Water in the Gas Tank

Posted by Stuart Staniford on March 26, 2007 - 10:24am

Further Forensics on Saudi Oil Supply

Background

I have been arguing recently that, since about the middle of 2004, Saudi Arabian oil production has been supply constrained, and that in particular the production declines since the middle of 2005 are not voluntary. See Saudi Arabian Oil Declines 8% in 2006 and A Nosedive Toward the Desert. Also see, for a contrasting view, Euan Mearn's posts Saudi Arabia and that $1000 Bet, and Saudi Production Laid Bare. Behind the scenes, Euan and I have exchanged a lot of email trying to figure out the points of agreement between us, as well as the remaining areas of disagreement.I see that Cambridge Energy Research Associates continues to have a radically different view of future (2015) oil supply:

Saudi Arabia was ranked No. 1. Its output was forecast by Cambridge to grow to 14.3 million barrels per day from 2005 output of 12.7 million bpd.I suppose if one thinks they produced 12.7mbpd in 2005, then one is in fantasy land about the past, never mind the future.

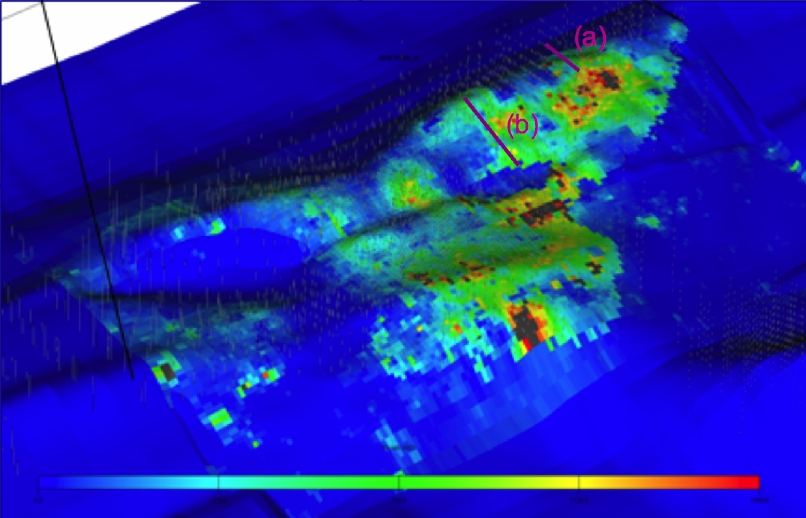

I'd like to start out this analysis by creating a lettering system for regions of interest in the Saudi production curve. The hope is to give us a common terminology for what we are referring to. I have lettered each separate feature (as I see it - we could always subdivide later if needed), so that we can debate what is going on at each phase. Here's my scheme, superimposed on a graph that shows Saudi production at the bottom, oil rig count in the middle, and sales weighted price of OPEC exports at the top:

I am focussing now on the period since the beginning of 2004, since there is no controversy about what was happening prior to that. Everyone agrees that, before the second quarter of 2004, Saudi Arabia had at least some spare capacity and was acting as the swing producer. The regions I have labelled, and a brief description of discussion so far are as follows.

- A:

- This is the rapid rise in Saudi production from April 2004 to August 2004. I have suggested, based on analyzing the extensive discussion in OPEC Monthly Oil Market Reports, that this was a deliberate effort to moderate prices in the face of increasing demand and prices rising far above the agreed OPEC price band at the time. I'm not aware of any serious dissent on this explanation. Saudi Arabia has increased production to accomodate rising demand many times in the past, so this behavior was "in character".

- B:

- From August 2004 to November 2004, Saudi production goes flat despite the fact that prices have not been brought under control and are still rising. My interpretation is that this level of production was the maximum possible at the time. Others seem to believe that in general perhaps the Saudis changed their approach and decided higher prices were fine and they'd prefer to make more money by voluntarily reining in production. I'm not sure if anyone thinks this decision was taken as early as August 2004, but I think to explain the data in B as voluntary holding back, one would have to make that assumption (which is fairly problematic since the Saudis would have no basis for changing their view of the effect of these prices on the world economy yet). I believe Euan may agree with me that this is likely the maximum plateau production at the time. It's also potentially significant that the rise in rig counts begins at the end of this period B. Given the lead time to get a rig to Saudi Arabia, it's likely that the decision to start building up the rig fleet was taken sometime during period B (or possibly earlier).

- C:

- From November 2004 to January 2005, there is a sudden and fairly sharp decline in production by about 350kbd. This coincides with a sharp price break down from $45 to $35 (in this series which is generally a little lower the the oft quoted NYMEX front month, or West Texas Intermediate spot price) I think at this point Euan and I are in relatively close agreement that this is probably something along the lines of "Phew, prices are dropping, let's rest some of our more tired/problematic wells."

- D:

- From January 2005 to July 2005, there is a gradual and slowing rise in production that roughly restores the November 2004 level. This occurs as prices are rising from $35 to $55. A mystery is why some of the 690kbd of additional production capacity from the Qatif megaproject does not allow for higher production during this period. I lean to the explanation that something else declined, but specific attribution is not possible at present (see discussion below). People who believe in voluntary restraint could argue that the Saudi's had by now decided the world could cope with $45 oil and wanted to see what $55 oil would do. However, the specific pattern of production rise seems very problematic for this explanation. As prices rise from $35, the Saudis increase production at the fastest rate we have seen since (suggesting an attempt to respond to demand and moderate prices), but then as prices continue to rise, they respond less and less. Why increase production at all if they just wanted prices to go up? And given that they decided to increase production, what are the implications of the gradual creep up, from a country that in the past could jump production by 1-2mbpd in a month or two? Rig count rises slowly but steadily through this period. (As an aside, the Oil Drum is founded in March during this interval as people everywhere start to wonder what is going on with oil markets. Twilight in the Desert is published in June).

- E:

- From July 2005 to Dec 2005, production is flat and then begins gently declining (continuing the deceleration trend of period D). This starts to occur in the face of sharp price increases to the 2005 peak of around $62 in September, and there is no noticeable break in the trend line as prices then fall back to to around $50 by December. I will argue below that the likeliest hypothesis for this decline is the beginning of the cresting of the flood front in North Ghawar. I am unclear how the voluntary restraint hypothesis can explain both the decision to push prices up to $62 by dropping production, and then allowing it to fall to $50 by not dropping production faster as price falls. Rig counts rise more rapidly through this period.

- F:

- There is a very slight production hike from Dec 2005 to February 2006. I now have ascertained that the Qatif redevelopment megaproject was not actually completed in all respects until December 2005. So it is possible that this represents a boost from some last portion of the Qatif redevelopment. Rig counts continue to rise.

- G:

- Production resumes declining , more rapidly now, from Feb to May 2006. This is occurring in the face of prices increasing sharply. I believe this is likely due to worsening problems in North Ghawar, though that can't be proven beyond a reasonable doubt. The voluntary restraint hypothesis would require that the Saudi's are deliberately dropping production to drive prices from the upper $50s to the upper $60s.

- H:

- Production increases again from May 2006 to July 2006, as prices first drop, and then crest in the $70s on fear of war with Iran or hurricanes in the Gulf. I interpret this as most likely the onset of the Haradh megaproject. The voluntary restraint hypothesis requires that the Saudis now change their minds and make a (very modest) production increase to try to ameliorate the price increases they have just been driving a few months ago. Rig counts continue to increase rapidly.

- I:

- Production and prices both continue to decrease. There may be scope for both explanations here, as problems continue in North Ghawar, but is also true that OPEC begins to talk of, and then carry out, small production cuts to prevent the price going too much lower than the levels they have now got used to (ie around $60). A few hundred kbd of Saudi production cuts might be accounted for this way. Rig counts have plateaued for the moment.

Let me now turn to documenting some of the things I alluded to above.

Ghawar

In response to Euan's latest post, we received a flying visit from Fractional_Flow, an experienced reservoir engineer, who provided a link to a very interesting paper as well as a few key insights. This led me to dig further into the recent petroleum engineering literature on the Ghawar field since the publication of Matt Simmon's book Twilight in the Desert. This exercise has helped a lot in fleshing out what I think is happening and I'd like to discuss what I found. The papers themselves are copyrighted and behind a paywall, but I will link to the abstracts and make some fair-use excerpts.It's also probably worth stressing here that I am not and never have been a reservoir engineer. I was academically trained in physics and computer science, and have mainly worked in the latter field. I am able to understand reservoir engineering textbooks and papers, but it's possible that lack of deep knowledge and operational experience may lead to errors. Unfortunately it seems that the world's reservoir engineers mostly work for someplace that doesn't want them discussing sensitive topics in public - but I encourage any of them to point out any errors in interpretation I might have made, and I'll do my best to fix them.

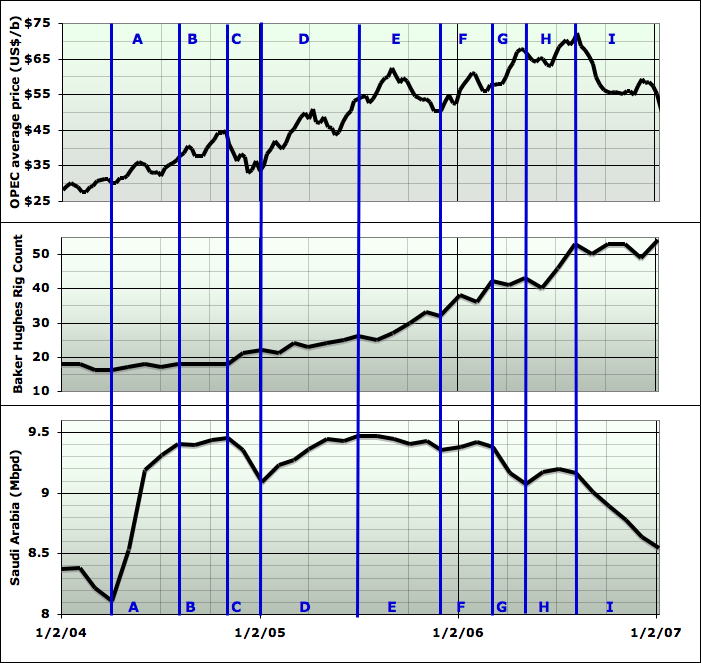

Let's start though by reminding ourselves of the basic facts about Ghawar (also see Greg Croft's summary).

