Flesh on the bones of Mexican oil production

Posted by Euan Mearns on February 7, 2007 - 12:41pm in The Oil Drum: Europe

Following on from Khebab's posts (Jan 2007 and July 2006) I wanted to put some production geology flesh on the bones of Mexican oil production. The main points I want to make are:

- Forecast production decline of 14% per annum in Cantarell sounds alarming but it is in fact the result of planned reservoir management.

- The forecast decline of Cantarell is due in part to the diversion of nitrogen injection from Cantarell to the neighbouring Ku-Maloob-Zaap (KMZ) complex of fields. Production at KMZ is forecast to rise to around 800 MBD and this will partly offset production falls at Cantarell.

- Cantarell / Mexican production is predominantly heavy crude, and it is postulated that any production declines in Mexico may be met by additoinal production of Saudi Arabian heavy crude forward to 2012.

- Notwithstanding point 3, Mexican oil production decline means that 4 out of 5 major OECD producers are now in decline (Norway, UK, USA and Mexico), leaving only Canada with growing production and this presents the OECD with a growing problem of energy security.

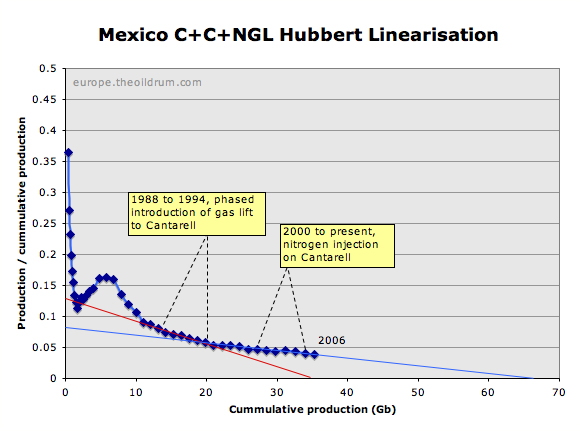

- The Hubbert Linearisation (HL) for Mexico reflects reservoir management (gas lift and nitrogen injection) and new field developments but the interpretation remains equivocal. A brief description is given of why Pemex have used gas lift and nitrogen injection to boost production at Cantarell.

Cantarell's loss is Ku-Maloob-Zaap's (KMZ) gain

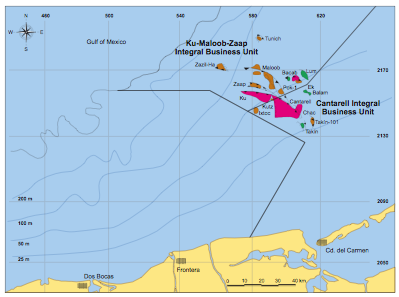

Much concern has revolved around the Cantarell Field in Mexico that is forecast to decline at an alarming 14% per annum. The Cantarell complex (Figure 1) has been a wonder producer for Mexico reaching maximum production of 2.14 million barrels per day (MMBPD) in 2004. This, however, was only acheived by the application of world leading reservoir management methods.

Figure 1. Map showing the location of the Cantarell and KMZ complexes in the Bay of Campehe (click to enlarge). Map copied from a Pemex report (large pdf).

Mexico produces heavy crude

72% of the crude oil produced in Mexico is heavy "Maya" with average API gravity of 22 degrees. Light crude has higher API gravity, and for example Brent Blend has API gravity of 38 degrees and Westexas Intermediate 39 degrees.

One of the key differences between light and heavy crude is the viscosity of the liquid. Light crude has a viscosity close to that of water, especially at reservoir temperatures. In other words light crude is highly mobile. Heavy crude is more viscous and has mobility more like thin syrup. Heavy crude, therefore, does not move through the reservoir rocks so easily and this can present production problems. Note that the viscosity of crude oil falls with increasing temperature and vice versa.

Gas lift used to increase production rates

Flow rates for heavy crude may be low, depending upon reservoir quality and pressure decline. On Cantarell, flow rates were increased by introducing gas lift to most wells in the period 1988 to 1994. Gas lift involves injecting natural gas into the oil production stream at the bottom of the oil well. This lowers the density of the oil throughout the whole well and lowering the density reduces the liquid pressure inside the well at its base. This creates a greater pressure difference between the reservoir and the well resulting in higher flow rates.

Nitrogen injection

Maintaining reservoir pressure can also be more problematic with heavy crude as water injection is less applicable. This is because injecting cold water may increase the viscosity of the oil and may result in a very uneven sweep of the reservoir. It is common practice to inject steam into heavy crude reservoirs to overcome some of these problems. In Cantarell, however, it was elected to inject nitrogen gas instead and this lead to the construction of the world's largest nitrogen plant at a cost of $6 billion. Note that it is not possible to simply inject air as the oxygen may set off a number of undesirable chemical and biological reactions in the reservoir.

Nitrogen injection is a form of miscible gas flood. The nitrogen helps to boost reservoir pressure and to mobilise the oil. In Canatrell the effects were miraculous with a marked rise in production accompanying nitrogen injection in 2000 (Figure 2). However, the nitrogen has now dones its work and continued injection is likely to damage reservoir productivity. The decision has now be made, therefore, to divert nitrogen from Cantarell to the neighbouring KMZ complex (Figure 1) where injection is expected to boost production to 800 MBD by 2010. This will offset more than half of the production decline from Cantarell (Figure 2).

Figure 2. Mexican oil production past and future, Wood Mackenzie, copied from here. Note how production from KMZ is forecast to expand and partly offset the decline in Cantarell.

Production forecast

Figure 2 shows that Mexican production is not about to go off a cliff edge. The cupboard is not yet bare, and new fields will be developed off the Tabasco coast and on-shore at Chicontepec. I think the "possible reserves" wedge needs to be ignored, and I consider it likely that the picture painted in Figure 2 may be over-optimistic. Furthermore, project delays may result in sharper production decline near term. Dave has discussed logistical problems in the oil industry "south of the border". But the fact remains that KMZ, Tabasco and Chicontepec will partly offset the demise of Cantarell forward to 2010.

With 60% of production forecast to decline at 14% per annum, it seems likely that 2004 will prove to be Mexico's peak production year. The new supplies indicated in Figure 2 are unlikely to plug the gap in my opinion, although, as detailed by Khebab, the EIA and IEA see Mexican production rising to over 4 MMBPD by 2010. The question for Mexico, therefore, is how rapidly production declines post-peak. As discussed below, it is still too early for Hubbert to provide this answer and it is only possible to make an educated guess. So my guess is decline will run at around 4% per annum which is appropriate for a mix of offshore and onshore production. Khebab's "Low Logistic" based on monthly crude+condensate data also declines at around 4% per annum.

