Marchetti's Curves

Posted by Luis de Sousa on July 10, 2007 - 10:30am in The Oil Drum: Europe

This is a brief account of the Energy Susbstitution Model developed by Cesare Marchetti in the 1970s at IIASA. Using data from the latest BP Statistical Review the evolution of the energy market is compared with the model to understand why the Hubbert Peak of fossils fuels represents a problem today.

The early Energy Substitution Model is described and analyzed in detail in the following papers:

Marchetti, C., 1977

Primary Energy Substitution Models: On the Interaction Between Energy and Society,

Technological Forecasting and Social Change, 10:345—356

Marchetti, C., 1979

Energy Systems -- The Broader Context,

Technological Forecasting and Social Change, 14:191—203

Marchetti, C., and Nakicenovic, N., 1979

The Dynamics of Energy Systems and the Logistic Substitution Model part I part II,

RR-79-13, International Institute for Applied Systems Analysis, Laxenburg, Austria

These documents often offer an optimistic view of the future, characteristic of the author.

This post in large measure addresses the "Energy source X will do it" claims, and can be considered part the Contrarian Arguments series.

A lifetime of research

Cesare Marchetti was born in Luca (Italy) in 1927 and got a degree in Physics from the Scuola Normale at Pisa in 1949. We would then leave Academia to never return back. In his own words:

I found University too constraining and in many ways petty, so, after my degree in physics, I chose to start free roaming, an attitude I did conserve for the following 50 years of my career.

By 1950 he was already working on Nuclear energy, researching heavy water reactors at CISE (Centro Informazioni Studi Esperienze). Later in the decade, after roaming some time in Argentina and Switzerland, he joined Agip Nucleare (now part of ENI) where he researched gas-cooled reactors.

In 1959, with Agip Nucleare going to state hands, Marchetti joined Euroatom with his 50 person team assembled at Agip. In a few years he had one lab in Italy and another in the Netherlands.

It was during this time at Euroatom that Marchetti and his team produced the most lasting results: the concept of Hydrogen as an energy vector and a "Hydrogen Economy", the concept of the Atomic Isle and the self sinking of radioactive waste away from the Earth’s crust. All of this still in the 1960s.

In 1973 Marchetti joined the recently assembled IIASA, in his words to veer away from an hostile environment at Euroatom. He started researching on energy with the intention of staying for some months, but a continued comfortable relationship kept him there for the rest of his life.

It was at IIASA that Marchetti brought successfully to energy systems analysis the simple concepts of logistic growth from the biology sciences. Although Hubbert had reached similar conclusions in the 1940s for the case of Oil, Marchetti widened the concept of deterministic behaviour of energy systems.

Beyond energy, Marchetti would study innovation, population dynamics, transport systems, war, banking and much more, using the same concepts of logistic predictive modeling.

An interesting auto-biography is available here.

The energy substitution model

The first problem Marchetti took on, after joining IIASA, was to find a long term energy market model, at the time an uncommon idea:

The first problem was to meet a challenge set by our boss for the energy group Prof. Haefele, physicist and theologian: to find a simple and predictive model describing energy markets for the last century or so. For the beard of Newton.

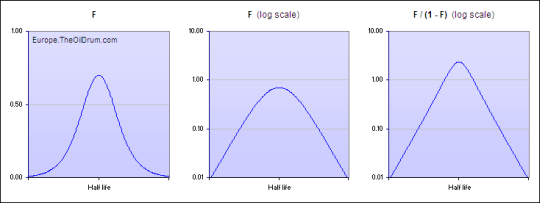

Marchetti tried using logistic curves to describe the way energy sources enter and leave the market. Using the Fischer-Pry analysis technique he plotted the share each energy source had on the market. This kind of analysis was introduced as a tool to study the market penetration of new technologies. Simplifying, this approach consists in calculating the market share of each energy source, F, and then calculating F / 1 - F.

The interesting thing about this representation is that on a logarithmic scale a new element entering the market following a logistic curve will describe two straight lines, one during the growth period, another during the decline period, connected by an arch at the peak. Further insight on the Fischer-Pry analysis can be found here.

Figure 1 – Using the Fischer-Pry representation for a Hubbert curve. Click for full image.