The whole structure is about 175 miles long, and around 20 miles wide at the widest - by far the largest field in the world. The oil in Ghawar is almost all in the pores of the Arab D carbonate rock shown in the Figure above (on which more in a moment). There are five major operating areas of Ghawar: 'Ain Dar, Shedgum, Uthmaniyah, Hawiyah, and Haradh. 'Ain Dar and Shedgum were the highest quality (highly permeable reservoir rock and sweeter crude), while the quality of both rock and crude tends to decrease from north to south. Accordingly, development of the field started at the north end, and each wave of new technology has tended to be applied at the top end first and then work south.

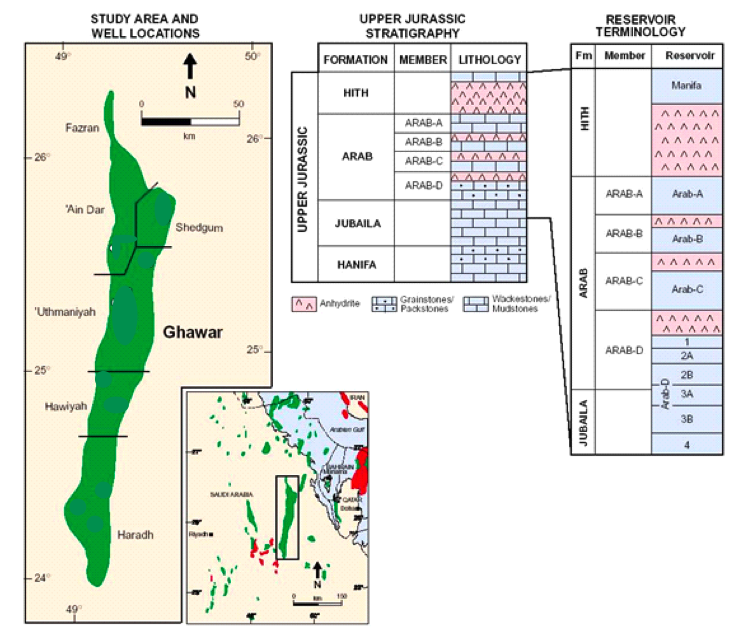

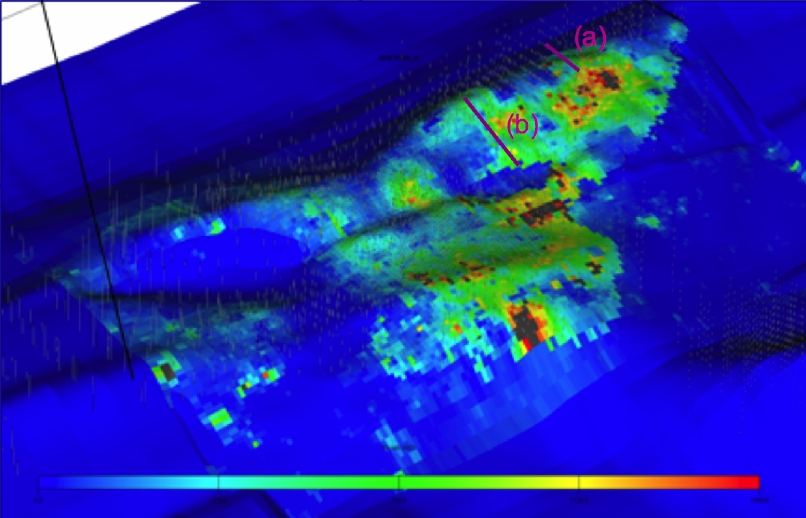

Let's look at 'Ain Dar and Shedgum first. This next picture is believed to show the permeability of the two regions. Ain Dar is the narrower longer ridge to the top (west) of the picture, while Shedgum is the broader shorter lump lower in the picture (ie to the east):

The two regions together are almost 45 miles from north to south, and around 20 miles east to west. The variable we are looking at, permeability (often denoted K) is related to how easy it is to push fluid through the reservoir rock. The more pressure drop across a given volume of rock, the more fluid is going to flow through it (just as when you suck harder on a straw, you get more to drink). Part of the constant of proportionality between the pressure and the flow is called the permeability of the rock (the other part is the viscosity of the fluid). It is measured in Darcies (after the French scientist who developed the most widely used equation of motion for fluids in porous media). Rock with a permeability of one Darcy (equivalently 1000 Millidarcies) will allow for a flow of 1 cm/s of a fluid with viscosity 1 centiPoise under a pressure gradient of 1 atm/cm. To make sense of the "1 centiPoise part", note that water has a viscosity of 1 centiPoise at 20oC. Ghawar oil is a little less viscous than water - varying from 0.62 centipoise in 'Ain Dar to 0.89 in Haradh. Highly permeable rock allows much more rapid production of oil (and of water).

As you can see, much of North Ain'Dar and Shedgum have very high permeabilities in the range of 750 mD. South 'Ain Dar has much lower permeability and is presumably far less productive in consequence. Also note the red and black regions in the picture. These are areas of very high permeability which likely allowed for the very high oil production early in the life of some Saudi wells, but also can channel large volumes of water later in the life of the field.

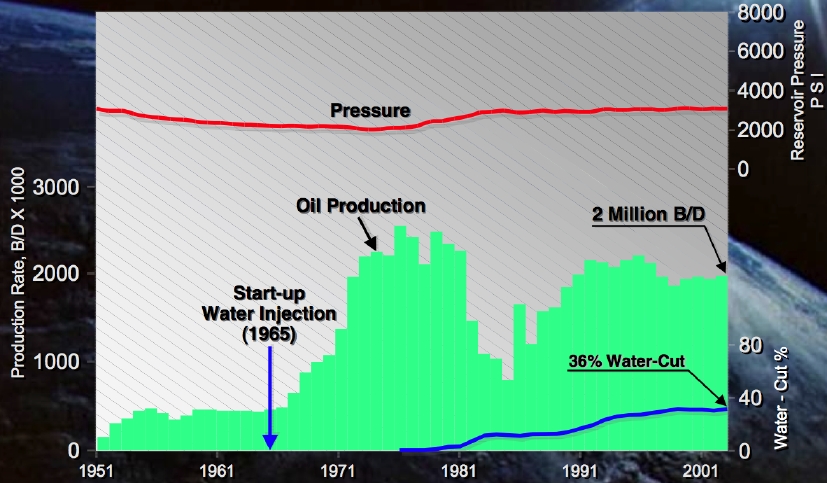

Data for the production history of 'Ain Dar and Shedgum together were given by Baqi and Saleri in their presentation to CSIS in February 2004 (the presentation that was essentially trying to refute Matt Simmons' concerns). Those data look as follows:

As you can see, production has recently been running at around 2mbd. This graph shows annual data through 2002. If we look at the Water Management in North 'Ain Dar paper, we get an annual production series just for North 'Ain Dar, which suggests that region was about one quarter of the total production of the whole 'Ain Dar/Shedgum north end:

Here the production data represent annual data through 2004. Assuming this data is accurate, production fluctuations in North 'Ain Dar cannot have contributed in a large way to changes in overall Saudi output through 2004 (though it is perhaps useful to note that 2004 is slightly down on 2003, whereas Saudi Arabia as a whole was up from 2003 to 2004 on an annual basis). At any rate, there is no evidence here of major trouble in North Ghawar production as of the end of 2004.

However, there are other indications in the paper suggesting that trouble cannot be far off at all. Let's look at this picture of the state of the reservoir in 'Ain Dar. This is taken from a paper titled Water Management In North 'Ain Dar, Saudi Arabia by Alhuthali et al and published by the Society of Petroleum Engineers as Paper #93439 in March 2005. Fractional_Flow pointed us to a bootleg copy that somebody put up, but if that disappears, you can get the official version behind the paywall.

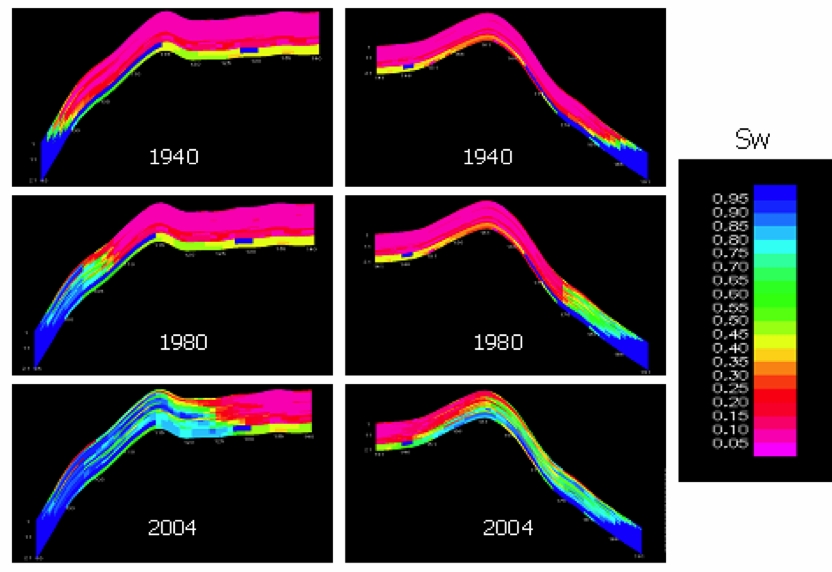

This is from a numerical simulation of the development of the reservoir over time. However, Saudi Aramco history-matches their reservoir models with extensive amounts of well log data, so it is probably a reasonably accurate picture of the history of the field. The variable being plotted is water saturation - that is the percentage of the pore volume in the rock that is filled with water, rather than oil. In Ghawar, the reservoir pressure has been maintained such that there is no gas cap (the gas is dissolved in the oil), and so the pores are filled with oil, water, or a mixture. You can get the general idea of the figure - at the beginning (in 1940) the crest of the reservoir was almost all filled with pink (ie oil with less than 5% water) and red (less than 25%). As time has gone on and more water has been injected at the periphery, there is less and less dry oil like that, and instead there are green and pale blue areas which are 50%-80% water by volume.

