Sixth Annual ASPO Conference – Cork, Ireland

Posted by Chris Vernon on September 15, 2007 - 9:55am in The Oil Drum: Europe

On Monday 17th and Tuesday 18th of September, Cork, Ireland hosts the sixth annual international conference of the Association for the Study of Peak Oil & Gas (ASPO). The conference comes at a time of increasing concern over the security of our oil supplies with the fear that after a century and a half of growth the industry is facing what is known as ‘peak oil’, the point at which the production of petroleum reaches a maximum before entering terminal decline.

UPDATE: Our own Nate Hagens is presenting at ASPO. Here is a brief summary of his talk:

The economic system that has ruled the planet while populations have grown will have to choose different ends on a full planet, which implies different means. Supply will gradually become inelastic in a world constrained by energy and power density, temporally and spatially diffuse alternative energy options, and increasing limitations to non-energy inputs such as soil, GHGs, land and particularly water. But perhaps more importantly, demand is inelastic too. We have evolved particular neural mechanisms through 250,000+ generations as hominids, and millions of generations as mammals that a)cause us to compete for resources, b)allow our systems to by hijacked by novelty and c) cause us to focus our attention on the present, rather than the future. The talk will discuss habituation, addiction, hedonic adaptation and other recent neuroscience research showing that homo economicus fails at its most basic assumption -- that man is rational. But where we cannot change the way we are wired, we can change what the metric is. Sociological research already shows that we are not happy with more pecuniary accumulation, but are happier with more social interactions, friends and community. Politics is genetic. Economics is cultural. We have to work on changing this cultural carrot, which will then dictate how best to use the remaining high quality fossil fuels.

Over two days the 500 delegates will hear keynote addresses from former US secretary of energy Dr. James Schlesinger and former non-executive chairman of Shell UK, Lord Ron Oxbrugh as well as from leading professionals from the oil industry, politicians and experts in economics and alternatives to oil dependency.

Registration is still available! Click Here.

Below the fold is much more about the event, including schedules and abstracts of talks.

- Supply: The Industry's Perspective

- Demand: The Economics

- Risk Management & Mitigation

- Policy & Environment

Supply: The Industry's Perspective

The first session will focus on supply and explore the industry’s perspective with speakers including Dr Jeremy Gilbert the recently retired Chief Petroleum Engineer from British Petroleum (BP), Mike Rodgers a PFC Energy Partner and a senior member of the firm's Upstream practice, Ray Leonard, Vice President (Eurasia) of Kuwait Energy Company (KEC) and professor Pierre-Rene Bauquis of the IFP School (French Institute of Petroleum) who previously held the position of Special Advisor to the Chairman of TotalFinaElf, authored Total’s energy review to 2050 and headed Strategy and Planning, then Head of Gas, Coal and Electricity at Total.

Professor Bauquis’ input is particularly welcomed as Total is the only western major to publicly support the peak oil view at the highest level. Chairman and outgoing CEO Thierry Desmarest told the 2006 World Gas Conference in Amsterdam:

“The capacity of raising (oil) production is a real challenge ... if we stay with this type of production growth our impression is that peak production could be reached around 2020,”And Christophe de Margerie, now CEO, when head of exploration and production at Total was reported by the Times of London saying:

“120 million barrels per day will never be reached”Referring to the then 2030 projection from the IEA with the Times continuing:

People are failing to deal with the reality of the price, which has nothing to do with speculators or even any lack of reserves, which are ample. "It is a problem of capacities and of timing," de Margerie says. "This is the real problem of peak oil."At the heart of the matter is concern that oil production will not be able to increase to meet the expected demand. Indeed in July this year the International Energy Agency (IEA), the OECDs energy watchdog established in the wake of the oil shocks of the 1970s warned of an oil supply crunch within five years. Their Medium-Term Oil Market report said:The oil is there, he says, but the amount you can deliver today depends on how many wells you can drill and how fast you can deplete an oilfield, not to mention gaining the co- operation of governments, which guard access to the precious resource jealously. There is no prospect of reaching the lofty peaks that economists at the International Energy Agency, predict will be needed to satisfy world demand for oil.

There are not enough engineers, rigs, pipelines and drillers to increase current world output of 85 million barrels per day to 120 million, he says.

