UK Energy Security

Posted by Euan Mearns on July 26, 2007 - 10:00am in The Oil Drum: Europe

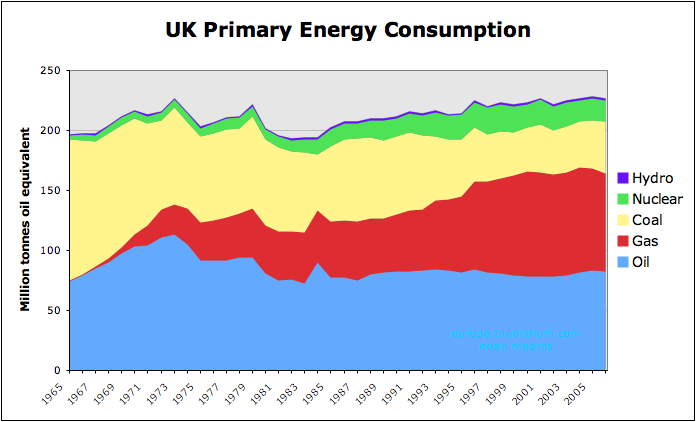

In 2006, 92% of the primary energy consumed in the UK was derived from fossil solar fuels - oil, natural gas and coal.

Not so long ago the UK was self sufficient in these energy resources but now we are importing increasing amounts of all three.

Dependency upon imported energy undermines UK national security and will have potentially dire consequences for the balance of trade.

UK Primary Energy Consumption - basic statistics

A beneficial attribute of the BP annual statistical review of world energy (used throughout this report) is that it shows primary energy consumption for the 5 principal energy sources normalised to millions of tonnes of oil equivalent. This eases comparison of energy consumption from oil, natural gas, coal, nuclear and hydroelectric power as shown for the UK (click all charts to enlarge).

In 1965 (when BP records begin) 98% of UK primary energy was derived from burning fossil solar fuels for transporation and power generation purposes. By 2006, the proportion of fossil solar in the energy mix had fallen marginally to 92% - largely due to an increase in nuclear energy.

In this period, the energy mix has changed significantly. In 1965, no natural gas was used. But with the discovery and development of offshore natural gas in the North Sea, the proportion of natural gas in the UK energy mix has increased steadily since 1968 largely at the expense of burning coal.

In 1965, the UK population was 54,350,000 and this had grown to 60,245,000 by 2005

This equates to 3.6 tonnes oil equivalent per person per annum in 1965 and 3.8 tonnes oil equivalent per person per annum in 2005. UK per capita energy consumption has been essentially flat in the period. Energy efficiency gains in transportation, building standards and in more energy efficient appliances have been lost to an overall rise in living standards and more prolific use of energy in transportation, single occupancy dwellings, foreign travel etc.

Each person in the UK uses on average 10 kgs of oil equivalent energy every day. The main message of this post is that it is in the vital national interest that this profligate level of energy consumption (and waste) is substantially reduced.

I will now look at the oil, natural gas and coal production and consumption records for the UK for the past 40 years and show how swings from deficit to surplus and back to deficit have affected our overall balance of trade. I will also examine oil and gas production forecasts for the period to 2012 and project how this will affect the trade balance and energy security.

Oil and gas prices

Historic average annual oil and gas prices are lifted from the BP statistical review. Inflation adjusted prices based on 2005 $US have been used.

Future oil and gas prices are of course impossible to predict with certainty. However, as a central aim of this post is to illustrate the potential impact of energy imports upon UK trade balance it is essential to make assumptions about future energy costs.

Future oil prices are based upon the oil price model presented here. This translates to an average 16% increase per annum to 2012.

| Year | $US / barrel |

|---|---|

| 2007 | 70 |

| 2008 | 80 |

| 2009 | 90 |

| 2010 | 110 |

| 2011 | 130 |

| 2012 | 160 |

Future gas prices are based on a 5% annual increase as shown below. BP quote gas production figures in BCM (billions of cubic meters) whilst prices are quoted in millions of BTUs (British thermal units). To convert, from BCM to BTU millions the former is multiplied by 36 million (see sheet on conversion factors in the BP review).

| Year | $US / million BTU |

|---|---|

| 2007 | 7.4 |

| 2008 | 7.7 |

| 2009 | 8.1 |

| 2010 | 8.5 |

| 2011 | 9.0 |

| 2012 | 9.4 |

Future price estimates do not include adjustment for monetary inflation or changes in exchange rates.

It is taken for granted that some may view the future oil and gas price estimates as too high whilst others may take the view they are too low. Future price estimates are presented for illustrative purposes only.

Oil

The historic oil production and consumption data shows large UK oil imports pre 1976. Once North Sea oil production got underway, imports were gradually reduced until in 1981, the UK became a net oil exporter. The UK remained an oil exporter until 2005. But in 2006, with falling production the UK once again resumed importing oil.

1.74 million barrels per day is a key figure for the UK as this represents the approximate level of daily oil consumption. If we produce more than this amount we can sit back and relax in the sure knowledge that our oil needs can be met from domestic supplies. Less than 1.74 million barrels per day means that the UK must compete for oil imports in the increasingly competitive world oil export market.

What will happen next? Three oil production forecasts are shown:

The first is by Alex Kemp who is Schlumberger Professor of Petroleum Economics at the University of Aberdeen. Professor Kemp has recently been appointed as energy economics advisor to the Scottish Parliament. The details of the Kemp forecast can be found here.

The second is by myself (Mearns2) the details of which can be found here and here.

The third is by the UK Department of Trade and Industry (DTI) who have responsibility for compiling UK oil and gas production forecasts and reporting those to the UK government. The DTI produce a forecast range. The upper range boundary is more or less coincident with Kemp whilst the lower range boundary is more or less coincident with Mearns2. Given this coincidence, the discussion will only consider the Kemp and Mearns2 forecasts.

The key difference between the Kemp and Mearns2 forecasts is that Kemp sees production rising this year and next and this mainatins the UK oil exporter status for a few years yet. The Mearns2 forecast sees the UK as a permanent oil importer with annual production declining at a rate of around 8% per annum.

The impact these different forecasts have upon the UK trade balance is quite profound. At times of high oil prices, oil exporters are handsomly rewarded whilst importers are penalised. The falling production and rising oil price implicit in the Mearns2 model shows the UK oil trade balance plunging from a surplus of over £5 billion in 2000 to a deficit of over £20 billion by 2012.

Which forecast is more likely to be correct? Only time will tell. Near term, the biggest impact upon UK oil production is the giant Buzzard Field that came on stream in January 2007. Production from Buzzard has pushed the UK into oil surplus for the first 4 months of the year according to the DTI Table et3_10 (XL spread sheet). However, oil and NGL production was 3.8% lower for Jan-April compared with the same period last year and I calculate an average daily production rate of 1.74 million bpd which is bang on UK average consumption levels and slightly higher than my forecast of 1.67 million bpd for the full year. Offshore maintenance programs combined with the relentless impact of decline means that production during the first half of the year is normally higher than during the second half and I would judge that my forecast for the full year is looking good.

Natural gas

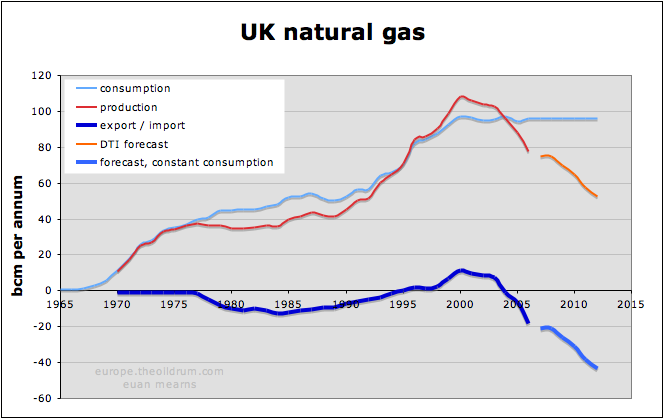

Offshore natural gas production in the UK got underway in earnest around 1968. Production grew steadily for over 30 years and peaked in 2000 and since then gas production has fallen, gradually at first, and then accelerated decline since 2003.

Up until around 1995, most domestic gas production was consumed within the UK. Domestic gas production was allowed to substitue for coal in home heating and in power generation resulting in cleaner air in our cities and helping to solve the acid rain problem associated with burning sulphur rich UK coal in power stations. Up until 1995 the UK also imported North Sea natural gas from Norway and Holland. But then in an extraordinary bout of bravado, the UK exported gas for a brief spell between 1996 and 2003.