Now, your first thought might be this: if there is 10% water and 90% oil in a particular volume of rock (pink areas in the figure above), then a well into that part of the rock would be receiving 10% water and 90% oil. Similarly, an area with 60% water and 40% oil might be producing at 60% water cut into a well into that area. However, this is not so: the difference is much more dramatic than that. The reason has to do with the physics of two phase flow in a permeable medium. If you want a mathematical treatment, try this, but let me try to illustrate the basic idea.

In a set of interconnected pores through which oil and water are being forced at pressure, the flow is too turbulent for large areas of the two fluids to separate out from one another. And yet, oil and water do not like to mix, and will tend to bead up in the presence of the other. If there is only a little water and a lot of oil, then the oil will form an interconnected network of fluid throughout the rock pores, whereas the water will tend to make small beads within the oil. Conversely, a little oil in a lot of water will result in a network of water throughout the rock, and small beads of oil within that network. Now, in either situation, the fluid that is interconnected can flow through the rock without making any change in the arrangement of beads and surfaces between oil and water. However, the fluid that is beaded up can only move by the beads physically moving around, and they are going to tend to get trapped by the rock pores.

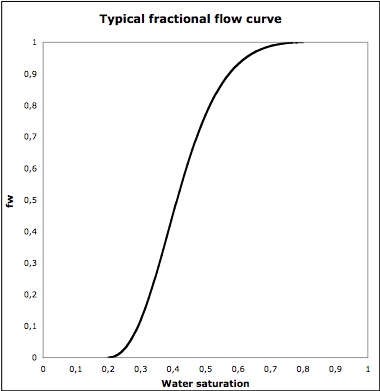

So for this reason, in a mixture of almost all oil, the water cannot flow at all. Conversely, once there is almost all water, the oil cannot flow at all (which sets an upper limit on the amount of oil that can ever be recovered by a water flood). In between, there is a changeover in which the proportion of oil flowing to water flowing changes much more rapidly than the changeover of the actual mixing ratio. The curve that describes this is called the fractional flow curve.

For example, the tutorial I referenced earlier shows this picture for a typical fractional flow curve:

So the way to read this is that when we are below 20% on the X-axis (less than 20% water in the oil), there is zero on the y-axis (the water will not flow through the rock at all). As we get above 20% water saturation, the flow of water increases rapidly, until above 80% water, there is no flow of oil at all. In the linear region at the center of the curve, the slope is about 3.6. That is, each 1 percentage point increase in water saturation results in a 3.6 percentage point increase in water flow in the rock.

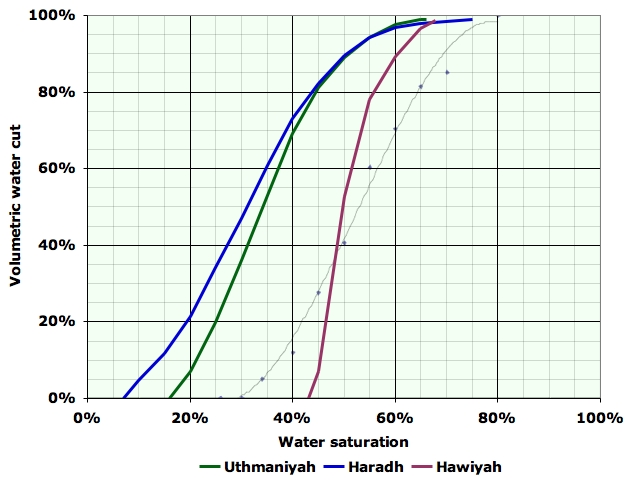

So that implies that the difference between the red regions (20% water saturation) in the simulation picture above and the green regions (60% water saturation) could be very large. That might be the difference between hardly any water flowing, and almost all water flowing. But does this abstract "typical" fractional flow curve really apply to Ghawar? Or might things be very different there?

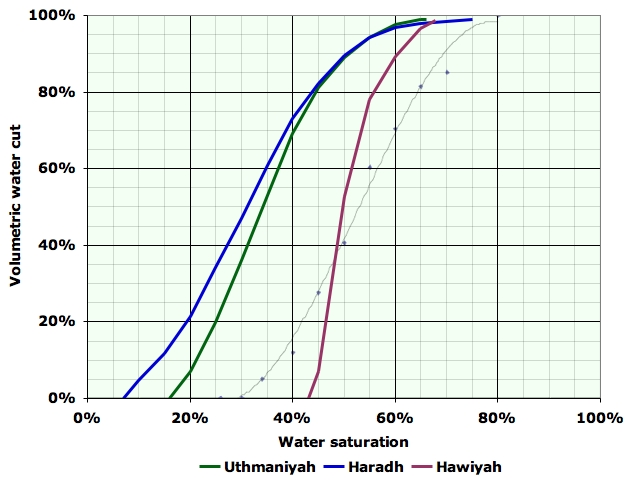

Well, I have managed to find in another SPE paper some actual data from which I was able to infer the fractional flow curve for three regions of Southern and Central Ghawar. In a different references, I found a carbonate fractional flow curve from the United Arab Emirates.

Clearly, these have the same general character as the "typical curve" above, and again there is going to be a dramatic difference between red regions and green regions in the cross sections above.

Now, we do not have quantitative fractional flow curves for 'Ain Dar and Shedgum at the moment. However, we know one point on the curve for 'Ain Dar from Alhuthali et al (Paper #93439), which reports on measurements of rock right next to an abandoned water injector well. The pores of that rock had 21% oil, 79% water. Rock next to a water injection well is bound to contain only that oil which is never going to move under any further waterflooding, and so tells us that the fractional flow curve must reach the top of the graph (y-axis of 100%) when the x-axis is at 79% water saturation. This appears to be roughly consistent with the other curves on the graph.

Thus, we can conclude that as long as there is red/pink in the simulations above, it will be possible to produce oil at very low water cuts by drilling horizontally into those oil layers. The overall water cut of the field can be somewhat controlled by making decisions about how much to produce out of the red-pink zone, and how much to produce from the watery green areas. Once the red/pink zone is gone, then there will be no way to produce oil except out of those green areas, which probably correspond to water cuts in excess of 70% (perhaps much higher depending on the exact shape of the fractional flow curve in this part of Ghawar).

Now, how long before the red zone is gone? Let me remind you of the simulation picture again, to save on scrolling:

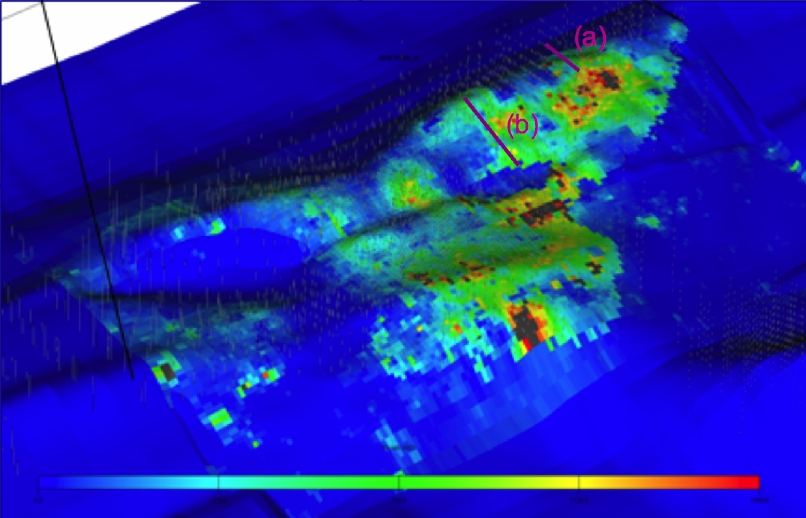

Now, after staring at the bumps in these figures, I think I have figured out roughly where in North 'Ain Dar these two cross sections -- a) and b) -- are. I have indicated them on the permeability visualization I showed before:

These placements are not exact - they could easily be a few miles north or south of where I have shown them, but I am pretty confident that I am in the right general region. Now, the conclusion I draw from this placement is as follows: the cross sections are reasonably representative of the crest of North 'Ain Dar. As the cross sections show only a reasonably thin layer of red/pink oil that, in two dimensions, is hugging the top of the reservoir, it seems very likely that, in three dimensions, we only have a layer of roughly that thickness throughout the entire crest of North 'Ain Dar.

So how long is that layer going to last?

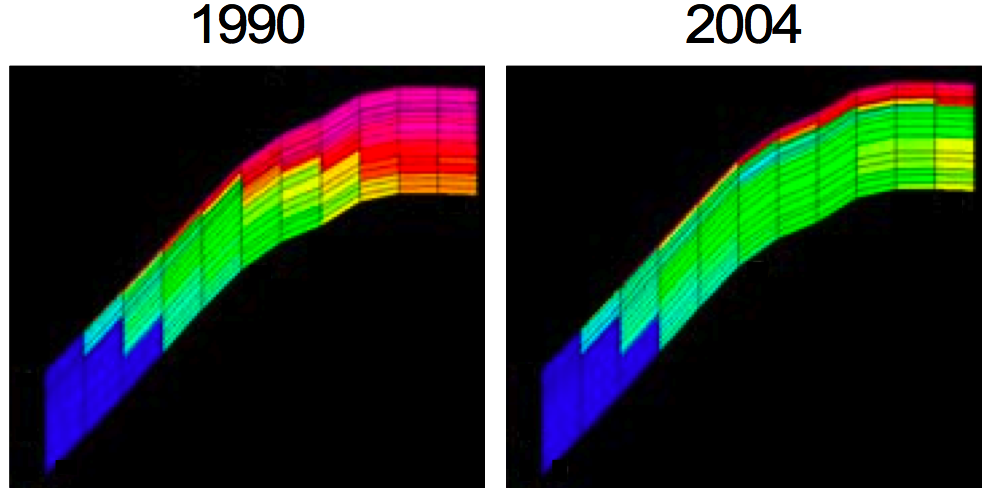

Well, if we blow up just the 1990 and 2004 pictures for the (a) cross section, that is the western flank, we get this picture:

So my layer counting says that over 14 years we went from 10 layers of red/pink in the crest to 2 layers of red in the crest. And if we do the same for the (b) cross section on the eastern flank, we get this:

Layer counting here says that 6-9 layers of red/pink have been reduced to 1 layer over the same 14 years, suggesting a similar pace. So, overall, we lose a layer about every 21 months, and there were 1-2 layers left at the time of the 2004 simulation. Now, we do not know for sure whether this simulation means by "2004", "2004.0" -- the beginning of the year, or the end of the year. However, labels on simulation visualizations in other papers shows annual data with a ".0", suggesting that is the convention. If so, then we would expect the green area to reach the top of the reservoir in some places in North 'Ain Dar in mid-late 2005, and in most places there by the middle of 2007. Thus in timing, this phenomenon would be consistent with the decline in output across production zones E-I (mid 2005 through the present).

