of taxation from the sticker price leaves a product price of 32.67 ppl or 34% of the sticker price. The taxation therefore accounts for 62.53 pence or 66%.

Increased Duty

With the recent 2p (2.35p with the additional VAT) increase taking the duty to 50.35 ppl and assuming the product price remains the same the breakdown will look like this:

Response to Product Price Change

If the product were to increase in price by 30% (approximately $100 oil) from 32.67 ppl to 42.47 ppl what would happen?The sticker price would become 42.47 + 50.35 + 17.5% = 109.06p. An increase of only 11.8% and the rate of tax would fall from 66.5% to 61.1%, albeit increasing by 1.71p per litre.

A feature of a high fixed taxation, the excise duty, is this damping effect of product price variations on the sticker price. In countries with little or no element of fixed duty such variation in the product price would have a much greater effect at the pump.

The petrolprices.com Survey

It’s fair to say the vast majority don’t like this duty increase, despite it only keeping up with inflation. I on the other hand welcome it and the subsequent increases already announced (yes I do drive a car, albeit a relatively efficient diesel).It is clear that the UK will have to use less oil in the future. In 1999 the UK was the 9th largest oil producer in the world. A third of the country’s North Sea oil production was exported delivering billions to treasury coffers each year. Since that peak year, production rates have fallen dramatically. So far in fact, that in 2006 the country was a net importer of oil for the first time since 1980. The treasury receipts have been replaced with a growing trade deficit, a trend only expected to continue and to be exacerbated by any increases in the price of oil.

Increasing reliance on imported oil against a backdrop of tightening global supplies and in competition with the rapidly expanding economies and healthy trade surpluses of India and China presents the UK with a problem. Maintaining the current oil consumption of 1.7 million barrels per day into the future will become increasingly expensive and ultimately no longer viable.

High and increasing levels of duty on fuel are certainly not the whole answer, but they provide a degree of price control, damping future volatility and providing a strong price signal in advance of that delivered by the actual price of oil. This advanced price signal has two advantages, it reduces consumption from what it would otherwise have been by encouraging more efficient vehicles and reduced vehicle-miles travelled and also delivers revenue to our government in the form of tax receipts rather than wealth transfer to oil exporting nations.

It can be argued fuel duty is regressive, affecting the poor to a greater extent. However this can be mitigated whilst maintaining the benefits, through a tax credit.

So why is the majority opinion against the increase? Because, in my opinion, they are thinking only about the direct and immediate impact on their wallet and are simply unaware of the structural changes oil depletion will force upon the country in coming years.

What does The Oil Drum think? Should the fuel duty in the UK, already with some of the most heavily taxed fuel in the world, increase further?

It's a no-brainer. The gov is doing this to send a clear signal: they aren't going to lessen the taxes just because the oil is high, so don't expect a free ride. It sends a message to the people to drive less, to increase mileage, to conserve.

So... it's not that it is bad. It seems though too thin an increase. It is as if the government is poking with the public to see if people will riot or not. For me, as long as the country doesn't enter poverty, anything to increase the petrol's price is welcomed.

I can't say I agree.

While the article echoes what I've said several times in the past about extreme taxation damping the effect of resource price rises, there is another aspect.

As the price of oil rises, certain countries where tax is low (such as the US) will be significantly adversely affected causing demand destruction. This is the flip side of the lack of action to reduce demand over the years. However as the oil price rises it increases the need for the UK government to reduce tax to maintain a working and viable economy that is not in recession. That in turn is needed to take the 'clear and present danger' presented by the demonstration of peak oil and turn it into significant action by the whole economy. Without these cuts in tax the economy grinds to a halt and none of this action takes place, ever.

The government has to have a policy plan for progressively reducing tax on oil to zero over a period of years, coupled with a plan for mass conversion to low oil intensive system-structures.

Now, on the brink of a global recession, is not the time to be adding a straw to the camel's back.

Reducing tax as the oil price rises removes ALL price incentive from the private sector to invest in low consumption technology at the same time as reducing government tax take, and available income for investing in alternative energy infrastructure. Net result, when the tax take falls to zero, the public gets a huge price rise shock that they are even less prepared for, and the government has invested NOTHING towards offsetting it.

What can easily be done by individuals has been done at the current UK tax level. Further action will only be taken in the face of clear immediate threat. The reduction in tax as the price of oil rises swiftly is only to mitigate the immediate effect of those rises - individuals still realise that a) one day it runs out b) others in other parts of the world are really suffering. Thus it acts as an enabler for action with the drive coming from elsewhere.

In essence high tax levels give you two bites of the cherry, they reduce demand early and they sustain investment capability longer - provided you use them right.

I can't say that I agree with you. Higher prices equals more motivation to mitigate and change lifestyles. If the government starts to send the signals that everything will be just OK, cause the gov is backing you up with lowering taxes, it may work out very well for the first years, but then you will end up pretty unprepared for what is to come.

Exactly, where's the thing not to like? We must ALL move out from FFs. The nations that do this first will be more prepared to face the uncoming crisis than the ones which don't.

So it's a matter of sight. If your sight is about 5 years long, tax increase is wrong. If your sight is about 20 years long, tax increase is the right move. It's like chess. What they did was to sacrifice a pawn. Seems stupid, but only to the ones who don't know how to play chess, as in the next 20 moves, it will strike as a brilliant move.

Well it would be, if the sacrifice was harder. Even so, it sends a clear message: you people are on your own, so start mitigating. Start conserving. Stop SUVing. etc. I'm all for it.

Planning horizons for most political, business and individual psyches are about 3 years, with attention falling off markedly after that.

Thus the evidence as seen in others (the US in particular) failing because of ever rising prices will have much more effect than the threat of it in future in some arbitrary future.

The model I've outlined is in effect a smoothing function on the transition between a supply-rich and a supply-constrained world. Less shock, more attenuation of the change to match the rate at which people can adapt. Trying to make the system bend and not break.

The worst thing is if the tax is not reduced at the right time and right amount. Keeping the tax high as oil price rises push it even higher will cripple business and prevent investment in alternatives. As companies go out of business individuals won't be able to afford to invest - and basically the system breaks.

When I on occasion feel obliged to defend the similarly high norwegian fuel duty, I use this argument. It's not easy to understand for everyone, or maybe they just don't want to understand any arguments in favor of the tax.