The UK has become hooked on natural gas for home heating and power generation and with plummeting production faces serious issues in securing future supplies. The production forecast is the DTI median forecast and combining this with assumed constant consumption produces an import requirement of over 40 bcm per annum in 2012. It is by no means certain that consumption will stay constant as new gas fired power generation plants are still being sanctioned and built!

The UK has pinned future gas supplies on a two pronged strategy. The most important strand is the new Langeled pipeline to Norway. This is the world's longest sub-sea pipeline starting at the Ormen Lange gas field off Mid Norway and ending in Easington, Yorkshire in the UK. At its peak, Ormen Lange will produce around 22 bcm per annum or around one half of the projected UK import requirement in 2012. It has to be noted that the UK will compete with continental Europe for Ormen Lange gas.

The second strand is to import liquified natural gas (LNG), especially from the North Field in Qatar. The UK will have to compete with the whole of the natural gas importing world to secure these supplies. Three terminals have been built:

The Isle of Grain with import capacity of 4.4 bcm per annum

Milford Haven (Dragon) with import capacity of 3 bcm per annum

Milford Haven (South Hook) with initial import capacity of 10.5 bcm per annum

The combined LNG capacity of 17.9 bcm per annum plus Ormen Lange capacity of 22 bcm per annum provides the magic number of 39.9 bcm per annum compared with the projected import requirement of 40 bcm per annum by 2012. So long as no one else wants that Norwegian and Qatari gas the UK should be OK.

UK government sources report Isle of Grain at 5 to 15 bcm per annum and Milford Haven at 10 to 25 bcm per annum.

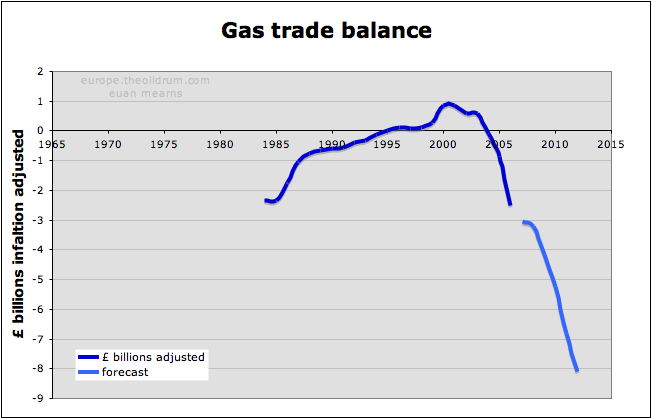

Whilst there may be doubts about the availability of gas for import to the UK, there seems to be unanimous agreement on the fact that the UK will have to import ever increasing amounts of gas for the foreseeable future and the imapct this will have upon the trade balance is shown below.

A surplus of £1 billion in 2000 is converted to a deficit of £8 billion by 2012. Note that this model assumes no growth in domestic gas consumption and a relatively modest increase in gas prices. There is also the possibility that the DTI forecast for domestic gas production proves over-optimistic.

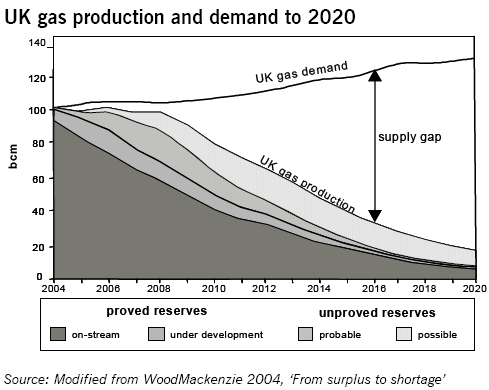

This chart taken from a UK government report shows gas demand increasing to 2020 and a gas import requirement of 100 bcm per anum.

How many LNG cargoes is that? LNG ships have current capacity of around 2.8 bcf. That translates to around 0.07 bcm, suggesting that the UK alone would require around 1400 LNG deliveries per annum to meet this import requirement.

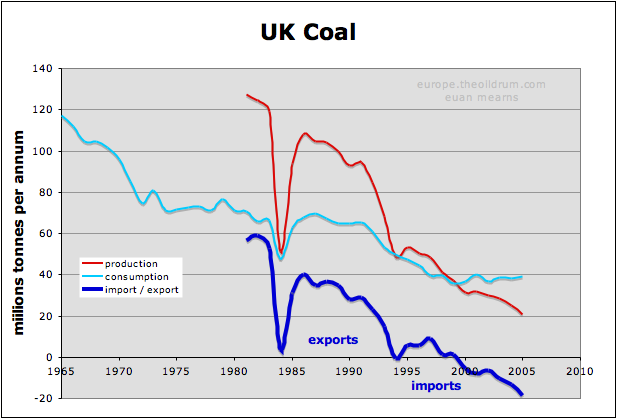

Coal

Back in 1965 (when BP records begin) coal accounted for around 60% of UK primary energy consumption and most of that was met by domestic supply. Both domestic production and consumption of coal fell steadily from 1965 to 1999 when coal accounted for only 16% of UK energy consumed. The spike down in 1984 represents the miners' strike. Since 1999 coal consumption as a percentage has once again begun to rise and in 2006 it represented 19% of the UK total.

So much for the UK government's feigned concern about global warming. Faced with the choice of switching off the lights, saving the planet and reaping the anger of the electorate, the UK government has made the pragmatic decision to keep the lights on, come what may, whilst voicing concerns for the welfare of polar bears.

In plotting these data I was somewhat surprised to see that the UK was once a significant exporter of coal and need to note that the production / consumption figures in tonnes do not agree with the BP data when transformed into BOE as shown in the next diagram. This shows the UK as a net coal importer since the 1980s. The trends, however, are the same, and show increasing dependence of the UK upon imported coal.

We have had much debate recently on The Oil Drum about the status of UK and Global coal reserves. See for example:

The Coal Question and Climate Change

Coal reserves and resources - a gentle cough

I tend to side with Heading Out on this debate and take the view that the UK has substantial deep coal resources that are uneconomic in the current economic and political climate. I think this climate is about to change and that a soaring energy trade deficit (see below) will result in a political decision to subsidise new deep UK coal mines in order to protect UK energy security and mitigate the plummeting trade deficit.

Energy and Trade Balance

Pulling all the data together for oil, gas and coal with nuclear and hydro provides the following picture of the overall UK energy balance. Note that following consultation with Jerome, I have shown nuclear as domestic supply due to the fact that the cost of importing uranium is a negligible part of the total cost of nuclear power (this is open to debate).

What we see is that during the 1960s and 1970s, the UK was a major importer of energy, mainly oil. At that time oil was cheap and the UK had a large manufacturing base, exporting goods all over the world. Trade back then was balanced (see below).

The advent of North Sea oil and gas resulted in a golden era of energy surplus from 1980 to 2004. However, with falling North Sea oil and gas production the energy balance is now plunging back into the red. So are we to return to the circumstances of the 1960s and 1970s? The answer is no! Back then energy was cheap and plentiful and the UK had a major manufacturing and export base. International energy supplies are now increasingly expensive, increasingly scarce, sourced from increasingly hostile geographic and political environments and our economy has lost much of its manufacturing export base that once enabled us to pay our way.

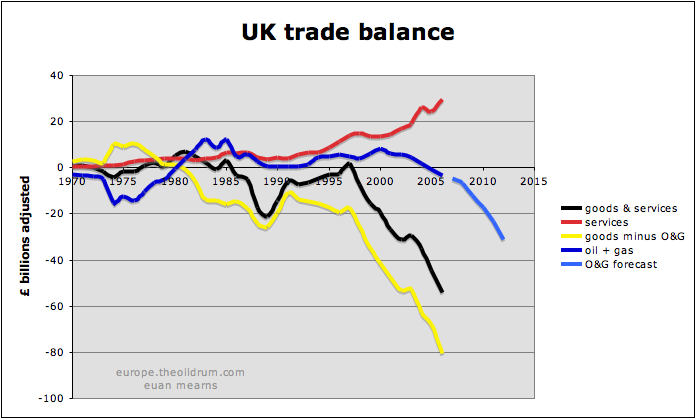

The UK trade balance has 3 main components: 1) goods, 2) oil and gas, and 3) services. The latter is made up mainly of financial services channelled through the major finance centres of London and Edinburgh. The chart is compiled from official government statistics using table 300570782. I have deducted oil and gas receipts from the goods column (IKBJ) to provide a separate picture for goods (less oil gas) and for Oil & Gas receipts.

From 1980 to 2004, the rapidly deteriorating trade deficit in goods was partly offset by surpluses in services and Oil & Gas. The Oil & Gas surplus, however, has now disappeared and the deficit looks set to get much worse as shown. The trade deficit of £54 billion recorded in 2006 looks set to hit £100 billion per annum by 2012.