It does not appear to me that, from a timing perspective, this phenomenon is well placed to explain any declines that offset whatever fraction of the 690kbd of Qatif megaproject production came on in late 2004 and early 2005 (zones B-D). We have production data for North 'Ain Dar which do not show more than a very small decline in 2004 on an annual basis, so any sizeable decline here could not have occurred before 2005.

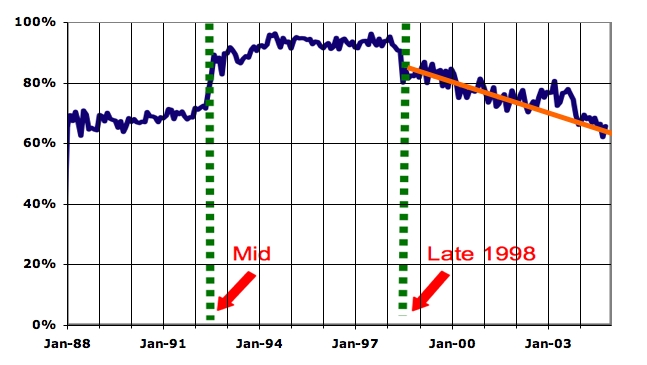

Euan has questioned whether an increase in water cut like this could have a large enough impact on production to explain all the declines we see. Let me try to make an estimate on how large it could be. We cannot do this with any precision from the fractional flow curve because we don't have an exact fractional flow curve for this part of Ghawar. However, there is other data in Paper #93439 which allows us estimate this. In particular, the paper contains a discussion of what fraction of production comes from behind the flood front, versus in front of the flood front. They discuss the desirability of trying to produce from behind the flood front as much as possible in order to maximize overall recovery of the oil. However, it is clear from Figure 10, that they have been obliged to produce more and more oil from above the flood front in order to maintain production. Specifically, the fraction of production below/behind the flood front is shown as follows:

Now, this is dropping, presumably because the water behind the flood front has higher and higher water cut over time, and the water handling facilities are limited. If we extrapolate out the orange line to today, only 55% of production would be coming from behind the flood front. However, once the flood front has reached the crest (which I argue must already have happened already in most places), then there can be no production from above the flood front. This line of reasoning suggests that the flood front reaching the crest would produce around a 45% reduction in production over a period of a couple of years.

Now, we only have enough data to make a convincing case for when this will occur in North 'Ain Dar, which represented only 500kbpd of production in 2004. However, it is at least plausible, though not proven, that the same thing could be happening in approximately the same time frame in the whole 'Ain Dar/Shedgum region. 'Ain Dar and Shedgum have very similar reservoir properties, very similar oil qualities, almost identical thickness of original oil layer, and were brought onto production at the same time. So it is plausible that they have been produced in parallel, and will be reaching the end of their production plateaus at around the same time.

If this were so, a 45% reduction in 2mbpd of production (as of 2002) would represent about 900kbd (with a large, say 50%, uncertainty in that number for a SWAG at the error bar). This might be enough to explain most of the decline in production from June 2005 to the present (though we would still require some other field in decline earlier in order to offset Qatif and Haradh III). and make up the rest of the overall production decline.

Some further circumstantial evidence for this point of view comes from Hussain et al, International Petroleum Technology Conference Paper #10395, November 2005. This paper is titled Optimizing Maximum-Reservoir-Contact Wells: Application to Saudi Arabian Reservoirs and covers the process of selecting locations in 'Ain Dar and Shedgum in which infill Maximum Reservoir Contact wells (MRCs) would produce incremental recovery over what could be recovered via the existing wells. For each potential MRC (basically a horizontal multilateral), a detailed reservoir engineering simulation is done on a fine scale grid to assess the impact on recovery and the economics of the proposed well. What is interesting is that these wells (which presumably represent the best remaining opportunities in the field where there is still some localized piece of the oil layer left to go after) are anticipated to begin declining very quickly.

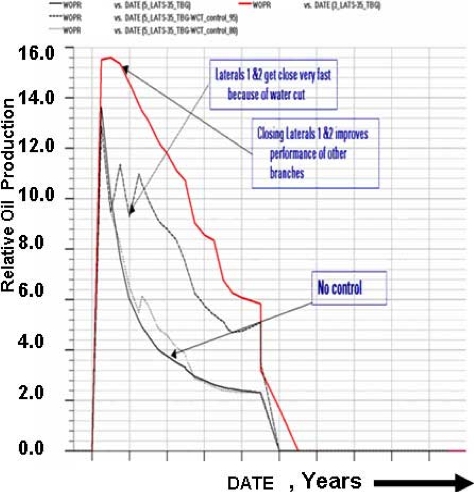

The new well studied in 'Ain Dar, which was "planned to be spudded early 2006" is simulated to begin declining sharply almost immediately:

My interpretation of this is as follows: there is nowhere left that one could put an MRC into a reasonably dry oil layer anywhere in 'Ain Dar. If there was, Saudi Aramco would have illustrated their paper with that well, instead of this one, and that hypothetical well would have had a longer plateau.

Similarly, the new MRC studied in Shedgum was "spudded in late 2004", and was anticipated to be on plateau through the end of 2008, before beginning to decline rapidly:

My interpretation of this is that the last remaining spots of dry oil layer in Shedgum will be gone by the end of 2008, implying that there are probably some places in Shedgum where the oil layer is gone already.

Uthmaniyah

The situation in Uthmaniyah is less clear. There is a paper Water Production Management Strategies in North Uthmaniyah Area, Saudi Arabia, which covers some of the same ground as the North 'Ain Dar paper. However, what it particularly lacks is any production data, so we cannot estimate either how much Uthmaniyah has produced, or any trend in that production.The paper does have some interesting hints of trouble. For example, "In August 2004, additional twenty-seven high water cut wells were put on cyclic production." Cyclic production means taking wells in wetter zones of the field off line for six months at a time to allow water to settle away from the well bores, and then running them again. It's interesting that this was happening right at the start of zone B, when Saudi production stopped rising even as OPEC was losing control of prices. However, 27 wells, which were presumably below the Saudi average at the time of 6kbd each, can only represent a number not much larger than 100kbd, and perhaps significantly smaller. So this is not evidence of much unless it were a harbinger of larger problems.

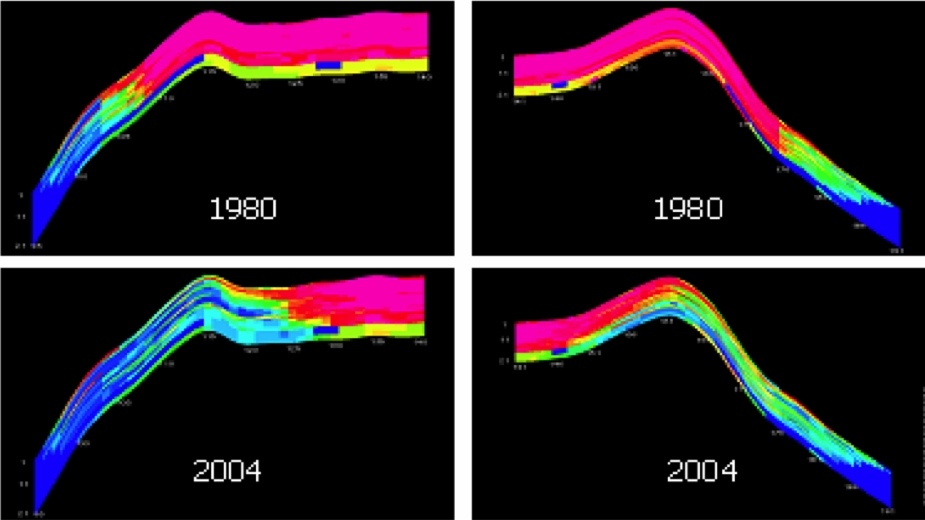

The paper does show cross-sections of a reservoir simulation again:

Several features are interesting. It looks as though there is more dry oil left in Uthmaniyah than in 'Ain Dar. However, it also looks like it is harder to flood uniformly: the simulation shows some streaking of water breaking through the oil layers that was not evident in the Ain Dar simulation. Some explanation for this is found in the fractional flow curve, which we actually have for Uthmaniyah:

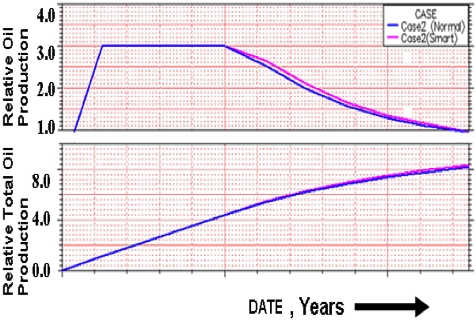

As you can see, the fractional flow curve for Uthmaniyah is not too nice. Once we get out of the pink (ie above 15% water saturation), water movement starts, and by the time we are into green (above 50% water saturation) water cut is up to 90%. Thus production outside of the dry oil will be a slow business in Uthmaniyah, and ultimate recoveries are bound to be lower. If we blow up just the 1980 and 2004 pictures, we can try to estimate how much oil is left:

Eyeballing this, and assuming these profiles are representative, it looks like about a quarter of the pink oil there in 1980 was still there in 2004, suggesting plateau might be maintained for another 8 years give or take a year or two (and modulo periodic breakthroughs from those streaks). After that, it appears that water cuts will start to rise rapidly and within another five years production will inevitably decline greatly as there are only yellow and green regions to try and produce from with very high water cuts.