I recently found an old receipt from a purchase of motor fuel carried out around the turn of the century. The price for that particular fillup was 9.09 NOK/ltr. Nowadays the price varies between 10.50 and 12.50 NOK/ltr. If it wasn't for the fact that it's mentioned in the news every time the oil price set's a new record I doubt the norwegian motorist would be any more aware of it than he is of the fact that norwegian oil production has been in decline for 6 years or so. (Seriously, I have yet to talk to a single person that knows this)

I usually compare the price of fuel to the price of a bus ticket. In my oppinion the price of fuel alone should be atleast twice the price of a bus ticket. A bus ticket is on average around 1 NOK/km I guesstimate. The average car I assume to use around 0.07 liters/km. 1*2/0.07=28.57 NOK/ltr. In other words, the price of petrol is still less than half of the target price.

GBP/NOK 11,08

USD/NOK 5,43

EUR/NOK 7,69

Yes, of course the tax should be raised further. We should increase the tax on petrol more than diesel so that petrol is the more expensive as it is in nearly every other country to aid a switch to more efficient diesel vehicles and increase the amount of vehicle fuel we can get out of a barrel of oil.

You cannot buy a right hand drive diesel Smart Car with its 88 miles per UK gallon fuel consumption for use in the UK. I suspect part of the reason is the lighter tax on petrol removes part of the incentive to own one.

Not that I would not advocate the same policy in the US, I really would, but have any of you looked at the message boards on GassBuddy.com?

I'd be scared of these people if the taxes went up.

Over the past year and a half, there has practically been a tax revolt when our state reset it's tax ($/gallon). It's reset every 6-months on the basis of average wholesale gasoline prices coming into the state.

What apparently does not occur for these people is that, yes, oil production is decreasing and prices of nearly all oil-derived products are increasing. But imagine their surprise when they found out that road maintenance can't be performed because thsoe products that require petroleum based products for maintenance have increased in cost.

Obviously a disconnect somewhere. Apparently they've bought the line of "trickle-down" (more like "trickled upon") tax theory that says the more you reduce taxes, the more tax revenue you receive.

The logical conclusion of this theory, therefore, must be infinite tax revenue is received once the tax rate is zero.

They don't have to "buy a line of 'trickle down'" to oppose the tax increase - excuse me, "reset". All they have to do is to figure - rightly or wrongly, and whatever that means - that your state is already getting more than enough of their money in general and they see no reason why it should get even more. This is not necessarily connected with highway maintenance, as they may feel that your state is getting so much of their money that it ought to find some elsewhere in its budget.

Except the common complaint is the conditions of the roads.

As I said...a disconnect.

As an aside, the fall of 2003, a local candidate and I had this rather interesting 'discussion' (it was civil, just a very strong difference in opinion). Her position was: the problem that would have to be grappled with is having enough cars for (low-income) people who wanted them (so they could "go to their jobs" which she also hoped to encourage by being on the local council).

Here we are at local election time and four years later. Gasoline has gone up by 75% (meaning highway tax revenue has also increased). Can't say there have been many "new jobs" created but it sure is much more expense to drive to work than it was four years ago (for those that don't car pool or ride the bus, though the mass transit system has improved somewhat).

I think this is the wrong approach since it doesn't explain

1) why it has to worsen the natural wholesale price rise

2) why fuel saved in the UK won't be used in China and India

3) whether governments will squander the revenue.

A better approach would some form of disguised rationing or a measure which eases price rises if motorists back off. For example nonstationary emissions could be included in the European Trading Scheme along with some other serious bug fixes. Using the recent price as a baseline there will be an extra carbon component. If the cap stays the same and people take the bus then the fuel price rise could stabilise. If they keep driving V8 Range Rovers the fuel price goes up even more.

Other schemes are discussed in

http://www.cfit.gov.uk/docs/2007/climatechange/pdf/2007climatechange-ets...

The excise duty should be calculated and used to pay for:

(1) removing CO2 from the atmosphere

(2) repairing all other environmental damages

(3) cover all health costs

(4) maintaining roads, traffic lights etc.

(5) research and development of clean(er) fuels

(6) building up public transport for the post peak oil era

Anyone with numbers? What have I forgotten?

2) why fuel saved in the UK won't be used in China and India

That is a GW/resource issue. The immediate UK problem is that the country is getting poorer. It is important to reduce our imports by discouraging oil use in the UK.

Ingenious rationing sounds good if you have a good scheme.

We seriously need to hypertax vehicles that consume even slightly worse MPG than a chosen value ie vehicles that have more power and weight than they need to have. They threaten to do this through road tax every year but they dont have the balls to really make it hurt. This is not just for socialist conspiracy reasons. The reason is found in the engineering phrase 'impedance matching'. If you have car A and car B, where A is 2 x the size, power etc, unfortunately, it doesn't consume twice the fuel of B when used identically because the load does not double. Yes it carries twice the weight up hills - then it rolls down. And most of the time its rolling flat. A tax on fuel actually penalises the low power engine more AS A PERCENTAGE OF ITS AVAILABLE POWER.

To make consuption go down.

Well, I can't garantee that. It is up to the UK citizens to keep their government honest and minimaly efficient. But even if the governemnt does sqander the revenue, its main objective, that is reducing consuption is achieved.

Now, the best one:

That is China and India problem. Because of the taxes, UK will be less dependent on oil while prices rise and will spend less money importing it. If China and India choose to stay unprepared and send their money away buying something with decreasing supply, too bad for them.

Demons are good things to attack. Shoot them with silver bullets, drive stakes into their hearts, and if they are inanimate objects that people need, then tax them so that the people using them will clap their hands in joy, not realizing that it is they, not the object that is being taxed (plundered).

I say that if the Brits are too out of touch to realize that their government is using a human calamity as an excuse to take more of what working people produce, then they deserve the butt f**king that they are getting. Sell them some KY Jelly to ease their pain, and to make a little profit to boot.

I'd have to agree. Tax is tax and nothing more, nothing less. If the government wanted to send a message then it can simply tell everyone, if it wanted to ensure a reaction it can legislate.

Tax payers money never goes towards anything good and usually finds its way into the coffers of those with the Government's ear. People wanting more taxes is pure insanity, besides the point that it doesn't work and horribly distorts economic activity, it is plain stupid.

Besides, recession will work much better at reducing consumption and we shouldn't have to wait long for that to appear.

High duty which the country can withstand is a useful gov economic tool. If times get bad the gov can freeze the duty, or in desperation reduce it. It follows the same logic as hoarding goods because you know the price will increase. As noted by Chris, it reduces price changes due to the resource.

