How to Address Contrarian Arguments – part III

Posted by Luis de Sousa on February 8, 2007 - 10:43am in The Oil Drum: Europe

On this third installment of the Contrarian Arguments series we’ll address the "Markets Will Solve It" claims.

A regular economist will tell you a fable like this:

If a shortage of potatoes occurs either by lack of supply or by growth on demand the market price will rise. This new higher price will signal to the farmers a need to produce more. Supply will rise, meeting demand, lowering the price and bringing the market back into balance.

Let’s see what’s wrong with this apparently correct logic.

Warm Up

In spite of the mathematics behind it and the historical data supporting it, Peak Oil is often dismissed on the basis that (free) markets avoid such phenomena. The so called Market “Magic Hand” purportedly guarantees that the right amount of a commodity is traded at the best price. The “Magic Hand” will take care of any occurrences that momentarily disrupt this balance.

From a regular economist’s point of view Oil is like any other good or commodity subject to the same rules above. As you might suspect it isn’t so. In the next lines we’ll see why and what is the real role of Markets and Prices in Oil Depletion.

The Basics

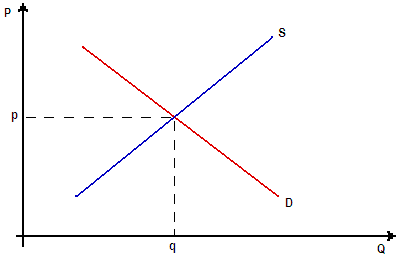

For starters we’ll use that old Price vs Quantity graph (if you never heard of it I think you’ll understand anyway, but you can learn more about it here or at Wikipedia). On the yy axis is represented the Price, on the xx axis is represented the Quantity traded for the good or commodity in study. To represent Demand a curve with downward slope is used - the higher the price the less consumers can by, as price lowers consumers are willing to buy more of the good. Supply is represented in an opposite fashion – the higher the price the more goods producers are willing trade, at lower prices producers will not be willing to sell as much.

In real life Demand and Supply are not linear, hence called curves, but for didactic purposes are usually represented as straight lines. These two curves meet at a specific point - the equilibrium. If the Demand and Supply curves used represent the market correctly, the equilibrium point determines the price and quantity traded of the good in question, as seen below:

Market Equilibrium. On an unconstrained Market, price and quantity traded are set by point where Demand and Supply meet.

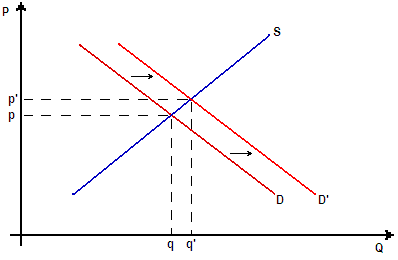

Now imagine that consumers really like this particular good, or become more dependent on it, in that case they’ll be willing to buy more than before. This case is modeled by shifting the demand curve to the right. As seen in the next picture a new equilibrium point will unfold, where more goods will be traded, but at a higher price.

The Demand curve shifts right to reflect a new will from consumers to buy more of the same good.

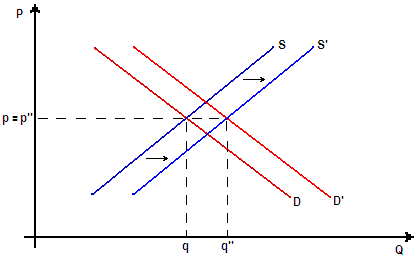

More goods traded at higher prices, this means profits for producers. This new profitability will make the market attractive for new producers that will make more goods available to trade. This new movement in the market can be modeled as a right-ward shift of the Supply curve.

The higher price set by the right shift of Demand triggers in its turn a right shift in Supply.

On a free market (without price or quantity regulations) after these two moves the final price will be the same as the initial. Such is the market “Magic Hand”. In a market with perfect concurrency (goods are not differentiable from producer to producer) goods are sold at the lowest price possible, and producers get virtually zero profits over base costs, benefiting consumers the most.

In the case of Oil this kind of movements happened constantly for about 20 years, from the mid 1980s up to 2004, where global demand for Crude plus NGL moved up from 57 Mb/d to 80 Mb/d. During that time Oil prices moved very little, apart from the 1990/1991 period with the invasion and subsequent liberation of Kuwait. Sometimes one tends to forget about this little detail, Oil demand has been a monster growing relentlessly.

So the regular economist might be right to some extent. Before moving on give it a little thought: is the present Oil market a free one?

Prices and Reserves

Among the financial and economic communities there seems to exist a hidden belief that Oil Reserves are set by prices. If prices go up by growing Demand then Reserves should follow, in order to allow Supply to match it. Even if Reserves grew with prices, it’s the flow of Oil to the market that has to grow in order to meet Demand. It’s really hard to understand why such belief exists or what created it, because there’s no physical or logic reason to think that way.

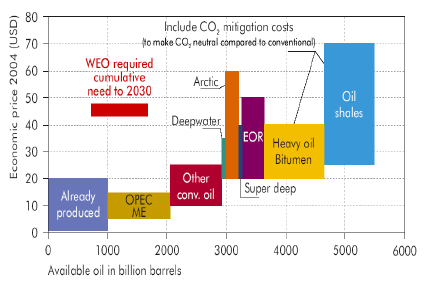

Unfortunately some institutions not only fail to dismiss such naive beliefs but even seem to propagate them. Following is a graph produced by the IEA that leads one to believe in some sort of link between prices and recoverable reserves:

IEA’s Reserves ties with Prices.

Hopefully the IEA has already made its act of contrition with the last World Energy Outlook, acknowledging energy supply problems in the next decade. But what the economics and environmental folks remember is that nonsensical graph.

The amount of oil found at a certain reservoir was formed dozens of million years ago, it’s a physical reality impervious to what happens above ground in the market. Whatever the price of a barrel of oil, whatever the amounts of money oil companies hold, the amount of oil remaining in a reservoir is the same. Pretty obvious, but hard to understand for some.

One could remotely argue that it is the money that oil companies hold that make it possible for the exploration of a certain reservoir. But that money only represents the availability of surplus energy to produce more oil, what really makes a reservoir producible is the energy profit that it will yield. As we shall see in the next section, the price of oil (and in tandem the money resources that oil companies may hold) are just mechanisms to set which reservoirs are more profitable and should come on stream first.

Money and Oil Flows

If it is the net energy that determines the amount of oil recoverable from a reservoir, what’s the role of oil prices? Actually they have a very important role, they set at each point in time which reservoirs should be on production, pushing those with higher EROEI first and leaving those with lower EROEI for last.

To illustrate this effect let’s use another parable: imagine there are two different energy sources available for exploration in an imaginary country (it could be Melnibone if you like):

. Energy Source A producible with an EROEI of 1:10 at a maximum rate of 10 energy units per time frame;

. Energy Source B producible with an EROEI of 1:2 at a maximum rate of 20 energy units per time frame.

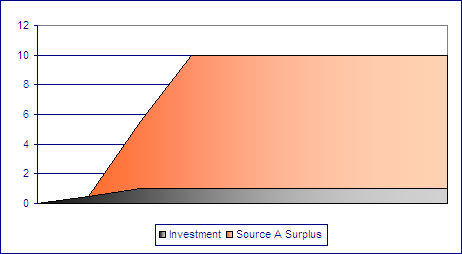

In the beginning there’s one energy unit available got from human hard work, and energy demand of 9 energy units. Although with larger reserves, energy source B does not provide enough profit for the current energy demand given such low input, so in the market it’ll have a prohibitive price. As for energy source A its market price will be lower and affordable, for it fulfills the entire energy needs of the imaginary country. If supply keeps steady we have equilibrium, were at each time frame 10 energy units are produced, 1 to produce energy in the next time frame and 9 to meet demand.

A possible scenario where energy production gets started from source A, covering a Demand of 9 units per time frame.