A Note on Well Productivity

Finally, I wanted to comment briefly on Euan's piece on well productivity, which I think might have been overly persuasive to some people. The first thing to note is that the main reason for the high well productivity of Saudi wells is that the rock is exceptionally permable by global standards. This allows a relatively small number of wells to drain a large volume of rock. It does not mean that once that rock has no dry oil in, production cannot decline rapidly, or that lots of further drilling into the depleted reservoir will necessarily do a great deal of good (it is noteworthy that the Saudis are putting in a fairly small number of very carefully planned wells in North Ghawar to extract the last oil they consider worth going after, rather than putting in large numbers of wells which would do little good).The second thing to note is that the OPEC data Euan used is annual. Not only that, it ends right as the alleged problem is just getting going. This conceals any signal of the problem in the data. I did an exercise to infer what the monthly well productivity would look like through the end of monthly data. I did this by assuming that well retirements occur at the same rate in the monthly data as they did on average in the OPEC annual data from 2001-2005. I further assume that the rigs Baker Hughes counted in Saudi Arabia drill wells each month at the same average rig productivity as the OPEC annual data show from 2001-2005. I linearly extrapolate the ratio of oil to NGLs to continue as it has been going. I applied this procedure from the beginning of 2004 on, and its reasonableness is attested to by the fact that it predicts the OPEC reported number of producing wells at the end of 2004 and 2005 to better than 1%. (Further interpolation into the next year is based on the OPEC actual, rather than the monthly interpolated estimate from the prior year).

With those assumptions, the well productivity graph looks like this:

As you can see, the well productivity shows evidence of an alarming decline starting in mid 2005, and accelerating through 2006. This is consistent with my overall hypothesis that declines in Saudi production are in significant measure forced, rather than voluntary.

The Future

Does this allow us any greater confidence in predicting the future? Probably not too much. On the one hand, it appears that Uthmaniyah may not imminently follow 'Ain Dar and Shedgum, and that the worst of the rapid damage in north Ghawar may already have occurred. On the other hand, the data appear to me to suggest that 'Ain Dar and Shedgum declines are not likely to be sufficient to fully explain the declines (net of megaprojects) that we have observed in total production. One possibility is that some other fields or regions of Ghawar are also declining (eg we know next to nothing about Hawiyah). Another possible explanation is that the redevelopment of Qatif and Abu Safah was largely a failure. A third possibility is a hybrid explanation in which some of the late 2006/early 2007 decline is voluntary as price has sagged below $60, over and above the forced decline. That might allow for a partial recovery of production this summer. However, this last would be somewhat inconsistent with the fact that Saudi Arabia's Asian customers have been put on allocation.Time and further investigation are required.

Footnotes

- The water cut was calculated as Krw/(Krw+Kro/Fv), where Krw is the relative permeability for water from the figure, Kro is the relative permeability of oil also from the figure, and Fv is the oil formation volume factor from Greg Croft.

Great work. Im wondering how close we are to the what the engineers in SA know? Do they know a lot more? Details for more of the area probably. I suppose they read this :)

However, Iam personnaly convinced that we have some problem with oil production world-wide, to get enough product on the market. This year.

So, again, are we (TOD) gonna spend another day debating this and that of what is wrong or right above, or do we want to discuss some larger points. Like, should we inform more people about peak oil? How is that done? Is there a printable sheet to hand out/pdf to people, explaining the basics?

What will happen 2007 or 2008 if SA reduces output down to say 7 mbpd? Ideas?

"So, again, are we (TOD) gonna spend another day debating this and that of what is wrong or right above, or do we want to discuss some larger points."

You've got to be kidding? Yes, of course, the public should be reached. But SA peaking is not a large point? TOD has people who know about this stuff and can argue it. What could possibly be of greater interest? There's no conflict between the two goals.

Reaching the public is not easy when you have spinmeisters like CERA preaching rosy outlook into 2030 and beyond. The sad truth is that "jerkin yerkin" and his band of merry makers have far greater influence in a 2 minute intervies on MSM with the clueless public and policy makers in denial than two years of TOD. The public will not be ready for facing reality let alone a change until we hit a wall.

soleman and davebygolly,

Agree with your points, and to me, Stuart's work in an EXCEPTIONAL article, well worked arguement, and great documentation is EXACTLY the stock in trade of what TOD is and why, even when I get pizzed at some small point or another, I keep coming back.

As to Yergin and the CERA merry makers, the problem is worse than that: CERA could be easily dismissed if the EIA of the U.S. Department of Energy and USGS did not basically back him up. I once argued that they should have to go before Congress and testify under oath to thier assessments once and for all, and if they turn out to have based thier numbers on thin air, be held accountable for them. The EIA recent long term outlook gives fuel and energy costs almost across the board as being no higher out to 2030 than we have already seen:

http://www.eia.doe.gov/oiaf/aeo/growth.html#prices

(!!!!)

Add to this the Saudi claims that they have it covered and ExxonMobil claims that there is no sign of peak anything and you see the problem. Those who accept the need for concern are having to persuade the public, investors, planners, etc. to bet against ALMOST EVERY MAJOR ENERGY POLICY INSTITUTION IN THE DEVELOPED WORLD. An uphill fight to say the least, and now almost impossible, due to bankers and policy makers sourcing the Department of Energy stats to get information, investment and funding for alternatives and mitigation will rapidly dry up.

General Motors now says that the plug hybrid car the "Volt" will possibly never be built. Volvo has essentially ignored its magnificant lithium battery electric car. Ford has done no further development on it's hydraulic hybrid truck/SUV which was developed in conjunction with Eaton Corp. and the EPA.

Why? If one assumes a petroleum price at or below $75 per barrel out to 2030, non of the above technology makes any sense to develop. It will simply not have a customer base.

Thanks Stuart Staniford, EXCELLENT ARTICLE, one for my "saved" file, as I have said before, if I have to accept someones numbers, I would accept yours long before I accept CERA, EIA, or USGS numbers, which are to me as screwed up as soup sandwich! :-)

(now, if we can resolve just how much oil is going to come on line from the Khurais field, the empty quarter, and offshore, we could get a clear picture of what is going to happen....until then, it's still a shot in the dark...:-)

PREPARE FOR ANYTHING.

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

Hi Roger,

Thanks and

re: "...An uphill fight to say the least"

Did you see Richard Heinberg's essay about his experience talking to EU people? http://www.energybulletin.net/27278.html

It's hard to say, is my take on it. Uphill...yes. (or...no?) And...how steep? We don't really know, do we? (In fact, this seems to have a much greater uncertainty factor than any reserves discussion. Despite many people's firmly held opinions.)

re: "...It will simply not have a customer base."

In regard to policies though, such as stopping some subsidies and implementing others...for eg., ag reform. and better ag policies (as perhaps touched on above)...the "customer base" perhaps can be changed. Just as it has been manipulated in a real sense in the past.

This is a great article on water flooding.

If a field is rested for a decent period (no idea how long) in conditions where it has been producing with a significant and rising water cut, does the oil permeate to the top over time so that production can once again proceed from drier oil at the top?

If so, the Saudis, with so many fields must be able to do this, as Euan suggests, but maybe their ability to control the situation, as Stuart points out so eloquently, is "in decline" as well.

Saildog, you ask a great question and I am not sure of the answer. But I do have a couple of comments. "Resting the fields" is a term I have only heard on this, and other, forums. I have never encountered the term in any technical literature or on any book about peak oil or oil production in general.

The only thing I think resting a field might do would be if coning had occurred then shutting the field down for several years might mitigate the situation somewhat. That is oil from the sides of the cone might migrate in and push the cone down some but I am not at all sure about this. Just guessing I would tend to doubt that resting a field would help the coning very much.

But I would bet that it would not help the water/oil mix one bit. I think it would take decades, or even centuries or more for the oil and water to separate inside the reservoir.

However I would just love to hear from someone who does know what the hell they are talking about on this subject because I sure as hell do not. But never having encountered the principle anywhere except on fourms such as this, I tend to doubt that it is a widespread practice.

Ron Patterson

ron, i agree with you to an extent. my first reaction when i read about "resting" the wells here for the first time was relative to water coning. my experience is that if/when coning occurs, shutting in the well for a time will give an instantaneous improvement but for a very limited time.

however, the saudi's may be "resting" the wells to their benifit. 1) resting the wells has the same effect as production at a lower rate. 2) the combination of high porosity and permeability, reservoir stratification and steep dip may actually result in gravity segregation of the oil and water (some on here dismiss this idea out of hand). 3) during the shut in periods, water may "imbibe" into the lower porosity rock and displace some oil "into the fairway". imbibition is very effective in displacing oil, although limited to a few % of pore volume.

At least in Uthmaniyah, the Saudis explicitly have a bunch of wells on cyclic production, where they produce for 6 mos and then rest 6 mos.

Thanks, Stuart,

re: Do they say explicitly why? Or, do you know (for sure) why?

SPE 98847 saith:

Stuart, et all,

I thought you might be interested in this story. Though its use for oil fields may not work one day, it is interesting and its about "flow" of liquids and what forces can be used to act upon that flow

http://www.livescience.com/technology/070327_laser_jet.html

"Light is actually pushing onto us slightly. This effect is called radiation pressure," Zhang said.

This gentle pressure generated by photons—particles of light—ordinarily goes unnoticed. But the liquid used in the new experiment—a soapy mixture—has such an incredibly weak surface that even light can deform it. It created a phase change that's a bit like how shampoo turns to soap when you add water, the scientists explained.

The newfound technique might offer a new way to control the flow of fluids through channels thinner than a human hair for biomedical and biotechnological applications, the researchers said.