Eg hypothetically - if next year all world govs confess to peak oil and said '10 years it will be 10 times the price' I would expect the Gov to freeze the duty.

deleted ...

Really? So what are you driving your car on, pray tell?

Right on gregorach!

Have you ever been to a country without a functioning tax collection system? There is very little infrastructure. Corruption is rampant. Quality of life is low, there are many homeless people in the streets. Children who can barely walk are begging for change. Children are not educated unless they are in the solid middle class. Investment is minimal. It's horrible. And trust me the private sector/private giving does not step up to the plate.

We can improve our allocation of funds, but taxes do provide a large number of public goods.

Any solution to peak oil, global warming and poverty will depend on wide or universal access to contraception.

Good point CMDC, I've spent some time in Senegal and the lack of centrally funded infrastructure is really apparent. Just little things, road signs, waste collection, paved roads etc... there's a real sense of "if you want something you have to do it yourself".

Exactly. My usual response to hard-core tax-hating Libertarians is to point out that their government-free utopia already exists and they're quite welcome to go and live there. It's call Somalia.

The time for timing is here.

Just in time the walmart jockey says

Just in time on the dime spin the wheels

Just in time the peak is here

Spun the wheels on the new

Car yet?

The guy down the street for

1,635 USDollar gives his old car the boot

The impaled impala is FleXFuel

E-85

No where in town

No stations are missing out

On his money

He has to buy gas

No where in town the E-85 bird flies

The Lord of flies

Filed this report

The retort

I'll tell you

Is fast the down slope

Faster still

I sit on a window sill

Now the thrills are gone

I am retired you see

A tup-Pence is not my wage

I asked for Higher salary

I wanted a Penny a day

In God We trust Our money says

What does the Brits say

I don't know

But I'll ask you?

eeeeewwwee,, I smile BS here

Again someone is playing games

With my money

Your money two

Markets

The bottom Line

You in the bread line too

I will be today in a few

I serve the Homeless

My retirement plan you see

Help the helpless

The hopeless

The crazier than the me Id's

Ego's

Libidos

I promist,, the promise

Mist the dew

hand me a Mountian dew Dude

I on down hill slope duty today

Sky patrol

Where do you work

Who so ever do you trust

I know who's name is on

My penny

My 2 cent's worth,

1982 old coppers of course

Everything else is not worth

anything it is all HOT AIR

Charles Edward Owens Junior

Check me out, My mail's in the profile

WEb blog too

I am Not dead yet

I have not gone to bed yet

Pushing 40 hours up now

bye bye buy buy by by lines

Chris, I agree that higher tax on oil consumption is required and that lower tax / greater incentives for UK oil production are also required. When prudent Mr Brown chickened out of petrol tax increases in 2000, he added the tax on the off shore producers instead, thereby encouraging the consume more, produce less paradigm for the UK economy.

As you point out though, high fuel taxes have a massive de-gearing impact on the rising cost of the underlying product and price based conservation is therefore muffled throughout Europe. In reality, we actually need a much more progressive tax on fuel if folks are to be forced to consume less. This, however, would be inflatioary and discriminatory.

So personally I'd prefer to see legislation on car engine size, power, efficiency and speed limits as a first measure for reducing consumption - does anyone know what the savings here might be?

Off topic - we are in the UK facing an allied problem with fixed interest rate mortgages where recent interest rate rises have not been felt by millions who remortgaged at around 4% fixed in 2003/4. The interest rates for millions will rise to over 6.5% between now and Christmas. Those who are paying interest only will face an over 50% rise in their mortgage payments.

I've been talking to several different bank managers recently to be told that the banks are now carrying a significantly higher level of open bridging - those who have bought a new house and have yet to sell their old. Furthermore, since the banks are being squeezed now, arrangement fees for new mortgages are set to escalate - from a few hundred to well over a thousand pounds.

Sorry for the digression - below is a chart showing the impact of rising oil imports on UK trade balance:

UK Energy Security on TOD E, July 2007.

A good start would be if the government enforced the existing 70mph limit on motorways. At present, I estimate a half of all drivers drive at 80+mph when the roads are not congested. Reducing and enforcing the limit to 60mph would reduce consumption on these roads by 20% or more. Travel times would increase marginally, but congestion would be reduced, because

the speed differentials at junctions, etc., would be reduced. The 'tail backs'

would build more slowly. I'm not sure what the percentage of fuel consumption motorways represent, but it must be significant. Also, if more

drivers accepted that driving at 80mph would see their licence revoked and their car crushed, the fashion for unnecessarly powerful cars might fade...

Bravo! If the Government want to send a message and make real progress on our excessive use of energy this is exactly the kind of thing they should do.

I fined it absolutely incredible that bright, educated people, believe adding taxes or increasing them will achieve anything other than unintended consequences. Giving more money to idiots (who probably use it to increase energy consumption) and forcing the poor and the aged off the road will achieve nothing. I wish people would wake up to the fact that governments are a problem, not a solution.

The UK is in a dire situation and only a wholesale change in the way people live and work can come anyway near mitigating the problem. Government cannot make this enormous change, the system within which they operate does not allow it (and this applies to all colours of government). Only individuals can make the change and by doing so improve their own chances in a rapidly changing world. They will also have to go against the Governments wishes in order to do so, as such individualism will threaten the economy and the State.

I'm not suggesting increased duty anyway near mitigates the problem, just that increasing duty is better than reducing duty – which has been be policy of late by holding it frozen against inflation. Over the last decade the real cost of motoring has fallen which has unsurprisingly led to increased usage. That’s a trend that will reverse, ideally in a controlled fashion in advance of oil supply related shocks.

The problem is not the cost of motoring, it's the way the economy is structured. People have little choice regards the extent of their motoring because they quite simply have to work. To correct this people will have to work close to where they live and also be close to friends and relatives. Without such work and living arrangements people are forced to accept any cost to continue motoring. Governments simply cannot fix this, only individuals can.

To change the subject slightly, what happened yesterday with gas supplies and electricity production (3 oil fired plants having to come on line)? Plus the problem with irregular flows through the Langeled pipeline throughout the summer?

There is a lot of this idiocy around, common american "know-how" that somehow governments are bad, taxes are the worst, so laissez-faire should be done. Newsflash, that is AMERICAN IDEOLOGY, not exactly the "truth".

I'd ask you a question, what is the mileage of the USA? Compare it to the UK? Right. Thought so. Why is that? Because of TAXES.