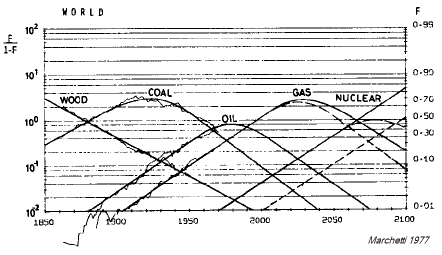

Using data for Wood, Coal, Oil and Natural Gas, Marchetti found indeed that the long term market penetration of these energy sources was ruled by logistic growth and decline. In his first paper on the Energy Susbstitution Model [pdf] from 1977 the results published were these:

Figure 2 – The Energy Substitution Model identified by Marchetti in 1977. Click for full image.

Marchetti didn’t use hydroelectric power in his analysis, probably due to lack of data. Hydroelectric energy has never penetrated more than 6% into the market; its absence changes little to the final result.

Beyond those elegant curves drawn in a logarithm-scale by the Fischer-Pry technique, this chart showed a very important thing: all of the Industrial Age energy sources follow a similar trend when entering the market. It takes 40 to 50 years for an energy source to go from 1% to 10% of market share and an energy source that eventually comes to occupy half of the market will take almost a century to do so, from the epoch it reaches 1%.

Internal Clocks

"Internal clocks" was a term Marchetti used to put in simple ways the deterministic behaviour of the energy market observed in the 1970s. From his analysis it seemed clear that energy sources enter and leave the market on a pre-determined fashion, beyond outside control.

Later, in 1978, Marchetti was invited to address the methodology of energy systems analysis at the IIASA Third Energy Status Report. A written version was published in 1979 entitled Energy Systems – The Broader Context [pdf] where he took a somewhat informal approach on the subject:

I am originally a physicist, a bit of the Bridgman school, and I always try to find an operational description of certain statements. The best operational description for our case is that of Alice in Wonderland who sees flowers and flowers, picks them, and then sees better flowers, so she throws the old flowers away and so on.

Marchetti also tried to grasp who decides which flowers Alice picks:

But the question now is who pick the flowers […] perhaps politicians, or the heads of large companies, are decision makers. Well, I had long discussions with them and a lot of them say: "We seem to be decision makers but we are so strongly conditioned that finally we don’t recognize any decision in our decisions. We are just optimizers."

But a subtle warning remained; the market doesn’t have to evolve exactly as the models predict:

Waiting for more insight, I would suggest not underrating the built-in wisdom of the system. As Nakicenovic showed, a "natural" phase-out of the old primary energy sources, and a phase-in of nuclear and perhaps of a new source around year 2020, may provide a smooth transition, with no muddling whatsoever, to the year 2030. The real constraints appear to be not in the realm of physical resources, but in that of international cooperation. There perhaps decision makers (optimizers!) should concentrate their action.

All of this was written before Iraq invaded Iran removing 8 Mb/d of Oil from the market almost overnight.

Looking at it today

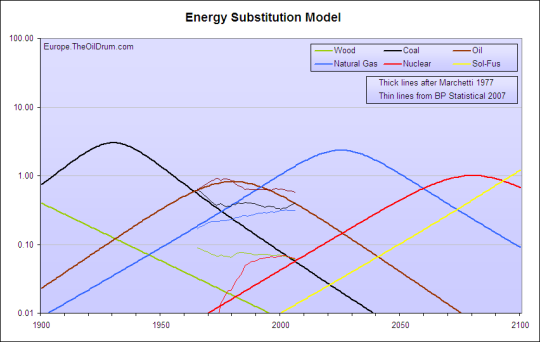

Thirty years later it is interesting to see how the market behaved. Using the data from the latest BP Statistical Review of World Energy, the result is the following:

Figure 3 – The Energy Substitution Model from 1977 and data from the BP Statistical Review of 2007. Wood fuel data from FAOSTAT. Click for full image.

In large measure the real data moved away from the model of the 1970s. This was probably due to the Oil shocks that upset the market, but the prolonged effects are not as easily explainable. What immediately emerges to view is that after the Oil crisis was surpassed in the 1980s, the market seems to have frozen, with each energy source maintaining its market share.

A closer look to each source is useful.

Wood

Marchetti only had data for Wood up to 1950 and extrapolated future production falling and loosing market share in line with the previous trend. FAO has published data for wood fuel consumption since 1961 that is considerably higher than the curve Marchetti projected. Wood fuel consumption data is something considerably hard to assess, and even FAO has preformed considerable revisions in later years. The discrepancies can be attributed to poor quality of the data prior to 1950, but the current trend in consumption is markedly different from what the model projected, still growing although not as fast as the Fossil Fuels.

Coal

Coal was following a logistic phase-out of the market when the Oil shocks came; it immediately stopped losing share. Since the year 2000 Coal has been moving upwards and looks as the best candidate to take Oil’s dominant place, as soon as the former peaks.