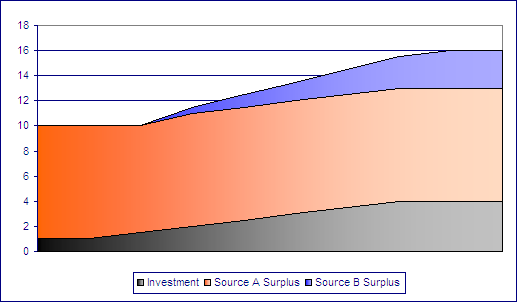

Now imagine that demand rises to 12 energy units per time frame. Energy source A wont suffice, energy source B has to come on stream. In this case equilibrium will be achieved by producing 10 energy units from source A and 6 from source B. In order to achieve this new equilibrium a period of turbulence will be underwent in order to raise the energy inputs needed to put source B on stream – this is where the price comes in to play. Until the new equilibrium is found the price will go up reducing demand and opening space for higher investments in the following time frame. After the new demand of 12 energy units is fully met the price will come back to its original value.

A possible scenario where a new effort has to be made to bring source B on stream. After a period where total surplus diminishes a new Demand of 12 units is finally covered.

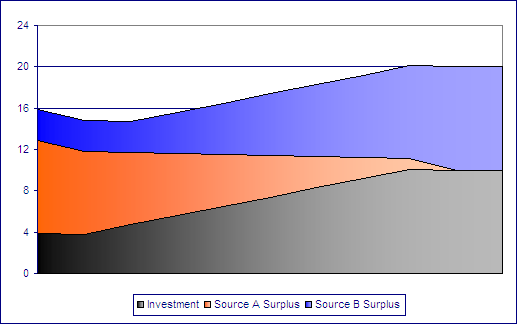

Take now a new scenario where energy source A goes in to depletion, diminishing 10% per time frame. The price will go up again to make possible the coming on stream of the full production from energy source B. But after the depletion cycle is over only 10 energy units will be available for trade, the price will remain high to keep Demand low.

A possible scenario for source A depletion. A new effort is made to bring source B into production but in the end the original Demand of 12 units cannot be met.

Prices basically set the order by which Society uses the energy sources available, putting those with higher EROEI at front. In light of this one can draw an interesting postulate:

A new energy source will come on stream on an unconstrained market if and only if all other energy sources with higher EROEI do not entirely cover current energy demand.

By doing so prices and markets guarantee that Society uses energy in the most profitable way possible. The only problem is when the energy sources with higher EROEI are finite.

Another point worth observing is that the Market is in itself an Agent of Depletion. It is the market that makes the low hanging fruit go first, producing the declining EROEI phenomenon observed in part I of this series.

The Regular Economist

If a shortage of potatoes occurs either by lack of supply or by growth on demand the market price will rise. This new higher price will signal to the farmers a need to produce more. Supply will rise, meeting demand, lowering the price and bringing the market back into balance.

What the regular economist doesn’t tell you is that the farmer will need more oil to produce more potatoes. It’s that simple. As long as enough energy is available the farmer can continue to adapt production to the signals sent by the market.

Now imagine that energy supply constraints prevent the farmer from acquiring more than some amount of fertilizers or diesel fuel, he won’t be able to meet a possible surge for potatoes. The same with Oil, energy surplus has to be found to produce more of it, or else rigs will falter, access to reservoirs will not be possible, etc. This is the major difference from Oil (and energy sources in general) to other commodities: more Oil (energy) has to be invested to produce more Oil (energy).

Conclusion

Although we don’t see the Market’s Magic Hand has been working quite well for the last century, making sure that Supply meets a breathtaking surging Demand. Major exceptions happened in 1973 (OPEC embargo) and in 1980 (Iran-Iraq war) but even then the Market prevailed, bringing things back to normal with time.

This “Magic Hand” is itself assuring that depletion will unfold by guaranteeing that energy sources with higher EROEI are explored first. That way net energy keeps falling to the point where production can no longer tackle demand, eventually peaking and entering in decline. Once energy scarcity unfolds there’s little the Market can do about it, for to generate a higher supply of energy more of it has to be invested.

Traditional Economics fails to grasp this reality for it deals with energy like any other good or commodity. The mainstream economic thinking does not acknowledge energy as a propelling factor of growth, even less as the major factor doing it. Researchers like Robert Ayres, Charlie Hall, R. Kummell et al. have been trying with some success to estabilish this link between energy, money and economic growth, but that’s a story for another time.

Previously on the Contrarian Arguments series:

Luís de Sousa

TheOilDrum:Europe

Folks, consider this a reminder to positively rate this articles (using the icons under the tags in the story title) at reddit, digg, and del.icio.us. Also, don't forget to submit this to your favorite link farms, such as metafilter, stumbleupon, slashdot, fark, boingboing, furl, or any of the others.

These posts are a lot of work, and the authors appreciate your helping them get more readers for their work however you can.

If I recall Economics 101 the upward sloping supply curve takes account of 'diminishing returns' so that it doesn't shift as shown in the third diagram. However I do agree the market seems to have a kind of inbuilt shortsightedness. A guy on TV discussing house prices said supply and demand is OK but not affordability, which like EROEI is a factor not explicitly shown on the supply and demand graph.

Somebody needs to look at the embodied energy capital requirement for the low EROEI future, especially grid generation. This implies a nontrivial fraction of current fossil energy should be set aside eg to smelt and fabricate aluminium for wind turbines. My guess is at least 10% instead of which we are using it all up having a good time.

Hello Luis,

This sentence from your Conclusion may need a correctional edit:

This “Magic Hand” is itself assuring that depletion will unfold by guaranteeing that energy sources with lower EROEI are explored first.

Don't you mean higher ERoEI?

Thanks for the tip, it’s correct now.

Economists say more than a) higher demand generates a higher price that in turn produces more of what is demanded. They also say b) that higher prices curb demand, and c) that higher prices encourage substitutes. So, in looking at the oil market as prices rose to last summer's peak, the response a) was weak, old field decline/depletion prevented higher production, but b) we have seen demand destruction in some parts of the world, which accommodated higher consumption in china and some exporting countries, and c) we have seen various substitutions, eg traditional ng taking the place of oil in those electrical generating plants that accommodate fues switching, and newer substitues, eg ethanol and tar sands. Turning back to a), it seems clear that in the absence of higher price some e&p, eg ultra deep water, would not occur... so, even as production stagnates, it should be conceded that production is nevertheless higher than it would be if prices were still at 25/b.

I have long thought that PO'ers and economists talk past each other, a pity as both have some things to teach the other.

Being both an engineer and an economist I can vouch that for the most part each profession sees the other as short-sighted fools. Pity indeed.

Hellasious and jkissing:

Those folks that I referenced on the Conclusion are trying to do just that, bring Economics and Engineering/Environments together. Also I used the term ‘Regular Economist’ because there are Economists out there that acknowledge these problems; I have the luck to know some.

The connection between energy, economic activity and money is organically obvious.

In a comment to Robert Rapier's recent request for alternate energy policy recommendations "If I were a global dictator", I offered this: tie money supply growth with renewable energy production growth. Properly done, nothing else is required policy wise. No tax revisions, no incentives, no CAFE regulations, no pollution agreements - nothing. It will all be done through this "simple" measure.

If anyone has questions on this, fire away...

A bright remark. Although to be done correctly it has to relate to exergy not plain energy, and that’s all but easy.

By exergy I take it you mean the thermodynamic definition, yes? Excellent remark and ultimately that is the theoretical limit one would strive for, but from a practical standpoint I really don't think you need to get nearly so complicated.

Equivalent renewable-source BTU or KWh will do just fine for a long time. Just the transition alone from a purely fiat currency to one backed by "green" BTU will take decades.

I call it the "Greenback"... But if we used your exergy suggestion we should call it the "Carnot(e)".

(smile)

Regards

That is hilarious! Thanks... gave me the best laugh of the morning.

:-)

Hi H,

Okay, so I have a question: Could you please expand and explain?

For example:

1) renewable energy prod. growth - you mean what and who exactly?

2) Who counts the "production growth"?

3) No money supply growth allowed otherwise? How do you stop it? Who stops it?

4) Can this be done unilaterally, eg. by the US only?

And so forth.

Hello Aniya,

The first two questions are pretty simple, really - solar, wind, geothermal, fusion,...the list is pretty long. It could also be defined as non-fossil and non-fission. Who counts? The same people that count it today..power cos., national and int'l agencies.