"Despite four years of high oil prices, this report sees increasing market tightness beyond 2010. It is possible that the supply crunch could be deferred - but not by much."IEA's head of oil industry and markets division Lawrence Eagles warned:

“The results of our analysis are quite strong. Something needs to happen. Either we need to have more supplies coming on stream, or we need to have lower demand growth.”There are three reasons why we are right to be concerned about future oil supplies. I call these the geologists’ warning, the analysts’ warning and geopolitics.These worrying conclusions are reached despite the IEA assuming a doubling in the production of biofuels and Saudi Arabia increasing their current output by 1.8 million barrels per day, neither of which are a certainty.

The Geologists’ Warning

To understand the geologists’ warning we have to go back to 1956 and the work of M. King Hubbert. Whilst working as Chief Geology Consultant for Shell’s research division Hubbert published a paper indicating that conventional petroleum production from the lower-48 states of the United States would continue to rise, reach a peak around 1970 then decline with the rate of production following a bell shaped curve. This was a highly controversial position to take, the US was world’s largest oil producer and production was rising steadily. Even come 1970 his detractors were pointing out that the US had never been so productive, the irony being that whilst they were correct, what the critics didn’t realise is that the US would never again be as productive as in 1970.

The way Hubbert (and others after him) calculated peak oil is based on two key points, an estimate of ultimate recoverable reserves (URR) and that the profile of the extraction rate curve is the derivative of the logistic curve following the well known bell-shaped curve, the area under the curve representing the URR. These two points and historic extraction data allows the complete curve to be calculated revealing the date of and extraction rate at peak.

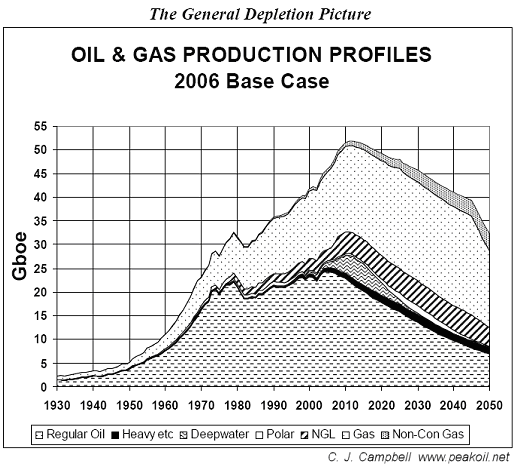

In hindsight the accuracy of Hubbert’s 1956 forecast involved a degree of luck, however the general theory has since been proved sound with many provinces having reached their peak before declining in similar fashion. With an understanding for individual provinces developed it is a simple task to extend this work to the world at large and predict a global peak. Today such analysis is indicating a peak in approximately 2010 but the situation is complicated by various types of oil, for example light, sweet conventional oil has already passed its production peak and with conventional oil plateauing since 2005 is it possible that, in hindsight, we recognise the conventional peak is in fact behind us.

The chart illustrates an application of the geologists approach carried out by Dr. Colin Campbell, retired petroleum geologist and founder of the Association for the Study of Peak Oil and Gas (ASPO). Campbell now lives in Ireland where he heads the Ireland branch of ASPO hosting the 2007 international conference.

The Analysts’ Warning

The geologists approach is a simple one, being based purely on the rocks (their content and behaviour). There is another method devised not by a geologist but by industry analyst and Editor of the UK’s Energy Institute’s “Petroleum Review” publication, Chris Skrebowski. Skrebowski who will also be speaking at the ASPO conference in September, calculates the timing and magnitude of peak oil not by studying the rocks but by studying the industry.

Skrebowski looks at the production profiles of fields today, those in decline, those in ascension and those holding steady. This data is clear. We know the depletion rate of the already peaked provinces so we know that if we don’t build any new supply capacity global extraction rates will decline, they would have been declining for decades were it not for new oil industry activity. Fortunately, in the past natural declining production in existing fields has been more than compensated for by new projects and net production has increased. Where Skrebowski sees a problem is looking forward over the next five years.

Skrebowski describes peak oil as:

“The point when further expansion of oil production becomes impossible because new production flows are fully offset by production declines.”This situation will occur when the loss of output from the countries in decline (USA, UK, Norway, Mexico etc.) exceeds the gains from those that are expanding. As more countries approach and roll over their peaks the annual losses become greater and with that the challenge borne by the few remaining countries yet to reach their peaks.