Oil

Interestingly, although Oil was the most battered energy source since the 1970s, it is the one following closer the substitution model. This means that Marchetti probably underestimated Oil’s trend which was bound to hit the 50% market share in the 1990s, soon before peaking. Today Oil is clearly loosing ground and will likely follow a downward trend not far from that inscribed in the model.

Natural Gas

Unlike Coal, Natural Gas was already in an alternate trend at the start of the 1970s. By then the understanding of this energy source was not the same it is today, and the model looks highly optimistic. The underestimation of Oil is probably reflected here in an overestimation of Natural Gas. Still it is interesting to see that the projected peak in market penetration by 2030 is in the same epoch of the presently expected production peak.

Nuclear

Marchetti expected Nuclear to enter the 5-10% interval by the year 2000, but that happened much sooner, Nuclear went over 5% in 1987. Up to the 1990s Nuclear energy greatly surpassed his expectations in the wake of the Oil crisis (which facilitated market penetration) but as liquid hydrocarbons production started growing again, Nuclear’s penetration in the market slowed down. By 2000 it hovered around 6.5%, but has fallen below 6% since then.

An interesting thing to note is that Nuclear is today very close to what Marchetti’s curve showed it would be. The difference is that the trend is currently downwards, while Marchetti expect the world to be entering the Nuclear Age by now.

Sol-Fus

There isn’t much to say about alternative energy sources, except that they never shown up. As a benchmark, Wind energy occupies today 0.2% of the energy market, a point Nuclear energy crossed still in the 1950s.

Looking ahead and back

What is the importance of the Energy Substitution Model? It seems that it broadly failed to achieve its intents: to predict future market dynamics.

First of all it is essential to observe that the growth trends were only broke during the Oil crisis, Nuclear energy’s spectacular growth occurred between 1975 and 1985. Besides this brief event never the growth trend was surpassed.

Most important of all is to understand what didn’t happened. Although Nuclear is today very close to where Marchetti expected it to be, it is in a clear downward trend, that even in the face of Peak Oil might not immediately reverse.

The last time an energy source crossed over 1% share of the energy market was 35 years ago. The last time an energy source crossed over 10% share of the market was more than 50 years ago. This is why the Hubbert Peak is a problem today.

To have a new energy source with 10% of the market by 2010, it had to have crossed the 1% threshold by 1970 the latest. Using the same metaphor, It seems that Alice feel in love with some flowers and forgot about picking more.

Does this mean that abandoning Nuclear energy was an error? Possibly. But more relevant than abandoning Nuclear energy was doing it without opting for an alternative. Abandoning Nuclear could have been an option back in the 1970s if a clear alternative had been pursued with proper research and development.

Naturally, in exceptional times a new energy source can penetrate the market much faster than the pace predicted by the model. Either by Society’s commitment to it, either by the decline of other sources, a new element can rapidly take its share, like Nuclear did during the Oil crisis. But these are exactly the disturbed times Society should avoid.

Finally it is important to stress that Oil is much more than an energy source today. It is the world’s most important manufacturing commodity, paramount to most industries, from Pharmaceuticals to Civil Construction, from Electronics to Clothing. And above all, the base of modern Agriculture.

Will Society ever be able to plan in advance for multi-decade cycles?

Luís de Sousa

The Oil Drum : Europe

Very interesting post Luís! I always wanted to revisit Marchetti's forecast.

It is surprising to see that wood is still a significant energy source (as important as nuclear!) most probably for third world countries.

My interpretation is that as long as coal reserves are cheap and plentiful, it will remain an important source for electricity generation. There is also the myopic focus on expanding military nuclear program while ignoring the urgent local need for clean, affordable electricity (see Iran and India). A good example is India that was supposed to make the transition between coal and Nuclear based on an ambitious program launch by Nehru in the 50s. But it never happened, India is now generating a mere 4.5 MW instead of 44 GW has initially planned. Reality is, at market rate, nuclear is still 50-60% more expensive than coal.

India has some leading research on Nuclear, using Thorium as fuel and everything. It’s just that Oil was so cheap and easy…

Once again wood-fuel consumption is hard to access, especially in developing and third world countries; the statistics have changed broadly in latest years. I think Marchetti caught a signal of wood-fuel phase-out in the developed countries, I doubt the data he used included Africa for instance.

Marchetti has left us such a legacy on energy and systems analysis that it was a shame for TOD not to have a post dedicated to him and his work.