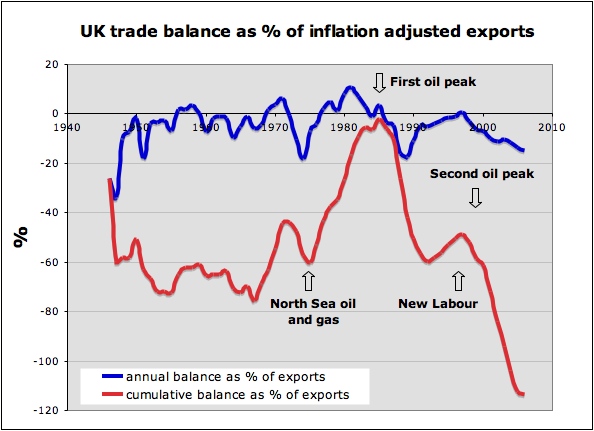

The government and main stream media (MSM) appear to be extremely sanguine about these eye popping numbers and one reason is that the deficit normalised to the size of the growing economy is much less significant.

In percentage terms, the annual deficit is no worse now than on occasions in the past. The absence of a period of surplus for the last 20 years, however, is resulting in the cumulative deficit expanding. Can the cumulative deficit be allowed to expand forever and how will it be repaid?

One of the main points of this post is to point out that rising North Sea oil and gas production rescued the UK trade balance during the 1980s and 1990s. The solution then is the problem now. Ballooning energy imports are set to make deterioration in the trade balance a whole lot worse.

Government response

The UK government is fully committed to private companies running our energy production and energy distribution industries and to a large extent our transportation infrastructure. These companies have one motive and that is to maximise turnover and profits via the eternal growth paradigm. The government tends only to interfere at the margin via regulation, taxation and occasionally setting strategy.

In recent years the government has:

1. Supported a massive expansion of UK airports

2. Supported on-going expansion of the road network

3. Shied away from increasing taxation on energy consumption

4. Introduced and then doubled windfall taxation on the profits of North Sea operating comapnies

5. Prevaricated about climate change, conservation and renewable energy without taking any decisive action.

The whole energy debate is shrouded in a carbon dioxide mist whilst the main thrust of policy has been to encourage the expansion of fossil fuel based transportation and to penalise the energy producers. The measures supported by the government are in my opinion the exact opposite of what are required to provide greater energy security for the UK.

What needs to be done?

The answer here is very simple. Domestic energy production should be maximised whilst energy consumption should be minimised. The strategy needs to be set within the context of national interest and energy security instead of being obscured by the fog of climate change.

1. The primary energy policy goal should be for the UK to remain in balance with respect to primary energy production and consumption.

2. To achieve this, domestic energy production should be expanded and in the near term this will inevitably mean expanding domestic coal production, nuclear energy and renewables with proven high ERoEI which for the UK means hydro electric and wind power.

2b. Construct a network of combined heat and power generators running on combustible domestic, industrial and agricultural waste.

Expanding these energy sources will unlikely replace the decline in domestic oil and gas supplies and the other side of the equation is conservation.

3. Meaningful energy conservation measures requires a clear and detailed understanding of where most energy is consumed by our society and a first step to conservation should be to audit our energy consumption patterns. Where is most energy being wasted and where can the easiest and least painful conservation measures be made? I suspect that government buildings (schools, hospitals, government housing and offices) and industry are profligate wasters of energy.

4. Set staged targets for per capita energy use reduction and identify stategies to achieve them. This must be linked to the primary objective of achieving energy balance which will likely require large incisions to be made in energy consumption.

5. Cars / automobiles are an obvious target and I would advocate aggressive legislation on motor efficiency that will inevitably mean reduced engine size, power and weight.

6. The strategy for cars should combine with a strategy for phased electrification of the automobile fleet and a proper evaluation / feasibility study of implementing V2G (vehicle to grid) technology combined with expansion of renewable energy sources.

7. Electrified mass transit systems should be built where possible.

8. Encourage pan-European taxation of jet fuel.

9. Legislate to discourage single occupancy dwellings and to encourage multi-occupancy. This has the added benefit of solving the apparent shortage of housing and will save the enormous energy cost of building millions of new homes.

10. Legislate to upgrade building standards for homes, industry and public buildings including the incorporation of micro renewables. Enable the upgarding of the existing building stock to improve energy efficiency - ensuring all the while that measures introduced do actually result in significant energy savings.

11. Audit our food production and distribution systems. Legislate in favour of energy efficiency which will inevitably limit choice. Ensure the energy infrastructure exists to guarantee our future food supplies.

12. Mount a public awareness exercise aimed at informing the public about decisions about energy use that are to be made on their behalf and their best interests.

These may seem draconian measures but they are in fact intended to provide a "business as usual model" for the UK based on using significantly less energy. There will inevitably be certain business casualties. But many new business opportunities will also be created.

The alternative may be to face real energy shortages in 2 to 8 years time when the anticipated supplies of imported natural gas and oil do not appear. Energy shortages combined with spiralling energy costs and energy import bills may paralyse our economy.

Two interesting links sent to me this morning by the DTI:

Digest of United Kingdom Energy Statistics 2007 (large pdf)

Both published by the Department for Business Enterprise and Regulatory Reform - BERR - previously DTI?

Hi Euan,

Very thorough work!

You say that "In 1965, the UK population was 54,350,000 and this had grown to 60,245,000 by 2005" and that "The main message of this post is that it is in the vital national interest that this profligate level of energy consumption (and waste) is substantially reduced."

Energy consumption is directly related to the population.

Given your graph on "UK Energy Balance" showing a worsening energy balance, do you think that, under your heading of "What needs to be done?", there should be another recommendation something like this

There appears to be a movement towards slower population growth rates

UK needs a two-child limit, says population report

http://society.guardian.co.uk/children/story/0,,2123344,00.html

However, I appreciate that any discussion about population limits can be unpopular

World Congress of Families Outraged by UK Group that Wants to Limit Family Size

"They Want the British to Commit Demographic Suicide"

http://www.associatedcontent.com/article/319041/world_congress_of_famili...

For those interested, the report on the two child limit was produced by the Optimum Population Trust

http://www.optimumpopulation.org/opt.media.html

A quote from their news release

“Without action, longages of humans – the prime cause of all shortages of resources – may cause parts of the planet to become uninhabitable, with governments pushed towards coercive population control measures as a regrettable but lesser evil than unprecedented conflict and suffering.”

Ace - population and demographics are of course vitally important to this debate.

It is not just the number of children that couples have but the age they are determines population growth. If couples wait till they are over 30 then you have 3 generations per century. Under 20 and you have over 5 generations per century. The UK has the worst record in Europe, I believe for under age teenage pregnancy.

The UK (along with many OECD countries) has a major problem at present with an ageing population. The governments concern is how to pay for pensions and caring for the elderly. And so they are encouraging immigration from Eastern Europe. At a personal level I think this is a great thing - we have loads of young, well educated and motivated workers comming to the UK. This of course boosts our population.

The government has pursued two policies in recent years that arguably have a negative impact upon our per capita energy consumption. One is a policy of caring for the elederly at home. At a human level this is a wonderful policy. But with millions of single old folks sitting at home alone all day with the heating full on (paid for by government) watching TV sure uses a lot of energy. It also keeps these dwellings off the housing market - creating a housing shortage and the need to build millions of new homes.

The other is education policy where Tony Blair decided that 50% of UK youngsters should attend university. This has resulted in a large migration of youngsters from country areas into the cities where they end up living alone in 2 bedroon flats - millions of which have been built recently. Previously they may have stayed with parents longer in the family home.

The role of religion in shaping world population growth also needs to be critically examined. The world population clearly cannot go on growing for ever. Right now I beleive a major famine is just around the corner.

[begin sarcasm]

Doomer porn! Doomer porn! How dare you bring such stuff into the holy of holies that we call TOD!!!!

[end sarcasm]

In truth, Euan, I agree with you on that statement too. The grain situation for the last 8 years has not looked very good at all as we've plunged from just over 100 days of global grain supply to about 50 days of global grain supply. Given that 7 of the 8 last years resulted in drawing down stocks of grain and in that time we've cut our stocks in half, we are literally 8 years away from famine if present trends continue.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Cereal Killer

This chart suggests cereal stocks reaching zero before 8 years. A topic I think we need a detailed look at. Stuart was working on a post but has gotten sidetracked - definitely a subject to pursue though. I was also interested in the comments of Ziz down the thread about fertilizer production being concentrated in the ME. This makes sense but doesn't half open up a major pile of security issues.

Isn't most grain used to feed livestock?

Couldn't we reduce our per-capita grain consumption by about 80% by going vegetarian?

Ya, enjoy those burgers and steaks while you can.

Euan,

thanks for a stark and devastating analysis of our future - or lack of it.