Of critical importance is to consider production flows rather than reserves, reserves are only useful as flows, the 10 billion barrel oil reserve is next to worthless unless it can be made to flow at a significant rate.

Looking forward some five years we know how much of today’s production we are going to lose each year to natural, already occurring depletion. The US National Petroleum Council in its report to the US government this month identified in its conclusion that:

“80 per cent of existing oil production will need to be replaced by 2030 to maintain present supplies with additional production required to meet increased demand.”Skrebowski also knows how much new capacity is coming on line, the new oil projects. These new projects are no secret, the oil companies publicise them, informing the world how much they are investing, timescales and how much oil a project will produce. Since it takes more than five years between discovery of an oil field, or even the decision to develop an already discovered field, and the field going into production we can be sure of all new production coming to market over this period, the die is cast. If it hasn’t started yet it won’t deliver soon.

This is where the problem lies, adding planned new production to depletion rates of existing fields doesn’t add up for long. According to Skrebowski new production isn’t adequate to offset the depletion we already know about past 2010-11,

“We have enough capacity coming online for the next two-and-a-half years. After that the situation deteriorates.”This is a similar time frame as that discussed by the IEA and the geologists. With the geologists’ warning and the analysts’ warming we are left with two independent approaches both in agreement with one another and with the IEA adding further confidence to the conclusion that global oil supply is likely to peak soon.

Geopolitics

The third point giving us reason to be concerned about supply is geopolitics. The first half of the oil, or any mineral resource, produced in a province or globally is the easy to get resource, putting off the harder more expensive production. It is only sensible to produce the cheapest reserves first. The geologists tell us we have produced approximately half of the world’s oil, the easy half.

Most of the world’s remaining oil can be found in Saudi Arabia, Iran, Iraq, Kuwait United Arab Emirates, Angola, Nigeria, Libya, Algeria, Sudan, Russia, Kazakhstan, Azerbaijan and Venezuela. Many of these countries are either unstable, corrupt, divided along ethnic or political lines, hostile to the US or ruled by dictators or fragile authoritarian regimes, these problems often being at least partially exacerbated by the presence of oil.

A lot depends on which reserve numbers from the Organisation of Petroleum Exporting Countries (OPEC) you find most compelling (there is growing concern in the ever static and unconfirmed figures provided by OPEC) but the rest of the world, after those countries and discounting tar sands due to flow rate limitations, have only 9% of the world’s remaining oil. That’s how much easy, safe oil we have left and not all of that is particularly easy anymore when you consider ultra deepwater or polar oil. Moving forward an increasing proportion of the global oil supply will need to come from these countries.

Such reliance on OPEC members to increase their production to offset declines in other countries focuses attention on the status of OPEC reserves. There exists uncertainty here due to the complete lack of external auditing and some large unexplained reserve revisions in the 1980s. During this decade, starting in 1983 just a year after production quotas based on stated reserves were allocated to each member to ensure no single country flooded the market lowering the price for all, OPEC members announced reserve increases without announcing associated new discoveries.

What is more, despite annual production of billions of barrels the stated reserve figures have not decreased to this day from the increased figures of almost 20 years ago. With OPEC members’ oil industries in state control and detailed information regarded as state secrets this conundrum has remained intractable, until that is Petroleum Intelligence Weekly, an industry journal, published an article in January of 2006 claiming to have credible evidence that Kuwait’s reserves were in fact only 48 billion barrels, less than half their officially stated reserves and surprisingly close to their original reserve figure of 64 billion barrels in 1984 minus production to date.

This story sent shock waves through the Kuwaiti parliament with opposition MPs demanding to know the truth. The row continues today with Kuwait's Oil Minister Shaikh 'Ali al-Jarrah recently resigning in order to avoid an impending vote of no confidence. Since the PIW report two further reports have been tabled:

“According to reports in al-Qabas and al-Rai al-'Am, veteran Popular Bloc leader Ahmad al-Sa'dun tabled a KOC document stating national oil reserves at just 24bn barrels and demanded this be reconciled with the figure of 51bn barrels stated by Finance Minister Badr al-Humaidhi. Since Kuwait's official oil reserves figure of 101.5bn barrels was challenged by the industry press in early 2006 (MEES, 30 January 2006), the government has been under pressure to present an accurate picture of national oil reserves to MPs. Former minister Shaikh 'Ali al-Jarrah in mid-2006 promised MPs a full report on reserves but later went back on this commitment. Neither of these latest figures (51bn barrels or 24bn barrels) has been officially endorsed, but the 24bn barrel figure, if true, represents a 75% reduction in officially-stated Kuwaiti reserves. As such, it represents a political bombshell that will undermine the government's credibility and have major reverberations outside the country.”If the 1985 Kuwait revision from 64 to 90 billion barrels is shown to be phantom it is highly likely that revisions from other OPEC members were similarly inflated in this political manner. The ramifications of this could not be more serious as the future production growth from OPEC relies on their enormous stated reserves. With these reserves halved there seems little hope for global production growth and the peak could be upon us.

These geopolitical concerns can impact the geologists’ understanding of peak oil. While the rocks tell us about the oil producing potential of a region, the geopolitics can in some cases introduce above ground factors that significantly constrain this potential as is happening today in Iraq and Nigeria or distort the very data production forecasts are derived from with devastating consequences as could be the case within OPEC.

Supply, a conclusion

There are three distinct reasons fuelling the growing concern for global oil supply, the geology, the behaviour of the industry and the geopolitics as supply becomes more reliant on unstable parts of the world. The geologists’ and analysts’ approaches are independent yet come to similar conclusions. Geopolitics can be a risk at any time but in light of the two other warnings and the increasing importance of non-OECD oil production could prove critical.

At the ASPO conference in September the session on supply will consider these concerns through contributions from a range of speakers with significant experience in the oil industry and a panel session will address specific questions from the floor.

Demand: The Economics

The second session will focus on demand and explore the economic aspects with speakers including Dr Herman Franssen former economic adviser to the minister of petroleum and minerals in Oman and chief economist of the International Energy Agency (IEA), Prof. Xiongqi Pang, chief editor of petroleum science and Jeffrey Rubin, chief economist and chief strategist, managing director, CIBC World Markets. Speaking before the conference Dr Franssen said:

On a per capita basis, the US uses about 26 barrels per person per year; Europe and Japan about 16 barrels per person per year, while China uses about 2.5 and India less than 1 bbl per person per year.The limit peak oil is likely to impose on the growth of emerging economies has the potential to dramatically disrupt what many are taking for granted. If the peak oil argument is right then this assumed growth will not be possible.Past global economic developments and oil consumption was largely confined to less than one-third of the global population. However since the early part of this decade when China joined WTO, its economy has taken off at a pace similar to that of the Asian Tigers in the 1970's and Japan before them. India is about 15 years behind China but, here too, economic growth has taken off at sustained rates of about 8% per year.

The big difference between the past and the present is the size of the populations. China and India together have a combined population of close to 2.5 billion people of whom about 500 million are considered middle class (in PPP). The global car fleet is expected to double to about 2 billion by 2020. The impact on oil consumption will be huge.

Even if OECD oil consumption will remain fairly stagnant (US is still expected to grow by about 5 mbd between now and 2025), the oil demand in the rest of the world will surpass OECD oil consumption and keep rising. The global dilemma will be how to provide fuel for growth in the developing world when global oil production may be close to peaking.

The ramifications are serious and it is likely that economic tools employed today will prove insufficient when faced with increasing competition for dwindling resources.

Joining Dr Franssen for the extended panel discussion is Dr David Fleming, Director of the Lean Economy Connection and inventor of the system of Tradable Energy Quotas (TEQs). Outlining the importance of the demand-side Dr Fleming said before the conference:

There is little we can now do about the supply side of the market for oil and gas; on the demand side, however, there are some essential measures to be put into effect without delay. Demand management will require (a) an efficient rationing system to ensure fair shares of a diminishing flow of energy; (b) an orderly energy descent, mitigating the worst of the turbulence on the supply side of the market, and establishing a long-term trajectory of decline. The conference will open up this urgent demand-side agenda.Failing to proactively address the demand-side as oil supplies peak and enter terminal decline is likely to cause economic disruption on a global scale. Demand would be tempered by volatile markets but at the expense of severe recessions and uncertainty.

During the conference leading experts will evaluate the economic risk posed by peak oil and new economic tools and thinking will be presented demonstrating possible alternatives which mitigate much of the potential economic damage as global energy supplies decline.