Now as to the other, more complicated questions:

(3) If you want true sustainability, no money supply beyond that will be allowed. But there has to be a very long transition period, too. Eventually, imagine a currency that is backed by say, 1 Greenback = 100 000 "green" BTU. This is not so far-fetched as it sounds: the US dollar today depends on oil for its global reserve status. Who and how stops money supply? The same people who regulate it today: central banks.

(4) Yes it can, and that is very intriguing because it IS feasible, by comparison with a single, global currency. It could happen thus: say today the split in production between "black"/"green" energy is 95%/5% and that production (in BTU) is rising 5%/20% respectively.

The "strictest" money supply policy would only allow M3 to rise by only 5%*20%= 1%. That would be so restrictive right now it would immediately throw the economy into a deep recession.

The "loosest" policy would be 95%*5% + 5%*20% = 5.75%. This would accomplish nothing.

A "transition" policy would be something like this: (1/2)*95%*5% + 5%*20% = 3.375%, i.e. you "penalize" black energy by 50%. At the very start of the transition period that "penalty" could start at 5% and rise gradually.

Monetarism with a twist..."green" monetarism.

Regards

Excellent article!

Ironically, nineteenth century British economists worried a great deal about running out of coal and worried a lot about the consequences of running out of coal. They understood that energy is fundamental and not "just another commodity."

Where cornucopian economists go wrong, in my opinion, is in their unwavering belief that good substitutes for oil exist or soon will be found. This issue comes down to technology: Are there good substitutes or are there not? My own opinion (and I'm an economist) is that for many uses there are no good substitutes for oil and natural gas. To some extent we may be able to substutute electricity generated from nuclear power for oil and natural gas--but this is not a quick or easy or complete substitution by any means. Biofuels have limited potential as substitutes for oil. Solar and wind power are more silver BBs, but again are not a quick or easy substitute for oil. Unconventional oil will help as will coal-to-liquids, but these are slow, difficult, and high-cost technologies with significant environmental concerns. Call them tarnished silver BBs.

The Econ 101 graphs work only where good substitutes exist. I think this is the essence of the issue: If there are good substitutes for oil, then Peak Oil is nothing to worry about. Because, in my opinion, there are only difficult and expensive substitutes for oil, Peak Oil is a Big Deal that will transform our lives.

"Because, in my opinion, there are only difficult and expensive substitutes for oil, Peak Oil is a Big Deal that will transform our lives."

1) I mostly agree -- depending on how we define the word "transform". I am certainly no "doomer", but finite resources are a constraint. Accordingly, I have already begun educating my boys on PO, its implications for the future, and for the types of job openings likely to be in demand in 10 years when they finish college.

2) This implies that the price of oil will rise faster than inflation in the years to come. If we add geopolitical concerns on top of this, we get that we all should be hedging this risk by owning domestic reserves in our portfolio. The energy index funds contain exposure to refining and the drillers, but there are a few publically traded firms that are more narrow.

3) I hope those who post here that truly believe in peak oil have been investing what funds they have accordingly. There's an old saying that goes roughly as follows, "If you want to know what someone believes in, flip through their checkbook". (A variation of "preferences are revealed through choice" phrase so often used by those in econ departments.) I hope the more vocal posters here are investing according to their beliefs.

Sonic - I adopted this very strategy last year, dumping many higher risk oil and mining stocks, to focus on companies with reserves concentrated in the OECD. Encana is I believe 100% N America, but the list of companies not exposed to political risks is pretty short. Quality exploration potential and growing production tends to be outside the OECD. So you got to balance growth prospects against safety.

I invest in small US e&p's with positive net and growing reserves. To sort, I try to extrapolate future net and compare with present EV,

reserves/ q production x q net/EV; the result should be at least 1.0; not many are.

Of US e&p's I have found 3 above 1; ard/gpor/gmxr

The first two are oils, the latter ng... imo the potential for increase in NA ng price is much higher than for world oil.

"imo the potential for increase in NA ng price is much higher than for world oil."

Many people agree with you that the odds of, say, a near-term 2X price increase is greater for NA nat gas than world oil. I don't know, but I am certainly not going to take the other side of your position.

Both oil & nat gas prices concern me. With my electricity mostly coming from NG, I have been one busy person lately: I've doubled my attic venting (all passive), added some radiant barrier stuff (if interested, see savenrg.com), and will soon add some solar shading on a few windows to reduce the a/c bill this summer. (If I install any more compact flourescents in the house, I think my wife will slug me.)

- Sonic

Which savenrg.com product did you use, the chips or the membrane?

I used something similar to the membrane: it's a major hassle to install (I got the stuff I used on an "inventory clearance sale"). The RB chips are FAR easier to install, but pricey. The TCM product, due to it being multi-layered, is not adversely affected by dust when placed over the attic insulation. Dust accumulation is not a major problem in my attic. Therefore, a single-layer, double-sided product (like the one I installed) installed over the insulation should perform well for many years -- at least I hope it will.

Best I can tell, dust problems are most prevalent for attics with powered gable fans: they seem to draw the dust in on one side of the house and deposit it along the way to exit fan. For these, the two savenrg products would work best.

The next house that I build (assuming it's in the South or Southwest) will be wrapped in the multi-layered TCM product. I also hope to avoid placing the a/c units & ducting in the attic. Homes with such setups (like my current home which I did not build/design) get a triple penalty from attic heat: the heat eventually seeps through the insulation, the insulation acts as a heat sink so that heat continues to radiate in after sundown, and the a/c ducts get super-heated. Just wonderful. When I moved into my current home, the attic would hit 120-130 when the outside air temp hit 100: that meant I was trying to get sub-80 degree air out of my a/c unit at a time when the ducts were 120-130. Surprise, surprise -- it took a very long time to get cool air out of ducts and into the house.

My experience (via electric bills normailized for avg temp) is that increased attic ventillation is a first order magnitude effect as is sealing the ducts for leaks: I lose less cool air due to leaks and have less of a temperature loss through the ducts since the ducts (& attic) are no longer 120-130 (just a chilly 110+!).

I found the radiant barrier to be a second order effect, but only if the attic is ventilated properly. RB installed over the insulation reduces the heat sink effect of the insulation by eliminating it from absorbing any radiant heat directly (it still gets heated by other means, hence the need for excellent ventilation to keep the attic relatively cool). A faculty member at Texas A&M has a study/note on RB placement -- something I'd like to quote right now, but can't seem to find. NOTE: In some cases, adding RB to a poorly ventilated attic can actually make the a/c bill worse, especially if the RB is installed up on the rafters.

Thanks for your words Don, I guess you got the main problem:

Substituting Oil is not solely about technology. Alternatives do exist on that basis, but what none other source seems to provide is the colossal energy flow that Oil allows.

You are correct that technology is not the only problem in finding substitutes. Another problem is that the "Great Transition" away from oil will require truly humongous investments in nuclear energy, wind power and other alternatives. Oil infrastructure is already in place, but to find the funds and get the land, skilled labor, and capital (including energy, a special kind of capital) and management together is a prodigeous task.

How well will market forces work to facilitate this prodigeous task? Most economists think it will work fast and with great power. I am concerned about the dynamics, the time lags, the nuts and bolts of making the Great Transition away from oil, and while I grant the power of market forces I also see their limitations.

If I were dictator of the United States I'd implement a World War Two type of mobilization and put half of all resources into dealing with Peak Oil using the command mode of organization. I think five years of such effort would do the trick, because with wartime priorities we could build (for example) hundreds of nuclear power generating plants in five years.

With business as usual, I expect major disruptions and serious hard times coming--and coming pretty darn quick, i.e. within the next few years.

In reading economists theorizing one frequently sees words and phrases such as "eventually the market comes into balance..." and "in the long run..." implicitly ignoring what goes on during the transition between one 'balanced' state and the next. If the doomster's dieoff occurs, the market will indeed come back into balance through demand destruction of the worst sort. Wasn't it Keynes who quipped "In the long run, we are all dead."

I'm admittedly fairly ignorant of the current state of economics thought (I read Heilbroner and others in the 60s), so I'll pose the question, "does educated economic thinking take the 'transition' into account as to how long in might be, how difficult it might be, what the human cost in suffering might be.", and so on. You seem to indicate that the answer to this is a qualified 'no' which leaves me more skeptical of the academic discipline of economics than ever.