The significant graph is to my mind, the balance of payments. While many cannot or will not see the impact of a Hubbert curve, the balance of payments dropping off a cliff will get attention with any politician.

Regarding population.

IMO: The UK is full up. We could not easily feed ourselves in 1917 or 1943. Feeding 60+ million is impossible.

More immigration both legal and illegal is simply going to be grist to the BNP mill and, as the economy declines, the BNP will be fast off the blocks with 'the answer'. To all who will not face this fact, I say this: The lifeboat is full. It is better to face this now than see a BNP government returned in 2013 or 2018. (My feet are too old to wear jack-boots, though I suspect I may find myself on the wrong side of the razor wire :-(...)

Regarding the costs of switching to alternative transport modes , building Nukes, alternative energy systems etc.

We are truly between a rock and a hard place.

Externally, we will be competing for resources with other countries. As well as oil and gas, this will include food staples

Internally, we will have competing claims on a dwindling wealth. 60% of UK 'wealth' is in housing which is merely a halucination. Competition for the wealth will come, (and simultaneously) from Rail Infrastructure, Nuke building, a burgeoning unemployment sector. This is without even considering the costs of continuing in Iraq and Afganistan, Trident replacement, our two new carriers and of course the trippling costs of the Olympics. Also throw in these costs:

Unfunded public sector pensions, the cost the ID card system, and any not yet recognised contingencies.

It may also be reasonable to assume that the billions lost in our summer of floods may be a more recurrent feature of life in the UK.

In short the charges on the ever diminishing purse will increase. As we speak, the UK is highly taxed and there is not much more margin for such increases.

The fact that we no longer sell manufactured goods but in fact now derive the bulk of our wealth in the City of London from share swapping, hedging etc means that as we go into recession and these spurious methods of earnings become increasingly fallacious both in the UK and in our dealings with the rest of the world suggest a shrinking tax base at a time of increasing demands upon that same tax base.

In short, wealth will be sucked out of the UK so fast, our ears will pop and the money required for nation saving projects will just not be there.

Forget pensions, care in old age, expensive medical care etc. These other huge charges on the state will evapourate.

I think we are too late.

God, this makes me so bloody angry.

How was the pizza by the way :-)

Even more worrying - if you look at the population pyramid of the UK:

http://www.statistics.gov.uk/populationestimates/svg_pyramid/default.htm

you will see that post '67 there was a MASSIVE drop in birth rate to BELOW maintenance level. I assume this is birth control. Therefore 1965/54 million should now be more like 45 - 50 million.

We have seen 15 million recorded [and the UK gov is famous for not recording the full numbers] immigrants. Hell, we could have a sustainable forest each and zero unemployment if it wasnt for this massive influx. And the flood is increasing yearly

Zero unemployment is impossible:

- Fringe unemployment: people who change jobs for any reason, voluntarily or unvoluntarily don't have an occupation in between.

- As soon as labor becomes short in supply, owners either automate, outsource or abandon their production.

Thanks Euan for a very interesting post.

I suspect that there may be a very quick upswing of interest in underground coal gasification in the UK. It has the potential to turn those deep underground coal seams into oil and gas. Some companies believe they've got the technology mostly right and are working on scale-up.

Does anyone here have some direct knowledge of this technology ?

I have worked on aspects of this in the past.

HO

Euan - a magnificent piece of work which should be required reading for every single important decision maker in the UK. As an initial entrypoint I suggest e-mailing it to the various Party energy spokespeople (you can forego the BNP - irony of ironies they are well switched on to the problem) and to the various economics editors of the relevant UK papers and magazines.

Well done!!!

A fantastic article. If only our nation could understand.

One thing that's always annoyed me is that we in the UK have relatively short commutes (At least compared to the US), and, importantly, a high-voltage, high power domestic electric supply. Plus a relatively mild climate.

This makes the UK one of the best places to try rolling out electric cars (Certainly better than, say, California), so what on earth is stopping them..?

It would require a 10-fold expansion of Nuclear plant capacity, but this does not seem to be a vast challenge. I remain appalled by some 'Green' groups that

Another part of the solution is general domestic electrification - the current system of having domestic energy heating and cooking met by natural gas 'locks in' quite a bit of consumption. And I think that natural gas is a much worse problem than oil for the UK.

"This makes the UK one of the best places to try rolling out electric cars (Certainly better than, say, California), so what on earth is stopping them..?"

Exactly correct, but I think your calculation of what would be needed to convert a sizable portion of the British car fleet to electric is incorrect when you say..."It would require a 10-fold expansion of Nuclear plant capacity, but this does not seem to be a vast challenge."

Why? The cars would be recharged mostly at night, meaning on off peak power....I still do not think that most people understand how much spare electric generating capacity most modern countries have at "off peak" times, which is most of the time! Toyota is now road testing it's first "plug hybrids", full "roadworthy" certification given by the Japanese government. This, folks, is radical news. In leaving behind the old primitive ways, we are getting ready to cross the Rubicon...

Another issue is methane recapture. the U.K. is up to it's bloody ears in cows and humans all of which do one thing well.....crap. As the EROEI fanatics will tell you, you can not run an economy on it's waste (it's like a snake trying to consume itself from the tail forward), but you can salvage a great deal of energy from waste that is going to occur anyway....farm, landfill, and sewer methane recapture should be a major effort in a country that will soon have to import so much natural gas, and in which every BTU will count.

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

Hi Roger,

its only off-peak power because we arent using it. If you timeshift the load to 100% utilise grid cpacity then there is no off-peak..

as for electric heating [post 2 above] the energy used nowadays would blow the grid in winter. 60 years ago UK heating was coal, and you heated 1 or 2 rooms midwinter. I grew up with it, and outside toilets. You would have riots if you tried that comfort level again.

Mind you when you cycle everywhere, a roof and walls seems like luxury..

Pondlife -

Actually, the average Combi boiler seems to be rated at 24kW, which is probably an over-estimate of the needs for electric heating - it's possible to have it on longer at a lower level.

''60 years ago UK heating was coal, and you heated 1 or 2 rooms midwinter. I grew up with it, and outside toilets. You would have riots if you tried that comfort level again.''

Did you also scrape the ice off the inside of your bedroom window? ...

If we could guarantee even that minimum level of existence in the future, I would weep with joy. And yes, that was with 50 odd million , not 60 million + people.

Something else:

To house and keep a family now takes two wage earners. (isnt progress a wonderful thing?). 60 years ago, a respectable skilled job would feed and house a family (taxes did not start so low down the wage scale as now). What did this mean? It meant that the wife and mother could function at home and concentrate on a level of thrift and efficiency unknown today.

As a student I remember the glass of water I always have by my bed (in case of emergency dehydration) freezing once.

The toilet was not outside - but shared on the landing.

When I moved to Norway in 1983 all we could afford to eat was bread and soup for several months. And the joys of home brewing:-)

home brewing followed by cold distillation?

Ice cold in Oslo.

Well 'ave a 'appy 'oliday.

Superb example of joined up thinking:

http://news.bbc.co.uk/1/hi/scotland/6918637.stm

Charges 'threaten' green energy

Campaigners are concerned wind farm plans could be affected

Plans to increase charges to remote generators could undermine renewable energy schemes in Scotland, according to campaigners.

Electricity regulator Ofgem said it was "minded to" back changes to the cost of transmission losses.

Generators nearer cities and areas of high demand, which have least losses en route to users, would pay less.

Opponents fear the changes would discriminate against projects such as wind farms in the north of Scotland.

They are concerned that such a move would encourage firms to locate in the south of England instead.

Ofgem said the scheme could lead to an overall saving of about £15m annually.

£15 MILLION...

You just couldnt make this up.

Symptomatic of why we wont make it.

This is still a consultation - see the Ofgem website. Responses to be in by 31 July. I have emailed them:

"I have just been made aware of this consultation by an article in The Scotsman.

This proposal seems to decrease the attraction of developing the richest

resources of renewable power in the north of the UK.

The oil and gas resources in the North Sea are depleting rapidly, and the UK

is returning to being a major importer of oil and gas. There will be a

significant adverse effect on the UK balance of payments as a result.

Everything possible should be done to encourage the rapid development of all

our indigenous energy resources, especially renewable resources in the

north. This proposal does not give such encouragement, and indeed may go in

the opposite direction.

The underlying reasoning certainly makes sense when considering power that

is generated by burning fuel, and especially if such a fuel produces CO2. It

makes less sense where the fuel cost is zero, and has no direct CO2

emissions, as with wind and tide generated power.

The transmission loss charges should be reduced for renewable power produced

by wind and tide, as some of the richest resources are located far from

consumers.

If the powers that Ofgem presently have do not allow for such discrimination

then Government should legislate to grant such powers."