And then these people contradict themselves. The economy's faults were created mostly by laissez faire politics. The suburban sprawl is greater in cities without central planning; cars are more abundant in cities who haven't mass transit politics, trains, buses, etc. Are you waiting for Rockefeller to build railtracks? Wait forever. Who is going to retrofit our cities, other than governments? Who has enough authority to bring down consumption in a large scale?

There is nothing wrong in governments, EXCEPT when they are poorly leadered. USA is only a perfect example.

To take out people from motorways is a great way to improve mass transit. Yes, the poor will be the most affected, but they would be always the most affected by peak oil anyway, so that's not even a choice we're making. And what's worse: to give money to native idiots or give money to tiranic foreigners, creating more war tension around the globe?

Governments are not the problem. People are. I wish you would wake up to that fact.

"The suburban sprawl is greater in cities without central planning"

Alas, what you really mean by such as this is that, by dint of some opaque process, you know better than anyone. That gives you the right, for example, to forcibly cram Americans, Soviet-style, into central-city chicken-coops few wish to live in. Or to cram them, Soviet-style, into overcrowded, germy, pokey, unreliable transit vehicles few wish to travel in.

Your intended victims may disagree with both your assertions and the sheer arrogance of the manner of their expression. Some may even disagree quite vehemently.

The decision is whether to cope with high gas prices when they become unavoidable, unpredictable, and sudden, or whether to cope with them now, gradually, voluntarily, with time to improve the situation (such as building more + better transit vehicles).

Well, it may also be that the UK has around sixty million bodies stuffed into an area about sixty percent the size of the state of California. You do the math. Nearly 30 million automobiles trawling a pretty small place. But then, you knew that.

Wherever you travel in the UK you're never further from the coast than sixty miles as the crow flies. The distance from Lands End to John O'Groats is just about 900 miles. So, maybe, just maybe, it has an awful lot to do with geography. Maybe taxes have something to do with fuel consumption and miles driven, but I can assure you in the South East where I live there’s no surfeit of motor cars. And people do use them. No matter how long it takes to get where they’re going. Not to mention the reduction in both rail and bus services. Both of which I can personally attest to.

Well, you must be very proud of the great achievements of Thatcher, Major, Blair, and, last but not least, Brown. A litany of true leaders. I’d want all of these, and maybe more, to be part of my lifeboat dream team, let me tell you.

Ah yes, the usual “fuck the poor, they don’t count” comment. How truly enlightened. I hope one day you experience the pleasure of being poor. A more deserving soul would be hard to find.

What joy to observe the antics of such a pure example of the prototypical fascist collaborator. I know it will come as a big surprise, but waiting for your government to save you from the evils of consumption and to bring about the benefits a city retrofit could confer… You might want to try this simple experiment. Put this reliance on your government in one hand, and then cup the other hand and piss into it. See which fills first. Even luisdias will not be troubled in determining the outcome., The “truth” so to speak.

While people may indeed be the problem, there’s no compelling evidence governments are any less a part of the problem. At least the ones I assume we’re considering here, such as the US, the EU twelve, Scandinavia, and Switzerland. That should about cover it. Not to mention transnational corporations, and various NGOs such as the UN, NATO, the World Bank, and the IMF.

Why is it the austerity programmes enforced by the World Bank and the IMF never seem to include the elite? We’ve already decided the poor are fucked so they don’t count. What about the beleaguered middle and working classes? Why are these the poor sods who get to take it in the shorts while the bastards that asked for the cash get to stuff it away like squirrels in numbered accounts in banks on Caribbean islands? Why is that? Oh yeah, I forgot, governments are always looking out for the well being of their citizens. Except the poor of course, after all they’re fucked.

Sadly, many of those governments have been complicit in all manner of shenanigans. But let’s not forget some of those other shinning examples of governments that have been so efficient and effective in compelling their “citizens” to behave in ways that are for their own good. I’m sure since luisdias is one of the brighter sparks to be found, wherever bright sparks are to be found, it won’t be necessary to enumerate them.

Put your faith in those guardians of your well being, by all means. Just don’t expect everyone else to share your unfettered enthusiasm.

Actually, reducing traffic volume on surface streets would be a far more effective strategy. Since most journeys are under five miles, our surface roads would benefit immensely from the reduction in the sheer weight of traffic. Busses would be able to run to schedule. With greater demand for busses, more busses could be scheduled. Cycling would be less like a suicide wish. Pedestrians would be able to cross the roads without fear of dying before reaching the pavement opposite. Reduced traffic would mean reduced noise pollution and reduced air pollution. That seems like a nice idea.

We could also use Monbiot’s proposal to turn the motorways into city link coach express ways. Interesting idea, I have to say. Since you’re so clearly so much greater in the intellect stakes than most of the rest of us, including the poor who don’t count anyways, I’ll leave it as an exercise for the luisdias to source the proposal.

The economy is structured that way in part because of the low cost of driving. In planning whether to build a tram system or a new highway belt, a township implicitly takes into account whether gas is 1₤/litre or 3₤/litre. In planning where you want to live and work, you take that fact into account. In deciding whether you want to live alone, or have roommates, you take that fact into account.

In the short term, petrol price elasticity is very, very low - adapting requires changing the way you life your life. In the long term, it is somewhat more measurable: commutes are cut, people refuse to live far from their work, they discover that driving to Paris on holiday is almost as nice as driving to Spain. In the longer term (town planning, investment, and development timeframes), it is enormous - it literally shapes the geography of the nation, as seen in US suburbia versus European towns.

The UK would be in far more dire situation right now if we had not had high fuel taxes for the last 15+ years. We would be driving far larger gas guzzlers, our balance of payments deficit would be far worse, and the poor would be in dire straits as they genuinely wouldn't be able to drive. Just look at the USA today.

As I look around, I find that even with these high taxes, the poor of the UK do not drive significantly more fuel efficient cars than the middle classes (The rich like to show off their profligacy). This is in part that the poor buy second hand cars, and in that market fuel efficiency adds to the price, but mostly it is because the cost of fuel is still too low to drive the market.

Also, it is overwhelmingly obvious from feedback websites that the lower income bracket see unlimited access to cheap fuel as a GOD GIVEN RIGHT. This short term attitude probably is part of the reason many of these people are in the lower income bracket to start with... but it also clearly shows that relying on UK individuals to show personal responsibility in this emergency is doomed to failure.