Impact on world crude oil market

With production of 3.7 MMBPD, domestc consumption of 2.1 MMBD, Mexico exported around 1.6 MMBD of predominantly heavy crude in 2006. Much of this was exported to the USA which has refining capacity tuned to refine heavy crude as discussed by Dave.

Figure 3. 86% of Mexico's oil exports go to the USA.

Assuming a 4% decline rate in Mexican production would result in avearge daily production falling from 3.74 MMBPD in 2006 to around 2.93 MMBPD in 2012. This represents a fall of around 800 MBPD by 2012. Whilst not wanting to trivialise this loss of OECD production, my opinion is that much of this lost production of heavy crude may be met by increased production of heavy Saudi Arabian crude from the Safaniya Field. In Twilight in the Desert, Simmons documents possible spare capacity at Safiniya of the order 500 to 1000 MBPD and this should meet falling Mexican production for a few years at least. What I'm trying to say is that falling Mexican production would be more serious if it were light sweet crude production that was lost. One consequnce of this, however, will be loss of conserved Saudi capacity and shrinking spare capacity going forward should be bullish for the oil price.

Figure 4. The Safaniya heavy oil field is described by Matt Simmons on pages 187 to 191.

Hubbert dog leg

Finally, I want to take a brief look at Hubbert Linearisation (HL) for Mexico. From the work of Khebab it was clear to me that there was a dog leg in the HL with a marked change in gradient at around 1995 (Figure 5). Note that in Khebab's more recent work, this dog leg is obscured through use of monthly as opposed to annual production data. I wanted to see what production geology event this might relate to as understanding this is vital to the overall interpretation - the pre 1995 leg points to reserves of 35 Gb whilst the post 1995 leg points to 66 Gb (Figure 5). What event might have added 31 Gb to Mexico's reserves? Or is there some deception at work here? Khebab, however, has noted that the pre 1995 leg has a P/Q value greater than 5% meaning that the production from this period is not sufficiently mature to provide a reliable estimate of URR.

Figure 5. Hubbert Linearisation for Mexico. Crude+condensate+NGL (C+C+NGL). Data from BP statistical review.

Unfortunately, the 1995 dog leg does not correlate with the major resevoir management interventions on Cantarell. The introduction of gas lift (1988 to 1994) pre-dates the dog leg and the introduction of gas injection in 2000 significantly post-dates the dog leg (Figure 5).

However, from Figure 2, it is quite clear that 1995 was a significant year for Cantarell because in this year production began to rise from the 1 MMBPD plateau (1990 to 1995) towards the 2 MMBPD reached in 2003. I can only speculate that new production platforms or new oil export facilities (pipelines) were brought on line in 1995 allowing production at Cantarell to grow significantly over the next 8 years - boosted by gas lift and nitrogen injection infrastructure.

So might this result in adding 31 Gb to Mexican oil reserves? Well the answer is yes and no. Gas lift and nitrogen injection provide higher production rates without necessarily adding to reserves. But on the other hand, nitrogen injection provides greater mobilistion of oil and more efficient sweep of the reservoir which will result in greater ultimate recovery than would have occured without this intervention.

Figure 6. HL "forecast" assuming 4% decline in Mexican C+C+NGL production from 2006 onwards points to ultimate recoverable reserves of around 55 Gb.

So the honest answer is that it is too early for HL to say. My best guess is based on assuming 4% annual decline and this points to ultimate recoverable reserves (URR) of 55 Gb, though it has to be said that this figure falls close to several other estimates for Mexican URR as summarised on Graphoilogy. But we must also remember that Mexico has a vast unexplored deepwater area that may yield some major discoveries in the years ahead. This will have no impact upon peak oil which I see in 2012 ± 3 years, but deep water Mexican production may have a significant roll to play in keeping the hybrids running post 2020.

The WSJ article on Cantarell last year noted, based on a leaked internal report, that the remaining oil column of about 800' was thinning at a rate of about 300' per year. Out of five scenarios, the worst case decline rate was a 40% decline rate per year. And, Pemex is canceling and/or reducing crude oil deliveries to various Gulf Coast refineries.

Just to remind everyone, this is the second largest producing field in the world.

David Shields, who has written extensively on Pemex and Cantarell, is predicting a net decline in Pemex production of 400,000 bpd this year and 400,000 bpd next year.

Shields has also documented how Pemex uses optimistic estimates for the Cantarell decline rate in public, versus more pessimistic internal estimates.

To tag on, I can't recall any case (although I am willing to be corrected) when EIA hasn't been far too optimistic about production rates following a regional or national production peak. They consistently underestimate decline rates going forward and overestimate new production. If history holds, your 4% annual average decline figure should be much too optimistic.

Jeffrey - when you say that the oil column is thinning, what do you mean? My understanding of Cantarell is that it is a seriese of separate oil pools and has multiple reservoir horizons - and will therefore have multiple oil-water and gas-oil contacts - and no single unique oil column.

What is the oil column thinning between?

I'd be interested to read the articles by Shields - can you post some links or references?

Euan,

I did a quick web search on Cantarell. I found one reference to oil/water contact (singular) and one reference to contacts (plural). In any case, the oil column reference is shown below in the WSJ article published one year ago. Perhaps they were averaging the oil columns on various discrete fault blocks.

Shields has lots of stuff on the web, and he has written two books on Pemex.

Jeff

Mexico's oil output may decline sharply

David Luhnow, Wall Street Journal

Pemex Study Points to Possible Drop At Major Field, Which Would Strain Global Supply

(9 February 2006)

-------------

From the WSJ website (same article):

BTW, for the first time, insofar as I know, CNBC just mentioned the Cantarell crash.

Jeffrey, I'm afraid I have to view this as DOOOOOMER journalism. In Khebab's Jan 2007 article, Figure 5, he estimates Cantarell production at around 1.75 MMBD for 2007 - and the WSJ article is suggesting around half that - not credible IMO - and to be ignored.

Euan,

This is not doomer journalism. They were reporting on a leaked internal Pemex report, which outlined five scenarios. When they talk about the worst two scenarios, they are talking about internal Pemex scenarios.

The Wall Street Journal engaged in DOOOOOMER journalism. Wow! I guess the noun SCENARIO, preceded by the adjective, WORST, has a different sense than I might have thought.

Yes, to be objective, the best case scenarios need also to be discussed - maybe the WSJ did that - and a balanced view presented.

From the WSJ article (February, 2006):

So the most optimistic scenario, assuming 2.0 mbpd for 2005, was for an annual decline rate of 11% per year.