Quid Clarius Astris

Ubi Bene ibi patria

In US wells using pumps, resting a well might simply refer to allowing the oil to seep in and fill the borehole. I know a lot of stripper wells operate on a few days a week (or month) type of schedule. Like you, Ron, I don't how the 'resting' would affect a high-production water drive oil field like in KSA, which is obviously going to be quite different than pump driven stripper wells.

The same issue has come up with regard to the Russian wells that had several years of 'resting' before being put into high production again. I suspect it is a combination of geological factors such as oil migration (imbibing) and technological factors such as horizontal wells, etc. that brought about the second Russian peak.

Assuming that Russia starts reporting lower crude oil production this year or or next year, IMO it is very likely that we may see as much as a 50% drop in net oil exports by the current top 10 net oil exporters, within a five year period. Note that the UK went from exporting one mbpd in 1999 to zero exports (a net importer) in 2005.

In any case, I estimate, based on some assumptions, that net oil exports by the top 10 fell by about 8% from 12/05 to 12/06.

What to do? Start thinking about how you are going to feed your family. While we can hope, I don't expect to see any policy changes in the short term, especially as ExxonMobil and CERA are telling us that we don't have to worry about Peak Oil for decades to come.

I recommend ELP--Economize; Localize & Produce. I think that it is a very good idea to get joint venture groups together to buy small tracts of land for organic farms. I am going to expound on this in a planned article next week.

I think we're screwed too. But in the case of KSA, I can see them maintaining exports even in the face of declining production, at least for a time. Given a choice between money and a rioting population, I think they try the riots.

I think westexas's point about food is crucial. Most people COULD get to work (assuming they still have any) by foot, bicycle or public transport and just have to put up with the inconvenience and extra journey time. Most people COULD get by with a lot less fuel for heat, etc. than they use now, with insulation and tolerating lower temperatures. They COULD do without (be happier without?) the endless power-hungry gadgets they currently have. You can't do without food, in fact if life is generally harder you need more.

It's no coincidence that the theme of the 2007 Soil Association (UK organic farming body) conference was peak oil. In that conference, Richard Heinberg said that UK would need 10 million more farmers (or the full-time equivalent thereof) within 20 or so years. That's at least a quarter of the working age (18-65) population.

A few days ago somebody mentioned that most jobs in W. Europe and USA were to do with people moving making, selling, moving or marketing goods that were totally inessential for everyday life - and asked what would these people do when there is a peak oil induced recession and nobody is buying them. According to Heinberg the previous paragraph contains the answer. What young people aspiring to comfortable office-based jobs would think, when told they have to spend 10-20 hours per week doing manual farm work is another matter. It's an almost surreal prospect and as Heinberg says, growing food takes some skill so would be a formidable reeducation task.

I have been a grower for a wholesale nursery for 21 yrs and have had my own now for 6yrs now (27 years total). I cannot stress enough that it takes time to learn how to grow plants consistantly, even with a horticulture education. I maintain @ 3 yrs to know how to grow a crop, again the key word here is consistantly. Besides different genus & specie, each "cultivar" (cultivated variety) has different requirements, nutritional needs and is attacked by different insects and diseases. It would amaze you how specific certain insects are to what they like. Crane fly lays it eggs in - Bellium munitum. Root weavil lays its eggs in -Galium oderatum. Even if both plants and insects are in the same greenhouse.

Like credit ratings plants have a 3 legged "disease triangle". susecptable host plant, correct enviromental conditions(temperature, humidity), and the disease or insect.

Insects act as vectors(transmission) for disease by carrying spores on thier bodies as they move about.

Under perfect disease conditions and with a highly susceptable host plant it is almost impossible to control diseases - hence chemicals.

Chemical(including organic spray type controls) application can be done preventatively "if" you understand the necessary conditions, disease, and the plant.

I cannot, cannot stress enough that it takes time and paying attention. If you screw up one year you might not get the chance to learn from your mistake until the following year. Hopefully then you will have made the right decision or you might have to wait until the next year again.

IMHO it takes 3 years to be consistant(consistant as defined by me as low losses, high quality).

Best D

D,

I was only half kidding when I suggested to a friend of mine from Africa that we should have a "Reverse Peace Corps" plan, where African farmers come over to the US to show American college students sustainable farming practices. As I said last year, at some point we will probably see unemployed college graduates competing with migrant workers for agricultural jobs.

I think that a good line of business may be running classes on how to set up your own Victory Garden.

I have forgotten the exact numbers, but before the Soviet Union collapsed, I think that tiny private agricultural plots accounted for something like half of all food output, while accounting for something like 5% of the arable land.

There's a huge collection (1,849) of book learning online at Cornell U. called Core Historical Literature of Agriculture. I can attest from owning an 1911 set of the Farmer's Cyclopedia that there's a boatload of knowledge on how to farm without fossil fuels and chemical fertilizers.

That is a fabulous link. A gold mine...

Westexas-thx your continuing input. OK by me you might repeat items...how else can newcomers catch-up?

Perhaps adapt Canada's view and pay well gollege students to do "manual labor that is valuable and productive...like planting zillions of seedlings [Canada's reforestation programs]. When did idea of manual labor become degraded? Who decides what is "skilled" and "unskilled"? Our food supply is victimized by narrow interests.

I dug, planted and harvested in a Victory Garden 1943-1947. The workability of that included full employment. No unemployment. So no hungry and desperate mouths to steal the fruits at night [except us little kids]. Very different now.

WT I can believe that with smaller plots of land. I know alot of farming includes the use of pre and post emergent herbicides. I have never found a herbicide yet that you can apply that will not stunt the crop you are trying to "save". "I want this plant to die right next to this plant I want to live and grow healthy" has never made sense or worked for me. I watched a $10,000 crop slowly die over 1.5 yrs using "recommended rates" of a particular pre-emergent herbicide. I haven't used them over plants since and do not recommend it. Boy was I mad, I'm not real popular with chemical co. rep's at trade shows.

The attention paid such as by the poster below on his peppers makes for bigger and better yield as skills are learned. Paying close attention to the plant and doing what it likes, and not what you like, is most of the battle.

I just made a similar realization. I tried raising a garden last year with minimal success. I made several mistakes, some of which I'm aware of, but some that I'm still trying to figure out. It struck me that when you only get one try per year, the learning curve is very long.

Lesson from first year:

Peppers like multiple days of >100*F. Herbs do not.

One good thing about global warming. My peppers and tomatoes will get better (I have an altitude problem)

I tried raising a garden last year with minimal success

I had the exact opposite experience. I basically threw a bunch of seeds down on some compost I had made and got huge, productive plants, no (and I mean not a one) insects, and no diseases. I basically didn't even have any weeds.

Of course that means I won't be able to grow a damn thing this year.

That style of gardening is no joke. I highly recommed all read the books of Masanobu Fukuoka of Japan. If you look you can find them in English.

His goal was to farm in the most natural way possible, with the least amount of effort, and the largest results.

In its particulars it is quite sophisticated but the basic story is this:

Throw some seeds around. Let the veggies grow like weeds.

In practice he uses "seedballs" so the seeds aren't eaten before they sprout. No tilling, no planting, no weeding, no chemicals, no fertilizer (except some natural compost), no pesticides. Just throw some seeds around, wait, and harvest. Mix up 100+ varieties of things you want to eat. If you toss this mix all over the place, the most appropriate plant will probably begin to thrive in the most appropriate place.

Since this technique requires very little work you can cover large areas with it. Then, even if your initial production is very low per acre, in total you can create large amounts of food.

In time Fukuoka was able to reach some of the highest yields in the world by any method, while doing almost no work. But this takes many years of fine-tuning.

I actually kind of practice this, without any refinements, and it is a valid approach - except for the insects. It would be interesting to see what his approach towards them was.

Picking off the potato bugs, and destroying any egg infested leaves works, for example, but it does take some time.

His approach was basically to leave them alone. After a while, a predator of the insects would appear. He said it was a different one each time. He was adamant that a generally inviting environment (no chemicals or pesticides) be maintained so that insect predators would appear.

He also found that the damage often looked worse than it was. In his case, he had "rice blast," which destroyed rice. His fields looked like a total loss but he found that yields declined only by about 30%. Not all the plants were affected and the ones that weren't tended to yield more because they had less competition.

One predator of insects on vegetables is chickens. He raised chickens, which ate the bugs and produced eggs.

If you look at plants in nature, in a forest or wild field for example, there are of course insects but the plants are usually healthy. He strove for this state in his "managed" fields.

Two of Fukuoka's Book:

* One Straw Revolution: The Natural Way of Farming.

* The Natural Way of Farming: The Theory and Practice of Green Philosophy.

are available at

http://www.soilandhealth.org/01aglibrary/01aglibwelcome.html

BTW, the above is a FANTASIC resourse.

If anybody knows forums for people practicing Fukuoka's methods, I'd like to know about them :-)

Try

http://fukuokafarmingol.info/farchive.html

Peter.

Most plants like moist yet well drained soil. 2nd to that is what you have discovered - sun. Location is big, you can kill or severely retard the growth of a plant with not enough or too much sun light. If you have a location for your peppers with reflected heat/light, be it off off concrete,a fence,a wall, or whatever that will help. 1/2 day of afternoon sun is very, very different to a light/heat sensative plant from 1/2 day of morning sun. Loose dark colored soils warm quicker than a light colored, dense, wet soil. Try placing white (plastic) buckets between plants to reflect light. Use a (plastic) milk jug with a small hole in it to 'drip' water plants- a great way to save water and reduce weeding. Built in handles makes for easy carrying.

I'm not a fan of (light colored) straw mulches. They might be good in southern climates but here in oregon we need warmer soil so I prefer dark mulches to collect as much heat as possible. Small differences I know but they do matter with some plants or locations.

Best D

@Bman

It takes several years to figure out gardening. Almost nobody gets good results the first year(s) but rest assured, you'll get better at it.