Risk Management & Mitigation

The third session will focus on the risk peak oil poses, how risk can be managed or even mitigated. Speakers include Dr Alfredo Curbelo, head of Cuba’s national R&D programme on Sustainable Energy Development, Dr Michael Dittmar of EHT Zurich, a particle physicist working at CERN who teaches the course “Energy and Environment in the 21st Century” and Nate Hagens, PhD student at the Gund Institute for Ecological Economics studying the impacts that a decline in liquid fuels will have on planetary ecosystems and society and editor at The Oil Drum.

Chairing this session is Dr Jeremy Leggett, chief executive of Solarcentury. Speaking before the conference Leggett outlined the risk we face.

Modern human society is geared to its rivets for ever growing supplies of affordable oil. Were it instead to face rapidly falling supplies of mostly unaffordable oil, the shock would hit hard across all sectors of the global economy. The US Department of Energy's Office of Naval Petroleum and Oil Shale Reserves has this to say of the prospect: "a serious demand-supply discontinuity could lead to worldwide economic chaos."The risks associated with the twin problems of oil depletion and climate change suggest it is Time To React. That these risks occur within the context of one another calls for mitigation strategies attuned to both.Is it that bad? Or are there risk management and mitigation strategies available to us? If so, what can work? How quickly? And even if we can't head off "worldwide economic chaos," how quickly can we rebuild our energy economies the other side of the crisis? Questions like these, which are nothing less than vital for the wellbeing of millions, will be discussed by some of the world's foremost experts on this subject in Cork. This is a conference not to miss.

Nuclear power is often proposed as response to both the challenge of depletion and climate change. Dr Michael Dittmar will evaluate the nuclear energy option, specifically identifying a range of common misconceptions present in the debate.

Nuclear fission and fusion energy is often considered to be the long term replacement of fossil fuels, either because of the required CO2 reduction or because of oil and gas depletion. Many misconceptions about today’s nuclear energy and the so called nuclear renaissance and its future potential remain unquestioned in the pro and contra nuclear energy debate.Joining for the extended panel session is Mary Graham, founder of Practical Small Projects (PSP) an organisation that facilitates micro-enterprise/finance projects for entrepreneurs whose businesses will help their country develop.This talk will analyse the misconceptions relating to future fission reactors, to uranium resources and uranium extraction as well as the real and remaining problems of commercial energy production from fusion.

Working with energy poor countries, Graham has an understanding of the practical approaches can be used to mitigate the risk associated with reliance on oil and gas. Speaking before the conference she outlined a responses to this risk:

The vast majority of West Africans have lived without electricity and plumbing in villages for the course of their lives. For these countries, access to electricity is primarily limited to cities and a significant portion of their capital and foreign exchange is spent on importing fuel and constructing large power plants and electrical distribution systems. Harnessing the power of the sun, Africa's most abundant and reliable natural resource, has great potential to ameliorate these problems, bring reliable energy to remote areas, alleviate burdens on the environment and reduce conflict.For poorer countries, reliant on imported oil and for whom oil not only means transport but also electricity, peak oil represents a critical risk. As global supplies run short it is first these nations that will face unaffordable oil and potentially a dramatic collapse of energy supply. Mitigating the impacts of this loss will be critical to these nations and there is much that richer nations can learn from their approaches.Solar energy serves as a tantalizing prospect to act as a catalyst to provide improved health, educational and income-generating opportunities in Africa. The implementation of solar lighting/electric projects, executed by local businesses such as Afriq Power, holds the promise of mitigating wide-spread problems such as access to decentralized energy and rapid urbanization in countries like Mali. Afriq Power makes the technology become indigenous as it is run by locals, manually assembles photovoltaic solar panels and installs lighting, pumping and electric systems in wells, schools and health clinics.

Learn more about solar energy in West Africa and its practical applications that are bringing increased prosperity and hope to the one of the five poorest countries in the world. Consider how your organization can apply this approach with people in other countries and, thus, minimize the degree to which continued reliance upon oil and gas is perpetuated.

This session on Risk Management & Mitigation moves the debate forward in a practical way, specifying the risks and weighing up potential management and mitigation strategies.