So, the spread between the best case decline rate and worst case decline rate--based on an internal Pemex report--was 11% to about 40% per year. Note that Pemex had been talking in public about increasing production from Cantarell.

The one year decline for 2006 was 25%, from 12/05 to 12/06. They did report somewhat of a rebound for January, but they have just been oil that was not produced when the field was down due to surface problems. We will know soon; however, what we do know now is that Pemex is eliminating or reducing crude oil deliveries to several Gulf Coast refineries.

if nitrogen injection has been real sucessful at canatrell and now the plan is to divert nitrogen supply to neighboring fields, that 40% decline scenario seems at least as reasonable as that 14% decline scenario.

it has been my experience that a 22 degree api field can be waterflooded successfully depending on the rate and permeability anisotropy. the powder river basin (wyoming)has dozens of examples where the typical recovery from a water drive or a real successful waterflood is in the 40 % range. nothing in the same league with canatrell, however. maybe the nitrogen injection has done better i dunno.

I have closely watched Cantarell for the last 18 months. My tentative conclusion is that neither the best (-14%/yr) or worst (-40%/year) scenarios are coming to pass. Reality seems somewhere between #2 & #3 with -20% to -25% (early results). New production is coming on-line (as other older Mexican fields decline) and +100,000 b/day seems doable outside Cantarell (for at least a year or two).

I see net Mexican production down only -4% as highly unlikely. I also see at least minimal Mexican oil exports in 2010 (no -40% compounded).

Eaun is way too optmistic IMHO, Jeffrey a bit too pessimistic. But the future is still dark, especially for Mexico & the US.

Mexican oil export income is largely recycled into US imports. We actually have stuff that an oil exporter wants ! This is far less true of other oil exporters (Russia wants what from the US ? Venezuela is moving away from US imports, we refuse to sell to Iran, Nigeria, Norway, etc. traditionally buy little but aircraft & food from the US, KSA seems to be moving away from US imports, China is creating a large new market in Angola, etc.)

KSA can stop using "we have no customers" excuse though.

I keep wondering about what happens when oil soars to 100 euros/barrel and the world decides that they have "enough" US dollars. We can liquidate our foreign investments (gov't nationalizes as UK did during WW I & II ?) to buy "critical" imports for a while, but not for long.

Boeing will grab market share from Airbus (as the weak $ is doing today) but we have few other exports that can be "ramped up".

Best Hopes,

Alan

Imagine a collapse of the dollar, say to .5Euro. US imports of european autos would collapse, us exports, eg caterpiller, would surge.

Most asians, eg those that tie their currency to the dollar, would continue... there is already a dollar region and a euro one, and the dollar region is growing much faster than the euro one as the US provides needed liquidity to developing markets. Oil exporters may eventually tie to euroland, but slowly and quietly, raising the price of oil in dollars, anyway a good thing.

The WSJ is probably the best paper in the country these days. Their editorial page is often nutty, but they have a strong firewall between the editorial and the news sections.

Dante posted this article at PO.com. He translated it from the Spanish, I think:

It's from here: http://www.reforma.com/

Dante has been finding a lot of Cantarell articles in the Mexican press, in Spanish only, unfortunately. They are reporting that Mexico expects to become a net importer by 2012.

Is there 1559 mmbd of extra capacity available currently?

They sound like they are drilling with the same problems as KSA increasing drilling and flat to declining production. I get a very bad feeling from this.

Thanks for posting this.

I posted an export model at the bottom of the thread - based on a 4% decline - and this still shows net exports by 2012. The exports disappear with an 8% decline (and 2% annual rise in consumption). 8% decline is similar to the North Sea - but the feeling I have is that Mexico has more in reserve by way of new production waiting to come on.

Here's an excerpt from another Dante's articles. It's from a site called El Economista.

Wish I could get a better translation of this article, but my Spanish is terrible.

Two questions:

1. Does anyone know the environmental impacts of this state-of-the-art technology for maintaining production in fields that are in decline?

I am concerned that this is never really addressed.

2. Deep Water production has its own risks and complications. How feasable will it be? How expensive? In what time frame? And do we know if there's enough oil in Mexico's deep water prosepects to justify production? Will it require new technology, or is Mexico's deep water production likely to require technology already in use?

Sorry, the second question is multiple -- but re-stated: "Is any 'Mexican deep water' talk real or just speculation at this point?"

Beggar - I imagine that gas lift and N2 injection have very little external impact as the gasses involved will be recycled through the Field / wells. Biggest impacts will be the actual N2 production plant and the CO2 consequences of the extra oil that is produced.

In answer to your Q2 - quite, very, 20+ years, no, maybe :)

The deep water is speculation - but the GOM is one of the most prospective oil provinces in the world. No disrespcet to Pemex, but I imagine they may need some help to explore, drill and develop any discoveries that might be made.

Thanks for the informative response!

Thanks also for the terrific post.

GOM deep water oil sounds expensive. Also it seems that we will need some patience to develop it -- it is no panacea for our liquid fuel shortage problems.

I find myself sceptical that much of it will really be produced, what with storms and rising costs of exploration and production.

But then if we see $200.00 per barrel any time soon, there will be some motivation to try!

Good story, Euan. On the KMZ, the EIA says (your link)

This "hope" from NO2 injection clearly differs from the Wood Mackenzie forecast (your figure). I don't know what to believe here.Dave, I'm sure I read somewhere that KMZ was to increase by 800 MBD - but in light of your comment the text has been ammended to read "to 800 MBD".

Thanks :-)

PS - it is N2 that is injected.

Of course it is N2 that is injected, as I myself have written many times. I must have climate change on my mind (nitrogen oxides NOx are greenhouse gases). A mindless mistake.

Anyway, the question remains about how much injection will improve production flows.

Well it worked wonders on Cantarell, so I have no reason to beleive that it won't do the same for KMZ. However, it is evident that beyond a certain N2 saturation in the oil, that the N2 starts to form gas pockets in the reservoir - breaking up the remaining oil which then can not be produced. So it seems like a short term production boost is achieved followed by more rapid decline - as the pressure support mechanism has to be switched off.

Did the N2 injection into Canterall simply bring forward oil extraction that would have happened at a slower rate without it?

or did it allow for an increase in the total amount of oil recovered from the reservoir?

I have been following peak-oil issues since 1999 and remember reading about the billions invested by Pemex for N2 injection into Canterall. Most of the extra oil extracted recevied quite low prices (relative to the last year or 2), so the whole project just appears to be a way of bringing forward revenue at the expense of significantly more in the future...

So why do the same for other fields?

if the nitrogen is miscible with the oil how does a gas phase develope ?