Have your soil analyzed at a laboratory while we are not (very far) over the peak. I had mine analyzed because cabbages and unions failed mysteriously and it appears micronutricients were missing. So I am adding volcanic stonemeal, compost and borax this year. From what I've heard this is a very common problem for soils that have been used a while for agriculture. Even the rules for organic farming allow for artificial micronutricientfertilizer to be added to the ground. Adding a lot of compost will probably prevent micrionutricient deficiency to a certain extent.

Re: borax,

Warning TOD readers use this extreemly sparingly! We inject ONLY .33 ppm(parts per million) to prevent deficiencies. We disolve 1 lb laundry borax into 5 gallons water and then take only 1 pt. of this solution injected into 1,000 gallons of water (= ratio 1:8,000)to get our .33 ppm. This stuff is toxic to plant life in the wrong concentrations.

Boron(borax) can be used to treat wood against wood boring insects or as a soil sterilant it all depends on the rate.

Get a soil test done. Most micro nutrient packages have boron already included.

That's right: Don't add borax if not explicitely adviced. I only do it due to advice on the grounds of soil test. It is a problem apparently typical for the sandgrounds I'm on.

My point was: Have a soil test.

@Bman

Second advice would be to start gardening for the love of it, not for peakoil scare. It greatly enhances the joy you get from it (You don't know happiness untill your first potatoe harvest), and joy is what you need for prefecting your skills in gardening.

My husband has been growing grapes, ornamentals, and food for many years and is considered to be one of those "green thumbs." But nearly every single day he runs across something he didn't anticipate or some new bug or disease that he has difficulty dealing with. It is a continuous learning process. I'm trying to wean him from chemicals, but it is very difficult. The best way to keep the chemicals and bugs down is to build a greenhouse that is capable of keeping out most pests, but that doesn't stop the diseases.

Anyone who thinks they can just wait until things get bad and then plant a garden to feed themselves is in for an unpleasant shock. Get started now and learn how to save seeds--it may someday save your life.

I couldn't agree more about starting now. A few years ago I posted a year-by-year time-line on another forum on just how long it takes to get even close to self-sufficiency. FWIW, figure seven years: 2 years taking appropriate classes and 5 years to get everything in place.

I've been gardening for close to 40 years including several as a certified organic farmer (small-scale) and I'm still learning stuff. One thing I've been doing for the past couple of years is converting all of our veggie growing area to Terra Preta/high carbon soils. I make my own charcoal from limbs leftover from firewood cutting.

How is the terra preta/high carbon soil working out? Pluses? Minuses?

Hi Cheryl,

I started with one raised bed (150 SF) 2 1/2 years ago. I first heard about Terra Preta on the Energy Resources forum and after doing more searching became intrigued by it. (FWIW, several of us have posted links on TOD so anyone interested can do a search.)

I was especially interested in its ability to hold phosphorous. My initial plan was to use winter wheat and grow it crop on crop since wheat won't head out without adequate P. I went out and bought 150# of mesquite charcoal at our farm supply, ground it (something I would never do again - messy!)and set up three sections. One was the control, one had 2.5% (by weight) and one had 5%. This test is still ongoing.

However, I began to add (and actually steal) charcoal from our wood heater to add to some other raised beds last year. Our crops looked the best we had ever seen until the wild pigs wiped them out. In any case, I was sold so, as I mentioned above, began using our unusable limbs to specifically make charcoal. Most of the limbs were 1 1/2" or less in diameter since I cut up bigger stuff to use in our wood cook stove.

In the past I would just make one big pile (usually 40' long, 6' high and 8' wide), light it up and be done with it. This year I made little piles that were about 5' high, 6-8' long and 4' or so wide. Since I don't have water where I burn, I raked the hot coals out and shoveled them into metal pails and popped on a lids. One fire yielded about 8# of charcoal This wasn't a lot of work but it WAS really hot. It also took a LOT more time. I will continue doing this and adding charcoal for the foreseeable future.

Again, I am absolutely sold on this! However, I think it is only viable for people like me who have wood to make charcoal. In one of the articles I read it indicated that the old Terra Preta soils had around 10% charcoal so it would cost an arm and a leg to buy it.

I'm only converting about 1,000 SF at this time. If society doesn't collapse in the next five years or so, I'll start converting our remaining beds that are terraced into a hillside. That's about another 1,200 SF. I'd also like to see what happens if I add it to the soil of our fruit trees, berries and grapes but that's long, long term.

Todd

Todd, that's great (and quite interesting/useful) info! As people read these things, I wonder if they start to really grasp how labor intensive small scale farming is...especially with minimal use of petrol and modern pesticides.

I'll print this out and also check out the links. It's amazing the wealth of info you can find on TOD.

We still have about 50 mac nut trees and Gary prunes them back every year, so we too have wood we can use. Unfortunately, we also have wild pigs here that love our mac nuts (as do the rats). Gary saw a huge sow and 9 piglets the other day up on the highway--not something most folks usually associate with Hawaii.

Mahalo!

Cheryl

Hi Cheryl,

Thanks for the always interesting glimpses of "Big Island" life.

re: "...(as do the rats).

Watch out for the rats. (partial :)) (If you read the link below, you'll see why.) Terry Hunt's work is on the complexity of eco-systems - or, the particular Easter Island one, anyway - and its failure...if you haven't seen this, you may be interested: http://www.americanscientist.org/template/AssetDetail/assetid/53200?full...

Well now, that's pretty creepy indeed. Rats are a big problem here--they not only eat the nuts, they love to nest in the roof overhangs. Since most of us rural folks are on catchment for water, having these nasty, incontinent critters contaminating your water supply is not good. Rats are a big source of disease on the islands--like leptospirosis. There is so much food everywhere that they thrive big time and if you add in the large number of dogs and cats that are fed outside and the problem just multiplies.

Americans have had it really good for a long time. The move to HI was my first exposure to anything like our ancestors may have lived. We are on catchment and need to keep our roof, gutters, and tanks clean. Whenever the power goes out, we lose our pump and running water. That means you can't even flush the toilet unless you carry buckets of water. And since there are no street lights, it gets VERY dark when the moon isn't out or the cloud cover is thick. But the darkness also makes for some astounding night skies and amazing lightning displays. The power does go out a lot during storms, and the satellite dish loses its signal multiple times per day.

Hi Cheryl,

Yes, night sky is so amazing. It's wonderful you have that.

I had no idea about the rat problem there. I'm curious what county health (or others) have to say/do about it? I wonder if it's worth doing some looking into it...? (Just trying to be helpful.) (I suppose the cats are afraid of them, too?)

Hi Aniya,

This will have to be my last post on this thread. My 3rd world DSL is just to slow to load and I don't want to make yet another pot of coffee.

The county health dept is pretty up on all of it and they do try to educate the public. But it appears a lot of the public doesn't want to be educated (like so many other things).

The one real stunner we found here was the number of cats and dogs. Most homes have 2 dogs, 3-5 isn't uncommon, and some are essentially kennels. Not only do the owners leave food outside (which the rodents love), but many of the owners don't clean up after their pets, and the worst ones seem to be the transplants from the continent. I guess they figure that if their dogs feces dried up in the desert and didn't cause a problem, then it is of no concern here.

But this is the tropics, and the feces are a huge problem. They stay warm and moist, and the minute the hit the ground the parasites are entering it. It's pretty gross, but they have a huge problem with dog dung flies here. They lay their eggs in the feces and feed and hatch in it (along with everything else). Then the other parasites attach to the feet of the flies and they transport the parasites everywhere. They get pretty thick, especially in the summer. All you have to do is have one land in the right place and voila, you have a parasitical infection. It is next to impossible to avoid unless you just don't go near the garden areas. When you are surrounded by thousands on a daily basis, you are going to get something. We did. The dog dung flies also like to land on mucous membranes, which is a direct route for infection. They love wounds, and will land on them and actually rasp away scabs. Very nasty critters, but you can't talk reason to most of the dog owners as they are in denial. Does that sound familiar?

I suspect that when the economy crashes, some of these folks (many are on public assistance) will not be able to support so many pets and the problem may rectify somewhat over time. I hope so as the dog dung flies had to be one of our biggest disappointments. There was one other, but I won't get into that now. It's also about dogs and what many owners let them do INSIDE the houses. Buyer beware.

I agree about the long learning curve. The first year I put some seeds and plants in the ground and had a great crop. The next year I was plagued by Japanese beetles, and a groundhog and a large limb which had fallen after a high wind storm and crushed several of my heirloom tomato plants. I just checked my fruit trees and the deer have eaten many of the branches this long winter. Who knew they would eat branches of apples, pear and plum trees? Now, I have to add yet another fence to keep them out. I'm just lucky to have started in time to be able to run to the hardware store and spend yet more money on items shipped from the other side of the world so I can keep the rats on long legs with white tails away from my fruit trees. The greenhouse is on order (20x48 feet) and I will be following Eliot Coleman's Winter Harvest which is low-tech winter gardening (I live not far from Kunstler despite my account name). I've gotten the canning down pretty well, and sauerkraut too, which is healthy and awesome tasting. Also, food dehydration is coming along. After drying some orange peels I made some pretty effective tooth powder for just pennies. As I read Stuart's wonderful post about Saudi Arabia I'm thankful I started when I did. It takes time, commitment, money, patience, intuition and a sense of humor to grow food!

I use almost zero chemical sprays. The few I use are nontoxic and mostly a light powder dusting for cabbage worms.

I think you might be speaking more of greenhouse conditions than gardens out in the open.

My gransparents also raised huge gardens and never had the least bit of chemical sprays.

I have been gardening for 55 years(at ten I had to help on the farm in gardening,picking tobacco worms,digging potatoes and so on). I raise fruit,berries , corn,potatoes,beans,cabbage,cucumbers,beets,cantaloupes,tomatoes

,eggplant and the list goes on and on.

I see it entirely different than you do. Granted it takes time to learn the essentials of gardening but not that long.

If you spend and hour each morning and an hour each evening ,in your garden, then you learn fairly rapidly.

In each part of the country(USA) certain varieties do better than in other locations. This is the stock that the hardware stores in the country carry. Such as black-seeded simpson leaf lettuce. I found none in N. Carolina but we grow it profusely here in W. Ky. Same with peas(crowder,blackeyedm,etc)...Mississippi Pink Eye Purple Hull are the best for my climate and soil. It took me one trip long ago to find this out. I stick with it now.