Most of economics at the undergraduate level is comparative statics and has nothing to say about dynamics (the path from one point to another) at all--or there is sometimes a very simple growth model.

At higher levels of economics the problems of dynamics are well understood. Keynes was a prominent advocate of looking at the costs of change as well as the benefits from the final position; he was a practical man who understood the real world as well as he did economic theory. However, economics is only as good as its assumptions. A key assumption of most economists is that there are ALWAYS substitutes lurking out there--real or potential ones that will be developed in response to higher price.

The education of most economists is deplorable. They learn economics and math but not much else. Although engineering is essentially applied economics ("An engineer is somebody who can do for a dollar what any damn fool can do for five dollars.") few economists can or do communicate with engineers. Indeed, outside of their specialties, most economists are woefully ignorant: They become captives of their elegant mathematical models and quite unable to think critically about the quality of their premises.

Now, having said all this, I do not mean to include all economists within my sweeping generalizations. The great economists of the past were also great critical thinkers--Keynes, whom I've already mentioned, Alfred Marshall and the other great nineteenth century economists, Kenneth Boulding and others.

To some extent I blame the writers of economics textbooks. To make a complex subject intelligible to undergraduates they oversimplify. Premises are left hidden and seldom are examined deeply (or at all, for that matter). The logic of economics is powerful, but its assumptions are often questionable. Most questionable in the context of Peak Oil, I think, is the question of the availability of substitutes for oil and natural gas.

For example, many economists seem to assume that because coal-to- liquids technology exists, and because coal is abundant, then there can be no Peak Oil problem, because coal-to-liquids (or some other and better) technology will save us. In a weird way, the economists are sort of right: If we could get effective carbon sequestration at reasonable cost, then (by itself) coal-to-liquids or coal-to-gas technologies could defer the harsh consequences of Peak Oil for several decades. In other words, oil production will probably not diminish faster than coal-based substitutes could be developed; the financial constraints are formidable but not insurmountable, and the binding constraint of not enough engineers could probably be relaxed in half a dozen years, if we really put our minds to it.

But for now carbon sequestration is a dream, not an on-the-shelf technology, and for now we have too few engineers--and most of them are not far from retirement.

For engineers there is no substitute.

If we could get effective carbon sequestration at reasonable cost, then (by itself) coal-to-liquids or coal-to-gas technologies could defer the harsh consequences of Peak Oil for several decades.

But if carbon sequestration is skipped, then CTL would defer PO even better, no? I'm afraid that is what will happen, and the climate will be ignored, since today's crisis takes precedence over tommorrow's even-bigger crisis.

Even if carbon sequestration technology existed, it would not be actually used if and when an energy "crisis" is upon us, because carbon sequestration necessarily uses up a significant fraction of the energy output, i.e., it lowers the EROEI, net energy output, and profits. Without stringent enforcement it would be turned off - and will the political will for such enforcement be there when CTL is not quite meeting the "demand" for liquid fuels?

And thus it (sequestration) will be ignored for most part. I'm finding it hard to believe that coal will not be that magical substitute turned to as oil and NG get more difficult to deliver to the customer.

Reminds me of a favorite physics problem. Lean a ladder against a wall and then imagine that the bottom starts to slip, how fast does the person (say, 3/4 of the way up the ladder) fall. The important thing to realize is that it's actually two problems. At some point the ladder stops touching the wall, and then it behaves in an entirely different manner, the guy just falls as if there were no ladder at all. The important thing is to realize when "the wheels fall off" of the original equations, and figure out the consequences of that.

Long story short, scientists learn early on that equations are only valid in certain domains, and you have to be careful to consider what happens when the situation leaves the domain in which your equations are valid. It seems that economists don't think this way. When the earth holds infinite (or effectively infinite) oil then the economic models work, but at some point it is clear that no matter the price production will be zero, so the model breaks down somewhere. The important thing is to realize where that boundary is, and account for it. Economists don't bother with such trivialities, so their equations become insanity at some point.

Reminds me of the extensive work put into divisia for EROEI calculations, but clearly nobody ever asked "why are we doing this.", because it is not in general a terribly useful thing to do, no matter how interesting the math. Let me just pose it in this way, if I ask how many barrels of ethanol the US can produce, I expect an answer in barrels of ethanol. EROEI is a dimensionless quantity, so in order to produce the answer, given an EROEI, you need to multiply by.... barrels of ethanol. Given EROEI, you can only compute the answer if you already knew the answer, not terribly useful it seems. Try it yourself and you'll see that EROEI is not useful for computing the answer to this problem. No matter how you go about calculating the answer it always ammounts to just throwing out the EROEI and computing from first principals. Given that, why bother with the EROEI at all if you'll just throw it out whenever you're asked an actual question of relevance?

With all due respect Slaphappy, I believe you mischaracterize the position of most mainstream economists. Few scientists, including economists, would argue that standard models begin to break down at boundary conditions.

What is important to remember is that under any reasonable oil depletion scenario there will be a non-trivial amount of oil being produced 50, 75, or even 100 years from now. So while you are correct in theory that the models will eventually break down, econometric modeling is in fact a very useful tool for analyzing and predicting the possible effects of peak oil and its after-effects even decades after peak.

I've only ever seen two things come from these models.

1) We'll always find more oil, so it isn't a problem. If the price goes up, there's oil to be had.

or.

2) The price of oil will diverge towards infinity as we pass the peak, and therefore everything will become arbitrarily expensive and we'll all die.

It's rare to see any argument that rests upon economic principals to not fall into one of those two camps, both of which are entirely unrealistic. Might as well be talking about dragons and unicorns at that point. Any argument that rests upon actual science (hmmmm, where are we planning to get energy, and is this a viable option) almost always avoids both of those pitfalls.

Slaphappy, I don't know what / who you've been reading. Most likely you are simply misunderstanding economists because neither of your two scenarios are predicted by economics.

What an economist will tell you is that we are currently seeing market forces at work. The high prices of the last two years has encouraged:

1) Increased efforts to pump conventional crude (with questionable results)

2) Increased production from non-conventional sources (tar sands, biofuels, etc.)

3) Increased efficiency and conservation, and in the long run, structural changes to the global economy to make it less dependent on oil.

The sum total of all three means that supply can be down slightly over the last two years without causing any major problems. If we've really peaked and supply continues to drop, prices will rise further, encouraging 1, 2, and 3 above.

None of this implies that either of your two scenarios will come to pass.

"good substitutes for oil exist or soon will be found" NOT.

I'm afraid I have to repeat your other admirers. It all has to do with substitutes. What does one eat in Ireland during the Potato Famine? Grass etc.. was a very poor substitute. Die Off (and move-off, of course, cause there was somewhere else to go) happened, und the pop. is still a little more than a third of what it was back then.

What do we substitute during an oil famine? Well..

"The Stone Age didn't end for a lack of stones". Clearly we'll find something better than oil. From an energy density point of view that would be ... let's see ... nuclear fission ... nuclear fusion ... antimatter. Hmm, Houston, we have a problem!

"What do we substitute during an oil famine? Well.."

We substitute busses and trains. We substitue the common sense NOT to live 50 miles from work but only five. We substitute solar and wind and well insulated windows for 3/8" panes of glass that were installed in the 1920s when the houses were heated with coal and wood.

We substitute smarts for desperation and a good sense of humor for doomerism. Once we do that, we'll be fine. Even you, my friend.

"Even you, my friend"

I just spend 70.000 Euro with a new roof (14cm of the best insulation you can imagine), solar panels to support the heater and hot water, new heater with an 800lt storage tank in the basement, windows, new facing insulation etc, etc, etc..

I ride the train to work every day.

I share a car with one of the neighbors and drive only when really necessary.

My point has nothing to do with an economy based on TRANSITION away from FF. This is doable. There will most certainly be JOLTS (discontinuity) to our system along the way, which our system MAY or may not survive.

Again: what substitutes do you use during a famine (electricity black-out, for instance) at the moment of the famine, when the UN can't come running to your aid. Have you ever experienced a famine?