Why aren't the gas injection wells simply moved to the top of the oil column so that the gas will continue to exert pressure on the oil but won't have to bubble through the oil and risk forming pockets?

If Nitrogen content is maxxed out in the oil and then millions of barrels are produced, doesn't the pressure in the rock drop? Won't the Nitrogen come out of solution when this happens?

i think you mean laughing gas,the kind the dentist gives you then tells some real corny jokes to see if it is working !!!!

as dave alluded to above euan, KMZ production will potentially increase to 800kbbls per day, not by 800kbbls. the difference is some 350kbbls, eyeballing the woods mckenzie graph, above.

Steverino, I'm sure I read somewhere that KMZ was to increase by 800 MBD - but in light of your (and Dave's) comment the text has been ammended to read "to 800 MBD".

Thanks :-)

I think "to 800" is correct. IIRC, the "by 800" was a Spanish-to-English translation error.

Isn't 800 MBD = 800 million barrels per day? Wow, no wonder Lee Raymond can state that 'there is no problem with oil supply'.

In that case, MBP means thousand barrels per day and MMBP= million barrels per day.

Recall your roman numerals M=1000... This pops up in Financial documents as well......

My understanding of correct terminology is:

MBPD = thousand barrels per day

MMPD = million barrels per day

Not the best of links but a start (I prefer to use B for barrel and not BBL)

http://www.lngplants.com/conversiontables.htm

Standard, as far as I know is

mbd (million barrels per day)

kbd (thousand barrels per day)

You stick the "p" for per in if you like.

Not on this side of the pond life algae. More tomorrow - cos I got screeching to deal with here - but a good starting place to look is the annual reports of the oil majors and independents.

What's happening here is Americans trying to appear modern by adopting metric conventions whilst us super confident Europeans are happy to stick with Latin when it comes to energy matters.

REAL reservior engineers (the kind sportin' crew cuts, pocket protectors and wielding a slide rule) use m for thousand mm for million as in mcf (1000 cubic feet) or mmbtu (million btu's) the kbd is perfectly understandable also . yes m for mil (1000)

A one page pdf from Cairn Energy providing a glossary of terms

http://www.cairn-energy.plc.uk/annualreport2005/documents/Cairn%20AR%20G...

It seems there is no settled convention - I looked through bp's last annual report and they are tending to not use abreviations.

All the major reporting agencies, IOC's, NOC's & MSM used to report in tonnes and/or several variances of bbl. In 1974 they adopted the kbd & mbd standard; but tonnes can still be seen (ogj) for comparison. Nobody (of 21) is using mm for global reporting in the material that i receive for Supply or URR analysis.

ever read a gas sales contract ? ,freddie

With respect, this is not a commercial site. We are discussing Peak Oil and the vocabulary of the Supply reporting is mbd and has been for three decades. If i was in a forum with buyers and agents, i'd oblige them as well. When in rome ...

Similarly, on int'l sites the convention is for everyone to quote in us$ not local currencies.

Our members have clear choice ... convention or stubborness.

Re: happy to stick with Latin when it comes to energy matters

Yes, when are you going to get out the Middle Ages and get your notation right? It's not bad enough that the FSU (Russia, et. al.) and the rest of these Asians report in tons (or tonnes) and I have to convert every time so I understand what the hell they are talking about.

standard cubic meters, Sm^3 is also used, at least by the Norwegian authorities :) If you think about it the only logical unit of measurement is the cubic meter, after all the meter is one of the seven base units of the SI system. Tonnes is another possible unit since a tonne is 1000 kg, kg being another base unit of the SI system.

What's happening here is Americans trying to appear modern by adopting metric conventions whilst us super confident Europeans are happy to stick with Latin when it comes to energy matters

Wrong diagnosis.

The use of M in American nomenclature predates any thought of metric (only the frogs & Germans used it "back then"). It comes straight from the Roman numerals (i.e. Latin).

I did once (on April 1) send a reservior (water, not oil) use calculation in acres-feet/day (a perfectly acceptable and even preferred term over here) instead of m3/sec to Landsvirkjun. I got a VERY quick response that showed a distinct lack of humor among Icelandic engineers >:-)

I like metric overall, but dislike Gl. Hard to visualize a gigaliter.

Best Hopes,

Alan

In your article you note that Saudi Arabia has some spare capacity.

I disagree. We have seen eveidence in the past that it does not exist

http://www.financialsense.com/fsu/editorials/2006/0810.html

Furthermore people underestimate how much refinery capacity has improved for heavy/sour crude over the last 2 years.

fireangel - well I looked at your link and found it was totally devoid of information that I would classify as evidence:

Quotes like this lead me to believe this is a spoof - ha,ha, ha.....

So lets look at the production profile of Saudi Arabia:

You see it has a history of goin up and down - and on every previous occasion it has gone down it has been due to voluntary restraint by the Saudis. So why should the current fall of around 2 MMBPD be any different? There are lots of biased opinions flying around about this - but very little evidence to prove that KSA is not resting tired reservoirs as they have done in the past.

In order to salvage some merit from your valued comment what you say about investment in refinery crackers etc to handle heavy crude is true - but can you contribute here by adding links and numbers - because this will be an important issue going forward.

Maybe I am missing something, but this plot seems to indicate that KSA production was about 11 mbpd in 2005, this seems high. Is it not? Or is this CERA approved production capacity?

BP stat review 2006. Tab "oil production barrels". Cell AP38 = 11035 thousand bbls per day C+C+NGL.

Can you explain the CERA approved production capacity quip - I don't understand it. This usually applies to forecasts and not historic data.

Thanks for the clarification, I was assuming C+C only.

Of course, this was also true of Texas, until 1973.

And the recent decline in Saudi production has corresponded to about a two-thirds increase in the average price of Brent crude (20 months of Brent spot prior to 5/05 versus 20 months after 5/05) combined with a rapid increase in drilling activity. This precisely what we saw in Texas in the Seventies: Higher Oil Price + Increased Drilling = Lower Crude Oil Production.

So what? Texas is more than 6000 miles from KSA.

The Large Magellanic Cloud is 180,000 light years away from us. Yet, magically, the structure of the sodium D line is the same there as it is in any physics lab on Earth. I guess distance does not preclude the world from working just the same here as it does over there.

:-)

The point I was trying to make is that they are two discrete unrelated events over similar but not identical sets, and therefore, using a statistical analysis method that has a very low sample, so far, is dubious at best. Also the uniqueness of each situation makes it questionable; coincidence is not the same ae causality.

Well, I guess that there is the point there have only been two swing producers of consequence, Texas and Saudi Arabia. And oddly enough, Saudi Arabia started "voluntarily" cutting production at a pretty consistent rate of about 8% per year, at the same stage of depletion at which Texas started declining.