A very simple trick. Shove tobacco sticks in the ground around the garden(a pole about 5 feet long) the bluebirds and others will light on them and then fly down to harvest insects.

Tomato worms? You simply pick them off. For cabbage lopers you put netting over the plants.

This is not rocket science. We(mankind) has been doing this for a very very long time.

You are likely scaring a lot of folks with this comment. Just go buy so Ruth Stout books or peruse old Mother Earth News. Its not that hard. It is very hard work but hey...better than paying money to sit on an exercise bike and watch Oprah.

Airdale...not being pissy about it..just saying the way it is for me and all the rest of the folks here. Maybe in California of New Yawk its different. I don't live there. I live where the soil is very rich and the rain is plentiful.

NOTE: This whole thread should have been on a drum beat and not going OT on a subject topic. Sorry Stuart. I posted before I realized it. The subject of gardening I doubt will ever be a Subject on TOD but thats why DrumBeats exist.

Hi airdale,

Thanks, and at risk of adding tangent length to Stuart's post...

re: "The subject of gardening I doubt will ever be a Subject on TOD but thats why DrumBeats exist."

Well, perhaps you could write up a short article and see if the editors would run it? It looks like it would generate interest and comments. It could well tie in to ag/energy policy and other issues, as well. Many people might have ideas. (I know I have some I'd like feedback on...)

Hello Aniya,

Due to my recent prolonged trip to N. Carolina I am way behind on my planting and time is very short. If your climate is like mine and with the nice dry spell we are in , you should have seed potatoes already in the ground, onions in,greens ditto and the corn as well, cucumbers too. Peas and beans can go later.

Many large rowcrop farmers here have already started with corn. The rest are running like mad.

Usually here we get a small window of good dry weather then it starts with the spring rains and you might not get another chance until quite a bit later. Earlier crops always beat out of a lot of the insects. When the deadly heat of July and August arrive you want to have already put up much of your produce and not be out sweating in the garden. The ground then gets fairly hard to deal with unless you water a lot and mulch. I had all mine done by July last year.

Every ones climate varies and dictates a lot of what must be done and the timing. One size doesn't fit all. Therefore I can't postulate too much for various regions.

In the older days we had a different environment. Free ranging chickens ate a lot of insects. Animal manure was plentiful. Child labor was there, now its almost a crime to have children work at home doing chores. Everyone pitched in and now you can't even ask others to help. Pretty hard for one man or one woman to put out a large garden yet I do it and in fact this year two. You have to almost love it. If you find it menial labor..well too bad. Its very healthy in fact and the results are extremely healthy food.

Good luck...again sorry for being OT but I wished to give you an answer. My advice. Start a smallish plot and grow it each year. Make some compost heaps. Find a source of good mulch(moldy hay,etc). Cruise the countryside and when you see a nice garden stop and talk and ask those tending it. Talk to those who set up roadside stands. Take a soil test of your soil. Amend it with lime as need be. Bring up the fertility. Poor fertility will kill you. Buy a wood chipper/mulcher and collect leaves/deadfall and brush to make mulch. Never bag and throw away your lawn clippings.

On and on it goes. Make some cold frames. A nice small cheap greenhouse of the south side of your house. Get an early start or grow in the late fall in the greenhouse. Can and preserve everything you grow. Canning jars packed via a pressure canner will keep a long time. Tomatoes if waterbath canned need to have lots of acid to can else must add some, like lemon juice or citric acid. Hybrid tomatoes many times do not have enough acid. Read up on botulism and processing. "Putting Food By" is a very good book to have. A water bath canner , a means of dehydrating , and a pressure canner is very nice to have. You can even use these over wood fires. Canning fruit is quite easy and keeps well. Also think of saving your seed. It might become very very precious. Let some plants go to seed then. I understand many hybrids will produce 'true to form' ..as per what others have told me. I know Jet Star tomatoes do and they are hybrid I believe. Not sure of the acid but many can them or make tomato juice. Bad canning can make you very ill so here in the south we cook our green beans a long time.

If you are thinking of freezing produce then consider what you will do when the grid starts to falter. A good root cellar to prevent freezing in the winter is nice and many here still use them. Just a hole in a bank in its simplest form.

This is not rocket science. We(mankind) has been doing this for a very very long time.

You are likely scaring a lot of folks with this comment. Just go buy so Ruth Stout books or peruse old Mother Earth News. Its not that hard.

This says it all. You just saved me a long comment. People on TOD tend to way overcomplicate things.

SS must be wondering what the hell this has to do with water and oil mix in KSA oilfields! But I see this food issue as one of the most critical effects of peak oil, especially if you live in a country like UK which imports much of its food, and where people are used to buying any fresh fruit or vegetable in any month. Look at articles on how Cuba coped with cut off of its oil supply and you will see that most are about food.

Also, like many things to do with peak oil and localisation, knowledge that may be vital in the future is being lost as the people who practiced home food growing and other manual crafts, grow old without passing the knowledge to a younger generation who don't seem interested. As many above have said, it takes time to learn these things so start now while possible failure only means a few extra trips to WalMart, rather than a hungry winter.

Also, a side effect in Cuba was that with so much physical outdoor work and eating more fresh veg, people got fitter and healthier and had less need for high-tech health care.

Hi doctorbob,

re: "SS must be wondering..."

My guess is Stuart understands a little about shock (hands over eyes, peeking through fingers)...

Poor SS - maybe we wil create "future" oil in our backyards. I'm not trying to scare people it just trying to train people to grow plants that do not have experience has been eye opening(!)

I think that we may tend to forget how much we know until you try and teach someone else who doesn't have years of garden/farming history. Whether we like it or not we are looking to be training the "nentendo generation" not the summer field labor that my generation was.

I think it is all to easy to think everyone has had similiar experiences. I suspect that the percentage of people with gardening experience is many times smaller that it was 30 yrs ago. If the comments I get from retail garden centers are any indication of plant knowledge there is going to be a big learning curve. Seriously asked questions -"Do I have to water this"? This climbing rose blooms on old wood- "Well my fence is new how long do I have to wait"? The leaves on my trees all fell off whats wrong with them (ITS WINTER? maybe??) Must have come from so calif.

IMHO You will be very popular if you know alot about gardening.

While I don't disagree with ELP, I think it won't suffice. There has to be a political response to all this. That "no man is an island" was never truer than today. A hostile government will defeat all efforts at individual or even group suvival no matter how rational on their own terms. We do not have a gov't that is interested in the survival of its citizens -- to put as diplomatically as possible. So long as politics is the province of big money we are totally screwed.

Isent big money ultimately a fairly large number of people who uses, controls and works with the wealth? They ought to want to live in a functioning society.

Like Krupp under Hitler?

Hi Magnus,

I appreciate your point here

re: "They ought to want to live in a functioning society."

A proposal - let's assume "they" do - (since "we" do) - and go from there.

That is indeed my assumption. And I try to figure out how to get things to become better or at least less worse if times get tough.

Like my friend the Chimp says, move. The US government is not the one you want to have to face when this stuff starts to happen...best to be somewhere else.

WT I value your contributions here a great deal, although I have just recently gotten a UN resolution passed which bans all references by yourself and other interested parties to HL for the next four weeks ;)

That said, I need to call you on this quote. It is pretty darn dramatic to say oil exports from the major countries declined nearly one tenth last year. First off what are the assumptions you are making and secondly, put simply, where did we get the oil we burned last year? Maybe I am missing something basic here, that's fine, however, there was not to my knowledge a decrease in oil consumption worldwide. There was, if I am correct, a very slight decline in oil consumption in the US in 2006 versus 2005. I don't have figures but I wonder whether there was a net decline in oil consumption by oil importing countries as a whole 2006 vs. 2005. I realize you are looking at a month vs. month comparison so the total average decline year over year might be on the order of 4% but are you saying all of this decline has so far been made up by drawing down stocks in oil importing countries? That, at first glance, seems a pretty dramatic drawdown, and if that isn't the case, well, at some point consumption has to jibe with oil available for export, correct?

I think the key is the "top 10". There are still quite a few exporters. Also, many of the poorer countries saw major demand destruction due to cost, so that makes up for some of our demand.

See my posts on Nepal it looks like Nepal is going to self destruct because of oil rght now. Expect Bangledesh then wealthier countries like India. Peak Oil or the effects of it are like a rapidly spreading cancer by the time we see it in the US it will be too late to save the patient.

If prices get worse this year expect millions of peak oil refugees to leave Nepal within the next two years. Most would be headed for India which will have its own problems.

Also Pakistan will probably destabalize as oil prices put pressure on its economy. The intrinisic problem is fuel shortages and the resulting high prices can rapidly take out a economy and destabalize a region.

I think you will see the effects a lot faster then most people think.

Ckupp and Memmel,

I can't find good figures on total exports. However, from previous discussion:

http://www.theoildrum.com/story/2006/10/5/215316/408

http://www.energybulletin.net/22213.html

http://i-r-squared.blogspot.com/2006/12/debate-on-oil-exports-part-ii.html

I think one can conservatively assume the top ten exporters account for at least 70% of exports. So if in total they declined 8% last year we would need about a 20% increase from non top ten producing nations to maintain exports if there were no increase in demand (which there was).

Nepal's oil consumption is less than 1/40th of the United States. Moreover, the major oil consuming nations (US, EU, Japan, China, Russia, India) are fairly transparent in their oil consumption data and to my knowledge none are reporting serious demand destruction. Rather some are increasing consumption and/or putting oil into strategic stockpiles.

So if exports did not significantly increase 12/05-12/06 and there was not significant demand destruction where did the oil come from? The only explanation I can see is a draw down in stocks. I am not familiar enough in this area to guess if this is possible.

I happen to agree with WT, SS and others outside this board that we have likely seen peak oil but my guess is WT jumped the gun on saying we have seen an 8% decline in exports 12/05-12-06. If that happened, just commonsensically, I'd think we would be in a world of hurt.