I contend that higher fuel taxes will help to wean this country off oil, even if the government spent the money burning North Sea oil straight out of the pipelines.

According to the latest DTI energy statistics, the 12-month moving average for petroleum production has been rising a little over the last three months. That's not to say the trend isn't downwards - it clearly is - but I'm not sure how fast that decline might be.

Are the DTIs figures reliable?

I completely agree with the trade balance crisis though. I imagine that once the credit crisis has worked it's way through the financial industry, we might be exporting less in this area, as well as importing expensive oil, and suffering lower house prices.

The UK pound might have made a slight resurgence as a reserve currency lately (because of the weakness of the dollar), but might it be the next one to suffer a dollar style collapse, especially if interest rates are heading lower?

Andy if you look at my forecast and the lower DTI forecast here you see that 2007 is a year N Sea oil production heads sideways owing to production from the giant Buzzard field coming on earlier this year. Next year and thereafter we do not have more of these giants to develop - so decline will take over once again.

See also here - look at the 10 year time series and you'll see production has moved sideways this year.

http://omrpublic.iea.org/supplysearch.asp

Thanks for that Euan. I don't follow the supply situation anything like as closely as some of you.

Any thoughts on the UK £ exchange rate(s) going forward, in the light of the deteriorating trade balance?

If you look at my post on UK energy security you'll see the trade balance going from dreadful to worse.

The markets seem to have managed to detatch themselves entirely from reality in a world of made up money and vacuum backed bonds.

One feels however, at some point a day of reckoning must occur. We used to produce and export real oil and gas and earned real money as a result. In future we will be importing ever greater quantities of oil, gas and coal and the question is for how long our creditors will accept our currency.

The wild card is creditors buying UK assets - property and companies - which provides a means for funds to flow back in. A kind of barter really - we'll swap you British Airways or Mayfair for a million tonnes of oil?

I think the £ must be very vulnerable - if I were Gordon and Alisdair I'd join the Euro as fast as I could - if they'll still have us.

Isn't it the buyers who are carrying the bridging loans? And if the market does turn down significantly, this will destroy most of them (as happened in 1989),

Peter.

Yes, buyers have bought but not yet sold so they own 2 houses - just what you want if the cost of borrowing increases and the market freezes up - and all the symptoms of it doing so are there for all to see. If the market turns down - its curtains for those who accidently find themselves in the possession of 2 homes and the inability to pay the loan on just one of these.

Just for completeness ...

a US gallon of petrol is now 3.79 x 0.9755 x 2.04 = $7.54

a US gallon of Diesel is now 3.79 x 0.9880 x 2.04 = $7.63

These are average prices - some people are paying much more!

UK North Sea production is declining at >8% year - so we don't just see 1% or 2% increase in oil imports like other countries steadily growing - it's closer to 10% of consumption just for the economy to stand still.

With world net exports declining, the UK is in a serious situation - but with an election due don't expect any more than a couple of pence of extra tax!

Xeroid.

thank you for reminding us of the conversion factors

So assuming the product/barrel price where correlated then $200 oil would result in a per litre price of about:

(200/80 * 32p) + 50.35p + 17.5% = £1.53 ($11.88 / gallon)

I think I can live with a 50% increase...

However, over in the US...

(if we assume $80 oil = $3 gas then $200 oil = $7.50

-or about the same as what we in the UK pay and have taken 20 odd years to get used to...)

Overall I think that government could do themselves a big favour by making it more transparent that the taxation goes on transport infrastructure and renewables perhaps.

Nick.

Food for thought.

1gal = 3.79L, 1 GPB = 2.024 USD therefore the price of 1 gal of petrol in the UK costs $7.74 the average US car has a gas tank rated at about 20 gal. 20 *7.74 = $154.00 for a fill up.

We here in the US are in for quite a shock when our pigeons start comming home to roost.

Note that commercial users reclaim the VAT, so they see a lower price, and for these users the 17.5% element of the price does not scale with increasing base cost.

The long time-scale for much of the adjustment to a significant change in the price of fuel is a key issue here - In the UK, (where I live), the price has been high for ages, and both commercial and consumer decisions are relatively well-adjusted to prices around the current price.

I would say that for a segment of the community (including myself and the companies I work with) the increasing awareness of GW has been a bigger issue than the fuel price increase in the last few years - there has been a substantial increase in the move to diesel-powered vehicles. One of the companies, RM, has moved to a diesel only-car fleet. Although there will be further adjustments if say oil went to $200 a barrel, in the UK we are significantly adapted to that sort of price.

In countries such as the US, where the percentage increase would be much larger, the problem is the time-scale for some elements of adaptation, for example the time it takes to significantly change the vehicle fleet.

These sorts of adjustment lags may be why 'peak oil', redefined to mean a shortage of oil relative to demand at prices similar to current world prices, may be delayed - the world is still not fully adapted to the three to fourfold increase that has occurred over the last few years, and it would seem likely or at least possible that the majority of the adaptation is still in the pipeline.

On the Oil Drum there is excellent debate and modelling of hypotheses of whether worldwide oil PRODUCTION capacity peaked forever in mid 2006, but there is little discussion of the fact that data shows that world oil CONSUMPTION definitely had a peak in mid 2006.

What remains unknown, is how much further world oil consumption will be affected by the increased prices that have already occured, and whether supply thus remains at or above demand, at these sort of prices for some time, even if oil rpoduction capacity is, and remains in, decline.

Yes: the UK government should significantly raise fuel taxes. We could make it net-out to consumers by reducing road tax to a commesurate amount, but we need to make the marginal cost of driving an extra mile higher.

Or, to put it another way, if we raise the price of using fossil fuels now, we mitigate the later effects of reduced oil availability. We encourage consumers to choose not to have a car, or to use it only sparingly. We make train or other public transport relatively cheaper. In other words, we use price elasticity of demand to reduce our dependence on oil before Hubbert's Peak forces us to do it.

Fuel duties are an enigma to me. Somehow these taxes managed to survive in Europe during a time of heavy liberal sentiment against any kind of State intervention on the markets. Recent strong attacks by the ultra-liberal sects of Society haven’t yet damaged the tax and up to now governments have managed to slowly increase them.

It might have to do with the fact that like the VAT the fuel duty is a tax that does not directly promote social equity, like a wage tax does. But still is an exception that makes the rule.

Fuel duties had their major role during the years of Cheap Oil, taming consumption per capita and promoting efficient urban planning and transport systems. As the Age of Cheap Oil comes to an end their use becomes more limited, although they remain as a useful tool to rapidly promote short term conservation. Legislation on engine size, vehicle weight, etc, takes several years to produce the desired effects.