Policy & Environment

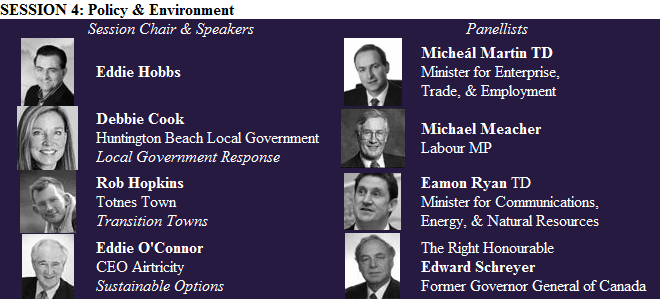

After considering issues concerning the supply of and demand for oil and the risk peak oil presents, the final session of the conference explores reaction. Chaired by Eddie Hobbs, speaker, writer and broadcaster on consumer issues with speakers including Debbie Cook, former mayor and Huntington Beach city councillor, Rob Hopkins, founder of Transition Network and Eddie O’Conner, founder of Airtricity, the session asks, Time to React?

Eddie Hobbs described this issue as:

...the single most pressing challenge facing the world over the next decade and beyond. If the prognosis is correct, then, at best the transition to the next energy age or post oil-dependency could make the economic depression of the 1930's look like a piece of cake.A concern is that acceptance of oil depletion thinking by politicians and the general public will not occur until it’s too late and a crisis has developed. This is compounded by the time taken for proactive actions to take effect, to mitigate risks associated with oil depletion actions need to be taken in advance of shortage.

From an investor perspective the coming transition provides for severe risks to exposed assets like deposits and bonds and great opportunities to invest in existing and new energy sources as well as underpin things with holdings in gold. So, while I am as concerned as most people who've stumbled their way reading into the data on peak oil and gas I also see it as a very pressing and immediate personal finance challenge that confounds traditional portfolio thinking.Speaking before for conference Debbie Cook identified the importance of oil and the lack of political will currently limiting reactions to this challenge:An ASPO conference in Ireland couldn't come at a more important time.

Oil is the lifeblood of local government: police, fire, flood control, trash removal, water, sewer, landscape equipment, street maintenance. The demands for fossil fuels are endless. What will become of essential services after peak oil? What is government doing to prepare?Debbie Cook will share resources, information, and the ingredients for success garnered from her seven years of service on the Huntington Beach City Council and numerous regional boards.The ability to transition to a sustainable society is largely a function of political will, available resources, and relationships with strategic partners. Fortunately, there are many existing resources, tools, programs, and partners to assist any community in developing a roadmap toward sustainability. Unfortunately, it is a lack of political will that is holding back the creation of the policy framework within which citizens can address both climate change and peak oil. While many communities get caught up in the debate over peak oil and climate change, others have been able to move beyond the rhetoric to action. In large part it has been the result of strong political action, broad participation, and sustained advocacy.

Since developing the Kinsale Energy Descent Action Plan and establishing Transition Town Totnes Rob Hopkins’ network of Transition Towns has expanded rapidly based upon reacting to four things.

Firstly, that life with dramatically lower energy consumption is inevitable, and that it’s better to plan for it rather than be taken by surprise. Second, that our communities currently lack the resilience to handle the severe energy shocks that peak oil will bring. Third, that we have to act for ourselves and we have to act now. And lastly, that by unleashing the genius of the local community to creatively design our energy descent, we can build ways of living that are more connected, more enriching and that recognise the biological limits of our planet.The Transition Network’s mission is to inspire, inform, support and train communities as they consider, adopt and implement a transition initiative. They’re building a range of materials, training courses, events, tools and techniques, resources and a general support capability to help these communities.

Joining the speakers for an extended panel session are politicians form Ireland, the UK and Canada, Micheál Martin TD, Eamon Ryan TD, Michael Meacher MP, and The Rt. Hon. Edward Schreyer.

The closing address will be delivered by Eamon Ryan TD, the Irish Government’s recently appointed Minister for Communications, Energy, & Natural Resources.

ASPO is a not-for-profit organisation founded by retired oil geologist Dr Colin Campbell, now living in Ireland, with national chapters around the world and the aim of advancing awareness and understanding of the subject of ‘Peak Oil’.

What else can I say than, all the best to the most important of all taskforces – ASPO !

Good luck (!) in forwarding the message to our various governments / UN – who “probably do their best from their actual understanding of the matter" ….. PO and beyond that is …

..but I’m afraid they haven’t yet gotten the necessary wide-angle focus to this matter.