I drive a small electric car (its a converted Rover Metro) in Coventry. I charge it (usually) at night.

There's a small degree of curiosity but in the main, people do not notice it because it is not big and powerful and cool.

I think the barrier to EVs (at least in my community) is that people have much more regard to their social status than to econonomic or environmental considerations.

most people, therefore, could not countenance giving up their large, powerful petrol car because of the drop in perceived status and road presence.

The will only change to EVs when a really clear signal (I mean totally unambiguous) tells them that it is the fashionable thing to do.

At the moment they aspire to 4 litre blacked out Range Rovers.

Carbon - Coventry UK

Hi Carbon,

Did you convert the car yourself or buy it like that?

What are the Tax, MOT & law implications?

I converted my mountain bike to electric assist as an experiment ... I'm not sure it's stricly street legal at 900W but goes like a rocket for around 5 miles or so until the nicads run flat.

I agree about the status thing ... but actually the only person who cares what car you drive is you! I persuaded my company to let me have expenses instead of expensive company car and had a more appropriate SMART car instead ... everybody accepted it ... but sadly none copied it! More fool them, I saved thousands of pounds in company car tax evey year ... to say nothing of the petrol.

Xeroid.

Hi Xeroid

I bought it from AVT http://www.avt.uk.com/ It was second hand and the batteries were dead. I rewired the car and welded in some new battery frames to fit 6V golf cart batteries instead of the original 12V batteries. You can find my car on this site http://www.austinev.org/evalbum It'll be the only Rover Metro in Coventry. I think you could put your electric bike there if it isn't there already.

I pay normal-ish for car insurance, but nothing for road tax.

I think AVT do an electric Smart car! The original Smart car is already pretty good though.

It was this site that made me do it!

Carbon - Coventry UK

Thanks for that Carbon, I'll do some more research.

Andytk, I totally agree about the batteries ... the reason people buy second hand cars is because they are cheaper than new ... if they potentially have the cost of new batteries people won't buy second hand even. The whole point of Peak Oil is that it isn't business as usual, changes to lifestyle WILL be made.

I think if Euan's work above is anywhere near correct it is a mistake to think that the fuel will be available to do 200 mile trips ... the petrol engine won't be a cost effective alternative.

So, IMO the options will be public transport (long & short distance), electric personal transport & bikes (short distance) or walk (local). The oil will largely be reserved for agriculture and the military. Eventually, no aeroplanes or long distance holidays either!

Xeroid.

My guess for Sweden is a fallback to a 1950:s middle class ideal. Monday - friday bicycling or a scooter to school and work or some collective traffic if it is a long way. For weekends a car in the garage and a visit to more distant friends, relatives, boat or cottage. If plug-in hybrids work out a large part of the commuting will be by car instead and the attractive area around large workplaces or collective traffic nodes will be much larger.

Parts of the 1960-2000 devlopment running in reverse due to changing market conditions will probably be a much faster change then 40 years since we now have much better infrastructure and a lot of the basic parts of the old structure are still there.

I agree. The 50's with TGV and Ipods.

No, you're wrong.

Many families in the UK only have one car (and indeed parking space for one car).

As such it must do everything that their car will ever be called upon to do.

This means that it must retain the ability to travel 200 miles or more and then be refilled in 1 minute before travelling another 100 miles.

How many people would willingly pay thousands for a new vehicle that will only travel 60 miles on a charge? History has proven time and time again that this number of consumers is incredibly limited.

Believing any different does not make that the case.

And that's before I touch on the issue of modern batteries inability to stand up to even 5 years worth of traction duties. I'm willing to bet that you're homemade EV will need its batteries replaced before they're 5 years old (unless your only travelling 5 miles a day, in which case I concede they may last a decade).

Again with the high cost of batteries, the average consumer will simply not put up with them failing every 5 years or so.

Especially when there is a cost effective alternative. The petrol engine...

Andy

Andytk -

Depends where you live; in my block of Suburbia, 2 cars is standard. Replacing one with an electric would involve no sacrifice at all.

There is no particular reason why such cars can't get 200+miles to a charge. The real reason electric cars have not sold as much is because of the noddy designs.

For 1-car households, it would be harder.. but you would have to make some major improvements to the rail network alongside the electric car scheme, so people who made long journeys a few times a year could take the train. If petrol reached £3-4 per liter, the economics would make sense for a lot of people.

As far as the batteries go, I would expect that people would have a 'battery insurance policy' alongside other insurance, allowing for the replacement of batteries as problems happened.

Hi,

The reason for the Nuclear expansion would be to do with the need to replace NG-fired generation, as well as increased usage due to electric cars and higher home usage.

Obviously, off-peak charging would be useful - maybe even with a smart meter, allowing the power company to remotely switch car chargers on and off to balance demand.

Off peak is only really helpful if it's non fossil (or baseload, anyway, depends on how urgent GHG-reduction is). Running peaking Gas plants full time to charge electric cars really would not help the UK.

Interestingly, if you have a situation with lots and lots of off-peak power, you can start using that energy to drive the transformation of fixed carbon - be it wood, paper, plastic, sewage, whatever - into viable liquid fuels. But that would require central planning, which I'm told is no longer allowed.

I would add replacing gas heating and electric cooling of individual houses in towns and cities with district heating and district cooling run with power from combined heat and electricity plants that also run absorbtion chillers. These plants can burn garbage, fossil fuel, biomass and in very large areas when the systems have been enlarged for 20 years nuclear power.

Another good technology for UK would be biogas.

Thanks Magnus - I knew I'd forgotten something important. I've added 2b.

...... and as an island nation - surrounded by all those waves - something like ........

CETO

I left wave and tidal off deliberatlely because I am not convinced they are viable. I'd need to see some ERoEI data and long term load capacity data before being convinced.

I'm concerned about marine fouling and maintenance of sea - based systems and their destruction in storms.

Show me some convincing data and I'll add it to my list - I watched the 2.6Mb CETO anaimation and was underwhelmed.

Euan,

I like your report but I think that you really need to read George Monbiot's book Heat. He focuses on the UK energy situation and has very thorough documentation. He points out that the wind resource in the UK is reliable and has a very large potential. It went from 1 GW production in 2005 to 2 GW this year, a very rapid growth rate. His ideas on the UK housing stock are also very interesting. You may want to adopt some of his recommndations in future work. Relying on BP for data on renewables that they don't invest in may be a problem. The British Wind Energy Association may be a help to you. I kibitz on Monbiot's ideas a little here.

mds - I bought Heat some time back but (might even have got a complimentary copy) haven't read it yet. I'm off on vacation next week so I'll take it with me.

He can be a little snippy, but I think you'll enjoy it.

Chris

Maybe not the detail required, but have you read this?

http://www.foe.co.uk/resource/briefings/severn_barrage_lagoons.pdf

regards

well not britan per se, but the bay of fundy in canada IIRC could put out 30GW continuously if it had dams. (something about how it is shaped like bathtub)

Would obviously fsck up the tidal ecosystem, but that's not important to us anyways.

Wave generators are a bit iffy to me, even in strong swells, how much power can you expect? and the lifetime of the generators! (being in the water, and saltwater at that!)

Hi Gilgamesh,

I don't think it's quite that high. Nova Scotia Power suggests it would be closer to 300 MW.

Source:

http://www.nspower.ca/about_nspi/in_the_news/2006/05162006.shtml

Interestingly, the EPRI study referenced above has "extractable" power coming in at about half that amount (Figure 3), plus an additional 15 MW from neighbouring New Brunswick. Estimated annual energy output would be 1.1 TWh in the case of Nova Scotia and 64 GWh for New Brunswick.

Source:

http://www.epri.com/oceanenergy/attachments/streamenergy/reports/008_Sum...

Cheers,

Paul

Hi Magnus,

With respect to district heating and cooling, the following video is a great resource:

http://www.youtube.com/watch?v=klooRS-Jjyo

Re: improving the energy efficiency of the U.K.'s housing stock, this Channel 4 presentation is "top shelf":

Part 1: http://youtube.com/watch?v=ylUv1Ftsx3k

Part 2: http://youtube.com/watch?v=N5nAhDm-biM

Part 3: http://youtube.com/watch?v=PHKPfjHS6gI

Part 4: http://youtube.com/watch?v=o7ocOYjOU2U

Part 5: http://youtube.com/watch?v=cenOhcsNjV8

Part 6: http://youtube.com/watch?v=2tfOIBN5IJg

(I hope I have these segments in proper order.)

With a tip of the hat to Alan, best hopes for conveying the message in ways all can easily understand.

Cheers,

Paul

I watched the first video - very good!

Thanks for posting these links.

And thank you, Euan, for this important contribution to the Oil Drum.