Cheers, Dom living in Munich

Let me see... you are doing all the right things, yet, you are worried. Why is that? I am not questioning that you are worried, I am simply wondering why you are worried since you know the right answers already.

The "jolt" hypothesis as well as the "may not survive" hypothesis have very, very little in common with reality. What are your indicators that there will be serious jolts or that there even might be famine?

The last time I was in Germany, food was plentiful and there was not a single thing missing from the stores.

Now... in my oppinnion doomerism is essentially an American export, just like creationism.

As I see it: my diet as well as the diet of my former Americans is mostly protein based. Meat protein takes enormous amounts of food starch to produce (approx. an order of magnitude more than what we would consume directly). Moreover, my daily caloric intake is probably 50% above what I need. In order for there to be famine, we would have to lose MOST of our agricultural production capacity, not just some. Would we have to change our diet? Yes. Would we starve? No.

Energetically speaking... I can cut down on my electricity demand by half without doing much else than by buying a European size fridge and by not using the stove as often as I do (or by using a slow cooker instead of evaporating water as I do in most of my dishes). I can cut down on my heating without being truly cold by insulating the windows better and putting on a sweater. I can cut down on my transportation fuel demand by having twice as many people use the train I am on. It would certainly be less comfortable but not impossible. I can also work from home four days a week, if necessary.

Look, the US is using 10kW/capita where Europe is using only 4kW/capita. We are not achieving anything that the Europeans can't achieve and don't achieve regularly. And I bet, you can get by on 3kW with some efforts. 3kW/capita is an amount of energy that can be generated with renewables, even in Europe and more easily so here in the US.

Reality is: there is not the smallest sign that there will be famines in the US or Europe. Not one. Every number derived from reality you look at points to the one conclusion: Americans are fat and they will have to lose some weight. Europeans are somewhat leaner but they won't be starving, either. We might have to go back to diets that look more like those of our grandparents (more beans, potatoes and veggies) but that's it. No famine. Just a more healthy lifestyle.

On the other hand, if you want famine, I would suggest you relocate to the Sahel. They have it there all the time. They use way less energy per capita, too. Probably more like a couple hundred Watt, one twentieth of what you have.

Dearest IP,

I am doing the right things. This works great in a system that TRANSFORMS, which you ASSUME will happen. This is MY hope.

"The "jolt" hypothesis as well as the "may not survive" hypothesis have very, very little in common with reality. What are your indicators that there will be serious jolts or that there even might be famine?"

1st - not food famine but energy famine - usually known as a shortage. More specifically, Russia cutting off its nat. gas, or not being able to deliver everywhere it delivers now; lines at the gas station, without knowing when the next delivery will be there; blackouts, especially in Italy and the US-NE.

*I* will do fine through all this as long as "the system" continues to work. As long as I keep my well-paying job. As long as the socialistic German government continues to provide a social net. But an individual is 98.5% dependent on the system he lives in. If something goes wrong with the system, then it really doesn't matter what precautions *I* made.

I believe that our energy systems, especially oil and gas, are very prone to disruptions. VERY prone.

If you want to call this doomerism, go ahead. I call it a basic REALISTIC distrust. I hope that the system will always continue to work - it has for the past 60 years! I doubt that it will, though, continuously the next 2-3 decades.

I consider your TRUST in the system, once oil and gas producion begins decreasing at 4% per year, as naive at best.

Cheers, Dom

ps If you only knew of the constructs of solar sails and space elevators and solar collection systems etc etc that I have constructed ON PAPER, I think you would understand better..

Actually there was an abundant and readily available substitute for potatoes during the famine in Ireland. It was called wheat. The problem was that it was too expensive for most irish peasants to buy, they simply could not afford this substitute. Also the wheat, barley and copious ammounts of other agricultural products, like pigs and beef were being exported to mainland britain. Apparently in some areas soldiers guarded the wheat fields and wagons carrying the wheat to the coastal ports.

The british government did try to find a substitute for the blighted potatoes. It had to be a cheap substitute though. It was known as indian corn and mainly imported from North America. Unfortunately the irish peasants had not experience of indian corn. Also it was so hard one needed a special iron grinder to mill it into flour. The whole scheme was academic anyway as the government didn't buy enough corn quick enough, or enough grinders, and the means to distribute this substitute and the central organization required to aleviate the worst effects of the famine were woefully inadequate. Government inspectors tried in vain for years to get London to react to the escalating crisis, but to no avail. Simply put the required solutions to the potato blight, solutions that in retrospect appear obvious today, failed because they contradicted the accepted economic and social dogma of the times. All this has of course little to do with Peak Oil, or does it?

Great post.

Potatoes as a metaphor for oil. Far more fitting than I would have guessed.

This is another area where some economists address the underlying issue, but many don't. That is simply the issue of having enough trading capital (money) in circulation to be able to act upon an existing demand. The dirt poor people of Haiti certainly have a demand for food and shelter, but nothing with which to trade.

Yes, a potato famine seems to be a great metaphore.

Actually I wasn't really thinking about the Irish potato famine because of the surrounding "politics". I was thinking of a potato famine in Saxony in the second half of the 18th century. There were no "normal" ways of feeding the population. The option was eating grass or leaving house and home to go begging hundreds of miles away...

Economics tends to describe a system of continuity, but not of Discontinuity.

And an excellent comment, Don.

Yes, it does come down to technology, which presumably will invent these "perfect" substitutes. However, forecasting technology trends is impossible. No one knows if some breakthrough in battery technology, fuel cells, cellulosic ethanol etc. will occur or not. Right now, energy is a "hot" investment and a lot of start-up capital is getting thrown at the problem of creating these substitutes. There are no guarantees. So, to various degrees, one hears statements that express "faith" that breakthroughs will occur. Some breakthroughs will occur. On the other hand, many envisioned, widely anticipated technologies will never come online.

While there may not be substitutes for oil, there are subsitutes for the primary user of oil, the automobile. The vast majority of us profoundly do not want to even contemplate such a world. Some of us are willing to contemplate moving out of the box that so desperately wants to maintain "easy motoring", especially those of us who have actually lived in vibrant communities and areas where the auto is not necessary, and is even less convenient than the alternatives.

One's views on this matter also depend on how serious one takes peak oil and global warming. Every single alternative, including EV, implemented by itself without any change in behavior or radical increases in efficiency will not be sufficient to do what is necessary to stabilize global warming. Many are excited about the fact that we have learned to make SUV hybrids and are convinced we can have our cake and eat it too. This will be woefully inadequate in a world where we need to cut energy use by at least 80%.

Yes, a miracle or a series of miracles may appear. That is what our society is counting on because the prospect of changing its lifestyles, travel habits, location, infrastructure, etc. is just too horrible to even think about.

Does it make sense to bet the planet's future on the efficacy of ethanol, fuel cells, or even plug in hybrids when there is little to no serious discussion at the political level to cut back our consumption? Well, if I had a farm I wouldn't be betting it.

On what do you base that 80% figure?

It's certainly not an argument based on capability to generate energy - there's plenty of that even after oil peaks. So I'm assuming it's an argument based on carbon emissions, and presumably believing they need to be reduced to near zero. Even then, though, current nuclear, hydro, solar, wind, and storage technologies would allow us to generate over 20% of global energy demand with little or no carbon emissions.

So why 80%?

I don't see why people keep claiming this.

It's probably not that it's too horrible to think about, but that it's not salient enough to most people to think about. There's only minimal discussion regarding changing lifestyles now because most people haven't been given a sufficiently compelling reason to consider it. If there becomes a compelling reason for them - either due to government action or due to high costs from other alternatives being insufficient - then people can radically change their habits in a short time (historical times of crisis have proved that), and will probably do so.

That most people don't see the current situation as providing the compelling reasons that you see doesn't mean they'll never be compelled, it just means they haven't been yet. Being fatalistic about their behaviour is like giving up on a first-grader because he doesn't know calculus.

There's plenty of serious discussion on that matter, even if the US is lagging in that regard. If conservation is crucial (as I think it is), then the US will come around. It's not a question of if, but of when, and of how much harder the delay will make the problem.