I need to ponder this a bit more but a couple of issues suggest themselves immediately;

1) phaseout of one energy source requires a set-aside for the next energy source. This could mean the descent curve is steeper than the ascent eg using more of the remaining coal to smelt metals like silicon.

2) humans plan ahead for looming shortages.

Wishful thinking.

I think one can be model as discovery of the new resource well ahead of its utilization. I.e for oil we fairly rapidly discovered. For coal it could be viewed as discovering new mines once coal became important. So your set-aside is discovery initially outpacing exploitation of the resource.

Hi Luis,

Thanks for interesting articles. I had not seen them. One of the fastest major substitutions in an energy market I have found is the growth of Wyoming coal, aided by the limits on sulfur in the Clean-Air Act in 1970. It was 0.9% of the total US coal market in 1969, and is now 38%.

Dave

Hi again Dave,

Please read the longer paper (the one in two parts) it has lots of analysis on smaller markets where fast market penetrations happened. It is also interesting to see that the authors were somehow foreseeing the slowdown on Nuclear energy and the need for alternative energy vectors.

The big questions must be why nuclear fell flat and why we meekly acquiesce to the rise and rise of coal. Maybe the model can be salvaged by another but late peaking curve for 'learned conservation'. BTW I just watched the Australian ABC show 'Carbon Cops' which has everybody feeling guilty and they are about to run a story on glacier melt in the Andes mountains. Maybe Joe Suburbia is sitting in front of the TV saying 'I'll drive less when oil runs out, nukes are kinda creepy but coal is already mainstream. I'll just go with the flow'.

Joe Suburbia is in a squirrel cage -- driving an hour or more to a mindless job, stuck in traffic, listening to Rush Limbaugh on the radio, feeling hopeless and angry and blaming whoever Rush tells him to blame for his discomfort, which he doesn't even have a name for.

When the gasoline goes up in price, he will forgo almost everything to keep on buying gas, because he doesn't know any other way. And won't learn.

When the gas becomes less available, he blame Congress, and wants a bill passed to produce more gas.

Some day, the gas just won't be there, and Joe will be helpless and unable to adapt --

There is no "substitution" going on in the USA, and no models for adaptive behavior to changed ecology. Only what people teach themselves -- for example, through the Oil Drum posts.

Also -- re above posts. India's nuclear program obviously did not reach the lofty civilian goal -- but they did build a bomb, which has presumably worked to the advantage of the elites who run the country. I think a lot of people are skittish about nuclear -- mainly because it is so easy, apparently, for the leaders to "forget" there is a civilian population that needs energy, and simply devotes reources to military purposes.

at a global level coal has never declined in absolute terms?

greater share of the market is not really substitution in my book but expansion or addition on top

Boris

London

My thoughts exactly. The model just doesn't work.

I didn't expect too much when I read the model was based on picking flowers!

there is some sort of infinite reserve assumption.. even if it requires a new resource?

Boris

London

That is a point that Marchetti makes and addresses in (at least) the original paper. He considers what the total amount of each primary energy source is assuming that the total world consumption grows at the historical trend of 2% per year, and compares the result to estimates of reserves. The papers linked by Luis are well worth reading, and they provide lots of food for thought and maybe controversial statements that can seed useful discussions.

_Can the last politician to go out the revolving door please turn the lights off?_

Very interesting article, Luis.

However, the Marchetti Model is simply useless, and while your article points to that, it does no full justice to that models true (lack of) value...

Nowadays there is no point in discussing it, except to point out how mere wishes and lack of understanding of physical realities tend to fail as models for prediction of those realities...

In fact the model is based on several totally wrong assumptions:

One of them is that rupture technological advances are cyclical, guaranteed to arrive at predefined intervals, and to have an impact similar to previous technologic innovations: All new energy sources/technologies grow to become dominant (why should they all become dominant? why should not some of them by limited by availability?) and then die, replaced by newer technologies (why cant some of them be sustainable and remain is significant use through longer times? why must all the energy sources/technologies be replaced by newer technologies?).

As an example, he conveniently ignored wind energy, which dominated both the marine transport and the land power generation (in mills) for an extremely long time (not compatible with the kind of regular "Kondratieff Waves" he likes to generate, or with regular substitutions he implies that should be ever present).

Another example: If significant sustainable solar energy generation is possible in the future, why should it be ruled by this kind of cycle?

Another amazing point he assumes (it is somewhat related to the first) is that resource availability does not constitute a reason for a source substitution. Only new technologies motivate that.