Sorry, double post.

The truly significant production drop revealed in your graph was in the early 1980's. At that time, the Saudi production decline trailed price declines from peak price in 1980 (yearly average). This suggests that Saudi Arabia was trying to brake the rate of price decline if not some decline in itself. Saudi production turned around in 1986, a year when the price fell more than any previous year. It appears that the Saudi's concluded that total export revenues could only be rescued by increasing volume. In other words, in the 1980's the Saudi's first withdrew and then increased production, with the same intent: to maximixe earnings.

Some have suggested that SA's production increases were also tied to a grand plan by the Reagan White House to sink the Soviets, though I believe this attributes intelligence where little was present. The evidence is that the U.S. Intelligence community was surprised by the collapse of the Soviet Empire.

If in the past the Saudi's have responded to a need to maximize export earnings, does that explain the current production decline?

Ae an aside, the collapse of the Soviet Union was forecast by John Davidson and Lord Mees-Roog in their book "Blood in the Streets" (1980?), and it had nothing to do with Reagan.

KSA Production

Yes, and what would you conclude from such a graph?

Thats funny.

That is exactly what is said in sequel which came out a a couple of weeks back.

http://www.financialsense.com/fsu/editorials/2007/0124.html

The point trying to be made here is that Saudi Arabia has peaked although the recent drop is voluntary.

The point of the first article was that no spare capacity at least usable exists or we would have seen some increase after 3 disruptions as not all of the capacity taken offline in all instances was LSC.

Was it Khebab, Dave, or (?) who did the chart that combined wells drilled with this data. I think now is an execelent time to drag it out. If my memory serves me correctly they have tripled the ammount of well drilled in the last few years with flat to declining production.

is it this one?

Blue= Rig Count, Red= Oil Prices, Green= Production (CO+NGPL)

It's a few months old, I have to update it.

Rig count was flat for a couple of years or so at around 18, now up 3x to 54, their stated intent a year ago was 80, now the right number is 130. IMO they will soon be looking for 180.

Euan -- when you say the Saudis (may or may not be) resting tired reservoirs as they have done in the past, what exactly are you talking about? Resting them? Oh, my, the reservoir oil pressure is getting a little slack now, despite the fact that we just injected the entire Persian Gulf down there to get this oil to come up, so let's just hold off a bit? Is that it? What do you mean by this?

Please explain.

Permeability anisotropy

Many if not most of the reservoirs in KSA are limestone with poor reservoir quality / characteristics. While oil may gush out of a sandstone it tends to bleed (non-arterial) out of limestone. Porosity can be fairly high, but permeability is often low. There are exceptions, such as the reservoir sweet spots of N Ghawar. What's more, the permeability can be highly variable with so called Super K horizons - which have extremely high permeability - such as open fracture systems.

So when you inject seawater to provide pressure support and to sweep the reservoir the result can be very, very uneven - the water often gushes along the Super K zones and appears at producers without doing its work. This is rather like trying to blow up a baloon that has a hole in it.

Bubble point

Large parts (most) of Ghawar has crap reservoir properties - it may contain a vast amount of oil - but this is vey tricky to produce. Very low permeability means it is difficult to maintain pressure. If you are pumping oil, the reservoir pressure will fall. Reservoir engineers will not allow the pressure to drop below the bubble point - the pressure where solution gas will come out of the oil. If this happens, you get gas bubbles forming in the reservoir and this reduces what's called the relative permeability - buggers your reservoir completely. So in the absence of pressure support from injection, as bubble point is approached engineers have no choice other than to shut in wells.

With the passage of time, pressure will rise in the reservoir as the natural aquifer attempts to restore the regional hydrostatic pressure gradient - the aquifer bleeding rather that gushing into the resrvoir. So after a period of months / years it may be safe to switch the wells back on again and produce - but only for a short while. Reservoirs such as this should ideally be produced very slowly using a huge number of wells, so that the natural aquifer can support the reservoir.

This account is from memory after reading Twilight - so I'm placing reservoir engineering spin on the wrods of a mercahnt banker.

So perhaps Saudi Aramco's decision to reduce crude oil production was "voluntary" in the sense that someone "voluntarily" hands over their wallet to a guy holding a gun on them.

is gahwar a water drive or partial water drive ? i speculated on this point a few days ago and ron promptly corrected me. i did a little searching on the subject, one of the characteristics of the field was a tilted water table (which may indicate a water drive) although there is a tar zone at the o/w contact (at least covering part of the field), preventing the aquifer from pressuring the oil column. it was my understanding from ron's discussion that water was injected around the perifery from very early in the life of the field. ???????

Parts of Gahwar do have a very active natural aquifer drive, but other parts, that have poor permeability, do not. There are reports of tilted OWC. And there is a huge tar mat. Water injection down the flanks was initiated decades ago.

Overall, this structure is so huge it is not possible generalise - what's true for one part of the field may not be true else where.

ok, thank you for the response. i understand about generalizing about a reservoir of this size.

Great post Euan. Some points:

In Khebab’s data the dog leg doesn’t show up because he is using Crude+Condensate whilst you are using Crude+NGPL. Also EIA’s data already includes 2006 data while BP’s does not.

Another thing, in ASPO’s newsletter n.35 Colin Campbell states that NO2 injection at Cantarell started in 1997, not in 2000.

Anyway, by looking at discovery Cantarell is far too marked to capture clearly if more than one cycle took place. What we can surely say using HL is that Mexico has past the 50% mark.

Hello Luis - I think in Khebab's most recent plots he is using C+C and monthly data - and both IMO serve to obscure what is going on. I have an ongoing debate with Khebab about this - my strong preference is to use C+C+NGL and annual data.

One problem I had in putting this together was conflicting information contained in the different articles. Fields appeared with different names on different maps and the timing of events etc varied - one of the hazards of using internet material. The eia report is probably the most reliable source - though their outlook needs to be taken with a pinch of salt.

If there are any Mexican geology students or Pemex geologists tuned in here, then it would be extremely valuable to have a short, factual account of the history of Mexican oil exploration and production.

I agree that Mexico looks past peak.

Hi Euan,

Perhaps you can outline the reasons that, for example, KSA HL analysis should include NGPL. Wouldn't the dynamics of NGPL extraction be significantly different than crude and, therefore, follow a different production rate profile (not to mention the fact that, at least in the case of KSA, significant production and/or reporting of NGPL has only shown up in the last few years)? To include NGPL would seem to add a systematic bias to HL analysis/results.