As the economic difficulties brought by the Hubbert Peak deepen the pressures on fuel duty will become progressively stronger. Being the liberal sentiment common to the vast majority of voters in Europe, it won’t take long before someone gets elected on the basis of a cut on fuel duties.

The people who say a tax is just a tax, have a good point. But I'm not so worried about whinging taxpayers, I am more interested in the dilemma for the government. They need to replace tax revenue from North Sea oil with something else. Ok, taxing petrol and CO2 emissions instead is a good idea, they get revenue and also discourage undesirable practice.

But what happens when we stop using petrol and become carbon neutral? The government will need to find something to tax to replace the money it got from fossil fuels, or reduce government spending. Is there any evidence that the government gets this?

In the long run, taxing undesirable practice also has the effect of making tax revenue dependent on the undesirable practice - the addiction is transferred, not eliminated. In addition, the taxation raised is used to finance millstones around the neck, e.g. health services and benefits. Having created these monsters using oil revenues, they are hard to cut back.

That is why I think the overall effect of taxes is rather neutral, and the ability of governments to influence behaviour via taxation is a lot more limited than people think. What the government needs to be doing is reducing spending, especially infrastructure maintenance costs.

Students of Tainter will note the danger of perpetuating practices of a previous paradigm, instead of adjusting to a new one.

Perhaps, if car use was reduced to essentially zero, they wouldn't need the tax revenue from petrol as the roads would not need as much maintennance.

As a general answer to your question, governments should never rely on income from taxing or fining undesirable practices. A government should expect its people to be law abiding and considerate. If a government relies on revenue from such sources it will actively try to create such revenue streams by declaring more and more practices "undesirable" or illegal and creating taxes and fines to go along with the new rules.

- Scott

"Try sour grapes; you might like them."

I agree that the taxes on alcohol and tobacco, gambling etc. simply transfers the addiction from the consumer to the government in receipt of the taxes. Eventually governments set taxes to maximise tax intake, not minimise consumption.

However, all these commodities are in plentiful supply. That will not be the case for oil based products. The tax revenue will fall even as the tax rates rise, because SUPPLY will fall even faster than demand. The key is to drive the market to consume less whilst there is still sufficient supply to power the infrastructure investment needed to develop alternatives. (conservation,

re-localisation etc., probably not biofuels). If we wait until the market price forces the investment, it will be too late.

Carbon neutral transport? In your dreams!

(It is probably too late anyway. It is the economic paradigm of exponential growth which means that collapse is inevitable).

I will avoid getting dragged into the arguments of the value of NHS etc. as tax money well spent..

Chris,

It seems that more governments are PO aware, or at least behave that way.

I would assume that especially in the UK, it is very clear to the government that they have peaked. They can see it in their production numbers.

Wrt your question if the government should raise tax more or not: That depends on how well alternatives are available. If no public transport, car pooling, telecommuting or bicycling/walking options are really available, then it is no more than a tax increase which cannot be avoided by the public. This also depends on how the infrastructure of your country is. It seems to me that this is the case in the US, with the big shopping malls and the streets without bicycle paths and no trains, but not really in the UK.

In the Netherlands, the government has also increased tax on diesel & petrol, but did also a few other things to reduce oil consumption.

For this American, your question poses a great mystery.

Europeans seem to routinely accept harsh, swingeing, punitive taxes in the manner of sheep being led ever so calmly and quietly to slaughter. Even the British petrol-tax revolt of 2000 was merely a bootless ritualistic exercise. To be sure, it engendered major inconvenience, but in the end the sheep calmly and quietly slunk home, having produced no lasting result whatsoever.

On the other hand, more than one returned American expat has told me, in effect, "The government over there took all my money and gave me back only a child's allowance. I don't understand why people over there put up with that, but they do. It was interesting to visit but I'm sure glad I don't live there."

On still another hand, your "hauliers" have been complaining mightily. But then again, they are exactly like farmers in this respect. They complain perpetually, with their words clearly stating they would be better off to find some other job. But just as perpetually, they keep on doing exactly what they keep on complaining about. In America, I'd be asking them - especially the younger ones - why they don't simply take up another occupation.

In the end, European culture seems so alien with respect to these matters that ordinary reasoning just doesn't seem to carry over. So is the tuppence increase for better or worse? I really don't have a way to know.

The UK has a relitivly low overall tax burden (taxes as a percentage of GDP) in Europe:

Lithuania (28.4 percent)

Latvia (28.6 percent)

Slovakia (30.3 percent)

Ireland (30.2 percent)

Poland (32.9 percent)

United Kingdom (36.0 percent)

Italy (40.6 percent)

France (43.4 percent)

Finland (44.3 percent)

Belgium (45.2 percent)

Denmark (48.8 percent)

Sweden (50.5 percent)

source

The highest tax burdens are found in Scandinavia and correlate with some of the highest welfare and "happiness" levels in the world. Contrary to the American ideology there is clearly nothing fundamentally wrong with high taxes.

The trouble with "happiness" indices is that they seem to me to be abstract professorial constructs lacking good connection to the real world - and that, as with many social surveys, they tend to produce results aligned with political views. After all, the elite EU ideology is every bit as much an ideology as the particular American one you allude to. And oftentimes the differences in allegedly measured "happiness" level, at least among the 'developed' countries, lie well beneath the methodological noise, which leaves plenty of room for ideological mischief.

So, all told, I feel rather free to disregard them in this context, all the more so as the expats I alluded to were in no case praising the high taxes, but instead treated them, or even condemned them, as massive wasted opportunity. And some of the visiting Scandinavians I have talked to have been quite scathing about the empty passenger trains and whatnot that their especially swingeing taxes pay for. I'm inclined to speculate that perhaps, at the margin, this statistically marginal additional "happiness" might simply reflect the ticking of survey boxes by a larger proportion of tax-supported grifters, including but not limited to the drivers of those empty trains. And after all, they, at least, ought indeed to be "happy".

I don't see how GDP is any less arbitrary, it is measurable but it's importance is exagerated. It's not a very descriptive number.

The happiness index is quite transparent. You can look at the different factors that go into it and how they are weighted. There are different indices and they take into account income inequity, health, security, inflation and similar things. It is not just survey boxes, and even if it was I wouldn't consider it valueless.