In the 1977 paper he demonstrates he is totally oblivious to much earlier (and infinitely better) work from Hubbert on fossil resources depletion, and he clearly states that "Final total availability of the primary reserves also seems to have no effect on the rate of substitution [of energy sources/technologies]" (p.348) and that "The extrapolation of these trends indicates that the same thing is likely to happen in the future, e.g., that oil reserves will never be exhausted because of timely introduction of other energy sources." (p.349).

See also p.352: "(…) substitution has a certain internal dynamics largely independent from external factors like reserves of a certain primary energy source. Thus the coal share of the market had started decreasing in the US around World War I in spite of the fact that coal reserves were in a sense infinite."

Such are the basic elements of his beliefs… (Talk about stones’ availability and the end of the Stone Age…)

Of course, not understanding that some resources are finite, and there must be a difference between renewable and non-renewable sources he does not follow to conclude that some of his energy cycles MUST end (due to resource exhaustion), while some others, related to renewable sources can continue through time, and may temporarily lose some share but may recover share later.

He also fails to understand the different value of the different energy sources (finite things that we are depleting are more valuable than "infinite" things that will "always" be available) and that the convenience and easy access to fossil energy allowed the fast replacement of earlier energy sources, but that that same convenience will make those fossil sources VERY difficult to replace (in particular to replace VOLUNTARILY, because they WILL be replaced, lol…).

In fact he rejects the concept of a finite Earth, and implies that infinite growth is guaranteed…

Those points, and the absolute failure of the model in the 30 years from 1977 (that Luis chart clearly ilustrates) should be enough to guarantee that his method is only regarded has a funny (old) misconception.

It is a true pity that nowadays there are still persons that base their entire “scientific” work on (extremely) bad adaptations of those models...

Ming, I agree not only with you, but with Boris, too. We're burning more coal than ever before, and burning more wood than ever before, and using more wind too.

He made no allowance for the exponential population growth, and no allowance for the continued use by impoverished people of these low tech fuels. There are over a billion people in Africa, a billion people in India mostly using wood for fuel. That's more people than the entire world population until the 1950's. There are over a billion people in china using mainly coal, as well as our spike in use generating electricity. The useage needs to be graphed on total number of calories derived from each source to be realistic.

Those curves and colors would make nice abstract art, though!

Bob Ebersole

Ming,

You and other readers (Bob, Boris) do not seem to understand what the model is or what it predicted in the 1970s.

First of all, the analysis of the market, done in this way isolates you from overall consumption growth or population growth. You are looking solely at how each energy source takes its place against the others. By the way, if you have data on wind energy use in the XIX and XX centuries go ahead and link us to it.

Ming you simply dismiss the model, without understanding why it failed; that is in itself a failure. Why was the following sentence wrong in 1977?

Was it the reserves that failed or the timely introduction of other energy sources?

That was your conclusion. If there was something else you were trying to tell us, I didn't get it.

What exactly are you trying to tell us about this model? Is it right or wrong? Did it fail or not?

I say the model is incorrect (I thought you did too), so it is pointless to discuss why reality failed to follow the model.

Why do you conclude that?

I think you have not fully understood what I wrote...

The tracing of the chart curves are isolated from a direct relation with those effects.

The energy use (from each source/technology) surely is NOT isolated from the intensity of the global consumption and from the overall availability of each source...

It seems extremely naive even to consider that hypothesis...

Again: I believe I understand why that model failed, and that it is you that do not understand what I wrote...

You don’t know why?

Just read the much earlier work from Hubbert on fossil fuels depletion.

The reserves did not fail. (How could they?)

It just happens that they are far from infinite…

As to technology, you must realize that oil (and fossil fuels in general) are EXTREMELY convenient energy sources (even nowadays by far the most effective way of powering transports, of producing grid electricity, etc.).

In fact, in the 70s there were no available technologies able to compete with fossil fuels except in niche settings and in a limited proportion of global energy consumption.

Also, back then there were no realistic prospects for the timely development of those technologies...

(Alice should have checked the availability of even prettier flowers just around the corner before assuming she could/should toss away the flowers she had picked before…)

Even nowadays we still don’t have any available (or prospective!) technology able to compete globaly with fossil fuels except if they are depleted and allow us no choice...

Do you understand that this point is precisely the reason why the PO is a problem for us?