I'm obsessed with heat pump technology (both geothermal and air-source) to the point where my friends roll their eyes whenever I mention it (which is admittedly often), but I think it would be a particularly good fit for the U.K.. I hope you might consider adding it to your list of potential solutions or as a topic of future discussion.

Cheers,

Paul

Makes me proud to be Danish...

First up (this is my first post here) is that everybody finds lack of energy to be disastrous.

I am a great believer in peak oil ( I have driven everyone around me mad with my doomertalk) but I do see some solutions.

I might be naive, but looking at the worlds current energy consumption I see many places with painless conservation, and CHE is one.

I live in a house actually served from E2. I have very low energy costs as I live in a new (2001) well insulated house and get energy at 400 DKK/MWh that is like 74 USD/MWh, BUT this includes MASSIVE taxes and should better be compared to oil or gas heating at tripple cost. I got 129 m2 with annual heating cost (including hot water and 4 pax) @ less than 10 MWh.

If Combined Heating and Electricity production could spread on massive worldwide scale we could easily save lots of energy at no pain. I know that Denmark is currently exporting knowhow and installing CHE in China with great succes. CHE replacing private coal burning heaters.

A bit off topic but since you got me started:

If Americans could learn that you can get big cars with small engines (and small cars with very small engines - perhaps even diesel) we could easily save lots of energy at no pain. I get sick to my stomach when I hear Americans justify their gasguzzlers with an argument that they got a big family... You need a 5 litre engine to transport your family ? ? ?

Anecdotal warning! Once heard an American saying that Diesel is not that much better than petrol when he compared a VW Tuareg V10 diesel to a V8 petrol model... Did you ever hear about the 2.5L Diesel version of the Tuareg ? ? ?

Still a gasguzzler but waaaay better than the V10.

Or the "VW Lupo 3L" ? The "3L" means 3 Litre/100KM... That's 77 MPG... Here in Denmark were petrol is 10 DKK ( 7USD/gallon) And the tax on cars is 180%, we have lots of small cars with 50+ mpg.

And trust me you can get comfortable and fast cars with great MPG (personally I drive a VW Passat 1.8T that goes 245 KM/h @ 190 HP with pleanty of room for five people and still I can get 40 MPG (If i dont use all the HP))

Why is the Prius the best you can think of?

If we could all learn to drive together we could save lots of energy at no pain.

Commute together (personally I often use the Metro/subway) but putting two people in a car doubles PMPG (PeopleMPG), and if congestion in traffic eases as a result of this, PMPG would improve further,

I Belive in 300USD oil (highly invested in energy) but I believe the coming crisis will be less doom.

Maybe I am being selfish but I see this as a bigger problem for the US than for Europe. With rising price of oil, the US-trade deficit will widen and the USD will fall. This mean that Europe wont be hit with higher oilprices as hard as Americans, and we got a high tax on energy that could be eased and a generally lower oil consumption per capita.

Rune

Being from Denmark it is hard to be against global warming :-)

P.S. Denmark is a cold place, and i hope you can see the ":-)" in the tag...

Hi Rune,

First of all, a warm welcome to you. I'm new to these parts myself and look forward to learning more about your views on these matters and those of your fellow contributors. Certainly Denmark and Sweden set a high standard in terms of energy efficiency and environmental awareness and we here in Canada would be wise to follow your example.

With respect to district heating and cooling, Canada's efforts to date have been sadly lacking, but there's some hope for us yet, as evidenced here: http://www.enwave.com/enwave/view.asp?/dlwc/energy

In terms of personal transportation, I'm afraid I set a rather poor example. I own two vehicles. One is a 2002 300M Special equipped with a high performance 3.5 litre six cylinder engine and the other is a Dodge Magnum powered by a 5.7 litre HEMI V8. In my defence, the Magnum has less than 4,000 km on it and the 300M averages no more than 5,000 km per year (I'm fortunate that I can walk pretty much everywhere I need to go).

Best regards,

Paul

P.S.: Oh, best not to ask about my next new vehicle [eek!]: http://www.allpar.com/cars/dodge/challenger.html

Hi Paul

DLWC looks sweet...

I want to see more of that! 90% electricity saved! Impressive!

Just my point. There are great energy savings out there - Still low hanging fruits...

I cant help thinking of California with their ever increasing problems at warm weather. Use the ocean... Or better still - Get used to 24 degrees! Why do you need AC to bring temperature down to a freezing 18 degrees C just because it is 30 outside? In the winter we heat to 20?

(need I say that we often wear more clothes at winter, and that this makes it even more strange that we need to have the cooling colder than the heaters?)

I like yor choise of cars, and I would like a bigger engine too, but with a new passat @ 84.000 USD with just a 2 litre turbo engine, I think this will be as big as it could get for me.

I know you will find it hard to believe, but people actually buys cars at that price... My brother just bought a Audi Q7 3.0TDi (diesel) for the small sum of 230K USD.

Cars are VERY expensive in Denmark, and just in Sweden the price is less than half. But it sure helps the smaller cars get on the road. (solves parking issues too)

But I guess the high taxes on personal incomes eases the problem :-) We got 60%+ tax on earnings above 65K a year...

Only problem with the expensive cars are that cars stay in service very long, and old cars just aren't that efficient. But to help this the old cars typically aren't run that many miles per year, and it is a small country with small distances. personally I drive less than 14.000 KM/year

I might come with some selfish point of view again, but I see Denmark as a very good place to be, as we are VERY efficient, export lots of know-how regarding energy efficiency and are still an energy exporting country.

(And the proud inventor of the modern windturbines...)

Rune

Being from Denmark it is hard to be against global warming :-)

Hi Rune,

When I worked for the Ontario Ministry of Energy back in the early '80s a number of us pushed hard for this project. It was tough sledding, but some twenty-five years later it's gratifying to see it finally in place.

As you no doubt appreciate, the war against waste is won one battle at a time. Here's one more success story:

http://www.csemag.com/article/CA6368554.html

$US 84,000.00 for a Passat!?! $US 230,000.00 for an Audi!?!

The Passat here in Canada retails for just over $31,000.00 CDN.

Source:

http://www.canadiandriver.com/articles/pw/vwdiesel.htm

... and your brother's Audi starts at $51,500.00 CDN.

Source:

http://www.audicanada.ca/audi/ca/en2/new_cars/Audi_Q7.html

Go ahead, cry in your Heineken. :-)

Cars are my passion (all have been MOPARs, with the exception of a SAAB 900 Turbo SPG). My first was a Dodge Challenger and peak oil be damned, I'm want another one.

http://www.youtube.com/watch?v=TBh3xYioaAA

Best hopes for more of those Danish turbines.

Regards,

Paul

Hi Paul

Heat pumps are soo old news here in Denmark :-)

With the taxes we got on energy here heatpumps has had a good start.

But again, it is an easy step to conserve energy without pain (except for the price of the system)

Regarding the prices of cars here, I did mention the 180% tax, and you can add VAT to that.

Here is the pricelist of VW-Denmark:

http://www.volkswagen.dk/pdfgen/pdfgen_person.asp?action=PriceFolder&str... limousine&modelAar=2008

A new Passat 2.0T Comfortline with automatic transmission is DKK 482.011 With USD @ 5.42 that is actually USD 88.931

I looked at the manual gear version...

But the high car prices is not that bad since we are world record holders in the discipline of high tax level. :-)

With a good job you net 3K USD/month so you may figure that cars are a BIG part of our spending, remember that petrol is 7USD/gallon and that insurance is expensive too as the cars are expensive. Add to that that we pay an annual tax to have a car registered too. I pay 800USD/year for my car.

This tax is dependant on the MPG rating of the car BTW.

Your Dodge would probably be way more.

You might figure that a Passat is not a cheap car here :-)

You may easy spend half of one persons wage after tax on a car. My car is 7 years old and I only drive a little, so for me it is not that bad. But calculating the price/KM is a thing I hate to do. The same calculation on my motorbike is even worse :-)

Did I mention we pay 61% tax if we earn just a little over average? Then add to that our 25% VAT and high tax on energy, property, land, inheritance and cars. Just a few years ago they at least stopped taxing fortunes.

Years ago you had to pay tax of your net worth!

But I wont complain. We have no poverty or noteworthy crime. Free hospitals, doctors and dentists. Free education and even a paycheck while you study, and a great cheap daycaresystem.

I might think that the equal distribution of wealth has gone too far here but that is a political issue I will deal with domestically. Not a subject for TOD.

The current sentiment is also to lower the highest taxes as a way to incourage people to work a little ekstra. Nobody wants to get their ekstratime in cash, we prefer time of, as the marginal tax is easy 60%. With a current unemployment less then 4% there is motivation to make people work more.