There is great peace of mind and contentment when an effective safety net is in place. Some people (being from wealthy families that have never experienced insecurity/desperation) never truly fear on the level that most people do. I count myself in this category, during a miserable day at work I can get through the day by telling myself "I can give in my two weeks notice and be without a job for 6 months, if this week is as bad as today I will." The fact that I have a significant cushion between joblessness and moving in with relatives is a huge mental lift.

The level of stress and misery that comes with living from paycheck to paycheck for basics like rent and healthcare shouldn't be dismissed. When rent and healthcare are easily obtained from the state, these fears are reduced. Poverty is a huge cause of unhappiness. Remember diminishing returns: the first $20,000 is lifesaving, the second $20,000 is comforting, the third $20,000 is exciting and inspiring, the next $20,000 makes you think about retiring early/making a killing in the market. Four people with $20,000 provides more utility that one person with $80,000.

Any solution to peak oil, global warming and poverty will depend on wide or universal access to contraception.

Minor quibble - the Eurostat table shows an overall burden of in the EU of 39.3%, with the UK at 36%, putting the UK just a touch below the middle, rather than in a truly low category. The Nordic countries, as well as the very low-tax countries, seem to be outliers with populations too small to have much effect on overall EU economic or social statistics.

Paul,

Unless you include VAT, that's close to 20%. Then everybody pays over 50% tax in Europe. Welcome to paradise!

(I should emigrate, I know ;-)

No no. VAT is included in those figures.

For context, US is just about 30%, so same level as Ireland.

The US has state and local taxation, and property tax in particular can be quite high.

The US has relatively low income taxes, equivalent social security taxes (national insurance), high excise taxes (liquor and tobacco, plus an inumerable list of hotel taxes etc. depending on state and municipality), sales taxes (typically around 7% per state, and unlike VAT, not recoverable).

Of course health insurance is mostly private in the US. So I would call that a tax.

Taxes on dividend and investment income (capital gains) tend to be very low in the US (15%).

So the US is a great country to have an above average income in.

Agreed we Europeans (or at least us Brits) whinge endlessly about tax (UK taxes are lower than most Europeans, but we whinge more). But we do get quite a lot in return.

Your American friend probably didn't notice many direct benifits from the high taxes he paid, and he probably paid for more than he got, but that is what 'progressive' taxation is about.

Europe is still largely social democratic - a socialist system with democratic oversight. It is far from perfect, but it works quite well for us.

The poor are (generally) not so poor as to resort to crime to get their way.

The health service provision is not brilliant, but it does work for most people, most of the time.

Infrastructure is not brilliant, but it is maintained to some extent.

The wealthy may not be as rich, but they have less fear, and are generally happier.

Of course some people will never accept this model of society, and they tend to drift into jobs where the monetary benefits are more directly linked to the work hours input. Road haulage, for example.

Paul,

I was thinking about a reply, how to explain that in Europe people also complain about tax, that europeans also know paying tax to the government makes no sense etc, etc.

But when we talk about gas tax, to tell you the truth, 7-8 US$ per gallon isn't really that much.

My car runs at 50 mpg (it's a small daihatsu), and the average mpg here is well over 30. I cycle to work and it is nearby anyway.

I spend about 25 euro on gas per week. Now why should I really care or complain about gas prices?

It is really not that a big deal.

PaulS

The reason higher taxes are accepted here is that many in Europe still have a strong collectivist bias. Taxes up to a certain level are not viewed as theft by the state from the individual but as the price of achieving a more egalitarian society. Socialised health care and state financed education and arts have overwhelming support and a large factor in that support is the commonality it brings across society. Very few in the UK oppose the BBC being funded partly by the state and partly by licence fee because of the unifying effect it has on the country. Many view a narrower spread of wealth as a desirable end in itself even if this means a lower average. The thought of the rich living in isolation in fortified suburbs while the poor rot in decaying inner cities is viewed with horror by many who could, if it came to it live with the rich.

Communists were elected and re-elected to local government all across Europe, and still are in some places, by electorates who were sophisticated and many of whom were quite prosperous and who had no illusions as to what they would get by their votes.

The Red Flag was sung again at the Labour Party conference this year. Some of us still remember the words without the teleprompter.

This is not not to say that there are not many on the right of politics in Europe that would like a society more like America and I am well aware of many Americans, some of whom contribute to this forum, share a collectivist outlook but European society will be hard to understand for Americans if you do not accept that the centre of gravity of European political thinking is well to the left of America. Things that for you "ordinary reasoning just doesn't seem to carry over" come from asking the question 'what is best for society?' rather than 'what is best for me?'

You were doing really well until you got to the Red Flag event at the Labour Party conference. If David Cameron (UK Conservative party leader) was to exploit that, PM Gordon Brown would be toast.

-B

The center of gravity of American political thinking is well to the right of America.

The center of gravity of Canadian political thinking is well to the left of American political thinking.

The center of gravity of European political thinking would be called treasonous and unthinkable by current American political thinking - this will not change entirely until the people whose public ideology grew up during the Cold War and represented the championship of capitalism as the last bastion of a free society, die or are totally shut out of government (say, via a veto-proof Democratic majority taking hold for a few terms, which looks possible, if not likely).

The centre of gravity of US politics is to the right. It has been since at least Reagan. Clinton wasn’t to the left, he was just popular. Most populist movements are inherently to the right of centre (Look back at William Jennings Bryan if you need a good example. If Bill Clinton had really been supported by the left Hillary’s health care reforms would have survived.). Just as it is in the UK, where so many of the working class still adore Thatcher, despite her destroying the unions and preventing at least a generation from organising against the corporate onslaught. The wholesale divestment of the commons, such as gas, electricity, telecoms, airlines, rail, buses, health care, education, … I don’t really need to go on now, do I? seems to be overlooked by the very people it damaged the most. Just as Thatcher was selling out Britain to her criminal friends in The City of London, millions of the working class hailed praise as she kept Argentina from occupying the Falkland Islands.

It is still amazing how no one regarded the sale of entire national infrastructures to private “enterprise” as a travesty of justice. Now that it’s done and gone, and almost none of the “individual” share holders still hold shares, it seems just a distant memory.

Man, you're one drug-addled lipstick. A veto-proof Democratic majority? What on earth are you talking about? I have no idea, to be sure. Nancy Pelosi said impeachment was off the table. How veto proof is that? Do you really think a change of any magnitude is imminent? If so, please explain why. After all, the veto-proof Democratic majority you are referring to is already in place. If the Democrats wanted to make Dubya’s veto impotent they could do so already. How many terms are you looking forward to?