The consequenses to this "PO-thing" is advanced philosophy and by far to many claimed to be "a theory" - AND such matters doesn't go well down with stateleaders and people in general - they (we) want more of the goods ... remember governments ARE ONLY people ... like You and Me ...

But who are they or we , actually ? Is everything now ?

Hopefully, webcasts and podcasts will be available for those that are unable to attend. (like myself)

I hope so too. Many of us will want to hear what these speakers have to say. MP3s and reports of the conference on the net deliver very good (campaigning) EROEI!

One must admit to being a bit disappointed by the speakers scheduled.

It seems as though a "Golden Age" is now behind us. Where are the "big lights" of the "movement", Matthew Simmons, Richard Rainwater, Ken Deffeyes, Richard Heinberg, and the old flamethrower himself, James Howard Kunstler? And the heavy hitters in the oil industry like T. Boone Pickens?

The policy wonks like Robert Hirsch?

And then, we see the great iconic image, "The General Depletion Picture, OIL AND GAS PRODUCTON PROFILES, 2006 BASE CASE", with that "peak", murky curve at the top still about 3 years out in front of us as it has been for so many years, taunting and so tauntingly close....and then HORROR!

Or is is it? the scenario now so famous still shows oil and gas being produced at a rate in 2018 or so that was being produced in 2010.

Out at 2030, we see oil and gas production finally getting back to about where we are now.

And at about 2045, when the first of the baby boomers born will turn 100, oil and gas would still being produced at a pace that has only been known in this new century, post 2000.

ABSOLUTELY ASTOUNDING. It is from this original geology that all the "Mad Max" scenarios, all the "back to the farm" for the masses scenarios, the "death of global trade and modern technology" scenarios, the "Ulduvian Gorge" world lit only by fire scenarios, the end of private property, the end of private transportation and liberty, the end of economies and paper money, the end of medical care, the end of......ALL THIS BUILT FROM THE GEOLOGY WE SEE IN THE GRAPH ABOVE....

Has there ever been greater proof of humankinds deep NEED to believe in some form of retribution, some form of PUNISHMENT for the sin of enjoying life? The human soul has a self loathing factor built right into it, a fuel for the philosophy of nihlism that is the one infinite fuel that will know no peak.

Perhaps the lack of the great names, the flamethrowers of the movement is a decline from the great rhetorical peak of the peak oil "movement, and what are seeing on the "backside" is a return to the geology, the science, the real options that are already being employed, the gritty business of dealing with a serious problem in an adult and rational way.

Perhaps.

RC

Interesting, I am actually of the opinion that this years speakers combination is the best yet. A serious program with good diversity.

If you want doomerish views, better read a semi-scientific book :) If you want serious options to mitigate peak oil, go to an ASPO conference!

Rembrandt,

Good positive take on the speakers list, and I don't want to be mistaken, from what I can find out about most of them, it should be an interesting forum.

Sadly, I cannot afford to fly to Ireland (I have always wanted to go just to see the place, being of Irish extraction, but like many Americans of Irish extraction, I am not wealthy....:-(

Hope those who do go will report back for us....and I agree with you, I do think the ASPO scenarios and mitigation ideas are more credible than many of the "Johny come lately's".

RC

I agree, it's a great speaker lineup. However, for anyone wishing for some of the more "traditional" names, and/or for anyone that can't afford to go to Cork, there will be an ASPO USA conference in Houston Oct. 17-20.

Among the speakers are:

T. Boone Pickens, Matt Simmons, Arthur Smith, Henry Groppe, Chris Skrebowski, Stuart Staniford, Euan Mearns, Jeffry Brown, Robert Hirsch, and Peter Tertzakian, plus 30 more speakers.

This conference also promises to be enlightening and well rounded. More info at www.aspo-usa.org

I don't think there is a lack of "great names". In fact quite the opposite, I think the calibre of speaker is the best yet, the most mainstream and the most credible ASPO has fielded. I don't want to take anything away from the fantastic work your great names have done over the last few years but there is a limit to the influence people like Heinberg and Kunstler have outside the movement.

I see it as a good thing that the conference isn't dominated by speakers from the traditional peak oil movement. When we have people like Bauquis (Total), Franssen (IEA), Gilbert (BP), Oxburgh (Shell), Schlesinger (US Gov.) - former affiliations I grant you, addressing this issue it shows how much more acceptable it is becoming. If we want our current politicians to take peak oil seriously the message must be delivered by people seen to be highly credible.