And we have just recently got rid of our foreign debt (the government still has debt, but it is domestic) things are looking better. Currently I believe the budget surplus is 70 Billion DKK, and the top 15% of tax only gives a revenue of 20B (70B is a GREAT surplus, but unfortunately is has been help by big payments from taxation of the rising stockmarket)

I dont know how an afterPO society with 15% or more unemployment will be financed as we have great unemployment benefits here. But hopefully our oil will give us great revenue at by this time if The North Sea don't plummet too fast.

Besides when energy costs explode, I believe there will be a great demand for danish know-how with lots of jobs and great exports to follow. I might mention Vestas, Novozymes, Danfoss etc.

Rune

Being from Denmark it is hard to be against global warming :-)

BTW Heineken is Dutch ! ! !

I am soo not Dutch ! ! !

I am Danish ! ! !

Carlsberg is a Danish beer you might know!

But Tuborg or "Royal Export" which I am drinking just now is better :-)

Tuborg and Carlsberg is now one brewery, but still two brands.

Rune

Being from Denmark it is hard to be against global warming :-)

Mea culpa. Clearly, I wasn't thinking. Your beer is widely available here in Canada and well praised.

See: http://www.carlsberg.ca/#

However, in my home province of Nova Scotia, one should never be seen drinking anything but this: http://www.keiths.ca/k_main/k_main_index.php

I raise my Keith's with the hope we can all learn from each other. Bunden i vejret eller resten i håret

(Oh, and to the Dutch, Gezondheid.)

Edit: I've re-read your comments pertaining to taxation (with new found sobriety) and I have to tell you my head hurts. Canada's social and fiscal policies fall somewhere between those of our American neighbours and Europe. IMHO, it's a reasonable and workable compromise, any schizophrenic tendencies aside. But there's a catch. Canada's economy and, by extension, its high standard of living, is heavily dependent upon resource extraction -- industries that, in many cases, will not be sustainable over the long run. Our nation is not unlike a child born into wealth and given everything he desires, but due to the very nature of his upbringing lacks the means to cope with the realities of adulthood. In so many ways, we need to grow up.

Cheers (and cheers!)

Paul

Ice Cold in Alex

http://en.wikipedia.org/wiki/Ice-Cold_in_Alex

Hi Euan,

One of the greatest films of its kind and a personal favourite of mine.

Cheers,

Paul

Wolkswagen Lupo is kick ass, and so is CHP. Now, let's just restart and convert Barsebäck to CHP and we can heat and power all of Copenhagen, Malmö and Lund.

;)

I just want to restart Barsebäck.

I dont mind that they use Øresund for cooling. Makes a beachtrip much more appealing. Wonder how much colder the water would get if they stopped pouring GigaWatts in the ocean :-)

Of course they should not waste that kind of GigaJoules heating the ocean... Just get that damn thing up and running again. I am not scared living that close to a nuclear plant. We can see it, so if it blows up, I can just start running.

Rune

Being from Denmark it is hard to be against global warming :-)

I think you just might be the most rational Dane I have ever had the pleasure to converse with. ;)

Euan, I'm looking down your list of "to be done" and I'd have to say I think the government is probably addressing most, if under the guise of global warming. You might argue about speed and scale - but which elements do you think they are not doing?

Gary - yeah, I was aware that many but not all items on my "must do" list are already being done. Much of my concern is about scale and urgency and feel strongly that wrapping up energy policy in the language of global warming just ain't working. Its very popular but I think entirely ineffective - renewables are still not sufficiently developed to show up on the charts and the only discernable trend in the energy mix recenty is more coal. This adds up to a total failure.

In Scotland, two of our main parties are totally against nuclear. This only makes sense in the context of an independent Scotland that would be self-sufficient in oil and gas for decades to come.

Policy on roads and air travell is to expand. Higher taxes introduced on larger vehicles are totally ineffective in reducing demand for Porsches and 4*4s.

There's much talk about improving building standards und upgrading the property stock. Its just darned expensive to do it. So I guess we need to wait for energy costs to rise a lot more which will then make the economics of conservation look more attractive.

As for food - at home we are growing bio-fuels which I think is the biggest mistake any government can make - but it allows them to look good in front of the ignorant masses - and we are still importing exotic foods from all over the Globe.

Oh man... those are some pretty scary numbers!

Re point 10, building standards: It's not enough to legislate better standards - we need to change enforcement of the standards we already have. The current system whereby builders hire their own inspectors simply isn't working.

See George Monbiot's The Inspectors Who Look the Other Way.

Hi Euan,

Well done ... an excellent all-round review of where we are in the UK. I will be using it, as a first step, to try and convince my MP of the seriousness of our predicament. It confirms my belief in the correctness of my own personal strategies which have been based on more 'fuzzy' data up to now.

Realistically, our government and parliamentary system operates on a very short term basis so a long term view is rarely taken. The result is government that reacts to events, and I doubt that a government that thinks peak oil may be in 2030 thinks it has any reacting to do just yet!

But the overriding policy for all political parties is GROWTH! So any of your proposals which require lack of growth probably won't even be considered. But I'll still keep trying to inform the MPs anyway.

IMO the measures you propose will definitely seem draconian to almost everybody. But although they seem sensible proposals to you and me Joe public will reject them (it's normal human nature) so the politicians won't even bother until it is way too late.

Many of your graphs have lines that look distinctly exponential to me ... so they are unsustainable ... IMO you might be wise to change yor final sentence to read

"Energy shortages combined with spiralling energy costs and energy import bills will paralyse our economy."

Xeroid.

Xeroid - thanks for this comment - keep plugging away at your politicians - same applies to all other UK readers!

The main point about the UK is that it is already staring into the abyss of energy decline and this provides an opportunity to get ahead of the game through massive expansion of non-fossil solar energy types and conservation - that would position us well for the day when the oil and LNG tankers don't show up.

Growth is the key to the fastest possible change to a humane sustainable society. The efficient technologies, lifestyles and power sources need to grow real fast.

A great comment. First time Ive heard someone turning that ugly word into something usable. Hey, your words might even convince an economist, if he/she doesnt think too much. Clever.

However, what is currently happening? Coal seem to increase faster than wind (=best renewable). Hmm, tricky. At least energy use per capita hasnt gone up (UK), but can one bring it down volontarily? Njaaeeh. So I think on the 10 year time scale not much will change in UK if business as usual continues. Pop. constant, energy per cap. constant, but lowering oil and gas production. Ouups, we have a small problem.

So EM's recommendations with a crash program to change the rates of growth of wind, and efficiency (possibly conservation), are really important to highlight to the general public.

No its not an effort to fool economists. There has been changes in industry and trade numerous times before and people and companies have had to retool and retrain to keep up and sometimes even go broke and restart something new. Old things die and new things grow and that gives growth even if it gives a society that lacks some of the things that were common before. Learn to love what runs efficiently on electricity and do withouth much of what runs on oil as oil becomes expensive due to climat change or peak oil.

An excellent post.

Maximising the UK’s indigenous energy production is going to be very important. An interesting paper I came across recently relates to tidal lagoons with pumped storage -

http://www.inference.phy.cam.ac.uk/sustainable/book/tex/Lagoons.pdf

Not only can lagoons generate power in their own right, they can help solve the storage problem for intermittent renewables such as wind. Indeed the level of storage that could be made available should allow a large increase in the amount of wind power made available to the grid. A great advantage is that the technology involved is not complex and has been fully proven already.

As TheTransition mentions above, underground coal gasification should be a very useful addition to the UK’s fossil fuel reserves, though its CO2 contribution will not be good for climate change unless CCS can be made to work with it. There is a UK based organisation promoting UCG - http://www.ucgp.com/ .

I do think that in the UK we have access to enough sources of energy to see a sensible future if all the actions mentioned by Euan are taken. However, I have serious doubts if we will be able to reach that future without some form of rationing being imposed, probably by means of a carbon trading scheme. Indeed if the Export Land model comes to fruition we may see outright rationing of liquid transport fuels. I intend to be at the head of the queue for the first sensible PHEV that appears!

Great post Euan, thanks.

Your graph of UK Trade Balance shows services growing upwards exponentially. Is it likely -or even possible- that this increase will offset the deficit?

[My thinking here is that all those 'petrodollars' earned by the Export Land exporters will be re-cycled through the financial heart of Europe: The City of London, earning massive amounts of wealth for the UK...]

Regards, Nick.

That's what my broker says will happen, and to be sure this will partly offset the deficit.

Countries like UAE, Kuwait and Qatar will buy assets in the UK - real estate and companies. Sainsbury has been subject to take over speculation by the Qataris.

So the pattern of the UK selling off assets at all levels to pay our way looks set to continue.