Hello Double D, a very good question and one that would take quite a long time to answer properly - but here goes.

In dealing with liquid fuel production, it is necessary to sub-dividide into categories - we have petroleum, syncrude, bio-fuels, coal to liquids etc.

Natural gas production liquids (NGPL or NGL) are light hydrocarbon liquids...

http://www.maverickenergy.com/lexicon4.htm

http://www.spe.org/spe/jsp/basic/0,,1104_1710,00.html

...that fall out of the gas production stream in process equipment. These light hydrocarbons tend to be very valuable.

The three main points I want to make:

1. NGL are part of the natural, free-flowing liquids from petroleum systems and IMO, therefore, should be included in C+C+NGL

2. Gas production and LNG (liquified natural gas - not to be confused with NGL) production is increasing now out of necessity. So when you suggest that including NGL with C+C may bias the picture, I would argue that the historic C+C picture is already biased by not including enough NGL.

3. We do not have the capacity to assimilate all the data that exists (or should exist), and so sub-dividing is convenient. For me the natural divisions are:

C+C+NGL

Syncrude+CTL+GTL - all fossil fuel based upgrading of quality

Biofuels

Thanks for the great reply,

It would seem, then, that the proper way to do HL analysis (or some derivative thereof) would be to use calculated BOE data (a weighting of each class of fossil fuel based on its respective energy value) from the extraction record of a given 'petroleum system'. This kind of data set, of course, only exists in a data-cruncher-geek's best pipedream.

In the absence of this kind of data, im still left w/ the problem of how to avoid an overly optimistic bias in the analysis. The famous dogleg that has developed in the KSA HL plot over the last few years seems to have been caused (at least in part) by NGL inclusion. Changing the slope of the best-fit line (HL extrapolation to URR) would seem improper. Inclusion of NGL should only shift the fit line out slightly to the right by some constant value.

This kind of logic should probably be applied to reservoirs/regions where enhanced recovery methods (eg nitrogen at cantarel) are implemented during the life of the producing field. The question everyone seems to have is how often and under what circumstances does the best-fit line in the HL analysis go back to the "pre-enhanced recovery" URR extrapolation.

Anyhow, lots of ought to's, un-answerable questions, and angst included in this. Good night..

And of course in agency reporting by eia, iea, opec and some others (aspo in occasion), we have 2mbd of processing gains...

Hello Euan,

Great Keypost--thxs! But your 14% decline is too optimistic, Pemex just officially admitted it is 15%:

http://today.reuters.com/news/articleinvesting.aspx?type=bondsNews&story...

------------------------------------------------------------

MEXICO CITY, Feb 7 (Reuters) - Mexican state-run oil monopoly Pemex acknowledged on Wednesday that output from its main oil field Cantarell was declining faster than previously thought.

Chief Executive Jesus Reyes Heroles said the company's official production estimate from Cantarell was for an average of 1.526 million barrels per day during 2007, down 15 percent from last year.

© Reuters 2007. All Rights Reserved.

----------------------------------------

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Thanks Bob, as indicated is my reply to Luis, one difficulty in putting this post together was different figures contained in different sources. Estimating future decline is somewhat a black art. I think we need to wait two or three years to see what underlying rate of decline emerges for Mexico. The underlying rate for the UK North Sea is 15% - but this is mitigated by a continuous program of new fields being developed.

This is interesting and informative debate, like TOD used to be in the old days. Calm, collected and rational. A good forum where one could learn someting. Civilized people discussing in a civilized way, not the bloody trial by fire it seems to be increasingly degenerating into these days. Is it just me or are there more "nutters" around than there use to be? There's such a proliferation of arrogance and ostentation, exacerbated by conceit and condesention, and lack respect for the views of others. So, so far, so good guys, thanks for getting us back on track.

The reason that it is civilized is because it is about oil production figures and projections. Its not about the end-of-technology, getting B12 from worms or fertilizing your garden with human manure. The post-PO apocalyptic visions is what draws the "less stable" posters. And I for one, enjoy this type of discussion a lot more (and is the primary reason for being here).

Thanks for your comment writerman. Getting the comment balance right has been the subject of a lot of debate here. And to be honest, as many here will know, I really enjoy a good argument. One thing that surprises me is the paucity of internet data on Mexico - maybe it exists else where? The Pemex website (in Spanish) says they want to be free and open - and I believe them - Mexico is an OECD member and news of impending decline of Cantarell was forthcoming. But I feel there has to be room for a comprehensive and definitive history of the Mexican oil industry - maybe we should get some Mexican students over to Aberdeen to attend the excellent MSc course on Petroleum Geology that is run at the university here?

I have been thinking about this problem lately, (by the way I remember you used to comment in the early days of TOD). This is the kind of post that has made me come back to this site almost daily for close to 2 years, even if the percentage of useful comments have been in decline for a long time. Perhaps because this is eu.tod.com and not TOD itself, some of the more singleminded posters don't think it's worth their time, don't feel confident enough to post, or don't find it untill it sometimes shows up on the frontpage of TOD? This is how all posts on TOD used to be commented on, imagine that :)

Agreed just like it was when I first stumbled onto it. Feels good to read all postings. I wish I could say it improves my lack of optimism.

I'm trying to promote Euan's good work (PG being sick) but so far it's pretty low:

The greatest take-away for me from Pemex's announcement is that these state production forecasts are consistently being revealed as overly-optimistic. Same sit in Norway and UK.

This throws into serious doubt EIA and IEA production forecasts, and leads me to believe that a similar situation could be devel;oing (but not acknowledged) in KSA.

Not just eia/iea. Bottom up analyses should be updated to incorporate new official decline rates, and maybe even boosted to the avg of past under estimates. We know about north sea and mex, highly suspect persian gulf production, not least sa but kuwait and iran too. Chris says peak 'not before 07'. But, does he update for the above? and, what about major announced delays, eg thunder horse etc in gom?

Is his stuff on a spreadsheet somewhere, where one might make guesses on some of these points to see possible effects? BTW, everything seems to go just one direction... decline rates higher than recently expected, projects coming on line later... kind of what might be expected at peak. Anybody hear of declines less than officially stated, or projects coming on line early?

Well, interestingly, Skrebowski (http://www.odac-info.org/bulletin/documents/megaprojects.htm) did just that when he updated his megaprojects report in April 2006. He determined that his previous underlying decline rate assumption of 5% annually was too high based on production data to 2005. He adjusted the number down so it's closer to 1 1/2%. You may disagree, but read his rationale.