Re: without any change in behavior or radical increases in efficiency and there is little to no serious discussion at the political level to cut back our consumption

Everytime I make the observation on TOD that no changes in human behaviour are being demanded by those who advocate half-way (or much worse) measures like those you mentioned, I am usually criticized right away or ignored. Yet, it all comes down to voluntary, wise changes in behaviour based on foresight. There is no free lunch.

This brings up the more interesting interesting question of whether such behavioural changes are possible at all — or whether crises will force the issue. Usually, this is couched in terms of economic concepts like "demand elasticity" and other similar arguments. Demand did indeed go down during the 70's and early 80's in response to very high prices. However, that will not do the trick this time around. The large supply response in the 80's (North Sea, Prudhoe Bay, etc) following the oil shocks can not happen again, should we experience a new round of catastrophic geopolitical events. Over the longer term, there is just no option. The oil supply will contract, global warming must be mitigated. Lowered demand due to price helps us muddle through, but does can not solve the underlying problems.

There is a deep question about human nature here. I myself feel that humans can not make significant changes in their behaviour without being forced to do so. Others may be optimistic — in which case, my response is like that of Missouri's U.S. congressman Willard Duncan Vandiver (1897 - 1903) —

All this is complicated by the optimistic forecasts of CERA, ExxonMobil, Saudi Arabia, Michael Lynch et. who, by reassuring the public that there is no problem, make any potential behavioural response utterly impossible. No one will change their behaviour when such "authorities" like these tell them that it is completely unnecessary to do so. This is where psychology and human nature enter the argument. Such statements (by CERA et. al) are in the realm of Freud's defence mechanisms in which the rationalization for not changing how we live reinforces the underlying reality — we are incapable of changing our behaviour. There are exceptions, but these are relatively few and far between. Sometimes these exceptional oddballs people get together — this is called a "peak oil" or a "climate change" conference.The question then becomes this: if everybody across the board was giving gloomy forecasts like some of us do here at TOD, would people be able to change their habits? Would they elect politicians that would enable such changes? Is this even possible?

Please look to Europe for guidance. People there do not waste nearly as much as the people in the US do and they are perfectly happy. Europe is humming along in an intellectual renassaince which the US can't even imagine. Every time I go there (or just watch it on tv), I think, this is what the roaring twenties must have been like. At the same time I love living in the US... I just think it should be a little bit more like Europe: upbeat and less fanatic about having to be No. 1 in everything, including waste. Being No. 2 or even No. 3 has an advantage: you get to do more fun stuff because if the savings.

The good news is: everything that worked for Europe would work for the US. That includes gas tax, higher efficiency standards and wind and solar energy. It just happens that the US is behaving like the faithful man on the roof of his flooded house who says: "God will help me!" every time a boat comes by to pick him up. Let's hope the US will not end up having to listen to God telling it "But I sent you the gas tax, did I not? And did I not send you the higher EPA standards? Did I not give you the most sun on the planet? It is not my fault that you turned down all the help I sent you."

:-)

Europe has some better policies, but they are in exactly the same "behavioural change" boat that we Americans are.

I remember when I lived in northern Italy in Torino. And to think that I once thought that it was only Americans who loved their cars too much!

Absolutely. The Europeans love their cars just as much as the Americans do. Probably even more, given the fact that the only truly beautiful cars are all made by Italians... :-)

The point is that people can learn and people do learn given the right incentives. There will always be some who will drive a 9mpg Lamborghini. And you know what? It doesn't matter if one person in a hundred thousand has one of those. Actually, they are lovely to look at and I marvel at them every time I see them. What really matters for PO is that less than one in two people in the US drive an ugly and useless pickup or SUV.

infinate - I sure agree, I was looking around today and 50% of the vehicles on the road in the US ("silicon valley" area in california) are either SUVs or those huge pickup trucks that are never used for work because it might get 'em dirty.

InfinitePostings:

Can you tell us what has been the growth rate in the consumption of transport fuel in Europe and the US over the past couple of decades?

Which one? Diesel or gasoline? One has gone steadily up, the other one has gone down since 1995 because more and more passenger vehicles are now using more economic diesel fuel.

http://www.ifp.fr/IFP/en/files/cinfo/IFP-Panorama05_10-CarburantsRoutier...

This is not the whole story, though. At the same time as hydrocarbons are being shifted towards the more efficient ones, alternative fuels and EV are ramping up. So you will have to offset the growth of the diesel curve in the future against a ramp up of the alternative and electric curve to get the correct answer. What you are seeing is indeed the second segement of a lengthy process of technological conversion from gasoline to diesel to alternatives.

And what is wrong with that? Change is good. At least in my world.

InfinitePostings: Thanks for your response, right to the point, as usual.

So then, in the twenty years from 1985 to 2004, the use of transport fuel increased by 50% in Europe and by 39% in the US.

Which of the European policies would you recommend as a first step for the Americans?

It's worth noting that vehicles per capita went up by about 10% in the US in that time - since its market was near saturation already - but by about 30% in Europe, due to a less mature car market.

Take public transit into account during city planning - that's cited as making a substantial difference in transit ridership in Europe and Canada vs. the US. Other transit matters (such as empowering the guys in charge to make customer-centric changes to routes and the like, improving the quality of the service so it's not seen as being beneath most people, etc.) are also cited as important differences.

High gas taxes, of course, provide an obvious and clear economic incentive to reducing oil consumption, and at relatively minor social cost (since much of the added price can be effectively removed via smaller and more efficient cars).

Rehabilitate city centres - New York is very walkable; Los Angeles is not. Detroit probably is, but you wouldn't want to. More trips during the day by foot means less driving, and synergizes nicely with public transit.

...

Unless you meant to suggest that Europeans have nothing to teach Americans about fuel consumption, since their use of transport fuel has increased relatively more quickly in the last 20 years.

I'm sure you weren't doing that, of course, because that would be silly. It would fail to take into account the fact that most of the European techniques were already applied to the European market 20 years ago (e.g., expensive petrol), and would nonsensically imply that an 80% lower per-capita gas usage was somehow irrelevant.

But, of course, you weren't suggesting anything of the sort, I'm sure.

From 1990 to 2002, GHG emissions from transport in the EU-25 grew by 22%.

If you look at Western Europe plus Italy (including the UK) you have very close to the same population as the US using slightly less than half the tranport fuel per capita. This is a fairer comparison to the US given relative levels of economic development, than one which includes Bulgaria and so on.

Europeans have more fuel efficient cars, and then large numbers drive as though they are training for the F1 race series. What is the fuel consumption at 160 klicks?

While the economy of Western Europe grew rapidly post WW2, it was nonetheless a period of hardship and sacrifice. Maintaining, rebuilding and expanding the public transport infrastructure was the most feasible way to provide the labour mobility a modern capitalist industrial economy requires. It was not an environment in which Firestone/GM and the rest could successfully tear up the competition's track.

In recent decades, Western Europeans have been resting on their laurels and have no lessons to teach. They are large consumers of hardwoods from former tropical rainforests and now of course want to feel green while racing down the autobahn at 160 klicks burning palm oil biodeisel grown where formerly the hardwoods prospered.

Americans are perfectly capable of sorting out their own mess, even though as of late they only appear to be capable of messing up other peoples' countries.

That we Canadians need to smarten up goes without saying.

"What is the fuel consumption at 160 klicks?"

Well, my minivan - 7 seater with room for luggage - gets about 34MPG at 160 klicks. Might not get there as fast as the BMW next to me though..

Cheers, Dom living in Munich

You are right about one thing: even the Europeans have means to lower their fuel consumption. Gas is around $6/gallon over there right now. When it will hit $5/gallon over here, they will be closer to $10/gallon. It will be interesting to see how many cars will be racing on the Autobahn then... :-)

You are kind of dismissive of European success but are not offering anything different for solutions. I guess it just hurts too much to know that North Americans are way, way behind and that physics leaves no wiggle room but to emulate what other people have done before. Sucks, doesn't it?

It does little good to talk about Potsdam in Peoria.

Generally, I agree with the tenor of the practical measures you propose; for example, in the case of anticipated 'food shortages' in the wealthy countries, I agree that the solution is evidently fewer calories per person, less meat and so on.