-Well he would say that wouldn't he? :o)

In addition your table shows a 16% DOLLAR rise in oil prices -this could be partly offset by the drop in the dollar -see this article:

http://www.thetrumpet.com/index.php?page=article&id=3473

-I think this virtually gaurantees that OPEC won't raise production -if they do they lose out, if they don't then oil prices rise, the US slides into a recession, interest rates get cut, the dollar devalues further and OPEC loses out again. Even without below ground PO factors does this sound like the start of a slippery slope to anyone??

Yes, any capitalsit pig who has been trying to make money from oil futures and oil stocks recently will have found out that much of the rise in oil has been chewed by the falling $-(

The £ has been very stable against the Euro but I don't see that lasting if the UK stays out of the Euro. At some stage the trade imbalance has to be reduced and the natural adjustment is for the £ to chase the $ down - against what?

So oil prices are not high in Europe and we can keep on driving as much as we like:-))

I think we need to welcome 'capitalist pigs' to the Peak Oil point of view not antagonise them -they are likely to be the ones that pump the Billions/Trillions into the Energy/Alt Energy sector that will help ease the pain of a decline... That's if they still have any paper money left of course...

If Oil continues to climb at the rate suggested by Ace and we maintain dollar parity then we will reach $180 a barrel in the 2012-2014 timeframe. At this price level I estimate due to high taxation rates here in Europe the cost per litre in the UK will have risen to around £1.50-60 range, a 50-60% increase... If this happens I think we will see a dramatic increase in Prius sales...

Meanwhile in the USA...

:-))

Do you remember the Selfangradisedtrader?

Hi SAT - if you're still out there call by some time. The FOOTSIE's lookin sick as dog with a broken leg today.

To be honest, I don't think even this would slow me down much. I'd simply absorb the cost into my household budget.

Its the effects of $180/barrel on everything else that would scare me.

Luckily at $180/barrel, the Americans will be paying at least $6/gal and won't be able to afford gas any more so we'll be swimming in the stuff.....;)

Andy

First rate analysis.

I would recommend anyone to read "Out of the Energy labyrinth" by David Howell (nee Lord Howell of Guildford 1980's Tory Min of Energy) and Carole Nakhle ISBN 978 1 84511 538 8 Pub I B Tauris.204 pp Approx £10 p back Amazon and also under TESCO non Food Online as "Entertainment" !!.

This covers much the same but far less successfully - curate's egg of a job, it is avery good book and avery bad book. What is god is that someone with a high political profile has at least provided a fairly decent analysis with some fairly sensible proposals.

They also knock (quite sensibly and reasonably) the insane carbon trading scam,...."Utopian schemes for a worldwide regimemof carbon pricing administered by stratospheric agencies acountable to no-one, merely distract..Much more compelling imperatives and...direct incentives will be required"

They fail totally to look at the fiscal consequences of the changing indigebnous / imported energy balance / gap .. as do so many people in the public sphere.

As for the to do's - who the hell is going to dig this coal out from super deep mines ? Who would ever put up the capital ? Even if the HMG gave 100% capital subsidy, where are the new miners ..displaced Polish plumbers ?

Coal gasification is a well developed technology (Thanks to trade restrictions on apartheid SA) - little known fact, even after Hiroshima and Nagasaki there were 1,000 more bombing raids on N Japan to totally destroy the oil gasification there to deny it to Russia.

I was at the Lugar / Purdue Summit on Energy Secirity lastv August 29th at Purdue IN and Ari Geertsema gave an insight into the atempts in US to adapt and use SA technology enormous caopital costs involved. The very beautiful Amy Myers Jaffe from the Baker Inst at Rice University also gave a talk on US "Sustaining Energy and Mobility" (note stress on Mobility) in which she expressed the hots for coal gasification.

AS to importing LNG.

1. Milford Haven facility is actually owned 80% by Qatar.

2. NE facility relies on US owned special ships owned by US company.

3. Isle of Grain is 25 yr old plant some issues on safety - re metal technology etc.,

All this adds to the fragility of the supply line ... regardless of the competitive market dominated by suppliers. NB the way Putin is cozying up to Algeria supplying arms etc.,trying to tie them into Russian caucus on energy...links to Italy and through to Gazprom. We sent Rentagob Howell there last week but the US are unanxious that we supply arms to them as quid pro quo for gas contracts.

Note that BP who have big plans in Algeria , has since the Amoco "take over" become increasingly a US company - Accts prepared in US$'s etc.,

On top of this the two biggest suppliers to world markets for urea based fertilisers (essential for growing Bio fuels like corn are Saudi and Qatar + or - 60% of world market and rapidly expanding - the world price of which has risen about 80% in last 2 years and US has no indigenous production at all and North America (inc Canada) was self sufficient in 1990) - a chemist friend says burning natural gas to heat yourself, or water

to produce steam

to drive a turbine

to drive a generator

to produce electricity

to distribute

to charge a battery

to power an electric motor for a road vehicle vehicle is like warming yourself by stoking the boiler with five pound (US$10 and rising) notes.

Could the author get in touch with me directly ? zizania at a gmail address

"little known fact, even after Hiroshima and Nagasaki there were 1,000 more bombing raids on N Japan to totally destroy the oil gasification there to deny it to Russia."

Sounds interesting (reference, anybody?) - things go back in time 50 years, ehh.

Before that too, Ive been told. It is an ugly beast we are up against...

You find EM's email in his profile in the editor box up right, BTW.

"little known fact, even after Hiroshima and Nagasaki there were 1,000 more bombing raids on N Japan to totally destroy the oil gasification there to deny it to Russia."

"The 509th Remembered" is a an illustrated history of the 509th Composite Group who dropped the 2 Atomic bombs on Japan in August 1945.Compiled by Robert and Amelia Krauss (who I met with Bill) with over 350 photographs (many never seen before) for the 59th Re-union in Wichita Kansas in October 2004. You can buy a copy here ;

http://www.enolagay509th.com/remembered.htm

Also see Postman Patel

http://tinyurl.com/2nv833

The Nagasaki Bomb survivor - and a, little known secret message to Japan from American nuclear scientists

I can dig out the pages / tables of the bombing and scan them - this book is a bit rare.

Hey you have to admit that Ms Jaffe is a bit of a hoochie coochie girl. I didn't get the impression that any exothermic heating reaction was underway in my presence though. She is however a VERY smart lady.

-----

On both Any Questions and Any Answers on BBC this weekend there was discussion about the Boy David's visit to Ruanda, leaving his flooded constitutents to themselves.

His visit to this poor beighted country was instructive as probably only 10% - 20% of the population probably have such a thing as clean, potable running water, of which they could be deprived by a mixture of God and bad planning.

So not much different at home at home then.

The TV coverage was also instructive - half way through his turgid speech to the partly attended Ruandan Parliament , the lights went out.

Which was a fate missed by inches of foul floodwater at a major (unmanned) National Grid (EON ?) Power switching station.

There was something delightfully primitive that the miracle of electricity was saved for some 600,000 consumers, including GCHQ and it's spooks and the (don't mention under threat of 'D' Notice Oldbury on Severn Power Station) by schoolboys dressed as soldiers manually filling and carrying sandbags to keep God's Acts at bay and civilisation just hangin in there..

It was a scene that might have been transported from the period when the pyramids were built - and it highlighted the execrable (or almost absence of) of national planning for energy security... 600.000 plus businesses, etc and a few sandbags between a third world existence and a pluralist libertarian Western Democracy.

Ziz - taking some of your points one at a time:

I may be wrong about a revival in deep coal mining - but lets wait and see.

The fact that Amy Jaffe is considered very beautiful is noted - she needs to learn a bit more about Suadi oil reserves none the less.

I'd noticed that the Qataris were big stake holders in Milford Haven - a very smart move by the Brits as this may incentivise LNG cargoes comming our way - if the competition gets hot.

Very interesting points about fertilizer - can you provide some more flesh on the bones by way of links?

Burning nat gas to power electric cars is of course mad - you can stick the LNG in your trunk - this technology has been around for more than 30 years. However, using infrequent wind electricity to charge batteries makes a lot of sense.

The CATS pipeline - again do you have links - I'd not heard about that - obviously been spending to much time in the company of XL.

Euan

Chaqu'un a son gout

:=)

OOOooooopppps.

Nobody seems to have noticed or remarked upon damage to the North Sea Central Area Transmission System (CATS) gas pipeline,which shut on July 1 after its conrete casing was damaged by a ship's anchor near Teesside port. Divers are inspecting the damage and Chief Executive Tony Hayward of operators BP told a news conference that it would be a "number of weeks" before repairs would be complete.They sent down robot carwlers first but only just this week have sent down divers. As gas cannot be extracted this also affects oil production - it seems unclear if the gas can be flared off to maintain optimal oil extraction.