Peakearl

On the link you show above of his latest upgrades he still has not adjusted, Chinguetti, Enfield, Exeter/Mutineer and others. If he cannot adjust for a transparent company like Woodside Petroleum I would suggest most of the other figures are way too optimistic as well. The decline rates in the UK Australia Norway and many others are way above 4% - I don't believe it's any where as low as that

Yes, I find his underlying decline rate number surprisingly small but interesting. If it's wrong it needs explanation. I think a partial explanation is that it didn't take into account production of prior excess capacity in KSA (and OPEC in general) during that time. But this wouldn't explain it all.

I recall now that he ignored the large increase from opec in response to surging demand from china around 03/04. BUt, all of the reserve capacity was brought on line by end 04 or earlier, so changes in 05/6 should show true depletion. Or, looking at it another way, the barrels he expected in 06 that never showed are the depletion he missed.

Another problem is that depletion is rising... every year we have more fields in decline than the year before, and every year the fields are older, so more are nearing decline. Meanwhile, the number of new fields are fewer, certainly as a percentage of all fields, and planned projects are now routinely delayed. Well, we will see soon enough. If 07, like 06, fails to produce the predicted wall of new oil, perhapse the modelers will fiddle with their models.

You got to remember that 06 production was flat because demand was flat. There has been a fair amount on new oil, especially the BTC pipeline (Azerbaijan), Angola, Brazil and growing NGL production associated with LNG production / plants. My feeling overall is that in 06 there was a net addition of capacity - meaning that certain OPEC countries, in particular KSA, have increased their reserved capacity.

So my bets are, if demand rises in 07, supply will rise to meet it. I hope this doesn't make me a blind optimist - cos I fully accept that every year it gets more and more difficult for supply to meet rising demand - and one of those years (2012±3) TSWHTF.

jk, not targeting anyone in particular today, i will say that it is disingenuous by many here to assert that the bottom-up analysts (11) are not factoring in overall field declines nor other variables in their works. While i see that they are light in some provinces (or years), they are high on others, but in general it all works out in the end and no analyst or firm that has been doing this as a non-virgin is making significant errors going forward (except Bakhtiari, who seems to using some voodoo arithmetic model with geopolitical layers).

Where the modelers see differences from their peers, they are mostly making adjustments. When scrutiny embarrasses them, they react favourably. I know some monitor TOD. But please don't infer that TOD pundits are for the most part ahead of the curve...

The calls by those at TOD that i will call Pretenders are usually disastrous and the Archives are their testament.

Remember what i said on the weekend about forecasting. The best ones don't have to be perfect ... just right more often than the pack. Pundits at Peakster sites have been saying that the Peak "was last year" since 1999.

Chris Skrewbowski has been calling for Peak of 95-mbd in 2011 since November. I understand that Rembrandt Koppelaar will be upward revising his Spring 2007 Update ... likely due to softening of refinery capacity restraints that were pre-eminent in his 2005 Outlook. It has been a pleasure to work with these gentlemen and many others whose studies are basically gratis for the common good in the hopes of shedding light on what is ahead.

Each month there are attempts by pundit pretenders to displace the modelers. Unfortunately they find the task overwhelming and come up with inferior product or give up when they see that there agenda is not being served...

Since 2005 i have in place an open challenge to other TOD members who wish to compete to put forth their forecast numbers that they'd like to see incorporated into either the TrendLines Scenarios or the URR Estimates. In December i gave Samuel Foucher (khebab) an unsolicited soapbox in the latter presentation 'cuz i desired another global linearization or two to balance the recent high estimates. And perhaps a Scenarios candidate will rise from some of the due diligence work carried out here occasionally.

The ability of many of the modelers to have forecast 2006 from a vantage in 1996 and be within 10% speaks volumes to their talents. This 1%/yr error margin is miniscule compared to the poor calls at TOD made in 2005 and 2006.

You think this is some sort of game?

Arnie's on the water tower again.

Kook-a-doodle-dooooo....

Freddy - what I've tried to do here is to walk a practical line between the Dooooomers on one hand who see super giants crashing all over the world and the blind optimists (eia and iea) who seem only able to take past trends and extrapolate those into the blue yonder.

So I'd really be interested to know your views on Mexico, where you see production heading. Has Mexico peaked, and if so, where do you see the decline rate?

I tend to agree with those who say that official forecasts are tending to be wildly optimistic - certainly the case in Norway and UK - though the UK have this rediculous spread in their forecast and the bottom end is close to reality.

I think the bottom up forecasts face two challenges - one being the huge amount of data that needs to be collated and the danger of propogating systematic errors (e.g. project delays - the miss-match between what comapnies want to do and waht they can do with available men and machines) the other being that they forecast capacity - which is OK in OECD producers who produce eyeballs out, but not OK for OPEC - who as you know have always had reserved capacity.

What I see is is the lack of desire for a true understanding on F's part. You have it right that he takes past trends and extrapolates these forward, unfortunately the data always appear to be cherry-picked selectively from the last few years. I have been on a kick to try to understand the overall evolution in a real historical framework, starting from the very early days of oil exploration. In this view, you tend to get a deeper appreciation for what is going on.

Extrapolate? WHT, i plot the plateau and exhaustion. Sometimes collaboratively. And sometimes arbitrarily. The Peak and the ride up is determined by each of the modelers.

Yes, but Freddy the questions were:

Do you think Mexico is past peak?

If so, what sort of decline rate do you anticipate?

About three weeks ago we had a thread that brought to light some misunderstanding around the press releases and the "to or by" 800k issue. This related to my comments in december about the same story methinx.

Since that thread i have rec'd no info from modelers that has had comments or resolution on mexico in particular. Your feature segment is excellent and summarizes the big picture whereas too many are focusing solely on Cantarell numbers.

My comments on Mexico at this time would be speculative musings and i'd rather not go there other than to say that like KSA, we should do some watchful waiting based on the Pemex press release before going off half cocked. Whatever the king's status, its harsh decline will be dampened by blending with the province's other fields.

Of more importance may be the political ramifications of Pemex profits going to aggressive exploration and development rather than general revenues of the Mexican Gov't. It lotsa funds were anticipated (and i don't know that they were), then deficits or cutbacks in program spending may be on the way for two or three years.

I was hesitant to respond and don't really want to pursue this as i have little to base suppositions on. Sorry.

That's reasonable.

Not sure where to pipe in with this comment...

One thing that appears to be missing from these bottom up analyses is a Monte Carlo simulation taking into account the uncertainties in decline rates. Say you have a hundred fields where the decline rates are anywhere from 2-10%. You could assume a common decline rate, or you could run 10000 interations of the model where the decline rates are picked randomly for each field. What you will get as a projection is a band delineating the upper and lower limits of the projected flows. My gut feeling is that the width of the band will be significant. For fields/countries where the decline rate is well known, the simulation can constrain the rate to say 3.5 - 4.5%. You can assume that the decline rates are normally distributed about a mean or you can assume a bounded uniform distribution.