I also support doing things smarter. At the moment, I am trying to convince engineers, planners and politicians alike, that planned sewer replacement work in my neighbourhood presents an opportunity for the installation of a sewer heat system (type of geo-exchange hardware) which could service both an adjacent municipal recreation centre and firestation. Of course, it is a European technology employed in a number of European countries. And I make mention of that fact. But what is relevant are local supply issues, local financing opportunities, local benefits and so forth.

That's odd - the database (wri.org) I'm looking at gives the liquid-fuels CO2 emissions from Europe as going down by 15% from 1992 (earliest year) to 2003, as opposed to up by 25% in the USA. France, Germany, Italy, UK - all the majors are flat or down over that period, with only Spain and a few other late-developers going up.

Total CO2 emissions are down 20% in Europe and up 20% in USA.

Methane is down 30% in Europe and flat in USA.

Flourinated gases down 10% in Europe and up 35% in USA.

Maybe there was some really unusual quirk in the transport sector or something, or maybe the database I've been looking at (World Resource Institute, earthtrends.wri.org) has totally different numbers than whatever you were looking at, but everything I can find shows Europe coming out much better than the US in the last 15 years.

In 2003, adding diesel+gas, we had (litres per capita per year):

France 810

Germany 740

Italy 740

Netherlands 770

Portugal 690

Spain 840

Switzerland 880

United Kingdom 800

Western Europe: 770

United States 2,140

Ratio: 2.8:1

So the US used about triple the transportation fuel per capita that Western Europe did. (And, looking at the numbers, I'm strongly suspicious that the CSM may have given the gas-only numbers rather than the gas+diesel numbers that they claimed.)

Perhaps you mean they have no new lessons; the US (and Canada, to a large extent) still haven't learned their old lessons. 'cuz, in this regard, Europe has rather more laurels on which to rest.

"EU officials said road transport accounts for about one fifth of the EU's CO2 emissions, with passenger cars alone responsible for 12 percent. They said carbon emissions from road transport rose 26 percent between 1990 and 2004."

http://in.us.biz.yahoo.com/ap/070207/eu_vehicle_emissions.html?.v=2

So the trend from through 2002 continued until 2004, and probably is ongoing.

Major reasons for the growth of road transport carbon emissions are the increasing size of vehicles and increasing trip lengths (sound familiar?), and the increasing use of heavy trucks to transport freight. The share of rail is now about one-half of what it was 30 odd years ago.

http://www.iht.com/articles/2006/06/30/business/wbrail.php

You use a different data source and a different grouping of countries than I did to find a comparison with the US on per capita transport fuel, but still 2.8 times is not what was originally claimed. In any case the gap between Europe and the US is narrowing.

It appears to me that the Europeans having being attempting to 'americanize' as much and as quickly as their historical legacy and current economic conditions allow. Since what the world needs is to 'de-americanize' as quickly as possible, I won't be looking to Europe for direction.

The EU expanded from 12 to 25 member states between 1990 and 2004, so that statement is exceptionally misleading.

False.

Take a look at the per capita data, so as to avoid statistical deception like the article you mistakenly believed. All of the trends show that the gap between Europe and America is growing.

Really. Go look for yourself if you don't believe me. But get the real data this time, instead of a deceptive piece of spin packaged by a news writer.

The 26% growth number is for the EU-25. Contact the EU.

That is not what the article you quoted says. Do you have any evidence that your claim is true?

Somewhere in my files is the EU report which showed a 22% increase for the EU-25 from 1990 to 2002 as per my initial comment. The article above is citing EU officials with updated numbers. They are for real. Sorry to burst your balloon and if I really have to I'll find a reference. At the moment, I'm a little exhausted after 3 hours spent, scraping and flooding the neighbourhood hockey rink.

As for the other matter regarding rates of increase per capita, you will find if you go to the road transport fuel section, at the site you provided, data for 1990 and 2001. You can get population data from the CIA handbook.

For the 8 countries you define as Western Europe, the population increased at an annualized rate of .32% per year from 1990 to 2001. Road transport fuel (not including diesel for tractors, trains and whatnot) for the 8 countries increased by 1.76% per year or 5.5 times the population growth rate. In the United States the population increased by 1.23% per year and the road transport fuel increased by 2.43% per year, or 1.97 times the population growth rate.

So 5.5 times the population growth rate in Western Europe and 1.97 the times the pop. growth rate in the US. I'm willing to wager that the trend hasn't changed by much if at all. We will have to wait for the data to be released however.

Upthread I didn't include Spain and Portugal in my definition of Western Europe as I consider them to be in Southern Europe. I did include the one southern nation that has a long history in the EU and a very industrialized northern region, Italy. I also included Belgium and Austria. If one was to consider my selection as a more appropriate comparison with the US, then the difference in the growth rates of road fuel consumption would narrow, but not by much.

EDIT: I still haven't located the actual report, but here is a link to a graph showing the growth rates from 1990 - 2003 in GHG for transport and other sectors in the EU-10, the EU-15 and the EU-25. You have to eyeball the percentage increases, but you can see that the numbers I cite upthread are right. You can also note that the rate of increase for EU-15 is the greatest of all.

http://dataservice.eea.europa.eu/atlas/viewdata/viewpub.asp?id=2165

good night and good luck

TFO, poor use of maths. Eg, 50% of 100 (=50) is still far less than 39% of 1000 (=390). Hence there is a lot Europeans can teach you Yanks about efficient car design. In fact we Aussies also ship far more efficent cars (we call them utes and Monaros) to the US for GM than your own American GM subsidiares can make.

If you are still around, you will have by now discerned that I'm a Canadian, though I'm not ashamed to be mistaken for an American. There are a lot of fine Americans; that is very apparent on this blog.

As for maths, I would suggest that in these matters it is what is happening at the margin which is important.

Dave, perhaps u missed my new graph. See the two gray lines? Those are mk hubbert's calls.

See the colours going up one-by-one-by-one? That is mr campbell's calls.

And what did mr michael lynch say back in 1996 about 2006? 84-mbd. And what did it end up? 85-mbd.

Dave et al, until the Peak Oil movement can forcast further than three quarters ahead and get it right, nobody is going to believe what u say. 90% of the posts at TOD say Peak was in 2005.

3/4 of them are trying to redefine what Peak is. What oil is. But then the last president they liked was clinton, right. "is"

TOD blowhards have no credibility. The ones that have got it right, like Rembrandt, are practically treated as if estranged.

Until u embrace the bottom up modelers, u will be dismissed. Life Rembrandt, Colin Campbell, Jean Laherrere & Chris Skrebowski do excellent work. Faults (or limits rather) in their methodology requires them to constantly upward revise. But rather than work with these gentlemen, Peaksters (esp at TOD) disown them cuz they have joined "the dark side" and foresee a post 2010 2011 or 2018 Decline.

Instead of respected oil sector stalwarts, most at TOD embrace the losers. the book merchants. the nihilists.

"U can't handle the truth"

eh.

And so your neighbours, ex friends, family, co-workers ... all ignore y'all. And they come to TOD ... the mutual admiration society!

freddy

No projection is the truth, they're all just guesses.

Lets talk about the truth...

Per eia, 06 is, at best, a tie with 05. What did your avg punter guess would be the increase in output over 05? I asked for this before, got no answer. IS it around 87Mb/d? (See below for comments on your graph.) If so, the missing barrels are enough to fill the planned SPR addition... Have you considered quizing them to find out where all this oil went?

What does your avg punter call for in 07? Write this avg guess down now, so later we can compare this guess with the truth as it arrives. I'm sure you will want us all to see how accurate your lot is. Is it around 89Mb/d?

I appreciate that you like all liquids, no doubt you realize traditional oil has been going down for some time, and meanwhile I agree that joe sixpack doesn't care what he is pumping into the tank as long as it works, and maybe he won't notice he has to fill up more often. So, by all means show us the all liquids numbers.

A little more truth... You keep talking about 85Mb/d... So far, 06 is nowhere near this value, 06 avg thru nov is 84.6Mb/d. We arrived on the 84Mb/d plateau in oct, 04, now into its third year, overall avg is 84.5Mb/d... Personally, I doubt we will ever get to 85, but maybe the wall of oil, due in 06, will arrive by and by and prove me wrong.