I hope and I think this is, as you put it getting on with “the gritty business of dealing with a serious problem in an adult and rational way.”

On Campbell's graph, I don't read post peak curves are predictions of what will be produced, but rather an envelope within which future production will fall.

Great and informative post, Chris, thank you!

My question is, among TODders, who is coming to Cork?

I'm going, and I think Chris, Rembrandt, Luis, Nate and Heading Out are all going.

Cool, I met Chris and Rembrandt last year in Pisa, I look forward to meeting you then!

Euan, confirm I will be going, see you there.

My real name is also Chris - I attended previous ASPO's in Lisbon and Pisa.

Bring a mac, or an umbrella - it's raining.

If you are going to ASPO in Cork, go have a nice little lunch in the "English Market" [an indoor farmers market in the city] and don't forget to make a pilgrimage to Kinsale, not far away, the site of the first town Energy Descent Action Plan. I wish I could go this year. Lots of great restaurants in Kinsale too.

Happiness is... a peak-nik in his victory garden!

Is anybody going in camo gear? Just asking.

Campbell and Green Minister discuss Peak Oil on Irish Radio (Mon Sept 17th)

As part of the press coverage for the ASPO meeting this week in Cork, the Irish national broadcaster (RTE) on their main morning talk show: Today with Pat Kenny had on Colin Campbell and the new Green Party energy minister Eamon Ryan discussing Peak Oil.

What the programme demonstrated is that Peak Oil awareness is has now fully penetrated the Irish Government and is spreading further out into society.

A podcast of todays programme can be found here:

http://www.rte.ie/radio1/todaywithpatkenny/ then click at "Shows from the past week" and the Monday link is:

javascript:showPlayer('/radio1/player_av.html?0,null,200,http://dynamic.rte.ie/quickaxs/209-rte-todaywithpatkenny-Monday.smil')

and then click on "Today with Pat Kenny" in the links below.

The interview begins at 13:52 minutes and continues for about 20 minutes.

In the interview Campbell informs the interviewer that Peak for Conventional Oil has already passed -last year, while he sees total liquids peak around 2010/2011 and goes on to say how during the era of cheap energy population has grown massively.

Pat Kenny asked Campbell how long we continue our standard of living given these facts and Campbell replies that we actually no longer are, mentioning the higher oil prices now and goes on to mention the relationship in the financial industry and the current problems now, as it is based on the idea of endless growth which is required for the increasing amounts of loans to be paid back. He states that the current problems in that sector are thus a manifestation of Peak Oil.

The interview then turned to Eamon Ryan, the Green Party minister, who pointed out how vulnerable Ireland is to oil in that 60% of our energy is from oil. It is pointed out that each Irish person uses about 8 pints of oil a day. He says Ireland should aim to be oil free by 2050 like Sweden's goal which is to be oil free by 2020. He outlines that in Ireland the main use for oil is in transport, heating and power generation. The aim he said is that we should start preparing and greatly increase the building standards, to decrease our heating requirements and eventually we should go for fully passive (solar) heating. For transport he says we should be changing our planning laws to basically reduce urban sprawl as it is the most critical energy. He pointed out that our oil consumption rose 150% in the last 15 years. He even mentions encouraging more broadband usage for adding flexibility to commuting to work.

Unfortunately what he failed to acknowledge here is that there is already massive urban sprawl, a good deal of which was built during the previous 10 year boom in Ireland and that we are saddled with this infrastructural millstone. Indeed in a separate programme 'Primetime' sometime back on RTE, it was revealed that the current upgrading of building standards had been stalled for a few years, right in the middle of the boom, during which time at least 100,000 houses were built at the old standard. This had come to light via a Freedom of Information request where the stalling was discussed in a internal dept memo.

(Back to Interview) Overall Eamon Ryan the Green minister stated that Peak Oil is going to be a huge challenge and by referencing the Hirsh report stated that preparation should have begun 20 years ago and outlines how he is trying to get all party (i.e. broad) political support to tackle this issue long term.

In the rest of the program, Kenny brings up Nuclear, but Ryan says this won't help for transport, so Kenny mentions the nuclear power could be used to generate hydrogen gas, but again he didn't hit this infeasible fallacy on the head but it seems clear from the time spent discussing it, that the pro-nuclear lobby are lurking in the background and are determined to force Ireland down this path.