The results would be quite instructive....

You don't necessarily need a MC simulation. A Markov approximation of an exponential rate automatically gives you a mean and a standard deviation where the standard deviation equals the mean. That's what the oil shock model accomplishes.

http://mobjectivist.blogspot.com/2005/11/oil-depletion-model-posts.html

This is pretty much like your view of eia/iea predictions. While acklowledging that many regions look ridiculously optimistic, you point out that overall they have been ok in predicting more output. BUt, this is like the weather forecaster predicting sunny weather, always right, day after day, for three months. Will you plan your picnic based on his sunny prediction? What if you found out that his method is to predict tomorrow whatever the weather was yesterday?

It has been easy to predict sunny oil production over the past century. BUt all of your punters called for sharply higher production in 06, all were wrong, and this during a period where prices both reached, and averaged, an all time record. And, the price surge was hardly too sudden for planning - prices had been increasing fast for over six years. Production is now declining in many regions that very recently were growing, exporting countries are becoming importing ones. C+C declining, all liquids barely holding up, the ability to increase ethanol/tar sands is low, rig rates soaring and tanker rates swooning. All giant fields over half a century old, and all those still standing beginning their fall. Lots of writing on lots of walls.

Agreed. That is what is most striking for me, too. The official estimates tend to be way too optimistic.

Thanks, Khebab.

On the article, I forgot to acknowledge that it was based on links posted from your earlier posts and that you also reviewed the article:-)

Also not that your disguise is in danger of being revealed.

Mexican Oil Experts and Heirs Address the Future

My apologies if this link has already been posted. But I thought it was a real eye opener.

http://www.mexidata.info/id1106.html

Ron Patterson

Regarding the calls for mexican engineers to give some insight about PEMEX.

The company is a very tight submarine. the discipline inside the corporation is strict. I truly doubt any of the insiders would start talking here.

That said: there is a lot of material on PEMEX available -in print, in spanish in public libraries in México city. Lots of heavy technical-financial-legal stuff for whoever feels compelled to do the due dilligence.

In my daily conversations, the Cantarell decline is a very uncomfortable topic to face: People above a certain average education are very aware that it spells BIG trouble in the fiscal front. For the most part they are not ready yet to emerge from denial -imho-.

As for the fact that PEMEX felt compelled to release preliminary production numbers for January when they usually take their precious time (42 days after the close of the month) speaks volumes on the pressure they are facing from the politicos in upper echelons around the theme. Calderón needed a rosy outlook to land in Davos.

The december drop notwithstanding, the trend of declining rates for the whole mexican inventory of producing fields is accelerating. Federico Reyes Heroles's forecast for Cantarell at 1.5MMbd for 2007 will be obsolete by june. In his farewell speech Luis Ramírez Corzo (former PEMEX chief) had his moment of honesty and declared that PEMEX had to basically reinvest 100% of its proceeds for the next decade if it wanted to prolong the productive plateau. It was duly published and then duly ignored. Lately there's also a smear campaign against him... These sort of food fights will increase in intensity as production decreases, The blame game is ON.

Hello Pleiotropik,

Thxs for this additional insight. I frequent a Mexican restaurant near me: I keep trying to get the employees up to Peakoil Outreach speed, but the language barrier is difficult to overcome. I keep trying to communicate to most of them that they could make alot more money/hour doing Peakoil research, then promoting widespread Peakoil Outreach to the Mexican citizenry. A spanish version of Savinar's LATOC, translating Peakoil books like Heinberg & Simmons to spanish, starting a ASPO/Mex, TOD/Mex, working for the EIA, DOE, etc, doing the heavy lifting in the Mexico City library, becoming a spanish Megan Quinn for TV & film, starting community conferences, and so on.

All Americans should be doing their best to alert the Hispanic Community: this should help prevent Mexico from following the Zimbabwe Syndrome. If you haven't googled lately, South Africa is being overrun with Zimbabweans fleeing their country. Consider that Zimbabwe is only 12 million--Mexico is approx. 110 million.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

"Cantarells Postulate" - 'Declining per capita oil production must equal emigration to maintain the status quo' sorry dark humor.

Thanks for posting!

I do get the feeling that there's a lot of info about Cantarell out there, but the language barrier is an issue. Maybe we need a TOD: Mexico.

In reply to a number of comments posted, here's what Mexico's predicament looks like assuming 4% annual fall in production and 2% annual growth in consumption. Obviously, if production falls faster than 4% per annum, as many here seem to think is going to happen, then the export situation will look a lot worse. But on the other hand, with such a calamity, consumption is hardly likely to keep rising.

Furthermore, if this type of scenario unfolds, then it seems likely that the price of oil will rise significantly, and this will cussion falling exports.

My impression is that David Shields has studied this issue much more intensively that any of us, and he is on record for predicting a net decline in Pemex production of 400,000 bpd from 12/06 to 12/07, and then another 400,000 bpd drop from 12/07 to 12/08.

Note that average annual production numbers would show lower declines, but the month to month numbers give us a better estimate of production for a given future month, especially when production is falling rapidly.

One of the key points that Shields makes is that Pemex is only replacing about 6% of their reserves. If Shields is right, by 12/08 Pemex will be exporting negligible amounts of oil, subject to what happens to domestic consumption.

BTW, it looks like Pemex is admitting to a 15% decline rate (average annual production) for Cantarell, which would suggest that Cantarell will, under even the current Pemex scenario, drop by 50% by 2010, from about 2.0 mbpd in 2005 to about 1.0 mbpd in 2010. Note that on a monthly basis, the December production numbers will be significantly lower than the annual averages.

I think that Shields is basically predicting that Pemex production (on monthly basis) will be down to about 1.0 mbpd in 12/08.

http://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/refinery_...

Can anyone (expert in refining) tell me whether in this chart the increase in sulphur barrels represents and increased ability to handle lower quaility crudes in the US?

Interesting observation, but first you'd need to normalise this for volumes of crude being refined before trying to say anything else.

The advent of very low sulfur diesel (0.015% down from 0.5%) for 85% of "over-the-road" diesel on June 1, 2006 (for most of the US & Canada(?), CA earlier) certainly increased the sulphur removed by US refineries. This change may have reduced US ability to process sour oil despite increased tonnage of sulphur being processed.

Best Hopes,

Alan

I think that I made a mistake. It looks like Shields is predicting that the worst case is the likely case, and that Cantarell may be down to about 500,000 bpd by 12/08.