BTW, your graph is extremely hard to read, particularly for the period of greatest interest, 2000-2025. Why not show a blow up of just this period, and maybe a separate one that shows just the consensus? You are on the side of clarity, right?

Had a look at your ng graph, projecting a US peak in 2017... you didn't notice that both us and canada peaked in 01? Or that the number of rigs went up 3x during the decline? Shades of SA... You're still listening to your shining star buddies at cera, who predicted $2/mcf forever, starting in 02... Freddy, we've already produced the good stuff, that bulge you show for the gom seems unlikely with our rigs floating off to sa and the s. atlantic... my favorite ng producer is working the texan tight sands. There's money to be made, but the wells are playing out faster than ever...

On a minor note, individually Canada peaked in 2002.

JK, i did answer your question about the Average's at length. Please check your archives.

It is unfortunate that u are still in denial of the increase in Supply since 2004Q4. It was 84.3 at that time and rose to 85.4-mbd in 2006Q4.

Sorry that u find little resolution in the short and medium term. The purpose of this presentation has always been to illustrate that ample oil Supply will be available far into the Century. And to allow comparison of the long term Outlooks on a basis reconciles with URR. In 2004, many did not disclose URR and their projections were open ended and misleading. I do pay much attn to monthly/qtrly/annual stats to search for confirmations of trend, but the individual projections over the next five years have little interest to me and is paramount to navel gazing. Please remember that there have been seven negative growth sessions since 1975.

The nat'l gas graph is from Jean Laherrere. Methinx he got it from EnergyFiles. It is consistent with EIA representations.

Per IEA, 2006 was up 0.8 Mb/d over 2005.

IEA gives 2006 average daily production as 85.24 Mb/d.

The difference is presumably due to different definitions of what constitutes "oil" and is included in production figures.

When stuart was plotting the 'bumpy plateau', he noted that eia and iea are getting further and further apart, with iea routinely higher but more likely to subsequently revise down. So, we may well see iea with downward revisions. Stuart never noted that there was any difference in oil definition, and indeed seemed perplexed by the growing difference, which did not exist a few years ago. Personally, as eia seems subject to less revision, I use eia numbers, and these show 05/06 flat.

Freddy, I am more than a little sceptical of curve fitting. Having expressed that opinion, has the 1976 MKH projection actually been invalidated by subsequent events?

Couldn't the area under the MKH 1976 projection [peak at circa 110 mbd circa 1990 per your graph] and the actual production to date potentially be explained by surplus capacity, a reaction to mid and late 1970s prices, and the collapse of Russian and other FSU production after the communists went into hibernation?

Phrased another way, maybe the world did not experience the towering 1991 peak solely due to a flattening in the quantity demanded redrawing the curve. Given that wouldn't slower production prior to the peak change the shape of the upsloping portion of the curve while not significantly altering the area under the curve or the peak capacity for flat out production on the downslope?

Phrased yet another way, if MKH was correct on the geology when the world did not reach a production / consumption peak of 110 mbd circa 1990 wouldn't the lower production push the peak to the right [and might not the resulting curve look like what we have seen to date]?

Bottoms up modeling makes a lot of sense, but I do not trust the KSA "royal" family and I have not seen the evidence for vast high flow rate developments elsewhere.

Belief in early peak [c+c] oil is IMO an excercise in scepticism. Belief in a ten to twenty year in the future peak s a leap of faith in untrustworthy players and for now I place CERA in the untrustworthy category. Neither the early or late peak contingents have sufficient factual basis to conclude with certainty.

Thoughts?

RWR, Hubbert's "1995" Peak was based on a URR of 2000-Gb. The volume that was "unused" between the '78 breakaway and today is 230-Gb and is available for the "future" after 2006.

If u want a comparison of what happens if we "shift it over to the right", the blue ASPO 2002 line is based on 2700-Gb and may be a good proxy.

OTOH, if u want to keep his 110-mbd Peak Rate, a good proxy is the aqua OPEC line on my Scenario graph. It has a very similar URR of 2246-Gb and Peak Rate of 106-mbd. U will notice that even tho it has a lower Peak Rate and higher URR, it has a very aggressive Decline Rate (6%) made necessary to exhaust the balance of the URR.

IHMO, the URR AVG (heavy blue line) of the models, 3025-Gb, is more likely and that would dampen the Decline Rate substantially.

Thanks. I the chart you included in your response was helpful.

"No one knows if some breakthrough in battery technology, fuel cells, cellulosic ethanol etc. will occur or not. "

Yes, we do, thanks to the laws of physics.

The answer is: "NO".

Perhaps you would explain yourself here. For example, how does physics preclude a more efficient energy storage device for use in electric cars?

It is even easier than that: many fuel efficient car designs cover the vast majority of user needs quite efficiently with enormous gains over the SUV concept. You have to keep in mind that the SUV is a design that sprung from the enormously insane idea of US lawmakers to put a tax on large vehicle that excludes trucks and semi-trucks! In other words: they created a monster. Of course, the marketing types were also eager to advertise that you could have a car that gets you to work, hauls your boat accross the rockies AND provides space for your family of eight (all of whome happen to be construction workers...). Truthfully: people don't use SUVs that way. They use them very much like regular cars. But instead of getting Mom and Dad to work for half a gallon to one gallon of gas, the family car now uses three (expecting that it is hauling a 15 foot boat accross the Rockies whole seating eight construction workers).

Physics is not the problem here. Stupidity is.

Re: Physics is not the problem here. Stupidity is.

I was just hoping when a person makes a statement that physics is the problem, they will back it up with a reasoned argument based in science. However, I think stupidiy is one of those "umbrella words" that encompasses a wide range of human traits — avarice, lack of intelligence, myopia ... many things.

To ask a doomer to back up a statement about energy with science is very much like asking a creationist to explain how God puts a new species on the planet. You are at best insulting their religion but you will never get an honest, well researched answer.

I agree, stupidity does encompass a whole range of human traits, but they are, in the end, all incompatible with reality. A stupid person, for all practical purposes, has to violate reality on some level. It may be intellectual, it may be practical or it simply may be religious/apologetic/ignorant. Sooner or later there is a conflict between such a persons ideas or actions and hard facts.

To continue driving SUVs, for example, will result in a supply/demand conflict which nobody, not even the SUV driver can escape.

To preach doom will, eventually, result in a lot of very quiet, deeply dissapointed people. A few thousand might take to the hills and await the second comming, but most of them will simply shut up.

I wonder how many of those who predicted the end of the world because of Y2K are still bragging about it? Y2K was an IT and social engineering problem (you had to get people to take it seriously, so they would spend the money to make the necessary IT changes). So is PO. It is an energy and social engineering problem. You have to get people to take it seriously and they will make the necessary lifestyle changes. In Europe that is being done with carrots and sticks and it is a success. In the US we will have to wait for supply and demand to hand out the beating that the politicians should have and could have handed out a decade (or two) ago. The results will be the same.

I agree with many of your comments.

I ought to inform the readership, as background, that I am a practicing physicist, and I am not a "doomer".

When it comes between fundamentalist cornucopican arguments and physical reality, I always choose physical reality.

For example, it is certainly true that communication technology has grown enormously. However, has any of it ever surpassed the fundamental limits set in 1905 by Einsteinian relativity applied to Maxwell's equations, and the limits set in 1949 by Shannon to information coding?

No, never.

Modern turbo codes for communication achieve in practice a slim dB or three away from ultimate limits of Shannon. We can modulate light on terahertz carriers (fiber optics) at multi GHz speeds, up to the amplification bandwidth line and physical transmission window. Are we going to do much better? Not really. Can we transmit information using much higher frequency x-rays and gamma rays? No, because they disrupt the atoms and molecules that we use for producing physical technological goods, as well as being hazardous to our health. Fiber optics can very well contain light, but the maximum frequencies they will transmit are limited by the specific nature and size of the atoms that stuff is made out of. Atoms will continue to be the same size as always.

Energy technology has equivalent limitations, and current practice is already much closer to immutable limitations than electronics were in 1960.

This is why oil depletion is qualitatively unlike other facts.