Can you enlighten me. I do seem to miss the point..

if the point is that new "pile ons" of energy come in waves which are no longer occurring because there is nothing left to burn with as good (excuse the term) eroei.. then yes I get it.

some part of the problem is the use of the term substitution.

the market is a expanding ball of consumptive activity not a fixed amount of activity

increased market share does not equate to other energy sources being "substituted" or if it it does a better term is "displaced" into other applications where they continue to grow in use

I think I'm missing something..

a comparison of one energy source over another for dominance IMO creates the standard misunderstanding common throughout society that one energy source has been replaced by another.

Mike Lynch held this view on the now overly long thread at PO.com. I would characterise it as missing the point.

however I do sense there is some nuance I am missing here

Boris

London

These curves clearly document why a non-market response is necessary. We need to heavily invest in nuclear, wind, solar, hydro, etc., but the curves show that growth from zero to half of the supply base can take at least a century. We may not have a century. We do have the technology but we are going to have to make a conscious decision, not an unconscious decision bound by pure greed (the market).

Your question, Luis - "Will Society ever be able to plan in advance for multi-decade cycles?" - is very appropriate. We must learn how to do this and very soon or we will suffer the consequences of shortsightedness.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

jbunt

A short time ago, the Discovery Channel had a one hour program pretty much devoted to going to the moon and "mining helium 3" and bringing it back to earth. The program kind of assumed that nuclear fusion would be easy if we had helium 3. That is, the main problem was obtaining helium 3 at a great expense, not that we then had to invent fusion with it. Is that true??

That is only part of the problem. The most difficult part is containing a stable plasma of protons, deuterons, and He3 ions at a minimum temperature of 15000000K (temperature at the core of the Sun, which burns Hydrogen via the proton-proton cycle). This is the most incredibly difficult engineering challenge, and is the reason we don't have fusion today, and won't have for a long while yet (partly due to willful lack of investment by vested interests IMHO).

Luis, thank you for a very interesting article.

I'm cross-posting this comment from the European Tribune thread, as unfortunately, while read and recommended, your article hasn't generated any debate over there.

=======

In the [1977] paper, Marchetti writes:

One can write this as

F'/F = a(1-F)

He then shows some examples from actual data, and says

After thinking about this for a while, I think Marchetti made a mistake there, though maybe not a very serious one.

With two products, with market shares F and G adding up to 1, one can write

F'/F = a G

which implies

F' = a F G

and, given that F' + G' = 0,

G'/G = -a F

So, in the case of two commodities the Fischer-Pry model is compatible with F + G = 1. Now, suppose we have F1, F2, F3, ... Then, Marchetti is right that

F1'/F1 = a1 (1 - F1)

F1'/F2 = a2 (1 - F2)

...

Fn'/Fn = an (1 - Fn)

is incompatible with F1 + ... + Fn = 1. However, realising that 1 - F1 = F2 + F3 + F4 + ... + Fn, one can see that the "proper" generalisation of the Fischer-Pry model to n > 2 commodities is

F1'/F1 = a12 F2 + a13 F3 + ... + a1n Fn

F2'/F2 = a21 F1 + a23 F3 + ... + a2n Fn

...

Fn'/Fn = an1 F1 + an2 F2 + ... + an{n-1} F{n-1}

which is compatible with F1 + ... + Fn = 1 as long as a{ij} = - a{ji}.

The coefficients a{ij} are a measure of the rate at which the ith commodity takes market share away from the jth one (or loses market share if the coefficient is negative).

So, question: do we have the necessary data to fit this extended model and compare it with Marchetti's simpler one?

=======

Aside from considering this a predictive model (given the assumption that the market share transfer coefficients are constant in time), the model can be used as a purely descriptive tool. That is, one can take the interpretation that Fischer and Pry are simply observing that the logit of market share is the "right" variable to consider when studying commodity market penetration, and the observational question then becomes to estimate the transfer coefficients from historical data and possibly forecast their future behaviour.

Can the last politician to go out the revolving door please turn the lights off?

Reminds me of what a philosopher I once studied with said about a "failure" of reality to conform to a system is valuable in that it teaches us something about reality.

Despite the shortcomings of the model (admirably developed by Ming above), posts like these are tremendously valuable and help make TOD such a great resource. Thanks, Luis.

I published a similar article back in March. You can see my take on the same idea at the following links:

http://analyst.energy.googlepages.com/TERNumber4.pdf

http://analyst.energy.googlepages.com/home

Larson

Excellent article Luis.

However everytime I see this particular spelling error I cringe.

Loose != Lose

It was probably years of being beaten by nuns for spelling mistakes that causes this response. :-)

Thanks again for the information. I plan on reading more about Marchetti's work in the near future.