As for Europe? Merkel and Sarkozy? Treason? Can you give me the address of the corner your drug dealer hangs at, please? These are not bastions of liberalism by any stretch of the imagination. These two, if not singing from the same hymn sheet as US neo-conservatism, are singing from the same hymn book. Whatever hole you’ve been living in isn’t the same one as the rest of us. Was Saddam a good conversationalist?

Just to be really clear here, are you saying the current crop of European politician’s ideology wasn’t framed by the Cold War? Is that a credible position? Maybe it is and I’m just a really stupid person with access to the Internet. In any case, I’d like to understand how living within the epicentre of the Cold War, for the entire time the Cold War persisted, won’t have affected in any way the perspective of today’s European politicians. If you can enlighten me I’d be grateful. If not, I’ll understand, honest. It won’t be easy. To say the least.

To close, if the centre of Canadian political thinking was that far left, Canada would have a different Prime Minister. It doesn’t. So it isn’t.

But Americans whinge about their healthcare plans: deductibles, absence of coverage, pre existing conditions.

I have friends who can't move jobs, because they have pre-existing conditions. Jobs they hate. I have friends who have been bankrupted by medical bills.

Americans spend a lot via tax subsidies: employer provided health insurance is so subsidised, so is mortgage interest. This is seldom discussed when considering the US tax system. The government has just made big consumption choices for you by doing that.

Europe is a place of high quality public life: be it public squares, the arts, health care, trains, mass transport. America is a place of low quality public life, of coccooning in your vast suburb with your big screen TV.

It's your call which you prefer. Certainly from an energy consumption point of view, you are in far worse shape than we are.

D*mn straight Valuethinker. When I look at the overall rate of deductions from my paycheck (medical insurance, medical payments, etc. etc.) I lose just as much of my gross income as I would in France. I wish my money was going towards protection for all of society instead of the profits of a few companies and their investors (d*mn CIGNA, d*mn it straight to hell, and they're considered to be a "good" insurance company).

Any solution to peak oil, global warming and poverty will depend on wide or universal access to contraception.

It can be argued that American's are paying more for fuel than Europeans. It's just that most of the cost is paid via income taxes to cover the expenses that have been externalized by the oil industry. This includes military protection for the gulf region etc:

http://www.evworld.com/news.cfm?newsid=11520

The UK certainly has some overhead too, but I suspect far less. So it's kind of funny to see an American mocking the UK motorist as a "sheep" for paying the visibly high price, while being completely unaware of the even higher price they are paying overall.

In the short term raising tax on fuel is probably the way the government will go.

However, this approach is likely to be overtaken by events, such that the only realistic option will be some form of rationing.

Whether this will be driven by a shortage of product, a balance of payments crisis or climate change is a moot point. However, the end result will be the same - there will be a per capita allocation of “low cost” fuel or a per capita carbon allowance, with extra fuel being able to be purchased at much higher cost on some form of market. Year by year the amount of the allocation will be reduced.

If the government have time to do so they will introduce the system under the climate change banner as a way to reduce CO2 emissions. Your future identity card will morph into a personal fuel/carbon allowance card.

Fuel tax revenue will fall to some degree and will be made up by charging for your fuel/carbon allocation. I think it quite likely that a road pricing scheme would also be introduced, so as to capture revenue from electric vehicles or high efficiency hybrids.

One thing we can be sure of is that tax revenues from personal vehicle usage will not decrease!

which all goes to show that a driving chimp and someone who sounds like a painter, may be right.

Which button to press for paradigm shift?

Who installed that button?

good luck.

More tax makes you more democratic! Less tax more avoidable...

Welcome to politics.

There is every danger of a tax revolt on this issue.

Yet the statistics show the real price of petrol in the UK has actually fallen since the petrol strike of 2000. But consumers don't think in inflation-adjusted prices, they think in terms of what's in their pocket (or not).

The real price of driving in the UK has been falling for 10 years, a function of the steep drop in the price of new cars. In consequence, the number of cars has risen by 20% (7 million cars) since 1997. But the consumer is just noticing petrol prices rose.

Of course it's all ludicrously short-sighted. We're going to depend on politically volatile regions (read: civil wars and supply interruptions, and Mr. Putin controlling our gas supply) for our energy in the future, so anything we do to reduce that dependency is a good thing.

Since the government won't say that to the public, that this is about the National Interest, and the future of the Nation, the public doesn't rise to the occasion.

Although I think global warming is the more immediate threat, the government would do better to talk about National Security, and patriotism, rather than something the public can't really understand and grapple with.

But that might lead to difficult questions about whether the invasion of Iraq was really about oil....

In a shadenfreudic spirit of mischief, I threw a stone at the hornet's nest by posting the following comment on the petrolprices.com website:

"A responsible government that was properly in touch with the terrifying geological and ecological realities now bearing down on us all -- whether we like them or not, whether we choose to see them or not -- would begin immediate motor-fuel rationing, plus a serious increase in travel-fuel prices, not a mere piddling sixpence a litre phased over time. Genuinely useful transport work, strictly defined, could earn a rebate on price, and extra rations. The rest of us would have to grin and bear it. And -- most importantly -- start working out ways to cope with a big drop in fuel availability, and a huge rise in its cost. We're going to have to do that anyway, however much we scream and fight against it. There are some geo/ecological realities over which humankind have no power whatever. But a wise government would at least start crash-priority preparations for the inevitable early, to alleviate the worst consequences. But then, for wise government, we'd need to live in a genuine democracy. Wonder if I'll live to see that in Britain? Probably not."

It was comment number eight thousand and something, so I don't suppose many people will read it. I also joined the nine percent of respondents on that website who voted to keep the increase. Seems that most of my fellow-Brits have a few more shocks to endure befor we come to the great awakening here.

PS: I should have said also in my previous comment that I live on a state pension of £119.5 per week, plus a bit extra earned by making things. And still I can afford to drive a modest diesel VW, for the few occasions when my bike can't handle the job, and the bit of fuel that I buy still seems criminally cheap, even to someone on my income level. It's just too damned easy for us to squander it here in Britain, even now, as we sit "...in the hollow of the deep sea wave...." And as I pedal about my locality, I'm just horrified by the steady increase of the number of sucker-trucks (SUVs) that my sleepwalking fellow-citizens are awarding themselves. The awakening, when it comes, is likely to be pretty shocking, I suspect.